#How to avoid loan default?

Explore tagged Tumblr posts

Text

Can a Bank Take Legal Action for Non-Payment of Personal Loans?

Taking a personal loan can help you manage financial needs such as medical expenses, home renovation, education, or debt consolidation. However, repaying the loan on time is crucial. If you default on your loan payments, the bank has the legal right to take action against you. Non-payment of personal loans can lead to severe financial and legal consequences, including penalties, credit score damage, and legal proceedings.

In this article, we will explore what happens if you fail to repay a personal loan, the legal actions banks can take, and how you can prevent such situations.

What Happens If You Don’t Pay a Personal Loan?

When you take a personal loan, you agree to repay it in fixed monthly installments, including the principal and interest. If you miss multiple payments, the bank may classify your loan as a "Non-Performing Asset (NPA)", and the consequences begin to unfold.

Here’s a timeline of what typically happens after non-payment:

First Missed Payment: You may receive reminders from the bank via SMS, calls, or emails asking you to make the payment.

30 Days Overdue: The lender may apply a late payment fee and report your missed payment to credit bureaus, affecting your credit score.

60-90 Days Overdue: If the payments remain unpaid, the bank will increase collection efforts, and your loan status may be marked as "delinquent."

90-180 Days Overdue: Your loan is classified as a Non-Performing Asset (NPA). The bank may escalate the issue to legal recovery teams.

Beyond 180 Days: The bank may initiate legal action, arbitration, or file a case under the Negotiable Instruments Act (if post-dated cheques were issued) or the SARFAESI Act (for secured loans).

Legal Actions Banks Can Take for Non-Payment of Personal Loans

If you default on a personal loan, the bank has the right to initiate legal action. The specific course of action depends on the loan agreement, the amount due, and the lender’s policies. Here are some possible legal consequences:

1. Credit Score Damage & Loan Blacklisting

The first and most immediate consequence of loan default is a negative impact on your credit score. The bank reports missed payments to credit bureaus like CIBIL, Experian, and Equifax. This can:

Lower your credit score significantly.

Make it difficult to get future loans or credit cards.

Affect your chances of securing financial products such as home loans or business loans.

2. Legal Notice & Demand Letter

If payments remain unpaid, the lender may send a legal notice demanding repayment. The notice outlines the outstanding amount, applicable penalties, and a deadline to make the payment. Ignoring this notice may lead to further legal proceedings.

3. Civil Lawsuit for Loan Recovery

Banks and NBFCs can file a civil lawsuit against defaulters under the Civil Procedure Code, 1908. They can:

Demand full repayment through the Debt Recovery Tribunal (DRT) if the loan amount exceeds ₹20 lakh.

Approach a civil court for lower loan amounts.

Request the court to issue a recovery certificate, allowing legal enforcement of the debt.

4. Legal Action Under the Negotiable Instruments Act, 1881

If you issued post-dated cheques for loan repayment and they bounce due to insufficient funds, the bank can file a case under Section 138 of the Negotiable Instruments Act. This can lead to:

A penalty or fine.

A possible jail term of up to two years in extreme cases.

5. SARFAESI Act for Secured Loans

Though personal loans are unsecured, if you have taken a secured loan with collateral, such as a home or fixed deposit-backed loan, the bank can:

Take possession of the pledged asset.

Auction it under the SARFAESI Act, 2002 to recover the outstanding dues.

6. Arbitration or Lok Adalat Proceedings

Many lenders prefer arbitration before filing a court case. The bank may:

Take the case to Lok Adalat or an Arbitration Tribunal for settlement.

Offer loan restructuring to recover dues without lengthy litigation.

7. Bankruptcy Proceedings

In extreme cases, if a borrower is unable to repay the loan, they may be forced to declare bankruptcy. This can:

Lead to legal proceedings under the Insolvency and Bankruptcy Code (IBC), 2016.

Affect all financial dealings and creditworthiness for years.

What Should You Do If You Can’t Repay a Personal Loan?

If you are facing financial hardship and can’t repay your personal loan, do not ignore the problem. Instead, take proactive steps:

1. Contact Your Lender Immediately

Banks often provide options such as:

Loan restructuring: Extending the loan tenure to reduce EMI burden.

Moratorium periods: Temporary suspension of payments during financial hardship.

Settlement options: In some cases, banks may offer a lump sum one-time settlement (OTS) at a reduced interest rate.

2. Request EMI Reduction or Loan Refinancing

Consider negotiating for lower EMIs if you’re struggling with payments.

Refinancing your loan with another lender at a lower interest rate can also help manage repayments better.

3. Avoid Borrowing More to Repay Existing Debt

Taking another loan or using a credit card to pay off a personal loan can lead to a debt trap. Instead, explore:

Side income opportunities.

Selling unused assets.

Asking family or friends for temporary financial support.

4. Seek Legal and Financial Advice

If you’re unable to negotiate with the bank, consult a financial advisor or lawyer for guidance on your rights and possible legal remedies.

5. Opt for a Loan Settlement Only as a Last Resort

Loan settlement involves paying a reduced amount to close the loan. While this may seem like a good option, it severely affects your CIBIL score and can make future borrowing difficult.

How to Avoid Legal Issues Related to Loan Default?

To prevent facing legal action from banks, consider these financial practices:

✅ Borrow only what you can repay. ✅ Keep an emergency fund to handle unexpected financial hardships. ✅ Set reminders for EMI payments to avoid missing due dates. ✅ Avoid multiple loans that can strain your finances. ✅ Monitor your credit score regularly and take steps to improve it.

Conclusion

Yes, banks can take legal action for non-payment of personal loans, but this happens only after multiple missed payments and repeated reminders. The consequences of defaulting include a damaged credit score, legal notices, court cases, and even bankruptcy proceedings.

To avoid such situations, always communicate with your lender if you’re facing financial difficulties. Banks may offer solutions like loan restructuring or settlement to help you manage repayments without facing legal trouble.

For more information on personal loans, repayment strategies, and trusted lenders, visit FinCrif Personal Loan.

#Personal loan default#Non-payment of personal loan#Legal action for loan default#Bank legal notice for loan#Debt recovery process#Loan repayment rules#Missed EMI consequences#Personal loan consequences#Loan default penalties#Loan repayment issues#What happens if you don’t pay a personal loan?#Can a bank take legal action for loan non-payment?#Legal process for loan recovery#Credit score impact of loan default#Personal loan recovery process#Debt collection laws in India#Personal loan settlement process#Bank actions against defaulters#Debt Recovery Tribunal India#How to avoid loan default?#personal loan online#nbfc personal loan#fincrif#personal loans#personal loan#loan apps#loan services#finance#bank#personal laon

0 notes

Text

Transit Sidereal Venus in Pisces & Aries

Venus is transiting into Aries on May 31st in the sidereal system. Here’s predictions for this past month and for this upcoming Venus transit! Enjoy babes :D

Keywords

Venus - harmony, complacency, pleasure, indulgence, attraction, seduction, relation

Pisces - confusion, fantasies, escapism, submission, delusion, sacrifice, dependency

Aries - competition, separation, selfishness, conflict, impulse, urgency, disruption

Note: this is for SIDEREAL rising signs. If you have your tropical ascendant/first house in 24° or below, I recommend checking for the sign before it.

Pisces Rising

Venus Pisces - People have been idealizing you, people projecting their fantasies onto you; self-sacrifice feels like a reflex, “yes” becomes your default; giving off romantic signals w/o realizing it

Venus Aries - May splurge and regret it fast, buyer’s remorse; self worth is reactive, highly sensitive to compliments and criticism; jealousy or envy towards other people’s success

Aries Rising

Venus Pisces - Falling in love with someone unavailable (secret, long-distance, spiritual, or delusional); you’re enabling your own emotional avoidance patterns; you feel inspired but don’t act

Venus Aries - people are drawn to how bold or seductive but are pushed back by aggressive behavior; you flirt/attract others but lose interest when someone gives in; self love turns into arrogance or bodily indulgence, confidence is fragile and impulsive

Taurus Rising

Venus Pisces - Fake friends feel real; giving too much to groups, like volunteering and donating and may be exploited in silence; delusional goals, chasing ungrounded purpose or dreams

Venus Aries - Catching feelings for unavailable people or sabotaging stable relationships; crave independence but isolate too hard; passive aggressive behavior, claim you’re done giving to others even when didn’t really ask for what you want in the first place

Gemini Rising

Venus Pisces - you look good to the public but feels fake or unsustainable image; bosses/authority treat you better but thin boundaries; chasing a fantasy job

Venus Aries - Joining groups for clout not connection, building friends for influence rather than loyalty; push you dreams out without a plan, making it about winning rather than building; friendships/ideals networking become an ego contest, misjudge who’s on your side

Cancer Rising

Venus Pisces - Falling in love with belief (conspiracy, philosophy, religion); idealize someone from another country or background; using spirituality to escape, all soothing no grounding, no discernment

Venus Aries - People start to notice you but maybe not for the right reasons; relations with authority turn awry because of vanity or lack of restraint (the intent is obvious); impulsive sweet talk, acting like you care in public but it’s for image than depth

Leo Rising

Venus Pisces - Romanticizing toxic bonds; feeling “blessed” with loans, shared money, inheritances but may vanish or get misused; sudden obsession with spiritual death

Venus Aries - Thinking your way or beliefs are best and shutdown other people; impulsive or flaky travel, spiritual, or educational decisions; having a guru complex, acting like a free spirit but really want to dominate other people’s worldviews

Virgo Rising

Venus Pisces - Projecting ideal traits onto others, not seeing partner clearly; attracting needy people, want to heal them yet resent them; love feels magical until it doesn’t

Venus Aries - Strong urges for desires and where there’s danger (like manipulation, secrets, obsession); arguments about loans, debt, or inheritances come out of nowhere, power games; confuse lust with healing, when it’s probably trauma bonding

Libra Rising

Venus Pisces - Work becomes an emotional sponge, end up drained or resented after doing favors; health warning signs ignored, using your “intuition” to say you’re fine; zero boundaries at work, romanticizing being of service to others

Venus Aries - Attract bold/selfish partners or “mirrors”, those who don’t stick around or play fair; picking fights in the name of connection; jump into love, sex, or commitment, and regret not long after

Scorpio Rising

Venus Pisces - flirtation feels like destiny, but they just wanna hookup; overindulgence in pleasure (sex, romance, drinking, art becomes escapism); idealizing children or your creative work and miss flaws

Venus Aries - Want appreciation at work/service but come off demanding or entitled; go all out in health habits until you crash and binge, no middle ground fr; burnout from people pleasing rage, helping until you snap

Sagittarius Rising

Venus Pisces - Domestic drama swept under the rug; romanticizing your childhood or parents; spending money on decorating or turning your home into a sanctuary

Venus Aries - Crushes flare fast but burn out faster, you’re bored once it’s not a challenge; you want to be the best lover or artist but lose interest when no one’s watching; overindulgence risk-taking, like in gambling, risky hookups, or reckless creativity

Capricorn Rising

Venus Pisces - Charming people with words or ideas but even you don’t believe it; siblings, peers, or relatives may manipulate softly, may think you’re being support but their may be guilt trips; mental fog masked as intuition

Venus Aries - Beautifying home to signal status yet may regret investments later; disputes over land or family valuables, more for ownership or clout than legacy; rejecting your roots impulsively, romanticizing being self-made

Aquarius Rising

Venus Pisces - Spending money on aesthetic purchases, gifts, or charity; self-worth tied to being seem as kind, artistic, or spiritually generous; financial illusion, like thinking you’re fine but may not be

Venus Aries - Everything you say sounds like a dare or unfiltered, whether it’s flirting, arguing, or compliments; may have petty communication tension with coworkers, neighbors, peers, or siblings, disagreements for ego points; scattered attention span

#astrology#astrology observations#sidereal astrology#astro notes#astro community#venus transit#transit#astrology blog#astronotes#astrology tumblr#astrology houses#traditional astrology#sidereal zodiac#sidereal observations#sidereal chart#sidereal venus#venus#venus in the houses#aries#pisces#neptune#mars#astrology signs#houses in astrology#astroblr

44 notes

·

View notes

Text

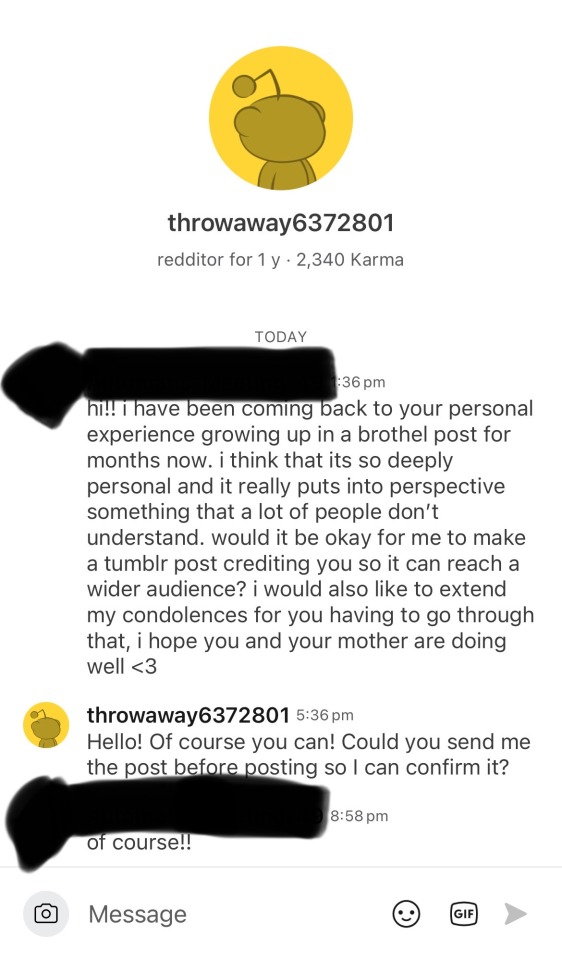

this post is a repost of an amazing reddit post by u/throwaway6372801 on the r/MoDaoZuShi subreddit.

https://www.reddit.com/r/MoDaoZuShi/s/GeHsDKCFON

Growing up in a Chinese brothel and how it may relate to Jin Guangyao/Meng Yao as a character

Just to start off I would like to preface that I’m not excusing his crimes, only putting in perspective parts of his character that I personally resonate with based on similarities. I will start off discussing how brothels and debts tend to work, especially involving children.

I will not be releasing where I grew up nor my name due to privacy reasons as I have somewhat personal information about myself on this account, despite its name.

But in short, I grew up in a brothel in China with my mother. She worked as a prostitute out of desperation and debt, which I ended up also helping with.

Debt was accumulated through food, housing, water, electricity, makeup, clothes, anything that we were unable to pay for ourselves and had to ‘take out a loan’ for. Things necessary for my mother to work, such as makeup, also fell into this category. This is not to mention baby items which were even more expensive and often times couldn’t be stretched out to last as long as other items.

Your co-workers are not your friends. You may both be in this situation, you may both have children, but if you cannot afford it, kindness is not an option. You have to be callous to survive.

On the same subject, politeness is a sought after commodity. If you can have a convincing smile, laugh, anything of the sort. Lying as well, if you can’t convince the man about to rape your child that they can’t because you would be ‘jealous’, you and your child are cooked.

Selling a child isn’t uncommon either. If someone has a particularly low-paying client who happens to be ugly or undesirable, they may offer the nearest person to them, not uncommonly a child that’s either their or one of their co-workers’.

Being a woman in a brothel is not a ‘women supporting women’ place. It is survival. And yes, some people are just evil, and will try and sell the child of a better paid co-worker than work themselves.

It doesn’t matter how pitiful you look, though it can help, you cannot stop it.

Onto Meng Yao. I will be calling him that since at this point in his life, he was indeed called Meng Yao.

We see when Wei Wuxian performs Empathy, that he goes into the body of Anxin. We as the readers get a glimpse into Meng Yao’s childhood at the brothel. It’s brief, and mostly focuses on the event of his mother, Meng Shi, being dragged naked into the streets, with himself after (fully dressed). Sisi comes to their defence.

But what I think that most people forget is that earlier, Anxin tries to sell Meng Yao to a customer. Not an uncommon thing to see in a brothel sadly.

We as the readers also are aware of Meng Yao’s signature ‘customer service smile’. This is pretty common with people in the customer service industry. Where you have to keep people happy to keep them from screaming at you. I have no doubt that this is likely a learned behaviour from his childhood at the brothel. All my fellow brothel brats, as well as myself, default to it as well.

Another response is possibly immediate lying/not taking fault in a situation where you are obviously at fault or have been caught red-handed. Think the scene of Meng Yao stabbing the Jin Captain and being caught be Nie Mingjue. Reading this scene, it always felt more like when a child drops a plate and immediately points to the dog to avoid punishment. While the child was clearly at fault, they took the blame off of themselves in an act of self-preservation. I’m not claiming that he was right here, just that his response makes sense to me. I have found myself and many others with a similar background doing it as well.

Well, that was definitely long. I don’t want to come off like I’m ridding Meng Yao of all his faults. I’m only trying to shed light on how some of his responses to things make sense given his upbringing, as well as maybe give people an insight as to how horrible brothels can be, especially to children.

If your mother is the only kind person to you, she is your whole world.

In addition, prostitution is often called ‘the first profession’ or ‘the oldest job’. I think this rings very true. Much of the practices mentioned have been practiced for centuries and likely will continue to be practiced for centuries to come.

If anyone decided to sit through and read everything, thank you. I would also like to apologise in advance for any grammatical or spelling mistakes, English is not my first language. I’m pretty all over the place here so apologies for that as well.

Edit: I forgot to mention the disgust and prejudice that people hold to this day. Meng Yao serving tea and it being seen as ‘tainted’ is a sentiment still somewhat held to this day. Same with him not being allowed to hold Jin Ling due to his perceived ‘dirtiness’. It’s something that is sad but true, and follows people for their entire lives. You will never be clean, due only to the circumstances of your birth and childhood, as well as a desperate attempt to survive. Prostitution is not something people aspire to achieve generally. If they do, they likely don’t understand the long term effects and social stigma that isn’t just limited to you.

Edit 2: Safety is another huge thing, especially for formal brothel brats. Safety comes with power. I’m not excusing Meng Yao’s use of getting power, he definitely used certain means that I don’t agree with. But especially growing up in that setting safety = power. I was given the advice many times growing up to cling to a powerful man in hopes that I become his wife, as that would grant me safety and stability. Many of the children I grew up with ended up working alongside their mothers or turning to drug dealing and criminal activity, which in turn gave them power. I think that what we learn growing up has a huge impact on people as adults. It can be very difficult to unlearn these associations.

Last edit, more of an update: I would like to thank everyone and extend that thanks on behalf of my mother. We are both doing well now. We have both come to America and I have started my own family in the past few months. She has a new job and recently moved. She’s very happy and has many friends here. Thank you all for your kindness and well wishes. Have a lovely day!

screenshots of the original post as well as my messages. cut off, but she did approve this post.

92 notes

·

View notes

Note

Does Yuuya have a more active role in the light novel compared to Yuu in the game? If so, how?

Also thank you for providing us some contents with twst light novel. I've been curious about it myself and glad I came upon your blog.

I guess that depends on what you mean by more "active"? Personally, I would say Yuuya is more involved just because of the structure of the light novel. We're able to hear more of his thoughts and emotions compared to Yuu, so by default Yuuya will feel more "active" anyway. We just understand him more than Yuu, who is designed to be a blank slate that's easily projected onto or self-inserted into. Yuuya basically goes through all the same general motions as in-game Yuu does. However, due to his cowardly and meek personality, he tends to react disparagingly/with little confidence and avoids conflict rather than throw himself into the thick of things. Additionally, because there are logical gaps that need to be filled in for light novels, we do see more detail on Yuuya's actions or little extra details in some parts. For example, it's never explicitly stated that Crowley gave Yuu a uniform in the game. In the light novel, Yuuya is said to have been loaned a uniform. As another example, Yuuya expresses fear when encountering Malleus and Leona for the first time, whereas in-game Yuu tends to demonstrate curiosity or just general shock instead. Yuuya also frequently flashbacks to the life he had in his original world, which is considerably more backstory than we ever get for Yuu. I unfortunately don't have the time or the space to run through every single variation or notable change between the light novel Yuuya and the game Yuu 💦 but I hope that this at least helped to give you an idea of what kinds of differences there are between the two mediums!

#twst#twisted wonderland#Malleus Draconia#Leona Kingscholar#Dire Crowley#twst light novel#twisted wonderland light novel#Yuu#Yuuya Kuroki#Kuroki Yuuya#disney twisted wonderland#notes from the writing raven#question

119 notes

·

View notes

Text

How To Manage and Pay Off Your Student Loan Debt: 10 Smart Strategies

Student loan debt is one of the most significant financial burdens facing Americans today. With over 43 million borrowers in the U.S. alone, understanding how to manage and pay off your student loan debt is essential for achieving long-term financial freedom. Whether you're just starting repayment or trying to eliminate your balance faster, here are the top 10 strategies to help you take control.

1. Understand What You Owe

Start by creating a full list of your student loans — including balances, interest rates, and loan servicers. Knowing the exact details helps you choose the best student loan repayment strategy.

Related keyword: managing student loan debt effectively

2. Choose the Right Repayment Plan

Federal student loans offer various repayment options like Standard, Graduated, and Income-Driven Repayment (IDR) plans. Choosing the right plan can lower your monthly payments or help you pay off the loan faster.

Related keyword: student loan repayment options

3. Make Extra Payments When Possible

Even small extra payments can make a big difference. By paying more than the minimum each month — even just $25 — you can pay off your student loans faster and reduce the interest paid over time.

Related keyword: how to pay off student loans faster

4. Use the Debt Avalanche or Snowball Method

Apply popular debt reduction strategies like the Avalanche Method (tackle loans with the highest interest first) or the Snowball Method (pay off the smallest loan first). These methods help you stay focused and motivated.

Related keyword: student loan payoff strategy

5. Set Up Autopay for a Lower Interest Rate

Most federal loan servicers offer a 0.25% interest rate reduction for borrowers who enroll in automatic payments. This can save you money in the long run and ensure you never miss a payment.

Related keyword: reduce student loan interest rate

6. Consider Loan Consolidation or Refinancing

Federal loan consolidation can simplify repayment, while private loan refinancing may lower your interest rate — especially if you have a high credit score. Just be cautious: refinancing federal loans means giving up benefits like forgiveness programs.

Related keyword: consolidate vs refinance student loans

7. Take Advantage of Student Loan Forgiveness Programs

If you work in public service, education, or non-profit sectors, you may qualify for Public Service Loan Forgiveness (PSLF) or Teacher Loan Forgiveness. Income-Driven Repayment plans may also lead to forgiveness after 20–25 years.

Related keyword: student loan forgiveness programs 2025

8. Look Into Employer Repayment Assistance

More employers are offering student loan repayment assistance programs as part of their benefits package. Check with your HR department — you might be eligible for thousands of dollars in assistance.

Related keyword: employer student loan repayment benefit

9. Budget Strategically for Debt Repayment

Use budgeting tools or apps to prioritize loan repayment. Cut unnecessary expenses and redirect that money toward your student loans. Every extra dollar makes a difference over time.

Related keyword: budget to pay off student loans

10. Avoid Default and Stay in Communication

Missing payments can lead to loan default, wage garnishment, and long-term credit damage. If you’re struggling, contact your loan servicer immediately to explore deferment, forbearance, or alternate repayment plans.

Related keyword: how to avoid student loan default

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Take Control of Your Student Loan Debt

Paying off your student loans doesn’t have to feel overwhelming. With the right strategy — whether it's optimizing your repayment plan, making extra payments, or qualifying for forgiveness — you can tackle your debt step-by-step and move toward financial freedom.

Don’t wait. Start managing your student loan debt today and take control of your financial future.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More!!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#managing student loan debt effectively#student loan repayment options#how to pay off student loans faster#student loan payoff strategy#reduce student loan interest rate#student loan#student loan debt

1 note

·

View note

Text

What is being ignored by the mainstream media are the dangers facing the global economy

Dec 03, 2024

On the economic front, it is more of the same, but just a different day.

The U.S. equities keep riding high following the re-election of Donald Trump.

While there are fears that his tariff policies will have negative effects on the economy, at this point, it is a guessing game.

The same with his plans to cut taxes. Will the richest Americans reap the biggest rewards like his last cuts in 2017, or will We the People of Slavelandia get a cut?

What is being ignored by the mainstream media are the dangers facing the global economy.

Economies were artificially propped up with trillions of dollars in fake money backed by nothing and printed on nothing, plus negative and zero interest rate policies, are now suffering from the draconian COVID lockdown policies imposed by politicians that destroyed the lives and livelihoods of billions of people across the planet.

We continue to report on the looming Office Building Bust that will cause Banks to Go Bust.

Need more proof?

The recent four-week office occupancy rate of the largest 10 cities in the U.S. was, according to Kastle Systems, down to 40.6 percent. Much of the decline was a result of the Thanksgiving holiday, but overall, for the year, the average is around 50 percent, while the vacancy rate, meaning empty office buildings, is at around 20 percent.

As of last week, the delinquency rates on commercial mortgage-backed securities (CMBS) was at 10.4 percent, up one percent in November, hitting its fastest spike in two years... the depth of the COVID War lockdowns.

According to Trepp data, the current CMBS delinquency rate is just .3 percent below the 10.7 percent spike during the Panic of ’08 Great Recession.

Illustrating the danger ahead, but again banned by the mainstream media, was the 31 October 2024 article in Wall Street on Parade, New York Fed Report: 27 Percent of Bank Capital Is “Extend and Pretend” Commercial Real Estate Loans... which in part states the dire office building crisis as a result of the vacancy rates and how it is being covered up.

They quote a paper written by Matteo Crosignani, financial research advisor at the New York Fed, and Saketh Prazad, a former research analyst at the New York Fed who is now a doctoral student in the Business Economics program at the Harvard Business School who wrote:

“In this paper, using detailed supervisory data, we document that banks have ‘extended-and-pretended’ their distressed CRE mortgages in the post-pandemic period to delay the recognition of losses. Banks with weaker marked-to-market capital—largely due to losses in their securities portfolio since 2022:Q1—have extended the maturity of their impaired CRE mortgages coming due and pretended that such credit provision was not as distressed to avoid further depleting their capital. The resulting limited number of loan defaults hindered the reallocation of capital, crowding out the origination of both CRE mortgages and loans to firms. The maturity extensions granted by banks also fueled the volume of CRE mortgages set to mature in the near term—a ‘maturity wall’ with the associated risk of large losses materializing in a short period of time.”

One of the scariest potential outcomes referenced by the authors is their so-called “maturity wall” when the debt bombs come due and losses pile up suddenly. The authors write this:

“…we document that banks’ extend-and-pretend has led to an ever-expanding ‘maturity wall’, namely a rapidly increasing volume of CRE loans set to mature in the near term. As of 2023:Q4, CRE mortgages coming due within three years represent 27% of bank marked-to-market capital, up 11 percentage points from 2020:Q4—and CRE mortgages coming due within five years represent 40% of bank marked-to-market capital. We show (i) that weakly capitalized banks drive this expansion, consistent with their extend-and-pretend behavior, and (ii) that the maturity wall represents a sizable 16% of the aggregate CRE debt held by the banking sector as of 2023:Q4.

“Taken together, our results highlight the costs of banks’ extend-and-pretend behavior. In the short term, the resulting credit misallocation might slow down the capital reallocation needed to sustain the transition of real estate markets to the post-pandemic equilibrium—for example supporting the conversion of office space into residential units and recreational spaces in large urban areas. In the medium term, the delayed recognition of losses exposes banks (and all other holders of CRE debt) to sudden large losses which can be exacerbated by fire sales dynamics and bankruptcy courts congestion.”

Further illustrating the reality of the looming CMBS debt bomb, today Wall Street on Parade noted that:

“Life insurers continued to allocate a substantial percentage of assets to risky and less liquid instruments, such as leveraged loans, collateralized loan obligations (CLOs), high-yield corporate bonds, privately placed corporate bonds, and alternative investments. Moreover, life insurance companies have material direct exposures to commercial mortgages and are large holders of commercial mortgage-backed securities (CMBS). This exposure to illiquid and risky assets makes life insurers vulnerable to an array of adverse shocks, including that of an economic downturn or of a significant further deterioration of the CRE [commercial real estate] market.”

TREND FORECAST: Yes, the significant further deterioration of the CRE [commercial real estate] market,” that so few are talking about... a mega trend we warned about when we had forecast the Office Building Bust and its socioeconomic implications.

2 notes

·

View notes

Text

see here's the difference:

YA/NA: 19 year old princess Cindy has two hot suitors vying for her hand while on the run from her father's murderer. how will she choose between these two utter hotties and still save her kingdom?

older audience: 30-40 year old Sarah works in the government as a high ranking official brokering peace between her country and a neighboring country, when suddenly someone wants her dead and frames her for murder. She's on the run from assassins while trying to stay alive, clear her name, and get that damn peace treaty brokered so she can avoid unnecessary war and bloodshed. Harvest time is coming and if the crops are destroyed then her people will starve. She has to worry about supply lines, finances, politics, and whether her country would default on international loans if it got engulfed with war. she doesn't know who to trust at this point except the warrior who happened to save her one night, but even he doesn't really understand the complexities of what's at stake, and the only one that does seems to be the assassin that's chasing her, and seems to be her counterpart from the other country. Perhaps they could put aside their differences and find out who benefits from war, and who really orchestrated events. the clock is ticking and there's so much at stake. She doesn't have time for love while staying alive and trying to solve everything, but sometimes you have no choice when love finds you. She hopes and prays that they stay alive long enough to find out what their future holds.

5 notes

·

View notes

Text

Take Advantage of the Assistance to Meet Your Urgent Needs Same Day Payday Loans

Same day payday loans could help you get your emergency finances under control if you're experienced in using a same day payday lending business to handle unforeseen expenses. Many lenders offer an easy-to-use service that enables hard-working Americans to obtain fast cash and repay it over time with a manageable payback schedule that works for them.

When you have no choice than to seek your employment, family, or friends for a same day funding loans, lenders may offer an alternative loan in cash because some people would rather not to divulge their current financial situation. The qualifications are as follows: you need to be a citizen of the United States, be at least eighteen years old, have an open checking account linked to your Social Security number, and perform a permanent job that pays a minimum of $1000 in a steady income.

It is also acceptable for people to gain as much as possible from same day payday loans without any reservations if they are dealing with bad credit elements such as defaults, arrears, foreclosure, late payments, and country court judgments (CCJs), IVAs, or insolvency, among others. With the flexibility of a two- to four-week repayment schedule, these loans allow you to get amounts ranging from $100 to $1000. You can use this loan to pay for a variety of expenditures, including those related to healthcare, power, groceries, unpaid bank overdrafts, and other expenses.

How Can I Obtain An Instant Fast Cash Loans Online?

It's simple to obtain fast cash loans online. Simply fill out the online application by providing your bank, job, and personal details. Within minutes, you will know if you are authorized. If you accept the terms of repayment, the funds will be transferred into your bank account by the following day. The money is then yours to do with as you like. Just remember to return the loan on schedule to avoid penalties.

You can be authorized in a matter of minutes if you submit an online application. One of our representatives will then give you a call to go over the procedure and confirm the information you provided. From that point on, you have the option of receiving your fast cash loans online via electronic check the following business day or on your debit card, enabling same-day funding.

Can I increase my Payday Loans amount after I accept the loan agreement terms?

Your maximum loan amount is based on your income. If you have taken out a loan for less than your maximum or you have paid down some of your principal through payments, then you can refinance and receive more money.

We offered with immediate approval for qualified applicants are known as payday loans online same day. You can obtain $100 to $1,000 sent to your bank account as soon as the same day with Nueva Cash. In contrast to certain typical payday loans, you don't have to wait days or weeks to be accepted. All you need is a phone number, a checking account, and three months of consistent work experience or more, as well as a minimum monthly salary of $1,000. You can even improve your credit by making on-time payments on the loan, which you will repay in manageable installments.

https://nuevacash.com/

3 notes

·

View notes

Text

What Happens If You Default on a Personal Loan Due to Medical Reasons?

Introduction

A personal loan can be a financial lifeline during emergencies, including medical crises. However, if an individual faces prolonged illness or a sudden health issue, managing loan repayments might become difficult. Defaulting on a personal loan due to medical reasons can lead to severe financial and legal consequences. This article explores what happens in such situations and how borrowers can mitigate risks and seek relief options.

1. Understanding Loan Default and Its Consequences

A loan default occurs when a borrower fails to make payments as per the loan agreement. Typically, lenders allow a grace period before labeling a loan as a non-performing asset (NPA). Consequences of defaulting on a personal loan include:

A. Negative Impact on Credit Score

Missing EMIs (Equated Monthly Installments) gets reported to credit bureaus like CIBIL, Experian, or Equifax.

A lower credit score (below 650) reduces future loan eligibility.

Defaults remain on credit reports for 7 years, affecting financial credibility.

B. Late Payment Penalties and Increased Interest

Lenders impose penalties on overdue payments.

Interest accumulation increases the overall repayment burden.

The lender may increase the interest rate if the risk of non-payment grows.

C. Legal Actions by Lenders

Banks and NBFCs can issue legal notices for continued defaults.

If the borrower is unable to negotiate, lenders may proceed with loan recovery proceedings.

In extreme cases, asset seizure or wage garnishment may occur based on court orders.

2. Why Medical Emergencies Lead to Loan Defaults?

Medical emergencies are unpredictable and can lead to significant financial distress. Reasons why individuals might default on a personal loan due to health-related issues include:

Loss of income due to hospitalization or inability to work.

High medical bills depleting emergency savings.

Insurance shortfalls, where medical insurance does not cover full expenses.

Inability to focus on finances due to health priorities.

3. Options to Manage Personal Loan Payments During Medical Crises

Before defaulting, borrowers should explore alternative solutions to manage their personal loan repayments:

A. Request a Moratorium Period

Many lenders provide a moratorium option in case of financial hardship.

A temporary pause on EMI payments (typically 3–6 months) can be granted.

The borrower must provide valid medical documents for approval.

B. Loan Restructuring Options

Borrowers can request extended loan tenure to reduce EMI burden.

Lower interest rates may be offered in exceptional cases.

Partial payments or revised repayment schedules can be negotiated.

C. Utilizing Emergency Funds or Medical Insurance

If medical insurance covers a substantial amount, the remaining funds can be allocated towards personal loan EMIs.

Building an emergency fund beforehand can help avoid loan defaults.

D. Seeking Financial Assistance from Family or Crowdfunding

Borrowers can seek temporary financial support from family or friends.

Crowdfunding platforms like Milaap, Ketto, and GoFundMe can help raise funds for medical expenses and loan payments.

E. Taking a Secured Loan for Debt Consolidation

Borrowers can apply for a gold loan or a loan against fixed deposit to clear pending EMIs.

Debt consolidation allows replacing a high-interest personal loan with a lower-interest secured loan.

4. How Lenders Handle Personal Loan Defaults Due to Medical Reasons

Lenders typically follow a structured process before taking legal action against defaulters. Steps include:

A. Reminder Calls and Emails

Lenders first send payment reminders before marking the loan as delinquent.

Borrowers should proactively communicate financial difficulties to negotiate alternative payment terms.

B. Grace Period and Restructuring Options

Most lenders provide a 30–90 day grace period to clear overdue payments.

Borrowers can request a temporary payment deferral due to medical emergencies.

C. Credit Score Downgrade and Loan Recovery Agents

If the borrower does not respond, the lender reports the default to credit bureaus, affecting future loan eligibility.

Loan recovery agents may contact the borrower for resolution.

D. Legal Action in Severe Cases

If no resolution is reached, lenders can initiate legal proceedings under SARFAESI Act (2002).

In some cases, court orders for wage garnishment or asset seizure may be issued.

5. How to Protect Yourself from Personal Loan Default Risks?

Taking preventive steps can help borrowers avoid the financial burden of loan defaults due to medical reasons:

A. Opt for Loan Insurance

Many lenders offer loan protection insurance, which covers EMI payments in case of hospitalization or disability.

Borrowers should check for personal loan insurance policies while availing loans.

B. Maintain an Emergency Fund

A savings fund covering 6–12 months of expenses can provide financial security.

Emergency funds should be kept liquid for easy accessibility.

C. Prioritize Low-Interest Loans Over High-Interest Loans

If managing multiple loans, clear high-interest debts first to reduce financial pressure.

Consider consolidating multiple loans into a single manageable loan with lower EMIs.

D. Communicate with Your Lender in Advance

Inform your lender before missing an EMI to seek a loan modification plan.

Provide medical proof to justify the need for loan deferment.

6. What Are Your Rights as a Borrower?

Lenders must follow ethical recovery practices. Borrowers have the following rights:

Right to Fair Collection Practices: No harassment, threats, or unethical collection tactics.

Right to Loan Restructuring: Borrowers can negotiate alternative repayment plans.

Right to File a Complaint: If unfair practices occur, borrowers can file a complaint with RBI’s banking ombudsman.

Right to Legal Representation: Borrowers can seek legal help if lenders misuse recovery tactics.

Conclusion

Defaulting on a personal loan due to medical reasons can be stressful, but borrowers have options to manage their situation. Open communication with lenders, loan restructuring, and financial planning can help mitigate the risks. If facing financial hardship, borrowers should explore relief measures such as moratoriums, insurance claims, and emergency funds. Understanding borrower rights can also ensure that lenders follow ethical practices. By taking proactive steps, borrowers can prevent loan defaults and maintain financial stability even during medical crises.

#personal loan#personal loan online#nbfc personal loan#fincrif#personal loans#bank#loan apps#loan services#personal laon#finance#Personal loan default#Loan default due to medical reasons#Personal loan EMI missed#Impact of loan default on credit score#Loan restructuring for medical emergencies#Personal loan repayment options#Medical emergency and loan default#Moratorium on personal loan#Loan settlement for medical reasons#Credit score after loan default#Legal action for loan default#Loan deferment options#Debt consolidation for personal loan#How to negotiate loan repayment#Personal loan insurance#RBI guidelines on loan default#Personal loan grace period#Medical crisis and financial planning#How to avoid personal loan default#Loan recovery agents

2 notes

·

View notes

Text

What is merchant cash advance stacking?

What is a merchant cash advance?

Merchant cash advance (MCA) is a popular alternative financing option for small businesses seeking quick access to capital. Unlike traditional loans, MCAs offer businesses the opportunity to receive a lump sum of cash upfront, which is repaid through a percentage of the business's future credit card sales. This type of financing is especially attractive to businesses with fluctuating revenue or those that have been denied traditional loans due to poor credit.

. FREE MCA LEADS -> https://www.fiverr.com/leads_seo_web .

MCAs are typically easier to qualify for compared to traditional loans, as the focus is more on the business's revenue-generating potential rather than its credit history. This makes them an appealing option for businesses in need of immediate funds.

While MCAs may provide a quick injection of cash, it's important for business owners to fully understand the implications and risks associated with this type of financing. One such risk is merchant cash advance stacking.

Understanding the concept of stacking

Merchant cash advance stacking refers to the practice of taking out multiple MCAs simultaneously or in quick succession. It is a strategy some businesses employ to secure additional working capital beyond what a single MCA can provide. However, stacking amplifies the risks associated with MCAs and can have severe consequences for businesses.

When businesses stack MCAs, they often end up with multiple repayment obligations, each with their own interest rates and repayment terms. This can quickly lead to overwhelming debt and financial instability. The high-interest rates and aggressive repayment terms of stacked MCAs can make it difficult for businesses to meet their financial obligations, resulting in a cycle of debt that is challenging to escape.

Risks and dangers of merchant cash advance stacking

Merchant cash advance stacking poses several risks and dangers for businesses. Here are some key considerations:

Increased debt burden: Stacking MCAs can lead to a significantly higher debt burden for businesses. Having multiple cash advances with varying repayment terms can make it challenging to manage cash flow effectively and meet the repayment obligations.

Sky-high interest rates: Stacked MCAs often come with exorbitant interest rates, which can further exacerbate the debt burden. The cumulative effect of high-interest rates can quickly spiral out of control, making it difficult for businesses to make progress on paying down their debt.

Limited financial flexibility: Stacking MCAs can limit a business's financial flexibility. The significant portion of future credit card sales that goes towards repaying multiple MCAs can leave businesses with limited working capital to cover day-to-day expenses or invest in growth opportunities.

Negative impact on credit: Defaulting on stacked MCAs or being unable to meet the repayment obligations can have a detrimental impact on a business's credit score. This can make it even more challenging to secure future financing or negotiate favorable terms.

Legal and regulatory risks: Depending on the jurisdiction, there may be legal and regulatory implications associated with merchant cash advance stacking. Businesses should ensure they are compliant with applicable laws and regulations to avoid potential legal issues.

How to avoid merchant cash advance stacking

Avoiding merchant cash advance stacking is crucial for businesses seeking to maintain financial stability and avoid overwhelming debt. Here are some strategies to consider:

Evaluate your financing needs: Before considering MCAs, assess your business's financing needs. Determine the amount of capital required and explore alternative financing options, such as traditional loans, lines of credit, or equipment financing. Understanding your needs will help you avoid the temptation to stack MCAs unnecessarily.

Research and compare MCA providers: If you decide that an MCA is the right financing option for your business, thoroughly research and compare different MCA providers. Look for reputable companies with transparent terms and reasonable interest rates. Read customer reviews and seek recommendations from trusted sources.

Negotiate terms: Don't be afraid to negotiate the terms of the MCA agreement. While MCAs are not traditionally subject to the same regulations as loans, some providers may be willing to offer more favorable terms, such as lower interest rates or longer repayment periods. Explore your options and advocate for your business's best interests.

Create a realistic repayment plan: Before accepting an MCA, create a realistic repayment plan that aligns with your business's cash flow. Consider the impact of the MCA on your revenue and expenses and ensure you can comfortably meet the repayment obligations without sacrificing the financial health of your business.

Seek professional advice: If you are unsure about the implications of an MCA or need guidance on managing your business's finances, consider seeking advice from a financial advisor or accountant. These professionals can provide valuable insights and help you make informed decisions about your business's financial future.

Alternatives to merchant cash advance stacking

Merchant cash advance stacking is not the only option for businesses seeking additional working capital. Here are some alternatives to consider:

Traditional loans: Explore traditional bank loans or credit lines as an alternative to MCAs. While they may have more stringent requirements, they often come with lower interest rates and more favorable repayment terms.

Small Business Administration (SBA) loans: The SBA offers various loan programs designed to support small businesses. These loans typically have competitive interest rates and longer repayment periods, making them an attractive option for businesses in need of funding.

Crowdfunding: Crowdfunding platforms allow businesses to raise funds from a large number of individuals who believe in their products or services. This option can be particularly effective for businesses with a strong online presence and engaged customer base.

Equipment financing: If your business requires specific equipment to operate or expand, consider equipment financing options. These loans are secured by the equipment itself and often have more favorable terms compared to unsecured financing options.

Invoice financing: For businesses with outstanding invoices, invoice financing can provide an immediate cash injection. This type of financing allows businesses to sell their unpaid invoices to a third party at a discount, providing immediate working capital.

Tips for managing merchant cash advance responsibly

If your business does decide to pursue a merchant cash advance, here are some tips for managing it responsibly:

Understand the terms: Carefully review and understand the terms of the MCA agreement before accepting the funds. Pay close attention to the repayment terms, interest rates, and any additional fees or charges.

Monitor your cash flow: Regularly monitor your business's cash flow to ensure you can comfortably meet the repayment obligations. Keep track of your credit card sales and adjust your budget accordingly to avoid cash flow constraints.

Prioritize repayment: Make timely repayments a priority. Falling behind on your repayment schedule can lead to additional fees and penalties, increasing the overall cost of the MCA.

Consider future financing needs: Be mindful of how an MCA may impact your ability to secure future financing. Excessive stacking or defaulting on MCAs can make it challenging to obtain other forms of financing when needed.

Seek professional guidance: If you are unsure about managing your MCA or need assistance with your business's financial management, consult with a financial advisor or accountant. They can help you develop a comprehensive plan for managing your business's finances and avoiding unnecessary risks.

Case studies of businesses affected by merchant cash advance stacking

To truly understand the potential dangers of merchant cash advance stacking, let's explore a few real-life case studies of businesses that have been negatively affected:

Case Study 1: A small retail business stacked multiple MCAs to fund inventory purchases during the holiday season. Unfortunately, the business struggled to generate sufficient sales to cover the high repayment obligations. As a result, the business was forced to close its doors due to overwhelming debt.

Case Study 2: A restaurant owner stacked MCAs to renovate their establishment and invest in new kitchen equipment. While the renovations attracted more customers, the business was unable to keep up with the aggressive repayment terms of the MCAs. The mounting debt eventually led to bankruptcy and the closure of the restaurant.

Case Study 3: A tech startup stacked MCAs to fund product development and marketing efforts. Despite initial success, the business was unable to generate enough revenue to cover the repayment obligations. The high-interest rates and multiple MCAs created a significant financial burden, resulting in the startup's failure.

These case studies highlight the potential pitfalls of merchant cash advance stacking and the need for businesses to approach MCAs with caution.

Legal and regulatory implications of merchant cash advance stacking

The legal and regulatory landscape surrounding merchant cash advance stacking varies by jurisdiction. While MCAs are generally not subject to the same regulations as traditional loans, it is essential for businesses to understand and comply with any applicable laws and regulations.

Some jurisdictions have introduced legislation to protect businesses from predatory lending practices associated with MCAs. These regulations may include requirements for transparency in loan terms, caps on interest rates, or restrictions on certain lending practices. Businesses should familiarize themselves with the laws and regulations in their jurisdiction to ensure they are operating within the bounds of the law.

Conclusion and final thoughts

Merchant cash advance stacking can be a risky financing strategy for businesses, often leading to overwhelming debt and financial instability. While MCAs offer quick access to capital, the high-interest rates and aggressive repayment terms associated with stacking can create a cycle of debt that is challenging to escape.

It is crucial for small business owners to thoroughly evaluate their financing needs and explore alternative options before considering MCAs. By understanding the risks and dangers of stacking, businesses can make informed decisions about their finances and seek more sustainable financing solutions.

Remember, responsible financial management is key to the long-term success of your business. Seek professional advice when needed, monitor your cash flow, and prioritize repayment obligations. By taking a proactive approach to managing your business's finances, you can avoid the pitfalls of merchant cash advance stacking and set your business on a path to financial stability and growth.

#mca leads#mcaleads#merchant cash advance#business loan#cash advance#b2b lead generation#funding#loans#mortgage#stacking

2 notes

·

View notes

Text

Short Term Loans UK Direct Lender: Find a Quick Fix for Your Money Issues

The loan market is flourishing these days thanks to sophisticated services for borrowers who require last-minute support or extra cash. These people can now receive significant financial aid using a debit card, but they must first apply for short term loans UK direct lender. There are no debit cards available in the finance sector seven days a week, twenty-four hours a day. They can obtain the required amount in a day by following the easy procedure.

This implies that all holders of non-debit cards are eligible to receive the prompt assistance of the aforementioned loans. However, in order for these candidates to be able to repay the loan balance, they must have a steady source of income. Then, and only then, may they complete the loan application form with the necessary information for short term loans UK direct lender in order to expedite the loan approval process. It is also acceptable for everyone who has bad credit history, such as defaults, arrears, foreclosure, late payments, CCJs, IVAs, or bankruptcy, to take advantage of these credits without any restrictions.

These loans are excellent short-term financial options for those in need of money right away. You can therefore take out a small loan of between £100 and £1000, which you must return within a month. The money received can assist people in resolving financial issues that surfaced in the middle of the month. Short term loans UK does not come with a little higher interest rate because the criterion holders are exempt from the additional procedures. It doesn't take long for candidates to settle their accounts after they can exhale comfortably after realizing they have paid off all of their debt.

What is meant by the term "Short Term Loans UK"?

It's obvious that it's referring to a loan that you could obtain fast rather than having to wait several days or more to hear back about your loan approval.

That is reasonable, but how quickly is fast?

How and where you apply for the short term loans direct lenders will determine a number of things. Nevertheless, let's start by talking about how long it takes to get approved and receive your money. This can take a few minutes, a day, or longer. For instance, after being approved, a payday loan could be sent to you in a matter of minutes. It's one loan type to consider while looking at payday quid. On the other hand, there are other short term loans direct lenders that could take a day or two longer; these are commonly referred to as personal loans or unsecured loans.

For whatever reason, you may need urgent cash, but you should think about how long a direct lender can take to process your payment. Usually, you can find out before applying for a same day loans UK. In this manner, unpleasant surprises and lengthier waits than anticipated are avoided. You must be familiar with the concept of quick loans. However, you may be wondering if they're just a myth. Our purpose is to respond to your inquiry. Can you obtain a loan quickly? Are they real? Is it possible that we will occasionally search for but never find a same day loan? In any case, how long might it take to find a loan?

https://paydayquid.co.uk/

4 notes

·

View notes

Text

How to Avoid Foreclosure: 10 Proven Strategies to Save Your Home

Facing foreclosure is one of the most stressful experiences a homeowner can endure. But the good news? Foreclosure is not inevitable — there are many ways to stop foreclosure and protect your home and financial future. Whether you're behind on mortgage payments or anticipating trouble ahead, this guide will walk you through how to avoid foreclosure with practical, proven strategies.

1. Contact Your Lender Immediately

The worst thing you can do is ignore the situation. Call your lender as soon as you anticipate a missed payment. Most lenders offer loss mitigation options, including modified payment plans, deferment, or forbearance agreements.

Related keyword: contact mortgage lender to avoid foreclosure

2. Apply for a Loan Modification

A loan modification adjusts the terms of your mortgage — reducing your monthly payment, interest rate, or extending the loan term — to make it more affordable. It’s a powerful tool many homeowners use to avoid losing their home.

Related keyword: modify home loan to prevent foreclosure

3. Use a Forbearance Agreement

If you’re experiencing temporary financial hardship due to job loss, illness, or a natural disaster, a forbearance agreement can pause or reduce your payments for a limited time. This gives you breathing room without immediately triggering foreclosure proceedings.

Related keyword: mortgage forbearance to stop foreclosure

4. Refinance Before It’s Too Late

If you still have decent credit and equity in your home, refinancing could lower your monthly payment or consolidate other debts. This option is ideal before default happens, so act early.

Related keyword: refinance to avoid foreclosure

5. Seek Foreclosure Assistance Programs

Government and nonprofit organizations offer free or low-cost foreclosure assistance programs that help you explore your legal and financial options. HUD-approved housing counselors are trained to negotiate with lenders on your behalf.

Related keyword: government help to avoid foreclosure

6. Explore a Repayment Plan

Lenders may allow you to catch up on missed payments by adding a portion of the delinquency to your regular monthly mortgage over time. It’s a structured way to pay off mortgage arrears without foreclosure.

Related keyword: repayment plan for past due mortgage

7. Sell Your Home Before Foreclosure

If keeping your home isn’t an option, consider selling it before the foreclosure process begins. Selling allows you to preserve your credit and potentially walk away with equity, depending on your home's market value.

Related keyword: sell home fast to stop foreclosure

8. Consider a Short Sale

If your home is worth less than what you owe, a short sale might be possible. This involves selling your home for less than your mortgage balance — with lender approval — and can help you avoid foreclosure on your record.

Related keyword: short sale to avoid foreclosure

9. Sign a Deed in Lieu of Foreclosure

This option lets you voluntarily transfer ownership of your home to the lender in exchange for debt forgiveness. While not ideal, it’s less damaging to your credit than a full foreclosure.

Related keyword: deed in lieu of foreclosure option

10. File for Bankruptcy (Last Resort)

Filing Chapter 13 bankruptcy can temporarily halt foreclosure proceedings and give you time to restructure your debts. This should be considered a last resort after exploring all other options, and requires consultation with a bankruptcy attorney.

Related keyword: use bankruptcy to stop foreclosure

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts: Act Early to Protect Your Home

The sooner you take action, the more options you'll have to prevent home foreclosure. Whether it's modifying your loan, applying for hardship programs, or selling your home on your terms, the key is to stay informed and proactive.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More!!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#contact mortgage lender to avoid foreclosure#modify home loan to prevent foreclosure#mortgage forbearance to stop foreclosure#refinance to avoid foreclosure#government help to avoid foreclosure#entrepreneur#personal finance#personal loans

1 note

·

View note

Text

🏛️ HOW THE GOVERNMENT BECAME BANKS’ BIGGEST ACCOMPLICE

Socialism for banks, capitalism for students 🤝

THE FFEL PROGRAM: LEGALIZED BANK WELFARE

💰 HOW THE SCAM WORKED (1970-2010):

🏦 For Banks:

✅ Make loans to students (collect interest)

✅ Government guarantees repayment (zero risk)

✅ If student defaults: Government pays bank in full

✅ Keep all profits: Heads I win, tails taxpayers lose

👨🎓 For Students:

❌ Still owe the money (even after government pays bank)

❌ Now owe government instead (with penalties)

❌ Higher interest rates (banks needed profit margins)

❌ Taxpayers backstop bank profits while students suffer

📊 THE NUMBERS:

Sallie Mae’s peak: $175 billion in government-backed loans

Market share: 4x larger than all other banks combined

Risk level: Literally zero (government guarantee)

Student protection: Also zero

THE REVOLVING DOOR OF CORRUPTION:

🚪 GOVERNMENT ↔ INDUSTRY PIPELINE:

From Government to Industry:

👔 Education Department officials → Executive jobs at loan companies

📋 Regulatory knowledge → Used to exploit loopholes

🤝 Insider connections → Favorable treatment for former employers

From Industry to Government:

💼 Loan company executives → Education Department positions

📜 Write regulations that benefit their former companies

🎯 Selective enforcement against competitors only

Real Example: The Navient Network

Education Dept → Navient: 12+ former officials hired

Navient → Education Dept: 8+ executives in government roles

Result: Policies written by people who profit from them

THE 2005 BANKRUPTCY LAW: BOUGHT AND PAID FOR

💸 THE LOBBYING INVESTMENT:

Sallie Mae alone: $9 million in lobbying (1999-2005)

Total industry spending: $25+ million

Campaign contributions: Millions more to key committee members

Return on investment: TRILLIONS in guaranteed profits

⚖️ WHAT THEY BOUGHT:

🚫 Private student loans = no bankruptcy discharge

🏛️ Same protection as federal loans (previously dischargeable)

🛡️ Equal to child support/criminal fines in legal status

♾️ Permanent debt with no escape mechanism

📊 THE LIE THEY SOLD:

Claim: “Students will abuse bankruptcy to avoid responsibility”

Evidence: None. Zero data supported this claim.

Reality: Student bankruptcies were extremely rare

Truth: Banks wanted guaranteed collection regardless of circumstances

CURRENT GOVERNMENT COMPLICITY:

🏛️ FEDERAL GOVERNMENT AS LOAN SHARK:

Biggest lender: $1.6+ trillion in federal loans

Revenue source: Interest payments fund government operations

Collection powers: Unlimited wage garnishment, tax seizure

Accountability: None. Government can’t go out of business

💼 LOAN SERVICING CONTRACTS:

Navient, Nelnet, MOHELA: Billions in government contracts

Performance standards: Minimal oversight

Profit motive: More profitable to keep people in debt longer

Consumer protection: Virtually nonexistent

THE REGULATORY CAPTURE PLAYBOOK:

📋 STEP 1: COMPLEXITY

Make rules so complicated that only industry experts understand them

Ensure those experts work for the companies being regulated

📋 STEP 2: SELF-REGULATION

Let industry write their own rules

Government rubber-stamps whatever they submit

📋 STEP 3: ENFORCEMENT THEATER

Occasional small fines that look like punishment

Fines smaller than profits, so violations remain profitable

No criminal charges for executives

📋 STEP 4: NARRATIVE CONTROL

Blame borrowers for “irresponsible” behavior

Frame debt forgiveness as “unfair” to those who paid

Ignore systemic issues, focus on individual responsibility

REAL CONSEQUENCES OF GOVERNMENT COMPLICITY:

💀 FOR STUDENTS:

42.7 million people trapped in government-designed debt system

Average $37k debt with no escape mechanism

Lifetime of payments regardless of income or circumstances

Credit destruction for those who can’t pay

💰 FOR BANKS/SERVICERS:

Guaranteed profits from government contracts

Legal immunity from most consumer protection laws

Regulatory capture ensures friendly oversight

Political protection from meaningful reform

THE BIPARTISAN NATURE OF THE SCAM:

🔴 Republicans:

Openly support bank profits over student welfare

Block forgiveness programs as “unfair”

Push for more private lending with fewer protections

🔵 Democrats:

Talk about reform while maintaining the system

Incremental changes that don’t threaten bank profits

Focus on managing debt rather than eliminating it

Result: No matter who wins elections, the debt machine keeps running.

WHY THIS MATTERS:

This isn’t just about money - it’s about democracy itself. When corporations can buy laws that guarantee profits at public expense, we don’t have a government of the people anymore.

Next up: The specific law that made student debt impossible to escape 🔒

Your government is supposed to protect you from predatory lenders, not partner with them. ⚖️

GOTO NEXT POST -> CLICK!

GOTO FIRST POST -> CLICK HERE

#student debt#government corruption#regulatory capture#FFEL#student loans#political corruption#lobbying#Bank Welfare#revolving door#systemic corruption#Corporate Capture#Legal Corruption#Bankruptcy Law#Student Loan Industry#gen z

1 note

·

View note

Text

Top Benefits of Building a DeFi Lending & Borrowing Platform

In the rapidly evolving world of decentralized finance, DeFi Lending/Borrowing Platform Development is revolutionizing how individuals and businesses access liquidity. By eliminating traditional intermediaries, these platforms enable seamless, peer-to-peer lending and borrowing of crypto assets. Smart contracts automate loan approvals, interest payments, and collateral management, offering a transparent and trustless experience. Startups and enterprises looking to disrupt traditional finance can leverage DeFi platforms to offer faster, borderless, and more inclusive financial services. With programmable interest rates and collateral ratios, developers can tailor financial products to meet diverse user needs and boost platform usability.

Why Choose DeFi Lending/Borrowing for Your Business?

1. Accessible Global Financing DeFi platforms eliminate geographical restrictions, allowing users to lend or borrow funds anytime, anywhere. This global access enhances financial inclusion and promotes a decentralized economy.

2. Transparent & Automated Process Smart contracts ensure that loan transactions are executed automatically with predefined conditions. This removes the risk of manipulation and promotes trust among users.

3. Collateralized & Secure Users can lock crypto assets as collateral, reducing the risk of default. These platforms often integrate real-time oracle data to maintain collateral values and avoid liquidation risks.

4. Revenue Generation Platform owners can earn through protocol fees, interest margins, and reward models. The ecosystem supports multiple income streams, making it attractive for investors and entrepreneurs alike.

5. Customizable Architecture DeFi lending protocols can be developed to suit niche business models—supporting fixed or variable interest, flash loans, or stablecoin borrowing options.

6. Community-Driven Growth With governance tokens, you can involve your community in decision-making processes, enhancing engagement and loyalty within your ecosystem.

Closing Thoughts

As a leading DeFi Development Company, Osiz offers cutting-edge solutions for businesses aiming to launch secure and scalable lending/borrowing platforms. With extensive experience in blockchain development, smart contract integration, and custom DeFi protocol creation, we tailor platforms that match your business goals and market expectations. Whether you're targeting retail users or institutional investors, our DeFi solutions are designed to deliver maximum flexibility, transparency, and performance. Empower your crypto loan venture with Osiz – your trusted partner in decentralized innovation. Our end-to-end DeFi development services ensure rapid deployment, high-grade security, and long-term scalability to position your brand at the forefront of the DeFi revolution.

0 notes

Text

Get Fast Cash with Direct Lender's Short-Term Loans UK for Debit Cards

Short term loans UK direct lender make it simple and timely to acquire financial aid. All you have to do is provide the lender with your debit card. You can receive financial aid with this loan and avoid the burden of additional papers. Unexpected costs can blow your budget, but with these debit card loans, you can acquire immediate cash and take care of your demands right now. Key characteristics of loans without debit cards with the help of this financial plan, loans between £100 and £2,500 can be obtained for duration of 14 to 30 days. Debit card loans are the sole prerequisite for these 12-month payday loans; no other requirements apply.

It is not necessary for you to give the lender any of your pricey assets or real estate. Furthermore, those with a poor credit history—default, late payments, insolvency, CCJs, etc.—can also apply for short term loans UK direct lender financial aid. Since there is no credit check involved, poor credit history is not a problem. Who is eligible to benefit from this scheme? The following requirements must be met by the borrowers in order to receive financial assistance from these loans:

1. The applicant must be an adult who is at least eighteen years old and a permanent resident of the United Kingdom.

2. He should have a long-term, UK-based bank account in his name that is no older than six months.

3. The borrower must also have been a regular employee of the same company for the last six months.

4. To be able to return the loan amount on schedule, he must make the required salary of at least £1,000 each month.

5. He ought to reside permanently in the United Kingdom. How is the plan applied for?

Applying for this short term cash loans is simple. All you have to do is provide some information (name, address, loan amount, account number, etc.) on an online application form. All you need for this online service is a PC and an internet connection. After approval, the money is sent into your account in less than a day. You can avoid waiting in line or going to the lender's office by using this service.

You are under no obligation to use any other form of identification in place of your debit card. Thus, those who are renters, non-homeowners, etc., can apply for short term loans direct lenders with ease. Debit card not used. Additionally, the loan amount helps you to pay for other little expenses such as unexpected auto repairs, school fees, medical bills, the purchase of new appliances, and other household necessities. In light of this, this financial plan is quite helpful for obtaining financial assistance during difficult times.

A short term loans UK can also refer to an advance of funds obtained through an ATM or bank transaction using an existing credit card. This sum typically maxes out at less than £1000 and is typically a fixed portion of the borrower's credit limit. As long as the amount you withdraw stays below your cash advance limit, this option is typically less expensive than a loan and offers greater flexibility.

https://classicquid.co.uk/

4 notes

·

View notes

Text

Personal Loan Pitfalls to Avoid in 2025