#HowtoTradeForex

Explore tagged Tumblr posts

Text

Forex Tools Checkers - MONEY MAKER TURBO MT4 FX EA Download Now...

#FX自動売買・EA#forexrobot#tradingforex#forexsignals#forexsuccess#forexinvesting#forextradingstrategy#automatedtrading#howtotradeforexforbeginners#metatrader#forexprofit#tradingbot#FOREX#tradingsoftware#forextrading#howtotradeforex#forexstrategy#forextradingforbeginners#forextrader#howtostartforex#forexforbeginners#forextradingsystem#forextips#algorithmictrading#forexmarket#forextradingstrategies#forexea

0 notes

Text

Trading Forex in a Downward Market: A Guide to Short Selling

Many forex traders focus on rising currency pairs, as opening BUY positions feels more straightforward and often yields good returns. However, choosing to hit that SELL button can also be a strategic move in certain conditions. Understanding short selling in the forex market can help you capitalize on various market trends. Here’s what you need to know about short selling forex assets to make the most out of any market condition.

Learn more on: https://www.investchannels.com/trading-forex-in-a-downward-market-a-guide-to-short-selling/

What is a Short Position in Forex?

Taking a “short” or SELL position in forex trading involves speculating that the asset’s price will decrease. Success depends on the asset moving down, turning a profit on the downward trend. These positions are also called “bearish,” and traders who take them are known as “bears.”

Just like long (BUY) positions, short positions are flexible in quantity—you can open as many as your account balance supports.

When Should You Short Sell in Forex?

The choice to BUY or SELL should depend on asset performance and your trading strategy. Generally, short positions are opened when an asset is predicted to drop soon. The key lies in choosing the best entry and exit points to optimize returns.

Traders may rely on technical or fundamental analysis, or a combination of both, to decide. When short selling, it’s wise to apply risk management tools, such as setting a stop-loss level, to counter potential market volatility.

How to Short Sell Forex on IQ Option

To start short selling on the IQ Option platform, follow these steps:

1. Choose a currency pair expected to fall in price.

2. Select the investment amount for the trade.

3. Enter the trade at the current price.

4. If the price moves down as predicted, close the trade to secure your profit.

Tips for Successful Short Selling in Forex

Short selling offers a way to profit when the market trends down, though it may take time to master. Here are four tips to improve your short-selling results.

1. Conduct Market Analysis

Performing comprehensive technical and fundamental analysis is crucial before short selling forex. Identify downtrends, resistance levels, and bearish signals on price charts. Indicators like the STARC Bands, Relative Vigor Index (RVI), or Psychological Line can provide insight.

For instance, when the RVI crosses below the zero line, it often signals a bearish trend. You may also want to monitor economic and geopolitical news, as events can influence currency pairs’ performance. The IQ Option platform’s ‘Market Analysis’ section is a good place to track such news without leaving the traderoom.

2. Set Realistic Profit Goals

Greed can lead traders to keep short positions open too long, risking profits. Instead, have a profit target in mind and stick to it. However, if unexpected market changes occur, be flexible—sometimes an early exit can safeguard your gains.

3. Use Risk Management Tools

Define your risk tolerance and apply a stop-loss to limit potential losses. A well-placed stop-loss can prevent surprises and secure capital in the event of sudden market shifts.

4. Keep Practicing

Short selling forex, like any trading technique, demands practice and patience. Start small, then gradually increase position sizes as you gain confidence. Maintain a trading journal to record deals, analyze outcomes, and learn from any mistakes.

Ready to try short selling? Visit IQ Option to start exploring the forex market’s full potential, regardless of direction.

#ForexTrading#ShortSelling#ForexStrategy#ForexTips#ForexMarket#ForexAnalysis#TechnicalAnalysis#ForexEducation#BearMarket#RiskManagement#ForexTradingStrategy#ForexForBeginners#HowToTradeForex#ForexIndicators#TradingPsychology

0 notes

Text

How to Develop a Trading Plan.

#WhatisForex#HowtoTradeForex#ForexChartPatterns#WhatisForexTrading#WhyTradeForex#CommonForexMistakes#ForexTradingSignals#TradingPlan#WhoTradesForex#HowtoBuyandSellCurrency

0 notes

Text

89% Win Rate Day Trading: Liquidity Breakdown STEP BY STEP GUIDE

89% Win Rate Day Trading: Liquidity Breakdown STEP BY STEP GUIDE https://ift.tt/G7KC5Jv Private VIP community Members Room – http://tradewithsolo.com In this video, I��m going to be sharing with you how I achieved an 89% win rate day trading, using a liquidity breakdown step by step. If you’re looking to start trading day trading, then this is the video for you! In this video, I’ll be explaining how I achieve an 89% win rate day trading, using a liquidity breakdown step by step. I’ll go over everything from market analysis to trade planning to execution, so that you can learn how to trade like a pro! #1 Broker I Use Ospreyfx: https://ospreyfx.com/trade-with-soloetv #1 Prop Firm Get 20% Off: https://prop.funderpro.com/signup/?referral=cc955a9d Exclusive Solo’s Mentorship: https://bit.ly/solosmasterclass Build Your Trading Journal Style & Strategies: http://lockittrade.com Subscribe to this channel here / @SoloETV Watch Our Top videos: Short on Time Try This 5-Minute Forex Trading Strategy for Small Accounts • Short on Time Try This 5 Minute Forex… Grow Any Account Size with This 5-Minute Scalping Strategy | Forex Trading Tips • Grow Any Account Size with This 5 Min… My Truth On My 5 MIN Scalping Strategy Started W $1700….. • My Truth On My 5 MIN Scalping Strateg… Stop The CAP Breakdown Real Facts $200K FUNDED! | FOREX • Video If you enjoy our episode, Hit the LIKE button, write COMMENTS below, SHARE your friends & Join our community. #ScalpingStrategy #5MinuteScalping #FOREX #Forex5MinuteScalping #trading #livetrading #livetrader #soloe #soloetv #forextrading #howtotradeforex #forexsignals #liveforexmarket #livetrading #livecryptotrading #solonetwork #soloefx from Solo E TV Trading https://www.youtube.com/watch?v=OgPMznLTfI4 via Solo E TV Trading https://ift.tt/E8GZW5o September 03, 2023 at 09:00PM

#solosforexstrategy#highwinrate#forexscalping#supplyanddemand#forextrading#forexmastery#solonetwork#soloe#soloetv#forexmistakes#forexsuccess

0 notes

Video

youtube

GBPJPY is one of my favorite pairs mainly because of its high volatility and that it respects levels making it less difficult to trade. In this video, I show you the strategies I use to trade GJ on scalping, day trading, and swing trading.

2 notes

·

View notes

Text

The Key Events that Shaped the History of Forex Trading!

Forex trading, a financial market that transcends borders and currencies, has a history deeply intertwined with the evolution of human civilization. From the barter system in ancient times to the modern global market, forex trading has undergone significant transformations, shaping the way nations, businesses, and individuals engage in international trade.

In this article, we delve into the captivating journey of forex trading, tracing its origins, pivotal milestones, and the factors that have propelled its growth into the largest and most liquid market in the world. The Barter System: The Genesis of Trade Human civilization has always thrived on the need for exchange and specialization. Before the advent of currencies, people relied on the barter system, a simple yet ingenious method of trading goods and services. Dating back to 6000 BC, this system enabled individuals to exchange commodities they possessed for ones they desired, fostering economic interactions and facilitating the fulfillment of diverse needs within communities. The Emergence of Currency: From Gold Coins to Global Trade As societies progressed, the barter system presented certain limitations, such as the need for a mutually desired item and the challenge of evaluating the relative value of different goods. To overcome these obstacles, the concept of currency emerged. During the 6th century BC, the first gold coins were minted, marking a significant shift in trade dynamics. These standardized units of value provided greater convenience, portability, and fungibility, laying the foundation for future advancements in monetary systems. The Medici Family: Pioneers of Forex Trading Fast forward to the 15th century, when the influential Medici family of Florence played a crucial role in the development of forex trading. With their extensive network of banks across different locations, the Medicis facilitated currency exchange and international trade. Their visionary approach not only enabled merchants to conduct business in foreign lands but also set the stage for the establishment of specialized financial markets dedicated to foreign exchange. The Birth of the First Forex Market in Amsterdam The 17th century marked a significant turning point in the history of forex trading. In Amsterdam, the world's first dedicated forex market came into existence, serving as a central hub for foreign exchange transactions. This pivotal development revolutionized the way currencies were traded, providing a platform for buyers and sellers to come together and establish exchange rates based on supply and demand. The Amsterdam forex market laid the groundwork for the modern forex market we know today. The Collapse of the Bretton Woods System: A Paradigm Shift The 1970s brought forth a transformative event that would shape the future of forex trading—the collapse of the Bretton Woods system. Previously, major currencies were pegged to the value of gold, fostering stability and predictability. However, as economic dynamics shifted, the fixed exchange rate system became unsustainable. The dissolution of the Bretton Woods system heralded the era of free-floating exchange rates, where currency values were determined by market forces. This fundamental change opened up new opportunities for traders to profit from fluctuations in currency values. The Technological Revolution: Empowering Individual Traders The 1980s witnessed a revolution in technology, particularly with the rise of personal computers and the internet. These advancements democratized forex trading, making it more accessible to individual traders worldwide. Previously, forex trading was predominantly the domain of large financial institutions and corporations. However, with the advent of user-friendly trading platforms, real-time data feeds, and online brokers, individuals gained the ability to participate in the forex market from the comfort of their own homes. This paradigm shift in accessibility and convenience marked a crucial milestone in the history of forex trading. Innovations in Trading Technologies: Breaking Down Barriers Continuing the trajectory set in the 1980s, the 1990s witnessed further advancements in trading technologies that revolutionized the forex market. The development of electronic communication networks (ECNs), algorithmic trading, and high-frequency trading brought unprecedented speed, efficiency, and transparency to forex transactions. These innovations not only reduced the barriers to entry for traders but also enhanced market liquidity, facilitating seamless execution of trades and enabling participants to capitalize on market opportunities with greater precision. A Global Market: Trading Around the Clock Today, the forex market transcends time zones and operates 24 hours a day, five days a week. This continuous nature of the market ensures that traders can engage in transactions at any time, regardless of their geographic location. The forex market's global reach has created a truly interconnected world of currencies, where traders can profit from fluctuations in exchange rates across different economies. The accessibility and liquidity of the forex market make it an enticing arena for investors seeking diversification, hedging, and speculative opportunities. The Future of Forex Trading: Unlimited Potential As we gaze into the future, the growth and importance of forex trading are poised to continue. With the world becoming increasingly interconnected and globalized, the opportunities for traders to profit from currency movements will expand. Technological advancements, including artificial intelligence, machine learning, and blockchain, are expected to revolutionize the forex market further. These innovations may enhance trading efficiency, provide new analytical tools, and foster increased transparency. As the forex market evolves, traders can expect a more dynamic, accessible, and rewarding trading experience. Overall, the history of forex trading is a captivating narrative that spans centuries of economic evolution and technological progress. From the barter system to the establishment of the first forex market in Amsterdam, and from the collapse of the Bretton Woods system to the digital age of algorithmic trading, each chapter in this journey has left an indelible mark on the forex landscape. Today, the forex market stands as the largest and most liquid financial market globally, inviting traders from all walks of life to explore its vast potential. If you aspire to delve deeper into the world of forex trading, a plethora of online resources and libraries offer valuable insights and knowledge to equip you on your trading journey. Read the full article

#beginner'sguidetoforextrading#forextradingforbeginners#forextradinghistory#futureofforextrading#historyofforexmarket#howforextradingstarted#howtotradeforex#keyeventsinforextradinghistory#learnforextrading#originsofforextrading#stockmarket#UK#unitedkingdom#unitedstates#USeconomy#USA

0 notes

Video

youtube

HuracanFX Official - FOREX ELITE MOTIVATION

#HuracanFX Official Elite 5% Trading ExposedFOREXHow to tradeforex take profitsFXlifestyleFortnightInstagramHuracanfxhuracan fxGoogle search#huracanfx#elitetrading#forex#forextrader#howtotradeforex#forexprofit#isforexprofitable#googlesearch#huracanfxgoldgroup#goldgroup#telegram#forexlife#forexlifestyle#financial#markets#usdjpy#gbpusd#eurusd#audusd#majors#minor#crosses#technicals#fundamentals#institucional

1 note

·

View note

Text

#supermarketfx#forextrading#forex#scalping#forexscalpingstrategy#1-minutescalping#tradingforex#tradingstrategies#bestscalpingstrategies#howtotrade#howtotradeforex#besttradingstrategy#foreign exchange trading#tradingcurrencies#forextradingforbeginners#howtotradingthe1minutechart#learnforex#forexscalptrading#metatrader#tradingview

1 note

·

View note

Video

youtube

Trading WTF (where-to-focus) with Theodore Kekstadt

#ForexTrading#HowToTradeForex#ForexTradingSignals#HighProbableJapaneseCandlestickPatterns#ForexTradingUnlocked#TeddyKekstadt

0 notes

Link

Many traders come and go from this market as many are not aware of the Forex Trading Strategies and How to Trade Forex Trading due to which they give up.

0 notes

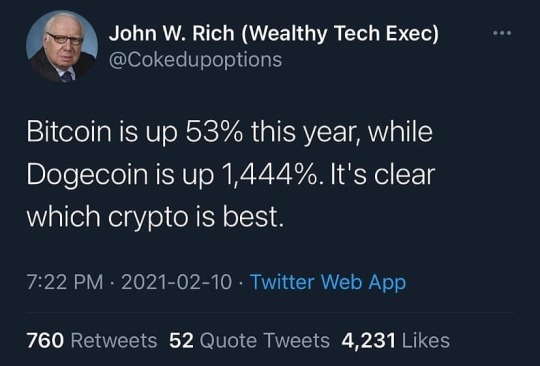

Photo

Clear winner here 😂 Credit: @richtechexec Follow: @provencrypto #econmemes #stockmarkettips #intradaytrading #howtoinvest #forexmemes #bitcoinmemes #howtotradeforex #tradinglifestyle #bullish #fundamentalanalysis #thewolfofwallstreet #stockmarketcrash #swingtrade #stockmarketmemes https://www.instagram.com/p/CLUY_QsgjEj/?igshid=opojdg59muww

#econmemes#stockmarkettips#intradaytrading#howtoinvest#forexmemes#bitcoinmemes#howtotradeforex#tradinglifestyle#bullish#fundamentalanalysis#thewolfofwallstreet#stockmarketcrash#swingtrade#stockmarketmemes

0 notes

Text

Common Forex Mistakes.

#WhatisForex#HowtoTradeForex#ForexChartPatterns#WhatisForexTrading#WhyTradeForex#CommonForexMistakes#ForexTradingSignals#TradingPlan#WhoTradesForex#HowtoBuyandSellCurrency

0 notes

Photo

Open anAccount: https://fbs.com/?ppf=11141604 Follow , like & share @dr_srf 🌟 . . . . . #forexeducation #forexfrance #forexnews #forexsignals #forexmarket #comercioforex #forexsignal #forexsignalservice #forex #tipsdeforex #analisisdeforex #forexlife #forextraders #forexlifestyle📊📉📈💴💵💷💸 #learnforex #forextips #forexbroker #forextrader #comoinvertirenforex #howtotradeforex (at United Arab Emirates) https://www.instagram.com/p/CEDdoeYD4kd/?igshid=189dcfiqeln4i

#forexeducation#forexfrance#forexnews#forexsignals#forexmarket#comercioforex#forexsignal#forexsignalservice#forex#tipsdeforex#analisisdeforex#forexlife#forextraders#forexlifestyle📊📉📈💴💵💷💸#learnforex#forextips#forexbroker#forextrader#comoinvertirenforex#howtotradeforex

0 notes

Text

Forex Chart Patterns

#WhatisForex#HowtoTradeForex#ForexChartPatterns#WhatisForexTrading#WhyTradeForex#CommonForexMistakes#ForexTradingSignals#TradingPlan#WhoTradesForex#HowtoBuyandSellCurrency

0 notes

Video

youtube

Ghost- A Forex, Nadex, and Binary Options Trading System!

Watch video Here https://youtu.be/stD8UJXCJDE

#Forex #Nadex #Binary #Options #trading #Day #Trading #forexsystem #indicators #mt4indicators #HowtoTradeForex #NadexIndicators #Nadextradingsystem

1 note

·

View note