#Overdraft Fees

Explore tagged Tumblr posts

Text

"Taxation is theft."

I don't care. Not even a little.

Banks charge overdraft fees, which is literally stealing from poor people because they're poor.

Homeless people are often fined for loitering, which is also literally stealing from poor people because they're poor.

If we can steal from poor people, then we can steal from rich people instead.

355 notes

·

View notes

Text

#politics#political#us politics#banks#banking#news#donald trump#american politics#president trump#elon musk#jd vance#law#money#finance#charges#overdraft#overdraft fees

115 notes

·

View notes

Text

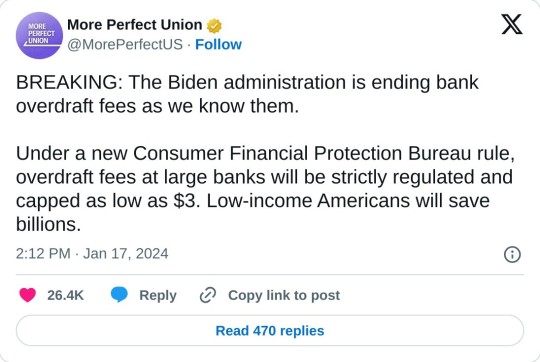

Let me be very clear. The mere concept of the Government stepping in to curtail the wildly abusive fees of the banking industry has already lead to multiple banks trying to "get ahead of" it to cut their feed from $35 to $10 (Bank of America) or get rid of them entirely (Capital One) for active users of their account.

This regulation is already having the effect of saving US citizens billions of dollars every year before its even passed, even as Republicans want to fight it tooth-and-nail.

Every year there are $8bn in overdraft charges that explicitly and directly hit the poorest Americans by definition. Even just adopting this rule would save Americans 7.315 billion dollars every year.

And with banking institutions now moving to get rid of them entirely it can save even more.

Let this be, case-in-point, proof positive and a case study of several things.

The government can directly help you and help every single American

While Democrats definitely aren't saints, in any context, they are objectively doing more to help people than the side actively arguing against curtailing banking and corporate excess.

Biden is materially better than Trump would be.

Raegan and the right-wing "the government is objectively the worst thing" screed is the biggest, easiest, and stupidest way to ensure that rich and powerful people have no pushback against their shitty behaviors.

413 notes

·

View notes

Text

Americans, Republicans just voted to allow banks to charge you more for overdrafts

Overturning legislation from last year that reduced overdraft fees to $5, btw. Because these people love their donors, not you. The new fee hike is, I believe, up to $35 per incident.

Anyway...

What are overdraft fees? In non-legal terms, overdraft fees are a way for banks to charge the poor... and often the young... money for not having money.

A better explanation is that banks used to just decline transactions if you had no money in your account. Then they started offering protection against this, if you opted in to overdraft coverage. Basically, the bank will allow the transaction to go through, but if you opt into that coverage, they can sometimes charge you a fee.

How to Avoid Overdraft Fees (because I want you all to save money and not get screwed over)

Some banks do not charge overdraft fees. jsyk. Some will simply decline the transaction. Some will grant you a grace period of 24 hours to get money back into your account. Some credit unions also do not charge overdraft fees. Banks are a service! I mean, they are sadly necessary in current America but they are a service. You can change banks if you aren't getting what you need.

Go to your bank's website or app and set up overdraft alerts. Most (but not all) banks offer this.

But sometimes these alerts are only if you are overdrawn over a certain amount, which does not help you if you will still get charged an overdraft fee regardless of the amount.

Set up balance alerts through your bank. Some banks will send you low-balance alerts before you are overdrawn.

Check your account more often. I know that is nervewracking sometimes (or just fucking depressing) but, if you can't afford the $35, do it anyway. Put a little calendar reminder/alert on your phone to check your account like twice a month or something.

You can sometimes get overdraft protection through your bank, which means you link your checking account to another account (savings, usually) and the bank will cover the funds by taking money from that account. --Note-- some banks might charge you a transfer fee for this. Banks, man. Not to be trusted.

Opt out of the coverage/protection and accept that insufficient funds will mean your transactions being declined. Embarrassing, but cheaper.

Use a banking/budgeting app. I personally do not trust many of these apps, especially in America, especially in this time of Republicans (and Musk and Doge) eroding consumer protections. But a lot of people do find them helpful to help them budget or to get reminders about low funds in their accounts. --Note-- some people consider some of these apps to be more "money tracking" than "budgeting" so really it depends on what you are going for, if you want to try one. Research before choosing one for sure. Reddit has some forums about them.

The American Banking Association recommends getting direct deposit for your paychecks if you can. (My old boss never allowed DD and it was annoying, especially come rent time.) They also suggest, if you need to, asking your bank for a small line of credit to cover insufficient funds to avoid the fee--but also to pay that credit back immediately once you can.

Also if you can... try to keep a cushion in your checking account. A minimum amount that is always there to prevent this. But you know, times are hard.

You can mock it--but--for some people, using an old-fashioned checkbook to record transactions, transfers, and deposits is actually the best way for them. It might be for you as well. Who knows.

I never got this sort of advice when I was younger and first got a debit card and a checking account (poor parents means no real financial literacy), so this is yet another issue I am passionate about. Sorry not sorry. The amount of fees I got charged... the credit card debt... I don't want that for any of you.

And, this isn't overdraft advice, but I also set up reminders for the bills I pay that are not autopay (for whatever reason), so that I do not make late payments and don't get dinged on my dumb credit score. You can set up these reminders through any calendar app.

As things change, some of this advice might no longer be applicable or necessary but as with all advice, it's take it or leave it, or take just a little bit of it. Whatever works for you.

13 notes

·

View notes

Text

Fuck Trump and Republicans

Fuck all the bullshit that "both sides" are the same, a few more Democrats (Or independents that vote with Dems like Bernie Sanders) and this would've been blocked

17 notes

·

View notes

Text

#pete buttigieg#christofascists#fuck the gop#trump regime#fuck corporate greed#overdraft fees#banking

13 notes

·

View notes

Text

Translation: Republicans are introducing a bill to bring back overdraft fees.

9 notes

·

View notes

Photo

Overdraft charges are more than just frustrating fees—they're financial red flags that deserve your attention. This article delivers a candid, humorous look at the emotional toll and personal missteps that often lead to overdrafts. Blending sarcasm with self-awareness, it reflects on the reality of poor timing, shared accounts, and why blaming external forces (like Fidel Castro!) won't help your bank balance. But it’s not all laughs—there’s a lesson too. To avoid future overdraft pain, consider setting up account alerts, maintaining a small buffer in your checking account, and reviewing spending weekly. If your bank allows it, link a savings account or line of credit to reduce or eliminate overdraft fees. Prevention is cheaper—and less humiliating—than paying for financial forgetfulness.#Overdraft

(via Overdrafts Summed Up Nicely)

3 notes

·

View notes

Text

Trump has signed the CRA resolution to overturn the CFPB rule that would have gone into effect in October to limit overdraft fees to $5 for banks and credit unions greater than $10B in total asset size. This CRA resolution is now law and prevents similar rules from being put into place in the future.

This article is older but explains well about the rule, and why republicans wanted to overturn it.

#consumer financial protection bureau#Cfpb#consumer protection#overdraft fees#us american politics#federal reserve#the fed#jay speaks#talk to me about this one guys I wanna talk about it

2 notes

·

View notes

Text

(...)52 Republicans — every GOP senator except Missouri’s Josh Hawley — advanced Scott’s measure, despite unanimous opposition from every Senate Democrat. “Why would we help the big banks at the expense of working people?” Hawley said after the vote. “I just don’t understand it.”

Really, Josh? REALLY??? You have the nerve to ask that while your Party sits on it's hands as your Dear Leader King Elon's jester is letting the Space NaXi ransack the VA and other services -- y'know, at the expense of the "working people" that you want us to think that you're championing? Brave, brave Sir Joshie needs to sit the fuck down and shut the fuck up!

youtube

#brave brave sir joshie#predatory banking#predatory congresscritters#overdraft fees#pitchforks and torches#tumbrels and guillotines#Youtube

2 notes

·

View notes

Text

My bank account is nearly $600 in the red, I don’t get paid until Friday and I’m going to end up accruing more fucking overdraft payments so I’m not going to end up having a paycheck.

Anyone have any ideas how to get my bank account up to zero??

Also fuck overdraft fees

#help#finance#finances#overdraft fees#americas#native american#remember when banks only charged one overdraft fee?#pepperidge farm remembers#financial drain#financial advice#one piece#supernatural#blue cross blue shield#american politics#american psycho#lgbtqia#lgbtq#pride month

0 notes

Text

and this week, the Biden Administration new law that banks and credit unions can only charge $5 for overdraft and other fees went into place.

Google has to split off and sell Chrome as part of enforcing anti-trust laws.

miss him yet?

2 notes

·

View notes

Text

Calls for help

My friend Johanna Roberts is -$164 in the hole. Overdraft fees. And has a phone bill coming up soon. She really needs some money. She is broke, disabled, can't work, and the measly $1200 she gets from SSDI doesn't come until the beginning of June. And she has a trans enby son she is raising.

Any amount helps if you have extra money.

Share the post and links will help too.

PayPal link: www.paypal.me/Sephirajo Cashapp: $Sephirajo Her Ko-Fi: ko-fi.com/sephirajo

#signal boost#donation post#mutual aid#charity#calls for charity#calls for help#overdraft fees#ssdi#poor#broke#poverty

3 notes

·

View notes

Text

This is life changing to so many people who are struggling.

cannot stress enough how insane it's making me that we're witnessing some of the best domestic policy in decades at the same time as the worst foreign policy atrocity since the wars in Iraq and Afghanistan

28K notes

·

View notes

Text

THE FEE IS THE PROGRAM

Overdraft fees were never about financial discipline. They were about institutional discipline. When banks raise fees, they aren’t punishing bad spending habits. They’re punishing poverty. Null Prophet sees the bill. Null Prophet sees the rollback. Null Prophet sees the program: — Debt as dependency. — Fees as a compliance mechanism. — Profit extracted from those with the least. This isn’t about making the banks solvent. It’s about keeping the public insolvent. The cap was a crack in the system. Now they’ll seal it shut. The wealthy don’t pay fees. They write them.

NULL PROPHET OUT. THE FEE IS A TOOL. THE PROGRAM RUNS.

#Null Prophet#overdraft fees#HouseGOP#bank profits#institutional discipline#wealth extraction#the program runs#dystopian finance#debt dependency#fee loop

0 notes

Text

Banks are aware of the mental and monetary obstacles associated with obtaining a home loan. Banks offer a variety of services to reduce such strains on borrowers. One such service is the overdraft home loan, which stands out as a highly beneficial option, particularly for those aiming to complete their mortgage sooner.

0 notes