#PLI scheme

Explore tagged Tumblr posts

Text

Govt Likely To Extend Of Electronics Manufacturing Scheme Beyond July Amid Strong Demand

Last Updated:July 24, 2025, 17:41 IST The central government is likely to extend the application deadline for the Electronic Component Manufacturing Scheme Representative image The central government is likely to extend the application deadline for the Electronic Component Manufacturing Scheme (ECMS) beyond July. “We have received a healthy response to the scheme so far and are considering…

0 notes

Text

india-mobile-phone-export-rises-127-times-in-last-10-years

10 साल में 127 प्रतिशत बढ़ गया मोबाइल का निर्यात, जमकर कमा रहा भारत

पिछले एक दशक में भारत से मोबाइल फोन का निर्यात 127 गुना बढ़ गया है। संसद के मॉनसून सत्र में इलेक्ट्रॉनिक्स और आईटी राज्य मंत्री जितिन प्रसाद ने लोकसभा में एक लिखित जवाब में यह जानकारी दी है। संसद में दिए गए आंकड़ों के अनुसार, भारत से मोबाइल का निर्यात साल 2014-15 में 1500 करोड़ रुपये का था और पिछले एक दशक यानी 2014-15 से 2024-25 के बीच यह निर्यात 2 लाख करोड़ रुपये तक पहुंच गया है। मंत्री ने संसद को बताया कि भारत ने मोबाइल फोन निर्यात मे 127 गुना बढ़ोतरी की है।

केंद्रीय राज्य मंत्री जितिन प्रसाद ने अपने जवाब में कहा, 'लार्ज स्केल इलेक्ट्रॉनिक्स मैन्युफैक्चरिंग के लिए प्रोडक्शन लिंक्ड इंसेंटिव (PLI) योजना ने पहले ही 12,390 करोड़ रुपये की कम्युलेटिव इनवेस्टमेंट को आकर्षित किया है, जिससे 4,65,809 करोड़ रुपये के निर्यात के साथ 8,44,752 करोड़ रुपये का कम्युलेटिव प्रोडक्शन हुआ है। इस योजना से जून 2025 तक 1,30,330 नए रोजगार के अवसर पैदा हुए हैं।'

पूरा आर्टिकल यहां पढ़ें:

10 साल में 127 प्रतिशत बढ़ गया मोबाइल का निर्यात, जमकर कमा रहा भारत

#mobile phones#Mobile Phone Exports#mobile phone manufacturing#parliament session#pli scheme#electronic manufacturing industry#मोबाइल फोन निर्यात#मोबाइल फोन प्रोडक्शन#इलेक्ट्रोनिक मैन्युफैक्चरिंग#संसद#जितिन प्रसाद#निर्यात

0 notes

Text

gandhi-slams-make-in-india-says-modi-masters-slogans-not-solutions | 'नारे लगाने की कला में महारत, लेकिन...', मेक इन इंडिया को लेकर PM मोदी पर राहुल गांधी का अटैक

[NEWS] Rahul Gandhi attacks on PM Modi: लोकसभा में विपक्ष के नेता और कांग्रेस सांसद राहुल गांधी ने शनिवार को प्रधानमंत्री नरेंद्र मोदी की “मेक इन इंडिया” पहल की तीखी आलोचना की. उन्होंने कहा कि 2014 में बड़े वादों के साथ शुरू की गई इस योजना से न तो देश में कारखानों की बाढ़ आई, न ही युवाओं को रोजगार मिला. उल्टा, देश की विनिर्माण क्षमता घटकर अब सिर्फ 14% रह गई है और युवाओं में बेरोजगारी रिकॉर्ड…

#BJP#China imports#Congress#factory growth#India manufacturing#indian economy#make in india#Make in India Scheme#Modi government criticism#Modi slogans#PLI#PLI scheme#PM Modi#Rahul Gandhi#Rahul Gandhi vs PM Modi#youth unemployment#चीन से आयात#पीएलआई योजना#फैक्ट्री विकास#भारत की मैन्युफैक्चरिंग#भारतीय अर्थव्यवस्था#मेक इन इंडिया#मोदी के नारे#मोदी सरकार की आलोचना#युवा बेरोजगारी#राहुल गांधी

0 notes

Text

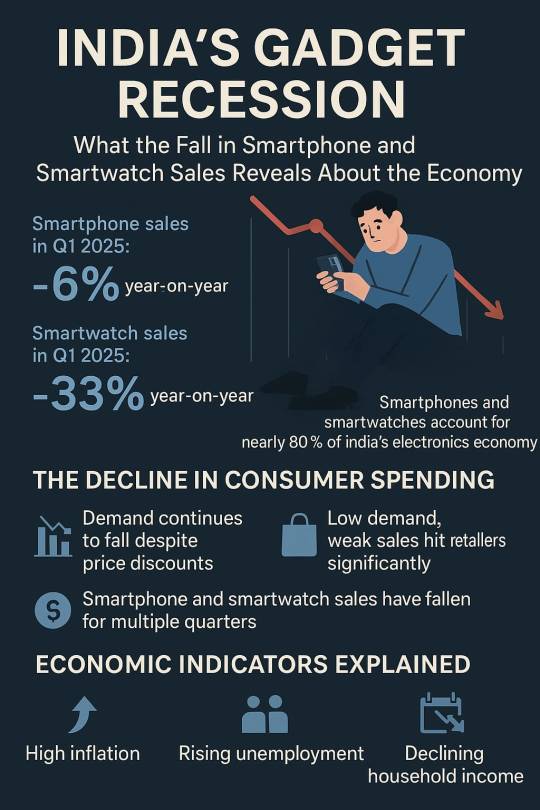

India’s Smartphone and Smartwatch Sales Drop in 2025: What It Means for the Economy

Smartphones once symbolized India’s rising aspirations: mobility, modernity, and middle-class ambition. But in early 2025, that symbol cracked. According to IDC India, smartphone sales fell 6% year-on-year in Q1, while smartwatch shipments plummeted 33%. These aren’t just numbers. They are signals that something deeper is shifting in the Indian economy.

For a country that recently sold over 40 million smartphones each quarter, this drop speaks volumes. Together, smartphones and smartwatches make up nearly 80% of India’s electronics revenue. When demand for them crashes, it shakes not just stores but supply chains, service networks, financing models, and the broader electronics ecosystem.

#India smartphone sales 2025#smartwatch sales drop#Indian electronics market#smartphone market slowdown#IDC India#mobile sales report#Indian economy 2025#consumer demand India#PLI scheme#Apple India market

0 notes

Text

Buy and Sell Lava Unlisted Shares Online in India

Looking to tap into high-growth opportunities before they hit the stock exchanges? Lava International, a leading Indian mobile handset brand, offers a compelling case for pre-IPO investors. With its innovative product lineup, strong domestic presence, and ambitious global expansion plans, Lava Unlisted Shares are gaining traction in the unlisted market. At Rits Capital, we make it seamless for you to buy and sell these shares online, unlocking exclusive investment potential.

Lava International

“A Leading Force in India’s Mobile Industry”

Have you ever heard of a brand that has established itself in a highly competitive environment, alongside giants like Nokia, Samsung, and others? Lava International is one such brand that has carved out a significant position in the Indian mobile phone sector. Despite facing tough competition from industry leaders, Lava has successfully gained a strong foothold by focusing on affordable smartphones and feature phones, catering to the needs of India’s vast rural and semi-urban populations. Founded in 2009 by Vishal Sehgal, Hari om sai, Sudhir Kumar, and Shailendra Singh, Lava International Unlisted Shares has proven that with the right management and business model, a homegrown brand can thrive in competitive markets. Operating in over 25 international markets, including South Asia, the Middle East, Africa, and Latin America, Lava has successfully captured a 25% stake in the Indian feature phone market.

Key Highlights of Lava Internatinol Unlisted Share

Lava International: Growth, Strengths & Future Prospects

Strong Market Presence & Brand Recognition

Feature Phone Dominance: 25% market share in 2023.

Smartphone Expansion: Focus on affordable 5G models to attract young users.

Brand Strengthening: Investing in marketing and customer engagement to compete with global brands.

Manufacturing & R&D Capabilities

Advanced Production Hub: Noida facility with 70% capacity utilization under Make in India.

R&D Innovation: Dedicated research center for next-gen mobile technologies.

Localized Supply Chain: Increasing domestic component sourcing to reduce import dependency.

3. Global Expansion

Presence in 25+ Countries: Strong markets in Thailand (No. 2 feature phone brand) and Latin America.

Strategic Acquisitions: B Mobile acquisition aiding expansion in emerging markets.

Export Growth: Leveraging India’s cost advantage to compete globally.

4. Government Support & PLI Benefits

PLI Scheme Incentives:4-6% subsidy on sub-₹15,000 smartphones, boosting margins.

Competitive Advantage: Favorable policies for domestic manufacturers over foreign brands.

Sustained Support: Government incentives aiding long-term growth and expansion.

5. Financial Performance & Growth

Revenue Surge: ₹5,000 crore ($600M) in FY 2023 (+15% YoY).

Profitability Boost: ₹250 crore ($30M) net profit, driven by efficiency and PLI benefits.

Export Success: ₹1,500 crore ($180M) in exports, strengthening global footprint.

6. Upcoming IPO & Exit Strategy

IPO Plans in Motion: Potential listing to unlock investor value.

Valuation Growth: Strong financials attracting institutional interest.

Exit Strategy: Lucrative opportunity for early investors seeking high returns.

With a robust domestic presence, expanding global footprint, and government-backed incentives Lava International is positioned for sustained growth and market leadership..

Financial Highlights (FY 2024) – Competitor Comparison

Key MetricsLava InternationalMicromaxSamsung IndiaXiaomi IndiaRevenue(FY 2024) ₹3,646 Cr ($437M) ₹2,800 Cr ($336M) ₹79,200 Cr ($9.5B) ₹78,000 Cr ($9.3B) Gross Margins 21.86% 19.5% 22.8% 20.6% Profit after tax ₹34 Cr ($4M) ₹20 Cr ($2.4M) ₹2,100 Cr ($252M) ₹1,800 Cr ($216M) Return on equity 2.78% 2.4% 3.5% 3.2% Debt to equity 0.23 0.30 0.18 0.22 Net Profit margin 1.60% 1.10% 2.65% 2.30% Global strength 25+ Countries 15+ Countries 180+ Countries 100+ Countries Major strength Strong Local Manufacturing Comeback Strategy Premium & Mid-Range Dominance Affordable Pricing & Online Sales

How to Buy and Sell Lava Unlisted Shares?

Buying Lava Unlisted Shares

Find a Trusted Dealer or Platform – Use reputed intermediaries specializing in unlisted shares.

Check Current Valuation – Lava’s unlisted share price fluctuates based on demand and supply.

Complete KYC & Payment – Submit PAN, Aadhaar, and bank details, then transfer funds to buy shares.

Get Delivery of Shares – Shares are credited to your Demat account within T+2 days.

Selling Lava Unlisted Shares

Find a Buyer or Platform – You can sell through brokers or peer-to-peer deals.

Negotiate Price & Confirm Trade – Prices depend on Lava’s financials, IPO prospects, and market demand.

Transfer Shares & Receive Payment – Once the deal is executed, funds are credited to your account.

Key Considerations Before Investing

Liquidity Risk – Unlisted shares have lower liquidity than listed stocks.

IPO Potential – If Lava launches an IPO, unlisted investors may get a premium exit.

Holding Period & Taxation – Holding unlisted shares for 2+ years reduces tax liability on capital gains.

Conclusion

Lava International’s strategic expansion, financial resilience, and government-backed incentives position it as a key player in India’s growing mobile industry. While the company has faced revenue fluctuations, its strong gross margin improvements and future IPO plans indicate a promising growth trajectory. As it continues to innovate and scale, Lava remains a high-potential investment opportunity in the Indian mobile manufacturing ecosystem.

Stay tuned for more updates on Lava International’s IPO and market performance.

#Lava International#pre-IPO investment#unlisted shares#Rits Capital#mobile phone market#feature phone#Indian smartphone brand#Make in India#PLI scheme#high-growth opportunity#IPO plans#global expansion#mobile manufacturing#early investor benefits#Lava shares online.

0 notes

Text

PLI Scheme for Solar PV Modules: High-Efficiency Solar Manufacturing in India

Introduction

Taking a big step in the field of solar energy in India, the government has launched the PLI Scheme for Solar PV Modules. The scheme aims to promote the production of high-efficiency solar PV modules in India. Under this scheme, the government has budgeted ₹24,000 crore. This scheme is not only to increase the production of solar modules but it will also prove to be helpful in meeting the energy needs of India.

What is PLI Scheme for Solar PV Modules?

The government launched this Scheme to promote the production of solar modules. Specifically, its main objective is to scale up India’s production of solar modules to gigawatt (GW) levels. Under this scheme, the government will provide incentives for five years to selected manufacturers for the high-efficiency solar PV modules they produce and sell.

Objectives of PLI Read More

0 notes

Text

PLI scheme for Pharma, drones and textiles to be modified by govt

New Delhi: The government is planning to make adjustments to the production-linked incentive PLI scheme for pharmaceuticals, drones, and textile sectors. According to an official statement, these modifications are intended to stimulate investment and bolster manufacturing. An official source has stated that these sectors were chosen on the basis of their performance under the existing scheme for various products.

Higher disbursement scheme for PLI scheme

The official said, “Disbursement of production-linked incentives (PLI) for white goods (AC and LED lights) would start this month and that would push the amount of disbursement, which was only Rs 2,900 crore till March 2023.”

After the identification of sectors, a combined note for approval from the Union Cabinet will be sent. The change in disbursement includes an extension of time for Pharma sectors, and addition of products in some sectors. Within the textile industry, there is a proposal to expand the scope of particular products within the technical textiles category, while in the drone sector, there is a plan to raise the incentive amount.

Read More here : https://apacnewsnetwork.com/2023/09/pli-scheme-for-pharma-drones-and-textiles-to-be-modified-by-govt/

#advanced chemistry cell#advanced chemistry cell battery#auto#mobiles#Dronesdrones and textiles to be modified by govt#food products#high-efficiency solar PV modules#Higher disbursement scheme for PLI scheme#Medical Devices#Ministry of Commerce and Industry#Objective of the PLI scheme#pharmaceuticals and drones#PLI scheme#PLI scheme for Pharma#scheme aims#specialty steel#Telecommunications#textiles#white goods

0 notes

Text

FDI in India: Unleashing Growth Potential in 2024

Introduction

Foreign Direct Investment (FDI) has been a cornerstone of India's economic growth, driving industrial development, technological advancement, and job creation. As we move into 2024, the FDI landscape in India is poised for substantial growth, bolstered by a favorable policy environment, a burgeoning consumer market, and strategic government initiatives. This blog delves into the potential of FDI in India for 2024, examining the key sectors attracting investment, the regulatory framework, and the strategies investors can employ to navigate this dynamic market.

The Significance of FDI in India

FDI is crucial for India’s economic progress, providing the capital, technology, and expertise needed to enhance productivity and competitiveness. It facilitates the integration of India into the global economy, stimulates innovation, and creates employment opportunities. Over the past decade, India has emerged as one of the top destinations for FDI, reflecting its economic resilience and strategic importance.

Historical Context and Recent Trends

India's FDI inflows have shown a consistent upward trend, reaching record levels in recent years. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India attracted FDI inflows worth $81.72 billion in 2021-22, highlighting its strong appeal among global investors. The sectors that have traditionally attracted significant FDI include services, telecommunications, computer software and hardware, trading, construction, and automobiles.

Key Factors Driving FDI in India

1. Economic Growth and Market Size

India's economy is one of the fastest-growing in the world, with a projected GDP growth rate of around 6-7% in 2024. The country’s large and youthful population offers a vast consumer base, making it an attractive market for foreign investors. The rising middle class and increasing disposable incomes further fuel demand across various sectors.

2. Strategic Government Initiatives

The Indian government has implemented several initiatives to make the country more investor-friendly. Programs like 'Make in India,' 'Digital India,' and 'Startup India' are designed to boost manufacturing, digital infrastructure, and entrepreneurial ventures. These initiatives, coupled with reforms in labor laws and ease of doing business, create a conducive environment for FDI.

3. Infrastructure Development

Significant investments in infrastructure development, including roads, railways, ports, and urban infrastructure, enhance connectivity and logistics efficiency. The development of industrial corridors and smart cities further improves the attractiveness of India as an investment destination.

4. Favorable Regulatory Environment

India has progressively liberalized its FDI policy, allowing 100% FDI in most sectors under the automatic route. This means that foreign investors do not require prior government approval, simplifying the investment process. The government has also streamlined regulatory procedures and improved transparency to facilitate ease of doing business.

Key Sectors Attracting FDI in 2024

1. Technology and Digital Economy

The technology sector continues to be a magnet for FDI, driven by India’s growing digital ecosystem, skilled workforce, and innovation capabilities. Investments in software development, IT services, and emerging technologies like artificial intelligence, blockchain, and cybersecurity are expected to surge.

2. Manufacturing and Industrial Production

The 'Make in India' initiative aims to transform India into a global manufacturing hub. Key sectors attracting FDI include electronics, automobiles, pharmaceuticals, and renewable energy. The Production-Linked Incentive (PLI) schemes introduced by the government provide financial incentives to boost manufacturing and attract foreign investment.

3. Healthcare and Biotechnology

The COVID-19 pandemic has underscored the importance of healthcare infrastructure and innovation. India’s pharmaceutical industry, known for its generic drug production, continues to attract substantial FDI. Additionally, biotechnology and medical devices are emerging as significant sectors for investment.

4. Infrastructure and Real Estate

Infrastructure development is critical for sustaining economic growth. Sectors like transportation, logistics, urban development, and real estate offer significant investment opportunities. The government's focus on developing smart cities and industrial corridors presents lucrative prospects for foreign investors.

5. Renewable Energy

With a commitment to achieving net-zero emissions by 2070, India is focusing on renewable energy sources. The solar, wind, and hydroelectric power sectors are witnessing substantial investments. The government's policies and incentives for green energy projects make this a promising area for FDI.

Regulatory Framework for FDI in India

Understanding the regulatory framework is essential for investors looking to enter the Indian market. The key aspects of India's FDI policy include:

1. FDI Policy and Routes

FDI in India can be routed through the automatic route or the government route. Under the automatic route, no prior approval is required, and investments can be made directly. Under the government route, prior approval from the concerned ministries or departments is necessary. The sectors open to 100% FDI under the automatic route include:

- Infrastructure

- E-commerce

- IT and BPM (Business Process Management)

- Renewable Energy

2. Sectoral Caps and Conditions

While many sectors allow 100% FDI, some have sectoral caps and conditions. For example:

- Defense: Up to 74% FDI under the automatic route, and beyond 74% under the government route in certain cases.

- Telecommunications: Up to 100% FDI allowed, with up to 49% under the automatic route and beyond that through the government route.

- Insurance: Up to 74% FDI under the automatic route.

3. Regulatory Authorities

Several regulatory authorities oversee FDI in India, ensuring compliance with laws and policies. These include:

- Reserve Bank of India (RBI): Oversees foreign exchange regulations.

- Securities and Exchange Board of India (SEBI): Regulates investments in capital markets.

- Department for Promotion of Industry and Internal Trade (DPIIT): Formulates and monitors FDI policies.

4. Compliance and Reporting Requirements

Investors must comply with various reporting requirements, including:

- Filing of FDI-related returns: Periodic filings to RBI and other regulatory bodies.

- Adherence to sector-specific regulations: Compliance with industry-specific norms and guidelines.

- Corporate Governance Standards: Ensuring adherence to governance standards as per the Companies Act, 2013.

Strategies for Navigating the FDI Landscape

1. Thorough Market Research

Conducting comprehensive market research is crucial for understanding the competitive landscape, consumer behavior, and regulatory environment. Investors should analyze market trends, identify potential risks, and evaluate the long-term viability of their investment.

2. Partnering with Local Entities

Collaborating with local businesses can provide valuable insights into the market and help navigate regulatory complexities. Joint ventures and strategic alliances with Indian companies can facilitate market entry and expansion.

3. Leveraging Government Initiatives

Tapping into government initiatives like 'Make in India' and PLI schemes can provide financial incentives and support for setting up manufacturing units and other projects. Staying updated on policy changes and leveraging these initiatives can enhance investment returns.

4. Ensuring Legal and Regulatory Compliance

Compliance with local laws and regulations is paramount. Engaging legal and financial advisors with expertise in Indian regulations can ensure that all legal requirements are met. This includes obtaining necessary approvals, adhering to reporting norms, and maintaining corporate governance standards.

5. Focusing on Sustainable Investments

Given the global emphasis on sustainability, investments in green technologies and sustainable practices can offer long-term benefits. The Indian government’s focus on renewable energy and sustainable development provides ample opportunities for environmentally conscious investments.

Conclusion

India's FDI landscape in 2024 is ripe with opportunities across various sectors, driven by robust economic growth, strategic government initiatives, and a favorable regulatory environment. However, navigating this dynamic market requires a deep understanding of the legal and regulatory framework, thorough market research, and strategic partnerships.

For investors looking to unleash the growth potential of their investments in India, staying informed about policy changes, leveraging government incentives, and ensuring compliance with local laws are critical. By adopting a strategic approach and focusing on sustainable investments, foreign investors can tap into the immense opportunities offered by the Indian market and contribute to its economic transformation.

In conclusion, FDI in India in 2024 presents a compelling opportunity for global investors. With the right strategies and guidance, investors can navigate the complexities of the Indian market and achieve significant growth and success.

This post was originally published on: Foxnangel

#fdi in india#fdi investment in india#foreign direct investment in india#economic growth#foreign investors#startup india#pli schemes#renewable energy#indian market#foxnangel

2 notes

·

View notes

Text

#PLI schemes#MakeInIndia#ElectronicsManufacturing#Semiconductors#IndiaRising#TechIndia#PLI#Innovation#DigitalIndia#electronicsnews#technologynews

0 notes

Text

ट्रम्प के टैरिफ से भारत को मिलेगा बड़ा मौका: कपड़ा, इलेक्ट्रॉनिक्स और सेमीकंडक्टर में बनेगा नंबर 1?

Delhi News: अमेरिकी राष्ट्रपति डोनाल्ड ट्रम्प ने 2 अप्रैल 2025 को भारत सहित कई देशों पर रेसिप्रोकल टैरिफ की घोषणा की, जिसने वैश्विक व्यापार में हलचल मचा दी। भारत पर 27% टैरिफ लगाया गया है, जबकि चीन पर कुल 54% (34% नया + 20% पहले से), वियतनाम पर 46%, और बांग्लादेश पर 37% टैरिफ थोपा गया है। यह नया टैरिफ तुरंत लागू नहीं होगा। 5 अप्रैल 2025 से 10% का बेसलाइन टैरिफ शुरू होगा, और भारत पर अतिरिक्त 27%…

#auto components India#China tariff 54%#competitive edge India#electronics sector India#global trade shift#India vs China trade#Indian economy benefits#Indian textile industry#PLI scheme India#reciprocal tariff 2025#semiconductor opportunities#textile exports USA#Trump tariff April 2025#Trump tariff India#US tariff impact

0 notes

Text

#postal life insurance#postal life insurance scheme#postal life insurance premium calculator#postal life insurance plan details#post office pli scheme#post office life insurance scheme#post office life insurance#life insurance with the post office#benefits of postal life insurance

0 notes

Text

"Reliance Industries' Strategic Investment: A Boost for Alok Industries and the Indian Textile Sector"

Title: “Reliance Industries’ Strategic Investment: A Boost for Alok Industries and the Indian Textile Sector” Introduction: In a significant development for the Indian textile industry, Alok Industries, a leading player in the sector, witnessed a remarkable surge of 20% in its share price on Tuesday following a substantial investment by Reliance Industries. The investment, totaling ₹3,300…

View On WordPress

#Alok Industries#Insolvency and Bankruptcy Code#Investment impact#Production Linked Incentive (PLI) scheme#Reliance Industries#Textile industry

0 notes

Text

Why don't you just give in? Pt.2

Fem reader

Pt.1

You

He's looking skinny, or as skinny as a man who's resembled a brick shithouse for the last two decades can be, less toned I suppose more lean. I watch as he turns away, the t-shirt he's wearing allowing for more creases, bagginess. He's forgone his mask, not that he needs it. He needs a shave instead, he almost resembles his Captain with that growth. His dirty blonde hair now sun bleached in parts and his tan somewhat deeper.

You know you want to run your fingers through it, feel the short hairs against the pads of your fingers as your hand moves against the grain. The last time you did that his hands were- My thoughts are both rudely and thankfully interrupted.

“Ohhh blimey you see the lads? Who's that with the scraggly face? The tall one?” I hear Laura beside me. Instantly the table I'm seated at falls into hushed gossip, as they always do when they see the task force. The SAS lads are a common sight around here, but the more specialist unit within it still garners mystique, enthusiastic and borderline obsessive gossip whenever they grace us with their presence.

“Ghost… you really don't recognise him without that rag on his face?” I murmur as I look down and bring my mug of coffee to my lips. Ghost... I still hate that callsign. Nickname. The lore. I mean I know how fucking vicious and brutal he can be. It's not learnt or adaptive behaviour since joining the military. As usual the table descends into the usual gossip, the girls wanting to follow them to the pub they'll inevitably end up at later on. Such is the routine when they land back on home turf, especially since they've clearly been gone a while. Eat, drink, fuck, repeat.

I zone out, leaving the others to continue their usual shite when they talk about the lads. Finishing up, I stand with my tray and head to the tray return carts, Laura shouts and tells me I will be joining them tonight and that it's final. Fuckin’ a! Wherever the lads will be, so will we, the sodding groupies they are. Though it won't take much to be out the way, they're only headed to a pub. No need to dress to impress.

Walking away from my table I steel myself, walking past Riley and his lot. I resist the urge to gob in his food, as usual. I would have done it years ago, but I've risen above that version of myself. I do however afford a quick glance down and I'm met with ochre orbs, his ochre eyes. This time I yield and look away, not wanting to walk into someone with a tray full leftover dinner.

Later I find myself freshly showered, the weather keeps flip-flopping so I decide on shorts with a tank and a hoodie with my favourite trainers. It's still warm and humid enough to warrant the summer gear, but as August stretches through to September there's a chill in the air. I look at myself in the mirror, my hair tousled and low key smokey eyes. I almost feel like I should scrub the makeup off, I'm in my mid thirties, why am I dressing like I'm fifteen years younger.

We all bundle in the taxi for fifteen minutes it takes for us to get to the town centre in Hereford. I listen as the others plan and scheme where the lads are, I give the usual non committal noises they'd expect but eventually I put my proverbial foot down. “Look, I don't want to spend all night with you lot drooling over them. We'll get pre-drinks at The Queen's Arms, some of you will get a quickie I'm sure, and then we should go somewhere better to spend our time.”

I'm met with eye rolls and smirks, it's no secret I'm not enthralled by the lads on the task force, and even under duress when plied with copious drinks I've still not spilt the beans. Finally the taxi pulls over and we hop out, the fare being prepaid since it was a group booking. I stay behind to organise a return journey later before following the girls into the pub. We're met with a wall of sound, almost raucous, as we filter in and find a table. I see Riley actually enjoying himself around the pool table for once.

Pt.3

#ghost riley#cod ghost#ghost call of duty#ghost x reader#simon riley cod#simon riley#simon ghost riley#simon riley x reader#simon riley x you#part 2

41 notes

·

View notes

Text

The sheer amount of parallels neatly spliced into episodes 6 & 7 is making my wee head spin.

The Party Ship 2.0 - only instead of them going into Stede's aristocratic world, this time, it's in the pirate world and Stede goes all the way when he destroys their enemies this time. (1x05)

The Party Ship 3.0 - Stede goes into the Republic like Jeff the Accountant went into the Party Ship and is the centre of attention. Ed murmurs warnings to him about how to handle it, but Stede doesn't listen because he thinks he knows better. (1x05)

It's a fickle crowd, mate - Stede's new friends aren't his new friends at all, just as Jeff the Accountant's weren't his (1x05)

Wee John turning up in a spectacularly dramatic costume (1x06)

Ed as the Human Shield (1x09)

"You've heard of me?" (1x03)

Stede's "Oh God" crisis on the couch after killing someone (1x01)

The Pyramid Scheme reloaded :D (1x05)

Someone who has known Ed/Stede a long time making cutting observations about their life/choices/worth and/or the inevitable doom of their relationship (1x01, 1x09, 2x04)

Ed's "my life is here now" and dropping the leathers overboard (1x01)

Stede being so desperate for approval and validation after an argument with his significant other that he sits down with a bunch of people who will say nice and affirming things to him, even though he knows they don't even know him (1x10)

Stede doing/saying dangerous/violent things while drunk after being lauded by his peers and plied with drinks (1x10)

Stede trying to reuse his amateur tricks in a fight with a much more skilled opponent (1x06)

"your boyfriend" (1x10)

Stede getting his ass handed to him in Jackie's by a woman with a sharp blade all over again (1x03)

Callbacks to Izzy and Stede's encounter at Jackie's (1x03)

Ed choosing to leave his entire life behind to pursue a career that he has the bare minimum of knowledge or experience about (Stede's entire S1 arc)

This is all from one viewing. I'm sure I'll find more on a second watch.

107 notes

·

View notes

Text

Hiranandani’s Greenbase to Expand Industrial and Logistics Parks in Chennai to 391 Acres

Greenbase Industrial and Logistics Parks, a collaboration between the Hiranandani Communities and Blackstone Group, has announced plans to acquire 211 acres of land in Chennai, expanding its total land holdings in the region to an impressive 391 acres. This strategic move underscores the group's commitment to scaling its operations in Hiranandani Chennai, one of the most promising industrial and logistics hubs in India.

The company plans to invest ₹700 crore to transform these newly acquired parcels into cutting-edge industrial parks, which will add 7.5 million sq. ft. of premium logistics and industrial space to its portfolio. This expansion will bring Greenbase’s total footprint in Chennai to 11 million sq. ft., with an ambitious target to deliver 20 million sq. ft. of industrial spaces across India in the next five years.

“We are in advanced stages of acquiring these land parcels, and the deals are expected to close soon,” said N. Shridhar, CEO of Greenbase Industrial and Logistics Parks.

The new acquisitions include strategically located parcels in South West Chennai’s Oragadam area and North Chennai. Two of these parcels are close to Greenbase’s existing industrial park in Oragadam, which spans 135 acres and generates annual rental revenue of ₹150–200 crore.

Having already delivered 3.5 million sq. ft. of built-to-suit space in Oragadam, Greenbase has catered to a diverse clientele, including sectors like e-commerce, electronics, renewable energy, automotive, and manufacturing. This development highlights the expertise of Hiranandani Communities in creating world-class industrial ecosystems.

Boosting Chennai’s Industrial Landscape

Chennai accounts for 40% of Greenbase’s growth portfolio, thanks to its skilled workforce, business-friendly environment, and favorable industrial policies. The planned expansion is expected to create around 1,000 new jobs, spanning both direct and indirect opportunities, further boosting the local economy.

Hiranandani Parks, a flagship project by the Hiranandani Communities in Oragadam, has also played a pivotal role in positioning the area as a key destination for residential, commercial, and industrial growth. Oragadam’s strategic location, robust infrastructure, and proximity to ports and airports make it an ideal hub for businesses across diverse sectors.

Supporting India’s Logistics Revolution

Greenbase’s expansion is fueled by rising demand for Grade A industrial assets, driven by initiatives like the Make in India programme, the production-linked incentive (PLI) scheme, and the China-plus-one strategy. The company is optimistic about India’s logistics sector, with Chennai playing a central role in this growth story.

This expansion reflects Hiranandani Chennai’s rising prominence in India’s industrial and logistics landscape, aligning with the Hiranandani Communities’s vision of sustainable and inclusive growth.

8 notes

·

View notes

Text

How India Became a Global Leader in Telecom

If you are interested in learning how India became a global leader in telecom equipment manufacturing and 5G innovation, this article is for you. You will discover how India leveraged its engineering talent, policy reforms, and open standards.

Equipment Manufacturing and 5G Innovation India is one of the fastest growing telecom markets in the world, with over 1.2 billion subscribers and 700 million internet users. But how did India achieve this remarkable feat? How did India transform itself from a net importer of telecom equipment to a net exporter and a global leader in telecom technology and innovation? How did India leverage its…

View On WordPress

#5G#6G#AI#Ashwini Vaishnaw#cyber security#equipment#export#India#Innovation#IoT#manufacturing#Narendra Modi#O-RAN#PLI scheme#standardization#telecom#VVDN Technologies#women empowerment

0 notes