#QPCR and dPCR Market

Explore tagged Tumblr posts

Text

Why Investors Are Eyeing the dPCR and qPCR Market for Growth Opportunities

The Digital PCR (dPCR) and Real-Time PCR (qPCR) Market is experiencing robust growth as advancements in molecular diagnostics and biotechnology revolutionize the healthcare and research sectors. According to a comprehensive analysis by SkyQuest Technology, the market is projected to reach unprecedented heights, reflecting a compound annual growth rate (CAGR) of 8.1% during the forecast period. As these technologies gain prominence, industries worldwide are embracing their potential for precision diagnostics, disease monitoring, and scientific breakthroughs.

Market Size and Growth Projections

The global digital PCR (dPCR) and real-time PCR (qPCR) market is thriving due to the surge in demand for advanced diagnostic tools. With a market value estimated at USD 10.1 billion in 2023, it is anticipated to achieve a value of USD 20.36 billion by 2032. This substantial growth is attributed to the increasing prevalence of infectious diseases, rising cancer cases, and a growing focus on personalized medicine.

Request a Sample of the Report here: https://www.skyquestt.com/sample-request/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Key Market Drivers

The growth of the dPCR and qPCR market is influenced by several factors, including:

Rising Demand for Molecular Diagnostics With a greater emphasis on early detection and precision, the demand for molecular diagnostic tools is skyrocketing. dPCR and qPCR technologies enable highly sensitive and accurate analysis of genetic material, making them indispensable in diagnosing critical illnesses.

Advancements in Technology Continuous innovation in PCR technologies is leading to faster, more accurate, and cost-effective solutions, enhancing their adoption across various industries.

Applications in Research and Development The increasing focus on drug development and genetic research has further expanded the utility of dPCR and qPCR technologies in laboratories worldwide.

Market Segments

The Digital PCR (dPCR) and Real-Time PCR (qPCR) Market is categorized based on technology, application, and end-user.

By Technology

Digital PCR (dPCR)

Real-Time PCR (qPCR)

By Application

Clinical Diagnostics

Research and Development

Forensic Applications

By End-User

Hospitals and Diagnostic Centers

Research Institutes

Biotech and Pharmaceutical Companies

Request a Customized Report Tailored to Your Needs: https://www.skyquestt.com/customization/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Regional Insights

The adoption of dPCR and qPCR technologies varies across regions, with distinct trends shaping the global market.

North America A dominant market due to advanced healthcare infrastructure, extensive research funding, and early adoption of innovative technologies.

Europe Strong emphasis on biotechnology and personalized medicine drives the market in countries like Germany, France, and the UK.

Asia-Pacific The fastest-growing region, fueled by the increasing prevalence of chronic diseases, expanding research activities, and government initiatives to enhance healthcare systems.

Latin America & Middle East Emerging markets show steady growth due to improving healthcare access and rising investments in diagnostic technologies.

Buy the Report to Get the Full Analysis: https://www.skyquestt.com/buy-now/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Top Players in the Market

The dPCR and qPCR market is highly competitive, with key players driving innovation and growth:

Thermo Fisher Scientific Inc.

Bio-Rad Laboratories, Inc.

Roche Diagnostics

QIAGEN N.V.

Agilent Technologies

Merck KGaA

Takara Bio Inc.

Promega Corporation

Illumina, Inc.

Fluidigm Corporation

View full ToC and List of Companies here: https://www.skyquestt.com/report/digital-pcr-dpcr-and-real-time-pcr-qpcr-market

Emerging Trends in the dPCR and qPCR Market

Increased Focus on Point-of-Care Diagnostics Portable and user-friendly devices are making molecular diagnostics accessible even in resource-limited settings.

Integration of AI and Big Data Advanced analytics are enhancing the accuracy and efficiency of PCR technologies, paving the way for groundbreaking discoveries.

Growth in Personalized Medicine With a shift towards tailored treatments, dPCR and qPCR technologies are playing a pivotal role in identifying genetic markers and designing customized therapies.

Expansion of Applications Beyond Healthcare The utility of these technologies is extending into food safety, agriculture, and environmental monitoring, further diversifying market opportunities.

Conclusion

The Digital PCR (dPCR) and Real-Time PCR (qPCR) Market is set to transform diagnostics and research on a global scale. As technological innovations continue to enhance the precision and accessibility of these tools, the market offers promising opportunities for growth across diverse sectors. Companies focusing on innovation, adaptability, and application expansion are poised to lead in this rapidly evolving industry.

#Asia dPCR and qPCR market#Europe dPCR and qPCR market#Middle East dPCR and qPCR market Size#North America dPCR and qPCR market

0 notes

Text

https://app.socie.com.br/read-blog/154633_digital-pcr-dpcr-and-real-time-pcr-qpcr-market-share-overview-competitive-analys.html

The Digital PCR (dPCR) and Real-time PCR (qPCR) Market in 2023 is US$ 8.5 billion, and is expected to reach US$ 15.76 billion by 2031 at a CAGR of 8.00%.

#Digital PCR (dPCR) and Real-time PCR (qPCR) Market#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Overview#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Share

0 notes

Text

Digital PCR (dPCR) and Real-time PCR (qPCR) Market Size, Analysis and Forecast 2031

#Digital PCR (dPCR) and Real-time PCR (qPCR) Market#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Scope#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Size

0 notes

Text

https://cynochat.com/read-blog/175004_digital-pcr-dpcr-and-real-time-pcr-qpcr-market-overview-size-share-and-forecast.html

#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Share#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Size

0 notes

Text

What Is Driving the Global Digital PCR and qPCR Market Toward $14.8 Billion by 2029?

The Strategic Shift in Precision Diagnostics

The global Digital PCR (dPCR) and Real-Time PCR (qPCR) market is poised for strong and sustained growth, rising from US$9.4 billion in 2023 to a projected US$14.8 billion by 2029, advancing at a CAGR of 8.1%. This dynamic expansion is no accident—it reflects a broader shift in how global healthcare systems approach diagnostics, disease management, and therapeutic development.

Fueled by precision medicine, the surge in infectious diseases, and the demand for faster, more reliable diagnostic solutions, dPCR and qPCR technologies are becoming indispensable. But the market also faces distinct structural and strategic hurdles. In this blog, we explore what’s really powering this market, where growth is concentrated, and how stakeholders—from diagnostics firms to pharma executives—can capitalize.

Download PDF Brochure

Why Is the Digital PCR and qPCR Market Gaining Momentum?

1. Rising Burden of Infectious and Genetic Diseases With the global rise in infectious diseases (like COVID-19 and its variants), tuberculosis, and rare genetic disorders, there's a mounting demand for high-sensitivity diagnostics. Both dPCR and qPCR offer fast turnaround, accurate pathogen quantification, and early detection—critical tools in combating outbreaks and managing chronic conditions.

2. Strategic Role in Biomarker Discovery As precision medicine moves into the mainstream, biomarker-driven diagnostics are becoming foundational. Real-time PCR is essential for gene expression studies, while dPCR provides absolute quantification, enabling more accurate companion diagnostics. The techniques are widely used in clinical trials, personalized therapy development, and oncology diagnostics.

3. Point-of-Care (PoC) Evolution qPCR and dPCR technologies are increasingly integrated into portable, PoC diagnostic platforms, allowing testing in non-laboratory settings such as rural clinics or emergency departments. This shift addresses global healthcare inequities and strengthens pandemic preparedness.

Where Are the Highest-Growth Opportunities?

Asia Pacific: The Fastest Growing Region

Asia Pacific is emerging as a hotbed of growth, thanks to:

Expanding pharma-biotech R&D in India, China, and South Korea

Heavy investment by CMOs and CDMOs

Government initiatives supporting molecular diagnostics

A large untapped market for PoC applications and cancer screening tools

However, instrument affordability and reimbursement gaps remain challenges that must be addressed to unlock full potential.

North America: The Market Leader

North America commands the largest share, led by:

Presence of dominant players like Thermo Fisher Scientific, Bio-Rad, and Danaher Corporation

Mature regulatory landscape supporting innovative diagnostics

High adoption of PCR in clinical diagnostics, biotech, and public health surveillance

How Do Instrument Innovations Drive Market Leadership?

Among instruments, droplet digital PCR (ddPCR) is leading the digital PCR sub-segment. Its ability to partition reactions into thousands of droplets, each acting as a mini PCR reaction, offers:

High precision

Inhibitor tolerance

Quantification without need for standard curves

This makes it ideal for oncology, liquid biopsy, viral load monitoring, and cell therapy R&D.

Who Are the Key Stakeholders in the Market Ecosystem?

The ecosystem spans multiple nodes:

Stakeholder

Role

Raw Material Suppliers

Reagents, enzymes, and microfluidics components

Instrument Manufacturers

ddPCR, chip-based, and real-time PCR platforms

End-Users

Hospitals, diagnostic labs, CROs, CDMOs, pharma-biotech firms, forensic labs

This diverse mix creates opportunities for strategic partnerships, co-development deals, and vertical integration.

What’s Holding the Market Back?

1. Reimbursement and Regulatory Complexity Despite technological advances, limited reimbursement coverage, particularly for advanced PCR tests, discourages widespread adoption. For example, the US CMS policy revisions in 2023–2024 caused confusion around billing for transplant-related diagnostics, underscoring the need for policy clarity.

2. Competition from Emerging Technologies Alternatives like Next-Generation Sequencing (NGS), CRISPR diagnostics, and ELISA are gaining traction. While PCR remains a gold standard, these methods offer greater scalability, faster throughput, and in some cases, lower operational costs.

3. Labor-Intensive Workflow and Standardization Issues Sample preparation and post-PCR analysis still involve manual steps, increasing time-to-result and introducing variability. There's a clear opportunity to innovate through automation and AI integration.

What Opportunities Can C-Level Executives Leverage?

1. Invest in Companion Diagnostics RT-PCR-based companion diagnostics are critical for pharma firms developing targeted therapies. By embedding these diagnostics into drug development pipelines, companies can accelerate regulatory approvals and boost patient stratification precision.

2. Explore Untapped Markets Emerging economies in Southeast Asia, Latin America, and parts of Africa offer immense opportunity. Strategic local partnerships and distribution models can help overcome infrastructure and cost barriers.

3. Adopt Platform Thinking Building scalable PCR platforms that integrate AI, cloud data, and IoT can revolutionize disease monitoring. This will create long-term value for health systems and open recurring revenue streams via software and data analytics.

Conclusion: Precision Diagnostics Is the Next Frontier

As healthcare increasingly moves toward precision, decentralization, and real-time decision-making, digital and real-time PCR technologies are central pillars. However, success in this market depends not only on technological superiority but on strategic alignment—from regulatory navigation and reimbursement advocacy to platform innovation and global expansion.

For More information, Inquire Now.

0 notes

Text

0 notes

Text

Genetic Research Driving PCR Growth with Biotechnology Innovations

The global polymerase chain reaction (PCR) market is experiencing robust growth, with its valuation estimated at $6.2 billion in 2024 and projected to reach $16 billion by 2034, achieving a compound annual growth rate (CAGR) of 10%. PCR, a cornerstone of molecular diagnostics, has transformed healthcare by enabling rapid and accurate detection of diseases. Drawing from FactMR’s market analysis, this blog explores the drivers, challenges, innovations, and future prospects of the PCR market.

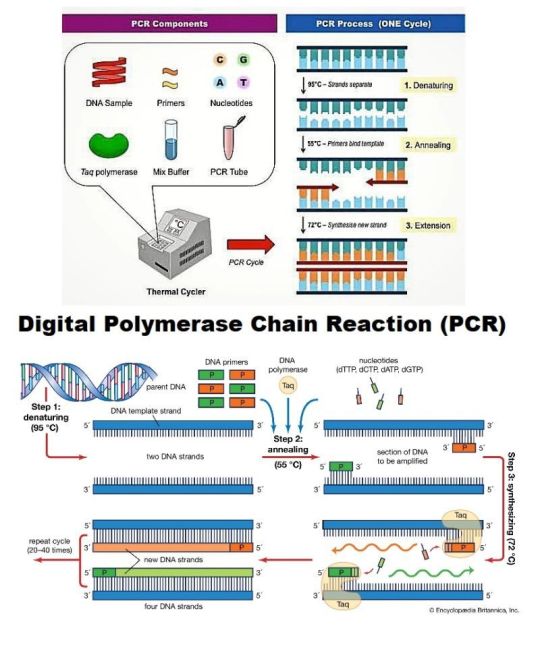

What is Polymerase Chain Reaction?

Polymerase chain reaction (PCR) is a laboratory technique used to amplify DNA segments, producing millions of copies from a single strand. This enables detailed analysis of genetic material, making PCR critical for diagnosing infectious diseases, genetic disorders, and cancers. Variants like real-time PCR (qPCR) and digital PCR (dPCR) enhance its precision and applicability in research, clinical diagnostics, and forensics.

PCR’s significance was underscored during the COVID-19 pandemic, where qPCR became the gold standard for detecting SARS-CoV-2 due to its high sensitivity and specificity. Its applications extend beyond diagnostics to include genetic research, forensic analysis, and biotechnology.

Key Market Drivers

The PCR market’s growth is driven by the increasing prevalence of infectious diseases and genetic disorders. Conditions like sexually transmitted infections, respiratory diseases, and hepatitis are boosting demand for PCR-based diagnostics. The technique’s ability to detect pathogenic DNA with high accuracy makes it indispensable in clinical settings.

Technological advancements are another key driver. Innovations like qPCR and dPCR have improved the speed, accuracy, and scalability of PCR tests. The development of portable, point-of-care PCR devices, such as Nuclein’s ‘Nuclein Anywhere’ test, has expanded access to diagnostics, particularly in home-based settings. FactMR notes that the rising adoption of these advanced systems is fueling market growth.

Government and private investments in healthcare and pharmaceutical R&D are also significant. Increased funding for developing rapid diagnostic kits, such as RT-qPCR for SARS-CoV-2 detection, is driving sales of PCR products. The expansion of healthcare infrastructure in developing economies further supports demand for clinical PCR solutions.

Regional Insights

North America, particularly the United States, dominates the PCR market, accounting for 45.6% of the North American market share by 2034. The region’s advanced healthcare infrastructure, high adoption of cutting-edge diagnostics, and significant R&D funding drive growth. The U.S. benefits from rising awareness of PCR products and their integration into clinical and research applications.

Japan is an emerging market in East Asia, driven by growing awareness among healthcare professionals of gene-based diagnostics. Public-private partnerships to develop novel PCR technologies are expected to accelerate growth in the region. Other regions, including Europe and Asia Pacific, are also seeing increased adoption due to expanding healthcare systems and research activities.

Challenges in the Market

The high cost of advanced PCR technologies, such as qPCR and dPCR, is a significant barrier. FactMR reports that qPCR devices range from $4,000 to $13,000 or more, while dPCR systems are even pricier. These costs limit adoption in developing economies, where budget constraints are common.

Another challenge is the complexity of PCR systems, which require skilled personnel and sophisticated infrastructure. This can hinder their use in resource-limited settings. Additionally, competition from alternative diagnostic methods, such as next-generation sequencing (NGS), may impact the PCR market in certain applications.

Innovations and Trends

Innovation is transforming the PCR market. Companies like SAGA Diagnostics are leveraging dPCR for non-invasive cancer detection, with products like ‘SAGAsafe’ enabling accurate diagnosis of multiple cancer types. Similarly, advancements in RT-qPCR kits have improved the detection of viral variants, maintaining their relevance post-COVID.

The development of portable and automated PCR systems is a key trend. Devices like Anitoa Systems’ MAx16 and Bio-Rad’s CFX Opus 96 Dx System offer rapid, user-friendly diagnostics, making PCR accessible in diverse settings. These innovations align with the growing demand for point-of-care and home-based testing.

Opportunities for Growth

The PCR market offers significant opportunities, particularly in developing economies where healthcare infrastructure is expanding. The rising prevalence of chronic and infectious diseases creates a steady demand for PCR diagnostics. Companies investing in affordable, portable PCR solutions can tap into these markets.

Collaborations between diagnostic companies and healthcare providers can also drive growth. By developing tailored PCR solutions for specific diseases, manufacturers can address unmet needs and expand their market presence. FactMR highlights that the increasing focus on early disease detection and genetic research will further boost demand.

Future Outlook

With a projected valuation of $16 billion by 2034, the PCR market is set for strong growth. Its critical role in diagnostics, coupled with ongoing innovations, ensures its relevance in healthcare and research. As global health challenges evolve, PCR will remain a cornerstone of molecular diagnostics, driving advancements in disease detection and treatment.

Conclusion

The PCR market’s rapid growth reflects its transformative impact on diagnostics and research. With a CAGR of 10% and a projected valuation of $16 billion by 2034, it offers immense potential for innovation and expansion. As technology advances and healthcare needs grow, PCR will continue to shape the future of medical diagnostics.

0 notes

Text

0 notes

Text

0 notes

Text

Digital PCR & qPCR Market

Digital PCR (dPCR) and quantitative PCR (qPCR) markets are rapidly expanding, driven by the growing demand for precise genetic analysis, diagnostics, and research applications. dPCR offers highly accurate quantification of nucleic acids, while qPCR is widely used for gene expression profiling and pathogen detection. Both technologies are advancing in fields such as oncology, infectious disease monitoring, and genetic research. The market growth is fueled by technological innovations, increased adoption in clinical diagnostics, and a rising focus on personalized medicine. Key players in the market include Thermo Fisher Scientific, Bio-Rad, and QIAGEN, with significant investment in R&D and product development.

For More : https://tinyurl.com/bdhjhwkf

0 notes

Text

0 notes

Text

https://tannda.net/read-blog/73424_digital-pcr-dpcr-and-real-time-pcr-qpcr-market-share-overview-competitive-analys.html

The Digital PCR (dPCR) and Real-time PCR (qPCR) Market in 2023 is US$ 8.5 billion, and is expected to reach US$ 15.76 billion by 2031 at a CAGR of 8.00%.

#Digital PCR (dPCR) and Real-time PCR (qPCR) Market#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Forecast#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Analysis

0 notes

Text

https://joyrulez.com/blogs/431307/Digital-PCR-dPCR-and-Real-time-PCR-qPCR-Market-Size

Digital PCR (dPCR) and Real-time PCR (qPCR) Market Size, Analysis and Forecast 2031

#Digital PCR (dPCR) and Real-time PCR (qPCR) Market#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Scope#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Size

0 notes

Text

https://writeupcafe.com/digital-pcr-dpcr-and-real-time-pcr-qpcr-market-overview-size-share-and-forecast-2031/

#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Share#Digital PCR (dPCR) and Real-time PCR (qPCR) Market Size

0 notes

Text

Digital PCR and Real-Time PCR: Strategic Catalysts in the Future of Precision Diagnostics

In the evolving landscape of molecular diagnostics, two technologies have emerged as central pillars for innovation, accuracy, and business transformation: Digital PCR (dPCR) and Real-Time PCR (qPCR). These technologies are not merely analytical tools; they are strategic assets poised to redefine operational paradigms across biotechnology, pharmaceutical development, clinical diagnostics, and public health infrastructure. For senior executives and decision-makers, understanding the implications of dPCR and qPCR is essential to navigating the future of life sciences and diagnostics.

Request Sample Pages

The Strategic Differentiation: Digital PCR vs. Real-Time PCR

Real-Time PCR, long considered the industry standard, enables the quantification of nucleic acids during the exponential phase of the PCR process. It is widely valued for its speed, sensitivity, and throughput capabilities, making it a cornerstone in clinical diagnostics, pathogen detection, and gene expression analysis.

Digital PCR, a more recent advancement, provides absolute quantification without the need for reference standards or calibration curves. By partitioning a sample into thousands—or even millions—of discrete reactions, dPCR offers enhanced precision, sensitivity, and reproducibility, particularly valuable in detecting rare mutations, copy number variations, and low-abundance targets.

For business leaders, the distinction is not merely technical—it is strategic. qPCR remains indispensable for routine diagnostics and large-scale screening. Meanwhile, dPCR is carving a niche in high-value, high-complexity applications, enabling companies to offer differentiated, premium diagnostics and research solutions.

Real-World Applications Driving Enterprise Value

The implementation of PCR technologies is generating measurable impact across various sectors:

Clinical Diagnostics: qPCR continues to dominate in infectious disease detection due to its high-throughput capabilities. However, dPCR is emerging as the gold standard in oncology diagnostics, enabling ultra-sensitive detection of circulating tumor DNA (ctDNA) for early cancer screening and treatment monitoring.

Biopharmaceutical Manufacturing: Both qPCR and dPCR are integral in quality control and contamination detection. dPCR, with its high accuracy, is increasingly used to validate critical quality attributes (CQAs) of biologics, driving compliance and reducing batch failures.

Precision Medicine: dPCR facilitates individualized treatment strategies by enabling accurate quantification of genetic mutations and biomarkers. This aligns directly with value-based healthcare models that prioritize outcomes and cost-efficiency.

Agrigenomics and Food Safety: qPCR has become essential in ensuring GMO compliance and pathogen detection. The precision of dPCR is expanding its role in detecting adulterants and allergens with greater specificity.

These use cases reflect not only technical viability but also commercial scalability, with direct implications for operational efficiency, regulatory compliance, and product differentiation.

Emerging Trends and Market Dynamics

The molecular diagnostics market is entering a period of accelerated innovation, shaped by macro-level trends that senior decision-makers must watch closely:

Decentralization of Testing: With growing demand for point-of-care (POC) and near-patient diagnostics, there is a rising emphasis on miniaturized, integrated qPCR and dPCR platforms. This shift enables faster clinical decisions and enhances accessibility in remote or underserved regions.

Regulatory Evolution: Regulatory bodies are increasingly endorsing dPCR for its reliability and robustness, especially in applications like non-invasive prenatal testing (NIPT) and minimal residual disease (MRD) detection. Early alignment with these regulatory trends will be critical to future market access.

AI and Data Integration: As molecular diagnostics become more complex, integrating AI for data interpretation is transforming how results from qPCR and dPCR are analyzed and utilized. Automated workflows and intelligent analytics are enhancing diagnostic accuracy while reducing turnaround time.

Sustainability and Cost Pressures: Labs and manufacturers are seeking PCR systems that minimize reagent usage and energy consumption. Innovations in chip-based dPCR and ultra-fast qPCR are addressing both ecological and economic concerns.

These trends are not ephemeral—they signal a durable evolution in how molecular tools will be developed, deployed, and monetized.

Business Opportunities and Competitive Differentiation

Executives and strategists should consider several high-value opportunities emerging from the ongoing evolution of PCR technologies:

Platform Innovation and IP Strategy: Companies that invest in developing proprietary qPCR or dPCR platforms—or secure strategic patents—will gain defensible market positions. Modular platforms that integrate seamlessly into digital ecosystems offer high adaptability and lifecycle value.

Vertical Integration and Ecosystem Control: Controlling more of the value chain—from reagents to software—enables tighter quality control and recurring revenue opportunities. End-to-end PCR solutions are becoming a key driver of customer retention and profitability.

Expansion into Adjacent Markets: With dPCR enabling applications in environmental monitoring, water safety, and industrial microbiology, life science firms can diversify revenue streams beyond healthcare and pharma.

Strategic Collaborations: Aligning with academic institutions, healthcare providers, or data analytics firms can fast-track product development and market validation. These alliances can also help navigate regulatory pathways more efficiently.

Global Market Penetration: Emerging markets in Asia, Latin America, and Africa are rapidly investing in molecular diagnostics infrastructure. Offering scalable, cost-effective qPCR/dPCR solutions tailored to regional needs will be essential for global growth.

Each of these vectors represents not only revenue potential but also long-term strategic resilience.

Visionary Outlook: PCR in the Next Decade

Looking ahead, PCR technologies will not exist in isolation. They will function as part of a broader, interconnected diagnostic and therapeutic ecosystem:

Integration with Genomics and Proteomics: PCR platforms will increasingly be used alongside next-generation sequencing (NGS) and proteomic tools, delivering a multi-modal approach to disease detection and monitoring.

Personalized Health Monitoring: Wearable biosensors and at-home diagnostic kits may soon incorporate miniaturized PCR components, enabling continuous monitoring of biomarkers with clinical-grade accuracy.

Global Health Preparedness: As pandemics and emerging infectious diseases remain a persistent threat, governments and global health bodies will rely on both qPCR and dPCR for scalable, rapid response frameworks.

Precision Manufacturing: In biologics and gene therapy, dPCR will play a central role in ensuring batch-to-batch consistency, regulatory compliance, and product safety.

The trajectory is clear: PCR is not a static technology—it is an evolving platform with transformative implications across industries.

Strategic Imperatives for Decision-Makers

For C-suite executives and senior leaders, the path forward involves proactive engagement with the PCR technology curve:

Invest in Advanced Capabilities: Allocating capital to in-house PCR development or acquisition of innovative startups can yield long-term competitive advantages.

Build Cross-Functional Expertise: Collaborate across R&D, regulatory, and commercial teams to ensure alignment on PCR integration strategies.

Embrace Digital Transformation: Leverage data analytics, cloud platforms, and AI to maximize the value of PCR-generated data.

Monitor Policy and Reimbursement Trends: Early visibility into changing regulatory and payer landscapes will position companies to capitalize on emerging opportunities.

By taking a forward-thinking, enterprise-wide approach to PCR, organizations can not only stay competitive but lead in a diagnostics market that is rapidly moving from reactive to predictive.

Conclusion

Digital PCR and Real-Time PCR are far more than technical instruments—they are enablers of precision, platforms for innovation, and strategic levers for growth. As the global healthcare and life sciences sectors evolve toward greater personalization, automation, and resilience, PCR technologies will remain at the center of this transformation. The executives who recognize and act on this convergence today will define the industry leadership of tomorrow.

For more information, inquire now! Inquire Now

0 notes