#Royal Dutch Shell

Explore tagged Tumblr posts

Text

RACE

488 notes

·

View notes

Text

The oil giant has big plans for the remainder of the decade. It wants to install around 70,000 public charging points by 2025 and around 200,000 by 2030, the report stated.

Unloading 1,000 stations would be like removing a drop out of the ocean—it’s equivalent to just 4% of the company’s sites(..)

P.S.Big oil sees the writing on the wall. Despite the recent negative campaign against the electric car market by mass media (ICE vehicle marketers and oil companies have enough money to buy journalists and bloggers), the EV business is actually growing quite well, surprisingly well... The interesting thing is that that electric cars appear more and more often in developing countries, especially in those without their own oil industry...

1 note

·

View note

Text

17th Century Shell Guard Broadsword

There's something unique about holding a piece of history that dates back four hundred years. They have a presence, a gravitas that, more recent swords lack.

So, what is this sword? The Royal Armouries simply describes the examples in their collection as an early 17th-century broadsword with shell guard (Object IX.172). While Ewart Oakeshott in his book "European Weapons and Armour - From the Renaissance to the Industrial Revolution" describes two types of swords with related characteristics: the German sabre, circa 1540s, with forward and rear quillons, a knuckle bow, and a distinctive shell guard covering the outside of the hand. Plus, the second type of Sinclair hilt, with its one-piece S-shaped crossguard forming the rear quillon and knuckle guard.

At the same time, the Dutch sword historian J.P. Puype describes these as a Solingen horseman's sword of the classical type: "The problem with this type of sword is that so far there has never been written a proper monography on them and that opinions on them are practically always unsubstantiated by evidence. The other problem is that they are often seen as naval but there is more evidence to tell us that they were army swords.

I think that I may be the first arms historian who identified these swords as cavalry swords, but I have to admit that in publications prior to 1998 I (too) identified them exclusively as shipboard cutlasses.

In the 1990s I became increasingly involved in writing publications and doing museum exhibitions on Prince Maurice and the new Dutch so-called States Army of the 1590s. In the course of this involvement I analysed the pictures by Jacob de Gheyn made during the 1590s of the infantry drill and cavalry drills. These infantry pictures were published in a book in 1607, although we know that its manuscript was already in existence c. 1595-c.1597, but was withheld by Prince Maurice for reasons of security.

Simultaneously, a book on the cavalry exercise was conceived, but its publication was permanently withheld by Maurice, partly for security reasons, partly also because Prince Maurice in 1597 or 1598 abolished the lancers.

Among the cavalry prints the heavy cavalry has as its chief weapon the lance (it was abolished in 1597 or 1598 in favor of the wheel-lock pistol, and the lancers became 'pistoliers'). However, the light cavalry is armed with swords with shell-guard hilts.

So we can only prove that the seashell-hilted sword apparently originated in the cavalry. The earliest proof that I have of its maritime use is after 1700. I do not know how to explain the picture of the French privateer Lolonois of 1684 (the year of appearance of the original Dutch edition) who is armed with a seashell-hilted cutlass with a curved blade with clipped point.

One other of the very few other 17th C pictures I know in which appear what seem to be shell-hilted cutlasses is on the title-page of a book published in 1673 (see the attachment). There is a heap of apparently seashell-hilted cutlasses in the foreground but it is clear that the hilts are rendered in a wrong version. The blades, however, are curved and with clipped point.

In or before 1978 the wreck of a flatboat was found in the lake what once was the Zuyderzee. This boat was full of arms and military equipment, destined for what were army outposts on islands against a possible French invasion in 1672. Among the cargo were four swords with seashell guards and straight blades. In the attachment are two archaeological drawings.

All this does not bring us definitive answers to the problem when we view the portrait of the French privateer l'Olonnais (spelled as Lolonois) in which he is holding a seashell-hilted cutlass with curved blade with clipped point. I do not know of the actual existence of such a sword - nowhere in the world. I dare not go so far as to suggest that swords of this type may be artists' impressions only but somehow it does feel that way!"

Jan Piet Puype.

In short, these are another variation of military broadsword that would have been common amongst the military armies of the first half of the 17th-century. While it is appealing to look at the portrait of the French privateer Lolonois as evidence that these swords have a naval connection, the unfortunate reality is that the artist likely never met his subject. Furthermore, he made a notable error in the sword's detailing; with the quillon and knucklebow reversed, the sword becomes impractical to wield. In conclusion, we see an artist's impression, not a historical representation.

In German and Dutch references, these swords are called houdegen or houwdegen, which translates to 'hewing sword'. Although short, their weight and broad, double-edged lenticular blades give these swords a no-nonsense functionality. A single fuller runs for the first 20% starting at the guard. The ricasso is a square block with two smaller side fullers running along its length. On both sides of the ricasso is a maker mark of a crown above an O and T. According to the Royal Armouries, this is the mark of a Spanish smith. However, I have seen one text attribute this to a Solingen swordsmith. Given that the blade has ME FECIT and SOLINGEN (Solingen Made Me) stamped into the fuller, it seems more likely that the stamp is either a copy of the Spanish maker mark or one unique to a Solingen blade maker.

The grip retains its' original wire and Turks head knots at each end. It has a pear-shaped pommel with a tang button on the top for the peen. Although I can't be sure, I expect the pommel is hollow, like we see on the Amsterdam Walloon swords.

The S-shaped crossguard and shell guard are two separate pieces that appear to have been forge-welded together. While the hilt and pommel on my sword are solid, the guard is loose. There probably used to be a fabric or leather washer between the blade shoulder and guard to hold them tight. On the inside of the guard, it continues to cover the thumb, curling around on itself to form a thumb ring. This combination of knuckle bow and shell guard offers the wielder a lot of hand protection.

Stats: Overall Length - 870 mm Blade Length - 725 mm Point of Balance - 90 mm Grip Length - 140 mm Inside Grip Length - 80 mm Weight - 900 grams

#antiques#swords#military antiques#light cavalry#17th century#80 years war#30 years war#shot and pike

130 notes

·

View notes

Text

Exposed: The Secret Dominion of the Rothschilds, Rockefellers, and Morgans 💥

Prepare to uncover the startling reality behind the world's most influential families and their immense control over the global economy. The Federal Reserve Cartel, consisting of the Rothschilds, Rockefellers, and Morgans, wields unprecedented power that extends well beyond the realm of oil.

Imagine this: The Four Horsemen of Banking, including Bank of America, JP Morgan Chase, Citigroup, and Wells Fargo, unite with the Four Horsemen of Oil, such as Exxon Mobil, Royal Dutch/Shell, BP, and Chevron Texaco. Yet, their dominion doesn't stop there. Through an intricate web of private banks, they have expanded their influence to encompass the music industry. These colossal entities, along with Deutsche Bank, BNP, Barclays, and other European old money giants, hold the reins of the music industry, allowing them to shape its trajectory and exert their influence.

The Machiavellian machinations of the Rockefeller dynasty reach far and wide, commencing with their commercialization of music in the early 1900s. They orchestrated a sinister plot to shift the world's standard tuning of music to 440 pitch. This insidious frequency was known to provoke heightened aggression, psychosocial agitation, emotional distress, and even physical ailments. Behind closed doors, this manipulation resulted in financial gains for those complicit in the monopoly, including agents, agencies, and companies associated with the North American Rockefeller crime cartel and influential organizations.

Fast forward to the late 1980s when the Rockefellers summoned top music executives and artists to a highly clandestine meeting in Los Angeles. Their sinister agenda? To usher in the era of Controlled Rap Music, intricately linked to the privatization of U.S. prisons. These privately owned prisons, operated by the Rockefellers, Rothschilds, Bush family, and other influential figures, served as money laundering operations, tax exemption schemes, and pyramid scheme enterprises.

Crafting a deceitful plan, the Rockefellers aimed to control the rap industry and target black communities by promoting violent music that fueled oppression and civil unrest. They brought together leading executives and prominent black artists, binding them with strict confidentiality agreements. Their objective was clear: orchestrate violence within the rap music movement while major record labels secured exclusive rights for production and distribution across the United States. In return, they would receive shares and points within the private prison systems.

The Masonic scheme unfolded with precision, resulting in over 1,500 private prison systems incarcerating more than 1 million black teenagers by 1990. These vulnerable youths, expressing the generational trauma imposed upon them, unknowingly contributed to the Rockefellers' malevolent plan. The private prison systems reaped billions annually from the government, establishing an extensive money laundering network through inflated products, such as ramen noodles priced at 8 times their actual value. The flow of hundreds of billions from government funding, pyramid schemes, and insurance companies transformed prison privatization into a multi-trillion-dollar enterprise.

Local courts and judges mercilessly sentenced petty criminals and first-time offenders, filling the expanding private prisons. Consequently, the United States holds the unfortunate record for the highest number of incarcerated individuals in the world, with an unprecedented number of prisons. This was not a coincidence—it was a meticulously orchestrated plan by the Rockefellers.

But their influence doesn't stop there.

As the true faces of those who wield global authority are revealed, the Rothschilds and Rockefellers find themselves targeted by military alliance operations aiming to dismantle the Rothschilds' deep state power in Europe, the UK, Russia, and China.

- Julian Assange WikiLeaks 🤔

#pay attention#educate yourselves#educate yourself#reeducate yourself#knowledge is power#reeducate yourselves#think for yourselves#think about it#think for yourself#do your homework#do your own research#do some research#ask yourself questions#question everything#wikileaks#julian assange#news

66 notes

·

View notes

Text

According to a new survey, lawmakers are playing an increasingly important role in holding corporations and governments accountable for failures to tackle the climate crisis.

The research was done by Columbia Law School, and was commissioned by the United Nations Environment Program (UNEP). It revealed that the number of climate-related court cases has more than doubled since 2017 and is steadily rising around the world.

Their report confirms a trend highlighted in the World Economic Forum’s Global Risks Report 2023, which claimed that individuals and environmental organizations were, more and more, turning to the law, as it became clear that the pace of transition to net-zero emissions was too slow.

“Climate litigation is increasing and concerns about emissions under-reporting and greenwashing have triggered calls for new regulatory oversight for the transition to net zero,” the Forum report said.

The UNEP report catalogues a number of high-profile court cases which have succeeded in enforcing climate action. In 2017, when climate case numbers were last counted, 884 legal actions had been brought. Today the total stands at 2,180.

The majority of climate cases to this date (1,522) have been brought in the US, followed by Australia, the UK, and the EU. The report notes that the number of legal actions in developing countries is growing, now at 17% of the total.

Climate litigation is also giving a voice to vulnerable groups who are being hard hit by climate change. The report says that, globally, 34 cases have been brought by children and young people, including two by girls aged seven and nine in Pakistan and India.

Here are five of the climate breakthroughs achieved by legal action so far.

1. Torres Strait Islanders Vs Australia

In September 2022, indigenous people living on islands in the Torres Strait between northern Queensland and Papua New Guinea won a landmark ruling that their human rights were being violated by the failure of the Australian government to take effective climate action.

The UN Human Rights Committee ruling established the principle that a country could be in breach of international human rights law over climate inaction. They ruled that Australia's poor climate record was a violation of the islanders’ right to family life and culture.

2. The Paris Agreement is a human rights treaty

In July 2022, Brazil's supreme court ruled that the Paris climate agreement is legally a human rights treaty which, it said, meant that it automatically overruled any domestic laws which conflicted with the country’s climate obligations.

The ruling ordered the government to reopen its national climate mitigation fund, which had been established under the Paris Agreement.

3. Climate inaction is a breach of human rights

Upholding an earlier court ruling that greenhouse emissions must be cut by 25% by 2020, the Netherlands Supreme Court ruled that failure to curb emissions was a breach of the European Convention on Human Rights.

The December 2019 ruling stated that, although it was up to politicians to decide how to make the emission cuts, failure to do so would be a breach of Articles 2 and 8 of the Convention which affirm the right to life and respect for private and family life.

4. Companies are bound by the Paris accord

Corporations, and not just governments, must abide by the emissions reductions agreed in the Paris climate treaty. This principle was established by a 2021 ruling in the Netherlands brought by environmentalists against energy group Royal Dutch Shell.

The court ordered Shell to cut its CO2 emissions by 45% by 2030 bringing them in line with Paris climate targets. The judge was reported as saying there was "worldwide agreement" that a 45% reduction was needed, adding: "This applies to the entire world, so also to Shell”.

5. Courts overturn state climate plans

Up until now, three European governments have been defeated in the courts over their climate plans.

In March 2021, Germany’s highest court struck down a climate law requiring 55% emissions by 2030 cuts, ruling it did not do enough to protect citizens’ rights to life and health. The same year, the French government was ordered to take “immediate and concrete action” to comply with its climate commitments. And in 2022, the UK’s climate strategy was ruled unlawful for failing to spell out how emissions cuts would be made.

#climate change#climate#hope#good news#more to come#climate emergency#news#climate justice#hopeful#positive news#long post#important#good post#links#for future reference#law#climate law#paris agreement#paris climate agreement#government#democracy#politicians#economics#politics

60 notes

·

View notes

Text

It's interesting looking back as recently as the late 2000s and seeing (1) that so many of the largest publicly traded companies by market value were oil and gas companies, and (2) how few of them were tech companies compared to today.

From Wikipedia, the ten largest companies in the first quarter of 2008, in order: (1) Exxon Mobil, (2) PetroChina, (3) General Electric (4) Gazprom, (5) China Mobile, (6) ICBC, (7) Microsoft, (8) AT&T, (9) Royal Dutch Shell, (10) Procter & Gamble.

Meanwhile the equivalent from the fourth quarter of 2024: (1) Apple, (2) Nvidia, (3) Microsoft, (4) Alphabet, (5) Amazon, (6) Meta, (7) Tesla, (8) Broadcom, (9) TSMC, (10) Berkshire Hathaway. You have to go all the way to #10 to find something that pretty much everyone would agree is not a "tech" company

6 notes

·

View notes

Text

Princess Tree - Paulownia tomentosa

Today's Plant Profile is a little different, I wanted to cover an 'invasive' that fascinated me.

Before I begin I wanted to dissect my terminology on invasive, the term is often thrown at plants without considering a racialized and often problematic methodology on how we relate to these species. Invasive species are typically advantageous in the face of disturbance and quick to colonize altered areas, the monumental spread of invasives is a direct result of euro-centric land commodification, international trade and colonization. These species would not be as 'destructive' as they are without dramatic change to wildspaces/once-thoroughly-managed landscapes. You don't have to love these plants but understand that they often occupy spaces we disturbed, and that doesnt mean i want monocultures of introduced species but we should analyze what makes them thrive the way they do. I usually cover natives species to a document a dramatic loss I noticed in my lifetime however every plant has a good story behind.

To start let's identify the Princess Tree! Best known for their showy pink-lavender foxglove like flowers, perfect structural form, and massive leaves. This tree can grow up 90 feet, it's extremely fast growing, full trees can form between bricks (see 2 images below). The massive leaves are heart-shaped cataylpa-like often exceeding a foot in size (I see people use them as umbrellas in a pinch). The bark is pretty light in color, younger bark is speckled then becomes furrowed with age. The flowers are rather large, about the size of my palm (image 2), typically growing in large triangular clusters. In fall and winter, flowers typically form this large rough shell (see branch cuttings below) that splits overtime, more about that later.

The Princess Tree has a very rich folklore and introduced history behind it. According to my Chinese classmates the Princess Tree gets it's name from an old story about a beloved betrothed Princess who was transformed into this tree by a trickster, her husband-to-be was transformed into a Phoenix and it's said that when a ruler as great as she returns the Phoenix will land on its branches. I see (mostly western anecdotes) claim that this tree is planted when girls are born and the wood is used as a dowry, my classmates did not agree with this (take note these are landscape students). The wood is very sought-after in east Asia as it is sturdy and light, occasionally some american cities will sell the wood from invasive groves back to China, how fascinating!

The introduced history comes in two parts. The first the tree was initially sold as an ornamental originating from the Dutch east India company, the tree reached America by the 1830s. Due to the structure of the tree itself up into the mid century, modernist designers LOVED this tree, I've seen so many architectural drawings lovingly depicting it's big leaves. The second interesting facet about this tree's spread is that certain Chinese porcelain companies used to use the seed pods as a form of packing peanuts. Since the porcelain was primarily shipped by train in continent the tree quickly took hold around rail lines, if you look in philadelphia the oldest trees are around the railroads. The tree was able to survive in the desolate railway soils because it (like most invasive species) is able to derive nitrogen directly from the atmosphere into its roots. That's why you see these babies growing directly in a brick wall like below, crazy right?

The Princess Tree's native range is central to Western China, not much is know about it's natural habitat because literal millenia of civilization scale landscape changes. What is known is that the tree was typically found in dry-ravines and open valleys. Due to the movement of interesting botanical species the tree found found itself everywhere, even in Catherine the Great's royal garden and eventually into colonial-core markets. In America its currently invasive from Pennsylvania to Florida but can be found in almost every major city.

As said before it typically only invades disturbed locations, it's a pioneer species therefore it's advantageous in areas of full sun, poor soil, and generally super dry. The tree can honestly grow anywhere but typically only thrives in that disturbance niche, it has trouble invading older growth forests. The tree itself usually doesn't live more than 70ish years and after that a new ecology typically sprouts from the area it formerly inhabited, this tree is very good at building a fertile soil network from its nitrogen rich leaves. It must be said that this tree does rootsprout vigorously, and these sprouts can grow a shocking 15 feet in one growing season!!! Trees derived from seed usually take 3 years to reach that size (see my alleyway below)...for basically any oak it would take like 10 years to maybe reach that.

As for ethnobotanical usage, this is invasive so I'm going to recommend you just use this tree to death honestly. The massive leaves are very rich in nitrogen and make great compost. Leaves also make an umbrella in a pinch. The tree is super vigorous and a rapid grower so you can imagine it makes great coppice (and for my silvoculturists: leaves makes good animal fodder). The flowers have a lovely scent and look like foxglove without the poison (and they last a while). The wood is quite light lovely and workable, it reminds me of a lighter colored black locust. Apparently this tree also utlizes C⁴ photosynthesis which utilizing a different compound of carbon to derive energy, that's kind of interesting. It has a lot of great qualities honestly, as far as invasives go I really like this tree.

If you want to plant this tree...don't <3...there's enough, go to any city to experience it. In Eastern America some good alternatives are northern catalypa or black locust. If any of my Chinese followers know the full Princess story I would love to hear about it! As always happy hunting!

#plant profiles#invasive species#princess tree#Paulownia tomentosa#plants of eastern North America#plants from China

7 notes

·

View notes

Text

Humans are burning about 40 gigatons (a gigaton is a billion tons) of fossil carbon per year. Scientists have calculated that we can burn about 500 more gigatons of fossil carbon before we push the average global temperature over 2 degrees Celsius higher than it was when the industrial revolution began; this is as high as we can push it, they calculate, before really dangerous effects will follow for most of Earth’s bioregions, meaning also food production for people. Some used to question how dangerous the effects would be. But already more of the sun’s energy stays in the Earth system than leaves it by about 0.7 of a watt per square meter of the Earth’s surface. This means an inexorable rise in average temperatures. And a wet-bulb temperature of 35 will kill humans, even if unclothed and sitting in the shade; the combination of heat and humidity prevents sweating from dissipating heat, and death by hyperthermia soon results. And wet-bulb temperatures of 34 have been recorded since the year 1990, once in Chicago. So the danger seems evident enough.

Thus, 500 gigatons; but meanwhile, the fossil fuels industry has already located at least 3,000 gigatons of fossil carbon in the ground. All these concentrations of carbon are listed as assets by the corporations that have located them, and they are regarded as national resources by the nationstates in which they have been found. Only about a quarter of this carbon is owned by private companies; the rest is in the possession of various nation-states. The notional value of the 2,500 gigatons of carbon that should be left in the ground, calculated by using the current price of oil, is on the order of 1,500 trillion US dollars.

It seems quite possible that these 2,500 gigatons of carbon might eventually come to be regarded as a kind of stranded asset, but in the meantime, some people will be trying to sell and burn the portion of it they own or control, while they still can. Just enough to make a trillion or two, they’ll be saying to themselves—not the crucial portion, not the burn that pushes us over the edge, just one last little taking. People need it.

The nineteen largest organizations doing this will be, in order of size from biggest to smallest: Saudi Aramco, Chevron, Gazprom, ExxonMobil, National Iranian Oil Company, BP, Royal Dutch Shell, Pemex, Petróleos de Venezuela, PetroChina, Peabody Energy, ConocoPhillips, Abu Dhabi National Oil Company, Kuwait Petroleum Corporation, Iraq National Oil Company, Total SA, Sonatrach, BHP Billiton, and Petrobras.

Executive decisions for these organizations’ actions will be made by about five hundred people. They will be good people. Patriotic politicians, concerned for the fate of their beloved nation’s citizens; conscientious hard-working corporate executives, fulfilling their obligations to their board and their shareholders. Men, for the most part; family men for the most part: well-educated, well-meaning. Pillars of the community. Givers to charity. When they go to the concert hall of an evening, their hearts will stir at the somber majesty of Brahms’s Fourth Symphony. They will want the best for their children.

Kim Stanley Robinson, The Ministry for the Future

2 notes

·

View notes

Text

Kenule Beeson “Ken” Saro-Wiwa (October 10, 1941 – November 10, 1995) was a Nigerian writer, television producer, environmental activist, and winner of the Right Livelihood Award for “exemplary courage in striving non-violently for civil, economic, and environmental rights” and the Goldman Environmental Prize. He was a member of the Ogoni people, an ethnic minority in Nigeria whose homeland, Ogoniland, in the Niger Delta, has been targeted for crude oil extraction since the 1950s and which has suffered extreme environmental damage from decades of indiscriminate petroleum waste dumping. Initially as spokesperson, and then as president, of the Movement for the Survival of the Ogoni People led a nonviolent campaign against environmental degradation of the land and waters of Ogoniland by the operations of the multinational petroleum industry, especially the Royal Dutch Shell company. He was an outspoken critic of the Nigerian government, which he viewed as reluctant to enforce environmental regulations on the foreign petroleum companies operating in the area.

At the peak of his non-violent campaign, he was tried by a special military tribunal for allegedly masterminding the gruesome murder of Ogoni chiefs at a pro-government meeting, and hanged by the military dictatorship of General Sani Abacha. His execution provoked international outrage and resulted in Nigeria’s suspension from the Commonwealth of Nations for over three years. #africanhistory365 #africanexcellence

2 notes

·

View notes

Text

In October of 2003, the Pentagon published a report on abrupt climate change.1 Its authors were by Peter Schwartz, a CIA consultant and former head of planning at the Royal Dutch/Shell Group, and Doug Randall of the California-based Global Business Network.

Their task was to assess the likelihood of abrupt climate change within the next twenty years. They were then supposed to develop a scenario of the possible consequences should abrupt climate change occur starting in 2004. Finally, they were to make recommendations to the President based on their study: An Abrupt Climate Change Scenario and Its Implications for United States National Security.

A few copies were printed and circulated around the Pentagon, which heavily censored the report and is now downplaying its significance.3 It remained effectively buried and all but forgotten until copies were leaked to the media, first to Fortune Magazine,4 and then to The Observer.5 The Pentagon has rightfully pointed out that this is a speculative report; they are not expecting abrupt climate change to begin in the year 2004. Schwartz and Randall are exploring a risk scenario, such as the Pentagon and the CIA draw up all the time ��їЅ what would happen if the Russians launched a nuclear attack this year; what would happen if California suffered the big one, etc. But the real importance of the report lies in the statement of probability and in the authors' recommendations to the President and the National Security Council.

he authors state that пїЅthe plausibility of severe and rapid climate change is higher than most of the scientific community and perhaps all of the political community is prepared for.пїЅ6 They say that instead of asking whether this could happen, we should be asking when this will happen. They conclude: пїЅIt is quite plausible that within a decade the evidence of an imminent abrupt climate shift may become clear and reliable.

#gofundme #gofundmeplease #gofundmedonations #gofundmecampaign #whatamarvelousnightforamoondance

#fy #fyp #fypage #fypシ #fypp #fyppage #fyppppppppppppppppppppppp #fyppp

#gofundme#gofundmeplease#gofundmedonations#gofundme campaign#trans#transgender#trans goddess#trans woman#intersex woman#intersex#intersexisbeautiful#intersexgoddess#goddess#devi#goddess lakshmi#goddess durga#goddess saraswati#intersex goddess#fyp#fypシ#fypツ#fypシ゚viral#fypppppppppppppppppppppppppppppppppppppppppppppppppppppppppppppppppppppp#fypage#tumblr fyp

2 notes

·

View notes

Text

Premarket U.S. Stock Movers: Tesla, Macy’s, Coinbase, Nio, Shell, Amazon

In today's early trading, the U.S. stock market is already buzzing with notable movements among key players. Investors and analysts are closely monitoring the premarket activity of several prominent stocks, each showing distinctive performance dynamics.

Tesla (NASDAQ) has started the day on a positive note, with its stock rising by 1.8%. This upward movement follows recent market optimism surrounding Tesla's innovative developments in electric vehicles and sustainable energy solutions. As a pioneering force in the automotive industry, Tesla continues to capture investor interest with its innovative technological advancements and ambitious growth strategies.

Macy’s (NYSE) is another standout performer in the premarket, showcasing a robust 6.8% increase. This surge reflects renewed investor confidence in the retail giant's ability to navigate challenges and capitalize on evolving consumer trends. Macy's ongoing efforts to enhance its digital capabilities and strategic initiatives in omnichannel retailing are positioning the company for sustained growth in a competitive market landscape.

Coinbase (NASDAQ), however, faces a 4.6% decline in its premarket trading. The cryptocurrency exchange platform is experiencing volatility amidst regulatory scrutiny and market fluctuations in digital assets. Despite its leadership in the digital currency space, Coinbase's stock performance underscores the inherent volatility and regulatory uncertainties impacting the crypto industry.

Nio (NYSE), known for its electric vehicle offerings, is witnessing a 2.3% decrease in its American Depositary Receipts (ADRs) during premarket trading. This decline comes amid broader sectoral challenges and market sentiment towards growth stocks in the EV sector. Nio continues to navigate through supply chain disruptions and competitive pressures as it strives to expand its market presence globally.

Shell (LON) ADRs, representing Royal Dutch Shell, have shown a modest 1.1% rise in premarket trading. As a global energy leader, Shell's stock performance reflects investor sentiment toward energy markets and macroeconomic factors influencing oil and gas prices. The company's strategic focus on sustainable energy transitions and operational resilience in a dynamic energy landscape remains pivotal amid evolving market conditions.

Amazon (NASDAQ), a cornerstone of e-commerce and cloud computing services, is demonstrating a minor 0.3% change in its premarket activity. Amazon's stock movement reflects ongoing investor sentiment towards tech giants amid regulatory scrutiny and competitive pressures in digital retail and cloud computing markets. The company continues to innovate across its business segments, driving growth and adaptation to evolving consumer behaviors.

Today's premarket movements highlight the diverse dynamics shaping the U.S. stock market. Investors are navigating through a mix of sector-specific trends, regulatory developments, and macroeconomic factors influencing stock performance. As market participants analyze these early signals, the day's trading session promises to offer further insights into the evolving landscape of global financial markets.

3 notes

·

View notes

Text

Prices were collapsing worldwide on the brink of the Great Depression, and this induced a price war among the major oil companies. Like the other leading oil companies, AIOC had two options: compete to win new markets for investment or set up joint ventures with other companies and divide markets among them. In response, AIOC actively pursued a parallel policy on world oil production, prices, and synthetic fuel technology. In August 1928, during the same period as his meeting with Iranian government officials in Switzerland, [John Cadman, chairman of AIOC] traveled to Achnacarry, Scotland, and agreed with the heads of the major international oil companies such as Standard Oil of New Jersey, Royal Dutch / Shell, Gulf Oil, and Standard Oil of Indiana to enter into a “Pool Association” or “As-Is” agreement. This monopoly arrangement was designed to manage the glut of oil supplies by establishing a uniform selling price so that participants would not have to worry about price competition. The group agreed to control world oil production as well, enabling the companies to increase their output above volumes indicated by their market quotas, but only so long as the extra production was sold to the other pool members.

The “As-Is” agreement additionally formed part of a much larger “hydrocarbon cartel” concerning not just oil but the chemical and coal industries. The goal was to control the chemical industry and block the coal industry from accessing the patented use of a hydrogenation technology known as the Bergius process that could be used to convert coal into oil and develop synthetic fuels. The agreement ensured that chemical firms were blocked from using the new technologies to make chemicals, synthetic rubbers, and fuels from the conversion of coal into synthetic oil. Such arrangements would help maintain a particular economy of oil through the construction of an artificial system of scarcity.

Katayoun Shafiee, Machineries of Oil: An Infrastructural History of BP in Iran, 2018

2 notes

·

View notes

Text

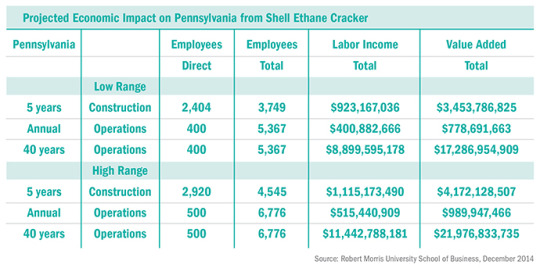

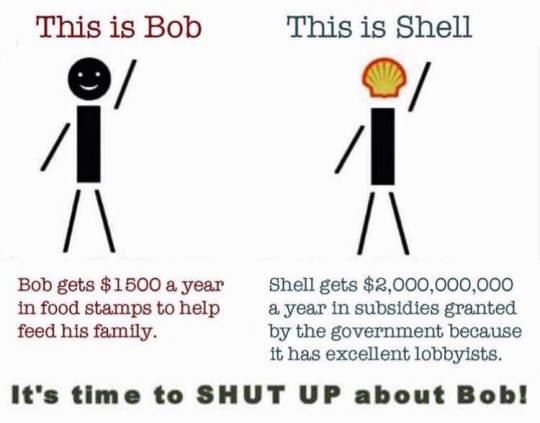

If it’s coming from the left, it’s probably a lie. The lies may be elaborately guarded with fake studies, fake data, massaged date,or misrepresented data, but it’s almost always a lie.

Take the parasite Bob on SNAP. He produces nothing of value. Yet he feels entitled to consume the hard work of the taxpayer to the tune of $1,500/a year and yet he pays NO taxes.

Now let’s look the leftist Shell game with Shell. First, Shell doesn’t get subsidized AT All, that’s right the lies start from the beginning. The $2,000,000,000 figure comes from a leftist “watchdog” called “Good Jobs First” — they’ve since pulled their Shell page, here’s their dead link:

http://subsidytracker.goodjobsfirst.org/prog.php?parent=royal-dutch-shell

Didn’t, of course, come from thin air. They took “almost real” numbers and misrepresented them:

The actual number listed on Good Jobs First page is not $2 Billion but $1.725 Billion (I guess they rounded up a few hundred million). Of that, at least somewhat auditable number, $1.65 Billion, or 95.7%, comes from a single deal with the state of Pennsylvania for a multi-year tax-credit to build a massive petrochemical plant. This probably needs to be explained to Liberals: A tax credit is not the State giving you money, it’s the state agreeing not to take as much money from you as they normally would. Still why would a State do such a thing? Could it be because, unlike Bob, Shell generates wealth?

Enough wealth that Pennsylvania slyly decided offer a tax reduction to lure Shell into building a plant in their State so that overall tax revenues would go up.

Still there’s another $275,000,000. Given the 93,000 people employed at Shell that’s almost $3000/person — except, no. The federal tax reductions account for only $4,900,000 of that amount ($52.69/per employ) and, again, this is money the government didn’t take from Shell, not money Shell was given.

How about the rest? Mostly tax right offs for demurage, depreciation, losses, research and development, etc. They call it “income tax” because it a tax on income, not assets, and certainly not on losses. It is incredibly dishonest of Good Jobs First to categorize them as subsidies — but then Leftists so it goes without saying. If your house burns down and you depreciate it’s value in your taxes and, God forbid, replace the house, you haven’t increased your income.

24K notes

·

View notes

Text

Chemical Market Rebounds with Sustainable Innovations and Smart Manufacturing: Market Square Insights Reports

Robust Demand, Green Chemistry, and Digitization Drive the Next Phase of Growth in the Global Chemical Market

The global chemical Market is undergoing a strategic transformation as market leaders adopt sustainable technologies, digitize operations, and respond to evolving regulatory frameworks. According to a new report by Market Square Insights, the sector is poised for strong growth, with innovations in specialty and performance chemicals taking center stage.

Market Overview

The chemical industry, a backbone of the global economy, spans a vast network of raw material processing, specialty product development, and manufacturing services that touch nearly every industrial vertical—from agriculture and automotive to pharmaceuticals and construction.

The Global Chemicals Market was valued at USD 6,176.3 billion in 2024 and is expected to grow at a CAGR of 2.3% during the forecast period from 2025 to 2034.

For In depth Information Get Free Sample Copy of this Report@

In recent years, specialty chemicals such as additives, polymers, adhesives, and surfactants have outpaced bulk chemicals in growth rate, as industries seek more value-added, customized solutions. Additionally, emerging economies like India, Brazil, and Southeast Asia are driving volume expansion through increased investments in chemical infrastructure and local production.

The global chemical market is segmented into basic chemicals, specialty chemicals, consumer chemicals, and agrochemicals, with demand rising for applications that support green energy, bioplastics, EV battery materials, and pharmaceutical intermediates.

More Selling Reports: -

Key Market Players:

BASF SE, Dow Inc., Saudi Basic Industries Corporation (SABIC), Exxon Mobil Corporation, Royal Dutch Shell, DuPont, LyondellBasell Industries, Mitsubishi Chemical Group Corporation, INEOS, Sumitomo Chemical Co., Ltd.

DROC Analysis: Drivers, Restraints, Opportunities, and Challenges

Drivers:

Surge in demand for specialty chemicals in electronics, automotive, and healthcare

Growing emphasis on green and bio-based chemicals driven by ESG goals

Advancements in process automation and AI-based chemical synthesis

Restraints:

Volatile raw material prices and geopolitical disruptions in oil and gas supply

Stringent environmental regulations and compliance costs in developed markets

Opportunities:

Rapid expansion in the Asia-Pacific region with favorable government policies

Development of bio-refineries and green hydrogen integration in chemical production

Adoption of carbon capture, utilization, and storage (CCUS) in industrial plants

Challenges:

Transitioning legacy plants to low-emission technologies

Global talent shortage in chemical engineering and R&D domains

Managing waste streams and traceability in complex supply chains

Market Trends and Forecast

Key trends shaping the future of the chemical sector include:

Rise of green chemistry and recyclable polymer design

Increased R&D investments in electrochemical and enzymatic processes

Vertical integration of digital twins and smart manufacturing platforms

Mergers and acquisitions focused on sustainability portfolios and regional dominance

For In depth Information Get Free Sample Copy of this Report@

About Market Square Insights:

At Market Square Insights, we understand research requirements and help a client in taking informed business-critical decisions. The company focuses on helping the clients achieve transformational growth by helping them make crucial business decisions. At Market Square Insights, we diligently study emerging trends across various industries at global and regional levels, to identify potential opportunities for our client.

Contact us:

Market Square Insights,

56/3, Kawade Nagar,

Sai Mandir Road, Near HDFC Bank,

New Sangavi, Pune-61

IND: +91 9405802422

0 notes

Text

Netherlands LNG Bunkering Market Trends 2025: Insights from Top OEMs

Netherlands LNG Bunkering Market was valued at USD X.X Billion in 2024 and is projected to reach USD X.X Billion by 2032, growing at a CAGR of X.X% from 2026 to 2032. What are the potential factors contributing to the growth of the Netherlands LNG bunkering market? The growth of the Netherlands LNG bunkering market is driven by several key factors. Firstly, the increasing environmental regulations aimed at reducing sulfur emissions from ships encourage the adoption of LNG as a cleaner alternative fuel. This aligns with global maritime initiatives focused on sustainability and reducing the carbon footprint of shipping. Secondly, the strategic geographical location of the Netherlands as a major European maritime hub enhances demand for LNG bunkering, supporting extensive shipping traffic through its ports. Thirdly, advancements in LNG bunkering infrastructure, including investments in LNG storage facilities and bunkering vessels, facilitate easier access to LNG fuel for maritime operators. Additionally, government incentives and supportive policies promoting cleaner fuel options further boost market expansion. The rising interest of shipping companies in complying with the International Maritime Organization’s (IMO) 2020 sulfur cap regulations also plays a significant role in increasing LNG adoption. Furthermore, the growing number of LNG-powered vessels, including container ships and ferries operating in and around Dutch waters, underlines a shift toward LNG as a preferred fuel option. These combined elements form a strong foundation for the continued growth of the LNG bunkering market in the Netherlands. Get | Download Sample Copy with TOC, Graphs & List of Figures @ https://www.verifiedmarketresearch.com/download-sample/?rid=475110&utm_source=PR-News&utm_medium=211 The competitive landscape of a market explains strategies incorporated by key players of the Netherlands LNG Bunkering Market. Key developments and shifts in management in recent years by players have been explained through company profiling. This helps readers to understand the trends that will accelerate the growth of the Netherlands LNG Bunkering Market. It also includes investment strategies, marketing strategies, and product development plans adopted by major players of the Netherlands LNG Bunkering Market. The market forecast will help readers make better investments. The report covers extensive analysis of the key market players in the market, along with their business overview, expansion plans, and strategies. The key players studied in the report include: Royal Dutch Shell Port of Rotterdam Gasunie Titan LNG Engie Spliethoff Group K Line LNG Shipping STASCO Knighthawk Energy TotalEnergies Netherlands LNG Bunkering Market Segmentation By Type of Product By Cooling Capacity By End-User Industry By Geography • North America• Europe• Asia Pacific• Latin America• Middle East and Africa The comprehensive segmental analysis offered in the report digs deep into important types and application segments of the Netherlands LNG Bunkering Market. It shows how leading segments are attracting growth in the Netherlands LNG Bunkering Market. Moreover, it includes accurate estimations of the market share, CAGR, and market size of all segments studied in the report. Get Discount On The Purchase Of This Report @ https://www.verifiedmarketresearch.com/ask-for-discount/?rid=475110&utm_source=PR-News&utm_medium=211 The regional segmentation study is one of the best offerings of the report that explains why some regions are taking the lead in the Netherlands LNG Bunkering Market while others are making a low contribution to the global market growth. Each regional market is comprehensively researched in the report with accurate predictions about its future growth potential, market share, market size, and market growth rate. Geographic Segment Covered in the Report: • North America (USA and Canada) • Europe (UK, Germany, France and the rest of Europe) • Asia Pacific (China,

Japan, India, and the rest of the Asia Pacific region) • Latin America (Brazil, Mexico, and the rest of Latin America) • Middle East and Africa (GCC and rest of the Middle East and Africa) Key questions answered in the report: • What is the growth potential of the Netherlands LNG Bunkering Market? • Which product segment will take the lion's share? • Which regional market will emerge as a pioneer in the years to come? • Which application segment will experience strong growth? • What growth opportunities might arise in the Welding industry in the years to come? • What are the most significant challenges that the Netherlands LNG Bunkering Market could face in the future? • Who are the leading companies on the Netherlands LNG Bunkering Market? • What are the main trends that are positively impacting the growth of the market? • What growth strategies are the players considering to stay in the Netherlands LNG Bunkering Market? For More Information or Query or Customization Before Buying, Visit @ https://www.verifiedmarketresearch.com/product/netherlands-lng-bunkering-market/ Detailed TOC of Global Netherlands LNG Bunkering Market Research Report, 2023-2030 1. Introduction of the Netherlands LNG Bunkering Market Overview of the Market Scope of Report Assumptions 2. Executive Summary 3. Research Methodology of Verified Market Research Data Mining Validation Primary Interviews List of Data Sources 4. Netherlands LNG Bunkering Market Outlook Overview Market Dynamics Drivers Restraints Opportunities Porters Five Force Model Value Chain Analysis 5. Netherlands LNG Bunkering Market, By Product 6. Netherlands LNG Bunkering Market, By Application 7. Netherlands LNG Bunkering Market, By Geography North America Europe Asia Pacific Rest of the World 8. Netherlands LNG Bunkering Market Competitive Landscape Overview Company Market Ranking Key Development Strategies 9. Company Profiles 10. Appendix About Us: Verified Market Research® Verified Market Research® is a leading Global Research and Consulting firm that has been providing advanced analytical research solutions, custom consulting and in-depth data analysis for 10+ years to individuals and companies alike that are looking for accurate, reliable and up to date research data and technical consulting. We offer insights into strategic and growth analyses, Data necessary to achieve corporate goals and help make critical revenue decisions. Our research studies help our clients make superior data-driven decisions, understand market forecast, capitalize on future opportunities and optimize efficiency by working as their partner to deliver accurate and valuable information. The industries we cover span over a large spectrum including Technology, Chemicals, Manufacturing, Energy, Food and Beverages, Automotive, Robotics, Packaging, Construction, Mining & Gas. Etc. We, at Verified Market Research, assist in understanding holistic market indicating factors and most current and future market trends. Our analysts, with their high expertise in data gathering and governance, utilize industry techniques to collate and examine data at all stages. They are trained to combine modern data collection techniques, superior research methodology, subject expertise and years of collective experience to produce informative and accurate research. Having serviced over 5000+ clients, we have provided reliable market research services to more than 100 Global Fortune 500 companies such as Amazon, Dell, IBM, Shell, Exxon Mobil, General Electric, Siemens, Microsoft, Sony and Hitachi. We have co-consulted with some of the world’s leading consulting firms like McKinsey & Company, Boston Consulting Group, Bain and Company for custom research and consulting projects for businesses worldwide. Contact us: Mr. Edwyne Fernandes Verified Market Research® US: +1 (650)-781-4080UK: +44 (753)-715-0008APAC: +61 (488)-85-9400US Toll-Free: +1 (800)-782-1768 Email: [email protected] Website:- https://www.verifiedmarketresearch.com/

Top Trending Reports https://www.verifiedmarketresearch.com/ko/product/legal-services-market/ https://www.verifiedmarketresearch.com/ko/product/luxury-packaging-boxes-market/ https://www.verifiedmarketresearch.com/ko/product/lng-marine-cryogenic-pump-market/ https://www.verifiedmarketresearch.com/ko/product/load-bank-market/ https://www.verifiedmarketresearch.com/ko/product/leave-management-system-market/

0 notes

Text

Royal Dutch Shell in Nigeria - 15.5MIL out-of-court settlement in 2009.

Ken Saro-Wiwa was hanged in 1995 for crimes he did not commit, alongside the rest of the Ogoni 9. 2 key witnesses in that 1995 "trial" have since alleged they were bribed by Shell to fabricate their stories.

i feel like the boeing whistleblower case should radicalize more people. a major airline company is producing planes with less and less regard for safety and it's starting to get noticeable. man takes them to court, which would reduce profit at the cost of public safety. he fucking dies the night that boeings legal team asks him to stay an extra day. if nothing happens about this, i hope it gets through to people that america would literally kill you for a few extra cents

97K notes

·

View notes