#STPI registration

Explore tagged Tumblr posts

Text

🏢 STPI and Non-STPI Registration in India: A Complete Guide for IT & ITES Businesses (2025)

In India, the IT and IT-enabled services (ITES) sector has witnessed exponential growth. To promote exports and innovation in this domain, the government offers STPI (Software Technology Parks of India) and Non-STPI registration models. These schemes provide fiscal benefits, regulatory support, and infrastructure to IT units. In this guide, we’ll explain the eligibility, process, documentation,…

#ITES registration India#MeitY schemes#non stpi#non stpi registration#Non-STPI registration#software export compliance#stpi#STPI approval process#STPI benefits for exporters#stpi registration#STPI registration India

0 notes

Text

The software export industry in India has witnessed tremendous growth, driven by global demand and government support. To streamline operations and encourage exports, the Software Technology Parks of India (STPI) scheme was introduced. STPI registration plays a crucial role in helping IT businesses expand internationally while enjoying tax benefits and regulatory support. Businesses that apply for STPI registration gain access to various incentives, making it easier to operate in a competitive global market.

#legal#legal services#tax#STPI registration#chims registration#zed certification#DSC registration#Apply for stpi registration#chims certificate registration#zed certificate for msme#digital signature registration

0 notes

Text

0 notes

Text

Startups in India are flourishing as they capitalize on technology and innovation. To succeed in international markets, businesses require a strong foundation that enables them to achieve export excellence. This is where STPI registration plays a pivotal role. By fostering IT and IT-enabled services, the Software Technology Parks of India (STPI) scheme helps startups scale globally while adhering to compliance and achieving operational efficiency.

0 notes

Text

Start Your Business Right – Register with Ease Today!

Looking to set up your business in India? Corpbiz makes it simple! Get your DSC Registration Online to securely sign documents, apply for STPI Registration for IT/ITES benefits, register a One Person Company to start solo, and obtain 12AB Registration for NGO tax exemptions. Our expert team handles everything from documentation to filing, so you can focus on growing your dream. Fast, reliable, and 100% online support — we’ve got you covered.

0 notes

Text

ITES Certificate in India: Benefits, Eligibility, and Step-by-Step Process for Service-Based Companies

India is home to one of the fastest-growing IT-enabled service sectors in the world. Whether it's BPO, SaaS, digital marketing, analytics, or software development — businesses that provide tech-driven services are thriving. But to scale operations, claim government benefits, or enter global markets, one document becomes essential: the ITES certificate.

In this blog, we’ll walk you through what an ITES certificate is, why it matters for your business, who needs it, and how to apply for it step-by-step.

🔹 What Is an ITES Certificate?

ITES stands for Information Technology Enabled Services. These are services that rely primarily on IT infrastructure and are delivered digitally — either remotely or online.

Some examples include:

Business Process Outsourcing (BPO)

Software Development & SaaS

Data Analytics & Processing

Technical Support Services

Website & App Development

Digital Marketing

Cloud-Based Services

An ITES certificate officially classifies your company under this sector. Issued by recognized government bodies, it serves as proof that your business operates in the IT-enabled services domain. It’s a key requirement for benefits such as tax exemptions, participation in tenders, STPI/SEZ registrations, and export documentation.

🔹 Why Is the ITES Certificate Important for Service-Based Businesses?

Whether you're a startup, SME, or established IT company, an ITES certificate can unlock multiple benefits:

✅ 1. Access to Government Incentives

The Indian government promotes ITES businesses through schemes like STPI (Software Technology Parks of India) and SEZ (Special Economic Zones). An ITES certificate is required to apply for these programs, which offer tax holidays, infrastructure benefits, and regulatory ease.

✅ 2. Global Business Credibility

When dealing with international clients, documentation plays a big role in building trust. Having an ITES certificate demonstrates your company’s legitimacy and industry classification.

✅ 3. Eligibility for Export Registration

Planning to export your services? ITES certification streamlines your IEC (Import Export Code) registration and helps categorize your company correctly with Export Promotion Councils.

✅ 4. Tender & RFP Compliance

Large-scale government and enterprise tenders often mandate ITES certification. Having it gives you a competitive edge when bidding for national and global contracts.

✅ 5. Smoother Taxation & Regulatory Compliance

The certificate helps with classification under SAC (Service Accounting Codes) for GST. This makes taxation and refund claims easier and more accurate.

🔹 Who Needs an ITES Certificate?

You should consider applying for an ITES certificate if:

You run a service-based business relying on IT infrastructure

You provide services to clients remotely or digitally

You aim to export your services

You’re planning to register under STPI or SEZ

You’re participating in government tenders or RFPs

Even freelancers or small agencies can apply, provided they have proper documents like GST registration, client agreements, and proof of service delivery.

🔹 Eligibility Criteria for ITES Certification

To be eligible for an ITES certificate, your business typically must:

Be legally registered (as Pvt. Ltd., LLP, OPC, or Partnership)

Offer IT-enabled services

Have relevant supporting documents like service agreements or invoices

Operate using IT infrastructure for service delivery

🔹 Step-by-Step Process to Get an ITES Certificate

Applying for an ITES certificate involves a few key steps. Here’s a breakdown:

Step 1: Organize Your Documents

Prepare the following:

PAN and GST certificates of the company

Incorporation certificate or LLP agreement

MoA (if applicable)

Business website and email domain

List of services offered

2–3 sample invoices or client contracts

Step 2: Choose the Right Certifying Body

Depending on your business needs, apply through:

STPI for export-focused firms

SEZ Authority if operating in a special zone

Export Promotion Councils (EPCs)

Or, for general classification, submit to relevant state IT departments

Step 3: Submit the Application

Most authorities have online portals. Upload documents, fill out the form, and pay any applicable fee.

Step 4: Verification

The certifying body may:

Review your application and documents

Conduct a physical or virtual verification

Request additional details, if necessary

Step 5: Receive Your Certificate

Once approved, the ITES certificate is issued — usually within 1 to 3 weeks.

🔹 Documents Required for ITES Certification

Here’s a general list:

Company PAN Card

GST Registration

Certificate of Incorporation / LLP Agreement

Director/Partner KYC (Aadhar, PAN)

Business website URL (optional but helpful)

List of ITES services provided

Client invoices, proposals, or service agreements

🔹 Post-Certification Compliance: What You Need to Maintain

Once you have the certificate, ensure you:

Keep records updated (new services, clients, etc.)

Renew the certificate if it has an expiry (based on issuing body)

Submit reports or documents if required annually

Maintain consistency in classification for taxation and export filings

🔹 Use Cases: Who Benefits from ITES Certification?

Sectors that benefit the most include:

BPO/KPO companies

SaaS startups

IT consulting firms

FinTech and EdTech startups

Data analytics service providers

UI/UX & software development agencies

Digital marketing agencies

🔹 Final Thoughts: Make Your Services Export-Ready

An ITES certificate is more than a compliance document — it’s a growth enabler. From gaining access to government schemes to boosting your reputation in global markets, it’s a powerful credential for any service-based business in India.

If you're planning to scale your services, apply for government incentives, or attract global clients — now’s the time to get ITES certified.

#ITESCertificate#ITESIndia#ServiceBasedBusiness#ITEnabledServices#ExportServices#SEZIndia#DigitalServices#Consulting

0 notes

Text

STPI India – Empowering IT & Software Export Growth Across the Nation

Explore STPI India's role in boosting IT exports, supporting startups, and enabling tech innovation. Get details on STPI registration, incentives, and compliance for software exporters in India.

Software Technology Parks of India (STPI) – Driving India’s IT and Innovation Ecosystem India’s global recognition as a technology powerhouse is largely due to the success of initiatives like the Software Technology Parks of India (STPI). Established by the government to promote software exports and boost IT infrastructure, STPI has been instrumental in driving innovation, employment, and digital transformation across the country.

🔹 What is STPI?

The Software Technology Parks of India (STPI) is an autonomous society under the Ministry of Electronics and Information Technology (MeitY). Since its establishment in 1991, STPI has provided critical support to IT/ITES companies through world-class infrastructure, incubation services, and policy facilitation.

The initiative has expanded rapidly, with over 60 centers across the country, making it a cornerstone of India’s technology development, particularly in Tier 2 and Tier 3 cities.

🔹 Key Objectives of Software Technology Parks of India

Promote software exports and foreign exchange earnings through duty-free zones

Support startups and MSMEs with incubation centers and business support services

Encourage innovation and R&D through CoEs (Centres of Excellence)

Facilitate regional development by decentralizing IT services

Enable policy support and FDI through streamlined regulations

By nurturing a favorable business environment, STPI has helped thousands of companies scale their operations while contributing significantly to India’s digital economy.

🔹 Services Offered by STPI

Customs Bonded Infrastructure: Duty-free imports of capital goods for export-oriented software development.

Incubation & Office Space: Affordable, fully equipped offices with high-speed internet and modern IT infrastructure.

Simplified Approvals: Single-window clearances for registration and compliance under the STP scheme.

CoEs & Innovation Hubs: Specialized facilities for sectors like IoT, AI, blockchain, and fintech.

Support for Startups: Business mentoring, investor connections, and access to government incentives.

🔹 Impact of STPI on India’s IT Growth

Facilitated ₹5+ lakh crore in annual software exports

Generated employment for millions of IT professionals

Boosted the startup ecosystem in regions outside of metros

Played a key role in India becoming a global IT outsourcing leader

STPI has helped India create a resilient, globally competitive IT industry by enabling seamless collaboration between government, industry, and academia.

🔹 Future of STPI in India’s Digital Vision

As part of the Digital India movement, STPI is evolving with a focus on emerging technologies such as artificial intelligence, 5G, robotics, and deep tech. Programs like Electropreneur Park and NextGen Startup Challenge are tailored to promote innovation and hardware-based entrepreneurship.

Through initiatives like the Software Technology Parks of India, the country is preparing its infrastructure and workforce for the next wave of digital transformation.

#STPIIndia#SoftwareTechnologyParks#ITExportsIndia#STPIRegistration#TechStartupsIndia#DigitalIndia#ITCompliance#STPIUnits#MakeInIndia#ITSEZ#STPIApproval#ExportPromotionIndia

0 notes

Text

How to Establish an IT Company in India: Legal Procedure, Dispute Management & Key Insights under BNS

Learn how to establish an IT company in India with a step-by-step legal guide, including company registration, dispute resolution strategies, and key BNS (Bharatiya Nyaya Sanhita) provisions.

Authored by B S Makar, Advocate & Solicitor.

Introduction

India’s IT sector is booming and continues to attract entrepreneurs from across the globe. Establishing an Information Technology (IT) company in India involves a blend of regulatory compliance, strategic planning, and legal foresight. Whether you’re a tech visionary or a legal advisor helping a startup, understanding the legal landscape — including the role of Bharatiya Nyaya Sanhita (BNS) in dispute resolution — is crucial.

This blog provides a step-by-step guide to setting up an IT company in India, navigating legal formalities, managing disputes effectively, and staying compliant with the latest Indian laws.

1. Preliminary Planning: Business Structure Selection

Before registration, choose the most suitable business structure:

Private Limited Company (most preferred for IT firms due to limited liability and scalability)

Limited Liability Partnership (LLP)

Sole Proprietorship

Partnership Firm

Each structure has different tax implications, compliance requirements, and funding potential.

2. Company Registration Procedure (MCA Compliance)

Registering a company in India is governed by the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013.

Steps to Register:

Obtain Digital Signature Certificate (DSC)

Apply for Director Identification Number (DIN)

Name Reservation via RUN (Reserve Unique Name)

Incorporation through SPICe+ (Simplified Proforma for Incorporating Company Electronically)

Apply for PAN & TAN (automatically included in SPICe+)

Open a Current Bank Account in the Company’s Name

Timeframe:

Registration typically takes 7–10 working days if documents are complete.

3. Licensing & Tax Registrations

GST Registration (if turnover exceeds Rs. 20 Lakhs or Rs. 10 Lakhs in special category states)

Professional Tax Registration (if applicable in your state)

Import Export Code (IEC) (if offering services to overseas clients)

Software Technology Parks of India (STPI) Registration (for export incentives)

4. Data Protection, Cyber Law & IP Compliance

Draft IT Contracts: NDAs, Service Agreements, Terms of Use, Privacy Policies

Intellectual Property: Register trademarks, copyrights for proprietary software and logos

Data Protection: Comply with the Digital Personal Data Protection Act, 2023

Cyber Law: Be aware of offenses under the Information Technology Act, 2000 and BNS provisions related to cyber fraud

5. Dispute Management for IT Companies

Disputes in IT businesses can stem from client conflicts, IP theft, payment delays, or employee misconduct. Having a structured dispute resolution mechanism is vital.

Common Legal Disputes:

Breach of Software Licensing Agreements

Cybersecurity Breaches or Data Leaks

Intellectual Property Infringement

Breach of Confidentiality

Dispute Resolution Strategies:

Arbitration Clauses in contracts

Mediation or Conciliation before court action

Digital Evidence Handling in case of cybercrime

6. Criminal Provisions under Bharatiya Nyaya Sanhita (BNS)

The new Bharatiya Nyaya Sanhita (BNS), which replaces the Indian Penal Code (IPC), includes robust provisions for cyber-related offenses relevant to IT companies:

Key BNS Provisions:

Section 336: Cyber fraud and identity theft

Section 337: Unauthorized access to computer networks

Section 338: Tampering with electronic records and digital signatures

Section 337(3): Offense of phishing, hacking or introducing malware

These sections provide the basis for FIRs and legal action in case of digital or contractual fraud.

7. Case Study: Cyber Theft Resolved through Mediation

XYZ Technologies Pvt Ltd faced a major cyber breach due to insider theft. The data theft was reported under Section 336 BNS. Rather than pursuing lengthy litigation, both parties agreed to arbitration.

Outcome:

Damages of Rs. 25 Lakhs were recovered

The insider was barred from the industry for 5 years

Reputation of the company remained intact

8. Conclusion: Legal Preparedness Ensures Growth

The Indian IT industry is dynamic and full of potential. However, legal preparedness — right from company registration to dispute resolution — is critical for sustainable growth. By understanding new laws like BNS and embracing strong compliance protocols, startups can avoid legal pitfalls and focus on innovation.

Need Legal Assistance?

If you are planning to start an IT company in India or facing legal disputes in the tech domain, professional guidance is just a call away.

Author:

B S Makar, Advocate & Solicitor

669, Sector-64 (Phase -10), Mohali, Punjab

Website: www.makarlaws.com Contact: +91 9878131111 Location: Mohali, Punjab, India

0 notes

Text

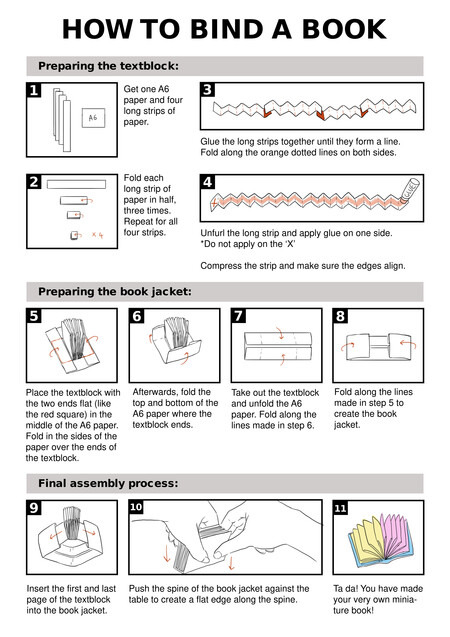

Week 14

Jul 16 ~ 20

This week was pretty chill compared to the other weeks I had from my intern.

I spend my week preparing instruction templates for two future workshops, a Sunday free walk-in workshop and a bookbinding workshop in collaboration with NLB.

In our weekly department meeting, we received a comment from our supervisor to manage the master schedule with all the sign-ups, price, and quantity checking.

Also, there was some feedback that both workshops were complicated for people to understand the process, and also time-consuming for instructors to explain for each participant.

I made this first demo but was told by my supervisor that it should concentrate more on the instruction itself.

Afterward, I changed the format of the instruction to be more simplified for the participants to understand easily.

Afterward, I started sketching out the instructions for the book binding. I would initially stick with the same format as the one above. But looking through other samples, I felt an illustrative instruction with hand hand-drawn process would make a good understanding.

I first made a sketch with a pencil on paper to get a picture of what the process is fully drawn out. There were 13 steps in total for the bookbinding process.

Afterward, I edited the scanned image into an instruction format.

I made two versions for A4 and A5 sizes to show to my supervisor and see what would be suitable for the workshop.

I had huge help from my colleagues to check the flow and the grammar of the instruction paper.

ASE - Beyond the Surface: Kitchen Lithography Workshop

While working on admin and digital works, our department prepared for a lithography workshop, which was part of the annual special exhibition. We were low on some materials, so I went to buy some on the way to work. Like coke, foil, and other various materials.

After we had all the materials, we started preparing for the workshop. As usual, we worked on the setup (based on the sign-up), setting up the projector and materials for the instructor, printing registration, etc.

On the day of the workshop, one of the interns had a half day. So I take over the afternoon session. There were fewer people so it was quite manageable. We just got a new intern in the creatives so she was taking pictures for most of the time. So I was just going around to instruct the participants to answer questions and direct them as they seemed to be struggling.

Afterward, we cleaned up, and another week has been fulfilled.

Photo courtesy of STPI Creative Workshop & Gallery

0 notes

0 notes

Text

Learn What is #STPI Registration and Why Do You Need It? we offer Best services for #stpiregistration including stpi online registration. For More Info: https://www.company-registration.in/blog/what-is-stpi-registration-and-why-do-you-need-it.php

0 notes

Text

Business registration Services in Dwarka/ Delhi

Legal-N-Tax Advisory for business setup consultancy services in Dwarka, registration in Delhi company incorporation, and Benefits of Business Registration in Delhi Business Setup Consultants in Dwarka | Business Registration Delhi Legal-N-Tax Advisory for business setup consultancy services in Dwarka, registration in Delhi company incorporation, and Benefits of Business Registration in Delhi Business Setup Consultants in Dwarka | Business Registration Delhi

Accumulate the whole information on Business Enrollments in Delhi, India The course of business enlistment in Delhi India includes the posting of your business on a public data set from where it contacts a colossal crowd. By providing customers who are looking for you online with additional useful information, this listing aims to promote your company. It is one of the fundamental and dynamic tasks that must be completed in order to operate a reputable, safe, and profitable business in any cherished economic field. There are different kinds of business enlistment. Some of them are given below:

Limited liability company: A business that is controlled by a solitary individual is known as a sole ownership. Partnership companies: In this sort of business Enlistment, at least two individuals share possession and the obligations of dealing with the firm. One Person's Business: This sort of business enrollment is the half-and-half type of sole ownership. The sole proprietors of this company own and operate the business. Public restricted organization: A public limited company is one that is not a private company. There must be at least three directors and seven members in this business. Confidential restricted organization: The organization which isn't public is known as a confidential restricted organization. Establishing a business in India and registering it in Delhi include the following steps:

For business enlistment in Delhi India, the concerned government body could be any of the directorates of enterprises in the genuine state; the registrar of companies, and the ministry of Corporate Affairs. The assistance and cycle of business enrollment depend on the kind of business to be enlisted which are given below:

For enrolling a private company in any state, in a split second concerned is the state directorate of enterprises or the region ventures focus. There are necessities for long-lasting and brief enlistments of independent companies. Contacts must be made with the assistance of MCA and its own portal for LLP registration. The application for registration of an EOU must be presented to the ministry as well as the relevant development commissioner of commerce and industry. For a private and public restricted organization enlistment, an STPI or segment 8 organization in any ideal territory of India, the most able body is the ROC of the state. The registrar of the society's state registration is immediately concerned with society registration. The importance of starting a business in India: There are different reasons that show the significance of business arrangements in India. The following are a few examples:

You'll be protected by the law if you register your business. Additionally, it is essential for obtaining a bank loan. Acquiring benefits from the plans of the public authority is likewise one of the primary purposes behind the significance of business enrollment. If you don't sign up, you might run into a lot of problems. Additionally, business registration aids in brand promotion. Your company's business registration is required for opening a current account on your behalf. Business enlistment is likewise significant for you on the off chance that you are running an organization firm and a sole ownership firm. There is a requirement for business registration in order to obtain the GSTIN. Business enrollment additionally helps in tracking down financial backers and helps in expanding your believability on the lookout. Business enrollment benefits: There are different advantages of business enlistment. Some of them are given below:

The following are the steps for registering a private limited company in India: Separate legal identity Easy transferability Limited liability Funding for the business Perpetual succession Meeting buyer criteria Easy and free transferability of shares Raising foreign investment Step 1: Get an endorsement having a computerized signature Stage 2: Get a chief ID number Stage 3: Record for endorsement of the name Stage 4: Step 5 of the SPICe form: e-MoA and e-AoA Step-6 Skillet and TAN application legitimate These are the means that should be followed when somebody needs to enroll in their confidential restricted organization.

Dwarka, a sub-city situated in the southwest locale of Delhi, is turning into an undeniably famous area for organizations. Legal and regulatory compliance, finding suitable office space, and developing a marketing strategy are just a few of the obstacles entrepreneurs in Dwarka may face when starting a business. This is where business arrangement experts come in. In Dwarka, Dwarka business setup consultants provide a variety of services to entrepreneurs who want to start businesses. They help with legal and regulatory compliance, guide entrepreneurs in developing a marketing strategy, and help them locate suitable office space. Business setup consultants in Dwarka can help entrepreneurs navigate the complexities of starting a business and increase their chances of success with their expertise and experience.

Visit:- https://www.legalntaxindia.com/service/business-registrations for additional information

0 notes

Link

STPI is a unit which is enlisted as software export unit and the premises of which is additionally reinforced with Customs department.

0 notes

Text

Starting a business in Bengaluru requires multiple regulatory approvals, one of the most important being the BBMP trade license. Issued by the Bruhat Bengaluru Mahanagara Palike (BBMP), this license is mandatory for businesses operating within the city limits. However, many applicants make avoidable mistakes during the application process, leading to delays, penalties, or even rejection. Understanding these common errors and learning how to navigate the process correctly can save time and ensure smooth business operations.

#legal#legal services#bbmp trade license#bbmp trade Registration#zed certification#zed certification apply online#STPI registration#Online stpi registration#DSC registration#digital signature registration

0 notes

Photo

Ajay sing is a goog Electrical engineering. My Date of birth is 17/04/1997. I am now join in smiwainfosol technologies company in Balasore , Odisha India. STPI software technologies park India. There are Digital Marketing, web design, Animation, Website Design, Web development, Mobile Apps Development, Animation development, multimedia, social media, SEO search engine optimization, Domain registration and hosting. This software company I have my work experience 2 year Search engine Optimization SEO.

My qualification is 3 year Diploma electrical engineering pass, then B.tech Electrical Engineering and MBA, M.tech Also.

Extra habit studying my focus educational Relationship and IIT sector Feature.

5 notes

·

View notes

Text

Complete Guide to Services Export from India Scheme(SEIS)

Complete guide to services export from India scheme present article will help you to understand the meaning of Services Export from India scheme (hereinafter referred to as the “SEIS”) in detailed manner, objectives, benefits, eligibility criteria, procedure and all other information required to avail the benefit of this SEIS scheme.

INTRODUCTION

As we are aware of the fact that the promotion of exports of a country is always been the most critical and vital course of action of any government. This is due to the reason that it has a vast impact on the overall development of a nation. The central government notified a scheme called Service Exports from India Scheme (“SEIS”) under Foreign Trade Policy 2015-20 (“FTP”). The purpose of the scheme is to make the export of Indian services more competitive in the international market. SEIS replaced ‘Served From India Scheme (“SFIS”) which was introduced in the past, the validity of the SEIS scheme is for a period of 5 years ie., till 2020. Under the SEIS scheme, incentives in the form of scrips at a rate ranging from 3% to 5% on services exporter’s net foreign exchange earnings are given to exporters of notified services that can be used to settle the payment of duties and are also freely transferrable in open market.

OBJECTIVES

The objectives of the scheme are provided under chapter 3 of FTP 2015-20 which are as follows:

Promote exports of notified services;

To make our services more competitive in the global market;

Incentives to exporters to offset infrastructural inefficiencies and associated costs involved.

BENEFITS OF SEIS SCHEME

The Duty Credit Scrips and goods imported/procured against these scrips shall be freely transferable. Credit Scrips may be used for payment of Basic Customs duties ie., BCD, Composition Fee, for Export Obligation (EO) defaults, Authorizations issued under Chapter 4 and Chapter 5 (i.e. Duty exemption Schemes and EPCG Scheme) of FTP 2015-2020, application fee under FTP 2015-2020, if any, and fees for permitted imports of inputs or goods, except the items listed in Appendix 3A of Hand Book Of Procedures (“HBP”) i.e. except items not allowed for import under Export from India Schemes. Once scrip is being issued, requests for splits could be permitted with the same port of registration for EDI enabled ports in terms of Para 3.09 of HBP. However, according to Trade Notice No.11/2018 Dt. 30/06/2017, IGST, CGST, SGST GST, and Compensation Cess, as may be applicable should be paid and may be availed as an input tax credit, if eligible, in accordance with the provisions of GST.

DUTY CREDIT SCRIPS

· Duty credit Scrips (“Scrips”) are nothing but incentives/rewards which are given to the eligible exporters at a notified rate. These Scrips can be used for the payment of different duties or taxes like customs duties, excise duties, service tax on the procurement of services, exchange duties, and others. These credit Scrips are valid for a term of 18 months from the date of its issuance.

· Service providers of eligible services are entitled to duty credit scrip at notified rates on the net foreign exchange earned by the Service providers. It is to be noted that these Scrips cannot be utilized for paying Integrated Goods and services tax (IGST) and GST Compensation Cess (if applicable) on the import of goods.

ELIGIBILITY CRITERIA UNDER SEIS

Basically there are 4 categories in which services can be delivered/exported:

Category-1

Category -2

Category -3

Category -4

Cross border trade of eligible services from one country to the other country.

Consumption of services abroad

Commercial presence of services of one country in the territory of another.

Presence of natural person of one country providing their service in the territory of another

It is pertinent to note that only the first two types of services are covered under SEIS and can take the incentive under the scheme.

Further, Service providers also required to satisfy below conditions for obtaining the benefits under SEIS.

1. Service provider must be located in India.

2. He must hold an IEC number.

3. If he is both ie., manufacturer as well as a service provider then the net foreign exchange earned by him shall be considered for services only.

4. Forth and the most vital condition can be defined as follows:

IN CASE APPLICANT IS A COMPANY, LLP OR A PARTNERSHIP FIRM

IN CASE APPLICANT IS AN INDIVIDUAL OR SOLE PROPRIETOR

Minimum of $15,000 net free foreign exchange earnings shall be there in the previous financial year to apply for the application to get rewarded.

Minimum $10,000 net free foreign exchange earnings shall be there in the previous financial year to apply for the application to get rewarded.

Here the term “Net Foreign exchange earnings” defined as under:

Net Foreign Exchange= Gross Earnings of Foreign Exchange (minus) Total payment/expenses/remittances of Foreign Exchange by the Service provider, relating to services in the Financial year.

INELIGIBLE CATEGORIES UNDER SEIS

Ineligible categories have been specified under Para 3.09 of FTP, the same can be enumerated herein below–

1. Foreign exchange remittances/sources of earnings:

equity or debt participation;

receipts of repayment of loans;

donations;

any other inflow of foreign exchange, unrelated to rendering of services, etc.

2. Export turnover relating to services of units operating under EOU / EHTP / STPI / BTP Schemes or supplies of services made to such units.

3. Special Provisions: The government has reserved its right if they find it in public interest, they can impose restrictions/change the rate/ceiling on Duty Credit Scrip under this policy, etc.

4. In order to claim the benefit under SEIS, the application must be filed within 12 months from the end of the financial year of the claim period.

It is to be noted that the application can be filed after the aforesaid period however in that case a small late cut shall be applied (as per Para 9.02 of the HBP). Hereinbelow is a table to understand the late cut to be imposed by the government.

PARTICULARS

CREDIT ALLOWED ON OR BEFORE THE DUE DATE

LATE CUT RATE TO BE IMPOSED

NET ELIGIBILITY

If Application is being received within 6 months from the last date of filing

100%

2%

98%

If Application is being received after 6 months but before 1 year from the last date of filing

100%

5%

95%

If Application is being received after a period of 12 months but before 2 years from the last date of filing.

100%

10%

90%

HOW TO APPLY FOR THE APPLICATION OF SEIS AND DOCUMENT REQUIRED

Now let’s have a look at the procedure for filing of application of SEIS online:

a). Visit www.dgft.gov.in ;

b). Go to the services tab;

c). In it you will find Online Ecom Application;

d). Thereafter choose the year for which application for SEIS is to be filed ie., 2015-2016 & 2016-2017, 2017-2018 & 2018-2019;

DOCUMENT REQUIRED:

A signed copy of the following documents needs to be uploaded:

1. IEC

2. Application Form for Service Exports From India Scheme(SEIS) in Form ANF 3B

3. Write Up of Services as per Form ANF 3B,

4. Invoices and FIRC’S

5. RCMC certificate

6. Certificate of Chartered accountant in Annexure to ANF3B

SERVICES AND RATE OF REWARD

Setting up fake worker failed: "Cannot load script at: https://www.letscomply.com/wp-content/cache/autoptimize/js/autoptimize_aba47fba196503712f6cab4f489bc618.worker.js".

CONCLUSION

Hence, one can say that it is a proactive step to boost our exports, the incentive of the scheme can be claimed under Chapter-3 of FTP on services as notified under the FTP 2015-2020. Once the application is approved Duty Credit Scrips will be issued which can be used for the payment of different duties. The application can also be applied after the last date of submission however; in that case, a late cut shall be deducted from eligible credit.

How we help

Letscomply helps its client to prepare and file the application along with the supporting documentation as required under the scheme. We also time to time after filing of the application update our clients and assist them to get rewarded at the earliest.

best virtual CFO services

Source

www.cbec.gov.in

https://dgft.gov.in/

www.nacenkanpur.gov.in

https://www.icai.org/

https://www.icsi.edu/home/

More Information Click Here: https://www.letscomply.com/complete-guide-to-services-export-from-india-scheme-seis/

Contact Us:

+91-97-1707-0500

https://www.letscomply.com/

1 note

·

View note

Text

STPI NGIS Unique Chunauti 2.0 for Startups Launched

STPI NGIS (Next Generation Incubation Scheme) Unique Chunauti 2.0 for Startups Launched @stpiindia #STPINGIS #Startups #Startup #Incubation #STPICHUNAUTI2.0 . Registrations are open

STPI NGI ( Next Generation Incubation ) today announced the launch of Chunauti 2.0 for startups. The applications are open for Indian startups working in software products, academicians, researchers, innovators, entrepreneurs & women-led startups to join #STPICHUNAUTI2.0 & transform their ideas into path-breaking products. Chunauti 2.0 focuses on key areas such as fintech, healthcare & wellness,…

View On WordPress

0 notes