#Saving and Investing Advice

Explore tagged Tumblr posts

Text

A healthy relationship with money

Healthy relationship with money Maintaining a healthy and positive relationship with money involves a combination of mindset, behaviors, and practical strategies. Here are key aspects to consider:1. Mindset Shift: – Abundance vs. Scarcity: Adopt an abundance mindset, focusing on opportunities and possibilities rather than a scarcity mindset centered on limitations. – Gratitude: Acknowledge and…

View On WordPress

#Budgeting for Success#Building Sustainable Wealth#Financial Freedom Blueprint#Financial Independence Roadmap#Financial Literacy Resources#Financial Planning Strategies#Frugal Living Tips#Growing Your Net Worth#Investment Planning Guide#Investment Portfolio Diversification#Money Management Techniques#Personal Finance Wisdom#Practical Money Saving Tips#Saving and Investing Advice#Smart Investing Insights#Strategic Financial Decision-Making#Wealth Accumulation Strategies#Wealth Building Tips#Wealth Creation Habits#Wise Money Choices

1 note

·

View note

Text

tory going from having to work 2+ jobs just to barely stay afloat to making $750,000 a year in salary, oh we love to see it.

#⚡ ooc. ── ❝ 𝘖𝘩 𝘯𝘰 𝘪𝘵'𝘴 𝘔𝘢𝘳𝘪. ❞#ck spoilers tw#t.anner exposed the actual number on the prop contracts in an interview and I screamed#I don't think tory would know what to do with all of that money tbh she's def going to daniel for advice about it#I think she'd be scared to spend it bc when you live in poverty for so long 'spending guilt' becomes a very real thing lol#but eventually she'll work through it (over the course of several years)#first thing she's doing is paying off all her debts and her mother's remaining debts and setting a clean slate#and making sure everything with brandon is taken care of. all his hobbies and his school fees? paid for. everything he wants.#then I think she would invest (but not in something stupid like crypto). she'll make a savings account separately for a portion of it.#her relationship with money is so?? complex actually I don't think she'll ever shake the feeling and experience of living in poverty#and being homeless at several points in her life#but having a life now where she won't have to worry about that again . . . yeah she's not gonna take that for granted. ever.

6 notes

·

View notes

Text

#brownsugar4hersoul#👻#turn into a ghost#save#hustle#invest#disappear#you don't need anyone#achievegreatness#you need to focus#to achieve greatness#stay focused#focus on your goals#focus on yourself#hustle hard#word of advice#stack money#get money#getting money#hustlehard#making money#making moves#investing#keep a small circle#move in silence#keep to yourself#mind your own#life advice#best advice#life reminders

19 notes

·

View notes

Text

How to Work Less to Achieve More

Key Point:

keep your attention on an important task by adopting hyperfocus. When you hyperfocus, you rid your environment of distractions, and become aware of what’s occupying your mind. What’s more, every time your attention strays, redirect it. Remember is that scatterfocus can help you with tricky problems that require creative solutions. With scatterfocus, you allow the mind to wander and make unusual connections. You can help create scatterfocus by nourishing your mind and allowing time to reflect.

In our fast-paced world, working long hours has become the norm. However, the key to achieving more is not simply working harder or longer—it's about working smarter. In this article, we will explore strategies to help you work less while accomplishing more. By training yourself to enjoy hyperfocus, cultivating meta-awareness and intentional focus, eliminating distractions, harnessing the power of scatterfocus for creative thinking, connecting seemingly unrelated information, and nourishing your mind, you can optimize your productivity and achieve greater success.

Train yourself to enjoy hyperfocus more.

Hyperfocus is a state of intense concentration where you become fully immersed in a task or activity. To work less and achieve more, it's important to train yourself to enjoy and leverage hyperfocus. Set clear goals, break tasks into manageable chunks, and eliminate distractions. Engage in activities that naturally captivate your attention and give you a sense of fulfillment. By training yourself to enjoy hyperfocus, you can maximize productivity and accomplish more in less time.

Meta-awareness and intentional focus are key to managing your attention.

Meta-awareness refers to being aware of your own thoughts and mental processes. Intentional focus involves directing your attention consciously and purposefully. Cultivating these skills is essential for effective attention management. Develop the ability to notice when your mind starts to wander and gently bring your focus back to the task at hand. By practicing meta-awareness and intentional focus, you can reduce time wasted on distractions and stay on track to achieve your goals.

Achieve hyperfocus by ridding your environment of distractions.

Distractions can significantly impact productivity and hinder your ability to work efficiently. Create a conducive work environment by minimizing distractions. Turn off notifications on your phone, close unnecessary browser tabs, and create a physical workspace that promotes focus. Consider using productivity tools or apps that block or limit access to distracting websites or applications. By eliminating external distractions, you can enter a state of hyperfocus and accomplish more in less time.

Scatterfocus helps you plan and think creatively.

Scatterfocus is the practice of intentionally allowing your mind to wander and explore different ideas, without a specific goal or objective. This mental state can be beneficial for planning and creative thinking. Set aside dedicated time for scatterfocus, allowing your mind to freely explore different thoughts and possibilities. Embrace daydreaming, engage in activities that stimulate your imagination, and give yourself permission to think outside the box. By incorporating scatterfocus into your work routine, you can generate fresh ideas and enhance your problem-solving skills.

Use scatterfocus to connect the dots between seemingly unrelated bits of information.

One of the unique benefits of scatterfocus is its ability to facilitate connections between seemingly unrelated information. During moments of scatterfocus, your mind can make unexpected connections and insights. Capture these ideas by carrying a notebook or using a note-taking app to jot down your thoughts. When you revisit these notes later, you may discover valuable connections and insights that can fuel your productivity and lead to innovative solutions.

Nourish your mind to make the most of scatterfocus.

To optimize scatterfocus and enhance your overall productivity, it's important to nourish your mind. Engage in activities that promote mental well-being, such as regular exercise, quality sleep, and mindfulness practices. Take breaks throughout the day to recharge and refresh your mind. Additionally, fuel your brain with nutritious foods that support cognitive function, such as fruits, vegetables, whole grains, and omega-3 fatty acids. By prioritizing self-care and nourishing your mind, you can maximize the benefits of scatterfocus and achieve more with less effort.

Working less while achieving more is within your reach. By training yourself to enjoy hyperfocus, cultivating meta-awareness and intentional focus, eliminating distractions, harnessing the power of scatterfocus for creative thinking, connecting seemingly unrelated information, and nourishing your mind, you can optimize your productivity and achieve greater success. Remember, it's not about working longer hours, but about working smarter. Embrace these strategies, experiment with different techniques, and find the balance that works best for you. As you implement these practices, you'll discover the power of effective attention management and witness your productivity soar.

Action Plan: Have a cup of coffee to help you hyperfocus.

Caffeine and hyperfocus are a match made in heaven. Caffeine keeps you alert and focused. It helps you persevere when work gets boring. And perhaps most importantly, it can improve your performance on a number of cognitive tasks. So the next time you need a burst of intense concentration, make sure you’ve got a cup of coffee to hand – if nothing else, it tastes wonderful.

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

14 notes

·

View notes

Text

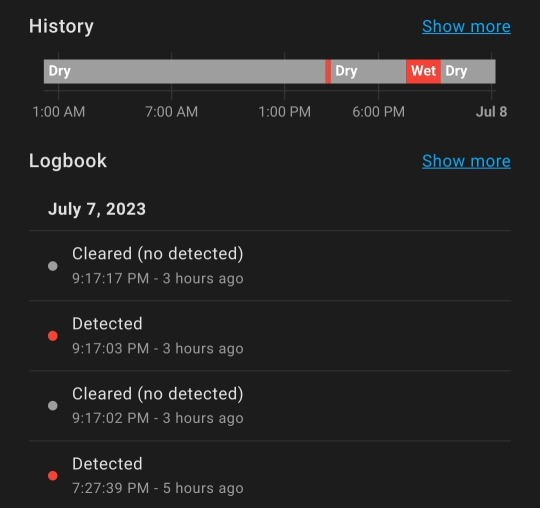

Installed a sensor on my girl so i know when

#Funy jokey#I've become addicted to cheap zigbee switches and sensors#I set this up so the air conditioner in our bedroom will stop running when the bucket is almost full theres something wrong with me#It works too and i love it :')#Next up is a small switched pump that will pump the water out for a set amount of time#Directly to the balcony plants#Our windowsill is too high up to run the condensed water out with gravity sadly so some kind of reservoir with sensor and pump has to do#Also planning a dedicated channel for outside air directly to the compressor with some kind of blowback valve#I hate mobile acs for how they are designed but there are no good high capacity mobile acs on the market yet#This should mitigate most of the issues though#The main issue is the lack of separation of compression and expansion stages which is why you should use outside air for the former#AND i have an hourly energy price contract which means i should switch the ac on/of on a set of preset conditions#I love tinkering and this is both pretty cheap and actually rewarding us with much better sleep during heat waves & less fuss#Also electricity savings#I put a bunch of stuff on this kind of sensing/logic already and its so nice to see your expenses go down with little to no impact#I feel like such a dad even though i dont have any kids#All of this is completely local and relatively cheap to set up but you have to like tinkering a little#Hmu if you want some advice i can point you away from large cloud based nonsense & help with initial startup#The two investments are a raspberry pi and a zigbee dongle#Possibly also a p1 reader or similar if you want data directly from your utilities#And after that most investments should be 10 dollars max per sensor or switch and most of the ali ones will work#And even have fancy features like somewhat accurately displaying power usage and current#Sorry for extremely rambly long tags i just get excited sometimes

2 notes

·

View notes

Text

I hate how much i'm afraid to open an art shop because my last 2 failures cost me so much money 😭😭😭😭 especially in this time of great, scary uncertainty! and i know i can't bother other people about this, so i'm in this alone. *sad yippee noise*

#lee text#lee rants#i keep asking if people are interested in things i could maybe sell and im not really getting much response....not looking good 😭#i *might* loose my job this summer. they say they are considering ending contractor jobs so contract ends august and i could be kicked#that means spending hundreds to get are merch made would be bad idea if i sell nothing! need to use savings to SURVIVE.#am disabled with no experience except 1 cleaning job. 300 job apps no one wants me. 4 interviews and im too visibly autistic for them#cant mask and hide it. so keep getting told youre too *undesirable autism trait here* and it feel awful. know i won't get a job this way#so need to make my own job. but selling art is SO DIFFICULT. i tried twice and sold nothing. $500 wasted!#i even had commissions open for like 6 years. i actually got ONE. it made me so happy and the person was ao happy with the art!#but that was it. it never opened the door to more opportunities#tangent aside. i dont know what to do. do i invest more money into an art shop amd hope i can sell? or keep putting it off?#i dont know the answer and i have no one to talk to about this to get any solid support/help and advice#since i barely have any art friends and other artists who sell art are so snooty about it (competitive and keep info to themselves)#so im on my own struggling with stupid autism and chronically ill brain amd facing possibility of not being able to#affird meds amd doctor appointments i need to LIVE (especially since trump is trying desperately to take my healthcare/insurance away)#sighs i know no ome cares and if i talk about this stuff especially if i did open a shop people will accuse me of guilt tripping#so i have just been keeping it all to myself and now im hiding it in tags and not even tagging with actual tags#sorry if you read this and its not the usual silly gremlin lee goofs. ive been struggling completely alone lately and its so hard.

1 note

·

View note

Text

youtube

#money rules#how to manage money#financial freedom#money tips 2025#wealth building habits#personal finance#budgeting tips#how to save money#investing basics#financial literacy#money mindset#how to build wealth#best money habits#emergency fund tips#passive income ideas#money advice#money management#The Wealthy Status#financial planning#financial success#money#Financial freedom#How to budget#Had to leave below you means#Cash is king#Roth IRA#fine living#money affirmations#affirmations#invest

0 notes

Text

Financial consultation

Pictures Of Finance #FinancialAdvisor #Consultation #Finance #Advice #WealthManagement #Investment #Savings #FinancialPlanning #Budget #Security

#Consultation#Investment#Security#Budget#Advice#FinancialPlanning#WealthManagement#Finance#Savings#Imagella

0 notes

Text

Our Resources - Financial Advices & Guide | Femme Finance

Our Resources – At Femme Finance, we focus on making money simpler and more manageable. Whether you’re just starting out or levelling up, we’ll help you.

Our step-by-step framework to boss your finances, nicely packaged into a playbook you can read at your leisure. Totally free.

#finance#investing#mortgage#pension#savings#financial planning#financial services#financial advice#insurance#personal loan

0 notes

Text

Discover how wealth management services can enhance dividend mutual fund returns through strategic planning, fund selection, and tax-efficient investing.

#Dividend Funds#Wealth Tips#Fund Returns#Smart Investing#Money Growth#SIP Strategy#Tax Saving#Mutual Fund ROI#Wealth Boost#Expert Advice#Smart SIPs#Financial Guide#Fund Planning#Tax Planning#ROI Boost#Passive Income#Safe Returns#Smart Funds#Invest Wisely#Gain More

0 notes

Text

How to Build Wealth from Scratch: Practical Steps for Beginners & Young Professionals

Building wealth from scratch may seem daunting, but with the right steps and mindset, anyone can create a solid financial foundation. Whether you’re a young professional just starting your career or someone looking to get their finances on track, these practical tips will guide you on the path to financial success. 🌟 Step 1: Know Where You’re Starting 📊 Before you can build wealth, you need to…

#50/30/20 rule#beginner investing#Budgeting for Beginners#budgeting strategies#Budgeting Tips#building wealth#ETFs#financial advice#financial education#Financial Freedom#financial goals#financial journey#financial milestones#Financial Planning#Financial Success#index funds#investing early#investing for beginners#money management#Money Mindset#passive income#personal finance#Personal Finance Tips#Real Estate Investing#REITs#saving money#smart investing#stay consistent#Wealth Building#wealth creation

0 notes

Text

Tuesday Morning Motivation: Build Wealth Like Warren Buffett, One Smart Decision at a Time

#Build Generational Wealth#daily wealth building#financial freedom tips#money habits for success#motivational money quotes#personal finance blog#save and invest tips#Smart Money Moves#Tuesday financial motivation#Warren Buffett financial advice

0 notes

Text

youtube

#kimbal musk#investing#corporate dominance#entrepreneur motivation#investment#shareholding#valuetainment#institutional investors#investment power#personal finance#elon musk#entrepreneur#yahoo finance#patrick bet-david valuetainment#tesla ownership#valuetainment media#entrepreneurship#savings#entrepreneur advice#business#stock market#startup entrepreneurs#yahoo finance premium#economy#entrepreneurs#family control#top shareholders#news#money#tesla

0 notes

Text

Why Savers Should Capitalise on Rising Interest Rates | Wills & Trusts Wealth

Learn how to make the most of rising interest rates with the right savings and investment strategies. Explore options like ISAs, fixed-rate accounts, and notice accounts to maximise your returns. Get expert advice from Wills & Trusts Wealth Management to secure your financial future. Contact us today.

#rising interest rates#UK savings strategies#Individual Savings Accounts#fixed-rate savings#investment advice UK#Wills & Trusts Wealth Management#maximise savings UK#financial planning UK#secure financial future

0 notes

Text

Winning Strategies To Make Your Money Last A Lifetime

Key Point:

Planning your retirement is more complicated than it was in the days of company pensions. That means you’ll have to be proactive if you want to enjoy your sunset years in comfort. Save money now by driving an older car and moving to a smaller house, and you’ll be well on your way. Once you’ve retired, you’ll want to stay invested in the stock market to generate inflation-busting yields while covering living expenses from a guaranteed income like an annuity. After taking care of your finances, you’ll need to ensure your heirs are taken care of by creating two must-have documents – a will and a trust.

Planning for retirement and ensuring your money lasts a lifetime is a complex and crucial endeavor. With changing dynamics in retirement planning, it's essential to adopt winning strategies that can secure your financial future. In this article, we will explore key strategies to help you maximize your retirement savings, protect your assets, and make informed decisions. From setting ground rules for financially dependent children to optimizing housing and investments, these strategies will empower you to make your money last a lifetime.

Planning for retirement is a lot more complicated than it was in the past.

Retirement planning has become increasingly complex due to factors such as longer life expectancy, changing economic conditions, and evolving retirement structures. It's important to recognize that a one-size-fits-all approach no longer suffices. Engage in comprehensive retirement planning that takes into account your individual circumstances, financial goals, and risk tolerance. Consider seeking professional guidance to navigate the intricacies of retirement planning effectively.

Retirees with financially dependent children need to set ground rules to guarantee their financial security.

If you have financially dependent children, establishing clear ground rules is essential to safeguard your own financial security. Set boundaries and expectations, ensuring that your children understand the level of support you can provide without compromising your retirement savings. Encourage their financial independence and educate them about responsible money management. By setting ground rules, you can strike a balance between supporting your children and securing your own financial well-being.

You can save a lot of money by making smart decisions about the car you drive.

Transportation expenses can have a significant impact on your retirement budget. Making smart decisions about the car you drive can lead to substantial savings. Consider factors such as fuel efficiency, maintenance costs, and depreciation when purchasing a vehicle. Opt for a reliable and cost-effective option that aligns with your needs rather than succumbing to unnecessary expenses associated with luxury or high-performance vehicles.

Reducing housing costs allows you to turbocharge your retirement savings.

Housing costs often constitute a significant portion of retirement expenses. Finding ways to reduce these costs can have a profound impact on your retirement savings. Consider downsizing to a smaller home, relocating to a more affordable area, or exploring alternative housing options such as renting or co-living arrangements. By reducing housing expenses, you can allocate more funds towards your retirement savings, ensuring a stronger financial foundation.

Patience pays in turbulent markets even when you're retired

Turbulent markets can be unsettling, especially for retirees who rely on their investments for income. However, it's crucial to exercise patience and avoid making impulsive decisions during market downturns. Maintain a well-diversified investment portfolio and stick to your long-term financial plan. Additionally, establish an emergency fund to cover unexpected expenses and supplement your income during market volatility. By remaining patient and having a contingency plan in place, you can navigate turbulent markets while protecting your retirement savings.

To avoid running out of money, take inflation into account when you plan for retirement.

Longevity and inflation are key considerations when planning for retirement. It's prudent to assume a longer life expectancy and account for the impact of inflation on your future expenses. Work with a financial advisor to calculate the projected costs of healthcare, living expenses, and leisure activities throughout your retirement years. By incorporating these factors into your retirement plan, you can mitigate the risk of outliving your savings and maintain your financial stability.

An income annuity provides a guaranteed income

An income annuity can be a valuable tool for retirees seeking a guaranteed income stream. By purchasing an annuity, you receive regular payments for a specific period or for the rest of your life. This provides a sense of security and stability, offsetting the demands of investing in the potentially volatile stock market. Consult with a financial professional to explore suitable annuity options that align with your retirement goals and risk tolerance.

Protect yourself and those you love by creating a will and a living revocable trust.

Estate planning is essential for ensuring the protection and distribution of your assets according to your wishes. Two vital documents to consider are a will and a living revocable trust. A will specifies how your assets should be distributed upon your passing, while a living revocable trust allows you to manage your assets during your lifetime and provides for the smooth transfer of assets upon death. Work with an attorney who specializes in estate planning to create these important documents and ensure your financial legacy is secure.

Achieving financial security throughout retirement requires careful planning, strategic decision-making, and a focus on long-term goals. By implementing winning strategies such as setting ground rules for financially dependent children, making smart financial choices, reducing housing costs, staying patient during market fluctuations, accounting for longevity and inflation, considering income annuities, and prioritizing estate planning, you can make your money last a lifetime. Remember, a comprehensive and adaptable approach is key to navigating the complexities of retirement and securing your financial future.

Action Plan: Consider saving online.

Brick-and-mortar banks are great when it comes to convenient access to cash and ATMs, but they don’t usually have the best interest rates on savings accounts. If you want a better deal, it’s a good idea to move your savings to an online bank or credit union. They can afford to pay higher yields because they don’t have physical branches with rent and overhead. So how big is the difference? Well, as of late 2019, traditional banks were paying around 0.25 percent on savings accounts while their online counterparts had yields of around 2 percent!

#Financial freedom#Building wealth#Personal finance strategies#Investment advice#Passive income stream#Early retirement planning#Debt reduction#Budgeting tips#Saving money#Wealth management#Financial independence#Secure financial future#Retirement planning#Financial planning#Personal finance#Money management#Investment strategies#Retirement savings#Investment portfolio#Financial education#Wealth creation#Financial goals#Wealth building#Financial security#Retirement income#Passive income ideas#Financial advice#Financial wellness#Financial planning tools#Financial management

8 notes

·

View notes

Text

Explore comprehensive budgeting tips for managing your personal finances with confidence. This guide offers strategies for creating a budget, tracking expenses, and maximizing savings. Learn how to effectively reduce debt, plan for retirement, and invest wisely to secure your financial future. Take control of your finances today and achieve your financial goals with expert advice and practical tools.

#Financial Planning Tips#Budget Planner Tools#Expense Tracking Methods#Saving Money Techniques#Debt Reduction Strategies#Money Management Advice#Investment Basics#Retirement Planning Guide#Household Budgeting Ideas#Financial Goal Setting#Frugal Living Tips#Emergency Fund Importance#Smart Spending Habits#Credit Score Improvement#Income Diversification Strategies

0 notes