#Financial Guide

Explore tagged Tumblr posts

Text

Discover how wealth management services can enhance dividend mutual fund returns through strategic planning, fund selection, and tax-efficient investing.

#Dividend Funds#Wealth Tips#Fund Returns#Smart Investing#Money Growth#SIP Strategy#Tax Saving#Mutual Fund ROI#Wealth Boost#Expert Advice#Smart SIPs#Financial Guide#Fund Planning#Tax Planning#ROI Boost#Passive Income#Safe Returns#Smart Funds#Invest Wisely#Gain More

0 notes

Text

Mastering MetaTrader 5: A Beginner’s Guide

MetaTrader 5 (MT5) is a leading trading platform used by millions worldwide. Its advanced tools, user-friendly interface, and diverse features make it ideal for trading forex, stocks, commodities, and more. Whether you’re a beginner or an experienced trader, this guide will help you navigate and master MetaTrader 5. We’ll cover the essentials, from how to use MetaTrader 5 to opening a real account and understanding its legitimacy.

What is MetaTrader 5? MetaTrader 5 is a multi-asset trading platform developed by MetaQuotes. It’s renowned for its powerful analytical tools, flexibility, and support for automated trading. Whether you’re analyzing the markets or executing trades, MT5 offers a seamless trading experience.

Why Choose MetaTrader 5? MetaTrader 5 stands out for its:

Advanced Charting Tools: Multiple chart types and timeframes for precise market analysis.

Diverse Asset Classes: Trade forex, indices, stocks, and commodities on one platform.

Algorithmic Trading: Automate your trades with Expert Advisors (EAs).

Multiple Order Types: Efficiently manage trades with market, limit, and stop-loss orders.

Mobile and Desktop Compatibility: Trade anytime, anywhere.

Getting Started with MetaTrader 5 Here’s how to begin:

Download and Install: Visit your broker’s website to download MT5.

Log In: Open the app and enter your account credentials.

Explore the Interface: Familiarize yourself with key sections like charts, market watch, and trading terminal.

Place a Trade: Select an asset, set parameters (lot size, stop loss, take profit), and execute your trade.

Analyze Markets: Use MT5’s built-in tools for market analysis.

Opening a Real Account To trade with a real account:

Select a Broker: Choose a regulated broker offering MT5.

Register: Create an account on the broker’s website.

Verify Identity: Provide ID and proof of address.

Fund Your Account: Deposit funds via the broker’s payment methods.

Start Trading: Log in to MT5 using your broker’s credentials.

Is MetaTrader 5 Legit? Yes, MetaTrader 5 is a legitimate platform developed by MetaQuotes. Ensure you choose a regulated broker for secure trading.

Tips for Beginners

Start with a demo account.

Learn market analysis and risk management.

Stay updated on financial news.

By mastering these basics, you’ll unlock the full potential of MetaTrader 5 and take your trading to the next level.

0 notes

Text

Cost and Financial Aid Options for Welingkar Distance MBA

Hey there! Are you thinking about doing a Welingkar Distance MBA? Great choice! It is a flexible and affordable way to level up your career. Let us discuss how much it cost, financial aid options, and some practical budgeting tips to help you. Summary of Tuition and Fees One needs to know what really is being paid for a course. Let us now examine the fee structure for the Welingkar distance…

View On WordPress

0 notes

Text

Are you contemplating ways to manage your assets, ensure they're preserved for the future, and provide financial security to your loved ones? If so, setting up a trust could be the ideal solution. A trust is a legal arrangement that allows you to transfer assets to a designated person, a trustee, who will manage those assets for the benefit of another person or a group of people, known as beneficiaries. This article will guide you through the process of setting up a trust in the UK.

#Trust setup#estate planning#legacy planning#financial guide#wealth management#inheritance#trust funds#asset protection#legal trust#financial planning#personal finance#wealth transfer#estate law#trust benefits

0 notes

Text

Basic Financial Rules To Live By 💰✨

Create a plan that shows how much money you get and how much you spend. This helps you see where your money goes.

Set aside a part of your money as savings. Try to save at least 10-20% of what you earn.

Be careful with borrowing money, especially if you have to pay back a lot of extra money (interest).

Save some money for unexpected things like medical bills or losing your job. Aim to have enough to cover your living costs for a few months.

Put your saved money into different things that can make it grow, like stocks or real estate. Be patient, as it takes time.

Don't spend more money than you make. Stick to buying what you really need, not just what you want.

Decide what you want to do with your money, both in the short term (like a vacation) and long term (like retirement).

Set up automatic transfers to your savings and bills so you don't forget to save or pay your bills on time.

Make saving money a top priority before spending on other things.

Regularly look at your money situation, adjust your plan as needed, and see how your investments are doing.

Pay your bills on time and use credit wisely (like credit cards) to keep a good credit score, which can help you get better deals on loans.

Save money for when you're older and don't work anymore. Use retirement accounts to help with this.

Think before you buy things. Don't buy something just because you want it; think if it's necessary.

Keep learning about how money works and how to make smart money choices.

Only use your emergency fund for real unexpected problems, not for things you just want to buy.

#financial planning#finance#investing#money#girl math#wealth#level up journey#it girl#dream girl#dream girl guide#dream girl tips#dream girl journey#that girl#becoming that girl#educate yourself#wealth mindset#growth mindset#success mindset

3K notes

·

View notes

Text

"Basic Money Guide for Comic Artists and Other Freelancers" [PRINT EDITION] is here, available in my shop!

One of the best gifts I gave myself before becoming full time self employed was a Roth IRA, so if you're interested in self employment (or even if you aren't but you want an emergency savings account) check out this zine!

Give a copy to the freelancer in ur life <3

Read for free here <3

Check out Secret Room Press! They printed this zine for me.

300 notes

·

View notes

Text

Excerpt from Smart Women Finish Rich by David Bach

#high value woman#leveling up#elegance#hypergamy#affluence#luxury#goals#level up#divine feminine#financialeducation#financial literacy#finance#bookblr#bookworm#books#hot and educated#hot girls read#dream girl journey#Dream girl#glow up diaries#glow up journey#glow up guide#glow up#powerful woman#self development#self improvement#becoming that girl#becoming her#beneficiaryblr#spoiledblr

59 notes

·

View notes

Text

finally cleared 4-30 beast yeast hard 😎

comment if you want the build

#cookie run#cookie run kingdom#cr kingdom#crk#wind archer cookie#creme brulee cookie#dark cacao cookie#awakened dark cacao#financier cookie#mystic flour cookie#mystic flour crk#crk guide#beast yeast#beast yeast hard mode#crk beast yeast

36 notes

·

View notes

Text

. . . control of one's own money meant control of one's own life, which was probably why men kept it from women in every way conceivable.

Alison Goodman, from The Ladies Road Guide to Utter Ruin

#agency#sexism#financial freedom#oppression#patriarchy#discrimination#social commentary#historical fiction#quotes#lit#words#excerpts#quote#literature#control#controlling#alison goodman#the ladies road guide to utter ruin

6 notes

·

View notes

Text

How Wealth Management Services Boost Your Dividend Mutual Fund Returns

Investors searching for regular earnings streams often turn to dividend mutual funds as a cornerstone in their investment portfolio. These specialized budgets focus on corporations that frequently distribute earnings to shareholders, creating capacity for both earnings and growth. Wealth management services play a critical function in assisting buyers in optimizing systematic investment plan returns from dividend mutual price range through expert guidance and strategic planning.

The Dividend Advantage

Dividend mutual funds provide distinct advantages that many self-directed investors forget about. These budgets cautiously choose shares from corporations with:

Sturdy dividend histories

Solid balance sheets

Sustainable payout ratios

Rather than chasing marketplace trends, dividend-targeted strategies prioritize consistency and reliability—features that show precious during marketplace volatility.

What sets dividend investing apart is the energy of compounding while distributions are reinvested. Each dividend fee purchases extra fund stocks, which then generate their very own dividends in the next intervals. This compounding impact accelerates over time, doubtlessly reworking modest investments into great wealth.

How Wealth Management Elevates Your Investment Strategy

Professional wealth control transforms how traders use dividend mutual funds in numerous key ways:

Strategic Fund Selection

The dividend mutual fund landscape includes hundreds of options with varying tactics, price ratios, and overall performance histories. Wealth control specialists conduct thorough analyses primarily based on factors like:

Fund composition and sector allocation

Historical dividend boom quotes

Expense ratios and tax performance

Risk-adjusted overall performance metrics

This knowledge facilitates perceiving a budget aligned with specific monetary goals as opposed to really chasing headline yield figures.

Optimized Systematic Investment Planning

Systematic funding plan returns rely closely on regular contribution techniques. Wealth control services design personalized investment schedules that:

Align with income styles and cash go with the flow

Leverage dollar-cost averaging during marketplace fluctuations

Adjust contribution amounts as economic situations evolve

Implement tax-green timing techniques

These customized approaches typically yield advanced outcomes compared to arbitrary contribution schedules.

Tax-Efficient Dividend Management

Taxation significantly impacts average returns from dividend investments. Qualified dividends get preferential tax treatment as compared to normal income, but navigating these differences requires know-how. Wealth management professionals put in force strategies like:

Strategic account placement (taxable vs. tax-advantaged money owed)

Tax-loss harvesting to offset dividend income

Timing distributions around tax year barriers

Adjusting portfolio composition based totally on tax bracket modifications

These tax control techniques frequently hold several percentage points of return yearly—a giant distinction when compounded over decades.

The Long-Term Impact on Financial Security

The systematic funding plan returns generated through nicely controlled dividend mutual funds create a powerful foundation for economic independence. As dividend payouts step by step increase over the years, investors construct an income move that could sooner or later assist retirement desires or different economic desires.

Wealth control offerings provide the oversight needed to keep the field through marketplace cycles. When markets decline, inexperienced traders often abandon systematic investment plans precisely when the capacity for future returns is highest. Professional steering allows preserving attitude during these important moments.

For investors extreme about constructing lasting wealth, expert management of dividend mutual fund strategies gives a compelling fee proposition. The mixture of:

Strategic fund choice

Optimized systematic contribution schedules

Tax-efficient distribution management

creates a framework for sustainable increase that few person buyers can reflect on independently.

While dividend mutual price ranges stay accessible to self-directed traders, the complexity of optimizing returns normally justifies expert wealth control involvement, particularly as portfolio values and tax considerations emerge as increasingly great. Starting early with professional steering allows traders to harness the full capability of compound increase, creating a strong pathway towards financial freedom through disciplined, dividend-centered investing techniques.

#Dividend Funds#Wealth Tips#Fund Returns#Smart Investing#Money Growth#SIP Strategy#Tax Saving#Mutual Fund ROI#Wealth Boost#Expert Advice#Smart SIPs#Financial Guide#Fund Planning#Tax Planning#ROI Boost#Passive Income#Safe Returns#Smart Funds#Invest Wisely#Gain More

0 notes

Text

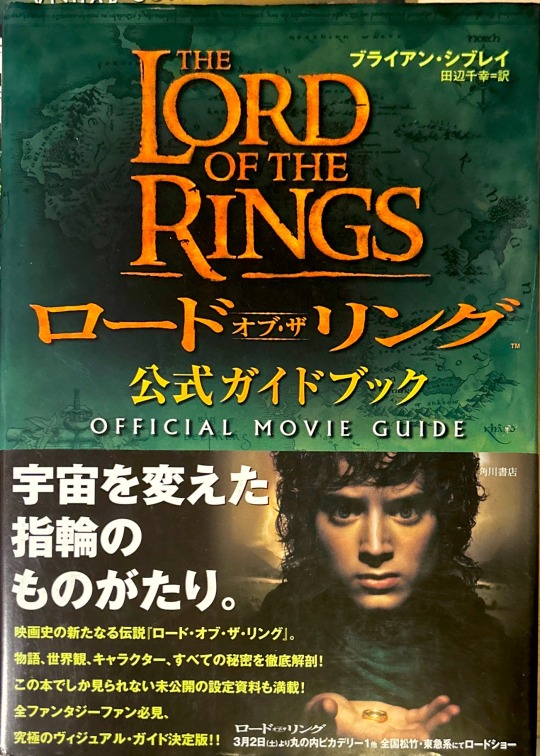

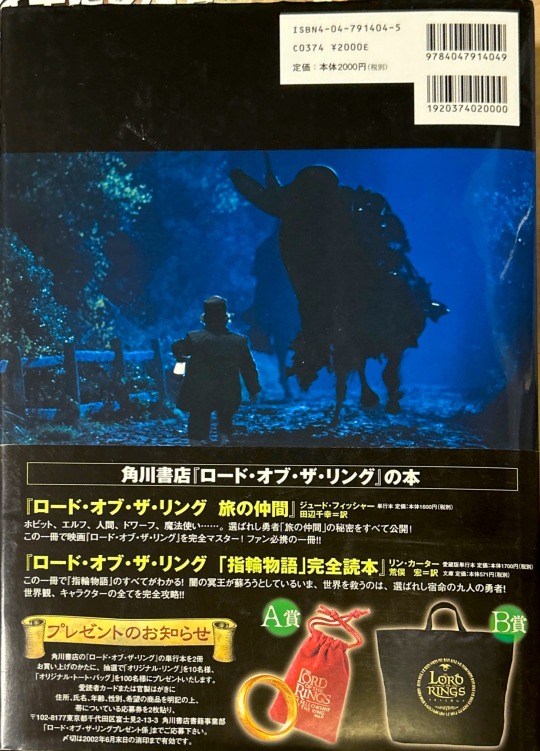

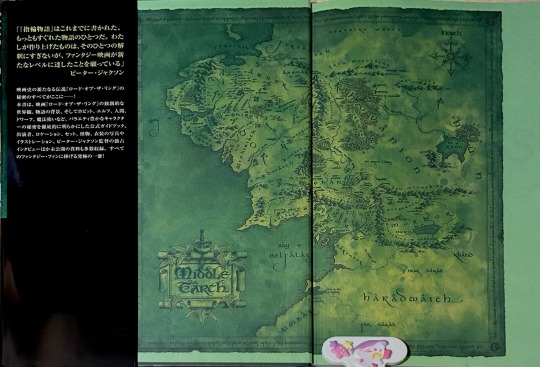

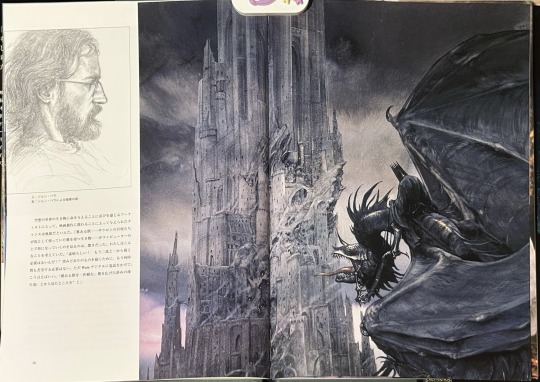

The Lord Of The Rings Official Movie Guide (in japanese)

i only ever found this because i was looking for random images of a japanese tv show called Rookies and then found a whole photo book, put it in my cart, scrolled through the sellers page and then found THIS BEAUTIFUL SPECIMEN. it came in a 2-pack with a LOTR Visual Companion but ill post that seperately. NOT TO MENTION THEY WERE ONLY $9 !!!!!!! 1!!!!!!!!!!!!!1!!! (plus shipping so it really wasnt that cheap.) i cant read any of it cause i dont know japanese, but im definitely using the pictures in them for fanart Anyways click ⬇️ for pictures of the movie guide :3 :3

this ones my favorite (sorry for the glare . ...) cause it is PERFECT for fanart reference ⬇️⬇️⬇️

TA DAAAA!!!! overall im very hyped about this. tomorrow i might take pictures of the visual companion (if i remember. cuz i never remember) both of them including the other books i ordered arrived in SUCH GOOD CONDITION considering they're older than i am. but also im not quite that old, but still im old enough to be shocked at how old these are and they still look so good (minus the crumpling on the edges but that just means theyre loved) thank u for reading!!!!!!!!!!! pls excuse the unicorn clip, as it was the only clip i had on hand to hold the pages down cause they just WOULD NOT STAY DOWN

#lord of the rings#lotr#lord of the rings movie guide#photobook#lord of the rings photo book#oh my gosh this thing is so awesome sauce#$50 of my dwindling financial state#totally worth it

7 notes

·

View notes

Video

youtube

🧘🏽♀️ Financial Well-Being Guided Meditation

#youtube#money#meditation#financial#well-being#guided meditation#support#groundworkfoundations#dignityindebt#hopeinhealing#alligned#abundance#trust#attract what is aligned#weareenough

2 notes

·

View notes

Text

Life Insurance Premium Calculator: Plan Smart, Secure Smarter

When planning for your family's financial future, choosing the Right Life Insurance Policy is essential, but understanding the premium cost is just as important. That’s where a Life Insurance Premium Calculator becomes a powerful tool. It helps you estimate how much you'll need to pay to get the life cover and benefits you desire.

In this article, we’ll explore what a life insurance premium calculator is, how it works, and why it’s vital when comparing the best life insurance policy options.

What is a Life Insurance Premium Calculator?

A Life Insurance Premium Calculator is an online tool that helps individuals estimate the premium they need to pay for a particular life insurance policy. It uses various parameters such as age, income, policy term, sum assured, and smoking habits to provide an accurate premium estimate.

This tool is especially helpful when comparing life insurance plans or determining affordability before making a financial commitment.

Why Use a Life Insurance Premium Calculator?

Using a premium calculator before buying a policy ensures you:

Avoid Under or Over Coverage

Understand Premium Variations Across Plans

Compare the Cost of Different Policy Terms

Evaluate the Impact of Riders/Add-ons

Make Informed Financial Decisions

How Does the Life Insurance Premium Calculator Work?

The calculator works by taking specific inputs from you and instantly generating a premium estimate based on your selected life insurance plan. Here's how:

Age – Younger individuals usually pay lower premiums.

Gender – Premium rates may vary based on gender; for example, females often have slightly lower premiums due to lower risk statistics.

Policy Term – The length of the coverage period affects the premium. Longer policy terms generally lead to higher premiums.

Sum Assured – This is the coverage amount you want. A higher sum assured means a higher premium.

Type of Policy – Whether it's Term Insurance, Whole Life Insurance, ULIP, Endowment, or Money-Back Plan—each type has different premium structures.

Smoking Habits – Smokers are considered high-risk, and hence pay higher premiums compared to non-smokers.

Riders/Add-ons – Adding extra benefits like Critical Illness Cover, Accidental Death Benefit, or Waiver of Premium increases the premium amount.

Benefits of Using a Life Insurance Premium Calculator

Let’s look at the key benefits of life insurance premium calculators:

✅ Quick Estimates: Get instant quotes without paperwork or waiting.

✅ Customizable Options: Modify variables to find the perfect plan.

✅ Informed Comparison: Compare multiple insurers and types of life insurance policies.

✅ Transparent Costing: No hidden charges or surprises.

✅ Time-Saving: Avoid agent consultations for basic premium insights.

Types of Life Insurance Policies You Can Calculate Premiums For

Before using a premium calculator, it’s important to know the types of life insurance policies commonly available:

1. Term Life Insurance

Pure protection plan offering high coverage at low premiums.

2. Whole Life Insurance

Covers your entire life (usually up to 99 or 100 years), with maturity or death benefit.

3. Endowment Plans

Offer savings along with life cover, ideal for long-term wealth creation.

4. Unit Linked Insurance Plans (ULIPs)

Market-linked plans that offer dual benefits of investment and insurance.

5. Money Back Policies

Provide periodic returns along with life cover.

Each of these policies can have different premium amounts, so the calculator helps you find what suits your budget and goals.

Features of Life Insurance Premium Calculators

User-Friendly Interface – Simple and easy to use; no financial expertise required.

2. Mobile-Friendly – Works smoothly on smartphones, so you can calculate premiums anytime, anywhere.

3. No Personal Details Needed – Most calculators give you premium estimates without asking for your phone number, email, or OTP.

4. Rider Comparison – You can add or remove riders like critical illness or accidental death benefit to see how they impact your premium.

5. Real-Time Calculation – Instantly generates accurate premium quotes so you can make quick and informed decisions.

Importance of Life Insurance in Financial Planning

Understanding the importance of life insurance is key before even calculating the premium. Life insurance:

Acts as income replacement for your family.

Helps cover outstanding debts, especially home loans.

Offers tax-saving benefits under Section 80C and 10(10D).

Helps build wealth or retirement corpus (in savings-based plans).

Offers peace of mind through financial security.

Using a life insurance premium calculator ensures that you can achieve all these benefits while staying within your budget.

How to Use an Online Life Insurance Calculator

Most insurance providers and aggregators offer free online calculators. Here’s a step-by-step guide:

Visit the insurer's official website.

Go to the Life Insurance Plans section.

Click on “Calculate Premium.”

Enter your age, annual income, policy term, and sum assured.

Add any riders like critical illness or accidental death benefit.

Click “Calculate” to view your premium.

Now you can compare plans or tweak values to match your financial goals.

Tips for Choosing the Best Life Insurance Policy

To make the most of your premium calculation and plan selection, keep the following in mind:

Choose a plan based on your life stage (young, married, with kids, nearing retirement).

Opt for a sum assured that is at least 10–15 times your annual income.

Consider whole life insurance if you want long-term family protection.

Look for flexible plans with premium waiver and critical illness riders.

Always check claim settlement ratio and customer service of the insurer.

Final Thoughts

A Life Insurance Premium Calculator is a must-use tool when planning to buy a life insurance policy. It ensures you're not underinsured or overburdened by premium costs. Whether you’re exploring term insurance, whole life insurance, or investment-linked plans, calculating your premium first will give you the clarity and confidence to make the right choice.

With rising uncertainties, understanding the features of life insurance, and utilizing digital tools to find the best life insurance policy has become more important than ever. So don’t delay—use a premium calculator today and take the first step toward protecting your family’s future.

#life insurance#insurance calculator#life insurance premium calculator#term insurance#whole life insurance#insurance tips#financial planning#money matters#insurance policy#insurance advice#insurance quotes#online insurance#personal finance#insurance guide#budget planning#secure future#insurance for family#best life insurance#life goals#protect your future

1 note

·

View note

Text

5 Common Crypto Investment Mistakes and How to Avoid Them.

With its potential for high returns comes equally high risk. New investors often find themselves making critical mistakes that can impact their financial health. We'll explore five common mistakes.

Investing in cryptocurrency can be both thrilling and daunting. With its potential for high returns comes equally high risk. New investors often find themselves making critical mistakes that can impact their financial health. Here, we’ll explore five common errors and provide in-depth guidance on how to avoid them. 1. Lack of Research and Due Diligence Mistake: Jumping into investments without…

View On WordPress

#Altcoin Investment#Altcoins#Avoid FOMO#Avoiding Crypto Scams#Beginner’s Guide to Crypto#Blockchain Technology#Crypto Community#Crypto Investment#Crypto Investment Strategy#Crypto News#Crypto Portfolio#Crypto Research Tips#Crypto Scams#Crypto Whitepapers#Cryptocurrency Investing#Cryptocurrency Red Flags#Dollar-Cost Averaging#Financial Advice#How to Spot Crypto Scams#Identifying Genuine Crypto Projects#Investing in Cryptocurrency#Investing Tips#Legitimate Crypto Projects#Meme Coins#Reputable Crypto Exchanges#Risk Management#Secure Investments#Token Distribution

2 notes

·

View notes

Text

I actually have a fic idea but lc is a show that's like. you will never ever have all the information and context until the end. and I am a writer who writes best and more confidently when I have all the info and context at my fingertips. so now I'm just like 🧍♂️

anyway. ramble in the tags

#mine musings#not tagging etc etc#it's an AU so it shouldn't even matter actually. but. whatever. i'll still try to write it. it'll take a while#it's more like character exploration anyway. a role reversal (my favorite kind of au)#i.e. what would the emma case look like if cxs is the one who keeps timelooping to save lg?#it's not a power swap or personality swap so i think it'll be an interesting exploration of the limits of their personalities#for example: in this au i think lg is still protective of cxs and acts as the guide. but he's closer to og!timeline lg#so i'm thinking that he's still very principled but perhaps less strict about doing small deviations from the timeline#cxs is still empathetic and reckless and i think that would actually get worse in a timelooping cxs#since he's the possessor he rationalizes to himself that he gets to shield lg from the messy parts of an operation#and how this self-matyrdom pulls at the fragile trust they have. because their partnership is never equal when someone is timelooping#i'm thinking in like the emma case this all comes to a head when emma gets the text from her parents#in S1 lg tells him “it's better not to look”#i think in this au. cxs would have already honed his acting skills and be like “lg. does she check the phone?”#and lg who is protective but a little naive and not as strict with rules is like#cxs looks so sad :( he's been missing his parents lately :( emma doesn't see the text until tomorrow but...#this probably won't change the timeline too much... right? i think cxs needs to feel loved right now :) “yes she checks her phone”#and cxs is like “... are you sure?”#lg: “yes i'm sure”#and then post-dive cxs finds out emma dies but he doesn't tell lg :) he just keeps it to himself :)#bc it's his job to handle all the messy parts :) like the emotions of their clients. their regrets and obsessions. their fates#in his mind. the more lg knows the more he tries to sacrifice himself to save cxs. so it's important that lg is kept in the dark#something something actor/scriptwriter metaphors idk still working on the idea#just. role reversal shiguang... cxs who keeps timelooping bc he has abandonment issues so he can't handle lg dying...#lg basically is like 9S from nier automata who always dooms himself by learning the truth#this could've been a read more instead of a tag essay i'm sorry. i keep forgetting that feature. i am a yapper in the tags#cxs after dragging lg out for dinner so he doesn't catch the news: “hey lg. we followed the script to a tee right?”#“i didn't forget any lines or anything?”#lg (confused) (lying): “yes. aside from getting the financial data part. we did everything right.”#cxs: “okay 😊 i trust you 😊 past or future let them be”

4 notes

·

View notes

Link

🔥🚀 Ready to make your mark in the crypto world? Our latest article breaks down everything you need to know about creating a meme coin and turning it into a cash cow! 🤑💰 From concept to launch, we've got you covered. Get the inside scoop on how to build, market, and profit from your very own meme coin. 💡🔧

👑 Be the next meme coin champion! 🎉

🔗 Read the Full Article

#crypto#meme coin#memecoin#blockchain#crypto trends#altcoins#token creation#crypto success#crypto tips#blockchain development#crypto guide#digital currency#financial freedom#crypto journey#tech trends#invest smart

3 notes

·

View notes