#Semiconductor Controlled Rectifier

Explore tagged Tumblr posts

Text

SCR Silicon Controlled Rectifier TT425N16KOF

TT425N16KOF is a Silicon Controlled Rectifier (SCR) manufactured by Vishay Semiconductors.

The SCR is a type of semiconductor device that can switch and control large amounts of power, making it suitable for a variety of industrial applications.

The TT425N16KOF SCR has the following specifications:

Repetitive Peak Off-State Voltage (Vdrm): 1600V

On-State Current (It(RMS)): 425A

Peak Non-Repetitive Surge Current (Itsm): 5500A

Gate Trigger Current (Igt): 150mA

Operating Temperature: -40°C to +125°C

This SCR is designed for use in high-power industrial applications such as power supplies, motor controls, and welding equipment. It features high voltage and current ratings, low on-state voltage drop, and high surge capability, making it a reliable option for high-power switching and control.

#Silicon Controlled Rectifier#Semiconductor Controlled Rectifier#SCR Silicon Controlled Rectifier#SCR Controlled Rectifier#Silicon Diode Rectifier#Controlled Rectifier#Rectifier Silicon#SCR Controlled#SCR Rectifier#SCR Silicon#SCR Electronics#Vishay Semiconductors#Vishay Semi#TT425N16KOF

0 notes

Text

UCC28C45QDRQ1 PWM controllers at higher discount only by SUV System Ltd

A leading electronic component supplier in China, is rolling out SPECIAL DISCOUNTS on their hottest selling #semiconductordevices

With offices in Hong Kong and Shenzhen, and a fully stocked product warehouse, we offer a wide range of products from leading brands. We guarantee the authenticity and quality of every component we supply. With strict standards and certifications including ESD, ISO9001, ISO14001, ISO45001, and ISO13485, you can trust that you're getting the best of the best.

For queries, Contact us at [email protected]

Skype: [email protected]

To purchase this product, click https://www.suvsystem.com/en/pitems/UCC28C45QDRQ1.html

0 notes

Text

Silicon is the king of electronics, but it wasn’t always that way. In the early days, materials like germanium and selenium were used in making transistors and diodes. Germanium was great because it had high conductivity and worked well in early circuits, but it had one big problem—it couldn’t handle high temperatures. Selenium was used in rectifiers, but it wasn’t as efficient as today’s semiconductors. Then came silicon, and it changed everything.

Silicon became the top choice because it has the perfect balance of electrical properties and stability. It’s a semiconductor, meaning it can act as both a conductor and an insulator, depending on how it’s treated. This makes it ideal for transistors, microchips, and other electronic components. One major advantage is its ability to withstand high temperatures, unlike germanium, which breaks down easily when things heat up. Silicon also has a stable crystalline structure, which makes it reliable for long-term use in circuits.

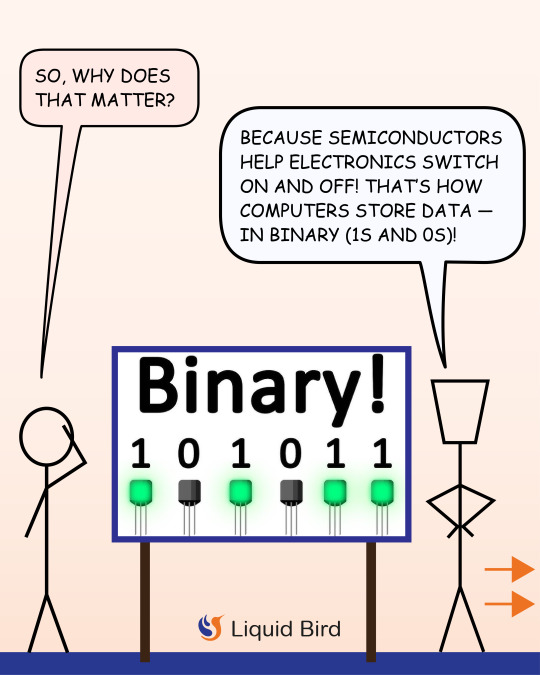

Another big reason for silicon’s dominance is how easy it is to “dope.” Doping is the process of adding tiny amounts of other elements to change how silicon conducts electricity. By adding phosphorus or boron, engineers can create either n-type or p-type silicon, which are essential for making diodes, transistors, and integrated circuits. This precise control over its conductivity is what makes modern electronics possible.

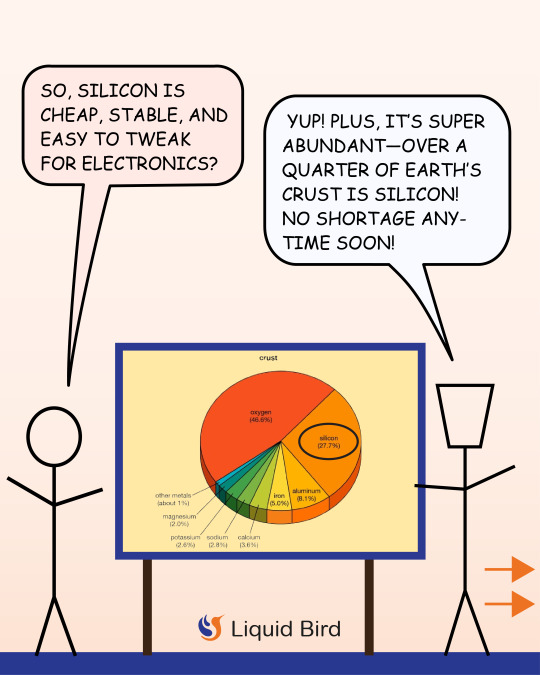

On top of all that, silicon is incredibly abundant. It’s the second most common element in Earth’s crust, found in sand and quartz. This makes it cheap and easy to source compared to rarer materials. Because of this, silicon-based chips are affordable and mass-producible, making electronics available to everyone.

From the first germanium transistors to today’s advanced silicon microprocessors, technology has come a long way. And thanks to silicon, we have everything from smartphones to supercomputers.

Follow for more such educational content daily!

Check, our substack for more in-depth articles on such topics.

#comics#sciencecomics#webcomics#science#stem#educationalcomics#liquidbird#becurious#comicstrips#rockets#space#electronics#aircraft

5 notes

·

View notes

Text

Electropolishing for Deburring Critical Metal Parts

Stamping and machining processes can leave metal parts with burrs that can affect the fit, function and durability of metal parts.

When these parts are destined for food or pharmaceutical production equipment or fuel lines and gear assemblies used in aerospace manufacturing, burrs are more than just a surface imperfection – they’re a potentially catastrophic defect that can prevent the proper sealing or connection between two parts, become dislodged near moving parts, or cause seizing of screws and other fasteners.

To prevent such risks, manufacturers in many industries often specify electropolishing as the final step in finishing their critical metal parts.

How Does Electropolishing Work?

Electropolishing is a highly effective finishing process for removing metal surface defects like microburrs caused by processes like broaching, fine blanking, grinding, lapping or milling.

Using a combination of a chemical bath and a rectified electrical current, electropolishing removes a precise and uniform layer of surface material, leaving behind a shiny, smooth, passive and defect-free surface.

Among other advantages, electropolishing can remove a microscopically precise amount of surface material with surface roughness improvement of up to 50%, eliminating surface defects for high-quality results within very tight tolerances.

By eliminating microcracks and other defects that can harbor bacteria or become initiation sites for corrosion, electropolishing also leaves metal parts with significantly improved resistance to corrosion and pathogen growth. The ultrasmooth surface finish that electropolishing leaves behind has been shown to inhibit the formation of bacterial biofilms that can be resistant to ordinary cleaning methods. The finish also leaves behind a surface that is easier to clean, without cracks or defects where pathogens can hide – a critical advantage for medical, pharmaceutical and food and beverage production.

Why Use Electropolishing for Deburring?

Fragile or intricate metal parts, like those used for medical devices and implants, are not well suited for finishing processes like mechanical or vibratory polishing, which can damage fragile parts or create inconsistent results for parts with complex shapes.

Successful deburring for critical metal parts is contingent upon the ability to remove a precise layer of surface material. No other process can match electropolishing for its ability to control the material removal to +/- .0002”.

By deburring the threads on metal fasteners, for example, electropolishing can reduce the risk of adhesion between two mating surfaces, also known as “galling,” which can cause material between the surfaces to deteriorate and seize up when parts are pressed together.

Burrs can also shorten the lifespan of a part, by breaking off or becoming an initiation site for corrosion.

Larger burrs that occur as the result of rough milling or displaced metal from drilling operations, however, may need pre-treatment using other methods. Likewise, heavy die break burrs caused by improper tooling maintenance will generally require additional treatment.

Much in the way that lightning is drawn to the highest points, electropolishing delivers higher current density on the high points or edges which makes it ideal for micro-deburring The customized nature of the electropolishing process, from racking to chemical formulation to timing, would be of little value if it could not be reproduced consistently. But unlike other finishing processes, electropolishing is prized for its consistent results.

Electropolishing also offers a key advantage for parts with critical microfinishes or made from the lighter, more fragile materials increasingly used in the manufacturing of medical devices, electrical components and semiconductors, among other industries. These parts are not suitable for mass finishing techniques that can create distortion, nicks and scratches. Electropolished parts are individually racked to prevent contact and ensure the even application of the process for even the most fragile parts.

Advantages of Electropolishing for Deburring

The electropolishing process can be customized by alloy, by application and by the desired results. Beyond its ability to remove a uniform layer of surface material to eliminate surface defects like microburrs, microcracks, scale and staining, electropolishing offers many collateral benefits for the manufacturers of critical metal parts.

Microscopically precise removal of surface material with control to +/-.0002”

Customized racking to accommodate fragile and complex parts small and large

Leaves parts with enhanced durability and cycle life

Creation of a pathogen-resistant surface

Superior cleanability

Ultraclean finish

Decorative finish

One stop process for cleaning and removing surface defects

30X more corrosion resistance than passivation alone

Parts are also left passivated in the process

Improves conductivity of copper and aluminum alloys

What Alloys Can Be Electropolished?

A long list of alloys can be effectively deburred using electropolishing. The process is also equally effective on parts that are fully annealed or hardened. That is one reason that electropolishing is frequently specified for the final deburring and finishing of parts after all fabrication and heat treating processes have been completed.

Electropolishing is effective for a wide variety of alloys including:

Stainless Steel 200-300 Series

Stainless Steel 400 Series

Stainless Steel: Precipitating Hardening Grades

Nitinol

Titanium

Aluminum

Carbon Steels

Copper

Brass

Nickel Alloys

Specialty Alloys

And more

Electropolishing for Critical Metal Parts

As the world’s largest electropolishing specialist with seven decades of electropolishing expertise and innovation, Able Electropolishing provides consultation and collaboration from the earliest stages of prototyping through production to create highly customized electropolishing processes for a wide variety of metal parts.

6 notes

·

View notes

Text

Capacitive Stylus Market size Overview: A Stylized Future of Precision and Productivity

The Capacitive Stylus Market Size is evolving rapidly in the digital era, where touchscreen interaction and digital writing tools are revolutionizing industries ranging from education to graphic design. A capacitive stylus offers precise control, enabling fluid interaction with smartphones, tablets, and interactive displays. As the demand for mobile devices, digital whiteboards, and e-learning platforms rises, the capacitive stylus is becoming a core accessory for professionals, creatives, and students alike.

This stylus technology leverages the conductive properties of the human body, allowing natural writing, drawing, and navigation experiences. With growing integration of capacitive screens in smart devices and increasing preference for paperless workflows, the capacitive stylus is witnessing significant adoption. Innovations in pressure sensitivity, palm rejection, and customizable functions have further expanded its functionality across sectors such as digital art, education, and enterprise productivity.

Market Size Dynamics and Drivers

Several factors are driving the upward trajectory of the capacitive stylus industry:

Proliferation of Smart Devices: The surge in touchscreen devices fuels demand for precise input tools.

Remote Learning and Digital Education: E-learning platforms increasingly adopt styluses for interactive learning.

Creative and Professional Applications: Graphic designers, architects, and business professionals use styluses for accuracy and ease.

Tech Advancements: Developments in stylus design, battery life, and Bluetooth connectivity enhance user experience.

Segmental Insights

The capacitive stylus market can be segmented by type (fine-tip stylus, art stylus, active stylus), application (drawing, writing, navigation), and end-users (individual consumers, educational institutions, enterprises).

Among these, the active stylus segment is gaining prominence due to its advanced features like pressure sensitivity and tilt recognition. In terms of applications, drawing and design remain dominant, thanks to rising demand from digital artists and designers.

Regional Outlook

North America leads due to high adoption of smart classrooms and BYOD (Bring Your Own Device) trends in enterprises.

Asia-Pacific is rapidly emerging, driven by manufacturing hubs and increasing student populations using stylus-integrated tablets.

Europe shows consistent growth, especially in digital learning and creative industries.

Leading Companies

Key players shaping the capacitive stylus landscape include:

Adonit

Wacom Co., Ltd.

Apple Inc.

Microsoft Corporation

Hanvon Technologies

Logitech

These companies focus on enhancing stylus ergonomics, durability, and compatibility with a range of devices to remain competitive.

Emerging Trends

AI-Enhanced Styluses for predictive text and smarter gesture recognition

Eco-friendly and Rechargeable Styluses for sustainability

Customizable Stylus Features tailored to specific industries like architecture or animation

Integration with AR/VR Devices for immersive learning and design experiences

Conclusion

As the digital interface becomes more dynamic and interactive, the capacitive stylus continues to grow in relevance. Technological innovations, rising digitalization across industries, and user demand for precision will sustain strong growth in the coming years.

Trending Report Highlights:

Semiconductor Device For Processing Application Market Size

Sensor Fusion In Autonomous Vehicle Market Size

Handheld Thermal Imaging Equipment Market Size

Hazardous Waste Handling Automation Market Size

Inductor Market Size

Lab Automation In Genomic Market Size

Laser Cleaning Market Size

Power Supply Device Market Size

Rectifier Market Size

Rf Front End Module Market Size

Refurbished Computers and Laptops Market Size

Water Automation and Instrumentation Industry Market Size

IR and Thermal Imaging Systems Market Size

Industrial And Service Robot Market Size

Kiosk Market Size

Safety Programmable Controllers Market Size

0 notes

Text

Silent Powerhouses: How igbt rectifiers Are Redefining Industrial Energy Conversion

Picture a bustling manufacturing floor at dawn. Conveyor belts glide, robotic arms pivot with precision, and high-power motors hum in perfect synchrony. All of this choreographed action relies on stable direct current—even though the utility grid delivers alternating current. Converting AC to DC might sound mundane, yet it’s the unglamorous heartbeat of virtually every modern factory, data center, and electric-rail system. Tucked inside control cabinets and power bays, igbt rectifiers are the silent powerhouses making this conversion cleaner, smarter, and dramatically more efficient.

From Diodes to Digital Brains

For decades, silicon diodes and thyristors dominated rectification. They were sturdy, inexpensive, and—let’s be honest—fairly dumb. They could only switch on and off in crude, bulk fashion, producing DC that was rife with voltage ripple and harmonic distortion. That was acceptable in an analog world, but today’s precision-driven operations need better. Enter the Insulated Gate Bipolar Transistor (IGBT): a semiconductor that marries the high-current capability of a bipolar transistor with the fast switching of a MOSFET.

When engineers embed IGBTs in rectifier topologies, the result is a new class of high-frequency converters capable of pulse-width modulation (PWM), soft-start functions, and active power-factor correction. Suddenly, rectification isn’t just about flipping waveform polarity—it’s about sculpting perfect current for sensitive loads, saving megawatts in the process.

A Day in the Life: Humanizing High Tech

Let’s walk in the shoes of Ananya, maintenance lead at a sprawling metro-rail depot in Bengaluru. She remembers the era when traction substations ran on mercury-arc or SCR rectifiers. “It was like taming a dragon,” she jokes. Voltage spikes chewed through bearings, transformers overheated, and harmonics crept back onto the grid. Then came the retrofit: a modular cabinet stuffed with igbt rectifiers. Overnight, the depot saw a 6 % drop in energy losses and, more surprisingly, quieter lines. “Passengers didn’t notice the upgrade,” Ananya says, “but my team sleeps better knowing the system’s self-diagnostics flag issues before they escalate.”

That’s the hidden human upside—less emergency call-outs, more predictive maintenance, and a work culture that shifts from crisis mode to optimization mode.

Under the Hood: Why IGBT Architecture Shines

High-Frequency Switching IGBTs can switch tens of kilohertz, shrinking bulky transformers and filters. Smaller magnetics mean lighter enclosures and better thermal management.

Low Conduction Losses Compared to MOSFETs at high voltage, IGBTs maintain lower on-state resistance, translating into cooler operation and longer component life.

Built-In Protection Advanced gate-driver ICs monitor temperature, current, and voltage in real time, shutting down the device within microseconds if thresholds are breached.

Bidirectional Capability Paired with appropriate circuitry, they enable regenerative braking in electric locomotives, feeding energy back to the grid instead of dumping it as heat.

Sustainability by Design

Energy efficiency isn’t just a line on a spec sheet—it’s a planetary necessity. Traditional 12-pulse SCR rectifiers often hover near 90 % efficiency under ideal loads. Modern PWM-controlled igbt rectifiers push beyond 97 %, slicing gigawatt-hours off cumulative utility bills over their service life. Multiply that by thousands of installations and you have a tangible dent in global CO₂ emissions.

Moreover, precise DC output means motors run cooler, electrolytic capacitors last longer, and upstream generators experience smoother load profiles. Less wear equals fewer raw materials mined, shipped, and processed for replacements—a virtuous cycle of resource conservation.

Beyond the Factory: Emerging Frontiers

Data Centers – Hyperscale operators love IGBT rectifiers for redundant, hot-swappable power shelves that squeeze more watts per rack while meeting stringent harmonic limits (IEEE 519).

Electrolysis for Green Hydrogen – Stable, low-ripple DC is crucial for membrane longevity. As electrolyzer farms scale into the gigawatt realm, PWM rectifiers slash idle losses and enable dynamic ramp-up tied to renewable generation.

EV Hyper-Chargers – Ultra-fast DC stations (350 kW and higher) rely on modular IGBT blocks to convert grid AC into tightly regulated DC that won’t fry delicate vehicle battery chemistries.

Challenges on the Road Ahead

No technology is perfect. IGBT modules are sensitive to over-voltage transients and require sophisticated snubber networks. Their thermal cycling limits call for meticulous heatsink design and, in harsh climates, liquid cooling. Meanwhile, wide-bandgap semiconductors—silicon carbide (SiC) and gallium nitride (GaN)—are nipping at IGBT heels, promising even faster switching and lower losses.

Yet cost remains king. For high-power (≥ 1 MW) applications, mature supply chains and proven robustness keep igbt rectifiers solidly in the lead. Hybrid topologies that mix SiC diodes with IGBT switches already deliver incremental gains without breaking budgets.

Skills and Workforce Implications

Technicians who once wielded soldering irons on analog boards now brandish oscilloscopes with gigahertz bandwidth to capture nanosecond edge transitions. Training programs are evolving: power-electronics courses in Indian ITIs and polytechnics now include gate-drive design, thermal simulation, and module-level repair practices.

For young engineers, this field offers a blend of hands-on tinkering and digital analytics. Predictive-maintenance dashboards stream real-time data—junction temperatures, switching losses, harmonic spectra—turning power rooms into high-tech command centers.

Final Reflections: Small Silicon, Massive Impact

It’s easy to overlook the humble converter tucked behind a metal door. But in the grand choreography of electrification, igbt rectifiers are the quiet conductors, synchronizing renewable surges, feeding smart grids, and keeping industry humming. They exemplify how incremental innovations—faster switches, smarter firmware, better cooling—compound into game-changing efficiency.

Next time you glide on an electric train, boot up a cloud server, or see a wind farm blinking on the horizon, remember: somewhere underneath, tiny gates are opening and closing thousands of times a second, silently shaping the clean-energy era. And that is technology worth celebrating, even if it never seeks the spotlight.

0 notes

Text

Renewable Energy Surge Elevates Demand for Power Modules

The global power semiconductor market reached US$ 56,155 million in 2022 and is projected to grow to US$ 171,709 million by 2031, at a CAGR of 15.0% during 2024–2031, fueled by rising demand across automotive, industrial, consumer electronics, and defense sectors. Asia Pacific leads the surge, driven by booming EV adoption and industrial automation. Power semiconductors like MOSFETs, IGBTs, and diodes are critical for efficient energy conversion, while key players such as STMicroelectronics, Toshiba, and Texas Instruments drive innovation in the competitive landscape.

Unlock exclusive insights with our detailed sample report :

Key Market Drivers

1. Electrification of Transportation

With EVs gaining global momentum, power semiconductors are essential in managing electric drive systems, inverters, DC/DC converters, and battery management systems. Their role in achieving efficiency and thermal control is critical in both vehicles and EV charging stations.

2. Renewable Energy Integration

Power semiconductors are pivotal in solar inverters, wind power systems, and energy storage solutions. These devices ensure efficient energy conversion, grid synchronization, and load balancing, essential for stable and sustainable energy infrastructure.

3. Wide Bandgap Material Adoption

The shift from silicon to SiC (Silicon Carbide) and GaN (Gallium Nitride) semiconductors is transforming power electronics. These materials offer superior switching speeds, thermal resistance, and power density, critical for next-gen EVs, 5G, and aerospace.

4. Smart Grids and Industrial Automation

As smart cities and Industry 4.0 evolve, power semiconductors underpin intelligent energy management, motor control, and automation systems, allowing real-time efficiency in manufacturing and smart infrastructure.

5. 5G Network Expansion

The rapid deployment of 5G networks requires high-performance RF components, power amplifiers, and energy-efficient base stations, creating robust demand for advanced power semiconductor devices.

Regional Insights

United States

The U.S. remains a major consumer and innovator in power semiconductors due to:

Massive investment in semiconductor manufacturing (CHIPS and Science Act).

Booming EV market led by Tesla, GM, and Ford, all reliant on SiC and GaN power components.

High demand for data center power solutions to support AI, cloud computing, and 5G networks.

U.S. companies such as Texas Instruments, ON Semiconductor, and Wolfspeed are leading domestic innovation in wide bandgap technologies.

Japan

Japan is renowned for its expertise in high-efficiency, compact power electronics. Key developments include:

Leadership in SiC development with companies like ROHM, Mitsubishi Electric, and Fuji Electric.

Advanced integration of power semiconductors in robotics, railway systems, and renewables.

Government-backed efforts to secure local chip production and reduce import dependency.

Japanese innovation focuses on packaging technology, ultra-low-loss switching, and EV-grade reliability.

Speak to Our Senior Analyst and Get Customization in the report as per your requirements:

Market Segmentation

By Device Type:

Power MOSFET

IGBT

Diode & Rectifier

Thyristor

Bipolar Junction Transistor (BJT)

By Material:

Silicon

Silicon Carbide (SiC)

Gallium Nitride (GaN)

Others

By Application:

Automotive & Transportation

Consumer Electronics

Industrial

ICT (5G, IoT, Cloud)

Energy & Utilities (Solar, Wind, Smart Grid)

By Packaging Type:

Surface Mount Devices (SMD)

Through-Hole Devices

Chip-scale Packages

Wafer-Level Packages

Latest Industry Trends

Shift Toward Wide Bandgap (WBG) Devices Automakers and energy firms increasingly shift to SiC and GaN to reduce energy losses and improve high-voltage application efficiency.

Integration of AI in Power Management Systems AI-enabled power modules allow predictive control in electric grids, optimizing load sharing, energy storage, and consumption.

Advancements in Thermal Management and Packaging New materials like copper sintering, ceramic substrates, and 3D packaging enhance heat dissipation and longevity.

Collaborative R&D Projects Between U.S. and Japan Research alliances focus on compound semiconductor scalability, reliability testing, and supply chain development.

Miniaturization and Integration for Consumer Devices Compact, high-efficiency power semiconductors are being integrated into smartphones, wearables, and VR systems to manage battery and power usage.

Buy the exclusive full report here:

Growth Opportunities

Fast-Growing EV Ecosystem: Demand for SiC-based inverters and DC/DC converters in EVs and charging stations.

Offshore Wind and Solar Energy: New power conversion architectures using WBG devices to improve offshore energy output efficiency.

Asia-Pacific Smart Grid Projects: Growth in APAC utilities deploying next-gen power modules for smart metering and substation automation.

Defense and Aerospace Applications: Lightweight, ruggedized power semiconductors essential for drones, satellites, and avionics.

Data Center Electrification: Rising need for high-efficiency power supplies to handle AI and cloud computing workloads.

Competitive Landscape

Major players include:

Infineon Technologies AG

Texas Instruments Inc.

ON Semiconductor

STMicroelectronics

Mitsubishi Electric Corporation

Toshiba Corporation

Wolfspeed, Inc.

ROHM Semiconductor

Vishay Intertechnology

Renesas Electronics Corporation

These companies are:

Expanding SiC and GaN production lines.

Collaborating with automotive OEMs for integrated solutions.

Investing in next-gen fabrication plants and foundries across the U.S. and Japan.

Stay informed with the latest industry insights-start your subscription now:

Conclusion

The power semiconductor market is experiencing a major growth phase as global industries shift toward electrification, renewable energy, and smart technologies. Driven by advances in wide bandgap materials, packaging, and AI integration, power semiconductors are becoming essential to energy-efficient design across sectors.

With ongoing support from governments, rising sustainability mandates, and transformative innovations in the U.S. and Japan, the market is set to play a central role in the next wave of global industrial and technological progress.

About us:

DataM Intelligence is a premier provider of market research and consulting services, offering a full spectrum of business intelligence solutions—from foundational research to strategic consulting. We utilize proprietary trends, insights, and developments to equip our clients with fast, informed, and effective decision-making tools.

Our research repository comprises more than 6,300 detailed reports covering over 40 industries, serving the evolving research demands of 200+ companies in 50+ countries. Whether through syndicated studies or customized research, our robust methodologies ensure precise, actionable intelligence tailored to your business landscape.

Contact US:

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: [email protected]

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

#Power semiconductor market#Power semiconductor market size#Power semiconductor market growth#Power semiconductor market share#Power semiconductor market analysis

0 notes

Text

High-Power Rectifiers Market Emerging Trends Transforming Industrial Power Systems

The high-power rectifiers market is witnessing significant transformation driven by technological advancements, rising energy demands, and the need for improved efficiency in industrial operations. High-power rectifiers are essential for converting alternating current (AC) to direct current (DC) in applications requiring high-voltage and high-current supply. These devices are critical across a range of sectors including power utilities, electrochemical processing, electric arc furnaces, railway traction systems, and renewable energy integration. As industrial infrastructure modernizes and the shift towards electrification accelerates, several emerging trends are shaping the future trajectory of this market.

Integration with Smart Grid Systems

One of the most prominent trends in the high-power rectifiers market is their growing integration with smart grid technologies. As utilities upgrade legacy grids to improve load balancing, efficiency, and fault detection, high-power rectifiers are being adapted to work in tandem with intelligent monitoring and control systems. These rectifiers are increasingly being embedded with digital interfaces and sensors that enable real-time diagnostics, remote monitoring, and predictive maintenance, thereby enhancing operational reliability and lifespan.

Surge in Demand from Green Energy Applications

The transition to renewable energy sources is another key driver influencing the high-power rectifiers market. With increased investment in solar photovoltaic plants, wind farms, and hydroelectric facilities, there is a corresponding demand for high-capacity rectifiers to ensure consistent and efficient power conversion. These systems are particularly crucial in storing renewable energy in battery systems or integrating it into high-voltage DC (HVDC) transmission lines, which require stable rectification systems to handle variable input loads.

Advancements in Semiconductor Materials

Recent innovations in semiconductor technologies, particularly the adoption of silicon carbide (SiC) and gallium nitride (GaN), are enabling the development of high-power rectifiers with superior performance characteristics. These wide-bandgap materials offer higher thermal conductivity, voltage tolerance, and switching speeds compared to traditional silicon-based rectifiers. This allows rectifiers to operate at higher frequencies with greater efficiency, making them ideal for compact, high-performance industrial systems. As manufacturing costs for SiC and GaN devices decrease, their adoption in high-power rectifiers is expected to rise significantly.

Growing Adoption in Electrochemical and Metallurgical Processes

High-power rectifiers are indispensable in electrochemical industries, especially in applications such as metal electrolysis, electroplating, and anodizing. With the revival of infrastructure projects and increasing demand for metals like copper, aluminum, and zinc, industries are scaling up their production facilities. Modern rectifiers now offer precise control over voltage and current, which is crucial for maintaining product quality in such processes. Additionally, there is a rising trend towards using energy-efficient rectifiers that reduce electricity consumption and lower carbon emissions in metallurgical operations.

Customization and Modular Design

Industrial end-users are increasingly seeking customized high-power rectifier solutions tailored to specific application needs. This has led manufacturers to develop modular rectifier systems that offer scalability and flexibility. Modular designs not only facilitate easier maintenance and upgrades but also enable rapid deployment in remote or space-constrained environments. This trend is particularly relevant in mining operations, offshore platforms, and mobile power stations where adaptability and resilience are key requirements.

Expansion in Railway Electrification Projects

As countries invest in railway electrification to reduce dependence on fossil fuels, high-power rectifiers are becoming a vital component of traction substations. These systems are required to supply reliable DC power for electric locomotives and auxiliary systems. The ongoing electrification of rail networks in regions such as Asia-Pacific, Latin America, and parts of Africa is driving demand for rugged, high-efficiency rectifier units that can withstand harsh operating conditions while maintaining high performance.

Emphasis on Energy Efficiency and Sustainability

Environmental concerns and regulatory pressures are compelling industries to adopt energy-efficient rectification technologies. Modern high-power rectifiers now come with features like low harmonic distortion, soft-start capabilities, and regenerative energy systems that contribute to overall energy savings. Manufacturers are focusing on creating eco-friendly designs that minimize energy waste and contribute to sustainability goals, a trend that is increasingly resonating with environmentally conscious stakeholders.

Digital Twin and Predictive Maintenance

The implementation of digital twin technology is another cutting-edge trend impacting the high-power rectifiers market. By creating a virtual replica of the physical rectifier system, operators can simulate various operational scenarios, optimize performance, and predict maintenance needs. This approach helps in reducing unplanned downtime and extending the service life of the equipment. Predictive maintenance powered by AI and IoT is gaining traction among large-scale industrial users for its cost-efficiency and effectiveness.

Conclusion

The high-power rectifiers market is undergoing a dynamic evolution, influenced by innovations in materials, automation, energy integration, and sustainability. As industries continue to digitize and decarbonize, the demand for smarter, more efficient rectification systems will only intensify. Manufacturers that embrace these emerging trends and invest in R&D for next-generation technologies will be best positioned to capture the expanding opportunities in this essential industrial sector.

0 notes

Text

Closing in on superconducting semiconductors

New Post has been published on https://sunalei.org/news/closing-in-on-superconducting-semiconductors/

Closing in on superconducting semiconductors

In 2023, about 4.4 percent (176 terawatt-hours) of total energy consumption in the United States was by data centers that are essential for processing large quantities of information. Of that 176 TWh, approximately 100 TWh (57 percent) was used by CPU and GPU equipment. Energy requirements have escalated substantially in the past decade and will only continue to grow, making the development of energy-efficient computing crucial.

Superconducting electronics have arisen as a promising alternative for classical and quantum computing, although their full exploitation for high-end computing requires a dramatic reduction in the amount of wiring linking ambient temperature electronics and low-temperature superconducting circuits. To make systems that are both larger and more streamlined, replacing commonplace components such as semiconductors with superconducting versions could be of immense value. It’s a challenge that has captivated MIT Plasma Science and Fusion Center senior research scientist Jagadeesh Moodera and his colleagues, who described a significant breakthrough in a recent Nature Electronics paper, “Efficient superconducting diodes and rectifiers for quantum circuitry.”

Moodera was working on a stubborn problem. One of the critical long-standing requirements is the need for the efficient conversion of AC currents into DC currents on a chip while operating at the extremely cold cryogenic temperatures required for superconductors to work efficiently. For example, in superconducting “energy-efficient rapid single flux quantum” (ERSFQ) circuits, the AC-to-DC issue is limiting ERSFQ scalability and preventing their use in larger circuits with higher complexities. To respond to this need, Moodera and his team created superconducting diode (SD)-based superconducting rectifiers — devices that can convert AC to DC on the same chip. These rectifiers would allow for the efficient delivery of the DC current necessary to operate superconducting classical and quantum processors.

Quantum computer circuits can only operate at temperatures close to 0 kelvins (absolute zero), and the way power is supplied must be carefully controlled to limit the effects of interference introduced by too much heat or electromagnetic noise. Most unwanted noise and heat come from the wires connecting cold quantum chips to room-temperature electronics. Instead, using superconducting rectifiers to convert AC currents into DC within a cryogenic environment reduces the number of wires, cutting down on heat and noise and enabling larger, more stable quantum systems.

In a 2023 experiment, Moodera and his co-authors developed SDs that are made of very thin layers of superconducting material that display nonreciprocal (or unidirectional) flow of current and could be the superconducting counterpart to standard semiconductors. Even though SDs have garnered significant attention, especially since 2020, up until this point the research has focused only on individual SDs for proof of concept. The group’s 2023 paper outlined how they created and refined a method by which SDs could be scaled for broader application.

Now, by building a diode bridge circuit, they demonstrated the successful integration of four SDs and realized AC-to-DC rectification at cryogenic temperatures.

The new approach described in their recent Nature Electronics paper will significantly cut down on the thermal and electromagnetic noise traveling from ambient into cryogenic circuitry, enabling cleaner operation. The SDs could also potentially serve as isolators/circulators, assisting in insulating qubit signals from external influence. The successful assimilation of multiple SDs into the first integrated SD circuit represents a key step toward making superconducting computing a commercial reality.

“Our work opens the door to the arrival of highly energy-efficient, practical superconductivity-based supercomputers in the next few years,” says Moodera. “Moreover, we expect our research to enhance the qubit stability while boosting the quantum computing program, bringing its realization closer.” Given the multiple beneficial roles these components could play, Moodera and his team are already working toward the integration of such devices into actual superconducting logic circuits, including in dark matter detection circuits that are essential to the operation of experiments at CERN and LUX-ZEPLIN in at the Berkeley National Lab.

This work was partially funded by MIT Lincoln Laboratory’s Advanced Concepts Committee, the U.S. National Science Foundation, U.S. Army Research Office, and U.S. Air Force Office of Scientific Research.

0 notes

Text

Bipolar Discrete Semiconductor Market Size, Share, Trends, Demand, Growth and Opportunity Analysis

Bipolar Discrete Semiconductor Market – Industry Trends and Forecast to 2029

Global Bipolar Discrete Semiconductor Market, By Type (Diode, General-Purpose Rectifiers, High-Speed Rectifiers, Switching Diodes, Zener Diodes, Electrostatic Discharge (ESD) Protection Diodes, Variable-Capacitance Diodes, Transistor, Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET), BIPOLAR, Thyristor, Modules), End Users Vertical (Automotive, Consumer Electronics, Communication, Industrial, Others) – Industry Trends and Forecast to 2029.

Access Full 350 Pages PDF Report @

**Segments**

- **Type**: The bipolar discrete semiconductor market can be segmented based on the type of devices, including bipolar transistors, diodes, and thyristors. Bipolar transistors are widely used in various applications such as amplification, switching, and regulation. Diodes are essential components for rectification and signal modulation in electronic circuits. Thyristors, on the other hand, are used for controlling large electrical currents.

- **Application**: Another key segment is based on the applications of bipolar discrete semiconductors. This includes segments such as automotive, industrial, consumer electronics, telecommunications, and aerospace & defense. The automotive sector is a significant consumer of bipolar discrete semiconductors for applications like engine control units, airbags, and traction control systems. Industrial applications cover a wide range of devices used in manufacturing, power distribution, and automation systems. Consumer electronics rely on bipolar discrete semiconductors for products like smartphones, laptops, and TVs. The telecommunications sector uses these semiconductors in network infrastructure equipment. The aerospace & defense segment requires high-performance bipolar discrete semiconductors for mission-critical applications.

- **End-User**: The market can also be segmented based on end-users, which includes segments like original equipment manufacturers (OEMs), electronic manufacturing services (EMS) providers, and distributors. OEMs are the primary users of bipolar discrete semiconductors, integrating them into their products across various industries. EMS providers offer manufacturing services to OEMs and play a crucial role in the supply chain. Distributors act as intermediaries between semiconductor manufacturers and end-users, providing efficient distribution channels for bipolar discrete semiconductors.

**Market Players**

- **Infineon Technologies AG**: Infineon is a key player in the bipolar discrete semiconductor market, offering a wide range of products such as bipolar transistors and diodes. The company focuses on innovation and strategic partnerships to maintain its competitive edge in the market.

- **ON Semiconductor**: ON Semiconductor is another major player, providing high-quality bipolar discrete semiconductors for various applications. The company's product portfolio includes bipolar transistors, diodes, and thyristors that cater to the growing demand in the market.

- **NXP Semiconductors**: NXP Semiconductors is a leading semiconductor manufacturer, known for its advanced bipolar discrete semiconductor solutions. The company's products find applications in automotive, industrial, and consumer electronics sectors, driving its presence in the market.

- **STMicroelectronics**: STMicroelectronics is a prominent player offering a diverse range of bipolar discrete semiconductor products. The company's innovative technologies and global presence contribute to its strong position in the market.

The bipolar discrete semiconductor market is competitive, with key players focusing on product development, strategic collaborations, and expansion into new markets to gain a competitive advantage. The market is driven by increasing demand for electronic devices across various industries, technological advancements, and the growing trend of automation. As the need for efficient power management and high-performance electronic systems continues to rise, the bipolar discrete semiconductor market is expected to witness significant growth in the coming years.

https://www.databridgemarketresearch.com/reports/global-bipolar-discrete-semiconductor-marketThe global bipolar discrete semiconductor market is experiencing substantial growth driven by the increasing adoption of electronic devices across diverse industries. The market segmentation based on type allows for a targeted approach towards catering to the specific needs of applications such as amplification, rectification, and control of electrical currents. Within the application segment, the automotive sector stands out as a significant consumer of bipolar discrete semiconductors for essential functions like engine control and safety systems. The industrial segment also plays a crucial role, employing these semiconductors in manufacturing processes, power distribution systems, and automation technologies. Consumer electronics, telecommunications, and aerospace & defense sectors further contribute to the market demand, highlighting the versatile applications of bipolar discrete semiconductors across industries.

In terms of end-users, original equipment manufacturers (OEMs) are major consumers of bipolar discrete semiconductors, integrating them into a wide range of products. Electronic manufacturing services (EMS) providers offer valuable manufacturing services to OEMs, further driving the adoption of these semiconductors. Distributors play a significant role in providing efficient distribution channels for bipolar discrete semiconductors, ensuring a seamless supply chain for end-users.

Key market players such as Infineon Technologies AG, ON Semiconductor, NXP Semiconductors, and STMicroelectronics are driving innovation and competitiveness in the bipolar discrete semiconductor market. These companies focus on developing advanced semiconductor solutions, forming strategic partnerships, and expanding into new markets to gain a competitive edge. With a focus on product development, collaborations, and market expansion, these players are poised to capitalize on the growing demand for efficient power management and high-performance electronic systems.

The competitive landscape of the bipolar discrete semiconductor market is shaped by factors such as technological advancements, increasing automation trends, and the rising demand for electronic devices across industries. As the market continues to evolve, players are expected to leverage innovation and strategic initiatives to meet the diverse needs of end-users in automotive, industrial, consumer electronics, and aerospace & defense sectors. The market outlook remains optimistic, with significant growth opportunities on the horizon as the demand for efficient and high-performance semiconductor solutions continues to rise.**Segments**

- Global Bipolar Discrete Semiconductor Market, By Type (Diode, General-Purpose Rectifiers, High-Speed Rectifiers, Switching Diodes, Zener Diodes, Electrostatic Discharge (ESD) Protection Diodes, Variable-Capacitance Diodes, Transistor, Metal-Oxide-Semiconductor Field-Effect Transistor (MOSFET), BIPOLAR, Thyristor, Modules) - End Users Vertical (Automotive, Consumer Electronics, Communication, Industrial, Others) – Industry Trends and Forecast to 2029.

The global bipolar discrete semiconductor market is witnessing significant growth due to the increasing adoption of electronic devices across various industries. The market segmentation based on types such as diodes, transistors, and thyristors allows for a targeted approach in catering to specific application needs like rectification, amplification, and current control. The automotive sector stands out as a prominent consumer of bipolar discrete semiconductors, utilizing them in critical functions such as engine control units and safety systems. The industrial segment also plays a vital role, incorporating these semiconductors in manufacturing processes, power distribution, and automation systems. Additionally, the consumer electronics, telecommunications, and aerospace & defense sectors contribute to the market demand, showcasing the versatile applications of bipolar discrete semiconductors across a wide range of industries.

Original Equipment Manufacturers (OEMs) are key end-users of bipolar discrete semiconductors, integrating them into various products across industries. Electronic Manufacturing Services (EMS) providers play a crucial role in offering manufacturing services to OEMs, further boosting the adoption of these semiconductors. Distributors serve as essential intermediaries, ensuring efficient distribution channels for bipolar discrete semiconductors, thus facilitating a seamless supply chain for end-users.

Market leaders like Infineon Technologies AG, ON Semiconductor, NXP Semiconductors, and STMicroelectronics are driving innovation and competitiveness in the bipolar discrete semiconductor market. These companies focus on developing advanced semiconductor solutions, forming strategic partnerships, and expanding into new markets to gain a competitive edge. With an emphasis on product development, collaborations, and market expansion, these players are poised to capitalize on the increasing demand for efficient power management and high-performance electronic systems.

The competitive landscape of the bipolar discrete semiconductor market is influenced by technological advancements, automation trends, and the rising demand for electronic devices across industries. As the market continues to evolve, market players are expected to leverage innovation and strategic initiatives to meet the diverse needs of end-users in automotive, industrial, consumer electronics, and aerospace & defense sectors. The market outlook remains promising, with significant growth opportunities emerging as the demand for effective and high-performance semiconductor solutions continues to surge.

Table of Contents: Bipolar Discrete Semiconductor Market

1 Introduction

2 Global Bipolar Discrete Semiconductor Market Segmentation

3 Executive Summary

4 Premium Insight

5 Market Overview

6 Bipolar Discrete Semiconductor Market, by Product Type

7 Bipolar Discrete Semiconductor Market, by Modality

8 Bipolar Discrete Semiconductor Market, by Type

9 Bipolar Discrete Semiconductor Market, by Mode

10 Bipolar Discrete Semiconductor Market, by End User

12 Bipolar Discrete Semiconductor Market, by Geography

12 Bipolar Discrete Semiconductor Market, Company Landscape

13 Swot Analysis

14 Company Profiles

Countries Studied:

North America (Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, United States, Rest of Americas)

Europe (Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Poland, Russia, Spain, Sweden, Switzerland, United Kingdom, Rest of Europe)

Middle-East and Africa (Egypt, Israel, Qatar, Saudi Arabia, South Africa, United Arab Emirates, Rest of MEA)

Asia-Pacific (Australia, Bangladesh, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Taiwan, Rest of Asia-Pacific)

Objectives of the Report

To carefully analyze and forecast the size of the Bipolar Discrete Semiconductor market by value and volume.

To estimate the market shares of major segments of the Bipolar Discrete Semiconductor

To showcase the development of the Bipolar Discrete Semiconductor market in different parts of the world.

To analyze and study micro-markets in terms of their contributions to the Bipolar Discrete Semiconductor market, their prospects, and individual growth trends.

To offer precise and useful details about factors affecting the growth of the Bipolar Discrete Semiconductor

To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Bipolar Discrete Semiconductor market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Browse Trending Reports:

Veterinary Clostridium Vaccine Market Far Field Speech And Voice Recognition Market Farbers Disease Drug Market Dc Motor Control Devices Market Chronic Depressive Personality Disorder Treatment Market Adams Oliver Syndrome Market Cancer Supportive Care Drugs Market n Methyl 6 Pyrrolidone Market Crosslinking Agent Market Molecular Quality Controls Market Paper Band Market Epidermolytic Ichthyosis Market Hemolytic Anemia Market Cortical Necrosis Market Bronchodilators Market Biological Seed Treatment Market Engine And Transmission Thermal Systems Market Antimicrobial Packaging Market Automotive In Wheel Market Bread Improvers Market Antibiotics In Aquaculture Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]

0 notes

Text

What is SCR?

A silicon controlled rectifier (SCR) is a four-layer semiconductor device that functions as a switch to regulate the flow of electrical power. SCRs belong to the class of semiconductor devices called thyristors, which are used to control power in alternating current (AC) circuits. Because SCRs may be turned on and off with an external signal, unlike traditional diodes, they are essential for applications needing precise control of high-power circuits. An SCR is composed of four layers of alternating p-type and n-type materials that create three junctions. The SCR may enter conduction when a short gate pulse is applied. After this, it remains in conduction until the current drops below a certain level, known as the "holding current."

In power electronics, silicon-controlled rectifiers (SCRs) are essential parts that control and manage electrical power. Due to its ability to tolerate high voltage and current levels, SCRs are widely used in a wide range of applications, such as motor speed control, light dimming, and power regulation systems. This article examines SCRs' primary characteristics, applications, advantages, and working principles as well as the reasons they are seen to be a crucial component of modern power electronic systems.

1 note

·

View note

Text

Powerex KSB13060: The Powerhouse of Silicon-Controlled Rectifiers (SCRs)

Buy KSB13060 and other power semiconductors for as low as $1 at https://www.uscomponent.com/buy/Powerex/KSB13060.

In the dynamic field of power electronics, ensuring robust and efficient control of high-power applications is critical. Powerex introduces the KSB13060, a high-performance Silicon Controlled Rectifier (SCR) designed to meet the rigorous demands of industrial and commercial power control systems. Whether you are managing motor drives, power supplies, or industrial heaters, the KSB13060 delivers unmatched performance, reliability, and efficiency.

Exceptional Performance

The Powerex KSB13060 is engineered to deliver outstanding performance across a broad range of applications. With a voltage rating of 600V and a current rating of 130A, this SCR is capable of handling significant power loads with ease. Its high surge current capability ensures reliable operation even under extreme conditions, making it an ideal choice for applications requiring high power and durability.

Robust Construction

Reliability and durability are at the core of the Powerex KSB13060. Constructed with high-quality materials and advanced manufacturing processes, this SCR is designed to withstand harsh environments and demanding operating conditions. Its rugged design ensures long-term stability and performance, reducing maintenance costs and downtime.

Versatile Applications

The versatility of the KSB13060 makes it suitable for a wide range of applications. In motor control systems, it provides precise and reliable power control, ensuring smooth operation and extended motor life. For power supplies and rectifiers, the KSB13060 ensures efficient and stable power conversion. It is also an excellent choice for industrial heating applications, where precise temperature control is essential for optimal performance.

Easy Integration

Powerex understands the importance of seamless integration in your power control systems. The KSB13060 is designed for easy installation and compatibility with a variety of control circuits. Its standard package size and configuration simplify the upgrade process, allowing for quick and hassle-free implementation in existing systems. This ease of integration helps minimize downtime and ensures a swift return on investment.

Superior Control

The KSB13060 offers superior control capabilities, with fast switching speeds and low switching losses. Its excellent thermal management ensures consistent performance, even under heavy load conditions. This high level of control enhances the efficiency and reliability of your power systems, contributing to improved overall performance and reduced energy consumption.

Environmentally Conscious

In an era where energy efficiency and environmental responsibility are paramount, the KSB13060 stands out as an eco-friendly solution. By enhancing the efficiency of power control systems and reducing energy losses, it helps lower your carbon footprint and supports sustainable operations. Integrating the KSB13060 into your systems is a step towards greener and more responsible technology solutions.

Conclusion

The Powerex KSB13060 SCR is more than just a semiconductor device; it's a cornerstone of advanced power control systems. With its exceptional performance, robust construction, versatile applications, easy integration, superior control, and environmental benefits, the KSB13060 sets a new benchmark in the industry.

Upgrade your power control solutions with the Powerex KSB13060 and experience the future of high-power applications. For more information and to see how this powerful SCR can enhance your operations, visit our website or contact our sales team. Embrace the power of innovation with Powerex.

#SCR#Semiconductor#Transistor#Silicon Controlled Rectifiers#Powerex#Electronic Components Distributor#SCR Electronics#SCR Silicon Controlled Rectifier#Power SCR#Powerex SCR#SCR Transistor#High Voltage SCR#Powerex Distributor

0 notes

Text

Power Electronics Market Set for Growth Owing to Renewable Integration

The Global Power Electronics Market is estimated to be valued at US$ 51.01 Bn in 2025 and is expected to exhibit a CAGR of 5.9% over the forecast period 2025 to 2032.

The power electronics market comprises semiconductor-based devices and systems that control and convert electric power efficiently across applications such as renewable energy, electric vehicles, industrial drives, and consumer electronics. These products—including inverters, converters, rectifiers, and power modules—offer advantages such as higher energy efficiency, reduced heat loss, compact design, and enhanced reliability. Rising demand for grid modernization, growing adoption of solar and wind energy, and the shift toward electric mobility have amplified the need for advanced power electronics. Power Electronics Market Insights is manufacturers are leveraging wide bandgap materials like silicon carbide (SiC) and gallium nitride (GaN) to deliver higher switching frequencies and lower conduction losses, driving down overall system costs and improving energy density. Additionally, innovations in digital power management and embedded control enable predictive maintenance and real-time monitoring, supporting industry trends of smarter and more connected energy systems. With increasing market share among key companies and expanding product portfolios, the sector is poised for robust market growth.

Get more insights on,Power Electronics Market

#Coherent Market Insights#Power Electronics Market#Power Electronics#Power Electronics Market Insights#Silicon Carbide

0 notes

Text

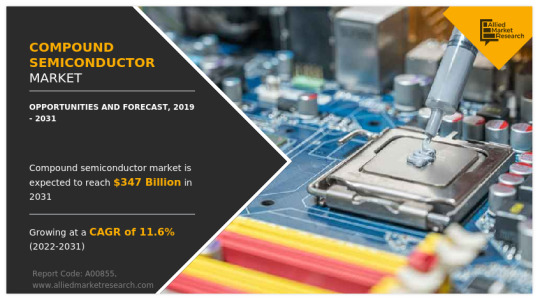

Compound Semiconductor Market Will See Strong Expansion Through 2031

Allied Market Research, titled, “Compound Semiconductor Market Size by Type, Product, Deposition Technology, and Application: Global Opportunity Analysis and Industry Forecast," The compound semiconductor market was valued at $90.7 billion in 2019, and is estimated to reach $347 billion by 2031, growing at a CAGR of 11.6% from 2022 to 2031.

Compound semiconductors are single-crystal semiconductor materials that comprise two or more elements. Some qualities change as two or more elements come together to create a single semiconductor crystal, while other properties are added. Rather than using silicon, which lacks this feature, in light-emitting diodes, compound semiconductor technology is preferred.

Key factors that drive the growth of the compound semiconductor market include an increase in demand for compound semiconductor epitaxial wafer in LED technology, emerging trends toward compound semiconductor wafers in the automotive industry, and the advantage of compound semiconductors over silicon-based technology. Compound semiconductor devices have three times the thermal conductivity and a breakdown electric field strength that is 10 times higher than those made of silicon. This characteristic reduces the complexity and expense of the device, enhancing reliability and enabling it to be used in a variety of high-voltage applications, including solar inverters, power supplies, and wind turbines. The market for compound semiconductor power devices is expanding due to the rising need for power electronics. Electrical power is effectively and efficiently controlled and converted due to power electronics. Compound semiconductor power devices are increasingly being used as a result of the expanding need for power electronics in sectors such as aircraft, medicine, and defense.

The compound semiconductor industry offers growth opportunities to the key players in the market. The technology used in 5G wireless base stations must combine efficiency, performance, and value. GaN solutions play a crucial role in providing these qualities. GaN-on-SiC delivers considerable gains in 5G base station performance and efficiency over Laterally Diffused Metal-Oxide Semiconductors (LDMOS). Greater thermal conductivity, strong robustness & reliability, improved efficiency at higher frequencies, and comparable performance in a lower-size MIMO array are further advantages of GaN-on-SiC. GaN is anticipated to enhance power amplifiers for all network transmission cells (micro, macro, pico, and femto/home routers), which might substantially impact the rollout of next-generation 5G technology.

The compound semiconductor market share is segmented on the basis of type, product, deposition technology, application, and region. By type, the market is categorized into III–V compound semiconductors, II–VI compound semiconductors, sapphire, IV–IV compound semiconductors, and others. The III–V compound semiconductors segment is further divided into gallium nitride (GAN), gallium phosphide (GAP), gallium arsenide (GAAS), indium phosphide (INP), and indium antimonide (INSB). The II–VI compound semiconductors segment is classified into cadmium selenide (CDSE), cadmium telluride (CDTE), and zinc selenide (ZNSE). The IV–IV compound semiconductors segment is bifurcated into silicon carbide (SIC) and silicon germanium (SIGE). The others segment includes aluminum gallium arsenide (ALGAAS), aluminum indium arsenide (ALINAS), aluminum gallium nitride (ALGAN), aluminum gallium phosphide (ALGAP), indium gallium nitride (INGAN), cadmium zinc telluride (CDZNTE), and mercury cadmium telluride (HGCDTE).

On the basis of product, the compound semiconductor market size is categorized into power semiconductors, transistors, integrated circuits (ICs), diodes & rectifiers, and others. The transistors segment is further classified into high electron mobility transistors (HEMTs), metal oxide semiconductor field effect transistors (MOSFETs), and metal-semiconductor field effect transistors (MESFETs). The integrated circuit is bifurcated into monolithic microwave integrated circuits (MMICs) and radio frequency integrated circuits (RFICs). The diode & rectifiers segment is further segmented into PIN diode, Zener diode, Schottky diode, and light emitting diode. By deposition technology, the market is segmented into chemical vapor deposition (CVD), molecular beam epitaxy (MBE), hydride vapor phase epitaxy (HVPE), ammonothermal, liquid phase epitaxy (LPE), atomic layer deposition (ALD), and others.

On the basis of applications, the compound semiconductor market analysis is segregated into IT & telecom, industrial and energy & power, aerospace & defense, automotive, consumer electronics, and healthcare. IT & telecom is further segmented into signal amplifiers & switching systems, satellite communication applications, radar applications, and RF. Aerospace & defense is classified into combat vehicles, ships & vessels, and microwave radiation. Industrial and energy & power are further segmented into wind turbines and wind power systems. Consumer electronics is further segmented into inverters, LED lighting, and switch-mode consumer power supply systems. The automotive segment is further divided into electric vehicles & hybrid electric vehicles, automotive braking systems, rail traction, and automobile motor drives. The healthcare segment is further bifurcated into implantable medical devices and biomedical electronics.

Region-wise, the compound semiconductor market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, Australia, and the rest of the Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

KEY FINDINGS OF THE STUDY

The IV-IV compound semiconductor segment dominated the compound semiconductor market growth, in terms of revenue, and is expected to follow the same trend during the forecast period.

The power semiconductor segment was the highest revenue contributor to the market in 2021, and it is anticipated to grow at a significant CAGR during the forecast period.

The chemical vapor deposition and molecular beam epitaxy segments collectively accounted for around 42.7% market share in 2019, with the former constituting around 23.5% share

The IT and telecom segment was the highest revenue contributor to the market in 2021.

Asia-Pacific and North America collectively accounted for around 74.2% share in 2019, with the former constituting around 51.37% share.

The key players profiled in the report include Cree Inc., Infineon Technologies AG, Nichia Corporation, NXP Semiconductor N.V., Qorvo, Renesas Electronics Corporation, Samsung Electronics, STMicroelectronics NV, Taiwan Semiconductor Manufacturing Company Ltd., and Texas Instruments Inc. These players have adopted various strategies such as product launch, acquisition, partnership, and expansion to expand their foothold in the industry.

#semiconductors#Compound Semiconductor#electronics#battery#black sapphire cookie#black sapphire crk#star sapphire#transistor radio

0 notes

Text

Fast Rectifiers Market Drivers: Key Forces Accelerating Growth in Power Electronics Applications Globally

The fast rectifiers market is experiencing notable expansion driven by the rising need for efficient power management solutions across multiple industries. Fast rectifiers are semiconductor devices that convert alternating current (AC) to direct current (DC) with high-speed switching capabilities, making them crucial components in a wide range of electronics. Their ability to reduce power loss, improve energy efficiency, and handle high-frequency signals positions them as essential elements in modern power electronics.

One of the primary drivers of the fast rectifiers market is the increasing adoption of advanced consumer electronics. With the global surge in smartphones, laptops, gaming consoles, and smart home devices, manufacturers are focusing on incorporating components that enhance performance while conserving energy. Fast rectifiers offer quick switching, low forward voltage drop, and thermal stability—features that are ideal for compact and high-efficiency electronic devices. As consumer expectations for faster, slimmer, and more energy-efficient devices continue to rise, so does the demand for fast rectifier technologies.

Another significant factor propelling the market is the growth of the automotive sector, especially with the acceleration of electric vehicle (EV) adoption. EVs require sophisticated power electronics to manage battery charging, electric motor control, and overall vehicle efficiency. Fast rectifiers are integral in on-board chargers, DC-DC converters, and inverter systems, where their speed and energy efficiency are critical. As governments worldwide push for cleaner transportation and invest in EV infrastructure, the automotive industry's demand for fast rectifiers is expected to grow rapidly.

The telecommunications industry also plays a key role in boosting the fast rectifiers market. The rapid expansion of 5G networks and the increasing need for high-speed data processing demand reliable and efficient power supplies for base stations and data centers. Fast rectifiers ensure minimal signal interference and power loss, making them vital in maintaining consistent network performance. The scaling of telecom infrastructure, particularly in emerging economies, presents a lucrative opportunity for market growth.

In addition to telecommunications and automotive, the industrial and manufacturing sectors are increasingly integrating fast rectifiers into automation systems, robotics, and industrial control units. With Industry 4.0 becoming the standard across production lines, the use of high-speed and high-efficiency power electronics is essential. Fast rectifiers contribute to improved operational reliability, better energy utilization, and cost savings, making them an attractive solution for industrial applications.

Technological advancements in semiconductor materials also significantly influence the market. The shift toward silicon carbide (SiC) and gallium nitride (GaN) materials in fast rectifier production has led to improved thermal performance, higher voltage capabilities, and greater efficiency. These materials enable rectifiers to operate at higher frequencies with reduced energy loss, addressing the performance limitations of traditional silicon-based rectifiers. This innovation opens new possibilities for fast rectifier applications in high-demand areas such as aerospace, renewable energy systems, and high-end computing.

Furthermore, the global focus on energy efficiency and sustainability is another critical driver. Governments and regulatory bodies are implementing stringent energy consumption standards across industries, encouraging the use of energy-efficient components. Fast rectifiers, known for minimizing power loss during conversion, support these initiatives and help manufacturers comply with environmental regulations. Their role in renewable energy systems like solar inverters and wind turbines further highlights their relevance in the transition toward green energy.

The rising investments in research and development (R&D) by key market players are enhancing product capabilities and broadening application scopes. Companies are focusing on developing rectifiers with faster response times, smaller footprints, and higher power densities to meet the evolving requirements of end-users. Collaborative efforts between semiconductor firms and application-specific manufacturers are also accelerating innovation, ensuring the market keeps pace with technological demands.

Despite the optimistic outlook, the market faces challenges such as high initial costs and complex integration requirements. However, these are gradually being mitigated through technological progress and economies of scale. The benefits of improved performance and energy savings outweigh the upfront costs, making fast rectifiers a cost-effective solution in the long run.

In conclusion, the fast rectifiers market is driven by a confluence of factors: rapid technological evolution, growing demand in automotive and telecom industries, the global push for energy efficiency, and ongoing innovation in semiconductor materials. As industries continue to seek high-speed, energy-efficient solutions for modern electronic systems, the fast rectifiers market is poised for sustained and significant growth worldwide.

0 notes

Text

Sensor Industry: Innovations, Applications, and Market Outlook to 2030

The Sensor Industry is experiencing transformative growth, driven by rapid technological advancements and the increasing adoption of smart systems across various sectors. From automotive and industrial automation to healthcare and consumer electronics, sensors are the backbone of data-driven intelligence. With the global market projected to exceed USD 415.8 billion by 2030, growing at a robust CAGR of 8.9%, the industry is witnessing significant disruption and opportunity.

Industry Overview

Sensors are vital components that detect physical, chemical, and biological parameters and convert them into digital signals. The evolution of microelectromechanical systems (MEMS), Internet of Things (IoT), and artificial intelligence (AI) has enabled sensor technologies to be more compact, energy-efficient, and intelligent. As a result, the Sensor Industry is becoming a cornerstone of innovation across multiple applications.

Key Industry Trends

1. Rise of Smart Sensors

Smart sensors integrated with AI and wireless technologies are enabling real-time decision-making in applications such as predictive maintenance, automation, and smart homes.

2. Healthcare and Wearable Devices

Health monitoring through wearable devices has become mainstream. Biosensors are crucial in detecting heart rate, temperature, oxygen levels, and even chronic conditions.

3. Automotive Sensors for Safety

In the automotive domain, sensors are crucial for ADAS (Advanced Driver Assistance Systems), electric vehicle monitoring, and in-car infotainment systems.

4. Industrial IoT (IIoT)

Smart manufacturing and Industry 4.0 heavily rely on sensors for real-time monitoring, quality control, and automation across factories and supply chains.

Segment Insights

By Type:

Image Sensors

Pressure Sensors

Temperature Sensors

Proximity Sensors

Motion Sensors

Gas and Chemical Sensors

By Technology:

MEMS

CMOS

Optical

Capacitive

Piezoelectric

By Application:

Consumer Electronics

Healthcare

Automotive

Aerospace & Defense

Industrial Automation

Regional Landscape

Asia-Pacific leads the global market, fueled by large-scale electronics manufacturing in China, South Korea, and Japan.

North America benefits from robust demand in healthcare and industrial automation.

Europe shows growth in automotive and green energy solutions driven by sustainability policies.

Competitive Outlook

Prominent players shaping the Sensor Industry include:

Honeywell International Inc.

STMicroelectronics

Bosch Sensortec

Texas Instruments

Omron Corporation

TE Connectivity

Analog Devices

NXP Semiconductors

Panasonic Corporation

Infineon Technologies

These companies are investing in R&D, partnerships, and product miniaturization to maintain competitive advantages.

Trending Report Highlights

Stay informed with the latest developments from adjacent and high-impact markets:

Insulated Wire and Cable Industry

Micro Datacenters Industry

Photosensitive Semiconductor Device Industry

Tactical Radio Industry

UV LED Industry

Semiconductor Rectifiers Industry

Gyro Sensor Industry

0 notes