#TallyPrime with e-Invoicing

Explore tagged Tumblr posts

Text

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Tally Software Services (TSS)

Keep Your TallyPrime Updated, Compliant & Secure

Antraweb Technologies is a leading provider of Tally software solutions and services, with over two decades of experience serving a wide range of customers. They offer a comprehensive suite of Tally products, including TallyPrime, Tally Virtual User (TVU) License, Tally ERP 9, and TallyPrime Server.

A key offering is Tally Software Services (TSS), which ensures TallyPrime users have continuous access to critical features like GST compliance, remote data access, and real-time data synchronization. Renewing TSS keeps TallyPrime updated, enabling direct E-invoice and E-way bill generation, remote report access, and automated bank reconciliation. TSS plans are available for single and multi-users, often with promotional offers.

Antraweb's services extend to Tally support, data synchronization, training, and invoice customization. They also develop Tally Apps for mobile use, such as Business Dashboard App and Customer Profiling App, and provide various solutions for integration and customization to meet diverse business needs, including GST compliance.

The company prides itself on its experience, having served thousands of Tally customers and resolved numerous support tickets, earning recognition for its performance and customer service. Antraweb emphasizes its core values of trust, honesty, transparency, and customer satisfaction, aiming to streamline accounting processes for businesses across retail, manufacturing, services, and finance sectors.

For more details on their services and products, you can visit their websites:

Antraweb Technologies

Tally Software Services (TSS)

0 notes

Text

One Software, Multiple Solutions – TallyPrime

From accounting to GST compliance, e-invoicing to inventory management – TallyPrime helps you handle it all with ease!

🔹 Smart Business Management 🔹 Seamless Compliance & Taxation 🔹 Powerful Reporting & Automation

👉 Take your business to the next level – Get TallyPrime Today! 🚀

📞 Call us now +91 11 4990 1562 | +91 8368006107 💻 Visit: ezeetechonline.com

2 notes

·

View notes

Text

Buy TallyPrime in MENA – Simplify Your Business Operations Today

Looking to buy Tally in the MENA region? Whether you're running a startup, SME, or large enterprise, TallyPrime offers a powerful and easy-to-use business management software tailored for MENA businesses. From accounting and inventory to VAT compliance and payroll, TallyPrime helps you streamline all key operations with one trusted platform.

Buying Tally in MENA is more than a software purchase—it’s an investment in business efficiency and regulatory peace of mind. With country-specific features and support for multiple currencies, languages, and tax structures (including UAE VAT and Saudi Arabia e-invoicing), Tally adapts to your local compliance needs effortlessly.

The process to get started is simple: select the right Tally license for your business, choose between online or on-premise deployment, and get support from authorized partners near you. Whether you're upgrading or starting fresh, you’ll benefit from quick implementation, data security, and unmatched scalability.

#computer billing software#billing software#accounting software online#accounting software#business management software

1 note

·

View note

Text

What Are the Top GST Accounting Tools for Retailers?

Running a retail business in India? Then you already know how important it is to stay GST-compliant. Thankfully, choosing the right GST accounting software can simplify invoicing, tax filing, and inventory tracking—all in one platform.

Here are some of the top tools retailers are using:

Busy – A trusted name among retailers, Busy offers robust features like GST billing, inventory management, e-way bill generation, and auto tax calculation. It’s designed to make accounting simple and accurate.

TallyPrime – Widely used for its easy interface, TallyPrime handles GST returns, invoicing, and reports, making it ideal for small to medium businesses.

Zoho Books – Known for its cloud access and automation features, Zoho Books supports end-to-end GST compliance.

Marg ERP – Especially popular in pharma and FMCG retail, Marg ERP is strong in billing and inventory sync.

For retailers, using a powerful GST accounting software like Busy means less time stressing over compliance and more time focusing on growth. Choose smart—stay compliant, stay ahead.

0 notes

Text

🚛 E-Invoice and E-Way Bill in TallyPrime: Proven 10-Step Guide for easy Compliance

Electronic invoicing (e-Invoice) and e-Way Bill generation have become mandatory compliance requirements under GST in India. TallyPrime simplifies both processes with integrated features, allowing businesses to generate IRNs (Invoice Reference Numbers) and e-Way Bills directly from Tally—saving time, reducing errors, and ensuring real-time GST compliance. In this guide, you’ll learn how to…

#e-invoice in tally#E-Invoicing#e-Way Bill#e-way bill part b#e-way bill tally setup#einvoice in tally#einvoice vs ewaybill#eway bill in tally#generate IRN in tally#gst compliance tally#gst invoice tally#irn upload tally#qr code invoice tally#tally#tally einvoice integration#tally eway bill filing

0 notes

Text

What’s New in TallyPrime 6.0? Key Upgrades & Comparison with Earlier Versions

TallyPrime has long been India’s most trusted accounting and business management software. With the release of TallyPrime 6.0, Synergy Soft Solutions is here to break down what’s new and how it compares with earlier versions like 5.0, 4.x, and the original Prime.

Let’s dive into the latest features and understand why upgrading matters for your business.

Highlights of TallyPrime 6.0

Connected Business Experience:

Real-time sync between head office and branches.

Remote access with improved security and user-level controls.

Faster & Smarter Reporting:

Enhanced report customization and filtering.

Instant data insights with drill-down options.

Export to Excel, PDF, and even directly share via WhatsApp.

Inventory Management Enhancements:

Smarter batch tracking and multiple godowns.

Real-time stock valuation and reorder alerts.

GST & Compliance Made Simpler:

Auto e-Invoice generation for eligible businesses.

Seamless integration with e-Way Bill portal.

Support for the latest GSTR formats and statutory updates.

User Experience:

Clean interface with keyboard shortcuts and intuitive navigation.

Multi-tasking support — work on multiple reports at once.

TallyPrime 6.0 vs. Earlier Releases

FeatureTallyPrime 6.0TallyPrime 5.0 & Earliere-Invoice Integration

Built-in

Not availableMulti-tasking Capability

LimitedData Sync Across Locations

Real-time

Basic or manualCustomization Flexibility

More options

Less advancedAdvanced Reporting & Filters

Smarter reports

Basic filters onlyStatutory Compliance (2024–25 GST)

Fully updated

Needs patching

Why Upgrade with Synergy Soft Solutions?

At Synergy Soft Solutions, we specialize in:

Seamless migration to the latest TallyPrime version.

Training & support for staff.

Cloud-based Tally access.

Customized Tally modules for your business.

Whether you’re a small business, distributor, or large enterprise, we ensure your TallyPrime 6.0 upgrade is smooth, fast, and secure.

Ready to Upgrade?

Connect with Synergy Soft Solutions — your Authorized Tally Partner in Mumbai

Visit: www.synergysoft.in Let’s future-proof your accounting with TallyPrime 6.0.

Conclusion:

TallyPrime 6.0 is a significant leap forward in business management software. From real-time data syncing to seamless e-Invoice and e-Way Bill integration, this release brings enhanced efficiency, compliance, and user experience. For businesses still using earlier versions, upgrading to TallyPrime 6.0 is not just a step forward — it’s a necessity to stay compliant and competitive in today’s fast-paced digital economy.

At Synergy Soft Solutions, we ensure smooth migration, personalized support, and feature-rich customizations tailored to your industry. Whether you’re looking for better reporting, GST readiness, or cloud access,

Frequently Asked Questions (FAQ):

Q1: What is the biggest difference between TallyPrime 6.0 and earlier versions? A: TallyPrime 6.0 offers full integration with e-Invoice and e-Way Bill systems, real-time remote access, better reporting tools, and enhanced inventory tracking — making it ideal for modern business needs.

Q2: Will my data from older versions of TallyPrime be safe if I upgrade? A: Yes. Synergy Soft Solutions ensures 100% secure data migration and backup during the upgrade process. Your historical data will remain intact and accessible.

Q3: Do I need internet connectivity to use TallyPrime 6.0? A: No, internet is only required for online features like e-Invoice, remote access, and data syncing. Offline features will continue to work as usual.

Q4: Can I use TallyPrime 6.0 on multiple devices or locations? A: Yes! With TallyPrime 6.0, you can enable multi-location access, allowing teams to work remotely or from different branches in real-time.

Q5: How can Synergy Soft Solutions help with my upgrade? A: We provide end-to-end support — from installation and migration to staff training and advanced customizations. Our experts ensure a smooth and error-free transition to TallyPrime 6.0.

0 notes

Text

Hidden Benefits That Justify Tally Prime Cost for Enterprises - Gseven

If you're running a business, you know how important it is to manage your accounts properly. You might be using Excel or other software to handle your numbers, but as your business grows, these tools may fall short. This is where TallyPrime comes in. Some business owners hesitate because of the tally prime cost, but once you understand the hidden benefits, you'll see why it's worth every rupee.

Real-Time Business Decisions

TallyPrime gives you instant access to your financial data. This means you don’t have to wait for reports from your accountant or waste hours collecting numbers manually. With just a few clicks, you can view sales, expenses, profits, and stock details. This helps you make smarter decisions quickly — something every enterprise needs in today’s competitive market.

GST Made Simple

If you’re a business registered under GST, TallyPrime makes compliance very easy. It automatically calculates taxes, fills in your GSTR reports, and alerts you about errors. This saves time and avoids penalties from wrong filings. Even non-accountants can manage GST tasks confidently with Tally.

Safe and Secure Accounting

Security is a major concern for any enterprise. With TallyPrime, your financial data stays safe and protected. You can set user access rights so that only the right people see or change important information. This reduces chances of fraud and builds trust in your financial system.

Faster Invoicing and Payments

In business, speed matters. TallyPrime helps you create professional invoices in seconds. You can add your logo, terms, GST numbers, and more. The software also supports e-invoicing and e-way bills, which are now required by the government. Quick billing means faster payments — improving your cash flow.

Flexibility for Growth

TallyPrime is not just for one type of business. Whether you have a shop, factory, or office, it can be customized to fit your business processes. As your company grows, you can add new features, reports, or even users. You don’t need to switch software later — just upgrade as you grow.

Want to experience the full value of TallyPrime?

Many enterprises miss out on the real benefits because they don’t use the software properly. That’s why choosing the right Tally partner is important. Gseven, a 5-star Tally partner, offers everything your business needs — from consultation and installation to training, customization, and ongoing support.

Their team understands your business and tailors the software to meet your exact needs. You also get access to Tally Prime on cloud server, which makes it easy to work from anywhere, securely.

Conclusion

The tally prime cost may seem like a one-time investment, but the long-term value it adds to your business is much higher. From simplifying accounting to helping you stay compliant and secure, it offers features that help your enterprise grow efficiently. If you want to move ahead confidently, choose Gseven — your trusted partner for all Tally needs.

0 notes

Text

Top ERP Companies in Delhi Revolutionizing Business Operations

In the ever-evolving world of digital transformation, businesses must adopt cutting-edge solutions to stay ahead of the curve. One of the most impactful technologies that has reshaped how organizations operate is Enterprise Resource Planning (ERP) software. In Delhi, a city known for its thriving commercial ecosystem and diverse industries, ERP adoption has surged. From manufacturing to retail, healthcare to education, businesses in the capital are increasingly turning to ERP solutions to streamline operations, improve efficiency, and ensure sustainable growth.

If you're a business owner looking for the right technology partner, this article highlights some of the top ERP companies in Delhi, their offerings, and how they can help your organization reach its full potential.

Why Businesses in Delhi Are Adopting ERP Systems

Before diving into the key ERP players, it's important to understand why ERP software is in high demand in Delhi:

Process Automation: ERP eliminates manual processes, automating core functions like accounting, inventory, HR, and sales.

Centralized Data: It integrates all departments into a single system, ensuring data consistency and better decision-making.

Regulatory Compliance: With evolving GST regulations and tax norms, ERP helps businesses stay compliant.

Scalability: Whether you're a startup or an established enterprise, ERP systems scale with your business.

Features Businesses Look for in ERP Companies

When evaluating ERP companies in Delhi, businesses typically look for the following features:

Customization and Flexibility

Cloud and On-Premise Deployment Options

Mobile Accessibility

Real-Time Reporting and Analytics

User-Friendly Interface

Integration with Third-Party Applications

Robust Customer Support and Training

Now, let’s explore some of the best ERP solution providers in the Delhi region.

Top ERP Companies in Delhi

1. Odoo Partners in Delhi

Odoo is a modular, open-source ERP that allows businesses to add features as they grow. Several Delhi-based firms specialize in Odoo implementation, customization, and training.

Highlights:

Open-source flexibility

CRM, HRM, e-commerce, and POS integration

Great UI/UX and mobile support

2. ERPNext Implementation Partners in Delhi

ERPNext, an open-source ERP system, has gained traction among companies looking for a flexible and cost-effective solution. Several IT companies in Delhi specialize in ERPNext customization and implementation, offering services for industries like manufacturing, healthcare, and services.

Highlights:

Open-source and highly customizable

Integrated CRM, HR, and accounting modules

Affordable for startups and SMEs

3. Tally Solutions (TallyPrime Partners)

Tally, known primarily for accounting, has evolved to offer more ERP-like capabilities through its TallyPrime platform. Various Delhi-based partners provide implementation, support, and training services for businesses transitioning to Tally ERP.

Highlights:

Strong accounting and financial features

Easy to use and well-supported in India

GST and e-invoicing ready

4. SAP Business One Partners in Delhi

SAP, a global ERP giant, has a strong partner ecosystem in Delhi offering SAP Business One—an ERP solution tailored for small and midsize enterprises. These partners provide consulting, implementation, and support services.

Highlights:

Global best practices and scalability

Robust modules for finance, sales, production, and inventory

Ideal for growing enterprises with complex needs

5. Oracle NetSuite Partners

For businesses with international operations or ambitious growth plans, Oracle NetSuite partners in Delhi offer a cloud-based ERP that supports financial management, CRM, e-commerce, and more.

Highlights:

Cloud-native ERP platform

Real-time global business management

Scalable for large enterprises

6. Marg ERP

Marg ERP is a well-established name, particularly in the domains of retail, distribution, and manufacturing. Known for its cost-effective solutions tailored for small and medium businesses, Marg ERP offers modules for billing, inventory, accounting, and supply chain management.

Highlights:

Ideal for wholesalers and retailers

GST-compliant software

Strong presence in the North Indian market

Industries Served by ERP Companies in Delhi

ERP companies in Delhi cater to a broad spectrum of industries:

Manufacturing: Streamline production planning, inventory, and quality control.

Retail & Distribution: Real-time inventory management and billing.

Healthcare: Patient records, billing, and compliance management.

Education: Student lifecycle management, fee tracking, and academic performance.

Real Estate & Construction: Project costing, contractor management, and procurement.

Choosing the Right ERP Partner in Delhi

Selecting the right ERP vendor is critical to project success. Here are a few tips for businesses in Delhi:

Define Your Requirements Clearly: Know your pain points and process gaps.

Check for Industry Experience: Choose a partner who understands your sector.

Evaluate Support & Training: ERP is a long-term investment. Ensure post-deployment support is available.

Look for Case Studies: Previous successful implementations build confidence.

Ask for a Demo: Always test the software before finalizing.

Final Thoughts

With the digital transformation wave sweeping across all sectors, ERP software has become more of a necessity than a luxury. Fortunately, businesses in Delhi are well-positioned to embrace this change with the support of numerous experienced ERP solution providers. From budget-friendly local software to globally renowned platforms, ERP companies in Delhi offer solutions that can fit businesses of all sizes and needs.

Whether you're a small business aiming to streamline your accounting or a manufacturing giant looking to digitize your entire supply chain, there's an ERP solution waiting for you in Delhi. The key is to choose a partner who not only understands your industry but also aligns with your growth goals.

Looking for the Right ERP Partner in Delhi?

At Banibro, we specialize in delivering tailored ERP solutions that drive business growth and efficiency. Whether you're a startup or an enterprise, our expert team ensures smooth implementation, customization, and ongoing support to match your unique business needs.

Streamline Your Operations Today with Banibro!

0 notes

Text

GST Professional Course in Delhi – Join Now

🧾 GST Course in Delhi Laxmi Nagar – एक Best Training Option

📚 Introduction: GST सीखना क्यों ज़रूरी है?

Goods and Services Tax (GST) ek one nation one tax system है. इसे समझना हर business owner और accountant के लिए जरूरी है.

Laxmi Nagar, Delhi, एक well-known hub है for professional courses, especially for GST training programs.

इस area में आप को कई reputed institutes मिल जाएंगे जो आपको expert बना सकते हैं in GST filing and compliance.

🎯 GST Course Kya Hota Hai? | GST पाठ्यक्रम क्या है?

GST course ek short-term practical training program होता है. इसमें students को सिखाया जाता है about GST basics, returns, filing, and compliance procedures.

इस course में शामिल होते हैं – GST registration, invoicing, input tax credit, and GSTR-1, 3B filing practically.

Iska purpose होता है लोगों को industry-ready बनाना in a short span of time.

📍 Why Choose Laxmi Nagar for GST Training? | क्यों चुने Laxmi Nagar?

Laxmi Nagar को कहा जाता है "Education Capital of East Delhi." यहां best faculty aur professional institutes available हैं.

यहाँ की fees भी pocket-friendly होती है, और institutes offer करते हैं job-oriented GST classes with placement support.

आपको मिलता है hands-on practical training in software like TallyPrime, Busy, and Excel.

🏆 Top Features of a Good GST Course | एक अच्छे GST Course की विशेषताएँ

1. Practical GST Training

Course में theoretical concept से ज्यादा focus होता है real-time filing पर.

Live data entry, GST portal usage, और Tally software का अभ्यास कराया जाता है.

2. Industry Expert Faculty

आपको मिलते हैं CA professionals और GST consultants से lectures, जिनके पास years of experience होता है.

ये experts आपको सिखाते हैं real-world problems aur unke solutions.

3. Certification & Placement Support

Course complete करने के बाद आपको मिलता है government or ISO-certified certificate.

इसी के साथ, कई institutes offer करते हैं internships aur job placement in CA firms.

🎓 Who Should Join GST Course in Delhi Laxmi Nagar

Commerce background वाले students

Working professionals looking for career boost

Entrepreneurs और small business owners

Job seekers in finance & accounts field

Aapko अगर compliance, accounts, या tax domain में career बनाना है, तो ये course perfect है.

⏱️ Duration and Timings of GST Course | पाठ्यक्रम की अवधि और समय

Most GST Courses की duration होती है 30 to 60 days with both weekend and weekday batches.

Classes होते हैं morning, afternoon aur evening timings में — जो students और working professionals दोनों के लिए suitable हैं.

💰 Fee Structure of GST Course | GST कोर्स की फीस

GST course की fee vary करती है depending on institute, content, and faculty experience.

Average fee होती है ₹5,000 से ₹15,000 तक. कुछ institutes installment में भी payment accept करते हैं.

Note: Fee में कई बार software training और certification charges भी शामिल होते हैं.

🛠️ Tools & Software Covered in Course | Tools जो course में सिखाए जाते हैं

GST Portal

Tally Prime for GST entries

Excel for GST data handling

Busy Software

ClearTax और अन्य e-filing tools

इन tools की मदद से आप सीखते हैं actual GST filing practically करना.

🔍 Topics Covered in GST Course | GST कोर्स में सिलेबस क्या होता है?

GST Basics

GST introduction

CGST, SGST, IGST

Reverse charge mechanism

GST Returns Filing

GSTR-1, GSTR-3B, GSTR-9

Input Tax Credit

E-invoicing and E-way bills

GST Registration

New GST Registration

Amendments & cancellation

Composition scheme

Tally Prime for GST

Ledger creation

GST configuration

Return generation through Tally

ये topics आपके theoretical और practical knowledge को strong बनाते हैं.

🧑💼 Job Opportunities After GST Course | कोर्स के बाद करियर विकल्प

GST course के बाद आप apply कर सकते हैं कई job roles के लिए:

GST Executive

Tax Assistant

Accounts Executive

GST Consultant

Data Entry Operator (GST Return Filing)

Firms like CA offices, finance BPOs, tax consultancies, और corporate companies hire करते हैं GST-trained professionals.

🏢 Best GST Training Institutes in Laxmi Nagar Delhi

1. IPA – Institute of Professional Accountants

Highly rated institute offering GST, Tally, Accounting courses with 100% placement assistance.

🧑🏫 Real Student Experience: क्या कहा Students ने?

Ritika Sharma (B.Com Graduate): "Mujhe GST aur Tally bilkul नहीं आता था. IPA से course करने के बाद, मुझे ek CA firm में job मिल गई!"

Amit Verma (Working Accountant): "Evening batch ke कारण मुझे job के साथ सीखने का मौका मिला. बहुत hi practical training मिली."

ऐसे ही कई students की life बदली है सिर्फ 2 months के GST course से.

📢 Final Thoughts: क्या GST Course Worth It है?

Bilkul! अगर आप accounts या finance field में career banana चाहते हैं, तो GST Course in Delhi Laxmi Nagar is a smart choice.

यह course short duration में high return देता है — both knowledge और career growth में.

आप सीखते हैं practical filing, GST law understanding और software tools — जो आपको बनाएंगे job-ready.

📝 Reference & Source

Course curriculum verified from: IPA Institute, Laxmi Nagar

Best Tally Course Training

Accountant Course

Accounting Institutes

Tally Course Training Institutes in East Delhi NCR Laxmi Nagar

Institute of Professional Accountants

Tally Institutes

Computer Course

Computer Institutes

GST Course in Delhi

0 notes

Text

Accounting Software for All Business: Simplifying Financial Management Across Industries

Discover how modern accounting software empowers businesses of every size to manage finances, ensure compliance, and streamline operations.

In today’s fast-paced digital economy, financial accuracy, transparency, and efficiency are vital for the success of any enterprise. Whether you’re a startup founder, a small business owner, or managing a large-scale organization, accounting software for all business types has become an essential tool. From tracking expenses to generating real-time reports, accounting software automates and simplifies complex processes—allowing you to focus on growth and strategy.

Why Every Business Needs Accounting Software

Regardless of the industry, all businesses share common financial needs—budgeting, invoicing, tax filing, payroll, cash flow management, and reporting. Manual systems are not only time-consuming but also prone to errors. This is where accounting software steps in.

Key benefits include:

Accuracy: Automates calculations, reducing human error.

Efficiency: Speeds up financial processes like invoicing and reconciliations.

Scalability: Grows with your business—from sole proprietorships to enterprises.

Compliance: Ensures tax and regulatory adherence with up-to-date features.

Insights: Offers real-time analytics and financial forecasting.

Features to Look for in Accounting Software for All Business Types

Not all software is created equal. The best accounting platforms cater to various sectors with customizable modules. When selecting accounting software, consider these core features:

Automated Bookkeeping: Automatic data entry from bank feeds, invoices, and receipts.

Multi-Currency Support: Ideal for businesses that deal with international clients.

Inventory Management: For retail, e-commerce, and manufacturing industries.

Payroll Integration: Streamlines salary processing, tax deductions, and compliance.

Mobile Access: Enables remote accounting on the go.

Cloud-Based Storage: Ensures data security, backup, and anywhere-access.

Custom Reporting: Generates balance sheets, income statements, and cash flow summaries.

These features ensure that businesses from various domains—retail, services, manufacturing, or freelance—can tailor the software to suit their financial operations.

Popular Accounting Software Platforms

Here are some widely-used accounting tools suitable for all business types:

QuickBooks Online Known for its user-friendly interface and extensive features, QuickBooks is ideal for SMEs and freelancers.

Xero Offers excellent mobile apps and cloud-based access, making it a favorite among startups and remote teams.

Zoho Books A great option for growing businesses that need project tracking, inventory, and full automation.

FreshBooks Best suited for freelancers and small businesses focused on client billing and time tracking.

TallyPrime Widely used in India, especially among traditional businesses needing GST-ready compliance.

Each of these solutions offers core functionality while also allowing for industry-specific customization.

How Accounting Software Adapts to Different Business Sizes

For Small Businesses: Small companies benefit from straightforward features like invoice generation, bill tracking, and bank reconciliation. Tools like FreshBooks and Zoho Books offer affordable plans tailored for startups and micro-businesses.

For Medium-Sized Enterprises: Mid-sized firms need multi-user access, inventory modules, and advanced reporting. Software such as QuickBooks or Xero provides a scalable infrastructure that supports business expansion.

For Large Corporations: Enterprises typically require ERP integrations, multi-departmental reporting, and custom dashboards. Solutions like SAP, NetSuite, or Odoo integrate accounting with HR, CRM, and supply chain systems.

By adapting functionalities according to business size, accounting software for all business segments makes financial management inclusive and efficient.

Industry-Wise Use Cases

Retail and E-commerce: Track inventory, process payments, and manage vendor invoices—all from one dashboard.

Professional Services: Bill clients by time, manage project budgets, and track profitability per project.

Manufacturing: Monitor raw material costs, manage production expenses, and forecast inventory needs.

Healthcare: Simplify insurance claims, billing cycles, and compliance reporting.

Freelancers and Consultants: Generate invoices, manage receipts, and estimate quarterly taxes with ease.

Accounting software bridges the financial gap between industries, offering tailor-made modules and integrations that support unique workflows.

The Rise of Cloud Accounting

The shift from desktop-based to cloud-based accounting systems has redefined how businesses handle finances. Cloud platforms offer:

Real-time collaboration with accountants or financial advisors

Automatic software updates and backups

Data access from any device or location

Enhanced security with encrypted storage

This evolution ensures that accounting software remains future-ready and globally accessible—crucial for hybrid work cultures and international business operations.

Tips for Implementing Accounting Software in Your Business

Define Your Needs: Make a list of must-have features based on your industry and size.

Try Before You Buy: Use free trials or demos to test usability and performance.

Train Your Team: Ensure staff is trained on how to use the platform efficiently.

Integrate With Existing Tools: Look for software that integrates with your CRM, ERP, or payment gateways.

Review Regularly: As your business grows, reevaluate your accounting needs to upgrade or expand modules.

Conclusion

From solopreneurs to global enterprises, accounting software for all business types has transformed the way finances are managed. It provides more than just basic bookkeeping—it enables smarter decisions, ensures compliance, and drives business growth.

In a digital-first world, investing in the right accounting software is not a luxury but a necessity. Make the switch today, and empower your business with accurate, efficient, and intelligent financial management.

0 notes

Text

How is e-Accounting Revolutionizing Modern Business?

Discover how e-Accounting is transforming the way modern businesses operate. In today’s digital-first economy, traditional accounting methods are being replaced by faster, smarter, and more accurate cloud-based systems. From automating routine bookkeeping to real-time financial reporting, e-Accounting helps businesses streamline processes, ensure compliance, and make smarter decisions. This infographic breaks down how e-Accounting tools like TallyPrime, GST software, cloud invoicing, and digital ledgers are making accounting more accessible and scalable for startups, MSMEs, and large enterprises. Learn how it reduces manual errors, boosts productivity, and enhances financial transparency — all crucial for business growth in a competitive market.

#e-Accounting training institute in uttam nagar#e-Accounting coaching center in uttam nagar#tally prime training institute in uttam nagar#tally prime institute in uttam nagar#busy accounting training institute in uttam nagar#busy accounting coaching center in uttam nagar#GST course in uttam nagar#e-Accounting course in uttam nagar

0 notes

Text

Top 5 Benefits of Subscribing to Tally ASC (Annual Support Cover)

Unlock Year‑Round Peace of Mind: Tally Annual Support Cover (AMC) by Antraweb

Protect Your Business with Comprehensive AMC Plans Ensure business continuity with our tailored Tally Annual Support Cover—supporting you through busy seasons, year‑end, and even unexpected emergencies. With packages starting from just ₹7,200/year for single‑user access, our plans include unlimited telephone, email, chat, instant remote support, guidance at our Tally Support Centre, and optional onsite visits—even on weekends and evenings

Choose the Plan That Fits You

Basic Plan: Ideal for solo users—get unlimited remote, email, and phone support, plus onsite visits on request.

Enhanced Plan: Perfect for small multi‑user firms—add staff training and Tally best‑practices guidance into the mix.

Premium Plan: Designed for multi‑location businesses needing data synchronization between branches and HQ.

Platinum Plan: Our most elite support tier—monthly onsite visits, same‑day engineer availability if notified before noon, and VIP treatment year‑round Best Tally Support Solutions+1Best Tally Support Solutions+1.

Why Antraweb’s AMC Stands Out

Expert Team: Our engineers are Tally‑certified and highly trained. We’ve resolved over 500,000 support tickets and trained 15,000+ users Lusha+4LinkedIn+4Best Tally Support Solutions+4.

Proactive Business Insight: A dedicated relationship manager reviews your support history, identifies unused Tally features, and recommends tools like invoice customization, GST reminders, and barcode printing .

Efficient Support System: Easily log, track, and resolve tickets via our online portal with fast turnaround times.

Flexible Access: Get support over phone, email, chat, WhatsApp, or remote‑desktop—whichever suits you best

How This Benefits You

1. Save Money & Time Avoid costly downtime with our all‑encompassing AMC plans starting under ₹600/month.

2. Boost Operational Efficiency Our team not only fixes issues—but proactively unlocks advanced modules like Smart Backup++, Audit Trail, and E‑way Bill integration.

3. Grow with Confidence Whether you're scaling to multi‑location setups, adding inventory modules, or integrating with other systems, our Premium and Platinum plans have you covered.

4. Naturally Compliant & Updated Stay ahead with the latest TallyPrime updates, GST advisories, and software best practices—all without lifting a finger.

Read the full guide here:https://www.antraweb.com/blog/tally-annual-support-cover-benefits

https://www.antraweb.com

0 notes

Text

Streamline E‑Invoicing in Saudi Arabia with TallyPrime MENA’s ZATCA-Compliant Software

Operating in Saudi Arabia and seeking a reliable e‑invoicing software that meets ZATCA mandates? Tally Solutions offers TallyPrime MENA Edition—a fully ZATCA-accredited platform that handles real-time integration with the Fatoora portal, automatically generating Invoice Reference Numbers (IRN) and QR codes for both B2B and B2C invoices. The system supports bilingual (Arabic–English) invoicing, allowing simultaneous document creation and reporting in both languages, crucial for regulatory compliance and local usability.

Designed for seamless adoption, TallyPrime auto-converts sales vouchers into ZATCA-compliant XML, submits them to Fatoora, and archives audit-ready XML/PDF/A‑3 records. Users can generate bulk e‑invoices, monitor compliance status in real time, and rely on built-in edit logs to flag any unauthorized changes—aligning with regulations that prevent altering invoices post-issuance.

This solution locks finalized invoices as per ZATCA rules—any modifications are processed only via credit/debit notes, enhancing audit integrity. Plus, its multilingual interface boosts usability across bilingual teams and integrates effortlessly with accounting, billing, and inventory modules for unified operations.

Adopting TallyPrime MENA’s e‑invoicing software equips Saudi businesses with automated compliance, faster billing cycles, and confidence in ZATCA alignment—all within one trusted platform.

1 note

·

View note

Text

5 Best Billing Software for Small Businesses in 2025

Efficient billing is the backbone of any successful small business. Whether you run a retail shop, offer professional services, or operate a small manufacturing unit, accurate and streamlined invoicing ensures steady cash flow, organized accounts, and simplified tax filing. Thankfully, modern billing software has made it easier than ever to manage business finances.

In this blog, we explore the 5 best billing software ideal for small businesses in 2025 with a spotlight on the rising favorite, KhaataPro.

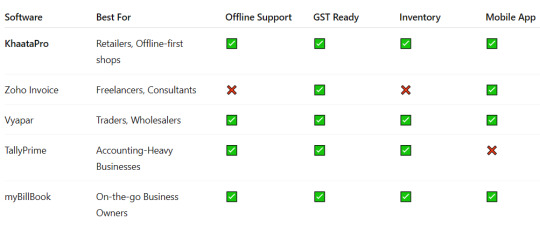

1. KhaataPro – Smart Billing, Simple Business

Khaata Pro is a powerful and easy-to-use billing software designed specifically for small and medium-sized businesses in India. Launching in 2025, Khaata Pro is poised to become a game-changer for retailers, wholesalers, and service providers who want digital billing without the tech headache.

Key Features:

Offline & Online Billing Modes

GST-Compliant Invoicing

Expense and Stock Management

Customer Credit Tracking

Multi-Language Interface (including English, Hindi, Marathi)

Mobile-Friendly Dashboard for Shopkeepers

Why Choose KhaataPro? With its user-friendly interface, regional language support, and offline functionality, KhaataPro is perfect for shop owners and local businesses that need digital solutions without constant internet access.

2. Zoho Invoice – Ideal for Service Providers

Zoho Invoice is a cloud-based billing solution tailored for freelancers, consultants, and small service-based businesses. It allows users to create professional invoices, automate payment reminders, and track time-based billing.

Highlights:

Customizable Invoice Templates

Client Portals

Online Payment Integrations

Time Tracking & Project Billing

Best For: Freelancers, consultants, and agencies looking for project-based billing with detailed time logs.

3. Vyapar – Designed for Indian Small Businesses

Vyapar is a popular GST billing software used widely in India, especially among traders and local retailers. It offers mobile and desktop support and includes features that go beyond billing, such as accounting, inventory, and order management.

Highlights:

Barcode Scanning & Inventory

Bill-wise Payment Tracking

GST Reports and Filing Assistance

Delivery Challans & Quotations

Best For: Indian shopkeepers and wholesalers who need both inventory and billing in one place.

4. TallyPrime – Trusted Accounting with Invoicing

While Tally is traditionally known for accounting, TallyPrime brings in simplified billing features with a deep focus on compliance and scalability. It suits businesses that need invoicing tied closely with accounting, inventory, and statutory reports.

Highlights:

Invoicing with Inventory Integration

GST and Multi-Tax Invoicing

Bank Reconciliation

Customizable Reports

Best For: Small to medium-sized enterprises that want billing + full-fledged accounting in one package.

5. myBillBook – Mobile-First Billing Software

myBillBook is a modern GST billing app that offers quick invoicing, real-time inventory updates, and analytics. Its mobile-first approach is great for businesses that are always on the move.

Highlights:

Create Bills in Seconds via Mobile

Digital Catalog & Stock Alerts

E-Way Bill Generation

Automatic Payment Reminders

Best For: Mobile-savvy small businesses that want flexibility and accessibility.

Final Thoughts

0 notes

Text

Best ERP Software in Saudi Arabia: A Complete Guide for Modern Businesses

As Saudi Arabia accelerates toward Vision 2030, businesses are embracing digital transformation to remain competitive. One of the key drivers of this transformation is ERP software—an integrated solution that streamlines business operations and enhances decision-making across departments.

Whether you're in manufacturing, construction, healthcare, or retail, implementing the right ERP software in Saudi Arabia can unlock operational excellence and long-term growth.

✅ Why ERP Software Is Crucial for Saudi Businesses

With the Kingdom pushing for innovation and economic diversification, ERP systems offer a centralized platform to manage core business functions such as:

Finance & Accounting

Inventory & Supply Chain

Human Resources

Customer Relationship Management (CRM)

Project Management

ERP also ensures compliance with ZATCA e-invoicing and Saudi VAT regulations, making it a necessity for local enterprises.

🏆 Top ERP Software in Saudi Arabia (2025)

Here are the top ERP platforms trusted by businesses in Saudi Arabia:

Odoo ERP A modular and scalable open-source ERP, Odoo is widely adopted by SMEs and enterprises. It supports localized features, e-invoicing, and Arabic interfaces, making it highly adaptable for Saudi businesses.

SAP Business One / SAP S/4HANA Suitable for large corporations and industries with complex needs. SAP offers strong analytics, manufacturing, and finance capabilities with local compliance support.

Oracle NetSuite A cloud ERP solution ideal for growing businesses, NetSuite supports finance, procurement, and CRM functionalities in a unified platform.

Microsoft Dynamics 365 Combines ERP and CRM with AI-powered insights and deep integration with Microsoft tools—excellent for retail, services, and manufacturing in Saudi Arabia.

Focus ERP A UAE and Saudi-based provider offering localized ERP systems tailored for trading, construction, and logistics industries with VAT and ZATCA support.

TallyPrime Preferred by SMEs for accounting and financial management, Tally is known for simplicity and VAT readiness in Saudi Arabia.

Sage ERP Designed for mid-sized businesses, Sage X3 delivers flexibility in accounting, production, and warehouse management.

ERPNext Open-source and cost-effective, ERPNext is gaining popularity among startups and small businesses seeking an affordable ERP solution.

Infor CloudSuite Industry-specific ERP software with powerful features for manufacturing and distribution companies in the Kingdom.

Acumatica A cloud-native ERP offering mobility, scalability, and real-time insights—perfect for dynamic and growing enterprises.

📌 Benefits of Using ERP Software in Saudi Arabia

Regulatory compliance (ZATCA e-invoicing, VAT)

Arabic language support

Real-time financial reporting

Centralized control of operations

Improved collaboration and productivity

📢 Looking for a Trusted ERP Partner in Saudi Arabia?

At Banibro IT Solution, we help Saudi businesses implement powerful and scalable ERP systems like Odoo tailored for the region’s compliance and operational needs. Our ERP experts understand the Saudi market, offer Arabic interface support, and deliver smooth onboarding and training.

👉 Get your free ERP consultation now and accelerate your business with the best ERP software in Saudi Arabia.

0 notes