#Tally Certification Course

Explore tagged Tumblr posts

Text

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Why Choose a Salesforce Cloud Data Platform Course Online?

Master Salesforce Cloud Data Platform Course with an advanced online course designed for data-driven professionals. Learn to manage customer data, implement effective marketing strategies, and streamline sales processes using Salesforce CDP. This hands-on course includes real-world projects, expert mentorship, and certification preparation. Enhance your data integration and analysis skills to drive business success. Enroll today to transform your career with Salesforce expertise!

#salesforce cloud data platform course#mulesoft training online#mulesoft course online#mulesoft online training#aws course online#togaf training online#hr training online classes#catia training online#rpa training online#catia course online#aws training online#online certification trainings#blockchain training online#tally training online#rpa course online#catia online training#blockchain online training#catia online course#servicenow training online#togaf course online#hadoop online training#servicenow course online#iot training online#salesforce marketing cloud online training#internet of things online course#hr online training#internet of things online training#rpa online course#online training courses#online cad training

2 notes

·

View notes

Text

Master Tally ERP9 with GST: A Complete Practical Course

Boost your accounting skills with this complete Tally ERP9 with GST course designed for students, job seekers, and professionals. This hands-on program covers everything from accounting entries to GST returns, including billing, inventory management, TDS, and payroll in Tally ERP9. Learn how to handle real-time business transactions, create GST-compliant invoices, and perform accurate tax filing. Ideal for those looking to master Tally with GST and pursue a successful career in accounting and finance. Get certified and job-ready with expert-led practical training.

📚 Learn Complete Tally ERP9 with GST: Attitude Academy

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#Tally ERP9 course#GST with Tally training#Tally practical course#Tally GST certification#GST return filing in Tally

0 notes

Text

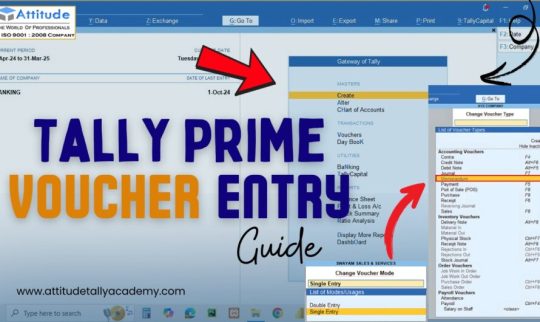

Tally Prime Course

Take full control of your accounting skills with our in-depth Tally Prime Online Recorded Course. Specially crafted for beginners to advanced learners aiming to master business accounting. Learn how to manage ledgers, vouchers, inventory, GST, TDS, payroll, and banking in Tally Prime. Understand real-time business processes with practical case studies and demo companies. Step-by-step video lessons in simple language—ideal for students, entrepreneurs, and job seekers. Get downloadable notes, worksheets, and Tally practice files with every module. Course available 24/7—watch and rewatch videos anytime as per your convenience. Perfect for those looking to work in accounting firms, finance departments, or start freelancing. Boost your accounting knowledge and gain confidence in financial reporting. Updated regularly with the latest Tally Prime features and GST compliance norms. Doubt-solving support through email or community forums ensures you're never stuck. No time limit or pressure—learn completely at your own pace. Certificate of completion provided to enhance your CV and career prospects. Trusted by thousands of learners across India and beyond. Start learning today at www.mwcedu.com and give your career a smart accounting edge!

#tally prime course with certificate#online tally prime#tally prime course#online education platform

0 notes

Text

Excel in Digital Marketing & Global Accounting software’s - Perfect Computer Education

At Perfect Computer Education, we focus on teaching real-world skills that help you build a solid career — whether you're just starting, switching fields, or growing your business. In Digital Marketing, we'll help you learn How to rank websites on Google using SEO, run paid ads on Google and Social Media, grow your local brand on social media, and much more.

You will master the Accounting Software and manage and record an organisation's day-to-day financials, including Asset Management, Expense Management, Revenue Management, Accounts Receivable, Accounts Payable, Sub-ledger Accounting and reporting and analytics.

Everything is taught with fundamental tools, live practice and personal guidance

#digital marketing course in ahmedabad#foreign accounting training#learn accounting in ahmedabad#usa accounting training#myob training#learn foreign accounting ahmedabad#tally certification in ahmedabad#xero training in ahmedabad#foreign accounting and taxation training#quickbook training ahmedabad#Digital Marketing#Global Accounting software#Perfect Computer Education

0 notes

Text

best computer coaching near rieva hospital | best digital marketing coaching near Rai Purwa | one of the best tally|gst course free with certificate

Unlock Your Future with the Best Computer Coaching Near RIEVA Hospital Looking to enhance your skills and kickstart a promising career in IT and business? ASDC Kanpur is your destination for the best computer coaching near RIEVA Hospital. Whether you're a beginner or someone aiming to polish your skills, our comprehensive courses are designed to meet industry demands. What’s more, our dedicated placement support ensures you get real opportunities once you complete your course.

Top-Rated Digital Marketing Coaching Near Rai Purwa In today's digital-first world, mastering online marketing is a smart move. ASDC offers the best digital marketing coaching near Rai Purwa, taught by industry experts with real-world experience. From SEO to social media and email marketing, our curriculum equips you with everything you need to excel. And yes, you’ll get full placement assistance to help you land the right job right after completing your training.

One of the Best Tally Courses in Kanpur – Now with GST & Free Certification ASDC is proud to offer one of the best Tally training programs in Kanpur, which now comes bundled with a free GST course and certificate. This combo is perfect for aspiring accountants, entrepreneurs, and commerce students looking to boost their career prospects. With hands-on learning and practical examples, you’ll gain confidence to manage real-world financial data. And our placement program will connect you with top companies hiring in this field.

Why Choose ASDC Kanpur? Our institute stands out due to its experienced trainers, state-of-the-art infrastructure, and a strong track record of student success. Whether it’s our best computer coaching near RIEVA Hospital, the top digital marketing coaching near Rai Purwa, or our Tally+GST free certificate course, every offering is tailored to help students grow. Don’t just take our word for it—check out our student success stories on our placements page.

Join ASDC Kanpur Today and Start Building Your Career The right training makes all the difference. With ASDC Kanpur, you get high-quality education, free certifications, and guaranteed placement support. From digital marketing to accounting, we’re here to prepare you for tomorrow’s jobs. Ready to make the leap? Explore our placement opportunities and see how far your skills can take you.

#best computer coaching near rieva hospital#best digital marketing coaching near Rai Purwa#one of the best tally|gst course free with certificate

0 notes

Text

GST for Online Business and E-commerce: A Step-by-Step Guide

E-commerce and online businesses have totally transformed the global economy. Entrepreneurship is made easy now since it is much simpler for entrepreneurs to sell goods and services across geographical boundaries. But ease brings along with it the problem of compliance, particularly in the case of the Goods and Services Tax (GST). In this blog post, we will look at how GST has impacted e-commerce and online businesses, main compliance requirements, and how businesses can remain compliant while also obtaining maximum returns.

GST for E-commerce Businesses

GST is an indirect tax that is imposed on the supply of goods and services. It consolidates various indirect taxes such as VAT, service tax, and excise duty into one uniform tax system. E-commerce companies are governed by certain provisions of the GST Act, hence it is critical for online sellers, marketplaces, and service providers to know their tax liability.

Who Have to Get Registered Under GST in E-commerce?

E-commerce Operators (Marketplaces): Marketplaces in e-commerce such as Amazon, Flipkart, and Shopify who process sales on sellers' behalf must follow GST law.

Online Sellers & Vendors: Companies which sell products or services online either through third-party marketplaces or their own web pages are necessary to get registered for GST without regard to turnover.

Dropshipping Businesses: Those businesses running dropshipping models need to be GST compliant too, if they sell taxable goods or services.

Freelancers & Digital Service Providers: Freelancers offering digital services like graphic designing, content writing, programming, or consulting services through digital platforms need to get GST registered, if their turnover exceeds the threshold limit.

GST Registration Threshold for E-commerce Businesses

Unlike regular business units, GST registration is required only when turnover exceeds ₹40 lakhs for goods and ₹20 lakhs for services (₹10 lakhs for special category states), while e-commerce vendors have to mandatorily register under GST irrespective of turnover under Section 24 of the CGST Act.

Tax Collected at Source (TCS)

E-commerce operators (marketplaces) need to collect 1% TCS (0.5% CGST + 0.5% SGST or 1% IGST) from the sellers on the platform. The amount is withheld while paying sellers and has to be remitted to the government.

GST Return Filing

E-commerce companies need to file GST returns from time to time, depending upon their registration type:

GSTR-1: Quarterly or monthly return of outward supplies (sales).

GSTR-3B: Combined monthly tax liability return.

GSTR-8: Filed by e-commerce operators reporting TCS collected.

Place of Supply & GST Applicability

Place of supply plays an important role in identifying whether CGST, SGST, or IGST applies. For e-commerce transactions:

Intra-state sales (seller and buyer within the same state) attract CGST + SGST.

Inter-state sales (seller and buyer in different states) attract IGST.

Exports are considered zero-rated supplies, and firms are entitled to recover refund of GST paid on inputs.

Reverse Charge Mechanism (RCM)

E-commerce firms need to understand RCM, where the purchaser is required to pay GST in lieu of the supplier in certain situations (i.e., obtaining services from unregistered persons).

GST Benefits & Problems for E-commerce Firms

Benefits:

✅ Uncomplicated Tax Structure: GST is a change from several indirect taxes, making compliance less complex.

✅ Input Tax Credit (ITC): Enterprises can take credit of GST paid on procurement.

✅ Ease of Doing Business: Easy inter-state business due to GST.

✅ Promotes Compliance: Compulsory registration helps ensure transparency.

Concerns:

❌ Mandatory Registration: Small online vendors too must register, thereby enhancing cost of compliance.

❌ Different Return Filing: Multiple GST returns complicate the job of small sellers.

❌ Cash Flow Problems: TCS deduction impacts suppliers' working capital.

How Online Businesses Can Remain Compliant

Register GST Timely: Avail GST registration before initiating an online business.

Keep Proper Invoices & Documents: Provide invoices with GST compliance and keep procurement records.

Submit Returns Timely: Avoid charges by following the due dates of GST returns.

Be Aware of TCS & RCM: Be aware of deductions and liability that apply.

Claim Input Tax Credit: Record GST paid while procuring to minimize tax outgo.

Conclusion

GST compliance is required for online and e-commerce businesses in India. While it brings about challenges such as compulsory registration and TCS deductions, it also offers advantages such as uniformity of tax and input tax credit. If e-commerce companies learn about GST rules and adopt best practices, they can stay compliant while growing their business economically.

For expert assistance with GST registration and filing, consider consulting a tax professional or using online tax compliance tools. Staying informed and proactive can help businesses navigate GST complexities effectively!

#gst course in delhi#gst certification course in delhi#tally gst course in delhi#gst course duration#gst course fee#what is gst course#gst practitioner course in hindi#gst practitioner course in delhi#gst certification course online#gst certification course by government#gst courses in delhi#gst course in delhi by govt

0 notes

Text

TALLY PRIME COURSE

Tally Prime is a powerful business management tool designed to streamline tasks related to accounting, inventory, payroll, and taxation. This course offers a comprehensive step-by-step approach to mastering Tally Prime, suitable for both novices and experienced users. You will discover how to create ledgers, log transactions, and produce financial reports effortlessly. Additionally, the course includes advanced subjects such as GST compliance, e-invoicing, and bank reconciliation. Through practical exercises and real-world scenarios, you’ll acquire hands-on experience in utilizing the software effectively. Whether you’re overseeing a small business or looking to enhance your accounting abilities, this course prepares you for success. By the conclusion, you will feel assured in managing financial responsibilities accurately with Tally Prime.

#Account with Tally prime course#Online account with tally prime course in india#Online account with tally prime course with certificate#Account with tally prime course in Punjab

1 note

·

View note

Text

Scope Computers

Master Tally with Our Prime Tally Course! 🎓

Learn Tally from basics to advanced, including GST, payroll, and financial reporting. Perfect for students, professionals, and business owners.

✅ Hands-on Training ✅ Expert Guidance ✅ Certification Included

📅 Enroll Today and Elevate Your Accounting Skills

#tally#tallyprime#tallyeducation#tally course#tally training#financialaccounting#tally expert#tally certification#payroll management#skill development#boost your career#gst training

0 notes

Text

Tally prime with advance gst

Tally Prime with Advanced GST is a powerful business management software that fully integrates GST compliance features, automating complex tasks like tax calculations, return filing, and data reconciliation. This ensures businesses meet all GST requirements without hassle. It simplifies the process of creating GST-compliant invoices, allowing automatic calculation of CGST, SGST, and IGST based on transaction types, and generates detailed sales and purchase reports. The software supports multiple GSTNs, helping businesses manage GST filings across different states, and also handles Reverse Charge Mechanism (RCM) transactions seamlessly.

#Tally prime with advance gst course in India#Account with tally prime with advance gst course in Punjab#Tally prime with advance gst#Online account with tally prime course in india#Account course online with certificate#Online account course with certificate#Online learning platform

1 note

·

View note

Text

Setting Up Payroll in Tally: a Step-by-step Guide

The accounting, inventory, and payroll procedures used by companies have been completely transformed by the all-inclusive company management software ERP 9. Among its many features, keeping correct financial records and guaranteeing adherence to legal requirements depend heavily on controlling wage payments using journal vouchers.

Those enrolled in the tally course online with certificate will find this article particularly helpful as it walks them through the process of passing a salary payment voucher in Tally utilizing journal vouchers.

Understanding the tally salary payable voucher

It is critical in the field of company accounting to have exact financial transaction records. Salary payments are a major transaction among others because of their regularity and effects on the company as well as the workers. An invoice for salary payment in Tally.

Documenting the obligation of wage payments that a company owes to its workers is made much easier with ERP 9. Compliance and correct financial reporting depend on knowing how to handle this procedure well.

A journal entry called a salary payable voucher documents the company’s obligation to pay employees. It basically records, as a liability on the company’s balance sheet until the payment is made, the amount owed to workers for a certain time. This voucher contributes to guarantee that the financial statements provide a realistic and equitable picture of the liabilities and financial status of the business.

1. Precise financial reporting:

Companies may be confident that all obligations are fairly represented in their financial statements by keeping track of the wages payable. Stakeholders who depend on these reports to make decisions need to know this.

2. Statutory compliance:

Reporting and recording of employee pay is required by a number of statutes. Following these legal requirements is made easier with the use of salary payment vouchers as proper documentation.

3. Payroll administration:

Methodical payroll administration is made easier with the use of salary payment vouchers. Employee satisfaction and morale are maintained by timely payments and the tracking of the amounts owed to workers.

4. Audit trail:

An audit trail that is necessary for both internal and external audits is created when salary payables are clearly recorded. Easy payroll transaction verification and validation are made possible by it.

Installing payroll in tally

The payroll function in Tally must be enabled before you can transmit a salary payment voucher. How can you accomplish it is as follows:

Turn on the payroll feature

Go to the Gateway of Tally after launching Tally.ERP 9.

Make the F11: Features selection.

Browse to Accounting Features.

Mark Maintain Payroll to Yes under Payroll and Statutory.

Accept the screen to lock the modifications.

Make employee master

See Gateway of Tally > Masters > Create > Employee.

Put the name, department, and classification of the individual.

Save the staff record.

Form pay heads

Pay heads are parts of salaries, like base pay, HRA (home rent allowance), transportation, etc.

Go to Pay Heads > Create in Gateway of Tally.

Type the pay head’s name and indicate if this is an earning or a deduction.

Indicate the kind of computation (%, flat rate, etc.).

Enter pay details

Go to Gateway of Tally > Payroll Info > Salary Details > Create to assign workers pay heads.

Choose the employee and give the relevant pay heads the proper amounts.

Opening salary payable ledger accounts

Creating certain ledger accounts that will be utilized in the journal voucher is necessary to pass a salary payment voucher.

Open the payables ledger:

Go to Ledgers > Create under Accounts Info in Gateway of Tally.

Give the ledger name (such as Salary Payable).

Choose Current Liabilities as the group.

Save the ledger.

Make a salary expenses ledger:

Go to Ledgers > Create under Accounts Info in Gateway of Tally.

Give the ledger name (such as Salary Expenses).

Click on the Indirect Expenses group.

Save the ledger.

Salary payable voucher passes

You may now send the salary payable voucher with a journal voucher when the payroll setup and ledger generation are finished.

View journal voucher:

To Accounting Vouchers, go to Gateway of Tally.

Make the Journal selection F7.

Enter the information of the journal voucher:

Date: Put the day the salary is due in.

Debit: Put the whole salary amount into the Salary Expenses ledger.

Credit: Make the equal amount entry on the Salary Payable ledger.

Enter a succinct explanation, like “Being the salary payable for the month of [Month].”

Hold onto the Journal Voucher.

Press Enter after inputting all the information to store the coupon.

Extra transactions and accounting procedures

Recording the actual compensation payments to workers comes next after passing the salary payable voucher.

Report payroll:

Go to Accounting Vouchers in Gateway of Tally.

Choose Payment using F5.

Date: Type the day of payment here.

Amount: Enter the amount being paid and choose the Salary Payable ledger

Credit: Choose the cash or bank ledger from which to make the payment.

Enter a narrative, like “Being the salary payment for the month of [Month].”

Keep the payment voucher safe.

Press Enter to save the coupon after entering all the information.

Use of journal vouchers for salary payable benefits

Several advantages come with using journal vouchers to handle salary payout in Tally:

Correct financial records: Makes sure that obligations and salaries are correctly documented, therefore displaying the actual financial situation of the company.

Regulatory compliance: Precise payroll transaction recording aids in upholding regulatory standards.

Easy to handle: Easy to handle and monitor salary payments, efficient payroll management streamlines the payroll procedure.

Simple auditing: Because all payroll transactions are kept systematically, auditing payroll transactions is made simple.

Conclusion

Any company hoping to keep precise and legal financial records must pass a salary payment voucher in Tally utilizing journal vouchers. Your payroll procedures will be more efficient and streamlined if you handle salary payables as described in this article. Those enrolled in a Tally course will find this information very helpful as it improves their comprehension of real-world accounting procedures.

Successful completion of this procedure guarantees the efficient operation of your payroll system and enhances the general financial stability of your company. Regardless of your role—small company owner, accountant, or accounting student—passing salary payable vouchers in Tally is an essential ability that will benefit you much in your career.Source Url: https://shorturl.at/sWTk3

#Tally Course in Hindi#Tally Course Online#Tally Course Online With Certificate#Tally Erp 9 Online Course#Tally Prime Course Online

0 notes

Text

What Makes CATIA Course Online Perfect for Design Enthusiasts?

Master CATIA Course Online with this expertly curated course for mechanical and product design professionals. Learn 3D modeling, analysis, and simulation from industry experts. Designed for both beginners and advanced learners, the course includes real-world applications and project-based training. Gain certification and enhance your design skills to excel in automotive, aerospace, and engineering industries. Join today and build your expertise in CATIA!

#salesforce cloud data platform course#mulesoft training online#mulesoft course online#mulesoft online training#aws course online#togaf training online#hr training online classes#catia training online#rpa training online#catia course online#aws training online#online certification trainings#blockchain training online#tally training online#rpa course online#catia online training#blockchain online training#catia online course#servicenow training online#togaf course online#hadoop online training#servicenow course online#iot training online#salesforce marketing cloud online training#internet of things online course#hr online training#internet of things online training#rpa online course#online training courses#online cad training

2 notes

·

View notes

Text

Step-by-Step Guide to Migrate Your Data to TallyPrime

Discover how to easily migrate your data to TallyPrime with this comprehensive guide. Learn essential steps and tips for a seamless migration.

#Tally Erp 9 Online Course#Tally Course in Hindi#Tally Course Online#Tally Course Online With Certificate#Tally Prime Course Online#Learn Tally Online

0 notes

Text

Unlock your Career Potential with Certified Accounting Courses

Get Certified: Accounting Course for Career Growth. A must-attain set of certifications that make the accounting skills and career better. From the core knowledge in accounting principles and tax rules to getting hands-on with the Digital Accounting Course With Articleship that preps you for jobs. Along with this, the Tally Prime Course Online And Job Placements offer job placement assistance as well as connect you with possible employers.

Table Of Content: -

Get Certified: Accounting Course for Career Growth

Master Tally Prime: Online Course With Certificate

Join Now: GST Online Course with Certification

Digital Accounting Course with Articleship Options

Tally Prime Online Course: Job Placement Support

Frequently Asked Questions (FAQs)

Get Certified: Accounting Course for Career Growth

Relevant certification in the modern competitive market can help you grow immensely in your career. Such a Certified Accounting Course, therefore, will be a qualification booster to set you apart from different employers. These courses include skills and knowledge required in accounting.

Benefits of Taking Certified Accounting Courses:

In-depth Knowledge: This helps understand accounting principles, financial reporting, and tax laws.

Professional Development: These certifications tell the employer that you respect your profession and are not willing to compromise on such things.

In addition to these regular courses in accountancy, specializations include online Tally Prime Course With Certificate. This course is based on the software package Tally Prime. As known, this is being largely used by the business fraternity in the country for their needs and purposes of accountancy as well as inventory management. This will improve your technical know-how and thereby enhance the prospects of job opportunities available to you in the marketplace.

Another worth offering is the GST Online Course With a Certificate. An accounting professional in India should know about the Goods and Services Tax, or GST because it has been a game changer in taxation.

Digital Accounting Course With Articleship is an excellent opportunity to learn while working. Here, the theoretical concept will not only be studied but articles, which will include practical hand training.

Tally Prime online course also has Tally Prime Job Placement. Here, you will be connected with the providers of the job opportunity.

Master Tally Prime: Online Course With Certificate

Mastering software tools in accounting is a compulsive requirement and not a choice. Any aspirant accounting professional who is desirous of increasing prospects for his career and aims at higher positions should take up the course designed specifically for mastering Tally Prime, the robust, advanced accounting software. Online Tally Prime Course with certificate provides in-depth Tally Prime knowledge with significant prospects of employability improvement by certification.

Advantages of Online Tally Prime Training

Comprehensive Curriculum: Everything, from basic functions to all the possible features of Tally Prime, will be learned in this online training on Tally Prime to get proper knowledge of the software in totality.

Flexibility: The online training system enables you to study at a flexible pace according to one's convenience. This feature benefits working professionals as the availability of time for work could be flexible and comfortable at the same time.

Certification: Get certified after completion, indicating validation of skills and knowledge gained through Tally Prime.

With all these, it would also be helpful to be able to apply for an accounting course that is qualified such that I will get some better principle knowledge about accountancy. The two courses combined with a GST course which is online results in getting a certificate, so I will be able to fully appreciate the Indian Taxation system.

The Digital Accounting Course With Articleship will then provide you with the on-the-job experience to be completed. Some programs add the Tally Prime Course Online And Job Placements, where you get an opportunity to face employers that are actively in search of the right employee.

Join Now: GST Online Course with Certification

Accountancy professionals have no option other than being updated regarding GST regulations and compliance in a rapidly changing finance world. Our GST Online Course With Certificate will be a comprehensive learning session on the regulation, compliance, and the impact of GST on businesses. This will add much value to your professional profile and enrich your knowledge.

Key Features of GST Online Course

Expert Trainers: Learn from industry experts about the real-life application of GST.

Flexibility: This online program is flexible, and you study at your own pace, very suitable for busy professionals, and

Certification: On completion, you can get a recognized certificate about your expertise in GST.

The additional course can be the GST course, and then support it with a Certified Accounting Course that will enhance building up basic accounting skills. An online Tally Prime Course With a Certificate further will bolster your skills especially since accountancy software is globally utilized in most businesses.

Besides, for the hands-on experience enthusiasts, a digital accounting course with articles is also available. Many of these programs also provide online Tally Prime courses along with job placements, and you'd directly be connected with the employers looking for the right candidates.

Digital Accounting Course with Articleship Options

As the digital world is evolving day by day, there is an exponential growth of demand for skilled accountants. Our Digital Accounting Course With Articleship gives the much-needed accounting skills accompanied by practical experience through articles, making you totally job-ready upon completion of the course.

Benefits of the Digital Accounting Course

The curriculum would focus on digital accounting tools, financial reports, and compliance regulations.

Articleship Experience: Articleship provides practical insight into industry professionals; therefore, you experience in your learning.

Certification: Certification is provided that confirms your digital accounting skill, thus making you a highly competitive one in the job market.

Apart from that, you may choose a certified accounting course that will make your base sound in accounting principles. Then, there is the GST Online Course With Certificate which gives you the necessary knowledge regarding tax regulations, if you wish to go deeper into specialization.

This great Online Tally Prime Course With a Certificate coming to you is one that takes much concern with the mastery of software much in demand anywhere, today. Thousands of these institutes present you with an opportunity like this so that you get complete assurance that no problem may arise at any time before, during, or after your transition from education to employment.

Tally Prime Online Course: Job Placement Support

If you are serious about a career in accounting, then there is no alternative but mastering Tally Prime. We offer Tally Prime online course along with the certificate course with job placement support from us to give that initial boost towards a better career.

What are the advantages of this Tally Prime online course?

Complete Training: Tally Prime training provides all the functionalities from simple to complex so that you are completely prepared for the work field.

Certification: A completion certificate is also included which makes you an impressive candidate in the eyes of the employers.

Job Placement Assistance: Job placement assistance helps students find job placements with organizations that are actively seeking skilled professionals in Tally Prime.

Apart from the Tally Prime course, one can further qualify by doing a Certified Accounting Course that would cover the most basic accounting principles. If there is interest in taxation, then the GST Online Course With Certificate is a very good add-on that would give critical insights into the regulations of GST.

Practical experience can be received through a Digital Accounting Course With Articleship. You will not only become theoretical but also prepared to face the practical world.

Frequently Asked Questions (FAQs)

1. Benefits of doing a Certified Accounting Course

A Certified Accounting Course trains in accounting principles, reporting financial statements, and other tax laws, therefore assuring professional growth. Moreover, it shows that a person is dedicated to this field, and it makes him an excellent candidate for any company.

2. How does the Tally Prime Online Course with Certificate help with placement?

An All-inclusive Tally Prime Training from Basic to Advanced. After you complete the courses, you will be entitled to the recognized certificate you will gain, and it will further make you eligible for acquiring the Tally Prime Course Online And Job Placements with the help of which you will get tied up to the employers on the lookout for adequate professionals.

3. What on-the-job experience do I get through the Digital Accounting Course with Articleship?

The Digital Accounting Course With Articleship merges the article's practical skills training and the theory knowledge so you enjoy practical insight from such people who are in the industry. Prepared Experience: You would have some real-life challenges going on in regard to the accounting profession itself, and making the workforce even more absorptive.

Source url: https://ajmalhabib.com/unlock-your-career-potential-with-certified-accounting-courses-2/

#Certified Accounting Course#Online Tally Prime Course With Certificate#Gst Online Course With Certificate#Digital Accounting Course With Articleship#Tally Prime Course Online And Job Placements#digi schema

0 notes

Text

Tally Prime Course

Boost your accounting skills with the industry-leading Tally Prime course at MWC Edu. Whether you're a student, entrepreneur, or professional—this course is for you. Learn how to manage business accounts, inventory, payroll, and taxation efficiently. Get step-by-step training in voucher entries, ledgers, and financial statements. Master GST, TDS, and statutory compliance in practical business scenarios. Understand inventory valuation, stock tracking, and godown management. Configure and manage payroll, employee records, and salary structures with ease. Work with cost centers, budgets, and multiple company accounts. Practice with real-world examples to gain job-ready experience.

Access high-quality video lessons taught by certified Tally experts. Download assignments and case studies to reinforce your learning. Study at your own pace with lifetime course access and mobile compatibility. Join live sessions and clear doubts through our active support system. Earn a professional certificate to add value to your resume and LinkedIn profile. Suitable for beginners and those looking to upgrade their Tally skills. Prepare for roles like accountant, billing executive, or tax consultant. Build confidence to handle real business accounts independently. Join thousands of successful learners and professionals across India. 📌 Enroll now at www.mwcedu.com and master Tally Prime with confidence!

#tally prime basic to advance#tally prime course#tally prime online course#tally prime course online#tally prime course with certificate

0 notes

Text

Master Digital Marketing with Ahmedabad’s Leading Institute! Perfect Computer Education

We provide fast-track, job-ready digital marketing courses designed for success. Learn SEO + Google Analytics, Google Ads & PPC, Instagram & Facebook Marketing, Canva, Logo & Website Maintenance, and more—all with hands-on projects led by industry experts! Learn the latest industry trends, tools, and strategies and gain hands-on experience with live projects.

Read More:- https://perfecteducation.net/digital-marketing.php

#digital marketing course in ahmedabad#foreign accounting training#usa accounting training#foreign accounting and taxation training#xero training in ahmedabad#learn foreign accounting ahmedabad#quickbook training ahmedabad#tally certification in ahmedabad#learn accounting in ahmedabad#myob training

0 notes