#Financial Accounting with Tally

Explore tagged Tumblr posts

Text

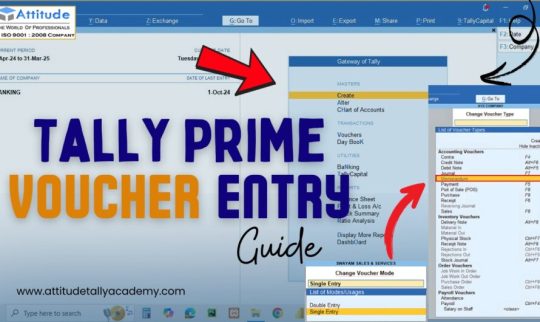

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

Mastering Financial Insights: Understanding Tally Balance Sheet

When it comes to managing your finances, understanding where your business stands is super important. It's like taking a snapshot of your company's money matters at a specific time. The Tally balance sheet is one of the most critical financial statements for any business. It provides a snapshot of a company's financial position at a given moment in time, showing its assets, liabilities, and shareholders' equity. The balance sheet is prepared using the fundamental accounting equation, which states that Assets = Liabilities + Shareholders' Equity. For more details, visit us at https://www.suvit.io/

#Financial Insights#tally automation#excel to tally import#excel to tally#excel to tally software#e invoice in tally#automation for accountants

2 notes

·

View notes

Text

Delhi’s Best Institute for Courses After B Com

Best Courses after B Com – बेस्ट कोर्सेज फॉर करियर ग्रोथ

अगर आपने B Com complete कर लिया है, तो अगला step होना चाहिए सही career course choose करना. Delhi NCR, especially Laxmi Nagar, में कई reputed institutes हैं जो career-focused courses offer करते हैं.

आपका सही course selection, आपकी future job opportunities को कई गुना बढ़ा सकता है।

Why to Choose Professional Courses after B Com? – क्यों जरूरी हैं स्किल-बेस्ड कोर्स?

सिर्फ B Com degree से high-paying job मिलना थोड़ा मुश्किल हो सकता है। इसलिए जरूरी है कि आप कुछ additional job-oriented courses करें।

Professional courses आपकी practical knowledge को enhance करते हैं और आपको job-ready बनाते हैं।

Factors to Consider Before Choosing a Course – कोर्स चुनते समय ध्यान रखें ये बातें

Duration of the course – कोर्स की अवधि

Course Fee – फीस कितनी है?

Placement Support – जॉब दिलाने में हेल्प करेगा या नहीं

Industry Demand – मार्केट में स्किल की डिमांड है या नहीं

Laxmi Nagar के institutes, जैसे The Institute of Professional Accountants, इन सभी factors को ध्यान में रखते हुए best courses offer करते हैं।

Top Career Options After B Com – टॉप कोर्सेज जो बदल सकते हैं आपकी किस्मत

1. Tally with GST Course – अकाउंटिंग के लिए बेस्ट कोर्स

अगर आप accounting field में जाना चाहते हैं, तो Tally + GST course एक solid option है।

यह कोर्स practical accounting knowledge के साथ-साथ GST filing और return के बारे में भी सिखाता है।

Duration: 1-2 months Fee: Approx ₹5000/- Best Institute: TIPA, Laxmi Nagar

2. Diploma in Financial Accounting – प्रोफेशनल अकाउंटिंग स्किल्स के लिए

Financial accounting में career बनाने वालों के लिए यह कोर्स बहुत effective है।

इस���ें आप सीखते हैं ledger posting, final accounts, tax filing, और bank reconciliation जैसे concepts.

Duration: 2-3 months Fee: ₹5000 to ₹7000 Suitable For: B Com Pass, Freshers

3. Income Tax Course – टैक्सेशन में करें करियर

अगर आप Income Tax return और TDS filing में expert बनना चाहते हैं, तो यह course आपके लिए है।

इस course में आप सीखेंगे ITR filing, Form 16, और TDS provisions in-depth।

Ideal For: Those aiming to work as tax consultants or accountants.

4. GST Practitioner Course – Become a GST Expert

GST एक ऐसा field है जो हर business के लिए जरूरी है। GST Practitioner course से आप authorized GST expert बन सकते हैं।

Small businesses से लेकर big corporates तक सबको GST filing की जरूरत होती है।

Learning Outcome: GST registration, monthly & annual return filing Certification: Valid across India Location: Available locally at top institutes in Laxmi Nagar

5. Diploma in Taxation – Complete Tax Solution Course

यह course पूरी तरह से taxation पर focused होता है – income tax, GST, TDS, और business tax rules.

Fee: ₹6000 to ₹8000 Career Options: Tax Consultant, Tax Advisor, Tax Analyst Institutes: Many GST-focused coaching centers in Delhi offer this

6. SAP FICO Course – इंटरनेशनल लेवल अकाउंटिंग कोर्स

SAP FICO is for those who want to work in multinational companies or big firms.

यह course आपके resume को international level पर stronger बनाता है।

Best Suited For: B Com graduates with basic computer skills Fee: ₹15,000 to ₹30,000 Location: SAP-certified centers in Delhi NCR

7. Business Accounting and Taxation (BAT) – All-in-One Combo

BAT course एक combo course है जिसमें Tally, GST, Income Tax, और Excel सब कुछ शामिल है।

Perfect Course for: Freshers looking for 100% job-oriented training Benefits: Practical knowledge + Job placement assistance Duration: 3-6 months

Where to Do These Courses in Delhi NCR? – कहां करें ये बेस्ट कोर्स?

Delhi के Laxmi Nagar area में बहुत सारे reputed institutes हैं। लेकिन अगर आप well-researched और trusted institute ढूंढ रहे हैं, तो The Institute of Professional Accountants (TIPA)एक strong recommendation है।

Why Choose TIPA?

15+ years of training experience

Job placement assistance

Affordable course fees

Updated syllabus with real-life projects

Location: E-54 3rd Floor, Metro Pillar No. 44, Laxmi Nagar, Delhi

Contact: 📞 9213855555

Website: 🌐 www.tipa.in

Jobs After These Courses – कौन-कौन सी जॉब्स मिलेंगी?

Courses complete करने के बाद आप apply कर सकते हैं:

Account Executive

TDS Return Executive

GST Filing Agent

Tax Assistant

SAP FICO Analyst

Junior Accountant

इन सभी roles में starting salary ₹15,000 से ₹25,000 तक मिलती है, और experience के साथ salary बढ़ती जाती है।

Conclusion – अब देर न करें, स्किल बढ़ाएं और करियर बनाएं

आज के time में सिर्फ degree से काम नहीं चलता। Practical skills और certification courses ही आपको job market में edge दिला सकते हैं।

अगर आप Delhi NCR में रहते हैं, तो Laxmi Nagar का TIPA एक best option है career को boost करने के लिए।

Start now – क्योंकि सही कदम ही सही मंज़िल तक पहुंचाता है।

Name:-

Institute of Professional Accountants

Address:-

E-54 3rd floor, Metro Pillar No. 44, Laxmi Nagar, Block E, Laxmi Nagar, Delhi 110092

Phone:-

092138 55555

Description:-

"The Institute of Professional Accountants (TIPA), located in Laxmi Nagar, Delhi, is a leading institute offering job-oriented Diploma in E-Accounting, Taxation, Tally Course and GST. Our popular courses include DFA (Diploma in Financial Accounting), Tally Prime, BUSY, SAP FICO, Income Tax & GST return filing, and Advanced Excel. Ideal for 12th pass, B.Com, and working professionals, TIPA ensures 100% job placement in Delhi NCR. We also offer Business Accounting & Taxation (BAT) course with online/offline modes. Join today to build a high-paying career in accounting. call 9213855555 for brochure, fee, and syllabus."

www.tipa.in ,,https://g.co/kgs/K97g9Xp , https://www.facebook.com/tipainstitute , https://www.youtube.com/c/IPAInstituteOfProfessionalAccountants , Best Tally Course Training , Accountant Course , Accounting Institutes , Tally Course Training Institutes in East Delhi NCR Laxmi Nagar , Institute of Professional Accountants , Tally Institutes , Computer Course ,Computer Institutes , GST Course in Delhi ,Local KW AI ,AI 03-07-25 ,AI 04-07-25 ,AI -05-07-25 ,AI-06-07-25 , AI-07-07-25 , IPA Karol Bagh

Accountant Courses ,

Taxation Course

courses after 12th Commerce ,

after b.com which course is best ,

Diploma in accounting ,

Accounting and Taxation Course ,

GST Practitioner Course ,

Basic Computer Course fee ,

Payroll Course in Delhi,

Tally Course in East Delhi

diploma course after b com ,

Computer ADCA Course

Data Entry Operator Course in Delhi,

six months course in accounting

Income Tax

Accounting

Tally

Career

#business accounting and taxation (bat) course#diploma in taxation#sap fico course#tally course#finance#stock market#gst course#payroll management course#accounting course#diploma in financial accounting

0 notes

Text

Start Your Career in Financial e-Accounting Today

Gain in-demand skills with this practical Financial e-Accounting course, designed for aspiring accountants and finance professionals. Learn everything from Tally ERP9 with GST, Income Tax, and Payroll to e-filing and digital accounting software. This course covers the core of modern accounting practices, ensuring you’re ready for today’s job market. With hands-on projects and real-time simulations, you'll master how to maintain accounts, generate reports, and handle tax compliance efficiently. Perfect for commerce students, business owners, and job seekers aiming to excel in finance roles.

📚 Learn Financial e-Accounting Attitude Academy

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#Tally with GST training#Financial e-Accounting course#Income tax & payroll course#Job-ready accounting skills

0 notes

Text

Top Accounting Practices in Tally for Better Financial Management

Effective Accounting Practices with TallyPrime – A Complete Guide

TallyPrime is a powerful accounting software that simplifies financial management for businesses by streamlining tasks like recording transactions, managing expenses, generating reports, and tracking inventory. With a user-friendly interface and automation features, it ensures accuracy, saves time, and supports informed decision-making.

Why Effective Accounting in Tally Matters: Accurate accounting in Tally helps businesses stay tax compliant, prevent errors, and maintain transparency with stakeholders. Tally’s real-time data, customizable reports, and seamless integration with third-party tools enable better financial insights.

Key Accounting Practices Using TallyPrime:

Setup and Configuration: Tailor Tally with default paths, multi-address support, and voucher settings for smooth operations.

Transaction Recording: Use vouchers and ledgers to accurately record sales, purchases, and expenses.

Bank Reconciliation: Match bank statements with your records to detect discrepancies and ensure accuracy.

Cash Flow & Inventory Management: Monitor inflow/outflow of cash and maintain real-time stock tracking with various inventory vouchers.

Financial Reports: Instantly generate reports like Balance Sheet, Profit & Loss, and Cash Flow to evaluate business performance.

Integration & Customization: Connect Tally with ERP, eCommerce, and mobile platforms using APIs, FTP, or Excel with help from Antraweb.

Security & Backup: Apply user roles, enable password protection, and automate backups with Smart Backup++.

Remote Access with Tally on Cloud: Access your data securely from anywhere, on any device, ensuring uninterrupted operations.

TallyPrime Server: Improve multi-user performance and data consistency with advanced monitoring and administrative control.

Boost Tally’s Capabilities with Antraweb Add-ons: Enhance your Tally experience with tools like Document Manager, GST Reminder, and One Click Outstanding for greater efficiency.

👉 Explore more Tally solutions tailored to your business needs with Antraweb Technologies.

Click Here To Read The Full Blog Now:

Top-Accounting - Practices - in - tally - for - Batter - Financial - Management

Visit Our Website To Learn More:

0 notes

Text

The Benefits of Finance and Accounts Courses

With changing times comes a fast-paced economy- knowing finance and accounts has since become a basic ability across industries. Whether you are an aspiring entrepreneur, a professional wanting a career boost, or a student investigating career purposes, an account and finance course could work wonders for you. They are the best practical knowledge, develop good decision-making skills, and create opportunities for other options of careers. Let us see why it could be the best to enrol in the best account and finance courses for a beginner. Understanding Finance and Accounts: Your Key to Success Finance and accounts are the bedrock of every business. These skills are absolutely indispensable for any business that seeks to maximize its profit, manage its resources of finance judiciously, and earn competitive viability. Hence the reason why an accounts taxation course covers many such areas extensively that include an in-depth knowledge of tax laws, knowledge about compliance, and how to undertake strategic tax planning whether for an individual or for a business.

Some of the following skills can be developed through a finance and accounts course: • Practical knowledge: Persons able to handle ground realities with topological information such as maintaining ledgers, analysis of financial statements, and preparation of returns. • Skills relevant to the industry: Some software knowledge as Tally, QuickBooks, or SAP that are globally accepted. • Problem-solving skills: Provide training in complete problem-solving for financial distress. One such platform delivering these skills is NettechIndia, an institute of repute with some comprehensive finance and accounts courses designed for both beginners and professionals. Structured to meet industry-specific requirements, each program leaves students fully employable. The Roadmap to Getting Your Success: Your Guide into Finance and Accounting Courses Choose a roadmap to follow at the outset for the successful accomplishment of finance and accounts. Here matters about how to get started and shine in this domain:

Set Your Goals: Preparing the generic goals: should it be a financial management plan for yourself, or some steps that will facilitate entry into the corporations that deal with accounting tax?

Choose the Right Course: Choose a course suited to you. The beginners should be going toward basic courses, while the skilled might think of a more advanced course such as ACCA, CPA, or CFA.

Assimilate Training with Practical Knowledge: Look for programs providing internships or case studies. It is the exposure, regarding feelings, sharing ideas or knowledge, and deciding on what can or what cannot be done. Nettech India’s finance and accounts courses provide just that, combining theoretical knowledge with practical application to ensure holistically wise education.

Keep Yourself Updated with the Changes in This Field: Since finance is a field that keeps changing day by day, change the syllabus depending on different changes in tax laws, accounting standards, and financial regulations.

What makes courses in accounts and finances appealing?

1. Career options galore: These courses open new doors with prospective careers as financial analyst, accountant, auditor, tax consultant, and investment banker. 2. International significance: Universally accepted principles of both finance and accounting make such courses useful in the global market. 3. Benefit that comes from business: An entrepreneur skilled in finance would always be in a better position to manage its resources, lure investors, and earn profits. 4. Independence in finance: The management of personal finances constitutes yet another underappreciated opportunity.

Reasons to Take Courses in Finances and Accounts 1. High demand: Demand for finance professionals is evergreen. Whether big or small, every organization will depend on finance experts to handle their finances. 2. High remuneration: Trained professionals in finance and accounting are offered a competition hit on their pay/dollars. 3. Flexibility: With the rise of remote working, finance professionals, could be working anywhere that suits them without compromising flexibility. 4. Future proof career: As economies develop, some segments will perpetually require finance professionals, therefore this makes it a secure career choice. Conclusion An account and finance course are much more than a certification; it's an investment for your future. Whether you're beginning or brushing up on your old skills, these programs give you the knowledge and confidence to conduct yourself in a competitive world. From filing taxes to making effective financial decisions, the sky is the limit. Many institutes, such as Nettech India, provide some of the best accounting and finance courses for beginners, ensuring that you are empowered to become one of the best in the ever-dynamic industry. From on-the-job training to real expertise guidance, they equip you for challenges that will confront you in the real world. So begin your journey today. Enroll in one of Nettech India's finance and accounts courses and enter a universe of possibilities that awaits you in the dynamic world of finance and accounting.

#gst#goods service tax#goods and services tax gst#good service tax#account#accounts#finance#goods and services tax#gstin#tally erp9#tally erp 9#gstnumber#accounting finance#accounting and financial accounting#account and finance#financial accounting

0 notes

Text

#Bookkeeping services UAE#Accounting solutions UAE#Professional bookkeeping UAE#Financial record keeping UAE#Small business bookkeeping UAE#Accounting Firms Ajman#Bookkeeping Firms Ajman#Professional accounting services in Ajman#Online Bookkeeping Services UAE#Accounting Outsourcing Services in Ajman UAE#Accounting and Bookkeeping Ajman#Audit Firms Ajman#Audit period in the Ajman UAE#Financial statement audit importance in Ajman#IT support for small and medium scale industries in Ajman#IT Support Services in Ajman UAE#VAT consultation services in Ajman UAE#VAT Registration in Ajman UAE#VAT & Tax Registration Services in Ajman#VAT advisory services in Ajman Dubai#Tax Audit Services in Ajman UAE#Tally Software Solutions Ajman#Tally accounting services in Ajman UAE#Value Added Tax (VAT) in Ajman

0 notes

Text

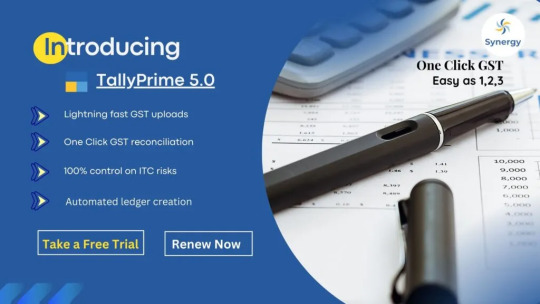

Benefits of Upgrading to Tally Prime 5.0 for Your Business

Upgrading to Tally Prime 5.0 presents a unique opportunity for businesses to enhance their financial management and streamline their operations. With the Tally Prime 5.0 download available, users can access a range of robust features designed to elevate their accounting processes. From small startups to large enterprises, the versatility offered by Tally Prime 5.0 makes it a suitable choice for companies across various sectors. By embracing this latest version, businesses not only improve their efficiency but also gain the flexibility needed to adapt to the demands of an ever-changing commercial landscape.

One of the standout aspects of Tally Prime 5.0 is its user-friendly interface and simplified navigation. Users can expect to save precious time on routine accounting tasks, thanks to enhancements that allow for quicker access to essential features. This upgrade also introduces advanced reporting capabilities, enabling businesses to generate insightful analyses of their financial health seamlessly. With the new tools and analytics at their disposal, decision-makers can expect to make more informed choices, ultimately driving growth and profitability.

Additionally, Tally Solutions has integrated cutting-edge technology into this update, enhancing security and data integrity. Businesses can rest assured that their sensitive financial information is well protected, thanks to improved encryption and backup features. This emphasis on security provides peace of mind for users, allowing them to focus on their core operations without the worry of data breaches. The new features and benefits accompanying Tally Prime 5.0 make it easier than ever to manage various aspects of a business while ensuring robust protection against potential threats.

In conclusion, the decision to upgrade to Tally Prime 5.0 is one that can significantly benefit organizations looking to maximize their operational efficiency and safeguard their financial data. The combination of a user-friendly interface, advanced reporting tools, and enhanced security measures positions this software as a leading solution in the accounting field. With the Tally Prime 5.0 download readily available, businesses are encouraged to leverage the new features and benefits with Tally Solutions, ensuring they remain competitive in today’s dynamic marketplace.

#TallyPrime 5.0#TallyPrime upgrade#accounting software#business management software#TallyPrime features#TallyPrime benefits#financial management#GST compliance#data security#automated ledger#Tally solution

0 notes

Text

How Tally Simplifies Complex Financial Processes: A Visual Guide

In today's fast-paced business world, good financial process management is critical to success. Traditional accounting procedures can be inefficient and prone to errors, resulting in increased stress. Enter Tally, a comprehensive accounting software solution that simplifies complex financial procedures, streamlines operations, and improves accuracy. This visual guide will look at how Tally transforms complex financial activities into manageable and efficient operations.

1. Simplified accounting interface

Visual Element: A screenshot of Tally's Dashboard

Tally's user-friendly dashboard is intended to offer users with a clear picture of their financial information. The user-friendly design makes navigating easier and decreases the learning curve for new users. Real-time data updates, accessible menus, and customisable reports all help consumers locate the information they need without becoming lost in complex menus.

2. Effective Transaction Management

Visual element: Flowchart of Transaction Processing in Tally.

Managing transactions is an important component of accounting. Tally makes this process easier by automating certain operations. The program enables the seamless recording of transactions, whether they be sales, purchases, receipts, or payments. Tally uses automation to assure accuracy and save time by minimizing manual data entry and reconciliation efforts.

3. Comprehensive Financial Reporting.

Visual element: Sample financial reports from Tally

Tally excels in creating thorough financial reports with a few clicks. Users can view a variety of pre-configured reports, such as balance sheets, profit and loss statements, and cash flow statements. The software's ability to generate these reports rapidly and reliably gives firms with current information about their financial health, allowing for better decision-making.

4. Advanced Inventory Management

Visual element: Diagram of Inventory Management Features in Tally

Inventory management may be a difficult and time-consuming operation, particularly for companies with big stockpiles. Tally's extensive inventory management tools make this process easier by providing real-time tracking, automatic stock updates, and detailed inventory reports. Users may track stock levels, set reorder points, and analyze inventory turnover to ensure optimal stock levels and minimize operational disturbances.

5. Streamlined Tax Compliance

Visual Element: Tax Compliance Workflow in Tally

Navigating tax regulations and ensuring compliance can be challenging. Tally streamlines tax management by automating tax computations, producing tax reports, and maintaining regulatory compliance. The software supports a variety of tax systems, including GST, and gives regular updates on tax rules, allowing firms to easily avoid penalties and maintain compliance.

6. Secure Data Management

Visual element: Overview of security features in Tally

Data security is critical in financial management. Tally prioritizes data security with sophisticated security features such as user access limits, data encryption, and scheduled backups. This ensures that critical financial information is kept private and only accessible by authorized individuals, lowering the risk of data breaches and unauthorized access.

7. Streamlined integration and customisation

Visual Component: Integration Capabilities Diagram

Tally's adaptability goes beyond its primary functions. The software seamlessly integrates with other company applications, including ERP systems, CRM tools, and banking platforms. Furthermore, Tally's customisation capabilities allow organizations to adjust the software to their individual demands, ensuring that it properly matches their operational requirements.

Conclusion

Tally's ability to simplify complex financial procedures makes it an indispensable tool for firms looking for efficiency, accuracy, and ease of use. Tally simplifies financial duties by tracking transactions, providing reports, maintaining inventories, and assuring tax compliance. Businesses can focus on growth and strategy by exploiting Tally's powerful capabilities and straightforward design, certain that their financial administration is in capable hands.

For companies wishing to improve their financial operations and achieve more accuracy, Tally offers a comprehensive solution that handles the complexity of modern accounting. Accept the power of Tally and achieve a new level of financial simplicity and efficiency.Are you ready to master Tally and transform your financial management?

Join CACMS Institute for thorough Tally training in Amritsar! As the best-authorized training facility in the region, we provide hands-on training with flexible scheduling to accommodate your needs.

Our skilled instructors will walk you through every part of Tally, ensuring that you obtain the practical skills and information you need to succeed in financial management. Don't pass up this opportunity to advance your career with our top-rated Tally training.

For further information and to enroll, please contact us at +91 8288040281 or visit our website at CACMS Institute Begin your path to master Tally with CACMS Institute, where greatness meets knowledge!

#cacms institute#cacms#techskills#techeducation#Tally Training in Amritsar#Tally Training Course#tally accounting software#tallyprime#tally erp 9#tally on cloud#Tally Accounting#Learn tally#Complex#Financial Process#Tally Accounting Training

0 notes

Text

Which Certificate Course Is Best For Accounting And Finance?

In today's competitive job market, having specialized skills and qualifications is essential for career advancement, particularly in fields like accounting and finance.

#tally prime advanced course#certificate courses in accounting and finance#accounts and taxation courses in kolkata#top financial accounting training college in kolkata#diploma course in financial accounting#certificate course in tally prime with gst

0 notes

Text

0 notes

Text

Become a Certified e-Accounting Expert with Real-Time Skills

Step into the future of accounting with a complete e-Accounting course designed for today’s digital economy. This industry-oriented program covers everything from manual accounting to advanced computerized systems like TallyPrime with GST, Busy, and MS Excel. Whether you're aiming to manage accounts independently or get hired in a professional role, this course builds a strong foundation in payroll, tax management, e-invoicing, banking processes, TDS, TCS, and GST compliance.

Ideal for students, job seekers, business owners, and working professionals, this course empowers you with practical knowledge of accounting software and tools widely used in companies today. Gain real-time skills, understand accounting workflows, and master digital finance management to accelerate your career in accounting.

Visit Attitude Academy

📚 Learn e-Accounting : Attitude Academy

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#accounting course in uttam nagar#accounting course in yamuna vihar#busy accounting course in uttam nagar#busy accounting course in yamuna vihar#tally prime course in uttam nagar#tally prime course in yamuna vihar#tally ERP course in uttam nagar#financial e-Accounting course in uttam nagar

0 notes

Text

Learn Banking Skills with Finance Diploma

Diploma in Banking Finance Course Benefits: डिप्लोमा बैंकिंग एंड फाइनेंस कोर्स के फायदे

What is a Diploma in Banking Finance?

Diploma in Banking Finance ek short-term professional course hai. यह कोर्स बैंकिंग और finance industry के लिए students को तैयार करता है।

इसमें theoretical knowledge और practical training दोनों शामिल होते हैं। Students को basic banking operations और financial instruments की समझ दी जाती है।

Why Choose This Course? – क्यों करें यह डिप्लोमा कोर्स

Banking Finance Diploma Course करना बहुत ही फायदेमंद होता है। यह course career opportunities के लिए एक अच्छा foundation बनाता है।

आजकल private और government banks दोनों में skilled professionals की ज़रूरत होती है। इसलिए यह कोर्स बहुत demand में है।

Scope and Growth Opportunities – स्कोप और करियर के मौके

इस कोर्स के बाद आपको banking jobs, finance sector roles, और insurance companies में काम मिल सकता है।

अगर आप commerce background से हैं, तो यह diploma आपके लिए best option हो सकता है।

Private sector में salary packages अच्छे मिलते हैं, और government sector में job security मिलती है।

Benefits of Diploma in Banking and Finance – फायदे और उपयोगिता

H3: Quick Employment – तेज़ रोजगार के मौके

Diploma complete करने के बाद immediate job मिलने की संभावना होती है।

Banks prefer करते हैं professionally trained candidates को। इससे आपको edge मिलती है बाकी applicants पर।

Industry-Relevant Skills – इंडस्ट्री बेस्ड स्किल्स

आपको real-world banking systems की training दी जाती है।

Modules include करते हैं – retail banking, credit management, और financial services।

ये सभी topics practical knowledge पर based होते हैं।

Affordable Course – किफायती कोर्स

इस कोर्स की फीस बहुत ज्यादा नहीं होती।

हर student इसे easily afford कर सकता है।

बहुत सारे institutes EMI options भी offer करते हैं।

Course Duration and Eligibility – कोर्स की अवधि और योग्यता

Diploma in Banking and Finance course की duration 6 months से लेकर 1 year तक हो सकती है।

Eligibility usually होती है 12th pass या graduation complete करना।

कुछ institutes entrance test भी लेते हैं।

Career Options After the Course – कोर्स के बाद करियर चॉइस

Job Profiles – कौन-कौन सी नौकरियाँ मिल सकती हैं?

इस डिप्लोमा कोर्स के बाद आप इन profiles में काम कर सकते हैं:

Bank Clerk

Loan Officer

Financial Analyst

Relationship Manager

Insurance Advisor

Work Sectors – किस क्षेत्र में काम मिलेगा?

आपको jobs मिल सकती हैं:

Private Banks

Government Banks

NBFCs

Mutual Fund Companies

Insurance Companies

Salary Expectations – सैलरी की उम्मीदें

Entry-level पर starting salary ₹15,000 से ₹25,000 per month हो सकती है।

Experience के साथ salary ₹40,000+ तक जा सकती है।

Private companies performance-based incentives भी देती हैं।

Real-World Applications – वास्तविक जीवन में कोर्स की उपयोगिता

इस कोर्स से आपको day-to-day banking operations की understanding होती है।

आपको customer dealing, document verification और loan processing में hands-on knowledge मिलती है।

यह सब field में काम करते समय बहुत काम आता है।

Future Study Options – आगे की पढ़ाई के अवसर

Diploma in Banking Finance के बाद आप higher studies भी कर सकते हैं।

Options include:

MBA in Finance

Certification in Investment Banking

Post Graduate Diploma in Banking

इससे आपकी qualification और value दोनों बढ़ती है।

Who Should Do This Course? – यह कोर्स किन लोगों को करना चाहिए?

अगर आप commerce, arts या science background से हैं, तब भी आप यह course कर सकते हैं।

Working professionals भी इसे part-time mode में कर सकते हैं।

यह course उन students के लिए perfect है जो short-term में job पाना चाहते हैं।

Additional Perks – और भी फायदे

Networking Opportunities

आपको classmates और faculty से networking करने का मौका मिलता है।

इससे future job referrals भी मिल सकते हैं।

Certifications and Recognition

Course complete करने पर आपको recognized certificate मिलता है।

यह certificate आपकी resume value बढ़ाता है।

Conclusion – निष्कर्ष

Diploma in Banking Finance Course एक career-defining कदम हो सकता है।

यह कोर्स आपको knowledge, skills और job opportunities तीनों देता है।

अगर आप finance sector में career बनाना चाहते हैं, तो यह कोर्स सही विकल्प है।

Accounting interview Question Answers

Tax Income Tax Practitioner Course

How to become an income tax officer

Learn Tally free online

Best Accounting Training Institute

journal entries questions with answers

What is B Com full form

Highest Paying Jobs in India

ICWA Course

Short Cut keys in tally

Tally Prime free download

Tally Prime Features

Meaning of sundry debtor creditor

Income Tax Return Filing services

Education Business ideas

Accounting Entry

Income Tax

Accounting

Tally

Career

#banking and financial institutions#diploma in taxation#business accounting and taxation (bat) course#tally course#sap fico course

0 notes

Text

USAmericans: If you want to save your democracy, participate in it.

I've heard from people both IRL and online who feel helpless and overwhelmed in the face of SO MUCH awful news -- from the hostile fascist takeover of our government to the dissolution of our foreign aid agencies to the establishment of "detainment camps" (we all know what they really are) both inside and outside U.S. borders.

It's easy to feel hopeless and overwhelmed when there's so much to take in. In fact, that's exactly what the perpetrators of this crisis want you to feel. They want to flood the opposition to the point that we stop fighting back.

But here's the thing: We still have elected officials in Washington, and midterm elections loom on the horizon. Midterms can (and often do) switch which party holds the majority of seats in Congress. Even if your elected officials are Republicans, they can't alienate their entire constituency if they want to keep their jobs. The more dissenting voices they hear from their home districts, the more motivated they will be to listen.

If you want Elon Musk to keep his paws off your Social Security number, or if you want the USAID office reinstated, or if you oppose racist policies being enacted or prison camps being built or literal war crimes being committed (as Trump has proposed), contact your representatives now. Don't put it off, don't feel intimidated. Add one more tally mark to the "opposed" column in their offices.

How to make your voice heard in four easy steps:

Go to this site: https://www.usa.gov/elected-officials/

Put in your home address (or an address near where you stay, if you do not have a home address) to access a list of your elected officials ranging from the President all the way down to city offices.

Expand the "Federal" tab. Find your U.S. Senators and U.S. Representative. Their phone numbers should be listed under their names. (If it is not listed, you can Google their name and "office phone number" and it should turn up. It will have a 202 area code.)

Call each of their offices. Calling is more effective than emailing. If you are unable to call, you can email, or you can call and email, but if you're going to pick just one, calling has MUCH more impact.

Note: If you call during office hours, you will likely speak to a staff member who will take your name and address or email and ask what issue you would like to comment on. If you call after hours, you can just leave a voicemail. If you hate speaking to strangers on the phone, write down a couple of sentences about your chosen issue in advance, call after hours, and read your statement to the voicemail. It takes less than a minute.

Sample Scripts:

It doesn't have to be complicated! You can just say something simple like this:

Hi, my name is [name] and I live in [city/state]. I am calling to state my opposition to [whatever outlandish thing Trump just proposed]. I would like [elected official] to take steps to oppose this in Congress. Thank you.

Or you can go into more detail about a specific issue:

Hello, my name is [name] and I live in [city/state]. I am calling to express my concern about the unlawful seizure of personal taxpayer information by the DOGE. Elon Musk has no legal right to access the sensitive personal and financial data of millions of Americans, and I am very concerned that my Social Security and bank account numbers are now in the hands of a group with no government oversight. This is a clear violation of our privacy, and the potential for abuse of this information is high. I am asking [elected official] to protect [his/her] constituents by enacting legislation to restrict the DOGE, and working to restore the authorized, Congressionally-funded departments that Elon Musk has taken over or shut down. Thank you.

Additional tips:

Be polite. Yes, everything the Trump administration does makes us want to swear a blue streak, but the person taking your call or listening to your message is a low-level staffer or intern, and they didn't make the policies you hate. They are responsible for recording and collating the data about calls received, however, so don't give them any reason to omit yours.

Be brief. Your goal is to add one more tally mark to the list of "constituents who oppose Elon Musk having their personal bank account numbers," not to write a persuasive essay explaining what identity theft is and why this is a problem.

You can call more than once. Don't spam a bunch of calls about the same issue, but just because you called this week about the DOGE doesn't mean you can't call next week about illegal ICE raids, or the week after that about the Department of Education being dissolved, or the week after that about the detainment camps. If another issue comes up that concerns you (and let's face it -- it will), call and leave another message! Keep their phones ringing.

144 notes

·

View notes

Text

Top Accounting Practices In Tally For Better Financial Management

Managing finances efficiently is crucial for every business, and Tally is a top choice for streamlined accounting. With Tally, businesses can effortlessly track sales, manage expenses, and generate accurate financial reports. Its user-friendly interface and powerful features simplify accounting tasks, ensuring transparency and compliance with tax regulations.

Setting up Tally for optimal performance is key. Customize it to your company's needs by setting default data paths, enabling auto-login, and configuring voucher preferences. This helps in accurate record-keeping and timely decision-making.

Tally also excels in bank reconciliation, cash flow management, and inventory tracking. It offers comprehensive financial reports that provide insights into your business's performance. With Tally's integration capabilities and robust security measures, businesses can enhance efficiency and protect their data.

For more insights on optimizing financial management with Tally, visit our blog

Top Accounting Practices In Tally For Better Financial Management

For expert guidance on implementing Tally for your business, contact us at

Antraweb Technologies Pvt. Ltd.

#tallyprime#tallysoftware#tallyoncloud#accounting software#automation#Top Accounting Practices in Tally#Crucial Accounting Practices in Tally for Better Financial Management#Tally Financial Management#Accounting Practices in Tally#Antraweb Technologies

0 notes

Note

ideas for a backstory for someone who is a writer?

Writing Ideas: Writer Backstory

Abandoned by a parent/s

Experienced financial instability; usually moved frequently

Experienced bullying, contributing to feelings of isolation

Grew up in an affluent household, thus had access to a huge library

Grew up in a small village, often close to nature, thus developing observational skills for their writing

Had a solitary childhood, usually read numerous books

Lost a significant other, or other personal tragedies

Struggled with addiction (e.g., alcoholism) or other mental health conditions

Was a former professional in a different field

Went to a prestigious school where they learned literature or different languages

Examples

Briony Tallis in Atonement. When we first meet Briony, she is a 13-year-old who likes to write; when we last hear from her, she is a novelist in her late 70s. What passes between first appears to be merely the story of her life and her family’s life, but in the final pages, all is revealed: it is she who is the author of what we have just read—and things did not turn out quite the way she said.

Dr. Watson, in the Sherlock Holmes stories by Sir Arthur Conan Doyle, is a medical professional, but it's on account of his writings about Holmes that Holmes is so well known. Of course, the stories he writes that make Holmes famous are the same ones that we read, so this could be the world's first meta example of the Most Writers Are Writers trope.

Esther Greenwood, the protagonist of The Bell Jar, is in many ways Sylvia Plath. Essentially every aspect of Esther from her appearance, talent for writing, bad luck with hypocrite boyfriends to her mental breakdown, suicide attempts, and subsequent hospitalization can be traced back to Plath herself in some way. Which takes a meta twist when Esther starts a draft of an account of her experiences, which is obviously The Bell Jar in a nascent form.

Jack Torrance in The Shining. The typical alcoholic writer type, who accepts a winter position at the Overlook in the hopes of fixing up his life.

Jo March in Little Women. An alter ego for Louisa May Alcott herself, Jo is a strong-willed tomboy who loves to read and write. She writes plays and short stories in her youth, and later goes to seek success as a writer in New York City. In the end, she gives up writing and gets married.

Kurt Vonnegut. The main character in his novel Cat's Cradle is a writer who starts out doing research for a book he's planning to write about the day the first atomic bomb was dropped on Hiroshima. Later in the story, he takes an assignment from a magazine to visit the island of San Lorenzo and write an article on it, where he gets more than he bargained for.

Stephen King's Misery. The main character has written a long series of popular genre-novels (historical romance, rather than horror), but wants to write more "serious" fiction, and is kidnapped by an obsessed fan who needs to know how the series ends.

Winston Smith, the unassuming protagonist of Nineteen Eighty-Four, works as a writer for the Ministry of Truth, his specific job being to redact inconvenient news stories or incorrect predictions made by the ruling Party, and replace it with propaganda he is told to make up from whole cloth. He says that his writing is the high point of his life. His love interest, Julia, is also a writer, albeit of amateur pornographic novels and other tripe meant to keep the populace distracted and happy. Author George Orwell was a highly experienced writer, and was wearily self-aware about the nature of the literary world, and it shows best here. Orwell also worked for the BBC during WW 2 and observed Britain's wartime propaganda broadcasting firsthand. In some respects, the Ministry of Truth is, pretty much exactly, the wartime BBC.

Sources: 1 2 3 ⚜ More: Writing Notes ⚜ Writing Resources PDFs

Here are some examples for inspiration. Choose which ones you would like to incorporate in your story. Consider combining or modifying them as needed/desired. You can find more in the sources. If you have a specific writer/s in mind, you can study their life story to get more ideas. Hope this helps with your writing!

#anonymous#writers#backstory#character development#writeblr#writing reference#literature#dark academia#writers on tumblr#spilled ink#writing prompt#creative writing#light academia#writing ideas#writing inspiration#writing resources

63 notes

·

View notes