#TronNetwork

Explore tagged Tumblr posts

Text

🚀 Seamless Crypto Swaps with RocketX! 🌟

Looking to explore the Tron Network or convert ETH to TRX? Here’s how you can effortlessly manage your crypto on @rocketxexchange:

1️⃣ Convert Ethereum to TRX

Connect your wallet (MetaMask, Trust Wallet, etc.).

Select Ethereum Mainnet and Tron Mainnet.

Enter the amount of ETH to swap for TRX.

Confirm and receive your TRX in minutes!

2️⃣ Swap TRX to USDT

Use TronLink or a compatible wallet.

Choose TRX as the source token and USDT as the destination.

Review, confirm, and enjoy the best swap rates.

💡 Pro Tip: Secure your TRX and TRC20 tokens in trusted wallets like Ledger Nano, TronLink, or Trust Wallet for added safety.

With RocketX, trading across networks is fast, reliable, and cost-efficient. Start your journey today!

#CryptoMadeEasy #TronNetwork #RocketX #CryptoTrading

Click here for complete Guide:

0 notes

Video

youtube

TRON network, tronnetwork mining platform - TRON.LOVE

To participate in mining, please choose to use: TRON network (lower fees) TronlinK wallet (easy to understand), TRON official mining platform (safe, stable, long-term, daily income of more than 9%) Mining registration link: https://tron.network.com.im

News Report: https://t.co/qhDUYGxB61

0 notes

Text

The Tron (TRX) DeFi ecosystem has experienced a notable surge in activity, signaling a substantial period of growth and development. This expansion isn’t limited to the realm of decentralized finance alone; recent data underscores a correlated upward trajectory within Tron’s TRX token staking ecosystem. This trend suggests that both DeFi and staking on the Tron blockchain are witnessing increased interest and participation from users and investors, thereby fostering a more robust and dynamic Tron ecosystem. But, there’s more interesting side of the narrative that has provided Tron a major lift. In recent days, Tron has observed a notable uptick in its Total Value Locked (TVL) metric, signifying an increase in the value of assets participating in various activities within the Tron ecosystem. Tron TVL Swells To Over $15 Billion At press time, the TVL associated with TRX has surged to an impressive $15.8 billion, reflecting a substantial growth rate of more than 2% within the span of just 24 hours. Hey #TRONICS! Have you checked out @trondao‘s #DeFi? TVL on the #TRONNetwork is $15.3b! 🚀 Let’s dive in and #BUIDL together! 💪 Source👇 pic.twitter.com/sr2uL66zB6 — TRON DAO (@trondao) September 28, 2023 This noteworthy upswing in TVL underscores a heightened level of engagement and confidence among users and investors in Tron’s blockchain and associated DeFi protocols. Total Value Locked is a crucial metric in DeFi, representing the total value of assets locked within a specific DeFi platform or protocol, typically measured in US dollars. It encompasses assets used as collateral, liquidity in trading pools, staked tokens for rewards, and governance participation. TVL is essential for assessing a DeFi project’s health, security, and attractiveness to users and investors, and it plays a vital role in risk evaluation and competition analysis within the DeFi ecosystem. TRON market cap currently at $7.8 billion. Chart: TradingView.com TRX Sustains 6% Climb In The Last Week At the time of writing, TRX is trading at $0.088, down a measly 0.1%, but notched a decent 6.0% gain in the last seven days. TRX maintained its remarkable rise on Friday due to an increase in demand for the coin. The token reached its highest point at $0.090 since July 22nd. It is one of the top performing major cryptocurrencies of the year, close to its all-time high of $0.094. Tron stands out as the most active cryptocurrency in the industry, boasting stablecoins valued at over $44.5 billion and a user base exceeding 1.47 million, surpassing Ethereum and BNB Chain. The success of Tron is attributed to the strong performance of USDD, a stablecoin launched in 2022, which has maintained its peg through an over-collateralization strategy. The strong crypto market, with Bitcoin reaching $27,000 and XRP rising to $0.052, also helped TRX price surge. Source: TronScan Meanwhile, TRON’s blockchain has seen significant growth recently. The total number of addresses, based on TronScan data, on TRON reached almost 187 million, and the total transactions surpassed $6.4 billion. Additionally, TRON’s staking ecosystem has been thriving, with the staked amount of TRX reaching 46.8 billion, with 23.12% in Stake 2.0 and 76.88% in Stake 1.0. Stake 2.0’s increasing share indicates its rising popularity in the blockchain space. (This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk). Featured image from iStock

0 notes

Photo

New Post has been published on https://primorcoin.com/walmart-is-seeking-a-crypto-product-lead-the-dogecoin-foundation-is-active-again-after-a-long-break-coinbase-has-amassed-a-4-billion-cash-backed-war-chest-holders-digest-aug-15-21/

Walmart is seeking a crypto product lead, the Dogecoin Foundation is active again after a long break, Coinbase has amassed a $4 billion cash-backed war chest: Holder’s Digest, Aug. 15-21

Coming every Saturday, Hodler’s Digest will help you track every single important news story that happened this week. The best (and worst) quotes, adoption and regulation highlights, leading coins, predictions and much more — a week on Cointelegraph in one link.

Top Stories This Week

Walmart seeks crypto product lead to drive digital currency strategy

On Aug. 16, it was reported that U.S. retail giant Walmart was seeking out an experienced crypto expert who can develop and drive a digital currency strategy and product roadmap for the firm.

According to the job listing, Walmart is looking for someone with a track record of leading and scaling businesses. They also want at least 10 years of experience in product/program management and tech-based product commercialization.

Ideally, the candidate should also know a thing or two about crypto, blockchain tech and why JPEGs of poorly drawn pet rocks are selling for absurd prices on Ethereum.

Walmart’s future digital currency and crypto product lead will be based in the company’s home office in Bentonville, Arkansas. The state has produced talents such as Billy Bob Thornton and Johnny Cash, along with Bill and Hillary Clinton.

Team officially reestablishes Dogecoin Foundation after 6 years

There was good news for Doge fanatics this week as the Dogecoin Foundation resurfaced after several years of total media silence.

According to an announcement on Tuesday, the foundation stated it was reestablishing itself in a bid to support the fiery-eyed Dogecoin (DOGE) community. The foundation also said it would be announcing new projects that are centered on encouraging adoption of DOGE and promoting its utility.

The project’s website lists Ethereum co-founder Vitalik Buterin, Dogecoin co-founder Billy Markus and Dogecoin Core developer Max Keller as advisory board members. Furthermore, Tesla CEO and DOGE proponent Elon Musk’s interests may be catered to from the shadows via Neuralink CEO Jared Birchall.

It is yet to be revealed if Musk’s “toddler hodler” son has loaded up on DOGE in light of the announcement.

Coinbase amasses a $4B war chest so it can outlast ‘crypto winter’

Coinbase, the top U.S. crypto exchange, has amassed a cash-based war chest worth $4 billion on the back of two very productive quarters for the firm.

The company reportedly expected to use the cash to cover costs incurred by a variety of factors, including conforming to new regulations handed down by the United States legislature.

Coinbase has also announced its official launch in Japan in partnership with banking giant Mitsubishi UFJ Financial Group, while also revealing plans to add $500 million worth of crypto to its balance sheet and invest 10% of all generated profits into digital assets moving forward.

Winners and Losers

At the end of the week, Bitcoin is at $48,778, Ether at $3,282 and XRP at $1.28. The total market cap is at $2.09 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Avalanche (AVAX) at 105.79%, Arweave (AR) at 96.17% and Audius (AUDIO) at 93.78%.

The top three altcoin losers of the week are DigiByte (DGB) at -5.06%, Celsius (CEL) at -4.44% and BitTorrent (BTT) at -3.81%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“Poly Network has no intention of holding Mr. White Hat legally responsible, as we are confident that Mr. White Hat will promptly return full control of the assets to Poly Network and its users. As we have stated in previous announcements and encrypted messages that have been made public, we are grateful for Mr. White Hat’s outstanding contribution to Poly Network’s security enhancements.”

Poly Network team

“Lawmakers and regulators must work together to properly balance protecting innovation with any new regulations to ensure the digital asset marketplace flourishes in the United States.”

Glenn Thompson and Patrick McHenry, U.S. representatives

“The most important thing that can be done today is moving away from the idea that coin voting is the only legitimate form of governance decentralization.”

Vitalik Buterin, Ethereum co-founder

“Here at home in America, […] our payments infrastructure is arguably the worst of any developed country in the world, and increasingly falling behind, while China is moving with determination and haste to build an infrastructure that will make the digital yuan a challenger to the dollar as the world’s reserve currency.”

David Marcus, Diem co-creator

“Ethereum is outperforming Bitcoin, and it can be expected to continue this trend for the rest of 2021.”

Nigel Green, CEO of DeVere Group

“This is all about DeFi. […] This is the Treasury Department trying to work out how to get jurisdiction over DeFi […] and also expand its warrantless surveillance over a peer-to-peer financial system.”

Jake Chervinsky, general counsel at Compound

“Frankly, as one of the first pilots, we have on the table the question of paying salaries to employees of the Ministry of Digital Transformation in electronic hryvnia.”

Mykhailo Fedorov, vice prime minister of Ukraine

“It’s important to remember that when we look at the business, the long-term arc of adoption of digital assets in crypto matters far more than the businesses we are building.”

Mike Novogratz, founder and CEO of Galaxy Digital

Prediction of the Week

Ethereum ‘liquidity crisis’ could see new ETH all-time high before Bitcoin — Analyst

Bitcoin, the crypto industry’s largest asset by market cap, and Ethereum (ETH), the second-largest asset, have both posted notable price recoveries over the past several weeks. Although BTC has yet to be surpassed as the crypto industry’s top dog, ETH might tap its own all-time price high near $4,400 sooner than BTC reaches its record level of nearly $65,000, according to thoughts from CryptoQuant CEO Ki Young Ju.

“$ETH might reach its all-time high earlier than $BTC in the long term,” Ju tweeted on Wednesday. “Current $ETH price is closer to ATH compared to $BTC. Higher demand, lower supply. $ETH sell-side liquidity crisis still intensifies, while $BTC exchange reserve stopped its downward trend in May.”

On Friday, BTC fluctuated above the $48,000 mark, and ETH traded above $3,200 — which, however, are both still notably shy of their record highs.

FUD of the Week

JPMorgan Chase reportedly shuts down bank accounts of Bitcoin mining firm

On Aug. 19, U.S. banking behemoth JPMorgan Chase reportedly blocked all account activities of Bitcoin mining firm Compass Mining.

Whit Gibbs, the CEO of Compass Mining, took to Twitter to share the news:

“Shoutout to @Chase for shutting down @compass_mining accounts for doing our part to replace the old guard with self-sovereign, future-focused supporters of hard money. Get behind #Bitcoin or get out of our way.”

It is unclear if the temper tantrum will be enough to sway JPMorgan Chase to change its mind, and it is also unclear how shutting down banking services to one Bitcoin mining firm represents an attack on BTC in any way.

If anything, the banking giant has been upping its exposure to Bitcoin and the crypto sector in 2021.

Liquid exchange hacked to the tune of $80 million

Liquid, a Japanese crypto exchange, was the victim of a $80 million-plus hack this week which made the platform not so… liquid.

Cointelegraph reported on the news quickly after the exchange announced the attack, which compromised digital assets including BTC, Tron (TRX), Ripple (XRP) and Ether.

The exchange explained that only its hot wallets were affected and added that its assets were being moved into cold storage for security purposes.

The platform has since provided an update and revealed the hack totaled $91.35 million. The firm has urged users to not deposit any crypto assets in Liquid wallets until further notice.

T-Mobile looking into potential hack of data on 100 million customers

Speaking of hacks, U.S. telecom giant T-Mobile was looking into an alleged massive data breach at the start of this week that may have compromised the information of more than 100 million users.

According to Vice’s Motherboard, T-Mobile is looking into a potential data breach claimed by an author who posted details on an underground forum. A Sunday report said the hacker claims to have obtained data on more than 100 million customers from T-Mobile servers.

Unlike the Poly Network hacker, who syphoned $600 million worth of digital assets because “cross-chain hacking is hot,” the T-Mobile hacker seems to be displaying entrepreneurial instincts, as they were asking for 6 BTC — worth around $280,000 at current prices — in exchange for some of the data.

Best Cointelegraph Features

Shanghai Special: Crypto crackdown fallout and what happens next

Owning Bitcoin isn’t banned, but many fear for the future of regulations in China. Here’s a look at where we stand and where we might be headed.

Poly Network hack exposes DeFi flaws, but community comes to the rescue

The DeFi hacker’s initial intentions remain unclear, but they refused to accept a $500,000 bounty after returning all funds.

The perfect storm: DeFi hacks will advance the crypto sector moving forward

There is a silver lining from the DeFi hacks as new tech develops to protect the sector: “DeFi will be much safer in 12 months from now.”

Source link

#Blockchain #Coinbase #CoinbaseNews #Crypto #CryptoNews #DOGE #DogeCoin #ElonMusk #RippleNetwork #TraedndingCrypto #TronNetwork #TRX #XRP

#Blockchain#Coinbase#coinbaseNews#Crypto#CryptoNews#DOGE#DogeCoin#ElonMusk#RippleNetwork#TraedndingCrypto#TronNetwork#TRX#XRP#CryptoPress#Trending Cryptos

10 notes

·

View notes

Text

✅Joke or Drunk? Sun Admit That TRX is a Sh*tcoin✅

Read Out More 👉 https://www.cryptoknowmics.com/news/joke-or-drunk-sun-admit-that-trx-is-a-shtcoin

#CryptoNews#IsTRXaShitcoin#TronNetwork#TRX#Cryptocurrencyindustry#PeterMcCormack#JustinSun#Tron#Shitcoin#Cryptoworld#Cryptospace#Cryptocurrency#CryptocurrencyNews#CryptocurrencyMarket

3 notes

·

View notes

Text

💥 TRON FASTER FOUNDATION💥

is a fully decentralised platform to building a blockchain decentralized split game . 💎ROI SYSTEM 💎(3 plans)

➡️MINIMUM DEPOSIT 10TRX TO 50000TRX

➡️WITHDRAW AVAILABLE IN ANY TIME

🔥1st plan - Diamond🔥

➡️Minimum Deposit 10 to 50000 TRX 9.5% everyday for 45 days Total return on investment 427% 50% Reivest 50% withdraw Reinvest ROI 2.5% lifetime Forever

🔥2nd plan - Platinum🔥

➡️Minimum Deposit 10 to 50000 TRX 11.5% everyday for 25 days Total return on investment 287% 50%reivest 50% withdraw Reinvest ROI 1.5% lifetime forever

🔥3rd plan - Gold🔥

➡️Minimum Deposit 10 to 50000 TRX 13.5% everyday for 18 days Total return on investment 243% 50%reivest 50% withdraw Reinvest ROI 1% lifetime forever

join telegram 👉 https://t.me/tronfaster telegram channel 👉 https://t.me/tronfasterfoundation Website 👉 https://tronfaster.com/

#TronNetwork#Crypto#cryptocurrency#CryptoCommunity#TRX#Binance10M#ComingSoon#instagood#instagram#instabussines#newlaunch#crypto#blockchaintechnology#trc20#cryptoding

0 notes

Photo

New Post has been published on https://coinprojects.net/aave-aave-usd-jumps-by-a-weekly-10-is-it-attractive-now/

Aave (AAVE/USD) jumps by a weekly 10%. Is it attractive now?

Aave (AAVE/USD) is currently trading for $81.59. The price represents a 10.32% increase in the past week and a 0.64% daily loss. Despite recent volatility in the crypto market, AAVE price is on an upward trajectory.

Although the sentiment could hold, the total value locked in the DeFi blockchain is on a decline. AAVE’s TVL has dipped 7% in the past week to $4.82 billion. The protocol is currently ranked fourth on DefiLlama in the TVL list, deployed across seven networks.

Besides, the whale investor activities seem not to favour AAVE. The latest data from whale alert shows that Tron’s founder, Justin Sun, transferred $50 million of USDT from Aave protocol to an anonymous wallet. Aave’s transactions in the past day have also declined. It is down 12% to $128 million in the period.

Some other fundamentals in the Aave ecosystem relate to the GHO stablecoin. The network recently released a whitepaper for digital assets. AAVE described GHO as a ‘flexible, decentralised, configurable token designed to maintain a stable value.’ From the technical outlook, AAVE struggles to clear a key resistance level.

AAVE faces resistance at $81

Source: TradingView

According to the daily price outlook above, AAVE moved from $70 on October 14 to the current price of $82. The price is a significant level that has been tested severally. Despite the MACD looking bullish with green histograms, AAVE has entered the overbought zone. Thus, it may be due for a retracement.

Concluding thoughts

Despite AAVE currently looking bullish, it is facing a hurdle at $81. However, it could not be the most appropriate price entry. First, the DeFi crypto is overbought and needs enough buyers to break above the level.

Although the MACD level looks green, AAVE is not out of the woods yet. The price must clear the current resistance to welcome a bullish sentiment. Otherwise, it could retest the immediate support level of $69.

Where to buy AAVE

Binance

Binance is one of the largest cryptocurrency exchanges in the world. It is better suited to more experienced investors and it offers a large number of cryptocurrencies to choose from, at over 600.

Binance is also known for having low trading fees and a multiple of trading options that its users can benefit from, such as; peer-to-peer trading, margin trading and spot trading.

Buy AAVE with Binance today

Coinbase

Coinbase is a global cryptocurrency exchange. Its platform is well designed for beginner investors and it offers a wide range of coins, as it has over 100 to choose from.

Coinbase has high level security built into the platform, a range of diverse features to use and it offers its users options for storing their crypto, such as being able to store coins on the Coinbase exchange.

Buy AAVE with Coinbase today

Disclaimer

Share this articleCategoriesTags

Source link By Motiur Rahman

#Altcoin #Binance #Bitcoin #BlockChain #BlockchainNews #BNB #Crypto #CryptoExchange #TronNetwork #TRX

#Altcoin#Binance#Bitcoin#BlockChain#BlockchainNews#BNB#crypto#CryptoExchange#TronNetwork#TRX#Blockchain#CryptoPress

0 notes

Photo

What is a tron? What are its benefits? Also Read more about Tron crypto token development -

https://cryptosoftwares.com/blog/tron-crypto-token-development-and-its-benefits/

#Tron#tron smart contract#tronnetwork#tronblockchain#cryptocurrency#crypto#BTC#token sale#cryptotrading#TRONChain#cryptonews

0 notes

Text

Review FRX Token - DeFi Hedge Fund

FRX TOKEN- MAKING HEDGE FUND INVESTMENT MORE PROFITABLE AND WORTHWHILE

INTRODUCTION:

Guys, If you want to know about FRX First you need to know about is DeFi?

DeFi:

DeFi is an open financial ecosystem where you can build various small financial tools and services in a decentralized manner.

We see Decentralized Finance (DeFi) market began its meteoric rise in early 2020. it’s very good time for crypto community and investors.

Iast 6 months, the total value of all assets locked in DeFi has grown by a factor of 15 - from $600 million to $9 billion. Such changes indicate an increase in interest from the crypto community and investors. DeFi can be safely called the ‘hot hit’ of 2020.

FRX is a globally decentralized hedge fund token, a combination of different alpha-powers of hedge funds with the freedom granted by a denied ecosystem.

Forex Advisors is a registered firm that specializes in providing crypto trading advice to established and potential crypto exchange platforms and its clients. It was established in 2013 in Dubai, a market in the United States.

They operate derivative accounts for some business and external clients and have developed and developed derivative strategies for several for-profit businesses around the world over the past decade. Their main goal is to set and achieve a high interest rate for their clients with an investment target of at least 30% per year. They also offer cryptocurrency managed accounts that help achieve return rate rates.

Be Your Own Hedge Fund

#PoW & overload causing tremendous fees for Ethereum, all the competing chains are on the rise, Tron, Polkadot, BNB, Matic, even Avalanche.

Join the party with #FRX, making #TronNetwork professional, be your own hedge fund.

Seed Round live at: http://feroxadvisors.com/frx

Introduction to Crypto Derivatives, Advanced Bitcoin Trading Strategies, Bitmex Update 2019 & 2020

https://youtu.be/8ru7iv99mUI

Ferox Advisors(FRX):

Native Token of Ferox Advisors Limited FRX Token Platform. Demand for FRX Coins will increase with the development of Forex Advisors Ltd. With a professional and systematic marketing strategy, high interest rates and attractive rewards, it is certainly a project that is suitable for investment.

Why Choose Ferox Advisors??

The Ferox Advisor platform works using liquidity pools. These are token pools that are locked in the smart contract, these tokens so that you can be able to exchange with each other using AirTX as hydraulic. Lots of tokens (TRC-20) and all kinds of tokens that are currently supported by Firix Advisors. Also, a new liquidity pool can create a new exchange pair for any token at any time.

Private companies:

As a private company, FRX is an open platform for anyone who wants to join and invest in it individually or for company owners. As part of the FRX platform, you can benefit from a number of programs:

Key Features: Provides high liquidity, provides returns up to 300% / year, Full Intraday Trading Optionality, Low Fees at Trading,

Combining IT experts with today's technology.

As a platform that combines high technology and technology and business experts, the FRX platform hedge fund trading platform aims to:

Maximum income, profits of up to 399% per annum, is open to all without exception.

Derivatives:

Investors and users can benefit from this system. This is because derivatives are secured deposits / tokens that are guaranteed under certain agreements so that they can buy and sell transactions in exchange. And besides, investors will be able to sell first even if they haven’t bought before.

Managed Accounts:

By creating profitable strategies for investors and traders, the FRX platform can help you grow your business without imposing large fees for the trading transactions you make. Because it is definitely the main attraction for its users by providing up to 300% profit per year.

FRX VISION:

The project seeks to maintain an annual return on net equity

The minimum is 30%, with the ability to further increase the price of free gamma. We have successfully achieved both crypto options and derivatives as of 2017.

At Bitmax, we doubled our equity in less than a month's trading in 2012. We have achieved a standard fit with stock options of technology by 2020.

Now we want to provide a better profit profile for outside investors.

Removes the fund structure, banks and depositors from the equation and allows the investor to own shares of a decentralized hedge fund directly with 0 operating or operating fees.

FRX Token

Ferox Advisors is not just a hedge fund firm, it provides token hedge funds called FRX Tokens. The FRX token is a TRC20 token designed in the Tron blockchain. With this combination, Forex Advisor Alpha Hedge Fund provides a decentralized token hedge fund with productivity capabilities and the benefits of the DFI ecosystem. FRX tokens can be purchased and received by users through the Seed Round program. Users can get multiple bonus rates up to 300% in this program. The bigger the investment, the higher the bonus.

The utilities of the FRX token

In addition to participating in hedge funds, FRX is the preferred token of betting directly from the Firx Consulting website. These bets will be dynamic versions of binary options (or bets on a consistent spread), allowing users to make daily predictions on the prices of large cryptocurrencies and products such as gold, silver and crude oil via the FRX token in the payment structure.

Ferox Advisor Tokenomics:

Forex Advisors is a private limited company in which they have invented a crypto token - for investors to share its profits and for partners to participate. The FRX token will feature liquidity mining and standard yield cultivation, allowing its holders to retain tokens and generate dividends.

The project plans to deliver a total of 70,000 million TRX tokens The company said The 400 million tokens will be minted in the first year of the first year and sold and distributed in the second year. The rest will be set aside for split funding, special promotions and development roadmaps.

TOKEN INFORMATION:

Name: FEROX (FRX)

Contract : TKTENn9v56yVKHu4obmdQGpe8wFVimczxq

Symbol: FRX

Decimals: 8

Circulating Supply : 700,000,000.00000000FRX

FRX Pre-Sale is now Live!

The FRX mentioned in the previous paragraph is a trading company that focuses on trading cryptocurrencies and derivatives. The company specializes in account management for investors and earning returns based on their investments. FRX has created their platform token called FRX which is tron based. The token is designed in Tron Blockchain, one of the fastest, scalable, secure and highly efficient blockchain networks in the world. FRX is the domestic token of the FRX decentralized hedge fund platform.

FRX PRESALE INVESTMENT TIER is as follows :

10,000 TRX investment , 1 TRX = 3 FRX , Investors will get 27,000 FRX by transferring 9000 TRX to FRX wallet above

Investment worth 10,000 TRX to 50,000 TRX ( 1 TRX - 3.3 FRX) Deposit 33,000 worth of TRX, you will get 99,000 FRX

Investment up to 50,000 TRX to 300,000 TRX ( 1 TRX - 3.6 FRX) Depositi100, 000 TRX , you will receive 360,000 FRX

Investment up to 300,000 TRX and above attracts ( 1 TRX - 4FRX) Depositing 500,000 TRX will , you will receive 2,000,00 FRX

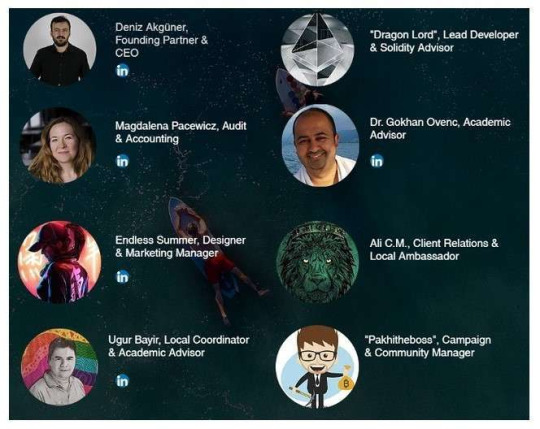

TEAM member:

CALCULATION:

An investment is an activity that is managed by allocating a certain amount of money to tools such as gold, real estate, etc. for future profit. Currently, many companies provide investment services for attractive return users. But there are risks to investing, users must be prudent in investing their money so that they do not lose their assets.

Above all, to guarantee the traceability, and authentication of ownership, the FRX Token transactions are registered into the blockchains, and these will enable the mobility, liquidity, and trading of physical gold. Now is the right time for crypto enthusiasts and investors to enjoy the great benefits which FRX Defi Investment offers by investing in tins amazing, highly secure, and valuable token (FRX Token)

MORE INFORMATION:

Website: http://feroxadvisors.com/team

Twitter: https://twitter.com/feroxadvisors

Telegram: https://t.me/FRXalpha

Medium: https://frx.medium.com/

Github: https://github.com/opentron/opentron

AUTHOR:

Bitcointalk Username: Manuel Akanji Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2954998

Tron Wallet: TCNg5eeoLS4QkfRLWZKzBRAdSNNQ4Pf4x5

2 notes

·

View notes

Photo

New Post has been published on https://primorcoin.com/heres-how-defi-market-looks-after-terra-collapse/

Here's How DeFi Market Looks After Terra Collapse

Terra’s ecosystem had roughly 15% of the DeFi market share before its collapse last month. According to DeFiLlama data, this makes it the second-largest hub for all decentralized finance. But after a $40 billion network goes bankrupt, where do the investors flee? When Terra was still alive and active on May 6, Ethereum had 55% of all DeFi activity, BNB Chain had 6%, Avalanche had 4%, Solana had 3%, Fantom had 2%, and Tron had 2%.

Those data now appear to be substantially different. Ethereum, which now has a market share of 61 percent, BNB, which now has a market share of 7.6 percent, and Tron, which now has a market share of roughly 6 percent, were the greatest winners. Harmony, a lesser-known company, currently has 5.2 percent of the market.

Surprisingly, Fantom and Avalanche actually lost some market share during this time, while Solana remained stable at 3%. Projects like Arrakis Finance (a liquidity management protocol), Iron Bank (a protocol-to-protocol lending platform), and Euler (another lending platform) on Ethereum have been instrumental in absorbing new money into DeFi.

Projects like pNetwork (a validator network), Wombat Exchange (a Curve-like decentralized exchange), and TokensFarm (a yield aggregator) have all done well on BNB Chain in the last month.

TRON Emerges a Winner

Despite the fact that Tron has nearly doubled its market share since Terra’s demise, it has done so with essentially the same product as Terra’s UST: USDD.

USDD is a new algorithmic stablecoin that works in a similar way to Terra’s UST’s mint-and-burn process. The Tron DAO is currently purchasing Bitcoin, Tron, and USDT as collateral. As a result, it’s a strange mash-up of numerous methods.

Despite the fact that stablecoins are DeFi’s bread and butter, consumers appear to be flocking to USDD for its high returns rather than its virtues as a decentralized currency. Tron, for example, promises some very extravagant double-digit payouts on a few different platforms on USDD’s site.

Was this writing helpful?

Source link

#CryptoExchange #DEFI #DEFINews #NFT #NFTNews #TronNetwork #TRX

#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#TronNetwork#TRX#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes

Text

✅Cryptoknowmics' Daily Dose of Crypto Updates | 23 Dec✅

Watch full Video 👉 https://www.cryptoknowmics.com/videos/cryptoknowmics-daily-dose-of-crypto-updates-23-dec

2 notes

·

View notes

Text

TRON (TRX) Smart Contract Based MLM Software Development-MLM software tamilnadu

What Is a TRON Smart Contract?

Smart Contracts- Ensures decentralization in any blockchain application, Just like Bitcoin, Ethereum, and every other blockchain, TRON is also having its own smart contract protocol. Tron Smart Contract is the most preferred smart contract solution for decentralized MLM Business in recent days over Ethereum Smart Contract. We develop and deploy TRON Dapps for all kinds of business verticals with more attractive features and plugins, TRON Smart Contract development for MLM Business, Health Care, IT Departments, and more.

Smart Contract-Based MLM on TRON

“Smart Contract-Based MLM on TRON” - The term can be used to denote a fully decentralized MLM network or dapp powered by TRON smart contract. The process of developing and deploying a smart contract on the TRON Blockchain network for the MLM business process which uses customized TRX tokens as rewards is termed as Smart Contract MLM development on TRON or TRON based Smart Contract MLM development.

Starting a smart contract-based MLM on TRON will ensure for the safe and secured MLM business and will surely result in a high customer base as well as high ROI. We provides the best Smart Contract based MLM developed on TRON to make your MLM Business more unique and profitable.

MLM Platforms with Ethereum Smart Contracts

Most of the cryptocurrency MLM platforms work on the Binary Matrix Model which relies on the Ethereum Blockchain network or uses ETH as a gifting scheme. There are many popular Ethereum Smart Contract-Based MLM platforms in the market with a trustworthy user base and ever-increasing revenue.

We MLM software chennai - Leading Smart Contract MLM Development Company offers the clones of the top-most Ethereum-based Smart Contract MLMs to reach a huge audience within a short span of time.

Ethereum Based MLM Clone Scripts :

Million Money Clone Script

Forsage MLM Clone Script

Double Way MLM Clone Script

Ethereum Cash MLM Clone Script

XOXO MLM Clone Script

What makes TRON a better mechanism for crypto MLM software?

With this particular token standard, it is very easy to access a vast pool of resources and to create a more reliable environment for operations. And that happens without having you to spend a great number of funds right off the bat. The crafting of these solutions helps you immensely and they let you reckon the impact of your initiative in any domain effectively. You can equip your platform with the most avant-garde tools that help in outflanking your competitors. When you work with this standard, the tokens are streamlined easily and the transactions get foolproof to the hilt.

However, to make your venture forward and successful, it is essential that you prepare a more specific mechanism that could safeguard the assets and assist the tweaking of the system every now and then. With that, we bring changes that are permanent and important in every way, you also get to enable your company with one of the most feasible solutions.

TRON Smart Contract Optimization

Whether it is a centralized system or a decentralized network, the task of optimization gets into the core of the functionality and it gets improved as well. Things start getting more subtle and outcomes can be obtained very quickly without wasting time in updating the backend with new measures. The impact of your venture in its domain can be doubled and the changes could be made revolutionary in no time. With this mechanism, the benefits are multiplied and the features of the wallet get more subtle in very less duration.

Smart Contract-Based MLM Development on TRON

Building an MLM platform on TRON blockchain works based on a Binary matrix as same as the MLM platforms built on the Ethereum Network and with a gifting scheme which offers the users to earn TRX tokens instead of ETH.

As TRON and TRX are creating a big competition against Ethereum and ETH, there are huge adaptations of Tron and TRX by business people and also traders in recent days.

Thus, many business people choose TRON blockchain to build their business dapps, and also many traders believe in trading through TRX. Thus you can also use TRON blockchain to build the smart contract of your MLM business with a customized TRX token reward system.

Benefits of TRON Smart Contract-Based MLM

TRON smart contract-based MLM is also as Highly Guaranteed Platform as that one built using Ethereum Smart Contract.

The level of security is high in TRON based smart contract MLM which increases the Trust of the MLM Platform.

When the Trustworthiness increases among the users, accordingly the new users to the platform and the participation by the already existing users increase.

Thanks for reading our content. For more details, kindly visit our website mentioned below;

MlM Software Tamilnadu,

https://www.mlmsoftwaretamilnadu.in/ ,

26, 49th Avenue, Ashok nagar,

Chennai – 600083,

9840566115.

0 notes

Text

Justin Sun is stepping down as Tron's CEO

Justin Sun is stepping down as Tron's CEO https://cryptoplayboys.blogspot.com/2021/12/justin-sun-is-stepping-down-as-trons-ceo.html?spref=tw #JustinSun #tron #trx #TronPad #Tronfoundation #TRONICS #TronNetwork #trxmining

3 notes

·

View notes

Photo

New Post has been published on https://primorcoin.com/nft-and-crypto-games-outperformed-defi-amid-market-selloffs-in-may-report/

NFT and Crypto Games Outperformed DeFi Amid Market Selloffs in May: Report

DApp discovery and analysis platform DappRadar released a detailed report analyzing the state of the crypto market in May. It mainly covered three areas: DeFi, NFT activities, and crypto games, stating that the Terra debacle did not destroy the overall DeFi ecosystems. NFT trading volume was only down 6% from April if measured in token prices, and interest in blockchain games remained sturdy amid crypto selloffs.

DeFi Is Not Dead

According to DappRadar’s report, shared with CryptoPotato, DeFi was the most beaten-down sector in May. The industry had a total of $117 million in Total Locked Value (TLV) – 45% below what it had achieved as recorded by the end of April. Among all the DeFi protocols, Tron noticeably was the only network that recorded a positive number for TLV – an increase of 47% MoM – while the rest of the major projects all experienced declines.

Despite the seeming weakness exacerbated by Terra’s historic collapse, the report stated that the sector is “far from dead” because it has achieved an 11% YoY growth in terms of TLV. Moreover, dominant decentralized exchange Uniswap reached the landmark of $1 trillion transaction volume in the same month.

NFT Is Consolidating

NFT transaction volume dropped 20% MoM – when measured in USD – but the number would have come down to 6% if viewed in the native tokens of the NFTs. It shows that the bear market did not fundamentally shake out people’s convictions in the sector, the report found.

It’s worth noting that Solana NFTs generated $335 million across all marketplaces, growing 13% from April, defying the overall market condition. Despite the plunged floor prices of blue-chipped projects like BAYC and MAYC, the NFT space did not lose momentum as new protocols continue to attract volume from investors.

In terms of marketplaces, OpenSea’s dominance declined along with the rising competition derived from Solana-based Magic Eden, Wax’s Atomic Hub, and more. Coinbase Marketplace was viewed as a “failed experiment” since it only generated $2.5M since launching on April.20th this year.

The report further noted that despite the recent contraction occurring in the NFT space, the rapidly growing sector has been in a consolidation stage since it peaked in January this year, and its engagement with non-crypto-native populations has changed the current crypto landscape.

The exposure that the blockchain industry receives from NFTs, puts today’s crypto market in an entirely different position from the conditions seen in the 2018 crypto winter. In those days the levels of engagement and enthusiasm around the industry were alarmingly low. While the mainstream media keeps calling for the NFT bubble to burst, the market conditions of the NFT space disagree. – reads the paper.

Blockchain Games Remain Resisilent

Compared to DeFi or even NFTs, blockchain games suffered the least, with the number of such transactions only down 5% from April. Meanwhile, the report quoted a16z’s $4.5 billion commitment as a boost to the Metaverse and related blockchain games.

The document attributed the latest move-to-earn trend – embedding a gamification element to physical activities – as a new incentive that onboards new players and sustains the sector’s growth.

SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).

PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to receive up to $7,000 on your deposits.

Source link

#Binance #BNB #Coinbase #CoinbaseNews #CryptoExchange #DEFI #DEFINews #NFT #NFTNews #TronNetwork #TRX

#Binance#BNB#Coinbase#coinbaseNews#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#TronNetwork#TRX#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

0 notes