#VAT Process

Explore tagged Tumblr posts

Text

VAT Return HMRC

A VAT Return HMRC is a tax document that UK organizations enrolled for VAT should submit, regularly on a quarterly premise. It subtleties the VAT charged on deals (yield Tank) and the VAT paid on buys (input Tank). The structure ascertains the net VAT owed to HMRC or the sum to be discounted. Organizations should guarantee opportune and precise accommodation to agree with charge guidelines. The VAT Return incorporates significant figures, for example, absolute deals and buys, how much Tank owed, and any Tank reclaimable. Inability to present the profit from time can bring about punishments and interest charges. At Finex Outsourcing , we work in dealing with these entries productively, guaranteeing consistence and limiting the gamble of blunders or punishments for our clients. We offer thorough help by keeping up with precise records, planning itemized reports, and submitting gets back immediately. Our group stays refreshed with the most recent Tank guidelines and offers master counsel to streamline Tank the board. We handle all parts of the VAT Return process, permitting organizations to zero in on their center tasks without the concern of duty consistence issues.

#VAT Return#HMRC#UK VAT#Tax Compliance#Output VAT#Input VAT#VAT Refund#Tax Penalties#Finex Outsourcing#VAT Submission#Tax Regulations#Accurate Records#Detailed Reports#Tax Management#Business Operations#VAT Process#Quarterly VAT#Tax Document#VAT Expertise#Compliance Support

0 notes

Text

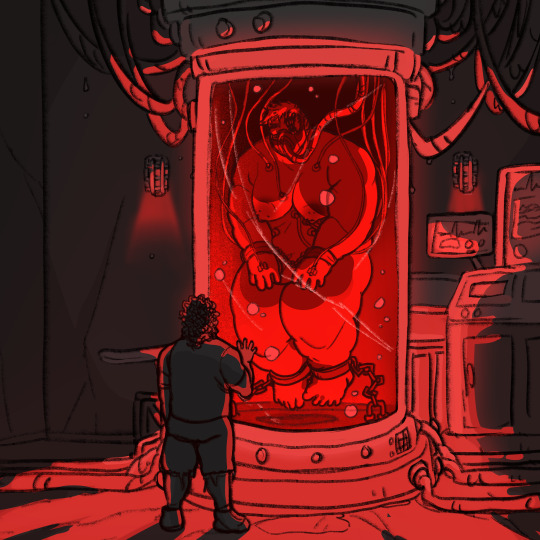

suspended in a medically induced coma while their body reconstitutes itself after receiving their run of the augments

#trigun#trigun maximum#livio the double fang#razlo the tri punisher of death#razlo the trip of death#trigun oc#oc tag: sidney#sid definitely snuck into where they're being held but he is not there out of concern lol#he just wanted to see what the process was from the outside because he's already experienced it and doesn't remember any of it#Floating in a Vat of Weird Liquid is a fun sci fi trope btw#sidraz#brawler draws#trigun tag#art

46 notes

·

View notes

Text

but still I keep your hand, as a precious souvenir...

#em draws stuff#oc time again hehe#haunted by your hand#the gambler: james webster#the highwayman: kate heriot#remember that 'what should I draw' poll? well girl soup won so here is Girl Soup as you so politely requested.#feel like I ought to tag this for Something but for the life of me I do not know What.#time to say a little context also. for I fear that this needs context.#james's entire Deal is a bit 'sad old bartender with a dead wife in the walls somewhere' except that she's not particularly sad or old#and the wife in question is not precisely in the walls so much as being preserved in alcohol in a barrel in the basement#'but what else are you Supposed to do after you've stolen your ladylove's corpse and turned her hand into a sorcerous artifact?#just bury her? well that would be both a difficulty and a waste wouldn't it. better to keep her close. right here. right here.'#so you see james's thought process on this one. and if she's drinking a little of what's in that vat of dead girl juice what's the problem.#...I realize now that I'm not ever sure I Said what the haunted by your hand storyline was out loud on the website before.#so if this was a sudden bucketload of information then. well. do not know what to say beyond That's Just How It Is.#aaaaand caption lyrics from tom lehrer's 'i hold your hand in mine' since I am still finding room to get a little silly with it around here

26 notes

·

View notes

Text

I was supposed to talk about Lustrum hours processing once upon a time, wasn't I?

#*brainpower seeping into the negatives*#tldr hours are actually an element so dense its metaphysically inverted itself.#you separate the rough ore by magnetic proerties and then send that mineral into large vats of water#and the vats give off O2 gas as the hours bond with H and form crystals and thats how you get refined hours#sskies#hire me failbetter#just googled and apparently K burns purple so im on the right track Hours are just some stupid high-density d shell element#Okay now im putting too much thought into it but Al and K burn purple so what if we pretended Hours was something like fucked up carbon#no no oxygen. so you have something like (K#(K-Hour) CH CO3 so its volatile and itll burn and its a magic stupid mineral with a magic stupid endmember with purple burning k#so the mineral you DONT want is K and they burn that and then send hours to be processed#ITS SO LATE. WHY AM I THINKING ABOUT THIS

4 notes

·

View notes

Text

#internal audit#audit firms in uae#business services#Best internal audit outsourcing services#Internal audit services for free zones in UAE#Internal auditing for VAT compliance in UAE#Internal audit process for financial institutions in UAE#Internal Audit & Risk Management in the UAE#Internal audit services for healthcare companies#Customized Internal Audit Services for Startups#How Internal Audits Shape Government Agencies#Internal audit consulting services for corporate governance#Internal Audit Checklist for UAE Businesses

0 notes

Text

How to Register for VAT in the UK: Process, Benefits & HMRC Guidelines

How to Register for VAT & Why VAT Registration Matters

As your business grows, staying compliant with tax regulations becomes increasingly important. One critical milestone is VAT registration. Whether you’re approaching the VAT threshold or planning ahead, understanding how to register for VAT, the registration process for VAT, and why it matters can help you avoid penalties and take full advantage of the benefits available to VAT-registered businesses.

In this detailed guide, brought to you by Regent Business Strategies, we’ll walk you through every aspect of VAT—from legal obligations to strategic advantages. We'll also provide guidance based on the latest HMRC guidelines, helping ensure your business stays on the right side of the law.

What is VAT?

VAT (Value Added Tax) is a consumption tax levied on most goods and services sold in the UK. Businesses collect VAT on behalf of HMRC, adding it to their sales and remitting it through regular VAT returns. It’s a vital component of the UK’s tax system and one that every business must understand as they scale.

Who Needs to Register for VAT?

A business must register for VAT if its taxable turnover exceeds the VAT threshold, which is £90,000 in a rolling 12-month period (as of 2024). It’s important to note that the threshold is not based on a calendar year but on any 12-month rolling period.

However, even if your business turnover is below the threshold, voluntary VAT registration may be beneficial. Voluntary registration allows you to reclaim VAT on expenses and can improve your business credibility—especially if you deal with other VAT-registered businesses.

Why VAT Registration Matters

VAT registration is not just about compliance. It also provides a range of strategic benefits that can support your business growth:

1. Legal Compliance

Failing to register once you cross the VAT threshold can lead to backdated VAT payments, penalties, and interest. Registering on time ensures compliance with HMRC guidelines.

2. Reclaim VAT on Purchases

Once registered, you can reclaim VAT paid on eligible business expenses, including goods, services, and some types of capital equipment. This can significantly reduce your overall costs.

3. Enhanced Business Credibility

A number for VAT on your invoices indicates a legitimate, established business. This can improve client confidence, especially if you’re working with other VAT-registered companies or government entities.

4. Eligibility for VAT Schemes

HMRC offers several VAT schemes tailored to different business needs. These schemes can simplify your accounting, reduce paperwork, and in some cases, reduce your VAT liability.

5. Greater Market Access

Certain contracts, particularly in the public sector or with large corporations, may require suppliers to be VAT-registered. Being registered gives you access to more opportunities.

The Registration Process for VAT

Registering for VAT is a structured process. Here’s a step-by-step guide to help you understand how to register for VAT in the UK:

Step 1: Assess Whether You Need to Register

Check if your total VAT-taxable turnover exceeds the VAT threshold of £90,000. If so, you must register within 30 days of reaching this threshold. You can also opt to register voluntarily below this threshold.

Step 2: Choose the Right VAT Scheme

Before registering, decide on the VAT scheme that best suits your business. The main schemes include:

Standard Accounting Scheme – Suitable for most businesses.

Flat Rate Scheme – Simplifies VAT by letting you pay a fixed percentage of your turnover.

Annual Accounting Scheme – Allows you to file one VAT return per year.

Cash Accounting Scheme – Useful for managing cash flow, as you only pay VAT when customers pay you.

Regent Business Strategies can help you evaluate which scheme works best for your situation.

Step 3: Register Online Through HMRC

Go to the official HMRC VAT registration page and complete the application. You’ll need:[ez-toc]

Business name and address

Details of your turnover

Business activities

National Insurance number (for sole traders)

Bank account details

If you’re unsure about any part of the registration process for VAT, Regent Business Strategies offers expert guidance every step of the way.

Step 4: Receive Your VAT Registration Certificate

After successfully applying, HMRC will send you a VAT registration certificate. This document confirms your number for VAT, the effective date of registration, and when to submit your first VAT return.

This certificate is typically issued within 30 working days, though delays can occur. Once you receive your VAT number, you must:

Add VAT to your invoices

Show your VAT number on invoices and receipts

Submit your VAT returns regularly

Post-Registration Responsibilities

VAT registration comes with ongoing obligations. Here’s what you’ll need to do:

1. Submit VAT Returns

You must file VAT returns—usually quarterly—detailing the VAT you’ve collected and paid. This can be done using HMRC's online services or through approved software.

2. Maintain Accurate Records

You’re required to keep detailed records of all sales, purchases, VAT invoices, and VAT returns for at least six years.

3. Pay VAT to HMRC

The amount you owe (or reclaim) is the difference between the VAT you charge your customers and the VAT you pay on purchases.

4. Stay Up to Date

Tax laws and HMRC guidelines can change. Working with an advisory firm like Regent Business Strategies ensures you stay compliant and take advantage of any changes that benefit your business.

Frequently Asked Questions

Can I Register Before Reaching the VAT Threshold?

Yes. Voluntary VAT registration is allowed and may be beneficial depending on your customer base and costs.

What Happens if I Don’t Register on Time?

You could face financial penalties, backdated VAT bills, and potential interest charges from HMRC.

How Do I Cancel My VAT Registration?

If your business turnover falls below the deregistration threshold, or if you close your business, you can apply to cancel your VAT registration through your HMRC account.

Final Thoughts

Understanding how and when to register for VAT is essential for any growing UK business. Beyond compliance, VAT registration provides financial advantages, improves business reputation, and creates new opportunities.

At Regent Business Strategies, we specialize in guiding businesses through the registration process for VAT, helping you understand your obligations and choose the best VAT scheme for your needs. From applying for your VAT registration certificate to managing returns, our expert team ensures you stay compliant and informed.

Need Help with VAT Registration?

Don’t let VAT complexity slow down your business growth. Contact Regent Business Strategies today for personalized support with VAT registration, financial planning, and ongoing tax compliance.

#registration process for VAT#VAT registration#HMRC guidelines#VAT scheme#VAT registration certificate#number for VAT#Regent Business Strategies

1 note

·

View note

Text

How to Register for Excise Tax in UAE – Step-by-Step Process

How to Register for Excise Tax in UAE – Step-by-Step Process

Excise tax registration in UAE is required for any business that imports, produces or stockpiles excise goods, or releases them from a designated zone. An excise tax registration service in UAE needs to be done as per the law of the UAE. Unicorn Global Solutions Auditing is offering the best and most timely excise tax registration services in UAE.

Excise tax registration in the United Arab Emirates (UAE) is the process by which businesses or individuals engaged in certain activities or selling certain products are registered with the Federal Tax Authority (FTA) and are required to pay excise tax on those products. Excise tax is levied on goods harmful to public health or the environment, such as tobacco, sugary drinks, and energy drinks.

Registered businesses must file excise tax returns regularly and pay the tax due on their excise goods. Failure to register or pay the tax can result in penalties and fines by the FTA. Our Excise Tax Consultants in UAE help you register, audit, and file your tax returns effectively with 100% compliance through expert advisory services.

Who is Required to Register for Excise Tax?

Businesses engaging in the following activities must register for excise tax:

Importing excise goods into the UAE

Producing excise goods for consumption in the UAE

Stockpiling excise goods

Warehouse keepers or those overseeing designated excise zones

The FTA offers guidance, but it is the business's responsibility to ensure compliance. The FTA can conduct audits and impose penalties for non-compliance.

Exemptions for Excise Tax Registration

Businesses that do not import excise goods regularly may qualify for exemption. To qualify, you must prove that excise goods are imported:

Only once every six months

Or less than four times in twenty-four months

Even with exemption, excise tax may still be due if goods exceed the duty-free threshold.

Documents Required for Excise Tax Registration in UAE

Prepare the following documents for excise tax registration in UAE:

Emirates ID of owner, top management, and manager

Trade license

Declaration of Incorporation (if applicable)

Authorized signatures

Passports of owner, manager, and senior management

Articles of Association / Partnership Agreement (if applicable)

Bank account details

Customs number (if applicable)

Company information and purpose of excise registration (producer, importer, etc.)

TRN if registered in another GCC country

Details of excise goods handled

Customs Authority registration (if applicable)

What Are Excise Tax Rates in UAE?

Excise Tax ProductsExcise Tax RateTobacco Products100%Energy Drinks100%Carbonated Drinks50%

Since December 2019, excise tax also applies to:

Electronic smoking devices or tools

Liquids used in these devices

Sweetened drinks

How Does Excise Tax Affect Consumers?

Excise tax increases product prices, though not always by the full amount of the tax. The cost is shared between producers and consumers, depending on the supply and demand elasticity of the product.

How to Register for Excise Tax in UAE?

Steps to register:

Create an e-Services account on the FTA website

Sign up with username and password

Verify your email within 24 hours

Log in to the e-Services account

Click "Register for Excise Tax"

Complete all mandatory fields (*)

Click "Submit for Approval"

Deadline for Excise Tax Registration in UAE

There is no specific deadline. Businesses must register before engaging in excise-related activities.

Why Is Excise Tax Imposed in UAE?

The UAE government imposes excise tax to discourage the consumption of harmful goods and generate revenue for public services.

Excise Tax Registration Services

Unicorn Global Solutions Auditing supports you throughout the excise tax registration process in the UAE. We also offer VAT registration, auditing, accounting & bookkeeping, business consultancy, and tax compliance services — covering all aspects of excise tax services in UAE.

#Unicorn Global Solutions Auditing supports you throughout the excise tax registration process in the UAE. We also offer VAT registration#auditing#accounting & bookkeeping#business consultancy#and tax compliance services — covering all aspects of excise tax services in UAE.

0 notes

Text

If you are running a business in Dubai, understanding the VAT registration process is necessary. VAT is a government-imposed tax on goods and services, and businesses that meet certain revenue criteria must register for it.

#vat registration services dubai#vat accounting services#vat tax accounting#vat services dubai#vat in uae#vat services in dubai#tax residence certificate#tax certificate uae#tax consultant uae#tax consultant in dubai#tax registration#VAT registration process in uae#corporate tax consultant in dubai#corporate tax consultants dubai#dubai corporate tax consultants#registration VAT#vat registration

0 notes

Text

Debunking business loan myths

There can be a lot of confusion around business loans - what's available, who business loans are for, when you can apply for them, when you can't, and so forth.

Perhaps the most confusing thing for any business owner is who to trust - how do you find a reputable lender if you're not going to a high street bank – keeping in mind that high street banks don't generally offer businesses the kind of funding they need, like working capital loans?

Usually, the result is word of mouth - a recommendation from someone you know, or perhaps you liaise with a broker who introduces you to a lender like Rivers. In this article we look to help you make the best decision for you and your business by debunking a few of the common myths we have heard on the grapevine.

If you would like to speak to us about whether a Rivers business loan is right for you, contact us or check your eligibility, including possible repayment amounts using the online business loan calculator at the bottom of our homepage.

Read full blog - https://www.riversfunding.com/news/debunking-business-loan-myths

#Business finance#Business growth funding#Business loan calculator uk#Business finance loans#Business loan finance#Business loans#Cash flow solutions for smes#Medium term Business loans#Short term Business loans#Small Business loans#Unsecured Business loans#Vat funding for Businesses#Working capital loans#Trusted lender transparent fees#Cash flow loans#Affordable business loan renewal options#Small business loan renewal process#Easy business loan renewal in UK#Loans for Christmas marketing campaigns#Loans for Christmas stock#Loans for seasonal stock#Affordable loans with transparent fees#Affordable startup loans UK#Affordable loans for small businesses

0 notes

Text

Hire Professional HR Consultant for the Best Company Set Up Service in Dubai

An experienced and competent HR team offers the best help for the company set up in dubai. The HR team is well-versed with all the best practices and methods that support business setup. Moreover, the HR team performs other major roles efficiently.

Every company needs an HR consultant to ensure smooth performance and management. You can hire the best and most experienced HR consultant to meet your business needs at our company if you are ready to acquire the best HR consultant, why look here and there when our company provides the best assistance for the freezone company setup dubai.

Freezone company set-up is challenging work. However, if you want to set up your Freezone company and are looking for a professional HR consultant for the best assistance, Then our company is the right choice. Our HR team provides complete information and informs you about all the rules and regulations so that you do not face any legal issues in the future.

Freezone Company set in dubai is a type of business where the the business has complete foreign ownership. There is no local partner. Hence, if you want our help with the Freezone company setup in dubai, our team will provide the best service.

There are several benefits of hiring an HR consultant for the business. It saves you from the recruitment process and also reduces your cost. Our HR consultants are well-versed with all the latest trends and business updates and ensure that they provide the best service to all clients. You can dig more about our service through our site. Contact us when you are looking for the professional assistance for the company set up dubai.

We understand that every business has unique needs. Hence, our HR team offers tailor-made solutions and ensures all clients receive the best assistance. We provide the best assistance if you need our professional and experienced HR for management, recruitment, admin management work, or payroll. Our HR consultants are highly skilled and qualified to offer the best service. You can rely on our company every time you search for the best HR consultant for your company.

#company set up dubai#Freezone company setup dubai#Offshore Company Setup#Corporate & Personal Bank Account Opening#Golden Visa Process Dubai#Golden Visa Real Estate Dubai#Freelance Visa Dubai#Property Golden Visa Dubai#HR Services in Dubai#Medical Insurance Dubai#Equivalency Certificate Dubai#PRO Service Dubai#Cyber Security Services Dubai#Corporate Tax Filing & VAT Returns Filing#Company Incorporation Dubai

1 note

·

View note

Text

What are the Key Steps Involved in VAT Registration?

What is VAT Registration?

Value Added Tax (VAT) registration is a mandatory requirement for businesses exceeding a specified turnover threshold in many countries worldwide. It involves formalizing your business with tax authorities to collect VAT on behalf of the government.

Understanding VAT Registration

Navigating the Vat Registration Process In UAE can be crucial for businesses aiming to comply with tax regulations and expand their operations. Understanding the steps involved ensures smooth compliance and avoids potential penalties. Here’s a comprehensive guide on how to proceed with VAT registration.

Who Needs to Register for VAT?

Businesses that surpass the predefined turnover threshold within a designated period must register for VAT. It applies to both local and international transactions, impacting various industries and business sizes.

Key Benefits of VAT Registration

Compliance: Avoid legal issues and penalties by adhering to VAT regulations.

Business Credibility: Enhance your reputation and credibility with customers and suppliers.

Input Tax Recovery: Reclaim VAT paid on business expenses, reducing overall tax liability.

Market Expansion: Facilitate trading within the VAT system, both domestically and internationally.

Steps to VAT Registration

Preparing for VAT Registration

Before initiating the registration process, gather essential documents such as business incorporation certificates, proof of address, and financial statements. Ensure your business structure and operations align with VAT requirements.

Submission of Application

Complete the VAT registration application accurately, providing all required information. This includes business details, turnover figures, and supporting documentation. Submit the application through the designated tax authority's online portal or office.

Verification and Processing

Tax authorities verify the submitted information and may conduct additional checks. This process ensures accuracy and compliance with VAT regulations. Be prepared to respond to any queries or requests for further documentation promptly.

Issuance of VAT Registration Certificate

Upon successful verification, the tax authority issues a VAT registration certificate. This document confirms your legal obligation to collect VAT and enables you to issue VAT invoices to customers.

Conclusion

Navigating the VAT registration process is essential for businesses aiming to operate legally and efficiently within their respective markets. By understanding the steps involved—preparation, submission, verification, and certification—you can streamline your compliance efforts and focus on business growth. For expert assistance with VAT registration and compliance, contact us today to ensure your business meets its tax obligations effectively.

0 notes

Text

#vat registration requirements#vat registration process#top vat registration#vat registration process in uae#steps to register vat#vat registration in uae

0 notes

Text

Danny’s (Un)Deadly Detour

Danny Fenton should have known better.

Gotham was not a pit stop for casual road trips. It was the kind of city that screamed “keep driving,” especially for someone with Fenton Luck™. But he’d needed gas, a snack, and maybe a picture of Wayne Tower for Jazz. What he hadn’t needed? To get kidnapped by a clown on bath salts.

But here he was. Tied to a rickety metal chair in the middle of an abandoned amusement park, with cameras pointed at him from every angle. And the Joker—the actual Joker—was monologuing.

Again.

“…and this, my sweet little roaches of Gotham, is what happens when you wander into my city without a sense of humor!” the Joker cackled, his voice sharp and jittery as he zoomed in on Danny’s blank, deadpan face. “Let’s see what the Bat thinks of this fresh-faced nobody!”

Danny sighed. Loudly. “You know, if you’re gonna monologue, can I at least get popcorn? By the way the name is Danny.”

“Rude!” the Joker snapped, flinging a pie at him. Danny let it hit. Custard wasn’t the weirdest thing he’d dealt with today.

But the worst was yet to come.

Joker danced over to a second chair—this one wheeled in by a henchman—and with dramatic flair, yanked the bag off the second hostage.

It was Robin.

Not Nightwing, not Red Hood—nope, the angriest of them all. The one with the sword that had to be taught not to kill.

Robin’s sword was gone, but the glare on his face could cut through steel. “You will regret this,” he snarled.

“Ohohoho!” Joker shrieked with glee. “Isn’t this just delicious! A no-name civilian and Gotham’s pint-sized prodigy! Let’s spice things up, shall we?”

He pulled a lever, and both chairs were suddenly suspended above a vat of glowing green chemicals.

Danny blinked. “You have to be kidding me. That’s actual toxic goo? Like, cliché supervillain-grade?”

“It’s authentic!” Joker sang. “You’re welcome!”

A signal light flashed. Batman was watching the stream.

“Here’s the game, Batsy,” Joker said to the camera, eyes manic. “You choose! Robin, your precious brat—or the poor, sweet innocent who made the mistake of existing in Gotham. Pick one to save. Or I drop them both.”

Robin scowled but said nothing. Batman’s voice came through a speaker—low, angry, calculating. He was trying to buy time. “Let them both go, Joker. This won’t end well for you.”

“Oh, I know, Bats,” Joker giggled. “That’s what makes it fun!”

Danny, meanwhile, had had enough. He rolled his shoulders slightly. The ropes weren’t great—they were tight, but not ghost-proof. And he really didn’t want to risk Robin getting hurt.

Danny exhaled. “Welp. Time to Fenton this up.”

Before anyone could stop him, he broke free of his restraints with a loud snap, flipped forward—and let himself fall into the vat of chemicals.

“DANNY!” Robin shouted, jerking in his bonds.

Even the Joker stared in stunned silence. “Did… did he just—did he really—?”

Batman’s voice cut in, alarmed. “No!”

The vat bubbled.

The camera zoomed in.

The feed went black.

Joker didn’t have long to process the shock. A cold wind whooshed through the funhouse, flickering lights and rattling metal. The shadows stretched too long, too thin.

“Wha—what is this?!” he hissed, looking around. “Where’s my laugh track?!”

Then, behind him: a voice.

“I died,” it said, whispery and echoing, “because of you.”

The Joker spun—and froze.

Floating in midair, eyes glowing toxic green, was a white-haired, fanged apparition. Phantom. Danny. And he looked pissed.

“You killed me,” Danny intoned, letting the lights flicker with every word. “You wanted a show. I hope you enjoyed it.”

Joker stumbled backward, babbling nonsense. “N-no—this isn’t—there’s no such thing as ghosts—!”

Danny opened his mouth and let out a low, haunting wail—enough to shake the floorboards and rattle the Joker’s bones.

The clown's eyes rolled up into his head, and with a pitiful whimper, he collapsed in a heap.

…and soiled himself.

Five minutes later, Batman burst in through the skylight. Robin was already free, sword in hand, glaring down at the unconscious Joker.

“What happened?” Batman demanded.

Robin looked up. “He jumped in. Broke the feed. Then came back as a ghost and scared Joker into unconsciousness.”

Danny floated down behind them and shrugged. “It was either that or listen to another twenty minutes of his monologue. No offense, but your rogue gallery sucks.”

Batman stared at him.

“…You’re a ghost.”

Danny gave a lazy salute. “Half ghost, technically. Long story. Want some popcorn?”

Robin, for the record, was still annoyed. “You could have warned me before pretending to die in front of me!”

Danny grinned. “Where’s the fun in that?”

Moral of the story: Never road trip through Gotham. Especially not with Fenton luck.

#dpxdc#danny fenton#danny phantom#batman#damian wayne#dc joker#joker is a joke#danny fenton is a little shit#Fenton luck

1K notes

·

View notes

Text

#business#auditing services#audit firms in uae#strategy#Best internal audit outsourcing services#Internal audit services for free zones in UAE#Internal auditing for VAT compliance in UAE#Internal audit process for financial institutions in UAE#Internal Audit & Risk Management in the UAE#Internal audit services for healthcare companies#Customized Internal Audit Services for Startups#How Internal Audits Shape Government Agencies#Internal audit consulting services for corporate governance#Internal Audit Checklist for UAE Businesses

1 note

·

View note

Text

Understanding UAE VAT Registration: A Comprehensive Guide

A Tax Audit, or VAT audit, is a government assessment of a company's compliance with tax laws to ensure accurate VAT liability by examining maintained records and adherence to tax regulations.

0 notes

Text

SHOPIFY STORE GRAND OPENING!

Finally!! Finally after a lot of set up and time my Shopify is LIVE!!!!!

After fighting with Etsy for a long time after my shop was hacked a few months ago, I figured I would finally buckle down and open up my own store so I can have some more control over everything! I'm still in the process of getting out back ordered pins from Etsy, so if you have an order waiting there rest assured it will be sorted out within the next week, (and I might still use it for international orders because it takes care of all of the customs/VAT/etc that I know nothing about,) but in the meantime!!!

To celebrate my shop being open, I'm running a sale!

Everything in store is 25% off for the first week of being open!!

For the time being, while I'm figuring everything out, the store is only available in the US - I do apologize for that! If I can figure out how to use customs/international shipping on Shopify without too many problems and hiccups then I'll do so, but regardless whenever that update happens another sale will run!

Here's to a (hopefully) smoother process and better shop experience for everyone involved!

#shop#Shopify#enamel pins#pride pins#cats#kitty#shopify enamel pins#enamel pin store#etsy#pokemon#pkmn#eevee#eeveelutions#spamton#deltarune#spamton g spamton#etsy seller

2K notes

·

View notes