#VWAP indicator

Explore tagged Tumblr posts

Text

Swing trading is a dynamic and popular trading strategy that sits between the realms of day trading and trend trading. This approach involves capturing short-to-medium-term price swings within an overall trend. Unlike day trading, swing traders hold their positions for more than one trading session, aiming to capitalise on short term market movements. This strategy offers benefits such as flexibility and the potential for significant returns, but it also comes with limitations and requires a strategic approach. Exploring the nuances of swing trading provides insights into its meaning, advantages, and inherent challenges in navigating the financial markets.

0 notes

Text

Volume Weighted Average Price (VWAP) in Trading

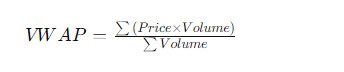

The VWAP indicator stands for Volume Weighted Average Price and is used by traders across the globe to analyse the average price of the security over a period of time taking into account both its price and volume.

Read Full Article: What is VWAP (volume-weighted average price) in trading?

0 notes

Text

VWAP

Unlocking Trading Strategies with VWAP Indicator: A Comprehensive Guide Are you an aspiring trader looking to navigate the complex world of financial markets with precision and confidence? Or perhaps you’re a seasoned investor seeking to enhance your trading strategies with advanced tools? Whatever your level of expertise, understanding the VWAP (Volume Weighted Average Price) indicator can be…

View On WordPress

#day trading#Financial Markets#learn technical analysis#Market Sentiment#stock markets#Support and Resistance#swing trading#technical analysis#Trading Strategies#trading tools#Trend Identification#Volume Weighted Average Price#VWAP#VWAP bands#VWAP crossovers#VWAP indicator

0 notes

Text

VWAP vs Moving Averages Compare VWAP with moving averages to determine the best indicator for your trading style. Understand key differences in strategies. Learn more: https://brokeragetoday.com/vwap-indicator/ #VWAPvsMA #TradingComparison

0 notes

Text

Master The Art Of Day Trading With ICFM’s Expert-Led Intraday Trading Course For Profitable Market Execution Skills

Learn Profitable Day Trading With Intraday Trading Course Only At ICFM Stock Market Institute In Delhi NCR

Intraday trading has become one of the most dynamic and high-potential ways to make money from the financial markets. For those interested in short-term market movements, mastering the art of quick trade entries and exits can generate consistent returns. The best way to build such skill is by enrolling in a specialized intraday trading course, and ICFM - Stock Market Institute is the only institute offering a result-oriented, practical, and live market-based intraday trading course in Delhi NCR. Designed for beginners and intermediate traders alike, the intraday trading course at ICFM trains students in the strategies, tools, and psychology required to profit in intraday setups. From identifying trade opportunities using technical indicators to executing trades with precision, this course builds confidence and discipline. The intraday trading course combines chart reading, live demonstrations, and mentorship that helps every learner succeed in volatile market conditions, especially in equity, futures, and options.

Learn Real-Time Strategy Building With ICFM Intraday Trading Course For Fast-Paced Market Movements

ICFM’s intraday trading course focuses on empowering traders with the skill to take quick and informed decisions. Students learn to analyze 5-minute, 15-minute, and 30-minute charts using powerful indicators like VWAP, RSI, MACD, Supertrend, and Moving Averages. The course trains learners on how to read price action, spot breakout patterns, and predict reversals. More importantly, students are taught to differentiate between false signals and valid setups to avoid unnecessary losses. The intraday trading course also covers order types such as market, limit, stop-loss, and bracket orders, making execution smoother during high-volatility sessions. ICFM’s training includes real-time strategy building, where students plan their trades in the live market and receive expert feedback on entry and exit timing. Through simulated sessions and market practice, learners build confidence in making independent trades using setups taught in the intraday trading course. ICFM ensures that students don’t just learn theory but build habits that reflect in actual trading performance.

Get Mentored By Market Professionals During ICFM Intraday Trading Course With Live Terminal Access

What makes the intraday trading course by ICFM more valuable than others is the level of real market exposure it offers. Every class is conducted by market professionals who trade daily and understand intraday dynamics deeply. These mentors guide students through the entire trade planning process—from stock selection and chart analysis to risk calculation and position sizing. The intraday trading course provides access to live market terminals, demo accounts, and tools like TradingView, Zerodha Kite, and live NSE/BSE feeds. With this, learners get to experience the stress, speed, and decision-making conditions of real trading. Students execute trades under supervision, review their performance, and refine their approach every day. This level of engagement and feedback makes ICFM’s intraday trading course the most practical and transformation-oriented training available in India today. Instead of just watching tutorials, students get real coaching in a market environment.

Build Career And Trading Confidence With Certified Intraday Trading Course From ICFM Institute In Delhi

Completing the intraday trading course from ICFM gives students not just market skills but also career credentials. After the course, students receive a recognized certification that validates their training in intraday trading. This certificate is useful for applying to broking firms, prop trading desks, investment advisory roles, and portfolio management companies. Moreover, many ICFM students use the skills gained from the intraday trading course to start their own trading journey from home. The course includes risk management lessons, capital protection techniques, and money management rules that are essential for long-term survival in day trading. Students are also taught how to handle emotions, stick to rules, and build trade journals—practices followed by professional traders. This means ICFM’s intraday trading course not only teaches how to make money but also how to keep it safe. It turns average learners into disciplined traders with a serious approach to markets.

Choose ICFM Intraday Trading Course For Most Affordable, Practical And Career-Ready Stock Market Training In India

ICFM’s intraday trading course is not only professional and practical but also affordable. The course fee is structured in a way that every aspiring trader can access top-quality training without financial burden. All tools, resources, live classes, recordings, and certification are included. Students get lifetime access to course content, market updates, and can also attend future revision sessions without additional cost. ICFM ensures that each student receives the same quality of support whether they attend the course online or at the Delhi campus. The intraday trading course can be completed in a flexible schedule, with weekend and weekday batches available. With structured content, expert mentors, and a learner-first approach, ICFM has created a training environment that is unmatched in the industry. For those who want serious success in stock market trading, choosing the intraday trading course from ICFM is a wise and rewarding decision.

Enroll Today In Intraday Trading Course And Take Control Of Your Trading Future With ICFM Institute

The stock market is filled with opportunity, but success requires the right training, discipline, and guidance. ICFM’s intraday trading course is built for those who want to enter the market with skill and confidence. Whether you are a beginner, a student after 12th, a working professional, or a trader struggling with consistency—this course can change your market experience. You’ll learn how to read charts, identify trades, manage risk, and build a repeatable intraday strategy. With hands-on learning, live mentorship, and certification, the intraday trading course becomes your launchpad to a profitable trading future. Thousands of ICFM students have already created success stories by applying what they learned, and now it’s your turn. Take the first step toward disciplined, informed, and strategic trading by joining the intraday trading course exclusively at ICFM - Stock Market Institute. Your trading journey starts with the right training—and ICFM provides exactly that.

#education#stock market#stock market course in delhi#share market#stock market course#financial#stock market courses#trading strategies#marketing#finance

0 notes

Text

What are some successful intraday trading strategies that can help traders make consistent profits in volatile markets?

Successful intraday trading strategies rely on quick decision-making, technical precision, and disciplined risk management. One popular strategy is breakout trading, where traders identify key support and resistance levels and act when the price breaks through with volume confirmation. Another is momentum trading, which focuses on stocks showing strong price movements and volume trends. Scalping, involving multiple small trades throughout the day, can also be profitable for those with high-speed execution tools. Traders often use technical indicators like VWAP, RSI, MACD, and moving averages to guide their entries and exits. Proper stop-loss placement, risk-reward ratio maintenance, and avoiding emotional trades are key to success. Intraday trading isn’t just fast-paced—it demands a clear strategy and constant market awareness.

Want to build your skills with proven techniques? Join the Successful Intraday Trading Strategies course at Stock Learning. Stock Learning – where sharp traders are trained. Enroll today and trade smarter!

0 notes

Text

10 Essential Things to Know About VWAP Moving Average in Forex Trading

The VWAP moving average is essential for Forex traders to identify trends, support/resistance levels and improve trading strategies. The VWAP moving average, or Volume Weighted Average Price, is a powerful tool for Forex traders. It helps them understand the average price at which a currency pair has traded throughout the day, based on both volume and price. This makes it a crucial indicator for…

0 notes

Text

pro scalper indicator script free download

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

Top Free Intraday Indicators for Quality Buy and Sell Signals

Here are some of the most widely used and trusted free indicators that intraday traders use to generate buy and sell signals.

1. VWAP (Volume Weighted Average Price)

Type: Price + Volume Indicator Best For: Institutional-level price zones and intraday support/resistance

VWAP calculates the average price of an asset throughout the day, adjusted for volume. It helps identify where most of the volume is concentrated and provides insight into whether buyers or sellers have control.

Price above VWAP: Indicates buying pressure

Price below VWAP: Indicates selling pressure

Use Case Example: If a stock is trading below VWAP all morning and then breaks above with volume, this can be a high-probability buy signal—especially during a reversal session.

2. Supertrend

Type: Trend-Following Indicator Best For: Simplified trend direction and buy/sell triggers

Supertrend is plotted on the price chart and flips between green (bullish) and red (bearish) zones. It uses Average True Range (ATR) to adjust for volatility.

Green line below price: Bullish (buy signal)

Red line above price: Bearish (sell signal)

Use Case Example: On a 5-minute chart, a flip from red to green with price closing above the Supertrend can be a potential long entry, especially if supported by momentum.

3. Relative Strength Index (RSI)

Type: Momentum Oscillator Best For: Overbought and oversold identification

RSI measures how quickly and extensively a price has moved in a short time. The values range from 0 to 100.

Below 30: Asset may be oversold (buy signal)

Above 70: Asset may be overbought (sell signal)

Use Case Example: In a flat market, RSI dropping below 30 and turning upward can suggest a short-term buy opportunity, especially when confirmed by price action near support.

4. MACD (Moving Average Convergence Divergence)

Type: Trend + Momentum Indicator Best For: Trend reversals and momentum confirmation

MACD consists of two lines—the MACD line and the signal line. Crossovers between these lines indicate potential trading opportunities.

MACD line crosses above signal line: Bullish (buy signal)

MACD line crosses below signal line: Bearish (sell signal)

Use Case Example: On a 15-minute chart, if the MACD line crosses above the signal line after a pullback, it may confirm a bullish continuation.

5. Bollinger Bands

Type: Volatility Indicator Best For: Mean-reversion and breakout signals

Bollinger Bands consist of three lines: a simple moving average (middle band), and two outer bands that adjust based on price volatility.

Price touching the lower band: Potential bounce (buy setup)

Price touching the upper band: Possible reversal (sell setup)

Use Case Example: If price contracts into a narrow range (bands squeeze) and then breaks out on high volume, this can signal a strong intraday buy or sell breakout.

6. Stochastic Oscillator

Type: Momentum Indicator Best For: Reversal zones in choppy markets

Stochastic compares the current closing price to the price range over a recent period.

Below 20: Oversold (buy signal potential)

Above 80: Overbought (sell signal potential)

Use Case Example: In a range-bound market, a crossover from below 20 to above, combined with a bullish candlestick pattern, may signal a short-term buy trade.

Combining Free Indicators for Stronger Setups

Rather than relying on one tool, the most effective approach is to combine 2–3 non-correlated indicators to validate signals.

Example Intraday Setup (5-Minute Timeframe):

VWAP: Price must be above VWAP (buy bias)

Supertrend: Indicator must be green

RSI: Should be between 50–70 for confirmation of upward momentum

Entry Rule: When all three conditions align, place a buy order on a pullback or breakout.

Exit Rule: Close position when RSI approaches 70–75 or price drops below VWAP.

Why These Indicators Are Free (and Still Valuable)

You might wonder—if they’re free, are they really good?

Yes, and here’s why:

Public domain math: Most indicators are based on formulas developed decades ago, which are no longer under license restrictions.

Built-in on most platforms: Modern trading platforms like MetaTrader, TradingView, and Thinkorswim offer these tools by default.

Widely tested: Since these tools are open to all, they’ve been studied and applied across millions of charts, helping traders refine their use.

Free doesn’t mean ineffective—it means accessible.

Tips for Using Intraday Indicators Responsibly

To maximize the usefulness of these tools:

Avoid overloading your chart. Stick to 2–3 indicators that complement each other.

Always use stop-loss orders. Indicators can fail—protect your capital.

Avoid trading solely on indicator signals. Always confirm with price action and volume.

Backtest before going live. Use past data to see how your setup performs across different market conditions.

Keep a trading journal. Track what indicators worked and when they failed to improve future decisions.

Things No Indicator Can Predict

Sudden market-moving news (earnings, geopolitical events)

Emotional behavior of crowds (panic selling, FOMO buying)

Flash crashes or order book imbalances

That’s why risk management and strategy discipline are even more important than the indicators themselves.

Platforms That Offer These Indicators for Free

You don’t need expensive software to use these tools. Some of the most user-friendly platforms include:

TradingView (freemium model with access to almost all popular indicators)

MetaTrader 4/5 (MT4/MT5) (free for most brokers)

Thinkorswim by TD Ameritrade (free for account holders)

Investing.com chart tools (web-based and accessible)

Final Thoughts: Consistency Over Certainty

While no indicator can promise 100% accuracy, using well-tested, free tools like VWAP, RSI, MACD, and Supertrend in combination with smart trade planning can significantly improve your intraday performance.

Indicators are not magic signals. They are guidance tools—and their effectiveness depends entirely on how consistently and wisely you apply them.

Key takeaways:

Avoid looking for a “holy grail.” Instead, aim for consistency.

Learn your indicators inside-out—know when they work and when they don’t.

Respect the market. Use indicators as a map, not as a guarantee.

By developing your skills and combining indicators with risk management, you can build a responsible and potentially profitable intraday trading strategy—even without spending a dime on tools.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex education#forex market#forex factory#forex online trading#forex news#forex ea#forex broker#forex

0 notes

Text

Why Are These TradingView Indicators Trending Among Nifty Intraday Traders in 2025?

For Nifty intraday traders on TradingView, the daily fair-value benchmark is via VWAP. These are tools that are trending, according to the title of this blog, and with a focus on how you can use VWAP to back up and confirm market sentiment – bullish above and bearish below. VWAP with volume validates trades on 15min charts,and custom scrips allow to extend the view to a multi-sessions analysis. VWAP is also integrated into platforms such as Quantzee where traders get the real time view, improving indicator Nifty intraday trading strategies. It is used by traders as a trailing stop to prevent consistent loses and keep their profits from the fast Nifty 50 index.

0 notes

Text

In the dynamic world of financial markets, traders constantly seek tools and indicators to enhance their decision-making process and improve their chances of profitability. One such tool that has gained significant popularity among traders is the VWAP indicator (Volume weighted average price indicator). In this blog, we’ll find out what VWAP is, how it works, and how traders can effectively utilise it in their trading strategies.

0 notes

Text

Which indicators work best for Nifty & Bank Nifty intraday trading?

Curious about the best indicators for Nifty and Bank Nifty intraday trading? Key tools like Moving Averages, RSI, MACD, VWAP, and Bollinger Bands can help identify trends, reversals, and entry/exit points. Combine these indicators with price action and volume analysis for higher accuracy. Keep your strategy simple and avoid indicator overload. Focus on real-time data and set stop-loss levels to manage risk effectively. Want to improve your intraday trading performance? Learn how to use these powerful indicators and start making smarter, faster decisions in Nifty and Bank Nifty today!

0 notes

Text

Tick Trading Strategies Mastered with ICFM - Learn Real-Time Profitable Techniques from Market Experts

Discover the powerful dynamics of tick trading from ICFM - Stock Market Institute

Tick trading is a high-frequency trading method that captures profit from every tiny movement in a stock's price. It involves monitoring each tick—or the smallest upward or downward movement in price—and executing trades accordingly. Unlike swing or position trading, tick trading demands minute-by-minute market attention, lightning-fast decision-making, and a deep understanding of price momentum. ICFM - Stock Market Institute, one of India’s most reputed financial training platforms, offers a specialized tick trading course that delivers expert knowledge to aspiring traders who want to dominate short-term markets. The institute’s focus is on live market exposure, enabling students to understand tick trading in real time rather than just theory.

How ICFM’s tick trading course transforms beginners into fast-paced decision-makers

The tick trading course by ICFM - Stock Market Institute is not a generic program; it is curated to help traders thrive in volatile, fast-moving environments. Students are trained in reading tick charts, interpreting real-time price actions, identifying immediate trends, and executing trades in milliseconds. Every module is integrated with practical tools and platforms that mirror institutional trading setups. With direct access to industry mentors, learners gain insight into actual tick trading strategies used by professionals. The teaching methodology is interactive and immersive, giving learners the real feel of a trading desk. Over time, students build confidence to spot trends, make quick entries and exits, and protect capital while pursuing profits through tick trading.

Why ICFM is the only place to master practical and real-world tick trading

While many institutes offer generic trading courses, only ICFM - Stock Market Institute goes deep into tick trading, teaching the method as a specialized discipline. The faculty includes traders with actual market exposure who share not just theoretical knowledge but practical trading rules and tactics. The tick trading training includes hands-on software usage, live terminal operations, and in-depth analysis of tick-by-tick price movements. Students learn about order book reading, volume shifts, liquidity pockets, and how to identify breakout moves before they unfold. With access to simulation tools and real market conditions, learners develop the reflexes and decision-making speed that are crucial to tick trading success. The course also includes personalized doubt-clearing sessions, practice assessments, and strategy development workshops.

Real market success begins with understanding tick trading the ICFM way

Tick trading requires laser focus and quick reflexes, as profits are gained in tiny, repeated bursts. At ICFM - Stock Market Institute, students are taught how to manage trades within seconds to minutes, optimize entry and exit points, and use the most responsive indicators. Concepts like VWAP, Level 2 Data, market sentiment, and time and sales data are used to fine-tune tick trading decisions. This kind of advanced education is rarely found in traditional stock market courses, which is why ICFM stands apart. The institute ensures that students develop not only knowledge but also the ability to apply tick trading in any market—be it uptrending, downtrending, or consolidating. Through repeated practice and expert supervision, students learn to convert micro price movements into consistent returns.

Learn precision trading by mastering tick data and real-time analytics at ICFM

ICFM’s tick trading program puts a strong emphasis on precision, where even a one-second delay can change the outcome of a trade. To support this, ICFM trains students using advanced charting software, professional-grade terminals, and simulated real-time environments. Participants learn how to trade using tick charts instead of time-based charts, which allows for higher clarity and faster decision-making. The tick trading approach at ICFM includes both manual scalping and algorithm-backed trade identification, helping learners to adapt their skills for both discretionary and automated strategies. Every trade is reviewed and analyzed for improvement, ensuring a progressive learning curve. By the end of the course, learners are equipped to engage in tick trading with high levels of precision and consistency.

Tick trading at ICFM ensures practical exposure, technical analysis, and risk management mastery

Tick trading is not just about identifying entry points—it’s also about managing exit strategy, handling emotions, and protecting capital. ICFM - Stock Market Institute incorporates all aspects of trading psychology and risk management into its tick trading modules. Trainees are taught to create stop-loss levels, identify fake breakouts, and implement risk-reward ratios that make sense in high-frequency situations. With daily practice, demo trading, and live market exposure, students internalize these rules and execute them with confidence. ICFM offers real-time mentoring so traders know what to do during volatile market hours. Whether it’s dealing with sudden spikes in volume or unexpected reversals, ICFM ensures its students remain composed and strategic while practicing tick trading.

Get industry-ready with ICFM's certified tick trading course and career development support

ICFM - Stock Market Institute’s tick trading course doesn’t just end with knowledge delivery. It includes certification that adds value to a trader’s professional credibility. The institute also guides students on how to use tick trading strategies to pursue proprietary trading jobs or start their own trading journey. Many ICFM students have successfully transitioned into full-time traders or analysts after completing the tick trading program. From basic theory to strategy execution and ongoing support, ICFM is committed to producing market-ready professionals who can confidently execute tick trading strategies in live markets.

#education#stock market#share market#stock market course in delhi#stock market course#financial#trading strategies#marketing

0 notes

Text

What are the most effective Nifty & Bank Nifty Trading Strategies & Methods for consistent profits?

Mastering Nifty & Bank Nifty Trading Strategies & Methods can help you capitalize on market volatility with precision. These indices offer high liquidity and movement, making them ideal for intraday and positional traders.

🔹 Learn breakout, momentum & reversal strategies 🔹 Apply technical indicators like VWAP, RSI, and Supertrend 🔹 Understand risk management and position sizing 🔹 Get insights from live market examples 🔹 Suitable for both beginners and experienced traders

🟥 Join Empirical Academy’s expert-led course and trade Nifty & Bank Nifty with confidence and strategy! 🟥

0 notes

Text

Scalping Indicator Pro MT4 free download

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

What Makes an Indicator Effective for Intraday Trading?

Intraday traders operate in fast-moving markets, so the indicators they rely on need to be:

Responsive: Able to adapt to rapid price changes.

Clear: Easy to interpret with minimal noise.

Compatible with lower timeframes: Such as 1-minute, 5-minute, and 15-minute charts.

Reliable for short-term signals: With a balance of momentum and trend-based data.

Supportive of risk management: To aid in placing stop-loss and take-profit levels.

It’s also important to remember that no indicator is foolproof. Indicators don’t predict the future; they offer a structured way to analyze the market and make informed decisions.

1. Relative Strength Index (RSI)

Type: Momentum Indicator

The Relative Strength Index (RSI) is one of the most widely used momentum indicators. It measures the speed and change of price movements over a specified period, typically 14 periods.

RSI ranges from 0 to 100:

Above 70: Overbought conditions (potential sell signal)

Below 30: Oversold conditions (potential buy signal)

How It Helps Intraday Traders:

RSI helps identify potential reversal points during intraday market swings.

It works best in sideways or range-bound markets.

Example:

If the RSI drops below 30 and starts rising, it could indicate a potential buy signal, especially when supported by a bullish candlestick pattern.

2. Supertrend Indicator

Type: Trend-Following Indicator

The Supertrend indicator is a simple but powerful tool that changes color depending on the trend.

Green line below price: Bullish trend (buy signal)

Red line above price: Bearish trend (sell signal)

It’s calculated using the Average True Range (ATR) and is very responsive to price changes.

Why It’s Great for Intraday Trading:

Provides easy-to-read buy/sell signals on charts.

Filters out noise and helps you stay on the right side of the market.

Example:

On a 5-minute chart, when Supertrend flips from red to green and the price closes above the indicator, a buy signal is generated. Conversely, a red Supertrend line appearing above the price can signal a short-selling opportunity.

3. Moving Average Convergence Divergence (MACD)

Type: Trend & Momentum Indicator

MACD uses two moving averages (typically 12 EMA and 26 EMA) to reveal momentum shifts and trend changes. It also includes a signal line (9 EMA of the MACD line).

Buy Signal: When MACD line crosses above the signal line

Sell Signal: When MACD line crosses below the signal line

Pros:

Useful in identifying divergence (early warning of reversals)

Strong in trend confirmation

Example:

If the MACD line crosses above the signal line on a 15-minute chart during a price breakout, it reinforces a bullish trade setup. Conversely, a downward crossover can signal a potential sell trade.

4. Volume Weighted Average Price (VWAP)

Type: Price-Based Indicator

VWAP represents the average price a security has traded at throughout the day, based on both volume and price.

Price above VWAP: Buying strength (potential long entry)

Price below VWAP: Selling strength (potential short entry)

Key Benefits:

Widely used by institutional traders

Helps identify high-probability trade zones

Example:

Suppose price crosses above the VWAP after being below it all morning. With rising volume, this could be a signal that institutional buyers are entering the market—making it a buy signal with limited downside risk.

5. Bollinger Bands

Type: Volatility Indicator

Bollinger Bands consist of a middle band (20-period SMA) and two outer bands based on standard deviation.

Price touching lower band: Potential buy zone (if supported by bullish momentum)

Price touching upper band: Potential sell zone (if showing reversal signals)

Best Use:

Effective for mean reversion strategies

Helps identify breakout setups when bands expand

Example:

A tight consolidation followed by a breakout above the upper band on high volume can generate a strong buy signal.

6. Stochastic Oscillator

Type: Momentum Oscillator

The Stochastic Oscillator compares the closing price to a range of prices over a selected period. It generates values between 0 and 100.

Above 80: Overbought (potential sell signal)

Below 20: Oversold (potential buy signal)

Why Intraday Traders Like It:

Excellent for short-term reversals

Works best in combination with trend filters

Example:

If the stochastic crosses from below 20 and moves upward, combined with a Supertrend flip to bullish, it may serve as a buy confirmation.

How to Combine Indicators for Stronger Signals

Relying on a single indicator may lead to false signals. That’s why many experienced intraday traders use a combination of tools. Here’s a reliable 3-indicator setup:

Intraday Strategy Example:

Timeframe: 5-minute chart

Indicators Used: Supertrend + RSI + VWAP

Buy Signal Criteria:

Supertrend turns green

RSI is above 50 but below 70

Price breaks above VWAP

Sell Signal Criteria:

Supertrend turns red

RSI is below 50 but above 30

Price falls below VWAP

This setup offers a balanced approach, combining trend, momentum, and volume-based price averages to filter out low-quality trades.

Risk Management Matters More Than Indicators

Regardless of which indicators you choose, risk management should always be your top priority. Here are some practical rules:

Use stop-loss orders based on volatility (e.g., using ATR)

Limit your position size to avoid large losses

Aim for a risk-to-reward ratio of at least 1:2

Avoid trading during extremely volatile news events unless you’re highly experienced

Even with the best tools, poor risk management can lead to significant losses.

Backtest Before You Go Live

Testing your strategy on historical data before applying it in live markets is crucial. This helps you:

Understand how often signals occur

Calculate your potential win rate

Refine entry and exit conditions

Use platforms like TradingView, MetaTrader 4, or Thinkorswim to perform your backtests.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex market#forex education#forex factory#forex online trading#forex broker#forex indicators#forex#crypto#forex ea#forex news

1 note

·

View note