#X-ray Radiation Detector

Explore tagged Tumblr posts

Text

North America X-ray Detectors Market to be Worth $1.48 Billion by 2032

Meticulous Research®—a leading market research company, published a research report titled, ‘North America X-ray Detectors Market by Product Type (FPD, CSI, GADOX, CR, CCD), FOV (Large, Medium, Small), Portability (Portable, Fix), System (New, Retrofit), and Application [Medical (Mammogram, Spine), Dental, Industrial, Veterinary] - Forecast to 2032.’

According to this latest publication from Meticulous Research®, the North America X-ray Detectors Market is projected to reach $1.48 billion by 2032, at a CAGR of 5.5% from 2025 to 2032. The growth of this market is driven by the growing geriatric population coupled with the rising prevalence of chronic diseases & respiratory infections, the rising demand for X-ray imaging in industrial & security markets, and the growing adoption of digital X-ray detectors. Furthermore, ongoing innovations in X-ray imaging systems are expected to offer significant market growth opportunities. However, the health hazards caused by radiation restrain the market’s growth.

Key Players:

The key players operating in the North America X-ray detectors market are Varex Imaging Corporation (U.S.), Trixell (France), Canon Inc. (Japan), Agfa-Gevaert N.V. (Belgium), Teledyne Technologies Incorporated (U.S.), Carestream Health, Inc. (U.S.), Konica Minolta, Inc. (Japan), Rayence (U.S.), Vieworks Co., Ltd (Republic of Korea), Hamamatsu Photonics K.K. (Japan), Analogic Corporation (U.S.), and FUJIFILM Holdings Corporation (Japan).

The North America X-ray detectors market is segmented by Product Type [Flat Panel Detectors {Flat Panel Detectors (FPD), by Type (Indirect Flat Panel Detectors [Cesium Iodide Flat Panel Detectors, Gadolinium Oxysulfide Flat Panel Detectors), Direct Flat Panel Detectors)}, Flat Panel Detectors, by Field of View (Large-Area Flat Panel Detectors, Medium-Area Flat Panel Detectors, Small-Area Flat Panel Detectors), Flat Panel Detectors Market, by Portability (Portable Detectors, Fixed Detectors), Flat Panel Detectors Market, by System (New Digital X-ray Systems, Retrofit X-ray Systems), Computed Radiography Detectors, Charge-Coupled Device (CCD) Detectors, Line Scan Detectors], by Application [Medical Applications, Static Imaging {Radiography (Chest Radiography, Orthopedic Radiography, Other Radiography Applications), Mammography}, Dynamic Imaging {General Fluoroscopy, Cardiovascular Imaging, Surgical Imaging, Interventional Spine Procedures, Other Imaging Techniques}, Dental Applications, Security Applications, Industrial Applications, Veterinary Applications], and Geography. The study also evaluates industry competitors and analyzes the country-level markets.

Among the product types included in the report, in 2025, the flat panel detectors segment is expected to account for the largest share of the North America X-ray detectors market. The large market share of this segment can be attributed to the numerous benefits offered by flat panel detectors, including higher spatial resolution, user-friendliness, portability, and a diverse range of applications in various fields such as dental radiology, mammography, orthopedic & surgical radiology, analytical radiology, and scientific radiology.

Among the applications included in the report, in 2025, the medical applications segment is expected to account for the largest share of the North America X-ray detectors market. The large market share of this segment is attributed to the extensive utilization of X-ray detectors in the healthcare sector due to their easy availability, low cost, and increased performance for imaging internal body parts to diagnose & treat fractures, abnormalities, or diseases.

Geographic Review

This research report analyzes major geographies in North America, namely the U.S. and Canada. In 2025, the U.S. is expected to account for the largest share of the North America X-ray detectors market. Due to the policies that promote research and development and embrace emerging technologies, the U.S. exhibits a high adoption rate of newer technologies. Furthermore, the rise in demand for better healthcare services contributed to the country’s largest share.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5597

Key questions answered in the report-

Which are the high-growth market segments in terms of product type, application, and country?

What was the historical market for X-ray detectors market across North America?

What are the market forecasts and estimates for the period 2025–2032?

What are the major drivers, restraints, and opportunities in the North America X-ray detectors market?

Who are the major players in the North America X-ray detectors market?

What is the competitive landscape, and who are the market leaders in the North America X-ray detectors market?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#North America X-ray Detectors Market#X-ray Flat Panel Detectors#Flat Panel Detectors#X-ray Detectors#X-ray Metal Detector#XRD Detector#X-ray Radiation Detector#Line Scan Detectors

0 notes

Text

WHAT IS THE COSMIC MICROWAVE BACKGROUND??

Blog#492

Welcome back,

Saturday, March 29th, 2025.

Scientists consider it as an echo or 'shockwave' of the Big Bang. Over time, this primeval light has cooled and weakened considerably; nowadays we detect it in the microwave domain.

ESA's Planck mission detected this first light, which is also the 'oldest' radiation detectable and carries information about our past and future. By observing it, Planck saw the Universe as it was almost at its origin.

The CMB radiation was discovered by chance in 1965. Penzias and Wilson, two radio astronomers in the United States, registered a signal in their radio telescope that could not be attributed to any precise source in the sky.

It apparently came from everywhere with the same intensity, day or night, summer or winter. They concluded that the signal had to come from outside our Galaxy. It came almost from the origin of the Universe.

Scientists considered their discovery as solid evidence for the 'Big Bang' theory. This theory predicted that the 'shockwave' of that primeval explosion would be still detectable as a subtle 'wallpaper' coming from everywhere behind all galaxies, quasars and galaxy clusters.

Today, the Big Bang model is still the only model that is able to convincingly explain the existence of the CMB. According to this model, the Universe started with a very dense and hot phase that expanded and cooled itself; for several hundreds of thousands of years the temperature was so high that neutral atoms could not form.

Matter consisted mostly of neutrons and charged particles (protons and electrons). Electrons interacted closely with the light particles, and therefore light and matter were tightly coupled at that time (that is, light could not travel for a long distance in a straight line). Light could therefore not propagate and the Universe was opaque.

It took about 300 000 years for the Universe to cool down to a temperature at which atoms can form (about 3000 °C). Matter then became neutral, and allowed the light to travel freely: the Universe became transparent. The relic of that 'first light' is the CMB.

Since the time when that radiation was released, the Universe has expanded, becoming at the same time cooler and cooler. The cosmic background has been affected by the same process: it has expanded and cooled down. Space has 'stretched' itself, and with it all length scales.

Light is, after all, a wave, just like waves in the sea, and when you stretch a wave its characteristic length scale (as well as its ‘frequency’) changes. Today, we can detect the CMB at microwave frequencies or length scales, which are much longer than, for example, the length scales to which our eyes are can see.

For this reason, human eyes cannot see the microwaves from the CMB (or X-rays or infrared rays either). However, using specially designed detectors, such as those carried by Planck, we can.

The CMB is the farthest and oldest light any telescope can detect. It is impossible to see further beyond the time of its release because then the Universe was completely 'opaque'. The CMB takes astronomers as close as possible to the Big Bang, and is currently one of the most promising ways we have of understanding the birth and evolution of the Universe in which we live.

Originally published on https://www.esa.int

COMING UP!!

(Wednesday, April 2nd, 2025)

"WHAT DOES IT MEAN TO LIVE IN A QUANTUM UNIVERSE??"

#astronomy#outer space#alternate universe#astrophysics#universe#spacecraft#white universe#parallel universe#space#astrophotography

59 notes

·

View notes

Text

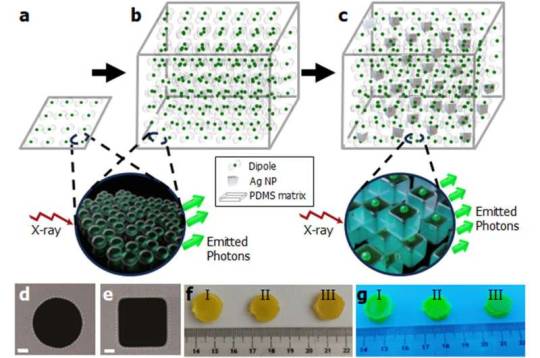

From thin to bulk: Affordable, brighter and faster scanning with high-energy radiation sources

Imagine a medical scanner that works faster and produces clearer images, or a radiation detector that pinpoints tiny traces of radioactive material with unprecedented accuracy. These futuristic possibilities are a step closer to reality thanks to new research by scientists at the Łukasiewicz Research Network—PORT Polish Center for Technology Development. In a publication in Advanced Materials, they reveal how they've scaled up a new type of light-emitting material—known as a scintillator—by embedding it with nano-engineered metallic structures, unlocking performance previously thought unattainable in bulk materials. Scintillators are special substances that emit visible light when exposed to high-energy radiation such as X-rays or gamma rays. They are critical in numerous fields—from medical imaging and security screening to high-energy physics experiments. But traditional scintillators have limitations: They often emit weak signals or respond slowly, making them less efficient for demanding applications.

Read more.

#Materials Science#Science#Radiation#Scintillators#Plasmonics#Nanotechnology#Nanoparticles#Self assembly

6 notes

·

View notes

Text

Unlocking the mysteries of the universe with multi-messenger gravitational lensing

Combining the way that massive galaxies and galaxy clusters bend space and magnify our view of the distant universe with powerful new instruments sensitive to gravitational waves and electromagnetic radiation will lead to scientific breakthroughs in fundamental physics, cosmology, and astrophysics, a new study reveals.

Discovering and studying gravitationally lensed explosions using multiple types of signals (multi-messenger gravitational lensing) will help to answer big questions about the history and structure of the universe.

Publishing their findings in the Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences, an international team led by scientists at the University of Birmingham, notes challenges such as pinpointing the exact locations of these lensed explosions and coordinating observations and analysis across numerous different scientific communities.

The researchers call for closer inter-disciplinary collaboration, including better data sharing, new analysis methods, and detailed simulations to overcome these hurdles.

Professor Graham Smith, from the University of Birmingham, commented, "Recent advances in detector technology mean we can now observe these cosmic events across a huge range of energies and signals, from radio waves to gamma rays and gravitational waves.

"This innovative approach promises to deliver significant scientific breakthroughs over the next 5–10 years—allowing us to explore big questions such as the true nature of gravity, how fast the universe is expanding, the properties of dark matter, and how compact objects like black holes and neutron stars form and evolve."

Multi-messenger gravitational lensing involves the use of messengers spanning 30 orders of magnitude in energy from high-energy neutrinos to gravitational waves, and powerful survey facilities capable of continually scanning the sky for transient and variable sources.

The technique can magnify and duplicate signals from distant sources, letting scientists test theories of gravity over vast distances and improve measurements of the universe's expansion. It also opens new ways to study the physics of distant explosions and learn about how different phenomena, such as fast radio bursts and gamma-ray bursts, might relate to the same underlying events that are viewed in different ways.

Scientists are likely to focus on discoveries and science that are feasible over the next decade with current and imminent technology, including the LIGO-Virgo-KAGRA network of gravitational wave detectors, the Vera C. Rubin Observatory, and contemporary gamma/X-ray satellites and radio surveys.

The Vera C. Rubin Observatory's Legacy Survey of Space and Time (LSST) is due to begin in late 2025 and will be a game-changer for multi-messenger gravitational lensing. The Rubin team and their international partners are gearing up for a "first look" event this summer, to showcase the early test images of the night sky that have been obtained with their Simonyi Survey Telescope.

"Multi-messenger gravitational lensing marks a significant milestone in physics and astronomy," added Professor Smith. "Reaching this point has been an international community effort that includes many early career researchers—creating lots of exciting future opportunities. By bringing together all these talented people, we can drive innovations and discoveries that will transform our understanding of the universe in the coming years."

Dr. Gavin Lamb, from Liverpool John Moores University, commented, "This is an ambitious vision of future science that will be revealed as our detectors get more sensitive. Something that was a novel side-thought 5 or 10 years ago is now the foundation for our next generation scientists."

Helena Ubach, a postgraduate researcher at the Universitat de Barcelona's Institut de Ciències del Cosmos, added, "I'm very excited to have had the opportunity to be part of this, and am looking forward to advances in the emerging field of multi-messenger gravitational lensing in the near future."

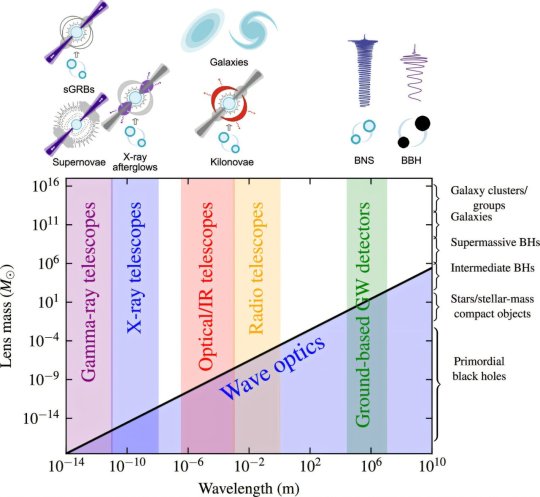

TOP IMAGE: Illustration of the mass scales at which wave optics effects become relevant for gravitationally lensed signals. The geometric optics regime is valid when the wavelength of the radiation is much smaller than the scale of the lensing potential. The wave optics regime is valid when the wavelength is comparable to the scale of the lensing potential. Because the wavelength of GWs detected by the current ground-based detectors is typically much larger than the wavelength of most light sources, wave optics effects can become relevant for lenses below ≲100M⊙. Since other GW detectors like LISA will be sensitive to even longer wavelengths, wave optics effects will be even more important. The precise mass scale also depends on the lensing configuration, such as the distance from the caustic, where wave optics effects can become more prominent close to a caustic when the magnification is large. Credit: Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences (2025). DOI: 10.1098/rsta.2024.0134

LOWER IMAGE: A schematic for the steps to localize a dark-lensed binary merger. Credit: Philosophical Transactions of the Royal Society A: Mathematical, Physical and Engineering Sciences (2025). DOI: 10.1098/rsta.2024.0134

3 notes

·

View notes

Text

Why a High-Quality X-Ray Image Can Make or Break a Diagnosis or Surgery

In modern healthcare, an X-ray image is like a doctor’s second pair of eyes. From diagnosing bone fractures to guiding high-precision spinal surgeries, a clear, properly positioned X-ray image is the cornerstone of accurate clinical decision-making.

So, what makes a truly “high-quality” X-ray? Let’s explore the answer through the lens of Perlove Medical’s professional imaging technology.

1. Proper Patient Positioning = Valuable Imaging

Some patients present previous X-rays that are tilted, misaligned, or poorly centered — making it hard for doctors to accurately assess the problem. Poor positioning can lead to misjudgments or missed diagnoses.

Perlove Medical’s digital radiography systems (such as the PLX5100 and PLX5500) feature precision positioning mechanics and smart interfaces that help radiographers quickly align the imaging region, ensuring scientifically accurate patient posture and image angles — so doctors don’t have to “guess.”

2. Clear Image Quality Builds Clinical Confidence

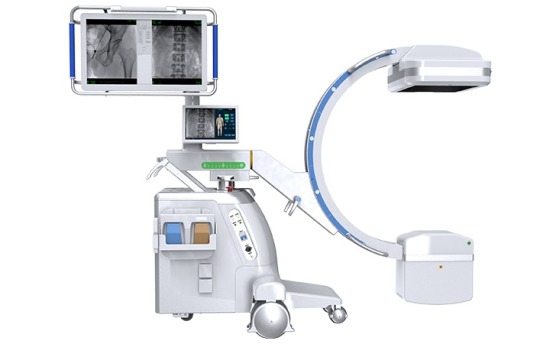

Image sharpness directly determines whether the doctor can “see” key anatomical structures. Perlove Medical’s high-end dynamic DR and mobile C-arm systems use advanced flat panel detectors and proprietary image processing algorithms to deliver high-resolution, high-contrast, low-noise images. This clarity reveals fine details — from fracture lines to soft tissue contours.

For example, during spinal procedures, surgeons rely on a clear visualization of the “cat’s eye” sign — a critical X-ray landmark that helps ensure screws are precisely placed within the pedicle. Perlove’s mobile C-arm systems (like the PLX118F and PLX7500) are tailored for such demanding tasks, providing high frame rates and instant imaging that enhance intraoperative precision.

📌 Knowledge Tip: The “cat’s eye” refers to the pedicle shadow in anteroposterior (AP) X-ray views, resembling a feline pupil. It’s a key visual indicator for proper pedicle screw placement.

3. Proper Exposure — Not Too Bright, Not Too Blurry

Overexposed or blurry images can obscure diagnostic details. Perlove Medical’s DR systems are equipped with Automatic Exposure Control (AEC) technology, which intelligently adjusts radiation levels based on tissue density — protecting the patient while ensuring image clarity.

Meanwhile, intelligent image optimization enhances contrast and detail across regions of interest, including bone, soft tissue, and metallic implants — making Perlove’s systems ideal for orthopedics, emergency care, neurosurgery, and beyond.

4. 2D + 3D Imaging = Safer, Smarter Surgeries

Traditional 2D X-rays require surgeons to rely on experience to judge depth and alignment — leaving room for error. Perlove Medical’s advanced 3D C-arm (such as the PLX7200) supports real-time 3D reconstruction, upgrading standard fluoroscopy to a 3D view that reveals bone structure and implant paths in detail.

Surgeons can directly visualize whether a screw is safely inside the pedicle or deviated from its intended path — enabling accurate intraoperative adjustments, increasing safety, and boosting the success rate of complex surgeries.

🎯 Conclusion: Clinical excellence begins with clear imaging — and behind every high-quality X-ray is a high-performance device. Perlove Medical is committed to empowering medical professionals with advanced imaging solutions that help them see better, decide faster, and operate with greater precision.

📍 For more product information and clinical case demonstrations, please visit the Perlove Medical official website or contact an authorized distributor.

1 note

·

View note

Text

I hate researching occult and spiritual stuff in general because everywhere you look for information is rife with people into it as a gimmick who use fancy words but do not explain what the fancy words mean, or how anyone arrived at the conclusions they seem to be jumping to; and it’s also rife with people trying to scam the very soul out of their viewers.

“There is a book banned by the church which says there are three types of humans………” and then he never says the name of the book in the short. When you scroll in the comments, the first one pinned is his own comment: a promotional code to buy a book HE WROTE. Like wow you’re not even trying to be convincing at this point. Shut the fuck up and get a real job💀💀

I don’t want your pseudoscientific, pseudospiritual, phrenological, appropriated nonsense; I want diagrams and manuals. I want source material. I want to talk to a ghost. I want to behold the other side and see if it’s even there.

Okay so one thing I have consistently seen in videos of people documenting paranormal activity is the use of an EMF detector, because whatever it is we perceive as ghosts or spirits causes spikes in electromagnetic activity. I am inclined to believe this more than most things I see on the internet because it is so consistent; so now I have an EMF detector. Groovy. Now onto protection…

“Black tourmaline absorbs EMF radiation; so wearing this bracelet will protect you from harmful electromagnetic frequencies which some people find helpful during ghost hunting.” Ooookayyy so by that logic, if I wear a lead bracelet to a dental X-ray, the lead bracelet will draw the harmful rays away from my chest and into my wrist? That’s not how physics works. Radiation is a field, which is the reason why you wear a whole lead bib when you get your teeth X-rayed. Lead absorbs radiation, but it does not draw it away; it is a shield. Furthermore, dentists do not make bibs out of black tourmaline for people to wear while they look at their teeth.

Ergo: If you want to protect yourself from the ghostly hand of influence in the form of EMF radiation — assuming EMF radiation spikes aren’t a pop culture gimmick common to alleged haunted houses, created by cooking ramen noodles in a microwave in a hidden room — the best course of action would be to wear a lead vest to your seances; because

1.) lead is PROVEN to block radiation, and 2.) a vest of lead would block this radiation from meddling with your vital organs.

Why isn’t anyone advocating for those looking to the occult to wear lead vests during seances for protection? Because they’re ugly and don’t match the Witchy Aesthetick™ companies appropriated and are now profiting off of far and wide. A lead vest is not as marketable or “natural” as black tourmaline. And let’s be honest, many many people who get into the occult nowadays are doing it to look cool or be cool because they feel as if they are boring, with gigantic holes in their self-esteem, and don’t know how else to fill them in any other way than playing into trends deemed “edgy” and “in-style” and making it their whole personality. (If you are not one of these people; then I am not talking about you. I am talking about other people. For the love of god I’m not pissing on the poor. Please.)

Also, the majority of the online witch space is filled with white people messing with other people’s cultural practices as a sort of game; which obviously impacts the credibility of the information these witches present, as well as other, worse things which I don’t even need to mention… New Age spirituality is to the cultures its practices were taken from as Taco Bell is to genuine Mexican cuisine. It can be nice and may very well work as intended but it lacks the depth and reasoning of the original.

Not to say new-age is all bad; it isn’t. There are just so many people who don’t care what something is, where it came from, or why they’re using it because “witchy” and “hippie” are hot on the market these days. It’s frustrating. That’s all.

#occult#discourse tw#metaphysics#Sorry if I sound like a pretentious bitch; I promise I’m not. I should just read more old books…#Pre-1990s books. I don’t trust any made after that date unless there is some degree of scientific testing involved#Preferably I’d like to read some that are like 5000 years old

2 notes

·

View notes

Text

Portable X ray veterinary

Technological Origins and Development

The ability to peer inside a living body transformed human medicine, and veterinary practice was no exception. While traditional fixed X-ray systems became staples in clinics, the need for imaging large, immobile, or distressed animals where they are drove the development of portable veterinary X-ray systems. Their origins lie in adapting early, cumbersome portable human units, but significant miniaturization, power efficiency improvements, and crucially, the transition from film to Computed Radiography (CR) and then Digital Radiography (DR) panels revolutionized the field. The introduction of lightweight, battery-powered generators coupled with durable, highly sensitive digital detectors in the late 1990s and early 2000s truly unlocked portability. Modern systems are remarkably compact, often featuring wireless DR panels, enabling true point-of-care imaging.

Clinical Applications and Advantages

The clinical impact of portable veterinary X-ray is profound.

Its core advantage is mobility: imaging occurs stall-side, barn-side, in the field, or even in the comfort of a pet's home. This drastically reduces stress for patients, especially large animals like horses or fearful pets, eliminating risky transportation or complex sedation.

It significantly improves workflow efficiency——a fractured leg on a cow or a respiratory emergency in a critical canine can be diagnosed immediately. Portability enables essential imaging in emergency situations (trauma, colic) and during surgical procedures (confirmation of implant placement, locating foreign bodies).

For practitioners, the instant digital images allow for rapid assessment, better client communication by showing results on-site, and efficient sharing with specialists for consultations.

The reduced need for heavy shielding in multiple rooms (compared to fixed units) also offers cost and space savings for clinics.

Future Directions

The future of portable veterinary X-ray is bright and interconnected. Enhanced integration with practice management software and cloud storage for seamless access to patient records and images is key. Artificial Intelligence (AI) is poised to play a significant role, offering automated preliminary analysis (e.g., fracture detection, lung pattern recognition) to augment the veterinarian's diagnosis, especially valuable in field conditions. We can expect continued improvements in image quality and detector durability alongside longer battery life and potentially lighter, even more ergonomic designs. Connectivity will advance, enabling real-time remote specialist viewing during procedures.

Challenges and Industry Trends

Initial investment costs for high-quality DR systems can be significant, though long-term savings on film/chemicals and efficiency gains offset this.

Ensuring consistent radiation safety for personnel in diverse, often uncontrolled environments requires rigorous protocols, training, and appropriate personal protective equipment (PPE).

Image quality optimization can be trickier in suboptimal lighting or with uncooperative patients compared to a controlled radiology room. Furthermore, navigating complex and varying regulatory requirements across different regions adds an administrative layer.

Industry trends clearly indicate robust growth. The rising demand for advanced pet care, including from mobile veterinary services and specialty practices, is a major driver. Increased adoption in large animal and equine medicine continues, while even small animal clinics appreciate the flexibility for critical care, dentistry, and exotics. Technological convergence, blending portability with advanced capabilities like fluoroscopy or higher power for challenging anatomies, is emerging. The focus is also shifting towards user-friendly interfaces and comprehensive training solutions to maximize the technology's potential and ensure safety.

Conclusion

Portable veterinary X-ray technology is far more than just a convenient alternative to fixed systems; it's a transformative tool that redefines the point of care. By bringing diagnostic imaging directly to the patient ——whether in a stable, a pasture, an exam room, or an emergency site ——it enhances animal welfare, improves diagnostic speed and accuracy, streamlines workflows, and expands the capabilities of veterinary professionals in diverse settings. As technology continues to evolve, becoming smarter, more connected, and more accessible, portable X-ray will remain at the forefront of delivering advanced, compassionate, and efficient veterinary medicine, ensuring better outcomes for animals wherever they may be.

0 notes

Text

Active Dosimeter Market, Emerging Trends, Technological Advancements, and Business Strategies 2025-2032

Global Active Dosimeter Market size was valued at US$ 198.7 million in 2024 and is projected to reach US$ 367.4 million by 2032, at a CAGR of 9.26% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the highest growth rate due to increasing nuclear energy investments.

Active dosimeters are real-time radiation detection devices that provide immediate dose rate measurements and cumulative exposure data. These sophisticated instruments utilize solid-state detectors, ionization chambers, or Geiger-Müller tubes to monitor X-rays, gamma rays, and beta particles across medical, industrial, and nuclear applications. Key product segments include TLD (Thermoluminescent Dosimeters) and OSL (Optically Stimulated Luminescence) technologies, with TLD holding over 45% market share in 2024.

The market growth is driven by stringent radiation safety regulations, expanding nuclear power generation, and increasing diagnostic imaging procedures. However, high device costs and technical complexities pose adoption challenges in developing economies. Major players like Mirion Technologies and Thermo Fisher Scientific are enhancing product portfolios through smart dosimeters with IoT capabilities – Mirion’s Instadose®+ wireless dosimeter system being a notable 2023 launch addressing occupational monitoring needs.

Get Full Report : https://semiconductorinsight.com/report/active-dosimeter-market/

MARKET DYNAMICS

MARKET DRIVERS

Stringent Radiation Safety Regulations to Fuel Active Dosimeter Demand

Global radiation protection standards have become increasingly stringent across medical, industrial, and nuclear sectors, driving substantial demand for active dosimeters. Regulatory bodies worldwide are mandating real-time radiation monitoring with higher accuracy thresholds – for instance, the International Atomic Energy Agency (IAEA) now requires occupational exposure monitoring with 10% improved precision standards compared to previous guidelines. This regulatory push has accelerated adoption across healthcare (especially in diagnostic imaging and radiation therapy), nuclear power plants, and defense applications where real-time dose tracking is critical for worker safety. The healthcare sector alone accounts for over 38% of current active dosimeter deployments globally.

Advancements in MEMS Technology Enabling Next-Gen Solutions

Micro-electromechanical systems (MEMS) advancements are revolutionizing active dosimeter capabilities by enabling miniaturized, wearable form factors with enhanced sensitivity. Modern devices now incorporate silicon photomultipliers and CMOS-based detectors that achieve detection thresholds below 10 μSv – a 300% improvement over traditional technologies. These innovations are particularly valuable in medical applications where precise, real-time dose monitoring during procedures like CT-guided interventions can reduce patient exposure by up to 40%. The military sector is also adopting these advanced dosimeters for special operations in potentially contaminated environments.

➤ Leading manufacturer Mirion Technologies recently launched the Instadose+ system featuring Bluetooth connectivity and cloud-based dose tracking, representing a 15% reduction in size compared to previous models while maintaining NIST-traceable accuracy.

MARKET RESTRAINTS

High Initial Costs and Maintenance Challenges

While active dosimeters offer superior real-time monitoring capabilities, their adoption is constrained by significant cost barriers. Advanced systems with wireless connectivity and data logging features can cost 3-5 times more than passive dosimeters, making them prohibitive for budget-conscious organizations. Additionally, calibration and maintenance requirements add 15-20% to total ownership costs annually – a particular challenge in developing markets where technical support infrastructure is limited. This price sensitivity is most evident in the industrial sector where nearly 60% of facilities still rely on passive TLD badges despite their delayed reporting limitations.

Interoperability Issues Across Vendor Platforms

The lack of standardization in data formats and communication protocols creates significant interoperability challenges. Many organizations operate mixed fleets of dosimeters from different manufacturers, resulting in fragmented dose records that complicate regulatory compliance. This issue is particularly acute in large healthcare networks where radiation workers may use 4-6 different dosimeter models across various departments. The absence of universal data standards means institutions often need to maintain multiple software platforms, increasing IT costs by 25-30% compared to standardized solutions.

MARKET OPPORTUNITIES

Expanding Nuclear Energy Sector Presents Growth Potential

With 58 new nuclear reactors under construction globally and plans for 100+ additional units, the nuclear energy sector represents a significant growth avenue for active dosimeter providers. Modern reactor designs emphasize continuous personnel monitoring with 90% of new facilities specifying active dosimeters as part of their radiation protection programs. Emerging markets in Asia and the Middle East are particularly attractive, with China alone accounting for 40% of current nuclear construction projects. Vendors offering ruggedized, explosion-proof dosimeter solutions tailored to power plant environments stand to capture substantial market share.

Integration with IoT and AI for Predictive Safety

The convergence of dosimetry with IoT platforms and AI analytics is creating new value propositions. Next-generation systems now incorporate predictive algorithms that can forecast potential overexposure scenarios by analyzing historical dose patterns and work schedules. Early adopters in the oil & gas sector have reported 35% reductions in regulatory incidents through such predictive monitoring. Cloud-based dose management platforms are also gaining traction, enabling centralized monitoring across geographically dispersed workforces – a capability particularly valuable for military and homeland security applications.

MARKET CHALLENGES

Battery Life Limitations in Continuous Monitoring

Despite technological advances, battery performance remains a persistent challenge for active dosimeters. Continuous wireless operation typically limits device runtime to 7-14 days, necessitating frequent recharge cycles that disrupt monitoring continuity. In industrial settings where workers may be deployed for extended periods, this limitation often forces a compromise between real-time monitoring and operational practicality. While some manufacturers have introduced solar-assisted charging, these solutions add 20-25% to unit costs and aren’t viable in all environments.

Regulatory Lag for Emerging Technologies

The rapid pace of technological innovation has created a regulatory gap where new dosimeter capabilities often outpace certification frameworks. Advanced features like AI-based dose prediction and multi-parameter sensing face 12-18 month delays in regulatory approval across major markets. This uncertainty discourages investment in R&D and slows the commercialization of breakthrough technologies. The challenge is particularly acute for startups attempting to introduce disruptive solutions, as they lack the resources to navigate complex, multi-jurisdictional certification processes.

ACTIVE DOSIMETER MARKET TRENDS

Increasing Adoption in Nuclear Power and Healthcare to Drive Market Growth

The global active dosimeter market is experiencing significant traction owing to heightened regulatory scrutiny in nuclear power plants and medical radiation safety. With radiation exposure risks escalating across industries, demand for real-time monitoring solutions has surged. The market, valued at approximately $250 million in 2024, is projected to grow at nearly 6% CAGR through 2032. While North America leads in adoption due to stringent OSHA and NRC compliance mandates, Asia exhibits accelerated growth with expanding nuclear infrastructure in China and India. The healthcare sector alone accounts for over 35% of total active dosimeter deployments, driven by rising diagnostic imaging procedures and radiotherapy applications.

Other Trends

Miniaturization and Wearable Technology Integration

Manufacturers are prioritizing compact wearable designs that enable continuous radiation monitoring without impeding worker mobility. Devices under 50 grams with Bluetooth connectivity now represent 28% of new product launches, a significant jump from 12% market penetration in 2020. This shift responds to end-user demands for ergonomic solutions in confined industrial environments. Recent innovations include smart badges with vibration alerts and dosimeters integrated into safety helmets, particularly valuable for petrochemical plant inspectors and radiochemistry lab personnel.

Advancements in Sensor Technologies

Silicon photomultipliers (SiPMs) are revolutionizing active dosimeter sensitivity, enabling accurate detection below 10 keV energy ranges – crucial for medical isotope handling. Meanwhile, solid-state detectors now achieve ±5% measurement accuracy even in mixed radiation fields, addressing longstanding challenges in nuclear decommissioning projects. The integration of AI-powered predictive algorithms allows these devices to forecast cumulative exposure risks, with some enterprise systems automatically triggering work rotation protocols when thresholds are approached. Such technological leaps are prompting fleet upgrades across defense sectors, where legacy systems accounted for 62% of military dosimeter inventories as recently as 2023.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Shape Market Competition

The global active dosimeter market demonstrates a moderately consolidated structure, with established players continuing to dominate while agile mid-tier companies gain traction through technological differentiation. Mirion Technologies Inc. emerges as a market leader owing to its diversified radiation detection portfolio and strong foothold in nuclear power and medical applications. The company accounted for approximately 18% revenue share in 2024, supported by its recent acquisition of Thermo Fisher’s radiation measurement business, which expanded its geographic reach across Asia-Pacific markets.

Meanwhile, Landauer Inc. maintains robust positions in healthcare and industrial sectors through its patented optically stimulated luminescence (OSL) technology. The company’s strategic partnerships with diagnostic imaging providers have reinforced its dominance in medical applications, which constitute nearly 40% of its dosimeter revenue. Conversely, Polimaster Inc. differentiates through compact wearable solutions favored by military and homeland security end-users, capturing significant Eastern European and CIS markets.

Several competitors are actively pursuing growth through multiple avenues:

Thermo Fisher Scientific is investing heavily in next-generation TLD dosimeters with IoT capabilities

Fuji Electric recently launched real-time monitoring systems integrating AI-powered dose prediction algorithms

ATOMTEX expanded production capacity in Belarus to meet growing Eastern European demand

The market also sees increasing specialization, with companies like Unfors RaySafe focusing exclusively on medical radiation safety solutions, while Far West Technology caters to niche aerospace and defense applications. This trend towards vertical specialization is expected to intensify as regulatory requirements become more stringent across end-use industries.

List of Leading Active Dosimeter Manufacturers

Mirion Technologies Inc. (U.S.)

Landauer Inc. (U.S.)

Polimaster Inc. (Belarus)

Thermo Fisher Scientific Inc. (U.S.)

Fuji Electric Co. Ltd. (Japan)

ATOMTEX SPE (Belarus)

Tracerco Limited (UK)

Unfors RaySafe AB (Sweden)

Far West Technology Inc. (U.S.)

Rotunda Scientific Technologies LLC (U.S.)

Raeco Rents, LLC. (U.S.)

Recent industry movements suggest intensifying competition in smart dosimeter development, particularly for applications requiring continuous monitoring and data integration. Over 35% of new product launches in 2024 incorporated Bluetooth or cellular connectivity features, reflecting the market’s shift towards digital solutions. While pricing pressures remain moderate in regulated medical and nuclear sectors, commercial and industrial segments are witnessing heightened competition that may drive consolidation among smaller manufacturers in coming years.

Segment Analysis:

By Type

TLD Dosimeter Segment Dominates Due to Superior Accuracy in Cumulative Radiation Measurement

The market is segmented based on type into:

TLD Dosimeter

OSL Dosimeter

Electronic Personal Dosimeter

Subtypes: Pocket Dosimeters, Ring Dosimeters, and others

Self-Reading Dosimeter

Others

By Application

Medical Segment Leads with Growing Need for Radiation Monitoring in Healthcare Facilities

The market is segmented based on application into:

Medical

Industrial

Military and Homeland Security

Power & Energy

Others

By End User

Healthcare Providers Hold Largest Share Due to Strict Radiation Safety Regulations

The market is segmented based on end user into:

Hospitals and Diagnostic Centers

Nuclear Power Plants

Research Laboratories

Defense Organizations

Industrial Facilities

Regional Analysis: Active Dosimeter Market

North America The North American active dosimeter market is driven by stringent radiation safety regulations and high adoption in healthcare and nuclear sectors. The U.S. holds the dominant share, contributing significantly to the projected $XX million market size by 2032. Key players like Landauer Inc. and Mirion Technologies lead the market with advanced TLD and OSL dosimeters. Regulatory frameworks, including OSHA and NRC standards, mandate radiation monitoring in medical, industrial, and defense applications. However, high costs of advanced dosimeters and competition from passive dosimeters remain challenges. The region also invests in smart dosimeters with real-time monitoring, enhancing occupational safety in nuclear plants and hospitals.

Europe Europe’s active dosimeter market reflects steady growth, supported by EU Directive 2013/59/EURATOM, which enforces strict radiation protection norms. Germany and France are key markets, owing to their nuclear energy infrastructure and advanced healthcare systems. Demand is surging for wearable dosimeters in industrial and medical sectors. The region’s focus on precision and compliance drives innovation, with companies like Thermo Fisher Scientific and Unfors RaySafe introducing IoT-enabled devices. However, economic uncertainties and slow adoption in Eastern Europe hinder broader market expansion. Nonetheless, the shift toward real-time dose tracking presents long-term opportunities.

Asia-Pacific Asia-Pacific dominates the global active dosimeter market, with China and India leading due to rapid industrialization and nuclear power expansion. China’s $XX million market valuation in 2024 stems from heavy investments in nuclear energy and healthcare modernization. Japan’s stringent post-Fukushima safety norms further boost demand. However, cost sensitivity in emerging economies favors low-cost TLD dosimeters over premium active variants. India’s growing defense and space programs offer untapped potential. Despite fragmented regulations, urbanization and increased awareness of radiation risks are accelerating market growth. Key players actively expand distribution networks to capitalize on regional opportunities.

South America South America exhibits moderate growth, driven by mining and healthcare sectors in Brazil and Argentina. Regulatory frameworks lag behind global standards, limiting adoption in high-risk industries. However, oil & gas exploration and radiopharmaceutical applications are emerging demand drivers. Economic instability and low budgetary allocations for radiation safety equipment impede progress. Still, collaborations with international manufacturers aim to improve accessibility. While the market remains niche, gradual infrastructure development and rising awareness of occupational hazards signal future potential.

Middle East & Africa The MEA market is nascent but promising, with growth centered in the UAE, Saudi Arabia, and South Africa. Nuclear power initiatives, such as the UAE’s Barakah plant, fuel demand for dosimeters in energy and defense sectors. However, limited local manufacturing and dependency on imports constrain affordability. Gulf nations prioritize smart monitoring solutions for oilfields and healthcare, whereas Africa struggles with funding gaps and weak enforcement of radiation safety protocols. Strategic partnerships with global suppliers could catalyze market expansion as industrial and medical sectors evolve.

Get A Detailed Sample Report : https://semiconductorinsight.com/download-sample-report/?product_id=97524

Report Scope

This market research report provides a comprehensive analysis of the Global and regional Active Dosimeter markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The Global Active Dosimeter market was valued at USD million in 2024 and is projected to reach USD million by 2032, growing at a CAGR of % during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (TLD Dosimeter, OSL Dosimeter), application (Medical, Industrial, Military and Homeland Security, Power & Energy, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis. The U.S. market is estimated at USD million in 2024, while China is projected to reach USD million by 2032.

Competitive Landscape: Profiles of leading market participants including Landauer Inc., Polimaster Inc., Mirion Technologies Inc., Thermo Fisher Scientific Inc., and Fuji Electric Co. Ltd., covering their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in radiation detection, integration of IoT in dosimetry, and evolving industry standards for workplace safety.

Market Drivers & Restraints: Evaluation of factors driving market growth such as increasing nuclear power generation and radiation therapy applications, along with challenges like stringent regulatory requirements.

Stakeholder Analysis: Insights for healthcare providers, industrial safety officers, military personnel, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Primary and secondary research methods are employed, including interviews with industry experts, data from verified sources, and real-time market intelligence to ensure the accuracy and reliability of the insights presented.

Customisation of the Report In case of any queries or customisation requirements, please connect with our sales team, who will ensure that your requirements are met.

Related Reports :

Contact us:

+91 8087992013

0 notes

Text

Industrial Cabineted X-ray Market Key Growth Drivers Fueling Expansion in the Global Systems Market

Industrial Cabineted X‑Ray Market Drivers

1. Surge in Non‑Destructive Testing (NDT)

One of the primary factors fueling the demand for industrial cabineted X‑ray systems is the escalating need for non‑destructive testing (NDT). Sectors like aerospace, automotive, electronics, and machinery heavily rely on precise inspection tools to ensure structural integrity and detect defects without damaging critical components. Cabineted X‑ray systems deliver high-resolution imaging, enabling the identification of flaws such as voids, inclusions, cracks, or assembly errors—essential for maintaining quality standards in high‑stakes industries.

Regulatory frameworks and industry standards increasingly mandate stringent quality control protocols. The ability of cabineted X‑ray systems to conduct detailed inspections while ensuring compliance with safety regulations makes them indispensable. Regulatory pressure — particularly in aerospace and pharmaceuticals — further amplifies their adoption.

2. Technological Advancements: Digital Imaging & AI Integration

Robust growth in digital radiography (DR) and computed tomography (CT) technologies has revolutionized X‑ray inspection. DR systems, equipped with advanced detectors and imaging software, significantly enhance image quality and operational efficiency. They offer faster acquisition, improved clarity, and decreased radiation exposure—advantages that are increasingly prioritized by industrial manufacturers.

Beyond DR, the advent of artificial intelligence (AI) and machine learning (ML) marks a transformative shift. These systems can automatically detect defects with high precision, reducing manual inspection errors. AI enhances throughput and consistency and can even predict maintenance needs to reduce system downtime.

3. Broadening Applications Across Industries

While traditional industrial sectors—electronics, aerospace, automotive—continue to drive demand, cabineted X‑ray systems are finding new use cases:

Electronics: Miniaturization in semiconductors and surface‑mount technology necessitates high-precision inspection to detect hidden defects in microcomponents.

Pharmaceuticals: X‑ray cabinets ensure tablet integrity, detect contaminants in packaging, and verify labeling accuracy—critical in compliance‑driven environments.

Food & Beverage: Safety concerns demand reliable contaminant detection (e.g., metal shards, glass, stones) in packaged foods; X‑ray systems provide non‑destructive inspection without opening containers.

Security & Logistics: Heightened global security demands have led to widespread use of cabineted X‑ray systems at airports, ports, customs, and government facilities to detect contraband and ensure safe shipments.

4. Safety and Regulatory Mandates

Strong regulatory emphasis on radiation safety is pushing organizations to adopt enclosed cabineted X‑ray solutions. These systems are equipped with shielding to protect personnel and comply with stringent international standards and certifications.

In sectors like pharmaceuticals, aerospace, and defense, thorough inspection is legally required to guarantee safety. Cabineted X‑ray systems offer the reliability and traceability needed to satisfy audits and certification bodies—making the technology a must-have in highly regulated environments.

5. Industry 4.0 & Automation Integration

The shift toward Industry 4.0-driven smart manufacturing favors X‑ray systems that integrate with automated production lines and IoT platforms. Automated conveyor-fed cabineted X‑ray systems provide real-time defect detection and feedback, enabling manufacturers to halt or adjust defective workflows instantly—minimizing waste and improving operational efficiency.

These systems not only detect issues but can also predict maintenance needs through embedded AI and analytics tools, reducing unplanned downtime and extending equipment life.

6. Portable, Compact, and Eco‑Friendly Solutions

Manufacturers are engineering more compact and mobile cabineted X‑ray units, ideal for on-site inspections—particularly in industries like construction, oil & gas, and field service operations.

Moreover, there is a growing emphasis on eco-friendly solutions. Advancements in energy-efficient emitters and green sourcing of components are aligning X‑ray systems with sustainability objectives—an increasing consideration for industrial buyers aiming to reduce carbon footprints.

7. Geographical Market Expansion

North America and Europe remain dominant players due to mature sectors and strict compliance regimes. Meanwhile, Asia‑Pacific—led by China and India—is rapidly catching up thanks to booming industrialization, stronger healthcare infrastructure, and heightened security concerns.

Initiatives like India’s “Make in India” are boosting domestic manufacturing quality standards, driving demand for advanced inspection technologies. Similarly, airport expansions, customs modernization, and healthcare upgrades across the Asia-Pacific region present substantial market opportunities.

Conclusion

The industrial cabineted X‑ray market is experiencing strong, sustained growth, fueled by several interrelated drivers:

A rising need for non‑destructive testing across critical industries

Breakthroughs in digital imaging, AI, and automation

Expanded applications in electronics, healthcare, food safety, and security

Regulatory pressures around quality control and radiation safety

Integration with Industry 4.0 protocols for smart manufacturing

Development of portable, energy‑efficient systems

Rapid industrial expansion in Asia‑Pacific

Together, these factors not only point to increasing adoption—but also signal that cabineted X‑ray technology is becoming integral to quality assurance, safety standards, and operational efficiency in modern manufacturing and inspection landscapes.

0 notes

Text

Amorphous Selenium Detector Market: Key Drivers, Challenges, and Regional Insights 2025–2032

MARKET INSIGHTS

The global Amorphous Selenium Detector market size was valued at US$ 287.4 million in 2024 and is projected to reach US$ 446.7 million by 2032, at a CAGR of 6.6% during the forecast period 2025-2032.

Amorphous selenium detectors are advanced X-ray detection devices formed by coating amorphous selenium on a thin-film transistor (TFT) array. Unlike traditional amorphous silicon detectors, these devices directly convert X-rays into electrical signals without requiring scintillation crystals, enabling higher resolution imaging. When X-rays strike the selenium layer, electron-hole pairs are created, which move under an applied bias field to generate current that’s stored as charge in the TFT array.

The market growth is driven by increasing demand for high-quality medical imaging equipment and technological advancements in digital radiography. The U.S. currently dominates the market with an estimated share of 32% in 2024, while China’s market is projected to grow at 8.1% CAGR through 2032. Key applications include mammography, chest radiography, and security screening, with the 14*17 inch detector segment accounting for 45% of total sales. Major players like Hologic, Fujifilm, and KA Imaging are investing in R&D to improve detector efficiency and reduce manufacturing costs.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for High-Resolution Digital Radiography to Boost Market Growth

The global amorphous selenium detector market is experiencing robust growth driven by the accelerating adoption of digital radiography systems worldwide. These detectors offer superior spatial resolution compared to traditional computed radiography systems, with typical resolutions exceeding 10 line pairs per millimeter (lp/mm). This enables more precise imaging for critical applications like mammography and chest radiography. The transition from analog to digital imaging is gaining momentum, supported by government initiatives incentivizing healthcare digitization. For instance, several European countries have implemented policies mandating the replacement of outdated film-based systems with digital alternatives by 2025-2030.

Expansion of Digital Breast Tomosynthesis Creates New Growth Avenues

The rising prevalence of breast cancer worldwide is fueling demand for advanced screening technologies like digital breast tomosynthesis (DBT), where amorphous selenium detectors play a crucial role. These detectors enable 3D imaging with excellent contrast resolution, helping radiologists detect tumors at earlier stages. DBT adoption is growing steadily, with installation rates increasing by approximately 15-20% annually in developed markets. The technology’s superiority in dense breast imaging and its ability to reduce false positives by up to 40% compared to conventional mammography make it particularly valuable in modern diagnostic workflows.

The ongoing advancements in detector technology are further enhancing their performance characteristics. Recent developments include improved charge collection efficiency, reduced electronic noise, and faster readout times, all contributing to better image quality while maintaining low radiation doses.

➤ For instance, newer amorphous selenium detectors now achieve detective quantum efficiency (DQE) values exceeding 70% at typical mammography exposures, representing a significant improvement over previous generations.

Furthermore, strategic collaborations between detector manufacturers and medical imaging system OEMs are accelerating product innovation and market penetration, particularly in emerging economies where healthcare infrastructure modernization is gaining pace.

MARKET RESTRAINTS

High Initial Costs and Complex Manufacturing Process Limit Market Penetration

While amorphous selenium detectors offer superior imaging performance, their high production costs present a significant barrier to widespread adoption. The vacuum deposition process required to create uniform selenium layers is complex and energy-intensive, resulting in manufacturing costs that can be 50-60% higher than competing technologies. Moreover, the detectors require specialized readout electronics and temperature control systems, further increasing the total system cost. These factors make the technology less accessible for price-sensitive markets and smaller healthcare facilities with limited budgets.

The sophisticated nature of these detectors also contributes to longer lead times for repair and maintenance. Replacement components often require specialized handling and recalibration by trained technicians, which can extend downtime for critical imaging systems. Healthcare providers must carefully evaluate the total cost of ownership when considering amorphous selenium-based solutions, particularly in resource-constrained environments.

Competition from Alternative Technologies Challenges Market Expansion

The amorphous selenium detector market faces intense competition from other digital radiography technologies, particularly CMOS-based and amorphous silicon detectors coupled with scintillators. These alternatives offer advantages in certain applications, such as reduced noise in low-dose imaging or faster acquisition speeds. In portable radiography systems especially, the lighter weight and improved durability of competing technologies make them preferable choices for many healthcare providers.

Additionally, the development of advanced scintillator materials with improved light output and reduced afterglow has narrowed the performance gap between amorphous selenium and indirect conversion detectors. Market share data indicates that indirect conversion detectors currently dominate the general radiography segment, accounting for over 65% of installations globally.

MARKET CHALLENGES

Technical Limitations in High-Energy Applications Restrict Market Potential

Amorphous selenium detectors face inherent limitations when applied to high-energy radiological examinations such as fluoroscopy or interventional imaging. The material’s relatively low atomic number reduces stopping power for high-energy photons, leading to decreased quantum efficiency in these applications. At typical fluoroscopy energies above 80 kVp, the detectors’ performance degrades significantly compared to alternatives using high-Z materials like cesium iodide or gadolinium oxysulfide.

The detectors also exhibit temperature sensitivity issues that complicate their use in varied clinical environments. Selenium’s electrical properties change with temperature, requiring sophisticated compensation algorithms to maintain consistent image quality. This becomes particularly challenging in mobile applications or in facilities without controlled environmental conditions.

Other Challenges

Regulatory Hurdles Stringent regulatory requirements for medical imaging devices create lengthy approval processes for new detector technologies. Changes in manufacturing processes or materials often require complete revalidation, slowing down product iterations and innovations.

Supply Chain Vulnerabilities The specialized materials and equipment required for amorphous selenium detector production create supply chain vulnerabilities. Disruptions in selenium supply or vacuum deposition equipment maintenance can significantly impact production volumes and lead times.

MARKET OPPORTUNITIES

Integration with Artificial Intelligence Presents Significant Growth Potential

The combination of amorphous selenium detectors with artificial intelligence (AI) algorithms represents a major growth opportunity for the market. The detectors’ high spatial resolution and excellent contrast characteristics make them ideally suited for AI-assisted diagnostic applications. Several manufacturers are developing dedicated interfaces and software development kits to facilitate AI integration, enabling applications ranging from automatic lesion detection to image quality optimization. The global market for AI in medical imaging is projected to expand rapidly, presenting lucrative opportunities for innovative detector technologies that can provide the high-quality input data required for optimal algorithm performance.

Emerging Applications in Security and Industrial Imaging Offer Diversification

Beyond medical imaging, amorphous selenium detectors are finding new applications in security screening and industrial quality control. Their ability to provide high-resolution imaging at relatively low radiation doses makes them attractive for baggage screening systems where detailed inspection is required. In industrial settings, the detectors are being evaluated for semiconductor wafer inspection and aerospace component analysis, where their direct conversion architecture eliminates the resolution limitations imposed by scintillator spreading in conventional detectors.

The development of flexible amorphous selenium detector prototypes also opens possibilities for novel form factors in specialized imaging applications. Researchers are exploring curved detectors for specific medical procedures and lightweight detectors for field-deployable security systems. These innovations could create new market segments beyond traditional medical radiography.

AMORPHOUS SELENIUM DETECTOR MARKET TRENDS

Medical Imaging Advancements Drive Market Growth

The increasing demand for high-resolution medical imaging solutions is currently accelerating the adoption of amorphous selenium (a-Se) detectors. These detectors offer superior direct conversion capabilities compared to traditional scintillator-based systems, particularly in mammography and digital radiography. Recent advances in thin-film transistor (TFT) technology have enhanced the efficiency of charge collection in amorphous selenium layers, reducing dose requirements by up to 25% while maintaining diagnostic image quality. The market is responding to healthcare providers’ needs for lower radiation exposure, which is particularly critical in pediatric and repeated-exposure scenarios.

Other Trends

Industrial and Security Applications Expansion

Beyond healthcare, amorphous selenium detectors are gaining traction in industrial CT scanning and airport security systems. Their exceptional sensitivity to low-energy X-rays makes them ideal for detecting organic materials and liquid threats in baggage screening. The global security equipment segment is projected to grow at a CAGR exceeding 9% through 2032, driven by increased airport modernization projects and stringent safety regulations. Meanwhile, in industrial settings, the detectors’ ability to visualize micro-cracks in composite materials has found applications in aerospace and automotive quality control.

Asia-Pacific Emerges as High-Growth Region

Manufacturing expansions by key players like Fujifilm and concentrated healthcare investments are fueling market growth across Asia-Pacific. China’s domestic production capacity for 14*17 inch detectors has doubled since 2020, while India’s medical imaging equipment market is growing at 12% annually. Government initiatives such as Japan’s “Healthcare Vision 2030” are accelerating the replacement of outdated radiographic systems with a-Se based digital solutions. The region now accounts for over 35% of global detector shipments, with localization strategies reducing import dependencies.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansion Define Market Leadership in Amorphous Selenium Detector Space

The global amorphous selenium detector market features a competitive yet moderately consolidated landscape dominated by specialized manufacturers and medical imaging innovators. Hologic Inc. emerges as a frontrunner, leveraging its established reputation in diagnostic imaging systems and proprietary detector technologies. With an estimated 30% market share in 2024, the company dominates through its direct conversion digital mammography systems that utilize amorphous selenium panels for superior image clarity.

Meanwhile, KA Imaging has gained notable traction with its portable X-ray detectors featuring selenium-based technology. The company’s recent FDA-cleared CEO (Contrast-Enhanced Orthopedic) imaging system demonstrates how niche players can carve significant market segments through specialized applications. When combined with Fujifilm’s longstanding expertise in flat panel detectors, these leaders collectively shape evolving industry standards.

Furthermore, established conglomerates like Teledyne Technologies bring cross-industry expertise from defense and aerospace sectors into medical imaging. Their investments in selenium detector R&D—particularly for high-resolution industrial CT applications—illustrate vertical expansion strategies. This diversification proves crucial as manufacturers balance between addressing immediate clinical needs and anticipating future technological convergence.

List of Key Amorphous Selenium Detector Manufacturers

Hologic, Inc. (U.S.)

KA Imaging (Canada)

Analogic Corporation (U.S.)

Fujifilm Holdings (Japan)

Teledyne Technologies (U.S.)

Newheek (China)

Segment Analysis:

By Type

Size 14*17 Segment Leads Due to High Adoption in Diagnostic Imaging Applications

The market is segmented based on type into:

Size 14*17

Subtypes: Standard and high-resolution variants

Size 17*17

Others

Subtypes: Custom sizes for specialized applications

By Application

Medical Imaging Equipment Accounts for Largest Share Due to Critical Diagnostic Needs

The market is segmented based on application into:

Medical Imaging Equipment

Industrial CT

Security Equipment

Others

By Detector Configuration

Flat Panel Detectors Gain Preference for Superior Image Quality

The market is segmented based on detector configuration into:

Flat Panel Detectors

Charge-coupled Devices (CCD)

Line Scan Detectors

By End User

Hospitals and Diagnostic Centers Drive Adoption for Patient Care Applications

The market is segmented based on end user into:

Hospitals

Diagnostic Imaging Centers

Industrial Facilities

Security and Defense Organizations

Others

Regional Analysis: Amorphous Selenium Detector Market

North America The North American market for amorphous selenium detectors is propelled by advanced healthcare infrastructure and significant investments in medical imaging technologies. The U.S., which accounts for the largest regional market share, benefits from the widespread adoption of high-performance X-ray detectors in mammography and digital radiography applications. Regulatory approvals from the FDA have accelerated product commercialization, while the presence of key players like Hologic and Analogic Corporation strengthens the supply chain. However, high manufacturing costs and competition from alternative technologies, such as amorphous silicon detectors, pose challenges to market expansion. The increasing emphasis on preventive healthcare and early disease diagnosis continues to drive demand for these detectors.

Europe Europe’s market is characterized by stringent quality standards and a strong regulatory framework favoring precision-based imaging solutions. Germany and the U.K. lead the region in adopting amorphous selenium detectors for diagnostic and industrial non-destructive testing (NDT) applications. The growing geriatric population and rising cancer screening programs contribute to higher demand in medical imaging. Meanwhile, industrial applications, particularly in aerospace and automotive sectors, are utilizing these detectors for advanced CT scanning. Although the market shows steady growth, high costs and the presence of well-established alternatives, like direct radiography (DR) systems, may restrain rapid market penetration.

Asia-Pacific Asia-Pacific exhibits the fastest growth rate, driven by rapidly expanding healthcare infrastructure and increasing government spending on medical equipment. China dominates the region, supported by local manufacturing capabilities and rising demand for advanced diagnostic imaging in hospitals. India and Japan are also significant contributors due to growing awareness of early disease detection and technological advancements in digital radiography. Cost sensitivity, however, results in preference for traditional systems in some markets. Nevertheless, the increasing adoption of industrial CT scanning in electronics and automotive manufacturing presents lucrative opportunities for amorphous selenium detector suppliers.

South America The South American market is emerging, with Brazil being the primary adopter due to expanding healthcare facilities and government initiatives to modernize medical imaging infrastructure. However, economic instability and budget constraints limit the penetration of high-cost amorphous selenium detectors. Industrial applications, particularly in oil & gas inspection and aerospace, are gradually driving demand, but adoption remains slower compared to more developed regions. Market growth is further hindered by insufficient awareness of advanced detector technologies among small-scale healthcare providers.

Middle East & Africa The Middle East & Africa region shows nascent but promising potential, with Gulf Cooperation Council (GCC) countries leading in healthcare infrastructure development. Saudi Arabia and the UAE are investing in cutting-edge medical imaging technologies to enhance diagnostic accuracy. However, underdeveloped healthcare systems in other parts of Africa restrict market growth. Industrial applications, particularly in oil and security equipment, are gradually increasing demand, though affordability remains a key challenge. Long-term growth will depend on economic stability and government investments in health and industrial automation.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Amorphous Selenium Detector markets, covering the forecast period 2024–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Amorphous Selenium Detector market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (Size 14*17, Size 17*17, Others), application (Medical Imaging Equipment, Industrial CT, Security Equipment, Others), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The U.S. market is estimated at USD million in 2024, while China is projected to reach USD million by 2032.

Competitive Landscape: Profiles of leading market participants including Hologic, KA Imaging, Analogic Corporation, Fujifilm, Teledyne, and Newheek, covering their product offerings, market share, and strategic developments.

Technology Trends & Innovation: Assessment of emerging detector technologies, integration with medical imaging systems, and advancements in amorphous selenium fabrication techniques.

Market Drivers & Restraints: Evaluation of factors driving market growth such as increasing demand for digital radiography, along with challenges like high manufacturing costs and technical limitations.

Stakeholder Analysis: Insights for medical device manufacturers, imaging system integrators, component suppliers, and investors regarding market opportunities and strategic positioning.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

What You Need to Know About X-Rays: Safe, Simple & Essential for Health

X-rays are one of the most widely used tools in modern medicine, and for good reason. These powerful images give doctors the ability to see what’s happening inside your body without surgery or invasive procedures. Whether it’s checking for a fracture, spotting an infection, or assisting with a diagnosis, an x-ray is a quick and effective diagnostic solution.

What Is an X-Ray?

An x-ray is a form of electromagnetic radiation that passes through the body to create an internal image. Dense materials like bones appear white, while softer tissues show up in shades of gray. This contrast helps medical professionals detect injuries, infections, or abnormalities quickly and safely.

How Does an X-Ray Work?

An x-ray machine emits a controlled beam of radiation that passes through your body. A special detector or film on the other side captures the image. Your doctor can then examine these images for signs of broken bones, lung infections, or other internal issues.

The process is fast, painless, and non-invasive—perfect for urgent health concerns.

What Can an X-Ray Reveal?

X-rays are used to detect a wide range of health issues. Some common examples include:

Broken bones or fractures

Pneumonia and lung infections

Dental cavities and bone loss

Arthritis and joint problems

Swallowed objects (especially in children)

Digestive system obstructions

These images are often the first step in identifying a problem and deciding on treatment.

When Should You Get an X-Ray?

Doctors recommend an x-ray when symptoms suggest something hidden beneath the surface. You might need one if you’ve suffered an injury, have a persistent cough, or feel unexplained pain. Quick access to x-ray services helps speed up diagnosis and reduce discomfort.

Where Can You Get an X-Ray?

One of the most convenient places to get an x-ray is at an urgent care center. Facilities like Fast Track Urgent Care offer same-day x-ray imaging for a variety of conditions. It’s faster than a hospital visit and doesn’t require an appointment.

This option is ideal for injuries, sudden pain, or when your primary doctor isn’t available.

Is It Safe?

Yes. While x-rays use radiation, the amount is very small and considered safe for most people. Protective gear like lead aprons may be used to shield parts of your body. Doctors follow strict guidelines to ensure you’re exposed only when necessary.

Benefits of X-Rays

Fast diagnosis

Painless and non-invasive

Helps detect issues early

Widely available

Supports effective treatment planning