#audit workflow software

Explore tagged Tumblr posts

Text

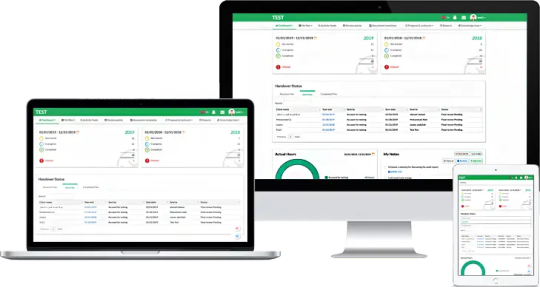

Audit Workflow Software

1Audit's "Audit Workflow Software" is a comprehensive solution that automates and optimizes the entire audit process. It streamlines task management, from planning and data collection to analysis and reporting, ensuring seamless coordination among audit teams. With customizable workflows, real-time tracking, and automated reminders, it helps ensure audits are completed on time, in compliance with regulations, and with minimal errors. The software enhances transparency, efficiency, and collaboration, allowing auditors to focus on critical analysis and decision-making. For more information, visit Website: https://1audit.com/

0 notes

Text

Why Your Business Needs a Powerful Audit Workflow Management Tool in 2025?

In today’s fast-paced regulatory environment, organizations such as BFSI (Banking, Financial Services, and Insurance), Fintech, Healthcare, and IT no longer rely on spreadsheets and manual tracking for their audit processes. From risk mitigation to compliance assurance, an audit workflow management tool plays a critical role in ensuring improved efficiency and transparency across all levels. With increasing regulatory pressure and growing cybersecurity risks, businesses must adopt modern audit solutions to maintain control, accuracy, and accountability across audit departments and processes.

What Is Audit Management Tool and Why Does It Matter?

Audit management tool is a digital solution designed to streamline, schedule, and manage internal audits effectively for governance, risk, and compliance management online anytime and anywhere. Internal audit management software replaces traditional paper-based processes with automated workflows, reducing human error and saving valuable time. Audit tools empower audit teams to conduct internal audits systematically while maintaining a centralized repository of audits.

Key Benefits of Using Internal Audit Management Software:

It centralizes all audit documents in one secure, organized, and accessible location.

It simplifies the end-to-end audit cycle including planning, scheduling, execution, and reporting.

It promotes seamless collaboration between internal teams and external auditors in real-time.

It minimizes risks of non-compliance and helps avoid costly regulatory penalties and fines.

In highly regulated sectors, like Banks, Finance, Fintech, and Healthcare, choosing an audit workflow management software ensures not only compliance but also fosters data integrity and protects organizational reputation in the long term.

Advantages of Audit Workflow Management Tool for Financial Institutions:

Internal audits are vital for assessing risk management, internal controls, and governance processes. The right audit management software ensures your audit teams work efficiently, stay aligned, and maintain data integrity throughout the audit lifecycle.

Automated scheduling and task assignment: Allows teams to define timelines and assign responsibilities efficiently with zero overlap.

Audit trail tracking for full transparency: Tracks all changes and actions taken during audits, ensuring accountability and data integrity.

Integration with existing compliance systems: Seamlessly connects with regulatory tools, risk frameworks, and data repositories.

Risk scoring and issue prioritization: Identifies critical risks based on severity and frequency, enabling timely response and mitigation.

Custom reporting and dashboards: Delivers insightful audit summaries with visual dashboards tailored to various stakeholder needs.

By utilizing dedicated internal audit management software, organizations can reduce audit cycle times, enhance decision-making, and establish a proactive compliance culture.

Move to the Cloud with Cloud-Based Audit Software

A growing number of companies in BFSI (Banking, Financial Services, and Insurance), Fintech, Healthcare, IT, and Manufacturing sectors are using cloud-based audit software for real-time access and collaboration across audit departments. Audit workflow tool eliminates the constraints of on-premises systems and ensures data security with cloud encryption. The features of Cloud-based audit management tools:

Remote access from multiple devices: Audit data is accessible securely via desktop, tablet, or mobile from anywhere.

Secure data backup and version control: Ensures records are safe, updated, and retrievable when needed for reviews or audits.

Lower IT maintenance costs: Reduces reliance on in-house infrastructure and support, saving operational expenses.

Scalability for growing audit teams: Easily accommodates expanding teams and evolving audit requirements without extra setup.

Automatic updates and compliance-ready templates: Keeps your system updated with the latest features and regulatory forms.

A well-defined workflow is the backbone of an effective audit. Audit workflow tool structures audit tasks, checkpoints, and documentation into a centralized, trackable system. Whether you call it an audit workflow tool or an internal audit management software, the goal remains the same: streamline your audit lifecycle from planning to final reporting.

Choosing the Right Audit Management Tool for Your Business

Not all internal audit software solutions are created equal. Choosing the best audit workflow management software for Banks, NBFCs, fintechs, Insurance, healthcare, etc. depends on the organization’s size and regulatory obligations. Businesses must consider integration, user-friendliness, and support for multi-layered audits when choosing a solution to ensure future scalability and compliance continuity. Here are some essential features to consider when choosing audit software:

Tailored features and modules for regulated sectors like BFSI, Healthcare, and Fintech.

Built-in compliance templates aligned with industry standards and regulations.

Real-time monitoring aligned with RBI, SEBI, IRDAI, SOX, and Basel III requirements.

End-to-end encryption and controlled user access to protect sensitive audit data.

Compatibility with both internal audits and external compliance inspections.

Check the audit software free demo before its purchase

Adopting a powerful audit workflow management tool is no longer a luxury — it’s a necessity. As regulatory frameworks grow more complex and the volume of audits increases, businesses must be equipped with reliable, scalable, and secure audit management system. Investing in the right platform will enhance compliance, boost team productivity, and safeguard your organization’s integrity.

Stay compliant. Stay ahead. Choose the right audit solution today or learn about AuditWise — a cloud-based audit workflow management software built for Banks, Fintech, Insurance, SaaS, NBFCs, and other regulated industries. Get started with a free demo.

#audit workflow tool#audit workflow software#audit workflow management software#audit workflow management tool#Internal audit management software#audit management software#cloud-based audit software#audit software free demo#audit management software for banks#audit management software for fintech#audit software for financial Institutions

1 note

·

View note

Text

Audit Management System

1audit offers a comprehensive Audit Management System tailored to meet your organizational needs. Their cutting-edge software streamlines external audit reviews, ensuring compliance with industry-leading standards. Experience seamless management of audit processes with advanced features designed for efficiency and accuracy. Elevate your auditing procedures with customizable workflows, real-time tracking, and robust reporting capabilities. Trust 1audit to optimize your audit management practices, enhance productivity, and uphold audit standards effortlessly.

0 notes

Text

Enhancing Audit Workflow Management with Cutting-Edge Tools from AudTech

Introduction

In the ever-evolving landscape of finance, audit and accounting firms must adopt innovative workflow management tools to stay competitive and deliver high-quality services. This blog explores the latest trends in audit workflow management and how AudTech’s advanced software is setting new standards in the industry. https://audtech.co.in/2025/04/03/regulatory-updates-in-statutory-audits-key-compliance-changes-firms-need-to-be-aware-of/

AI and Machine Learning: The Future of Audit Efficiency

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing audit workflows. By automating repetitive tasks, such as data collection and analysis, AI-driven tools help auditors focus on high-risk activities. AudTech’s software integrates AI to enhance data accuracy, identify anomalies, and provide predictive insights, streamlining the entire audit process.

Cloud-Based Solutions for Seamless Collaboration

Cloud computing is transforming audit workflow management by enabling real-time collaboration and accessibility. AudTech’s cloud-based platform allows auditors to access documents, share updates, and collaborate with clients from anywhere, at any time. This flexibility not only improves efficiency but also ensures that audit teams can work cohesively, even remotely.

Enhanced Data Security with Advanced Technologies

Data security is paramount in the auditing process. With increasing cyber threats, adopting robust security measures is essential. AudTech’s software incorporates state-of-the-art encryption and access control mechanisms, ensuring that sensitive financial data is protected against unauthorized access and breaches.

Real-Time Analytics and Reporting

Real-time analytics is a game-changer for auditors, providing immediate insights into financial data. AudTech’s platform offers advanced analytics tools that help auditors generate comprehensive reports quickly and accurately. This capability is crucial for making informed decisions and delivering timely audit results to clients.

Workflow Automation and Efficiency

Automated workflow management tools, such as those offered by AudTech, significantly enhance audit efficiency. These tools automate key audit processes, from planning and execution to reporting and follow-up. By reducing manual tasks, auditors can save time and focus on critical areas that require professional judgment.

Integration with Existing Systems

Modern audit workflow tools must integrate seamlessly with existing systems to maximize efficiency. AudTech’s software is designed to integrate with various financial and enterprise systems, ensuring a smooth workflow and eliminating data silos. This integration enhances data consistency and reduces the risk of errors.

Conclusion

Staying ahead in the competitive audit industry requires adopting the latest workflow management tools. AudTech’s advanced software provides auditors with the tools they need to enhance efficiency, accuracy, and client satisfaction. By leveraging AI, cloud computing, and automation, audit firms can streamline their workflows and deliver superior services in today’s digital age.

Contact

Office No. 810, 8th Floor,

LMS Finswell, Viman Nagar, Pune, Maharashtra, India, 411014

+91 9112118221 / [email protected]

0 notes

Text

The Future of Accounts Payable and Receivable Automation in India

In today’s fast-paced business environment, financial transactions must be handled efficiently to maintain cash flow and profitability. Companies are rapidly shifting towards digital solutions to optimize their financial operations. Accounts payable automation in India is revolutionizing how businesses manage their outgoing payments, ensuring accuracy, compliance, and seamless processing. Likewise, accounts receivable automation in India is helping organizations streamline invoicing, payment collection, and reconciliation, reducing manual errors and delays.

The Rise of Financial Services Automation in India

As industries expand and transactions increase, traditional manual financial processes become inefficient and error-prone. This has led to a surge in demand for financial services automation in India. Businesses across sectors are embracing automation to improve efficiency, enhance compliance, and minimize risks. Automated financial workflows not only speed up payment cycles but also provide real-time visibility into transactions, ensuring better decision-making.

Key Benefits of Accounts Payable and Receivable Automation

1. Enhanced Efficiency and Speed

Automation eliminates repetitive tasks, reducing the time spent on invoice processing and payment approvals. Companies using accounts payable automation in India can process invoices swiftly and avoid late payment penalties.

2. Error Reduction and Compliance

Manual data entry often results in miscalculations and compliance issues. With accounts receivable automation in India, businesses can ensure accurate billing, automated reminders, and error-free financial records.

3. Improved Cash Flow Management

By automating accounts payable and receivable functions, businesses can maintain a healthy cash flow, avoid bottlenecks, and ensure timely payments and collections.

4. Fraud Prevention and Security

Automation software comes with built-in security features that protect businesses from fraud, unauthorized access, and financial discrepancies.

Choosing the Right Accounts Payable and Receivable Automation Software

Selecting a reliable Accounts Payable Receivable Automation Software Company is crucial for businesses looking to modernize their financial operations. A good software provider offers features such as AI-powered invoice processing, automated reconciliation, seamless integration with ERP systems, and real-time reporting. Investing in the right automation solution ensures long-term financial efficiency and business growth.

Conclusion

The demand for accounts payable automation in India and accounts receivable automation in India is growing as businesses recognize the advantages of financial digital transformation. Partnering with a top Accounts Payable Receivable Automation Software Company can help organizations achieve operational excellence, reduce costs, and improve financial accuracy. Embracing financial services automation in India is no longer a choice but a necessity for companies looking to stay ahead in the competitive market.

If your business is looking for a seamless transition to automated financial processes, now is the time to explore cutting-edge solutions and take a step towards financial excellence!

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india#Accounts Payable Receivable Automation Software Company#financial services automation in india

0 notes

Text

Moon in Virgo: Tidy Up Your Biz and Harvest Financial Abundance

Astrologers, rejoice! Business gurus, unite! Because under the meticulous gaze of the Moon in Virgo, it's time to blend cosmic wisdom with practical strategy. Get ready for a potent mix of grounded energy, keen analysis, and a sprinkle of earthy magic ready to boost your business and finances.

Virgo's Virgo-ness: Picture a spotless spreadsheet, a perfectly balanced budget, and a to-do list so organized it whispers sweet satisfaction. That's Virgo's domain. When the Moon dances through this earth sign, it brings a laser focus on details, a knack for efficiency, and an urge to declutter both your physical and financial spaces.

Business Benefits:

Sharpened Skills: Hone your expertise, take that online course, or finally master that new software. Virgo's energy fuels learning and skill development, making you a powerhouse of knowledge and competence.

Channel your inner Hermione Granger under the Virgo Moon! Devour knowledge like polyjuice potion, mastering that new software with flick-of-the-wand ease. Whether it's an online course on astrological forecasting or the intricacies of blockchain technology, Virgo's studious energy makes you a sponge for information, transforming you into a confident, competence-wielding powerhouse ready to tackle any business challenge.

Streamlined Operations: Virgo loves a well-oiled machine. Use this lunar phase to audit your business processes, identify bottlenecks, and implement systems that save time and resources.

Don your efficiency hat, because under the meticulous Virgo Moon, streamlining your business becomes a cosmically ordained quest. Scrutinize processes like a celestial accountant, unearthing time-sucking bottlenecks and banishing them with automated spells (aka, handy new systems). Watch as email chains unfurl into streamlined communication channels, meetings morph into laser-focused action sessions, and your once-chaotic workflow hums like a perfectly tuned engine, freeing up precious time and resources for your entrepreneurial magic to truly shine.

Networking with Purpose: Quality over quantity is Virgo's motto. Connect with potential clients or collaborators who share your values and expertise. Think strategic partnerships, not random coffee chats.

Forget the business card bingo of generic gatherings – Virgo's discerning Moon demands quality connections. Seek out collaborators and clients who mirror your values and expertise, like kindred spirits drawn together by constellations of shared passion. Think chess match, not cocktail party. Craft targeted pitches that resonate with their specific needs, and cultivate strategic partnerships that feel like cosmically ordained alliances. This intentional networking isn't about collecting contacts, it's about igniting mutually beneficial collaborations that propel your business towards the stars.

Marketing Magic: Craft targeted campaigns that speak directly to your ideal customer's needs. Virgo's analytical prowess helps you understand your audience and deliver messaging that resonates.

Under the analytical gaze of the Virgo Moon, ditch the shotgun marketing blasts and unleash laser-focused campaigns that whisper sweet nothings to your ideal customer's soul. Virgo's eagle eye pinpoints their deepest desires and pain points, transforming you into a messaging maestro. Craft content that speaks their language, addresses their specific struggles, and showcases your solutions like the missing puzzle piece to their perfect life. Let go of generic pitches and embrace storytelling that resonates with their values, because under this lunar influence, targeted marketing isn't just effective, it's downright magical.

Financial Fortunes:

Budgeting Bliss: Break out the spreadsheets and get granular. Categorize expenses, track income, and create a budget that feels secure and sustainable. Virgo loves a balanced bottom line.

Spreadsheets sing and budgets balance under the Virgo Moon! Unleash your inner accounting alchemist and transform financial chaos into crystal-clear clarity. Categorize expenses with the precision of a cosmic librarian, track every penny like a moonbeam, and craft a budget that feels not like a restrictive cage, but a beautifully organized, secure haven for your financial future. Virgo craves equilibrium, so find that sweet spot where income and outgoings waltz in perfect harmony, leaving you feeling abundant and empowered, the maestro of your own financial orchestra.

Debt Disposal: Tackle outstanding debts with renewed determination. Negotiate better terms, make extra payments, and experience the liberation of financial freedom.

Ditch the debt demon and embrace the warrior spirit under the Virgo Moon! Channel your inner debt disposal dragon, breathing fire upon outstanding balances with renewed determination. Hone your negotiation skills like a celestial diplomat, securing lower interest rates and crafting repayment plans that fit your budget like a cosmic glove. Make extra payments with the fervor of a moonbeam illuminating a dark cave, watching those numbers shrink faster than a vampire in sunlight. Embrace the sweet liberation of financial freedom, feeling the weight of debt lift like a cosmic spell dissolving, leaving you empowered and ready to conquer your financial Everest.

Savvy Investments: Research, compare, analyze – Virgo's energy is perfect for making informed investment decisions. Seek advice from trusted professionals and prioritize long-term stability over short-term gains.

Transform into a celestial stockbroker under the Virgo Moon! Put on your research goggles and analyze potential investments like a cosmic detective, comparing, contrasting, and sniffing out hidden risks. Consult trusted financial oracles for guidance, but ultimately, let your own Virgo-honed discernment be your compass. Prioritize long-term stability over fleeting trends, building a portfolio that grows like a well-tended celestial garden, not a gambler's dice roll. Embrace the slow and steady path, for under Virgo's meticulous gaze, informed investments blossom into financial freedom, one calculated decision at a time.

Unexpected Windfalls: Keep an eye out for unexpected opportunities to increase your income. Virgo favors those who put in the work, so your dedication could be rewarded with a bonus, a new client, or a lucky windfall.

Keep your antennae tuned to cosmic whispers under the Virgo Moon, for fortune often favors the prepared! Your dedication and sharpened skills could attract unexpected boons like a bonus shimmering out of thin air, a new client drawn by your newfound expertise, or a windfall landing softly as a celestial feather in your lap. Remember, Virgo rewards hard work, so keep hustling, honing, and learning, and trust that the universe may just surprise you with a bonus chapter in your financial story.

Bonus Tip: Embrace the earthy magic of Virgo! Surround yourself with green spaces, incorporate crystals like citrine and jade into your workspace, and practice grounding exercises to channel the Moon's practical energy.

So, there you have it! The Moon in Virgo is your invitation to tidy up your biz, fine-tune your finances, and reap the rewards of your focused efforts. Remember, success is a marathon, not a sprint. Pace yourself, celebrate the small wins, and trust that under Virgo's meticulous guidance, your business and finances will shine.

Now go forth and conquer, astrologically savvy entrepreneurs! Your financial stars are aligned.

#Moon in Virgo#Virgo Moon#business astrology#Astrology business#finance astrology#astrology updates#astro#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology community#astrology observations#astropost#astro observations#astro community

50 notes

·

View notes

Text

Why Your Business Needs ServiceNow Integration Now More Than Ever

In today’s fast-paced digital world, organizations are continuously finding methods to increase powerful solution that has emerged to meet these problems is ServiceNow, a robust cloud-based platform that streamlines IT service management (ITSM), automates workflows, and fosters digital transformation.

However, to fully leverage its capabilities, ServiceNow integration with your existing systems is essential. Here’s why ServiceNow integration is not just beneficial — it's critical for your business success now more than ever.

1. Unify Disconnected Systems for Better Visibility

Modern enterprises often rely on a patchwork of software systems — CRMs, ERPs, HR platforms, help desks, and more. The lack of communication between these systems leads to data storage, pointless processes, and missed opportunities. ServiceNow integration connects these numerous platforms, enablingstreamlined workflows and real-time data exchange. This cohesive perspective improves departmental cooperation, boosts productivity, and gives decision-makers useful information.

Customer service teams can access support ticket statuses directly within the CRM by connecting ServiceNow with Salesforce, for instance, which speeds up resolution times and improves customer satisfaction.

2. Increase Operational Efficiency Through Automation

Doing manual tasks takes a lot of time, often leads to mistakes, and can be costly. ServiceNow helps by connecting different departments—like HR, IT, finance, and facilities—and taking care of routine work automatically. When your systems are linked, tasks that once needed several steps across various tools can now be done in one smooth process.

Take employee onboarding, for example. You may eliminate the need for manual setup of user accounts, equipment assignments, and workspace preparation by integrating ServiceNow connectivity with HR platforms such as Workday. This ensures both speed and accuracy across departments.

3. Enhance Employee and Customer Experience

In the digital age, experience is everything. Frustrated employees dealing with broken workflows and delayed approvals are less productive and more likely to disengage. Similarly, customers expect prompt and effective service.

ServiceNow integration helps businesses create a more responsive and proactive support environment. For

instance, when performance problems are identified, combining ITSM with monitoring software such as SolarWinds or Nagios can immediately generate incident tickets, cutting down on downtime and speeding up problem solving.

Integrated ServiceNow environments improve internal and external experiences by simplifying communication and lowering process friction.

4. Adapt Faster with Scalable, Flexible Infrastructure

With business needs evolving faster than ever — especially in a post-pandemic, hybrid-work world — agility is crucial. ServiceNow’s integration framework allows businesses to scale and adapt quickly. With ServiceNow's integrations, you may grow into new markets, introduce new applications, or switch to remote operations without having to completely revamp your current tech stack.

For instance, as more firms implement hybrid or remote work models, connecting ServiceNow with collaboration platforms like Microsoft Teams or Slack provides real-time changes, approvals, and communication from within those tools, keeping teams connected and productive.

5. Strengthen Compliance and Security

Adherence to industry rules (like HIPAA, GDPR, or SOX) is non-negotiable. Integration ensures that all systems are consistently enforcing policies and security protocols across the organization. ServiceNow can help centralize compliance reporting and automate audits by pulling data from multiple integrated sources.

Integration with cybersecurity tools also creates a more secure operational environment like Splunk or CrowdStrike, which improve the capacity to identify and address attacks.

6. Drive ROI Through Smarter IT Investments

Confusion, redundant work, or underutilized tools are frequently the results of firms introducing new tools but failing to properly integrate them with their current system. ServiceNow integration ensures that everything functions properly, which helps reduce waste. Your teams can get the information they need without jumping between platforms, and you gain more value out of the tools you’ve already paid for.

The journey toward digital transformation is now mandatory — it’s a strategic imperative. As business demands grow and the technology landscape becomes more complex, ServiceNow integration becomes a vital tool for fostering development, agility, and efficiency.

Working smarter, not harder, is possible, by integrating ServiceNow with your business systems, whether your goal is to increase security and compliance, optimize operations, or improve user experiences. Don’t wait until inefficiencies or outages force your hand. The time to integrate is now — and your business will be stronger for it.

4 notes

·

View notes

Text

Boost Your Business with Field Service Management Apps by FieldEZ Technologies

In today’s fast-paced, customer-centric business landscape, ensuring efficient field operations is not just an advantage — it’s a necessity. Whether you manage service technicians, sales teams, or retail staff on the ground, optimizing their workflow and performance can directly influence your business growth. That’s where field service management apps come in — and FieldEZ Technologies leads the way with smart, intuitive solutions designed to automate, streamline, and scale your field operations.

The Power of Field Service Management Software:

Field service management software helps businesses manage their remote workforce efficiently. It encompasses features like task scheduling, dispatching, real-time location tracking, attendance management, expense reporting, and analytics. This software transforms traditional manual operations into a seamless, automated experience — improving productivity, reducing errors, and enhancing customer satisfaction.

By integrating workflow automation, FSM apps eliminate repetitive tasks, reduce paperwork, and give managers better control over every stage of a field operation. With FieldEZ Technologies, you get a comprehensive suite of tools that empower your teams and delight your clients.

Introducing FieldEZ Technologies:

FieldEZ is a trusted name in field service automation, catering to various industries such as telecom, HVAC, retail, healthcare, and more. Their innovative platforms — ServiceEZ, SalesEZ, and RetailEZ — are designed to meet specific operational needs while delivering maximum efficiency.

Let’s dive into how these apps can boost your business:

1. ServiceEZ — Streamlining Field Service Operations

ServiceEZ is a powerful field service management app built to simplify the life of service teams. From job assignments and live tracking to invoicing and customer feedback, everything is integrated into one seamless platform. ServiceEZ ensures:

Faster response times

Reduced service delays

Better workforce utilization

Transparent customer communication

With its intuitive interface and workflow automation features, ServiceEZ minimizes downtime and ensures that service technicians are always where they need to be, with the right tools and information.

2. SalesEZ — Empowering Field Sales Teams

Field sales can be unpredictable and hard to manage without the right technology. SalesEZ gives you control over sales representatives in real time. Features like route planning, geo-tracking, sales reporting, and lead management help boost sales performance significantly. SalesEZ enables:

Real-time sales data insights

Automated reporting and forecasting

Seamless lead-to-order workflows

Geo-fenced check-ins and time tracking

By automating repetitive tasks and offering mobile access to customer information, SalesEZ improves the effectiveness and accountability of your sales force.

3. RetailEZ — Enhancing Retail Execution

For retail brands with distributed teams handling merchandising, audits, or promotions, RetailEZ brings unmatched visibility and control. It helps ensure retail execution is consistent, data-driven, and timely. Key benefits include:

Real-time field activity updates

In-store compliance tracking

Promotion execution monitoring

Inventory and planogram audits

RetailEZ supports efficient retail operations while delivering valuable insights into market trends and consumer behaviors.

Why Choose FieldEZ?

What sets FieldEZ Technologies apart is its commitment to workflow automation, mobile-first design, and customizable modules. Their solutions integrate easily with your existing ERP, CRM, or HR systems, ensuring a hassle-free experience across departments. With features like offline mode, AI-driven analytics, and multilingual support, FieldEZ apps are built for real-world field challenges.

Conclusion:

Investing in field service management software like those offered by FieldEZ Technologies can be a game-changer for your business. Whether you aim to improve service response, empower your sales team, or manage your retail presence, FieldEZ’s apps — ServiceEZ, SalesEZ, and RetailEZ — offer the tools you need to succeed.

Boost your business with smarter, faster, and more connected field operations — powered by FieldEZ.

#fieldez#field service#services#apps#management software#field management#field service software#field force management#field workforce management#workflow automation

2 notes

·

View notes

Text

Traditional Vs Automated Direct Mail Services

Direct mail has long been a trusted marketing channel. In 2025, businesses face a choice between traditional direct mail services and automated solutions. Understanding the difference can drastically impact your campaign’s efficiency, ROI, and customer experience.

What Is Traditional Direct Mail?

Traditional direct mail involves manual processes such as:

Designing postcards or letters by hand or through desktop software

Printing at local shops or internal print facilities

Manually stuffing, stamping, and mailing

Tracking via physical receipts or third-party couriers

Pros:

Full control over the process

Hands-on personalization

Local vendor relationships

Cons:

Time-consuming

Prone to human error

Hard to scale

Costlier for small volumes

What Is Automated Direct Mail?

Automated direct mail refers to using software or APIs to trigger, personalize, print, and send mail pieces based on digital actions or CRM data.

Examples:

A new customer signs up, and a welcome postcard is triggered automatically

Abandoned cart triggers a mailed coupon

Real-time API sends birthday cards based on database date

Pros:

Scalable for millions of mailings

Real-time integration with CRMs and marketing platforms

Consistent branding and quality

Analytics and tracking included

Cons:

Higher setup cost initially

Requires data hygiene and tech alignment

Key Differences Between Traditional and Automated Direct Mail

FeatureTraditionalAutomatedSpeedSlow (days to weeks)Instant or scheduledScalabilityLimitedHighly scalablePersonalizationManualDynamic via variable dataTrackingManual or nonexistentDigital trackingIntegrationNoneAPI and CRM support

When Should You Choose Traditional?

For small, one-time mailings

When personal touch matters (e.g., handwritten letters)

In areas with no access to digital tools

When to Use Automated Direct Mail?

For ongoing marketing campaigns

When speed, consistency, and tracking are priorities

For eCommerce, SaaS, healthcare, insurance, and real estate

Use Case Comparisons

Traditional Use Case: Local Real Estate Agent

Manually prints and mails just listed postcards to a zip code every month.

Automated Use Case: National Insurance Company

Triggers annual policy renewal letters for 500,000+ customers via API.

Benefits of Automation in 2025

Real-Time Triggers from websites, CRMs, or payment systems

Enhanced Reporting for ROI measurement

Reduced Costs with bulk printing partnerships

Faster Delivery using localized printing partners globally

Eco-Friendly Workflows (less waste, digital proofing)

How to Switch from Traditional to Automated Direct Mail

Audit your current workflow

Choose a provider with API integration (e.g., PostGrid, Lob, Inkit)

Migrate your address data and test campaigns

Train your team and build trigger-based workflows

Conclusion: Choosing the Right Direct Mail Method

Ultimately, the right choice depends on your goals. While traditional direct mail has its place, automated direct mail offers speed, flexibility, and scale. For modern businesses aiming for growth and efficiency, automation is the clear winner.

SEO Keywords: traditional vs automated direct mail, automated mailing services, direct mail automation, API for direct mail, manual vs automated marketing.

youtube

SITES WE SUPPORT

Healthcare Mailing API – Wix

2 notes

·

View notes

Text

Fixed Asset Management and Software Solution

Fixed Asset Management and Software Solution

In today’s fast-paced business world, fixed asset management is more than a ledger entry—it’s a strategic cornerstone. Leading the way, Impenn offers a comprehensive, technology-driven solution tailored to the nuances of modern enterprises. Whether you handle IT equipment, manufacturing machines, or real estate, Impenn transforms fixed asset management into a business accelerator.

1. Real-Time Tracking & Tagging

Impenn’s platform supports RFID, barcodes, and QR codes, enabling real-time visibility and accuracy. Each asset, from laptops to heavy machinery, receives a unique tag. Field personnel scan assets during physical verification, ensuring records align with reality. This foundation of fixed asset management minimizes losses and ensures audit readiness impenn.in.

2. Centralized Dashboard & Automation

Impenn centralizes asset data across locations and departments. A unified portal displays acquisition dates, maintenance schedules, depreciation, and compliance status. Automated depreciation calculations reduce manual work and errors, reinforcing the integrity of your fixed asset management cycle .

3. Physical Verification & Reconciliation

Regular physical audits are essential to effective fixed asset. Impenn’s solution supports scheduled verifications, matching scanned tags with ledger entries. Discrepancies trigger reconciliation workflows, uncovering missing, moved, or retired assets. This precision helps streamline FAR restructuring and compliance needs .

4. Compliance Reporting & Audit Trails

Adhering to financial regulations is critical. Impenn enables comprehensive compliance reporting with audit trails showing who updated what, and when. Whether local tax authorities or global standards apply, Impenn’s detailed logs strengthen both governance and fixed asset management practices impenn.in.

5. Integration with Financial & HR Systems

A standout feature in Impenn’s fixed asset management solution is its seamless integration with financial and payroll modules. By linking asset values and depreciation with general ledger entries, it ensures real-time accounting accuracy. The HR‑payroll sync aligns salary costs and asset allocations, offering a holistic view across finance, operations, and HR .

6. Asset Lifecycle Optimization

Effective fixed asset accounting includes planning for acquisition, usage, maintenance, and retirement. Impenn supports lifecycle workflows, including maintenance reminders, warranty tracking, and retirement triggers. By proactively monitoring asset performance, organizations can maximize ROI and reduce downtime.

7. Productivity Gains & Cost Savings

Impenn notes that businesses experienced reduced administrative overhead and improved productivity after digitizing fixed asset management across locations. Real-time insights enabled smarter budgeting, timely disposal of redundant assets, and more precise capital planning impenn.in.

8. Industry-Specific Asset Tagging

Recognizing that needs vary, Impenn offers customizable tagging schemes tailored to specific industries. Healthcare, manufacturing, IT, and education sectors benefit from predefined tag templates, but the system also allows custom fields for regulatory codes or warranty schedules. This flexibility elevates fixed asset management to industry-grade relevance impenn.in.

9. Scalability & Multi-location Support

From single-site operations to multinational corporations, Impenn’s platform supports multi-site deployment. Assets from various branches feed into a single dashboard, enabling consolidated views and granular drill-downs. Organizations can apply consistent fixed asset management policies across all locations, ensuring global control.

10. AI-Enabled Insights

Impenn goes beyond tracking with AI-driven analytics. The system identifies usage patterns, flags anomalies (e.g., unusually low utilization), and suggests cost-optimization strategies. These insights help managers make data-driven “fixed asset management” decisions.

Why Choose Impenn for Fixed Asset Management?

Feature

Benefit

Asset tagging & real-time tracking

Eliminates manual entry, reduces errors, and ensures asset visibility

Automated depreciation & compliance

Simplifies financial audits and regulatory adherence

Integrated finance & HR

Aligns asset values, payroll, and accounting for unified reporting

Lifecycle management & analytics

Optimizes usage, maintenance, and budgeting through actionable insights

Multi-industry & multi-site support

Scales with business growth and diverse regulatory environments

Founded in 2018, Impenn Business Solutions Pvt. Ltd. began with a core mission to streamline general ledger reconciliation and close visibility gaps in compliance processes. Headquartered in Udyog Vihar, Gurugram, India, the company quickly expanded into integrated financial, HR-payroll, and inventory solutions, all built on the same unified platform impenn.in.

Today, Impenn serves clients across sectors, including manufacturing outfits, pharma companies, IT firms, educational institutions, and healthcare providers. Its asset platform seamlessly integrates with their finance and HR modules, offering a 360° enterprise view. Users can track asset purchases in finance, assign depreciation codes, and tie assets to employee records—all within the same system.

Getting Started with Impenn’s Fixed Asset Management

Initial Audit & Tagging Begin by scanning existing assets using mobile devices. Impenn supports durable barcode and RFID tags to ensure long-term readability.

Integration Setup Sync asset data with finance (GL accounts) and HR/payroll systems to enable real-time reporting and tracking.

Depreciation & Lifecycle Configuration Define depreciation rules, warranty terms, and maintenance schedules. Impenn automates notifications and depreciation posting.

Scheduled Physical Verification Implement regular scans across locations to validate asset existence and condition. Discrepancies are flagged for reconciliation.

Reports & Analysis Use dashboards and audit logs to monitor asset activity. Impenn’s AI insights help managers make informed reallocation or retirement decisions.

Compliance & Audit Support Generate regulatory-ready reports with full audit trails. Depreciation and asset movement logs are exportable for external review.

Real-World Impact

Organizations adopting Impenn’s fixed asset management platform report:

30–50% faster asset audits

15–20% reduction in unnecessary asset purchases or retirements

Transparent audit logs, minimizing compliance risks

Consolidated views across finance, HR, and asset teams

In an era where assets drive capital investments and operational capability, mastering fixed asset software is vital. Impenn delivers a full-spectrum solution—from precise tagging to AI-based recommendations—backed by automation, audit transparency, and system integration. Based in Gurugram, India, and active since 2018, Impenn stands as a compelling choice for businesses seeking a centralized, efficient, and intelligence-driven approach to asset governance.

By embracing Impenn, you’re not just managing assets—you’re steering them as strategic levers for growth, compliance, and financial clarity. Ready to transform your asset landscape? Discover Impenn’s fixed asset management platform today.

Visit Website For More Information: www.impenn.in

2 notes

·

View notes

Text

Audit Workflow Software

1Audit's "Audit Workflow Software" is a comprehensive solution that automates and optimizes the entire audit process. It streamlines task management, from planning and data collection to analysis and reporting, ensuring seamless coordination among audit teams. With customizable workflows, real-time tracking, and automated reminders, it helps ensure audits are completed on time, in compliance with regulations, and with minimal errors. The software enhances transparency, efficiency, and collaboration, allowing auditors to focus on critical analysis and decision-making. For more information, visit Website: https://1audit.com/

0 notes

Text

Audit Solution

1audit offers a comprehensive Audit Solution designed to streamline your external audit review process. Their cutting-edge audit management system utilizes advanced technology to enhance efficiency and accuracy. With their intuitive audit management software, you can seamlessly navigate through audits, track progress, and ensure compliance with ease. Say goodbye to cumbersome paperwork and hello to a simplified auditing experience. Trust 1audit for all your audit needs, and elevate your organization's efficiency today.

0 notes

Text

The Shift to Cloud-Based Auditing – Why Firms Are Moving Towards Digital Audit Solutions

The auditing landscape is undergoing a massive transformation with the rapid adoption of cloud-based audit software. As regulatory requirements grow stricter and businesses seek efficiency, firms are shifting towards audit workflow management software to streamline processes, enhance security, and ensure compliance. This digital shift is not just a trend—it’s a necessity for firms aiming to stay competitive in a rapidly evolving financial environment.

The Need for Digital Audit Solutions

Traditional auditing methods relied heavily on manual data entry, paper-based documentation, and inefficient workflow management. These outdated processes often led to errors, compliance risks, and delays in report generation. The rise of audit automation software has eliminated these challenges by providing real-time collaboration, automated reporting, and AI-powered insights for auditors and accountants.

Key drivers for the adoption of cloud-based audit software include:

Increasing regulatory scrutiny and compliance complexities

The need for secure, remote access to audit files

Demand for enhanced accuracy and reduced manual errors

Efficient management of large volumes of financial data

Cost-effectiveness and scalability of cloud solutions

Benefits of Cloud-Based Audit Solutions

Enhanced Workflow Automation

A cloud-based audit workflow management system helps firms automate repetitive tasks, improving efficiency and productivity. Features like audit file management software and audit sampling software enable auditors to manage documentation, track workflows, and generate reports with minimal effort.

Improved Data Security and Compliance

Cloud-based audit management software solutions come with robust security measures, including encryption, multi-factor authentication, and compliance with international data protection standards. Unlike traditional on-premise audit tools, cloud solutions offer automated updates to meet regulatory changes in statutory audits. https://audtech.co.in/2025/04/08/the-shift-to-cloud-based-auditing-why-firms-are-moving-towards-digital-audit-solutions/

Seamless Collaboration and Remote Access

With firms adopting hybrid and remote work models, audit workflow software enables real-time collaboration. Team members can access audit files securely from anywhere, reducing dependency on physical office spaces. This feature is especially beneficial for statutory audit firms that handle global clients.

Cost-efficiency and Scalability

Cloud-based audit digitization software reduces infrastructure costs, eliminating the need for physical servers and extensive IT maintenance. Firms can scale their audit management software as needed, ensuring flexibility in handling audits of varying complexities.

Advanced Analytics and AI-Powered Insights

Modern audit software for accountants and CPA firms integrates data analytics tools to detect anomalies, assess risks, and provide predictive insights. This enhances decision-making and strengthens the overall audit process by identifying potential fraud or compliance breaches early.

Key Compliance Challenges Addressed by Cloud Auditing

One of the primary reasons firms are shifting towards cloud-based audit automation software is to ensure compliance with ever-changing regulatory requirements. The latest audit quality maturity models emphasize the importance of audit sampling tools, digital record-keeping, and automated compliance checks. Top statutory audit software solutions now include built-in regulatory updates, reducing the burden on firms to track compliance changes manually.

Implementing Cloud-Based Auditing – Best Practices

To fully leverage the benefits of audit workflow management, firms should follow these best practices:

Choose the Right Audit Management Software – Select a solution with audit file management, document collaboration, and compliance tracking.

Train Your Team – Ensure auditors and accountants are well-trained in using audit automation software to maximize efficiency.

Prioritize Data Security – Implement strict security protocols, including multi-layer encryption and access control features.

Monitor Regulatory Updates – Use software with built-in compliance tracking to stay aligned with statutory audit regulations.

Conclusion

The shift to cloud-based audit solutions is no longer optional—it’s an industry standard for firms aiming to improve efficiency, compliance, and security. Investing in audit workflow software enables firms to stay ahead in an increasingly complex regulatory environment while optimizing operations. By adopting audit automation software, firms can reduce errors, enhance collaboration, and ensure compliance with evolving audit regulations.

Whether you’re a small CPA firm or a large accounting practice, upgrading to cloud-based audit tools will future-proof your business and position it for long-term success.

Optimize your audit process today with a powerful cloud-based solution. Explore the best-in-class audit software tailored for statutory audits, financial reporting, and compliance management.

Contact

Office No. 810, 8th Floor,

LMS Finswell, Viman Nagar, Pune, Maharashtra, India, 411014

+91 9112118221 / [email protected]

0 notes

Text

Revolutionizing Healthcare with HIPAA Compliant Workflow Automation in India

The healthcare industry in India is rapidly evolving, with digital transformation reshaping how medical data is managed and secured. With increasing concerns over patient privacy, regulatory compliance, and operational efficiency, healthcare providers must adopt HIPAA compliant workflow automation in India to streamline their processes while ensuring data security and regulatory adherence.

The Need for HIPAA Compliant Workflow Automation in India

Healthcare organizations deal with vast amounts of sensitive patient data, making security and compliance crucial. Manual processes not only slow down operations but also pose risks such as data breaches, unauthorized access, and compliance violations. By implementing HIPAA compliant workflow automation in India, hospitals, clinics, and medical service providers can enhance efficiency, reduce errors, and maintain compliance with global standards.

Key benefits of workflow automation include:

Improved Data Security: Automating healthcare workflows minimizes human intervention, reducing the chances of data mishandling.

Regulatory Compliance: Automated systems ensure that healthcare organizations meet regulatory standards effortlessly.

Operational Efficiency: Faster data processing, seamless coordination, and reduced paperwork enhance overall patient care.

Ensuring Data Protection with Healthcare Data Security Solutions in India

Data security remains one of the biggest challenges in the healthcare sector. With cyber threats on the rise, implementing robust healthcare data security solutions in India is non-negotiable. These solutions help in protecting electronic health records (EHRs), preventing unauthorized access, and ensuring that sensitive patient data remains confidential.

Leading healthcare data security solutions in India include:

End-to-End Encryption: Protects patient data during storage and transmission.

Access Control Mechanisms: Ensures only authorized personnel can access sensitive information.

Regular Security Audits: Helps identify vulnerabilities and maintain compliance with regulations.

Streamlining Compliance with Healthcare Regulatory Compliance Software in India

Navigating the complex regulatory landscape in India’s healthcare sector requires specialized tools. Healthcare regulatory compliance software in India helps organizations adhere to industry guidelines such as HIPAA, NABH, and GDPR by automating compliance processes, reducing human error, and ensuring regular reporting.

Features of compliance software include:

Automated Compliance Checks: Reduces risks of violations and penalties.

Audit-Ready Reports: Simplifies regulatory inspections and documentation.

Real-Time Monitoring: Ensures continuous adherence to evolving regulations.

The Future of Healthcare Automation and Compliance in India

As India’s healthcare sector embraces digitalization, the demand for HIPAA compliant workflow automation in India, healthcare data security solutions in India, and healthcare regulatory compliance software in India will continue to grow. By leveraging these technologies, healthcare organizations can enhance efficiency, improve security, and ensure seamless regulatory compliance, ultimately leading to better patient care and trust.

If you’re looking to implement top-tier healthcare automation and security solutions, now is the time to invest in cutting-edge technologies that protect your organization and your patients.

#aviation compliance software in india#audit tracking system#hipaa compliant workflow automation in india#document approval workflows in india#aviation document management system#healthcare data security solutions in india#accounts payable automation in india#healthcare regulatory compliance software in india

0 notes

Text

How Can Legacy Application Support Align with Your Long-Term Business Goals?

Many businesses still rely on legacy applications to run core operations. These systems, although built on older technology, are deeply integrated with workflows, historical data, and critical business logic. Replacing them entirely can be expensive and disruptive. Instead, with the right support strategy, these applications can continue to serve long-term business goals effectively.

1. Ensure Business Continuity

Continuous service delivery is one of the key business objectives of any enterprise. Maintenance of old applications guarantees business continuity, which minimizes chances of business interruption in case of software malfunctions or compatibility errors. These applications can be made to work reliably with modern support strategies such as performance monitoring, frequent patching, system optimization, despite changes in the rest of the system changes in the rest of the systems. This prevents the lost revenue and downtime of unplanned outages.

2. Control IT Costs

A straight replacement of the legacy systems is a capital intensive process. By having support structures, organizations are in a position to prolong the life of such applications and ensure an optimal IT expenditure. The cost saved can be diverted into innovation or into technologies that interact with the customers. An effective support strategy manages the total cost of ownership (TCO), without sacrificing performance or compliance.

3. Stay Compliant and Secure

The observance of industry regulations is not negotiable. Unsupported legacy application usually fall out of compliance with standards changes. This is handled by dedicated legacy application support which incorporates security updates, compliances patching and audit trails maintenance. This minimizes the risks of regulatory fines and reputational loss as well as governance and risk management objectives.

4. Connect with Modern Tools

Legacy support doesn’t mean working in isolation. With the right approach, these systems can connect to cloud platforms, APIs, and data tools. This enables real-time reporting, improved collaboration, and more informed decision-making—without requiring full system replacements.

5. Protect Business Knowledge

The legacy systems often contain years of institutional knowledge built into workflows, decision trees, and data architecture. They should not be abandoned early because vital operational insights may be lost. Maintaining these systems enables enterprises to keep that knowledge and transform it into documentation or reusable code aligned with ongoing digital transformation initiatives.

6. Support Scalable Growth

Well-supported legacy systems can still grow with your business. With performance tuning and capacity planning, they can handle increased demand and user loads. This keeps growth on track without significant disruption to IT systems.

7. Increase Flexibility and Control

Maintaining legacy application—either in-house or through trusted partners—gives businesses more control over their IT roadmap. It avoids being locked into aggressive vendor timelines and allows change to happen on your terms.

Legacy applications don’t have to be a roadblock. With the right support model, they become a stable foundation that supports long-term goals. From cost control and compliance to performance and integration, supported legacy systems can deliver measurable value. Specialized Legacy Application Maintenance Services are provided by service vendors such as Suma Soft, TCS, Infosys, Capgemini, and HCLTech, to enable businesses to get the best out of their current systems, as they prepare to transform in the future. Choosing the appropriate partner will maintain these systems functioning, developing and integrated with wider business strategies.

#BusinessContinuity#DigitalTransformation#ITStrategy#EnterpriseIT#BusinessOptimization#TechLeadership#ScalableSolutions#SmartITInvestments

3 notes

·

View notes

Text

📁 Interview 004: "Voicebank configuration on MacOS." ft. chevrefee

Today's topic is something we've covered on this blog before in my voicebank configuration tutorial series! In my tutorial series we go over the basics of configuring your first CV-VV voicebank on MacOS. After practicing the fundamentals, you can explore other configuration types for UTAU. Our guest with us today is Chevrefee who specializes in C+V English voice banks! There are many ways to record an English voicebank. This format is more compact than the standard VCCV English configuration, which is daunting for most users. If you are interested in configuring an English UTAU, Chevrefee has a detailed tutorial on their C+V method, I will link that below if you would like to read more about it.

Q. To start off this interview, please introduce yourself and your work!

Chev: With pleasure, I'm Chevrefee, an animator and creator for UTAUs Ceta and Veria! People might know me best for my C+V English voicebanks and tutorial, since I've been dedicating a lot of time to promote the format.

Your materials on C+V English are incredible! I have watched through your tutorial on it and would love to make a voicebank some day! In today's interview, we will be discussing this subject more.

Q. For our first question, how long have you been doing UTAU for?

Chev: Thank you for your enthusiasm!! I've only been doing UTAU for only a little more than a year, but I have been using other vocal synthesizers for 2 years at this point!

Ah really? That's really impressive as you know so much already!! UTAU is a very expansive format as its very customizable.

Q. What other synthesizers do you have experience in?

Chev: I mostly used Synthesizer V prior to using UTAU! I loved creating designs for the mascot-less voicebanks and I realized that I loved that customizable aspect of it, so moving on to creating UTAUs was somewhat expected.

Ah! I went through your website and was looking through your SynthesizerV designs, I love them so much!! It's nice having a face to attach to the character's voice, my favorite out of them would be Ryo as I love characters with glasses.

Q. Returning UTAU, before we discuss anything on voicebank creation, I am curious to hear what your workflow on MacOS is like! I want to share the process with the audience so its not from my own experience.

Chev: I exclusively use OpenUTAU, RecStar and VLabeler for my UTAU works! I record the samples on my iOS Recstar and a USB microphone, oto in VLabeler and tune in OpenUTAU ( sometimes doing both at the same time ), and then I move on to Adobe Audition to mix and bring it all together! Seems like an odd choice for a DAW (since its barely one) but I mainly use Audition for its compatibility with other Adobe software, since I also create my MVs there! I also use Audition to clean my samples since there's a batch processing option.

Its so cool hearing someone take advantage of UTAU mainly on MacOS that's not me! I'm pretty much the same except I do most of my OTOing inside of UTAU-Synth! Can't break the habit as I've been working in there for 7 years now. OpenUTAU, VLabeler, and Recstar changed everything on MacOS when they released. We finally had proper applications for bank creation. So I feel like as someone on MacOS you got into UTAU in the golden era! (haha) I've got a few friends who use Adobe Audition, and I've used it once myself! Couldn't exactly navigate it well, but my friends who do use it make it look like a piece of cake. There are no batch export options for Garageband, and for UTAU, batch exporting is a very crucial feature.

Q. For our next question in bank creation, what are your recommendations for beginners in terms of recording and hardware?

Chev: I feel the same way! I feel really lucky that I got into UTAU when its at its most accessible for MacOS users, especially since I upgraded to a Mac Silicon device and lost access to Windows Bootcamp. For beginners I would recommend familiarizing using RecStar! I would suggest using the iOS or Android version of it especially if the user is recording in their bedroom space. I found that using a phone helps manage the space better when I stuff myself into a closet to record ( classic UTAU experience ). I think users should prioritize their comfort first when they record for a first time - Just relax, drink enough water before and during recording, and record something that's within comfortable talking or singing range. I would recommend recording a Japanese CV just to learn the ropes of UTAU recording! For hardware, I recommend podcast mics for a very budget friendly option! I use a Maono AU-PM360TR Condenser Mic to record all my voicebanks. I found that the usual recommended mics for UTAU ( namely the Blue Yeti ) can be way out of budget for a lot of people, especially in Southeast Asia (where I come from). I think a budget podcast mic is very much usable and can stand up against other more expensive microphones! I would also suggest having a pop filter to tame all those little nasty plosives. ( I DIY-ed mine with a sock and hangers! ) If users have access to a recording studio (perhaps a bookable mini studio from their college/university) I would also highly recommend using those resources as they usually have better equipment that's free to use.

Its really unfortunate the loss of features with every update. In my previous interview we discussed alternatives to Windows Bootcamp for MacOS Silicon devices! I would record on Recstar using my iPad… I will take note of this for myself! For beginner configuration, I made a complete tutorial series for getting started with your first JP CV-VV voicebank. That will be linked here.

Voicebank Configuration Series. . .

https://keitaiware.com/post/763148617255092224/macos-utau-voicebank-configuration-series

What my tutorials did not have were thorough hardware recommendations. I do not own a studio mic and record my voicebanks on a pair of Apple auxiliary earbuds. So these were very good recommendations! Outside of the UTAU scene, I have heard many topics on the Blue Yeti being difficult for beginners to use as well. I had asked my friend who is fascinated with audio engineering about mics before, and has recommended XLR mics. So I did mention those, but you would need an external audio interface to route them to your computer, which means, you cannot use them with Recstar. So the mic recommendation you gave is very appreciated! DIY pop filter sounds like a nice way to save money! Socks and a wire coat hanger would do very nicely, anything to absorb the sound before the mic. I do believe I mentioned renting a recording space too! If you live near a rentable recording space I highly recommend that as well.

Q. For our next question, how did you discover C+V and go about making your C+V English tutorial?

Chev: Earbuds!! I wasn't aware of the Blue Yeti's difficulty especially with the external audio interface. Glad I avoided buying that for my first mic… The way I discovered C+V is honestly somewhat funny - I actually discovered it in an oto commission list! At that time I was planning my second voicebank, Veria, and I looked around to see who I could commission for her oto. My frequent oto-er and current collaborator for my C+V English projects, Biggity Boy, had C+V English listed as one of the available formats he could oto. I tried to find any sort of info on the format but all I could find was an entry in the UTAU wiki that basically said "This is a joke format." with no reclist or anything. So I was like 'well that's kind of interesting.' The problem with English UTAU voicebanks to me was always the immense workload that comes with creating it, and I took a wild guess and expected C+V English to be the easiest way to record and English voicebank. I asked Biggity for the reclist and oto, and it all started from there! It's hard to imagine that all of my work wouldn't happen if I didn't take a look at Biggity's commissions list. Veria's beta tests were seen by a lot more people than I expected, and I held a poll asking if people wanted a tutorial for creating C+V English voicebanks. The poll ended with an overwhelming positive response, so I sought out to create the tutorial! An extensive tutorial was very much needed apart from the usual UTAU recording and otoing tutorial since prior to Cadlaxa's involvement with the dedicated phonemizer, C+V English relied on the EN ARPA phonemizer, and users needed to jump through extra optimization to use the voicebanks. 3 Months and tons of contributors and beta testers later, the tutorial has since been regularly updated with user feedback, and a refined tutorial via the upcoming website is being worked on! None of this could've happened without the hard work of contributors.

I remember looking into C+V after discovering your work, I do believe the wiki said that at the time of me reading it as well! Since your work on C+V English, I believe the reputation of the configuration has evolved completely since Veria's release. The Shelter cover (Link), showcasing Veria's voice left a long lasting impression on me! When it comes to resources in the UTAU community, they always catch my eye. This is souly because at the time when I started 7 years ago, there were no resources for MacOS and it lead to me frequenting the UTAforum. I started getting back into UTAU, with two other friends about two years ago? But one of those friends was a Mac user as well, and he was struggling to find resources. That's what lead up to me launching this blog! Your tutorials were very well put together, as I have not dabbled into video format, but aside from being insightful it was very fun to watch! Its absolutely brilliant. This being said, I hope more people are inspired to share what the create and know by seeing creatives like yourself!

Chev: I'm very aware of your work!! The Keitaiware blog is such a vital resource for MacOS users, especially for UTAU-Synth users! Just yesterday I sent an entry from your blog to someone trying to troubleshoot a problem with UTAU-Synth since I wasn't well versed at all with it. Truly it is my go-to resource when I need to troubleshoot the software. And thank you!! The video is more of a way to get more eyes on the written tutorial than anything, but I'm glad people enjoyed my editing :D

Q. To finish up this interview, do you have any future plans with your vocal synth work?

Chev: I have a lot in my cards at the moment with vocal synth work, but I'm currently finishing up work on a voicebank I recorded a year ago when I got an illness that made my voice drop into a Tenor male range!! Here's a preview of his work in progress artwork and voice.

I'm also heavily involved with IDN100%, a group that specializes in Indonesian UTAU synthesis, and we are working hard for our 2025 release!!

How exciting!! The project is looking super professional so far, I am rooting for the team to meet their deadlines!! I haven't seen many UTAUs with a knight motif, the armor is very well drawn! If you don't mind sharing some details, what is his name?

Chev: I'm thinking of sticking with Nisegane Julian, (偽金 ジュリアン ) - Nisegane being fake or fools gold, since I'm planning on this character to like flaunting and be full of himself while being a coward. I'm so glad you heard of IDN100%, thank you for your support!

Nisegane Julian is such a clever name.. fools gold to reflect his vain personality, I love that! I can't wait to see your current projects come to fruition Chev, these are very exciting! That concludes our interview for today, if you would like to see more of Chevrefee's work, C+V English tutorials, and are interested in the IDN100% project. All materials will be linked below. Thank you for sharing your time with the KEITAIWARE project today!

Bsky: https://bsky.app/profile/chevrefee.bsky.social Chevrefee’s Resources: https://chevrefee.wordpress.com/ C+V English Tutorial: https://youtube.com/watch?v=jeDmqo0wwkU&ab_channel=chevrefee IDN 100%: https://twitter.com/UTAU_IDN100

3 notes

·

View notes