#bitcoinstandard

Explore tagged Tumblr posts

Text

The Evolution of Money: From Seashells to Bitcoin

Money has existed in countless forms throughout history, yet most people never stop to ask: What makes good money?

For thousands of years, civilizations experimented with different forms of exchange—seashells, gold, paper, and now digital numbers in bank accounts. But each step in the evolution of money had flaws—until now.

With Bitcoin, we have found humanity’s final form of money—a system so perfect in design that we will never need to create another. This is the end of the road.

But to understand why, we need to take a journey through money’s evolution—from its primitive origins to its unstoppable digital future.

1. The Barter System: The First Attempt at Money

Before money, people relied on barter—trading goods and services directly. A farmer might trade wheat for a blacksmith’s tools. But bartering had major problems:

No common measure of value (how many fish equal one cow?)

No easy way to store value for the future

No portability—you can’t carry 100 goats to the marketplace

Bartering worked in small, localized communities, but as societies grew, they needed a universal standard of value. Thus, money was born.

2. Commodity Money: When Money Had Real Value

Early civilizations experimented with commodity money—physical items that held intrinsic value, such as: ✅ Gold & silver ✅ Salt (Roman soldiers were paid in salt, hence “salary”) ✅ Cattle ✅ Seashells

These materials worked better than barter because they were scarce, durable, and widely accepted.

Gold and silver eventually became the dominant form of money because they were: ✔ Difficult to counterfeit ✔ Easily divisible into smaller units ✔ Portable compared to heavy trade goods

For thousands of years, gold was money. It was the foundation of trade, wealth, and empires. But gold had a problem—it was too honest. Governments and rulers couldn’t manipulate it easily. So they found a way to cheat the system.

3. Paper Money: The First Step Toward Corruption

Carrying gold was inconvenient, so people began storing it in banks. In return, banks issued paper notes that represented a claim on gold—essentially IOUs for real money.

At first, these notes were backed 1:1 by gold, but over time, governments realized they could print more paper than they had gold, allowing them to: ❌ Fund wars without raising taxes ❌ Control the economy by printing money at will ❌ Steal wealth from citizens through inflation

This was the birth of fiat money—currency that is backed by nothing but government decree.

4. Fiat Money: The Great Experiment

In 1971, the U.S. completely abandoned the gold standard, turning the dollar into pure fiat—money backed by nothing but the government’s promise.

The result? 📉 The dollar lost over 90% of its purchasing power 📈 Wealth inequality skyrocketed as the rich got first access to new money 💸 Inflation became a permanent, systemic problem

Fiat money is a historical anomaly. Every single fiat currency before today has collapsed due to overprinting, hyperinflation, or government mismanagement.

The U.S. dollar is no different—it’s just the latest version of the same mistake.

This is why Bitcoin was created.

5. Bitcoin: The Final Evolution of Money

In 2009, Satoshi Nakamoto introduced Bitcoin, the first form of money that solves every problem fiat money created: ✅ Fixed supply—only 21 million BTC will ever exist ✅ Decentralized—no government can manipulate it ✅ Portable—move millions across borders in seconds ✅ Divisible—spendable in fractions (satoshis) ✅ Immutable—no one can change the rules

Bitcoin is money upgraded for the digital age—a return to honest money, but with even better properties than gold. Unlike fiat, it can’t be printed into oblivion. Unlike gold, it can be transferred instantly across the world.

But more importantly, Bitcoin is the last form of money we will ever need.

For the first time in history, humanity has discovered the perfect monetary system—one that is truly scarce, censorship-resistant, and immune to manipulation. There will never be a better form of money than Bitcoin.

Every previous attempt at money was just a stepping stone to get us here. The search is over.

Conclusion: The Return to Sound Money

History is clear: fiat is an experiment, and Bitcoin is the correction.

For thousands of years, money was scarce, valuable, and honest. Bitcoin brings us back to that reality, but in a modern, digital form.

This isn’t just another monetary system—it’s the final iteration of money itself.

The evolution of money is complete. Now it’s up to you: 🚀 Will you adopt the next generation of money? 🕰️ Or will you be left behind in a failing fiat system?

Tick tock, next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#MoneyEvolution#SoundMoney#FiatIsFailing#DigitalGold#BitcoinFixesThis#FinancialFreedom#HardMoney#EndTheFed#InflationKills#HistoryOfMoney#BitcoinStandard#CryptoRevolution#DecentralizedFinance#BarterToBitcoin#TickTockNextBlock#cryptocurrency#financial education#digitalcurrency#finance#globaleconomy#financial empowerment#financial experts#unplugged financial#blockchain

11 notes

·

View notes

Text

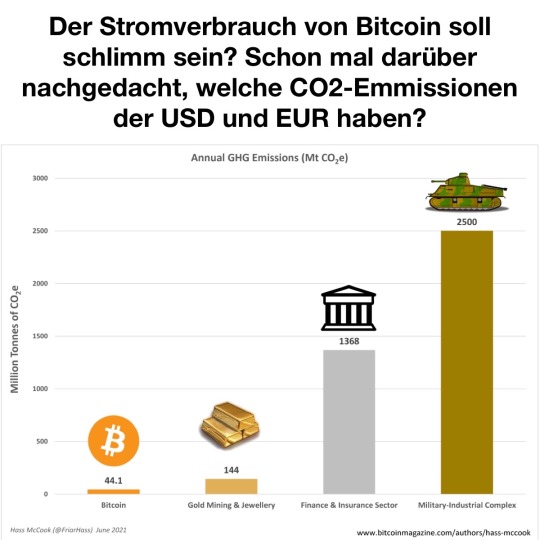

https://x.com/memesaufdeutsch/status/1745211190098243680?s=12

Was ist ein Bitcoin ETF?

0 notes

Text

Onboarding My Younger Sister To Bitcoin - Bitcoin Magazine

This is an opinion editorial by Santiago Varela, a bitcoin miner and writer from Mexico City.My sister turned 18 years old in the beginning of 2023 and I gave her a very unusual gift during this holiday season. Because I love her, I truly believe that the best gift I can give her is the orange pill.It all started with a letter that I wrote for her explaining the gift I was about to give her. Then, I handed her a copy of “The Bitcoin Standard” by Saifedean Ammous and a hardware wallet. However, that was just the beginning of a long process that we had to go through together if I really wanted to orange pill her.Of course, I was well aware that her first reaction to my surprise wasn't going to include the typical face of an 18-year-old girl opening her presents on a joyful Christmas morning. At first, she seemed more confused than excited. I have no doubt that she was expecting some nice pair of shoes or a cool gadget. I'm sorry sis, but that's how we maximalists roll. In the birthday/holiday letter, I pointed out three reasons why I was giving her this specific gift:- I want to set her on the path to financial freedom - I want her to be a sovereign woman in a fiat world where dishonest relationships have been normalized - As a high school senior who doesn't know what she wants to study in college, she could benefit from Bitcoin which might give her some ideas for what she wants to doThe long process of orange pilling my sister began with a quote from the prologue of “The Bitcoin Standard,” which I consider the perfect starting point. I asked her to read this quote over and over again before beginning the orange-pilling journey:“This book does not offer investment advice, but aims at helping elucidate the economic properties of the network and its operation, to provide readers an informed understanding of bitcoin before deciding whether they want to use it. Only with such an understanding, and only after extensive and thorough research into the practical operational aspects of owning and storing bitcoins, should anyone consider holding value in bitcoin. While bitcoin´s rise in market value may make it appear like a no-brainer as an investment, a closer look at the myriad hacks, attacks, scams, and security failures that have cost people their bitcoins provides a sobering warning to anyone who thinks that owning bitcoins provides a guaranteed profit. Should you come out of reading this book thinking that the bitcoin currency is something worth owning, your first investment should not be in buying bitcoins, but in time spent understanding how to buy, store, and own bitcoins securely. It is the inherent nature of bitcoin that such knowledge cannot be delegated or outsourced. There is no alternative to personal responsibility for anyone interested in using this network, and that is the real investment that needs to be made to get into bitcoin.”In the letter, I told her that I would help her set up the hardware wallet and I would send her a little bit of bitcoin. To begin, I sent her $10 worth of bitcoin. But then, to make sure that she invested time into acquiring the basic, necessary knowledge and to make her understand the proof-of-work philosophy, I promised that I would send her $100 worth of bitcoin for every chapter of the book that she read. Therefore, I prepared a quiz for each chapter to verify that she really read carefully. However, as someone who is deep down the Bitcoin rabbit hole, I knew that making her read the book to stack sats on her hardware wallet wasn't enough. That was nothing, we were just getting started. So, what was next in the orange-pilling journey? Every time that I crossed by any opportunity, I tried to convert that moment into a little Bitcoin lesson. For example, there was such an opportunity after my sister was assigned a project in her high school philosophy class. Knowing that I am a big fan of philosophy, she came to ask me for help. The project consisted of having a conversation with one of your family members but using the famous Socratic method for the conversation. If you don't know what that is, the Socratic method (named after Socrates) is “a form of cooperative argumentative dialogue between individuals, based on asking and answering questions to stimulate critical thinking and to draw out ideas and underlying presuppositions.” Obviously, we had a dialogue about Bitcoin and money using the Socratic method.Another thing I did in this orange-pilling journey was to show her a rabbit hole inside of the Bitcoin rabbit hole: bitcoin mining and energy. I love bitcoin mining and the energy aspects of Bitcoin. In fact, I love it so much that we have an ASIC in our garage. It wasn't really hard to make her grasp how passionate I am about home mining. Believe it or not, she had never even seen my ASIC (she had only heard the “brrrrrr”). Consequently, I took her to the garage and she got some hands-on experience. I also have my Bitcoin and Lightning nodes in the garage. That was a lot of fun because with tools like Mempool.Space and LnVisualizer I was able to help her see the tangible side of Bitcoin. This is when I really felt that it all began to come together.As you all likely know, knowledge about Bitcoin can’t be delegated or outsourced. When it comes to Bitcoin, there is no alternative to personal responsibility. Although I’ve told her that I’d love to help her with anything, I can’t guide her down the rabbit hole forever. You have to go down the Bitcoin rabbit hole by yourself. I guided her for a long time but the moment for her to embark on the journey for herself is here. Like Oscar Wilde once said: “Education is an admirable thing. But it is well to remember from time to time that nothing that is worth knowing can be taught.”So, I began treating her like any other Bitcoin pleb out there and let her go down the rabbit hole by herself. The only thing I did was to send her a bunch of resources (articles, podcasts, videos, books, etc.) and let her go her own way. At the same time, I realized that I could do this with other kids that are about the same age as my sister. Even better, I realized that my sister could help me with this and introduce her digital-native friends to Bitcoin because, if you care about Bitcoin, you should onboard people individually. Accordingly, I’ve decided to turn our garage into a little Bitcoin academy. Although my sister was the guinea pig for this experiment (and, as I am writing, she is the only student that has attended Bitcoin academy), I have to give a big shout out to other Bitcoiners around the world who have shared educational content for anyone to use. For example, Mi Primer Bitcoin (from El Salvador) has an amazing Bitcoin diploma workbook that anyone can download for free. I have no doubt that initiatives like theirs or like Escuelita Bitcoin in Uruguay are what we need if we want a future with sovereign individuals. We need to teach the young. Hopefully, this inspires other Bitcoiners around the world to introduce their younger siblings to Bitcoin. I was inspired by initiatives like the ones mentioned above and by stories like the Denver middle schoolers who became Bitcoin entrepreneurs. With a little bit of luck, the next time I write an article for Bitcoin Magazine, it’ll be about Mexico City middle schoolers who became Bitcoin entrepreneurs. For now, stay humble and stack sats my friends. This is a guest post by Santiago Varela. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine. Read More Source by Read the full article

0 notes

Photo

#bitcoinstandard #currency of the internet. #consensus #proofofwork #PoW #mining #trustcode #newage #storeofvalue #mediumofexchange #btc #bch #internetmoney #limitless #boarderless #decentralized (at Decentralized) https://www.instagram.com/p/BnF2IgwgQYi/?utm_source=ig_tumblr_share&igshid=114mzpz71y907

#bitcoinstandard#currency#consensus#proofofwork#pow#mining#trustcode#newage#storeofvalue#mediumofexchange#btc#bch#internetmoney#limitless#boarderless#decentralized

4 notes

·

View notes

Photo

The Fiat Standard - The debt slavery alternative to human civilization. The Bitcoin Standard - The decentralized alternative to central banking. GOOGLE @SANDHUVALUEINVESTING Website- www.Sandhuvalueinvesting.blogspot.com Instagram- https://www.instagram.com/sandhuvalueinvesting Telegram- https://t.me/SandhuValueInvesting WordPress- https://sandhuvalueinvesting.wordpress.com Sharechat- https://sharechat.com/profile/sandhuvalueinvesting?d=n Pinterest- https://pin.it/2PES7ya Twitter- https://twitter.com/SandhuInvesting?t=5DDavO8KP6snBPqIM7_chA&s=09 Facebook- https://m.facebook.com/SandhuValueInvesting/ LinkedIn- https://www.linkedin.com/in/sandhuvalueinvesting #fiat #fiatstandard #bitcoin #bitcoinstandard #stockmarkets #sandhuvalueinvesting #debt #slavery #debtslavery #debtslave #centralbank #centralbanks #decentralized #decentraland #decentralization #decentralizedfinance #decentralizedworld #Cryptocurrency #binance #Wazirx #matic #maticcoin #maticnetwork #fantom #fantomcoin #shibainucoin #ethereum #mana https://www.instagram.com/p/CXbcdtmvumg/?utm_medium=tumblr

#fiat#fiatstandard#bitcoin#bitcoinstandard#stockmarkets#sandhuvalueinvesting#debt#slavery#debtslavery#debtslave#centralbank#centralbanks#decentralized#decentraland#decentralization#decentralizedfinance#decentralizedworld#cryptocurrency#binance#wazirx#matic#maticcoin#maticnetwork#fantom#fantomcoin#shibainucoin#ethereum#mana

0 notes

Photo

Dr. @saifedean Ammous, author of “#thebitcoinstandard and “The Fiat Standard,” joined Dr. Jordan B. Peterson, clinical psychologist, best-selling author, and host of The #JBP Podcast, to discuss #money, #economics, incentives, #decentralization, #Bitcoin, and #fiatcurrency “Learned a lot,” @jordan.b.peterson tweeted, after the conversation with Ammous. “Bought some more #bitcoin. Inflation be damned.” Ammous walked through many of the nuances of Bitcoin, including its #technology and #economic dynamics, shedding light on plenty of reasons why the monetary system is unique. The author of The Fiat Standard, a follow-up to his famous work The #BitcoinStandard, delved into details in a beginner-friendly fashion, hashing out complex topics into more straightforward concepts. #Peterson asked thoughtful questions, which were explored in detail throughout the conversation. Many of his doubts resonate with beginners, who naturally try to puzzle through the distinctiveness of Bitcoin and why exactly it is the solution for many problems society currently faces. “There are no insiders on Bitcoin,” Ammous said while explaining how the #monetarynetwork manages to be a genuinely decentralized one, differently than other projects. “Bitcoin only has users…no admins. There is nobody with a master key.” https://www.instagram.com/p/CWalCbZsfkH/?utm_medium=tumblr

#thebitcoinstandard#jbp#money#economics#decentralization#bitcoin#fiatcurrency#technology#economic#bitcoinstandard#peterson#monetarynetwork

0 notes

Photo

I’m trying to show these biztards, how putting profit into BTC and ETH. Supercharged my trading profits. Crypto is a rising tide that lifts all ships. But don’t get caught going against the 4 year, BTC cycle. That’s how you get rekt! Thank you Plan B, Saifedean Ammous and Satoshi. 🤓 Turn on notifications and swipe right for a peak inside my strange mind. #bitcoinstandard #thebitcoinstandard #saifedeanammous #planb #planbitcoin #stocktoflow #stock2flow #btchalvingcycletrader #trendtrading #trendtrader #cryptotrends #btctrends #hodluntil2022 #illmakeyourich #youllmakeyourselfwealthy #wediditfrens (at Boulevard Pool at The Cosmopolitan of Las Vegas,) https://www.instagram.com/p/CEdNhhTgl59/?igshid=uqcuizzzdnhs

#bitcoinstandard#thebitcoinstandard#saifedeanammous#planb#planbitcoin#stocktoflow#stock2flow#btchalvingcycletrader#trendtrading#trendtrader#cryptotrends#btctrends#hodluntil2022#illmakeyourich#youllmakeyourselfwealthy#wediditfrens

0 notes

Photo

📣 #Tonga to Make #BTC as Legal Tender by Q2 & #BTCMining by Q3 of 2023

👉 #LordFusitu’a, a former member of the Tongan parliament, has shared a timeline for the country’s plan to adopt #Bitcoin (#BTC).

👉 A #Tongannobleman, Fusitu’a, had previously disclosed the four-step plan, a copy of the Salvadoran #Bitcoin playbook.

👉 Step one is remittance, two is legal tender, three is #Bitcoinmining, and four is moving national treasuries into #Bitcoin, effectively upgrading the nation onto a #Bitcoinstandard.

👉 During a #Twitter conversation, Lord Fusitu’a said that if the bill is passed in the beginning to mid-October. After this, the bill goes to the palace office for three to four weeks. HM [His Majesty] will give or not give royal assent by mid-November.

Learn more...👇

Web 🌐 http://bit.ly/358ywyu

Android 📲 http://bt.ly/2PhGUF5

iOS 📲 https://apple.co/2DJ7bqL

&

YouTube https://bit.ly/3oHXDBB

Telegram 🌐 http://bit.ly/2XgolES

Medium 🌐 https://bit.ly/3eGCaVE

Discord https://bit.ly/3yjEkUB Airdrops 💰 https://bit.ly/3bDim5m

0 notes

Text

The Alternative to Central Banking – Robert Kiyosaki and Saifedean Ammous [Rich Dad Radio Show]

youtube

Gold became money as determined by the free market because of its properties—scarcity. But with the invention of Bitcoin, we are now seeing a historical event that will never be repeated. Bitcoin’s characteristics make it a direct competitor to the central banks because of its absolute scarcity, resistance to theft and confiscation, and the system that it’s built upon prevents it from being shut down.

Saifedean Ammous, economist and author of The Bitcoin Standard: The Decentralized Alternative to Central Banking says, “The higher the ratio of the stock to the flow, the more likely a good is to maintain its value over time and thus be more salable across time.” And he says it’s this reason Bitcoin is the only working alternative for central banking.

Host Robert Kiyosaki and Saifedean Ammous answer the questions surrounding Bitcoin and why it the “first demonstrably reliable operational example of digital cash and digital hard money.”

Website: www.saifedean.com

#robertkiyosaki #bitcoinstandard #financialeducation

https://www.richdad.com/

Facebook: @RobertKiyosaki https://www.facebook.com/RobertKiyosaki/

Twitter: @TheRealKiyosaki Tweets by theRealKiyosaki

Instagram: @TheRealKiyosaki https://www.instagram.com/therealkiyosaki/

The post The Alternative to Central Banking – Robert Kiyosaki and Saifedean Ammous [Rich Dad Radio Show] appeared first on News Lookout.

source https://newslookout.com/inspire/the-alternative-to-central-banking-robert-kiyosaki-and-saifedean-ammous-rich-dad-radio-show/

0 notes

Text

Institutional Bitcoin Demand

It’s easy to get caught in the waves of emotion that come with this space. One day it’s euphoria, the next it’s despair. But when you learn to stop watching the surface and start paying attention to the undercurrent — you’ll see something that never stopped flowing:

Institutional demand for Bitcoin is not only alive — it’s accelerating.

🏦 BlackRock Goes Global with Bitcoin

Let’s start with BlackRock — the $10 trillion behemoth. They already shook the financial world with their U.S. Bitcoin ETF, and now? They’ve launched their first European Bitcoin trust: the iShares Bitcoin ETP. Trading across Xetra, Euronext Paris, and Amsterdam, this ETP is designed to give institutional investors exposure to Bitcoin without needing to touch it.

And they’re not just dipping their toes in. They’re waiving fees (just 0.15% through 2025) and securing custody through Coinbase, signaling to every money manager in Europe: it’s safe to come in now.

This is a clear expansion strategy, not a test. BlackRock is laying Bitcoin rails across continents. It’s no longer “if” — it’s “where next?”

🧠 Strategy (formerly MicroStrategy) Has Entered Beast Mode

Michael Saylor isn’t backing down. In fact, he just shifted into a higher gear. Now operating under the rebranded name “Strategy,” the company has purchased another 6,911 BTC for $584 million — and that’s on top of the 500,000+ BTC already in their cold storage war chest.

How did they do it? By raising funds through convertible notes and preferred stock. That’s right — they issued debt to buy more Bitcoin. Call it crazy, or call it conviction. Either way, they’ve gone full “Bitcoin standard,” and at this point, they’re basically a leveraged orange coin ETF.

While everyone else debates if the price will hit $58k or pull back to $47k, Saylor’s strategy remains unchanged: stack until your balance sheet becomes the new Federal Reserve.

🎮 GameStop Joins the Fray (No, Seriously)

And now the wild card: GameStop.

You remember the retail frenzy of 2021 — WallStreetBets, meme stock madness, diamond hands. But now, GameStop is making a completely different kind of bet. They’re raising $1.3 billion via a convertible bond offering — and part of that cash? It’s going to Bitcoin.

This isn’t just a pivot. It’s a resurrection attempt. A reinvention. GameStop knows its legacy model is outdated, and like any company with survival instincts, it’s chasing where the real innovation is — decentralized, digital value. If MicroStrategy was the first domino, GameStop might be the first meme stock to go full Satoshi.

🗺️ What Does This All Mean?

It means the narrative is no longer theoretical.

The floodgates didn’t just crack open — the institutions kicked them down. They’re no longer just researching Bitcoin. They’re allocating, integrating, and in some cases, restructuring their entire strategy around it.

And yet... retail still hesitates. People still ask, “Is it too late?”

Let me say this clearly: it’s only too late if you don’t act.

You don’t need to raise a billion dollars. You don’t need to be on Wall Street. You just need to understand what’s happening before the masses do — and front-run their future.

🔎 The Signal in the Noise

When the noise gets loud, remember this:

While your coworker is mocking crypto at the water cooler, BlackRock is onboarding Europe.

While the media tries to spook you with volatility, MicroStrategy is issuing bonds to buy more.

While Twitter fights over ETF inflows, GameStop is quietly shifting to Bitcoin exposure.

This is a monetary revolution unfolding in real time.

So do what the institutions can’t do with speed: Stack. Stay humble. Educate yourself. Spread the signal.

And when the next wave comes, you won’t be washed out. You’ll be riding it.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#BTC#BitcoinNews#BitcoinAdoption#BitcoinETP#BitcoinETF#BitcoinStandard#BitcoinStrategy#MicroStrategy#MichaelSaylor#BlackRock#GameStop#StackSats#HODL#InstitutionalAdoption#CryptoInvesting#DigitalAssets#FinancialRevolution#MacroTrends#SoundMoney#MonetaryShift#WealthPreservation#StackStayHumble#TickTockNextBlock#UnpluggedFinancial#WakeUp#FutureIsNow#EscapeTheFiat#DecentralizeEverything#financial empowerment

4 notes

·

View notes

Text

https://x.com/memesaufdeutsch/status/1700805372460646802?s=12

0 notes

Video

( BITCOIN STANDARD ) in Deutsch ! CHINA Neues Kryptographie-Gesetz !

0 notes

Quote

Mooi artikel over de rol van #Bitcoin versus #goud en de hypothetische introductie van een mogelijke Bitcoin standaard – #BitcoinStandard!https://t.co/T3CYYLLFQq — Jan Mertens (@mertensposts) April 6, 2018 https://platform.twitter.com/widgets.js via Twitter https://twitter.com/mertensposts April 07, 2018 at 01:05AM

https://t.co/T3CYYLLFQq

0 notes

Photo

Don’t leave home without it. Spiritual scripture for the truth seekers. Salvation comes from saving BTC. 🤓 Turn on notifications and read the books that they don’t want you to read. #saifedeanammous #ismyhero #bitcoinstandard #thebitcoinstandard #drinkingyourmilkshake #cryptotrader #cryptotrading #cryptotraders (at Sugarloaf, Big Bear National Forest) https://www.instagram.com/p/CD4UaaOA5Aj/?igshid=4pgkbubi3va0

#saifedeanammous#ismyhero#bitcoinstandard#thebitcoinstandard#drinkingyourmilkshake#cryptotrader#cryptotrading#cryptotraders

1 note

·

View note

Text

Conscious Currency: What Bitcoin Teaches Us About Value and Awareness

What if your entire perception of value—of time, work, even self-worth—was built on a lie? What if the very money in your pocket was the root of a fog that clouds everything you see, touch, and believe in? This isn’t a conspiracy theory. It’s a reality too many people never stop to question. Because when you’re born inside a system, you rarely pause to consider that the system itself might be broken.

Fiat currency is a masterpiece of illusion. It pretends to be stable, but it erodes. It acts like a store of value, yet silently leaks your time and energy through inflation. The dollar doesn’t just lose value—it steals clarity. It convinces you to chase numbers on a screen while the real wealth—your attention, your freedom, your future—is siphoned away.

And then along comes Bitcoin. Not as a quick fix or a get-rich scheme, but as a new way of seeing. A peer-to-peer, decentralized protocol of truth that doesn’t ask for permission, doesn’t lie, and doesn’t inflate. It simply is. A tool with the power to change your relationship with value, because it’s the first form of money that operates like a mirror—reflecting back the truth of your actions, your time, your priorities.

Bitcoin is the red pill. The deeper you understand it, the more it reshapes how you see the world. Once you truly see Bitcoin through the eyes of its creator—once you grasp the elegance, the honesty, the intent—you can use that lens to look at everything else. And when you do, you realize just how broken everything really is.

You start to see how inflation props up empires and devours savings. How debt is sold as freedom. How institutions feed off confusion. How most of society is sprinting on a treadmill powered by lies.

But Bitcoin doesn’t just fix money. It fixes your perception. It shows you that value is not what they told you it was. It’s not dollars or titles or trends. Value is rooted in time, energy, and trust. And once you can see that, you stop playing their game. You start playing your own.

Bitcoin is conscious currency. It’s value with awareness baked in. It doesn’t just upgrade your wallet—it upgrades your worldview.

Because at the end of the day, this isn’t about digital coins. It’s about digital clarity. It’s about realizing that you were never broken—your money was. And now, for the first time, you have a choice.

Tick tock. Next block.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#ConsciousCurrency#FiatIsBroken#BitcoinRevolution#FinancialAwakening#SoundMoney#DigitalClarity#MoneyTruth#DecentralizedFuture#EconomicPhilosophy#WakeUp#BitcoinStandard#RedPillMoney#EndTheFed#ValueAwareness#UnpluggedFinancial#TheFutureIsBitcoin#TickTockNextBlock#FreedomThroughBitcoin#cryptocurrency#digitalcurrency#finance#globaleconomy#financial education#financial experts#financial empowerment#unplugged financial#blockchain

4 notes

·

View notes

Text

Bitcoin: The Immune System of Finance

In 2008, the global financial system suffered a massive shock. The collapse of major financial institutions, reckless risk-taking, and the subsequent bailout by governments exposed the deep-rooted flaws in our traditional financial structure. This crisis wasn't just a temporary setback—it was a symptom of a chronically ill system, one plagued by corruption, opacity, and centralized control. It was in this moment of failure that Bitcoin was conceived, emerging as a powerful immune response to a diseased financial world.

Just as our immune system protects us from pathogens, Bitcoin acts as a shield against the viruses of financial manipulation and centralized control. When established banks and governments failed us, Bitcoin offered a revolutionary alternative: a way to safeguard wealth from the contagion of irresponsible monetary policies and opaque institutions. While critics may point out potential drawbacks of Bitcoin, these pale in comparison to the systemic, far-reaching flaws of our current financial system.

Consider the following:

Inflation vs. Scarcity: Central banks can print money at will, devaluing currencies and eroding savings. Bitcoin's fixed supply of 21 million coins acts as an antidote to this inflationary disease, preserving purchasing power over time.

Centralization vs. Decentralization: Traditional finance concentrates power in the hands of a few institutions, making the entire system vulnerable to their mistakes or malfeasance. Bitcoin's decentralized network distributes power among thousands of nodes, creating a robust system that can withstand attacks and corruption.

Opacity vs. Transparency: The inner workings of banks and financial institutions are often shrouded in secrecy. Bitcoin's public blockchain offers unprecedented transparency, allowing anyone to verify transactions and audit the system.

Exclusion vs. Inclusion: Millions remain unbanked or underbanked in the current system. Bitcoin provides financial services to anyone with internet access, fostering true financial inclusion.

Bailouts vs. Personal Responsibility: The 2008 crisis showed how taxpayers can be forced to bail out failing banks. In the Bitcoin ecosystem, there are no bailouts—each participant is responsible for their own financial decisions.

While detractors may point to Bitcoin's volatility or energy consumption, these issues are either temporary growing pains or vastly overstated when compared to the enormous resources consumed by the traditional financial system. Moreover, Bitcoin's ability to transfer value globally, instantly, and at low cost far outweighs these concerns.

The immune system analogy extends even further when we consider how Bitcoin is adopted and defended by its community. Just as immune cells recognize and remember pathogens, Bitcoin’s supporters—miners, developers, and users—work collectively to protect and strengthen the network. When threats arise, such as regulatory crackdowns, hacking attempts, or misinformation, the community responds, adapting to ensure the network’s continued health and growth. This collective effort is similar to how an immune system evolves to counter new challenges, constantly learning and improving its defenses.

Moreover, Bitcoin’s limited supply of 21 million coins serves as a safeguard against the inflationary practices of traditional fiat systems. Central banks have the power to print money at will, often devaluing currencies and eroding purchasing power. Bitcoin’s scarcity is akin to the body’s natural regulation mechanisms that maintain balance and stability. In the same way that our immune system prevents harmful overreactions, Bitcoin’s monetary policy prevents the reckless expansion of supply that leads to economic instability.

Another aspect of Bitcoin’s immune-like qualities is its transparency and openness. The Bitcoin blockchain is a public ledger, allowing anyone to verify transactions and ensuring that no single entity can manipulate the system without detection. This transparency is similar to how the immune system communicates signals throughout the body, ensuring that all parts are aware of potential threats. The open-source nature of Bitcoin’s code allows developers from around the world to contribute, audit, and improve the network, much like how the immune system relies on a diverse array of cells and proteins to function effectively.

Bitcoin also embodies the concept of decentralization, much like how the immune system is distributed throughout the body rather than centralized in a single organ. This decentralization is a critical strength, making Bitcoin resistant to attacks and failures. There is no central point of control or failure, just as there is no single organ responsible for immune defense. This structure ensures that even if parts of the network are compromised, the overall system remains resilient and capable of functioning.

The resilience of Bitcoin has been tested numerous times since its inception. From exchange hacks and regulatory bans to forks and scalability debates, the network has faced numerous challenges. Each time, it has emerged stronger, with its community adapting and evolving to ensure its survival. This is reminiscent of how the immune system builds immunity over time, learning from past encounters to better respond to future threats. Bitcoin’s ability to withstand and grow through adversity is a testament to its design and the strength of its community.

In conclusion, Bitcoin can be seen as the financial system’s immune response—a decentralized, adaptive, and resilient alternative to traditional finance. It emerged in the wake of a systemic crisis, offering a way to protect individual sovereignty, maintain transparency, and build a more robust and fair financial ecosystem. Just like the immune system, Bitcoin is not without its challenges, but its strength lies in its ability to adapt, evolve, and provide a defense against the weaknesses of the traditional financial world. It represents a shift towards a more transparent, secure, and decentralized future, one that empowers individuals rather than relying on centralized institutions that have repeatedly shown their vulnerabilities.

As our financial immune system, Bitcoin doesn't just offer an alternative—it provides a cure for many of the ailments afflicting our current financial structure. It empowers individuals, promotes transparency, and creates a more resilient economic ecosystem. While no system is perfect, Bitcoin represents a quantum leap forward in financial technology and philosophy. The traditional financial system has had centuries to prove its worth, and yet it continues to fail us repeatedly. Bitcoin, in just over a decade, has already demonstrated its potential to rewrite the rules of finance. As more people recognize the inherent weaknesses of the old system and the strengths of this new paradigm, Bitcoin's role as the immune system of finance will only grow stronger.

In conclusion, while Bitcoin may have its challenges, they are mere speed bumps on the road to a more equitable, transparent, and robust financial future. The real disease lies in our current system—a system that has repeatedly shown itself to be vulnerable to corruption, manipulation, and catastrophic failure. Bitcoin offers us not just an alternative, but a cure—a way to inoculate ourselves against the financial ills that have plagued us for too long. It's time we embrace this powerful financial immune system and build a healthier economic future for all.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#FinancialFreedom#Decentralization#FinanceRevolution#SoundMoney#CryptoCommunity#InflationProtection#EconomicResilience#Blockchain#FutureOfFinance#BitcoinStandard#DigitalGold#FinancialInclusion#AntiFragile#financial empowerment#finance#globaleconomy#financial experts#digitalcurrency#financial education#unplugged financial

4 notes

·

View notes