#gridstorage

Explore tagged Tumblr posts

Text

#FlowBattery#EnergyStorage#RenewableEnergy#GridStorage#BatteryTechnology#SustainableEnergy#UtilityScaleStorage#CleanEnergy#PowerSolutions#BatteryMarket

0 notes

Text

Flow Battery Market Driving Sustainable Energy Future

Is the US Flow Battery Market the Next Big Energy Storage Gold Rush?

The energy storage landscape is witnessing unprecedented transformation, and flow batteries are emerging as a potential game-changer. But are industry leaders asking the right questions about this rapidly evolving market? With projections showing explosive growth and significant investment opportunities, the stakes have never been higher.

Market Growth: Real Opportunity or Inflated Expectations?

How reliable are the growth projections flooding investment circles across America? The numbers are certainly compelling—the global flow battery market is anticipated to grow from USD 0.34 billion in 2024 to USD 1.18 billion by 2030, recording a CAGR of 23.0%. Some analysts push even more aggressive forecasts, suggesting a CAGR of 30.68% through 2034.

But should companies take these projections at face value? The U.S. held the largest market share in 2023, positioning American companies as global leaders. Yet, does market leadership today guarantee sustained dominance tomorrow? The renewable energy integration segment holds the largest market share currently, while UPS applications are expected to experience the highest growth rates. This divergence raises critical questions about where companies should focus their strategic investments.

Technology Leaders and Market Dynamics

Are established players like ESS Tech, Inc. and Primus Power maintaining their competitive edge, or are emerging technologies threatening their market positions? The redox segment dominated the market with 85.6% revenue share in 2024, but is this dominance sustainable as alternative chemistries advance?

The technology landscape remains fragmented across multiple approaches—vanadium redox, zinc-bromine, and iron-chromium systems. Each promises unique advantages, but which technology will ultimately capture the largest market share? For industry leaders, the question isn't just about current market players, but about identifying which technological approach will prove most commercially viable long-term.

Investment Timing and Market Entry Strategy

With 20-30% CAGR growth projections, is immediate market entry essential, or should companies adopt a wait-and-see approach? The growing penetration of distributed renewable resources has created demand for effective storage solutions, but are flow batteries the optimal answer, or merely one of several competing technologies?

The non-degrading nature of flow batteries presents a compelling value proposition compared to lithium-ion alternatives. However, does this theoretical advantage translate into measurable ROI improvements? Independent scaling of power and energy capacity offers design flexibility, but at what cost premium compared to conventional storage solutions?

Supply Chain Challenges and Material Dependencies

How exposed are flow battery investments to material supply chain disruptions? Vanadium supply chain considerations remain critical, though new joint ventures are delivering price-competitive vanadium electrolyte using unique leasing models. But does this innovation truly mitigate supply risk, or simply redistribute it across different stakeholders?

Are companies adequately preparing for potential material shortages or price volatility? The concentration of vanadium production in specific geographic regions introduces geopolitical considerations that could significantly impact long-term project economics. Should industry players view these supply chain challenges as temporary growing pains or fundamental structural weaknesses?

Application Focus and Market Segmentation

Renewable integration applications currently hold the largest market share, but UPS segments are projected for highest growth. Does this divergence suggest market fragmentation, or natural evolution toward more diverse applications? Are companies spreading resources too thin by pursuing multiple market segments simultaneously?

Grid modernization initiatives present significant opportunities, but do current regulatory frameworks adequately support flow battery deployment? The utility-scale market offers substantial revenue potential, but requires different commercial strategies than distributed applications. How should companies balance these competing opportunities?

Competitive Positioning and Strategic Partnerships

Should companies develop internal flow battery capabilities, pursue strategic partnerships, or acquire existing players? The market remains fragmented with multiple technology approaches, suggesting opportunities for consolidation. However, does early-stage market consolidation risk stifling innovation or creating more focused competitive advantages?

ESS Tech and Primus Power represent established market positions, but are these companies properly valued relative to their growth potential? Joint ventures are emerging for materials supply, but do these partnerships create sustainable competitive moats or merely temporary cost advantages?Regulatory Environment and Policy Support

What level of government incentives and policy support can companies realistically expect? Current renewable energy policies favor storage deployment, but political landscapes change. Are flow battery investments sufficiently robust to survive potential policy reversals?

Grid modernization initiatives could accelerate demand, but regulatory approval processes often extend project timelines. How should companies factor regulatory uncertainty into their investment planning? Does the current policy environment provide sufficient visibility for long-term capital commitments?

Strategic Decision Framework

For industry leaders, the flow battery market presents both compelling opportunities and significant uncertainties. The technology offers genuine advantages over alternatives, including fade-free performance and scalable architecture. Market growth projections suggest substantial revenue potential, while U.S. market leadership provides strategic positioning advantages.

However, material supply chain risks, technology fragmentation, and competitive dynamics require careful evaluation. Companies must balance first-mover advantages against premature market entry risks. The question isn't whether flow batteries will succeed, but when, where, and at what scale.

Success in this market will likely depend on asking the right questions rather than accepting optimistic projections. Organizations that critically evaluate growth assumptions, assess competitive positioning realistically, and develop robust risk mitigation strategies will be best positioned to capitalize on this emerging opportunity.

The flow battery market represents a high-stakes bet on the future of energy storage. The companies that navigate these strategic questions most effectively will likely emerge as tomorrow's market leaders.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5419

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#FlowBattery#EnergyStorage#RenewableEnergy#GridStorage#BatteryTechnology#SustainableEnergy#UtilityScaleStorage#CleanEnergy#PowerSolutions#BatteryMarket

0 notes

Text

#FlowBattery#EnergyStorage#RenewableEnergy#GridStorage#BatteryTechnology#SustainableEnergy#MarketGrowth#EnergyTransition

0 notes

Link

The discovery could lead to new low-cost, long duration energy storage systems that can write fossil energy out of the picture by capturing wind and solar power for weeks, months, or even whole seasons.

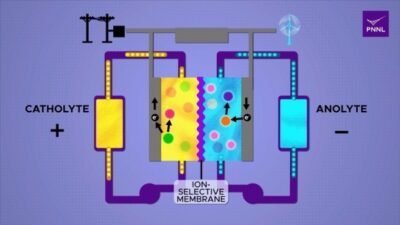

To provide full day, utility scale energy storage as more wind and solar power enter the grid, a flow battery fits the bill.

I really love that there is so much research, and the associated results flowing back, around all sorts of different approaches to batteries. Without a doubt, grid storage is now the big thing needed for variable power generation technology. Being storage, it can also be located where it is required for use.

See https://cleantechnica.com/2023/07/12/new-flow-battery-lasts-all-year-on-simple-sugar/

0 notes

Text

Flow Battery Market to Reach $1.03 Billion by 2031 Amid Rising Energy Storage Demand

Meticulous Research®—a leading global market research company, published a research report titled, ‘Flow Battery Market by Offering (Energy Storage Systems), Battery Type (Vanadium Redox Flow Batteries, Zinc-bromine Flow Batteries), Material, Ownership, Application, End User (Utilities, Commercial & Industrial), and Geography - Global Forecast to 2031.’

According to this latest publication from Meticulous Research®, the global flow battery market is projected to reach $1.03 billion by 2031, at a CAGR of 16.5% from 2024–2031. The growth of the flow batteries market is driven by the high demand for flow batteries in utility applications and increasing investments in renewable energy. However, the lack of standardization in the development of flow battery systems and the high initial costs of flow battery manufacturing restrain the growth of this market.

Furthermore, technological innovation and the growing demand for backup power among data centers are expected to offer significant growth opportunities for players operating in the flow batteries market. However, the declining rate of flow battery deployment and disruptions in the supply of raw materials for battery manufacturing may hinder the growth of this market. Additionally, advancements in flow batteries and energy storage as a service are prominent trends in the flow batteries market.

The global flow battery market is segmented by offering (batteries, energy storage systems, and services), battery type (vanadium redox flow batteries, zinc-bromine flow batteries, all-iron flow batteries, and other flow batteries), material (zinc-bromine, vanadium, hydrogen-bromine, and other materials), ownership (customer-owned, third-party-owned, and utility-owned), application (peak shaving, load shifting, transmission & distribution, frequency regulation, commercial, EV charging, residential, and other applications), and end user (utilities, commercial & industrial, EV charging stations, off-grid & micro-grid power, residential, and other end users). The study also evaluates industry competitors and analyzes the market at the regional and country levels.

Based on offering, the global flow batteries market is segmented into batteries, energy storage systems, and services. In 2024, the energy storage systems segment is expected to account for the largest share of the global flow battery market. The large market share of this segment is attributed to various factors, such as redox flow batteries are a relatively new advanced technology for storing large quantities of energy. These batteries enhance flexibility, reduce environmental risks, and improve response times to energy demands.

However, the battery segment is projected to register the highest CAGR during the forecast period due to the various benefits offered by flow batteries, such as scalability, long cycle life, durability, and rapid response. Also, flow batteries can be used for storing energy from intermittent renewable sources such as wind and solar power, enabling grid stabilization.

Based on battery type, the global flow batteries market is segmented into vanadium redox flow batteries, zinc-bromine flow batteries, all-iron flow batteries, and other flow batteries. In 2024, the vanadium redox flow batteries segment is expected to account for the largest share of the global flow battery market. The large market share of this segment is attributed to various factors, such as vanadium redox flow batteries are considered promising electrochemical energy storage systems due to their efficiency, flexibility, and scalability. Moreover, VRFBs have a long cycle life and can store large amounts of energy, making them suitable for grid energy storage and renewable energy integration.

Additionally, this segment is projected to register the highest CAGR during the forecast period.

Based on material, the global flow batteries market is segmented into zinc-bromine, vanadium, hydrogen-bromine, and other materials. In 2024, the vanadium segment is expected to account for the largest share of the global flow battery market. The large market share of this segment is attributed to various factors, such as vanadium in the flow batteries allows for efficient and reversible electrochemical reactions, making it a key component of this energy storage technology.

Additionally, this segment is projected to register the highest CAGR during the forecast period.

Based on ownership, the global flow batteries market is segmented into customer-owned, third-party-owned, and utility-owned. In 2024, the utility-owned segment is expected to account for the largest share of the global flow battery market. The growth of this segment is driven by the increasing demand for utility-scale ancillary services and the growing need to deliver peak loads to consumers through flow battery-powered ESS instead of extending power lines and transformers.

Additionally, the same segment is projected to register the highest CAGR during the forecast period.

Based on application, the global flow batteries market is segmented into peak shaving, load shifting, transmission & distribution, frequency regulation, commercial, EV charging, residential, and other applications. In 2024, the load shifting segment is expected to account for the largest share of the global flow battery market. The growth of this segment is driven by various factors, such as flow batteries can be easily scaled up or down to meet specific energy storage needs. This makes them suitable for a wide range of applications, from residential to utility-scale projects. Also, flow batteries have a longer cycle life compared to many other energy storage technologies, such as lithium-ion batteries.

Additionally, this segment is projected to register the highest CAGR during the forecast period.

Based on end user, the global flow batteries market is segmented into utilities, commercial & industrial, EV charging stations, off-grid & micro-grid power, residential, and other end users. In 2024, the utilities segment is expected to account for the largest share of the global flow battery market. The growth of this segment is attributed to the increasing efforts by market players to launch flow batteries that align with the environmental, longevity, and safety goals of the utility industry and the growing usage of BESS for various applications.

Additionally, this segment is projected to register the highest CAGR during the forecast period.

Based on geography, the flow battery market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2023, Asia-Pacific is expected to account for the largest share of the global flow battery market. The growth of the flow battery market in Asia-Pacific is attributed to increased energy storage investments in the region as the governments in growing economies are making new policies to improve the reliability and quality of the power distribution facilities to residential customers.

Additionally, Asia-Pacific is projected to record the highest CAGR during the forecast period.

Key Players

The key players operating in the global flow batteries market include Invinity Energy Systems PLC (Jersey), Sumitomo Electric Industries, Ltd. (Japan), ESS Tech, Inc. (U.S.), Redflow Limited (Japan), StorEn Technologies, Inc. (U.S.), LION Alternative Energy PLC (England), CEC Science & Technology Co., Ltd. (China), StorTera Ltd (U.K.), Largo Inc. (U.S.), ViZn Energy, Inc. (U.S.), VRB ENERGY (U.S.), Primus Power Solutions (U.S.), SCHMID Energy Systems GmbH (Germany), Stryten Energy (Georgia), and Delectrik Systems Pvt. Ltd (India).

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5419

Key Questions Answered in the Report:

What are the high-growth market segments in terms of the offering, battery type, material, ownership, application, and end user?

What is the historical market size for the global flow battery market?

What are the market forecasts and estimates for 2024–2031?

What are the major drivers, restraints, opportunities, challenges, and trends in the global flow battery market?

Who are the major players in the global flow battery market, and what are their market shares?

What is the competitive landscape like?

What are the recent developments in the global flow battery market?

What are the different strategies adopted by major market players?

What are the trends and high-growth countries?

Who are the local emerging players in the global flow battery market, and how do they compete with other players?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#FlowBattery#EnergyStorage#RenewableEnergy#GridStorage#BatteryTechnology#SustainableEnergy#MarketGrowth#EnergyTransition

0 notes

Text

UK Energy Regulator Supports Vehicle-To-Grid Proposal

UK Energy Regulator Supports Vehicle-To-Grid Proposal - UK could avoid investing in new power plants with the equivalent generation capacity of up to 10 large nuclear power stations

Ofgem is the independent energy regulator for the UK. Working with government, industry, and consumer groups, it strives to deliver a net-zero energy economy at the lowest cost to consumers while promoting competition and innovation. Recently, it has unveiled a proposed new policy that would expand the availability of vehicle-to-grid technology in the UK so that EV drivers can sell the energy stored in their car batteries back to power grid. It’s all part of a plan to make the switch away from fossil fuel cars more affordable for consumers.

In its purest form, V2G technology allows local utilities to draw power from the batteries of electric cars when demand peaks. That, in turn, allows them to avoid powering up so-called “peaker plants,” which are typically gas-fired thermal generating stations that sit idle until needed. Bringing them online is quite expensive. The dirty little secret of peaker plants is that they tend to emit large amounts of carbon dioxide during the start-up phase and are exempt from normal emissions rules during that time.

According to The Guardian, if enough drivers take advantage of the opportunity to make money from their car batteries by using vehicle-to-grid technology, the UK could avoid investing in new power plants with the equivalent generation capacity of up to 10 large nuclear power stations. That could help keep energy bills lower for all households in Great Britain, even those that do not have an electric vehicle parked in the driveway. An additional benefit is that tapping into a large number of vehicle batteries will allow utility companies to avoid some of the cost of installing grid scale battery storage facilities.

See https://cleantechnica.com/2021/09/05/uk-energy-regulator-supports-vehicle-to-grid-proposal/

#environment #EV #gridstorage #V2G #UK

https://cleantechnica.com/2021/09/05/uk-energy-regulator-supports-vehicle-to-grid-proposal/

0 notes

Text

U.S. Energy Department Releases Request for Information on Electric Vehicle Grid Integration

U.S. Energy Department Releases Request for Information on Electric Vehicle Grid Integration

Through this RFI, DOE is soliciting input in five categories:

* An evaluation of the use of EVs to maintain the reliability of the electric grid.

* The impact of grid integration on EVs.

* The impacts to the electric grid of increased penetration by EVs.

* Research on the standards needed to integrate EVs with the grid, including communications systems, protocols, and charging stations.

* The cybersecurity challenges and needs associated with electrifying the transportation sector.

A request for information is always the best way to go to first determine what needs to be considered before designing any specifications for later tenders, versus having your specifications shaped by a single dominant player already in the market. Another positive here is that they are clearly also looking to see how EVs can be used as broader grid-storage and grid frequency stabilisation (first and fourth categories point towards this).

See https://cleantechnica.com/2021/06/15/u-s-energy-department-releases-request-for-information-on-electric-vehicle-grid-integration/

#environment #EV #USA #energy #gridstorage

https://cleantechnica.com/2021/06/15/u-s-energy-department-releases-request-for-information-on-electric-vehicle-grid-integration/

0 notes

Text

Researchers Claim Redox Flow Battery Breakthrough Will Cost $25 Per kWh Or Less

Researchers At Warwick University In The UK Claim Redox Flow Battery Breakthrough Will Cost $25 Per kWh Or Less

Despite their advantages, until now redox flow batteries have not had a significant cost advantage over batteries and had a shorter service life. But researchers at Warwick University in the UK, in cooperation with colleagues at Imperial College London, say they have found a way to dramatically reduce the cost of redox flow batteries to £20 per kWh or less using inexpensive materials like manganese and sulfur which are found in abundance nature. They claim the cost of materials for their new battery is about 1/30th that of the materials needed for a lithium ion battery, which may use expensive elements like cobalt. Their research was published recently in the journal Applied Materials & Interfaces.

Dr Barun Chakrabarti, one of the lead authors on the paper, says “This EPD technique is not only simple but also improves the efficiencies of three different economical hybrid flow batteries thereby increasing their potential for widespread commercial adoption for grid-scale energy storage.” If what the researchers say holds up in real world use, the world of renewable energy and energy storage just took a big step forward.

See https://cleantechnica.com/2021/01/25/researchers-claim-redox-flow-battery-breakthrough-will-cost-25-per-kwh-or-less/

#environment #gridstorage #batteries

https://cleantechnica.com/2021/01/25/researchers-claim-redox-flow-battery-breakthrough-will-cost-25-per-kwh-or-less/

0 notes

Text

New, Cheap Electric Energy Storage System (Like Pumped Hydro, But Subterranean!)

New, Cheap Electric Energy Storage System (Like Pumped Hydro, But Subterranean!)

Two shortcomings experienced with renewable energy is lack of grid storage and outdated transmission infrastructure. This one helps address the grid storage side.

Pumped Hydro Compressed Air Energy Storage (PHCAES) is a new system that can deliver stored energy at two to three cents per kilowatt-hour. This cost, far lower than that of lithium batteries, is similar to Pumped Hydro Energy Storage (PHES), a proven technology. Although it has many similarities to PHES, PHCAES has significant advantages over PHES — including lower capital costs and significantly less land space required.

Like PHES, PHCAES uses a ground-level water reservoir and a power plant. The difference is in the pressure reservoirs. While PHES uses a high elevation water reservoir to create a water pressure head, PHCAES uses a depleted underground well (gas/oil/water) that contains a reservoir of water along with high-pressure air to create its water pressure head. Both PHES and PHCAES pump/reverse water flow between the surface water reservoir and their respective high- pressure head reservoirs through a power plant to either store or produce electric power.

See https://cleantechnica.com/2021/01/13/new-cheap-electric-energy-storage-system-like-pumped-hydro-but-subterranean/

#environment #gridstorage

https://cleantechnica.com/2021/01/13/new-cheap-electric-energy-storage-system-like-pumped-hydro-but-subterranean/

0 notes

Text

Neoen Says Hornsdale Tesla Battery Has Exceeded Expectations | CleanTechnica

Neoen Says Hornsdale Tesla Grid-Scale Battery In South Australia Has Exceeded Expectations

Engineering consultant Aurecon Group said in a statement last week the Hornsdale battery installed two years ago in South Austrialia has exceeded expectations for the way it has stabilized the grid and lowered grid related costs. So far, the Hornsdale facility has successfully met the challenge of three major system outages and reduced network costs by about $76 million in 2019, according to a report by Bloomberg. The battery has slashed the cost of regulating the South Australia electrical grid by 91%, bringing it in line with other regions in the nation, Aurecon said. Those savings are passed on to utility customers in South Australia.

Garth Heron is the head of development for French energy company Neoen, which owns and operates the Hornsdale installation. He says batteries smooth out fluctuations in the flow of electricity that can destabilize the grid. The Tesla battery is capable of responding to such frequency events more quickly than coal or gas fired generators and at much lower cost. “The grid has a heartbeat that needs to be regulated,” Heron tells Bloomberg. “I think there will be a faster battery roll-out than most people expect. They really are able to solve a multitude of problems.”

See https://cleantechnica.com/2020/03/02/neoen-says-hornsdale-battery-has-exceeded-expectations/

#environment #australia #gridstorage

https://cleantechnica.com/2020/03/02/neoen-says-hornsdale-battery-has-exceeded-expectations/

0 notes

Text

Will Your EV Keep the Lights On When the Grid Goes Down?

Will Your EV Keep the Lights On When the Grid Goes Down? Yes, a Leaf can power an average home in Japan for two to four days!

For much of any given day, EVs are parked in garages or at offices. When paired with a power control system, the battery packs in those EVs are functionally little different than a stationary battery system.

One big difference: EV battery packs are much larger. Many EVs on the market today are outfitted with battery packs with capacities ranging from 40 to 65 kilowatt-hours. Tesla vehicle battery packs are even larger: up to 100 kilowatt-hours in the Model S or Model X. By comparison, Tesla’s Powerwall home battery has a 13.5-kilowatt-hour nameplate capacity.

See https://www.greentechmedia.com/articles/read/will-your-ev-keep-the-lights-on-when-the-grid-goes-down

#EV #environment #gridstorage

https://www.greentechmedia.com/articles/read/will-your-ev-keep-the-lights-on-when-the-grid-goes-down

0 notes

Text

472 Vehicle-To-Grid Smart Chargers Coming To The Netherlands | CleanTechnica

472 Vehicle-To-Grid Smart Chargers Coming To The Netherlands - The Cars Give Back By Helping Stabilise The Grid

The Dutch government states that a more stable electric grid, better use of renewable energy, and making money with your battery electric car (BEV) are the reasons it is promoting the use of smart chargers, which are able to invert the flow of the current to go from the car battery back into the grid.

Of course, the whole capacity of a car’s battery won’t be available as a buffer for the grid. The owner/driver can set the amount of electricity the grid can borrow and what minimum charge the car should have. With only 472 cars connected to the grid, it is not the size of the reserve capacity that matters, but the speed with which it can react to fluctuations in the grid. When we have a hundred times as many smart public chargers, that’s when capacity becomes relevant.

Yes going electric means being able to do so much more instead of a legacy type one-way grid with a massive base-load generation. Smarter grids allow for EVs to help stabilise fluctuations along with static battery storage, and should allow for decentralised wind and solar PV generation from different areas across a country or a continent. It even offers the opportunity for individuals to generate and sell their own power. It's a whole new world...

See https://cleantechnica.com/2019/09/02/netherlands-subsidy-for-472-vehicle-to-grid-smart-chargers/

#environment #gridstorage #EV

https://cleantechnica.com/2019/09/02/netherlands-subsidy-for-472-vehicle-to-grid-smart-chargers/

0 notes