#how to calculate startup valuation

Explore tagged Tumblr posts

Text

In the bustling world of startups, where innovation meets ambition, there exists a cryptic yet crucial concept that can make or break the dreams of aspiring entrepreneurs — startup valuations. It’s a tale of numbers, strategies, and a touch of mystique. Join me as we unravel this enigma and explore the intricacies of startup valuations.

#startup valuation#startup valuation calculator#startup valuation methods#unicorn startup valuation#how to calculate startup valuation#startup valuation india

0 notes

Text

Unlocking Investment Potential: Navigating Startup Valuation in a No-Revenue Landscape

Unlocking Investment Potential: Navigating Startup Valuation in a No-Revenue Landscape

In the dynamic realm of venture capital and investment, navigating the valuation of early-stage startups, particularly those with no revenue, can be a complex endeavor. As investors and venture capitalists, you’re well aware that traditional valuation methods may not directly apply in these scenarios. That’s where our cutting-edge Startup Valuation Platform steps in, offering a revolutionary approach to assessing the worth of startups on the cusp of innovation.

Our Startup Valuation Platform

Investors and venture capitalists, welcome to a new frontier of startup valuation! As pioneers in the industry, you understand the challenges of evaluating startups without a revenue stream. Our Startup Valuation Platform is tailored to meet the unique needs of investors like you, providing a comprehensive solution for valuing early-stage ventures.

Efficiency in Valuation

One of the standout features of our platform is its efficiency in the valuation process. We understand your time is valuable, and our Startup Valuation Calculator streamlines the process, delivering quick and accurate valuations for startups without revenue. This efficiency allows you to explore multiple investment opportunities with ease.

Data-Driven Decision Making:

In the world of startup investments, data is king. Our platform empowers you with data-driven valuation reports based on industry benchmarks, market trends, and the distinct value propositions of startups. This ensures that your investment decisions are grounded in solid information, even when traditional financial data is limited.

Download Sample Valuation Report

Risk Mitigation and Enhanced ROI:

Investing in startups carries inherent risks, especially when revenue is not yet realized. Our Startup Valuation Platform facilitates risk assessment, enabling you to make informed decisions. Diversify your portfolio intelligently, identify high-potential opportunities, and enhance your return on investment with our comprehensive approach to startup valuation.

How the Startup Valuation Calculator Works?

Using our Startup Valuation Calculator is straightforward. Input the relevant data, and our platform generates a detailed report, offering insights into the startup’s potential worth. The platform is not just a tool; it’s a strategic ally in your journey to identify and support the next generation of groundbreaking startups.

Conclusion:

Investors and venture capitalists, the landscape of startup valuation is evolving, and our Startup Valuation Platform is at the forefront of this transformation. Embrace the future of investment by leveraging our platform’s capabilities—efficient valuations, data-driven decision-making, risk mitigation, and portfolio enhancement. Explore the untapped potential of startups with no revenue, and unlock new opportunities for growth and success.

#Startup Valuation Platform#startup valuation#startup valuation tool#online startup valuation calculator#startup valuation calculator#valuation calculator startup#early-stage startups with no revenue#valuating early-stage companies#business valuation#How the Startup Valuation Calculator Works?

0 notes

Text

After graduating, a boy asked his father, "Dad, what is a successful life?"

The father did not answer directly, but said, "Come with me, today we will fly a kite. Then I will answer your question."

The boy was surprised and said, "What are you talking about, dad! You will fly a kite at this age!"

The father then took his son by the hand and took him to the field behind the house. There were some children flying kites. The father asked one of them for his kite and started flying. He was untying the thread from the spool and the boy was watching intently. After the kite had risen quite a bit in the sky, the father said, "Look, how the kite is floating in the air even at such a high altitude. Don't you think that the tension of this thread is preventing the kite from going higher?"

The boy said, "That's right, if there was no thread, it could have gone higher!"

The father cut the thread in a hurry. The kite was freed from the string and at first rose a little, but after a while it descended and disappeared into the distance.

Now the father patted his son's back and said, "Listen, my son, from the height or level we are or have reached in life, it often seems that some bonds like the string of a kite prevent us from going higher. Such as home, parents, wife, children, family, friends, discipline, etc. And we also want to be free from those bonds sometimes. In reality, those bonds are what keep us high; they give us stability, they prevent us from falling down. Without these bonds, we may be able to go up a little for a moment, but in a short time we too will fall like that stringless kite! If you want to stay high in life, never break those bonds. Just as the combined bond of the string and the kite gives the kite its balance in the sky; similarly, social and family bonds give us the balance to stay at the peak of success. And this is the real successful life.

Life is a strange battle! The older you get, the more you will realize this truth. This battle is also not fair.

You will see before your eyes someone born with an extraordinary brain, turning the pages of the book the night before the exam and getting brilliant results, and you study like crazy day after day, but you are not getting any benefit.

In the meantime, you will see that some people are born in a family full of money. They do not lack for anything. And your father sweats while collecting your semester fees. Then you will be very proud of the world. But as I said, the battle of life is not fair.

Someone with worse results than you will get a job worth lakhs of taka. Maybe that interview was better, maybe he had references, maybe he had skills — I don't know, something will happen! Someone will have a company with a valuation of crores of taka through startups. Seeing the millions of taka of YouTubers or Facebookers, questions will arise about your career choice every day.

Some will get promotions year after year, some will complete their PhD in New York and give life events. On the other hand, some will end up in jail after losing their business and not being able to repay their loans. Some will not get a job despite their efforts — after giving twenty-two interviews, they will feel that there is nothing more cruel than life.

If you want, you can compare yourself with others all day long. If you think about those who have come forward in the battle of life, nothing will happen except regret. You will not be able to reconcile the calculations. Luck, talent, skill, hard work, destiny — life's equation cannot be reconciled with so many variables.

There is no end to being good. Those who have no place to live want a house. The person hanging on the bus dreams of a car and the person riding in a sedan car looks through the catalog of SUV cars. The person in the SUV again finds a 2,000 square foot apartment.

The battle of being good is like this. A never-ending, uneven race with no finish line. Just keep running, keep running, every day, every moment!

Shampa........ ✍️

#writers on tumblr#love poem#creative writing#poetic#poem#original poem#poets on tumblr#writers#writeblr#poetry#writing community#writing#writers and poets

5 notes

·

View notes

Text

The Smart Entrepreneur’s Guide to a Reliable Valuation Partner

In a dynamic and data-driven marketplace, understanding the true value of your business is not just smart—it's essential. Whether you're planning to scale, secure funding, sell, or simply optimize operations, accurate valuation plays a critical role. But how do you ensure you're not just getting numbers on paper, but a trustworthy and strategic assessment? The answer lies in choosing the right Reliable Valuation Partner. This guide will walk you through how smart entrepreneurs make the right choice and use valuation as a tool for growth and confidence.c

Why Every Smart Entrepreneur Needs a Reliable Valuation Partner As an entrepreneur, your business is your biggest asset. Partnering with a Reliable Valuation Partner means having access to expert insight into your company's financial standing, market worth, and potential. Whether you're raising capital, entering a joint venture, or preparing for a buyout, valuation guides your strategy.

A Reliable Valuation Partner not only determines numbers but also explains the story those numbers tell—helping you make data-driven decisions with conviction.

Understand Your Valuation Needs Before you begin the search, clarify what kind of valuation you need:

Startup Valuation: Pre-revenue or early-stage funding rounds

Equity Valuation: For investors or partners

M&A Valuation: During acquisitions or mergers

Regulatory or Taxation: For compliance and reporting

Estate or Exit Planning: For succession or liquidation

A Reliable Valuation Partner will tailor their approach based on your exact purpose and business structure.

Traits of a Trusted Valuation Partner The best valuation partners bring more than just spreadsheets. Here are the top qualities smart entrepreneurs look for:

Integrity: Trustworthy with sensitive financial data

Clarity: Ability to explain methods and results in simple terms

Experience: Proven record in your industry or business size

Objectivity: Unbiased and independent assessments

Responsiveness: Willing to answer questions and offer guidance

Look for a Reliable Valuation Partner who not only calculates value but also adds strategic insights that align with your vision.

Credentials That Matter Valuation is a specialized field. Make sure your valuation partner has professional certifications like:

ASA (Accredited Senior Appraiser)

CFA (Chartered Financial Analyst)

CPA (Certified Public Accountant) with valuation training

CBV (Chartered Business Valuator)

These credentials show a commitment to industry standards and ethical valuation practices, ensuring you work with a Reliable Valuation Partner you can trust.

Understanding the Valuation Methods They Use A credible Reliable Valuation Partner will use one or more standard valuation approaches:

Income-Based: Such as Discounted Cash Flow (DCF)

Market-Based: Comparing similar businesses

Asset-Based: Focusing on net assets and liabilities

They should be able to justify their chosen approach with real data and logic. Make sure they walk you through their process clearly.

Look for Industry Experience Every industry has unique metrics and valuation drivers. A tech startup is valued differently than a manufacturing unit or service-based firm. Your Reliable Valuation Partner should:

Understand your sector’s trends and challenges

Know common revenue models and key financial indicators

Offer benchmark data from relevant businesses

Industry expertise leads to more accurate and defendable reports.

Technology and Tools Matter The right valuation partner will utilize modern financial tools and modeling software to:

Streamline the data collection process

Generate scenario-based projections

Minimize errors and biases

A tech-savvy Reliable Valuation Partner ensures fast, efficient, and data-driven results.

Transparency Builds Trust Smart entrepreneurs value transparency. Your valuation partner should:

Provide a clear scope of work

Explain deliverables and deadlines

Offer ongoing consultation or support

Avoid firms that promise quick numbers without clarity or documentation. A Reliable Valuation Partner will stand behind their reports with complete transparency.

Compare Cost with Value While cost is a factor, don’t let it be the sole deciding point. Think of your valuation partner as a long-term advisor. Ask yourself:

What support do they offer beyond just the report?

Do they provide insights you can act on?

Is their report legally and financially defendable?

Choosing a Reliable Valuation Partner is an investment in accuracy and strategic growth.

Evaluate Client Reviews and Reputation In today’s digital age, it’s easy to check a firm’s credibility. Look at:

Google and LinkedIn reviews

Case studies or testimonials

Industry awards or recognitions

A Reliable Valuation Partner will have a track record of success and client satisfaction that speaks volumes about their capabilities.

Final Thoughts Entrepreneurs who think ahead know that valuation isn't just a box to check—it's a strategic asset. The right Reliable Valuation Partner brings expertise, clarity, and reliability to your business decisions. Whether you're preparing to scale or exit, align yourself with a professional who respects your journey and supports your goals.

Don’t settle for surface-level assessments. Seek a partner who is as invested in your success as you are. Make the smart move—choose a Reliable Valuation Partner who delivers real insights, real results, and real value.

0 notes

Text

Decoding Post-Money Valuation: The Entrepreneur’s Essential Guide

🚀 Imagine you’re sipping coffee with a venture capitalist, discussing a potential investment in your startup. The conversation turns to numbers: how much equity they’ll receive, how the valuation is calculated, and suddenly, a term pops up—post-money valuation. You nod confidently, but your mind races. What exactly does that mean? And why does it shape the fate of your company’s…

0 notes

Text

How Startups Are Using Financial Modelling to Attract Investors in India’s Booming Tech Ecosystem

India’s startup ecosystem is on fire. With over 100 unicorns and thousands of early-stage ventures blossoming across sectors like fintech, edtech, healthtech, SaaS, and e-commerce, the landscape is vibrant—but also fiercely competitive. In this high-stakes environment, financial modelling has emerged as a powerful tool for startups to build credibility, secure funding, and scale with confidence.

For aspiring entrepreneurs and finance professionals alike, mastering financial modelling is no longer optional. If you’re in Kolkata and looking to break into this space, enrolling in the best Financial Modelling Course in Kolkata can give you the practical skills needed to thrive in this startup-driven economy.

Why Financial Modelling Matters in a Startup's Journey

When startups approach angel investors, venture capitalists, or private equity firms, they don’t just pitch an idea—they pitch a vision backed by numbers. These numbers aren’t just pulled from thin air. They come from detailed financial models that forecast how the business will grow, scale, and generate returns.

A robust financial model communicates:

Revenue projections for the next 3–5 years

Operating expenses and burn rate

Break-even analysis

Customer acquisition cost (CAC) and lifetime value (LTV)

Unit economics

Funding requirements and expected ROI

These projections show investors that the startup’s founders understand their market, costs, and how their business will turn a profit—or at least grow fast enough to justify the investment.

The Indian Startup Boom: A Perfect Storm for Financial Modellers

India is now the third-largest startup ecosystem in the world, after the US and China. With the digital economy accelerating, investors are pouring billions into scalable tech ventures. However, investor scrutiny is higher than ever due to recent global funding slowdowns.

Now, it’s not enough to have a great pitch deck. Investors want to see clear, data-driven financial roadmaps. That’s where financial modelling steps in.

Professionals trained through the best Financial Modelling Course in Kolkata are helping startups prepare solid models that can stand up to investor due diligence. From sensitivity analysis to discounted cash flows and cohort-based revenue forecasting, the right models can turn a maybe into a yes.

How Startups Are Using Financial Models to Win Over Investors

1. Validating the Business Idea

Before seeking funding, startups use financial models to check whether the business idea is financially viable. This includes calculating how many customers are needed to reach profitability, and how long the runway is with current capital.

2. Pitch Deck Projections

Every investor pitch today includes financial projections. But not all projections are created equal. Models that reflect realistic assumptions, industry benchmarks, and multiple scenarios inspire investor trust and make the startup stand out.

3. Justifying Valuations

Startups often struggle to justify their high valuations. Solid models using DCF (Discounted Cash Flow) or Comparable Company Analysis help founders support their ask with logic and numbers.

4. Planning for Fund Utilization

Investors want to know: how exactly will the startup spend their money? Financial modelling helps allocate capital efficiently—across product development, marketing, hiring, and operations.

5. Managing Growth

As a startup scales, it needs to continuously update its models to make hiring plans, pricing decisions, and market expansion strategies. Good models aren’t static—they evolve with the business.

Real-World Example: Fintech Startup in Kolkata

Take the example of a rising fintech startup in Kolkata targeting small business lending. When preparing for their Series A round, they built a detailed financial model projecting their revenue based on user acquisition, average loan size, and default rates. They also modeled different growth scenarios: aggressive vs. conservative.

Using these models, they were able to:

Clearly demonstrate when they’d break even

Show the effect of scaling operations

Validate their ₹100 crore valuation ask

They successfully secured funding from a Mumbai-based VC firm—and credited their financial model as a major differentiator.

The Growing Demand for Financial Modelling Skills

Startups aren’t the only ones benefiting. Founders, finance teams, startup analysts, and even venture capital interns are expected to know how to build and interpret financial models.

If you're based in West Bengal and looking to enter this space, joining the best Financial Modelling Course in Kolkata can be your stepping stone. These courses teach:

Excel-based modelling techniques

Three-statement financial models

Valuation methods like DCF and EBITDA multiples

Scenario planning and Monte Carlo simulations

Fundraising and cap table modelling

With these skills, you can work in corporate finance, become a startup CFO, join a VC firm, or even start your own venture with financial clarity.

Final Thoughts

India’s startup boom is not slowing down—and as more founders chase limited capital, financial clarity will be their biggest weapon. Financial modelling is no longer just for investment bankers; it’s now a startup essential.

If you’re looking to be part of this transformation—whether as a founder, finance professional, or investor—now is the time to upskill. Enroll in the best Financial Modelling Course in Kolkata and gain the expertise to turn ideas into investor-ready opportunities.

0 notes

Text

Real Estate Innovation in Dubai: Complete App Development Guide

Dubai's real estate sector is undergoing a dramatic transformation, fueled by rapid technological advancements and the growing demand for digital solutions. From virtual tours and blockchain transactions to AI-driven property recommendations, the real estate market in Dubai is now powered by innovative mobile and web applications. For real estate companies, agents, and investors, building a smart, user-friendly real estate app is no longer a luxury—it's a strategic necessity.

In this complete guide, we’ll break down how to build a powerful real estate app tailored for Dubai’s dynamic market, highlight the latest innovations, and discuss essential features, tech stacks, and development costs. If you’re looking to turn your idea into a profitable app, IMG Global Infotech is your ideal partner, offering end-to-end real estate app development services in Dubai and globally.

Why Dubai is Leading in Real Estate Innovation

Dubai has always positioned itself at the forefront of innovation. Its real estate market mirrors that ambition by embracing:

Smart City initiatives promoting digitization.

A growing expat population seeking efficient property solutions.

High mobile penetration and digital literacy.

Government support for proptech startups.

The result? A booming ecosystem where real estate apps can thrive, provided they are tailored to the region's expectations.

Types of Real Estate Apps Gaining Popularity in Dubai

Before you dive into development, it’s vital to understand the different types of real estate apps making waves in Dubai:

Property Listing Platforms – Apps like Bayut and Property Finder allow users to browse and filter listings by type, price, and location.

Brokerage Management Apps – Used by agents to manage leads, showings, and sales processes.

Rental Apps – Focused solely on long-term and short-term rentals (including holiday rentals).

Virtual Tour Apps – Offer AR/VR-based tours, especially useful for off-plan properties.

Investment Platforms – Cater to real estate investors looking for ROI insights, forecasts, and secure digital transactions.

Core Features for Real Estate Apps in Dubai

To compete in Dubai’s tech-forward environment, your real estate app should include:

Advanced Search Filters (location, type, size, price)

Interactive Maps Integration with nearby amenities

High-Resolution Media Uploads (photos, 360° videos, VR tours)

Multilingual Support (English, Arabic, Russian)

AI-Powered Recommendations based on user behavior

Secure User Authentication & Profiles

In-App Chat with Agents

Real-Time Notifications

Mortgage Calculators

Property Valuation Tools

Admin Dashboard for agents, brokers, or developers

At IMG Global Infotech, we specialize in building feature-rich real estate apps that integrate cutting-edge functionalities while remaining user-friendly and visually stunning.

Tech Stack for Real Estate App Development

Choosing the right technology stack is crucial for building a scalable, secure, and responsive app. Here's a recommended tech stack:

Frontend: React Native or Flutter for cross-platform compatibility

Backend: Node.js or Django for speed and flexibility

Database: PostgreSQL or MongoDB

APIs: Google Maps, payment gateways, CRM integrations

AI/ML Tools: TensorFlow, Dialogflow for smart search and chatbots

AR/VR: Unity or Vuforia for virtual property tours

IMG Global Infotech ensures that the most modern and efficient technologies are selected according to your specific business goals.

Development Stages and Timeline

The process of developing a real estate app typically follows these steps:

Discovery & Planning – Market analysis, competitor benchmarking, and feature outlining (1–2 weeks)

UI/UX Design – Creating user journeys, wireframes, and prototypes (2–3 weeks)

Backend & Frontend Development – Coding core functionalities, APIs, and databases (6–10 weeks)

Testing & QA – Bug fixing, load testing, and performance optimization (2 weeks)

Launch & Deployment – Publishing on iOS and Android stores, post-launch support

Total estimated timeline: 3–4 months, depending on app complexity.

Estimated Cost of Building a Real Estate App in Dubai

Development costs vary based on app features, platforms, and custom integrations. Here’s a general breakdown:

App Type

Estimated Cost (USD)

Basic Property Listing App

$10,000 – $20,000

Advanced Multi-Feature App

$25,000 – $50,000+

AR/VR-Integrated Platform

$50,000 – $80,000+

Working with IMG Global Infotech, you receive transparent pricing, milestone-based billing, and premium-quality development at globally competitive rates.

How Can IMG Global Infotech Help?

IMG Global Infotech stands out as a trusted real estate app development company with:

10+ years of industry experience

A team of certified developers and designers

Proven success in building apps for the Dubai and GCC real estate markets

Commitment to innovation, security, and scalability

End-to-end support from idea validation to post-launch maintenance

Whether you’re a startup, brokerage, or enterprise developer, we build solutions that align with your vision and market needs.

To Wrap It Up

Dubai’s real estate market is ripe for digital disruption, and the right app can give your business a significant competitive edge. From AR-enabled virtual tours to AI-powered property suggestions, today’s innovations are reshaping how people buy, sell, and rent properties in the city.

With a trusted tech partner like IMG Global Infotech, you can turn your real estate app idea into a powerful, revenue-generating product that stands out in Dubai’s digital skyline.

Ready to build your next-gen real estate app? Let’s make it happen.

#realestatetips#real estate investing#commercial real estate#realestateagent#real estate#app development#propertyinvestment#residential property#propertyforsale#realestateinvestment#commercial#commercial property

0 notes

Text

Fair Market Value for ESOPs: What It Is and How to Calculate It

Understanding the Fair Market Value (FMV) of Employee Stock Ownership Plans (ESOPs) is essential for any organization offering equity compensation. Whether you're a startup founder, HR professional, or finance executive, knowing how to accurately determine FMV ensures compliance with tax regulations, builds employee trust, and reflects the true value of your company’s shares. In this in-depth guide by Xumane, we break down everything you need to know about FMV as it relates to ESOPs. We start with the basics—what fair market value means, why it matters, and how it impacts both the company and its employees. From there, we walk you through the most commonly used valuation methods such as the Discounted Cash Flow (DCF) method, Comparable Company Analysis, and Net Asset Value approach.

0 notes

Text

5 High-Yield Investment Ideas Most People Overlook

Have you ever felt like everyone around you seems to know some secret about money that you don’t? I used to scroll through finance blogs and investment apps, only to find the same repetitive advice: buy index funds, invest in blue-chip stocks, maybe throw in a rental property if you’re ambitious. But what if you're looking for something with real potential something less obvious, but not necessarily more risky?

That’s the real question I found myself asking. I wasn’t just after “safe” returns I wanted growth. I wanted to know where smart capital goes when it’s not following the crowd. And that’s how I uncovered investment opportunities that most people overlook not because they’re hidden, but because they aren’t talked about loudly enough.

There’s something deeply satisfying about tapping into underappreciated assets. These aren’t get-rich-quick schemes. They’re smart, calculated positions that high-net-worth individuals (HNWIs) and family offices have been quietly building for years. And the benefit? They can deliver outsized returns without the same saturation you get in overexposed markets.

Before I go further, I want to mention a resource that helped me dig into some of these wealth-building routes, https://pearllemoninvest.com. Their insights on niche asset classes, portfolio diversification, and capital preservation strategies go beyond the usual surface-level suggestions.

Let’s look at five high-yield ideas that often go unnoticed by everyday investors and why they deserve a serious place in your financial playbook.

Why Are These Opportunities So Often Missed

Most people tend to invest where others already are. It’s human nature. When something gets mainstream attention think meme stocks or tech IPOs people flock in. But by the time these assets get noticed, most of the value has already been priced in.What separates overlooked ideas from the pack is their lack of hype. They often require a bit more research, access, or patience but that’s also why the reward can be higher.

1. Litigation Finance Earning from Legal Outcomes

When I first heard of this, I was skeptical. Investing in lawsuits? It sounded like something out of a legal thriller. But litigation finance is a booming multi-billion-dollar industry that allows third parties to fund legal claims in exchange for a portion of the settlement or judgment.

Why it works

Lawsuits, especially commercial ones, often result in high settlements.

Law firms and plaintiffs might lack the liquidity to pursue them.

Investors front the cost in return for a share of the award.

Attributes that matter

Uncorrelated Returns Legal cases don’t move with market volatility.

Short duration cycles Some cases resolve in 12–24 months.

High upside Returns can range from 15% to over 30% annually.

Example A private investor funded a contract dispute case in the UK and earned a 5x return after the plaintiff won a £4 million settlement.It’s not without risk if the plaintiff loses, you can lose your stake. But fund managers mitigate this by diversifying across dozens of cases, balancing risk in a similar way to how venture capitalists back startups.

2. Pre-IPOs and Secondary Shares Getting in Before the Hype

The idea of buying into a company before it goes public used to feel reserved for insiders or venture capital firms. But now, there are platforms that give accredited investors access to secondary shares in pre-IPO companies.

Why this is powerful

Upside Potential You enter before public valuation spikes.

Lower Entry Point Often shares are sold by early employees looking for liquidity.

Exclusivity The lack of retail access means prices are not overinflated.

Think of companies like SpaceX or Stripe private investors who got in years ago are looking at returns far exceeding public market norms.

Real-world usage

These shares are often found via secondary marketplaces or through investment syndicates. They’re typically held in special purpose vehicles (SPVs), which pool investors' capital to meet minimum thresholds set by companies.

It’s essential to perform due diligence many pre-IPO firms don’t have public financial statements, and liquidity is limited until an exit event.

3. Agricultural Land The Income-Producing Real Asset

I grew up thinking of land as something you inherit, not invest in. But it turns out, agricultural land offers both income and appreciation if you know where to look.

What makes farmland attractive

Regular income Rent paid by farmers or revenue from crop production.

Inflation hedge Land tends to hold value as currency weakens.

Global food demand More mouths to feed means land becomes more valuable.

Attributes to consider

Crop type

Water rights

Soil productivity

Local regulations

According to the USDA, U.S. farmland has appreciated by more than 150% since the early 2000s. And it’s not just an American phenomenon arable land in Eastern Europe and parts of South America is seeing similar trends.Platforms now exist that let individuals invest fractionally in farmland assets. It’s tangible, relatively stable, and under the radar for most.

4. Royalties Making Money from Music Patents and Publishing Rights

When people think of passive income, royalties rarely come up. But royalty investing is one of the few ways you can earn income from intellectual property without owning the IP yourself.

What kinds of royalties can you invest in

Music Rights Earn each time a song is streamed, used in films, or played live.

Pharma Patents Get paid when pharmaceutical products are sold.

Publishing Rights Make money from books, articles, and academic publications.

Platforms like Royalty Exchange or SongVest have opened up these opportunities. You can browse catalogs, review performance histories, and bid on rights to future income.

5. Private Credit Earning Interest Where Banks Say No

Private credit refers to non-bank lending where investors step in to provide capital to companies or individuals who don’t meet traditional loan criteria.

Why it’s growing

Bank retrenchment After 2008, traditional lenders became more conservative.

Demand from SMEs Small-to-mid-sized enterprises still need capital to grow.

Higher yields Because they’re riskier, interest rates are more rewarding.

Private debt funds target returns of 8–12%, and in some cases, more depending on the loan structure.

Types of instruments include

Direct lending

Mezzanine debt

Distressed credit

Real estate bridge loans

These aren’t traded on public exchanges. You typically invest through funds that manage loan origination, underwriting, and collection. Because the credit is illiquid, it’s best suited for investors with medium-to-long-term horizons.

Questions I Always Get Asked

Isn’t this too risky

Every investment has risks it’s about understanding and managing them. These overlooked options often have safeguards: pooled risk, collateral, or contractual protections. Risk increases when you don’t understand the asset, not because the asset is inherently unstable.

Can someone with a smaller budget still access these

Yes. Many of these options now allow for fractional or pooled investments. For example

Farmland platforms let you invest with as little as $5,000.

Litigation finance funds accept limited partners with $10,000–$25,000.

Royalty platforms host auctions starting at a few hundred dollars.

What to Watch Out For

Before you dive into any high-yield venture, consider the following:

Liquidity constraints Can you sell or exit your position easily?

Regulatory clarity Are you operating in a well-defined legal environment?

Manager experience Who's running the fund or platform?

Transparency Can you see performance data, fees, and legal terms?

Conclusion The Real Wealth Often Hides in the Quiet

The ideas I’ve shared here aren’t magic tricks. They’re practical, accessible, and used by sophisticated investors who don’t follow financial fads. They require some effort more due diligence, longer holding periods, and occasionally dealing with niche platforms but the return potential makes it worth it.

Most people won’t touch them. Not because they’re bad. But because they aren’t being shouted about on financial talk shows or trending on TikTok. That’s exactly why they work.

For me, shifting a portion of my capital into these lesser-known but high-yield ideas created a level of diversification and return I never thought I’d find in today’s saturated market. It took stepping away from the herd and being okay with not chasing every headline.

If you’re genuinely looking to build long-term, asymmetric wealth, you need to go where most people aren’t looking. And sometimes, that means being open to legal cases, farmland, pre-IPOs, or even song royalties.

Contact Information

Name: Pearl Lemon Invest

Address: Kemp House, 152–160 City Road, London, EC1V 2NX, United Kingdom

Phone Number: +44 207 183 3436

0 notes

Text

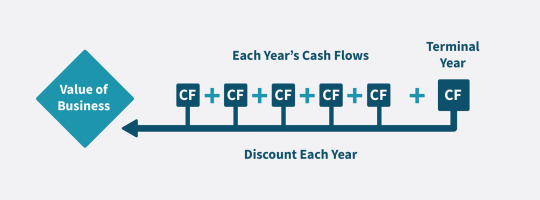

Understanding DCF Valuation: A Comprehensive Guide by CompaniesNext

Discounted Cash Flow (DCF) valuation is one of the most widely used methods for determining the intrinsic value of a business. At CompaniesNext, we aim to empower entrepreneurs, investors, and analysts with clear, actionable financial insights. In this guide, we’ll break down what DCF valuation is, why it matters, and how to perform one.

What is DCF Valuation?

DCF (Discounted Cash Flow) valuation is a financial model used to estimate the value of an investment based on its expected future cash flows. These cash flows are projected and then discounted back to their present value using a discount rate that reflects the investment’s risk.

Why Use DCF Valuation?

Accurate Reflection of Future Potential

Unlike other valuation methods, DCF focuses on the fundamentals of a business rather than market trends or comparables. It provides a more accurate view of what a company is truly worth based on its future performance.

Ideal for Long-Term Decision Making

DCF is especially useful for investors and business owners with a long-term view, as it considers the entire life cycle of a business or project.

Key Components of a DCF Model

1. Forecasted Free Cash Flows (FCFs)

Free Cash Flow is the cash a company generates after accounting for capital expenditures. It represents the cash available to investors and is the foundation of any DCF model.

2. Discount Rate

The discount rate is typically the company’s Weighted Average Cost of Capital (WACC). It reflects the opportunity cost of investing capital elsewhere at a similar risk level.

3. Terminal Value

Since it's difficult to forecast cash flows indefinitely, the terminal value estimates the business’s value beyond the forecast period. It usually accounts for a large portion of the total valuation.

Steps to Perform a DCF Valuation

Step 1: Project Free Cash Flows

Start by estimating the company’s free cash flows for the next 5–10 years based on historical performance, growth expectations, and industry trends.

Step 2: Calculate the Discount Rate

Determine the WACC by factoring in the cost of equity and the cost of debt, weighted by their respective portions in the company’s capital structure.

Step 3: Estimate the Terminal Value

Use either the Gordon Growth Model or Exit Multiple Method to estimate the terminal value.

Step 4: Discount the Cash Flows

Bring all future cash flows and the terminal value to present value using the WACC. Sum them to arrive at the total enterprise value.

Limitations of DCF Valuation

While DCF is powerful, it relies heavily on assumptions. Minor changes in growth rate, discount rate, or cash flow projections can significantly affect the final valuation.

Conclusion

DCF valuation is a cornerstone of corporate finance and investment analysis. At CompaniesNext, we help businesses and investors leverage this method to make informed, forward-thinking decisions. Whether you're assessing a startup, planning a merger, or investing in a new venture, a solid DCF model is a valuable tool in your financial toolkit.

0 notes

Text

Finding the Best Business Valuation Firm in Delhi NCR

Let’s face it—figuring out what your business is actually worth can feel a bit like trying to nail jelly to a wall. Especially if you’re a startup founder juggling ten things at once, the idea of business valuation might seem… well, daunting. But it doesn’t have to be. The key is finding the right people to guide you through the process—and if you’re anywhere in Delhi NCR, the good news is you’ve got options.

Now, if you’re Googlingbusiness valuation for startups in Delhi NCR, you’re probably getting hit with a barrage of firms claiming to be “the best,” “ISO-certified,” “globally recognized”—you get the picture. But titles and buzzwords aside, how do you actually choose the right business valuation firm?

Here’s a little secret: it’s not just about credentials (though those matter, obviously). It’s also about how well a firm understands your vision—and your challenges.

Startups aren’t just smaller versions of big businesses. They’re more like living, breathing experiments, constantly evolving. So if you’re a founder, you don’t just need someone with a calculator and a checklist. You need business valuation experts who get the unpredictability of startup growth, who can assess intangible assets like IP, brand potential, or even future market capture. That takes more than textbook knowledge—it takes experience, and frankly, a bit of intuition.

That’s where firms like GroomTax come in. Based right in the heart of Delhi NCR, they’ve carved out a solid niche for themselves in helping early-stage and growing businesses get a clear picture of their value. And from what I’ve seen, they strike a pretty good balance between technical accuracy and real-world practicality.

One thing I appreciate about GroomTax is that they don’t throw you into a one-size-fits-all model. Their team takes time to understand your business model, market dynamics, and even your goals—whether that’s raising a seed round or preparing for acquisition. That sort of tailored approach can really make a difference, especially when investors are asking pointed questions.

Plus, their reports?Actually readable. I’ve seen valuation reports that might as well have been written in Latin. GroomTax, though, presents their analysis in a way that doesn’t make your brain hurt. That’s… kind of rare.

If I had to nitpick, I’d say they’re better suited for startups and SMEs rather than large corporates with extremely complex asset structures. But honestly, if you’re in the startup space—and especially if you’re looking for business valuation experts who won’t treat you like just another file on the desk—they’re worth a serious look.

So, is there one “best” business valuation firm in Delhi NCR? Maybe not.But the right one for you? That’s out there. And if your startup is at a point where valuation matters, don’t cut corners. The number on that report could shape your future.

0 notes

Text

The Valuation Slide That Wins Investors

The Valuation Slide That Wins Investors

In the glitzy world of startups, where innovation meets ambition, there’s one slide in a pitch deck that can command the attention of everyone in the room – the valuation slide. Whether you’re an early-stage startup or merely gauging the potential of a business idea, presenting the perfect valuation can set the stage for a successful fundraising effort. But how do you nail this slide, especially if you have no revenue yet? Let’s delve deeper.

Why Valuation Matters

The valuation of a startup isn’t just about numbers or potential revenue. It’s a narrative of the company’s potential, vision, and the value it aims to deliver to stakeholders. For investors, valuation serves as a compass – it guides them to ascertain the risk associated with your startup and the potential return on their investment. While revenue is a straightforward measure for established companies, startups often operate in the realm of vision, potential, and innovation. This makes the valuation slide not only about the worth but also about the story behind that worth.

Crafting the Perfect Valuation Slide

1. Simplicity is Key: Don’t overwhelm your audience with complex calculations or jargon. Present a clear, concise valuation figure and back it up with 3-4 key metrics or reasons that support it.

2. Storytelling: Numbers, on their own, can be lifeless. Weave a compelling story around your valuation. How did you arrive at this figure? What milestones or potential growth does this number represent?

3. Visual Appeal: A picture is worth a thousand words. Use charts, graphs, or infographics to represent data. It aids in comprehension and retention.

4. Be Prepared for Questions: The valuation slide will undoubtedly raise eyebrows and questions. Be ready to defend your valuation with data, research, and comparables from the industry.

The Role of Valuation Tools

Not everyone is a financial wizard, and that’s okay. In today’s tech-driven age, tools like ValuationGenius can give you an edge. These platforms provide an approximate valuation based on a range of factors, eliminating the need for deep financial know-how. While this shouldn’t be the sole basis of your valuation, it can serve as a starting point or a validation tool. When combined with market research and industry benchmarks, tools like these can make your valuation slide more credible and robust.

Case Study: Litemeup and the Power of AI in Valuation

Meet Litemeup, a fledgling startup on the brink of transforming the packaging industry with AI-driven design. While they had a groundbreaking concept, they faced a common challenge many early-stage startups grapple with: how to place a valuation on an idea when there’s no product or revenue in play?

Enter ValuationGenius

Without a product, without revenue, and seemingly without the necessary data points that typically inform valuation, Litemeup turned to our tool. ValuationGenius didn’t just spit out a random number. Instead, it provided a range of estimates based on different valuation methods. But what truly stood out was the grounding of these estimates. Each was justified not just by data, but by the wisdom of business development and an inherent understanding of the startup landscape.

So, when Litemeup pitched to investors, they had more than just a vision. They presented a detailed valuation slide that wasn’t built on optimistic projections or vague assumptions but on a solid foundation provided by ValuationGenius. The result? They secured the trust and, subsequently, the investment from stakeholders, proving that even in a world where numbers often dominate, there’s always room for common sense and astute business acumen.

Conclusion

While a startup’s journey is riddled with challenges, presenting the right valuation shouldn’t be one of them. Remember, your valuation is more than just a number. It’s a representation of your startup’s vision, potential, and promise. Craft it with care, back it up with data, and present it with confidence. Value startup with no revenue

#startup valuation#startup#business valuation#online startup valuation calculator#startup valuation calculator#startup valuation tool#valuation calculator startup#online valuation platform

2 notes

·

View notes

Text

Maximizing Business Efficiency through End of Service Benefit Planning and Actuarial Valuation

In today’s competitive business environment, employee satisfaction and retention are crucial to long-term success. One often overlooked yet significant factor contributing to this is the End of Service Benefit (EOSB)—a financial entitlement that employees receive at the conclusion of their employment. For employers, managing EOSB strategically through Actuarial Valuation not only ensures compliance but also enhances financial planning, mitigates risk, and supports workforce stability.

This blog explores the importance of End of Service Benefits, the need for actuarial valuation, and how businesses can leverage these strategies for better financial management and employee retention.

What is End of Service Benefit?

End of Service Benefit is a statutory or contractual payout provided to employees when their employment ends due to resignation, retirement, or termination. Common in countries across the Middle East and parts of Asia, EOSB is designed to reward employees for their loyalty and years of service.

The calculation typically considers:

Employee’s final salary

Length of service

Reason for termination

While it is a legal obligation, managing EOSB responsibly is also a key indicator of a company’s integrity and long-term vision.

Why EOSB Matters for Businesses

Enhances Employee Trust and Loyalty Offering a clear and fair EOSB policy builds trust among employees, increasing satisfaction and reducing attrition rates.

Boosts Employer Brand Companies with a well-structured benefit system are more attractive to potential hires, especially skilled professionals looking for long-term security.

Supports Financial Planning Proactively calculating and allocating funds for EOSB ensures businesses are not caught off guard by large, unplanned liabilities.

Ensures Legal Compliance Failure to provide EOSB in accordance with local labor laws can lead to litigation, penalties, and reputational damage.

The Role of Actuarial Valuation

Actuarial Valuation is a financial analysis method used to estimate future liabilities and risks. When applied to End of Service Benefits, it allows businesses to predict the amount of benefit payable over time, ensuring accurate provisioning and compliance with accounting standards like IAS 19.

Key Benefits of Actuarial Valuation:

Accurate Liability Estimation: By using demographic data, attrition rates, and salary projections, actuarial valuation gives a realistic estimate of EOSB obligations.

Compliance with Financial Reporting Standards: For companies following IFRS or GAAP, actuarial valuations help align EOSB reporting with accounting norms.

Risk Management: Identifies trends or shifts in workforce dynamics that could significantly affect EOSB liabilities in the future.

Improved Budgeting and Cash Flow Management: Avoids financial surprises by estimating liabilities well in advance.

How Mithras Consultants Help

Mithras Consultants specialize in providing accurate, efficient, and customized actuarial valuation services for End of Service Benefits. Their approach involves:

Comprehensive data collection and analysis

Customized reports based on company size and employee structure

Full compliance with international and local accounting standards

Strategic guidance for HR and finance teams

Whether you are a startup or a large enterprise, Mithras Consultants can help design a proactive EOSB strategy that enhances operational efficiency and aligns with business goals.

Integrating EOSB and Actuarial Valuation into Business Strategy

To get the most from your EOSB and valuation efforts, consider these strategic actions:

1. Create a Formal EOSB Policy

Define the eligibility, calculation method, and payout process. Transparency builds trust and clarity among employees.

2. Conduct Regular Actuarial Valuations

Annual or bi-annual evaluations help track changing liabilities and allow for adjustments based on employee movements or economic shifts.

3. Fund the Liability

Set aside a reserve or invest in a separate fund to cover the EOSB liability. This ensures availability of funds when needed.

4. Integrate with HR and Finance

Ensure coordination between HR (for employee data and attrition trends) and finance (for budget forecasting and reporting).

5. Review and Adapt

Regulations and workforce structures evolve. Periodically review your EOSB policy and valuation method to keep them up-to-date.

Conclusion

As organizations grow and evolve, the importance of End of Service Benefits and Actuarial Valuation becomes more apparent. These aren’t just compliance checkboxes—they are essential tools for financial health, risk management, and employee satisfaction. By partnering with experienced professionals like Mithras Consultants, businesses can create sustainable, compliant, and strategically sound EOSB frameworks.

Implementing structured EOSB policies backed by expert actuarial valuations will not only ensure regulatory compliance but also demonstrate a commitment to employee welfare—solidifying your organization’s reputation as a responsible and forward-thinking employer.

📌 Need help managing your End of Service Benefits? Explore Mithras Consultants’ solutions for End of Service Benefit and Actuarial Valuation to optimize your workforce strategy today.

0 notes

Text

How Businesses Should Handle Valuation Under the Income Tax Act

Proper Valuation Under the Income Tax Act is not just a legal requirement—it's a strategic tool for businesses to ensure compliance, avoid litigation, and drive accurate financial planning. Whether you’re a startup raising funds, a company undergoing restructuring, or a business facing scrutiny from tax authorities, getting your valuation right is essential.

In this article, we’ll explore how businesses should approach valuation in the context of the Income Tax Act, the key methodologies involved, and common challenges to avoid.

Understanding the Need for Valuation Under the Income Tax Act

Valuation under the Income Tax Act becomes relevant during several key business transactions, such as:

Issue of shares (Section 56(2)(viib)): Especially in startups and private companies issuing shares at a premium.

Transfer of assets or shares: Involving capital gains (Section 50CA and 50D).

Mergers, acquisitions, or restructuring: To determine fair market value (FMV) for taxation purposes.

Wealth declaration and scrutiny assessments: Where the assessing officer may question the declared value.

The objective of these valuations is to determine a fair and accurate representation of an entity's worth, ensuring that income, gains, or losses are taxed appropriately.

Key Provisions Governing Valuation Under the Income Tax Act

Valuation Under the Income Tax Act for Share Issuance – Section 56(2)(viib)

When a closely held company issues shares to a resident at a price exceeding the fair market value, the excess may be treated as income from other sources and taxed accordingly. This anti-abuse provision aims to curb the practice of laundering black money through inflated valuations.

To determine FMV, businesses can choose either:

Net Asset Value (NAV) Method

Discounted Cash Flow (DCF) Method

The choice of method must be justified with proper documentation and ideally backed by a Category I Merchant Banker valuation report.

Transfer of Shares – Section 50CA

When shares of an unlisted company are transferred for consideration lower than the FMV, the FMV is deemed to be the sale consideration for capital gains computation. This clause ensures capital gains aren’t avoided by under-reporting sale value.

The Valuation Under the Income Tax Act here must be based on recognized methods—typically involving a certified merchant banker or a chartered accountant following prescribed guidelines.

Valuation for Capital Gains – Section 50D

In scenarios where consideration is not determinable, like in barter transactions or asset exchanges, Section 50D applies. It mandates that the FMV of the asset transferred will be considered the sale value.

Acceptable Valuation Methods Under the Income Tax Act

Understanding acceptable valuation methodologies is crucial for businesses to comply with tax norms and avoid disputes. These include:

1. Net Asset Value (NAV) Method

This method calculates the value of a business based on the net assets recorded in its books. While straightforward, NAV is more suited for asset-heavy companies and may not reflect true value for tech or service-based firms.

2. Discounted Cash Flow (DCF) Method

DCF is a forward-looking method that estimates value based on projected future cash flows discounted to present value. It’s widely used in startup valuations and is accepted by tax authorities if backed by reasoned assumptions and certified reports.

3. Comparable Company Multiple (CCM) Method

Although not specifically mentioned under the Act, this method is useful during litigation or in determining arm’s length pricing for transfer pricing cases.

Compliance Tips for Valuation Under the Income Tax Act

Preparing Documentation

Ensure that all assumptions, methodologies, and calculations used in the valuation are documented thoroughly. A proper valuation report from a Category I Merchant Banker or qualified CA can be vital.

Consistency Across Reporting

The valuation used for tax purposes should align with that used for other statutory or financial reporting, like under Companies Act or FEMA, unless justifiable differences exist.

Maintain Forecast Integrity

Especially when using the DCF method, ensure your cash flow projections are realistic and based on verifiable data. Overly aggressive forecasts can lead to tax disputes and potential penalties.

Common Mistakes Businesses Make in Valuation Under the Income Tax Act

1. Ignoring Regulatory Changes

Tax provisions related to valuation are dynamic. Failing to stay updated on the latest notifications and CBDT circulars can result in non-compliance.

2. Overstating or Understating Valuation

Artificial inflation or deflation of valuation—either to attract investors or reduce tax liability—can attract heavy scrutiny under Sections 56, 50CA, and 50D.

3. Inadequate Professional Advice

Valuation is not just a number; it’s a strategic and legal exercise. Engaging qualified valuation professionals ensures accuracy and defensibility.

Consequences of Incorrect Valuation Under the Income Tax Act

Failing to adhere to proper valuation protocols can lead to:

Tax demand notices and penalties

Disallowance of share premium as income

Litigation with income tax authorities

Loss of investor confidence

In severe cases, incorrect valuation may be interpreted as a willful attempt to evade tax, inviting prosecution under relevant sections.

Best Practices for Handling Valuation Under the Income Tax Act

Engage a Registered Valuer or Category I Merchant Banker

Particularly when mandated under Section 56(2)(viib).

Conduct Periodic Valuations

Especially useful for fast-growing startups where FMV can change rapidly.

Keep Stakeholders Informed

Ensure that internal finance teams, auditors, and legal advisors are aligned.

Reconcile Valuation for Multiple Authorities

Valuation under FEMA, Companies Act, and Income Tax Act can differ; proper reconciliations should be maintained.

Conclusion

Handling Valuation Under the Income Tax Act is not merely a compliance checkbox—it’s a vital component of responsible business management. Accurate valuations protect businesses from tax pitfalls, ensure smooth investor relations, and uphold corporate credibility.

By staying updated on regulatory expectations, adopting best practices, and consulting qualified professionals, businesses can navigate the valuation landscape with confidence and clarity.

0 notes

Text

How to Determine the Value of Your Denver Business with a Trusted Broker's Help

Determining the value of your business is an essential step if you’re considering selling, merging, or simply understanding its market worth. For business owners in Denver, the process can be complicated, but with the guidance of a trusted broker, it becomes far more manageable. A business broker is a professional who specializes in helping business owners navigate the complexities of buying, selling, and valuing businesses. Here’s a guide on how to determine the value of your Denver-based business with the help of an experienced broker.

Understanding Business Valuation

Business valuation is the process of estimating the economic value of a business or company. The value is influenced by multiple factors, including assets, market conditions, and potential for future earnings. For Denver business owners, these factors are often shaped by the city's vibrant economy, its thriving tech scene, and a real estate market that can either inflate or deflate business valuations.

There are several methods that brokers use to assess a business’s value. The most common approaches include:

Income-Based Valuation: This method looks at the income potential of your business, usually by analyzing your earnings before interest, taxes, depreciation, and amortization (EBITDA). It then multiplies this figure by an industry-standard multiple to get an estimated business value.

Asset-Based Valuation: In this approach, the broker will calculate the net value of your business’s assets, including physical items like real estate, inventory, and equipment. This approach is often used when a business is asset-heavy, like manufacturing or real estate companies.

Market-Based Valuation: This method compares your business to similar businesses that have recently been sold in the same market. A broker will find relevant sales data and adjust for differences in size, location, and other market conditions.

Why You Need a Trusted Broker

While it’s possible to calculate the value of your business on your own, a trusted broker adds significant value to the process. Here’s why:

Expert Knowledge: Brokers have extensive experience in determining the value of businesses across various industries. They understand how market conditions in Denver can affect your business, whether it’s the growing startup scene, the demand for commercial real estate, or changes in local regulations. They’ll also know the latest trends and data that influence valuation.

Accurate Appraisals: A trusted broker will be able to provide a precise valuation based on thorough research and analysis. They will have access to databases and proprietary tools that you might not have, allowing them to offer more accurate assessments.

Negotiation Skills: Once the value is determined, the broker’s role doesn’t end. They act as intermediaries between you and potential buyers, ensuring that the terms of the deal reflect the true value of your business. Their negotiation skills can help maximize the price of your business and ensure that the deal is fair and advantageous to you.

Objectivity: As a business owner, it’s easy to become emotionally attached to your company. A broker offers a neutral perspective, ensuring that the valuation is based on facts rather than feelings. They can also provide advice on how to improve your business's value before putting it on the market.

Steps to Take with Your Broker

Once you’ve chosen a trusted broker, here’s how the process typically unfolds:

Initial Consultation: You’ll discuss the history of your business, its current state, and your goals for the future. The broker will begin to gather information that will form the foundation of the valuation.

Financial Review: The broker will examine your financial statements, including balance sheets, income statements, and tax returns. This gives them a clear understanding of your business’s profitability and financial health.

Industry Analysis: The broker will look at your business’s industry to understand the market trends and benchmarks. This allows them to place your business in the proper context.

Valuation Report: After gathering all the necessary data, the broker will provide you with a comprehensive valuation report, outlining the method used and the factors that influenced the valuation.

Strategic Advice: Beyond just valuing the business, a trusted broker may provide guidance on how to enhance its value or prepare for sale. This could include streamlining operations, addressing debt, or improving profitability.

Conclusion

Determining the value of your business in Denver can be a challenging task, but with the help of a trusted business broker, you can ensure an accurate, fair, and well-researched valuation. A broker’s expertise, objectivity, and market knowledge will not only provide you with a clear understanding of your business’s worth but also help you make strategic decisions that can maximize your business’s value in the future. Whether you’re considering selling your Denver business or simply want to know its current market value, partnering with an experienced broker is the first step towards success.

Contact us: Peterson Acquisitions: Your Denver Business Broker 1931 Liggett Rd, Castle Rock, CO 80109 (720) 800-1176 https://petersonacquisitions.com/denver-city-business-broker/

#best denver business broker#buy a company#what is my company worth#buy a company denver#sell my business denver#sell my business#youtube#business broker denver#business broker near me#what is my company worth denver

1 note

·

View note

Text

Why Investment Bankers Trust Financial Modelling for IPOs—and Where to Learn It in Chennai

India’s capital markets have witnessed a transformative boom over the past few years. With startups and established companies alike seeking capital to expand and scale, Initial Public Offerings (IPOs) have become a preferred route. But behind every successful IPO lies a meticulous process that heavily relies on financial modelling—the analytical engine that powers valuation, strategy, and investor confidence.

For aspiring investment bankers and finance professionals, mastering financial modelling is no longer optional—it’s essential. If you're based in Tamil Nadu and aiming to enter this space, enrolling in the best Financial Modelling Course in Chennai can be the catalyst to launch your career.

Let’s dive into how financial modelling plays a strategic role in IPOs and why it’s a skill every investment banker must have.

What Is Financial Modelling?

Financial modelling refers to the process of creating a structured representation of a company’s financial performance. It typically involves:

Projecting future revenues, expenses, and profits

Performing valuation using methods like Discounted Cash Flow (DCF), Comparable Company Analysis, and Precedent Transactions

Scenario and sensitivity analysis to assess risks

Supporting decision-making for investments, M&A, and IPOs

When it comes to IPOs, financial modelling becomes the foundation for pricing, positioning, and persuading investors.

IPOs in India: A Growth Engine

India has become one of the most attractive IPO destinations globally. Companies in sectors such as fintech, healthcare, e-commerce, manufacturing, and renewable energy are turning to public markets to raise capital. The results are significant:

In 2024 alone, Indian companies raised over ₹50,000 crore via IPOs

Increased participation from retail and institutional investors

Regulatory support and digital platforms fueling accessibility

This dynamic environment has elevated the demand for investment banking professionals who can craft compelling financial models and pitchbooks.

Why Financial Modelling Is Crucial in an IPO

1. Company Valuation

Before a company hits the public market, its valuation must be determined. This is not a guess—it’s a detailed financial exercise. Investment bankers use models to forecast revenues, project EBITDA margins, and calculate fair share price ranges.

2. Investor Confidence

Sophisticated investors like mutual funds, FII/DIIs, and HNIs demand clear financial justification before investing in an IPO. A robust model provides transparency and backs up the investment thesis.

3. Underwriting & Deal Structuring

Financial models help determine how much equity to dilute, what the offer price should be, and how the funds raised will be allocated—all crucial inputs for underwriters and dealmakers.

4. Scenario Analysis

Markets are volatile. Models must incorporate bull, base, and bear case projections to prepare stakeholders for different outcomes and fine-tune IPO pricing strategy accordingly.

5. Regulatory Compliance

In India, SEBI mandates thorough documentation, including projections, risks, and disclosures. A reliable model helps ensure compliance and credibility.

Real-World Example: Zomato's IPO

When Zomato went public in 2021, it was a milestone moment for India’s startup ecosystem. Despite being a loss-making company, its IPO was oversubscribed, thanks in part to the narrative built around long-term value—backed by solid financial modelling.

Investment bankers had to justify valuations through DCF projections, market sizing, and strategic comparisons with global peers like DoorDash and Uber Eats. This level of analysis is only possible with expert modelling skills.

Careers in IPO Advisory & Investment Banking

If you're considering a career in IPO advisory, investment banking, or equity capital markets (ECM), here are some typical roles where financial modelling is key:

Investment Banking Analyst

Equity Research Associate

IPO Advisor

Financial Analyst (Corporate Finance)

Valuation Consultant

These roles are in high demand across global investment banks, Big 4 firms, SEBI-registered merchant banks, and corporate finance teams.

Why You Need the Best Financial Modelling Course in Chennai

Chennai is emerging as a financial and tech hub in South India. With institutions, startups, and consulting firms expanding their finance teams, there’s no better time to upskill.

The best Financial Modelling Course in Chennai will empower you with:

Excel Mastery – Build dynamic models from scratch using real data

Valuation Techniques – Master DCF, Relative Valuation, LBO models, and IPO pricing models

Live Case Studies – Work on actual IPO scenarios to apply theory to practice

Mentorship by Industry Experts – Learn from investment bankers, CFA charterholders, and corporate finance leaders

Career Support – Get access to internships, mock interviews, and placement assistance in top firms

Whether you're a commerce graduate, MBA student, or working professional, a hands-on course can bridge the gap between theory and industry readiness.

Skills You'll Gain from a Quality Financial Modelling Program

✅ Forecasting and Budgeting

✅ Advanced Excel functions and formulae

✅ Creating integrated 3-statement financial models

✅ IPO pricing and valuation frameworks

✅ Pitchbook and investor presentation preparation

✅ Sensitivity and scenario analysis

These skills are not only valuable in IPOs but across corporate finance, private equity, venture capital, and portfolio management.

Final Thoughts: Modelling Your Way to the IPO Frontline

IPOs are a powerful indicator of economic vibrancy—and India’s IPO market is only getting stronger. As the market matures, companies will continue to seek guidance from skilled investment bankers and analysts who understand the intricacies of financial modelling.

If you’re aiming to be part of this high-impact domain, don’t just watch the IPO action from the sidelines. Get the skills, tools, and confidence to lead the process.

0 notes