#how to make money from arbitrage

Explore tagged Tumblr posts

Text

youtube

BEST ARBITRAGE TO EARN DAILY 3% RISK FREE

This video is just to show you proof of withdrawal i made from Pantrage.com I will be showing you guys my recent withdrawal of $20 made from my account and i received it instantly on my Binance wallet.

At Pantrage, their team of Crypto Experts uses Artificial Intelligence BOT to scan the top 10 Crypto Exchange Platforms and then Buy low at one Platform and sell high at another platform simultaneously.The entire process is carried out countless times a day by their team without you doing a single thing. Once the arbitrage transactions for the day have been completed, you will be paid your daily 3% earnings at the end of each trading day. Minimum deposit is $100. You also earn $5 per each referral that joins through your referral link and you can withdraw your referral bonus once it get to the $20 minimum withdrawal amount without using it for the arbitrage. Deposit and withdrawal method is by USDT only. There is no risk involved here and your funds are 100% safe. This is pure arbitrage and not a Ponzi scheme or Trading. Join through my referral link below and start earning your daily profit as well.

NB: My referral link https://pantrage.com/my-account/?wwref=abbafrye

YouTube Video: https://youtu.be/5UHj3pxSF6g

#arbitrage#crypto arbitrage#latest arbitrage#2024 arbitrage#make money online#make money from crypto arbitrage#how to make money from arbitrage#risk free arbitrage#best arbitrage#profitable arbitrage#new arbitrage#arbitrage trading#free arbitrage bot#trade arbitrage#bot arbitrage#arbitrage US#US arbitrage#best worldwide arbitrage#profit from arbitrage#Youtube

0 notes

Text

Can the Perpetual Protocol (PERP) make money from Automated Arbitrage?

They claim the Perpetual Protocol (PERP) can make money from automated arbitrage. Moreover, they claim Perpetual users can earn a share of protocol revenue in USD Coin (USDC) stablecoins. Hence, they claim the Perpetual Protocol pays stakers with fiat currency, US Dollars. To explain, USD Coin is a stablecoin that pays with US Dollars they hold in BlackRock (BLK) and BNYMellon (BK) trust…

View On WordPress

#Can the Perpetual Protocol (PERP) Generate Revenue in USDC?#Can the Perpetual Protocol (PERP) make money from Automated Arbitrage?#How Hot Tub Vaults Make Money#How Perpetual (PERP) Automates Arbitrage#How Perpetual Protocol offers Leveraged Exposure to Crypto#Protocol (PERP)#The US Dollar is DeFi’s future

0 notes

Text

The second house indicates what’s on you, with you, or generated by you. It deals with resources that keep you alive and functioning, so it also reveals the abilities required to generate these things. Your labor, your skills, your physical effort, your trade. It’s your tools, talents, and offerings that get exchanged for survival or stability.

It’s not about career (10H), passions(5H), or gifts from others (8H). It’s about how you produce, control, own, and can turn into survival, sustainability, and eventually wealth, from nothing but your essence. So it’s like your gut, resource base, harvest. That’s why it’s the house of “I have”.

» 2nd House in Aries

You’re not built to wait, you’re built to charge first, think later, and monetize through your energy, momentum, and nerve. The value you offer isn’t softness, it’s force, action, and quick-start heat. People trust you when things are urgent. You get paid when others freeze. You’re instinct-driven, so your talents live in survival-based skills and adrenaline spaces.

Things you can pursue: personal training; boxing, MMA or self-defense coaching; high-speed freelance gigs; stunt work; solo business launches; pressure-based consulting; sports-based YouTube content; fast-paced reselling; fire-arts or pyrotechnic crafts; combat or emergency-response training; outdoor survival courses; leadership in risky or chaotic fields.

This works because Mars rules the 2H, so your value is pure motion. You don’t accumulate value, you ignite it. When you stop waiting and start acting, money flows.

» 2nd House in Taurus

You make money by bringing people back to their body. You thrive when you sell comfort, consistency, and sensory pleasure. You’re tuned to the pace of nature, and people pay for your ability to calm them, feed them, or bring them beauty that lasts. You don’t rush, you anchor, and that slowness is what makes you valuable.

Focus on: baking and comfort-food catering; skincare and herbalism; massage therapy; homemade soap or natural body care; gardening, farming, or flower arrangement; perfume blending; handmade clothes or ceramics; aesthetic YouTube/blog content; slow fashion or textile repair; brand consulting with a beauty focus; luxury thrift resale.

This works because Venus rules here, the Venus of soil, texture, and reliability. Your value doesn’t need to scream. It just needs to be felt.

» 2nd House in Gemini

You make money by moving information, ideas, and connections. You think fast, speak fast, and sell with your words, not with polish but with speed, wit, and adaptability. People don’t buy from you because you’re deep, they buy because you’re efficient, mentally alive, and plugged into what’s trending. You thrive in work that needs flexibility and talking, not perfection.

Monetize this by: copywriting; reselling or dropshipping; digital marketing; transcription; tutoring; podcasting; live hosting; short-form content creation; running newsletters; social media ghostwriting; flipping information into templates or digital products; workshop teaching; online arbitrage.

This works because Mercury rules here and Mercury doesn’t build, it connects and moves. You earn by being sharp, not settled.

» 2nd House in Cancer

You make money by nurturing, preserving, and giving people a sense of safety or belonging. You’re emotionally wired to feel what others need before they say it, and people pay for the feeling you create. Whether it’s food, care, or sacred space, you’re profitable when you tap into tenderness, memory, or home.

Go for: family-based businesses; doula or birth support; meal prepping; grief or trauma work; elder or childcare; womb wellness; handmade memory boxes or photo albums; domestic healing services (cooking, organizing); herbal tea blends; moon-based planning; ancestral work; protective crafts; home cooking shows.

This works because the Moon rules here, and the Moon holds, reflects, and responds. Your value is very relational and intuitive, not so much transactional.

» 2nd House in Leo

You make money by being seen. You offer the world your personality, shine, and magnetism, and people pay you to help them shine too. You’re not here to play it safe; you thrive when you lead, perform, and help others feel important. You’re most valuable in industries that reward boldness, presence, and confidence.

Try: acting; public speaking; children’s education or entertainment; fashion design or styling; branding and personal image work; YouTube or TikTok with strong visual identity; designing gold-toned products or “luxury” experiences; talent development; party planning; photo or video production; designing showpieces or centerpiece products.

This works because the Sun rules this house, and the Sun doesn’t blend in. It radiates. Your value shines brightest when you actually own the spotlight.

» 2nd House in Virgo

You earn through your ability to fix, clean, and perfect. You’re built to spot flaws and bring order to chaos. People pay you because you catch what everyone else overlooks. You’re most valuable where details, accuracy, and cleanliness matter. Your money comes from refining things, making them safer, clearer, or more useful.

Go into: editing, proofreading, transcription; herbal remedies or nutrition services; spreadsheet or database building; system organization; habit coaching; cleaning or detox services; planner or journal design; technical writing; wellness consulting; making workbooks or method-based tools; diagnostic services; VA work.

This works because Mercury rules here in earth mode. You don’t just think, you optimize things. Your value is about being practical, efficient, and fix-it-focused.

» 2nd House in Libra

You monetize through your ability to balance, beautify, and mediate. You’re naturally valuable when you’re helping people find their style, their peace, or their place. You thrive in relational or visual work that calls for grace and taste. You’re not built for mess, you shine when things are harmonious.

Try: fashion styling; interior design; event planning; brand visuals; relationship coaching; etiquette work; aesthetic consulting; jewelry design; couple-based content; wedding planning; high-end resale; social media curation; conflict resolution or facilitation services.

This works because Venus rules Libra, the Venus of symmetry and social connection. Your value comes from knowing how things should look, feel, and flow.

» 2nd House in Scorpio

You sell intensity, strategy, and transformation. People don’t come to you for surface-level stuff, they come for your ability to go all the way down and dig up truth. You’re valuable in high-stakes, high-emotion, or hidden work. You’re most profitable when you’re handling what others avoid, like pain, power, depth, or taboos.

Monetize this through: therapy or shadow work; sex education or intimacy coaching; occult research; investigative journalism; trauma work; death care or grief services; forensic fields; intuitive readings; emotional cleanup services (extraction, detox, cord cutting); helping people recover from breakdowns or losses.

This works because Mars rules here in its nocturnal mode, which is strategic, deep, and intense. You’re built to transform pain into power. :)

» 2nd House in Sagittarius

You make money by expanding people’s minds and breaking them out of boxes. Your value is your vision, your perspective, and your ability to connect the dots across time, cultures, or beliefs. People pay for your big-picture thinking, your stories, and your knowledge. This works when you’re in motion or exploring something real.

Focus on: teaching or tutoring; writing (especially essays or spiritual topics); outdoor guiding; creating belief-based content; language learning; travel blogging; online course creation; ethical business coaching; translating ideas into teachings; workshop leading; comedy with a message; philosophical merch.

This works because Jupiter rules here, which is the planet of meaning, growth, and teaching. You thrive when you help people see farther.

» 2nd House in Capricorn

You monetize through structure, ambition, and long-game focus. You build value like a mountain builds height, slow, steady, unshakable. People pay for your discipline and your ability to handle what’s heavy or serious. You’re most valuable when responsibility is involved.

Try: business planning; accounting or budgeting; construction or renovation work; long-term investing; systems design; eldercare or estate management; corporate consulting; structural coaching; digital product architecture; mentorship programs; real estate work; time management or goal tracking tools.

This works because Saturn rules this house, which preserves, hardens, and endures. You’re not the flashiest, you’re typically the one who lasts.

» 2nd House in Aquarius

You make money by being different, futuristic, and community-minded. Your value isn’t in fitting in, it’s in standing out and breaking systems that no longer work. People pay for your weird genius, especially when it helps them belong to something better.

Focus on: tech-based design; social media strategy; niche or alt content; astrology or futurism; digital product creation; community building platforms; AI-based services; protest gear or radical wellness tools; open-source project work; network systems; innovation consulting; experimental art.

This works because Saturn rules here too, but in air, so it’s more cold and conceptual. You build by breaking molds, not following them.

» 2nd House in Pisces

You sell dream, spirit, and softness. Your value comes from your ability to flow, to channel what’s unspoken and emotional. People come to you for atmosphere, empathy, and escape. You’re not here to be literal, you’re here to help people feel.

Monetize this through: art or music; film scoring or editing; intuitive reading; dream work; scent blending; ocean or water-based products; abstract visuals; poetry or lyric writing; ritual creation; sanctuary design; sound healing; cinematic editing or storytelling; spiritual guidance; working with animals or oceanic life.

This works because Jupiter rules here in traditional astrology, but the Jupiter of vision and transcendence. You monetize meaning that can’t be explained, only felt.

#2nd house#second house#2nd house Aries#2nd house Taurus#2nd house Gemini#2nd house cancer#2nd house Leo#2nd house Virgo#2nd house libra#2nd house Scorpio#2nd house Aquarius#2nd house Pisces#2nd house Capricorn#2nd house Sagittarius#astrology#astrology observations#astro notes#astro community#astrology signs#astro observations#astronotes#houses in astrology#astrology blog#astrology tumblr#astrology houses

405 notes

·

View notes

Text

— stepdad!sylus x reader ૮ ․ ․ ྀིა

synopsis: sylus becomes the daddy you never had.

tw: smut yaaay, stepcest, age gap, abandonment trauma, slightly inspired on ‘lolita’ and ‘the virgin suicides’, mentions of death, usage of ‘daddy’, kinda long ig, cheating, daddy issues, virginity loss, etc.

your mom marrying one of the most influential and rich man that society has ever seen was not on your life’s plans, not even the passing of your father.

as the oldest sister out of four you always had an eye on your parents relationship, having to be the one arbitraging their stupid fights and ordering them to stop bickering around when your siblings were asleep.

many would feel sorry for you when they found out about the responsibilities you had on your shoulders since such a young age, acknowledging the reason why you seemed so grown and mature; in reality it was all a facade to protect your sisters.

when you father fell ill you didn’t even flinch, and when he passed away a few months later you didn’t even cry. sure, you appreciated him but farther from the truth, he was just there.

you viewed him as a man you happened to live with, not a member of your family.

on the contrary, you looked up to your mother, being aware of the hard work she put to raise and provide to you and your sisters.

you tenderly recall the nights sitting on her vanity before going to bed as she detangled and oiled your hair, giving her advice as if she was your best friend.

the love for your mom was undeniable and you would always support every decision she’d make.

so when she invited her new boyfriend over to dinner you were as supportive as always, ordering your sisters to behave in his presence as you did their make up and advised them on their clothes.

but what you weren’t expecting when you walked downstairs was a tall and broad figure taking sit in the chair your father used to occupy, his white and lavish hair the only thing you could see from where you stood.

your siblings rushed to sit next to him, eager to form the stupidest questions ever made, as you walked towards the kitchen to help you mother with the rest of the preparations for dinner, coexisting in silence.

you weren’t blind, even as her daughter you could tell your mother was a beautiful woman. living her middle years after four pregnancies and keeping up a stunning figure and fancy features, carrying herself around as the elegant woman she always aspired to be.

⠀⠀ “this one was unexpected, mom.” you spoke under your breath as your pulled out the plate from the oven, taking off the gloves and apron to gaze her way.

⠀⠀ “you didn’t even speak to him yet, baby, give him a chance.” she stated, leaving the kitchen to place the utensils on the dining table.

and so you did. gave him a chance. your mom had some hookups along the passing months, nothing decent or closely acceptable.

you thought that’s what this was, a hookup. good sex that was invited to dinner a random night to then be dumped because he made the girls uneasy.

but you could tell this was not the case.

sylus was the name of the scary man sitting in front of you. the white hair you saw before put together neatly, thick eyebrows that dressed a pair of cat-like orbs, colored crimson.

you noticed as you ate the baked potatoes how his clothes were clearly too expensive for you to even think about, his perfume reaching your nostrils to the point you could almost taste it mixing with the garlic.

if your widowed mother was going to take advantage of the (you assumed) rich man you weren’t going to complain. because his money would be your mom’s, and your mom’s money would be yours.

later on you’d find out who sylus was, what was his place in the world. he’d mention companies you knew to be his, and you couldn't believe your luck.

⠀⠀ “so, if you live in such a high end environment, how’d you two meet?” you questioned after sipping on some water, crossing your arms.

⠀⠀ “we simply bumped into each other at one of my restaurants. your mother was the waitress and spilled some whine on my shirt.” he lightly answered with a deep voice that got stuck in your head for the rest of the day.

sylus seemed to adore your mom, and you were happy for her, really.

he started to come over your humble home more and more often, and your sisters couldn’t stop talking about him and yearn to spend time together.

‘have you seen his hands?’, ‘today his pants were tighter than usual.’, ‘his lips look so kisseable.’ blah blah blah.

they were fixated on this stupid tradition your mom started, friday movie night. the man would come home and stay the night after watching movies together as a big and happy family.

an excuse to fuck your mother, you thought. you seemingly knew it all, you knew everybody’s mind.

but as smart as you thought you were, you couldn’t acknowledge sylus’ admiration for you, the oldest sister. he’d stare at you and wonder if this yearning was even moral.

he would fixate his red eyes on you when nobody else was watching, would take in how you munched on the popcorn he prepared and how your glasses framed your perfectly structured face. the mere thought of you was chasing him around every second of the day, even when he was with your mom, his fiancée.

the imagine of your started to replace your mom’s, he started to imagine you were the one he was pounding so hard into. started to fantasize about taking you out to these fancy dinners instead of your her.

he even sneaked into your room after fucking and waiting for her to fall asleep, just to sit next to you in your bed and caress your hair with his knuckles, going down until his hand cupped your cheeks and your oh-so-desirable lips formed a pout.

it was all wrong, he knew that.

taking advantage of your innocence? he knew you were the most mature amongst your sisters, but you were very naive still. sylus loved showing you things you didn’t know about, talking of countries you never heard of and teaching you random facts about anything.

he knew how to make you desire him as much as he desired you. you both started to spend more time together in an organic way you couldn’t notice, him being more and more present in your every day life.

he started taking you and your sisters to class, you being the last one he kissed on the cheek goodbye, closer to your lips than he did to your siblings. he sat next to you every chance he got, his big palm wrapping around your thigh when nobody else was looking, arriving home with gifts for you and you only, taking you out on secret dates.

and so you did, you fell in love with him, with the way his voice pronounced your name, the warmth of his honey like skin… everything about him seemed to be divine to your eyes.

it was all wrong, but it was bearable. until it wasn’t.

until his desires started to grow bigger in his chest and his expensive pants. you’d become more confident around him and started wearing skimpier clothes inside the house, leaving little to imagination.

you didn’t do this on purpose, you raised yourself around women, and this was what you were accustomed to. you didn’t know the reason why sylus had to excuse himself mid conversation was because of the half of your ass showing outside those stupidly small shorts, and you didn’t know he rushed to the bathroom to jerk off with both hands like a horny teenager.

⠀⠀ “sy, you okay?” you asked after knocking on the bathroom door. great, that’s the last thing he needed.

⠀⠀ “all good, princess, i just felt a little nauseous. it’s all good.” the last sentence was said as a whisper, trying to convince himself to stop massaging his foreskin as he spoke to you and dress up and act like a decent person.

⠀⠀ “are you sure, can i help you with anything?” you insisted with a sweet voice. fuck, that voice drive him crazy. his hand sped up, faster, harder.

he went silent for half a minute and you started to worry, knocking on the door again, pressing an ear against the wood to hear squelching and huffs on the other side.

was he…? no, he couldn’t be doing that... right?

your thighs pressed together in an attempt to ignore your clit throbbing against your cotton panties. you were getting ahead of yourself.

on the other hand, sylus was losing it. it was too much for him to hold back. the way your nipples craved through your tank top, the way you sucked on the damn spoon and licked your lips after each sip, the way you were so goddamn concerned about his wellbeing.

you were about to knock again as a curious cat would before gasping at the sudden grasp on your wrist, pulling you inside the bathroom.

sylus’ pants were undone, zipper down and boxers misplaced, trying to hide and obvious problem.

he cornered you against the tiled wall, placing both hands next to your head as he reached down, his nose caressing yours as he spoke with an almost trembling voice, trying to hold himself back, just a little bit longer.

⠀⠀ “of course you can help, my dear. you actually caused the problem in the first place.” he whispered against your lips while pressing his knee between your closed legs, feeling warmth leaving your body and earning a low chuckle.

⠀⠀ “sylus, what are you—” you tried to pull away as an instinct. this was wrong. you knew what he wanted, you wanted it too. but it was wrong.

he didn’t allow you to finish that pointless question, losing every bit of self control when he saw the way you looked up at him with those big eyes he loved to stare at, attacking your cherry lips effusively.

you whined against his mouth, the hands you had placed on his chest to pull him away now pulling him closer, grinding yourself against his knee.

no more self control, even if it was wrong.

he grabbed both your hips to shortly walk you both towards the bathroom counter, refusing to break the wet and nasty kiss he so desperately wanted for so long.

⠀⠀ “gonna be a good girl and take me, doll? gonna take everything I’ve been keeping for you and only you?” he asked you while he bended you over the flat surface, steeping behind you.

⠀⠀ “mhfm, daddy, I’ll take it all, please, please.” you started to cry. god this was twisted and plain disgusting. he knew about your daddy issues, about the longing for a fatherly figure. he should’ve felt repulsed by the nickname, his dick should’ve just go soft instantly. but it was a shock to his body, an impulse that added to the need for you, to be inside you.

he just loved hearing the new name roll out your sinful mouth.

⠀⠀ “that’s right, princess, daddy’s gonna fuck you stupid, hmm? want that? of course you do.” he stated while adverting down, seeing how your ass swayed from side to side against his erection, your face full of tears and your nipples sensitive against the cold marble.

your hands reached out, grabbing both your asscheeks to spread them apart and give him a view of the curve of your pussy against the cottony material of your shorts, tracing the wet line with a manicured finger.

⠀⠀ “fucking god, doll, when did you become so nasty, uh?” he was in awe, slapping the fat of your butt before tearing those damned shorts apart along with your annoying panties, tracing your bare pussy with a thumb.

you tried reaching for his erection, your cries making it impossible to answer anything. from his point of view you seemed pathetic, if he yearned you as a madman, you yearned him as a pathetic bitch in heat. sylus couldn’t believe the sweet and reserved girl he fell in love with was acting like this right before his eyes.

⠀⠀ “shh, angel, I’ll give it to you, quit crying.” he lied, he didn’t want you to stop crying, actually. he pulled out his aching cock, pumping it a few times before pushing himself inside you way too wet cunt.

you just couldn’t hold back your moans, the squelching sound of both your arousals and the tapping of his balls against your wet skin making you feel dizzy.

blood showed up not a lot long after, an evidence of the loss of your innocence. he didn’t even think of that, didn’t even consider the possibility of you being completely untouched.

⠀⠀ “fuck, princess, I’m corrupting you entirely, am I? daddy’s claiming you as a woman.” he said between thrust, loving how your ass jiggled against his pelvis. you could only nod and moan as a response. the connection you two were having too carnal, too raw.

it didn’t take long for him to cum white stripes inside your bloody cunt, followed up by you creaming his cock entirely, holding himself to the counter as he kept on thrusting, slower each time until he stopped.

you were fucked out, your brain mush as you tried to understand your environment and the situation, feeling both your releases drip to the tile flooring.

⠀⠀ “daddy? sylus?” you cried out, trying to turn around to reach for your stepdad as you started to cry once more, scared of being left behind again. “please daddy, don’t leave me again, please, I’ll be good I promise.” you kept on rumbling.

⠀⠀ “it’s okay, babydoll, I’m here. I’m here.” he reassured you, pulling out as his arms wrapped your body and brought you against his chest to hug you, his hands caressing your hair as he kissed your forehead, carrying you bridal style towards your bedroom after a little while.

he would change your clothes into new and fresh ones, clean up the mess he made while he pampered kisses all over your face, tuck you both in your bed while he caressed your long hair, staring at your angel like face while clarity hit him.

he didn’t care about the consequences he had to face in the morning. the pandora box was already open, he had a taste of you and he couldn’t let you go, not now.

sylus thought of all the ways he could escape, run away with you. he would leave your mom behind if it meant another night next to you, sleeping in his chest as you were doing now.

you were his little girl, you trusted him.

and he was going to take care of you as good daddies do.

a/n: I love daddy sylus guys u don’t understand (◞‸◟;)

— masterlist.

#lads headcanons#lads smut#love and deepspace smut#lads x reader#love and deepspace fic#lads sylus smut#sylus smut#sylus x reader#sylus headcanons#ldns sylus#love and deepspace sylus smut#sylus fluff#sylus imagine#sylus x mc

714 notes

·

View notes

Text

Remember: always lowball. Every day, I hear hobbyists in every hobby complain about how expensive things have gotten. Those speculators have shown up, those businessmen, and they wish to extract every red cent out of your unhealthy love for this specific kind of blackboard chalk. They have decided to hoard, and they have decided to profiteer, and there is only one thing you can do: offer them a pitiful amount of money.

I was raised in the before-times, like a lot of you, and we were always taught to be fair and just in negotiations. That was because our folks were buying entire thirty-unit condominium buildings for $1000 and shaking at $950 seemed like a fair negotiation to both parties. Let me tell you this: those days are over. There's a guy on my local Kijiji trying to sell a single piece of firewood for eighty bucks.

Now, I hear a lot of you saying: just don't buy it, then. No. Not buying things just says "maybe nobody wants to buy it." Extreme lowballing says: "there's a lot of interest for it, at this insultingly-low price that makes me want to punch my grandma." And anyone who would punch their own grandmother really does not deserve to make a profit from modern-day retail arbitrage, do they? I certainly don't think so. Fuck 'em.

If there is a downside to be said for the modern lowballer, it's when your frantic efforts result in the total collapse of a market. One weekend of my passive-aggressive eBay "Make Offering" resulted, single-handedly, in significantly moving the price of Volare crossflow manifolds. Unfortunately, it also meant I was contractually obligated to buy all of them at that price. Of course, that means I now have cornered the market, and you're all gonna pay the price I'm asking for them. Time to get paid.

216 notes

·

View notes

Note

The other problem with rent control is that it can incentivize weird shit like people holding onto leases on flats and subletting bc they can make money from the large arbitrage between the rent the market will bear and the rent they are paying (cf Berlin). Even where it’s dubiously legal it’s hard to enforce, and bc finding a flat is incredibly difficult (due in part to rent control) renters will still take that deal if they have to. You can try to ban that sort of thing, but as long as there’s a strong incentive toward it, bans are at best going to require costly enforcement efforts. In that way you can create a situation where renting is great if you’ve been living in the same flat for the last fifteen years but really bad if you need to move for some reason, and given that people will often need to move for various reasons (they have kids and need bigger space, they want to downsize or save and need less, they want to move closer to their job or to a specific neighborhood to be near an ailing relative etc) you’re just shifting the friction of the rental market from the Kaltmiete sticker price to spending months or years having to hunt for flats.

If you want to keep rents low or lower them, it’s much better to directly put downward pressure on rents by building extensively, than to enact awkward price control schemes that have lots of weird side effects from market distortions. As triv says, rent control isn’t a big deal if you pair it as a sop to renters along side good policy, but many cities treat rent control as sufficient. I think this is because enacting rent control is seen as “doing something” and relieves political pressure, even if it doesn’t on its own relieve scarcity. It would be better if rent control was off the table, so that if politicians wanted to be seen to be doing something, they were forced to look at other policies.

I suspect rent control is also better for property owners—it usually lapses when a new tenant takes over, or owners are allowed to increment the rent more, so rents can still rise in principle, keeping property values higher. Building more reduces the rate of rent rise in a more durable way (or, if you really go all out, lowers rents), which is terrific for renters but bad for existing property owners. Obviously it would be better for owners if there was no rent control, but if you had to choose between the value of your property rising more slowly and the value becoming stagnant or falling you would choose the first.

Okay yeah I agree that building more is better than rent control on its own, but that does not make rent control in general bad. Absent other options or, as in the discussed case, alongside other measures, rent control does indeed do something and isn't just for appearances.

To be fair, my personal experience with renting is only in flatshares. The one I am living in right now has existed for decades, with inhabitants slowly rotating in and out, thus keeping the GbR (which is the actual renting party) instact and keeping rent low. Of course this is not an option for families, but like ... every person who is helped by a policy is a win. That it isn't helping everyone is not an argument against it. (I realize this is easy to say when I am one of the people who are in fact benefitting.)

Subletting for profit defeats the purpose, of course, and should be restricted or at least heavily taxed. I am not like familiar with the matter, but intuitively this seems hard to hide from bureaucracies. Is this actually that big of a problem? I have never lived in Berlin.

and bc finding a flat is incredibly difficult (due in part to rent control)

Again here is the implication of a causation. How does rent control induce scarcity if it doesn't even apply to newly built houses? It should have no effect either way on incentives for building. It helps the people already living there, but that does not mean it screws over those who want to move to a city, it should just have no effect on them. Unless, I guess, you think people stay living in the city despite wanting to move away just because they are in a rent controlled flat, which I don't think is very common. Like, there will be a few people who this describes, but this should not make a significant dent in supply.

About politicians choosing to do rent control over incentivising building more just because it's easier, I have no idea how to evaluate if this is a big problem. Sure rent control might silence the nagging renters a little, but housing scarcity has a lot of detrimental effects besides making renters complain to politicians. Politicians should already want to solve this.

35 notes

·

View notes

Text

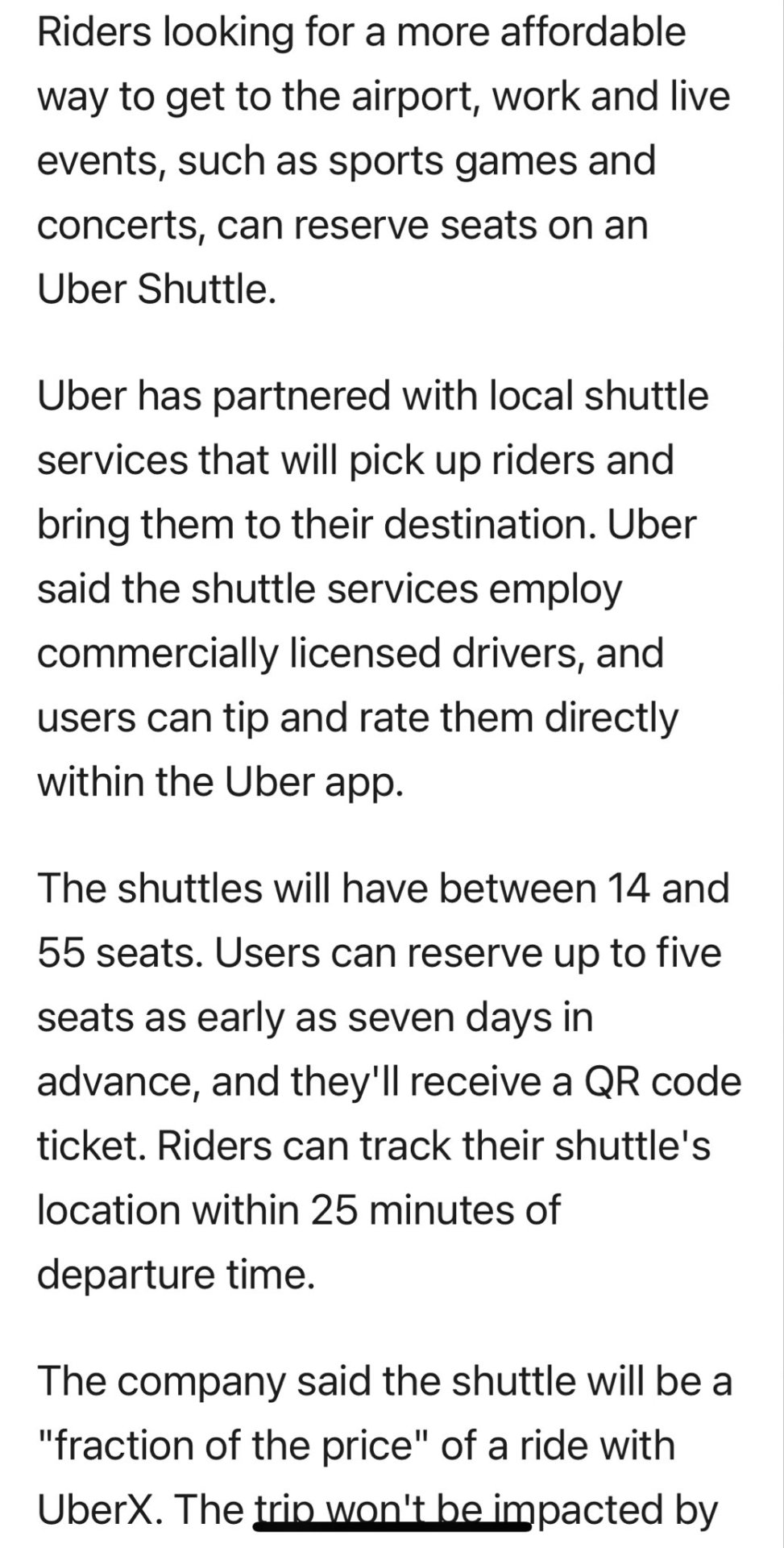

Gonna go on a classic rant here, as the "Uber Shuttle....do you mean a BUS LOL" complaint is making the rounds:

This objection - "why are you just re-inventing buses" has always been very silly because buses are not exclusive services, they aren't like a train where building two "competitive" tracks is a huge waste of money. They can just go on the road like a car! That is the whole point of roads. And US public buses...pretty universally suck (on average, varies per city ofc). We have poor stop infrastructure, incredibly late arrival times, unoptimized routing, and in particular a stubborn refusal to enforce safety and decorum standards, which means riding the bus is very often just a not fun ordeal. I still do it, it is of course normally fine, but if I was richer and could easily pay 3x the going rate for a good bus I would do that a lot. Certainly for trips to the airport or farther distances.

Buses don't have any generalized reason to be shielded from competition, you can just run multiple buses. Its generally better to run more, that means less cars! There are some kinks about traffic flow and stop points, but on average private buses are great. They don't often exist in the US (a good number do ofc, the US is vast) because they have been made either dejure or defacto illegal in many places- though as expected shadow networks exist, which exactly plug the demand gaps that public transit is failing to fill. Private buses are good.

Uber is likely going to be playing the same regulatory arbitrage that its always been with taxis, trying to use tech to help classify itself outside the regulatory system that currently bans private buses - though idk maybe they have worked out deals with the cities its doing its pilot in, not relevant to my point. You wanna complain about how they treat drivers or regulations or w/e, totally fine (or at least a separate topic). But a kneejerk "buses are public" is an ignorance-showing moment, they both aren't in many places and shouldn't be in more.

(pour this one out for @voxette-vk, long lost tumblrite who I know would stan the fuck out of private buses back in the day)

46 notes

·

View notes

Text

Gamestonks

There is a huge gulf between how stocks work, and how stocks are supposed to work.

The way stocks are supposed to work is that a company wants money, and so sell tiny portions of the company. At the end of the year, any money that the company made (gross profit), over costs, (net profit), that they decide to not hold in a war chest or reinvest in the company is distributed as dividends, based off how much of the company you own, i.e. stocks.

So, you look at the company, and it produced x-dividends the last couple of years, and so you decide, say, to buy it for 5x earnings. So, on the sixth year, you make 20%, which then climbs by 20% every year. (percent of initial purchase). For pretty much everyone, that would be a great deal.

Too good.

Instead, corporations work of projections, lies, damned lies, and statistics. The stock market value ends up with little to no connection to actual earnings. It's all derivatives of estimations of projections of lies.

Alright, how the fuck are you supposed to make money off of this.

Well, for one thing, YOU are not supposed to make money. THEY are.

And the way to answer the question is through arbitrage. Commodity markets always fluctuate. You have quarterly earnings reports, international currency fluctuations, speculations, short sellings, etc.

You have have one person make a typo and sell 10x what he meant to sell, and this creates a panick that upsets the market index funds, and the market index fund creates more disruptions.

This causes the market price of a stock to increase and decrease, several times over the course of a single day. This leads to day trading, where you buy and sell the same commodity in a single trading day.

Some terms:

Arbitrage: Change in the price of a good, without any change to the good itself.

Commodity: Interchangeable products. Say you buy a 1oz gold coin, and sell it, and buy another 1oz gold coin of the same type, and it would have the same price. If you do it for stocks, it doesn't matter which set of stocks you have for a company, as they are all interchangeable.

Speculation: Literally guessing. If someone thinks a stock will increase in value, they will buy up a lot of that stock. If they are a big enough of a broker, this might be enough to actually change the marker price of the commodity. Effectively creating a self-fulfilling prophecy.

Panick: If the price of the commodity drops enough, it could make investors worried, which will cause them to sell the stock. This can lead to a cascade of selling, which lowers the price of the stock further, and further, and further.

Leverage: Take debt out on a product that you then invest. So named because it acts like a lever, applying a much larger effect to the initial product. You can stand to make AND lose a lot more money. You can leverage other debt products.

Short Sale: You borrow a commodity with a specific date of return. You sell the commodity. You then buy the commodity later and return it. If the commodity's price drops in the interim, then it's cheaper to buy the commodity later, and so you make money.

Short Squeeze: With a short sale, you are required to buy the product back. If you are required to buy enough of the product back you can cause a short-term increase the market price. The opposite of a panick occurs. Short sellers see the price increasing, and so buy the commodity they shorted now, rather than waiting, when it will be at a higher price.

Now onto Gamestonks. A group of redditors wanted to stick it to the rich hedge funds.

Now, because the government inflates your money away, you CANNOT save for retirements. As your money would lose so much value in that time you might die from the stress of it. You have to invest it in the stock market.

Gamestop is a terrible video game retailer. The only reason they survived as long as they did is because they bought out the competition.

Their stock was dropping. And when a stock drops, you get a lot of short sellers. And the Redditors were ready to strike.

There was a new app on the market, called Robinhood. The obvious implication is that you get to rob the rich. It allowed the average person to play the stock market without brokerage fees. They used this to collectively buy a lot of Gamestop stock. If you have a large buying spree, this increases the price of the commodity. This caused the price to increase by around 30x in a single month.

This caused a lot of financial damage to hedge funds, who complained, because only THEY are allowed to manipulate the stock market. Who do these plebs think they are?

Oh, Robinhood?

. . .

If you don't pay for the product, you ARE the product. The software turned out to have been built by people who built High Speed Trading infrastructure. Everyone thinks High Speed Trading is bad, but it's much worse than most people could imagine. See the Addendum for details. But, the point was basic to gather information from users.

Robinhood, being the Robin Hood they are, FORCED the sale of Gamestop stock. This pushed it back onto the market, and pushed it back onto it's downward spiral, to save the hedgefunds. Or their own liquidity, which means they were trading beyond their means, and decided to NOT meet this commitment.

Addendum: High Speed Trading

Stock trading happens on exchanges. You say put in a buy or sell order for a commodity on your exchange. If there is a compatible order on the exchange, the commodities are traded.

If there is not, the exchange sends the order to other exchanges.

High speed trading has a much faster hardline between exchanges. So, they see an order on an exchange. They see it not be fulfilled. They know it will be sent to other exchanges. They send their own orders to these exchanges, faster. They reach the new exchange first.

So, let's say Able puts a $15 buy order on an exchange for X.

Hilariously, I can just use X.

Anyways.

So, Able puts $15 buy order for say, 10,000 of Galen stock on X exchange. This will buy any stocks from Galen at $15 or less.

There are is one $10 sell order on the exchange, for 5,000 Galen stock. So, they exchange it for $10.

But, there are still 5,000 units missing.

So, X exchange sends out calls to Yankee and Zulu exchange with the orders.

The $15 buy order for 5,000 Galen stock hits Yankee exchange, a split second faster than Zulu.

Bravo High Speed traders have a faster hardline between X and Yankee. So, they send their own $15 buy order for 5,000 Galen stock to Yankee exchange, which arrives before Able's does. They find a Sell Order for $12 for 5,000 units. They buy these 5,000 units and then immediately create a sell order for $15. So, when Able's order gets there, he buys 5,000 units for $15 rather than $12.

P.S. One of the best part of this is that the financial analysts quickly learned the gamestonks lingo so they could properly advise on it.

5 notes

·

View notes

Text

"From Risk to Reward: My Success Story in the Slots Market"

In my years of online money-making experience, I've discovered that platforms like this are reliable. Their focus is on gamblers, not us, for profits. It's that simple: take calculated risks to earn.

After thorough exploration, I've developed a strategy that allows me to profit from this platform without engaging in actual gambling. My aim isn't just financial gain, but responsible success. This approach isn't about wagering or risking funds; it's about securing steady and safe profits.

In just 6 months, this platform has gained a staggering 800,000 members, many fall victim to scams or financial instability. However, our chosen slot machine market stands out. While not flawless, its global growth underscores its potential, extending beyond the Philippines.

Gaming is a massive industry, evident in famous casinos like Las Vegas and Atlantic City. These establishments flourish by setting rules and employing strategic marketing tactics to attract players and host betting contests with enticing prizes.

Driven by human nature, gaming ensures profitability through player engagement. Quest rewards create an exciting atmosphere, engaging users across various games. By following our team's strategies and managing speculative tendencies, you can profit from these quests.

Maximizing Profits Strategically, Without Gambling

The slots market functions as an online casino, but it comes with a unique twist: the opportunity for profit through incentive tasks. These tasks provide an additional avenue for earnings beyond traditional gambling. In this virtual casino realm, you can amplify your profits by completing specific tasks, known as incentives. Unlike pure chance-based gambling, these tasks empower you to take an active role in boosting your earnings.

Imagine earning profit without the usual risks associated with gambling. Let me share how I managed to enhance my earnings through this dynamic approach.

Steps to Earning

Download the Slots Market app by clicking the Slots Market to receive 200 coins ($2) free

2. Register, verify, and reach out to My Telegram with your 6-digit account ID or profile screenshot to claim your 200 coins ($2) bonus. Note: This bonus is redeemable exclusively through the provided link.

3. Follow these steps to start earning:

- Activate tasks (refreshes hourly)

- Divide your chips by 8

- Diversify your bets among 8 options

By utilizing the Incentive reward on tasks and following the steps above, you can earn 0.15% on every bet, increasing your funds by 0.15% every hour (up to 3.6% for 24 hours). This game-changing strategy allowed me to gain profits and maximize earnings.

Deposit $50 to earn $50 monthly, or deposit $500 to earn $500 monthly.

SLOTS MARKET is an online casino app. Why is there a quest return token campaign?

For instance, take CAR ROULETTE, which offers 40 draws hourly, allowing you to recover 0.775% of your bet with a single chance. With 8 options and a winning payout of 7.95 times, the platform's net profit per hour exceeds 25%

A larger team means higher commission earnings. Creating your strategy involves risk in any game!!!

Casinos profit through player turnover, similar to the platform's activities.

The platform understands gambling's universal allure, securing profits regardless.

Our approach avoids gambling, utilizing activities for earnings.

Platform rewards are rebates for turnover, while our team employs security strategies for arbitrage

We leverage the platform to our advantage.

The platform encourages gambling, while we advocate caution.

Human nature's complexity fuels the platform's profits, allowing us to earn consistently.

Remember, only risk-takers make money. Stay safe and prosperous!

For further guidance, I invite you to join our active Telegram group, a community of over 4,000 members engaging in this endeavor. Together, we embark on a journey of responsible and rewarding success.

Connect with our social media for more tips, guides and updates

Facebook

Tiktok

7 notes

·

View notes

Text

Understanding Category I, II, and III AIFs in India

Alternative Investment Funds (AIFs) have become a hot topic among HNIs and sophisticated investors looking for higher returns, portfolio diversification, and access to unique opportunities. But here’s the catch — most people get confused between Category I, II, and III AIFs.

If you’re nodding in agreement, this blog is your simplified, no-jargon guide to understanding the three categories of AIFs in India, what makes them different, and how to decide which one fits your goals.

What Is an AIF?

An Alternative Investment Fund (AIF) is a privately pooled investment vehicle that collects money from investors to invest by a defined strategy. These aren’t your regular mutual funds — they’re designed for qualified investors seeking exposure beyond the public markets.

SEBI (Securities and Exchange Board of India) regulates AIFs under the SEBI (AIF) Regulations, 2012. AIFs are classified into Categories I, II, and III, based on their investment style and risk profile.

Category I AIFs – Backing the Future

What They Are:

Category I AIFs invest in economically and socially desirable sectors. Think startups, infrastructure, SMEs, or green projects.

These funds are encouraged by the government because they align with national priorities — so they may receive incentives or tax benefits.

Typical Investments:

Venture Capital Funds

Angel Funds

Social Venture Funds

Infrastructure Funds

Key Features:

Long-term investment horizon

Higher risk, but potential for higher returns

SEBI-regulated and often supported by policy initiatives

Ideal For:

HNIs wanting to bet on India’s next big startup or nation-building projects.

Category II AIFs – The Balanced Path

What They Are:

These are the most popular type of AIFs among serious investors. Category II AIFs don’t get special government incentives, but they also don’t take excessive leverage or short positions like Category III.

Typical Investments:

Private equity

Debt funds

Real estate funds

Mezzanine funds

Key Features:

Stable return profiles (esp. in private credit and real estate)

Lock-in periods usually 4–6 years

No leverage or complex derivatives

Most regulated Category by SEBI

Minimum Investment:

₹1 crore (except for employees/directors where it’s ₹25 lakh)

Ideal For:

HNIs and family offices looking for moderate risk with predictable returns, especially via private debt or pre-IPO plays.

See Rits Capital’s insights on private market investing

Category III AIFs – The Hedge Fund Territory

What They Are:

Category III AIFs are designed for high-return strategies using complex tools like derivatives, leverage, long-short trading, and intraday positions. This is the hedge fund model of India.

They can invest in listed and unlisted securities, but their core play is agility and alpha generation.

Typical Strategies:

Long-short equity

Arbitrage

Quant funds

Derivative trading

Key Features:

High risk, high reward

Higher churn, shorter lock-ins (1–3 years)

No restrictions on leverage or shorting

Taxed like business income (unlike LTCG for Cat I & II)

Ideal For:

Sophisticated investors looking for alpha and active trading exposure, often complementing their long-term portfolios.

📖 Read more on hedge fund-like investing

Key Differences at a Glance

Real-World Use Cases

A tech-savvy investor in Bengaluru might put ₹1 Cr in a Category I AIF that supports early-stage AI startups.

A conservative HNI in Mumbai could allocate ₹3 Cr into a Category II real estate debt AIF for consistent annual yields.

A market-savvy entrepreneur might park ₹50 lakh in a Category III quant fund to ride short-term opportunities.

Is AIF Investing Safe?

AIFs are regulated by SEBI, but they are meant for informed investors. Each AIF comes with:

A Private Placement Memorandum (PPM)

Detailed strategy, tenure, and risk disclosures

Professional fund managers with skin in the game

However, unlike mutual funds, AIFs are not daily liquid. You must stay invested until maturity or pre-defined liquidity events.

Final Thoughts

Alternative Investment Funds are no longer niche. In 2025, they’re mainstream for India’s wealth-conscious elite, offering access to private markets, innovation, and active strategies that can’t be found in traditional avenues.

Understanding the three categories — I, II, and III — is key to using AIFs effectively. Whether you’re a growth-seeker, yield-hunter, or market player, there’s an AIF that fits your style.

But don’t invest blind. Work with licensed platforms like Rits Capital that conduct deep due diligence and help you navigate taxation, regulation, and fund performance with clarity.

0 notes

Text

Quantitative Trading: What It Is and How to Get Started.

In today’s fast-paced financial markets, data is king. Traders and investors are increasingly relying on technology and mathematical models to make decisions. One of the most advanced and data-driven forms of trading is Quantitative Trading. But what exactly is it, and how can someone with a strong interest in finance and data get started?

In this blog, we’ll break down quantitative trading in a simple and practical way—perfect for beginners.

What Is Quantitative Trading?

Quantitative trading, often called quant trading, is the process of using mathematical models, statistical techniques, and algorithms to make trading decisions. Instead of relying on gut feeling or market news, quant traders use data—sometimes millions of data points—to identify patterns and execute trades.

It’s the backbone of hedge funds, proprietary trading firms, and even large banks.

How Does It Work?

Quantitative trading typically involves the following steps:

1. Strategy Development

A quant trader builds a hypothesis or idea (like “buy when the 10-day moving average crosses above the 50-day moving average”) and backtests it using historical data.

2. Backtesting

This involves running the strategy on past market data to see how it would have performed. It helps filter out poor strategies before they are used in real markets.

3. Execution

Once a strategy is validated, it’s automated using trading algorithms that execute trades quickly, often without human intervention.

4. Risk Management

Risk models are built into strategies to control losses and manage capital efficiently.

Why Is Quant Trading Popular?

Data-driven: Decisions are based on logic, not emotions.

Speed: Algorithms can execute thousands of trades in seconds.

Backtesting: You can test your strategy before using real money.

Automation: Reduces human errors and emotional decisions.

Who Can Become a Quant Trader?

You don’t need to be a Wall Street veteran to start. If you have a background in:

Mathematics or Statistics

Computer Science or Programming

Finance or Economics

Data Science

You’re already halfway there.

Even self-learners with an interest in stock markets and programming (like Python or R) can get into quant trading.

How to Get Started in Quantitative Trading

1. Learn the Basics of Trading

Understand how stock markets work, different types of orders, and common trading strategies.

2. Start Learning Python

Python is the go-to language for quant trading. Focus on:

Pandas (for data analysis)

NumPy (for numerical operations)

Matplotlib/Seaborn (for visualizations)

SciPy, scikit-learn (for statistical models)

3. Explore Quant Libraries

Backtrader

Quant Connect

Zipline

PyAlgo Trade

These help you build and test your strategies easily.

4. Understand Financial Data

Learn how to fetch and process data from sources like Yahoo Finance, Alpha Vantage, or Quandl.

5. Study Quant Strategies

Some popular ones:

Mean Reversion

Momentum Trading

Arbitrage

Pairs Trading

Machine Learning Models

6. Backtest Your Ideas

Always test your trading ideas using historical data before going live.

7. Paper Trade

Try your strategies in real market conditions using demo accounts to reduce risk.

8. Go Live (Cautiously)

Once confident, go live with small capital and track performance.

Top Resources to Learn Quant Trading

Books:

“Quantitative Trading” by Ernest Chan

“Algorithmic Trading” by Andreas Clenow

“Advances in Financial Machine Learning” by Marcos López de Prado

Courses:

Coursera: “Machine Learning for Trading”

Udemy: “Python for Financial Analysis and Algorithmic Trading”

Websites & Communities:

QuantInsti

Quantocracy

Elite Trader forums

Reddit r/algotrading

Final Thoughts

Quantitative trading is not just for big institutions anymore. With the right skills, mindset, and tools, individual traders and finance enthusiasts can build and test their own trading algorithms.

It’s a perfect blend of finance, data science, and technology—and the possibilities are endless.

If you’re passionate about the markets and want to use logic and data instead of emotions, quantitative trading might just be your next big move.

Ready to Begin Your Quant Trading Journey?

Join Traders Training Academy and take your first step toward becoming a confident, data-driven trader.

Enroll in our exclusive Pro Trader Course – where you’ll learn advanced strategies, live trading systems, and practical skills to build and backtest your own algorithms.

0 notes

Text

Yield‑Bearing Stablecoins: Earning While Staying Stable

Stablecoins—digital tokens pegged to fiat currencies like the U.S. dollar—have long served as a convenient bridge between traditional finance and crypto markets. Yet most stablecoins (USDC, USDT, DAI, etc.) remain idle assets—they neither appreciate nor accrue interest. Enter yield‑bearing stablecoins, an emerging innovation that enables holders to earn passive income while preserving price stability.

This post explores how yield bearing stablecoins work, why they matter, key examples, risks, and how they may shape the future of digital money.

What Are Yield‑Bearing Stablecoins?

A yield‑bearing stablecoin is a stablecoin specifically designed to generate interest or yield simply by holding it. Unlike traditional stablecoins, where you must lend or stake tokens to earn any return, yield‑bearing stablecoins embed the earning mechanism directly into the token.

There are two broad categories:

Asset‑backed stablecoins: These are backed by yield‑producing real‑world assets—like U.S. Treasury bills or money market funds—and distribute the earned interest to holders.

DeFi‑native tokens: These use decentralized finance protocols to lend out collateral or engage in yield strategies, with the returns reflected automatically in the balance.

By combining price stability with automatic passive income, yield‑bearing stablecoins aim to replicate the benefits of traditional deposit accounts, but on open blockchain rails.

Why They Matter

Offset Inflation & Preserve Value

Unlike fiat savings accounts, many conventional stablecoins don’t pass reserve‑generated yields to token holders. Circle and Tether hold billions in low‑risk assets like treasury bills, yet these returns stay with the issuers. Yield‑bearing stablecoins flip that model: holders see interest that helps combat inflation.

Inclusive, Borderless Access

Global users—even those without access to U.S. banking or investment vehicles—can earn yield on dollar‑pegged assets. This democratizes returns that were once reserved for institutions.

Integration into DeFi & Capital Efficiency

By embedding yield inside the token, these coins simplify user experience. Users don’t need to manually stake or lend; yield accrues automatically. That boosts liquidity and capital efficiency across digital finance ecosystems.

The Growth Trajectory

From a niche experiment in early DeFi, yield‑bearing stablecoins have grown rapidly. Supply ballooned from $666 million in August 2023 to nearly $10.8 billion by February 2025, representing around 4–5 % of the total stablecoin market. Growth soared over 500% in a single year.

Analysts compare this acceleration to the rise of traditional money market funds (MMFs) in the 1970s. Projections suggest yield‑bearing stablecoins could capture half the stablecoin market by 2030—potentially expanding to hundreds of billions in value.

Yet, while adoption is rising fast, it remains a small slice of total stablecoin usage. The trend is still early in its lifecycle—but the pace of growth signals deep interest from both retail and institutional investors.

Leading Examples

Here are some of today’s most prominent yield‑bearing stablecoins, each offering different mechanisms and risk profiles.

HLUSD (HeLa USD)

HLUSD is native to the HeLa blockchain and reportedly offers yields around 15 % APY. It's integrated into the HeLa ecosystem—used for gas fees and staking—making it both a utility token and a yield‑earning stablecoin.

Ethena’s sUSDe (Staked USDe)

Built on a delta‑neutral arbitrage model involving perpetual futures and staking, sUSDe gained massive traction. Peak yields reached 100 %+ in early 2024 but have since stabilized between ~12–29 % APY. Its market cap nears $5 billion.

SyrupUSDC

A DeFi‑native yield‑bearing version of USDC that pools DeFi lending and liquidity strategies to generate passive returns. Holds a significant share of the yield‑bearing market.

USDY (Ondo US Dollar Yield Token)

Backed by real‑world assets such as U.S. Treasury bills and bank deposits. Supports automatic yield accrual with no staking required, available across Ethereum, Solana, and Arbitrum.

Other Notable Tokens

Also popular are Staked Frax USD (sFRAX), OpenDollar (USDO), Noble Dollar (USDN), Staked Level USD (SLVLUSD), and Elixir’s SDEUSD—all varying by asset backing and yield model.

How Yield Is Generated

Yield‑bearing stablecoins typically earn returns through one or more of these mechanisms:

DeFi lending: The issuer deposits collateral into protocols like Aave or Compound and passes interest back to token holders.

Liquidity provision & staking: Funds may be deployed into decentralized pools or stake-capable assets, earning fees or staking rewards.

Real‑world asset backing: Treasury bills, money market funds, or bank deposits generate interest. Some tokens pass these yields directly to holders.

Algorithmic / delta‑neutral strategies: Synthetic tokens like sUSDe perform futures arbitrage to capture funding‑rate yields, balancing risk exposure.

Each yield pathway comes with trade‑offs in transparency, speed of accrual, and risk.

Risks and Considerations

Despite their appeal, yield‑bearing stablecoins come with meaningful risks:

Smart Contract & Protocol Risk

Tokens relying on decentralized protocols or arbitrage structures are exposed to bugs, flash‑loan attacks, or DeFi exploits. A failure in the code can result in loss of funds.

Liquidity & Redemption Risk

Rapid redemptions during stress events can strain liquidity. If underlying assets aren’t liquid enough, holders might face slippage or delays.

Yield Sustainability

High yields—especially those from arbitrage models like sUSDe—may decline as competition increases or market dynamics shift. Some returns have dropped from 60 %+ to under 5 % within months.

Collateral Devaluation

If the underlying assets (like staking tokens or synthetic collateral) lose value or depeg, token stability is compromised—even if the price remains technically “stable.”

Regulatory Environment

Governments are eyeing stablecoins closely. New laws may affect how these assets are issued, traded, or taxed. Compliance challenges and evolving jurisdictional rules could restrict access or require changes in structure.

Algorithmic Failure Risk

Synthetic and algorithmic yield‑bearing models echo some past failures like Terra’s UST collapse. While more robust models exist today, they are not immune to market shocks or design flaws.

Use Cases & Who Should Care

Yield‑bearing stablecoins appeal to a wide range of users:

Retail Holders: Individuals looking to preserve purchasing power while earning a passive return on stable digital dollars.

Institutions: Crypto treasuries and funds can park idle capital in yield‑generating tokens for short‑term gains.

DeFi Users: Traders and users who want low‑maintenance, yield‑earning collateral in their wallets.

Global Users: Especially useful in regions where access to dollars or inflation‑hedging instruments is limited.

They serve as a bridge between DeFi earnings and stable assets, offering a useful tool in both volatile and quiet markets.

Future Outlook

The future of yield‑bearing stablecoins looks promising. As crypto matures and integrates with real-world finance, these tokens may evolve into programmable equivalents of digital savings accounts. They could also drive deeper institutional participation and foster new financial tools—such as on-chain treasuries, interest-earning payrolls, and smart contract–enabled lending loops.

Adoption will depend on transparency, regulatory compliance, and long-term yield reliability. If issuers can meet these standards, yield-bearing stablecoins may well become a standard feature of the digital financial landscape—blending the safety of stable value with the incentive of steady growth.

0 notes

Text

Algorithmic Options Trading Made Simple

Algorithmic Options Trading: The Future of Smart Investing

Introduction

Imagine having a smart assistant who can analyze thousands of data points in seconds and make accurate trading decisions on your behalf—even while you're sleeping. That's exactly what Algorithmic Options Trading does. It brings together the power of data, speed, and emotionless logic to the trading world using automated trading software or algo software. This might sound futuristic, but it’s already transforming how people invest.

In this article, we’ll break it all down in simple language. Whether you’re new to trading or curious about how auto trading software works, you’re in the right place.

Discover Algorithmic Options Trading with automated trading software, auto trading software & powerful algo software in this easy-to-follow guide.

What is Algorithmic Options Trading?

Algorithmic Options Trading is the use of computer programs to automate trading strategies in the options market. These programs follow a defined set of rules—based on price, timing, volume, or even technical indicators—to make trades automatically.

Think of it like this: it’s similar to using cruise control in your car. You set the speed and direction, and the system handles the drive. You only intervene if needed.

How Does Algo Trading Work in Options?

In options trading, algorithms monitor the market and place orders based on pre-defined logic. For example:

Buy a call option when the price crosses a moving average.

Sell a put option if volatility drops below a certain level.

All of this happens automatically, without needing you to watch the screen 24/7.

Why Algorithmic Trading is Gaining Popularity

More and more retail and professional traders are turning to auto trading software. Here’s why:

Speed: Algorithms react faster than humans.

Accuracy: Eliminates emotional decision-making.

Efficiency: Can handle large volumes and multiple trades at once.

Accessibility: With modern tools, even beginners can use algorithms.

Key Benefits of Using Auto Trading Software

Let’s take a closer look at the advantages of using automated trading software:

Emotion-Free Trading: Say goodbye to fear and greed.

Backtesting Ability: Test your strategy on historical data.

24/7 Monitoring: Algorithms don’t sleep or take breaks.

Diversification: Trade across multiple strategies or assets simultaneously.

Bottom Line: It’s like having a team of tireless, super-fast assistants working for you.

Common Strategies in Algorithmic Options Trading

Not all algorithms are created equal. Some of the most common strategies include:

a. Trend Following

Buys when the market is trending up, sells when it trends down.

Based on technical indicators like Moving Averages or MACD.

b. Mean Reversion

Assumes prices will return to their average.

Useful for short-term strategies.

c. Arbitrage

Profits from price differences between markets or instruments.

Fast execution is key.

d. Volatility-Based

Trades based on how volatile an asset is.

Especially useful in options where volatility directly impacts price.

Components of Algo Software for Trading

To make it all work, an algo software typically includes:

Strategy Builder: To define rules and logic.

Data Feed: Real-time market data for decisions.

Backtesting Module: Try your logic on past data.

Execution Engine: Places trades with your broker.

Risk Management Tools: Stop-loss, position sizing, etc.

How to Get Started with Algorithmic Options Trading

Here’s a step-by-step plan:

Understand Options Basics – Know what calls, puts, and strike prices are.

Choose a Strategy – Pick one that fits your style.

Select Algo Software – Find a platform that supports your broker and has user-friendly tools.

Backtest Your Strategy – Use historical data to validate it.

Paper Trade First – Test without real money.

Go Live – Start small, monitor performance.

Real-Life Examples: How Algorithms Win

Example 1: A trader sets an algorithm to buy NIFTY options every time it crosses above the 20-day moving average. The system catches small trends before most traders even notice.

Example 2: During a volatile day, a volatility-based algorithm sells out-of-the-money puts and quickly profits as the market stabilizes.

These are not just simulations—they happen every day in real markets.

Manual vs Algorithmic Trading: What’s Better?

Let’s compare:

Feature

Manual Trading

Algorithmic Trading

Speed

Slower

Lightning Fast

Emotions

High

None

Accuracy

Varies

Consistent

Scalability

Limited

High

Verdict? If you value consistency, scalability, and objectivity, algo trading wins hands down.

Risk Factors You Should Know

Trading with algorithms is powerful—but not risk-free.

Overfitting: Strategy works only on historical data but fails live.

Technical Failures: Bugs or internet outages can ruin trades.

Market Changes: Algorithms must adapt to new market conditions.

Tip: Always keep an eye on your algo, especially in volatile markets.

Regulation and Legal Considerations in India

In India, SEBI regulates algorithmic trading. Here are a few key points:

Only brokers and entities with SEBI approval can deploy fully automated strategies.

Some platforms allow semi-automated or API-based trading.

Retail investors should ensure the platform follows SEBI rules.

Best Practices for Success in Auto Trading

To stay on the winning side:

Start Simple: Don’t overcomplicate your first strategy.

Track Performance: Keep logs and learn from your results.

Update Regularly: Markets evolve, and so should your algorithm.

Risk Management is Key: Never risk more than you can afford to lose.

How to Choose the Right Algo Software

Not all platforms are equal. Look for:

Ease of Use: Drag-and-drop strategy builders are beginner-friendly.

Backtesting Tools: Must-have for testing.

Broker Integration: Supports your preferred broker.

Real-Time Data: Accurate and fast data is non-negotiable.

Support & Community: Forums, tutorials, and help when you need it.

Popular platforms include:

Quanttrix

AlgoTest

TradingView (with Pine Script)

Zerodha Streak

Future of Algorithmic Options Trading

The future looks bright, thanks to:

AI and Machine Learning: Smarter algorithms that adapt in real-time.

Cloud-Based Platforms: Trade from anywhere, anytime.

Lower Barriers: More accessible for the average investor.

Greater Customization: Tailor strategies down to the last variable.

Final Thoughts

Algorithmic Options Trading is no longer just for techies or hedge funds. With the rise of user-friendly automated trading software, anyone can build and deploy powerful strategies.

It’s like upgrading from a manual car to a Tesla—you still control the destination, but the ride is smoother, faster, and more efficient.

If you’ve been hesitant about jumping in, start small. Use auto trading software to test ideas, gain confidence, and slowly scale your strategies. The future of trading is here—and it’s automated.

Frequently Asked Questions (FAQs)

1. What is algorithmic options trading?

Algorithmic options trading uses computer programs to automatically buy and sell options based on pre-defined rules and strategies.

2. Is algorithmic trading better than manual trading?

For many, yes. It’s faster, emotion-free, and more efficient—especially when using robust algo software.

3. Do I need coding knowledge to use automated trading software?

Not necessarily. Many platforms now offer no-code or low-code solutions, making it beginner-friendly.

4. Can retail investors in India use algorithmic options trading?

Yes, but they must ensure compliance with SEBI regulations. Many platforms offer semi-automated tools for retail users.

5. What’s the best algo software for beginners?

Platforms like Quanttrix and Zerodha Streak are great for beginners due to their simplicity and features like drag-and-drop strategy building.

0 notes

Text

Start and Scale: The Definitive Course on Having an Airbnb Business That Actually Works

If you've ever stayed in a well-designed, cozy Airbnb and thought, “I could do this too,” you’re not alone. Thousands of people around the world are turning their spare rooms, guesthouses, or entire properties into money-making machines with Airbnb. But here’s the truth: just putting your listing online doesn't guarantee bookings or success.

The difference between hosts who struggle and those who thrive? Knowledge and strategy. That’s where The Definitive Course on Having an Airbnb Business comes in—your blueprint to building an Airbnb business that actually works, from day one.

Let’s break down what makes this course so effective, what you’ll learn, and why it’s the smartest investment you can make before diving into the hosting world.

Why Start an Airbnb Business?

Before diving into the course itself, let’s talk about why Airbnb has become such an attractive business model:

Low upfront cost: You don’t need to buy property—you can start with your existing home or sublet.

Flexible income: Whether you want to make a few hundred extra a month or run a full-time hospitality business, it scales to fit your goals.

Global demand: Travelers now prefer authentic stays with local hosts over cookie-cutter hotel rooms.

You’re in control: Pricing, availability, guest interaction—it’s all up to you.

But as exciting as it sounds, becoming a successful Airbnb host involves more than fresh linens and cute decor. It’s a business. And just like any business, you need systems, marketing, and customer service to really thrive.

What This Airbnb Course Teaches You

If you’re looking for a step-by-step guide on how to start, manage, and grow your Airbnb listing into a full-fledged business, this course is it. The Definitive Course on Having an Airbnb Business covers everything you need, including:

✅ Setting Up for Success

From choosing the right space to listing optimization, you’ll get actionable tips on how to make your property booking-worthy. You’ll learn how to:

Create standout listings with professional photos and descriptions

Use competitive pricing strategies

Select essential amenities that increase bookings

Understand Airbnb’s ranking algorithm to boost visibility

✅ Guest Communication and Management

Great communication turns a one-time guest into a 5-star review. The course walks you through:

Automating messages to save time

Handling inquiries and common guest questions

Creating house rules and check-in instructions

Managing guests respectfully and professionally

✅ Business Mindset and Legal Know-How

What sets this course apart is its focus on treating Airbnb like a business, not a side hustle. You’ll explore:

Tax implications and income tracking

Legal aspects and city regulations

Insurance and guest damage protection

How to expand with multiple listings or even arbitrage

✅ Crisis and Conflict Resolution

Let’s face it—things go wrong. This course teaches you how to:

Deal with difficult guests without losing your cool

Handle cancellations and emergencies

Protect your property and your reputation

Who Should Take This Course?

This isn’t just for homeowners with spare rooms. It’s for anyone ready to earn passive income and build a long-term business model through Airbnb. Whether you’re:

A travel lover who wants to fund their lifestyle

A real estate investor looking to boost property ROI

A stay-at-home parent searching for flexible income

A hospitality enthusiast ready to go all-in

This course is designed for both beginners and current hosts who want to up their game.

Real Strategies That Work in the Real World

What makes this course different from free YouTube advice or Airbnb blogs?

It’s structured, actionable, and built from real hosting experience. You’re not getting fluff or generic advice—you’re learning from someone who’s been there, done that, and knows what works.

By the end of the course, you won’t just know what makes a successful Airbnb—you’ll have a plan you can implement immediately.

The Perks of Getting Trained Before You Host

Let’s talk about ROI (return on investment). Hosting without a game plan can lead to:

Empty calendars and low booking rates

Poor reviews that tank your visibility

Property damage or loss from avoidable mistakes

Pricing errors that cut into your profits