#iphone buyback software

Explore tagged Tumblr posts

Text

Wonder how cell phone buyback software can save you time and money? Check our Websites to schedule a phone buyback shop software demo!

#cell phone buyback software#mobile phone buyback software#phone buyback software#iphone buyback software

0 notes

Text

The Best Ways to Sell Your Phone and Find Phone Repair Services Near You

Are you planning to upgrade your smartphone and wondering, "Where can I sell my phone?" Or maybe your device has stopped functioning correctly, and you're searching for "phone repair near me" to fix it. Whether you're looking to sell your old phone for the best price or find a reliable phone repair shop, this guide will help you navigate your options effectively.

Why You Should Sell Your Old Phone

Selling your old phone instead of leaving it unused comes with many benefits, such as:

Earning Extra Cash: Selling your phone can help fund your new device.

Environmentally Friendly: Recycling and reselling prevent electronic waste.

Retaining Value: Smartphones depreciate over time, so selling sooner ensures you get the best price.

Best Platforms to Sell My Phone

1. Online Marketplaces

Online selling platforms provide competitive prices for used smartphones:

eBay – Offers bidding and direct sales for various phone models.

Facebook Marketplace – Allows direct sales to local buyers.

Craigslist – Suitable for selling locally but requires caution.

2. Trade-In Programs

Trade-in programs offer convenience over the highest cash returns:

Apple Trade-In – Offers store credit toward a new iPhone.

Samsung Trade-In – Provides instant discounts for older models.

Amazon & Best Buy Trade-In – Both provide store credit for used devices.

3. Local Phone Stores

Many phone repair shops also buy used smartphones. Searching for "phone repair near me" might lead you to local stores that offer trade-in deals.

4. Carrier Buyback Programs

Verizon, AT&T, and T-Mobile have buyback programs that provide credits or cash for old phones.

How to Get the Best Price When Selling Your Phone

Research Market Value: Check platforms like Swappa or eBay for price comparisons.

Prepare Your Phone: A factory reset and cleaning enhance buyer appeal.

Include Accessories: Selling with original chargers and boxes can boost value.

Use Quality Photos: Clear images attract more buyers.

Finding Reliable Phone Repair Near Me

If your phone is damaged, searching for "phone repair near me" can help you find repair services. Here’s what to look for:

1. Check Online Reviews

Google, Yelp, and Trustpilot reviews provide insight into customer experiences with repair shops.

2. Compare Prices

Request estimates from multiple shops to ensure fair pricing.

3. Certified Technicians

Ensure the repair shop has skilled technicians experienced with various phone brands.

4. Warranty and Repair Guarantee

A reputable repair service will offer a warranty to cover repairs.

5. Fast Turnaround Time

Many shops provide same-day services for common repairs like screen replacements.

Common Phone Issues That Can Be Fixed

Cracked Screens: A frequent issue that most repair shops fix quickly.

Battery Problems: A replacement can significantly extend your phone’s lifespan.

Water Damage: Many experts can repair water-damaged phones.

Charging Port Issues: Fixing a faulty charging port can restore your device’s functionality.

Software Issues: Technicians can address software glitches and crashes.

Should You Repair or Replace Your Phone?

Deciding whether to repair or sell your phone depends on:

Repair Costs: If repair costs exceed half the phone’s value, selling might be a better choice.

Phone Age: Older phones might not support the latest software updates.

Overall Functionality: If a repair can extend usability, it might be worth it.

Conclusion

Whether you need to sell my phone for extra cash or are searching for phone repair near me, understanding your options ensures you make the best decision. By selecting the right selling platform or finding a trustworthy repair shop, you can maximize the value and functionality of your smartphone. Don’t let your old or broken phone go to waste—explore your options today!

1 note

·

View note

Text

UK Stocks Hit New High, GBPUSD Steady

UK blue-chips hit new highs on Thursday as investors digested a big batch of corporate earnings, as well as interest rate decisions from the European Central Bank (ECB) and, overnight, by the US Federal Reserve.

After the Fed, as expected, kept its monetary policy unchanged on Wednesday night, the ECB reduced its key interest rate by 25 basis points to 2.75%, also as anticipated, on the back of figures showing the eurozone economy flatlined late last year.

UK100Roll Daily

Meanwhile, Fed chair Jerome Powell dialled back the hawkish tone taken on inflation in the US central bank’s latest policy statement. In his post-meeting press conference, Powell clarified that the change in statement language was not a signal, adding that the Fed sees no cause to adjust rates again until data shows risks to the job market or a fresh drop in inflation.

US data on Thursday saw fourth-quarter economic growth miss expectations, with gross domestic product up by 2.3% over the final three months of 2024, a marked slowdown against the 3.1% seen over the third quarter, and lower than analysts’ expectations of 2.7%.

Meanwhile, US initial jobless claims dropped by 16,000 to a seasonally adjusted 207,000 for the week ended January 25, well below forecasts for 220,000 claims.

On foreign exchanges, sterling was mixed, gaining 0.08% to 1.2461 versus the US dollar after the hawkish Fed statement on inflation, but slipping 0.01% against the euro to 1.1948 following the ECB news.

GBPUSD H1

US stocks were higher in morning trading on Thursday as investors assessed Jerome Powell’s less hawkish comments, as well as quarterly earnings reports last night from Big Tech companies, including Tesla, Microsoft, and Meta Platforms, with iPhone maker Apple due to report after the Wall Street close on Thursday.

At the stock market finish in London, the FTSE 100 index was up 1.1% at 8,646, a closing high and just below a new all-time peak at 8,655, having breached the 8600 level for the first time ever. Meanwhile, the FTSE 250 index jumped 1.2% to 20,805.

Precious metals miners Endeavour Mining jumped 7.2% after it reported solid 2024 production results. The boost also came after gold prices hit a record high.

The busy day for blue-chip earnings also saw Shell add 2.6% as the oil major maintained its US$3.5 billion pace of share buybacks despite weaker-than-expected fourth quarter earnings, which reflected write-offs in its exploration business and lower crude prices.

Wealth manager St James’s Place added 10.2% as it saw its assets under management hit a record last year, with 2024 net inflows of £4.33 billion, after the fourth quarter brought in £1.5 billion.

Airtel Africa gained 9.0% as the mobile telecoms firm reported a strong third-quarter operating performance and launched a second $100 million (£80 million) share buyback.

But BT Group shed 1.6% as the telecoms giant said third-quarter revenues had fallen amid weaker phone sales and a struggling business unit.

And Sage Group shed 0.6% as the accounting software firm only maintained its revenue forecast for fiscal 2025 even after posting 10pc growth in first-quarter underlying revenue.

Elsewhere, FTSE 100-listed discount airline easyJet rose 4.3% and British Airways-owner IAG added 1.2%, supported by London airports expansion plan hopes.

But Wizz Air dropped 5.5% as the FTSE 250-listed group cut its annual net income forecast for the second time in six months, as it grapples with rising costs related to the grounding of planes due to engine problems and economic uncertainties.

Meanwhile, on AIM, Fevertree Drinks jumped 20.2% after signing a long-term strategic partnership in the US. As part of the deal, brewer Molson Coors is to buy an 8.5pc stake in the posh tonic firm for £71 million in cash, with the proceeds set to be returned to shareholders via a share buyback programme.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.

The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Turn E-Waste Into Earnings: Sell Your Old Phone in 5 Easy Steps!

Introduction: Why Selling Your Old Phone Matters

Chances are, you have an old phone sitting in a drawer somewhere, gathering dust. But did you know that your outdated device can actually be turned into cash? Sell old phone not only helps you declutter but also contributes to reducing e-waste. It's a win-win! But how do you go selling your phone without a hassle? I've got you covered. Here are five easy steps to get you started.

Step 1: Assess the Condition of Your Phone

Before you can sell your phone, you need to know what condition it’s in. This helps you set expectations for its resale value.

Internal and External Check

Physical Condition: Inspect for scratches, dents, or cracks on the screen and body.

Battery Life: Assess how long your phone holds a charge. If the battery drains quickly, it may lower the resale value.

Functionality: Make sure all buttons work, the camera is functional, and there are no software issues.

Data Security

Backup Your Data: Ensure you've backed up all your important data like photos, contacts, and apps.

Factory Reset: Wipe all personal data by performing a factory reset. This step is crucial for your privacy.

"You wouldn't want your private messages ending up in someone else's hands, would you?"

Step 2: Research the Market Value

Understanding how much your phone is worth can help you get the best deal.

Use Online Tools

Price Comparison Websites: Websites like Swappa, Gazelle, and eBay can provide an estimated value.

Brand Forums and Communities: These platforms often discuss resale values and trending prices.

Check for Promotions

Buyback Programs: Some manufacturers and retailers offer buyback programs which might give you a good deal.

Seasonal Sales: Sometimes selling during a specific season fetches higher prices, like when a new phone model is released.

Step 3: Choose Your Selling Platform

Now that you know your phone's worth, it’s time to select where to sell it.

Online Marketplaces

eBay and Craigslist: These platforms reach a broad audience but require dealing with buyers directly.

Specialized Sites: Sites like Gazelle and Decluttr specialize in buying used electronics and offer a smoother process.

Retail Buyback Programs

Apple Trade-In: If you have an iPhone, Apple’s trade-in program might give you credit for future purchases.

Carrier Trade-In Programs: Verizon, AT&T, and other carriers often have their own trade-in programs.

Step 4: Create an Attractive Listing

A good listing can make or break your sale. Here’s how to create one that stands out.

High-Quality Photos

Lighting and Angles: Take clear photos in good lighting and from multiple angles.

Close-Ups: Include close-ups of any damages or unique features.

Comprehensive Description

Key Details: Mention the model, storage capacity, and condition.

Honesty: Be upfront about any defects. Honesty builds trust and can lead to a smoother transaction.

"A well-described listing can sell your phone faster. Think of it as online dating for your device!"

Step 5: Finalize the Sale

Once you’ve found a buyer, it’s time to close the deal.

Secure Payment

Payment Platforms: Use secure platforms like PayPal or Venmo for transactions.

Shipping Confirmation: If shipping the phone, get tracking information to ensure it reaches the buyer safely.

Transfer Ownership

SIM Card and Accessories: Remove your SIM card and include any accessories like chargers and earphones.

Ownership Transfer: Make sure to de-register your device from any accounts and remove any locks.

"Completing these final steps ensures a smooth handover and leaves both you and the buyer satisfied."

Conclusion: Make the Most of Your Old Tech

Selling your old phone might seem like a daunting task, but it's totally manageable with these five steps. Not only do you get to earn some extra cash, but you also contribute to reducing e-waste. Start today and turn that old phone into a handy payday!

Remember, a little effort goes a long way in making the selling process smooth and rewarding. Happy selling!

0 notes

Text

Sell Your Used iPhone Today! UAE's Trusted Buyer Awaits

Does your once-beloved iPhone now reside in a forgotten drawer, a silent testament to its bygone glory days? Its cracked screen is a constant reminder of a time when it captured every moment, every adventure. Fear not, iPhone enthusiasts! In the heart of the UAE, a beacon of trust and instant gratification awaits.

Forget the hassle of online listings and endless negotiations. We offer a refreshingly simple solution: turn your pre-loved iPhone into instant cash, on the spot! No waiting, no drama, just the sweet satisfaction of decluttering and putting some extra dirhams in your pocket.

Why Choose Buybackdubai?

Instant Cash in Your Hand: We believe in immediate gratification. Upon evaluation, you’ll receive your payment right away, no waiting, no runaround. Think of it as finding an oasis of dirhams in the desert, minus the sand between your toes.

Any Condition Accepted: Scratches, cracks, even a questionable encounter with the swimming pool? No problem! We buy iPhones in any condition, even if they’re just a collection of parts held together by hope and duct tape. We have a soft spot for underdogs.

Fast and Transparent: Our evaluation process is quick and straightforward. No hidden fees, and no shady deals. We believe in honesty, just like your iPhone once believed it could survive that epic waterslide incident.

Environmentally Friendly: By selling your iPhone to us, you’re not just decluttering your home, you’re doing your part for the planet. We responsibly recycle or refurbish used iPhones, reducing e-waste and giving precious resources a second chance. Think of it as karma for all those times your iPhone mysteriously died right before capturing that perfect Burj Khalifa sunset.

UAE’s Trusted Buyer: With a proven track record and a commitment to customer satisfaction, Buyback Dubai is the go-to destination for Sell Your iPhone in UAE. We’re your neighbors, your fellow tech enthusiasts, and your trusted partner in decluttering with a smile.

Selling Your iPhone is Easier Than Ordering Shawarma!

Get a Quote: Visit our website to sell iphone uae or download our app. Select your iPhone model, enter its condition, and voila! You’ll instantly receive an estimated quote.

Schedule a Pickup: Choose a convenient time and location for our friendly team to visit you. Kick back with a cup of karak chai, reminisce about the good old days of Snake on your first iPhone, and let us handle the rest.

Get Paid: Once we’ve evaluated your iPhone, you’ll receive your instant cash payment on the spot. No paperwork, no fuss, just dirhams clinking in your hand.

The Rebirth of Your iPhone: From Drawer Dweller to Shining Star

Depending on its condition, your iPhone will embark on one of these exciting journeys:

Refurbished: iPhones in good condition get a spa treatment, a software upgrade, and a new lease on life. They then find loving homes with budget-conscious buyers, spreading joy and selfies across the UAE.

Recycled: iPhones beyond repair are ethically dismantled and their components are recycled. From circuit boards to precious metals, nothing goes to waste. We give your iPhone’s innards a chance to shine in new gadgets, like maybe a smartwatch that won’t judge you for dropping it in your hummus again.

So, don’t let your old iPhone gather dust! Give it a chance to write a new chapter in its story. Sell it to Buyback Dubai and watch it go from forgotten drawer dweller to shining star (or at least a reliable paperweight in someone else’s home). Visit our website to Sell my iphone Dubai or download our app today and unlock the potential of your pre-loved iPhone!

Let’s turn old iPhones into instant cash, one dirham at a time! We also buy other brands of smartphones, tablets, laptops, and other gadgets! So, if you’re on a decluttering spree, bring them along too! We’re always happy to give your tech treasures a second chance.

#where to sell used phones in dubai#sell any phone dubai#sell your phone dubai#sell used phones in dubai#sell used macbook dubai#sell any phone#sell phones for cash#sell my phone dubai#sell phones for cash dubai#sell mobile uae

0 notes

Text

computer shop near me

Expert Computer Repair and Cash for Computers Services in Schenectady, NY

Computer Shop Near Me - WillPowerPCS offers the best computer repair store and the lowest price. Get your computer and laptop repaired today!

When your computer encounters technical glitches or is ready for an upgrade, finding a reliable solution is crucial. In Schenectady, NY, Focus Place stands as a trusted destination for top-tier computer repair services and a unique opportunity to sell your computers for cash. Discover how Focus Place combines expertise and convenience to meet your technology needs seamlessly. Apple store albany ny

Computer Repair Services:

Focus Place takes pride in offering comprehensive computer repair solutions. From software issues to hardware malfunctions, our experienced technicians are equipped to diagnose and address a wide range of problems. Our goal is to provide efficient repairs that restore your computer's performance while minimizing downtime.

Selling Computers for Cash:

iphone screen repair nyc - Upgrade your technology and declutter your space by taking advantage of Focus Place's computer buyback program. We assess the value of your old computers and offer competitive cash offers. It's a hassle-free way to turn your unused devices into cash, all while contributing to a more sustainable tech ecosystem.

Top Computer Repair Store in USA

At Focus Place, customer satisfaction is paramount. Our customer-centric approach ensures that you receive personalized solutions tailored to your specific needs. Our transparent communication keeps you informed throughout the repair process, providing peace of mind and a stress-free experience.

Located in Schenectady, NY, Focus Place is easily accessible for residents and businesses alike. Our user-friendly website, willpowerpcs.com, offers detailed information about our services and allows you to request quotes or schedule visits online.

When it comes to reliable computer repairs and cash for computers services, Focus Place is the name to trust in Schenectady, NY. Our experienced technicians, customer-centric approach, and commitment to quality set us apart. Whether you're facing technical issues or looking to upgrade, Focus Place provides the solutions you need. Visit willpowerpcs.com today to learn more about our services and take the next step in optimizing your technology. iphone repair nyc

High-Quality Computer Repairs

At Focus Place, we understand the frustration that comes with a malfunctioning computer. Our team of skilled technicians is dedicated to providing efficient and effective solutions for a wide range of computer issues. Whether it's a software glitch, hardware malfunction, or even a virus infestation, our experts have the knowledge and tools to diagnose and fix the problem promptly. With years of experience under our belts, we take pride in our ability to restore your devices to optimal performance.

Sell Your Computer for Cash

Computer shop near me - Looking to upgrade your computer and wondering what to do with your old one? Focus Place offers a convenient solution through our computer buyback program. Our team will assess the value of your old computer and offer you a competitive cash offer. This not only allows you to free up space and declutter but also puts some extra money in your pocket. It's a win-win situation that sets us apart from other repair shops in Schenectady.

Comprehensive Repair Services

From desktops to laptops, our technicians at Focus Place have the expertise to handle a wide range of devices. Whether you're facing a slow computer, a cracked screen, or a non-responsive keyboard, we've got you covered. Our goal is to provide comprehensive repair services that address all aspects of your device, ensuring it functions smoothly and efficiently.Computer repair store near me

Desktop and Laptop Repairs Services at Will Power PCS

What truly sets Focus Place apart is our commitment to customer satisfaction. We understand that every computer issue is unique, and every customer's needs are different. That's why we take the time to listen to your concerns, provide tailored solutions, and keep you informed throughout the repair process. Our transparent communication ensures that you're always in the loop, making your experience with us smooth and stress-free. Computer places near me

Located in Schenectady, NY, our central location makes it easy for customers to drop off their devices for repair or assessment. Our user-friendly website, willpowerpcs.com, offers detailed information about our services and contact information. You can also request a quote or schedule a visit online, saving you time and effort.

More Tags - computer repair near me, computer store near me, computer fix near me, macbook repair near me, laptop screen repair near me, iphone charging port repair, headphone repair, places that buy used computers near me, sell computer for cash near me, computer fix, mac virus removal, lg phone repair, kindle fire screen replacement, iphone 5s repair

More Information - https://willpowerpcs.com/

0 notes

Text

Silicon Valley’s imaginary Q2 2020 earnings call

[switch to long version]

CEO, MEGA TECH CORP - Hello everyone. These aren’t normal times. We’re not going to talk about our 10Q on this call. We’re here to talk about the next 10 years. So if you’re here for DAUs, ARR or CPC, you can drop off now.

We’ve been doing a lot of thinking about the race, health and economic crises our country faces. Over the last few weeks, I’ve asked our exec team to leave their homes, their [Zoom alternative] calls and their DoorDash deliveries to join protests and explore our community through new eyes.

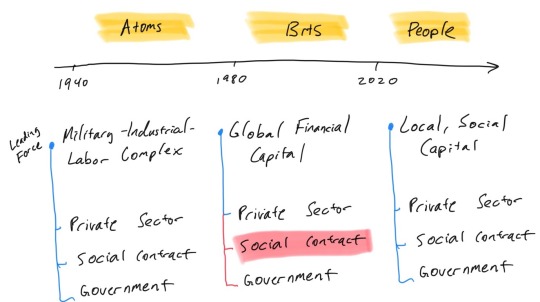

What we now see - more clearly than ever - is that our entire company, industry, and Valley - are built on flawed foundations. A flawed social contract.

We can no longer just focus on the magical software bits and hope someone else figures out racial equity, employment, climate and health. This is Joel Spolsky’s Law of Leaky Abstractions on the ultimate scale. The abstractions are failing - and we’re seeing bugs and unintended consequences all around us. And the more we invest to deal with one-off bugs, the more likely we are to calcify change and imprison ourselves inside a failing stack. It’s like we decided to build the world’s notification service on Ruby on Rails - or building an iPhone competitor on Windows CE. Fail Whale everywhere. Unfortunately, America’s democratic institutions are in poor condition. They are struggling to deal with inequality let alone looming environmental disaster. A polarized electorate - particularly at the national level - leads to populism and makes it hard for these institutions to execute meaningful, long-term plans.

We talk a lot about speech, misinformation, fairness of targeted ads etc. But it’s becoming clear that UX, linear algebra/training data and monetization in our products is just the tip of the spear to address polarization. We believe polarization is a product of the underlying conditions of civil rights, education, health and climate debt that affect Americans differentially based on race, wealth, neighborhood and region.

So will today’s peaceful protests for racial justice expand into tomorrow’s revolution(s) for economic freedom? If you don’t think things are bad now, think about what happens when the stimulus checks run out. Take a look at the amount of debt in the public sector, use any imagination about COVID, work out what happens to their tax base / pension returns and consider the impact on public services, public servants and their votes. MMT better be a real thing. Maybe we didn’t start these fires, but that refrain won’t save us when the flames come our way.

We’re done debating why we need to act. It’s clear America needs our help. Let’s talk about how we’re going to rise to the occasion. Our mantra will be “internalize, innovate, institutionalize”.

First, we’re going to internalize our problems. I’m here to tell you that issues of racial and economic justice are not just moral issues but they’re financial issues. Racial debt, education debt, health debt, climate debt will hit us harder and harder each year. (By the way, revolution probably won’t be great for your DCF models.) So we’re going to recognize these off-balance sheet liabilities - which amount to a few hundred billion in the US alone over the next 10 years for a company at our scale. You should assume other CEOs are thinking the same things - even if it takes them a few more quarters or years to say it.

Second, we’re going to innovate against these systemic problems - but our only shot at making progress is if we realign the entire company’s mission to address them. This is not about optics. This is not about philanthropy. This is not another bet. We have no choice but to put all our chips behind one bet - America - at least to start. It's the country that backed us in the first place, it's where most of our people are and most of our profits. The job for our existing products, platforms and cash flows will be to advance four areas: place / race, skilling / manufacturing, health / food and climate / mobility - starting in America. The board will measure me based on job creation and diversity. It should go without saying that we’re pausing dividends and buybacks for the foreseeable future. Every dollar will serve our mission. Every senior leader will need to sign up for our new mission - and those who choose to stay will receive a new, back-end loaded, 10 year vesting schedule. We want them focused on the long-term health of society - not the whims of Robinhood day traders or strengthening the moats of existing products. We will need to invent entirely new ways to operate and ship products. As Joel Spolsky said, “when you need to hire a programmer to do mostly VB programming, it’s not good enough to hire a VB programmer, because they will get completely stuck in tar every time the VB abstraction leaks”. We need engineers, designers and product managers that will look deep into the stack, confront the racial, job access, health and climate debts that our products, our companies and our communities are built on top of. This is not about CYA process to protect cash cows or throwing things over the fence to policy. We will need to innovate across technical, cultural and organizational lines. This requires deep understanding and curiosity. Systems and full-stack, not just pixels. This will bring more scrutiny to our company - not less. Change must not be the burden for only our Black employees or other subsets. Everyone must be on board - so for the next 12 months, we’re giving folks a one-time buyout if they want to leave.

Third, we can’t do any of this by ourselves. The problems are too big. Our role will be to provide enlightened risk capital (from our balance sheet or by re-vectoring operating spend) alongside R&D, product, platform leverage to help leaders and innovators pursue solutions in these areas. We will work with our peers and the public sector wherever possible - buying/R&D consortia, public-private partnerships, trusts, etc. Collaboration is the default, not the exception. But the new era and landscape demands that we explore institutional models beyond global capital/startups, labor unions, NGOs or government. We need models that can more flexibly align people and purpose, that innovate on individualized vs. socialized risk/reward - and that ultimately help build and sustain local, social capital. It’s difficult to say what these will look like - but increasingly figuring this out will be existential for our core business. Right now, it doesn’t matter if you’re designing the best cameras in Cupertino or the best ways to see their snaps in Santa Monica - we’re all just building layers of an attention stack for global capital. Our Beijing competitors have figured this out. ByteDance is already eating our lunch. They’re using the same tech inputs as us - UX, ML and large-scale systems - which are now a commodity - but with vastly lower consequences for the content they show - creating a superior operating / scaling model. They’re not internalizing social or political cost. What we need in this era is the accumulation stack - where each interaction builds social capital. This is not about global likes. This is about local respect. We’ll create competitive advantage when we build products that reach across race / economic lines to harness America’s amazing melting pot and do so in ways that build livelihoods / property rights for creators and stakeholders.

With this operating model in place, we’re committing to fundamental change in four areas:

Place & Race - Over the next 10 years, 100% of our jobs will be in diverse communities that embrace inclusive schooling, policing, housing and transit policies. (Starting tomorrow, we’re putting red lines on our maps around towns with exclusionary zoning.) This is not about privatizing cities or an HQ2-style play to extract concessions. This is about investing our risk capital and our reputation to innovate alongside government. How do we bring world-class education to neighborhoods with concentrated poverty? What is the future of digital/hybrid charter schooling? Unbundled public safety? We’re done with de facto segregation. We’ll embrace “remote-first” with physical centers of gravity as a means to this end. The Bay will become one physical node alongside several others (e.g. Atlanta, DC, LA) creating a strategic network to develop diverse talent across the country. We’re going to coordinate our investment with leading peers - since after all, this isn’t about cost or cherry-picking. It’s about broadening our country’s economic base.

Skilling & Manufacturing - We’re going to 10x the tech talent pool in 10 years - by inventing new apprenticeship models that bring women, minorities and the poor into the workforce. We’ll start with our existing contractor base, convert them to new employment models with expanded benefits and paths for upward mobility. Next, we will invent new productivity tools for all types of workers - from the front office to mobile work to call center - that brings the power of AI and programming to everyone. These will be deeply tied into new platforms for work designed from the bottom-up to build social and financial capital for individual workers and teams. Last, we’re setting a goal to manufacture most of our hardware products - from silicon all the way to systems - entirely in the US in 10 years. This will require massive investment, collaboration and innovation. It may require a revolution in robotics - but we will pursue this in a way that makes the American worker competitive - not a commodity to be automated away. If we’re successful, the dividends of our investment here will have massive spillover benefits to every other sector of manufacturing in the US - autos, etc. - including ones we have yet to dream up.

Health & Food - We’re not going to tolerate a two-class system for healthcare. As we convert our contract workforce to new employment models, we’ll innovate on the fundamental quality/cost paradigm. This may feel like a step down but it will put us (and the rest of society if we’re successful) on a fundamentally better long-term trajectory. Can we use AI to help scale the reach of community health workers? Can we help them create co-operatively owned care delivery orgs that offer new ways to share risk and support behavior change? Local, social capital is critical. Food is part of Health, and we’re going to innovate there too. Free food for employees is not going to come back post-COVID. Instead, we’ll use our food infrastructure to bootstrap cooperatively-owned cloud kitchens. We’ll provide capital to former contractors - mostly Black and Hispanic - to invest and own these. We’ll build platforms to help them sell food to employees (partly subsidized), participate in new “food for health” programs and eventually disrupt the extractive labor practices we see across food, grocery and delivery.

Climate & Mobility - Lastly, we’ll be imposing a carbon tax on all aspects of our own operations - which we’ll use to “fund” innovation in this space - with a primary focus on job creation. This is an area where we’re going to be looking far beyond our four walls from the beginning. As a first step, we’re teaming up with Elon and Gavin Newsom to buy PG&E out of bankruptcy and restructure it as a 21st century “decentralized” network of community utilities. It will accelerate the electrification of mobility - financing networked batteries for buses, cars and bikes along with charging infrastructure - and lead a massive job creation program focused on energy efficiency. It will use its rights of way to provide Gigabit ethernet + 5G to everyone - which will help people and help fund some of this. Speaking of mobility, private buses aren’t coming back after COVID. Instead, we’re teaming up with all of our peers to create a Bay-wide network of electric buses (with bundled e-bikes) that will service folks of all walks of life - including our own employee base. Oh and one more thing - we’re bringing together the world’s most advanced privacy/identity architecture and computational video/audio to bake public health infrastructure directly into the buses. For COVID and beyond. None of this is a substitute for competent, democratically accountable regional authorities. This is us investing risk capital on behalf of society - with the goal of empowering these authorities.

Open technology for global progress - While we have to prioritize America given the scale of problems, the intent is not to abandon the rest of the world or hold back it’s progress. We feel the opposite - that over the coming decades each country’s technology sectors will thrive. To get there, we will continue to invest patiently - hiring, training, partnering, investing and innovating - but with a clear north star to help each country develop local leaders in new areas. Long-term, we’ll continue to contribute open technology that others can build upon.

America should be the proverbial city on a hill for everyone - not a metaverse for the rich with the poor dying in the streets. We don’t have much time so we’re getting to work now. See you next quarter.

2 notes

·

View notes

Text

Cell Phone Repair Service in Ellenton FL

Cell Phone Repair Service in Ellenton FL

From battery replacement, to charging ports to screen repair our expertly trained technicians do it all! For any phone listed below we fix all models.

Cracked screen replacement service at Cell phone repair service in Ellenton FL, are both fast and affordable. In fact, a majority of iPhone screen repairs can be completed within one business day, if not while you wait in-store.

If your iPhone is suffering from water damage visit switch wireless Cell phone repair service in Ellenton FL. We will perform a professional diagnostic to determine the extent of the damage, clean out the device, flush out any debris and test accordingly. If buttons on your iPhone are malfunctioning or broken, count on the technicians of switchwireless for professional Cell phone repair service in Ellenton FL. We work quickly to fix the problem so that you never have to be without your iPhone for long. If your Samsung Galaxy no longer sounds loud and clear, you may have speaker issues. Whether you just need a tune up or a full speaker replacement switchwireless has you cover.

When you are experiencing weak signal or no signal on your iPhone switchwireless is here to help. Your iPhone could be suffering from a variety of issues including water damage, SIM card damage, or outdated software.

More services:

screen

battery

charging port

ear speaker

loud speaker

camera / r.camera / proximity sensor

microphone

headphone jack

power / volume / vibrator

factory reset

factory unlock

software

trade – ins & buybacks

water treatment

1 note

·

View note

Photo

What to know this week

Traders are gearing up for a busy week of corporate earnings results from the mega-cap technology stocks this week. This will come alongside a slew of economic data reports and a monetary policy decision from the Federal Reserve.

The biggest names in the S&P 500 — including Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Facebook (FB) and Alphabet (GOOGL) — are set to report second-quarter results this week. The reports will add to what has already been an exceptional earnings season: So far, 24% of companies in the S&P 500 have reported second-quarter results, and of these, 88% have topped Wall Street’s earnings per shares estimates, according to an analysis from FactSet. The blended earnings growth rate for the blue-chip index, which includes both companies’ reported growth rates and the estimated rates for the companies have yet to report, stands at 74.2%, which would be the highest since the fourth quarter of 2009.

Earnings results from technology companies Snap (SNAP) and Twitter (TWTR) last week underscored the strength in the internet advertising market, suggesting a strong backdrop that likely also benefitted bigger ad-driven companies like Facebook and Alphabet. Snap’s second-quarter revenue growth came in at 116%, or the biggest jump in four years, and the stock rocketed to a record high following the results. Both Snap and Twitter grew active users more than expected, and their estimates topping second-quarter revenues suggested better monetization of these increased users.

According to JPMorgan analyst Doug Anmuth, Snap’s results especially “will likely raise the bar for other ad names,” including Alphabet and Facebook. The companies report results on Tuesday and Wednesday, respectively.

“GOOGL shares are well-owned, but GOOGL remains one of our Top Ideas in 2021 as we believe: 1) reopening will remain a tailwind for Search and YouTube ads, especially as overall spend continues to shift online and travel continues to recover; 2) overall margins will remain meaningfully above pre-pandemic levels … 3) Cloud growth will remain solid at 40%+ while profit losses continue to improve; and 4) greater capital returns are likely on the heels of the $50 billion incremental buyback authorization last quarter,” Anmuth wrote in a note published July 22.

Story continues

As for Facebook, “advertising should continue to benefit from reopening and we are encouraged by newer initiatives around Reels and Shops, as well as the creator economy, audio, and AR/VR [augmented reality/virtual reality] a bit further out,” Anmuth added.

An illustration picture taken in London on December 18, 2020 shows the logos of Google, Apple, Facebook, Amazon and Microsoft displayed on a mobile phone and a laptop screen. (Photo by JUSTIN TALLIS / AFP) (Photo by JUSTIN TALLIS/AFP via Getty Images)

Alphabet has been the best performer of the Big Tech FAANG stocks so far in 2021, with shares rising 52% compared to the S&P 500’s 17.5% gain for the year-to-date. As a company that derives meaningful revenue from travel-related advertising revenue, Alphabet has been viewed as a key beneficiary of the broader economic reopening that began to occur in the spring of this year. Other software names, by contrast, have generally been viewed as bigger beneficiaries of a stay-at-home and work-from-home environment.

Alphabet’s second-quarter revenue, excluding traffic acquisition costs (TAC), is expected to grow 46% to $46.1 billion, according to Bloomberg data, which would mark the fastest top-line growth for the company since the fourth quarter of 2012.

Still, other online advertisers are also poised to get a boost from the reopening environment, with marketers more open to spend as pandemic-related uncertainty eased. Facebook’s revenues likely grew 49% over last year to $27.9 billion for the second quarter, accelerating slightly from the 48% rate in the first three months of 2021. That growth would come even as the company continues to contend with some decreased ad-targeting abilities after a recent Apple update that allowed users to opt out of tracking in apps including Facebook on iOS devices.

And Apple, for its part, likely also had a strong fiscal third-quarter, according to Wall Street’s estimates. Though consensus analysts expect to see that revenue growth slowed sequentially to 24% from the second quarter’s 54%, a boost from Apple’s latest iPhone upgrade cycle will likely still be at play, according to Wedbush analyst Dan Ives.

“While the chip shortage was an overhang for Apple during the quarter, we believe the iPhone and Services strength in the quarter neutralized any short term weakness that the Street was anticipating three months ago,” Ives said in a note published July 21. “Taking a step back we believe based on our recent Asia supply chain checks that iPhone 13 demand will be similar/slightly stronger than iPhone 12 out of the gates which speaks to our thesis that this elongated ‘supercycle’ will continue for Cupertino well into 2022.”

Meanwhile, e-commerce behemoth Amazon is heading into its first-ever earnings report without founder Jeff Bezos at the helm. The stock has underperformed so far in 2021, rising 12.3% for the year-to-date, after jumping by more than 76% in 2020 amid a pandemic-fueled boom in e-commerce demand.

“We expect strong top-line growth in ’21, albeit decelerating versus pandemic-charged ’20, led by e-commerce growth of +27% y/y (vs. +42% y/y), including a strong 2Q and solid growth in 3Q-4Q as AMZN comps the pandemic surge,” Cowen analyst John Blackledge wrote in a note.

An early Prime Day sales extravaganza is poised to help boost Amazon’s second-quarter top-line growth. The two-day event took place in late June this year, or at the end of the second quarter, compared to July 2019 and October 2020. And on the bottom-line, Amazon’s faster-growing, high-margin Amazon Web Services (AWS) cloud computing platform likely continued to help boost profitability.

Federal Reserve decision

The Federal Reserve kicks off its latest two-day meeting on Tuesday, with a monetary policy decision and press conference from Fed Chair Jerome Powell set to take place Wednesday afternoon.

The Fed’s June monetary policy statement and updated Summary of Economic Projections were taken as much less accommodative than many market participants expected, with the central bank raising its median forecasts for U.S. economic growth and core inflation over the next two years. The projections suggested the Fed might be more inclined to adjust policy in light of a fast-recovering economy experiencing rising inflation.

Federal Reserve Board Chair Jerome Powell testifies before Senate Banking, Housing, and Urban Affairs hearing to examine the Semiannual Monetary Policy Report to Congress, Thursday, July 15, 2021, on Capitol Hill in Washington. (AP Photo/Jose Luis Magana)

The Fed’s first monetary policy move would impact the central bank’s quantitative easing program, with asset purchases still taking place at a rate of $120 billion per month. Powell’s discussions around these purchases have shifted throughout his recent public appearances, suggesting more serious consideration among FOMC members to announce the start of tapering. In April, for instance, Powell said the economy was “a long way from” achieving the Fed’s employment and inflation targets that would trigger a pivot to less accommodative monetary policy. But after the Fed’s June meeting, Powell said the economy was “still a ways off” from the central bank’s goals.

“Next week’s FOMC meeting should be less eventful than June’s hawkishly-perceived meeting. There will be no new interest rate forecasts ‘dots’ so attention will focus on the post-meeting statement and Chair Powell’s press conference,” JPMorgan economist Michael Feroli wrote in a note. “We believe the statement’s wording around asset purchases will be unchanged, but we expect that Powell will relate that the Committee discussed tapering again and that the economy is slowly getting closer to passing the ‘substantial further progress’ test to actually start tapering.

However, in the weeks since the Fed’s June meeting, more concerns arose around the Delta variant of the coronavirus, which triggered a sell-off in markets last week and which might increase monetary policymakers’ perceptions of the risks still present in the economy. At the same time, however, the risk that fast-rising inflation might need to be curbed with a monetary policy adjustment has also increased, with core consumer prices and producer prices each rising faster-than-expected in June.

But on net, the Fed is likely to maintain a wait-and-see approach before making any adjustments, according to Feroli.

“Powell’s mid-July Congressional testimony raised the prospect that the FOMC statement would introduce an asymmetric policy bias: standing prepared to adjust policy if the Fed ‘saw signs that the path of inflation or longer-term inflation expectations were moving materially and persistently beyond levels consistent with our goal,'” Feroli said. “Since that testimony the rise of the Delta variant has injected some downside growth risks into the outlook, and this should help the doves argue for retaining the current symmetric policy bias.”

Earnings Calendar

Monday: Lockheed Martin (LMT) before market open; Tesla (TSLA) after market close

Tuesday: Centene (CNC), UPS (UPS), 3M (MMM), SiriusXM Holdings (SIRI), Sherwin-Williams (SHW), General Electric (GE), Stanley Black & Decker (SWK), Polaris (PII), Waste Management Inc (WM), Boston Scientific Corp (BSX), JetBlue (JBLU), Fiserv (FISV), Raytheon Technologies (RTX), Invesco (IVZ), Lamb Weston Holdings (LW) before market open; Apple (AAPL), Starbucks (SBUX), Advanced Micro Devices (AMD), Alphabet (GOOGL), Teladoc Health (TDOC), Visa (V), Microsoft (MSFT), Mondelez International (MDLZ), Juniper Networks (JNPR), The Cheesecake Factory (CAKE) after market close

Wednesday: Humana (HUM), CME Group (CME), Pfizer (PFE), McDonald’s (MCD), Six Flags Entertainment (SIX), Boeing (BA), Moody’s Corp (MCO), General Dynamics Corp (GD), Teledyne Technologies (TDY), Bristol-Myers Squibb (BMY) before market open; Facebook (FB), Ford (F), Xilinx (XLNX), PayPal (PYPL), ServiceNow (NOW), Lam Research Corp (LRCX), Align Technology (ALGN) after market close

Thursday: Merck & Co (MRK), Intercontinental Exchange (ICE), T Rowe Price Group (TROW), Comcast Corp (CMCSA), Spirit Airlines (SAVE), Valero Energy (VLO), Hilton Worldwide Holdings (HLT), The Carlyle Group (CG), Mastercard (MA), Molson Coors Beverage Co (TAP), Keurig Dr. Pepper (KDP), Yum! Brands (YUM), PG&E (PCG), Citrix Systems (CTXS), S&P Global Inc (SPGI) before market open; Amazon (AMZN), Overstock.com (OSTK), Albertsons Co (ACI), Altria Group (MO), T-Mobile (TMUS), World Wrestling Entertainment (WWE), Twilio (TWLO), Pinterest (PINS), Mohawk Industries (MHK), Upwork (UPWK), Skyworks Solutions (SWKS), United States Steel (X), Gilead Sciences (GILD),

Friday: Caterpillar (CAT), VF Corp (VFC), Exxon Mobil Corp (XOM), Chevron Corp (CVX), Danimer Scientific (DNMR), Procter & Gamble (PG), AbbVie (ABBV), Charter Communications (CHTR) before market open

Economic Calendar

Monday: New home sales, month-on-month, June (4.0% expected, -5.9% in May); Dallas Fed Manufacturing Activity Index, July (32.3 expected, 31.1 in June)

Tuesday: Durable goods orders, June preliminary (2.0% expected, 2.3% in May); Durable goods orders excluding transportation, June preliminary (0.8% expected, 0.3% in May); Non-defense capital goods orders excluding aircraft, June preliminary (0.8% expected, 0.1% in May); Non-defense capital goods shipments excluding aircraft, June preliminary (0.8% expected, 1.1% in May); FHFA House Price Index, month-on-month, May (1.6% expected, 1.8% in April); S&P CoreLogic Case-Shiller 20-City Composite Index, month-on-month, May (1.50% expected, 1.62% in April); S&P CoreLogic Case-Shiller 20-City Composite Index, year-on-year, May (16.20% expected, 14.88% in April); Conference Board Consumer Confidence, July (124.0 expected, 127.3 in June); Richmond Federal Reserve Manufacturing Index, July (20 expected, 22 in June)

Wednesday: MBA Mortgage Applications, week ended July 23 (-4.0% during prior week); Advance Goods Trade Balance, June (-$88.0 billion expected, -$88.1 billion in May); Wholesale Inventories, month-on-month, June preliminary (1.1% expected, 1.3% in May); FOMC Monetary Policy Decision

Thursday: Initial jobless claims, week ended July 24 (380,000 expected, 419,000 during prior week); Continuing claims, week ended July 17 (3.192 million expected, 3.236 million during prior week; GDP annualized, quarter-on-quarter, second quarter (8.5% expected, 6.4% in first quarter); Personal consumption, second quarter (10.5% expected, 11.4% in first quarter); Core personal consumption expenditures, quarter-over-quarter, second quarter (6.0% expected, 2.5% in first quarter); Pending home sales, month-on-month, June (0.5% expected, 8.0% in May)

Friday: Personal income, June (-0.4% expected, -2.0% in May); Personal spending, June (0.7% expected, 0.0% in May); PCE deflator, month-on-month, June (0.6% expected, 0.4% in May); PCE deflator, year-on-year, June (4.0% expected, 3.9% in May); PCE core deflator, month-on-month, June (0.6% expected, 0.4% in May); PCE core deflator, year-on-year, June (3.7% expected, 3.4% in May); University of Michigan Sentiment, July final (80.8 expected, 80.8 in prior print)

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Read more from Emily:

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit

0 notes

Link

Samsung released the Galaxy S21-series in January, just three months after Apple’s iPhone 12 lineup arrived. Considering these phones can cost as much as $1,200 (depending on which model is purchased), it is worth taking a moment to question which type of smartphone will best stand the test of time and provide longer-lasting value.

A recent analysis of buyback costs showed that the iPhone retains its value nearly twice as well as an Android phone during the first two years, though that began to level out after owning the device for four years. Samsung’s phones were not exempt from the quick drop in resale value that affects other Android devices. However, understanding the value of a phone has more complexity than simply the amount that can be recovered when it’s time to upgrade. For some, a used phone won’t be resold, but instead retained as a back-up phone, gifted to someone else or even recycled.

Related: How To Take A Screenshot On Samsung's Galaxy S2

When deciding how long a smartphone is useful, considering how long the current level of technology will meet the owner’s needs, both hardware and software, is important. Apple and Samsung are top-tier manufacturers, so every component will be very good quality and will serve most users well for at least one year or two. However, considering long-term needs can shine a light on details that may be lacking and inspire an earlier upgrade to a new phone. For example, a processor that is sufficient for current apps may feel strained if something new comes out and demands greater performance. Smartphones are already capable of good quality gaming and fairly proficient with augmented reality, but the limits will continue to be pushed by developers. Having a fast CPU, GPU and neural processor are therefore important. Both the iPhone 12 with its A14 chip and the Galaxy S21 with the Qualcomm Snapdragon 888 have users covered with blazing fast speeds that should stand up well over time.

When it comes to cameras, Samsung has an edge in telephoto, so if a sudden interest in bird photography were to arise in the next year, an iPhone owner would find themselves wishing for more range. Samsung can literally take photos of moon craters with its 110-times Space Zoom, though they are a bit noisy. The very best Apple camera has a 2.5-times zoom. Each offers varying levels of storage topping out at 512-gigabytes, so planning ahead for what is needed will help increase the lifespan of a phone.

The operating system (OS) is a critical part of any computer technology and smartphones are mobile computers. Regular updates to the OS maintain compatibility with new apps and resolve newly discovered errors. More importantly, OS patches may come frequently to protect the security of the device and the privacy of the owner. Samsung has a good policy that provides updates for new phones for three years. This is fairly standard in the smartphone industry. Apple goes beyond, currently offering its newest iOS 14.4 to iPhone models as old as the first generation iPhone 6S, which launched in 2015, so that is over 5 years of support. For those likely to update within three years, the difference may not matter, but the Apple device will remain usable by the original owner (or others) for longer.

Another measure of long-term value is durability. Apple engineered a new type of glass, Ceramic Shield for the iPhone 12 which it claims is the toughest smartphone glass in terms of drop resistance. Samsung’s Galaxy S21 uses Gorilla Glass Victus, the best available for Android devices and it can withstand drops better than the previous generation. In real-world drop tests both prove to be quite durable. When it comes to water resistance, Apple again claims better performance with the iPhone 12 capable of withstanding being submerged to a depth of six meters for half an hour. The Galaxy S21 is rated at 1.5 meters for the same duration. This means either phone should be able to survive use in the rain and accidental drops into the sink or even a shallow pool or stream. The iPhone may actually withstand a drop into the deep end of the pool or near the edge of a lake. As a measure of durability, Apple has a slight edge for anyone spending a good amount of time around water.

Both Samsung and Apple make among the best phones in the world, so opting for a device from either company will likely serve the user well over a long period. However, knowing some of the longevity concerns in advance can help to make the next purchase decision between Samsung and Apple phones a little easier.

Next: Galaxy S21 Vs. iPhone 12: Is Samsung Or Apple Best For Mobile Gaming?

Source: Samsung, Apple

Galaxy S21 Vs. iPhone 12: Which Phone Is A Better Long-Term Purchase? from https://ift.tt/2MZiGSG

0 notes

Text

Why Peoples Go For iPhone Rather Than Smartphone?

I also have both smartphone and iPhone when someone ask me which phone to buy than without any thinking I will recommend iPhone over Android. Then people ask why?

Firstly I want to confess that I like Android phones as their looks, software updates and camera quality is awesome and I love all of these features. When someone asks me about Android phone then my mind diverts toward the One Plus 7 pro, Google Pixel 3 as these are considered as the best phone of the era with awesome look, fast processing, best camera quality if anyone go for android then these are the best choice but there are a few reasons that come to mind while buying a new phone.

As the first thing the iPhone beats a Smartphone in many ways. Let's have a look at all the major obstacle :

Camera : Nowadays there are many phones available in the market with the best cameras like 48 MP back camera 20 MP front camera but everybody knows very well whether you put a 100 MP camera in your smartphone the iPhone has the best camera quality.

Quality : I am not saying smartphones don't have better quality but some of the brand don’t use best quality as compare with iPhone. iPhone are well built well designed as the all the accessories are of premium quality.

Performance : Some people have a problem with my this point but I use both the phones I have old iPhone 5 s and a new Red-mi Note 7 s when we compare the performance my old iPhone work best without any lag issue as compare the android phone it will get stuck so many times while playing a game.

App Store : Both the phones mostly have the same apps but if any new app first launches in the market then it is first uploaded in iPhone rather than Smartphones.

Updates : Here an iPhone will win the race. As some smartphones are struggling in the market for the latest up date while an iPhone that is almost 3 years old will get the latest update IOS 11.

Selling : When the things comes to selling a Phone for cash . The Smartphone don’t get enough worth on investment while if you want to sell iPhone for cash everyone is ready to buy it. As there are many websites where you can sell iPhone for cash & get the best price.

Security : IOS is a closed source operating system hence no application will directly interact with operating system without any permission. As IOS is built for every specific supported phone whereas smartphone is universal no data gets safe in the smartphone.

As if you want to sell iPhone for cash then there are so many options available online where you can sell your device and get some money but what you get is not actual worth of your device so I want to share one website where you can sell your old devices like mobile phones, tablets and iPod and get the actual worth of your devices. Device Traders compare the whole market to give you the best price guarantee buyback offer.

Hence the main conclusion is that an iPhone beats a smartphone in so many ways . Therefore iPhone is considered as the best option to buy.

#Trade-in Cell Phones#sell iphone for cash#Sell Your Used iPhone#Trade In your iPhone for Cash#Device Traders

0 notes

Text

Restaurant POS Software India-An Analysis

Point of sales computer software is evolving quickly. A web-based version of POS interface has taken the place of the previous complicated computer software that won't to run on systems put in at user's finish. The new fashionable, throw and less complicated POS versions have given a whole makeover to shopper retail stores. These are accessible through hand-held net devices like - smartphones, iPhones or IPads and therefore, permit businesses to travel mobile.As compared to the normal, awkward and overpriced POS systems web-based versions are lighter, transportable and supply value blessings. As a result, smaller retailers are step by step moving removed from the normal versions and paving the approach for wider acceptance of hosted purpose of sales computer software solutions.

Adoption of cloud has freed enterprise applications from complicated hardware and computer software necessities. Software-as-a-service resolution suppliers supply enterprise applications hosted somewhere in cloud which will be accessed on the systems at 'users' end' via net. Users will directly transfer the applying on on-line browser and begin victimization it - permitting your brick and mortar business to travel online.The online version permits users to store all client data at one place and conjointly conduct business from it. After you have client details keep at one place you'll be able to bank thereon in building a personalised relationship along with your shoppers and drive in additional business. Moreover, it's a better approach towards conserving your business's valuable material, i.e. customer. Restaurant POS system store client data furthermore as integrates the rear workplace with the front table for sleek functioning.Single user interface: You not have to be compelled to do the disport in taking orders, receiving payments, returning balances etc. of these currently are often taken care of from the purpose of sales interface of your restaurant. A restaurant POS system might have functionalities like self service interface, menu, multiple menus, client receipts, bar tab, MasterCard process, item modifications and deletion, promos/buybacks/coupons and additional.

Accessibility: The web-based POS is accessible on application program and is intended to supply additional interactive interface. HTML5 enabled purpose of point of sale software is visually enriched, fast, interactive and even intuitive. Further, these supply knowledge storing and sharing facilities on cloud.No hardware requirements: In contrast to the normal inflexible POS systems, that needed plenty of hardware modifications, on-line POS systems are offered on net browsers. The hardware necessities are ordinarily taken care of by the service supplier.Upgrades: Since cloud POS is obtainable as computer software as a service the system in maintained and managed by the third-part service supplier. Ordinarily the service supplier takes the initiative in upgrading the versions of the applying time-to-time and created those offered to users.Easy pay-for-use: Web-based POS do not lock you into a binding contract along with your service supplier and therefore, don't demand immense direct investment. On-line purpose of sales application is versatile and therefore the users are needed to pay just for their usage. it's additional sort of a partnership model and therefore the user will cancel the agreement anytime if he's not pleased with the services.

0 notes

Text

Five Technology Stocks With High-Yielding Dividends

Although technology stocks aren't known for their dividend prowess, there are several companies that pay above-average yields. We’ve tracked down five tech sector players with attractive yields and other value metrics that are worth considering. You can see a quick summary in the chart below (values were calculated as of the time of this writing).

Source: Company earnings reports, Yahoo Finance.

Microsoft Inc. (NASDAQ: MSFT)

Dividend Yield: 1.64% ($1.84 per share) Dividend Growth: 15 years Last November, Microsoft briefly surpassed Apple and Amazon as Wall Street’s most valuable company – a title it hadn’t held in 15 years. Though short-lived, Microsoft’s market cap superiority reflected the company’s resurgence under the direction of Satya Nadella. The software giant has become a major player in the cloud computing market, with its Azure platform generating massive growth in recent years. For the second straight quarter, Azure’s revenue grew 76%. The company’s “Intelligent Cloud” category as a whole booked $9.4 billion in sales, up 20%. Microsoft’s dividend yield is much higher than the tech sector average of 0.99%. Double-digit revenue growth, favourable PE ratios relative to its peers and an expanding cloud/blockchain presence make Microsoft a solid opportunity.

Qualcomm Inc. (NASDAQ: QCOM)

Dividend Yield: 4.59% ($2.53 per share) Dividend Growth: 8 years When it comes to big tech dividends, very few companies measure up to Qualcomm. At 4.59%, Qualcomm’s dividend yield has essentially quadrupled over the past decade. The multinational semiconductor giant distributes roughly two-thirds of its earnings as dividends, guaranteeing high quarterly payouts but likely sacrificing future growth in the process. In its most recent quarter, Qualcomm posted better than expected earnings but said revenues fell short of estimates. Despite the mixed results, the company issued positive guidance on its fiscal second-quarter, where it expects to earn between $0.65 and $0.75 per share on a revenue range of $4.4 billion to $5.2 billion.

ASML Holding N.V. (NASDAQ: ASML)

Dividend Yield: 1.09% ($1.99 per share) Dividend Growth: 3 years Investors on the prowl for high growth and above-average yield will find ASML Holdings an attractive bet. The European semiconductor company has grown its dividend for the last three years, including a 50% spike in 2018. Over the past ten years, ASML payouts have increased tenfold. In 2018, AMSL benefited from strong revenue growth, better than expected earnings and a payout ratio of less than 30%. Combined with rising gross margin and large buyback activity, ASML looks poised to offer greater value in the near term. Share prices have also outperformed the Nasdaq over the past five years.

Verizon Communications (NYSE: VZ)

Dividend Yield: 4.29% ($2.39 per share) Dividend Growth: 12 years Verizon Communications fell out of favour with some investors last quarter after the company took a $4.6 billion write-down due to its underperforming “Oath” media unit. Still, that wasn’t enough for income investors to turn their back on the telecommunications giant. After all, VZ’s dividend yield is more than four times higher than the technology sector average. Although the company missed analysts’ fourth-quarter revenue target, it posted a 30% surge in adjusted net profits. Verizon also surprised where it matters most: wireless subscribers. In Q4 alone, the company added 1.2 million wireless net retail postpaid subscribers thanks to a variety of cost-cutting initiatives. The mobile shift to 5G technology – something Verizon has marketed heavily in recent years – will likely play into the company’s hands moving forward.

Apple Inc. (NASDAQ: AAPL)

Dividend Yield: 1.67% ($2.93 per share) Dividend Growth: 6 years Apple may have admitted it has a big China problem after smartphones sales in the world’s second-largest economy slowed, but there’s no denying its emerging status as a major dividend player. The iPhone maker has grown its dividend in each of the last six years while keeping its payout ratio at less than a quarter of net income. Relative to earnings, Apple’s stock price is inexpensive. It’s even more of a bargain when you strip out the $130 billion in excess cash (doing so reduces the company’s PE ratio to 11.5 from 14.2 presently). Aggressive share buyback plans and continued profitability should lead to higher dividends for the foreseeable future. While China continues to offer strong headwinds, a reprieve in the form of a new free trade agreement with the United States is likely coming. The Wall Street Journal reported Sunday that a new trade deal looks imminent after both sides made a number of concessions on tariffs and protected industries. That optimism may trickle down to Apple in subsequent quarters. Read the full article

0 notes

Text

Apple: Beware The January Curse

New Post has been published on http://cyberspace2k.com/apple-beware-the-january-curse/

Apple: Beware The January Curse

Negative Media Coverage Is Not Something To Be Trivialized

It was only in August when Apple Inc. (AAPL) became the first company in history to claim a trillion dollars in market capitalization. Up until early November, Apple retained its trillion-dollar status. However, weeks of correction has brought the market cap down to around $784 billion. It’s still a huge sum no doubt but there’s no hiding the fact that hundreds of billions of dollars evaporated.

Source: YouTube screengrab

Recently, the humiliation has been exacerbated as the media rubbed salt on investors’ wounds by harping the fact that for the first time in eight years, the market cap of Microsoft Corp. (MSFT) surpassed that of Apple’s. News outlets around the world rushed to highlight the misfortune.

Source: FastCompany

Source: Forbes

In the past few trading days, the gap has widened. Given the prevalence of algorithmic trading, it is possible that such negative media coverage has had a damaging impact on the share price of Apple.

MSFT Market Cap data by YCharts

There have been studies reflecting the domination of algorithmic trading in recent years. By 2012, the percentage of algorithmic trading had reached 85 percent, representing the lion’s share of market volume, according to certain sources. High-Frequency Trading (“HFT”), a branch of algorithmic trading, was estimated to account for more than half of all equity trades. HFT relies on pre-programmed software to look for certain keywords or data and execute trades based on the triggered trading strategies, all happening in milliseconds. There are no hard feelings as humans are usually not involved in real-time.

Source: Rick Verheggen

The Typical ‘iPhone Production Slowdown’ Rumors To Happen In January?

Unfortunately, regardless of the long-term prospects of Apple, the drag on the investors’ sentiment on Apple would result in a near-term weakness in its share price. What’s concerning for shareholders is that next month, there is the possibility that rumors of iPhone production slowdown return with a vengeance. The following snapshot of an article from MarketWatch sums up the issue succinctly.

Source: MarketWatch

The bugbear for Apple management must be the perennial ‘iPhone sales/production slowdown’ speculations that seem to recur sometime in January every year. A Google (NASDAQ:GOOG) (NASDAQ:GOOGL) search with the keywords ‘iPhone sales slowdown’ for news around late January turns up plenty of news articles regarding the topic (see the following snapshot).

It could be supplier guidance or comments from analysts with regards to their iPhone shipment estimates. Whatever the case, to dismiss the rumors for what they are would be ignoring the consequence to the share price. This year, the iPhone company saw its share price slumped around 10 percent over the period when the sales/production slowdown topic was trending. A 10 percent drop means a loss of $78 billion in market cap based on the current level and around $100 billion if Apple regains its ‘trillion-dollar’ crown by then. This is certainly not a trivial amount.

AAPL data by YCharts

Value Destruction With Ill-Timed Buybacks?

Thanks partly to the generous Republican tax cuts, listed companies have launched aggressive share buyback programs this year. The passage of the Tax Cuts and Jobs Act dubbed the Trump Tax Reforms last December resulted in the reduction of the statutory business tax rate from 35 percent to 21 percent and granted companies a limited period reprieve on returning foreign cash holdings to the United States.

The five US tech companies with the largest cash piles – Apple, Alphabet, Cisco (CSCO), Microsoft and Oracle (ORCL) – spent more than $115 billion in the first three quarters on buying back their own stock. For Apple, in particular, the company kept up with its share repurchase even as its share price climbed to a record. On a trailing twelve-month basis, Apple stock buybacks jumped to $72.07 billion, more than doubling the around $30 billion level in the prior year.

While it, of course, took more money to repurchase a single share as the price went higher, it should be noted that there was an acceleration in the share repurchase at the same time. In the process, the outstanding share count is reduced to 4.7 billion.

AAPL data by YCharts

‘No one can accurately foresee the bottom’ is the common excuse for retail investors who bought into a stock only to see the share price go below the buy price. The next best alternative is probably ‘I bought it with a long-term perspective’. Should we hold the management to a higher standard when they execute share buybacks? After all, don’t they have a better understanding of the demand for their products? Otherwise, shouldn’t we be worried?

With the apparently ill-timed buybacks, Apple executives might have disappointed shareholders due to the fewer shares the company repurchased when the price was near the peak. This raised the question if the management had been over-confident of the iPhone demand. To what extent should we rely on their guidance then?

Are Analysts Similarly Over-Confident?

I believe avid Seeking Alpha readers are familiar with the General Electric (GE) story the past two years. We have seen how the analyst price targets keep chasing the share price downwards.

GE data by YCharts

Now, I don’t mean to imply that Apple will follow in the footstep of GE. Instead, I question whether analysts will continue to revise their price targets on Apple downwards in response to the large disparity with the prevailing share price, a typical phenomenon. If that happens, what follows is perhaps a vicious cycle where market sentiment turns more bearish, the share price falls further and necessitating more price target cuts. ‘Low’ P/E ratio is not the perfect answer to whether the share price has appreciation potential or not, as Micron Technology (MU) shareholders are well aware of.

AAPL data by YCharts

Investor Takeaway

An article from MarketWatch noted how news related to a slowdown in iPhone sales or production tend to crop up every year in January. There is no guarantee that the phenomenon will recur in 2019 but when it does, Apple share price could take a hit like it did in the past.

The apparent ill-timed share buybacks by Apple hint of an over-confident management or a misjudgment of the demand of iPhones. Either way, that doesn’t give much confidence to the market in terms of their future guidance. Besides the destruction of value from the shares purchased at peak prices, the disappointment comes from knowing that Apple executives seemed no better at predicting the fortunes of their company. What else do we expect from the analysts?

I asked in November whether it’s time to revisit the bullish thesis for Apple. At that time, Apple share price was still trading above $200. I received plenty of brickbats in the comments section ostensibly from those who long the stock. I harbor no ill will against Apple shareholders. I wish to reiterate my earlier suggestion that shareholders consider strategies to limit their downside given the potential headwinds and the one-off nature of several catalysts which pushed up the stock prices previously.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AAPL, GOOG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Apple: Beware The January Curse

New Post has been published on http://cyberspace2k.com/apple-beware-the-january-curse/

Apple: Beware The January Curse

Negative Media Coverage Is Not Something To Be Trivialized

It was only in August when Apple Inc. (AAPL) became the first company in history to claim a trillion dollars in market capitalization. Up until early November, Apple retained its trillion-dollar status. However, weeks of correction has brought the market cap down to around $784 billion. It’s still a huge sum no doubt but there’s no hiding the fact that hundreds of billions of dollars evaporated.

Source: YouTube screengrab

Recently, the humiliation has been exacerbated as the media rubbed salt on investors’ wounds by harping the fact that for the first time in eight years, the market cap of Microsoft Corp. (MSFT) surpassed that of Apple’s. News outlets around the world rushed to highlight the misfortune.

Source: FastCompany

Source: Forbes

In the past few trading days, the gap has widened. Given the prevalence of algorithmic trading, it is possible that such negative media coverage has had a damaging impact on the share price of Apple.

MSFT Market Cap data by YCharts

There have been studies reflecting the domination of algorithmic trading in recent years. By 2012, the percentage of algorithmic trading had reached 85 percent, representing the lion’s share of market volume, according to certain sources. High-Frequency Trading (“HFT”), a branch of algorithmic trading, was estimated to account for more than half of all equity trades. HFT relies on pre-programmed software to look for certain keywords or data and execute trades based on the triggered trading strategies, all happening in milliseconds. There are no hard feelings as humans are usually not involved in real-time.

Source: Rick Verheggen

The Typical ‘iPhone Production Slowdown’ Rumors To Happen In January?

Unfortunately, regardless of the long-term prospects of Apple, the drag on the investors’ sentiment on Apple would result in a near-term weakness in its share price. What’s concerning for shareholders is that next month, there is the possibility that rumors of iPhone production slowdown return with a vengeance. The following snapshot of an article from MarketWatch sums up the issue succinctly.

Source: MarketWatch

The bugbear for Apple management must be the perennial ‘iPhone sales/production slowdown’ speculations that seem to recur sometime in January every year. A Google (NASDAQ:GOOG) (NASDAQ:GOOGL) search with the keywords ‘iPhone sales slowdown’ for news around late January turns up plenty of news articles regarding the topic (see the following snapshot).