#itll save me a lot of stress in the future i think...

Explore tagged Tumblr posts

Text

Doing some more work on the comic viewer since I haven't worked on it for a few months :] I think it's coming along nicely! I'm not entirely sure what else I'm gonna add to it yet. The transcript system is a lil different than the one that the SC pages have and it's a little wonky so I'm thinking of altering it a bit but I'm not entirely sure how I'm gonna do that yet... We'll see.

#as of rn the transcripts are just collapsible tabs on each update but I'm gonna see if i can find a way to make it a little more-#-user friendly. i have a few ideas but i havent actually tested them at all yet so i guess we'll just have to see what i can do...#bootstrap is making this entire process a LOT easier#ill just have to see how i can make it a little more efficient. idk yet#right now my code is pretty complex and clunky and I'd like to reduce its complexity if i can#itll save me a lot of stress in the future i think...#text#btw i make posts like this bc this is currently a development blog!

30 notes

·

View notes

Text

Ep. 2: “iF yOu SeE a VoLcAnO wHy NoT jUmP oVeR iT” - Marie

Marie

Fuckin volcano

Felix

I feel secure because Charlie is going to be the one to go. I just know it. If we go to tribal that is. They have barely spoken and I don't know them too well. Might be the same for everyone else here

Marie

Still salty bout the goddamn volcano

Marie

iF yOu SeE a VoLcAnO wHy NoT jUmP oVeR iT

Flint

I am really enjoying the banter with Jay and our tribe. Having a great time with this immunity challenge and chatting with Joey and Felix. Wish the other tribe mates were as active.

Brianna

Ya know coming into this competition i didn’t expect it to be me and Bradley as the last two people representing our team. I guess he’s gonna be more active now since his busy week is over so that’s swell but like. God I really wanna sleep.

Felix

To sum up, I feel like I am getting a deeper bond with Flint and Joey. They seem to be willing to talk with me most often. So, even if we do go to tribal I am safe for the most part. I just feel like I am liked in the tribe. Also, I am the one putting in the most work for the tribe, so I have that going for me. I just feel safe because of the work I have put in, but I don't want to give up just yet. If I can avoid tribal, then I will. According to both Joey and Flint, Suzy and Charlie have been very inactive. Therefore, it will be them on the chopping block come time for tribal. Joey thinks Charlie is more inactive whereas Flint thinks Suzy is more inactive. It'll just come down to what Cassie and I feel in the end. Doesn't hurt us either way since I think they are the weakest links on our tribe, especially Charlie. I don't think she put in enough effort last immunity challenge. Plus, she was totally inactive for this challenge that she auto-lost. Cassie missed this challenge too, but she at least did really well last challenge. If we go to tribal, I think I would vote for Charlie in the end since they are the person I feel least closest to. If only Bradley dropped, I could win this challenge for my tribe and cement my place as a valuable asset.

Lysandre

I am SO SORRY GIGI! I thought you were a returnee so I decided to snap! The comment looked pretty mean compared to the others, which it was. The tribe, Marie and Kathleen, was wondering who said the mean comment and they believed it was David. I said yeah I think it was him as well. I love accidently painting a target in him and being a rat child.

Lysandre

Ok so I completely missed the challenge! I had no idea it was going to start early and I was at ine of ny sibling's events. I'm rooting for my team and hoping that my absence doesn't paint a target on my back. Also! I am loving being Lysandre! The writer in me is having a field day because I get to create a character and their background, quirks, and personality BUT THEN I GET TO BECOME THEM.

Flint

I couldn't outlast that second Immunity challenge. It was fun but my body couldn't carry on. I hope that Felix can pull through for Tuai! If we have to go to tribal I think it will be an easy vote, for me at least. I think that Cassie or Suzy should go. Cassie hasn't shown much initiative as our leader and Suzy isn't very social.

Bradley

This challenge is taking forever. Im the last one for my tribe. I dont want to lose cuz itll suck and havent been on that much so my soical game isnt too strong either. I just want to beat one tribe.

Cassie

I'm so proud of Felix for sticking it out for the tribe so that we don't have to go to tribal tonight. Plus we still have the numbers advantage, so that is always a positive.

Flint

So relieved we won immunity again! The Tuai tribe is unstoppable so look out! I'm a little jealous that Felix won an advantage but he deserves it and maybe with some buttering up he'll share the information with me.

Felix

Can you believe I have done THAT! I single-handedly won this challenge for my tribe, and got an advantage on top of that. I know why Raul and Kathleen gave it to me, though. If I won and people knew I had an advantage, I would have a big target on my back. It does seem that Kathleen and Raul are working together, so I have to watch out for them. Whether I tell this to anyone on my tribe is a different matter entirely. Though they all know I have an advantage. I think I won't be seen as a threat until later on in the game. I'm still an asset to them though this early on so I hope I would stay if we had to go to tribal in this stage of the game.

Raul

I really did not think I was gonna be able to compete but I got back into it was in the last 2 of our tribe. When it came down to 4 of us 2vs1vs1 we knew we needed to just knock out Bradley and he did that to himself. The best thing to come out was that Kathleen and I grew together plus I'm pretty sure I know the identity of Kathleen which helps cause I love this person. Also there was a individual advantage to be won and Felix had 0 while Kathleen and I had 2. Kathleen and I had decided that Felix could have it but try to work a little magic and make a relationship with him and a deal to work together if the opportunity arose. My smart self realized that that if we just gave it to him it would be announced we made a deal, so I said we continue the comp and just throw it that way it wouldn't be revealed what we were actually doing. This way it keeps this threesome possibility a secret. Whether it remains one or not we shall see. At the very least we aren't going to tribal. Hoorah, 1 point Raul the Snake 0 points survivor gods . . .

Kathleen

"Ohhhh bitch this ones gonna be different from my last one.

David? Trash. Will 100% be the one to go next tribal we go to if I have anything to say about it.

Marie? The sweetest and most opinionated 13 year old I’ve ever met. We love a politically aware teen.

Lysandre? *insert that lady Gaga gif of her going ‘gorgeous, amazing incredible’ ect*

And Raul? I’m sooo glad we were the last two left in the immunity challenge. We bonded AND made an underhanded deal with someone from another tribe. Can you say icons?

Hotel? Trivago."

Bradley

I could still potentially be going home. Since someone brought up the fact that they all talked how they havent talked to me a lot. They do appreciate me doing really well in the challenge and i have Apollo and Brianna wanting to work with me each separately. So hopefully i can avoid being voted off this round and just work on more social connections with them all.

Suzy

love felix but lowkey what if they are doing this for everyone

Boris

"Hello im STRESSED. I went from feeling like im in a comfortable position on the tribe, to the absolute bottom just in one day. Being forced to sit out of the challenge really fucked me up. I feel like the tribe is low-key bitter at me.

And on top of that. We have less than 12 hours to vote someone out. And NO ONE is really talking game to me. Im so nervous. The only person I connect with on a game level is Apollo. I have no idea where the tribe is leaning, but I have a sinking feeling its me.

God I hope im wrong and just insanely paranoid. "

Boris

"IN HAPPIER NEWS. I finally got something GOOD in the idol hunt? And it could be game changing!!!

I found 1 half of a super idol. It can't help me tonight but its leverage, and a super idol is the most powerful thing in the game, it could literally save my life in the future of the game. All i have to do is survive tonight, if I have to use the super idol piece as leverage, I will. "

Felix

I think the advantage is less about doing someone on the other tribe a favor. I'm telling everyone about it because, if I do that, it garners trust because they know I'll be open with them about any advantages I have. Plus, it wouldn't hurt to tell the truth to gain trust. The extra vote could also get me an ally on the other side. Let's see if this plays out like I hope it does.

David

Everyone is nice which makes it hard to decide who to vote off. Performance in the next challenge will base my vote and probably others.

Felix

I think my plan is working. Cassie offered me an alliance with her and Flint. I think those two are really cool so I think working with them is in my best interest. Also, I have connections with Mea through Raul and Kathleen. Hopefully, since I'm giving an extra vote to Bradley, I can gain a connection with him despite not having met him. I hope this plays out well! My social game seems to be climbing!

Felix

I have made my first alliance in this game! It's the Tuai Quad Alliance, LLC featuring Cassie, Joey, Flint, and I. It's basically everyone I wanted to work with since the beginning of the game! I think I have found myself in a good position on this tribe. To be honest, I'd like to see Charlie go first, but we'll see how this all pans out. I'm glad I finally have a security blanket though. Hurray for a good social game!

Cassie

I love being a part of the Tuai tribe and was happy to become the leader. Despite liking all of my tribemates, I've become part of an alliance. We're calling it the TQA, LLC. Maybe someday that can be trademarked, hehe. But the Tuai Quad power is strong with Felix, Flint, Joey, and myself.

Brianna

Well. We lost the challenge. I made a pact with Bradley that we should stick together since we were the last two people left in the challenge. I also talked to Apollo and Boris. I seem to be close to them. Boris mentioned making an alliance with me, him, Bradley, and Apollo and I would be totes down for that. So. Guess this will be pretty simple hopefully

Zest

I just cast my first vote and it was wild. I didn't know what to expect going in to tribal. I hope no one blindsides me because I am really getting invested in this game. I think while my performance in the last challange wasn't the greatest, I can still be a strong social player. Not sure if I'm feeling like Parvati or Hannah Shapiro. I need another few weeks to find out what kind of player I am going to be.

Charlie

I feel so bad for missing the challenge but once again not much new is happening.

Boris

"I have been putting in WERK todah to make sure I'm in the best possible position going into tonight.

I first was talking to Brianna, and she mentioned the only people she didnt wanna vote was me, Apollo, and Bradley. So, naturally, when presented with a majority of the tribe, I suggest an alliance! Ofc she agrees hehe, so now thats in the works.

On my tribe, the most likable people and those I get along with/vibe the most with is Apollo and Zest. I approach them both and plant that seed, another alliance of just us three forms. Im SO excited to be working with them, we bounce off each other really well and I truly think we can go to the end together.

So yeah, even tho I was worried this morning I think I placed myself in a near perfect position. I really don't think theres any way I leave tonight. "

Joey

unfortunately, i wasn’t the best in the challenge but at least i showed up! i was invited in by cassie to an alliance with her felix and flint, but it was obvious i was the last one asked. i plan on being loyal, but i need to let cassie play leader while i get closer with felix. slow and steady.

Thomas M

Not much, Bradley did well on the challenge but unfortunately we are in the bottom. Have been preoccupied with a big assignment so have not gotten to fully experience things in the last round at least. Am nervous of who is going to get booted, excited to see what's to come!

Marie

Wow, idol hunt hates me

Apollo

We lost, I feel like I’m getting played though, if this is the last you’ve seen of Apollo, it’s been a great run!

Brianna

I’m really laughing over Thomas’ first message to me after we lost 30 minutes before tribal....like...it’s a little too late sorry bud

Bradley

It looks like the vote should be Thomas which Im fine with. And theres an alliance of Borris, Apollo, and Brianna who want to make a four person with me which makes me really happy. Started off rocky in this game but with challenge preformance actually helped me a lot.

Apollo

Borris and Apollo? “Name a more iconic duo”

1 note

·

View note

Photo

125 questions about me

i was tagged by @surreysimmer and @oasisable, lov u guys. the point of the tag is to create a simself w your traits and answer the questions!

i tag: @brndletonbae @vvindenburg and anyone else who hasnt done it yet!

my traits are dog lover, geek and hot-headed!

125 questions below the cut

1. what is your name? taylah

2. what is your nickname? tay

3. birthday? aug 30 1998

4. what is your favorite book series? the illuminae files by amie kaufman and jay kristoff

5. do you believe in aliens or ghosts? yessss

6. who is your favorite author? neal shusterman

7. what is your favorite radio station? i only use apple music

8. what is your favorite flavor of anything? raspberry flavour mhm

9. what word would you use often to describe something great or wonderful? incredible

10. what is your current favorite song? i literally have no idea

11. what is your favorite word? no clue

12. what was the last song you listened to? i can hear my mother listening to abba downstairs

13. what tv show would you recommend for everybody to watch? brooklyn nine nine

14. what is your favorite movie to watch when you’re feeling down? mr beans holiday

15. do you play video games? yeeee, lately ive been playing detroit become human, the new spiderman game and gta v :-)

16. what is your biggest fear? CLOWNS

17. what is your best quality, in your opinion? im really empathetic

18. what is your worst quality, in your opinion? i can be an asshole

9. do you like cats or dogs better? dogs

20. what is your favorite season? winter

21. are you in a relationship? no

22. what is something you miss from your childhood? my dad,,,,,

23. who is your best friend? jacqui + kelsey and also jills + haley

24. what is your eye color? hazel

25. what is your hair color? black

26. who is someone you love? my dog

27. who is someone you trust? see q.23

28. who is someone you think about often? my dad

29. are you currently excited about/for something? christmas

30. what is your biggest obsession? i develop fixations real fast u could ask me my biggest obsession and itll change in 2 days

31. what was your favorite tv show as a child? probably zoey-101 or smth like that

32. who of the opposite gender can you tell anything to, if anyone? bold of q.32 to assume i trust people

33. are you superstitious? yeah

34. do you have any unusual phobias? broken glass

35. do you prefer to be in front of the camera or behind it? behind

36. what is your favorite hobby? watch netflix, game, work kkfbcuaajl

37. what was the last book you read? sadie by courtney summers

38. what was the last movie you watched? bohemian rhapsody

39. what musical instruments do you play, if any? none

40. what is your favorite animal? dogs, sloths and sharks

41. what are your top 5 favorite tumblr blogs that you follow? i cant narrow things down im indecisive

42. what superpower do you wish you had? invisibility

43. when and where do you feel most at peace? when i knock tf out and finally sleep kwbaubfdl but also when im home alone

44. what makes you smile? when someone laughs at my dumb jokes

45. what sports do you play, if any? this is so funny

46. what is your favorite drink? vanilla coke

47. when was the last time you wrote a hand-written letter or note to somebody? no clue

48. are you afraid of heights? kind of

49. what is your biggest pet peeve? when people dont listen

50. have you ever been to a concert? yeah

51. are you vegan/vegetarian? no but i want to be

52. when you were little, what did you want to be when you grew up? hotel manager

53. what fictional world would you like to live in? harry potter lmao

54. what is something you worry about? everything!!!!!

55. are you scared of the dark? not really

56. do you like to sing? like to yes, but i cant sing

57. have you ever skipped school? yes and i skip uni all the time im depressed

58. what is your favorite place on the planet? my bed

59. where would you like to live? anywhere but australia

60. do you have any pets? i have a fifi!! (a dog... she was gonna be in the photos with my simself but her breed isnt in the game so sad)

61. are you more of an early bird or a night owl? night owl

62. do you like sunrises or sunsets better? sunsets

63. do you know how to drive? yes

64. do you prefer earbuds or headphones? i call them earphones so no clue what the difference is

65. have you ever had braces? no

66. what is your favorite genre of music? literally anything

67. who is your hero? no clue

68. do you read comic books? i read graphic novels but not comic books

69. what makes you the most angry? rude people!!!!!

70. do you prefer to read on an electronic device or with a real book? both im not bothered

71. what is your favorite subject in school? rn i love my social science classes

72. do you have any siblings? 4 brothers 2 sisters

73. what was the last thing you bought? gta v

74. how tall are you? 5′4 / 163cm

75. can you cook? yeah

76. what are three things that you love? my friends, my family, my dog

77. what are three things that you hate? stress, rude opinionated people, people who ignore what you say

78. do you have more female friends or more male friends? female friends i dont talk to men besides my brother and my boss

79. what is your sexual orientation? lmaoooooooooo no idea atm ha

80. where do you currently live? australia

81. who was the last person you texted? sam

82. when was the last time you cried? the other night larbnlcbadj

83. who is your favorite youtuber? how ridiculous

84. do you like to take selfies? not really

85. what is your favorite app? tumblr

86. what is your relationship with your parent(s) like? pretty good but my mums a taurus so shes stubborn af

87. what is your favorite foreign accent? french

88. what is a place that you’ve never been to, but you want to visit? everywhere im stuck in the bottom of the globe someone save me

89. what is your favorite number? 7

90. can you juggle? no

91. are you religious? no

92. do you find outer space of the deep ocean to be more interesting? space!!! but both are interesting tbh

93. do you consider yourself to be a daredevil? no

94. are you allergic to anything? no but im lactose intolerant

95. can you curl your tongue? yes

96. can you wiggle your ears? no

97. how often do you admit that you were wrong about something? no im also stubborn af

98. do you prefer the forest or the beach? neither

99. what is your favorite piece of advice that anyone has ever given you? someone, the other day, told me im young with relatively little life experiences and that struggling with myself is okay and to not worry about the future idk this makes no sense with 0 context to what we were talking about but it helped a lot.

100. are you a good liar? depends i can tell my boss im sick and i cant work when im Depressed^tm just fine but i cant lie to a friend

101. what is your hogwarts house? slytherin

102. do you talk to yourself? yes rip

103. are you an introvert or an extrovert? bitta both

104. do you keep a journal/diary? i have a priv twitter acc where only 2 people follow me and i act like its my journal so close enough

105. do you believe in second chances? depends on the circumstances

106. if you found a wallet full of money on the ground, what would you do? turn it in

107. do you believe that people are capable of change? again depends

108. are you ticklish? oh yes

109. have you ever been on a plane? yes

110. do you have any piercings? i have my ears done twice, my helix and my nose

111. what fictional character do you wish was real? cress from tlc

112. do you have any tattoos? no

113. what is the best decision that you’ve made in your life so far? deciding to go to uni

114. do you believe in karma? yeee

115. do you wear glasses or contacts? glasses, contacts freak me out

116. do you want children? no, if i were to have kids id wanna adopt

117. who is the smartest person you know? no idea

118. what is your most embarrassing memory? anything from 2015/2016

119. have you ever pulled an all-nighter? yes

120. what colour are most of you clothes? black and grey

121. do you like adventures? depends

122. have you ever been on tv? no

123. how old are you? 20

124. what is your favorite movie quote? the gone girl monologue i wont quote it because its a SPOILER but its my fav

125. sweet or savory? sweet

#saviorhide#nonsims#tag#get to know me tag#also i have bangs and theres no decent cc with bangs that LOOKS LIKE MY HAIR#so deal w me still using grimcookies kathryn hair

22 notes

·

View notes

Text

now im watching last week’s ep of tco4 bc i havent had time to get to it yet and i need to take my mind off snzm

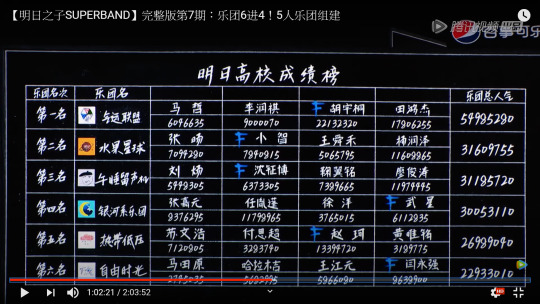

UGH its sad to hear xy, fsc and xiao huang talking about their rankings rip but their laughing makes it even more sad

UGH NOT FRUIT PLANET I REALLY LIKE THEMMMM sigh i gotta face the reality that theyre likely gonna get separated... but PLEASE AT LEAST SOMEONE SAVE XIAO ZHI PLEASE THATS ALL I ASK, im not gonna be greedy :(

oof i respect ma zhe saying that he doesnt want to win bc he recognizes other kids like FRUIT PLANET KIDS, zy and xiao zhi, are so skilled. he knows winning is just a numbers game and would not serve as proof of his skill. thats a tough place to be in, and it isnt uncommon but i think i rarely hear a contestant say it like that. “i dont want to win bc im not worthy” “i dont want to win bc i know im not as talented”

wow i was a little confused as to why they were doing these solo spotlights but actually this is really nice! its nice to see them really going hard at their strengths and really pouring their all in to show off a bit. it can be hard to do so in a group setting all the time, and really it reminds you that there a lot of really talented musicians among these kids. i think itll also be good to remind the kids who are picking later what the other kids’ skills are and what they’re capable of.

oh whoa i thought about there only being 2 bassists, i didnt realize there are only 2 pianists too

hm maybe im just biased but i thought xiao li’s playing was a litttleee bit cleaner than szb’s heheh but i respect that they attempted to even play a duet from across the room, thats a challenge

i respect muji’s playing

LOL why do xiao huang and zhao ke’s voices singing together sound so strange to me LOL

LOL switch to ljt’s group and im just !!!!! HIS VOICE !!!! I LOVE LIAO JUNTAO’S VOICEEE and also the cafe vibe is so him LOL this group is so him

wait so someone explain to me why ljt wasnt in the solo section? is he considered a vocal? but what about his guitar skills??

im kinda sad jym isnt smiling when drumming anymore :\

YAY FRUIT PLANET !! i love how happy xiao zhi and wsh look when playing hahah

AW talking about xiao zhi being like a dad and 包容 and taking care of them im ughhhh UGH THIS IS A MINI XIAO ZHI FEATURE IM CRYINGGGG THIS CHILD DESERVES THIS “the one who’s left standing when everyone else falls down” hes just so supportive and warm.. ugh watching him break down crying thinking about all he couldve done better and you can tell he feel so guilty and blames himself that fruit planet isnt doing well

HAHAHAHA EVERYONE WANTS XIAO ZHI !!! except szb lol but at least i know if they do get disbanded, hopefully xiao zhi will still be safe :’) im glad they all recognize his talent and the importance of having a bassist!!!

oof xiao xiong talking about hyt being overbearing and reminding him of his ANGRY DAD thats a big ouch. it is true that xiao xiong’s skill level may not be up to hyt’s standards, but i can see hyt doesnt respect him enough as a team member. the more familiar hyt gets with him, the more he isnt afraid to show his true feelings of frustration. esp bc theyre in such a stressful situation, it must be rough as a leader. also seems rough for xiao li to be stuck in between this. from the beginning hyt has shown himself to have high standards and he demands high quality so he isnt gonna be the soft, encouraging leader xiao xiong probably would prefer, unfortunately. ouch the way hyt straight up says “this is going to be painful” like theres nothing he can do about it and they just have to accept it. like ps says, he’s not good at understanding other people’s feelings, like he doesnt seem to be willing to try to understand xiao xiong’s.

the way hyt lists what other people are doing and then asks xiao xiong “那你呢?” ouch........ that seems really mean? manipulative? harsh? but at the same time, we dont really know all the context so this is just want tencent wants us to think.

hyt also wants xiao zhi???? I cant imagine xiao zhi in this group, even tho itd probably be good for his possible debuting prospects, but xiao zhi gives me such a laid back, warm, taking care of everyone, creating a nice, supportive environment type of leader, and this group is literally the opposite of that??? ugh and yet, despite their superior group environment, fruit planet is at risk of getting disbanded... so sad.

man with the way these votes are trending hyt is gonna win and ljt wont debut? :(

lol tencent cutting the speeches of less popular contestants not surprised

wait wat. isnt qiang ge very popular??? what happened to his votes? wait what. im confused. what???

LOL FRUIT PLANET IS SAFE IM SO RELIEVED HAHAH okay i know i came into this show for ljt but xiao zhi has become one of my picks too, i cant deny anymore LOL and also xiao li -- but hyt’s group’s dynamic makes me feel uncomfortable at the moment. but yea ljt, xiao zhi, xiao li are my top 3... too bad they DEF wont be in the same group / wouldnt mesh well in a group together LOL

i love fruit planet group dynamic :’) watching them talk to each other just makes me smile

OH MY GOODNESS XIAO LI IS LEAVING?????? i can understand though, this grouping is not ideal from a music making standpoint either, like why are there so many vocalists lol but also i respect that hes putting his music first and he knows what he wants and needs for his music. even if it means leaving hyt who is basically a guarantee for popularity on this show. im so surprised xiao xiong isnt saying he will leave too.. or even hyt himself at this point. theyre all just... crying.... but honestly how can they make music without xiao li???

AWH my heart.... xiao li asking xiao xiong “你會恨我嗎?” i have never felt “do you hate me” hit me in the feels like this before. its such an OOF. and xiao xiong saying hes super close to xiao li, you can tell hes been under such emotional duress and xiao li has supported him through and now hes just conflicted between betraying hyt (who he wouldnt be here without) and suffering with hyt without xiao li there to help. this is so sad to watch..... ok but honestly just seeing how in this emotional time, ma zhe and xiao xiong are talking to xiao li and NOT hyt says something about how theyre afraid to touch him.

what xiao li says about hyt being kidnapped by his popularity makes so much sense, with what hyt said about chasing after his expectations and trying to live up to them. hes really not relaxed. ever. and i think thats what xiao li doesnt want to work with. i respect that he wants to be recognized for his music rather than just be recognized.

wat is this show doing why did they just stop and let them wallow in their feelings for hours??? wtf?? i mean i appreciate they respect that its a difficult and important decision but shouldnt they make them move on more efficiently?? what a waste of everyone’s time...

lol hyt learning some eq? yes you have to take care of your group members’ feelings, theyre people....

L O L XIAO LI GOING BACK ON HIS DECISION IM DYINGG HAHHAHAHAHHAHA WHAT A WASTE OF EVERYONES TIME HAHAHHAHA WHAT IS THIS SHOW. but okay yes i respect xiao li for having the guts to say he wants to leave, bc that hopefully gave hyt the wake up call he needed. BUT ALSO i do think staying with hyt makes sense career-wise. gaining popularity first isnt a bad thing. and he can always (continue to) prove his worth and make all different types of songs in the future, whether during or after his time with hyt. but staying with hyt = exposure, and thats never a bad thing. its just... hopefully they can resolve their emotional issues from here on out.

technically the smart move is to pick a popular contestant like zhao ke, to boost your group’s popularity overall. BUT hyt is so popular it really doesnt matter LOL

L O L xiao li being like well i cant get the group i want anyway, so idgaf lets just keep on “戲劇化” HAHAHAHHA he gives no effs anymore

but also i cant imagine them with another non-instrumentalist LOL and what kind of style will they have now?

ok wait let me go back to look at this:

hm yea the only other person of choice that would be helpful for votes is qiang ge. but i also cant imagine him on fruit planet???? ugh i wonder if qiang ge turned them down bc he feels like he’d ruin them like he blames himself for ruining his past groups.

i cant believe xiao li said he tried to talk to qiang ge for 3 hours until 6am... to convince him to come to fruit planet? wild.

UGH so sad that fruit planet didnt get a successful pick but honestly i am kinda glad mty didnt agree bc i kinda really would like to continue seeing xiao zhi play bass..... but ofc i guess it would be nice for him to show other skills too, ah im conflicted. but he really looks so carefree and like hes having so much fun when playing bass, id hate to take that away

LOL BASICALLY SZB CONFESSING TO MUJI HAHAHHAHAHA IS THIS A HIGH SCHOOL DRAMA ALL THE SUDDEN HAHAHHAHA actually i havent seen them interact before but i can kinda see muji’s personality meshing with their group’s, like hes kinda quirky and strange too LOL its cool they do get along tho

OOF SO MANY REJECTIONS. but also muji’s right, last time he wasnt strong enough, so i respect that hes really trying this time.

omg szb throwing a tantrum and trying to force muji’s hand is not very respectful to muji’s wishes and it makes muji look like a bad guy :( im glad muji’s standing his ground tho, this is not the time to indulge a child’s tantrum lol

on the bright side, i love xiao zhi’s laugh, so at least we got something out of this LOL

LOL xy so easily pulling fsc over LOL why cant they all be like this LOL save tencent editing time LOL

i knew there were too many emotions on ljt’s team........ i cant believe as soon as szb is like marginally okay, jym is like NOPE....... L O L

.....i cant believe..... they’re just.... cutting it off...... like this....... WHAT IS THIS SHOW AHHAHAHAH okayyyyyyyyyyyy thennnnnnnn

oof wasnt 車站 ljt’s last song before elimination? i just got hit with a wave of sadness and memories oof i wasnt ready

man its so interesting bc i feel like on other shows, the contestants are always like “i dont want to get eliminated!” but here its like “i dont feel like i can fit into their music, id rather be eliminated.” its an interestingly different type of setting. i respect that they respect their own music, but i guess theyre not thinking enough about their future career progression? if they really want to make it in the music industry? idk. its interesting bc i feel like ljt has struggled so hard since getting eliminated from the first season that i assume / hope he has more of a mindset of wanting to make it to the end.

anyway im kinda surprised fruit planet made it so high LOL but yay for them, i really wonder what will happen with them picking their 5th member. im surprised qiang ge’s votes are so low? itll be sad if he really leaves though. ugh only 2 out of 4 groups successfully regrouped and one of them took an extra 2 hours to decide.... lol. i still dont understand why that was allowed in the first place but okay. this is the most struggle elimination ep ive ever seen LOL

#rants#since when did mrzz get so dramatic??? LOL#also i guess a benefit of being behind on watching is that the next ep literally will air tomorrow so i dont have to wait very long#this is a very dramatic cliffhanger LOL

0 notes

Text

Questions About Checking Accounts, Nintendo Switch, iPods, TSP, and More!

Whats inside? Here are the questions answered in todays reader mailbag, boiled down to summaries of five or fewer words. Click on the number to jump straight down to the question. 1. Great advice for job seekers 2. Old hometown checking account 3. Making your own seasoning mixes 4. Inexpensive Nintendo Switch games 5. Partner has extreme debt 6. TSP contribution questions 7. Uses for old iPod? 8. Job search not that simple 9. Value of authenticating sports cards 10. Financial independence and career plans 11. Advice for selling books 12. True hourly discretionary income question I wanted to offer a little update on my switch to a standing desk for professional purposes. About two weeks ago, I moved my main workstation to a standing desk. The purpose for doing this was to significantly reduce the amount of time I spend sitting in a given day, because sitting for your job all the time has some negative long term health consequences. I did recognize that doing this fully cold turkey is a bad idea, and so I planned from the start to do it in stages. My plan was and still is to use the desk until I felt noticeable discomfort, then switch to a laptop in a chair for a while, then maybe alternate back later in the day. My goal was to simply raise my average time at the standing desk a little each week as I strengthen different muscle groups. After a couple of weeks of doing this, Ive found that the big impact has been on my lower back, with a smaller impact on my feet. Im able to work for about four to five hours a day at the standing desk, with other work time spent sitting in a comfortable chair with a laptop. What generally happens is that my lower back starts to get sore, not in a something is broken way but in a this is a muscle thats getting taxed due to exertion and needs a break way. Ill sit down for a while and itll feel much better. However, its constantly experiencing a low-grade soreness, the kind of soreness that happens when you exercise a muscle group. Theres nothing wrong here if I felt something wrong, I would stop using the standing desk for a while. However, it can be a little uncomfortable. Ive had some very minor foot discomfort, mostly on my heels, but nothing significant and it honestly seems to be fading over the last few days. Its hard to tell yet whether or not the standing desk is improving my health in any notable way. I certainly dont think its been bad, but I havent noticed a big health improvement. I do exercise most days, so thats definitely a positive factor, but its hard to extract the benefits of standing with the other benefits of exercise. I think its very likely that there have been some minor benefits, and I likely would have noticed more if I didnt already exercise. Its all about feeling healthy for as long as possible. On with the questions. Q1: Great advice for job seekers I wanted to share some advice from my own experience as an interviewer [in a large corporate HR department]. The big thing is that you shouldnt be hard on yourself if you interview for a job and dont get it. Often, there is already a candidate that is pre-selected and the interview process is a mere formality. Someone thought you were a good candidate and brought you in, but you didnt actually have a real chance at the job no matter how you interviewed. In fact, you should treat all interviews like that. Dont get stressed about them, because theres a good chance that theres already an anointed candidate. I would say that 75-80% of the time, we already have our minds made up regarding which candidate to hire before the interview process begins and interviews virtually never change our minds. Sometimes we will interview someone great and put them on a list of people to call in the future but almost without fail those people already have a job when we call them back. So please dont be hard on yourself if you dont succeed at an interview! And dont get overly stressed about it because theres a good chance that theres already an anointed candidate anyway. Just go in there and answer the questions and learn about the company and let the chips fall where they may. Alison This is great advice, and in line with some of my own hiring experiences in the past. I have been on all sides of this coin at various points. I have been the anointed candidate in a hiring process. I have also been one of the other candidates in a hiring process (where I knew someone else was anointed for an absolute fact). Ive also been involved with several hirings, some of which had strongly preferred candidates and some of which did not. The thing is, you never really know which kind of situation it is when youre interviewing. It may be a more open position where you actually have a good chance, or it may be a situation where you are one of the other candidates in an open process engineered to bring in the vastly preferred candidate with minimal questions. I think the mantra of dont worry about it is the right one here. Just go in there, answer the questions, ask some questions about the company, and move on and keep looking for the next interview or opportunity. If youre the right candidate, theyll call. Often, you wont be, and it wont be due to a fault of your own. Q2: Old hometown checking account I have left a checking account open at my old hometown bank for the last 20 years. It pays a very small interest rate 0.05%. I have a balance of about $1,200 in there. I have always looked at it as a last ditch emergency fund. If anything seriously goes wrong, Ill go there and use that money. But its just sitting there. Isnt there something better I could be doing with it? Dana I dont think theres anything wrong with having a last ditch emergency fund in a bank thats not easy to access. That idea is fine by me. However, its probably just going to sit there for a long time, so you might want to consider doing something with it that earns a better return. The next time youre in your hometown, stop by that bank and see what other options they have. Simply explain that this is an emergency fund for you and you want it in a place where it earns a little more, doesnt lose value, and could be withdrawn in an emergency but isnt likely to be withdrawn. Its very likely that theyll suggest a certificate of deposit, which is akin to a savings account except that it earns a bit higher interest rate and theres a small penalty for withdrawing it early. It wont take very long at all for the CD to earn more than the penalty for early withdrawal and then, after that, its onwards and upwards. Make sure that the bank allows you to automatically roll over the CD when it matures. Right now, with interest rates a bit higher than they were but still fairly low, Id choose a medium term CD, something in the range of one to two years. That will give you a higher interest rate than a short term CD but wont lock you in to these relatively low historical rates forever. Set it to automatically roll over, then forget about it until that last ditch emergency occurs. Q3: Making your own seasoning mixes Have you ever written an article about making your own seasoning mixes instead of buying mixes at the store? You can buy the component spices and mix them yourself and save a lot of money if you use seasonings a lot. I make an Italian seasoning and a chili seasoning and a toast seasoning myself. Margaret Toast seasoning? Youre going to have to send me that one. I have a bagel seasoning mix that I like to use on buttered toast sometimes I wonder if theyre similar. Although Ive mentioned seasoning mixes before and noted how its cheaper to make your own, I dont think Ive ever written a listing of the various spice mixes we have and how we store them. I store most of my spice mixes in large baby food jars that we still have from when our children were babies. I usually make them by mixing other spices by the teaspoon into a bowl and then stirring them thoroughly so theyre mixed, then I fill up the jar with the spice mix. I use masking tape for labeling. Using a mix is a learning experience. Over time, you start figuring out how much to put in stuff. Our chili mix, for example, usually takes a tablespoon and a half per batch, and a batch fills up our slow cooker about halfway. I could write a full post about this if theres interest, including some of my recipes. Just send me a message on Facebook if youd like to see that. Q4: Inexpensive Nintendo Switch games My husband and I bought our son a Nintendo Switch for Christmas. It is his first video game console and he had been asking for it all year so it was really fun to see him open it. Both sets of grandparents got him a game for it so he has had two games to play. His birthday is coming up soon and we asked him what he wanted and of course he wanted a Switch game. We asked him for a list of the ones he wanted and it has 15 or so games on it. The problem is that they are all $50 or more. Why are Switch games so expensive? Our full birthday gift budget for him is $50. Can you help? Anna This is a consistent challenge with Nintendos consoles, and it has been since the 1980s. Nintendo makes very high quality exclusive titles for their consoles those are usually the ones that wind up filling wish lists for console owners but they rarely go down in price until later in the consoles production cycle and the Switch is a pretty young system. Trust me your son isnt being greedy here. Hes probably listing most of the best games for the console, but they all happen to be expensive ones. I would guess that in a year or two, Nintendo will have a line of some of their top titles from a few years prior as Platinum titles for a much lower price point around $20 but were not there yet. So what can you do now? My recommendation is to visit a video game store that sells used games, like Gamestop, and see what they have available for the Switch thats used. Switch games, as you know, come on small cartridges, so its very easy to test a game to make sure it works you can ask them to test it before you buy. Getting a game used in the original packaging will still cost 50% to 75% of the sticker price and the selection may be a bit limited, but this is probably a fairly safe bet for getting one of the games he wants within your price point. A used Switch game is just as good as a new one in terms of someone focused on actually playing the games, so Id look there. Another approach would be to give him a gift card to the Nintendo eShop. There are a lot of very good downloadable titles for the Switch, and you use those gift cards to buy those downloadable titles. While this wouldnt give him any of the games he specifically wants, it would enable him to get a couple of games at least, and there are some very good games for $9.99 or less on the eShop. Q5: Partner has extreme debt I recently discovered that my bride-to-be (June) has about $140K in student loan debt. She had said that she had some student loans in the past but I did not have any idea how much. I am very uncomfortable with being saddled with that much debt. This has caused a great deal of conflict between us over the last few months and I found this out during the holidays. I am not sure what to do. Daniel The biggest factor Id look at is her day to day behavior right now. Is she a frugal person? Does she watch her nickels and dimes? Is she committed not in words but in actions to getting that debt paid off? Is she making extra payments on that debt? If you see that, then I wouldnt fret about it. On the other hand, if she seems to think that such a big debt isnt a big deal, she spends money frivolously all the time, and she isnt making much progress on that debt I would think very, very carefully about this relationship, because thats a value mismatch thats going to chafe for years and years. Beyond that, I would also consider what kind of field that her degree is in. Was the degree she earned in a field with a high income potential, or was it something that will never earn a substantial income? Also, Id look at other factors, like whether or not parental support was promised and then denied. If shes aiming for a high paying career, such as medicine or law or some types of engineering, I wouldnt worry too much about it. If she took out that much debt for a career path that has a very low likelihood of earning a high salary, I would be really concerned. I would also be concerned with that level of debt if there was also significant financial support from her parents where did all of that money go? The challenge with marriage is that you are financially tied to each other in a very deep way and her choices regarding the debt she took out for her education are indicative of the decision making process she will likely employ going forward except now youll be financially liable for them. Having that much debt unless you are both high income earners will significantly affect your life decisions for a very long time, likely for the rest of your life. It will delay your ability to have children that you can support financially, for starters. It will alter both of your career choices and possibilities. It will delay your ability to have a home of your own. I guess, in this situation, what I would really look for are signs of financial maturity beyond that of the student loans. Is she focused on repaying that debt with or without you? Is she making the most of her degree? Does she spend frivolously? I cant answer for you whether this woman is worth it to you. She may be perfect for you in every other way, in which case youll be happier with her. However, having that much student loan debt, and given the alarm bells it sets off in your head, is a sign of likely incompatibility over financial issues, and thats not a recipe for a great marriage. As always, conversation is key, as is paying attention to her actions. What kind of steps is she taking (not just talking about, but taking) in her life knowing that huge debt is sitting there? If youre struggling to answer that and this debt makes you this uncomfortable, this may not be the best situation for you. Q6: TSP contribution questions I am 36 years old, single, no children, no plans to ever marry. I just got a government job that I hope to keep for the rest of my life. Knowing that I am receiving FERS and Social Security already in retirement, how much should I contribute to my TSP to be able to have a comfortable retirement?Want to retire at 65 and have about the same amount of disposable income when I retire. Janine For those unfamiliar, FERS is the pension plan for US federal government employees. TSP is an optional 401(k)-like plan for additional retirement savings. Based on this, FERS should provide about 33% of your final salary when you retire. Social Security, depending on your income level, will provide somewhere around 30% of your income. That means you need to make up about 37% of your income from TSP. If you contribute 5% of your salary to TSP, the federal government matches another 4%. Above that, theres no matching. Given all of that information, I ran some back of the envelope calculations and conclude that given your age and your aim to retire at age 65 with your full salary intact from your various retirement sources and that you want to be able to draw from TSP for the rest of your life, you should contribute 15% of your salary to TSP. This should enable you to withdraw enough from TSP each year to make up your salary shortfall when you retire at age 65 and the TSP balance should last for the rest of your life. Youll want to invest TSP fairly aggressively the target retirement options should work. While I cant guarantee that 15% will get you there, I can certainly say that it is extremely likely that it will either get you there or get you very close to your goal. Q7: Uses for old iPod? Found an old iPod in a desk drawer along with charging cable. Is there any use for this or should I just junk it? I powered it up and it turns on just fine. Adam I dont own an original iPod (I had one way back in the day but I sold it off circa 2007-2008), but a friend of mine keeps one in her car and listens to music with it every day using a cassette tape adapter. You could do the same thing with an auxiliary cable if your car has an AUX port. Just load it up with mp3s of a bunch of music and/or podcasts that you like, keep it in your car, and listen to it during commutes. If you have a charger that hooks into the cigarette lighting receptacle in your car, then you can plug into that and keep it permanently charged. My friend has hundreds of albums that she loved in her teens and twenties. If you like alternative or indie rock from about 1990 to about 2007, theres a good chance youll find a ton to love on her iPod. Just fill yours up to the brim with stuff you like and youll always have something to listen to. You can fill it up with the full archives of a podcast and listen to the entire run of a podcast, too. Old iPods are great for these kinds of things. In other words, use it for what it was intended for. Load it up with audio. Q8: Job search not that simple While I appreciate your regular encouragement to go find a new job if your current one is sapping you, its not always that simple. I have been working as a legacy systems programmer for the same company for 16 years. Most of my day is maintaining old code, migrating it to new machines, and dealing with corporate [nonsense]. I literally hate going into work each day. There arent any available jobs nearby that match my skill set. Trust me, Ive looked. I cant move because my daughter has particular health care needs and needs to be near a top notch medical facility. That also means I need good insurance. I cant just go into work and say, Well, time to find a new job today! Thats just a pipe dream. Terry All right, so what jobs are available in your area that are close to your skill set? Youre obviously in a metro area of some kind. I guarantee there are programming jobs in that area. Whats actually available? What things are most similar to your skillset? Once you know that, start honing your skillset at work so that you can make that leap. Learn how to write tools that will help you with the legacy coding you already do. Start trying to port your legacy code over to a new language for modern systems during your downtime. Use this as an opportunity to learn new languages and paradigms. Get involved with any and all local software development groups. Try to go to their face to face meetings and get heavily involved in any online spaces they have, being as helpful as you possibly can there. Build up some good relationships in your field, then just casually ask about positions that match your refurbished skill set. Also, keep your resume honed on LinkedIn so you can be discovered by people who might be looking for folks in your area. Dont aim for hopelessness. Aim for a light at the end of the tunnel. You can do this at any job. I had a job where I was literally shoveling dirt for hours and hours during the middle of the night by myself and yet I found ways to aim that toward my next step. Q9: Value of authenticating sports cards I have a bunch of sports cards mostly baseball and basketball from the 1960s. I have looked at selling some of them individually but when I look online almost all sales are authenticated cards in a special holder. I looked into this and it looks like you send your cards to an authentication service and pay them a fee and they put them in a special plastic holder with a tag that says its authentic and gives it a grade for its condition. Is this worth it for selling trading cards? Are there ways to sell cards without this kind of service? Marvin You basically described the sports card authentication world pretty well. It exists because there was rampant fraud in older sports cards and other trading cards for a while, so some reputable dealers popped up and started offering authentication and grading services so that people would know exactly what they were buying. Its become the de facto standard for any sports cards of significant value. Basically, if the card is older than about 1975 or so, the player has any name recognition at all, and the card is in reasonably good shape, youre going to make more money selling it after authentication than before, even including the cost of authentication. If its a no-name player or its beat up, youre not going to make a whole lot for it anyway, as people will just want those to help complete sets and they wont sell for more than pennies. What Id do is look for Hall of Fame caliber player cards from your collection (or, as a friend of mine said, Hall of Famers plus Pete Rose) and get those authenticated to sell individually. The rest, Id just divide out by set and sell in bulk. (I have an almost complete 1965 Topps set missing just a few commons that Ive worked on for literally decades, so Im fairly familiar with all of this.) Q10: Financial independence and career plans So how much financial independence would a person need to be able to have full career independence where you still want to have a career but you just feel empowered to make whatever choice seems exciting to you without really worrying about salary but still assuming youre earning a decent salary to live on? I make about $80K and think I can live well on about $40K so my savings rate is about 30% after taxes. How many years would I have to do this before money exits the equation as a career consideration? Barney I think the real question youre asking is how much do I need to save so that retirement is fully covered? This calculator is probably my preferred one. Youll want to play around with different settings to see how long youll need to save to hit your goals. The further you are from retirement, the lower your total savings goal will be. Also, if you assume Social Security benefits will come to you at rates similar to whats available today, the lower your total savings goal will be. You may even be at your target in several years. However, Id still recommend that you save for retirement after you hit your goal number if youre earning a good salary. This allows you to walk away even earlier if you just get tired of the rat race before a typical retirement age. Q11: Advice for selling books I have a collection of hardback books I want to sell. What is the best way to get maximum value for them? Tracy First of all, it depends a lot on what books youre exactly trying to sell. Are they novels? Cookbooks? Old Dungeons and Dragons books? Encyclopedias? Youll want to go to eBay and try to get a sense as to what theyre actually worth. You will probably get the maximum value from them by selling them individually. However, that is exponentially more work for only a fairly modest rate of return. You might be able to sell a lot of ten books for $20 or sell them each individually for $3, for example. Is that extra effort in packaging and shipping and tracking and communication for nine additional packages worth the $10 to you? Another note: if youre selling books, USPS Media Mail is your friend. Its a highly discounted shipping rate that applies to sending books through the mail, and it comes with a tracking number. (Its cheap because its slow and USPS knows a book can sit in a warehouse for a day with zero problems.) You should always use this when shipping books and magazines. Q12: True hourly discretionary income question I understand how this perspective helps to highlight the high cost of non-necessary spending now in terms of lost leisure in the future. But I think it overstates the cost of non-necessities in terms of hours worked. In your example where your annual net wage is $34,000 and your annual work hours is 2,740 (so you net $12.41 per hour worked) and your necessities cost $24,600/year, you should account for 1,982 work hours (= $24,600/$12.41 per hour) as covering necessities, leaving 2,740 1982 = 758 hours for non-necessities. In each of those 758 hours, you net $12.41/hour, and that is the cost of your necessities in terms of hour worked. So a $50 board game costs you $50/$12.41 per hour = 4 hours, not 10.5 hours. The key is to see that you still actually net $12.41/hour, regardless of whether those earnings go to necessities or non-necessities. One way to see this is to realize that the approach in the post can lead to unrealistic implications for the hours of work required to purchase non-necessities. For example, suppose in your example above, necessities are only $10,000 year, and non-necessary spending is then $34,000 $10,000 = $24,000. If your hourly wage for non-necessities is really $4.96/hour like the post says, then it would take $24,000/$4.96 per hour = 4,838 hours to earn that $24,000. But you earned the $34,000 with only 2,740 hours, so something is wrong. Max Max is referring to this article from last week, Using Your True Hourly Discretionary Income to Make Smarter Purchases. Youre just looking at the same issue in a different way. Rather than looking at each hour as being subdivided between essential expenses and non-essential expenses, youre doing the same thing with the total hours over a year. In that example, then, 1,741 of the hours you work essentially earn you nothing in terms of spending money, because all of it goes to essentials. So, frugality in essence just means that youre migrating some of the hours you work from your pool of hours spent on essential expenses to the hours you work for spending money. My angle was different. I divided the income from each hour into essential expenses and spending money. The essential expenses gobble up $7.45 of the $12.41 you earn each hour, while your spending money makes up only $4.96 of the $12.41 you earn each hour. So, then, you judge whether an expense is worth it using just the $4.96, since its the only portion you can actually freely spend. In this case, frugality moves a little bit of money from the $7.45 essential expenses per hour pile to the $4.96 spending money per hour pile. Got any questions? The best way to ask is to follow me on Facebook and ask questions directly there. Ill attempt to answer them in a future mailbag (which, by way of full disclosure, may also get re-posted on other websites that pick up my blog). However, I do receive many, many questions per week, so I may not necessarily be able to answer yours. https://www.thesimpledollar.com/questions-about-checking-accounts-nintendo-switch-ipods-tsp-and-more/

0 notes

Text

Case study: Starting with less than zero

I am not a trained financial expert. Im not an accountant, Im not a financial planner, and Im not a stock broker. Whats more, Ive made many many money mistakes on my own financial journey. As a result, Ive always been reluctant to sit down with people and go over their budgets. That seems to be changing. In March, I spent a couple of hours talking with a friend about her financial situation. A few days ago, another friend asked if Id be willing to meet with him in the near future to puzzle through his budget woes. And yesterday, I took three hours to chat about money with my friends Wally and Jodie. As always, Ive changed names and certain identifying features in the story that follows. Unless I have explicit permission to share details, I do my best to protect peoples privacy when I write about their intimate financial lives. Wally and Jodie have recently begun dating. Hes in his early forties (and recently divorced); shes in her late twenties. They both work in food service, and have done so all of their lives. Their trouble and the reason they asked me for help is that they cannot seem to make ends meet. They work hard but never have anything to show for it. In fact, they feel like theyre falling further and further behind. Can you help us? Wally and Jodie asked. I can try, I said. Lets look at your numbers. An Income Problem To start, I said, lets look at how much youre bringing in. Thats part of the problem, Jodie said. We dont have a fixed income. Because most of our money comes from tips, we cant predict how much were going to make from one month to the next. Right, said Wally. And it doesnt help that our hours are irregular. We both work at several different restaurants. Some pay better than others. Plus, there are days when you wont have any customers. When that happens, youre sent home early with nothing to show for it. Well, how much would you say you make on average? I asked. Wally and Jodie made some calculations. I make maybe $1400 per month, Wally said. On a good month, Ill make $1700. And Jodie makes another $1500. These numbers are after taxes. Jodie nodded. But we each just picked up a shift at a new restaurant. That should give us each maybe $500 extra each month. Thats great, I said, jotting down numbers in my notebook. But I dont like looking at potential numbers. I learned the hard way that when you budget based on future raises, bonuses, or other expected sources of income, you can get into real trouble. Obviously, you hope that extra money comes through, and when it does, you can apply it to your budget. Until then, though, its best to ignore it. I thought for a moment. My first impression before we even look at your spending is that youre not making enough money. Youre making less than $3000 per month combined. We should brainstorm some ways you can earn more. Starting with Less than Zero I turned a page in my notebook. Now, lets talk about how much youre spending. Thats the problem, Jodie said. We spend exactly what we bring in, no matter how much we bring in. That means theres never enough to catch up on our debts some of which were behind on. What are your biggest expenses? I asked. Well, our apartment costs $900 per month but itll go up to $950 pretty soon, Wally said. Not bad, I said. Thats actually a great price for Portland. And its a reasonable amount based on your income. I explained how the average American household spends one-third of its income on housing; I advocate aiming for 25% or less. Food costs money, Jodie said. We budget about $100 per week for groceries, but thats just bare bones stuff, you know? I have a car payment, Wally said. In fact, thats one of our biggest problems. I took out the loan when I was married. My ex-wife and I are both on the loan. It seemed reasonable at the time. Now, though, its a pain in the ass. I owe $12,500 on the car and payments are $300 per month. To make matters worse, Im already a couple of months late on my payments. This is causing me a ton of stress. It makes Jodie stressed, it makes my ex-wife stressed, and it makes me stressed. Hm, I said. I dont have any experience with getting behind on payments. I used to live paycheck to paycheck, for sure, but I was lucky. I never had an accident or got sick, so I was always able to make payments on time. I dont know that I have any good advice for you about this problem, but maybe some of my readers at Get Rich Slowly could help. Wally nodded. Honestly, thats one of our biggest frustrations with the money advice weve found, said Jodie. All of it assumes that youre starting from zero. Or more than zero. What if youre starting with less than zero? What if youre deep in debt we have $35,000 in debt, just like you used to and what if youre behind on your payments? What then? All of the advice we read seems to be written by rich people for rich people. Yeah, I can see how that would be frustrating, I said. Like I said, I dont have experience starting at less than zero. I started at zero. I was deep in debt, but once I stopped spending, I already had a gap between my income and spending, so I could immediately start paying down debt. You two have some catching up to do. We need to figure out how you can play catch-up. A Mountain of Debt As we worked through their budget, I was mostly impressed. While Wally and Jodie arent bringing in a lot of money, theyre not spending a lot of money either. As with most budgets, they did have some discretionary items that could be cut, but not a ton of them. (Their biggest discretionary expense seems to be local travel. Theyre spending a couple of hundred dollars each month to visit family and/or have fun with friends.) My biggest concern was their debt. Between the two of them, they have $35,000 in debt: $12,500 for Wallys car, on which hes upside-down. (I wish I could just sell it and wipe out the debt, Wally said. But Id still owe about $3000 if we sold it.)$12,500 for Jodies student loans.$10,000 of miscellaneous debts, such as $500 they just spent to buy new tires after getting stranded because of a flat. To complicate matters, Wally and Jodie are going through several large life transitions right now. Wally is fresh from his divorce, they just moved in together, theyre both trying to find permanent full-time jobs, and theyre thinking about moving to a cheaper place to live. So, thats our situation, Jodie said. For good or ill, thats what we have. Where do we start? How do we get out of this mess? Well, I said, the good news is that I think youre both capable of working together to build a brighter future. The bad news is that its going to take some time. Its also going to require some sacrifices or what seem like sacrifices. If you want to fix this, youll have to do some stuff that sucks in the short term. But I want you to remember: Most of these sacrifices are temporary. Theyre only until you manage to get rid of the debt. I read what you wrote about growing up poor and having a scarcity mindset, Wally said. I totally relate. My family was poor too. Any time my parents got money, they spent it. They felt like they deserved to treat themselves because theyd gone without for so long. And looking at my own life, I see that I do that too. Thats a tough trap, I said. I totally relate. And I know first-hand how when youre poor, you feel like any windfall should be spent on fun. But if you want long-term happiness and financial stability, you have to decide that for a year or two youre not going to give in to that temptation. When you get a bonus or a raise or a big tip from a table at work, youll put that money toward your financial goals, not toward a nice dinner out. Once you get rid of the debt, you can have all sorts of nice dinners out. But until then, you have to agree to make a game of living on less. Growing the Gap I want you to focus on two things, I said. The first thing is the gap between your earning and spending. Right now, you dont have a gap. Youre spending exactly what you earn. Its impossible to save for the future or to catch up on your debt if you dont make more than you earn. So, to start, you two need to do whatever you can to increase this gap. I turned back to my notes on their budget. You should trim your budget in whatever way you can. You dont have a lot to trim, but if theres anything you can cut, cut it. I know family is important to you, but maybe you can explain what that youre trying to get out of debt and need to take some time off from the visits. Or maybe make the visits shorter a weekend instead of a week. And remember: Youre not cutting these things forever. Youre only cutting them until you get rid of your debt. Wally and Jodie nodded. Because you dont have a lot to cut from your budget, I continued, I think the best way for you to increase your gap is to find ways to earn more money. Right now, youre both working at two or three or four different restaurants. You only have a few hours per week at each place. None of the restaurants are that nice, so you dont make great tips. Honestly, I think this is where you should focus most of your attention. Wally sighed. Weve talked about that, he said. Wed love to earn more, but nothing ever seems to work out. One place says its going to give us more hours, but it never does. Jodie will pick up a shift a nice restaurant across town, but then its a logistical problem to get there. I get frustrated by how much time is involved with all of this. Thats a good point, I said, and I dont have a good solution. Actually, you know what Id do if I were you? Youre both great servers. You do good work. Your bosses like you, and so do your customers. If I were you, I wouldnt be looking for work at diners and cafes. In your spare time which I know isnt much you should be applying for work at upscale places. When you work at a nicer place, you dont do any more work, but you make a lot more money. Plus, you have the advantage of interacting with a different sort of clientele. If you build relationships with some of them, who knows where that could lead? When I was in college, I made money by waiting tables. I received several job offers from regular customers who were impressed by my work ethic. I suspect that if Wally and Jodie were in the right environment, theyd experience the same kind of thing. Another option is to pick up a few hours work doing something completely different, I suggested. Maybe Jodie could work in a womens clothing store. Maybe Wally could do yardwork or handyman stuff. I think we get where youre going with this, Jodie said. We need to increase the gap between our earning and spending. Because we dont spend a lot, the best way to do this is to earn more moneysomehow. Yep, I said. Thats the gist of it. Thats the first thing I think you should focus on. Taking Baby Steps The second thing you should tackle is your debt. I know you both have things you want to save for long term, but I want you to put those dreams on hold for now. You cant save for your future until you pay off your past. My dad tells me I should save first before tackling the debt, Jodie said. He says I should build six months of savings before anything else. What do you think? I disagree, I said. I think saving six months worth of expenses is a fine goal, and thats absolutely what you should aim for. But thats not where you should start. As you increase your gap between earning and spending because remember everything depends on this gap I think you should apply your money according to the Dave Ramsey plan. Here, Ill explain. I made a modified list of Dave Ramseys baby steps: Build a basic emergency fund of roughly $1000 (while continuing to make minimum payments on debt). My advice is to keep this fund in a brand-new bank account that isnt connected in any way to your other accounts, I said. You want to make this easy enough to access when you need it, but not so easy that you can just access the money on a whim.Pay off all debt using some version of the debt snowball method. When I was struggling, I couldnt figure out how to get out of debt, I said. Dave Ramseys version of the debt snowball helped me. In your case, Id use a slightly different version. Wallys car seems to be a huge psychological weight. You two need to prioritize that. After youve saved your emergency fund, throw as much money as you can at debt with everything extra you can find going to that car.Save an enhanced emergency fund equal to six months of normal expenses. After youre out of debt, beef up your savings. I know youll want to start saving for other goals right away, but dont. Take time to add some margin to your life. Youll be glad you did.Pursue long-term financial goals, such as traveling, moving to Idaho, or buying a motorcycle. You know whats awesome? I said. After youve taken time to pay off what you owe using the debt snowball, then you can immediately start building a wealth snowball. If youre paying $500 toward debt each month, then once that debt is gone you can immediately start saving $500 per month! That all sounds great, said Wally, but to be honest, J.D., in some ways your advice is just like the other advice. What do you mean? I asked. Well, its assuming that were starting from zero. But were not. Were starting with less than zero. I have an idea, said Jodie. What if we added a step zero to the baby steps? We could call it putting out the fires. Before we save the basic emergency fund, we could throw every dollar toward catching up on the car payments. I think thats fantastic, I said. In fact, I think thats really smart. If you can take some quick steps toward increasing your gap between earning and spending, then you should be able to get caught up on the car within a few months if nothing goes awry. Then you can pursue the plan Ive laid out. Wally nodded. I think that makes sense, he said. Final Thoughts After three hours on the back deck, I sent Wally and Jodie home with a handful of money books. I could tell their minds were bubbling with new ideas. (Is gas for the car a Want or a Need? Wally texted me yesterday afternoon. I love it!) I know that Wally feels frustrated. He hates being over forty yet feeling like hes in the same place he was when he was twenty. I get it. But heres the thing: He has to adopt a beginners mind. Start where you are, I wrote in January. Dont fret about the past or how other people are doing. Wally needs to accept that his situation is what it is and work to improve from that point. Knowing what I know about these two, I really do believe theyre capable of starting where they are starting with less than zero and destroying their debt in a relatively short period of time. It took me 37 months to get out of debt. (I started on 21 October 2004 and finished on 03 December 2007. Thats a total of 1139 days to pay off $35,196 in debt.) Progress was slow at first, but accelerated rapidly toward the end of that period. Wally and Jodie have exactly the same amount of debt as I did when I decided to become CFO of my own life. My challenge for them is this: Get out of debt quicker than I did. Do it in less than 1139 days. If we count yesterday as Day One, then 29 September 2021 would be day 1138. Wally and Jodie, my hope for you is that together you can be debt free by that date or sooner. What advice do you have for Wally and Jodie? What can they do to improve their financial situation? Did you start your financial journey with less than zero? Have you ever fallen behind on payments? If so, how did you handle it? How did you caught up? https://www.getrichslowly.org/less-than-zero/

0 notes

Text

Case study: Starting with less than zero