#multi MOSFET driver

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--analog--drivers--motor-drivers/l298n-stmicroelectronics-5319967

STMicroelectronics, L298N, Drivers Motor Drivers

L298 Series 46 V 2 A Dual Full Bridge Driver Vertical - Multiwatt-15

#STMicroelectronics#L298N#Drivers Motor Drivers#DC motor driver control#circuit#h bridge#4 Phase Bridge Driver#multi MOSFET driver#Bipolar stepper#motor driver chip#Programmable motor driver#brushless motor driver

1 note

·

View note

Text

Brushed Motor Driver IC Market | Analysis by Industry Trends, Size, Share, Company Overview, Growth, Development and Forecast

Brushed Motor Driver IC Market, Trends, Business Strategies 2025-2032

The global Brushed Motor Driver IC Market was valued at 2767 million in 2024 and is projected to reach US$ 4108 million by 2032, at a CAGR of 6.0% during the forecast period.

Brushed motor driver ICs are specialized semiconductor components designed to control the operation of brushed DC motors. These integrated circuits regulate critical motor parameters including speed, direction, torque, and current flow while providing essential protection features. Key product segments include single half-bridge ICs, multi half-bridge ICs, and integrated full-bridge ICs, each offering different levels of control complexity and power handling capabilities.

The market growth is driven by increasing automation across industries, with robotics applications alone accounting for nearly 28% of demand in 2024. While automotive applications continue to dominate with 35% market share, emerging sectors like medical equipment and consumer electronics are showing accelerated adoption. However, competition from brushless motor technologies poses challenges, particularly in high-efficiency applications where they offer 15-30% better energy performance. Leading manufacturers such as Texas Instruments and STMicroelectronics are responding with advanced driver ICs featuring integrated MOSFETs and smart diagnostic functions to maintain market competitiveness.

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis https://semiconductorinsight.com/download-sample-report/?product_id=103286

Segment Analysis:

By Type

Integrated Full-Bridge IC Segment Leads Due to Higher Efficiency and Advanced Control Features

The market is segmented based on type into:

Single Half-Bridge IC

Multi Half-Bridge IC

Integrated Full-Bridge IC

By Application

Automotive Segment Holds Major Market Share Due to Increasing Electric Vehicle Adoption

The market is segmented based on application into:

Automotive

Industrial Equipment

Consumer Electronics

Medical Equipment

Others

Regional Analysis: Brushed Motor Driver IC Market

North America The North American brushed motor driver IC market benefits from robust industrial automation trends and a strong presence of automotive manufacturers requiring precise motor control solutions. The U.S. leads regional adoption, driven by technological advancements in robotics and electric vehicles, where these ICs manage window controls, seat adjustments, and wiper systems. Canada’s growing focus on energy-efficient industrial equipment further supports market demand. While brushless motors gain traction in premium applications, brushed motor drivers maintain cost advantages in mid-range automotive and consumer electronics segments. Major semiconductor firms like Texas Instruments and Allegro Microsystems dominate supply chains here.

Europe Europe’s market thrives on stringent efficiency standards (e.g., EU Ecodesign Directive) pushing brushed motor driver IC innovations for reduced power consumption. Germany, as an industrial hub, extensively uses these ICs in manufacturing equipment and automotive subsystems. The region shows growing preference for integrated full-bridge ICs that simplify PCB designs in space-constrained applications like medical devices. However, environmental regulations partially restrain the market by encouraging brushless alternatives in new energy applications. European manufacturers like STMicroelectronics and Infineon lead R&D in thermal management and noise reduction features for improved reliability.

Asia-Pacific Accounting for over 40% of global brushed motor driver IC consumption, Asia-Pacific’s growth stems from mass production of consumer electronics and expanding automotive manufacturing in China, Japan, and South Korea. China’s dominance in low-cost IC production creates pricing pressures but boosts accessibility for SMEs. India’s “Make in India” initiative accelerates industrial equipment demand, while Southeast Asian nations see rising adoption in household appliances. Though brushless technology adoption grows, the cost-effectiveness of brushed solutions ensures their prevalence in budget-sensitive markets. Local players like Toshiba and ROHM compete strongly in regional supply chains.

South America Market growth here is tempered by economic instability but shows potential in Brazil’s automotive sector and Argentina’s industrial renewal projects. Brushed motor drivers find steady demand in legacy industrial systems and basic consumer appliances where upgrade cycles are longer. The lack of local semiconductor fabrication limits technological advancement, making the region dependent on imports. Nevertheless, the repairs/maintenance sector provides consistent aftermarket opportunities for replacement ICs in motor control applications.

Middle East & Africa This emerging market sees gradual uptake in HVAC systems and oil/gas equipment, where brushed motors remain prevalent due to simpler maintenance. UAE and Saudi Arabia lead adoption through infrastructure projects, while South Africa’s manufacturing sector shows growing interest. The market faces challenges from inconsistent power quality affecting motor driver performance and a preference for lower-cost mechanical controls in some applications. However, urbanization and industrialization trends indicate long-term growth potential for motor control ICs as automation penetration increases.

List of Key Brushed Motor Driver IC Companies

Texas Instruments (U.S.)

STMicroelectronics (Switzerland)

Infineon Technologies (Germany)

NXP Semiconductors (Netherlands)

Microchip Technology (U.S.)

Diodes Incorporated (U.S.)

ON Semiconductor (U.S.)

ROHM Semiconductor (Japan)

Toshiba Electronic Devices (Japan)

Allegro Microsystems (U.S.)

The global push toward industrial automation is significantly boosting the brushed motor driver IC market. Industrial automation deployments grew by over 18% in 2023, with brushed DC motors remaining fundamental components in conveyor systems, assembly lines, and packaging machinery. These motors require precise control ICs to manage torque, speed, and directional changes – capabilities that modern brushed driver ICs deliver efficiently. The integration of smart control features in newer IC generations allows for seamless communication with PLCs and IoT systems, making them indispensable in Industry 4.0 implementations. For instance, the automotive manufacturing sector alone accounted for 28% of brushed motor driver IC demand in 2024, demonstrating their critical role in automated production environments.

Consumer electronics manufacturers continue to prefer brushed motor solutions for cost-sensitive applications, driving consistent demand for companion driver ICs. The market benefits from brushed motors’ simplicity and reliability in household appliances, where they power functions ranging from electric toothbrush vibrations to adjustable monitor stands. With global consumer electronics production increasing by approximately 7% annually, brushed motor driver IC shipments have correspondingly grown to meet this demand. Compact driver IC designs enabling battery-efficient operation in portable devices represent a key innovation, with recent product launches featuring quiescent currents below 1μA to extend device battery life.

The medical equipment sector presents promising opportunities for brushed motor driver IC suppliers, particularly in portable and disposable medical devices. The global market for motorized medical devices is projected to grow at 8.5% annually through 2030, with brushed motors remaining the preferred solution for many low-cost, single-use applications. Driver ICs tailored for medical applications must meet stringent reliability requirements while operating from battery power – a combination that favors the inherent simplicity of brushed motor control architectures.

Recent innovations include ultra-low-noise driver ICs for imaging equipment and vibration motor controllers for wearable drug delivery systems. These specialized applications command premium pricing while requiring relatively simple modifications to existing brushed motor driver architectures, making them attractive targets for IC manufacturers seeking higher-margin opportunities.

Meanwhile, the continuing electrification of automotive subsystems – from power seats to sunroof controls – sustains steady demand from the automotive sector. Each modern vehicle incorporates an average of 15-20 brushed motors, with driver IC requirements evolving to meet automotive-grade temperature ranges and electromagnetic compatibility standards.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies https://semiconductorinsight.com/download-sample-report/?product_id=103286

Key Questions Answered by the Brushed Motor Driver IC Market Report:

What is the current market size of Global Brushed Motor Driver IC Market?

Which key companies operate in Global Brushed Motor Driver IC Market?

What are the key growth drivers?

Which region dominates the market?

What are the emerging trends?

Browse More Reports:

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

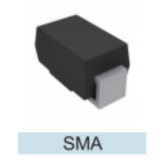

Leiditech Recommends a TVS Diode with Low Leakage Current (100uA), Low Voltage (3.3V), and 400W Power

Transient Voltage Suppression Diode, or TVS for short. When the two poles of a TVS are impacted by reverse transient high energy, it can switch from high impedance to low impedance in 10⁻¹² seconds, absorb surge power up to several kilowatts, and clamp the voltage between the two poles at a predetermined value. This effectively protects precision components in electronic circuits from damage caused by various surge pulses.

Electronic products require power efficiency and energy savings, so they often use low-voltage power supplies such as 3.3V, 2.5V, or 1.8V. Especially for battery-powered electronics, low voltage alone is insufficient — low leakage current is also required.

The advantage of low voltage drop and low leakage current is that the lower power loss ineffectively can improve the conversion efficiency of the power supply.

The advantages of low voltage drop and low leakage current include reduced power loss, which effectively improves power supply conversion efficiency.

The SMAJ3.3LIR can be widely used in automotive electronics, smart lighting, smart home systems, mobile phone fast-charging circuits, consumer electronics, switching power supplies, frequency converters, driver circuits, and other electronic circuits.

Leiditech’s SMAJ3.3LIR is already widely used in automotive electronics. Please contact us if you need it!

TVS Selection Tips

1. The TVS’s reverse working voltage (Vrwm) should be at least 10% higher than the maximum DC or continuous operating voltage of the protected circuit, as well as the circuit’s rated standard voltage and “high-side” tolerance. If the selected Vrwm is too low, the device may enter avalanche mode or disrupt normal circuit operation due to excessive reverse leakage current. Series connection divides voltage, while parallel connection divides current.

2. The TVS’s clamping voltage (Vc) should be lower than the damage threshold voltage of the protected circuit.

3. The TVS’s peak pulse power (Ppp) should exceed the peak pulse power that may occur in the protected circuit.

4. The TVS’s peak pulse current (Ipp) should be greater than the transient surge current in the circuit.

5. For lightning protection in data interface circuits, low-capacitance semiconductor ESD devices are recommended.

6. Select the TVS’s polarity and package based on the application: Bipolar TVS diodes are more suitable for AC circuits; semiconductor ESD arrays are more advantageous for multi-line protection

Leiditech is committed to becoming a leading brand in electromagnetic compatibility solutions and component supply, offering products such as ESD, TVS, TSS, GDT, MOV, MOSFET, Zener, and inductors. Leiditech has an experienced R&D team that can provide personalized customization services according to customer needs and offer the highest quality solutions.

If you’d like to learn more or have any questions, don’t hesitate to reach out:

Visit us at [en.leiditech.com]

#TVSdiode #CircuitProtection #ElectronicsDesign #Leiditech #SmartDevices #AutomotiveElectronics #3_3VProtection #LowLeakage #PowerEfficiency #SurgeProtection #ESDprotection #IoTdesign #EngineeringInnovation

0 notes

Text

Smart High Side Switch ICs Market : Key Trends, Emerging Technologies, and Global Forecast to 2032

The global Smart High Side Switch ICs Market size was valued at US$ 674.9 million in 2024 and is projected to reach US$ 1.08 billion by 2032, at a CAGR of 6.1% during the forecast period 2025-2032.

Smart High Side Switch ICs are semiconductor devices designed to control power distribution in electronic circuits with built-in protection and diagnostic features. These components operate on the high-side of electrical loads (between power supply and load), offering advantages like short-circuit protection, thermal shutdown, and current limiting. Key product variants include single-channel and multi-channel configurations, with applications spanning automotive systems, industrial automation, and power management solutions.

The market growth is driven by increasing vehicle electrification and demand for energy-efficient industrial equipment. The automotive segment accounts for over 40% of total demand, fueled by advanced driver-assistance systems (ADAS) and electric vehicle powertrains. Recent developments include Infineon’s launch of the PROFET+ 2.12V high-side switch series in Q2 2024, featuring enhanced diagnostic capabilities for 48V mild-hybrid systems. Major players like Texas Instruments and STMicroelectronics continue to expand their portfolios with integrated protection features and lower RDS(on) values for improved efficiency.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/smart-high-side-switch-ics-market/

Segment Analysis:

By Type

Multi-Channel Segment Leads Due to Its Efficiency in Complex Circuit Applications

The market is segmented based on type into:

Single Channel

Multi Channel

By Application

Automotive Segment Dominates Owing to Increasing Adoption of Advanced Vehicle Electronics

The market is segmented based on application into:

Automotive

Industrial

Consumer Electronics

Telecommunications

Others

By End User

OEMs Hold Major Market Share Due to Direct Integration in Electronic Systems

The market is segmented based on end user into:

Original Equipment Manufacturers (OEMs)

Aftermarket

By Technology

MOSFET-based Switches Gain Traction for Their High Efficiency and Fast Switching

The market is segmented based on technology into:

MOSFET-based

BJT-based

IGBT-based

Regional Analysis: Smart High Side Switch ICs Market

North America The North American smart high side switch ICs market is driven by robust automotive electrification trends and industrial automation adoption. With the U.S. semiconductor industry generating $142.1 billion in sales (17% YoY growth in 2022), the region benefits from strong R&D investments by key players like Texas Instruments and Analog Devices. The automotive sector, particularly electric vehicle production, accounts for over 35% of regional demand as manufacturers integrate advanced power management solutions into next-gen vehicle architectures. However, supply chain disruptions and trade restrictions with China continue to create volatility in component availability. Canadian and Mexican markets are following similar adoption patterns, though at a slower pace due to smaller manufacturing bases.

Europe Europe’s market growth is propelled by stringent efficiency regulations in automotive and industrial applications, particularly under the EU’s Ecodesign Directive. Germany leads regional adoption with its strong automotive OEM base, while Nordic countries show fastest growth in industrial automation applications. The region’s $53.8 billion semiconductor market (12.6% YoY growth in 2022) provides stable infrastructure for local development. Infineon Technologies and STMicroelectronics dominate the landscape with their specialized automotive-grade high side switches. European manufacturers face challenges from high operational costs, but maintain competitiveness through technological differentiation in areas like fault protection and diagnostics.

Asia-Pacific Accounting for the largest global market share, Asia-Pacific demonstrates heterogeneous growth across sub-regions. China’s massive electronics manufacturing sector and rapid EV adoption drive over 40% of regional demand, despite the overall APAC semiconductor market contracting 2% in 2022. Japan and South Korea maintain leadership in high-reliability industrial applications, while Southeast Asian nations are emerging as cost-effective manufacturing hubs. India shows promising growth potential with its expanding automotive electronics sector. The region benefits from proximity to wafer foundries and packaging facilities, though intellectual property protection remains a concern for foreign investors. Local players like ROHM Semiconductor are gaining traction against multinationals through competitive pricing strategies.

South America The South American market, while comparatively small, is experiencing gradual growth in automotive and industrial applications. Brazil dominates regional demand, supported by its well-established automotive manufacturing cluster, though economic instability periodically disrupts growth. Argentina shows potential in industrial applications, particularly for agricultural equipment and oil/gas systems. Import dependency remains high (over 75% of components) due to limited local semiconductor manufacturing capacity. Market growth is further constrained by currency fluctuations and variable trade policies across the region. Nevertheless, increasing foreign investment in EV production facilities indicates long-term opportunities for smart power IC suppliers.

Middle East & Africa This emerging market exhibits concentrated demand in Gulf Cooperation Council countries, particularly for industrial and oilfield applications. Israel’s strong semiconductor design ecosystem contrasts with Africa’s minimal local production capacity. The region shows increasing adoption in automotive applications, particularly in Turkey and South Africa, where local assembly plants are integrating more electronic systems. Infrastructure limitations and reliance on imports hinder faster market penetration, though strategic investments in UAE and Saudi Arabia aim to develop regional electronics manufacturing capabilities. Energy sector modernization projects across the region are expected to drive future demand for ruggedized power management solutions.

MARKET OPPORTUNITIES

Emerging 48V Power Architectures Create New Application Frontiers

The transition to 48V power distribution in automotive and data center applications represents a significant growth avenue for advanced switching solutions. These higher voltage systems provide critical efficiency improvements but require more sophisticated power management than traditional 12V implementations. Smart high-side switches with enhanced voltage ratings and diagnostic capabilities are uniquely positioned to enable this transition. Suppliers that can deliver robust 60V-rated solutions with integrated current sensing stand to capture substantial market share as major OEMs finalize their 48V system designs. Early adoption in mild hybrid electric vehicles and server power supplies has already demonstrated the viability of these solutions in next-generation power systems.

Advanced Packaging Technologies Enable New Integration Possibilities

Innovations in semiconductor packaging are creating opportunities to combine smart switching functionality with complementary power management features. Chip-scale packaging and multi-chip modules allow integration of gate drivers, power MOSFETs and control logic into single devices with superior thermal performance. These advancements enable power subsystem consolidation that reduces bill-of-materials costs while improving reliability. Early adopters in the automotive sector have achieved up to 30% space savings and 15% efficiency improvements by leveraging these integrated solutions. As packaging technologies continue advancing, they will enable smart switches to address increasingly sophisticated power management challenges across various industries.

Predictive Maintenance Requirements Drive Adoption of Intelligent Monitoring

The growing industrial focus on predictive maintenance creates strong demand for power components with enhanced diagnostic capabilities. Smart high-side switches that can monitor thermal stress, contact wear and switching cycles provide valuable data for condition-based maintenance strategies. Facility operators increasingly recognize that the incremental cost of intelligent switching solutions is justified by their ability to prevent unplanned downtime, which costs manufacturers an estimated $50 billion annually. Suppliers that enhance their diagnostic features and develop predictive analytics tools will gain competitive advantage in this rapidly emerging market segment, particularly in capital-intensive industries where equipment uptime is critical.

SMART HIGH SIDE SWITCH ICS MARKET TRENDS

Electrification and Automation Drive Demand for Smart High Side Switch ICs

The global smart high side switch IC market is experiencing robust growth, propelled by accelerating electrification across automotive and industrial sectors. These ICs, which function as protective switches in high-side configurations (connected between the power supply and load), have become critical components in modern electronic systems. The market was valued at over $500 million in 2024 and is projected to grow at a compound annual growth rate (CAGR) of approximately 8.5% through 2032. This growth is primarily driven by stringent safety regulations in automotive applications, where these ICs prevent short circuits and overload conditions in advanced driver assistance systems (ADAS) and electrified powertrains. With the semiconductor industry shifting focus toward energy-efficient solutions, smart high side switches are increasingly replacing mechanical relays due to their reliability and diagnostic capabilities.

Other Trends

Integration of Advanced Protection Features

Manufacturers are embedding sophisticated protection mechanisms such as overcurrent limiting, thermal shutdown, and under-voltage lockout into smart high side switches. Nearly 65% of new automotive designs now mandate these features for compliance with ISO 26262 functional safety standards. The industrial sector follows closely, adopting these ICs for factory automation equipment where predictive maintenance capabilities reduce downtime. Recent product launches showcase switches with current monitoring accuracy within ±3%, a significant improvement from the ±10% tolerance common just five years ago. Furthermore, the integration of diagnostic feedback via SPI or I2C interfaces enables real-time system health monitoring—a capability particularly valued in mission-critical applications.

Miniaturization and Power Density Improvements

Advancements in packaging technologies are enabling remarkable reductions in footprint without compromising performance. The latest generation of smart high side switches now achieves power densities exceeding 30A/mm² in packages smaller than 5x5mm—a 40% improvement over previous generations. This miniaturization directly addresses space constraints in modern automotive electronics and IoT edge devices. Meanwhile, efficiency gains have reduced typical power dissipation by nearly 20% through optimized MOSFET architectures. Leading manufacturers are leveraging gallium nitride (GaN) and silicon carbide (SiC) materials to push these boundaries further, though silicon-based solutions currently dominate over 90% of the market due to cost advantages and manufacturing maturity.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansions Drive Market Leadership in Smart High Side Switch ICs

The global Smart High Side Switch ICs market exhibits a semi-consolidated structure, with established semiconductor giants competing alongside specialized manufacturers. Infineon Technologies leads the segment, holding an estimated 18-20% revenue share in 2024 through its PROFET™ and HITFET™ product families. The company’s dominance stems from its automotive-grade solutions that meet stringent AEC-Q100 qualifications, coupled with its vertically integrated manufacturing capabilities across Europe and Asia.

Texas Instruments and STMicroelectronics follow closely, collectively accounting for nearly 30% of the market. These players differentiate through advanced diagnostic features like current mirroring and thermal shutdown protection in their multi-channel switches, which are increasingly critical for industrial automation systems. Their R&D investments in silicon carbide (SiC) and gallium nitride (GaN) compatible switches have further strengthened market positions.

Meanwhile, Asian manufacturers such as ROHM Semiconductor and NOVOSENSE Microelectronics are gaining traction through cost-optimized solutions for consumer electronics and EV charging infrastructures. ROHM’s recent 40V/1.5A BD9P series demonstrates this trend, combining MOSFET and control IC in single package to reduce PCB footprint.

The competitive landscape is witnessing two strategic shifts: 1) European and American suppliers focusing on functional safety certifications (ISO 26262 for automotive), and 2) Japanese manufacturers like Sanken Electric developing high-voltage (>60V) variants for industrial motor drives. These developments suggest increasing specialization along application segments.

List of Key Smart High Side Switch IC Companies Profiled

Infineon Technologies (Germany)

Texas Instruments (U.S.)

STMicroelectronics (Switzerland)

NXP Semiconductors (Netherlands)

ROHM Semiconductor (Japan)

Analog Devices (U.S.)

Monolithic Power Systems (MPS) (U.S.)

Sanken Electric (Japan)

onsemi (U.S.)

Learn more about Competitive Analysis, and Forecast of Global Smart High Side Switch ICs Market : https://semiconductorinsight.com/download-sample-report/?product_id=103551

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Smart High Side Switch ICs Market?

-> Smart High Side Switch ICs Market size was valued at US$ 674.9 million in 2024 and is projected to reach US$ 1.08 billion by 2032, at a CAGR of 6.1% during the forecast period 2025-2032.

Which key companies operate in Global Smart High Side Switch ICs Market?

-> Key players include Infineon Technologies, Texas Instruments, STMicroelectronics, NXP, ROHM Semiconductor, Analog Devices, and Onsemi, among others.

What are the key growth drivers?

-> Key growth drivers include increasing automotive electronics content, industrial automation trends, and demand for efficient power management solutions.

Which region dominates the market?

-> Asia-Pacific is the fastest-growing region, while North America remains a significant market for high-end applications.

What are the emerging trends?

-> Emerging trends include integration of diagnostic features, higher current handling capabilities, and miniaturization of power ICs.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

0 notes

Text

Global Class-D Audio Power Amplifiers Market: Applications, Drivers, and Restraints 2025–2032

Global Class-D Audio Power Amplifiers Market Research Report 2025(Status and Outlook)

The global Class-D Audio Power Amplifiers Market size was valued at US$ 4.93 billion in 2024 and is projected to reach US$ 8.74 billion by 2032, at a CAGR of 8.53% during the forecast period 2025-2032

Our comprehensive Market report is ready with the latest trends, growth opportunities, and strategic analysis. https://semiconductorinsight.com/download-sample-report/?product_id=95835

MARKET INSIGHTS

The global Class-D Audio Power Amplifiers Market size was valued at US$ 4.93 billion in 2024 and is projected to reach US$ 8.74 billion by 2032, at a CAGR of 8.53% during the forecast period 2025-2032.

Class-D amplifiers are electronic devices that use switching technology to achieve high efficiency in audio signal amplification. Unlike traditional linear amplifiers (Class A/B), these devices operate by rapidly switching transistors on/off to recreate audio waveforms, achieving efficiency levels above 90%. Key components include MOSFETs, pulse-width modulators, and low-pass filters that reconstruct the amplified signal while minimizing power loss as heat.

The market growth is primarily driven by increasing demand for energy-efficient audio solutions across consumer electronics and automotive applications. The proliferation of smart devices, advancements in electric vehicle infotainment systems, and stricter energy efficiency regulations are accelerating adoption. Leading players like Texas Instruments and STMicroelectronics continue to innovate with integrated solutions, such as TI’s 2023 release of 70W stereo amplifiers with 92% efficiency for automotive audio systems.

List of Key Class-D Audio Amplifier Companies

Texas Instruments (U.S.)

STMicroelectronics (Switzerland)

Infineon Technologies (Germany)

Analog Devices (U.S.)

NXP Semiconductor (Netherlands)

Cirrus Logic (U.S.)

ROHM Semiconductor (Japan)

Icepower A/S (Denmark)

Qualcomm (U.S.)

ON Semiconductor (U.S.)

Segment Analysis:

By Type

Channel Segment Dominates Due to High Demand in Home Audio and Automotive Applications

The market is segmented based on type into:

Mono-Channel

2-Channel

4-Channel

6-Channel

Others

By Application

Automotive Segment Leads the Market Owing to Increasing Adoption of Advanced In-Vehicle Infotainment Systems

The market is segmented based on application into:

Smartphones

Television Sets

Home Audio Systems

Desktops and Laptops

Automotive

Regional Analysis: Global Class-D Audio Power Amplifiers Market

North America The North American Class-D audio power amplifier market is characterized by high adoption rates of advanced audio technologies and stringent energy efficiency standards. The region, particularly the U.S. and Canada, is witnessing strong demand from consumer electronics, automotive, and professional audio sectors. The U.S. Department of Energy’s efficiency regulations have accelerated the shift from traditional Class-AB to Class-D amplifiers, which offer up to 90%+ efficiency. Major players like Texas Instruments and Maxim Integrated dominate the supply chain, while home theatre systems and smart speakers continue to drive consumer demand. However, the mature market faces pricing pressures due to intense competition among semiconductor manufacturers.

Europe Europe maintains a robust ecosystem for Class-D amplifier innovation, supported by strict EU directives on power consumption and noise reduction in electronic devices. Germany and the UK lead in automotive integration, where premium car manufacturers increasingly adopt multi-channel Class-D solutions for infotainment systems. The consumer audio segment shows steady growth with rising demand for compact, high-fidelity wireless speakers. Environmental regulations like RoHS and REACH influence material sourcing and manufacturing processes, creating opportunities for companies like NXP and Infineon to develop eco-friendly amplification solutions. The professional audio market remains strong in music production and public address systems.

Asia-Pacific As the largest and fastest-growing regional market, Asia-Pacific accounts for over 45% of global Class-D amplifier demand, driven by massive electronics manufacturing in China, South Korea, and Japan. China’s domestic brands leverage local semiconductor production to offer cost-competitive solutions for smartphones and televisions. India’s expanding middle class fuels demand for affordable audio products, while Southeast Asian nations emerge as key manufacturing hubs. The region faces challenges with counterfeit components but benefits from aggressive R&D investments by firms like ROHM Semiconductor. Automotive audio systems show particular promise with rising vehicle production across emerging markets.

South America The South American market demonstrates steady but uneven growth, with Brazil and Argentina as primary consumers. Economic constraints limit premium audio adoption, favoring entry-level Class-D solutions in portable speakers and basic entertainment systems. Local assembly of consumer electronics creates opportunities for amplifier integration, though reliance on imported semiconductors persists. The automotive aftermarket shows potential as customers upgrade factory-installed audio systems. Political and currency instability occasionally disrupts supply chains, prompting manufacturers to adopt flexible inventory strategies for the region.

Middle East & Africa This emerging market presents long-term growth opportunities, particularly in Gulf Cooperation Council (GCC) countries where high disposable incomes drive premium audio purchases. The UAE and Saudi Arabia lead in smart home adoption, creating demand for integrated amplifier solutions. Africa’s gradual urbanization and mobile device penetration foster demand for low-power audio amplification in smartphones and portable media players. While infrastructure challenges persist, the region benefits from increasing investments in electronics distribution networks. Local assembly remains limited, with most products imported from Asia and Europe.

Market Dynamics:

The Class-D amplifier market faces ongoing challenges from global semiconductor supply constraints that emerged during the pandemic and continue affecting production capacity. Many amplifier ICs rely on specialized processing nodes that are in high demand across multiple industries. Lead times for key components have extended to 40+ weeks, forcing manufacturers to revise product roadmaps and inventory strategies. These disruptions are particularly acute for automotive applications where qualification processes limit component alternatives. Industry analysts predict these supply chain issues may persist into 2025, requiring manufacturers to develop more resilient sourcing strategies and potentially influencing regional manufacturing footprints.

Intensifying competition in consumer electronics creates significant cost pressures for Class-D amplifier manufacturers. As smart speaker and headphone markets mature, brands are aggressively optimizing bill-of-materials costs, often at the expense of audio quality. This creates a challenging environment where suppliers must balance performance, power efficiency and price – a complex equation that frequently results in compromised solutions. The situation is further complicated by regional pricing disparities and the rise of low-cost competitors from emerging markets. Maintaining profitability while meeting these demanding cost targets remains one of the industry’s most pressing challenges.

The rapid development of spatial audio and immersive sound technologies presents significant growth opportunities for Class-D amplifier manufacturers. As content creators and streaming services embrace Dolby Atmos and similar formats, demand for multi-channel amplification solutions is expanding beyond traditional applications. The professional audio sector is particularly promising, with concert venues and broadcast facilities requiring densely-packed amplifier arrays. Manufacturers addressing these needs with innovative multi-channel ICs and modular solutions stand to gain substantial market share. Recent product launches demonstrate this trend, including ROHM Semiconductor’s 8-channel Class-D amplifier specifically designed for immersive audio applications.

The explosive growth of true wireless stereo (TWS) earphones and wireless speakers creates extensive opportunities for advanced Class-D solutions. These applications demand ultra-low power consumption without compromising audio quality – a combination perfectly suited to Class-D architecture. Manufacturers are responding with innovative products integrating Bluetooth connectivity, DSP processing and amplification in single-chip solutions. Qualcomm’s QCC5100 series, for example, combines these functions with advanced power management, enabling 50+ hours of playback time. As wireless audio penetration continues growing across multiple price segments, these integrated solutions will play an increasingly important role in the market.

The market is highly fragmented, with a mix of global and regional players competing for market share. To Learn More About the Global Trends Impacting the Future of Top 10 Companies. https://semiconductorinsight.com/download-sample-report/?product_id=95835

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Class-D Audio Power Amplifiers Market?

Which key companies operate in this market?

What are the key growth drivers?

Which application segment dominates the market?

What are the emerging technology trends?

Related Reports:

https://semiconductorblogs21.blogspot.com/2025/07/global-single-use-bioprocessors-sensors.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-photonic-infrared-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-industrial-digital-contact-image.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-edge-computing-ai-chips-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-semiconductor-intellectual.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-post-cmp-residue-removal-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-cmp-equipment-market-value.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-wet-cleaning-equipment.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/wafer-used-oxidation-equipment-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-used-lithography-equipment.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-used-coater-and-developer.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/wafer-used-etching-equipment-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-used-ion-implantation.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-used-dry-etching-equipment.htmlhttps://semiconductorblogs21.blogspot.com/2025/07/global-wafer-used-pvd-equipment-market.html

CONTACT US: City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 [+91 8087992013] [email protected]

0 notes

Text

Disruptive Innovation! VBsemi TSM2N7002KDCU6 RF-VB Dual MOSFET: Compact Size with Giant Potential, Leading the Next-Gen Electronics Revolution

1. Product Overview and Core Parameter Analysis

1.1 Product Highlights

Dual N-channel integration: Saves PCB space, suitable for multi-channel signal switching or power management.

Low threshold voltage (2.5V): Can be directly driven by MCUs or low-voltage logic circuits, eliminating need for additional driver ICs.

Wide temperature range: Meets industrial-grade and automotive-grade requirements.

Supply chain advantages: Utilizes TSMC for wafer fabrication + JCET for packaging/testing, ensuring yield and supply stability.

2. Technical Features and Application Potential

2.1 RF and High-Frequency Suitability

The “RF-VB” designation suggests optimization for RF applications like low-frequency RF switching (<1GHz), antenna tuning, or signal routing.

Low gate charge (Qg) improves switching speed, but 1800mΩ Rds(on) may limit high-frequency/high-current applications.

2.2 Typical Applications

Power Management:

Low-side switches in DC-DC converters/LDO bypass circuits.

Load switches for battery-powered devices (TWS earphones, smartwatches).

Signal Switching:

I²C/SPI bus isolation to prevent signal conflicts.

Analog switches (audio/RF signal routing).

Industrial Control:

PLC I/O port protection.

Pre-driver circuits for motor control.

3. MOSFET Technology Trends

3.1 Rise of Wide-Bandgap Semiconductors (SiC/GaN)

SiC MOSFETs: Ideal for EVs, solar inverters, industrial PSUs with 1700V ratings and 50% lower switching loss vs. silicon.

GaN MOSFETs: High electron mobility enables fast charging (PD 3.1), 5G base stations, data centers.

Market forecast:Yole predicts the SiC power device market will reach 6.3billion,withtheGaNmarketat6.3billion,withtheGaNmarketat2 billion by 2027, demonstrating a CAGR exceeding 30%.

3.2 Super Junction & Trench Gate Technologies

Super Junction MOSFETs: Optimized P/N pillars enable lower Rds(on) at 600V–900V.

Trench Gate MOSFETs: Infineon/ON Semi offer <1mΩ Rds(on) for higher efficiency.

3.3 Packaging Innovations

DFN/QFN/CSP packages: Reduce size while improving thermal performance (e.g., TI’s dual-cooling SON).

Integrated power ICs: Combine MOSFETs + drivers + protection (e.g., ST’s VIPer series).

3.4 Digital Control & Smart Features

Digitally controlled MOSFETs: MCU-based dynamic voltage/current regulation for AI servers/autonomous vehicles.

4. Industry Outlook & Challenges

4.1 Growth Drivers

EVs: Chargers/BMS fuel demand for high-voltage MOSFETs.

Renewables: Solar inverters/energy storage need high-efficiency MOSFETs.

Consumer electronics: Fast charging/TWS rely on compact, low-power MOSFETs.

4.2 Key Challenges

SiC/GaN cost: Still higher than silicon — scale production needed.

Thermal management: Advanced packaging critical for high-power-density designs.

5. Conclusion

VBsemi’s TSM2N7002KDCU6 RF-VB excels in portable electronics, industrial controls, and RF switching with its dual N-channel design, low Vgs(th), and SC70–6 package.

MOSFET trends favor higher efficiency (SiC/GaN), miniaturization (advanced packages), and intelligence (integration). Silicon MOSFETs (like this product) remain vital for medium-low voltage markets.

0 notes

Text

How do constant current LED drivers maintain steady current?

The following are the core mechanisms and technical implementation methods of the constant current LED driver to maintain a stable current, combined with its working principle and key components for explanation:

1. The basic principle of constant current drive

Negative feedback control mechanism

The constant current driver monitors the LED current in real time through the built-in feedback loop (usually obtains the voltage signal through the series sampling resistor) and compares it with the preset reference value.

When the current deviation is detected, the driver chip automatically adjusts the output (such as adjusting the MOSFET switch duty cycle or linear impedance) to return the current to the set value.

Linear constant current and switching constant current technology

Linear constant current: Directly control the current by adjusting the impedance of the transistor or MOSFET, with a simple structure but low efficiency (suitable for low voltage difference scenarios).

Switching constant current: Using the buck, boost or buck-boost topology, the energy transmission is adjusted through high-frequency switching, and the efficiency can reach 80%-90%.

2. Key technologies for maintaining current stability

Precision current sampling and compensation

Use high-precision sampling resistors (such as 0.1Ω-1Ω) to convert the current into a voltage signal, and compare the reference voltage through the error amplifier to achieve a constant current accuracy of ±1%.

Some chips integrate input voltage compensation function to prevent grid fluctuations from affecting output.

Temperature management design

Built-in over-temperature regulation (OTP) function, automatically reducing current when chip temperature exceeds threshold to avoid thermal runaway.

Improve system stability by reducing heat dissipation design (such as high-voltage linear solution).

Anti-interference and protection mechanism

Add filter circuit to input stage to suppress surge voltage and electromagnetic interference (EMI).

Integrated short circuit protection, open circuit protection and reverse voltage protection to prevent abnormal working conditions from damaging LED or driver.

III. Typical application scenarios and dimming function

Dynamic dimming implementation

PWM dimming: Control the average current by adjusting the duty cycle of the switching frequency to avoid color deviation (frequency is usually >100Hz).

Analog dimming: Directly adjust the reference voltage value to change the output current, suitable for scenes without flicker requirements.

Multi-channel intelligent control

High-end chips support multiple independent constant current outputs, each of which can be programmed separately to meet complex lighting needs (such as RGB mixed light).

IV. Advantages and limitations

Advantages:

Ensure LED brightness consistency and long life (avoid rapid light decay caused by overcurrent).

Adapt to wide input voltage range (such as 5V-60V), compatible with a variety of power supply environments.

Limitations:

The linear constant current solution generates a lot of heat and requires additional heat dissipation design; the switch solution has a high cost.

Reference design example

H6901B boost chip: supports 12V-100V input, sets current through external resistors, and has an efficiency of >90%.

SM2082EAS linear chip: built-in over-temperature derating function, suitable for low-voltage applications such as LED light strips.

If you need a specific circuit diagram or selection suggestions, you can further analyze the voltage, power and dimming requirements of the application scenario.

#led car light#car lights#led lights#led auto light#youtube#led headlights#led headlight bulbs#ledlighting#led light#LED

0 notes

Text

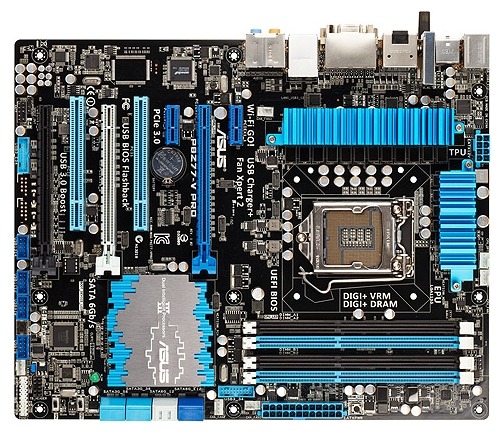

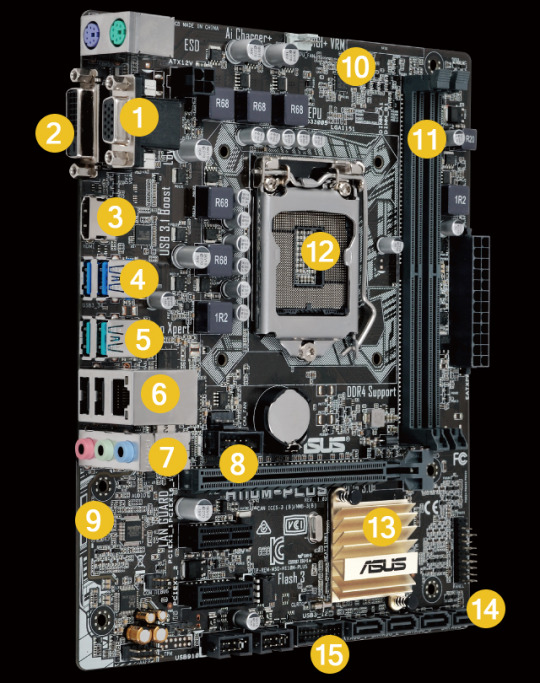

Asus ROG Strix B660 A Gaming WIFI D4 Features: Intel LGA 1700 Socket: Ready for 12th Gen Intel Core, Pentium Gold and Celeron processors Optimal Power Solution: 12+1 power stages with ProCool power connectors, high-quality alloy chokes and durable capacitors to support multi-core processors Optimized Thermal Design: Integrated I/O cover, VRM heatsinks with high conductivity thermal pads, and three onboard M.2 heatsinks High-performance Networking: On-board Intel WiFi 6 (802.11ax) and Intel 2.5 Gb Ethernet with ASUS LANGuard Best Gaming Connectivity: Supports HDMI 2.1 and DisplayPort 1.4 output, three M.2 slots, as well as USB 3.2 Gen 2×2 Type-C Intelligent Control: ASUS-exclusive AI Cooling, AI Networking and Two-Way AI Noise Cancelation to simplify setup and improve performance DIY Friendly Design: M.2 Q-Latch, pre-mounted I/O shield, BIOS FlashBack button and Q-LED Unmatched Personalization: ASUS-exclusive Aura Sync RGB lighting, including one RGB header and three addressable Gen 2 headers Industry-leading Gaming Audio: ALC4080 with Savitech SV3H712 amplifier, along with DTS Sound Unbound and Sonic Studio III Renowned Software: Bundled 60-day free trial of AIDA64 Extreme, and an intuitive UEFI BIOS dashboard ROG Strix B660-A Gaming WiFi D4 offers premium power delivery and optimized cooling to unleash the full force of the latest 12th Gen Intel Core processors. Onboard PCIe 5.0, WiFi 6 and three PCIe 4.0 M.2 slots provide lightning-fast data transfers for an endless variety of scenarios, and ASUS-exclusive intelligent controls to help optimize PC settings. On top of all that, DIY-friendly innovations help simplify the PC building process to get to you up and running smoothly. TEAMED POWER STAGES 12+1 power stages combine high-side and low-side MOSFETS and drivers into a single package, delivering the power and efficiency that the latest Intel processors can take full advantage of. ALLOY CHOKES AND CAPACITORS High-end chokes and durable capacitors are engineered to resist extreme temperatures, enabling performance that exceeds industry standards. PROCOOL POWER CONNECTOR The ASUS ProCool socket is built to exacting specifications to ensure flush contact with the PSU power lines, enabling lower impedance and better heat dissipation. DIGI+ POWER CONTROL The Digi+ voltage regulator module (VRM) is one of the finest in the industry, ensuring ultra-smooth and clean power delivery to the CPU. SIX-LAYER PCB A multi-layered printed circuit board design quickly dissipates heat around the voltage regulators to improve overall system stability and provide the CPU with more overclocking headroom. Two-Way AI Noise Cancelation This powerful ASUS-exclusive utility leverages a massive deep-learning database to reduce background noise from the microphone* and incoming audio while preserving voices. Distracting keyboard clatter, mouse clicks and other ambient noises are removed so you can hear and be heard with perfect clarity while gaming or during calls. Asus ROG Strix B660 A Gaming WIFI D4 AI Cooling ASUS AI Cooling technology automatically manages and controls motherboard-connected fans to ensure optimal settings based on current system load and temperature. AI Networking The proprietary ROG GameFirst VI utility is designed to help all users beginners, experts, and everyone in between optimize network settings to ensure smooth online gameplay. New to this generation, GameFirst VI features AI-enhanced identification and boost technologies to ensure faster and smarter network optimization. Adaptive Intelligence GameFirst VI notes what you’re currently doing and adjusts bandwidth accordingly to ensure smooth online experiences, even when multitasking. OptiMem II OptiMem II technology offers higher clock speeds through trace layout optimizations that significantly reduce signal distance and crosstalk while enhancing memory stability and compatibility. ROG Strix B660-A Gaming WiFi D4 supports up to 128 GB of DDR4 memory across four slots.

WiFi 6 (802.11 ax) Onboard WiFi 6 (802.11ax) supports ultrafast wireless-networking speeds, improved capacity and better performance in dense wireless environments, providing exceptional online gaming experiences. Pair your motherboard with ASUS WiFi 6 routers to fully experience the networking potential of WiFi 6. Intel 2.5 Gb Ethernet Onboard 2.5 Gb Ethernet gives your wired connection a boost, with up to a 2.5x improvement over standard Ethernet connections for faster file transfers, smoother lag-free gaming and high-res video streaming. SupremeFX ROG SupremeFX is a unique blend of hardware and software that provides superior audio. In ROG Strix B660-A Gaming WiFi D4, SupremeFX features the ALC4080 codec to increase playback resolution from 192 kHz to 384 kHz across all channels. The front-panel output is streamed through a highly integrated Savitech amplifier thatands capable of driving of a wide variety of gaming headsets and high-fidelity headphones. Undeniably ROG Strix The ROG Strix B660-A Gaming WiFi D4 will turn heads with a striking silver-white finish that contrasts with a bold Aura RGB-illuminated glitch-effect logo. Meanwhile, parallel strakes and dotted text on the aluminum I/O shroud, M.2 and PCH heatsinks tie the whole aesthetic together and underline the ROG Strix fundamentals of speed, diversity and attitude. M.2 Q-LATCH The innovative Q-Latch makes it easy to install or remove an M.2 SSD without the need for specific tools. The design employs a simple locking mechanism to secure the drive and neatly eliminate traditional screws. CERTIFIED COMPATIBILITY ROG Strix motherboards undergo an extensive certification program to ensure compatibility with the widest range of components and devices. Our Qualified Vendor List (QVL) provides a reference for identifying guaranteed-compatible components and memory. ASUS AIO coolers are also compatible with a wide variety of CPUs, up to and including 12th Gen Intel processors, giving you ultimate flexibility to cool the CPU that fits your needs. THE ROG STRIX ECOSYSTEM AWAITS Level up your game with ROG Strix. Enjoy complementary aesthetics, control and compatibility across AIO coolers, cases, peripherals, and much more. ROG offers more choices than any other brand. UEFI BIOS The renowned ROG UEFI (BIOS) provides everything you need to configure, tweak, and tune your rig. It offers intelligently simplified options for newcomers to PC DIY and more comprehensive features for seasoned veterans. Sonic Studio III ROG Sonic Studio supports HRTF-based (head-related transfer function*) virtual surround for VR headsets, casting an immersive aural landscape that draws you deeper into the action. The intuitive Sonic Studio interface also offers a range of EQ options and one-click presets, allowing you to tailor acoustics to suit personal preferences or the characteristics of your headset. DTS: Sound Unbound dts ROG Strix B660 motherboards are pre-loaded with the DTS Sound Unbound app that envelops you in audio as never before, conjuring whole new levels of immersion for extraordinary gaming and entertainment experiences. By leveraging Windows Sonic spatial technology, DTS Sound Unbound delivers audio in a virtual 3D space putting you right in the middle of the soundscape, where you can sense the location and direction of every gunshot, footstep or other sound in your virtual environment. Stereo Sound: Discrete left and right audio channels enable headphone or two-speaker setup. Surround Sound: Audio is split and served over multiple speaker channels e.g., 5.1 or 7.1 to create an enveloping experience on a single, logical plane. Spatial Sound: A virtual audio sphereand effect creates astonishing 360° immersion with you at the center, where sounds seem to travel in all directions. AIDA64 EXTREME ROG Strix B660 motherboards include an AIDA64 Extreme 60 days free trial. This industry-leading system information tool provides detailed information about installed hardware

and software, and it also provides benchmarks for measuring performance of the entire system or individual components. AIDA64 Extreme includes a monitoring and diagnostics feature to detect and prevent hardware issues. All vital system sensors can be tracked in real time, allowing voltage readings, fan speeds, and temperature information to be displayed on the desktop or sent to dedicated displays or to the OLED panels of ROG AIO liquid coolers*. Armoury Crate Armoury Crate is a software utility designed to give you centralized control of supported gaming products, making it easy to tune the look and feel of your system. From a single intuitive interface, Armoury Crate helps you customize RGB lighting and effects for compatible devices and synchronize them with Aura Sync to create a unified lighting scheme across your system. In addition, Armoury Crateands Fan Xpert4 tool provides comprehensive control over fans, water pumps and all-in-one (AIO) coolers. Asus ROG Strix B660 A Gaming WIFI D4

0 notes

Text

MOSFET Driver Market | Analog Devices, Broadcom, Infineon, Littelfuse,Inc

Introduction:

The introduction to the report serves as a gateway into the comprehensive world of the mosfet driver market. As industries continue to evolve and adapt to changing consumer demands and technological advancements, understanding the market dynamics becomes paramount for industry stakeholders. The report takes on the responsibility of offering a profound and all-encompassing analysis of the mosfet driver market, catering to the needs of a diverse audience that includes manufacturers, suppliers, distributors, and investors.

Scope and Purpose:

The report's primary goal is to provide invaluable insights that empower industry stakeholders to make informed decisions. Whether it's manufacturers seeking to refine their product offerings, suppliers strategizing their supply chain management, distributors gauging market trends, or investors evaluating potential opportunities, the report aims to be a comprehensive guide. It endeavors to illuminate the current status of the mosfet driver market while projecting its future trends.

Request for Sample Report:

Value to Industry Stakeholders:

Recognizing that knowledge is power, the report promises to deliver a wealth of information encompassing various aspects of the mosfet driver market. By delving into the intricacies of market dynamics, competition, growth avenues, challenges, and regional variations, the report seeks to equip its readers with an arsenal of insights. This information is not merely descriptive; rather, it's intended to be actionable, aiding stakeholders in making critical decisions that can shape their strategies and endeavors in the market.

Promising Comprehensive Analysis:

To fulfill its promises, the report assures a comprehensive analysis that leaves no stone unturned. It pledges to unravel the factors propelling the market's growth, dissecting shifts in consumer preferences and technological breakthroughs that are driving the demand for mosfet driver products. Simultaneously, it acknowledges that challenges and obstacles are part of any industry landscape, and it vows to illuminate these hurdles, be it economic uncertainties or the intense competition that often characterizes such markets.

Guiding the Path Forward:

As the report extends an invitation to its readers to explore its contents, it sets the stage for uncovering the competitive landscape. It introduces the major players in the mosfet driver market and their strategies, offering insights into what makes them thrive. This insight-rich analysis is meant to guide others on their path forward – whether it's to navigate the competition more effectively or to find inspiration in successful strategies.

Anticipation of Insights:

With an awareness that the market is not monolithic but rather a composition of various segments, the report pledges to provide a nuanced understanding of these segments. It promises to detail their sizes, potential growth trajectories, and key trends. This targeted knowledge assists stakeholders in carving out specialized strategies and ensuring optimal resource allocation.

Market Dynamics:

Factors Driving Market Growth: The section dedicated to the factors driving the growth of the mosfet driver market provides a comprehensive overview of the key forces propelling its expansion. It delves into a multi-dimensional analysis that underscores the multifaceted nature of this growth. The following aspects are discussed in detail:

Changing Consumer Preferences: The report recognizes that consumer preferences are ever-evolving, influenced by shifting lifestyles, demographics, and societal trends. It highlights how mosfet driver products are witnessing increasing demand due to consumers' heightened awareness of environmental sustainability and their preference for more efficient and eco-friendly solutions. As consumers increasingly seek products that align with their values, the market experiences a surge in demand.

Technological Advancements: A prominent driver of market growth is technological progress. The report emphasizes how advancements in manufacturing processes, materials, and product designs are enhancing the appeal and performance of mosfet driver products. These innovations lead to improved product efficiency, durability, and functionality, thereby attracting both consumers and industry players.

Government Regulations and Initiatives: The report recognizes the influential role of governments in shaping the market landscape. It details how regulatory frameworks and initiatives that promote the adoption of sustainable and environmentally friendly products are fostering the growth of the mosfet driver market. These regulations incentivize manufacturers, suppliers, and consumers to opt for mosfet driver products, driving their adoption and market penetration.

Potential Hindrances to Market Growth: In a balanced assessment, the report acknowledges that alongside growth drivers, there are potential impediments that can affect the trajectory of the mosfet driver market's expansion. These include:

Economic Uncertainty: Economic fluctuations and uncertainties can impact consumer spending patterns and investment decisions. The report discusses how economic downturns or uncertainties may lead to cautious spending behavior, affecting the demand for non-essential products such as mosfet driver goods. This economic sensitivity can create fluctuations in market growth rates.

Supply Chain Disruptions: The global supply chain is subject to various risks, including natural disasters, geopolitical tensions, and pandemics. The report highlights how disruptions in the supply chain can lead to production delays, shortages, and increased costs. Such disruptions can hinder the consistent availability of mosfet driver products in the market.

Intense Market Competition: The report acknowledges that as the mosfet driver market gains traction, competition among market players intensifies. It explores how the proliferation of products and companies in this sector can lead to price wars, reduced profit margins, and the need for innovative marketing and differentiation strategies to stand out.

Balancing Forces and Strategic Implications: By elucidating both the driving forces and potential obstacles, the report paints a holistic picture of the market dynamics. It enables industry stakeholders to navigate the competitive landscape with a deeper understanding of the forces at play. Manufacturers can align their innovation efforts with consumer preferences and regulatory trends, thereby enhancing their market position. Investors and decision-makers can be better prepared to address economic uncertainties and supply chain vulnerabilities. Overall, this section equips readers with insights to make strategic decisions that account for both growth opportunities and challenges in the mosfet driver market.

Experience Our Sample Report:

Exploring the Competitive Landscape:

The section dedicated to the competitive landscape of the mosfet driver market offers an intricate exploration of the market's key players, their strategies, and their impact on the industry. This segment aims to provide a comprehensive understanding of the market's dynamics, the role of major companies, and the strategies they employ to thrive. The analysis encompasses several critical aspects:

Major Players Introduction: The report begins by introducing the major companies that play a significant role in the mosfet driver market. These players are identified as key influencers within the industry and are pivotal in shaping its direction. The inclusion of their profiles establishes a foundation for the subsequent analysis.

Business Strategies: The report delves into the business strategies adopted by these major players. It explores their approaches to market penetration, product development, marketing, distribution, and customer engagement. This insight offers readers an understanding of the distinct paths these companies take to secure their positions and expand their market shares.

Product Portfolios: Understanding the range of products offered by these major companies is essential in comprehending their market presence. The report delves into their product portfolios, highlighting the diversity and uniqueness of their offerings. This analysis provides a glimpse into the variety of options available to consumers and underscores how companies differentiate themselves.

Recent Trends and Innovations: The competitive landscape analysis is not static; it also captures the dynamism of the market. The report explores the recent trends and innovations introduced by these major players. It sheds light on how these companies continually adapt to changing consumer preferences, technological advancements, and emerging market demands.

Financial Performance: The financial aspect of these companies is a vital indicator of their market strength and sustainability. The report offers insights into the financial performance of major players, including revenue figures, profit margins, and growth trajectories. This information provides a quantitative perspective on the players' market impact and resilience.

Some of the major companies in the MOSFET Driver market are as follows: Analog Devices, Broadcom, Infineon, Littelfuse,Inc, Microchip, NXP Semiconductors, ON Semiconductor, Power Integrations, Renesas, Rohm, STMicroelectronics, Texas, Toshiba, Vishay

Strategies for Sustaining Position:

By presenting a holistic view of the competitive landscape, this section allows readers to glean insights into the strategies employed by major companies to maintain their positions:

Differentiation: Companies strive to differentiate themselves from their competitors. The report reveals how major players leverage unique product features, quality, branding, and customer experiences to set themselves apart in the market.

Innovation: Innovation is a cornerstone of success. By exploring recent trends and innovations, the report illustrates how companies continuously invest in research and development to stay ahead of the curve and meet evolving customer needs.

Market Penetration: Understanding the strategies for expanding market presence is crucial. The report discusses how companies approach entering new markets, expanding their customer base, and increasing their market share.

Adaptability: The competitive landscape is subject to change. Companies that exhibit adaptability in the face of shifting trends and challenges are more likely to sustain their positions. The report highlights how major players adjust their strategies in response to market dynamics.

Customer-Centric Approaches: Successful companies prioritize their customers. The report showcases how major players tailor their products and services to align with customer preferences, creating lasting relationships and fostering brand loyalty.

Request a Glimpse of Our Sample Report:

In-Depth Market Segmentation Analysis:

The report dedicates a section to delve into the market segmentation of the mosfet driver market, focusing on two specific segments named "Type" and "Application." This segmentation analysis serves as a critical framework for understanding the intricacies of the market's composition and potential. The following details are likely explored in this section:

Segment Characteristics: The report initiates the analysis by outlining the unique characteristics that define each segment. Whether these segments are categorized based on product types, customer demographics, use cases, or other distinguishing factors, the report provides a clear picture of how these segments are defined and differentiated.

Market Size: Understanding the size of each market segment is crucial for gauging its significance within the overall market landscape. The report likely provides quantitative data to illustrate the market share and contribution of "Type" and "Application" segments to the entire mosfet driver market. This information helps stakeholders appreciate the relative importance of each segment.

Growth Potential: Beyond current market size, the report delves into the growth potential of these segments. It explores factors such as emerging trends, consumer behaviors, technological advancements, and regulatory influences that could drive the future expansion of these segments. This forward-looking perspective aids stakeholders in identifying where the market's growth opportunities lie.

Key Trends: The analysis likely captures the key trends specific to each segment. Whether it's changing consumer preferences, evolving technology adoption, or shifting regulatory landscapes, the report provides insights into the forces shaping the behavior of "Type" and "Application." These trends inform stakeholders about the directions these segments might take in the coming years.

Strategic Insights: The segment analysis extends beyond descriptive data to offer strategic insights. By understanding the characteristics, potential, and trends of "Type" and "Application," industry participants can make informed decisions. Manufacturers can tailor their product development strategies to meet the demands of these segments, and marketers can create targeted campaigns to reach specific customer groups.

Resource Allocation: Effective resource allocation is a cornerstone of successful business strategies. Armed with knowledge about the characteristics and growth potential of each segment, stakeholders can allocate their resources – whether it's budget, manpower, or marketing efforts – in a more focused and efficient manner. This optimization is crucial for maximizing returns on investments.

Competitive Dynamics: The segment analysis also influences the competitive landscape discussion. Understanding the major players operating within each segment and their strategies provides insights into how companies compete within specific niches. This knowledge helps stakeholders identify where there might be gaps in the market or opportunities for differentiation.

Market Segmentation:

Type: Full Bridge, Half Bridge

Application: Home Appliance, Automotive, Display & Lighting, Power Supply, Others

Strategic Decision-Making:

The comprehensive analysis of the "Type" and "Application" segments equips industry stakeholders with actionable insights:

Niche Strategies: Armed with a deep understanding of each segment's characteristics, stakeholders can craft specialized strategies to cater to the unique needs of "Type" and "Application" customers. This can involve tailored product offerings, marketing campaigns, and distribution approaches.

Growth Opportunities: The growth potential assessment informs strategic decisions. Stakeholders can identify which segment holds the most promise for expansion and investment, helping them prioritize their efforts and resources.

Mitigating Risks: Knowledge of key trends within each segment enables stakeholders to anticipate potential challenges and mitigate risks. They can proactively adapt to changing customer preferences, technological shifts, or regulatory changes.

Targeted Resource Allocation: With a clear picture of the market size and potential for each segment, stakeholders can allocate resources more effectively. This optimization enhances efficiency and increases the likelihood of achieving desired outcomes.

In sum, the segmentation analysis provides a roadmap for industry participants to navigate the diverse landscape of the mosfet driver market. By examining "Type" and "Application" segments in detail, the report empowers stakeholders with the insights needed to make informed decisions, seize growth opportunities, and tailor their strategies for success.

Sample Report Available at Your Request:

Exploring Regional Dynamics:

The section dedicated to the regional analysis of the mosfet driver market provides a comprehensive exploration of how the market fares across different geographical areas. This analysis recognizes that markets are not homogenous and that regional variations can significantly impact market dynamics. The report delves into the intricacies of each region – North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa – to provide stakeholders with valuable insights. The analysis includes the following components:

Geographical Coverage: The report begins by outlining the regions under consideration: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Each of these regions represents a unique landscape with distinct economic, cultural, and regulatory characteristics that influence market behavior.

Sub-Regional Breakdown: Within each major region, the analysis likely provides a sub-regional breakdown. For instance, in Europe, the report might focus on countries like Germany, the U.K., France, Italy, and Spain. This detailed approach recognizes that even within larger regions, markets can differ significantly due to factors like language, culture, and consumer behavior.

Market Size and Growth Potential: The report quantifies the market size for each region and sub-region. This information provides a benchmark for understanding the relative significance of each market in the global context. Moreover, the analysis explores the growth potential of each region, considering factors such as economic growth, population trends, and market maturity.

Trends and Drivers: Regional trends and drivers play a pivotal role in shaping market behavior. The analysis delves into trends specific to each region, highlighting factors such as technological adoption rates, consumer preferences, and regulatory changes. These insights offer stakeholders a nuanced understanding of what is currently driving market dynamics.

Market Challenges: Recognizing that challenges vary by region, the report likely addresses obstacles specific to each geographical area. Regulatory complexities, economic constraints, and cultural nuances can all pose challenges that impact market entry and expansion strategies.

Competitive Landscape: Understanding the competitive dynamics within each region is crucial. The report may highlight major players operating in each region and their strategies. This insight helps stakeholders gauge the intensity of competition and assess the potential barriers to entry.

Culmination of Insights:

The conclusion of the report serves as the final crescendo in the symphony of insights, encapsulating the significance and value that the report brings to industry stakeholders. This section distills the entire report into a concise yet powerful message, reinforcing the key takeaways and underscoring the importance of the information presented.

Comprehensive and Practical Information: The conclusion reiterates the core objective of the report: to provide a comprehensive and practical resource for industry stakeholders. It emphasizes that the report goes beyond mere data collection and presents information in a way that is actionable and applicable to real-world business scenarios.

Insights into Market Dynamics: The report's value is highlighted by its ability to offer insights into the dynamic nature of the mosfet driver market. From dissecting market trends to uncovering growth opportunities and potential risks, the report equips stakeholders with the understanding needed to navigate this ever-evolving landscape.

Informed Decision-Making: One of the central themes of the conclusion is how the report empowers stakeholders to make informed decisions. By offering a deep understanding of market trends, competitive dynamics, and potential challenges, the report serves as a guiding light in an environment often characterized by uncertainty.

Strategic Guidance: The conclusion underscores that the report isn't just a collection of facts; it's a strategic tool. It aids manufacturers in refining their product offerings, guides suppliers in optimizing their supply chain, assists distributors in capitalizing on market trends, and helps investors in evaluating potential opportunities.

Holistic Perspective: The conclusion highlights that the report provides a holistic perspective on the mosfet driver market. It covers a range of critical aspects – from market dynamics to regional variations – ensuring that stakeholders have a comprehensive view that informs their decision-making.

Final Call to Action: The conclusion not only encapsulates the report's essence but also provides a call to action:

Informed Business Decisions: It urges readers to recognize the report's potential to transform their approach to business decisions. By absorbing the insights within, stakeholders are better equipped to navigate challenges, seize opportunities, and strategically position themselves in the market.

Continuous Adaptation: The conclusion suggests that success in the mosfet driver market requires a commitment to continuous adaptation. The insights offered in the report are not static; they reflect the ever-changing landscape. The report encourages stakeholders to view it as a guide for ongoing adaptation and evolution.

A Blueprint for Success: Ultimately, the conclusion presents the report as a blueprint for success. By leveraging the knowledge and insights presented within its pages, industry stakeholders can chart a course that capitalizes on market trends, mitigates risks, and embraces growth opportunities.

Closing Thoughts:

In essence, the conclusion encapsulates the report's journey. It emphasizes the report's role as a strategic tool, a navigator, and a decision-making companion in the complex world of the mosfet driver market. The provided text not only outlines the structural elements of a market report but also captures its essence – to inform, guide, and empower stakeholders as they navigate the dynamic and ever-evolving mosfet driver market.