#optimizing accounts payable process

Explore tagged Tumblr posts

Text

Healthy Business Operations & Relationships - Optimise AP Process With Moolamore

Is it difficult for your small and medium-sized business to maintain a healthy cash flow and run smoothly? Are late payments causing problems with your vendors, suppliers, or creditors? Accounts payable (AP) management is an important part of any business. However, it is frequently overlooked or misused in financial management.

That is why, in today's blog, we will discuss the consequences of late payments and demonstrate how the groundbreaking Moolamore cash flow tool can optimize your accounts payable process, resulting in healthy business operations and relationships.

#optimizing accounts payable process#streamlining AP operations#improving AP efficiency#AP process optimization

0 notes

Text

Achieve Seamless Financial Operations with End-to-End AP Outsourcing

As businesses scale, managing accounts payable becomes increasingly complex. That’s why many are turning to payables outsourcing to streamline processes, improve accuracy, and boost overall efficiency. End-to-end solutions offer a comprehensive approach, handling everything from invoice capture to payment disbursement.

One of the key advantages is the implementation of full-cycle AP services. These services encompass every stage of the payables process, including invoice receipt, approval workflows, exception handling, and final payment. This integrated approach reduces manual errors and ensures a seamless payment cycle.

Process optimization is another significant benefit. Outsourcing firms use best-in-class technology and proven methodologies to identify inefficiencies and redesign workflows for better performance. As a result, businesses experience faster turnaround times, better compliance, and reduced administrative burden.

A critical component of payables outsourcing is efficient invoice processing. Automation tools can capture, match, and validate invoices with minimal human intervention. This not only cuts down on processing time but also enhances data accuracy and minimizes the risk of duplicate payments.

Moreover, outsourced accounting gives you access to finance professionals who specialize in AP management. These experts provide strategic insights, manage vendor relationships, and help maintain cash flow by ensuring timely and accurate payments.

In summary, payables outsourcing with end-to-end solutions brings together full-cycle AP, invoice processing, and expert support to deliver real business value. From process optimization to outsourced accounting, businesses can operate more efficiently and focus on strategic growth rather than back-office tasks.

0 notes

Text

Chicago Real Estate Market: Trends, Opportunities, and What to Expect in 2025

Managing a business involves more than just delivering excellent products and services. Financial management plays a critical role in the success of any business. For many business owners in North Carolina, bookkeeping can become an overwhelming task that diverts attention from core operations. However, outsourcing bookkeeping services can streamline financial processes, save valuable time, and lead to significant cost savings.

Here's a closer look at how professional bookkeeping services can optimize financial management.

Time Savings: Focus on What Matters

Every business owner understands the importance of time, and bookkeeping tasks can quickly take up valuable hours that could be better spent on growing the business. Managing financial records, categorizing transactions, and reconciling accounts can be complicated and tedious. Outsourcing these tasks to experienced bookkeepers frees up time to focus on strategic goals, customer relations, and other business operations.

By trusting experts with financial duties, owners ensure that these tasks are handled efficiently and accurately. Bookkeepers use specialized tools to organize and maintain financial records, making the process faster and more reliable. As a result, businesses avoid spending time correcting mistakes and can rest assured that financial records are up to date.

Financial Clarity: Informed Decision-Making

Clear, accurate financial data is essential for making informed decisions. Without up-to-date reports, it can be challenging to understand the true state of a business's finances. Professional bookkeeping services provide valuable insights into cash flow, income, and expenses. Business owners gain a clear picture of financial health, which is vital for planning and budgeting.

Regular financial reports, including profit and loss statements, balance sheets, and cash flow summaries, help identify trends and highlight areas for improvement. With this knowledge, businesses can adjust strategies, identify opportunities for growth, and make smarter decisions that lead to success. Understanding the numbers simplifies the decision-making process and helps ensure long-term sustainability.

Reducing Costs: Avoiding Errors and Penalties

Handling bookkeeping independently often leads to mistakes—whether it's misclassifying an expense or missing a tax deduction. These errors can result in costly penalties, missed savings, or poor financial decisions. By working with professional bookkeepers in Chicago for real estate, businesses can reduce the risk of errors that could lead to economic setbacks.

Experienced bookkeepers ensure that taxes are filed correctly, transactions are properly recorded, and all necessary deductions are applied. This not only helps avoid penalties but also uncovers potential savings by identifying overlooked deductions or financial inefficiencies. Outsourcing bookkeeping services, therefore, saves money by preventing costly mistakes.

Streamlining Operations: Efficient Financial Management

Bookkeeping involves more than just tracking income and expenses. It also includes managing accounts payable, accounts receivable, payroll, and tax filings. Keeping up with these responsibilities can become overwhelming, especially as a business grows. Professional bookkeeping services automate many of these processes, ensuring they are completed efficiently and on time.

Timely payment of invoices and the smooth processing of payroll help businesses maintain strong relationships with vendors and employees. At the same time, timely billing and collections keep cash flow consistent. By handling these essential tasks, bookkeeping services allow business owners to focus on other aspects of their operations, while the financial side of the business remains in capable hands.

Scalability: Adapting to Business Growth

As businesses grow, so do their financial complexities. Whether it's increasing revenue, adding new employees, or expanding to new markets, the need for more detailed financial management arises. Professional bookkeeping services can scale with a business, providing tailored solutions as needs evolve.

Outsourcing bookkeeping allows businesses to avoid the cost and hassle of hiring additional in-house staff or purchasing expensive software. Bookkeepers can adjust their services to accommodate changing demands, whether it's managing more transactions or overseeing more complex accounting tasks. This scalability ensures that businesses are equipped to handle growth without compromising on financial accuracy.

Data Protection: Safeguarding Financial Information

When it comes to financial data, security is critical. Storing sensitive business information—such as revenue details, tax filings, and payroll records—requires a high level of protection. Professional bookkeeping services use secure systems to ensure that financial records are safely stored and only accessible to authorized personnel.

By employing encryption and secure cloud storage, bookkeepers safeguard against data breaches and fraud. Additionally, regular reconciliations and audits help detect any discrepancies or signs of fraudulent activity, providing an extra layer of protection for the business's financial assets.

Conclusion: Why Bookkeeping Services Are an Investment

Outsourcing bookkeeping may seem like an added expense, but it's an investment that yields significant returns. By entrusting financial management to experts, business owners save valuable time, reduce the risk of costly errors, and gain valuable insights into their financial health. From improving cash flow management to identifying areas for cost savings, professional bookkeeping services help businesses optimize operations and increase profitability.

For businesses in North Carolina, professional bookkeeping is not just a convenience—it's a strategic asset that ensures financial processes are efficient, accurate, and secure. By freeing up time and minimizing costs, bookkeeping services allow businesses to focus on what matters most: achieving long-term success and growth.

To know more about real estate services, visit the website now.

2 notes

·

View notes

Text

Expert Bookkeeping Services New Mexico: Streamlining Your Financial Success

Bookkeeping Services New Mexico

In today’s fast-paced business environment, accurate and reliable financial management is crucial to business success. One of the foundational pillars of sound financial practices is bookkeeping services. For businesses in the Southwestern region, especially in New Mexico, accessing professional bookkeeping services New Mexico can make all the difference between thriving and merely surviving.

The Importance of Bookkeeping for Modern Businesses

Every business, regardless of size, must maintain a clear and accurate financial record. Bookkeeping involves recording all financial transactions, including income, expenses, payroll, and taxes. This process ensures that a business remains compliant with local and federal regulations while also providing a clear snapshot of financial health.

Why Choose Bookkeeping Services in New Mexico?

1. Local Expertise

New Mexico has unique tax laws, business regulations, and economic opportunities. Working with a provider that specializes in bookkeeping services New Mexico means you benefit from professionals who understand local compliance standards and financial requirements.

2. Tailored Solutions

Professional bookkeeping services are not one-size-fits-all. Businesses in different industries require customized bookkeeping solutions. Whether you're a small business, a startup, or an established enterprise in New Mexico, tailored services ensure your finances are managed effectively.

3. Cost Efficiency

Outsourcing your bookkeeping services can save you money compared to hiring a full-time, in-house bookkeeper. With outsourced bookkeeping services New Mexico, you gain access to expert knowledge without the overhead costs.

4. Technology Integration

Modern bookkeeping relies heavily on software and cloud solutions. Experts offering bookkeeping services New Mexico use the latest tools to streamline data entry, automate recurring transactions, and generate insightful reports.

Services Offered by Bookkeeping Providers in New Mexico

Professional bookkeeping firms in New Mexico offer a range of services to meet the specific needs of their clients:

General Ledger Maintenance

Accurate recording and categorization of all financial transactions to ensure your general ledger remains up to date.

Accounts Payable and Receivable

Efficient tracking of incoming and outgoing payments, helping you manage cash flow and avoid late fees or missed invoices.

Bank Reconciliation

Matching bank statements with internal records to identify discrepancies and ensure accuracy.

Payroll Processing

Timely calculation and distribution of employee salaries, tax withholdings, and benefits.

Financial Reporting

Generation of monthly, quarterly, and annual reports including income statements, balance sheets, and cash flow statements.

Tax Preparation Support

Proper organization of financial documents and coordination with CPAs to simplify the tax filing process.

Advantages of Outsourcing Bookkeeping Services New Mexico

Outsourcing is a strategic move for businesses looking to optimize their financial operations. Here’s how outsourcing bookkeeping services New Mexico can be beneficial:

Time Savings: Focus on growing your business while experts handle the books.

Accuracy: Reduce errors and discrepancies with skilled professionals managing your finances.

Compliance: Stay up to date with local and federal tax laws and financial regulations.

Data Security: Access to secure digital storage and cloud-based accounting systems.

Scalability: Easily scale services as your business grows.

Who Can Benefit from Bookkeeping Services in New Mexico?

Small and Medium Enterprises (SMEs)

SMEs can manage their finances better and avoid costly errors by outsourcing their bookkeeping to professionals.

Startups

Startups can save valuable time and resources by relying on expert bookkeeping services to establish strong financial foundations.

Freelancers and Consultants

Independent professionals can gain peace of mind by ensuring their income and expenses are properly tracked.

Non-Profit Organizations

Proper financial reporting and transparency are essential for non-profits to maintain trust with donors and stakeholders.

Choosing the Right Bookkeeping Partner in New Mexico

When selecting a bookkeeping provider, keep the following in mind:

Experience: Look for a team with a proven track record in delivering top-notch bookkeeping services New Mexico.

Reputation: Check reviews, testimonials, and references from other clients.

Technology: Make sure they use modern tools for accuracy and efficiency.

Support: Ensure they provide ongoing support and personalized service.

Why Choose CFO Advisory India?

If you are looking for reliable bookkeeping services New Mexico, CFO Advisory India offers a comprehensive suite of financial services tailored to your business needs. With a team of skilled professionals, CFOAD delivers timely, accurate, and compliant bookkeeping that allows businesses to focus on core operations.

What Sets CFOAD Apart?

Expert knowledge in local New Mexico compliance and tax laws

Personalized solutions for businesses of all sizes

Efficient use of technology and secure cloud-based systems

Transparent communication and client-first approach

Conclusion

Accurate bookkeeping is the backbone of any successful business. Whether you're a growing startup, a seasoned entrepreneur, or a non-profit organization in New Mexico, professional bookkeeping services New Mexico are essential for financial clarity and success. Partnering with a trusted provider like CFOAD can help you navigate the complexities of financial management with ease, ensuring your business stays on the path to growth and profitability.

Embrace professional bookkeeping today and take the first step toward financial excellence in New Mexico.

1 note

·

View note

Text

With Innrly | Streamline Your Hospitality Operations

Manage all your hotels from anywhere | Transformation without transition

Managing a hotel or a multi-brand portfolio can be overwhelming, especially when juggling multiple systems, reports, and data sources. INNRLY, a cutting-edge hotel management software, revolutionizes the way hospitality businesses operate by delivering intelligent insights and simplifying workflows—all without the need for system changes or upgrades. Designed for seamless integration and powerful automation, INNRLY empowers hotel owners and managers to make data-driven decisions and enhance operational efficiency.

Revolutionizing Hotel Management

In the fast-paced world of hospitality, efficiency is the cornerstone of success. INNRLY’s cloud-based platform offers a brand-neutral, user-friendly interface that consolidates critical business data across all your properties. Whether you manage a single boutique hotel or a portfolio of properties spanning different regions, INNRLY provides an all-in-one solution for optimizing performance and boosting productivity.

One Dashboard for All Your Properties:

Say goodbye to fragmented data and manual processes. INNRLY enables you to monitor your entire portfolio from a single dashboard, providing instant access to key metrics like revenue, occupancy, labor costs, and guest satisfaction. With this unified view, hotel managers can make informed decisions in real time.

Customizable and Scalable Solutions:

No two hospitality businesses are alike, and INNRLY understands that. Its customizable features adapt to your unique needs, whether you're running a small chain or managing an extensive enterprise. INNRLY grows with your business, ensuring that your operations remain efficient and effective.

Seamless Integration for Effortless Operations:

One of INNRLY’s standout features is its ability to integrate seamlessly with your existing systems. Whether it's your property management system (PMS), accounting software, payroll/labor management tools, or even guest feedback platforms, INNRLY pulls data together effortlessly, eliminating the need for system overhauls.

Automated Night Audits:

Tired of labor-intensive night audits? INNRLY’s Night Audit+ automates this crucial process, providing detailed reports that are automatically synced with your accounting software. It identifies issues such as declined credit cards or high balances, ensuring no problem goes unnoticed.

A/R and A/P Optimization:

Streamline your accounts receivable (A/R) and accounts payable (A/P) processes to improve cash flow and avoid costly mistakes. INNRLY’s automation reduces manual entry, speeding up credit cycles and ensuring accurate payments.

Labor and Cost Management:

With INNRLY, you can pinpoint inefficiencies, monitor labor hours, and reduce costs. Detailed insights into overtime risks, housekeeping minutes per room (MPR), and other labor metrics help you manage staff productivity effectively.

Empowering Data-Driven Decisions:

INNRLY simplifies decision-making by surfacing actionable insights through its robust reporting and analytics tools.

Comprehensive Reporting:

Access reports on your schedule, from detailed night audit summaries to trial balances and franchise billing reconciliations. Consolidated data across multiple properties allows for easy performance comparisons and trend analysis.

Benchmarking for Success:

Compare your properties' performance against industry standards or other hotels in your portfolio. Metrics such as ADR (Average Daily Rate), RevPAR (Revenue Per Available Room), and occupancy rates are presented in an easy-to-understand format, empowering you to identify strengths and areas for improvement.

Guest Satisfaction Insights:

INNRLY compiles guest feedback and satisfaction scores, enabling you to take prompt action to enhance the guest experience. Happy guests lead to better reviews and increased bookings, driving long-term success.

Key Benefits of INNRLY

Single Login, Full Control: Manage all properties with one login, saving time and reducing complexity.

Error-Free Automation: Eliminate manual data entry, reducing errors and increasing productivity.

Cost Savings: Pinpoint problem areas to reduce labor costs and optimize spending.

Enhanced Accountability: Hold each property accountable for issues flagged by INNRLY’s tools, supported by an optional Cash Flow Protection Team at the enterprise level.

Data Security: Protect your credentials and data while maintaining your existing systems.

Transforming Hospitality Without Transition

INNRLY’s philosophy is simple: transformation without transition. You don’t need to replace or upgrade your existing systems to benefit from INNRLY. The software integrates effortlessly into your current setup, allowing you to focus on what matters most—delivering exceptional guest experiences and achieving your business goals.

Who Can Benefit from INNRLY?

Hotel Owners:

For owners managing multiple properties, INNRLY offers a centralized platform to monitor performance, identify inefficiencies, and maximize profitability.

General Managers:

Simplify day-to-day operations with automated processes and real-time insights, freeing up time to focus on strategic initiatives.

Accounting Teams:

INNRLY ensures accurate financial reporting by syncing data across systems, reducing errors, and streamlining reconciliation processes.

Multi-Brand Portfolios:

For operators managing properties across different brands, INNRLY’s brand-neutral platform consolidates data, making it easy to compare and optimize performance.

Contact INNRLY Today

Ready to revolutionize your hotel management? Join the growing number of hospitality businesses transforming their operations with INNRLY.

Website: www.innrly.com

Email: [email protected]

Phone: 833-311-0777

#Innrly#Innrly Hotel Management Software#Bank Integrations in Hospitality Software#Tracking Hotel Compliance#hotel performance software#hotel portfolio software#Hotel Performance Management Software#hotel reconciliation software#Hotel Data Entry Software#accounting software hotels#hotel banking software#hospitality automated accounting software#hotel automation software hotel bookkeeping software#back office hotel accounting software#hospitality back office software#accounting hospitality software#Hotel Management Accounting Software#Hotel Accounting Software#Hospitality Accounting Software#Accounting Software for Hotels#Hotel Budgeting Software#Automate Night Audit Software#Automate Night Audit Process#Best Hotel Accounting Software#Best Accounting Software For Hotels#Financial & Hotel Accounting Software#Hospitality Accounting Solutions

2 notes

·

View notes

Text

Maximize Efficiency with Expert Cash Management Solutions

In today’s fast-paced business environment, effective cash management is crucial for maintaining financial stability and supporting growth. Expert cash management solutions can help businesses streamline their operations, optimize liquidity, and enhance overall financial efficiency. This article explores how leveraging advanced cash management solutions can maximize efficiency and drive business success.

What is Cash Management?

Cash management involves the collection, handling, and use of cash in a business. The goal is to ensure that a company has enough cash on hand to meet its short-term obligations while optimizing the use of its funds. Effective cash management helps businesses avoid liquidity problems, reduce financing costs, and invest surplus cash wisely.

Key Benefits of Expert Cash Management Solutions

Improved Cash Flow Visibility

Expert cash management solutions provide real-time insights into cash flow. By integrating these solutions with your financial systems, you can gain a comprehensive view of your cash position, including incoming and outgoing funds. This visibility allows for better forecasting and planning, helping you anticipate cash needs and avoid potential shortfalls.

Enhanced Liquidity Management

Managing liquidity effectively is essential for ensuring that your business can meet its obligations without holding excessive cash. Advanced cash management tools help optimize liquidity by analyzing cash flow patterns and recommending strategies to manage working capital more efficiently. This includes managing accounts receivable and payable, optimizing cash reserves, and reducing idle cash.

Streamlined Cash Collection and Disbursement

Automated cash management solutions streamline the collection and disbursement processes. For example, electronic invoicing and payment systems can accelerate the receipt of payments, reducing the time it takes to convert receivables into cash. Similarly, automated disbursement systems help manage outgoing payments, ensuring that bills and payroll are processed efficiently and on time.

Enhanced Fraud Prevention and Security

Security is a critical aspect of cash management. Expert solutions offer robust security features to protect against fraud and unauthorized transactions. This includes encryption, multi-factor authentication, and transaction monitoring. By implementing these security measures, businesses can safeguard their cash and reduce the risk of financial losses due to fraud.

Optimized Investment Opportunities

Efficient cash management doesn’t just involve managing daily transactions; it also includes investing surplus cash to generate returns. Expert cash management solutions help identify and evaluate investment opportunities that align with your company’s risk tolerance and financial goals. Whether it’s investing in short-term instruments or managing liquidity portfolios, these solutions provide insights to make informed investment decisions.

Regulatory Compliance

Adhering to regulatory requirements is essential for avoiding penalties and maintaining financial integrity. Advanced cash management systems help ensure compliance with relevant regulations by automating reporting and record-keeping. This includes managing tax-related cash flows, regulatory filings, and maintaining accurate financial records.

Implementing Expert Cash Management Solutions

To maximize efficiency with expert cash management solutions, consider the following steps:

Assess Your Needs

Begin by evaluating your business’s cash management needs. Identify areas where improvements are needed, such as cash flow forecasting, liquidity management, or fraud prevention. This assessment will help you choose the right solutions that align with your business objectives.

Choose the Right Tools

Select cash management solutions that offer the features and functionality you need. Look for tools that integrate with your existing financial systems, provide real-time insights, and offer robust security measures. Consider solutions that are scalable and can grow with your business.

Implement and Integrate

Once you’ve selected the appropriate solutions, implement them within your organization. This may involve integrating the solutions with your current financial systems, training staff on how to use the tools, and establishing processes for managing cash flow effectively.

Monitor and Optimize

Regularly monitor the performance of your cash management solutions to ensure they are delivering the expected benefits. Use the insights provided by these tools to make data-driven decisions, optimize cash flow, and adjust your strategies as needed.

Review and Adjust

Periodically review your cash management practices and solutions to ensure they remain effective. As your business evolves, your cash management needs may change, requiring adjustments to your strategies and tools.

Conclusion

Expert cash management solutions are essential for maximizing efficiency and achieving financial stability in today’s competitive business landscape. By leveraging advanced tools and strategies, businesses can gain better visibility into their cash flow, optimize liquidity, streamline processes, and enhance security. Implementing these solutions helps ensure that your business can meet its financial obligations, invest wisely, and maintain a strong financial position. Embracing expert cash management practices not only improves day-to-day operations but also supports long-term growth and success.

For more details, visit us:

expense tracker software

Expense Management Software

invoice management system

best expense reimbursement software

3 notes

·

View notes

Text

Nordholm: Redefining Accounting and Bookkeeping Success in Dubai, UAE

Amid Dubai's dynamic economic landscape, Nordholm emerges as the beacon for unparalleled Accounting and Bookkeeping Services in Dubai. Our tailored approach transcends norms, offering bespoke financial solutions finely crafted to meet the diverse needs of businesses in the UAE.

Our seasoned professionals reimagine Bookkeeping Services, seamlessly navigating complex processes like Company Formation, Visa Protocols, Bank Account Establishment, HR Management, Payroll Administration, and VAT Compliance. As strategic partners, we empower enterprises with the guidance and expertise needed for triumphant growth.

At the core of our commitment lies adherence to International Financial Reporting Standards (IFRS). Leveraging our expertise, we meticulously document daily transactions and furnish comprehensive financial reports, ensuring seamless compliance with UAE laws.

Explore Our Tailored Spectrum of Specialized Services:

Efficient Accounts Payable Management: Streamlining payable accounts for operational fluency.

Regular Bank Reconciliation Services: Ensuring steadfast accuracy in bank statements.

Meticulous General Bookkeeping Duties: Attending to foundational tasks with precision.

Essential Profit and Loss Statement Preparation: Proficiently evaluating financial performance.

Optimal Accounts Receivable Management: Seamlessly tracking and managing receivables.

Compliance-driven Employee Benefits Management: Expertly handling benefits in accordance with regulations.

Timely Payroll Processing Services: Accurately managing payroll for streamlined HR operations.

Insightful Financial Reporting and Analysis: Providing data-backed reports for informed decision-making.

Tailored Expert Accounting Guidance: Crafting strategies tailored to specific business needs.

Beyond merely addressing immediate accounting requisites, our mission at Nordholm is to erect resilient frameworks that pre-emptively tackle potential financial hurdles. With an unwavering commitment to providing the Best Accounting and Bookkeeping Services in Dubai, we alleviate the burdens of financial management, enabling businesses to soar toward enduring success.

#DubaiAccounting#BookkeepingServices#FinancialManagement#UAEFinance#AccountingSolutions#NordholmDubai#BusinessConsulting#VATCompliance

7 notes

·

View notes

Text

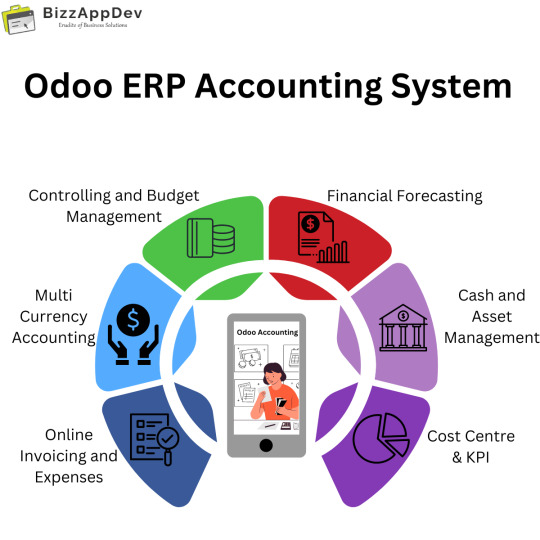

Looking to gain control of your finances and make data-driven decisions? Look no further than Odoo ERP Accounting System, a comprehensive solution designed to simplify and automate your financial processes.

Here are some of the benefits of using Odoo ERP Accounting System:

Consolidated financial management: Odoo ERP Accounting System can help you to manage all your financial data in one place, including accounts receivable, accounts payable, general ledger, and inventory. This can help you to improve your financial reporting and forecasting.

Automated accounting tasks: Odoo ERP Accounting System can automate many of your accounting tasks, such as invoicing, bill payments, and bank reconciliations. This can save your time and money.

Improved financial visibility: Odoo ERP Accounting System can provide you with real-time insights into your financial performance. This can help you make better business decisions.

Scalable Growth: Odoo adapts to your business needs. It seamlessly scales as your company grows, ensuring your financial management stays efficient.

Ready to transform your financial management?

Visit our website to learn more about how Odoo Finance Solution can empower your business. We offer free consultations to discuss your specific needs and demonstrate how Odoo can optimize your financial operations.

#odooimplementation#odoo services#odoodevelopment#finance#business#erp solution#erp systems#business growth#marketing#odoo erp#accounting

2 notes

·

View notes

Text

Enhancing Manufacturing Excellence: 6 Key Benefits of SAP Business One

Staying ahead of the competition requires more than just producing high-quality products. It demands efficient operations, streamlined supply chains, and real-time decision-making capabilities. This is where SAP Business One, a robust Enterprise Resource Planning (ERP) solution, steps in to transform the manufacturing sector. In this blog, we will explore six significant benefits that SAP Business One brings to manufacturers of all sizes, from small businesses to mid-sized enterprises.

Better Visibility

One of the primary challenges in manufacturing is maintaining visibility into the complex web of supply chains, operations, and inventory resources. SAP manufacturing software addresses this challenge by providing enhanced visibility through seamless integration with shipping logistics and supply chains. This integration empowers manufacturers with real-time data, enabling them to make well-informed decisions promptly.

Furthermore, the platform offers customized and interactive dashboards that offer a 360-degree view of the entire manufacturing process. This flexibility in analysis and insights allows manufacturers to adapt swiftly to changing customer demands and meet stringent deadlines.

Improved Productivity

SAP manufacturing software incorporates Material Requirements Planning (MRP) functionality, which replaces outdated production scheduling methods with a structured, multilevel production process. MRP also facilitates resource planning for machine maintenance, leading to overall productivity improvements.

Additionally, the MRP wizard streamlines material procurement and production planning, significantly reducing pre-production lead times. This efficiency boost directly contributes to enhanced productivity and better resource utilization.

Cost Control

Cost control is a paramount concern for manufacturing companies. SAP manufacturing software offers a solution by optimizing daily operations, reducing waste, and simplifying processes. Informed decision-making, enabled by SAP manufacturing software, aids in identifying cost-saving opportunities and increasing overall business profitability.

Working Capital Management

Managing working capital is essential for the day-to-day operations of manufacturing companies. SAP manufacturing software offers a comprehensive suite of modules and capabilities that help in managing working capital effectively. This includes overseeing accounts receivables, accounts payables, cash flow, liquidity, and inventory planning.

Customized purchasing reports provide real-time insights into working capital challenges, replacing the traditional year-end or month-end reports. This level of control from SAP services allows manufacturers to make proactive decisions, ensuring the stability of their operations.

Inventory Management

Effective inventory management is critical for manufacturing success. SAP Business One equips manufacturers with advanced warehouse tracking features and real-time stock reports. These features help document stock levels and monitor stock transfers between warehouses, ensuring a lean inventory management approach.

The ERP solution strikes an ideal balance between inventory stock and production capacities, facilitating on-time product deliveries, efficient inventory cost management, and meeting customer demands effectively.

Regulatory Compliance

Manufacturers must adhere to industry regulations at every stage of the manufacturing process, from procurement to final product delivery. SAP Business One plays a crucial role in improving regulatory compliance by integrating these standards into its operations seamlessly.

Furthermore, the platform empowers manufacturers to embed quality control into their manufacturing processes, providing insights into vendor performance and enhancing customer satisfaction.

Conclusion

SAP system emerges as a powerful ally, offering a wide array of benefits to manufacturers. From improved visibility and productivity to cost control, working capital management, inventory optimization, and regulatory compliance, this ERP solution empowers manufacturing companies to thrive in a competitive environment. By embracing SAP Business One, manufacturers can embark on a journey toward excellence, ensuring they meet customer demands efficiently and maintain a strong position in the market.

2 notes

·

View notes

Text

What is Quick Payable?

Quick Payable is a user-friendly application available on Salesforce's app exchange platform. It is designed to simplify and streamline the accounts payable process for businesses. Here are the key features and benefits of Quick Payable:

1. Efficient Bill Management:

- Quick Payable allows businesses to easily manage bills from multiple vendors.

- The intuitive interface makes it easy to organize and track invoices.

- Businesses can ensure timely payments and avoid penalties or late fees.

2. Automated Invoice Data Capture:

- Quick Payable leverages advanced software to automate invoice data capture.

- This eliminates the need for manual data entry, saving time and reducing errors.

- The system intelligently extracts relevant information from invoices, such as invoice numbers, due dates, and amounts.

3. Streamlined Approval Process:

- With Quick Payable, businesses can customize their approval workflow.

- Approvers can be assigned based on vendor configurations, ensuring the right people review and authorize invoices.

- This streamlines the approval process, reducing bottlenecks and delays in the payment cycle.

4. Complete Expense Visibility:

- Quick Payable provides rich dashboards and reports, offering complete visibility of expenses.

- Businesses can track and analyze spending patterns, identify unnecessary costs, and optimize their spending.

- This level of insight empowers businesses to make informed financial decisions and improve overall financial management.

5. Effortless Data Export:

- Quick Payable allows for seamless data export to third-party ERP systems.

- Businesses can integrate their accounts payable information with existing financial software.

- This eliminates the need for manual transfers and ensures data consistency across different platforms.

6. Enhanced Efficiency and Error Reduction:

- By utilizing Quick Payable, businesses can improve the efficiency of their accounts payable processes.

- The app automates repetitive tasks, freeing up valuable time for the finance team.

- With fewer errors and delays, businesses can focus on strategic financial planning and ensure accurate financial records.

In summary, Quick Payable is a powerful tool that simplifies and streamlines the accounts payable process for businesses. With features like efficient bill management, automated invoice data capture, and streamlined approval processes, businesses can improve their financial management capabilities. The complete expense visibility and effortless data export features further enhance efficiency and reduce errors. Embrace Quick Payable to optimize your accounts payable processes and take control of your financial management.

2 notes

·

View notes

Text

How Accurate Accounting Powers Growth for Retail & Wholesale Businesses

In the dynamic world of retail and wholesale, financial precision is not just important—it’s critical. Accurate accounting acts as the foundation for smarter decision-making, efficient operations, regulatory compliance, and sustainable business growth. Whether you run a boutique retail store or a multi-location wholesale operation, having robust financial systems and insights is the key to driving measurable growth.

At Mindspace Outsourcing, we specialize in providing accounting for retail and wholesale accounting solutions that empower businesses with the clarity and control they need to succeed in today’s competitive market.

Why Retail and Wholesale Accounting Is Unique

Retail and wholesale businesses operate on high-volume, low-margin models. They deal with fluctuating inventories, varying supplier terms, seasonal demand, and changing consumer preferences. That means generic accounting methods often fall short.

Accounting for retail focuses on:

Point-of-sale (POS) reconciliations

Real-time inventory tracking

Cost of goods sold (COGS) calculations

VAT and sales tax reporting

Multi-location financial consolidation

Meanwhile, wholesale accounting solutions deal with:

Bulk purchase orders and supply chain management

Wholesale pricing models and trade discounts

Accounts receivable and payable management

Contract-based invoicing

Complex logistics and shipping cost tracking

Each sector requires tailored financial processes that go beyond basic bookkeeping.

The Growth Impact of Accurate Accounting

1. Enhanced Cash Flow Control

Cash flow is the lifeblood of any retail or wholesale business. Accurate accounting ensures every penny is tracked, helping you understand incoming and outgoing cash, forecast shortfalls, and avoid liquidity crises. This allows businesses to maintain stock levels, pay suppliers on time, and plan for expansions confidently.

Client Case Study: One of our UK-based apparel retail clients improved their cash flow visibility by 45% after switching to our cloud-based accounting platform. This empowered them to open two new outlets within a year.

2. Data-Driven Decision Making

Accurate financial reporting provides insights into profit margins, best-selling products, loss-making SKUs, and seasonal trends. With this information, business owners can make informed decisions—whether it's negotiating supplier deals or launching new product lines.

Real Example: A wholesale electronics distributor leveraged our customized wholesale accounting solutions to identify inventory inefficiencies. Within six months, their net profit margin grew by 18%.

3. Compliance and Risk Mitigation

Retail and wholesale industries are subject to complex tax structures, including VAT, import duties, and inventory tax reporting. Inaccurate accounting can result in HMRC penalties, damaged reputation, or even business closure.

With Mindspace Outsourcing’s expertise, you receive:

Timely VAT submissions

MTD (Making Tax Digital) compliance

Detailed audit trails

Real-time financial dashboards

4. Inventory Optimization

Poor inventory management is one of the biggest barriers to retail and wholesale profitability. Accurate accounting ensures optimal stock levels by integrating inventory tracking with cost control. This minimizes overstocking, dead stock, and stockouts—all of which eat into your bottom line.

5. Investor & Lender Confidence

Reliable financial records and reporting instill confidence in banks, investors, and suppliers. If you’re planning to scale or seek funding, accurate books are non-negotiable.

Our clients frequently use our reports for:

Securing business loans

Attracting private equity investment

Presenting to board members and stakeholders

Why Choose Mindspace Outsourcing?

At Mindspace Outsourcing, we combine technology with industry expertise to deliver precise and scalable financial solutions for UK-based and global businesses. With over two decades of experience in accounting for retail and wholesale accounting solutions, we’ve helped hundreds of companies transform their operations.

Our Retail & Wholesale Accounting Services Include:

Bookkeeping & reconciliation

VAT & tax compliance

Inventory & POS integration

Cash flow forecasting

Financial planning and analysis

Outsourced CFO services

Final Thoughts: Accounting Is More Than Numbers—It’s a Growth Engine

When implemented correctly, accounting becomes a powerful growth tool. From boosting margins to streamlining inventory, the right financial strategy enables retailers and wholesalers to thrive even in volatile markets.

Don’t let poor accounting practices hold your business back. Trust the experts at Mindspace Outsourcing to provide the insight and precision your business needs to scale confidently.

Frequently Asked Questions (FAQ)

Q1: Why is accounting for retail different from other industries? A: Retail businesses handle high transaction volumes, fast-moving inventory, and frequent tax obligations, requiring real-time, sector-specific accounting solutions.

Q2: How can wholesale accounting solutions improve margins? A: By optimizing purchase orders, monitoring supplier payments, and analyzing product profitability, you can make cost-effective decisions that boost profitability.

Q3: Does Mindspace support cloud accounting integration? A: Yes, we offer integration with platforms like Xero, QuickBooks, and Zoho for both retail and wholesale businesses.

0 notes

Text

Master NetSuite Payables: Streamline Your Accounts Payable Process with Expert Guidance

In today's fast-paced financial environment, organizations need robust, automated systems to manage their accounts payable (AP) processes efficiently. NetSuite Payables, a core component of Oracle NetSuite ERP, empowers businesses to streamline invoice processing, control vendor payments, and maintain healthy cash flows — all from a cloud-based platform.

If you're looking to master NetSuite Payables end-to-end, we have curated a comprehensive video playlist and structured training courses that walk you through practical implementations, configurations, and real-world business scenarios.

🎥 Watch Now – NetSuite Payables Playlist Explore the complete YouTube series to understand how Payables works in NetSuite, covering everything from vendor creation to payment reconciliation: 👉 Watch the Playlist

✅ What You’ll Learn in the NetSuite Payables Series:

Vendor Creation and Categorization

Purchase Order and Invoice Matching

Bill Creation and Approval Workflows

Expense Reporting

Payment Automation and Batch Payments

Handling Prepayments and Credit Memos

Reconciliation with General Ledger (GL)

Reporting and Audit Trail Management

Each session is industry-relevant, hands-on, and designed for both beginners and experienced professionals aiming to implement or manage NetSuite Financials.

🎓 Enhance Your Skills with NetSuite Functional & Technical Training

If you're inspired by the YouTube series and want to take your skills to the next level, explore our certification courses designed by top NetSuite experts:

🔹 Oracle NetSuite Functional Training Learn how to configure, manage, and optimize NetSuite modules like Financials, Payables, Receivables, and Procurement. 👉 View Functional Course 👉 Register Now

🔹 Oracle NetSuite Technical Training Understand scripting, workflows, SuiteScript, and SuiteFlow for customizing NetSuite according to unique business needs. 👉 View Technical Course 👉 Register Now

🌟 Why Learn from BISP Trainings?

✅ 15+ Years of Industry Experience ✅ Real-Time Projects and Case Studies ✅ Hands-On Assignments & Practical Labs ✅ Certification-Oriented Curriculum ✅ Lifetime Access to Learning Materials ✅ Expert Mentorship and Support

Whether you’re preparing for a career as a NetSuite Consultant, transitioning into ERP implementation, or upgrading your finance team’s capabilities, our training will help you unlock NetSuite’s full potential.

📌 Final Thoughts

Accounts Payable is more than just paying bills — it's about optimizing spend and building strong vendor relationships. By learning how to manage Payables in NetSuite, you’re not just enhancing system skills — you’re also contributing to better cash flow management and financial compliance in your organization.

📺 Start Learning Today: 👉 Watch the NetSuite Payables Playlist

🎓 Enroll in NetSuite Functional or Technical Training: 👉 Functional Course 👉 Technical Course

Let’s build your NetSuite expertise — one module at a time!

0 notes

Text

Transform Your Business: Discover the Best ERP Software for Unprecedented Growth & Efficiency

In today’s rapidly evolving business landscape, staying competitive demands more than just hard work — it requires smart work. This is where a robust Enterprise Resource Planning software comes into play. It’s the central nervous system of your organization, integrating various functions into a single, cohesive system. When it comes to finding solutions that truly propel businesses forward, companies like Otibro Techni are at the forefront, offering cutting-edge ERP systems designed for modern challenges.

So, what makes an ERP system truly the “best,” and what are the crucial elements businesses often overlook? Let’s dive in.

The Foundation of Modern Business: Core ERP Benefits

At its heart, ERP software is about integration and streamlining. By bringing together departments like finance, human resources, manufacturing, sales, and supply chain, it breaks down data silos and fosters collaboration. The immediate benefits are undeniable:

Enhanced Operational Efficiency: Automating routine tasks and centralizing data dramatically reduces manual effort and human error, leading to smoother workflows.

Improved Decision-Making: With real-time data readily available, leaders can make informed, agile decisions based on accurate and up-to-the-minute insights.

Cost Reduction: Optimized inventory levels, streamlined supply chain management, and reduced operational bottlenecks translate directly into significant cost savings.

Scalability for Future Growth: A well-implemented ERP system provides a flexible foundation that can adapt and grow with your business, supporting expansion and new initiatives.

Key Features Driving Digital Transformation

While the benefits are broad, specific features define a truly effective ERP. Look for solutions that excel in:

Comprehensive Financial Management: Beyond basic accounting, this includes robust general ledger, accounts payable/receivable, budgeting, forecasting, and detailed financial management.

Optimized Supply Chain Management & Inventory Management: Crucial for manufacturing and distribution, these modules ensure efficient procurement, warehousing, logistics, and accurate stock levels, preventing both shortages and excess.

Streamlined Production Planning: For manufacturing businesses, features like master production scheduling, material requirements planning (MRP), and shop floor control are essential for automating business processes and maximizing output.

Integrated Customer Relationship Management (CRM): A good ERP often includes or seamlessly integrates with CRM functionalities, ensuring a 360-degree view of your customers, from initial lead to post-sales support.

The Unsung Hero: Advanced Analytics and Predictive Insights

While the above features are commonly touted, the most underrated feature of a modern ERP system that businesses often overlook is its Advanced Analytics and Predictive Insights capabilities. This goes far beyond basic dashboards and historical reports.

A truly intelligent ERP harnesses the power of data to:

Predict Future Trends: Leverage historical data and machine learning to forecast sales, demand, and even potential equipment failures.

Identify Opportunities & Risks: Automatically flag potential customer churn, highlight cross-selling opportunities, or identify bottlenecks before they impact production.

Optimize Resource Allocation: Use data-driven predictions to allocate resources more effectively, whether it’s optimizing inventory management holding costs or scheduling maintenance.

Ignoring these predictive capabilities means operating reactively instead of proactively. Businesses miss out on a powerful tool that can offer a competitive edge by enabling foresight and strategic action. This feature is paramount for true digital transformation, moving your business from simply managing data to leveraging it for strategic advantage.

Choosing the Right Partner for Your ERP Journey

Selecting and implementing an ERP system is a significant undertaking. It’s not just about the software; it’s about finding a solution that aligns with your unique business processes and a partner that understands your industry. Prioritize providers that offer comprehensive support, customizable modules, and a proven track record.

An effective ERP system is an investment in your company’s future, enabling seamless operations, significant cost savings, and powerful insights for sustained business growth.

Ready to explore how a modern ERP system can redefine your business operations and propel you towards unmatched efficiency and growth?

Contact Otibro Techni today for a consultation and discover tailored ERP solutions designed for your success.

0 notes

Text

Optimize Your Cash Flow with Expert Accounts Payable and Receivable Outsourcing by Aone Outsourcing

Managing accounts payable and receivable is essential for maintaining a healthy cash flow and building strong business relationships. However, handling these processes in-house can be time-consuming and prone to errors, especially without specialized expertise.

Aone Outsourcing is a trusted partner for businesses looking to outsource their accounts payable and receivable processes. With experienced accounting professionals, secure processing systems, and customized solutions, Aone Outsourcing ensures efficient and accurate management of your financial transactions.

0 notes

Text

Transforming Finance Operations: How Rightpath GS Optimizes Accounts Payable and Receivable

Rightpath Global Services, commonly known as Rightpath GS, is a reputed name in the field of finance and business process optimization. With clients across various sectors, the company offers tailored solutions in the areas of financial transformation, automation, and shared services. Their team comprises experienced professionals skilled in accounting, compliance, technology implementation, and process redesign.

Rightpath GS believes in solving finance-related challenges with a strategic mindset. Their approach is not just about processing transactions faster but also about enhancing visibility, control, and scalability of the entire finance function. The company’s mission is to help clients unlock long-term value by optimizing back-office operations through smart automation and business intelligence tools.

0 notes

Text

The Future of Finance: How AI Is Transforming Money Management

Artificial Intelligence (AI) is no longer a futuristic concept—it's now a financial force reshaping how we manage, invest, and understand money. From automated budgeting tools to predictive analytics in investment strategies, AI is revolutionizing personal and corporate finance at an astonishing pace.

But what does this transformation really mean for consumers, financial professionals, and businesses?

Let’s explore how AI is changing the game—and what the future may hold.

AI in Personal Finance: Smarter, Simpler, Personalized

Managing personal finances used to be time-consuming and complex. Today, AI-driven tools make budgeting and saving effortless for the average consumer. Apps like Cleo, YNAB (You Need a Budget), and Mint use machine learning to analyze spending behavior, suggest budgeting strategies, and even automate savings goals.

Personalized financial planning once required a visit to a professional advisor. Now, robo-advisors like Betterment and Wealthfront offer data-driven portfolio management for a fraction of the cost—tailored to your risk appetite and financial goals.

Key Benefits:

Real-time spending insights

Smart saving automation

Predictive bill tracking

Financial goal coaching

Business Finance: Speed, Accuracy, and Strategy

For companies, AI is rapidly becoming a trusted co-pilot in financial operations. AI algorithms can now analyze vast volumes of transactional data to identify fraud, improve risk assessments, forecast revenue, and optimize cash flow management.

Accounts payable and receivable are also being transformed through AI-powered automation. Platforms like Tipalti and Bill.com streamline invoice processing and payment approvals, reducing manual errors and freeing up finance teams for more strategic work.

Use Cases in Business Finance:

Intelligent forecasting and scenario modeling

Automated expense categorization

AI-driven auditing and compliance

Fraud detection and anomaly alerts

Investment and Trading: From Human Intuition to Machine Precision

The investment world has long relied on instincts, news, and economic indicators. But today, algorithms are outpacing humans. AI-driven trading platforms analyze thousands of data points—social media sentiment, market trends, company fundamentals—in milliseconds to make investment decisions.

Quantitative hedge funds are using AI to develop high-frequency trading strategies, while retail investors benefit from robo-advisors and AI-guided stock analysis.

Emerging Trends:

Sentiment analysis from news and social feeds

Portfolio rebalancing using machine learning

Predictive analytics for market trends

Real-time risk assessments

Financial Institutions: Reimagining Customer Experience

Banks and insurance companies are embracing AI to reimagine the customer journey. AI-powered chatbots offer 24/7 support, while virtual assistants help customers check balances, file claims, or apply for loans with zero wait time.

Behind the scenes, AI models assess credit risk more fairly by analyzing alternative data like utility payments or social behavior—expanding access to underserved populations.

AI Applications in Banking & Insurance:

Personalized product recommendations

Instant loan approvals

Fraud alerts via behavioral analysis

Enhanced KYC and AML processes

Challenges and Ethical Considerations

While AI brings remarkable efficiency, it also raises important concerns.

Bias in Algorithms: If trained on biased data, AI can reinforce financial inequality.

Privacy Risks: Collecting and processing financial data must be done with strict compliance and transparency.

Over-Reliance: Fully automated decisions can overlook human nuance, especially in complex financial scenarios.

The key lies in responsible AI—human-in-the-loop models that ensure fairness, security, and accountability.

What’s Next? A Hybrid Future

The future of money management isn't just AI—it’s AI + human insight. Tools that empower users and professionals, not replace them. Platforms that interpret patterns and recommend actions, while individuals make the final call.

Whether you're a consumer saving for retirement, a startup managing cash flow, or an investor navigating volatile markets—AI is here to stay, and it's reshaping the financial landscape with speed, scale, and intelligence.

LEAN MORE: https://intentamplify.com/demand-generation/

0 notes