#purchase contract

Explore tagged Tumblr posts

Text

How to Choose the Right Contract Management System for Your Business?

In today’s competitive business landscape, contracts are essential for safeguarding corporate interests and ensuring smooth collaboration. However, traditional methods of managing contracts are often plagued by inefficiencies, lack of transparency, and compliance risks. To address these issues, many organizations have adopted contract management systems to digitize and streamline the entire contract lifecycle.

With a wide range of systems available in the market, how can businesses select the one that best suits their needs? This article explores the key factors to consider and highlights the features of 8Manage Contract Management System as a leading solution.

Why a Contract Management System Is Essential

A contract management system is a digital tool designed to handle the entire contract lifecycle, from creation to renewal. It enhances efficiency, ensures compliance, and reduces risks.

Key Advantages of a Contract Management System:

1.Improved Efficiency: Automates processes, shortens approval times, and minimizes manual intervention. 2.Risk Management: Tracks compliance and maintains version control to reduce legal disputes. 3.Centralized Data Storage: Consolidates contracts for easy retrieval and analysis. 4.Enhanced Collaboration: Facilitates cross-departmental cooperation with transparent information sharing. As contract volumes and complexity increase, implementing a reliable contract management system has become a necessity for effective governance.

Five Key Criteria for Choosing a Contract Management System

1. Functionality

Ensure the system supports your business needs, including: ● Full lifecycle management (creation, approval, execution, renewal) ● Multiple contract types (procurement, sales, service) ● Integration with electronic signature tools 8Manage Contract Management System covers these aspects with customizable templates, multi-level approval workflows, and automated reminders to simplify every stage of contract management.

2. Ease of Use

A user-friendly interface is critical for widespread adoption. Complex systems can hinder employee engagement and reduce the effectiveness of the implementation.

8Manage offers an intuitive design, multi-language support, and accessible cross-device functionality, ensuring users can quickly get up to speed without extensive training.

3. Security

Contracts often contain sensitive information, making data security a top priority. Look for systems offering: ● Data encryption ● Role-based access controls ● Audit trails and activity logs 8Manage ensures robust data protection with advanced encryption, granular permissions, and compliance with global standards like GDPR.

4. Integration

The ability to integrate seamlessly with other business tools, such as ERP and CRM systems, is crucial for a cohesive workflow. 8Manage supports API-based integrations, enabling real-time data synchronization and eliminating silos between contract data and other business operations.

5. Support and Scalability

A good contract management system should include reliable technical support and the flexibility to scale as your business grows.

8Manage provides 24/7 technical assistance, regular updates, and tailored deployment options (on-premise, cloud, or hybrid) to suit businesses of all sizes.

Why Choose 8Manage Contract Management System?

8Manage Contract Management System stands out as a comprehensive solution for businesses seeking to modernize their contract processes. It combines advanced features such as lifecycle management, real-time collaboration, and data analytics, ensuring that every contract is handled efficiently and securely.

Key Features:

● Lifecycle Management: Streamlined workflows from creation to renewal. ● Real-Time Collaboration: Cross-departmental transparency and communication. ● Intelligent Automation: Reminders, reporting, and document tracking to save time. ● Flexible Deployment: Options for on-premise, cloud, or hybrid environments. Whether you’re a small business or a multinational corporation, 8Manage adapts to your needs, making it an ideal choice for businesses aiming to boost efficiency and compliance.

FAQs

Q1: Is a contract management system necessary for small businesses?

A: Yes. Small businesses can benefit greatly from contract management systems, especially as they scale operations. Lightweight SaaS-based solutions like 8Manage are affordable, quick to deploy, and provide essential features to meet fundamental needs.

Q2: Does 8Manage support multilingual and international business requirements?

A: Yes. 8Manage offers multi-language interfaces and modules tailored to meet compliance standards in various countries, making it suitable for businesses with cross-border operations.

Q3: What deployment options does 8Manage offer?

A: 8Manage supports multiple deployment methods: 1.On-Premise: Ideal for businesses requiring maximum data control. 2.Cloud-Based: Cost-effective and scalable for businesses seeking quick deployment. 3.Hybrid: Combines on-premise and cloud benefits for flexible and secure operations.

By understanding your business needs and evaluating systems based on functionality, security, ease of use, and integration capabilities, you can select a contract management system that drives efficiency and supports your long-term goals. For a robust, scalable solution, 8Manage Contract Management System offers unmatched value for businesses navigating today’s dynamic market.

0 notes

Text

It was very funny to find out today that Hank Green apparently gave a very passionate presentation on a TV show about how my job should be eliminated

#I'm being genuine btw#not everyday you catch stray bullets from a vlogbrother lol#for context: he said that grocery stores should be standardized like libraries and the dewey decimal system#my job is to design grocery store shelf layouts 🤣#noble idea but it wouldnt work because there's too much money involved in the shelf placement contracts#also the grocery stores rely too much on impulse purchases! if the layout is predictable then their sales drop.#that's also why they rearrange shit all the time

19 notes

·

View notes

Text

guys when cardfactory calls or emails me back after this interview trust im gonna start bankrolling all my honeys

#they call me sugarline#imagine how minted I’ll be on my eight hour cardfactory contract#25 per cent off purchases 👀#the ladies love it

30 notes

·

View notes

Text

yesterday i saw an apartment in like what's considered the best city to live in here esp for young ppl (so it's got extremely expensive rent. as you can guess) and it was decent. the landlord was very like. pushy? and a bit aggressive to the point that we now got the text from the real estate agent we went through where he convinced him to be flexible with our terms and prices and such. but bc of his vibe i said no. but this apartment was lovely and in an extremely insanely good location (and he agreed to lower rent to a price you might find in cheaper neighborhoods or cities). however. part of me also got scared bc idk if i can live in this city...... i simply do not have the tel avivi temperament i don't even smoke weed i'm not even vegan.. idk if i could handle it.......

#the issue is. in the city i do want to live in. there's barely any apartments for rent. mostly for purchase#bc it's more for families and ppl who are planning to settle down there for at least a few years#they're also just built bigger bc of it so prices go up with that. so this is all very unfortunate for me#however tlv is very much filled with apartments to rent. most of them awful but also most ppl don't care as long as they get to live in tlv.#there's also the city my friends live in which has a lot of young ppl too lol. due to its proximity to tlv with significantly cheaper rent#but it's very popular bc of that. and many buildings in it are so old that they have a bunch of issues (as i see in my friends' apartments)#like very weak water stream lots of power outages in winter and leakage on top floors etc#no elevators in most of them too so i have to settle for first floor which . i really don't wanna#it has cheap neighborhoods too but without a license and a car they're kinda impossible for me to live in 😬#this is why I've been looking for months but anything half decent gets taken super fast 🥲#the apartment i mentioned last week i think? got signed in the day or two where we passed the contract to a lawyer to see if it's okay#being careful doesn't pay off either...... but unfortunately since it is my first time leaving home i am Scared and ig so are my parents#anyway this is my apartment hunting ramble/rant for the day 😔 ignore me i'm just . suffering#at this point i can picture where exactly on the map each neighborhood is -_- even in cities i don't know that well

4 notes

·

View notes

Text

i think paul didn't wanna spend the money and thought he could guilt/pressure michael into giving the catalogue to him for free or at a discount. which is a huge gamble, and he lost, and that's how it goes. michael was not remotely obligated to do that. he DID do that for Little Richard (and maybe some others? LR is the only one i know for sure), and that was generous of him.

#regardless of if the contracts and deals that lead to it were fair - paul had the cash#little richard did not#he also didn't have the level of respect and recognition paul had/has#and i realize it's a bit apples to oranges bc pmc and LR are different artists with different worths#but that's kinda the point. why would mj spend the equivalent of $200M and then give one of the most valuable parts of the purchase away#that's bad business!!#i think!!! paul underestimated michael!!!!#many! such! cases!

4 notes

·

View notes

Text

I do think it’s very funny that people expect responsibly bred dogs to be cheap to buy or even like under $1,000 because they got a dog 10+ years ago at that price.

Like babe even 20 years ago that was cheap (almost in a red flag way) for responsibly bred purebred dogs (especially of certain breeds). My yearly vaccines are almost that cost and like senior rescue dogs are at LEAST $800 here. Dogs are not free from inflation.

#dogblr#dog breeding#my parents golden purchased on a limited reg contract#from health tested and titled parents was over 1000#I’ve never had a dog in my immediate family that’s was under that price

44 notes

·

View notes

Text

the price difference on the brazilian vs international version of the ordem merch website is fucked why are they selling the same tshirt for 60 reais and 30 usd respectively. that's like triple the price

#i am going to buy this anyway to be clear but like what the hell...#(...something something currencies having different purchasing power and probably also contracts with foreign shipping companies i know)#(but also ALAS)#echo.txt

6 notes

·

View notes

Text

I do have compassion for Whitney Port for having multiple pregancy losses and her surrogate who had two pregancy losses. But after a total of 6 pregancy losses at what point is the baby business just exploiting couples who want more children?

Whitney Port is starting to think about growing her family after going through a difficult fertility journey.

The Hills star admitted it was difficult to open up about going through miscarriage, but now she feels like she can talk about it now and is looking towards surrogacy now.

"I took a little breather from the fertility situation," Port explained to E! News.

Whitney Port is ready to start back on her journey to growing her family after suffering devastating pregnancy losses. (Instagram)

"I decided to take a few months off from thinking about it and talking about it and proactively doing anything about it so that I could take care of myself."

Port explained that now she's been through it, she can handle the questions and comments from people a lot better now.

The 39-year-old, who is mum to Sonny Sanford who is almost seven, has experienced three miscarriages and a chemical pregnancy. She and husband Tim Rosenman turned to surrogacy, but their surrogate went on to have two miscarriages.

The couple decided to put a pause on their journey to parenthood again after concerns there might be something happening with their embryos.

But in the next few months they're looking at getting back into things and working with a fertility doctor in New York.

"After a bunch of tries here, with both myself and a surrogate, we're going to do another round of egg retrieval in New York," Port said of Spring Fertility's Dr. Catha Fischer. "And in the meantime, looking for a surrogate for the next transfer."

And although Port was grateful to experience pregnancy with her so Sonny, she doesn't feel like she needs to do it again.

Although she noted that she was grateful to experience carrying her son Sonny Sanford, who turns 7 this month, Port said that she doesn't feel like she has to experience that again.

"It wasn't like I felt more connected to Sonny through my pregnancy or felt more connected to him when I gave birth," she explained.

For Port she felt like they really started to connect when he was a toddler and she wants other women to know that.

Port has been open about struggling through her losses and in 2021 she shared the devastating news that she had gone through a miscarriage on her Instagram stories and in a YouTube video.

"I'm so sad to say this, and some of you may have watched our latest YouTube episode, but we lost the baby," the reality TV star wrote. "We found out yesterday. I don't even really know what to say here."

Port explained she didn't feel as if she could just "sit here and go on with my life and not share it," adding, "I know that there's likely so many people out there that have had to deal with this".

The Red Nose Grief and Loss Support Line is available 24/7 for anyone affected by the loss of a pregnancy, stillbirth or death of a baby or child on 1300 308 307.

#Whitney Port#Tim Rosenman#Anti surrogacy industry#Reproductive purchasers exploit women#The fertility industry exploits people who should accept that more children are highly unlikely#Port and Rosenman already do have a child together#Babies are not commodities#Spring Fertility#Dr. Catha Fischer#Was the surrogate paid?#Some surrogacy contracts only pay the mother if a live baby is delivered

4 notes

·

View notes

Text

YOOOOOOO LET'S GOOOOOOOO

#I'M SO HAPPY FOR THEM#I love this game#The Sinking City#Frogwares#look up the game on wikipedia if you want the context of why this is a big deal#it's listed under Distributor dispute#tl;dr: Nacon was the distributor but then they didn't pay Frogwares so Frogwares terminated the contract#but then Nacon kept uploading their own pirated and altered version of the game onto various platforms while the legal dispute was ongoing#just to double down on the shittiness#like the Steam and PS5 versions were both Nacon's#I had to very carefully purchase the PS4 version from the Playstation Store because that was Frogwares's version#anyway absolutely thrilled

16 notes

·

View notes

Text

jesus fucking christ it's good to have a contract though

#i was having trouble feeling excited about it bc my immediately subsequent job was to field emails from people with technical questions#but in fact. it's good to have a contract#~$85/yr dental insurance! a vision plan that is only worth it in glasses-purchasing years but at least is worth it then‚ and exists now!#if you get trapped in University HR Department Harassment Investigation Hell for more than 6 months you can just go straight to arbitration#if you're working with chronic hazard exposure they have to give you regular hazard-specific preventive care!#every J1/F1 worker just gets $1200! because immigration is fucking miserable!#there is now a review process meant to prevent people from getting fired because they 'failed their prelims' in cases where that is#overtly a fig leaf for either 'advisor got bored of your project' or 'you are a woman in a mechanical engineering lab'#and while that one's not grievable for complicated reasons we DO get to put grad workers on the review board.#anyway. um. i think i did an okay job at my negotiations job‚ overall. is my main thought here#box opener

12 notes

·

View notes

Text

Demystifying Share Purchase Agreements: Understanding, Advantages, and Key Clauses

Understanding a Share Purchase Agreement (SPA): An SPA is not just a legal formality; it serves as a cornerstone in the business acquisition process. The buyer, in essence, takes on the company's obligations and assets, making due diligence imperative. Prior to finalizing the SPA, a term sheet is often created to discuss key clauses, simplifying the negotiation process.

Advantages of a Share Purchase Agreement (SPA):

Clarity of Transaction:

Provides transparency in the transaction, clearly delineating the proportion of shares allocated to the buyer or entity.

Rights and Liabilities:

Legally prescribes the rights and liabilities of all parties, ensuring clear definitions of roles and responsibilities.

Warranties:

All parties are covered by specific warranties outlined in the agreement, enhancing legal protection.

No Third-Party Involvement:

Being a legal contract between specific parties, the SPA eliminates the involvement of any third party.

First Point of Reference:

Serves as the primary point of reference in case of breaches or misunderstandings between parties in the future.

Major Clauses of Share Purchase Agreement (SPA):

Parties to the Agreement:

Clearly defines the seller, purchaser, and the company whose shares are being transferred, referred to as covenanters or guarantors.

Background:

Provides a factual background, leaving no room for errors, outlining the relationship between parties, the objective of the transaction, and details about the shares being transferred.

Consideration and Sale of Shares:

Details the structure of the sale consideration, specifying the number and value of shares, payment details, and pricing formula.

Conditions Precedent and Subsequent:

Exhaustively covers approvals, authorizations, and permits required before and after the execution of the transaction, including representations, warranties, and obligations.

Closing:

Establishes the closing mechanism, outlining the timeframe and actions to be taken on closing day, with a provision that closing occurs upon the satisfaction of condition precedents.

Covenants by the Parties:

Includes both negative and positive covenants, providing security to each party regarding their past and proposed actions related to the SPA.

Representations and Warranties:

Captures the capital structure of the company, the purchaser's right to contract, purchase, and ability to fulfill obligations, ensuring credibility of information.

Confidentiality:

Ensures that parties receiving confidential information keep it confidential and refrain from using it for prejudicial purposes.

Indemnification:

Specifies the limits of liability and the process for reimbursement of indemnity claims, a crucial clause in case of disputes.

Dispute Resolution and Arbitration:

Sets out the process for resolving disputes, either through the courts or via arbitration, with the decision of the arbitrator being final and binding.

Conclusion: In essence, the Share Purchase Agreement is a comprehensive document that not only confirms mutually agreed-upon terms and conditions but also specifies the intricacies of the share transfer process. From the type of shares being transferred to the price paid, the SPA is the cornerstone that ensures a smooth transition of ownership, laying the foundation for a successful business transaction.

#Share Purchase Agreement#Business Transactions#Legal Agreements#Business Acquisition#Corporate Law#Due Diligence#Business Contracts#Mergers and Acquisitions#Contractual Clauses#Rights and Liabilities#Confidentiality Agreements#Indemnification

2 notes

·

View notes

Text

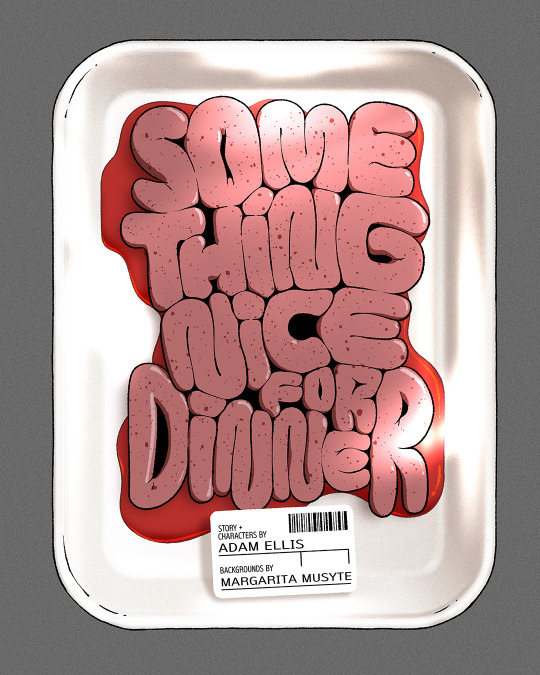

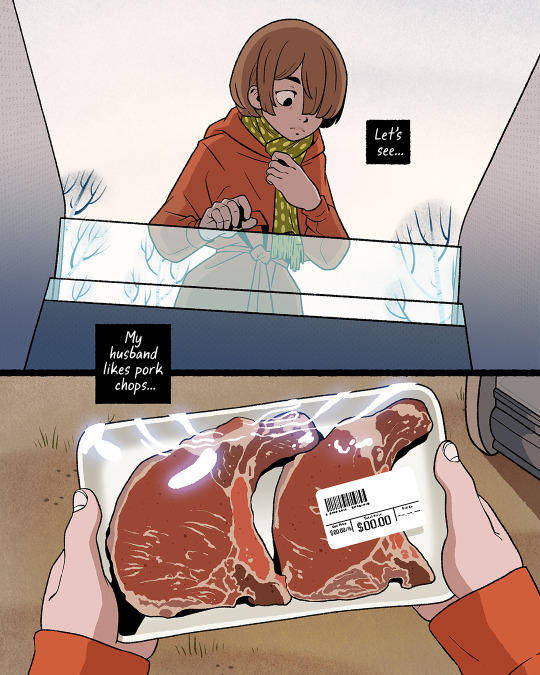

Guys.

It's not that the meat is suspicious, or that only the spread was poison.

It's that the local Fae got tired of waiting for her to catch on.

Dinner's ready :)

#clearly she was supposed to spend the grocery money saved via forest meat to purchase poisons#people just don't recognise a good fae contract anymore

11K notes

·

View notes

Text

idk if i should do vip pass for n.flying this tour cuz i did do snapshots w/ them last time.....

i want soundcheck, but im kinda tired of photo-ops i wish it was fansign like pav did :((((

but soundcheck alone is too much for just soundcheck

#personal#waahhhh i do have front row though...... so it's not that big a deal#but i need to save a bit for furniture and renovations probably... we're going to lawyer tuesday for contract meeting#for apartment purchase.... so i really should SAVE more

0 notes

Text

Expert Property Lawyer in Pune - Trusted Legal Solutions

Choosing the Right Property Lawyer In Pune for Real Estate Transactions

Real Estate Lawyer In Pune When dealing with property transactions, having a skilled property lawyer by your side is essential. Property Dispute Lawyer In Pune From title verification and drafting agreements to handling disputes and ensuring legal compliance, property lawyers provide critical support at every stage of buying, selling, or leasing real estate. Commercial Property Lawyer In Pune Their expertise can help you avoid legal pitfalls and protect your investments. Whether you're a first-time homebuyer or a seasoned investor, hiring a knowledgeable property lawyer ensures your transaction is secure and legally sound. Real Estate Litigation Lawyer In Pune

Why Legal Advice is Crucial in Property Matters

Property Purchase Lawyer In Pune - Legal issues in real estate can be complex and costly if not handled properly. A professional property lawyer offers tailored legal guidance, Real Estate Investment Lawyer In Pune helping clients navigate land ownership laws, property disputes, and registration procedures. Their role is especially vital during due diligence, where a thorough investigation can uncover hidden liabilities or encumbrances. Property Transfer Lawyer In Pune For those involved in commercial or residential property deals, timely legal advice from a trusted property attorney can save time, money, and stress while ensuring a smooth transaction process. Real Estate Contract Lawyer In Pune

#propertylawyerinpune#Real Estate Lawyer In Pune#Commercial Property Lawyer In Pune#Real Estate Litigation Lawyer In Pune#Property Purchase Lawyer In Pune#Real Estate Investment Lawyer In Pun#Property Transfer Lawyer In Pune#Real Estate Contract Lawyer In Pune

0 notes

Text

The Dangers of Overlooking Key Clauses in Purchase Agreements

Key TakeawaysMissing critical clauses in a purchase agreement can lead to inheriting unforeseen debts and liabilities.Vague language or absent indemnities can result in expensive lawsuits and regulatory fines.Properly crafted clauses are essential for protecting your investments and ensuring smooth operations. Safeguarding Your Investments with Effective ClausesIf you miss key clauses in a purchase agreement, you’re setting yourself up for hidden debts, expensive lawsuits, and operational chaos that can turn a solid investment into a nightmare.Imagine paying top dollar only to inherit a seller’s liabilities or facing unforeseen regulatory fines because of vague language or missing indemnities—these aren’t rare scenarios, but harsh realities.Wonder how the right clauses could protect your next deal and keep you ahead of the curve? Stick with me for actionable insights.Common Risks When Critical Clauses Are MissedWhen you’re steering a real estate transaction, missing even one critical purchase agreement clause can open the door to a cascade of risks—some immediate, others haunting you years down the line. Have you ever thought about what’s really at stake?Overlooking key clauses can cause valuation issues, leading you to overpay or underestimate future costs. If you miss financial or legal due diligence, you could inherit hidden liabilities, operational disruptions, or lawsuits that chip away at profits and sanity. Applying thorough risk assessment—an approach often emphasized in lucrative strategies like Airbnb arbitrage—can help you spot contract gaps before they spiral into larger problems.Missing survival clauses can mean that important protections like warranties, indemnities, or confidentiality obligations do not persist after closing, leaving parties vulnerable to post-transaction issues that would otherwise have been safeguarded.Worse, strategic alignment problems may surface later, undermining your business goals and integration plans. Did a previous owner’s baggage damage their reputation? Now it’s yours.Staying proactive with each clause protects you, your partners, and your long-term success—because in real estate, details crush shortcuts every time.Frequently Forgotten Clauses That Can Cost YouHey there! Have you ever watched a deal fall apart because of unexpected indemnification gaps or those pesky, poorly defined escrow terms? It's a bummer when you realize you've lost thousands just because you didn't pin down who really holds the liability for post-closing losses or left those fund release instructions a bit too vague.What's even riskier is ignoring a replacement of all prior agreements clause, which can leave you exposed to unexpected obligations from older, superseded contracts.Indemnification Gaps and RisksAlthough indemnification clauses might look boilerplate, overlooking their fine print can leave you dangerously exposed in a real estate deal. You might think indemnification caps protect you, but if they’re set too low, losses beyond the cap hit your bottom line.Worse yet, many deals cap breaches of representations and warranties but leave covenants and tax matters uncapped—often a costly oversight. In fact, nearly all deals with survival provisions include an indemnification cap, making the specifics of these clauses critically important to every transaction. Are you comfortable letting claim thresholds or baskets shut you out from recovering small but repeated losses?Undershooting on detail or failing to address carve-outs for fraud, environmental, or regulatory liabilities leaves you footing the bill for surprises later. Protect yourself by scrutinizing caps, claim thresholds, and exceptions. It’s not just paperwork—it's your shield against post-closing financial fallout.Escrow Terms and PitfallsEven the shrewdest investors can get blindsided by what’s lurking in escrow agreements. You might think escrow procedures are straightforward, but overlooking essentials like third party verification or clear refund terms can put your whole deal at risk.

Many buyers fail to conduct adequate due diligence before closing, which increases the chance that undisclosed liabilities or problematic contract terms will only surface after funds have already moved into escrow.For example, vague payment schedules have led buyers into costly cash flow issues, while unclear financing contingencies around property insurance have tanked transactions at the eleventh hour. If you miss dispute resolution clauses, a minor disagreement can escalate into costly litigation instead of a negotiated solution.The High Stakes of Overlooking Liability ProvisionsHey there! Have you ever thought about how overlooking a liability clause could potentially land you in a financial quagmire, bring about regulatory woes, or even result in surprise lawsuits after a deal is done? Ignoring these crucial provisions is like leaving the door ajar for unexpected costs that could jeopardize your business and tarnish your reputation. In fact, if liability clauses aren't carefully drafted and legally compliant, they may be rendered unenforceable, leaving your company fully exposed to risks you thought were limited by contract. Remember, partnership agreements play a vital role in outlining use and protection measures, which can further shield your business from future disputes related to overlooked liabilities.Hidden Liabilities UnveiledWhen a purchase agreement hits your desk, do you know exactly what you’re taking on—or what’s lurking beneath the surface? Hidden liabilities often hide behind asset encumbrance and unclear perfection status. Say a seller’s equipment is pledged as collateral; if you don’t confirm whether a lender has a perfected security interest—filed and public—you could unwittingly inherit those debts.Lenders, not forgiving in the least, may repossess assets if debts go unpaid, crippling your investment.That’s not all. Purchase agreements might contain sneaky clauses obliging you to assume unpaid taxes, lawsuits, or other undisclosed debts. In some states, successor liability exceptions can trigger your responsibility for debts, even if your agreement says otherwise, depending on how courts view the transaction.Without thorough due diligence and sharp negotiation of liability provisions, these hidden time bombs can detonate post-closing.Ask questions, demand disclosures, and never let liabilities slip by unnoticed.Regulatory Compliance RisksAlthough a purchase agreement may seem airtight, overlooking liability provisions tied to regulatory compliance can trigger a cascade of high-stakes consequences. Regulatory oversight today demands more than assumptions—you need ironclad compliance documentation. If you ignore exposure to risks like export controls, bribery, or anti-corruption, you could inherit not just fines, but damage to your reputation and balance sheet. A single misstep in compliance can disrupt operations, sour investor confidence, and cost an average of $5.47 million. Notably, the cost of non-compliance is more than double the expense of maintaining proper compliance measures, underscoring how critical it is to get these agreements right.Here's how risks stack up:Compliance RiskPossible ConsequenceExport ControlsLegal penalties & loss of contractsBribery/CorruptionHeavy fines, litigationDisclosure FailuresInvestor distrust, valuation dropWeak Docs & OversightRegulatory investigationAre you really prepared to absorb these risks?Post-Sale Legal ExposureEven the most carefully structured purchase agreement can leave you wide open if you underestimate the legal landmines hidden in liability provisions. Post-sale planning is critical—do you really know how exposed you're to successor liability?Courts have increasingly held buyers responsible for seller debts and torts, even when asset deals seem to exclude unwanted obligations. Litigation risks surge when sellers are distressed or insolvent, leaving you holding the bag.Tight liability management means leveraging due diligence, escrows, and bulletproof

indemnification clauses—draft them wrong, and you’ll face uncovered losses or endless disputes. Did you nail down what “knowledge” means? Vague terms and weak liability caps invite trouble.Learn from the recent spike in indemnity litigation: clarify, cap, and control your post-sale legal exposure early.Real-World Consequences for Buyers and SellersAstute investors and seasoned professionals know—overlooking key clauses in purchase agreements isn’t just a technical glitch; it’s a direct invitation to operational chaos, financial losses, and costly legal battles.Imagine rushing through contract negotiations and missing vital contractual nuances. Suddenly, you’re facing ambiguous obligations, payment disputes, or delays because deadlines weren’t detailed.Sellers bear holding and administrative costs as deals stall, while buyers often grapple with increased financing expenses or misrepresented property details.Without clear negotiation tactics or explicit indemnity clauses, simple oversights turn into courtroom drama—damages spiral, liabilities loom, and relationships fray.Do you really want your investment strategy handicapped by vague terms or unenforceable provisions?In real world transactions, every missed clause is an open door to risk, disruption, and expense.Modern contracts that overlook the significance of efficient plumbing in a property can lead to future repair costs, operational issues, and diminished long-term value.Essential Elements to Safeguard Your Purchase AgreementYou’ve seen how overlooking a single clause can unravel months of negotiation and planning—now let’s put that risk to rest. To safeguard your purchase agreement, you must guarantee essential elements are rock-solid. Who’s involved? List full legal names, addresses, and contacts to prevent identity disputes. Nail down every identifying detail about the property or item you’re acquiring—ambiguity will cost you. Specify the purchase price and payment terms, including sequences for deposits, contingencies, and payment deadlines, so everyone knows the financial roadmap. Clearly define closing, delivery, and possession dates to avoid last-minute confusion. Never ignore renewal clauses and robust dispute resolution provisions, which prevent future friction. In places seeing a booming real estate market, missing a clause can mean losing a prime investment opportunity.Essential ElementWhy It MattersIdentification of PartiesPrevents confusion, ensures liabilityProperty DescriptionAvoids legal and practical disputesPayment TermsSets financial expectationsDispute ResolutionMinimizes future conflictsProactive Steps to Prevent Costly OversightsWhile purchase agreements often look airtight on the surface, the smallest oversight can trigger a chain of disputes or financial loss down the line. So how can you stay one step ahead? Start with checklist-driven due diligence. Don’t just glance through financials—dig deep into legal, operational, and regulatory files.Have you covered contingencies, like financing or regulatory clearances, with explicit deadlines? Bring in savvy legal and financial pros to spot red flags before you sign. Regular cross-team reviews will help.And when something changes post-signing? Make sure your agreement's change-management protocol details exactly how contractual amendments get made—no room for misunderstandings, no loopholes.Real estate’s fast-paced, but pausing for these proactive steps will keep you protected when it counts most.AssessmentYou know, diving into a purchase agreement without scrutinizing those key clauses is like walking a tightrope without a net. It's easy to miss the fine print, and that can lead to some serious pitfalls.So, make sure you take a closer look and ask questions. Remember, it's your investment on the line. Want to avoid headaches down the road? Pay attention to those details now.Don't just breeze through it—ensure you're fully informed. Take action today and make those clauses work for you!

0 notes

Text

Power Purchase Agreements Market Trends & Growth Analysis

#Market Overview :#The global Power Purchase Agreement (PPA) market is projected to grow from USD 36.6 billion in 2024 to approximately USD 604.2 billion by 2#expanding at a compound annual growth rate (CAGR) of 32.4% over the forecast period from 2025 to 2034.#The global Power Purchase Agreement (PPA) Market is undergoing a significant transformation#driven by the accelerated shift toward renewable energy and increasing demand for long-term#cost-effective energy procurement solutions. PPAs#which are contracts between energy producers and buyers for the sale of electricity over a fixed period#have emerged as a critical tool in enabling the decarbonization of the global energy sector. These agreements provide financial certainty f#making them highly attractive to both corporate entities and utilities.#The industrial scenario is marked by a surge in utility-scale solar and wind projects#often backed by long-term PPAs#particularly in regions like North America and Europe. Additionally#the Asia-Pacific region is witnessing increased adoption#driven by rapid industrialization and evolving regulatory landscapes. Innovations such as virtual PPAs (VPPAs)#aggregated PPAs#and shorter-term contracts are expanding the market's accessibility and flexibility#enabling small and medium enterprises (SMEs) to participate in renewable energy procurement.#Key Takeaways:#In 2024#the global power purchase agreement (PPA) market was valued at USD 36.6 billion.#The market is projected to grow at a compound annual growth rate (CAGR) of 32.4% between 2024 and 2034.#Virtual PPAs accounted for the largest market share by type#holding 59.9% in 2024.#Based on location#the off-site segment dominated the market with an 83.9% share in 2024.#By category#the corporate segment led the market#contributing 87.1% of the total share.#In terms of deal type#the wholesale segment held the highest share at 61.9% in 2024.

0 notes