#quickbooks not updating

Explore tagged Tumblr posts

Text

How to Choose the Best Accounting Software for Your Business

Introduction In the fast-moving environment related to the business world, keeping yourself on top of the finances will never be an easy task. In reality, a company can easily slip into disarray without proper supervision of its finances. No matter whether yours is a small startup or a big corporation, the right kind of accounting software will certainly work wonders in the smooth flow of financial operations. But with accounting software options galore, how do you choose a software that’s suitable for your business? The guide from TechtoIO will take you through everything you need to know to make an informed decision. Read to continue

#analysis#science updates#tech news#trends#adobe cloud#nvidia drive#science#business tech#technology#tech trends#CategoriesSoftware Solutions#Tagsaccounting software comparison#AI in accounting software#automated invoicing software#best accounting software for business#blockchain accounting solutions#choosing accounting software#cloud-based accounting software#expense tracking software#financial reporting tools#FreshBooks review#integrating accounting software#mobile accounting software#QuickBooks vs Xero#scalable accounting software#secure accounting software#small business accounting software#top accounting software 2024#user-friendly accounting software#Wave accounting software

0 notes

Text

How to Update QuickBooks Desktop to Latest Release?

Updating QuickBooks to the latest release is very much essential, in order to enjoy the advanced features of the same. No doubt, updating to the latest release is always profitable, and with it the QuickBooks users can experience better security and performance. Many users might face difficulty in updating QuickBooks Desktop. Understanding this, we have come up with this blog post. Another option can be to get in touch with our team of experts at our toll-free number. Our team will assist the users to update QuickBooks Desktop smoothly.

How to verify whether the QuickBooks Desktop is updated?

To verify that whether QuickBooks Desktop is updated or not, you need to follow certain steps:

The first step is to start QuickBooks and then Press Ctrl+1 or F2 key, in order to get the Product information window.

After that, on the product information window, the user is required to verify the version and the latest release of the QuickBooks patch.

The next step is to examine the latest version of QuickBooks patch.

Update QuickBooks Desktop

In case your QuickBooks is not updated, the user can opt for any of the procedure from four of the below enumerated methods:

Automatic Update Process

On-Demand Update Process

Release Download Process

Manual Update Process

Steps for Automatic Process

First step is to click on the Update QuickBooks from the option Assistant Menu.

After that, the user is required to move to the Update Now window pane.

The next step is to choose the option as per the requirements.

Moving ahead, the user is required to prefer the update that they want to get and also from the update section, remove the update that you wish to update if you want to enable the Automatic update option.

In case you impaired the option, then after that you will not get any kind of notification, even if any updates are readily accessible.

To end with, select the Save option and then click on Close.

Read More....!!!

1 note

·

View note

Text

Job Update!

GOOD NEWS!!! I landed a job interview this morning! It's a small company owned by a family that we used to go to church with when I was like 5. And the environment seems chill and checks so many boxes.

It's run by people I trust to be decent people which is HUGE.

Employees are treated like humans.

They want someone who can stay long-term, and even retire one day.

They know I lack experience, and they expect me to take years to learn the job, not to get it all instantly.

They want me to ask questions and learn and grow.

They have a pretty standard 8 hour morning to afternoon

But they are pretty flexible as long as you make up the time.

They offer Insurance

And a live-alone-on-a-tight-budget-but-still-livable starting wage!!!

PAID UNION HOLIDAYS!!!!

Vacation time!

Insurance covered by a union which I've literally never had in my life.

And a small 401K is still more than I have ever had???

And sometimes I'm happy and thinking "now I can look at apartments!"... But I kinda also want to throw up and kinda want to cry because tomorrow I probably have to call and probably accept the job.

I'd probably be an idiot NOT to. Right? I've been out of a job for 4+ months at this point and then out of the blue I get a phone call from someone my mom knew 20-25 years ago when I was but a child, who just happened to hear from my pastor that I might be looking for a job. And I NEED this job, and it's the best offer I've ever gotten. At a GOOD place. Like God literally descended from the heavens and said "here you go, take it or leave it."

But the job is in accounting, which is something I never wanted... even when I kinda liked the idea of an "office" job, it was never specifically in accounting, but more of a reception desk/"here's your coffee, sir" kind of thing or like filing at a local library or working on an editing team. Working with systems and data and charts and excel spreadsheets and quickbook invoices for a company in a boring air maintenance industry specializing in getting "The Good Air™" to high need clients just doesn't sound interesting or fun to me--like I genuinely don't know if I can be happy doing it, but I want to be. But I doubt if I'm even the person they need. Then again, it's a chance for me to grow in an area where I lack, learn things I never knew... and maybe that's good?

And furthermore, The job is also not working with kids. And as scary and stressful as it can be, never knowing what will happen with kids each day (especially if you're in charge), I genuinely have LOVED the fulfillment I've gotten from working with kids and identifying as a preschool teacher('s assistant). I do tend to really enjoy the field of education... or what it could be... it was kind of like a comfort because in my secret heart I feel like I'll probably never get to be a wife or a homeschool mom, but if I can at least teach and nourish other babies and keep them safe, I can share in some of that joy ...but there's just not a lot of good options near me that would be close enough, pay enough, accepting of my incomplete educational background and lack of training, and in the field of Christian (or at least not woke) education.

8 notes

·

View notes

Text

Accounting Firms in India: Enabling Financial Growth for Modern Businesses

The Essential Role of Accounting Firms in India

In today’s competitive business environment, accounting firms in India have become indispensable to companies aiming for financial transparency, legal compliance, and sustained growth. These firms are not only handling traditional tasks like bookkeeping and tax filing but are also offering strategic support in areas such as auditing, payroll management, and financial consulting. As India’s economy continues to evolve, the role of accounting professionals is becoming more crucial than ever.

With the increasing complexity of tax laws and financial regulations, businesses are turning to professional accounting firms to manage their financial responsibilities accurately and efficiently. The right firm can help reduce financial risks, ensure compliance with Indian accounting standards, and support the overall decision-making process.

Why Businesses Choose Professional Accounting Firms

Managing finances internally can be overwhelming, especially for small and mid-sized businesses. That’s why many organizations choose to outsource accounting functions to expert firms. Here’s why this trend is growing:

Regulatory Compliance: Accounting firms keep up with evolving tax laws, ensuring that businesses remain compliant with GST, income tax, and MCA regulations.

Cost Savings: Outsourcing is often more affordable than hiring an in-house accounting team, reducing operational costs.

Efficiency and Accuracy: Professional firms use advanced software and tools to ensure accurate record-keeping and timely financial reporting.

Scalable Solutions: Services can be adjusted to meet the needs of growing businesses, from startups to established enterprises.

Services Offered by Accounting Firms in India

Accounting firms in India offer a wide range of services tailored to different types of businesses. These include:

1. Bookkeeping and Financial Reporting

Maintaining organized financial records is the foundation of sound business practices. Firms handle daily transaction tracking, journal entries, ledger management, and monthly financial statement preparation.

2. Tax Planning and Filing

Navigating India’s tax system can be challenging. Accounting firms assist with GST returns, income tax filings, TDS calculations, and tax audits, while also advising on effective tax-saving strategies.

3. Audit and Assurance Services

Internal audits, statutory audits, and compliance audits help identify risks and inefficiencies. These services enhance transparency and build trust with stakeholders and investors.

4. Payroll and Compliance Management

From salary processing to PF, ESI, and professional tax deductions, accounting firms handle every aspect of payroll while ensuring compliance with labor laws and statutory requirements.

5. Business Advisory and Financial Consulting

Many firms also provide financial planning, budgeting, and forecasting services. This helps business owners make informed decisions based on data-driven insights.

Qualities to Look for in an Accounting Firm

Choosing the right accounting partner is a strategic business decision. When evaluating potential firms, consider the following:

Certification and Experience: Ensure the firm is registered with the Institute of Chartered Accountants of India (ICAI) and has experience in your industry.

Technological Capability: Look for firms that use modern accounting tools such as Tally, Zoho Books, QuickBooks, or Xero.

Transparent Communication: A reliable firm provides regular updates, clear reports, and prompt support.

Customizable Services: Every business has unique needs. Choose a firm that offers tailored solutions instead of one-size-fits-all packages.

The Advantages of Hiring Indian Accounting Firms

India’s accounting sector is recognized for its high standards of professionalism and affordability. Some of the key benefits include:

Skilled Workforce: India produces thousands of qualified CAs and finance professionals each year.

Language Proficiency: English-speaking professionals make communication seamless for both domestic and international clients.

Competitive Pricing: Indian firms offer world-class services at cost-effective rates, making them attractive for global outsourcing.

The Evolving Future of Accounting in India

The accounting industry in India is rapidly adapting to technological innovation. Automation, artificial intelligence (AI), and cloud computing are transforming how firms deliver services. Clients now benefit from real-time financial data, predictive analytics, and paperless operations.

Additionally, government initiatives such as faceless assessments, e-invoicing, and digital compliance are pushing accounting firms to adopt smarter workflows and enhance client service quality.

As businesses continue to embrace digital transformation, accounting firms are expected to play an even bigger role—not just as compliance experts, but as strategic financial advisors.

Conclusion

In a fast-changing economic landscape, accounting firms in India have emerged as trusted partners for businesses that want to operate with confidence and clarity. Their expertise, combined with advanced technology and deep regulatory knowledge, allows companies to focus on their core activities while leaving the complexities of finance and compliance to the professionals.

Whether you're launching a startup, managing a growing enterprise, or expanding internationally, working with a reliable accounting firm can drive efficiency, reduce risk, and support long-term success.

2 notes

·

View notes

Text

The Role of Technology in Outsourcing Bookkeeping: How Assist Bay Uses Modern Tools for Seamless Integration

In today’s globalized economy, outsourcing bookkeeping services has become a strategic solution for businesses looking to streamline operations, reduce overhead costs, and improve efficiency. Particularly in the UK and the Caribbean, companies are increasingly outsourcing their accounting needs to offshore experts in India. At the heart of this transformation lies the role of technology, which has revolutionized the way businesses integrate with outsourced bookkeeping services. Assist Bay, a leader in providing outsourced bookkeeping solutions, is harnessing modern tools to make this process seamless, efficient, and transparent.

The Growing Trend of Bookkeeping Outsourcing

Outsourcing bookkeeping services is a growing trend, especially in the UK and the Caribbean, where businesses are constantly seeking ways to reduce operational costs while maintaining high-quality financial management. Many businesses in these regions, especially small to medium-sized enterprises (SMEs), are turning to offshore solutions like those provided by Assist Bay, which is based in India. Outsourcing bookkeeping not only allows companies to access skilled accounting professionals at a fraction of the cost but also ensures that businesses can focus on their core activities while maintaining financial accuracy and compliance with local tax laws.

Why India for Outsourcing Bookkeeping?

India has long been a go-to destination for outsourcing services due to its large pool of skilled professionals, a robust IT infrastructure, and cost-efficiency. Indian bookkeeping experts are well-versed in international accounting standards, including UK GAAP (Generally Accepted Accounting Principles) and Caribbean tax laws, making them a perfect fit for businesses in the UK and the Caribbean.

The Role of Technology in Bookkeeping Outsourcing

As the landscape of outsourcing evolves, so does the technology that supports it. At Assist Bay, modern tools play a crucial role in making bookkeeping outsourcing seamless. Here’s how technology is transforming the process.

Cloud-Based Bookkeeping Software

One of the biggest advancements in the bookkeeping industry has been the shift to cloud-based platforms. Tools like QuickBooks, Xero, and Zoho Books allow real-time access to financial data from anywhere in the world. This enables business owners in the UK and the Caribbean to collaborate effectively with their offshore bookkeeping teams in India. Cloud-based software ensures that all financial data is stored securely, and updates can be made in real-time, reducing the risk of errors. Whether it’s invoicing, payroll, or tax filing, cloud-based bookkeeping tools ensure that everything is up-to-date and accurate.

2. Automation of Repetitive Tasks

Another significant way technology has improved bookkeeping outsourcing is through automation. At Assist Bay, advanced automation tools are used to manage repetitive tasks such as data entry, transaction categorization, and reconciliation. This reduces human error, saves time, and ensures that the team can focus on more strategic tasks, like financial analysis and forecasting. By automating these routine tasks, businesses in the UK and Caribbean can rely on fast, accurate, and consistent bookkeeping services without the worry of manual errors creeping in.

3. Integration with Financial Systems

One of the key benefits of outsourcing bookkeeping to India is the seamless integration with a company’s existing financial systems. Modern tools allow for smooth integration with platforms like ERP systems, CRMs, and other financial applications. Assist Bay leverages APIs (Application Programming Interfaces) to connect various software tools, ensuring that data flows effortlessly between systems. This integration ensures that businesses don’t have to deal with fragmented information. They can access consolidated financial data, reports, and analytics from one central location, making decision-making more efficient and informed.

4. Data Security and Compliance

Data security and compliance are top concerns for businesses when outsourcing their bookkeeping. In the UK and the Caribbean, businesses need to ensure that their financial data is protected and compliant with local regulations. Assist Bay employs the latest encryption technologies to safeguard sensitive financial information, ensuring that only authorized personnel have access. Moreover, Assist Bay stays up-to-date with changes in tax laws and accounting standards, ensuring that all bookkeeping practices meet local regulatory requirements. For businesses in the UK, this means adhering to HMRC standards, while for companies in the Caribbean, it involves compliance with local tax laws, which can differ from one island to another.

5. Real-Time Collaboration and Communication Tools

Technology has also improved communication between outsourced bookkeeping teams and businesses. Assist Bay uses collaborative tools like Slack, Microsoft Teams, and Zoom to ensure constant communication and immediate resolution of any issues. This ensures that clients in the UK and the Caribbean are always in the loop and can easily discuss any concerns with their bookkeeping team. Real-time communication tools also allow for faster decision-making and better collaboration on financial reports and business strategies. As a result, businesses can stay agile and responsive in today’s competitive environment.

6. Data Analytics and Reporting

Gone are the days of manual ledger entry and paper-based reporting. With the help of modern tools, Assist Bay provides businesses in the UK and Caribbean with detailed financial analytics and real-time reports. By analysing financial data with AI-powered tools, Assist Bay helps businesses gain valuable insights into their spending habits, cash flow, and profitability. These reports can be customized to suit the specific needs of a business, giving stakeholders the information they need to make informed decisions. Whether it’s forecasting revenue, tracking expenses, or assessing tax liabilities, data-driven insights are now more accessible than ever before.

The Future of Bookkeeping Outsourcing

The future of bookkeeping outsourcing lies in the continued evolution of technology. As cloud computing, automation, and AI become more advanced, the role of technology in outsourcing will only grow. Assist Bay is at the forefront of this change, helping businesses in the UK and the Caribbean seamlessly integrate outsourced bookkeeping services with modern technology. By leveraging cutting-edge tools and maintaining a focus on security, accuracy, and compliance, Assist Bay ensures that businesses can confidently rely on outsourced bookkeeping services without compromising on quality. As the demand for outsourcing grows, businesses in the UK, Caribbean, and beyond will continue to benefit from the efficiency, cost savings, and strategic insights that modern technology offers. Outsourcing bookkeeping services to India is no longer just about saving costs — it’s about gaining a competitive advantage by leveraging the power of technology for smarter, more efficient financial management.

2 notes

·

View notes

Text

Revolutionizing Transactions with PayWint Digital Wallet

In a world where convenience and efficiency dominate, the demand for reliable and feature-rich digital wallets has skyrocketed. Enter PayWint, the ultimate digital wallet solution designed to streamline your financial transactions while ensuring security and ease of use. Whether you're a student, traveler, freelancer, or small business owner, PayWint is here to revolutionize how you manage, send, and receive money.

Why Choose PayWint?

PayWint stands out in the crowded digital wallet space with its seamless features tailored to meet diverse user needs. From real-time alerts to AI-powered fraud detection, PayWint ensures your transactions are not just swift but also highly secure.

Key Features at a Glance:

Instant Money Transfers: Request, send, and receive money in real-time, making it the perfect companion for personal and professional needs.

Multi-Currency & Multi-Language Support: Operate effortlessly across borders, thanks to PayWint's global usability.

Shared Wallets: Split bills or manage group expenses with family, friends, or business partners through shared wallets.

Virtual & Physical Cards: Open a digital bank account and enjoy the convenience of virtual or physical cards.

Perfect for Everyone

PayWint caters to a diverse audience, ensuring inclusivity and functionality for all.

Students and Freelancers can use PayWint to manage international payments, ensuring they can receive funds from clients or family abroad without delays.

Small Business Owners can streamline payroll, vendor payments, and even customer transactions, all from one centralized platform.

Travel Enthusiasts can enjoy hassle-free currency conversions and transactions no matter where they are.

Unparalleled Integrations

One of PayWint's standout features is its ability to integrate with leading financial and payment platforms such as Apple Pay, Google Pay, PayPal, CashApp, and Venmo. Users can also link multiple bank accounts or credit and debit cards for effortless transactions. Moreover, businesses can integrate accounting platforms like QuickBooks, Zoho, or FreshBooks to simplify bookkeeping.

Enhanced Security & Real-Time Updates

Security is at the heart of PayWint. With encryption and AI-powered fraud detection, users can trust their financial data is always safe. Real-time alerts via text, email, or push notifications ensure you stay informed about every transaction.

Beyond Payments

PayWint isn't just a digital wallet; it's a comprehensive financial management tool. The AI-powered budget planner helps users track expenses and set financial goals. For businesses, the ability to schedule recurring payments and integrate payment widgets into websites adds unparalleled convenience.

Always There for You

With 24/7 customer support available via phone, email, text, and chat, help is always just a call or message away. You can reach us at (408) 516-1413 for any assistance. Whether it's a quick query or a technical issue, PayWint ensures you're never left in the dark.

Get Started with PayWint

Ready to transform how you handle money? Download the PayWint Digital Wallet Mobile App today from the Apple Store or Google Play Store. Alternatively, visit PayWint.com to access your financial world instantly.

2 notes

·

View notes

Text

QuickBooks Desktop 2024 Release Date Anticipation

As we eagerly await the arrival of QuickBooks Desktop 2024 in 2023, discover the latest updates and features that will revolutionize your financial management. This insightful exploration delves into the anticipated release date, offering a sneak peek into the advancements that will streamline your accounting processes. Stay ahead of the curve with our comprehensive guide on what to expect from QuickBooks Desktop 2024.

2 notes

·

View notes

Text

Navigating Real-Time Operations: The Power of Operational Dashboards

Operational dashboards are dynamic visual interfaces that provide real-time insights into an organization's day-to-day activities and performance. These dashboards are particularly valuable for monitoring short-term operations at lower managerial levels, and they find application across various departments. They stand as the most prevalent tools in the realm of business intelligence.

Typically, operational dashboards are characterized by their comprehensive nature, offering junior managers detailed information necessary to respond to market dynamics promptly. They also serve to alert upper management about emerging trends or issues before they escalate. These dashboards primarily cater to the needs of managers and supervisors, enabling them to oversee ongoing activities and make rapid decisions based on the presented information. Operational dashboards often employ graphical representations like graphs, charts, and tables and can be customized to display information pertinent to the specific user.

Examples of data typically showcased on an operational dashboard include:

Sales figures

Production metrics

Inventory levels

Service levels

Employee performance metrics

Machine or equipment performance data

Customer service metrics

Website or social media analytics

It is crucial to emphasize that operational dashboards are distinct from other dashboard types, such as strategic and analytical dashboards. These different dashboards serve varied purposes and audiences and contain dissimilar datasets and metrics. Here are a couple of examples.

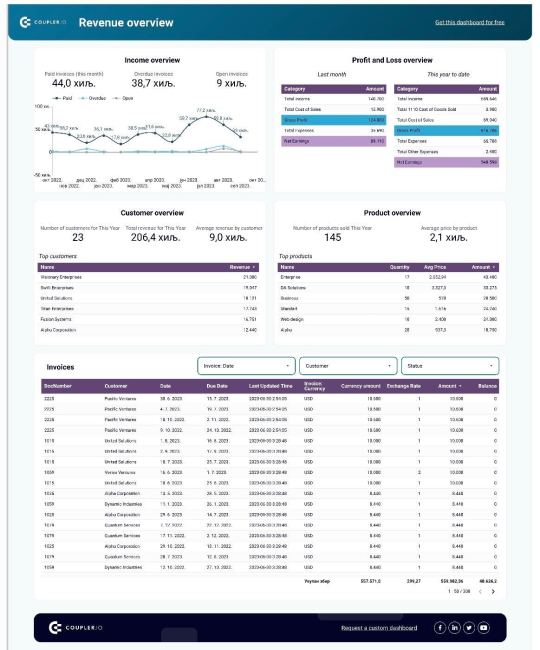

Below, you can see a Revenue overview dashboard for QuickBooks. It provides month-by-month overviews of invoices, products, customers, profit and loss. Such a dashboard can be used on a daily basis and help monitor and manage operating activities.

This data visualization is connected to a data automation solution, Coupler.io. It automatically transfers fresh data from QuickBooks to the dashboard, making it auto-updating. Such a live dashboard can be an important instrument for enabling informed decision-making.

This Revenue overview dashboard is available as a free template. Open it and check the Readme tab to see how to use it.

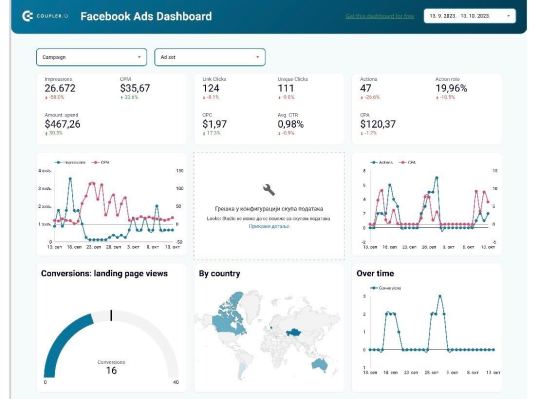

Here’s another example of an operational dashboard, the Facebook Ads dashboard. It allows ad managers to closely track their ad performance. This dashboard is also powered by Coupler.io, so it depicts ad data in near real-time. This allows marketers to quickly define what works and what doesn’t and make adjustments on the go.

Facebook Ads dashboard is available as a free template. You can grab it and quickly get a copy of this dashboard with your data. In conclusion, operational dashboards are indispensable tools for organizations seeking to thrive in a dynamic business landscape. These real-time visual displays offer invaluable insights into day-to-day operations, equipping managers and supervisors with the information to make swift, informed decisions. As the most widely used business intelligence instruments, operational dashboards empower businesses to adapt to market changes, identify emerging trends, and maintain a competitive edge. Their versatility and capacity to monitor a wide range of metrics make them an essential asset for managing the intricacies of modern operations.

#marketing dashboards#digital marketing#dashboards#data analytics#data visualization#operational dashboards

2 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

How Payroll Services Online Toronto Can Help You Save Money for Your Business

Managing employee payments efficiently and cost-effectively is critical to running a successful business. Payroll services online in Toronto offer businesses a modern, streamlined approach to handling payroll, saving time and money. However, many business owners may need to realize there are multiple ways to reduce the costs associated with these services. You can cut expenses by choosing the right provider, automating processes, and eliminating unnecessary fees without sacrificing quality or accuracy.

Suppose you're looking for ways to save on payroll. In that case, this guide will walk you through practical strategies for reducing payroll costs while maintaining compliance and employee satisfaction. Here's how to make the most of your online payroll service without breaking the bank.

1. Choose the Right Payroll Provider

Not all payroll providers offer the same features, pricing, or flexibility. Some providers may charge for features that your business doesn't need. The key to saving money on payroll services is to find a provider that offers only the essential features at the most affordable price.

How to Choose the Right Provider

Pay Only for What You Need: Avoid premium plans that include HR management, compliance support, or reporting features if you don't need them.

Look for Local Providers: Some local providers in Toronto offer customized plans for small businesses that are more affordable than large, global payroll platforms.

Look for Flat-Fee Pricing: Avoid providers that charge per-employee fees, significantly if your workforce is growing. Instead, opt for a flat-rate plan.

Take Advantage of Free Trials and Discounts: Many payroll services offer introductory discounts, referral bonuses, or seasonal promotions.

Pro Tip: Research providers like QuickBooks Payroll, Gusto, ADP, and Wagepoint to compare their features and pricing. If you're running a small business, local payroll services in Toronto may offer lower prices and more tailored support.

2. Avoid Per-Employee Fees

Many payroll providers charge a flat fee plus an additional per-employee fee. While this pricing model works for small teams, it can get expensive if your business grows.

How to Avoid Per-Employee Fees

Look for Providers With Flat-Rate Plans: Some payroll services offer unlimited employees for a fixed monthly fee.

Negotiate With Your Provider: If you have a large team, negotiate for volume-based discounts.

Ask About Unlimited Employee Plans: Look for providers with "unlimited employees" plans, especially if your workforce grows yearly.

Pro Tip: If you plan to expand your workforce, choose a provider that scales with your growth so you don't have to pay extra fees each time you hire a new employee.

3. Use Self-Service Payroll Options

If you're comfortable managing payroll tasks, consider self-service payroll options. These options typically cost less than full-service plans but still offer the essential features you need.

Benefits of Self-Service Payroll

Lower Fees: Self-service payroll is cheaper since you handle the data entry and approvals.

No Added Charges for Updates: Hiring or terminating employees doesn't require customer support, which avoids additional charges.

Simple Automation: Self-service tools allow you to automate payroll runs, tax filings, and payments.

Pro Tip: Platforms like QuickBooks Online Payroll and Gusto offer self-service options that are much cheaper than full-service plans, giving you the flexibility to handle payroll at a lower cost.

4. Automate Payroll Processes

Automation is one of the easiest ways to reduce payroll processing costs. Automation eliminates manual entry, reduces errors, and minimizes the need for administrative work.

How to Automate Payroll

Set Up Recurring Payments: Automate payments for salaried employees so you don't need to process their paychecks every pay period manually.

Direct Deposits: Switch to direct deposits to avoid the cost of printing, mailing, and handling physical checks.

Tax Filing Automation: Choose payroll services that handle payroll tax calculations and submissions on your behalf.

Pro Tip: Most online payroll services in Toronto offer automatic tax calculations and filings. This reduces the risk of errors and ensures compliance with the Canada Revenue Agency (CRA).

5. Reduce Payroll Frequency

One of the simplest ways to reduce payroll expenses is to process fewer payroll runs. If you currently pay employees weekly, consider switching to a bi-weekly or monthly payment schedule.

How Reducing Payroll Frequency Saves Money

Fewer Transaction Fees: Most payroll providers charge a fee for each pay run. Reducing the number of pay periods lowers the total cost.

Reduce Direct Deposit Costs: Fewer payroll runs mean fewer direct deposits, which can save on transaction fees.

Save Time and Labor Costs: Fewer pay periods mean less administrative work and fewer hours spent managing payroll.

Pro Tip: Consider switching from weekly to bi-weekly or semi-monthly payroll schedules to reduce pay runs and lower transaction fees.

6. Switch to Direct Deposit

Direct deposit is a simple but powerful way to reduce payroll costs. Unlike paper checks, direct deposit is fast, secure, and cost-effective.

How Direct Deposit Saves Money

No Check Printing or Mailing Costs: Say goodbye to check stock, postage, and envelope costs.

Eliminate Check Reissue Fees: If a paper check is lost or damaged, it costs time and money to issue a new one. Direct deposit eliminates this risk.

Reduce Payroll Errors: Direct deposit ensures payments are accurate and on time, reducing costly mistakes.

Pro Tip: Encourage your employees to switch to direct deposit and avoid the additional fees associated with paper checks. Most payroll services offer unlimited direct deposit as part of their base plans.

7. Bundle Payroll With Other Services

If you're already using accounting, HR, or time-tracking software, look for payroll providers that offer bundled packages. Bundling can save you money compared to paying for multiple standalone services.

Benefits of Bundling Services

Lower Monthly Costs: Bundled services cost less than subscribing to separate accounting, HR, and payroll platforms.

Simplified Management: Manage payroll, HR, and accounting all in one place, saving time and administrative costs.

Discounts on Add-On Services: Providers often offer discounts for bundling payroll with other services.

Pro Tip: If you already use QuickBooks for accounting, consider bundling it with QuickBooks Payroll for discounted rates on combined services.

8. Look for Free Trials and Promotions

Most payroll providers offer free trials or limited-time promotions to attract new customers. Please use these offers to test the platform and assess its value before committing.

How to Save With Trials and Promotions

Take Advantage of Free Trials: Try the service before you buy it to see if it meets your needs.

Look for Sign-Up Bonuses: Some providers offer cash bonuses or waived setup fees when you switch payroll providers.

Referral Discounts: Many payroll providers offer referral bonuses or credits for referring new customers.

Pro Tip: Watch for seasonal promotions from providers like ADP, Gusto, and Wagepoint. They often offer free months, waived fees, or discounted pricing during specific times of the year.

9. Skip Unnecessary Features

Many payroll providers offer expensive features like HR support, benefits management, and compliance monitoring. If you don't need these features, avoid paying for them.

How to Avoid Overpaying

Stick to Basic Payroll Services: Choose a plan focusing on essential features like pay processing, tax filings, and direct deposit.

Skip Advanced Add-Ons: If needed, only HR consulting, legal support, and advanced reporting tools.

Use Customizable Plans: Some providers allow you to pay only for the features you use.

Pro Tip: Review your payroll provider's service plan regularly to ensure you're not paying for unnecessary features or services.

10. Review and Update Your Plan Regularly

Business needs change over time, and so do your payroll requirements. What worked for a 5-person team may not work for a 20-person workforce.

How to Save by Reviewing Your Plan

Audit Your Plan Annually: Review fees, per-employee charges, and additional services you've added.

Downgrade Your Plan: If your needs have changed, switch to a lower-tier plan.

Request Custom Pricing: If you've grown significantly, ask for custom rates or bulk discounts.

Pro Tip: Many payroll providers have tiered pricing, so avoid paying for a "premium" plan when you only need the basic features.

By following these strategies, you can significantly reduce the cost of payroll services in Toronto. From automation and direct deposit to bundled packages and price negotiations, there are plenty of ways to lower payroll costs. Whether you're a small startup or an established business, the key to savings is to evaluate your provider, automate tasks, and take advantage of discounts and free trials.

0 notes

Text

How to efficiently manage small business admin

Below are practical steps to streamline your admin, save time, and boost productivity — so you can focus on growing your business.

Why Structure Is the Foundation of Success

Think of admin tasks as the backbone of your business. When they aren’t handled properly, things can quickly spiral out of control. Staying on top of administration allows you to:

Track business performance accurately

Stay compliant with UAE Federal Tax Authority (FTA) requirements

Reduce legal and financial risks

Structure isn’t just about avoiding chaos – it’s about creating opportunities. A clean admin system can help you spot inefficiencies, reduce unnecessary expenses, and scale with confidence.

Use Accounting Software to Simplify Financial Management

Manually tracking invoices, receipts, and expenses? That’s a recipe for lost paperwork and late-night stress.

Instead, use cloud-based accounting tools to automate repetitive tasks and stay audit-ready under UAE laws.

Here’s what accounting software can help with:

✅ Automated Bookkeeping: Sync your transactions automatically ✅ Payroll Processing: Handle WPS-compliant salary payments ✅ Real-Time Financial Reports: Monitor cash flow and profits at a glance

Popular tools for UAE businesses include Xero, QuickBooks, and Zoho Books, all of which are compliant with VAT and local tax standards.

Go Digital with Your Records

Paper-based admin is outdated, risky, and inefficient — especially when the FTA requires digital record-keeping

Here’s how to transition smoothly:

Scan Receipts: Use mobile apps to digitise invoices and bills

Use Cloud Storage: Platforms like Google Drive or Dropbox offer secure access from anywhere

Automated Tagging: Use software that categorizes and tags expenses by type or VAT code

Going digital saves time and makes year-end tax filing so much easier.

Organize Admin with Task Breakdowns

Admin becomes manageable when you break it into daily, weekly, monthly, and annual routines.

✅ Daily Tasks

Respond to emails and client messages

Log sales, purchases, and expenses

Digitise any paper invoices or receipts

✅ Weekly Tasks

Pay suppliers and check unpaid invoices

Reconcile bank accounts

Update your business website or post on social media

✅ Monthly Tasks

Process payroll (WPS if you have employees)

Review profit margins and track inventory

Check if VAT returns or compliance updates are due

✅ Annual Tasks

Prepare for VAT returns and renew business licenses

Review your business plan and set new goals

Audit contracts, software subscriptions, and insurance

When to Consider Outsourcing

If admin is draining your time, outsourcing can be a game-changer — especially in the UAE where penalties for non-compliance can be severe.

What you can outsource:

Virtual Assistants: Handle emails, data entry, and appointment scheduling

Accountants: Ensure FTA compliance and file accurate VAT returns

Bookkeepers: Manage day-to-day financial records

Freelance Admin Staff: Help with seasonal or one-off tasks

Want reliable experts to handle your admin work? Talk to us — our professionals help UAE businesses stay compliant, organized, and scalable.

Build a Sustainable Admin Routine

Managing business admin efficiently is all about smart systems and consistent habits. Here’s how to get started:

✅ Use cloud-based tools and accounting software ✅ Break tasks into bite-sized daily and weekly routines ✅ Rely on professionals when needed

Ready to Streamline Your Business Admin?

If you’re tired of juggling receipts, compliance tasks, and endless admin work — let us help. Our team at The Accountant specializes in bookkeeping, VAT filing, and business advisory tailored for UAE businesses.

📞 Get in touch today — and start working smarter, not harder.

0 notes

Text

Logistics Mistakes That Cost You More Than Money

Summary: Logistics can make or break a small business, yet it’s often one of the most overlooked areas. This blog breaks down five common logistics mistakes—from ignoring automation and underestimating shipping costs to poor KPI tracking—and explains how these missteps quietly eat away at time, money, and customer trust. With practical fixes, relatable analogies, and real-world tools, small business owners can take back control of their supply chain and turn logistics from a liability into a growth lever.

You probably don’t think about logistics until something breaks.

A delivery’s late. A customer’s upset. You’re knee-deep in spreadsheets trying to figure out where your stock went. Sound familiar? That’s the thing about logistics—when it works, nobody notices. When it doesn’t, it’s chaos.

For small businesses, this chaos hits harder. You’re not Amazon. You don’t have infinite warehouses, a dedicated fleet, or a crisis response team. You’ve got tight margins, lean teams, and customers who expect prime-level speed. Which means when something goes wrong, it really goes wrong.

But here’s the good news: most logistics failures aren’t disasters waiting to happen—they’re just quiet, repeated mistakes. And once you know what they are, you can fix them.

Let’s talk about five common logistics mistakes small businesses make—and how to avoid them before they turn into problems you can’t afford.

1. Automation Isn’t Just for the Big Guys

Still tracking orders in a spreadsheet? Writing down delivery schedules in a notebook? That might’ve worked when you had five orders a week. But once things scale—even a little—manual processes start leaking time, money, and patience.

The irony? Most small businesses assume automation is out of reach. Too expensive, too complex, too “corporate.” But that’s not the case anymore. Tools like QuickBooks Commerce, ShipStation, Zoho Inventory, or even basic Zapier workflows can automate order updates, trigger shipping labels, or sync inventory across sales channels.

Imagine this: instead of chasing your delivery team for updates, your system pings you when a package is scanned out. Instead of checking stock levels manually, you get an email when your bestseller hits 10 units.

It’s not about fancy software. It’s about freeing up your brain for things that actually grow your business.

You know what? Running logistics manually today is like trying to manage customer service without email. It’s outdated, it’s exhausting, and it’s holding you back.

2. Logistics Needs a Specialist — Not a Side Hustler

Let’s be honest: not everyone who prints labels is a logistics expert. And that’s okay—until you start relying on them for the whole operation.

One of the most damaging mistakes small businesses make is putting someone in charge of logistics who has zero experience. Maybe they’re a relative. Maybe they’re good with Excel. But if they don’t know the difference between a packing slip and a freight manifest, things can unravel fast.

Here’s the problem: logistics isn’t just moving stuff from A to B. It’s timing, compliance, documentation, inventory flows, carrier management, and customer communication—all happening in real-time.

And you can’t Google your way through all of it. Especially not when something goes wrong.

You don’t need a full-time logistics department. But you do need someone who knows the ropes. Whether it’s a part-time hire, a consultant, or a trusted third-party logistics partner (3PL), investing in real expertise can save you from very real headaches.

Think of it this way: you wouldn’t let your social media intern file your taxes. Logistics deserves the same respect.

3. Hidden Costs That Slowly Kill Your Margins

Here’s a sneaky one.

You’ve got your pricing figured out. You’ve run the numbers. But somehow, every month, shipping is eating more of your profit than you expected.

What happened?

It’s not just postage. It’s the packaging materials you forgot to factor in. It’s the return shipping fees. It’s the extra costs from failed deliveries, the oversized boxes, the extra handling for fragile goods.

And these add up. Quietly. Relentlessly.

The solution? First, track them. Break down your shipping costs per order. Know how much it actually costs you to send something—not what the label says, but the real number.

Second, consider working with a 3PL. Providers like Wright Logistics, ShipBob, or Deliverr often get volume-based discounts from major carriers. They can help you optimize packaging sizes, reduce dead weight, and even predict where you’re bleeding money.

Also—standardize. You don’t need ten different box sizes and three types of filler. Every extra variation is a cost multiplier.

This isn’t about being cheap. It’s about being smart. Because every penny you save on logistics is a penny you can reinvest elsewhere.

Recommended Reading: Top Strategies That Can Help India Combat Higher Logistics Costs

4. The Market’s Evolving — Are You?

Logistics isn’t static.

What worked last quarter might not work now. Carriers change rates. Customer expectations shift. One new TikTok trend and suddenly your demand spikes by 400% overnight.

And yet—so many small businesses set their logistics on autopilot. Same process, same partners, same assumptions. Month after month.

That’s risky.

Think about seasonality. Are you ready for Q4 volume? Do you know how long your supplier takes during Chinese New Year? What happens if fuel prices spike and your courier adds a surcharge?

You don’t need to be a trend analyst. But you do need to stay curious.

Keep an eye on what your competitors are doing. Subscribe to logistics newsletters (yes, they exist). Ask your 3PL about market changes. And most importantly—build flexibility into your process.

Staying nimble isn’t just a mindset. It’s a survival skill.

Read More: Transport and Logistics: 30 Myths You Need to Dispel

5. Your Gut Feeling Isn’t a Metric

Ever heard someone say, “I feel like our shipping’s been smoother lately”?

Feelings are fine. But in logistics, data talks.

If you’re not tracking key performance indicators (KPIs), you’re guessing. And guesses don’t help when customers are upset or orders are missing.

The fix? You don’t need a fancy dashboard. A simple spreadsheet will do. Here are a few KPIs every small business should be tracking:

On-time delivery rate

Order accuracy rate

Return rate due to fulfillment issues

Shipping cost per order

Customer complaints or support tickets related to delivery

Review them weekly. Spot trends. Adjust before things go south.

There’s a real comfort in knowing where you stand—not just feeling like things are okay, but having the numbers to back it up.

Because when the holiday rush hits, or a supplier goes dark, or your carrier delays every package for a week, you want to act with clarity—not panic.

Final Thoughts: It’s Not About Perfection, It’s About Control

Look, no one gets logistics right all the time. Things go wrong. Packages get lost. Systems break. It happens to billion-dollar brands too.

But the difference is—they know why. They’ve built systems to catch problems early. They adjust fast. They don’t let a minor shipping issue become a customer churn problem.

And you can do the same.

Start small. Audit your process. Track your metrics. Ask yourself which of these five mistakes you might be making right now.

Then fix one. Just one.

That one change? It might shave hours off your week. It might save you hundreds. It might keep your best customer from walking away.

Logistics doesn’t need to be perfect. But it does need to work.

And with the right tools, the right partners, and a bit of strategy—you’ll be surprised how much smoother it can get.

0 notes

Text

I took the company's copy of Quicken 2000 [for their personal records] home and used it for a decade or so for my personal checking account record. Later I converted that to the company's QuickBooks Pro [for the company records]. Now on 2019 version. Meanwhile at work. QuickBooks 5 went to 6 in my first year. Paid $100 for a disk each year with payroll form updates. Updated to one of the QBs with a year in the name for $150. Ran that for a while. Then got told that to continue we needed to buy a new one. $180. Three years later...a new one. $200. $220. $260. It all goes to digital download. No more disks. Then a brilliant new idea. QuickBooks is now a subscription. $500 a year. Plus $500 for the payroll updates. Direct Deposit is costing $50 per month. Software will brick if you don't pay. Need to sign in to confirm payroll subscription every 21 days.

113K notes

·

View notes

Text

Financial Accounting in Dubai: Top Bookkeeping Mistakes Businesses Make & How to Fix Them

Bookkeeping may not be the most glamorous part of financial accounting in Dubai. But, in Dubai’s fast-evolving regulatory landscape, you may need to ensure proper bookkeeping. If you opt for poor bookkeeping, you can trigger penalties, induce tax errors and miss business opportunities. This is important for all types of zones, including free zones and mainland.

Here are some of the top bookkeeping mistakes businesses in Dubai are likely to make and ways to avoid them. By avoiding them, you can stay compliant, audit-ready and financially healthy. 1. If you are a startup or solopreneur in Dubai, you may begin using the same account for personal and business transactions. This is a fact especially when you are in the early stages of business. It may be convenient. However, it can create a messy paper trail that becomes hard to track and reconcile. It can also lead to issues during audit. It is risky because it can lead to erroneous VAT reporting. Moreover, you will notice reduced visibility into the actual business performance. Lastly, it can complicate your expense categorization in financial accounting in UAE. You should ideally fix this issue by opening a dedicated business bank account, whether you are a freelancer or sole proprietor. You should use the accounting software like Zoho Books and QuickBooks to record expenses with proper tagging. You should avoid using the business debit card for personal purchases. 2. The second mistake you are likely to make is poor documentation of invoices and receipts. If you don’t collect the store receipts and tax invoices, you may face issues during VAT audits. It can also mean that the FTA, Federal Tax Authority, will disallow your input tax claim. This can prove to be risky as the VAT returns can be incorrect. Moreover, you may attract penalties of AED 10k+ for not having appropriate documentation. Lastly, your lost proof will make it harder for you to verify the expenses during an audit. You can use cloud-based tools like Dext and Hubdoc to store the receipts digitally. It can also help you keep track of all the supplier invoices, including their VAT details like TRN date. Lastly, you should have a recurring reminder to review and file these receipts weekly as part of financial accounting in Dubai.

3. You will make a mistake of delaying the bookkeeping or managing irregular updates. Most business owners update their books at the end of the quarter. In some cases, they would update it right before filing their VAT return. This would make it difficult for them to catch the errors and add to the stress. If you opt for delayed bookkeeping, you might forget the context of these transactions. You may also miss certain entries or misclassify them, leading to inaccurate reports. Lastly, you might incur high fines. You should always schedule bookkeeping updates once a week. Block the time or assign a member for the purpose. You should automate the bank feeds to reduce manual data entry. Lastly, you can hire a part-time bookkeeper to help. 4. You may be making a big mistake with financial accounting in UAE by ignoring the bank reconciliation. For instance bounced payments, delayed transfers or transaction issues. It can lead to cash flow mismanagement and difficult audits. You can fix this by reconciling your bank accounts monthly.

0 notes

Text

Odoo ERP Integration with QuickBooks, Shopify, and Amazon for U.S. Businesses

In today's hyper-competitive market, U.S. businesses need to operate with precision, agility, and seamless coordination across departments. Enterprise Resource Planning (ERP) systems like Odoo have emerged as critical tools for achieving operational excellence. However, to maximize their utility, these ERP systems must integrate with other widely used platforms such as QuickBooks, Shopify, and Amazon. This comprehensive article explores the value of Odoo ERP integration with these tools, the unique benefits for U.S. businesses, and best practices for successful implementation. Additionally, we’ll highlight the importance of selecting the right Odoo integration services in USA to ensure long-term success.

Table of Contents

Introduction to Odoo ERP

Why Integration Matters

Odoo + QuickBooks Integration

Odoo + Shopify Integration

Odoo + Amazon Integration

Benefits for U.S. Businesses

Implementation Challenges and Solutions

Choosing the Right Odoo Integration Services in USA

Final Thoughts

1. Introduction to Odoo ERP

Odoo is an open-source, all-in-one business management software that covers everything from CRM and accounting to inventory and HR. It's especially popular among small to medium-sized businesses (SMBs) due to its modular architecture, affordability, and high customizability.

Odoo ERP can serve as the digital backbone of a business, streamlining operations across sales, finance, procurement, logistics, and more. However, it truly shines when connected with external applications like QuickBooks for accounting, Shopify for eCommerce, and Amazon for online sales.

2. Why Integration Matters

Businesses today use multiple platforms to manage operations. Without integration, data is siloed, processes are fragmented, and errors become inevitable. Integration ensures:

Real-time data synchronization

Improved efficiency and productivity

Accurate financial reporting

Better inventory and order management

Enhanced customer experience

When integrated properly, Odoo ERP becomes a central hub that provides visibility into every aspect of the business. This is particularly crucial for U.S. companies operating across multiple channels and regions.

3. Odoo + QuickBooks Integration

Why Integrate Odoo with QuickBooks?

QuickBooks is one of the most popular accounting software solutions in the U.S., widely used for managing payroll, invoices, tax compliance, and reporting. Integrating it with Odoo allows businesses to sync financial data automatically, eliminating the need for manual data entry.

Key Features

Automatic synchronization of invoices, bills, and payments

Real-time tax calculation and compliance with U.S. regulations

Customer and vendor record matching

Seamless payroll tracking

Improved cash flow management

Benefits

Reduces manual data errors

Ensures consistent financial reporting

Saves time during audits and tax season

Enhances decision-making with accurate P&L statements

Use Case

A small U.S. manufacturer using Odoo for inventory and operations can integrate QuickBooks to automatically record sales invoices, update general ledger entries, and prepare tax reports based on real-time data.

4. Odoo + Shopify Integration

Why Integrate Odoo with Shopify?

Shopify is a leading eCommerce platform for U.S.-based D2C (Direct-to-Consumer) businesses. Integrating it with Odoo allows for automated order processing, inventory updates, and customer data syncing.

Key Features

Order synchronization from Shopify to Odoo

Inventory level updates in real-time

Product catalog syncing between Odoo and Shopify

Customer data consolidation

Shipping and fulfillment automation

Benefits

Improves order accuracy and fulfillment speed

Reduces stockouts and overselling

Centralizes inventory across channels

Enhances customer satisfaction

Use Case

A fashion retailer operating multiple Shopify storefronts can use Odoo ERP to manage inventory across locations, sync sales orders automatically, and gain real-time analytics on best-selling items.

5. Odoo + Amazon Integration

Why Integrate Odoo with Amazon?

Amazon is a crucial sales channel for many U.S. businesses. However, managing it separately from your ERP system can lead to delays and inefficiencies. Integrating Odoo with Amazon automates listing, order management, and fulfillment.

Key Features

Listing management from Odoo to Amazon

Order and return synchronization

Fulfillment by Amazon (FBA) tracking

Inventory syncing across warehouses

Performance analytics and feedback management

Benefits

Automates time-consuming tasks

Increases seller performance and ratings

Improves multi-warehouse fulfillment

Centralizes Amazon activity within your ERP

Use Case

A consumer electronics brand using FBA and fulfilling some orders in-house can use Odoo to manage all inventory, track Amazon sales, and streamline operations—all from one dashboard.

6. Benefits for U.S. Businesses

Here’s how U.S. companies benefit from these integrations: BenefitDescriptionRegulatory ComplianceIntegration with QuickBooks ensures compliance with U.S. GAAP and IRS tax requirements.Omnichannel ManagementCentralized data from Shopify and Amazon enhances customer experience.ScalabilityAs businesses grow, integrated systems allow for easier expansion across states or internationally.Operational EfficiencyAutomated workflows reduce administrative overhead and human error.Business IntelligenceUnified reporting across platforms provides deeper insights into sales, cash flow, and inventory trends.

7. Implementation Challenges and Solutions

While the benefits are significant, integration projects come with challenges:

Common Challenges

Data inconsistency between platforms

Customization limitations with third-party connectors

Latency in data sync

Security concerns

Regulatory and tax differences between states

Solutions

Custom-built connectors that address specific business needs

Middleware platforms for managing complex data flows

Experienced Odoo partners who understand U.S. compliance and business models

Regular data audits post-integration to ensure accuracy

8. Choosing the Right Odoo Integration Services in USA

To ensure a smooth and successful integration, it is crucial to partner with an experienced provider of Odoo integration services in USA. Here's what to look for:

Key Criteria

Experience with U.S. Clients Choose a provider familiar with American tax law, GAAP, and popular tools like QuickBooks and Shopify.

Portfolio of Successful Integrations Ask for case studies or references from similar industries.

Customization Capabilities Every business has unique needs. Your provider should offer tailored connectors, not just out-of-the-box plugins.

Security and Compliance Expertise Ensure they follow best practices for data encryption, access control, and audit logging.

Post-Integration Support The best Odoo partners offer continuous monitoring, maintenance, and upgrades.

Recommended Partner

Glorium Technologies stands out as a trusted U.S.-based Odoo partner with extensive experience in ERP integrations. Their team provides end-to-end services—from strategy and customization to deployment and support.

9. Final Thoughts

Integrating Odoo ERP with QuickBooks, Shopify, and Amazon is no longer optional for competitive U.S. businesses—it’s essential. These integrations bring immense value by enhancing accuracy, boosting efficiency, and enabling data-driven decisions. Whether you're a startup, SME, or growing enterprise, the benefits of a unified digital ecosystem are transformative.

However, achieving these results depends on thoughtful planning and selecting the right Odoo integration services in USA. Partnering with experts like Glorium Technologies ensures your systems work harmoniously, empowering your business to scale efficiently and thrive in a rapidly evolving digital landscape.

0 notes

Text

Top-Rated Startup Accountants in London: What to Look for and Why It Matters

Launching a startup in London, one of the world’s most vibrant business hubs, is both thrilling and daunting. With countless decisions to make—from securing funding to developing your product—it's easy to overlook one crucial component of startup success: accounting. Choosing the right startup accountants London can be the difference between thriving growth and financial chaos.

In this blog post, we’ll explore why working with top-rated startup accountants in London is essential, what qualities to look for, and how the right partner can drive your business forward.

Why Accountants Are Critical for Startups

Startups often operate on limited resources, tight deadlines, and rapid pivots. This dynamic environment makes financial clarity even more important. Here's why a good accountant is indispensable:

1. Compliance and Regulation

The UK tax system is complex, especially for new business owners. From Corporation Tax to VAT and PAYE, startups must meet strict deadlines and legal obligations. An experienced accountant ensures you're compliant and avoids costly penalties.

2. Cash Flow Management

Cash flow is the lifeblood of a startup. Mismanaging it can lead to missed opportunities or worse—business failure. Startup accountants help monitor cash flow, forecast trends, and create a buffer for lean periods.

3. Investor Confidence

When seeking funding from angel investors or venture capitalists, having accurate and professionally prepared financial statements boosts your credibility. It shows potential investors that you’re financially savvy and well-managed.

4. Strategic Advice

A great startup accountant does more than crunch numbers. They offer strategic insights into pricing, budgeting, and cost control. With their support, you can make smarter, data-backed decisions.

What to Look for in a Startup Accountant

Not all accountants are created equal—especially when it comes to startups. Here's what to look for when choosing startup accountants in London:

1. Startup-Specific Experience

Look for accountants who specialize in startups. They’ll understand your unique challenges—whether it’s pre-revenue planning, bootstrapping, or scaling rapidly. Experience with funding rounds, SEIS/EIS tax relief, and R&D tax credits is also a plus.

2. Tech-Savvy and Cloud-Based

Modern startups rely on digital tools. The best startup accountants in London use cloud-based software like Xero, QuickBooks, or FreeAgent. This enables real-time collaboration, data access from anywhere, and more efficient bookkeeping.

3. Transparent Pricing

Startups need predictable costs. Top-rated accountants offer clear, fixed monthly packages with no hidden fees. Avoid anyone who charges by the hour without a breakdown of what’s included.

4. Proactive Communication

You need a partner who checks in regularly—not someone you hear from once a year. Look for firms that offer proactive support, regular updates, and respond quickly to questions.

5. Scalability

Your accounting needs will evolve as your business grows. Choose an accountant who can scale with you—offering services like payroll, financial forecasting, international tax planning, and more as you expand.

6. Good Reviews and Testimonials

Reputation matters. Check online reviews, ask for case studies, or speak to current clients. Firms with a proven track record in helping startups succeed are worth shortlisting.

Top Benefits of Hiring a London-Based Startup Accountant

London offers a unique environment for startups—high competition, incredible opportunities, and a strong investor network. Hiring a local accountant offers specific benefits:

1. Understanding of the Local Market

Startup accountants in London are deeply familiar with the financial and legal landscape of the capital. Whether it’s business rates, local grants, or London-based investor trends, they bring valuable local knowledge.

2. Networking and Connections

Top-rated accountants often work with incubators, VCs, and legal professionals. Partnering with them could open up new business opportunities, strategic advice, or even funding connections.

3. Face-to-Face Accessibility

While most communication is digital today, being able to meet in person (if needed) adds an extra layer of trust and collaboration.

Questions to Ask Before You Hire

To ensure you're choosing the right firm, ask these key questions during your discovery call:

Do you have experience with businesses in my industry?

How many startup clients do you currently work with?

Can you support me as I scale and potentially expand internationally?

What cloud accounting platforms do you use?

How often will you provide reports or financial updates?

Can you help with funding applications or investor readiness?

Their answers will tell you a lot about their capabilities, communication style, and long-term suitability.

Recommended Startup Accountants in London

While there are many reputable firms, here are a few names that frequently receive praise from the startup community (note: always do your own research before choosing a provider):

Seed Accounting Solutions – Specialises in tech startups and R&D tax claims.

AccountsLab – Known for fixed-price packages and responsive service.

Swoop Accountants – Strong on funding advice and financial modeling.

Crunch – Cloud-based and ideal for small or solo startups.

These firms understand the rhythm and demands of startup life and are known for going beyond just bookkeeping.

Final Thoughts

The startup journey is exhilarating but filled with potential pitfalls—especially when it comes to finances. Choosing one of the top-rated startup accountants in London is an investment in your business’s future. They’ll help you stay compliant, attract investors, manage growth, and avoid financial surprises.

Remember, your accountant should be more than a number-cruncher. They should be a strategic ally—someone who understands your goals and helps you build a strong financial foundation.

So don’t leave it to chance. Do your research, ask the right questions, and choose a partner who will grow with you. The success of your startup might just depend on it.

1 note

·

View note