#thomas/a1/a2

Explore tagged Tumblr posts

Note

Ang.... Angels and Thomas three-way........ The suffering the hate of it all

i want this so so so so so so bad but i know it would never get committee approval

tessellate is the closest we’ll get to canon thomas/a1/a2

#oh the#the barrage of possibilities that just flooded my minds eye#a1 and a2 m#I SHANT SAY I SHANT SAY I SHANT SAY#asks#a1/a2#thomas/a1#thomas/a1/a2#tessellate

103 notes

·

View notes

Text

okay a day late and only a short little snippet of boot smut, but for you @headfulloffeathers and @sparklehag99 my beloved smut enablers here’s a sfw teaser

i’m hoping this inspires me to write more lmfao but we’ll see

happy belated birthday to jess and a1, the biggest a2 stans i know

Thomas steps out of the shower and meets Michael’s eyes in the mirror—and any coherent thoughts he may have had go sprinting out the door.

He’s wearing the crisp black suit Thomas had made for him a few years ago—one of the only outfits he owns that actually fits. It’s made of a ridiculously soft mohair blend that Thomas loves running his hands along, soft enough that it doesn’t set off any of Michael’s sensory issues, soft enough he’ll be willing to wear the suit for a few hours before he starts itching to take it off.

The jacket sits neatly across those incredibly broad shoulders and nips in sinfully at the waist. He’s paired it with a flat black shirt with buttons such a deep red they almost appear black themselves. Michael didn’t bother with a tie this evening, leaving the top few buttons of the shirt undone. Thomas trails his eyes down, down, down his legs, and his breath catches at the sight of the shoes Michael picked out.

Thomas had seen them in the atelier in Milan during a brief respite between contracts and had immediately had a pair made for Michael’s ridiculous sasquatch feet.

He’s left the front zippers of the boots undone, leaving them to gape open around the tapered legs of his suit. The laminated calf leather starts a rich black at the top of the boot, and transitions to a deep blood red by the time it reaches the sole.

That alone would have been enough to necessitate the purchase of the boots, but what really cemented the need was the stylized drips of paint down the modest stacked heel, pooling around the sole, that resembles nothing so much as blood.

Thomas might not be as bloodthirsty as Michael, but give him a break. One the hottest things he’s ever seen is his little mouse, feral eyed and covered in blood, looking at him with rage in his eyes.

Another is seeing him dressed up in ridiculously expensive clothes Thomas has bought him.

These boots are the best of both worlds, and immediately have him stiffening under his towel as he makes his way over to the bathroom counter.

“Give me 20 minutes, angel, and I’ll be ready to go.”

Michael gives him a tiny smirk as his eyes tick back up from where they’d been lingering around Thomas’ waist. He hums in assent and wanders back out into the apartment. He hears the Playstation power on and smiles a little to himself as he applies his aftershave.

8 notes

·

View notes

Text

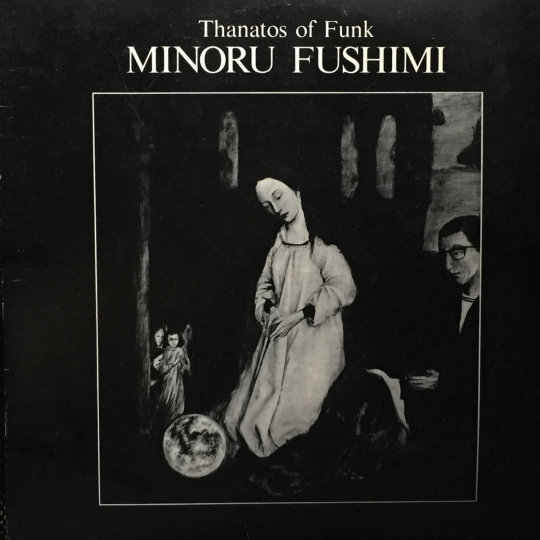

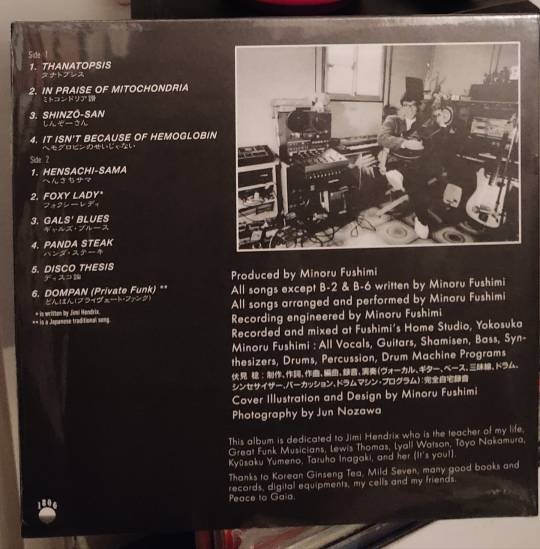

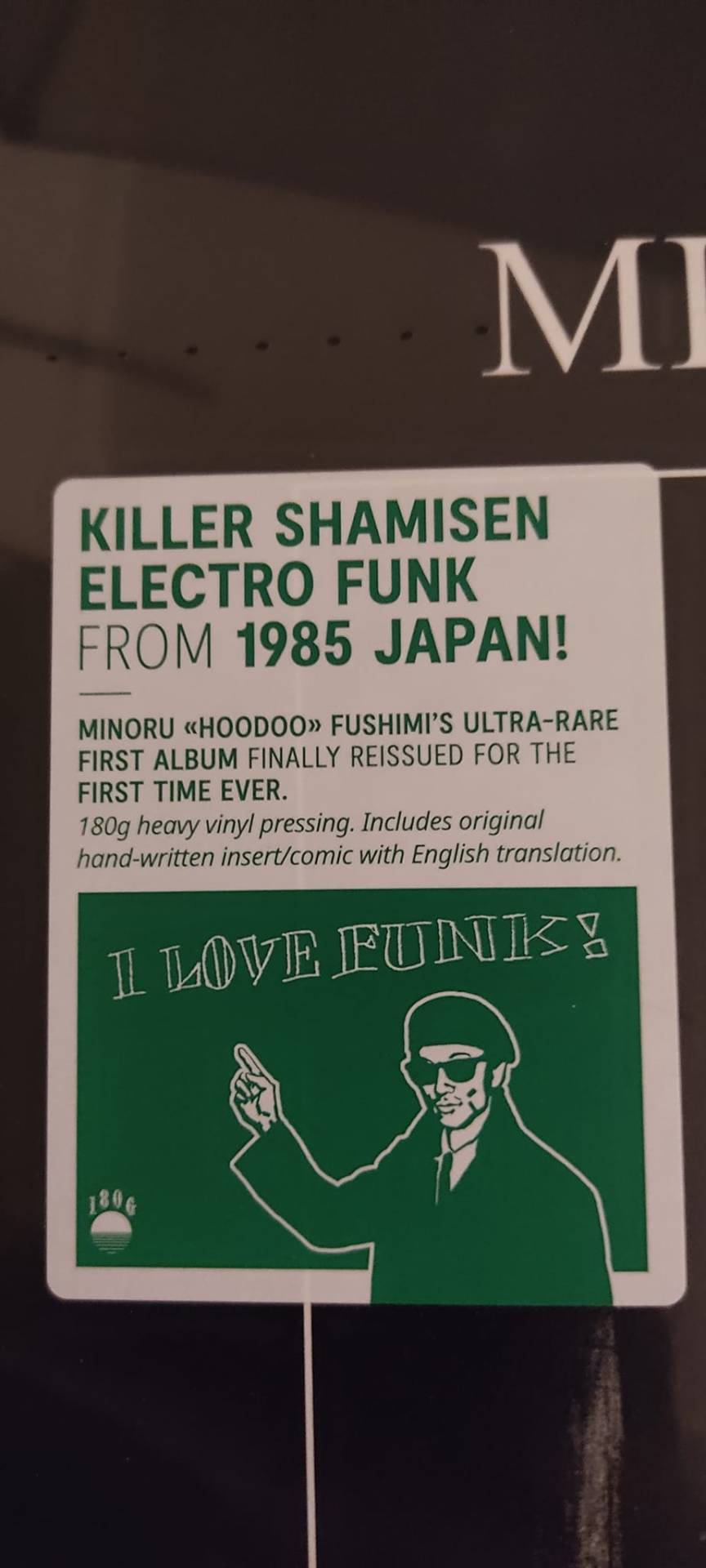

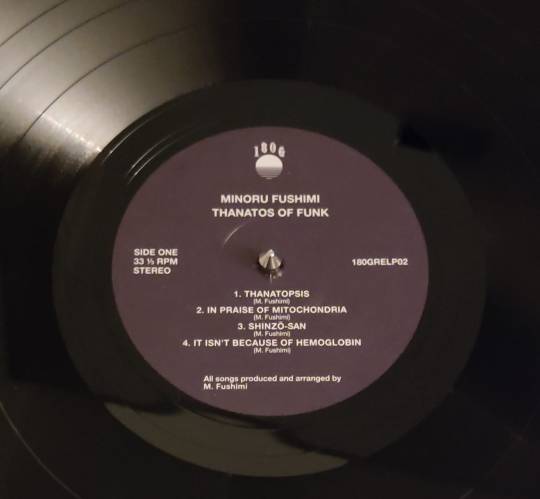

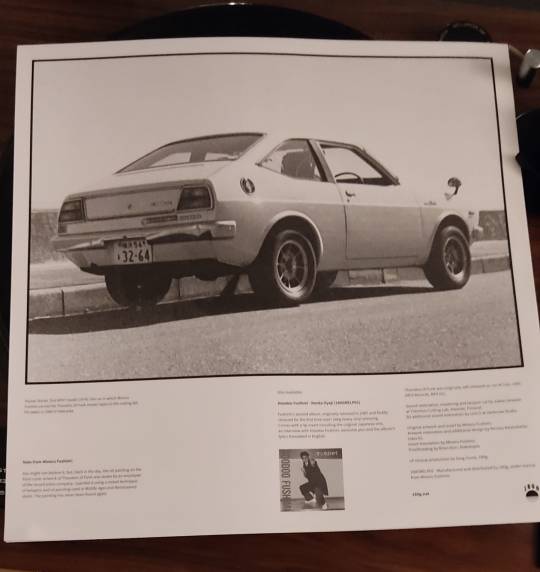

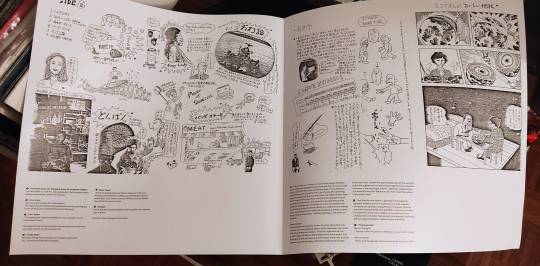

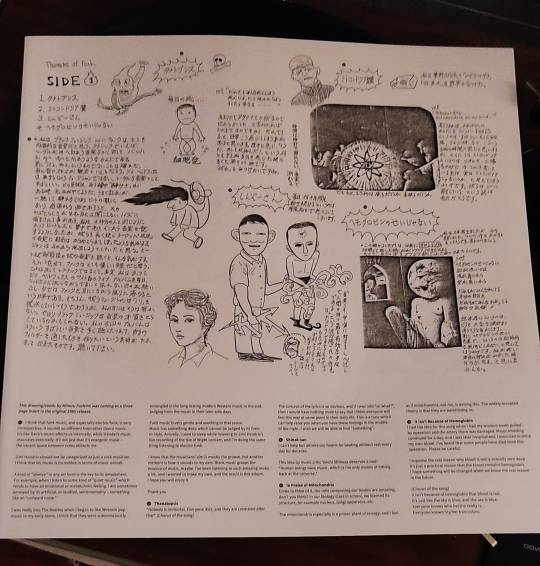

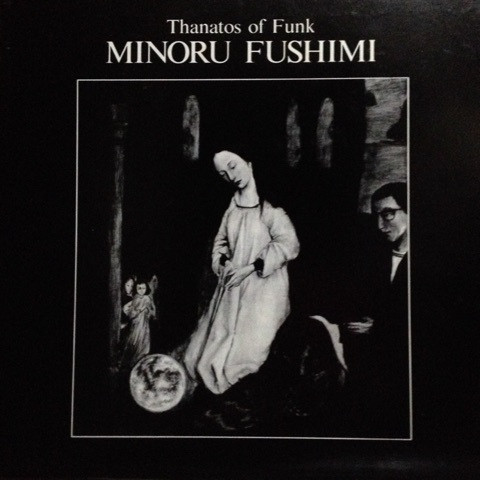

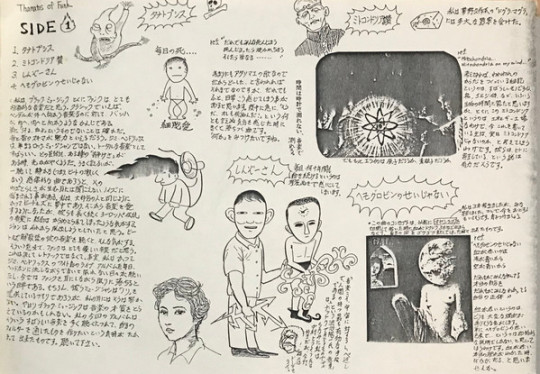

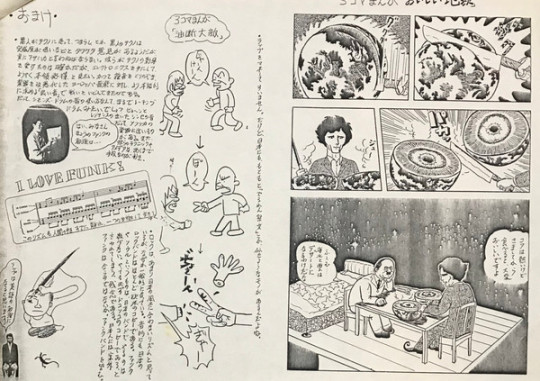

Minoru Fushimi "Thanatos Of Funk" 1985 Japan mega rare Electro Synth Funk,Electronic,Experimental,early Japanese Hip Hop Underground

full spotify

Reissue of this mega-rare, eccentric electro-funk album from Japan, originally released in 1985!...~ Recorded and mixed at Fushimi's Home Studio, Yokosuka This album is dedicated to Jimi Hendrix who is the teacher of my life, Great Funk Musicians, Lewis Thomas, Lyall Watson, Tōyo Nakamura, Kyūsaku Yumeno, Taruho Inagaki, and her (It's you!). Thanks to Korean Ginseng Tea, Mild Seven, many good books and records, digital equipments, my cells and my friends. Peace to Gaia.....~ Minoru “Hoodoo” Fushimi’s most wanted and impossible to find first album Thanatos Of Funk is finally reissued for the first time ever, in collaboration with Fushimi himself. Thanatos Of Funk is a milestone in Japan’s underground music and electro funk/early hip hop history. Entirely self-produced, designed and distributed in 1985 by Fushimi, a high-school teacher by day and music experimenter by night, Thanatos Of Funk is a love-letter to counter-culture, DIY, drum machines and synthesizers blent with some killer shamisen and guitar playing. This is truly unique music. The LP, re-mastered and cut at the Timmion Cutting Lab, comes with the original hand-written comic by Fushimi, with English translations. Essential!...~ Thanatos Of Funk is a milestone in Japan’s underground music and electro funk/early hip hop history. Entirely self-produced, designed and distributed in 1985 by Fushimi, a high-school teacher by day and music experimenter by night, Thanatos Of Funk is a love-letter to counter-culture, DIY, drum machines and synthesizers blent with some killer shamisen and guitar playing. Comes with a 4 pages insert including the original hand-written insert/comic by Minoru Fushimi, with English translations. Minoru “Hoodoo” Fushimi’s most wanted and impossible to find first album Thanatos Of Funk is finally reissued for the first time ever, in collaboration with Fushimi himself.....~ Later known as Hoodoo Fushimi, Japanese electro funk trailblazer Minoru first rose to prominence in 1985 with this mind-blowing homemade release. Written and composed after long days of teaching high school classes in Kanagawa, Fushimi channelled his off-kilter creativity into his nocturnal music-making experimentation. The result was a radical, DIY singularity - filled with unique shamisen riffs, chromatic synths, bluesy funk, glorious guitar shredding and peculiarly pitched speak-singing vocals. Produced, designed, illustrated and distributed by Fushimi himself, this surreptitious rarity also comes with a four-page, handcrafted comic book insert (with English translations of course)! Thanatos of Funk is truly the quintessential album for the leftfield spirit of the Japanese underground.....~ Tracklist A1 Thanatopsis タナトプシス A2 In Praise Of Mitochondria ミトコンドリア讃 A3 Shinzō-San しんぞーさん A4 It Isn't Because Of Hemoglobin ヘモグロビンのせいじゃない B1 Hensachi-Sama へんさちサマ B2 Foxy Lady フォクシー・レディ B3 Gals' Blues ギャルズ・ブルース B4 Panda Steak パンダ・ステーキ B5 Disco Thesis ディスコ論 B6 Dompan (Private Funk) どんぱん

Minoru Fushimi "Thanatos Of Funk" 1985 Japan mega rare Electro Synth Funk,Electronic,Experimental,early Japanese Hip Hop Underground

https://johnkatsmc5.blogspot.com/2025/06/minoru-fushimi-thanatos-of-funk-1985.html?view=magazine

https://johnkatsmc5.tumblr.com/post/785250120007663616/minoru-fushimi-thanatos-of-funk-1985-japan-mega

2 notes

·

View notes

Text

The engines as different basis (EoSR but built different) - 1

(Tender engines as tank engines, vice versa)

From No. 1 - 6 (Thomas, Edward, Emily, Henry, Gordon, James)

NWR 1 Thomas (formerly LBSCR 307, SR 2307)

Class: London, Brighton, and South Coast Railway (LBSCR) Class C3 Horsham Goods

Previous Owners: London, Brighton, and South Coast Railway; Southern Railway; British Railways (Southern Region)

Built: August 1906

Real-life Withdrawal: May 1949 (never received a BR number)

Designer: Douglas Earle Marsh

Builder: Brighton Works

Bio:

Thomas is the first tender engine purchased by the NWR, after the withdrawals of the original NWR 1 - 6 (the last one being in 1925). The NWR had believed that they wouldn't need any tender engine power until the withdrawal of NWR 1 in 1925.

NWR 2 Edward (formerly W&SR 5)

Class: Dublin, Wicklow and Wexford Railway (DW&WR) 52 class; North Western Railway (NWR) Class S-W52

Previous Owners: Wellsworth & Suddery Railway

Built: 1893

Real-life Withdrawal: n/a

Designer: William Wakefield

Builder: Sharp, Stewart and Company (Glasgow, Scotland)

Bio:

Edward was commissioned by the Wellsworth and Suddery Railway. His design was altered so that he could run on standard gauge rails. When the merger occured, he was passed down to the NWR, along with Emily, and the NWR attempted to rebuild him so he could handle the new jobs. This did not work out, resulting in Edward having poor steaming issues. He was swapped with Emily, working lighter and fewer jobs.

NWR 3 Emily (formerly GNR 1009 and W&SR 6)

Class: Great Northern Railway (GNR) Class H1 Stirling Tank; North Western Railway (NWR) Class S-S1 Stirling Tank

Basis (Inspiration): GNR Stirling Single A3, GNR G1, and B&ER 4-2-4 tank engines

Previous Owners: Great Northern Railway; Wellsworth and Suddery Railway

Built: 1882

Real-life Withdrawal: n/a

Designer: Patrick Stirling

Builder: Doncaster Works

Bio:

Emily is an experimental tank engine version of the GNR A1, A2, and A3 Stirling Singles, with a wheel config of 4-2-4T. While she did perform decently, she did not perform as they expected so she was withdrawn. The Wellsworth and Suddery Railway took interest in Emily. They purchased her from the GNR before she could be sold to a scrapyard. She worked welled on the W&SR, able to be passed down to the NWR in 1915, along with Edward. She ended up replacing Edward on the express passenger service when the latter's rebuilds proved to worsen his performance.

NWR 4 Henry

Class: North Eastern Railway (NER) Class F; North Western Railway (NWR) Class S-S5 (4-6-4T) Black Five Tank

Basis (Inspiration): NER Class D (pre-1935); LNER Class A2 (pre-1935); LMS Class 5MT Black Fives (post-1935); LMS 4MT 2-6-4T (two-cylinder) (post-1935)

Previous Owners: Unknown

Built: 1920

Real-life Withdrawal: n/a

Designer: Vincent Raven; Henry Stanier

Builder: Unknown

Bio:

Henry was built from stolen duplicates of Vincent Raven's plans of a 4-6-2T, which were derived from the NER Class D (4-4-4T). Unfortunately, these duplicate plans were the discarded designs due to uneven weights on the chassis and the use of a Schmidt boiler. He was under-powered and a hazard to operate. Sir Louis Topham Hatt I was swindled to buy Henry in 1922 when promised that Henry would be the next best thing for railways. This was when the NWR believed that they wouldn't need tender engines to run the railway. After the Flying Kipper crash, Henry was rebuilt into a new class of his own, the LMS Class 5MT Black Five Tank.

NWR 5 Gordon

Class: Great Northern Railway (GNR) Class B1; North Western Railway (NWR) Class S-G1

Basis (Inspiration): GNR Gresley Class A1, GNR Gresley Class A3, and GNR Gresley Class N2

Previous Owners: Great Northern Railway

Built: 1920 - 1923

Real-life Withdrawal: n/a

Designer: Nigel Gresley

Builder: Doncaster Works

Bio:

Gordon is an experimental tank version of the GNR Gresley A1s, in hopes of surpassing the capabilities of the Gresley N2s. This did not work out but served as a basis for the LNER V1s. He was sold off to the NWR, replacing Emily on heavy passenger duty, which was the express service for the NWR.

NWR 6 James (formerly L&YR 506, LMS 11546)

Class: Lancashire and Yorkshire Railway (L&YR) Class 24; NWR Class S-A25

Previous Owners: L&YR, LNWR, LMS

Built: 1919

Real-life Withdrawal: 1959 (BR number would've been 51546)

Designer: John Audley Frederick Aspinall

Builder: Horwich Works

Bio:

James was bought as he was originally built in 1925. However, Sir Bertram Topham Hatt II ordered for James to be rebuilt into a 2-6-2T. This took well over a few months until they finally came up with a decent design. Unfortunately, James' great performance came at the cost of James' loosing his memories.

#ttte thomas#ttte edward#ttte emily#ttte henry#ttte gordon#ttte james#muxse meeps#''what if'' AUs are so fun#ttte#ttte au#cerenemuxse#ttte alt basis au

11 notes

·

View notes

Text

Kraftwerk - Trans Europe Espress. Año 1977. Edición Chilena. Electrónica. EMI Odeon Chilena S.A.

Es el sexto álbum del grupo, publicado en 1977. Se grabó a mediados de 1976 en el estudio discográfico Kling Klang. Al igual que los álbumes anteriores y los que le sucedieron, Trans Europa Express es un álbum conceptual, en este caso, basado en el sistema ferroviario europeo, del que toma el título.

Se extrajeron dos sencillos: «Trans-Europe Express» y «Showroom Dummies».

Músicos Ralf Hütter - voz y sintetizador. Florian Schneider - voz y sintetizador. Karl Bartos - percusión electrónica. Wolfgang Flür - percusión electrónica.

Producción Florian Schneider - productor. Ralf Hütter - productor. Peter Bollig - ingeniero. Bill Halverson - ingeniero. Thomas Kuckuck - ingeniero.

Tracklist: A1 Europa Interminable 9:40 A2 El Salon De Los Espejos 7:56 A3 Maniquies 6:15

B1 Expreso Trans-Europeo 6:52 B2 Metal Sobre Metal / Asburg 6:52 B3 Franz Schubert 4:26 B4 Interminable, Interminable 0:55

#musiccollection#coleccióndemúsica#vinilos#viniloschile#viniloslp#sharemusic#compartirmúsica#lp#vinylrecords#electrónica#kraftwerk

4 notes

·

View notes

Text

Attempt at a headm8 count!!!!

Last updated 5/20/25

- Fefeta

·No subsys(?) - Nepeta/NK/Dokuro, "Princess", Flawless, Sarah Lynn, Emberlynn, Devi M, Rei, Lain/Nevada Tan, Birdie/Jack/Rorochan, Christine Chan, Alfred Alfer

·Eddsworld subsystem - Edd, Tord, Tom, Matt

·Adventure Time subsystem - Simon, Betty, Fionna

·Inside Job subsystem - Reagan, Brett

·Alpha trolls/Beforus (A1) subsystem - Damara, Rufioh, Mituna, Kankri, Meulin, Porrim, Latula, Aranea, Horuss, Kurloz, Cronus, Meenah

·Beta trolls/Alternia (A2) subsystem - Aradia/Andrew B, Tavros/Shinji, Sollux, Karkat, Kanaya, Terezi, Vriska/Asuka, Equius, Gamzee, Eridan, Feferi/Mabel/Poppy

·Beta kids (B1) subsystem - June (+John), Jade, Josh, Rose, Jasprose, Dave, Crow, Nanna

·Alpha kids (B2) subsystem - Jane, Jake, Roxy, Rox, Dirk, Hal

·Spritebloods + Swapkids subsystem - Davepeta, Fefeta, Erisol, Arquius, Joey, Jude

·Cherub subsystem - Calliope, Alt Callie, Caliborn, Alt Cal

·South Park/HP/SPurb subsystem - Kenny, Karen, Butters/Marji, Leslie/Trixie/Miku/Monika/ENA, Kyle, Stan, Eric/Gumball/Jax, Tweek/Pomni, Craig, Clyde, Token, Jimmy/Derpy/Spongebob, Wendyl/Twilight/Misato/Ragatha/YanChan, Bebe, Nichole, Heidi/Minty, Red, Yentl, Thomas/Gangle/Jon, Christophe/Paul, Gregory/Patryck, Estella, Pip, Damien, Pocket, Rebecca, Mark, Gary, Tammy/Ramona/Laurel, Charlotte, Terrance, Dogpoo, Scott, Kevin S, Mike/Streber, Henrietta, Pete, Micheal, Firkle, Tricia, Ike, Kevin M, Shelly, Randy, Towelie, Satan

1 note

·

View note

Note

No idea if you're still doing asks for your kins but)

Edd)

a1. If applicable, did you have any kind of relationships with Tord, Thomas, & Matt?

a2. What kinds of things did you like to do back home?

a3. Anyone else outside of the three mentioned you were close to?

a4. Did you have anyone you considered family?

a5. What is your species?

a6. What was different back home from here?

Tubbo)

a1. What hobbies did you do, and with whom?

a2. What is your species?

a3. Any allergies?

a4. What was different back home from here?

a4. Any technology back home that isn't here?

a5. Who did you spend time with a lot?

a6. Any different languages back home from here that you heard of or know?

Sure :3

Edd kin:

I was literally inseparable from them. We were fused together...

Draw when given the chance, hum a little.

Not really. I don't remember many of the rejects, though I remember that there was another Tomattoredd.

No, I don't.

Uh, human? Fusion? Well I mean, not a fusion anymore.

Well, for one, my friends were there. And I didn't really get to see outside. So that's a key difference.

Tubbo asks!

I liked to sit on the bench and listen to music with Tommy! And occasionally doodle.

Goat-ram thing :3

Nope :D

It was more magical, I guess? We had potions and knowledge of what happened after death. Also hybrids.

Potion making, uh the Revivebook

Tommy! He was my go-to man, tho I wish I spent more time with Boo.

Enderman, to help communicate with Ranboo! :3

#ask#kin ask#kinshift#nonhuman#hybrid#edd kin#edd eddsworld kin#tomattoredd fictkin#tomattoredd kin#eddsworld#eddsworld kin#dsmp kin#dream smp kin#tubbo kin#tubbo_ kin

2 notes

·

View notes

Text

Lords Vote

On: National Insurance Contributions (Secondary Class 1 Contributions) Bill

Baroness Kramer moved amendment 3, in clause 1, page 1, line 1, at end to insert— “(A1) In section 9(1A) of the Social Security Contributions and Benefits Act 1992, after paragraph (aa) insert— “(ab) if the employer is a specified employer under subsection (1B), the specified employer secondary percentage;”. (A2) After section 9(1A) of that Act insert— “(1B) A “specified employer” means— (a) a provider of education or childcare to children under five years of age— (i) registered in England in the early years register maintained by the Office for Standards in Education, Children’s Services and Skills, (ii) registered in Wales with Care Inspectorate Wales, or (iii) registered in Scotland with the Scottish Care Inspectorate; (b) a university; (c) a provider of further or higher education; (d) a registered charity; (e) a housing association; (f) a small or micro business, as defined by section 33 of the Small Business, Enterprise and Employment Act 2015; (g) a town council; (h) a parish council; (i) a business in the hospitality sector. (1C) For the purposes of this Act, the specified employer secondary percentage is 13.8%.”” The House divided:

Ayes: 77 (70.1% LD, 11.7% XB, 7.8% DUP, 3.9% Con, 2.6% Green, 1.3% , 1.3% Bshp, 1.3% PC) Noes: 153 (94.8% Lab, 4.6% XB, 0.7% ) Absent: ~630

Likely Referenced Bill: National Insurance Contributions (Secondary Class 1 Contributions) Bill

Description: A Bill to make provision about secondary Class 1 contributions.

Originating house: Commons Current house: Lords Bill Stage: 3rd reading

Individual Votes:

Ayes

Liberal Democrat (54 votes)

Addington, L. Alderdice, L. Bakewell of Hardington Mandeville, B. Beith, L. Bowles of Berkhamsted, B. Brinton, B. Bruce of Bennachie, L. Clement-Jones, L. Dholakia, L. Doocey, B. Featherstone, B. Foster of Bath, L. Fox, L. Garden of Frognal, B. German, L. Goddard of Stockport, L. Grender, B. Hamwee, B. Harris of Richmond, B. Humphreys, B. Hussein-Ece, B. Janke, B. Kramer, B. Ludford, B. Newby, L. Oates, L. Pack, L. Parminter, B. Pidgeon, B. Pinnock, B. Purvis of Tweed, L. Redesdale, L. Roberts of Llandudno, L. Russell, E. Scott of Needham Market, B. Sharkey, L. Sheehan, B. Shipley, L. Smith of Newnham, B. Stephen, L. Stoneham of Droxford, L. Storey, L. Strasburger, L. Suttie, B. Taylor of Goss Moor, L. Thomas of Winchester, B. Thornhill, B. Thurso, V. Tope, L. Tyler of Enfield, B. Wallace of Saltaire, L. Wallace of Tankerness, L. Walmsley, B. Willis of Knaresborough, L.

Crossbench (9 votes)

Alton of Liverpool, L. Boycott, B. Erroll, E. Finlay of Llandaff, B. Kilclooney, L. Londesborough, L. Mountevans, L. O'Loan, B. Pannick, L.

Democratic Unionist Party (6 votes)

Browne of Belmont, L. Dodds of Duncairn, L. Hay of Ballyore, L. McCrea of Magherafelt and Cookstown, L. Morrow, L. Weir of Ballyholme, L.

Conservative (3 votes)

Blackwell, L. Fraser of Craigmaddie, B. Moynihan, L.

Green Party (2 votes)

Bennett of Manor Castle, B. Jones of Moulsecoomb, B.

Non-affiliated (1 vote)

Altmann, B.

Bishops (1 vote)

Chelmsford, Bp.

Plaid Cymru (1 vote)

Smith of Llanfaes, B.

Noes

Labour (145 votes)

Adams of Craigielea, B. Alexander of Cleveden, B. Allen of Kensington, L. Alli, L. Anderson of Stoke-on-Trent, B. Anderson of Swansea, L. Andrews, B. Armstrong of Hill Top, B. Ashton of Upholland, B. Bach, L. Barber of Ainsdale, L. Bassam of Brighton, L. Beamish, L. Berkeley, L. Blackstone, B. Blake of Leeds, B. Blower, B. Blunkett, L. Boateng, L. Bousted, B. Bradley, L. Brennan of Canton, L. Brown of Silvertown, B. Browne of Ladyton, L. Bryan of Partick, B. Caine of Kentish Town, B. Campbell-Savours, L. Carberry of Muswell Hill, B. Carter of Coles, L. Chakrabarti, B. Chandos, V. Chapman of Darlington, B. Clark of Windermere, L. Coaker, L. Collins of Highbury, L. Cryer, L. Curran, B. Davidson of Glen Clova, L. Davies of Brixton, L. Donaghy, B. Drake, B. Dubs, L. Eatwell, L. Elliott of Whitburn Bay, B. Evans of Sealand, L. Faulkner of Worcester, L. Foulkes of Cumnock, L. Gale, B. Glasman, L. Golding, B. Goudie, B. Gray of Tottenham, B. Griffin of Princethorpe, B. Grocott, L. Hannett of Everton, L. Hanson of Flint, L. Hanworth, V. Harman, B. Harris of Haringey, L. Hayman of Ullock, B. Hayter of Kentish Town, B. Hazarika, B. Healy of Primrose Hill, B. Hendy of Richmond Hill, L. Hendy, L. Hermer, L. Hollick, L. Howarth of Newport, L. Hughes of Stretford, B. Hunt of Kings Heath, L. Jones of Penybont, L. Jones of Whitchurch, B. Jones, L. Katz, L. Keeley, B. Kennedy of Cradley, B. Kennedy of Southwark, L. Kennedy of The Shaws, B. Kingsmill, B. Kinnock, L. Knight of Weymouth, L. Lawrence of Clarendon, B. Layard, L. Lemos, L. Leong, L. Levitt, B. Levy, L. Liddell of Coatdyke, B. Liddle, L. Lister of Burtersett, B. Livermore, L. Mann, L. McConnell of Glenscorrodale, L. McIntosh of Hudnall, B. McNicol of West Kilbride, L. Mendelsohn, L. Merron, B. Monks, L. Moraes, L. Morgan of Drefelin, B. Morgan of Huyton, B. Nichols of Selby, B. Nye, B. O'Grady of Upper Holloway, B. Parekh, L. Pitkeathley of Camden Town, L. Pitkeathley, B. Ponsonby of Shulbrede, L. Prosser, B. Ramsey of Wall Heath, B. Raval, L. Rebuck, B. Rees of Easton, L. Reid of Cardowan, L. Ritchie of Downpatrick, B. Robertson of Port Ellen, L. Rook, L. Rooker, L. Rowlands, L. Royall of Blaisdon, B. Sherlock, B. Sikka, L. Smith of Basildon, B. Smith of Cluny, B. Smith of Malvern, B. Snape, L. Spellar, L. Stansgate, V. Stevenson of Balmacara, L. Taylor of Bolton, B. Taylor of Stevenage, B. Timpson, L. Tunnicliffe, L. Twycross, B. Vallance of Balham, L. Warwick of Undercliffe, B. Watson of Invergowrie, L. Watts, L. Wheeler, B. Whitaker, B. Whitty, L. Wilcox of Newport, B. Wilson of Sedgefield, L. Winterton of Doncaster, B. Young of Old Scone, B.

Crossbench (7 votes)

Butler of Brockwell, L. Chartres, L. Falkner of Margravine, B. Green of Hurstpierpoint, L. Hannay of Chiswick, L. Hogan-Howe, L. Kerr of Kinlochard, L.

Non-affiliated (1 vote)

Austin of Dudley, L.

0 notes

Text

Real Estate Credit Investments: Resilience of the NAV (LON:RECI)

Real Estate Credit Investments Ltd (LON:RECI) is the topic of conversation when Hardman and Co’s Analyst Mark Thomas caught up with DirectorsTalk for an exclusive interview.

Q1: Your recent report on Real Estate Credit Investments sits behind a disclaimer, what can you tell us about that?

A1: It is just the standard disclaimer that many investment companies have. In essence, for regulatory reasons, there are some countries (like the US) where the report should not be read. It is not a simple asset class, and the report should only be looked at by professional/qualified investors.

Q2: Your recent report was called ‘Portfolio management to optimise risk/reward’, what can you tell us about it?

A2: In previous notes, we have reviewed why we believe the fund has procedures and practices in place that limit downside losses to help ensure the resilience of the NAV.

In this note, we explore further how portfolio management helps optimise risk/reward with a dynamic approach to bond portfolio allocation, leverage, top 10 concentrations, geographical sectors, and duration.

Their portfolio is not a static, long-duration, totally illiquid book. The key message that we believe investors should take away is that they are an actively managed portfolio where Cheyne’s footprint and average loan life of just 1.5 years allows them to rapidly take advantage of opportunities as they arise.

It is a balanced management with, for example, the overall level, and mix, of leverage reflecting Cheyne’s view of the risk/reward at any time.

In terms of what this brings to investors, we highlight that Company’s NAV performance was recognised in the recent Citywire award.

Q3: So, tell us a bit more about what has changed in the asset mix of portfolio?

A3: Since 2016, the book has been migrating towards an all-senior loan book. The move to senior debt has involved not only a shift from mezzanine and other loans but also, in 2023, a re-allocation away from bonds.

The chart in our report shows how this has progressed through the year with the gross value of bonds just over a tenth of that at the start of the year. The advantages of being senior debt include being repaid earlier in the event of customer difficulties, and retaining absolute governance, covenants and control from its bilateral singular lending relationships. The Cheyne-controlled weighted average LTV on total portfolio by commitment value is around 60%. These three factors mean that the loss in the event of default is reduced.

Our note also examines how Cheyne has changed the sector, geographical, and duration mix, as well as how the top exposures have changed over time.

Q4: And leverage in portfolio has changed too, what has happened there?

A4: The fund has used different types of leverage for different assets, with the market bond portfolio significantly funded by REPOS and the use of asset-specific finance with some loans.

There has been a sharp reduction in overall leverage throughout 2023, from 36.2% NAV in January to 20.9% in October. They have chosen to reduce leverage during more uncertain times, bearing in mind the pressure from the rise in cost of funds (balance sheet leverage average cost up 2.7% on January 2023). Lower leverage in uncertain times is not a one-off and has been seen before (end-2018 balance sheet leverage 38.1% NAV reduced to 21.6% end-2020).

Secondly, the mix has changed with the increasing prevalence of asset-specific finance, which, typically, is longer term but whose cost has increased less than short-term REPOS.

Q5: What was the award it recently won?

A5: Real Estate Credit Investments won the best performance award for Specialist Debt at Citywire’s London-listed Investment Companies awards in November 2023. The award is given to the investment companies judged to have delivered the best underlying return, in terms of growth in NAV, in the three years to 31 August 2023.

Q6: And the risks?

A6: The risks of a recession are clear to see, with higher interest rates, lower disposable income, falling property prices (both residential and commercial, compounded by distressed sellers of assets), rising social tensions, governments facing large fiscal deficits and central banks’ inflationary pressures.

0 notes

Text

Real Estate Credit Investments: Resilience of the NAV (LON:RECI)

Real Estate Credit Investments Ltd (LON:RECI) is the topic of conversation when Hardman and Co’s Analyst Mark Thomas caught up with DirectorsTalk for an exclusive interview.

Q1: Your recent report on Real Estate Credit Investments sits behind a disclaimer, what can you tell us about that?

A1: It is just the standard disclaimer that many investment companies have. In essence, for regulatory reasons, there are some countries (like the US) where the report should not be read. It is not a simple asset class, and the report should only be looked at by professional/qualified investors.

Q2: Your recent report was called ‘Portfolio management to optimise risk/reward’, what can you tell us about it?

A2: In previous notes, we have reviewed why we believe the fund has procedures and practices in place that limit downside losses to help ensure the resilience of the NAV.

In this note, we explore further how portfolio management helps optimise risk/reward with a dynamic approach to bond portfolio allocation, leverage, top 10 concentrations, geographical sectors, and duration.

Their portfolio is not a static, long-duration, totally illiquid book. The key message that we believe investors should take away is that they are an actively managed portfolio where Cheyne’s footprint and average loan life of just 1.5 years allows them to rapidly take advantage of opportunities as they arise.

It is a balanced management with, for example, the overall level, and mix, of leverage reflecting Cheyne’s view of the risk/reward at any time.

In terms of what this brings to investors, we highlight that Company’s NAV performance was recognised in the recent Citywire award.

Q3: So, tell us a bit more about what has changed in the asset mix of portfolio?

A3: Since 2016, the book has been migrating towards an all-senior loan book. The move to senior debt has involved not only a shift from mezzanine and other loans but also, in 2023, a re-allocation away from bonds.

The chart in our report shows how this has progressed through the year with the gross value of bonds just over a tenth of that at the start of the year. The advantages of being senior debt include being repaid earlier in the event of customer difficulties, and retaining absolute governance, covenants and control from its bilateral singular lending relationships. The Cheyne-controlled weighted average LTV on total portfolio by commitment value is around 60%. These three factors mean that the loss in the event of default is reduced.

Our note also examines how Cheyne has changed the sector, geographical, and duration mix, as well as how the top exposures have changed over time.

Q4: And leverage in portfolio has changed too, what has happened there?

A4: The fund has used different types of leverage for different assets, with the market bond portfolio significantly funded by REPOS and the use of asset-specific finance with some loans.

There has been a sharp reduction in overall leverage throughout 2023, from 36.2% NAV in January to 20.9% in October. They have chosen to reduce leverage during more uncertain times, bearing in mind the pressure from the rise in cost of funds (balance sheet leverage average cost up 2.7% on January 2023). Lower leverage in uncertain times is not a one-off and has been seen before (end-2018 balance sheet leverage 38.1% NAV reduced to 21.6% end-2020).

Secondly, the mix has changed with the increasing prevalence of asset-specific finance, which, typically, is longer term but whose cost has increased less than short-term REPOS.

Q5: What was the award it recently won?

A5: Real Estate Credit Investments won the best performance award for Specialist Debt at Citywire’s London-listed Investment Companies awards in November 2023. The award is given to the investment companies judged to have delivered the best underlying return, in terms of growth in NAV, in the three years to 31 August 2023.

Q6: And the risks?

A6: The risks of a recession are clear to see, with higher interest rates, lower disposable income, falling property prices (both residential and commercial, compounded by distressed sellers of assets), rising social tensions, governments facing large fiscal deficits and central banks’ inflationary pressures.

0 notes

Text

Fra Fra “Funeral Songs” 2020 Ghana World Music

full spotify

Living in the north of Ghana, Fra Fra people have their very own traditions and customs, among them funeral music. This album was recorded live on the streets of Tamale by acclaimed producer Ian Brennan, and it’s part of Glitterbeat label’s fascinating series called Hidden Musics. Contrary to what some might expect, “Funeral Songs” won’t leave you depressed or even ruminative. It’s actually full of life and celebration, and you can imagine a funeral procession with such orchestra is not so far from a dancing party. (Thomas M.).......~ Fra Fra's "Funeral Songs" was recorded 100% live and outdoors without overdubs by Grammy- winning music producer and author, Ian Brennan (Tinariwen, Ustad Saami, The Good Ones [Rwanda], Zomba Prison Project) in northern Ghana. Far from deathly dirges, far fra's songs are largely celebrations. Their process of mourning bares more than a passing resemblance to a New Orleans second line marching band. It is challenging to disregard this as mere coincidence given the sad history of the transatlantic slave trade exploiting their very region in the north. The trio's 72-year-old leader “Small” plays a homemade, 2-string guitar with dog-tags for rattles and bears a raspy tenor of epic virtuosity. ...~ Music accompanies us in the development of our lives, traditional songbooks have a repertoire that is performed either to celebrate a birth, the games of young and old, to accompany work tasks, celebration of parties in the community and rites such as weddings, baptisms or funerals, each with its particularities and forms of expression. American music producer Ian Brenan (Tinariwen, Ustad Saami,...) says that "music is in all of us. Rhythm must run through our veins to lead life." In this case Brenan went to northern Ghana, to record the music played at funerals, and there what he found referred him to the processions that take place in New Orleans (many of the slaves predicted from West Africa). The Fra Fra trio is led by Small, yes, a man of very small stature who chose the kolongo guitar-lute, or what is the same as a semi-sphere-shaped box covered with a skin, with only two strings along a neck (a cylindrical rod) that ends in two plates as rattles; In addition, at funeral events they play tiny bone flutes that they call horn because that is the material with which they build them. The recording shows the rawness of the interpretations, without extra production and far from the commercial world of world music; it corresponds to a sound recording during a ceremony in which he had to use several microphones around the event to capture as faithfully as possible the performances, which extend far beyond the standard times of a conventional recording, and which on the album he has synthesized in pieces ranging from 21 seconds ("Goodbye"), to more than 12 minutes ("Helpless. Death has taken everyone"). Sixth release in Gliterbeat's acclaimed Hidden Musics series....~ Tracklist A1 Destiny (Orphans) A2 You Can't Escape Death A3 Naked (You Enter & Leave This World With Nothing) B1 Helpless (Death Has Taken Everyone) B2 Goodbye B3 I Will Follow You For Life, Everywhere B4 We Must Grieve Together Fra Fra “Funeral Songs” 2020 Ghana World Music

https://johnkatsmc5.blogspot.com/2025/06/fra-fra-funeral-songs-2020-ghana-world.html?view=magazine

https://johnkatsmc5.tumblr.com/post/785688686724579328/fra-fra-funeral-songs-2020-ghana-world-music

0 notes

Text

Real Estate Credit Investments: Resilience of the NAV (LON:RECI)

Real Estate Credit Investments Ltd (LON:RECI) is the topic of conversation when Hardman and Co’s Analyst Mark Thomas caught up with DirectorsTalk for an exclusive interview.

Q1: Your recent report on Real Estate Credit Investments sits behind a disclaimer, what can you tell us about that?

A1: It is just the standard disclaimer that many investment companies have. In essence, for regulatory reasons, there are some countries (like the US) where the report should not be read. It is not a simple asset class, and the report should only be looked at by professional/qualified investors.

Q2: Your recent report was called ‘Portfolio management to optimise risk/reward’, what can you tell us about it?

A2: In previous notes, we have reviewed why we believe the fund has procedures and practices in place that limit downside losses to help ensure the resilience of the NAV.

In this note, we explore further how portfolio management helps optimise risk/reward with a dynamic approach to bond portfolio allocation, leverage, top 10 concentrations, geographical sectors, and duration.

Their portfolio is not a static, long-duration, totally illiquid book. The key message that we believe investors should take away is that they are an actively managed portfolio where Cheyne’s footprint and average loan life of just 1.5 years allows them to rapidly take advantage of opportunities as they arise.

It is a balanced management with, for example, the overall level, and mix, of leverage reflecting Cheyne’s view of the risk/reward at any time.

In terms of what this brings to investors, we highlight that Company’s NAV performance was recognised in the recent Citywire award.

Q3: So, tell us a bit more about what has changed in the asset mix of portfolio?

A3: Since 2016, the book has been migrating towards an all-senior loan book. The move to senior debt has involved not only a shift from mezzanine and other loans but also, in 2023, a re-allocation away from bonds.

The chart in our report shows how this has progressed through the year with the gross value of bonds just over a tenth of that at the start of the year. The advantages of being senior debt include being repaid earlier in the event of customer difficulties, and retaining absolute governance, covenants and control from its bilateral singular lending relationships. The Cheyne-controlled weighted average LTV on total portfolio by commitment value is around 60%. These three factors mean that the loss in the event of default is reduced.

Our note also examines how Cheyne has changed the sector, geographical, and duration mix, as well as how the top exposures have changed over time.

Q4: And leverage in portfolio has changed too, what has happened there?

A4: The fund has used different types of leverage for different assets, with the market bond portfolio significantly funded by REPOS and the use of asset-specific finance with some loans.

There has been a sharp reduction in overall leverage throughout 2023, from 36.2% NAV in January to 20.9% in October. They have chosen to reduce leverage during more uncertain times, bearing in mind the pressure from the rise in cost of funds (balance sheet leverage average cost up 2.7% on January 2023). Lower leverage in uncertain times is not a one-off and has been seen before (end-2018 balance sheet leverage 38.1% NAV reduced to 21.6% end-2020).

Secondly, the mix has changed with the increasing prevalence of asset-specific finance, which, typically, is longer term but whose cost has increased less than short-term REPOS.

Q5: What was the award it recently won?

A5: Real Estate Credit Investments won the best performance award for Specialist Debt at Citywire’s London-listed Investment Companies awards in November 2023. The award is given to the investment companies judged to have delivered the best underlying return, in terms of growth in NAV, in the three years to 31 August 2023.

Q6: And the risks?

A6: The risks of a recession are clear to see, with higher interest rates, lower disposable income, falling property prices (both residential and commercial, compounded by distressed sellers of assets), rising social tensions, governments facing large fiscal deficits and central banks’ inflationary pressures.

0 notes

Text

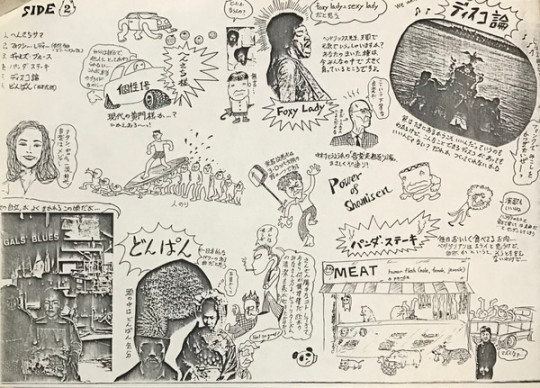

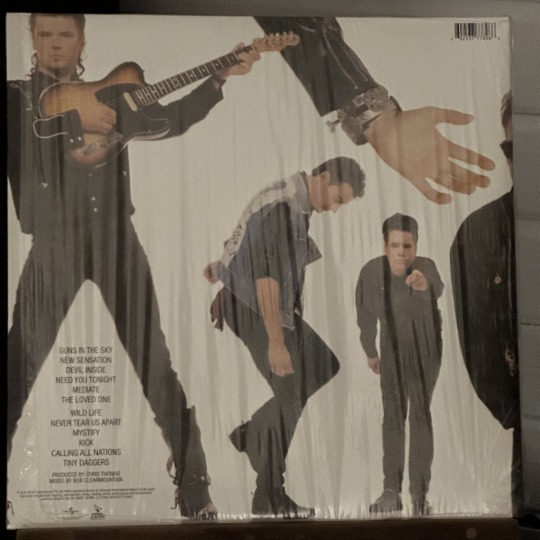

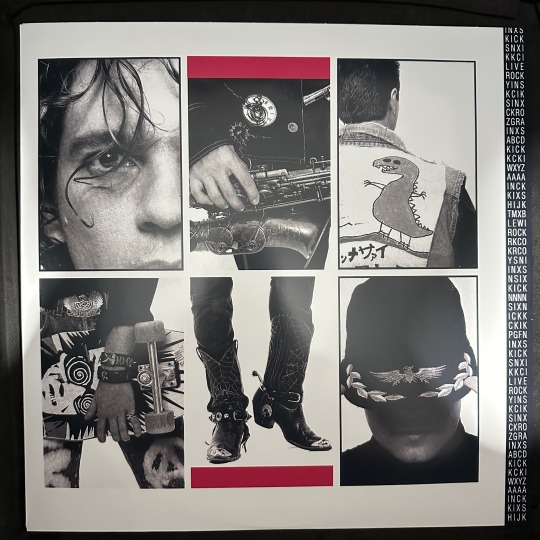

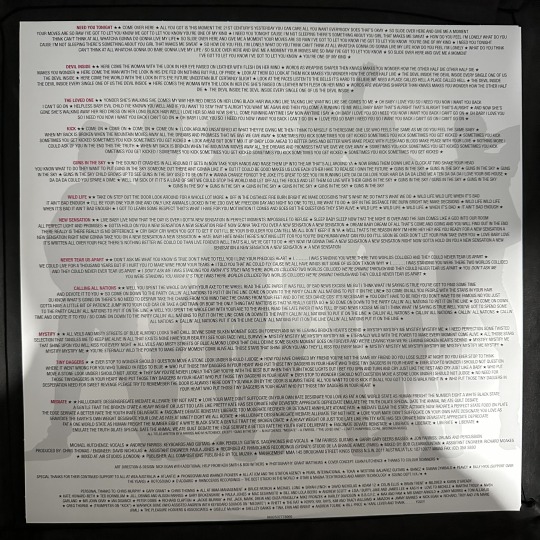

INXS - Kick. Año 1987. Edición Europea. Reedición Año 2014. Rock. Petroelectric Pty Ltd.

Es el nombre del sexto álbum de estudio de la banda. Fue lanzado al mercado por las compañías discográficas WEA, Atlantic Records en los Estados Unidos y Phonogram Records en el Reino Unido.

Los sencillos del disco fueron: "Need You Tonight", "Devil Inside", "New Sensation", "Never Tear Us Apart" y "Mystify".

Músicos Michael Hutchence - voz. Kirk Pengilly - guitarra, saxofón y coros. Andrew Farriss - teclados y guitarra. Tim Farriss - guitarra. Jon Farriss - batería, percusión y coros. Garry Gary Beers - bajo y coros.

Producción Chris Thomas - productor.

Tracklist: A1 Guns In the Sky 2:21 A2 New Sensation 3:39 A3 Devil Inside 5:14 A4 Need You Tonight 3:02 A5 Mediate 2:32 A6 The Loved One 3:37

B1 Wild Life 3:10 B2 Never Tear Us Apart 3:05 B3 Mystify 3:17 B4 Kick 3:14 B5 Calling All Nations 3:03 B6 Tiny Daggers 3:38

#musiccollection#coleccióndemúsica#vinilos#viniloschile#viniloslp#sharemusic#compartirmúsica#lp#vinylrecords#rock#inxs

1 note

·

View note

Text

Real Estate Credit Investments: Resilience of the NAV (LON:RECI)

Real Estate Credit Investments Ltd (LON:RECI) is the topic of conversation when Hardman and Co’s Analyst Mark Thomas caught up with DirectorsTalk for an exclusive interview.

Q1: Your recent report on Real Estate Credit Investments sits behind a disclaimer, what can you tell us about that?

A1: It is just the standard disclaimer that many investment companies have. In essence, for regulatory reasons, there are some countries (like the US) where the report should not be read. It is not a simple asset class, and the report should only be looked at by professional/qualified investors.

Q2: Your recent report was called ‘Portfolio management to optimise risk/reward’, what can you tell us about it?

A2: In previous notes, we have reviewed why we believe the fund has procedures and practices in place that limit downside losses to help ensure the resilience of the NAV.

In this note, we explore further how portfolio management helps optimise risk/reward with a dynamic approach to bond portfolio allocation, leverage, top 10 concentrations, geographical sectors, and duration.

Their portfolio is not a static, long-duration, totally illiquid book. The key message that we believe investors should take away is that they are an actively managed portfolio where Cheyne’s footprint and average loan life of just 1.5 years allows them to rapidly take advantage of opportunities as they arise.

It is a balanced management with, for example, the overall level, and mix, of leverage reflecting Cheyne’s view of the risk/reward at any time.

In terms of what this brings to investors, we highlight that Company’s NAV performance was recognised in the recent Citywire award.

Q3: So, tell us a bit more about what has changed in the asset mix of portfolio?

A3: Since 2016, the book has been migrating towards an all-senior loan book. The move to senior debt has involved not only a shift from mezzanine and other loans but also, in 2023, a re-allocation away from bonds.

The chart in our report shows how this has progressed through the year with the gross value of bonds just over a tenth of that at the start of the year. The advantages of being senior debt include being repaid earlier in the event of customer difficulties, and retaining absolute governance, covenants and control from its bilateral singular lending relationships. The Cheyne-controlled weighted average LTV on total portfolio by commitment value is around 60%. These three factors mean that the loss in the event of default is reduced.

Our note also examines how Cheyne has changed the sector, geographical, and duration mix, as well as how the top exposures have changed over time.

Q4: And leverage in portfolio has changed too, what has happened there?

A4: The fund has used different types of leverage for different assets, with the market bond portfolio significantly funded by REPOS and the use of asset-specific finance with some loans.

There has been a sharp reduction in overall leverage throughout 2023, from 36.2% NAV in January to 20.9% in October. They have chosen to reduce leverage during more uncertain times, bearing in mind the pressure from the rise in cost of funds (balance sheet leverage average cost up 2.7% on January 2023). Lower leverage in uncertain times is not a one-off and has been seen before (end-2018 balance sheet leverage 38.1% NAV reduced to 21.6% end-2020).

Secondly, the mix has changed with the increasing prevalence of asset-specific finance, which, typically, is longer term but whose cost has increased less than short-term REPOS.

Q5: What was the award it recently won?

A5: Real Estate Credit Investments won the best performance award for Specialist Debt at Citywire’s London-listed Investment Companies awards in November 2023. The award is given to the investment companies judged to have delivered the best underlying return, in terms of growth in NAV, in the three years to 31 August 2023.

Q6: And the risks?

A6: The risks of a recession are clear to see, with higher interest rates, lower disposable income, falling property prices (both residential and commercial, compounded by distressed sellers of assets), rising social tensions, governments facing large fiscal deficits and central banks’ inflationary pressures.

0 notes

Text

Lords Vote

On: National Insurance Contributions (Secondary Class 1 Contributions) Bill

Baroness Kramer moved amendment 2, in clause 1, page 1, line 1, at end insert— “(A1) The Social Security Contributions and Benefits Act 1992 is amended as follows. (A2) In section 9(1A) after paragraph (aa) insert— “(ab) if section 9AA applies to the earnings, the part-time worker secondary percentage;”. (A3) After section 9A insert— “9AA Part-time worker secondary percentage (1) Where a secondary Class 1 contribution is payable as mentioned in section 6(1)(b), this section applies to the earnings paid in the tax week, in respect of the employment in question, where the earner is a part-time worker. (2) For the purposes of section 9(1A)(ab), the part-time worker secondary percentage is 7.5%. (3) For the purposes of this section, a “part-time worker” has the meaning given in Regulation 2 of the Part-time Workers (Prevention of Less Favourable Treatment) Regulations 2000.” (A4) The Social Security Contributions and Benefits (Northern Ireland) Act 1992 is amended as follows (A5) In section 9(1A) after paragraph (aa) insert— “(ab) if section 9AA applies to the earnings, the part-time worker secondary percentage;” (A6) After section 9A insert— “9AA Part-time worker secondary percentage (1) Where a secondary Class 1 contribution is payable as mentioned in section 6(1)(b), this section applies to the earnings paid in the tax week, in respect of the employment in question, where the earner is a part-time worker. (2) For the purposes of section 9(1A)(ab) above, the part-time worker secondary percentage is 7.5%. (3) For the purposes of this section, a “part-time worker” has the meaning given in Regulation 2 of the Part-time Workers (Prevention of Less Favourable Treatment) (Northern Ireland) Regulations 2000.”” The House divided:

Ayes: 97 (62.9% LD, 17.5% XB, 6.2% , 6.2% Con, 5.2% DUP, 2.1% Green) Noes: 169 (90.5% Lab, 7.7% XB, 1.2% , 0.6% DUP) Absent: ~594

Likely Referenced Bill: National Insurance Contributions (Secondary Class 1 Contributions) Bill

Description: A Bill to make provision about secondary Class 1 contributions.

Originating house: Commons Current house: Lords Bill Stage: 3rd reading

Individual Votes:

Ayes

Liberal Democrat (61 votes)

Addington, L. Alderdice, L. Bakewell of Hardington Mandeville, B. Beith, L. Bonham-Carter of Yarnbury, B. Bowles of Berkhamsted, B. Bradshaw, L. Bruce of Bennachie, L. Campbell of Pittenweem, L. Clement-Jones, L. Dholakia, L. Doocey, B. Featherstone, B. Foster of Bath, L. Fox, L. Garden of Frognal, B. German, L. Goddard of Stockport, L. Grender, B. Hamwee, B. Harris of Richmond, B. Humphreys, B. Hussain, L. Hussein-Ece, B. Janke, B. Kramer, B. Ludford, B. Newby, L. Oates, L. Pack, L. Parminter, B. Pidgeon, B. Pinnock, B. Purvis of Tweed, L. Razzall, L. Redesdale, L. Roberts of Llandudno, L. Russell, E. Scott of Needham Market, B. Sharkey, L. Sheehan, B. Shipley, L. Smith of Newnham, B. Stephen, L. Stoneham of Droxford, L. Storey, L. Strasburger, L. Suttie, B. Taylor of Goss Moor, L. Teverson, L. Thomas of Gresford, L. Thomas of Winchester, B. Thornhill, B. Thurso, V. Tope, L. Tyler of Enfield, B. Wallace of Saltaire, L. Wallace of Tankerness, L. Walmsley, B. Willis of Knaresborough, L. Wrigglesworth, L.

Crossbench (17 votes)

Alton of Liverpool, L. Berkeley of Knighton, L. Boycott, B. Butler-Sloss, B. Chartres, L. Clancarty, E. Erroll, E. Finlay of Llandaff, B. Freyberg, L. Hope of Craighead, L. Kilclooney, L. Londesborough, L. Lytton, E. Mountevans, L. O'Loan, B. O'Neill of Bengarve, B. Pannick, L.

Non-affiliated (6 votes)

Altmann, B. Foster of Aghadrumsee, B. Fox of Buckley, B. Hoey, B. Taylor of Warwick, L. Tyrie, L.

Conservative (6 votes)

Bethell, L. Caithness, E. Chadlington, L. Griffiths of Fforestfach, L. Strathclyde, L. Trenchard, V.

Democratic Unionist Party (5 votes)

Browne of Belmont, L. Dodds of Duncairn, L. Hay of Ballyore, L. McCrea of Magherafelt and Cookstown, L. Morrow, L.

Green Party (2 votes)

Bennett of Manor Castle, B. Jones of Moulsecoomb, B.

Noes

Labour (153 votes)

Adams of Craigielea, B. Alexander of Cleveden, B. Allen of Kensington, L. Alli, L. Anderson of Stoke-on-Trent, B. Anderson of Swansea, L. Andrews, B. Armstrong of Hill Top, B. Ashton of Upholland, B. Bach, L. Barber of Ainsdale, L. Bassam of Brighton, L. Beamish, L. Berkeley, L. Blackstone, B. Blake of Leeds, B. Blower, B. Blunkett, L. Boateng, L. Bousted, B. Bradley, L. Brennan of Canton, L. Brooke of Alverthorpe, L. Brown of Silvertown, B. Browne of Ladyton, L. Bryan of Partick, B. Caine of Kentish Town, B. Campbell-Savours, L. Carberry of Muswell Hill, B. Carter of Coles, L. Chakrabarti, B. Chandos, V. Chapman of Darlington, B. Clark of Windermere, L. Coaker, L. Collins of Highbury, L. Cryer, L. Curran, B. Davidson of Glen Clova, L. Davies of Brixton, L. Donaghy, B. Drake, B. Dubs, L. Eatwell, L. Elliott of Whitburn Bay, B. Evans of Sealand, L. Faulkner of Worcester, L. Foulkes of Cumnock, L. Gale, B. Glasman, L. Golding, B. Goudie, B. Grantchester, L. Gray of Tottenham, B. Griffin of Princethorpe, B. Grocott, L. Hacking, L. Hain, L. Hannett of Everton, L. Hanson of Flint, L. Hanworth, V. Harman, B. Harris of Haringey, L. Hayman of Ullock, B. Hayter of Kentish Town, B. Hazarika, B. Healy of Primrose Hill, B. Hendy of Richmond Hill, L. Hendy, L. Hermer, L. Hollick, L. Howarth of Newport, L. Hughes of Stretford, B. Hunt of Kings Heath, L. Hutton of Furness, L. Jones of Penybont, L. Jones of Whitchurch, B. Jones, L. Jordan, L. Katz, L. Keeley, B. Kennedy of Cradley, B. Kennedy of Southwark, L. Kennedy of The Shaws, B. Kingsmill, B. Kinnock, L. Knight of Weymouth, L. Lawrence of Clarendon, B. Layard, L. Lemos, L. Leong, L. Levitt, B. Levy, L. Liddell of Coatdyke, B. Liddle, L. Lister of Burtersett, B. Livermore, L. Mann, L. McConnell of Glenscorrodale, L. McIntosh of Hudnall, B. McNicol of West Kilbride, L. Mendelsohn, L. Merron, B. Mitchell, L. Monks, L. Moraes, L. Morgan of Drefelin, B. Morgan of Huyton, B. Nichols of Selby, B. Nye, B. O'Grady of Upper Holloway, B. Parekh, L. Pitkeathley of Camden Town, L. Pitkeathley, B. Ponsonby of Shulbrede, L. Prosser, B. Ramsey of Wall Heath, B. Raval, L. Rebuck, B. Rees of Easton, L. Reid of Cardowan, L. Ritchie of Downpatrick, B. Rook, L. Rooker, L. Rowlands, L. Royall of Blaisdon, B. Sherlock, B. Sikka, L. Smith of Basildon, B. Smith of Cluny, B. Smith of Malvern, B. Snape, L. Spellar, L. Stansgate, V. Stevenson of Balmacara, L. Taylor of Bolton, B. Taylor of Stevenage, B. Timpson, L. Tunnicliffe, L. Twycross, B. Vallance of Balham, L. Warwick of Undercliffe, B. Watson of Invergowrie, L. Watts, L. Wheeler, B. Whitaker, B. Whitty, L. Wilcox of Newport, B. Wilson of Sedgefield, L. Winston, L. Winterton of Doncaster, B. Wood of Anfield, L. Young of Old Scone, B.

Crossbench (13 votes)

Burns, L. Butler of Brockwell, L. Carlile of Berriew, L. Colville of Culross, V. Craig of Radley, L. Green of Hurstpierpoint, L. Hannay of Chiswick, L. Hogan-Howe, L. Kerr of Kinlochard, L. Loomba, L. Meacher, B. Shafik, B. Watkins of Tavistock, B.

Non-affiliated (2 votes)

Austin of Dudley, L. Truscott, L.

Democratic Unionist Party (1 vote)

Weir of Ballyholme, L.

0 notes