#urban redevelopment estimating

Explore tagged Tumblr posts

Text

The Role of a Construction Estimating Service in Urban Redevelopment and Adaptive Reuse

Introduction: Breathing New Life into Old Structures

Urban redevelopment and adaptive reuse projects are reshaping city landscapes by revitalizing aging infrastructure and underused buildings. These projects are often more complex than new construction due to the need to evaluate existing conditions, comply with evolving regulations, and preserve historical features. A construction estimating service plays a critical role in providing cost clarity, identifying potential risks, and ensuring project feasibility from the outset.

Unique Cost Challenges of Urban Redevelopment

Unlike greenfield projects, urban redevelopment involves variables that are often hidden until construction begins. These may include outdated building systems, structural deficiencies, hazardous materials, or non-compliant layouts. A construction estimating service must thoroughly assess these unknowns during the preconstruction phase, allocating contingencies and documenting assumptions based on site investigations and historical data.

Detailed Scope Analysis and Phasing

Urban redevelopment often requires phased construction to manage occupancy, utility disruptions, or zoning limitations. For adaptive reuse, construction may need to occur while parts of the building remain operational. A construction estimating service helps plan each phase with precision, ensuring that logistics, sequencing, and access constraints are reflected in labor costs, equipment rentals, and schedule impacts.

Dealing with Historical Preservation Requirements

When adaptive reuse involves heritage buildings, compliance with historical preservation standards can increase costs significantly. Specialized materials, traditional construction techniques, and additional permits may be required. Estimators must understand these requirements and consult with preservation experts to ensure budgets are both realistic and sensitive to the historical integrity of the project.

Estimating for Environmental Remediation

Urban sites often have legacy environmental issues such as asbestos, lead paint, or contaminated soil. A construction estimating service collaborates with environmental consultants to price remediation efforts. These costs can be substantial, especially in older industrial or commercial buildings being converted into modern residential or mixed-use developments.

Integration of Modern Systems into Old Structures

Adaptive reuse demands retrofitting new mechanical, electrical, plumbing (MEP), and fire protection systems into outdated frameworks. This often requires custom solutions, selective demolition, or rerouting infrastructure. Estimators must account for higher labor costs and the challenges of fitting standardized systems into non-standard conditions, which can impact timelines and budgets.

Navigating Incentives and Funding Requirements

Urban redevelopment projects are frequently supported by government incentives such as tax credits, grants, or low-interest financing. Many of these incentives have cost-reporting or compliance requirements. A construction estimating service helps developers meet these criteria by providing detailed cost breakdowns and documentation that align with funding rules, particularly in affordable housing or sustainability-focused projects.

Supporting Sustainability and Resilience Goals

Many adaptive reuse projects aim for sustainability certifications like LEED or WELL. A construction estimating service assesses the cost impact of energy-efficient upgrades, low-emission materials, and improved building envelopes. In urban redevelopment, resilience against floods, heat, or seismic risks may also factor into estimates, especially in cities with updated codes to address climate change.

Managing Stakeholder Expectations

Redevelopment projects often face heightened scrutiny from communities, planners, and investors. A construction estimating service brings transparency to the cost implications of design decisions and regulatory mandates. Clear, itemized estimates support stakeholder buy-in, enabling informed decision-making throughout the project's lifecycle.

Technology and Site Intelligence Tools

To improve accuracy, estimators use tools like laser scanning, point cloud data, and Building Information Modeling (BIM) to analyze existing conditions. These technologies help convert outdated or incomplete building documentation into reliable inputs for cost modeling, reducing the risk of major surprises during construction.

Conclusion: Turning Complexity into Opportunity

Urban redevelopment and adaptive reuse projects offer environmental, cultural, and economic benefits—but only if budgets are accurately planned. A construction estimating service serves as a strategic advisor, helping project teams navigate the complexity of existing structures, permitting hurdles, and historical constraints. With detailed cost insights and contingency planning, estimators transform redevelopment challenges into viable, forward-looking projects that reinvigorate cities and preserve architectural legacy.

#urban redevelopment estimating#adaptive reuse cost#estimating old buildings#redevelopment construction service#cost estimate historic building#building retrofit cost#asbestos removal cost#phased construction estimate#urban zoning cost#legacy building systems#code upgrade estimate#adaptive reuse estimator#BIM for reuse projects#historical preservation cost#affordable housing cost estimate#grant compliance estimate#contaminated site cost#seismic upgrade estimating#LEED retrofit estimate#utility rerouting cost#estimating with unknowns#stakeholder budget planning#community housing estimate#fire system retrofit cost#sustainability upgrade cost#resilience planning estimate#estimating with point cloud#downtown redevelopment cost#mixed-use conversion budget#city infill estimator

0 notes

Text

On October 1st 1763 the contract to build Edinburgh’s North Bridge was signed.

Edinburgh in the 1700′s was a very different city to the one we know today. The city boundary was restricted to the dramatic crag and tail feature which swept eastwards from the castle. Up to 35,000 people inhabited a space under a mile long making Scotland’s capital one of the most densely populated urban areas in the world at that time. The overcrowded population were crammed into crumbling tenements, many of them up to fourteen storeys high in order to make the most of the limited space. Make no mistake, Edinburgh at this point in it’s history, was a skyscraper city, very few cities in the world had buildings the height of our capital!

Edinburgh’s nobility were often forced to accept the unthinkable and share dwellings with the lower classes. Change was not just desired, it was deemed an absolute necessity if the city was ever to move forward.

Plans to build a New Town to the north were discussed as early as the 1750s but without the means of connecting it with the rest of Edinburgh, it would be nothing more than a fanciful dream. Phase one required the draining of the ancient Nor��� Loch, a man-made stagnant body of water located in the area which we now term as Princes Street Gardens. Drainage began in 1759 and would continue up until the 1820s. Dry land at the east of the Nor’ Loch valley allowed for what was undoubtedly the most ambitious engineering project to have been built in the city at that point: An eleven-hundred foot long stone bridge. The North Bridge, as it would be named, enabled the New Town to become a reality. A brand new chapter in the city’s history was about to begin.

The foundation stone of architect William Mylne’s North Bridge was laid in October 1763 but it would be a further two years before any serious amount of progress was made. The magnificent multi-arched bridge first opened to pedestrians in 1769 to much fanfare and excitement. However, the cheers quickly died down in August of that year when a partial collapse claimed the lives of five people. Haste in construction and a poorly calculated estimate regarding the depth of the foundations were said to have been the primary cause. Rebuilding work demanded £18,000 (almost double the original cost of the project) and the city would have to wait until 1772 before the grand reopening.

The North Bridge consisted of three main arches and several smaller arches, many of them concealed, on either side. After the bridge’s final completion, building work on the first residences of the New Town would commence within five years. Edinburgh would go on to expand like never before as the world’s largest Georgian townscape began to take shape.

The much-anticipated bridge was only to last a little over a century. Redevelopment and expansion of Waverley train station was being held back by the narrow space available between the piers of the North Bridge. It was becoming obvious that a new link was needed. Construction of the current steel bridge that we know today was completed in 1897 at a cost of £81,000. The North British Railway Company contributed to a third of the cost.

There are now several bridges in the city but it is the North Bridge which is most visible. Today the bridge continues to play a vital role in dictating the ebb and flow of the city, much as it has done for the past 240 years and at the moment work is continuing on a major restoration after defects were discovered in 2014, the work which was to cost an estimated £22 million, since then there have been several delays and the estimated cost, as of May this year is £86m The council say "multiple structural and safety defects" were identified."

The latest is work is now expected to be completed in 2025 - five years behind schedule.

8 notes

·

View notes

Text

Boston $2.5B Waterfront Project Approved, Investors Surge

Seaport Development Drives Land Values From $39.5m to $2.5b Since 2006Since 2006, Boston's Seaport district has experienced a remarkable escalation in land value. Property values have surged from $39.5 million to over $2.5 billion.This astounding appreciation represents a 6,229% increase over 17 years. The transformation has attracted significant investment from institutional players and development firms.The district's last large block, spanning 12.5 acres, sold for $359 million. This reflects the premium investors now place on Seaport real estate.Property transactions frequently exceed $1,000 per square foot. A notable sale includes 101 Seaport Blvd, which fetched $1,027 per square foot.WS Development has been a key catalyst in this value surge. Strategic acquisitions since 2006 helped transform the area from an industrial wasteland to premium real estate. Major corporations like Vertex Pharmaceuticals have anchored the district's growth with billion-dollar lease commitments.Today, the Seaport district boasts roughly $3 billion in estimated commercial property values. It stands as Boston's most valuable waterfront asset.Major Redevelopment Projects Attract High-Return Investment OpportunitiesAcross Boston's rapidly evolving terrain, major redevelopment projects are emerging as magnets for institutional capital. Investors are seeking double-digit returns in an increasingly competitive environment.Financial analysts report significant property value increases in large-scale urban innovation initiatives. These increases range from 50% to 75% in previously underdeveloped districts.Such appreciation rates are reshaping investment strategies across metropolitan markets. The employment multiplication effect further demonstrates compelling economic fundamentals.Major projects consistently create substantial job opportunities. They also mobilize private capital at ratios reaching $1:$7 for every public dollar invested. Recent suburban developments, much like Mission Gateway, highlight suburban renaissance in response to lifestyle-driven demands.Investment firms are using scenario analysis and predictive modeling. This helps to quantify returns in mixed-use developments combining residential, commercial, and recreational spaces. Economic assessment tools enable impact measurement before project implementation, allowing investors to better evaluate potential returns.These extensive projects are delivering mid-teen percentage returns over extended periods. Public-private partnerships are accelerating project timelines while distributing risk among stakeholders.Smart city technologies incorporating IoT and data analytics are enhancing property valuations. They also improve operational efficiency across redevelopment zones.AssessmentThe $2.5 billion waterfront approval marks a pivotal change in Boston's investment landscape. Land values have skyrocketed over 6,000% since 2006.Institutional capital is pouring into the Seaport district as development momentum reaches critical mass.The dramatic rise from a $39.5 million baseline positions Boston among the most volatile real estate markets in the nation.Industry analysts expect more price volatility as construction phases begin. Investor competition is intensifying across the remaining developable parcels.

0 notes

Text

Asbestos Testing Market to Grow at Pace Owing to Stricter Regulatory Compliance

The Global Asbestos Testing Market is estimated to be valued at US$ 242.3 Mn in 2025 and is expected to exhibit a CAGR of 5.2% over the forecast period 2025 to 2032.

Asbestos testing involves the systematic analysis of building materials, soil, air, and water samples to detect and quantify asbestos fibers, protecting public health and the environment. Products in this market range from sample collection kits and laboratory reagents to portable fiber analyzers and advanced microscopy systems. These solutions offer high sensitivity, accuracy, and rapid turnaround times, enabling stakeholders to identify potential risks in older structures, industrial sites, and renovation projects. Asbestos Testing Market Insights include compliance with stringent workplace safety regulations, reduction in liability, and actionable market insights for project planning. As global construction and renovation activities accelerate, especially in urban redevelopment and infrastructure upgrades, the need for reliable asbestos testing grows in parallel. Continuous monitoring and periodic assessments help facility managers and environmental consultants mitigate health hazards, optimize maintenance budgets, and align with evolving regulatory drivers. Furthermore, the integration of digital data reporting platforms enhances transparency across supply chains and supports data-driven decision-making.

Get more insights on,Asbestos Testing Market

#Coherent Market Insights#Asbestos Testing#Asbestos Testing Market#Asbestos Testing Market Insights#Bulk Material Testing#Air Quality Testing

0 notes

Text

1 BHK Flat Property in Kurla West – Premium Homes 2025.

In 2025, Kurla West stands out as one of Mumbai’s most promising localities for homebuyers seeking premium yet affordable 1 BHK flats. Strategically located with strong infrastructure, robust connectivity, and fast-paced development, Kurla West has attracted attention from reputed developers like Sayba Group who are offering modern, well-planned 1 BHK homes that cater to comfort, lifestyle, and smart investment.

Why Kurla West Is the Ideal Location for 1 BHK Flats

Kurla West offers a perfect blend of connectivity, lifestyle, and affordability. Located in the heart of Mumbai, Kurla West connects major business hubs like Bandra-Kurla Complex (BKC), Andheri, and Chembur. With increasing infrastructure upgrades such as the Mumbai Metro, Eastern Express Highway, and the Santacruz-Chembur Link Road, daily commute is easy and efficient.

Key advantages:

Close proximity to business zones like BKC and Lower Parel

Excellent road and rail connectivity

Presence of reputed schools, hospitals, and malls

Increasing infrastructure and redevelopment projects

Premium Features in Sayba Group’s 1 BHK Flats

Sayba Group, known for quality real estate in Mumbai, delivers thoughtfully designed 1 BHK flats that blend modern design with comfort. These flats are ideal for nuclear families, working professionals, or first-time buyers looking for stylish yet functional living spaces.

Top features include:

Vitrified flooring and branded bathroom fittings

Modular kitchen spaces

Balcony views with ventilation and natural light

Smart security systems

Ample parking and common recreation zones

These premium offerings ensure a comfortable lifestyle while retaining affordability.

Price Trends and Affordability in 2025

As per 2025 estimates, 1 BHK flats in Kurla West range between ₹75 lakhs to ₹1.1 crore depending on the exact location, amenities, and developer reputation. Sayba Group stands out by offering competitive pricing without compromising quality.

Current price range:

Mid-range 1 BHK: ₹75–90 lakhs

Premium segment: ₹95 lakhs–₹1.1 crore

This makes 1 BHK flats in Kurla West not only affordable but also a smart long-term investment.

Top Locations in Kurla West to Consider

When buying a 1 BHK flat, location matters. Within Kurla West, several micro-localities are rapidly developing and attracting buyer attention.

Top picks include:

Nehru Nagar: Affordable pricing, easy access to amenities

LBS Marg: Commercially vibrant and well-connected

New Mill Road: Popular for residential development

BKC Connector Zones: Ideal for professionals

Sayba Group projects are strategically positioned in these high-demand areas to offer you both convenience and growth.

Amenities That Redefine Urban Living

Modern buyers seek more than just a flat — they want lifestyle. Sayba Group’s premium 1 BHK properties come with an array of in-house amenities.

Lifestyle amenities include:

Gymnasium and fitness centers

Landscaped gardens and walking tracks

Children’s play zones

Rooftop seating and recreational lounges

High-speed elevators and 24x7 power backup

These features ensure holistic living, especially for young families and working individuals.

Strong Investment Potential in Kurla West

Investing in a 1 BHK in Kurla West in 2025 is not just a homebuying decision — it’s a financially sound investment. With consistent infrastructure upgrades and rising demand, capital appreciation is inevitable.

Investment benefits:

High rental demand due to proximity to BKC and Andheri

Appreciation potential with new metro lines and flyovers

Reputed developers ensuring quality builds and timely delivery

Whether you plan to live in it or rent it out, a 1 BHK flat in Kurla West offers solid ROI.

Sayba Group – A Trusted Name in Kurla Real Estate

When it comes to buying property, the builder’s credibility is crucial. Sayba Group has earned its reputation through transparency, timely project delivery, and premium construction quality. Their focus on customer satisfaction, superior design, and strategic location selection makes them a preferred choice among Kurla West buyers.

Why choose Sayba Group:

Over 10+ years of real estate experience

Focus on Kurla East & West redevelopment projects

Transparent pricing and RERA-registered properties

Customer-first service and after-sales support

Home Loan and Financing Tips for 1 BHK Buyers

Purchasing a home requires sound financial planning. For many first-time buyers, home loans make the dream a reality. Here's what to keep in mind in 2025:

Financing tips:

Compare home loan interest rates from top banks (range: 8%–9%)

Maintain a healthy credit score (750+ preferred)

Arrange for a down payment (typically 15%–20%)

Choose a builder approved by major banks (like Sayba Group)

You can also benefit from Pradhan Mantri Awas Yojana (PMAY) subsidies if eligible.

Conclusion: Secure Your Future with a 1 BHK in Kurla West

Kurla West in 2025 is no longer just a transit locality — it’s a premium residential zone poised for long-term growth. With excellent connectivity, quality construction, and high demand, buying a 1 BHK flat here offers both comfort and capital growth. Sayba Group’s projects are ideal for those who want a perfect blend of affordability, lifestyle, and investment value.

Whether you're a first-time buyer, working professional, or investor, Kurla West promises the right opportunity.

Contact Us: Explore Sayba Group’s 1 BHK flats in Kurla West and book your site visit today.

0 notes

Text

The Roofing Materials Market: A Multi-Billion Dollar Industry Overhead

Roofing Materials Industry Overview

The global Roofing Materials Market reached an estimated valuation of USD 129.62 billion in 2023 and is projected to expand at a CAGR of 3.9% from 2024 to 2030. This growth is anticipated due to increasing investments in the renovation and redevelopment of both commercial and residential structures. However, it's important to note that the global construction sector experienced hindered growth following the economic recession triggered by the COVID-19 crisis. This led to diminished investor confidence and a reduction in construction activities, causing a significant setback for the market in 2020.

Recent governmental initiatives worldwide aimed at promoting green building development have also encouraged consumers to undertake roof replacements. Furthermore, the demand for installing solar panels on roofs surged in 2020 and is expected to maintain its upward trajectory throughout the forecast period.

Detailed Segmentation:

Product Insights

The asphalt shingles segment is projected to register a CAGR of 3.9% in terms of volume over the forecast period. Low capital costs and an easy installation process are anticipated to drive the demand for asphalt shingles as roofing materials over the forecast period.

The metal roof segment is anticipated to grow at the fastest CAGR in terms of revenue from 2024 to 2030. Metal roofs are versatile and can be converted into any desired shape such as shingles or slates to fit the surface structures of different types of buildings. Moreover, the low lifecycle costs, less weight, and fire resistance of metal roofs are expected to drive their global demand over the forecast period.

Application Insights

The residential application segment led the market and accounted for 56.2% of the global revenue share in 2023. Factors such as the increasing global population and rising preference of consumers for single-family housing structures are anticipated to fuel the growth of residential segment of roofing materials market during the forecast period.

Regional Insights

The roofing materials market in China is expected to grow at a CAGR of 4.4% in terms of revenue from 2024 to 2030. Rapid urbanization in China is one of the primary factors fueling the growth of the construction industry in the country. In addition, various demographic factors such as the continuously increasing elderly population and the improvement in the standards of living of the masses owing to urbanization are expected to drive the growth of the roofing material industry in China.

Gather more insights about the market drivers, restraints, and growth of the Roofing Materials Market

Key Companies & Market Share Insights

The following are the leading companies in the roofing materials market. These companies collectively hold the largest market share and dictate industry trends.

GAF, Inc

Owens Corning

CertainTeed, LLC

Johns Manville.

Wienerberger AG

Crown Building Products LLC

Atlas Roofing Corporation

CSR Limited

Carlisle Companies Inc.

TAMKO Building Products LLC.

Order a free sample PDF of the Market Intelligence Study, published by Grand View Research.

Recent Development

In February 2023, Air TAMKO Building Products LLC. announced the product launch of innovative shingles called New Titan XT. The product has a layer of curated asphalt coating and aggressive modified sealants. The product was aimed to offer contractors and property owners a Class 3 Impact Rating and UL 2218-certified product.

In November 2023, CertainTeed, LLC announced the opening of a roofing material manufacturing and distribution center in Texas, U.S. This strategic investment reaffirms its position in the roofing market and allows the company to efficiently serve its customers in the southern part of the U.S.

0 notes

Text

ASEAN Heavy Construction Equipment Market Trends, Size, Segment and Growth by Forecast to 2030

The Heavy Construction Equipment Market size is expected to reach US$ 13.36 million by 2031 from US$ 8.10 million in 2024. The market is estimated to record a CAGR of 7.4% from 2024 to 2031.

Executive Summary and ASEAN Heavy Construction Equipment Market Analysis:

The construction industry in the ASEAN region is booming with rapid urbanization, growing populations, and substantial investments in infrastructure, housing, and industrial projects. With economic growth on the rise, governments, private investors, and multinational companies are driving large-scale projects across the 10 ASEAN countries: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam. The construction sector in ASEAN is witnessing robust growth driven by large-scale infrastructure projects, urbanization, and government initiatives in Indonesia, Vietnam, Thailand, the Philippines, etc. As the region invests heavily in infrastructure, transportation, and real estate development, the demand for heavy construction equipment such as excavators, cranes, bulldozers, wheel loaders, and dump trucks will continue to rise in the coming years. Download Full PDF Sample Copy of Market Report @- https://www.businessmarketinsights.com/sample/BMIRE00031237

ASEAN Heavy Construction Equipment Market Segmentation Analysis

The ASEAN heavy construction equipment market is analyzed based on key segments: machinery type, propulsion type, power output, and end-use industry.

By Machinery Type: The market is categorized into earthmoving equipment, material handling equipment, heavy construction vehicles, and others. Among these, the earthmoving equipment segment accounted for the largest market share in 2024.

By Propulsion Type: Segmentation by propulsion includes internal combustion engine (ICE) and electric. The ICE segment dominated the market in 2024, holding the largest share.

By Power Output: The market is divided into four categories: less than 100 HP, 101–200 HP, 201–400 HP, and above 401 HP. The 201–400 HP segment emerged as the market leader in 2024.

By End-Use Industry: The market is segmented into building and construction, forestry and agriculture, energy and power, mining, and others. The building and construction segment held the largest share of the market in 2024.

ASEAN Heavy Construction Equipment Market Outlook

Infrastructure development across ASEAN countries is significantly driving the growth of the heavy construction equipment market. In Singapore, the ongoing expansion of Changi Airport—including the construction of Terminal 5—is set to increase the airport’s capacity to 135 million passengers annually, reinforcing its status as a major air hub in Asia. Additionally, Singapore’s redevelopment of the Jurong Lake District into a dynamic business, residential, and leisure zone—with a focus on green buildings, smart mobility, and sustainable infrastructure—is another major initiative fueling demand for heavy machinery.

In Cambodia, the Phnom Penh-Sihanoukville Expressway is under development to enhance connectivity between the capital and the country's main port. This vital infrastructure project is expected to bolster trade, tourism, and investment.

The Philippines is advancing its first-ever subway system in Metro Manila, aimed at easing severe traffic congestion and promoting sustainable urban mobility. This transformative project will significantly improve public transport accessibility in one of the world’s most densely populated urban areas.

Meanwhile, Vietnam is making substantial investments in aviation infrastructure, notably through the construction of Long Thanh International Airport in Dong Nai Province. Designed to be the country’s largest airport, it will have the capacity to serve 100 million passengers annually, strengthening Vietnam’s global connectivity.

Collectively, these ambitious infrastructure projects across ASEAN are creating robust demand for heavy construction equipment, underscoring the market's strong growth trajectory in the region.

ASEAN Heavy Construction Equipment Market – Country Insights

Within the ASEAN region, the heavy construction equipment market includes Indonesia, Singapore, Malaysia, Thailand, Vietnam, and the Philippines. In 2024, Indonesia held the largest market share.

This dominance is driven by a surge in infrastructure projects and strong government support. Notably, in September 2024, the Millennium Challenge Corporation (MCC) and the Indonesian government announced a US$649 million investment for infrastructure development through 2028. This grant aims to enhance infrastructure capacity and improve access to financing for small and medium enterprises, further boosting equipment demand.

Indonesia’s construction sector is vital to its economy, contributing significantly to employment and national growth. Recent years have seen consistent expansion, fueled by investments in roads, bridges, airports, and urban development, aligned with the National Medium-Term Development Plan (RPJMN). The government's focus on transportation, energy, and housing infrastructure, especially toll road construction, continues to drive growth in the heavy construction equipment market.

ASEAN Heavy Construction Equipment Market – Company Profiles Key companies driving the ASEAN heavy construction equipment market include Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery, among others. These industry leaders are actively pursuing strategies such as regional expansion, product innovation, and mergers & acquisitions. The goal is to deliver advanced solutions to customers and strengthen their competitive position in the market.

Research Methodology This report is based on a systematic approach to data collection and analysis, involving the following key steps:

1. Secondary Research The research process began with in-depth secondary research, gathering both qualitative and quantitative data from a variety of reliable sources. These included:

Official company websites, annual and financial reports, investor presentations, and broker analyses.

Industry trade publications and relevant academic journals.

Government publications, national and international statistical databases, and comprehensive market studies.

News articles, corporate press releases, and webcasts focused on key market participants.

Can you see this our reports - Eastern Europe Last Mile Delivery Market - https://postyourarticle.com/eastern-europe-last-mile-delivery-market-trends-size-segment-and-growth-by-forecast-to-2030-2/

Asia Pacific Heavy Construction Equipment Market - https://businessmarketins02.blogspot.com/2025/04/asia-pacific-heavy-construction.html

Europe 3D Display Market - https://www.openpr.com/news/3971823/europe-3d-display-market-trends-size-segment-and-growth

Middle East & Africa Web Content Management Market - https://sites.google.com/view/businessmarketinsights-84/home

Europe Mechanical Ventilation Systems Market - https://www.openpr.com/news/3971929/europe-mechanical-ventilation-systems-market-trends-sizeAbout Us: Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Défense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications Author's Bio Akshay Senior Market Research Expert at Business Market Insights

0 notes

Text

Navigating the Transformations: An In-Depth Analysis of France's Office Real Estate Market

The French office real estate market is experiencing a period of significant transformation, influenced by evolving work habits, economic fluctuations, and a growing emphasis on sustainability. As of 2025, stakeholders are closely monitoring these dynamics to adapt and strategize effectively in a landscape marked by both challenges and opportunities.

Market Overview

The France Office Real Estate Market size is estimated at USD 29.05 billion in 2025, and is expected to reach USD 35.62 billion by 2030, at a CAGR of 4.16% during the forecast period (2025-2030).

In recent years, the French office real estate sector has faced a series of shifts. Major urban centers, particularly Paris, have traditionally been hubs for office activities. However, changing economic conditions and the global shift towards hybrid work models have impacted the demand and utilization of office spaces.

Investment Trends

The investment landscape has mirrored these shifts. Commercial property transactions have experienced fluctuations, reflecting broader European trends where factors like rising debt costs and increased office vacancies have influenced investor confidence. While some neighboring countries show signs of recovery, France's real estate market has been more cautious, with investment volumes not yet reaching pre-pandemic levels. CoStar

Challenges in La Défense

A notable concern is the state of office spaces in La Défense, Paris's premier business district. A significant portion of the area's office stock has been identified as outdated, necessitating redevelopment to meet contemporary standards. Efforts are underway to retrofit these spaces to align with modern environmental standards or repurpose them for alternative uses such as hotels and student housing. However, regulatory constraints present challenges to mixed-use redevelopment initiatives.

Emerging Trends

Sustainability and Green Retrofits

Environmental considerations are at the forefront of redevelopment initiatives. There is a concerted effort to retrofit existing office spaces with energy-efficient systems and sustainable materials to meet modern environmental standards and appeal to eco-conscious tenants.

Flexible Workspaces

The shift towards hybrid work models has led to increased demand for flexible office spaces. Companies are seeking environments that can adapt to varying workforce sizes and promote collaboration, prompting developers to design versatile and modular office layouts.

Mixed-Use Developments

To address the issue of obsolescence, particularly in areas like La Défense, there is a push towards converting outdated office buildings into mixed-use developments. This approach aims to create vibrant urban spaces that combine residential, commercial, and recreational facilities.

Future Outlook

While the current market presents challenges, there are opportunities for growth and revitalization. The focus on sustainability, flexibility, and mixed-use developments is expected to drive the evolution of the office real estate sector in France. Stakeholders who proactively adapt to these trends and address regulatory hurdles are likely to navigate the market successfully in the coming years.

In conclusion, the French office real estate market is at a pivotal juncture. By embracing innovation and sustainability, and by responding to the changing needs of businesses and employees, the sector can transform challenges into opportunities, paving the way for a resilient and dynamic future.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence: https://www.mordorintelligence.com/industry-reports/france-office-real-estate-market

0 notes

Text

Downtown Fort Worth Library Transforming into Two-Tower Development

Downtown Fort Worth is initiating a major development project that promises to change the face of the city. In December 2022, city managers decided that the historic Central Library, known for its neoclassical facade with elegant columns, no longer suited the city's long-term needs. With several floors closed due to the pandemic, the city determined that the 234,000-square-foot space at 500 W. 3rd St. was larger than needed. It has housed the Central Library since 1978.

In tandem with this decision, the city engineered an $18-million property sale to the national investment firm Dart Interests, LLC, which forwarded plans to demolish the building and redevelop the area. The municipal contract gave staff one year to relocate library materials, with offerings such as public programming, school field trips, and passport services ongoing until May 2023.

At the same time, city staff committed to seeking a smaller, more needs-appropriate venue for continued library operations downtown. The size of the building would determine which services it could offer to the public. Excess items would be distributed to other library locations or donated to local charities. Excess artworks would be placed in various city buildings, including the planned new City Hall. The popular Bumpersaurus art sculpture was moved to the newly opened Vivian J. Lincoln Library.

In June 2023, Dart Interests released preliminary renderings of a pair of 20-story towers it proposed to take the library’s place. The price for this project was estimated at above $200 million, exceeding the benchmark city officials had hoped.

As detailed in the Fort Worth Report, Dart Interests maintains a portfolio of more than a billion dollars in invested real estate in locations such as Houston, New York, South Carolina, and Washington, DC. This project represents the company's first North Texas project.

One of the city's conditions was that substantial space be reserved at the development site for a library that would serve the community for several years. While it was ultimately unclear whether the space would be used for that purpose, Dart Interest was on board with the concept and has made that space available to the city.

Looking to the future, Dart Interests executives described the downtown as going through an extensive residential development phase that will transform the urban fabric. The two-block property will be a vital part, with options for workforce and urban living needs. Residential and retail space will likely comprise the first phase with office space to follow. Despite a present lull in office development, analysts predict future growth.

Fort Worth’s last downtown high-rise office development was Frost Tower, which opened in 2018. In mid-2023, class A office vacancies stood at 13 percent, with full-floor options extremely limited. This has made relocating to the area challenging for companies.

In August 2024, the Fort Worth City Council voted to purchase the $6-million historic building at 512 W. 4th Street for the downtown library. Built in the 1920s, the five-story brick building first served as the Fort Worth Elks Lodge fraternity headquarters. In 1955, it was acquired by the Young Women’s Christian Association of Fort Worth and Tarrant County. It is currently the Center for Transforming Lives, but this organization is developing a new local headquarters.

1 note

·

View note

Text

Exploring the Turkey Construction Industry: Opportunities, Challenges, and Growth Trends

The Turkey construction industry has long been a cornerstone of the nation’s economy, reflecting its importance in driving GDP, employment, and urban development. Positioned strategically between Europe and Asia, Turkey is an emerging market where construction activity is shaped by a mix of governmental initiatives, private investments, and international projects. Let’s delve into the dynamics of this vital sector.

Market Overview

The Turkey Construction Market is projected to grow from an estimated USD 53.31 billion in 2024 to USD 68.43 billion by 2029, with a compound annual growth rate (CAGR) of 5.12% during the forecast period (2024-2029).

Turkey’s construction sector has demonstrated resilience despite economic fluctuations, supported by government-led urban renewal projects, infrastructure development, and increasing demand for residential and commercial spaces. Rapid urbanization and a growing middle class have further fueled the sector's expansion.

In 2024, the market is expected to gain momentum as Turkey continues to invest in mega infrastructure projects, such as highways, airports, and renewable energy facilities. However, geopolitical and economic factors, including inflation and currency volatility, play a crucial role in shaping the industry's trajectory.

Key Growth Drivers

Urban Transformation Projects: Turkey’s urban renewal initiatives aim to modernize aging housing stock and ensure earthquake-resistant infrastructure. Cities like Istanbul and Izmir are undergoing large-scale redevelopment projects, providing significant opportunities for local and international contractors.

Mega Infrastructure Developments: The Turkish government is heavily investing in transportation and energy infrastructure. Flagship projects such as Istanbul Airport, the Kanal Istanbul waterway, and high-speed rail networks highlight the sector’s focus on enhancing connectivity and logistics.

Housing Demand: With Turkey's young population and urban migration trends, demand for affordable housing is surging. Coupled with government incentives for homeownership, this sector remains a critical growth area within the construction market.

Foreign Investment: Turkey's strategic location attracts international developers, particularly from Europe, the Middle East, and Asia. Real estate and construction projects are increasingly being financed through foreign direct investment, strengthening the sector’s global ties.

Challenges in the Market

Economic Volatility: Currency depreciation and high inflation rates have escalated the cost of raw materials, impacting project budgets and timelines.

Regulatory Hurdles: Complex permitting processes and bureaucratic inefficiencies can delay construction projects and deter foreign investors.

Sustainability Requirements: As global standards shift toward eco-friendly practices, Turkish developers must adapt to sustainable construction methods, which may require additional investments.

Emerging Trends

Smart and Sustainable Construction: Turkey is increasingly adopting green building practices and smart technologies to enhance efficiency and sustainability in construction projects. Solar panel installations, energy-efficient designs, and smart home technologies are gaining traction.

Public-Private Partnerships (PPPs): Collaboration between the government and private sector is fostering the execution of large-scale projects, particularly in transportation and healthcare infrastructure.

Digital Transformation: Construction firms in Turkey are integrating advanced tools like Building Information Modeling (BIM) and artificial intelligence to optimize project management and reduce costs.

Future Outlook

The Turkey construction industry is poised for moderate growth, driven by infrastructure investments, urban transformation, and housing demand. However, addressing economic challenges and ensuring regulatory transparency will be critical to unlocking its full potential.

For stakeholders, this sector offers a mix of opportunities and risks. Firms that can leverage innovation, sustainable practices, and international collaboration will find Turkey an attractive market for construction endeavors.

Whether you are an investor, developer, or policymaker, staying attuned to Turkey’s construction market trends can provide valuable insights to navigate this dynamic industry successfully.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence https://www.mordorintelligence.com/industry-reports/turkey-construction-market

#turkey construction market#turkey construction market size#turkey construction market share#turkey construction market trends#turkey construction market growth#turkey construction market analysis#turkey construction market report#turkey construction market forecast#turkey construction market overview#turkey construction market outlook

0 notes

Text

Why BuildingS Are Demolished And Why There Is Demand For Demolition Services

There are many reasons why buildings are being demolished in Perth. Buildings are demolished primarily due to safety concerns. Some of the reasons may be when they reach the end of their lifespan are structurally compromised, or no longer meet current building codes. In some places, it is necessary to follow the law and public safety issues. Some other reasons include significant damage from natural disasters, fires, or owner preference for a different use of the property. Demolition services ensure the safe removal of these structures, paving the way for new construction or redevelopment projects. Here are some of the main reasons why building demolition companies in Perth are needed.

Urban Redevelopment:

The cities are expanding due to modernization. Older buildings and neighborhoods may be redeveloped to accommodate more residential or commercial buildings. Building demolition is necessary to enhance urban infrastructure. Demolishing existing structures is conducted for new apartments, shopping centers, or public spaces. Urban revival projects rejuvenate cities, improve living standards, and stimulate economic growth.

Illegal Construction:

In some places, the development has been led by Illegal registration & construction. Buildings are frequently constructed without proper permits or in violation of building codes and regulations. Local governments often mandate the demolition of such structures. They did it to adhere to urban planning standards, protect public land, and prevent further unauthorized construction. Illegal buildings in cities weaken municipal governance and compromise safety standards. It will lead to a rise in social and environmental issues.

Environmental Concerns:

Structures erected in environmentally sensitive areas. Building in these locations can exacerbate environmental degradation. It destroys natural habitats and increases the risk of harm from natural disasters. The structures such as floodplains, coastal zones, or protected forests, may be ordered to be demolished. It is necessary to safeguard the environment. Demolishing buildings in these areas helps mitigate environmental risks, protect wildlife, and promote sustainable land use.

Public Safety:

structurally unsound buildings are hazardous. Non-compliance with safety regulations poses significant risks to occupants and the neighborhood. unsafe structures are subjected to incidents like building collapses, fires, and other accidents. Authorities may order the demolition of such buildings. They did it to ensure public safety, prevent accidents, and enforce building codes.

Road Widening and Infrastructure Projects:

Some properties obstruct infrastructure development projects, such as road widening, metro rail expansion, or airport construction. It often needs to be acquired and demolished. It may be removed to facilitate improved infrastructure and better connectivity.

Urban Planning Initiatives:

As part of broader urban planning initiatives aimed at optimizing land use. Urban development authorities establish zoning regulations, and land use plans, to manage urban growth and maximize resource utilization. demolition is employed in urban planning to create better living, and recreational environments for all residents.

Being one of the leading building demolition companies in Perth, Big Bad Wolf Demolition can help you get quotes for your demolition projects in Perth. If you submit your project to them, they’ll assess the thing with due care and give you the estimate in a fee hours. Dial +61 424 316 734 to speak with one of their customer service representatives today!

0 notes

Text

The Benefits of Sofa Reupholstery for Small Spaces

Lian Wei gazed around his modest HDB flat, his eyes lingering on the well-worn sofa that had been with him since his university days. The apartment, like many in Singapore, was cozy—a polite way of saying small. Every square foot mattered, and Lian Wei knew he needed to make the most of his space.

As he contemplated whether to replace his trusty sofa or find another solution, a chance encounter with his neighbor would open his eyes to the world of sofa reupholstery and its unique benefits for small living spaces in Singapore.

The Small Space Dilemma

Living in a compact apartment in Singapore's bustling cityscape, Lian Wei faced a common challenge: how to refresh his living space without sacrificing functionality or breaking the bank. According to a recent survey by the Urban Redevelopment Authority, the average size of new flats in Singapore has decreased by 5% over the past decade, making efficient use of space more crucial than ever.

Lian Wei's neighbor, Mrs. Tan, noticed him eyeing furniture catalogs in the lift one evening. "Thinking of getting a new sofa?" she asked. When Lian Wei nodded, Mrs. Tan smiled knowingly. "Have you considered sofa reupholstery instead? It worked wonders for my small living room."

Intrigued, Lian Wei decided to explore this option further, discovering a range of benefits particularly suited to small living spaces in Singapore.

1. Preserving Precious Space

One of the primary advantages of sofa reupholstery for small spaces is the ability to maintain the perfect fit. "My sofa was custom-made to fit the awkward corner of my living room," Mrs. Tan explained. "Reupholstering allowed me to keep that perfect fit while giving it a fresh look."

Indeed, the Singapore Furniture Industries Council reports that 40% of Singaporeans living in small apartments struggle to find ready-made furniture that fits their space efficiently. Sofa reupholstery eliminates this challenge by working with existing pieces that already suit the space.

2. Cost-Effective Transformation

As Lian Wei researched upholstery services in Singapore, he was pleasantly surprised by the cost-effectiveness of reupholstery compared to buying new, especially for small spaces.

"In a small apartment, every piece of furniture is focal," explained Mr. Lim, a veteran upholsterer Lian Wei consulted. "Reupholstery allows you to achieve a high-end, custom look without the premium price tag of new bespoke furniture."

A study by the Consumers Association of Singapore (CASE) found that sofa reupholstery typically costs 30-50% less than purchasing a new sofa of comparable quality, with even greater savings for custom or space-efficient designs.

3. Eco-Friendly Solution for Sustainable Living

Living in a small space often goes hand-in-hand with a desire for sustainable living. Lian Wei was pleased to learn that choosing sofa reupholstery aligned with his environmental values.

"By opting for reupholstery, you're extending the life of your furniture and reducing waste," Mrs. Tan pointed out. This aspect resonated strongly with Lian Wei, who was aware of Singapore's push towards becoming a Zero Waste Nation.

The National Environment Agency estimates that furniture reupholstery can reduce household waste by up to 30 kg per item, contributing significantly to Singapore's sustainability goals.

4. Tailored Functionality for Small Spaces

As Lian Wei delved deeper into the world of sofa reupholstery, he discovered that many upholstery services in Singapore offer more than just fabric replacement.

"We can modify the sofa to better suit your needs," Mr. Lim explained. "For small spaces, we often adjust the cushion density for better support, or even add hidden storage compartments."

This level of customization is particularly valuable in small Singaporean homes, where multi-functionality is key. A survey by the Housing Development Board found that 65% of residents in smaller flats prioritize furniture with dual purposes.

5. Preserving Emotional Attachment

There was another aspect of sofa reupholstery that Lian Wei hadn't considered until Mrs. Tan mentioned it. "That sofa has been with you since university, hasn't it?" she asked. "Reupholstery lets you keep the memories while updating the look."

In small spaces, where every item holds significance, this emotional aspect of furniture can be particularly important. A study by the Singapore Psychology Association found that maintaining familiar items in living spaces can reduce stress and increase feelings of comfort, especially in compact environments.

6. Quick Turnaround for Minimal Disruption

Living in a small space means that any disruption can have a big impact. Lian Wei was relieved to learn that sofa reupholstery often has a quicker turnaround time compared to ordering new furniture.

"Most upholstery services in Singapore can complete the job within a week," Mr. Lim assured him. "For small space dwellers, this means minimal disruption to your daily life."

Lian Wei's Reupholstery Journey

Convinced by the benefits, Lian Wei decided to take the plunge into sofa reupholstery. He chose a local upholstery service with good reviews and a portfolio showcasing work in small spaces.

The process was smoother than he expected:

In-home consultation: The upholsterer visited Lian Wei's flat to assess the sofa and discuss options suited to his small living room.

Fabric selection: Lian Wei chose a durable, stain-resistant fabric in a light color to help make his space feel larger.

Customization: They decided to adjust the sofa arms to be slightly narrower, freeing up precious inches in the small room.

Reupholstery: The sofa was taken to the workshop and returned within a week, looking brand new.

The result transformed Lian Wei's living room. The reupholstered sofa not only looked fresh and modern but also seemed to fit the space better than ever.

Conclusion: Small Space, Big Impact

Lian Wei's journey into sofa reupholstery revealed a world of benefits particularly suited to small living spaces in Singapore. From cost-effectiveness and space efficiency to sustainability and personalization, reupholstery offered solutions to many of the challenges faced by dwellers of compact homes.

As more Singaporeans embrace small space living, the value of services like sofa reupholstery becomes increasingly apparent. It's not just about refreshing furniture; it's about maximizing the potential of every square foot, creating personalized, functional, and beautiful living spaces no matter their size.

So, the next time you find yourself squeezed for space and style in your cozy Singaporean home, remember Lian Wei's discovery. Sofa reupholstery might just be the key to unlocking your small space's full potential.

0 notes

Text

Exploring the UK Commercial Real Estate Industry and Market Trends in 2025

1. Market Overview

The UK commercial real estate market remains one of the largest and most sophisticated in Europe. It includes a wide range of property types, such as office buildings, retail spaces, industrial facilities, and mixed-use developments. According to market research, The UK Commercial Real Estate Market size is estimated at USD 156.12 billion in 2025, and is expected to reach USD 192.79 billion by 2030, at a CAGR of 4.31% during the forecast period (2025-2030).

While London remains the primary commercial real estate hub, the rest of the UK, including cities like Manchester, Birmingham, and Edinburgh, are emerging as important centers for investment, driven by infrastructure developments, business diversification, and increased demand for high-quality spaces.

2. Post-Pandemic Shifts in Office Spaces

The COVID-19 pandemic had a profound impact on office spaces in the UK, triggering a shift toward hybrid working models and changing the way businesses view office environments. Many companies are rethinking their office space needs, opting for flexible workspaces, co-working arrangements, and smaller, more collaborative office designs rather than large, traditional office footprints.

Hybrid Work Model: The rise of hybrid work is influencing the demand for office spaces. While companies continue to seek office spaces for collaboration and in-person meetings, there is a shift toward flexible layouts and leasing arrangements that can accommodate varying work patterns.

Flexible Office Market: The demand for flexible office solutions, such as serviced offices and co-working spaces, is increasing, particularly in central urban areas. Providers like WeWork and Regus are expanding their footprints to meet the needs of companies looking for shorter-term leases and flexible terms.

Sustainability Focus: There is a growing trend for businesses to seek out office spaces that adhere to sustainability certifications, such as BREEAM or LEED. Green buildings and energy-efficient systems are becoming a key selling point in the UK commercial office market.

3. Retail Real Estate: Adapting to E-Commerce Growth

The retail sector has been under pressure for several years, with the rise of e-commerce reshaping consumer shopping habits. However, the UK retail market is showing signs of adaptation and recovery in 2025. According to recent reports, brick-and-mortar retail real estate is finding new opportunities as it diversifies its offerings and embraces innovation.

Experiential Retail: To compete with online shopping, physical stores are increasingly focusing on creating unique, immersive customer experiences. Retailers are incorporating technology into their stores, offering services like augmented reality, virtual try-ons, and interactive displays.

Last-Mile Delivery Hubs: With the growth of e-commerce, the demand for logistical properties and last-mile delivery hubs is on the rise. Retailers are increasingly looking for properties that allow them to streamline distribution processes, offering faster deliveries to customers.

Retail Redevelopment: Retail properties, particularly in high-street locations, are being redeveloped into mixed-use spaces that combine retail with residential and office components. This trend is contributing to the revitalization of urban centers and the creation of more vibrant, multi-functional spaces.

4. Industrial and Logistics Real Estate Growth

The industrial and logistics sector is one of the fastest-growing segments of the UK commercial real estate market. The rise of e-commerce, coupled with the increased need for efficient supply chains, has driven significant demand for warehouses, distribution centers, and logistics hubs.

E-Commerce Impact: The boom in online retailing has led to a surge in demand for logistics properties, particularly last-mile delivery centers close to urban areas. Companies are looking for properties that offer proximity to key transportation routes and dense customer bases.

Urban Warehousing: With the growing importance of fast deliveries, urban warehouses are becoming more sought after. These properties are strategically located closer to city centers, reducing the time needed for goods to reach customers.

Sustainability: As with other sectors of the market, sustainability is becoming a key factor in industrial real estate development. Energy-efficient warehouses with solar panels, electric vehicle charging stations, and sustainable materials are becoming more common as businesses seek to meet environmental goals.

5. Sustainability and Green Building Trends

Sustainability continues to be a major driver in the UK commercial real estate market, with both developers and tenants increasingly prioritizing environmental considerations in their property decisions. Green building certifications, energy efficiency, and eco-friendly construction practices are no longer just trends, but expectations in the industry.

Net-Zero and Carbon Neutral Goals: Developers and investors are increasingly focused on building properties that meet net-zero emissions standards, aligning with the UK government’s climate targets. Buildings that are energy-efficient, with renewable energy sources and minimal carbon footprints, are highly sought after.

Building Renovations: Instead of demolishing old buildings, there is a growing trend toward retrofitting existing structures to make them more energy-efficient and environmentally friendly. This not only reduces environmental impact but also helps developers meet rising demand for sustainable spaces.

Green Leases: Many tenants are now looking for leases that reflect their sustainability goals. Green leases, which incorporate environmental clauses and promote energy efficiency, are becoming a common feature in the commercial real estate market.

6. Regional Market Dynamics and Opportunities

While London continues to be the main driver of commercial real estate activity, other regions in the UK are attracting increasing attention from investors and developers. Cities such as Manchester, Birmingham, and Leeds have become major commercial real estate hubs due to their strong economic growth, expanding infrastructure, and vibrant business ecosystems.

Northern Powerhouse: The UK government’s efforts to boost regional development through initiatives like the Northern Powerhouse have spurred growth in the North of England. As a result, cities like Manchester and Liverpool are seeing increased demand for office, retail, and industrial space.

Leeds and Birmingham: These cities are rapidly emerging as key competitors to London in terms of office leasing and investment opportunities. Their business-friendly environments, improved transportation links, and growing tech and financial sectors are driving demand for commercial real estate.

Investor Interest in Regional Markets: Investors are increasingly diversifying their portfolios by looking outside of London for high-yield opportunities. The lower price points in regional markets make them attractive options for investors seeking to maximize returns.

7. Challenges and Outlook for the Future

The UK commercial real estate market faces several challenges moving into 2025. These include rising inflation, changes in interest rates, and uncertainty surrounding economic recovery post-pandemic. However, the market is also resilient and adaptable, with the shift toward hybrid working models, increasing e-commerce, and sustainability initiatives providing ample opportunities for growth.

Conclusion

The UK commercial real estate market is undergoing a transformation, driven by technological advancements, shifting work trends, and a strong focus on sustainability. As we move further into 2025, investors, developers, and tenants will need to stay agile and adaptable to take advantage of emerging trends, particularly in office, retail, and industrial sectors. With the continued growth of regional markets, the rise of flexible working solutions, and increasing demand for sustainable buildings, the UK CRE industry is well-positioned for long-term growth and innovation.

For a detailed overview and more insights, you can refer to the full market research report by Mordor Intelligence.

https://www.mordorintelligence.com/industry-reports/commercial-real-estate-market-in-united-kingdom

0 notes

Text

Mystery of Abandoned Homes in London: A Haunting Tale of Forgotten Residences

In the bustling metropolis of London, amidst the towering skyscrapers and historic landmarks, lie hidden remnants of a forgotten past - abandoned homes. These dilapidated structures, once filled with life and warmth, now stand as eerie reminders of bygone eras. From the cobbled streets of East London to the leafy suburbs of the West, these abandoned houses evoke curiosity and intrigue among both locals and visitors alike. Let's delve into the enigma of abandoned homes in London and unravel the stories they hold.

The Allure of Abandoned Houses

Abandoned houses in London possess a unique allure, attracting urban explorers, photographers, and historians alike. Their crumbling facades and overgrown gardens offer a glimpse into a time long gone, sparking imagination and contemplation.

How Did They Become Abandoned?

The question of how these homes became abandoned is a common one. Some were left vacant due to economic downturns, while others fell victim to urban redevelopment projects. Additionally, changes in ownership, legal disputes, and structural issues have contributed to the abandonment of many houses across the city.

How Many Abandoned Homes Exist in London?

Pinpointing the exact number of abandoned homes in London is challenging due to their clandestine nature. However, estimates suggest that there are hundreds scattered throughout the city, each with its own story to tell.

How Are Abandoned Homes Regulated?

The regulation of abandoned homes in London falls under various jurisdictions, including local councils and housing authorities. Depending on their condition and location, abandoned houses may be subject to demolition, renovation, or preservation efforts.

How Do Abandoned Homes Impact Communities?

The presence of abandoned homes can have profound effects on surrounding communities. They may attract antisocial behavior, lower property values, and contribute to urban blight. However, efforts to revitalize these properties can breathe new life into neighborhoods and foster community engagement.

How Can Abandoned Homes Be Repurposed?

Repurposing abandoned homes presents an opportunity to preserve heritage and address housing shortages. Adaptive reuse projects, such as converting abandoned houses into community centers, artist studios, or affordable housing, offer sustainable solutions to urban decay.

How Do Abandoned Homes Reflect London's History?

Abandoned homes serve as tangible artifacts of London's rich history, reflecting the city's evolution over time. From Victorian terraces to post-war council estates, each abandoned house tells a story of its inhabitants and the societal forces that shaped their lives.

How Do People Discover Abandoned Homes?

Discovering abandoned homes in London often involves a mix of research, exploration, and serendipity. Urban explorers may scour old maps, follow local rumors, or simply stumble upon these hidden gems while wandering the city's streets.

How Can Abandoned Homes Be Preserved?

Preserving abandoned homes requires a coordinated effort between government agencies, preservationists, and community stakeholders. Initiatives such as heritage conservation grants, tax incentives, and public-private partnerships can help safeguard these architectural treasures for future generations.

How Do Abandoned Homes Inspire Creativity?

Abandoned homes serve as blank canvases for artistic expression, inspiring photographers, writers, and filmmakers to capture their haunting beauty. Through visual storytelling and creative interpretation, these forgotten spaces are immortalized in art and literature, ensuring that their legacy endures.

In conclusion, the phenomenon of abandoned homes in London is a testament to the city's complex history and ever-changing landscape. While these forgotten dwellings may seem desolate at first glance, they are imbued with stories of resilience, loss, and transformation. By uncovering their secrets and exploring their mysteries, we gain a deeper understanding of London's past and present, while charting a course for its future.

0 notes

Text

What are the barriers to TOD in America, and how can cities overcome this issue? Support your view with a successful example of TOD (in or outside the U.S.)

We think the obstacle to TOD in the U.S. is that the whole process of implementation is subject to legitimacy challenges.

The implementation of TOD in the capital markets is often predicated on land appreciation, and due to the large upfront investment, it must be guaranteed that land prices in the area will rise in order to operate. But there are huge risks involved, and most of these risks are borne by the city, not the developer. In order to promote a TOD strategy, the city usually has to provide upfront infrastructure funding, project management and community engagement services. As the founder of TOD, Peter Calthorpe reminds us that "affordable housing must start with affordable neighborhoods." Increasing the supply of affordable housing and providing more jobs must be urged by the government to accomplish this. And it is impossible to do so by relying on the capital markets, which tend to create eye-catching hedonistic environments that employ glamorous, highly educated elites.

Addressing this obstacle depends in large part on the ability of cities to develop appropriate housing strategies to make government affordable.

TOD does not work in isolation; it and affordable housing strategies accomplish each other. As people use public transportation more, the less they spend on transportation, which increases the overall affordability of the community. Extremely low-income households will move farther into the suburbs because they can't afford to pay downtown rents, spending even more than 50 percent of their household income on transportation to do so. While moving to the suburbs reduces the cost of housing, the additional cost of transportation makes it difficult for poor families to survive. Housing compensation in the form of affordable housing could therefore be provided for low-income residents displaced by regional development. Provide affordable housing for low income households within a half-mile radius around each transit hub. This is because the preservation of older homes and the development of affordable housing around transit stations is consistent with the State's macro-strategy of continued support for affordable housing.

The San Francisco Bay Rim project is a success story.

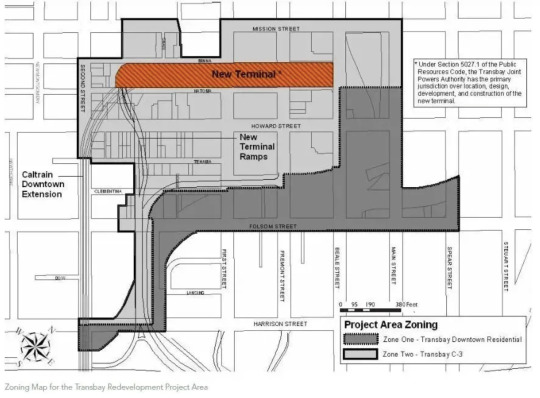

In executing the planning for the TOD project, the management recognized at the outset of the project that public interest and private enterprise complement each other ---- The private economic growth driven by public transportation will be used in part to pay for the cost of public transportation, and the public-private partnership needs to continue throughout the project. The Transbay redevelopment not only plans for residential land to match the office space, but also provides affordable housing at 35% for low-income people. The first project completed in the Transbay Redevelopment Area, Rene Cazenave Apartments, was developed by two local non-profit organizations. The eight-story building consists of 120 apartments with condominiums for the homeless, supportive services, and ground-floor retail space.

With the opening of the Salesforce Passenger Center, the redevelopment of the Bay Rim area opens up a new urban revitalization scenario: one that is transit-oriented and provides a high level of public amenities and a diversity of employment opportunities in a mixed-income community. The development is expected to increase the value of properties within 1.2 kilometers of the Salesforce Terminal by an average of 5%, with an estimated 11% increase in the value of properties directly adjacent to the Terminal.

Currently, the implementation of the TOD project not only pushes the construction of the surrounding land, but also attracts high-tech research and development industries to the city center with the perfect transportation system and new public facilities.

0 notes