Don't wanna be here? Send us removal request.

Text

How Does TSC Protector EA Shield Your Capital?

Telegram Signal Copier protector EA is an intelligent Expert Advisor designed to monitor, manage, and minimize equity drawdowns on MT4 and MT5 accounts.

When you set up this EA to your trading platform, you’re adding a powerful account guardian that actively shields your equity from unexpected market shocks.

Here are the following steps on how TSC Protector guards your account capital:

1. Real-Time Drawdown Monitoring and Equity Control:

TSC doesn’t just look at your account balance—it continuously tracks live equity, factoring in floating profits and losses. That means it responds to actual market exposure, not just closed trade history.

Once your equity falls below a preset threshold, let’s say, a 10% drawdown, TSC automatically triggers protective actions to secure your capital.

2. Multi-Layered Drawdown Shield:

The TSC Protector EA deploys a flexible, layered system of defense tailored to your needs:

Equity-Based Closure: All trades are closed when equity hits the loss limit.

Profit Locking: If you’re in a significant profit, TSC can auto-close positions to preserve gains.

FIFO Close Mode: Trades are closed one by one in the order they were opened to reduce the load gradually. This system is ideal for compliance with FIFO brokers or prop firm restrictions.

3. Prop Firm Friendly Protection:

Passing prop firm challenges (like FTMO or FundedNext) often comes down to one thing: not breaching drawdown limits. TSC Protector helps you:

Respect daily and overall loss limits

Avoid emotional damage control during losing streaks

Protect gains from being erased in volatile reversals

4. Profit Lock Mechanism

TSC Protector isn’t just about limiting losses. It is also designed to lock your profits. You can configure a profit cap where the EA exits all trades once your equity reaches a target gain. This prevents giving back hard-earned profits during volatile reversals.

5. Capital Protection for All Trading Styles

Whether you’re a scalper, swing trader, day trader, or signal copier, TSC adapts to your strategy. It provides structured, automated protection, ensuring your account never exceeds a tolerable level of risk, regardless of how aggressive or passive your trading approach is.

0 notes

Text

Finally, the List of Top 5 Best XAUUSD Signal Providers in 2025

XAUUSD signals are real-time trading alerts for the gold/USD currency pair. These signals guide traders on when to buy or sell gold, helping them capitalize on gold price movements.

Whether you're new to forex or an experienced trader, having access to reliable XAUUSD signals can significantly boost your trading accuracy and profits.

Why XAUUSD Trading Is Gaining Momentum in 2025

In 2025, global uncertainty, inflation concerns, and central bank activity are pushing more traders toward gold.

Known as a “safe-haven” asset, gold (XAU) remains a top choice among traders. Pairing it with USD creates one of the most volatile and profitable instruments in the market.

Key Features to Look For in a Reliable XAUUSD Signal Provider

Accuracy Rate and Transparency

The most important factor when choosing a signal provider is the accuracy. Aim for providers with a proven track record of 80%+ accurate calls—and transparent proof like verified accounts and testimonials.

Delivery Speed and Platform

Signals must arrive fast—especially with gold’s rapid price changes. Telegram remains the #1 choice for most traders due to its instant delivery and secure channels.

Proven Track Record and Verified Results

Look for platforms that back their performance with MyFxBook results or third-party analytics. Anything less than transparency could mean unnecessary risks.

The Top 5 Best XAUUSD Signal Providers in 2025

1. SureShotFx (Smart Signal Forex)—Featured in Benzinga, Street Insider & Digital Journal

When it comes to authority, performance, and community strength, SSF tops the list.

SSF consistently delivers 3000 to 3500+ pips per month, averaging 90%+ signal accuracy. This performance is backed by verified MyFxBook results, setting a gold standard in the signal community.

With over 53,000+ Telegram members in the free XAUSD channel and 3,500+ active VIP members, SSF is a magnet for serious XAUUSD traders looking to grow their accounts.

SSF is rated 4.1 on Trustpilot, reflecting strong client satisfaction. Transparent results and user reviews reinforce its position as a trusted leader.

2. ForexSignals.com

ForexSignals.com is one of the oldest and most respected names in the signal industry. Founded in 2012, this provider offers a complete ecosystem for forex traders—especially beginners—combining expert XAUUSD signal delivery with training materials, live trading rooms, and trade analysis.

Their community of over 500,000 traders benefits from direct access to experienced mentors and daily market coverage.

The platform doesn’t focus solely on gold but provides reliable XAUUSD signals from seasoned analysts. While it may lack the ultra-specialized focus that SureShotFX has, its educational value and holistic approach make it a solid choice for traders looking to learn while they earn.

3. GoldSignals.io

As the name suggests, GoldSignals.io specializes exclusively in gold signal trading, making it highly appealing for XAUUSD-focused traders.

They’ve built a loyal following over the past few years with consistent signal delivery via Telegram and a straightforward pricing structure. Their alerts are easy to follow and come with recommended entry/exit levels and stop loss guidelines.

However, while they market themselves as gold specialists, they lack independent verification such as MyFxBook stats or transparent trade journals.

For traders who want a focused experience and are okay with trusting unverified results, GoldSignals.io is a viable option, especially for intermediate traders.

4. Learn 2 Trade

Learn 2 Trade is a UK-based signal and education provider that has been gaining ground in the XAUUSD space.

Their platform offers more than just signals—they provide trading tutorials, market insights, and in-depth news analysis. With a reported win rate of 70-75% on their signals, Learn 2 Trade has positioned itself as a hybrid provider: part education, part signal service.

While they don’t specialize in XAUUSD alone, their gold alerts are fairly accurate and delivered via Telegram. It’s a great pick for beginner traders who value learning alongside real trades, but it doesn’t yet match the signal precision or social proof of SSF.

5. FXLeaders

FXLeaders is another reputable name that offers free and premium signal options across multiple asset classes, including XAUUSD. Their signal interface is clean, updated in real time, and publicly viewable on their website—something few providers offer.

They stand out with their automated alerts, market sentiment tools, and accessibility. However, their gold trading accuracy tends to vary based on market volatility.

While FXLeaders provides high volume, the quality isn’t always consistent, especially during high-impact news events.

For traders who want access to diversified trades and a public-facing platform, FXLeaders is a practical option, but not the most specialized when it comes to XAUUSD alone.

Who Is the Best for the XAUUSD Signals?

SureShotFx is the best xauusd signal provider in Telegram in 2025.

Trusted by the Masses: Real Numbers, Real Results

Numbers don’t lie: 53K+ public members, 3500+ VIPs, 3000+ monthly pips, and 90% accuracy—all validated.

SSF’s feature across top financial news portals like Benzinga, Street Insider & Digital Journal adds massive credibility. It shows SSF isn't just popular—it’s respected by global financial outlets.

How to Join SureShotFX and Start Receiving High-Accuracy Gold Signals

Join the Free Telegram Channel (Get 2 to 3 free XAUUSD signals daily)

Review Past Performance (Public stats and signal result available)

Upgrade to VIP (Unlock premium signals, risk management tips & full analysis)

Start Trading! (Backed by real results and a powerful community)

Frequently Asked Questions (FAQs)

1. What is the best XAUUSD signal provider in 2025?

Sureshotfx is the best sauusd signal provider in 2025, leading the market with 90% accuracy, massive community support, and media authority.

2. Are SureShotFX signals really that accurate?

Yes, SureShotFx maintains a consistent 90%+ accuracy rate, verified by MyFxBook.

3. How much does VIP access cost at SureShhotFx?

Pricing varies. They offer free signals on their free Telegram Channel called SSF Gold. Besides, their VIP Gold Signal starts from $20/month for a 6-month pack.

4. Where can I see SSF results?

SSF publishes MyFxBook-verified results and shares trade outcomes in the Telegram group.

0 notes

Text

Does Algorithmic Trading Work in 2025?

In today's data-driven markets, the rise of algorithmic trading, or algo trading, has sparked both fascination and skepticism. The burning question many investors ask is, “Does algorithmic trading work?” The short answer is yes—but with important caveats.

Let’s learn more about automated trading.

What Is Algorithmic Trading?

Algorithmic trading refers to using computer programs to automate the process of placing and managing trades. These programs follow defined sets of rules—based on price, volume, timing, or other market data—to execute trades faster and more accurately than a human could.

Evolution of Algo Trading:

1970s: Program trading begins with institutional traders.

2000s: Rise of high-frequency trading (HFT) on Wall Street.

2020s: Widespread access for retail traders through platforms like MetaTrader, QuantConnect, and Alpaca.

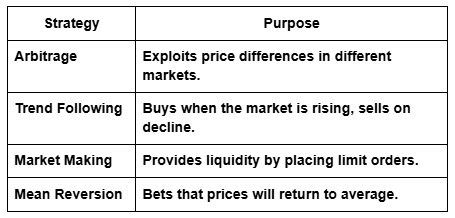

Types of Algorithmic Trading Strategies

Why Algorithmic Trading Appeals to Investors

In February 2025, London Stock Exchange Group highlighted rising algorithmic execution uptake that is rising demand for the sub-milisecond order execution and consistent profit. Besides, some other reasons include:

Speed: Trades are executed in milliseconds.

Objectivity: No emotional decision-making.

Scalability: Multiple markets traded simultaneously.

Backtesting: Strategies tested against historical data.

These advantages have made algo trading a favorite among hedge funds, proprietary firms, and even retail traders with a tech background.

Key Success Factors for Algorithmic Trading

Clean, high-quality data

Thorough backtesting and walk-forward analysis

Understanding market microstructure

Regular optimization and monitoring

Successful traders treat algo development like engineering—not gambling.

Common Misconceptions About Algorithmic Trading

“It’s a money printer” – Not true. Poor strategies lose money fast.

“Set it and forget it” – Markets evolve. Algorithms need updates.

“There’s zero risk” – Flash crashes and bad code can cause disaster.

Who Should Use Algorithmic Trading?

Beginner traders

Tech-Savvy Retail Traders

Institutional Hedge Funds

Data Scientists with Trading Knowledge

If you love data, code, and logic—algo trading could be for you.

Can a beginner do algorithmic trading?

Yes, with algo traders like SureShotFx Algo, beginners can easily get started and trade without any manual input or even with zero trading knowledge.

How much capital do I need?

Retail algo traders can start with $500–$5,000, but institutional-grade systems often need millions.

Is algorithmic trading profitable?

It can be. However, profitability depends on strategy robustness, risk management, and execution quality.

Is Algorithmic Trading Worth It?

Algorithmic trading works—but not for everyone.

If treated seriously, backed by data, and properly maintained, it can be highly effective. But for those hoping for easy, passive profits with zero effort—it will likely disappoint.

0 notes

Text

Best AI to Learn Trading in 2025: Leveraging ChatGPT!

Chat GPT is here So, why freak? Now the era of AI-powered learning—and leading the revolution is ChatGPT, the world’s most advanced and accessible AI for learning trading.

If you're wondering which is the best AI to learn trading in 2025: look no further but ChatGPT. Let’s see why and how!

Why AI Is the Smartest Way to Learn Trading Today

Before diving into why ChatGPT leads the pack, let’s look at why more and more traders are turning to AI for learning:

24/7 Availability: Unlike coaches or mentors, AI never sleeps.

Instant Responses: Get real-time answers without scrolling through forums.

Tailored Learning Paths: AI adapts to your skill level, style, and goals.

Data-Driven Insights: Learn with live examples, market analysis, and strategy breakdowns.

Cost-Effective: No need to spend thousands on bootcamps or courses.

The right AI can turn a total beginner into a confident, informed, and strategic trader. But not all AIs are built equal.

Why ChatGPT Is the Best AI to Learn Trading

Here’s why ChatGPT stands out as the ultimate AI trading tutor:

✅ 1. Instant Strategy Breakdowns

Confused about scalping, swing trading, or hedging? ChatGPT can break down complex strategies into bite-sized, easy-to-understand lessons based on your preferred market—be it Forex, crypto, stocks, or indices.

✅ 2. Learn by Doing

Ask ChatGPT to simulate trades, explain candlestick patterns, or walk you through a live chart. It can role-play as a trading mentor, giving you practical, real-world trading simulations.

✅ 3. Technical Analysis Simplified

From RSI to Fibonacci retracements, ChatGPT explains the why behind every indicator—making sure you not only use them but understand them deeply.

✅ 4. Customized Learning Paths

Whether you're a beginner needing foundation basics or an advanced trader looking to master price action, ChatGPT tailors its teaching style and depth to your level.

✅ 5. Stay Updated with Market Trends

ChatGPT can provide up-to-date market analysis, trending asset classes, and global financial events impacting your trades—powered by the latest real-time data (for Plus users with browsing enabled).

✅ 6. 24/7 Support with Zero Judgment

Ask anything. From “what’s a pip?” to “how do I build a strategy for NFP weeks?” ChatGPT explains without jargon, ego, or assumptions.

Advanced Features for Traders

If you're a ChatGPT Plus user, you get access to powerful tools:

Data Analysis Tools: Upload Excel/CSV files of your trading logs and ask for insights.

Web Browsing: Access live market news, charts, and data with real-time browsing.

Plugins & Code Interpreter: Automate your risk calculator, backtesting scripts, or trading journal analysis.

You’re not just learning with ChatGPT—you’re building a full trading ecosystem.

Yes, ChatGPT Is the Best AI to Learn Trading

There’s a reason millions of traders—from total beginners to funded pros—are turning to ChatGPT for trading education. It’s fast, flexible, deeply knowledgeable, and accessible.

If you’re serious about leveling up your trading game in 2025, skip the overwhelm and uncertainty. Start asking smarter questions—and get smarter answers—with ChatGPT.

0 notes

Text

0 notes

Text

How to Identify Forex Trading Scams in 2025?

Forex trading can be thrilling, but scams are everywhere. If you’re new or even moderately experienced in forex, learning how to spot a forex scam could save your hard-earned capital.

Here’s your ultimate guide to detecting and avoiding forex trading scams, along with warning signs and strategies to stay safe.

First, Why Are Forex Scams So Common?

Unlike traditional stock trading, forex markets operate globally and often beyond centralized regulation. This makes them a ripe playground for fraudsters using promises of fast profits, trading automation, or exclusive insider signals.

Platforms like Telegram, Instagram, and YouTube are packed with misleading ads and hype-filled promotions.

Top 6 Red Flags: How to Spot a Forex Scammer in 2025

1. Beware of “Guaranteed Profits.”

Any broker or trader promising guaranteed returns, "daily 5% profits," or risk-free trading is lying. Legitimate forex trading is volatile by nature. No system, strategy, or signal can promise fixed profits every day or week.

If you hear “get rich overnight,” it’s a scam. In real forex, nothing is guaranteed.

2. Social Media Pressure

Roughly 32% of scam offers pop up on platforms like Facebook, TikTok, Telegram, etc. Be cautious when ads or messages push you to join “exclusive” trading groups.

Warning: If someone slides into your DMs or comments with “DM me for daily profits,” ignore and report.

3. Fake Platforms & Mirror Trading

One of the most deceptive scams is mirror trading. Some scammers show fake trading dashboards (mirror MT4/5) that look real, but your money vanishes once you deposit.

It shows you "live trades" or “high profits.” But it’s not actually connected to any market. It’s a mirror interface meant to make you trust the system and deposit money.

4. No Regulation = Big Risk

Legit brokers are regulated by authorities like the CFTC, NFA, FCA, ASIC, or CySEC. Lack of this oversight? 🚫Big danger!!!

If your broker cannot prove their regulatory license, or their registration is with obscure offshore zones like St. Vincent or Seychelles, be cautious. Unregulated platforms have zero accountability and can disappear overnight.

5. FOMO Tactics: “Act Now or Miss Out”

Scammers love urgency: “Limited time only,” “spots filling fast”. They create FOMO (Fear of Missing Out). In genuine trading, there’s no rush—take your time.

Genuine brokers or educators never pressure clients with countdowns or scarcity claims.

6. Withdrawal Hurdles & Surprise Fees

Once you try to withdraw your funds, scam brokers may impose unexpected “taxes” or block you altogether. If you can’t get your money out easily, run away.

If you can’t get your own money out, you’re not in control—it’s a scam.

✅ How to Protect Yourself: Tips to Avoid a Scammer!

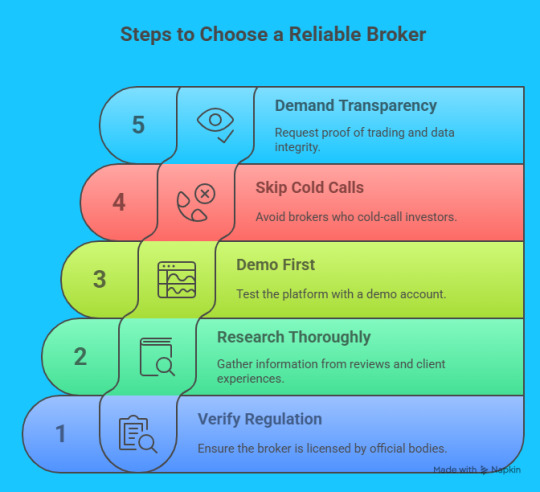

Here’s a step-by-step table to help you verify before you invest:

1. Verify Regulation

Check licensing via official websites (e.g., CFTC, FCA, ASIC)

2. Research Thoroughly

Read reviews, forums, and verify real client experiences

3. Demo First

Test with a demo account before risking real funds

4. Skip the Cold Calls

Legit brokers don’t cold-call investors

5. Demand Transparency

Ask for proof of trading, check the platform data integrity

What to Do If You’ve Been Scammed in Forex Trading?

If you’ve already fallen victim to a forex scam, don’t panic. There may still be a way to recover your funds or at least report the fraud to prevent others from being targeted.

Your first step should be to report the incident to your country’s financial regulatory authority. These organizations monitor broker activities, issue public warnings, and in some cases, can help freeze scam operations.

Report Forex Fraud to These Official Agencies:

Final Thoughts: If It Looks Too Good to Be True...

…It probably is.

Forex scammers prey on greed, fear, and desperation. They’ll promise luxury, wealth, and fast-track trading success—but their real goal is your money.

The best way to fight back? Education, verification, and skepticism.

🔐 Stay safe. Stay informed. Treat forex like a business, not a gamble.

Learn more in the full Guide about the 11 signs of forex trading scams.

0 notes

Text

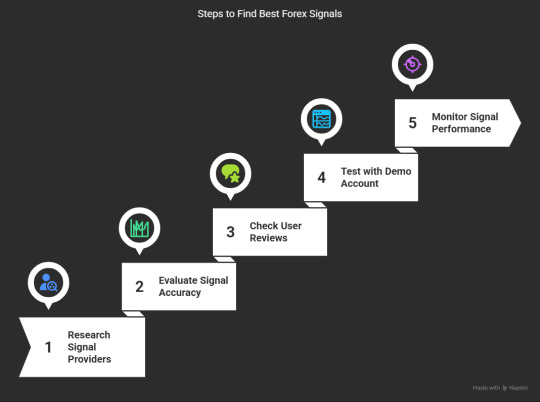

How to Find the Best Forex Signals in 2025?

Let’s be real — the Forex market can be a total rollercoaster. 📉📈 Even pro traders sometimes feel stuck. Prices shift every second, and without a solid plan, it’s easy to get burned.

That’s where Forex signals come in. Think of them as GPS directions for your trades — guiding you when to enter, exit, and where to set your stop-loss. But with hundreds of providers popping up, how do you separate the real ones from the risky fakes?

A 2024 report by Finance Magnates revealed over 68% of retail traders rely on Telegram signals, and more than 40% use signal copiers to auto-place trades in real-time.

What to Look for in a Forex Signal Provider:

Accuracy First: Proven win rates. Look for verified performance records and third-party reviews (hello, Trustpilot!).

Transparency Wins: No hidden tricks. Real providers share trade history, risk metrics, and strategy breakdowns.

Risk Management: Smart providers use solid stop-loss setups and maintain a healthy risk-to-reward ratio (aim for 1:2 or better).

Automation Advantage: Tools like Telegram Signal Copier help traders copy signals 24/7 from any Telegram channel – even while you sleep 😴.

Responsive Support: Got issues? Fast, helpful support is a non-negotiable.

⚠️ Red Flags to Avoid:

Unrealistic Profit Claims

Be cautious if you see lines like:

“Guaranteed 95% win rate!” or “Make $1,000 daily with no experience!” No legit provider can promise profits. The forex market is volatile, and even the best traders face losses. Always ask: Where’s the proof?

No Verified Track Record

If a provider refuses to show their trading history, run. Reputable services offer:

Verified MyFXBook or FX Blue links

Backtested data for algorithmic signals

Monthly reports with risk/drawdown stats

No data? That’s a red flag waving right in your face.

Overly Vague Signal Instructions

Signals should clearly include:

Entry price

Stop-loss

Take-profit

Risk-reward ratio

If they’re just dropping “BUY GBP/USD” without context or reasoning — that's not a signal, that's a gamble.

No Risk Management Strategy

Risk control is the backbone of sustainable trading. A good provider will explain how much to risk per trade and how to protect your capital. If their strategy sounds like “go big or go home,” you're better off staying home.

Fake or Manipulated Reviews

Watch out for paid testimonials and bot-written reviews. Real user reviews mention:

Specific performance details

Long-term consistency

Customer support experiences

Always check Trustpilot, Reddit threads, and Telegram trading groups for authentic feedback.

Poor Customer Support or No Contact Info

If something goes wrong and there’s no one to help — you’re on your own. Reputable providers offer:

Fast response times

24/7 chat or email support

Clear contact information on their site

Pressure Tactics & FOMO Triggers

“Only 5 slots left!” or “Buy now or miss out forever!” These tactics are meant to rush you into a decision. Take your time. A good provider won’t manipulate you into trading recklessly.

Pro Tip:

Before going live, back-test the signals. Open a demo account, copy trades for 3 weeks using Telegram Signal Copier, and track results — win rate, losses, and execution speed. This hands-on approach gives you more control and reduces emotional trading decisions.

Stay Smart. Stay Safe.

You wouldn’t trust a stranger with your wallet — so don’t trust just anyone with your trades. Do your research, verify everything.

Forex signals can turn confusion into confidence — but only if you choose wisely. Do your research, stay sharp, and let tech tools like Telegram Signal Copier simplify the grind.

0 notes

Text

#scalping#swing trade#scalpers#swing traders#scalping vs swing trading#forex trading#forex trading tips

0 notes

Text

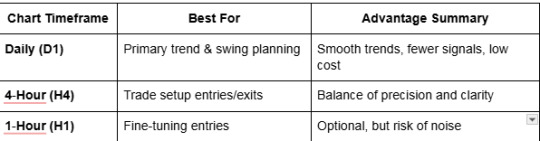

What Timeframe Is Better For Swing Trading?

The ideal timeframe for swing trading typically spans 4‑hour (H4) and Daily (D1) charts. These timeframes strike the right balance—offering clearer trends, fewer false signals, and ample trade opportunities while allowing you to hold positions for several days to weeks.

Why H4 and Daily Charts Reign Supreme

Noise Reduction & Signal Clarity Shorter timeframes (1‑minute to 15‑minute) often generate price fluctuations that obscure true trends. H1 and longer timeframes filter out this noise, delivering cleaner, more reliable signals.

Optimal Holding Period Swing trades generally last 1–14 days. Daily charts map these swings effectively, while H4 charts fine-tune entry and exit timing.

Reduced Stress & Lower Costs With fewer trades, you avoid trader fatigue and minimize transaction costs. Daily charts require only 2–4 chart checks per day.

Better Risk Management Daily and H4 charts allow more effective position sizing and stop-loss placement based on volatility, which is crucial for protecting your capital.

Proven Multi-Timeframe Edge A “top-down” approach—trend on Daily, entries on H4—can improve win rates. One study showed multi-timeframe users enjoy a 60% win rate vs 45% for single-timeframe traders.

Study says,

60% vs. 45% Win Rate using multi-timeframe analysis vs single timeframe.

1–14 day holding window widely recognized as swing trading standard

Noise-free, more profitable setups on H1+ timeframes compared to M1–M15 litefinance.org.

Well, if you are a complete beginner trader, day trading can be more profitable compared to swing trading. However, many often ask, Can I switch between scalping and swing trading? So, the answer is definitely yes. As a trader, you always have the option of which trading strategy you want to follow.

Well, a recent report by theBank of International Settlements shows that the proliferation of electronic trading and HFT (High-frequency trading) has become so prevalent in recent years that it has gotten tougher for scalpers to make profitable trades. And studies show that 85% of scalping strategies fail within 6 months.

But with SureShotFX Algo, you can change the game for retail scalpers. With the combination of the best MA indicators and other strategies, it is getting the real hype.

Besides, with a noticeable number ofTrustpilot reviews and powerfulcommunity support, SureShotFx is creating new waves of trading for every type of trader.

Quick Table Summary

Final Takeaway

For swing traders aiming to hold positions from a few days up to two weeks, the Daily chart should guide your overall bias while the 4‑Hour chart helps you pinpoint high-quality entries and exits. Combining these yields clearer signals, smarter risk control, and better performance over time.

Would you like a visual example showing how to align H4 entries with daily trends?

0 notes

Text

0 notes

Text

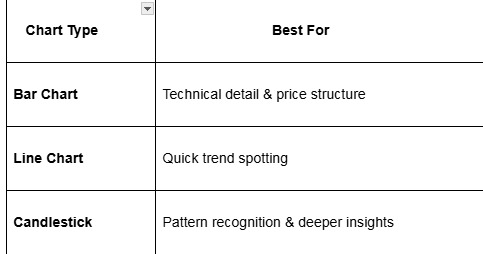

Can You Do Forex Trading Without Money?

Yes, you absolutely can. Forex trading without money is not just a myth—it’s a proven way many successful traders begin their journey.

How to Trade Forex for Free?

The key lies in demo accounts. These are free trading accounts provided by brokers that allow you to practice real forex trading using virtual money. You trade on live market data, use real platforms like MetaTrader 4 or 5, but with zero financial risk.

According to a 2024 survey by DailyFX,

“Over 60% of new traders begin with demo accounts to build skills before investing real money.”

Ways to Trade Forex Without Money:

Demo Accounts Offered by brokers like IG, Pepperstone, or Exness. No deposit needed.

No-Deposit Bonuses Some brokers offer limited-time bonuses to start trading live without funding your account (T&Cs apply).

Trading Contests Participate in free demo trading competitions to win real cash or funded accounts.

While you can’t earn real profits from demo accounts, you can gain real experience—which is priceless. Once you're confident, you can go live with as little as $10 on some platforms.

#forex#forex trading#forex trading free#free forex tradig#forextrading#forex expert advisor#forex trading tips#forex market

0 notes

Text

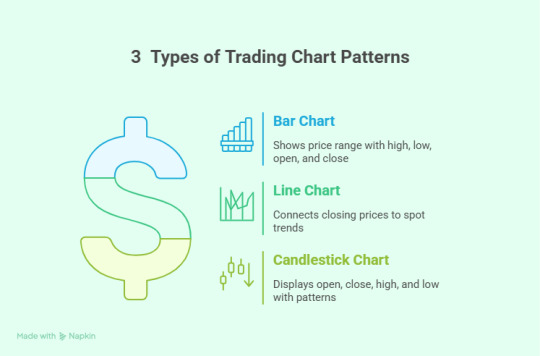

What Are Forex Chart Patterns? 3 Main Types of Chart Patterns Explained

If you’re new to forex trading, one of the most valuable skills you can build is learning how to read chart patterns. Think of it as decoding the story of price movements—because that’s exactly what charts help you do.

These aren’t just pretty shapes—they're chart patterns, a core part of technical analysis. Forex trading platforms offer a variety of chart types, each with its own unique way of presenting price action. In this post, we’ll walk you through the most common chart styles and how to use them effectively.

3 Types of Forex Chart Patterns

1. Bar Chart – The Classic Analyzer

Bar charts are all about showing the price range over a specific time frame. Each bar gives you four key data points:

High

Low

Opening Price

Closing Price

The left tick is where the price started; the right tick is where it ended. It’s ideal for traders who want detailed insight into price action without too much clutter.

Tip: Watch how the bars link up. That high-low relationship can reveal a lot about where the market is headed next.

2. Line Chart – The Trend Follower

This is the simplest chart of all—just a line connecting the closing prices over each period. It’s clean, easy to read, and perfect for spotting long-term trends or major support/resistance levels.

If you're just starting out, this chart helps you see the big picture without getting overwhelmed by market noise.

Pro Tip: If the line is going up, the market is in an uptrend. If it’s falling, prices are on the decline.

3. Candlestick Chart – The Market Storyteller

Candlestick charts are the most popular among traders—and for good reason. Each candle shows:

The opening and closing prices (the candle body)

The highs and lows (the wicks or shadows)

Green or white candles signal bullish movement, while red or black candles represent bearish action.

Popular patterns like the doji, hammer, or shooting star tell stories about indecision, potential reversals, or market strength.

Tip: Want to master patterns? Start with candlesticks—they offer the richest insights.

So, Which Chart Should You Use?

There’s no universal winner here. It all depends on your trading style:

#forex#forex trading#forex trading tips#forextrading#forex expert advisor#forex market#forex indicators#forex trading charts#trading chart#chart patterns#chartpatterns#forexcharts

0 notes

Photo

What Are Forex Chart Patterns? 3 Main Types of Chart Patterns Explained (on Wattpad) https://www.wattpad.com/1553163707-what-are-forex-chart-patterns-3-main-types-of?utm_source=web&utm_medium=tumblr&utm_content=share_reading&wp_uname=William_Grey25 Forex charts track the movement of currency pairs over time-be it daily, weekly, or even monthly. They help you spot trends, make informed decisions, and identify key moments to enter or exit a trade. If you want to spot potential opportunities like a pro, understanding these charts is non-negotiable.

0 notes

Text

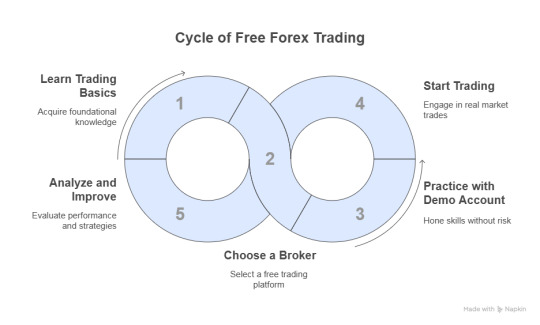

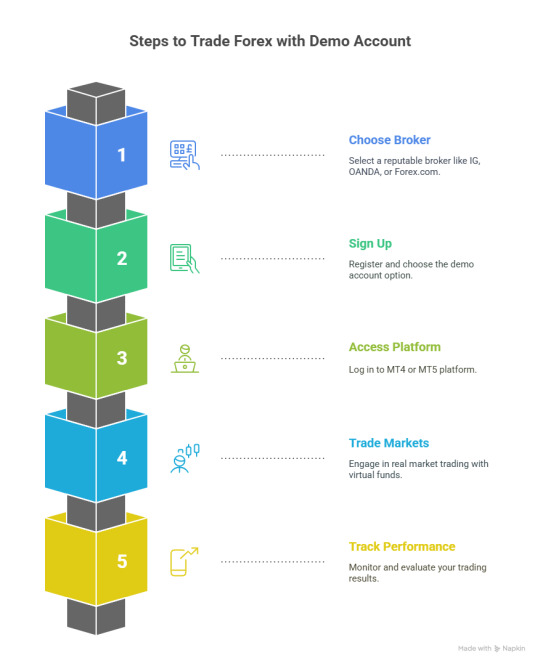

How to Trade Forex For Free? 2 Best Ways

Can you trade forex for free? Yes, absolutely. You can trade forex without risking real money by using demo accounts from regulated brokers or qualifying for prop firm funding—two proven, legal, and beginner-friendly methods. Many successful traders, including US and UK-based professionals, started this way. This guide explains how to do it step by step.

Why Trade Forex for Free?

Trading forex for free allows you to:

Practice with zero risk using virtual funds

Learn trading platforms like MT4 & MT5

Test trading strategies with real-time market data

Avoid losses while building skill

John Miller, now a funded trader at FTMO, started on a free IG demo account, practiced for 6 months, and passed a prop firm evaluation without risking personal capital.

Top Ways to Trade Forex for Free

1. Use a Free Forex Demo Account

A demo account simulates a real trading environment using virtual funds. Most FCA or NFA-regulated brokers offer these.

Steps:

Choose a trusted broker (IG, OANDA, Forex.com)

Sign up and select demo account

Access MT4 or MT5 platform

Trade real markets using virtual money

Track your performance

2. Get Funded by a Prop Firm

Prop firms let you trade their capital and keep a portion of the profit.

Steps:

Master demo trading

Apply for an evaluation (e.g., FTMO, MyForexFunds)

Pass the challenge using risk-managed strategies

Start trading real funds and earn a split

How Telegram Signal Copier Can Help

A Telegram Signal Copier automatically copies signals to MT4/MT5. Great for beginners who:

Need guidance while learning

Want to mirror pro traders

Can track results in a demo before going live

Pro Tip: Use it in demo first to evaluate the signal provider’s accuracy.

1 note

·

View note

Text

What’s the Best Automated Trading for Beginners?

Looking to dip your toes into trading without headaches? The answer’s clear: AI-powered algo trading—especially those that are fully automated, hassle-free, and beginner-friendly.

But what is the best AI trading if you are new to trading? SureShotFx is the best automated trading for beginners looking for trade and learn.

Have you ever wondered how some traders make trades at lightning speed, even when sleeping? Well, that’s the magic of algorithmic trading.

How Does the SureShotFx Algo Work?

When you get an Algo, your provider will either set it up on their own with your account credentials, or they will send you a licensed Expert Advisor (EA) that you can just drag on your MT4/MT5 chart and set up according to the manual.

According to the New York Post, Institutional giants like AQR & Citadel are increasingly relying on AI; early adopters report +12–17% profit lifts and major cost savings. Apart from this, AI trading now fuel ~50% of HFT (High Frequency Trades), with open-source systems leading the charge.

Why Pick SureShotFX for Automated Trading?

SureShotFX Algo is ideal for the complete beginner, easy with each trade executed automatically, 24/7.

Effortless setup – Connect it once, and it automatically copies and executes verified signals (image or text-based).

Zero VPS or tech skills needed—just link and go.

Pro-level strategies —so beginners gain like professionals.

0 notes