Text

Why Most Sellers Hire Real Estate Agents Today

Selling your house without an agent as a “For Sale by Owner” (FSBO) may be something you’ve considered. But you should know that, in today’s shifting market, more homeowners are deciding that’s just not worth the risk.

According to the latest data from the National Association of Realtors (NAR), the number of homeowners selling without an agent has hit an all-time low (see graph below):

And for the small number of homeowners who do decide to sell on their own, data shows they’re still not confident they’re making a good choice.

A recent survey finds three out of every four homeowners who don’t plan to use an agent have doubts about whether that’s actually the right decision.

And here’s why. The market is changing – not in a bad way, just in a way that requires a smarter, more strategic approach. And having a real estate expert in your corner really pays off.

Here are just two of the ways an agent’s expertise makes a difference.

1. Getting the Price Right in a Market That’s Evolving

One of the biggest hurdles when selling a house on your own is figuring out the right price. It’s not as simple as picking a number that sounds good or selling your house for what your neighbor’s sold for a few years back – you need to hit the bullseye for where the market is right now. Without an agent’s help, you’re more likely to miss the mark. As Zillow explains:

“Agents are pros when it comes to pricing properties and have their finger on the pulse of your local market. They understand current buying trends and can provide insight into how your home compares to others for sale nearby.”

Basically, they know what’s really selling, what buyers are willing to pay in your area, and how to position your house to sell quickly. That kind of insight can have a big impact, especially in a market that’s balancing out.

2. Handling (and Actually Understanding) the Legal Documents

There’s also a mountain of documentation when selling a house, including everything from disclosures to contracts. And a mistake can have big legal implications. This is another area where having an agent can help.

They’ve handled these documents countless times and know exactly what’s needed to keep everything on track, so you avoid delays. And now that buyers are including more contingencies again and asking for concessions, your agent will guide you through each form step by step, making sure it’s done right and documented correctly the first time.

3. Selling Your House Quickly Even in a Shifting Market

Now that the number of homes for sale has grown, homes aren’t selling at quite the same pace they were. But you can still sell quickly if you have a proven plan to help your house stand out.

Just remember, homeowners don’t have the same network or marketing tools an experienced agent does. So, if you want the process to happen fast, you’ll likely want a pro by your side.

Bottom Line

Having the right agent and the right strategy is key in a shifting market. Connect with a local pro so you don’t have to take this on solo – and so you can list with confidence, knowing you’ve got expert guidance from day one.

0 notes

Text

The Five-Year Rule for Home Price Perspective

Headlines are saying home prices are starting to dip in some markets. And if you’re beginning to second guess your plans based on what you’re hearing in the media, here’s what you need to know.

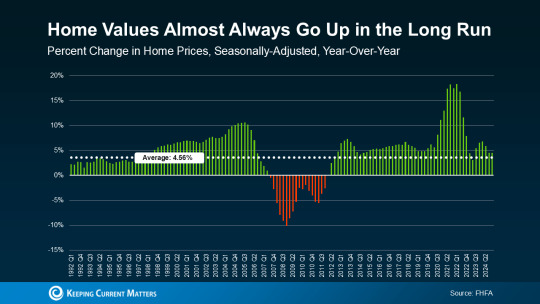

It’s true that a few metros are seeing slight price drops. But don’t let that overshadow this simple truth. Home values almost always go up over time (see graph below):

While everyone remembers what happened around the housing crash of 2008, that was the exception – not the rule. It hadn’t happened before, and hasn’t since. There were many market dynamics that were drastically different back then, too. From relaxed lending standards to a lack of homeowner equity, and even a large oversupply of homes, it was very different from where the national housing market is today. So, every headline about prices slowing down, normalizing, or even dipping doesn’t need to trigger fear that another big crash is coming.

Here’s something that explains why short-term dips usually aren’t a long-term deal-breaker.

What’s the Five-Year Rule?

In real estate, you might hear talk about the five-year rule. The idea is that if you plan to own your home for at least five years, short-term dips in prices usually don’t hurt you much. That’s because home values almost always go up in the long run. Even if prices drop a bit for a year or two, they tend to bounce back (and then some) over time.

Take it from Lance Lambert, Co-Founder of ResiClub:

“. . . there’s the ‘five-year rule of thumb’ in real estate—which suggests that most buyers can buffer themselves from mild short-term declines if they plan to own a property for at least that amount of time.”

What’s Happening in Today’s Market?

Here’s something else to put your mind at ease. Right now, most housing markets are still seeing home prices rise – just not as fast as they were a few years ago.

But in the major metros where prices are starting to cool off a little (the red bars in the graph below), the average drop is only about -2.9% since April 2024. That’s not a major decline like we saw back in 2008.

And when you look at the graph below, it’s clear that prices in most of those markets are up significantly compared to where they were five years ago (the blue bars). So, those homeowners are still ahead if they’ve been in their house for a few years or more (see graph below):

The Big Picture

Over the past 5 years, home prices have risen a staggering 55%, according to the Federal Housing Finance Agency (FHFA). So, a small short-term dip isn’t a significant loss. Even if your city is one where they’re down 2% or so, you’re still up far more than that.

And if you break those 5-year gains down even further, using data from the FHFA, you’ll see home values are up in every single state over the last five years (see map below):

That’s why it’s important not to stress too much about what’s happening this month, or even this year. If you’re in it for the long haul (and most homeowners are) your home is likely to grow in value over time.

Bottom Line

Yes, prices can shift in the short term. But history shows that home values almost always go up over five years. So, whether you’re thinking of buying or selling, remember the five-year rule, and take comfort in the long view.

When you think about where you want to be in five years, how does owning a home fit into that picture?

Connect with an agent to discuss how to get there.

0 notes

Text

Why Buying Real Estate Is Still the Best Long-Term Investment

Lately, it feels like every headline about the housing market comes with a side of doubt. Are prices going up or down? Are we headed for a crash? Will rates ever come down? And all the media noise may leave you wondering: does it really make sense to buy a home right now?

But here’s one thing that doesn’t get enough airtime. Real estate has always been about the long game. And when you look at the big picture, not just the latest clickbait headlines, it’s easy to see why so many people say it’s still the best investment you can make – even now.

According to the just-released annual report from Gallup, real estate has been voted the best long-term investment for the 12th year in a row. That’s over a decade of beating out stocks, gold, and bonds as America’s top pick.

And this isn’t new. Real estate usually claims the #1 title. But here’s what’s really interesting. This year’s results came in just after a rocky April for the stock and bond markets. It shows that, even as other investments had wild swings, real estate has held its ground. That’s likely because it gains value in a steadier, more predictable way. As Gallup explains:

“Amid volatility in the stock and bond markets in April, Americans’ preference for stocks as the best long-term investment has declined. Gold has gained in appeal, while real estate remains the top choice for the 12th consecutive year.”

That says a lot. Even though things may feel a bit uncertain in today’s economy, real estate can still be a powerful investment.

Yes, home values are rising at a more moderate pace right now. And sure, in some markets, prices may be flat in the year ahead or even dip a little – but that’s just the short-term view. Don’t let that cloud the bigger picture.

Real estate has a long track record of gaining value over time. That’s the kind of growth you can count on, especially if you plan to live in that home for a long time.

That’s part of why Americans continue to buy-in to homeownership – even when the headlines may sound a little uncertain. As Sam Williamson, Senior Economist at First American, says:

“A home is more than just a place to live—it’s often a family’s most valuable financial asset and a cornerstone to building long-term wealth.”

Bottom Line

Real estate isn’t about overnight wins. It’s about long-term gains. So, don’t let the uncertainty in a shifting market make you think it’s a bad time to buy.

If you’re feeling unsure, just remember: Americans have consistently said real estate is the best long-term investment you can make. And if you want more information about why so many people think homeownership is worth it, reach out to a local real estate agent.

0 notes

Text

Home Projects That Add the Most Value

Some Highlights

Whether you’re planning to move soon or not, you want to be strategic about which home projects you take on. Because not all of them will be worth it.

Before you decide what upgrades to tackle, talk to an agent who knows what’s in demand in your area and where you’re most likely to recoup the costs.

Connect with a local agent so you know which projects are actually worthwhile.

0 notes

Text

Real Estate Is Voted the Best Long-Term Investment 12 Years in a Row

In a recent poll from Gallup, real estate has once again been voted the best long-term investment. And it’s claimed that top spot for 12 straight years now.

That’s because homeownership is one of the top ways to build your wealth, even with home price growth moderating and ongoing economic uncertainty.

If you’ve been trying to decide if it makes sense to buy a home today, connect with an agent to talk about the programs that can help you become a homeowner.

0 notes

Text

Is It Better To Rent or Buy a Home?

You’ve probably asked yourself lately: Is it even worth trying to buy a home right now?

With high home prices and stubborn mortgage rates, renting can seem like the safer choice right now. Or maybe your only choice. That’s a very real feeling. And perhaps buying today isn’t your best move; it’s not for everyone right away. You should only buy a home when you’re ready and able to do it, and if the timing is right for you.

But here’s the thing you need to know about renting.

While it may feel like a safer bet today – and in some areas might even be less expensive month-to-month than owning – it can really cost you more over time.

In fact, a recent Bank of America survey found that 70% of aspiring homeowners worry about what long-term renting means for their future. And they’re not wrong.

Owning a home may seem way out of reach, but if you make a plan now and steadily work toward it, homeownership comes with serious long-term financial benefits.

Homeownership Builds Wealth Over Time

Buying a home isn’t just about having a place to live – it’s a step toward building your future wealth.

Why? Home prices typically rise over time, which means the longer you wait, the more expensive it is to buy. And even in some markets where home prices are softening today, the overall long-term trend speaks for itself (see graph below):

And as home values rise, so does your equity when you’re a homeowner. That’s the difference between what your home is worth and what you owe. So, with every mortgage payment, that equity grows. Over time, that becomes part of your net worth.

Today, the average homeowner’s net worth is nearly 40X greater than that of a renter. That’s a shocking difference, and the dollars in the visual below don’t lie (see graph below):

And it’s one of the big reasons why Forbes says:

“While renting might seem like [the] less stressful option . . . owning a home is still a cornerstone of the American dream and a proven strategy for building long-term wealth.”

The Biggest Downside of Renting

So, short-term, why does renting feel like a simpler choice? Lower monthly payments, less responsibility, no strings attached. But long-term? It can sting.

For decades, while home prices have been rising, rent has gone up too. And while rent has held rather steady more recently, history shows the overall trend is up and to the right. That makes saving for a home more complicated than ever (see graph below):

That kind of financial uncertainty has a real impact. In the same Bank of America survey, 72% of potential buyers said they worry rising rent could affect their current and long-term finances.

Because rent doesn’t build wealth. It doesn’t come back to you later. It pays your landlord’s mortgage – not yours.

So, whether you rent or own, you’re paying a mortgage. The question is: whose mortgage do you want to pay?

Renting vs. Buying: What Really Matters

Think of it this way. Renting means your money is gone once you pay it. Owning means your payment builds equity – like a savings account you can live in. Sure, buying comes with responsibility. But it also comes with the kind of reward that grows over time. And that’s why you need a solid plan to get there.

As Joel Berner, Senior Economist at Realtor.com, explains:

“Households working on their budget will find it much easier to continue to rent than to go through the expenses of homeownership. However, they need to consider the equity and generational wealth they can build up by owning a home that they can’t by renting it. In the long run, buying a home may be a better investment even if the short-run costs seem prohibitive.”

Bottom Line

Renting may feel more do-able today. But over time, it could cost you more – without helping you build anything for your future.

If homeownership feels out of reach today, you’re not alone. And the first step toward getting out of the rental trap is to set a plan. Connect with an agent to set your specific goals and explore your options – so you’re ready when the time is right.

#realestateadvisor#housingmarket#realestatemarket#realestate#28northgroup#home & lifestyle#homeownership

0 notes

Text

Why You’ll Want a Home Inspection

Some Highlights

Once your offer is accepted, an inspector will assess the condition of the house, including things like the roof, foundation, plumbing, and more.

That information is incredibly important and paves the way for you to re-negotiate with the seller, as needed. So, you don’t want to skip this step.

An inspection is your chance to avoid costly headaches and get peace of mind. Connect with an agent to talk about other ways to make your offer stand out.

0 notes

Text

Why Some Homes Sell Faster Than Others

As you think ahead to your own move, you may have noticed some houses sell within days, while others linger. But why is that? As Redfin says:

“. . . today’s housing market has been topsy-turvy since the pandemic. Low inventory (though rising) and high prices have created a strange mix: Some homes are flying off the market, while others sit for weeks.”

That may leave you wondering what you should expect when you sell. Let’s break it down and give you some actionable tips on how to make sure your house is one that sells quickly.

Homes Are Still Selling Faster Than Pre-Pandemic

The first thing you should know is that, in most markets, things have slowed down a little bit. While you may remember how quickly homes sold a few years ago, that’s not what you should expect today.

Now that inventory has grown, according to Realtor.com, homes are taking a bit longer to sell in today’s market (see graph below):

But before you get hung up on the ten-day difference compared to the past few years, Realtor.com will help put this into perspective:

“In April, the typical home spent 50 days on the market . . . This marks the 13th straight month of homes taking longer to sell on a year-over-year basis. Still, homes are moving more quickly than they did before the pandemic . . .”

By this comparison, if your house does take a little more time to sell this year, it’s not really a concern. It’s actually still faster than the norm. Plus, it gives you a bit more time to find your next home, which is welcome relief when you’re trying to move, too.

Just remember, some homes sell in less time than this. Some take even longer. So, what’s the real difference? Why do some homes attract eager buyers almost instantly, while others sit and struggle?

It comes down to having the right agent and strategy. Here are a few tips you need to know.

1. Price It Right

One of the biggest reasons homes sit on the market is overpricing. Many sellers want to shoot for a higher price, thinking they can lower it later – but that backfires by turning buyers away.

What to do: Work with an agent to make sure your house is priced right. They’ll analyze recent comparable sales (what other homes have sold for recently in your area), so you know you’re pricing appropriately for today’s market and what buyers are willing to pay. As Chen Zhao, Economic Research Lead at Redfin, explains:

“My advice to sellers is to price your home fairly for the shifting market; you may need to price lower than your initial instinct to sell quickly and avoid giving concessions.”

2. Focus on the First Impression

A messy yard or a house that needs paint? It’ll turn buyers off. Since buyers decide within seconds whether they like a home, a good first impression is key.

What to do: Outside, clean up your front yard, tidy up your landscaping, power wash walkways, and add fresh mulch. Inside, declutter and depersonalize. And consider minor touch-ups like repainting in a neutral tone. Your agent will offer advice on what to tackle.

3. Strong Marketing & High-Quality Listing Photos

If your listing or your photos don’t look professional, you could have trouble drawing in buyers who think you’re trying to cut corners.

What to do: Instead, lean on your agent’s skills, expertise, and resources. They’ll help you make sure you have:

High-resolution listing photos showing the home in its best light.

Detailed descriptions that highlight differentiating features of your house.

Your listing on multiple platforms, including major real estate sites and social media.

4. The Location of the Home

You may have heard the phrase “location, location, location” when it comes to real estate. And there’s definitely some truth to that. Homes in highly sought-after neighborhoods tend to sell faster.

What to do: While you can’t change where your house is located, your agent can highlight the best features of your neighborhood or community in your listing. By showcasing what’s great about your area, they can help draw buyers into what life would look like in your house.

Bottom Line

Homes that sell quickly don’t necessarily have better features – they have better agents and a better strategy.

Are you thinking about selling? Connect with an agent to talk about how to get your home sold quickly and for top dollar.

0 notes

Text

Why Pre-Approval Is More Important Than Ever This Spring

Spring is here, and so is the busiest season in real estate. More buyers are out looking for homes, which means more competition for you. If you want to put yourself in the best position to buy, there’s one step you can’t afford to skip, and that’s getting pre-approved for a mortgage.

Some buyers think they can wait until they’ve found a home they love before talking to a lender. But in a season where homes can sell fast, that’s a risky move. Getting pre-approved before you start your search is a much better bet.

Here’s what you need to know about this early step in the buying process.

What Is Pre-Approval?

Pre-approval gives you a sense of how much a lender is willing to let you borrow for your home loan. To determine that number, a lender starts by looking at your financial history. Here are some of the things that can have an impact, according to Yahoo Finance:

Your debt-to-income (DTI) ratio: This is how much money you owe divided by how much money you make. Usually, you can borrow more if you have a lower DTI.

Your income and employment status: They’re looking to verify you have a steady income coming in – that way they feel confident in your ability to repay the loan.

Your credit score: If your score is higher, you may qualify to borrow more.

Your payment history: Do you consistently pay your bills on time? Lenders want to know you’re not a risky borrower.

After their review, you’ll get a pre-approval letter showing what you can borrow. Having this peace of mind is a big deal – it helps you feel a lot more confident in your ability to get a home loan. And the fringe benefit is it can also speed up the road to closing day because the lender will already have a lot of your information.

It Helps You Figure Out Your Budget

Spring is a competitive season, and emotions can run high if you find yourself up against other buyers. Having a firm budget in mind is so important. You don’t want to get too attached and end up maxing out what you can borrow. As Freddie Mac explains:

“Keep in mind that the loan amount in the pre-approval letter is the lender’s maximum offer. Ultimately, you should only borrow an amount you are comfortable repaying.”

So, use this time to really buckle down on your numbers. And be sure to factor in other homeownership costs – like property taxes, insurance, and maybe even homeowner’s association fees – so you know what you can comfortably afford.

Then, partner with your agent to tailor your search to homes that match your budget. That way, you don’t fall in love with a house that’s out of your financial comfort zone.

It Helps Your Offer Stand Out During the Busy Season

Spring buyers aren’t just competing for homes. They’re competing for the seller’s attention, too. And a pre-approval letter can help you stand out by showing sellers you’ve already gone through a financial check. Zillow explains it like this:

“Having a pre-approval letter handy while you’re shopping for a home can also help you act quickly once you’ve found a home you love. The letter shows potential sellers that you’re a serious buyer who has the financial means to close on the home. In a competitive market, an offer with a pre-approval letter attached will stand out among other offers that don’t include one — increasing the chances of your offer being accepted.”

That means when sellers are choosing among multiple offers, yours could rise to the top simply because you’ve already taken this step.

And here’s one final tip for you. After you receive your letter, avoid switching jobs, applying for new credit cards or other loans, co-signing for loans, or moving money in or out of your savings. That’s because any changes to your finances can affect your pre-approval status.

Bottom Line

If you’re thinking about buying a home this spring, getting pre-approved should be your first move. It’ll help you understand your budget, show sellers you’re serious, and keep you from falling in love with a house that’s out of reach. Talk to a lender to get started.

What’s your plan to stand out in this competitive market? Connect with an agent to make sure you’re fully ready to buy.

1 note

·

View note

Text

4 Things To Expect from the Spring Housing Market

Spring is in full swing, and the housing market is picking up along with it. And if you’ve been wondering whether now is the right time to buy or sell, here’s the inside scoop on why this spring may be a great time to make your move.

1. There Are More Homes for Sale

After a long stretch of tight inventory, the number of homes for sale is finally improving. According to recent national data from Realtor.com, active listings are up 27.5% compared to this time last year.

Look at the graph below and follow the green line for 2025. You can see, even though inventory levels still haven’t returned to pre-pandemic norms (shown in gray), that number is higher than it has been going into the spring market over the past few years (see graph below):

Buyers: This means you have more choices, and you can be more selective.

Sellers: With more homes available than in recent years, you’re more likely to find what you’re looking for when you move. And knowing that inventory is still below more normal levels means there will be demand for your home when you sell it, too.

2. Home Price Growth Is Moderating

As inventory grows, the pace of home price growth is slowing down – and that will continue into the spring market. This is because prices are driven by supply and demand. When there are more homes for sale, buyers have more options, so there’s less competition for each house. Rising supply and less buyer competition causes price growth to slow, but it should still remain positive in most markets. As Freddie Mac says:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

And while prices aren’t dropping at the national level, every market is different. Some areas are seeing stronger price growth, while others are cooling off or even seeing some price declines.

Buyers: The slower pace of growth means prices aren’t rising as quickly as before – and that’s a relief. Any home you buy now is likely to appreciate in value over time, helping you build equity.

Sellers: While prices are still rising, you might need to adjust your expectations. Overpricing your house in a more balanced market could mean it takes longer to sell. Pricing your house competitively is going to be key to attracting offers.

3. Mortgage Rates Are Stabilizing

One of the biggest hurdles for buyers over the past couple of years has been high, volatile mortgage rates. But there’s some good news – overall, they’ve stabilized in recent weeks – and have even declined a bit since the beginning of this year. And while that decrease hasn’t been a big drop, stabilizing mortgage rates has helped make buying a home a bit more predictable. According to Selma Hepp, Chief Economist at CoreLogic:

“With the spring homebuying season upon us, the recent improvements in mortgage rates may help invite homebuyers back into the market.”

Buyers: When mortgage rates are more stable, it’s easier to plan ahead because you have a better idea of what your future payment might be. But remember, rates will continue to be volatile. So, lean on your agent and your lender to make sure you know what the latest mortgage rate means for you.

Sellers: Slightly lower rates that are starting to stabilize are encouraging more buyers to move forward with their plans. That’s good for demand when you’re planning to sell your house.

4. More Buyers Are Returning

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market. Demand is picking up, and data from the Mortgage Bankers Association (MBA) shows an increase in mortgage applications compared to the start of the year (see graph below):

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Sellers: This is great news for you – more buyers mean a better chance of selling your house quickly.

Bottom Line

Do you have questions about what the spring market means for you? Connect with a local real estate agent and talk about how to craft your plan this season.

With more homes for sale, slowing price growth, and stabilizing mortgage rates, how will this impact your decision to buy or sell this spring?

0 notes

Text

How Buying or Selling a Home Helps Your Local Economy

Whether you’re buying or selling a house, here’s something to think about that most people don’t. Your decision doesn’t just impact your life and your family’s, it sparks a ripple effect that has a positive impact on your entire community.

Every year, the National Association of Realtors (NAR) puts out a report that breaks down the financial impact that comes from people buying and selling homes.

The data shows that if you buy an existing (previously lived-in) home, you’re giving the local economy a boost of just over $60K. And if you buy a newly built home, that number goes up to over $125K (see visual below):

That’s because of all the people needed to build, fix up, and sell homes. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), explains how the housing industry adds jobs to a community:

“. . . housing is a significant job creator. In fact, for every single-family home built, enough economic activity is generated to sustain three full-time jobs for a year . . .”

When you think about it, it makes sense. Behind every home sale is a network of people involved, including contractors, city officials, real estate agents, lawyers, specialists, and more. Everyone has a job to do to help make sure your deal goes through.

Put simply, when you buy or sell a home, you’re helping out your neighbors. So, your decision to move doesn’t just meet your needs; it supports their families, strengthens your town, and shapes the future of your community.

Imagine walking through the front door of your next home, knowing your decision helped a local contractor keep their crew working or a small business thrive. Remember that feeling as you make your decision this year.

Bottom Line

Moving isn’t just a personal milestone – it's an investment in your community, too. If you’re ready to make a move, connect with a local real estate agent. You’ll make a difference for more people than you know.

What’s most important to you as you prepare to buy or sell your house this year?

#housingmarket#realestatemarket#realestate#realestateadvisor#homeownership#home & lifestyle#28northgroup

0 notes

Text

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must-have to protect what’s probably your biggest investment – your home. And while you never want to think about worst-case scenarios, the right coverage is basically your safety net if something goes wrong. Here’s how it helps you.

Covers Repairs and Rebuilding Costs: If your home is damaged by fire, storms, or other covered events, your policy helps pay for repairs or even a full rebuild.

Protects Your Belongings: Many policies can also cover personal items like furniture, electronics, and clothing if they’re stolen or damaged.

Provides Liability Coverage: If someone gets injured on your property, homeowner’s insurance can help cover medical bills or legal expenses.

In the simplest sense, it gives you peace of mind. Knowing you have protection against unexpected events helps you worry less. And with such a big purchase, having that reassurance is a big deal.

And while your first insurance payment will be wrapped into your closing costs, you’ll want this to be a part of your budget beyond closing day too. That’s because it’s a recurring expense you’ll have once you get the keys to your home.

Here’s what you need to know to help you budget for this important part of homeownership today.

Costs and Claims Are Rising

In recent years, insurance costs have been climbing. According to Insurance.com, there are four big reasons behind the jump in premiums:

More severe weather events and wildfires are leading to higher claims.

Insurance companies are pulling out of high-risk areas, reducing options for homeowners in some states.

Past rate increases haven’t kept up with the rise in claims.

The cost to rebuild or repair homes has gone up due to higher material and labor costs.

Basically, disasters are happening more often, repairs cost more, and insurers have to adjust their rates to keep up. Data from ICE Mortgage Technology helps paint the picture of how the average yearly premium has climbed over the last decade (see graph below):

What You Can Do About It

Homeowner’s insurance is a must to protect your home and your investment. But with costs rising, you’ll want to do your homework to balance the best coverage you can get at the best price possible.

Homeowner’s insurance rates vary widely based on location, provider, and coverage. Shop around and compare quotes before settling on a policy. And don’t forget to ask about discounts. Things like security systems or bundling with auto insurance could help lower your insurance costs.

Bottom Line

When you’re planning to buy a home, it’s important to look beyond just your mortgage payment. You’ll also want to budget for your homeowner’s insurance policy. It gives you a lot of protection against the unexpected. And while it’s true those costs are rising, there are things you can do to try to get the best price possible.

What’s your biggest concern when it comes to budgeting for homeownership? Talk to an agent to make sure you’re set up for success.

0 notes

Text

Is It Time To Put Your House Back on the Market?

If you took your house off the market in late 2024, you’re not the only one. Newsweek reports that data from CoreLogic and the Wall Street Journal (WSJ) says nearly 73,000 homes were pulled from the market in December alone – that’s more than any other December going all the way back to 2017 (see graph below):

Whether it was because offers weren’t coming in, the timing around the holidays felt overwhelming, or they wanted to see if the market would improve in the new year – a lot of other homeowners decided to press pause, too.

But now, with spring fast approaching, it’s time to reassess. The market is already picking up, and waiting any longer to jump back in may only mean you’d face more competition from other sellers down the road.

Why Now Could Be the Right Time

Selma Hepp, Chief Economist at CoreLogic, explains that some of those sellers may have pulled their listings late last year with the goal of trying again this spring:

“Another reason for a step back could be that sellers wanted to wait and see how spring home buying season goes, and if mortgage rates fall, which would bring more home buyers and competition back in the market.”

That’s because spring is when buyer demand is typically at its highest point for the year. More people start their home search once the weather warms up. They’re eager to close on a home so they can move in during the summer. So, it’s a great window for sellers. It means more buyers.

And while mortgage rates haven’t fallen dramatically, they have come down some in recent weeks. Early signs already show buyers are becoming more active as a result. Since January, demand has picked up – and that should continue as spring draws even closer.

What To Do Differently This Time

Start by checking the status of your listing agreement. Because even if you pulled your listing, you may still be under contract. And until your listing expires, your agent or brokerage is your best resource on what else you could try to get it sold. Realtor.com offers this advice:

“If you aren’t sure of the status of your listing, whether active, expired, or withdrawn, take a look at your listing agreement and talk to your real estate agent.”

If your contract is still active, now’s the perfect time to reconnect with your agent to explore strategies to get your home sold this time around. If your contract has since expired and you’re considering other options, reach out to a trusted real estate professional who can help you figure out where to go from here.

Either way, take some time to reflect on your last experience. What held you back from getting it sold before? And what can you do to improve your chances this time around?

Be sure to include your current agent in this thought process. They’ll give you an objective point of view and some advice based on what may have gone wrong last time, like:

Your Pricing Strategy: Did buyers overlook your house because it was priced too high? Your real estate agent can help you analyze the latest sales in your area to make sure you’re hitting the right number. Believe it or not, you could actually be leaving money on the table by not pricing competitively. When it’s priced appropriately for the market, your opportunities for multiple offers and buyer competition increase.

Your Marketing Approach: Was your home staged to look its best? Did you use a skilled photographer for your listing photos? Small tweaks can make a big difference in how buyers see your house. Something as simple as taking new photos now that it’s spring can help your house show better than it did in the winter listing.

Offering Concessions: Were you willing to offer incentives to buyers? As the supply of homes for sale grows, more sellers are entertaining the idea of concessions or incentives to get the deal done. If you weren’t open to those conversations, that may have been a factor, too.

Showings and Flexibility: Did you have limits on when buyers could see the home? If your house is accessible and available, you’ll likely get more offers.

Bottom Line

If your house didn’t sell last year, spring may be your second chance. With buyer activity rising, it’s the perfect time to talk to an agent about coming back into the market with a fresh strategy.

What do you want to do differently this time around? Talk to your agent to go over your options and make a plan.

0 notes

Text

What You Need To Know About Pre-Approval

Some Highlights

Before you even start looking at homes, there’s something you should do first – and that’s get pre-approved for your mortgage.

Pre-approval is when a lender checks your finances and decides how much you’re qualified to borrow for your home loan. This helps you determine your budget and makes your offer stand out for sellers.

Connect with a trusted lender to get the process started.

#realestate#homeownership#lending#mortgage#28northgroup#realestatemarket#housingmarket#realestateadvisor

0 notes

Text

Why a Pre-Listing Inspection May Be Worth It in Today’s Market

Selling a house comes with a lot of moving pieces, and the last thing you want is a deal falling apart over unexpected repairs uncovered during the buyer’s inspection. That’s why it pays to anticipate potential issues before buyers ever step through the door. And one way to do that is with a pre-listing inspection.

What Is a Pre-Listing Inspection?

A pre-listing inspection is essentially a professional home inspection you schedule before putting your house on the market. Just like the inspections your buyer will do after making an offer, this process identifies any issues with the condition of your house that could have an impact on the sale – like structural problems, faulty or outdated HVAC systems, or other essential repairs.

While it’s a great option if you’re someone who really doesn’t like surprises, Bankrate explains this may not make sense for all sellers:

“While it can be beneficial for a seller to do, a pre-listing inspection isn’t always necessary. For example, if your home is relatively new and you’ve been the only owner, you’re most likely already aware of any big issues that could impact a sale. But for an older home, a pre-listing inspection can be very insightful and help you get ahead of any potential problems.”

The key is deciding whether the benefits outweigh the costs for your situation. Sometimes a few hundred dollars now can get you information that’ll save you a lot of time and hassle later on.

Why It May Be Worth Considering in Today’s Market

Right now, buyers are more cautious about how much money they’re spending. And they want to be sure the home they’re buying is worth the expense. In a market like this, a pre-listing inspection can be your secret weapon to make sure your house shows well. Here are just a few ways it can help:

Gives You Time To Make Repairs: When you know about issues ahead of time, it gives you the chance to fix them on your schedule, rather than rushing to make repairs when you’re under contract.

Avoid Surprises During Negotiations: When buyers discover issues during their own inspection, it can lead to last-minute negotiations, price reductions, or even a deal falling through. A pre-listing inspection gives you a chance to spot and address any problems ahead of time, so they don’t turn into last-minute headaches or negotiation roadblocks.

Sell Your House Faster: According to Rocket Mortgage, if your house is listed in the best shape possible, there won’t be as many reasons for buyers to ask for concessions. That means you should be able to cut down on negotiation timelines and ultimately sell faster.

How Your Agent Will Help

But before you think about reaching out to any inspectors to get something scheduled, be sure to talk to an agent. Your agent will be able to give you advice on whether a pre-inspection is worthwhile for your house and the local market. Because it may not be as important if sellers still have the majority of the negotiation power where you live.

If your agent does recommend moving forward and getting one done, here’s how they’ll support you throughout the process.

Offer Advice on How To Prioritize Repairs: If the inspection uncovers problems, your agent will sit down with you and offer perspective on what’s going to be a sticking point for buyers so you know what to prioritize.

Knowledge of How To Handle Any Disclosure Requirements: After talking to your agent, you may decide not all of the repairs are worth it right now. Just be ready to disclose what you’re not tackling. Some states require disclosures as a part of a listing – lean on your agent for more information.

Bottom Line

While they’re definitely not required, pre-listing inspections can be especially helpful in today’s market. By understanding your home’s condition ahead of time, you can take control of the process and make informed decisions about what to fix before you list and what to disclose.

If you choose to skip this step, you may be just as surprised as your buyer by what pops up in their inspection. And that could leave you scrambling. Would you rather fix issues now or risk trying to save the deal later?

0 notes

Text

Is a Newly Built Home Right for You? The Pros and Cons

When searching for a home, you don’t want to skip over new builds as an option. Right now, there are more newly built homes to choose from than there would normally be in the market. And those added choices come with some pretty incredible benefits. Talking to your agent is the best way to see if this type of home makes sense for you.

Here’s a quick rundown of some things your agent will walk you through – including a few of the top perks of buying a newly built home today and some potential things you’ll want to think about before you ink any contracts.

The Perks of Buying a Newly Built Home

Customization Options: Many builders allow buyers to choose finishes, layouts, and upgrades so that you can personalize your home to your unique sense of style. This is obviously more of a draw if the home is still under construction, but sometimes you can have a builder agree to some tweaks even after it’s completed.

Less Maintenance and Fewer Repairs: Everything from the roof to the appliances is brand new, which should save you on any upfront maintenance or repair costs — for at least the first few years. Many builders also offer warranties on things like structural components and major systems, to give you extra peace of mind. And not having to worry about this sort of thing is a big perk when everything feels so expensive right now.

Eco-Friendly and Energy-Efficient Features: With stricter building codes, newly built homes tend to be more environmentally friendly. This can include energy-efficient upgrades like smart thermostats and high-efficiency HVAC systems or eco-friendly tech. And all of these features can save you money on your future energy bills – again a welcome relief while inflation is stubbornly high.

Builder Incentives: Some builders are also offering incentives to homebuyers. While this will vary by builder, it could include rate buy-downs or other ways to offset today’s affordability challenges. As Bankrate says:

“Some builders offer financial incentives, including flexible financing options, to encourage buyers to purchase. These incentives — especially if they get the buyer a lower interest rate — could make a new-construction home more affordable in the long run.”

Other Considerations When Buying a Newly Built Home

On the other side of the coin, there are some things that you’ll want to at least consider before making your choice.

Longer Timelines: If you’re purchasing a home that’s still under construction, you may have to wait several months — or longer — before you can move in. As Realtor.com puts it:

“For homebuyers who have a short time frame to move into a new home, buying new construction could be challenging if the house isn’t built yet. This is not always the case, since a community may have some quick move-in homes or spec homes that are already complete (or nearly so) and ready for a buyer to move in. But if not, a buyer may have to wait.”

Potential Price Changes: Keep an eye on costs, too. It’s easy to go over budget if you keep tacking on upgrades or add-ons as you customize your build. At the same time, building materials, like lumber, can be affected by the economy, inflation, and changing trade policies. And unfortunately, if the cost of supplies climbs, builders will pass at least some of that increase on to people like you. As HousingWire explains:

“Upgrades and add-ons, unforeseen delays due to weather, supply chain issues or labor shortages, and expenses like landscaping and fencing not included in the builder’s cost can significantly affect the final price.”

Bottom Line

New builds can be a great choice today, but you want to be sure you have all the information you need to make an informed decision on such a big purchase. To weigh the pros and cons, connect with a local agent.

0 notes

Text

Should I Update My House Before I Sell It?

With more homes for sale and buyers being more selective, it’s smart to make strategic updates. But how do you decide what’s worth doing? You lean on an advisor.

An advisor will be able to tell you what buyers want, quick wins that’ll have a big impact, and what projects have the best ROI.

What projects are on your to-do list before selling? With only a month left before spring, connect with a local agent so you know what’s worth the time and effort.

0 notes