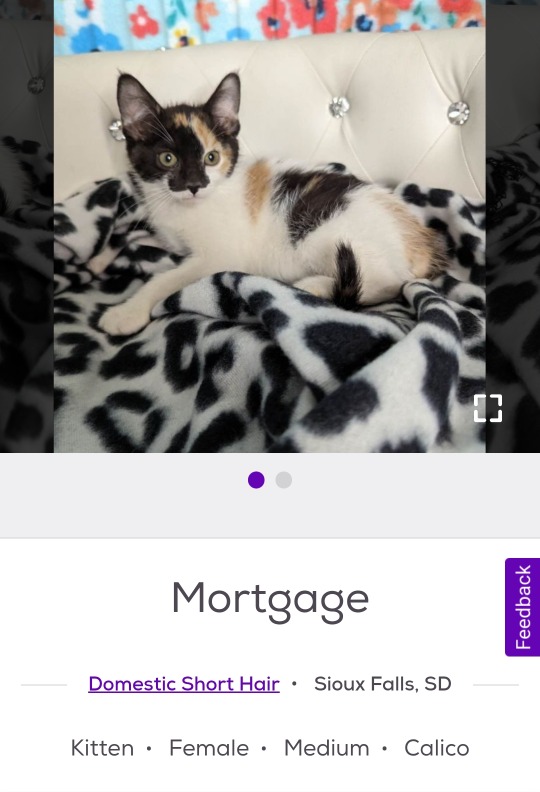

#mortgage

Text

#animal crossing#new horizons#acnh#switch#nintendo#nintendo switch#tom nook#finance#money#mortgage#dogs#cute#funny#lol#humor#meme#gaming#video games#villagers#animal crossing new horizons#ac

1K notes

·

View notes

Text

3K notes

·

View notes

Text

633 notes

·

View notes

Text

{ MASTERPOST } Everything You Need to Know about How to Pay off Debt

Understanding debt:

Let’s End This Damaging Misconception About Credit Cards

Season 2, Episode 10: “Which Is Smarter: Getting a Loan? or Saving up to Pay Cash?”

Dafuq Is Interest? And How Does It Work for the Forces of Darkness?

Investing Deathmatch: Paying off Debt vs. Investing in the Stock Market

How to Build Good Credit Without Going Into Debt

Dafuq Is a Down Payment? And Why Do You Need One to Buy Stuff?

It’s More Expensive to Be Poor Than to Be Rich

Making Decisions Under Stress: The Siren Song of Chocolate Cake

How Mental Health Affects Your Finances

Paying off debt:

Kill Your Debt Faster with the Death by a Thousand Cuts Technique

Share My Horror: The World’s Worst Debt Visualization

The Best Way To Pay off Credit Card Debt: From the Snowball To the Avalanche

The Debt-Killing Power of Rounding up Bills

A Dungeonmaster’s Guide to Defeating Debt

How to Pay Hospital Bills When You’re Flat Broke

Ask the Bitches Pandemic Lightning Round: “What Do I Do If I Can’t Pay My Bills?”

Slay Your Financial Vampires

Season 4, Episode 3: “My credit card debt is slowly crushing me. Is there any escape from this horrible cycle?”

Case Study: Held Back by Past Financial Mistakes, Fighting Bad Credit and $90K in Debt

Student loan debt:

What We Talk About When We Talk About Student Loans

Ask the Bitches: “The Government Put Student Loans in Forbearance. Can I Stop Paying—or Is It a Trap?”

How to Pay for College without Selling Your Soul to the Devil

When (and How) to Try Refinancing or Consolidating Student Loans

Ask the Bitches: I Want to Move Out, but I Can’t Afford It. How Bad Would It Be to Take out Student Loans to Cover It?

Season 4, Episode 4: “I’m $100K in Student Loan Debt and I Think It Should Be Forgiven. Does This Make Me an Entitled Asshole?”

The 2022 Student Loan Forgiveness FAQ You’ve Been Waiting For

2023 Student Loan Forgiveness Update: The Good, the Bad, and the Ugly

Our Final Word on Student Loan Forgiveness

Avoiding debt:

Ask Not How Much You Should Save, Ask How Much You Should Spend

How to Make Any Financial Decision, No Matter How Tough, with Maximum Swag

Your Yearly Free Medical Care Checklist

Two-Ring Circus

Status Symbols Are Pointless and Dumb

Advice I Wish My Parents Gave Me When I Was 16

On Emergency Fund Remorse… and Bacon Emergencies

Should You Increase Your Salary or Decrease Your Spending?

Don’t Spend Money on Shit You Don’t Like, Fool

The Magically Frugal Power of Patience

The Only Advice You’ll Ever Need for a Cheap-Ass Wedding

The Most Impactful Financial Decision I’ve Ever Made… and Why I Don’t Recommend It

3 Times I Was Damn Grateful for My Emergency Fund (and Side Income)

Buy Now Pay Later Apps: That Old Predatory Lending by a Crappy New Name

Credit Card Companies HATE Her! Stay Out of Credit Card Debt With This One Weird Trick

Ask the Bitches: Should I Get a Loan Even Though I Can Afford To Pay Cash?

The Bitches vs. debt:

I Paid off My Student Loans Ahead of Schedule. Here’s How.

I Paid off My Student Loans. Now What?

Hurricane Debt Weakens to Tropical Storm Debt, but Experts Warn It’s Still Debt

The Real Story of How I Paid Off My Mortgage Early in 4 Years

Case Study: Swimming Upstream against Unemployment, Exhaustion, and $2,750 a Month in Unproductive Spending

That’s all for now! We try to update these masterposts periodically, so check back for more in… a couple… months??? Maybe????

#debt#mortgage#credit card debt#debt management#debt consolidation#pay off debt#student loans#student loan debt#loan#financial tips#money tips#personal finance

80 notes

·

View notes

Text

24 notes

·

View notes

Text

Mortgage Calculator Service in California:

Use the free California Mortgage Calculator to estimate your monthly payment, including taxes, mortgage insurance, principal, and interest.

A mortgage calculator helps in calculating things in a few minutes.

Buying a new home is a time of dreams and opportunity, but navigating the mortgage process can also make it stressful and confusing. Different interest rates and repayment terms can make it difficult to compare mortgage loan offers.

Our mortgage calculator should help you understand everything. This helpful tool makes it easy to find mortgage loans and choose the best deal for you.

How to Use This Calculator:

Our mortgage calculator can help you understand how differences in interest rates and repayment terms affect the size of your monthly payment and the total cost of a home over time. Little information is required to get started. Adding a few more details using the calculator's optional advanced options can give you an even clearer idea of what your monthly mortgage payment might look like for different loans.

- House Price: This is the amount you pay the house seller. If you are in the early stages of home shopping, use the seller's asking price for comparison, but remember that this number is negotiable. If you are shopping in a highly competitive market and expect to be one of several bidders, you may want to bid above the asking price. In slower markets or for properties that have been on the market for a longer period of time, a bid below the asking price could be successful. Work with a real estate professional/ Mortgage Advisor to set your bidding strategy.

- Down Payment: When you enter the house price, the calculator automatically fills in the Down Payment field to reflect 20% of the house price. This is the standard down payment required for most traditional mortgages. Many mortgage lenders, including those who make government-backed loans, will accept lower down payments, usually in exchange for higher interest rates and/or fees - and with the stipulation that you pay for mortgage insurance, which you can factor into the calculator's advanced features.

- Term (in years): Enter the number of years required for the mortgage to be repaid. By default, this calculator assumes a 30-year mortgage, as this is the most common home loan term in America. Other standard mortgage terms include 15 years, 20 years, and 40 years. Adjust this number according to the offer you are evaluating. All things being equal, longer mortgage terms mean lower monthly payments, but also significantly higher interest costs over the life of the loan.

- Interest Rate: Enter the interest rate for the loan you are considering. Be sure to enter the interest rate, not the APR (annual percentage rate). These numbers may be similar, but the APR reflects interest costs plus additional financing costs like fees and mortgage insurance.

#mortgage#term#payments#downpayment#downpay#insurance#usa#united states#canada#advisor#mortgage adviser#financial advisers#calculator#calculations#california#year#loan#house#sale#service

186 notes

·

View notes

Text

159 notes

·

View notes

Text

Playing Starfield to live out my dreams of *checks notes* having a mortgage

14 notes

·

View notes

Photo

#nintendo#animal crossing#funny#finances#money#gaming#video games#home#house#mortgage#dog#new horizons#acnh#villagers#tom nook#switch#nintendo switch#lol#humor#meme#relatable#economy#animal crossing new horizons#ac

881 notes

·

View notes

Text

Insider news from Valve

Next month they will be releasing the trailer for their newest addition to the Half Life universe: "Half Life Babies"!

11 notes

·

View notes

Text

A new way I learned the fuckers entirely FUCK you.

The rich DON'T pay their #taxes. They take out #lifeinsurance policies on themselves (& others) at the MAXIMUM monetary value, accruing interest the whole time, then, taking that money out WHENEVER they want, tax free, in and out. Private savings account exclusively for the rich.

THEN they take out #mortgages on #houses to rent out. Rent out those houses, tax free since mortgaged, use the rent they collect on those houses to pay off the mortgage fees, and any extra income from said rent they use TO GET MORTGAGES ON EVEN MORE HOUSES TO #RENT OUT.

All this is basically #taxexempt since 'they don't officially own it.' But they can CLAIM that as an #investment, making them appear rich. WTF is going on. Our entire #economy is a ponzi scheme.

(and I learned ALL this from the guy doing my interview for a job. I didn't expect to learn something today at an interview, but am I glad I went. Interview went pretty solid too. A job exactly like I wanted.)

#tax#taxes#mortgage#house#houseing#home#rent#renting#apartment#condo#life insurance#insurance#scam#ponzi scheme#irs

4 notes

·

View notes

Note

Hi, I'm staring down the idea of owning my own house. Do you have any advice about purchasing a house/townhouse/condo whatever? It will be my first owned property and mortgage. I've never taken out a major loan before.

Congrats, kitten! This is an exciting step.

I highly recommend this episode of our podcast, which is specifically geared towards the resources you need when getting ready to buy your first home:

Season 2, Episode 2: “I'm Not Ready to Buy a House---But How Do I *Get Ready* to Get Ready?”

Did we just help you out? Tip us!

31 notes

·

View notes

Text

Mortgage Debt is a cryptid that deserves more attention

141 notes

·

View notes

Text

How I know my mother is completely disconnected from the reality I live in

Hey, you haven't travelled anywhere in so long! You should go to Turkey at least!

Mother, I'm like always 10 dollars away from the total financial ruin.

3 notes

·

View notes