A2ZCrypto (FIU-IND) has established a partnership with XREX, with A2Zcrypto concentrating on delivering seamless currency exchange services, allowing users to easily swap INR for USDT, BTC, and ETH. XREX, renowned for its industry-leading security measures, stands as the top-notch option for safeguarding cryptocurrency assets for users.

Don't wanna be here? Send us removal request.

Text

0 notes

Text

0 notes

Text

0 notes

Text

Popular Platforms for USDT to INR Exchange

If you're looking to convert INR to USDT, several platforms specifically cater to Indian traders, offering specialized services, competitive rates, and compliance with local regulations.

A2ZCrypto OTC: A2ZCrypto is a top OTC platform known for its smooth INR to USDT trading, competitive pricing, and exceptional customer support tailored for Indian users. For large conversions, ensure your KYC documentation is ready, including PAN, Aadhaar Card, the last six months’ bank statements, and two years’ ITR files. Note: A 1% TDS will be deducted and submitted against your PAN, along with a 0.2% platform fee.

WazirX OTC: WazirX offers an OTC desk with a minimum trade size of ₹100,000, providing personalized support and services for Indian clients.

Coindcx OTC: Coindcx enables INR to USDT trading with a minimum trade size of ₹50,000, offering competitive rates and dedicated support for Indian customers.

#convert INR to USDT#Best Crypto OTC Trading Platform#USDT to INR exchange#A2ZCrypto OTC#leading OTC platform#WazirX OTC#Coindcx OTC

0 notes

Text

The allure of cryptocurrencies in India is multifaceted: they promise high returns, provide an alternative to the traditional banking system, and offer a platform for technological engagement. Digital currencies like Bitcoin and Ethereum are increasingly viewed as tools for wealth accumulation and diversification, especially among the tech-savvy youth". Commented Krishnendu Chatterjee, Co-founder and CEO of A2Z Crypto.

1 note

·

View note

Text

#a2zcrypto#crypto exchange#p2p trading#web3 education#investments#USDT TO INR#INR TO CRYPTO#OTC TRADING

0 notes

Text

Distinguishing Exchange Trading from OTC Crypto Trading

Exchange trading involves the buying and selling of cryptocurrencies on centralized platforms, enabling interactions among buyers and sellers. Conversely, OTC crypto trading entails direct negotiations between two parties, bypassing intermediaries, albeit in a less formalized manner.

Distinct Advantages of Each Trading Method

Exchange trading ensures a high degree of transparency, with all transaction details visible to participants, while OTC trading emphasizes privacy, with transaction details not always publicly disclosed, especially for large-volume trades.

0 notes

Text

How OTC Crypto Trading Works

Most OTC desks mandate approval for trading and enforce trade minimums typically starting in the five or six-figure range. They assign individual account representatives to clients, offering options such as buying, selling, lending, borrowing, and custody services.

While some OTC desks connect buyers and sellers on a case-by-case basis, larger platforms often maintain a ready pool of liquidity for instant trades, akin to regular crypto exchanges.

OTC desks usually generate revenue by charging a spread or commission on trades, with spreads ranging from 0.25% to about 1% of the transaction size.

0 notes

Text

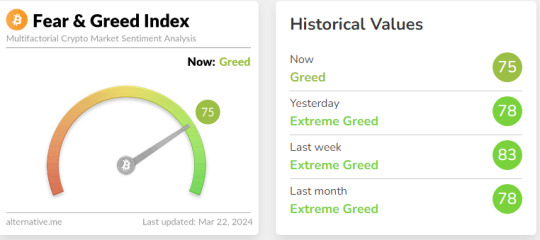

At its core, the Crypto Fear and Greed Index serves as a barometer for investor sentiment within the cryptocurrency market. It assigns a numerical value between 0 and 100, with lower values indicating extreme fear and higher values suggesting extreme greed. This index provides invaluable insights into prevailing market emotions, enabling investors to make informed decisions regarding their crypto portfolios.

https://www.bloglovin.com/@a2zcrypto/unlocking-crypto-fear-greed-index-a-comprehensive-12512075

0 notes

Text

0 notes

Text

#Bitcoin ETFs#SEC#cryptocurrency market#Spot Bitcoin ETF approval#cryptocurrency investment#ETFs vs. Direct Investment

0 notes

Text

#a2zcrypto#btc to inr#p2p trading#Cryptoswap#web3 education#Crypto Exchange#NR-Crypto swaps#BUY BTC TO INR#P2P EXCHANGE#A2ZCrypto Swap

0 notes

Text

#p2p trading#crypto investors#buy inr to crypto#inr to btc#a2zcryptoswap#ETH TO INR#crypto exchange#A2ZCryptoswap services

0 notes

Text

0 notes