#grid trading profitable

Text

0 notes

Text

Grid Trading: Forex Trading Strategy Explained

Grid trading is a systematic forex trading strategy that involves placing buy and sell orders at predetermined intervals above and below a set price level. This strategy aims to capitalize on market volatility by profiting from both upward and downward price movements without the need to predict market direction.

What is Grid Trading?

Grid trading involves creating a “grid” of orders at various…

View On WordPress

#Automated Trading#Forex Market#Forex Trading#Grid Trading#Market Volatility#Price Movements#Profit Fluctuations#Risk Management#Trading Strategy#Trading System

2 notes

·

View notes

Text

“Carbon neutral” Bitcoin operation founded by coal plant operator wasn’t actually carbon neutral

I'm at DEFCON! TODAY (Aug 9), I'm emceeing the EFF POKER TOURNAMENT (noon at the Horseshoe Poker Room), and appearing on the BRICKED AND ABANDONED panel (5PM, LVCC - L1 - HW1–11–01). TOMORROW (Aug 10), I'm giving a keynote called "DISENSHITTIFY OR DIE! How hackers can seize the means of computation and build a new, good internet that is hardened against our asshole bosses' insatiable horniness for enshittification" (noon, LVCC - L1 - HW1–11–01).

Water is wet, and a Bitcoin thing turned out to be a scam. Why am I writing about a Bitcoin scam? Two reasons:

I. It's also a climate scam; and

II. The journalists who uncovered it have a unique business-model.

Here's the scam. Terawulf is a publicly traded company that purports to do "green" Bitcoin mining. Now, cryptocurrency mining is one of the most gratuitously climate-wrecking activities we have. Mining Bitcoin is an environmental crime on par with opening a brunch place that only serves Spotted Owl omelets.

Despite Terawulf's claim to be carbon-neutral, it is not. It plugs into the NY power grid and sucks up farcical quantities of energy produced from fossil fuel sources. The company doesn't buy even buy carbon credits (carbon credits are a scam, but buying carbon credits would at least make its crimes nonfraudulent):

https://pluralistic.net/2023/10/31/carbon-upsets/#big-tradeoff

Terawulf is a scam from top to bottom. Its NY state permit application promises not to pursue cryptocurrency mining, a thing it was actively trumpeting its plan to do even as it filed that application.

The company has its roots in the very dirtiest kinds of Bitcoin mining. Its top execs (including CEO Paul Prager) were involved with Beowulf Energy LLC, a company that convinced struggling coal plant operators to keep operating in order to fuel Bitcoin mining rigs. There's evidence that top execs at Terawulf, the "carbon neutral" Bitcoin mining op, are also running Beowulf, the coal Bitcoin mining op.

This is a very profitable scam. Prager owns a "small village" in Maryland, with more that 20 structures, including a private gas station for his Ferrari collection (he also has a five bedroom place on Fifth Ave). More than a third of Terawulf's earnings were funneled to Beowulf. Terawulf also leases its facilities from a company that Prager owns 99.9% of, and Terawulf has *showered * that company in its stock.

So here we are, a typical Bitcoin story: scammers lying like hell, wrecking the planet, and getting indecently rich. The guy's even spending his money like an asshole. So far, so normal.

But what's interesting about this story is where it came from: Hunterbrook Media, an investigative news outlet that's funded by a short seller – an investment firm that makes bets that companies' share prices are likely to decline. They stand to make a ton of money if the journalists they hire find fraud in the companies they investigate:

https://hntrbrk.com/terawulf/

It's an amazing source of class disunity among the investment class:

https://pluralistic.net/2024/04/08/money-talks/#bullshit-walks

As the icing on the cake, Prager and Terawulf are pivoting to AI training. Because of course they are.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/08/09/terawulf/#hunterbrook

#pluralistic#greenwashing#hunterbrook#zero carbon bitcoin mining#bitcoin#btc#crypto#cryptocurrency#scams#climate#crypto mining#terawulf#hunterbrook media#paul prager#pivot to ai

371 notes

·

View notes

Note

🎁 & honestly literally anything heist au but especially george??

you're soooo sweet, and i hope you have the nicest holiday break 💕

🎁mutuals get ficlets for the holidays!🎁

A Rothko. George has always wanted a Rothko. In his most secret fantasies the Rothko is properly his, mounted on the wall of his imaginary climate-controlled personal vault, but he feels almost satisfied just running his hands over the canvas, feeling the slight texture of smoothed-over oil through his gloves.

“Orange and Yellow,” he breathes, careful not to mar the painting with the humidity of his breath. “Who did you snatch this from?” he asks Alex. Alex has his arms crossed smugly, one hip propped against the table George is examining the Rothko on.

“It was a more challenging take than just a snatch, Georgie,” says Alex, puffing his chest out. “Picture me in one of those harnesses, lowering myself through a laser grid. With those ridiculous green dark vision goggles. It was proper heist shit.”

George can’t help but choke on a little laugh imagining it. He pictures Alex’s skinny limbs spread like a spider, descending from the ceiling, pictures him back-flipping and somersaulting through red cartoon lasers, ducking behind plinths and slicing canvases from frames.

“Just kidding,” says Alex. “It was way more embarrassing than that. The guard dogs almost took my leg off when I was slipping out. Luckily I had leftover treats.”

George smiles, running his palm over the edge of the canvas, checking the condition, drawing up a mental tally of what the painting will fetch at the right kind of auction. Toto might even want this one for his collection—then George could visit it every day and think about Alex’s clever hands pilfering it from unappreciative owners. He pictures Alex hand-feeding giant, snarling Dobermans leftover treats in order to get away, the Rothko tucked under his arm. The image is less James Bond and more quintessentially Alex.

“Blimey,” says George. “I shouldn’t be expecting the police to descend on my apartment and lock you away, should I?”

“I got away clean,” says Alex. “Barely,” he adds, ruffling his own hair. “So how much will this pain in the ass fetch me?”

George pinches his lips, finishing the math in his head. “Ten million. Minus a bit for the trouble of selling on the black market. But you’ll turn a profit.”

Alex’s eyes go wide like they usually do when George mentions a sum so large. It’s barely anything to George, who appraises hundreds of millions of pounds of paper and canvas and paint each day, but watching Alex react always makes him remember the value of the materials beneath his hands. It’s unthinkable, sometimes, that the items George touches are anything other than colour and texture and coded meaning. It’s impossible to believe that they’ll be traded for something as banal as money.

“Not bad,” says Alex, shaking his head. His hands twitch at his sides, almost as though he wants to touch the painting too. He looks like he’s wondering the exact opposite of George, perplexed by the amount of cash a collector will fork over for two blotchy rectangles.

“You know,” says Alex, while George is snapping his gloves off and tossing them away. “I’m actually going to miss this one once it’s sold.” George arches an eyebrow at him, curious. “It kind of reminds me of you,” Alex explains. “You know. Square.” Alex laughs at his own joke, and George laughs too, even though the joke is a little bit mean. Alex’s laughter is just so infectious, red-faced and wheezing.

“Thanks for that,” says George, cheeks aching.

“Thank you, mate,” says Alex, nudging George in the side. Soon he’ll be running out of George’s apartment, the Rothko covered and tucked cautiously under his arm. George will miss them both. “Nobody else I would trust with this. Best in the business.”

26 notes

·

View notes

Note

Congrats on your celebration. I loved LOVED Don't forget to smile so could you do some headcanons for modern Tommy and please write a part two! Thanks boo

modern!Tommy Shelby ~ General Headcanons

[Celebration] [Celebration Masterlist] [Masterlist]

Warning: Mention of violence, drug use

I don't see Tommy going to war., at least not with the army. There was no need to conscript soldiers, and he is not the type of person to choose the army for a career path. I'd see Arthur and maybe even John doing that, but I'm not sure about them either.

However, I see them getting their 'warfare' experience from UK gang wars

Even so, they aren't as traumatised as they are in the show, even if they are still struggling because of the life they live and so Tommy would have retained some of his pre!war persona and we would see more of his cheeky side.

Modern!Tommy still loves horses and would have wanted to work with them and maybe become a professional equestrian but he sees the mistreatment of horses and becomes an activist in his youth (not necessarily animal rights in general, but horses rights)

And by activist, I mean slashing tyres, spraying graffiti, causing mayhem at the races as a teenager. That's how he met Greta and where he learns a lot of oganizing and sabotating skills

I still think the family would start with illegal gambling but on football games and not horse races

Tommy's expansion would be to start fixing boxing matches and MMA fights to make money while getting legal licences. They also take over strip clubs (and absolutely weed out human trafficking thanks to Polly's and Lizzie's input)

Within years he makes them the UKs gambling monopoly but also runs all those online casinos, betting apps etc (you know- the ones with the annoying ads) which takes them global

I still see him involved with trade and shipping and maybe manufacturing too but more in regards to technology and development. And of course, they are in the drugs business

They are UFC shareholders as well as all other MMA and boxing governing bodies and absolutely keep fixing fights. They also fix football matches and sponsor an F1 team (I want to say RedBull based on the Seb era but who knows?)

He is also hugely involved in real estate and housing

This Tommy would not get involved in active politics, even if he loses his mind over current, especially UK politics (when Brexit hits, he can't fathom the stupidity, the damages to his business and economy, and the general government incompetence)

Instead, he focuses on activism, like funding school lunches for poor children through their foundation

The 21st century is still classit but not as much as in the 20s, so he has more movement there. There would be far more discrimination in regards to his Irish Traveller background

The expansion to the US is far earlier.

Modern!Tommy is just as overworked as canon!Tommy if not more so due to the constant availability of our time so he still smokes, takes drugs and a lot of sleeping pills.

He does not have any social media and lives completely off the grid, not even a newspaper interview, which makes him a phenomenon, a ghost and an icon for the crypto bros.

He has a vintage car and motorcycle collection but his biggest treasure is a large horse ranch in the middle of nowhere where he keeps close to a hundred horses, either older horses or former race horses, which he keeps buying up. It's a gigantic facility and is absolutely not profitable (apart for a bit of money laundering) but giving the horses a calm place where they are well taken care of (kind of like a retirement home for horses) is his passion project.

Modern!Tommy has tattoo sleeves, definitely, but he would rather walk on broken glass before he puts on a SmartWatch or drinks a green smoothie

His lockscreen is either a childhood picture of him and Ada on a horse or just a black screen

Bonus fact:

On at least one occasion he has definitely shot his Tablet during a stressful day because the "Sorry- I didn't quite catch that" came at the wrong moment.

Thank you so much for participating in my celebration - I hope you like what I've written for you! I'll have to see about that Part 2. I know a lot of people like that story but I have a lot of other WIPs in the works, but it won't be forgotten

If you want to join in, click here to find out everything you need to know!

~

Taglist

Overall

@lilyrachelcassidy @jyessaminereads @chlorrox @watercolorskyy @books-livre @quarterpastmidnight @lilyevanswhore @polishcrazyone @zablife @just-a-harmless-patato @stevie75 @flyingjosephine-blog @runnning-outof-time @cillmequick @babayaga67 @alex-in-the-wilderness @butterfly-skinnylegend

Tommy

@knowledgefulbutterfly @babayaga67 @signorellisantichrist

@lespendy @geeksareunique @look-at-the-soul

#valentines1k#valentinesheadcanons#join me for a drink#modern!Tommy#modern!Tommy Shelby#Tommy Shelby imagine#modern!Tommy Shelby imagine#modern Tommy Shelby#Thomas Shelby imagine#Peaky Blinders imagine#Peaky Blinders

118 notes

·

View notes

Text

Maui Brewing Company raises $1.5 million for Maui wildfire relief via their Kōkua Project.

image courtesy Maui Brewing Company

Press Release

Kihei, Hawaii … In response to the wildfire tragedies across the island of Maui, Maui Brewing Company spearheaded the Kōkua Project, a collaborative beer effort inspired by Sierra Nevada’s Resilience project of 2018 to raise money for those in need. Translated as “extending help to others” in the Hawaiian language, the Kōkua Project was touted as “one beer, brewed by many, to support the people of Maui”. Over 700 breweries across the United States and internationally participated in the project which began in late August to raise funds for the people of Maui.

While Maui Brewing Company coordinated the efforts and provided the recipe for their suggested brew, brewing material partners jumped in with support by donating the yeast, hops, malts, and more to breweries that reached out for supplies. Ongoing email marketing kept brewing participants up-to-date on recipes, participating vendors, foundation information, events, marketing assets and logos, tap handles, and merchandising kits

“From New Zealand to Japan and every US state in between, the brewing community has come together in a powerful and humbling way to support the people of Maui,” said Maui Brewing Company Founder and CEO, Garrett Marrero. “As one beer, brewed by many, Kōkua supports our Maui ‘Ohana who have been affected by the tragic wildfires. We are grateful to every brewery who has participated this year.”

Maui Brewing partnered with Global Empowerment Mission to facilitate the fiscal responsibilities for the Maui Brewing Company Fire Fund. While participating breweries were encouraged to send their donations to GEM, some breweries opted to donate to Hawaii Community Foundation, Makai Foundation, or other legitimate non-profit organizations including Legacy of Aloha. Legacy of Aloha benefits Maui Brewing and TS Restaurants teammates that have been displaced and lost their belongings and livelihoods. The two restaurant groups partnered for the largest impact. Across these collaborative efforts, the beer community has raised $3M for Maui’s relief efforts with $1.5M pledged through the Kōkua Project.

President and CEO of Maui Brewing Co. Restaurants, Chris Thibaut sent the update, "We're stoked to share that we've hit the $1.77M mark through the Legacy of Aloha program! The amount of support and aloha our community has shown these past few months has been truly amazing. Huge Mahalo for making a real difference in the lives of our Maui 'Ohana!" The financials provided by Legacy of Aloha did not only include brewery contributions from the Kōkua Project.

The Maui Brewing Company team led by Garrett Marrero have been providing ongoing support to Maui, also facilitating supply missions, collecting vital items for the survivors, and delivering emergency drinking water to communities affected by the wildfires. As a result earlier this month, the brewing trade publication Brewbound announced their Best of 2023 Award Winners. Marrero was presented with the Person of the Year Award for “exemplifying the spirit of the craft brewing industry”.

Beer lovers and those looking to support Maui’s relief efforts can donate directly to the Maui Brewing Company Fire Fund online HERE.

For more information, visit MauiBrewing.com or follow @MauiBrewingCo on Facebook, Instagram, and Twitter.

###

About Maui Brewing Company

Founded in 2005, Maui Brewing Company is Hawaii’s largest craft brewery. MBC is based on Maui, with its grid-independent production brewery, restaurant and tasting room in Kihei, as well as restaurants in Kahana (Maui), Ka'anapali (Maui), Kailua (Oahu), and Waikiki (Oahu). Maui Brewing Company is available in 26 states, 1 district, and 3 international countries with more areas to follow.

…

from Northwest Beer Guide - News - The Northwest Beer Guide https://bit.ly/4aFdA4p

13 notes

·

View notes

Text

1231

Library of Circlaria

Cabotton University Timeline

Westerhill Mines

In 1204, construction was completed for an airstrip near the Westerhill Mines and workers' town in order to facilitate the importation of new workers. This airstrip would become Gentry County Airfield in the years to come.

Starting between 1205 and 1206, however, a boom in ebony mining from nearby Ebony Valley lowered ebony prices. Dave Morriston, the owner of Westerhill Mines, committed to preserving Westerhill profit margins by freezing pay raises as well as forcing workers to work longer hours for the same pay. In 1211, the mine workers, led by Merlin Kent Ogden, united and carried out a strike. Not wishing to negotiate, Dave Morriston resigned from his position and was replaced by George Cabot, a close in-law and family friend to Ogden. Thus, negotiations succeeded in improving pay, hours, and working conditions for the miners. Furthermore, housing in the town was refurbished to facilitate middle-class living standards; and Ogden was rewarded for his efforts with an especially large residence that would become the address: 124 West Mason Street.

In 1217, the dominance of Ebony Valley over the industry forced the Westerhill Mines to close. This led the economy in the former miners' town to shift to that of trading shops, predominantly those of the spellcrafter trade. While this provided stability, Combrian leadership in Hasphitat desired for more of a purpose to be served by this town. They were soon approached by Robert Barrington, who proposed to purchase the preserved lands owned by the Emoran Heritage Foundation and build a special academy to provide a second chance to those Combrians who failed out of the Combrian education system.

Combrian law required all Combrian citizens to attend school through the level of a University bachelor degree. Any person in the University system receiving failing grades would be expelled from said University system and made to take a civil service job with the option of going through military service first in order to be considered for better promotions and pay raises. The issue here was that beginning around the 1210s and 1220s, a growing number of Combrian citizens believed this doctrine to be unfair and furthermore believed that Combrian students should be given second chances.

And thus Barrington rose to the occasion by proposing a new alternative curriculum vested in the construction of the Westerhill Institute of Academic Rehabilitation.

Westerhill Institute for Academic Rehabilitation

A few groups of collective youth working as spellcrafter traders in the former miner town attempted to speak on behalf of the Emorans against the idea of converting the preserved consecrated land to the miner town's immediate South into property developed for this new Institute. However, the Combrian government utterly ignored them and approved Barrington's proposal. Construction began in 1228 and would be completed in the spring of 1231.

The Westerhill Institute of Academic Rehabilitation was "simple-oriented" in its structure, consisting of a vast grid of criss-crossing sidewalks over vast lawns. In each corner square, and in the center square, stood a large structure with a square base. Each structure had a center pillar-wing of rooms, and a pillar-wing in each of its five corners. And each structure was five floors tall. These structures were the Five Schools of the Institute, with the one in the Northwest Corner named the William Peck School of Grammar, the one in the Northeast Corner named the John Arthur School of Science and Spellfire, the one in the Southeast Corner named the John Cracker School of Mathematics, the one in the Southwest Corner named the Michael Kelvin School of History and Law, and the one in the Center Square named the Mack Schrader School of Citizenship. Each School consisted of classrooms on its First Floor and student dormitories on the remaining Floors. The overall design of the Schools and the grounds was designed to be cut-and-dry, as well as large and intimidating in order to incentivize student focus and discipline.

Every student enrolled in the Westerhill Institute was subject to the same basic curriculum: to present what one did to cause academic failure, to receive feedback from the assigned Schoolmaster (mostly shaming), and to complete an assignment schedule given by the said Schoolmaster, with said schedule involving "fundamentals" courses on the affected subject, courses that imposed intense lecture-and-drill. The assignment schedule also required each student to complete a sophisticated project which also involved writing long essays explaining how the student thought to complete each step. This would also be subject to harsh feedback from the Schoolmaster.

Robert Barrington served as the Headmaster of Westerhill Institute from 2 through 23 May 1231, after which he resigned and was replaced by Arnold Stone.

John Fleming, University Establishment

John Fleming was born in December 1208 and grew up in Bridgetown in the District of Ereautea, and pursued a career agenda to become a trade accountant. In 1227, Fleming graduated high school with good grades and enrolled in the local branch of the University of Ereautea. Fleming completed his college freshman year in 1228 with academic distinction, and was recommended to enroll into Bridgetown College, a school independent of the University system and reserved for honors students. Fleming excelled in Bridgetown College for his sophomore year, at the end of which he was accepted into their Upper Division program and assigned a field internship for his junior year. However, Fleming had a political falling-out with one of his peers during this internship, and was made to look as if he was academically incompetent. Fleming as a result was expelled from Bridgetown College and would later have his re-application rejected by the University of Ereautea.

Fleming would work a year as a groundskeeper for the Bridge but then accepted an opportunity he received by letter to enroll in the Westerhill Institute.

Martin Cross was born in 1211, and grew up in Jestopole, where he would pursue a career agenda to be a contract scriptfire planecrafter for the Edoran Kingdom. Cross graduated high school in 1229 and, like Fleming, did so with good grades. That year, Cross enrolled in the University of Combria where he, like Fleming, passed with distinction and was moreover recommended for Upper Division that same school year. For his sophomore year, Cross was tasked with completing a dymensional plane project and presenting it as a proposition to enter the Terredon Royal College in the neighboring Kingdom of the Great North. The project involved creating an imitation of the land and territory of the Duchy of Daylram set in the tenth century. And though it was deemed impressive by Cross' peers, it was utterly rejected by the Royal College, who wrote a scathing complaint to the University of Combria on this. Though the University of Combria did not discipline him over the complaint, Cross had a mental break from the outcome and largely stopped attending classes. The University of Combria would expel him for his resulting attendance issues.

Cross then received a letter to enroll in the Westerhill Institute.

Thomas Snow was born in 1212 and grew up in Ebony Valley in the District of Ereautea to pursue a career as an engineer in ebony and related hardware construction. Like Cross and Fleming, Snow graduated high school in 1230 with good grades, but decided to work one year for one of the Ebony Valley construction companies. In the summer of 1230, before he started his job, Snow trained for and attained his Spellcaster License, an achievement which he made known to his co-workers later that year. This led to abrasion with some of them, including the high manager's son, who set him up to take on an assignment that appeared to simply involve surveying territory to the immediate Northwest for ebony deposits. This turned out to be a set-up, a discovery that Snow and his fellow surveyors only made when they, during the trip out into the wilderness, encountered dangerous wysps kept and then released by the manager's son. One of Snow's surveying crew people ran off and went missing, while Snow saved the other two, discharging spells and killing two wysps in the process. They and the person that ran off were rescued, but the incident did not pass without consequence for Snow. He would later be charged with endangerment for not realizing the area surveyed was prone to wysps, and also be penalized for the killing of the wysps themselves as they were considered by the Remikran Union to be an endangered species. Snow had a lawyer who managed to reduce the sentence for the incident to simply a fine, but this would also result in academic implications later on.

Snow received good grades during his freshman year, 1230-31. However, the University of Ereautea received documentation regarding the wysp incident and the legal proceedings. Though they did not consider this a criminal disqualification, the University leadership cited Snow's apparent lack of knowledge for biology and geography to be grounds for requiring a "remedial exam" in those subjects. Though Snow knew the material, the wording of this exam led him to failing it. Snow was then made to reconsider his career path through an "aptitude exam." And while this exam was open-ended, it was possible for a student to fail it if they did not demonstrate measurable strength for any particular career path. Like the first exam, the wording of this second exam led Snow to receiving a failing score; and so as a consequence, Snow was destined to be expelled from the University system.

Westerhill Institute enrollment was selective in nature and was done by invitation. However, Snow, in the course of working in the ebony mining industry, had befriended Merlin Kent Ogden, who worked closely with the Institute and leveraged them into enrolling Snow.

And so in the summer of 1231, John Fleming, Martin Cross, and Thomas Snow became acquainted with one another.

Such a mutual acquaintance began with Cross and Snow, who were assigned roommates and were quarreling with one another over menial logistical matters. Fleming overheard the arguments and summoned Cross and Snow to his room, where the three of them shared their backgrounds and their common hatred toward the oppressive Combrian education system. Fleming was inspired by Cross' dymensional plane project and suggested that he and Snow build one here at Westerhill. Cross initially dismissed the idea as unfeasible, but Snow voiced disagreement, stating that Merlin Kent Ogden had the hardware and venue to build such an apparatus. Cross surrendered to the idea; and several days later, they met with Ogden, who agreed to the arrangement.

On 13 June 1231, Arnold Stone arrived at the Westerhill Institute to start his tenure as the new Headmaster. The next evening, he was visited by Cross and Snow, who were sent to him by the Master of the Kelvin School for poor academic performance; both students had failed an exam due to not being able to form words for answers quickly enough due to lack of sleep. Upon further investigation, Stone learned that the two students had stayed up late into the night working on the dymensional plane with Merlin Kent Ogden. In response, Stone asked to travel to 124 West Mason Street to see this dymensional plane project.

On 19 June, Stone made the visit to the venue, where instead of moving to shut down the project, Stone was impressed with it and requested to have it moved to the Library located in the Mack Schrader School. The next day, this move was made. And on 21 June, Cross and Snow presented this dymensional plane to the other Westerhill students, who took great interest. The following day, Headmaster Stone made an announcement to all Westerhill students and faculty that this dymensional plane project, now known as simply the Project, would serve as a central part of a new curriculum. Stone furthermore declared that all students and faculty would be termed equally as "Scholars" and that faculty were required to pose research questions and provide resourceful information. Stone also banned the oppressive grading system for academic performance and declared the Library open to all Scholars.

However, George Kormell, Master of the Mack Schrader School, reported Stone to the Combria Department of Education for "significant and detrimental educational curriculum deviations." The Education Department accepted the request to press this charge, and subsequently sent a letter to Stone on 13 September, dismissing him from the Headmaster position. Kormell was assigned as the next Headmaster, prompting waves of protests from the students.

As the new Headmaster, on 17 September 1231, Kormell announced his intent to re-instill the old lecture-and-drill curriculum. However, the students staged a mass-walkout and began forming human chains around each of the Five Schools, chanting "Bring back Stone!"

On 18 September, protests escalated, as students began throwing rocks and destroying property. The Masters of the John Arthur, Michael Kelvin, and William Peck Schools resigned, as Headmaster Kormell called in martial law, who, on that day, shot dead John Fleming during a heated confrontation in front of the Mack Schrader School.

This further enraged the student protestors, who, that evening, stormed the Schools under the Masters who resigned. They overtook the John Arthur School and renamed it the House of Thomas Adams, one of their still-living protest leaders. They also seized the Michael Kelvin School, renaming it the House of Alexander Norris, and the William Peck School, renaming it the House of James Randall.

On 19 September, the student protestors were joined by the former-miner town shopkeepers and the former-miners, both of whom held sympathy for the students and a common hatred toward the old Combrian system. The protestors that day stormed the John Cracker School and beat its Master to death; they would later rename this building the House of Karl Deering. In response, Kormell barricaded himself in his Office and refused calls to leave, and on 21 September, called in more reinforcements. This was countered with even more protestors, consisting of students and a growing number of allies. On 22 September, Kormell sent a ticker-text message to the Combrian government for a significant boost in money and resources to deal with this crisis, to which the government responded with a promise to do so.

Nevertheless, gridlock continued between both sides of the crisis, until 2 October, when Kormell was approached by George Cabot with a proposition to purchase the Institute as private property for a large sum of money. Kormell relented and signed a joint proposition with Cabot for approval from the Combrian government on this. The Combrian government approved the transaction, and, on 12 October, sent Kormell a letter granting him an honorable dismissal from the Headmaster position and a rewarding retirement.

George Cabot, on 13 October, transferred ownership of the Institute to Arnold Stone, who waived ownership to the Scholars. That day, they voted to rename the Institute to Cabotton University and also to rename Mack Schrader School as John Fleming House. On 2 November, the Cabotton University student body voted in a University Constitution, which mandated the University to be run democratically according to its administrative structure, as cited in a corresponding blog entry. And on 6 June 1232, Cabotton University began classes with its first Summer Semester.

Cabotton University would then begin its first official school year with a Fall Semester commencing on 2 September 1232.

<- 1203 <- || -> 1233 ->

2 notes

·

View notes

Text

History Of Mandalore

Build the Millennium Falcon: Guide to the Galaxy - The History of Mandalore

Sorry for the quality of the images, but it was the best ones I had

Text on the images is written down for those whose image isn't loading or simply find the quality of the images too hard to read, after the break.

I will handle first the actual text, then Death Watch and Symbolism, and finally the Behind the Scenes text. All the red (and yellow) texts will appear between two brackets at the end of the section that they appeared in.

(Mandalore: Grid Coordinates_0.7

Rotation period 19 Standard Hours, Orbital Period 366 local days; Moons: Concordia;

Astrogation Data:

Region - Outer Rim Territories/Mandalorian Space

Sector - Mandalore Sector

System - Mandalore System

Orbital Position - 5

Trade Routes - Hydian Way (closest)

Physical Data

Class - Terrestrial

Diameter - 9,200 km

Atmosphere - Type I (breathable oxygen/hydrogen/nitrogen mix)

Climate - Temperate, arid

Gravity - Standard

Primary Terrain - Deserts, cities

Population - 4 million

HISTORY OF MANDALORE:

Plagued by a turbulent history, Mandalore is an Outer Rim planet with a fiercely independent people that was divided by recent conflicts and the Clone Wars. Tough Mandalore's surface will probably never recover from the wars of the past, its people will always be proud to be Mandalorians.

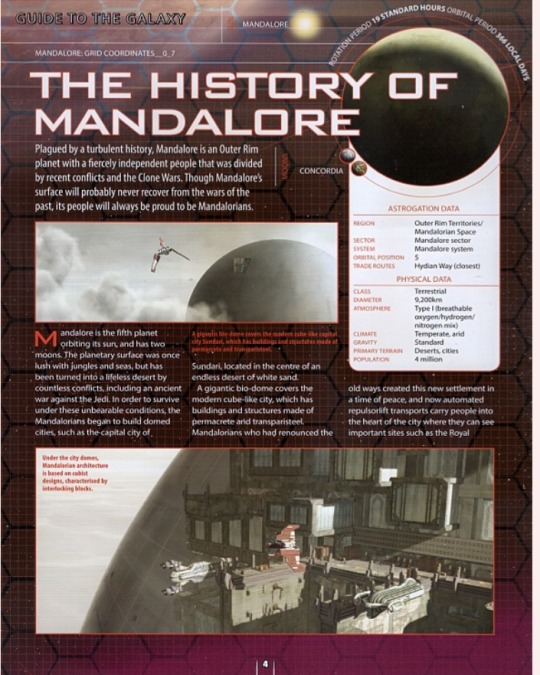

Mandalore is the fifth planet orbiting its sun, and has two moons. The planetary surface was once lush with jungles and seas, but has been turned into a lifeless desert by countless conflicts, including an ancient war against the Jedi. In order to survive under these unbearable conditions, the Mandalorians began to build domed cities, such as the capital of Sundari, located in the centre of an endless desert of white sand.

A gigantic bio-dome covers the modern cube-like city, which has buildings and structures made of permacrete and transparisteel. Mandalorians who had renounced the old ways created this new settlement in a time of peace, and now automated repulsorlift transports carry people into the heart of the city where they can see important sites such as the Royal Palace, the Royal Academy of Government and the Memorial Shrine. Mandalore is also home to MandalMotors, a large corporation that produces specifically Mandalorian spaceships, repulsorlift vehicles, weapons and equipment.

While the human population was able to survive because of technology, the wildlife of Mandalore suffered. A few species managed to survive by adapting to the changing conditions, and rare examples of others lived on in captivity. One lost species that had significant influence on Mandalorian traditions was the shriek-hawk, an avian predator also known as the jai'galaar. The long extinct mythosaur was a creature of gigantic proportions, whose memory still lives on today in the mythosaur skull emblem sported by many Mandalorians.

[A giantic bio-dome covers the modern cube-like capital city Sundari, which has buildings and structures made of permacrete and transparisteel.

Under the city domes, Mandalorian architecture is based on cubist designs, characterized by interlocking blocks.]

Warlike Traditions

The warlike Mandalorians are the stuff of legends used to scare children. Wearing their distinctive armour, they fought against the Jedi in the Old Republic, and were once part of a raid on the Jedi Temple. Despite the fact that the Mandalorians were able to expand their influence and territory considerably throughout the regions surrounding Mandalore and beyond, different factions made Mandalorian politics complicated and highly unpredictable. Traditionalists, reformers and invaders all ruled and profited from the civil wars that have raged on the planet.

[Inside the towering domes, the architecture of Mandalore's cities repeat cubist themes, with airy structures made of permacrete and transparisteel.]

New Mandalorians

After the Great Clan Wars, which took place a decade before the Clone Wars, the Mandalorians were ruled by Duchess Satine Kryze of Kalevala and her New Mandalorians, who broke away from the violent past and ruled Mandalore through peace and diplomacy. As leader of the Council of Neutral Systems, the duchess represented over 1,500 systems that strove to stay neutral during the Clone Wars. Satine ruled with the assistance of a Prime Minister and a Ruling Council of at least six Ministers, among them a Minister of Finance and a Minister of the Interior. Other functions in the government were those of the Governor and Deputy Minister.

The New Mandalorians struggled to minimise the influence of the group known as Death Watch, who longed to return Mandalore to its warrior roots with the support of the Confederacy. Secretly leading Death Watch was Governor Pre Vizsla of Concordia, one of Satine's trusted allies. Also on Death Watch's payroll was Prince Tal Merrik, the Senator of Kalevala and one of the duchess's oldest friends.

After being betrayed by her allies, Satine barely succeeded in avoiding a Republic intervention on Mandalore by uncovering a recording that showed the Republic Senate a forged message from the loyal Deputy Minister Jerec. Had that invasion taken place, Death Watchstood ready to act as the liberators of the Mandalorian people, who would undoubtedly have chosen their side against the Republic. The government of the New Mandalorians remained fragile, due to corruption among the political upper class and because Pre Vizsla, the leader of Death Watch, was constantly plotting against Duchess Satine.

Towards the end of the Clone Wars, with the help of the Shadow Collective crime syndicate, Death Watch finally managed to depose the New Mandalorains and they once again gained support of the Mandalorian people. Not all members of Death Watch remained loyal after Pre Vizsla was slain by Darth Maul, the leader of the Shadow Collective. Bo-Katan Kryze and the Nite Owls left Death Watch as another splinter group after the deaths of Vizsla and Satine Kryze. In the end, not even Death Watch could protect Mandalore from succumbing to the Galactic Empire, which installed a military Academy on the planet.

[Automated repulsorlift transport-decks with aerial landing plataforms to speed passengers around the Mandalorian capital city. Important locations include centres of government, culture and manufacturing.

As the leader of the Council of Neutral Systems, pacifist DDuchess Satine Kryze of the New Mandalorians represented over 1,500 systems that strove to stay neutral during the Clone Wars.

While touring the gardens, the duchess and Obi-Wan Kenobi witnessed a terrorist bomb explode and while they tended to the injured, saw a hologram of the Death Watch crest.

Prime Minister Almec, who had ruled the planet under Duchess Satine Kryze, was reinstalled after Death Watch staged a coupp, and told the people that Satine had murdered Death Watch's former leader Pre Vizsla.

As a means of gaining more power on Mandalore, Death Watch allied itself with crime syndicates and the two Sith Nightbrothers, Darth Maul and Savage Opress.]

Death Watch

(Wayland is a possible planet shown behind the white box of text that the Death Watch section is in.

OP here, is it possible that Wayland is the name of the second moon? Food for thought for those who are reading.)

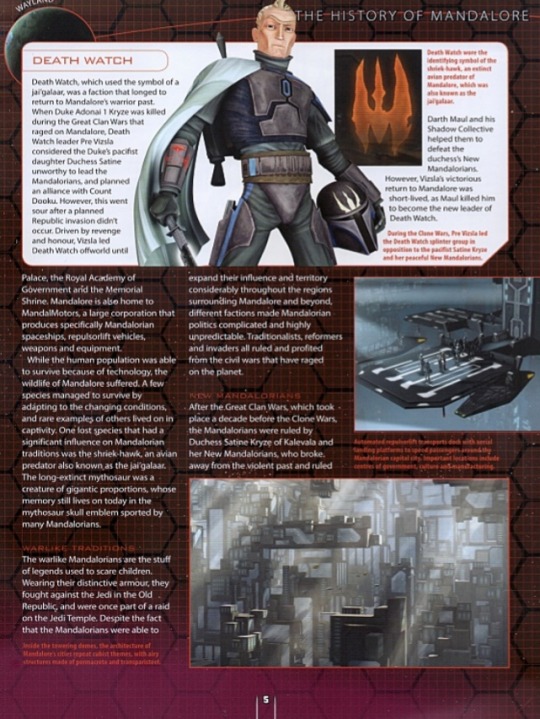

Death Watch, which used the symbol of a jai'galaar, was a faction that longed to return to Mandalore's warrior past.

When Duke Adonai 1 was killed during the Great Clan Wars that raged on Mandalore, Death Watch leader Pre Vizsla considered the Duke's pacifist daughter Duchess Satine unworthy to lead the Mandalorians, and planned an alliance with Count Dooku. However, this went sour after a planned Republic invasion didn't occur. Driven by revenge and honour, Vizsla led Death Watch offworld until Darth Maul and his Shadow Collective helped them to defeat the duchess New Mandalorians.

However, Vizsla's victorious return to Mandalore was short-lived, as Maul killed him to become the new leader of Death Watch.

[Death Watch wore the identifying symbol of the shriek-hawk, an extinct avian predator of Mandalore, which was also known as the jai'galaar.

During the Clone Wars, Pre Vizsla led the Death Watch splinter group in opposition to the pacifist Satine Kryze and her peaceful New Mandalorians.]

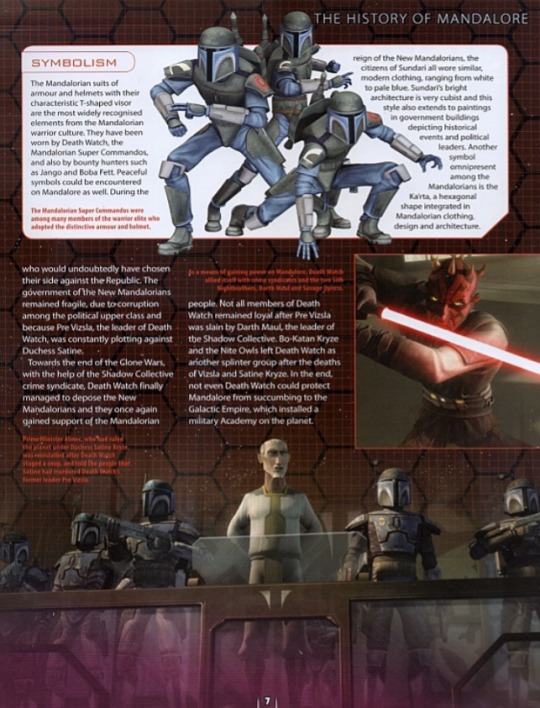

Symbolism

The Mandalorian suits of armour and helmets with their characteristic T-shaped visor are the most widely recognized elements from the Mandalorian warrior culture. They have been worn by the Death Watch, the Mandalorian Supper Commandos, and also by bounty hunters such as Jango and Boba Fett. Peaceful symbols could be encountered on Mandalore as well. During the reign of the New Mandalorians, the citizens of Sundari all wore similar, modern clothing, ranging from white to pale blue. Sundari's bright architecture is very cubist and this style also extends to paintings in government buildings depicting historical events and political leaders. Another symbol omnipresent among the Mandalorians is the Ka'rta, a hexagonal shape integrated in Mandalorian clothing, design and architecture.

[The Mandalorians Super Commandos were among the many members of the warrior elute who adopted the distinctive armour and helmet.]

Behind the Scenes: Long History

The name Mandalore first appeared as a mention on the Boba Fett concept art drawn by Joe Johnson for The Empire Strikes Back, which referred to him being a 'super commando from the Mandalore system'. The name Mandalore was kept alive and appeared for the first time in Star Wars 68: The Search Begins, a Marvel comic from 1983, where Leia is searching for Han Solo, frozen in carbonite. Many aspects of the planet and its culture were created after a connection had been established between the clone troopers and the Mandalorians. Author Karen Traviss once even worked on turning Mando'a into a working language. Star Wars: The Clone Wars chose a new direction for Mandalorian society, but also kept some elements from former stories, such as Death Watch. A lot of prequel concept art was reused for the Mandalorian designs, such as a concept art that had been originally intended for Amidala (Satine) and Sith (Mandalorian Royal Guards).

[The Mandalorian Royal Guards were based on concept art originally designed for the Sith.]

#star wars#sw#mr talks#mandalorians#build the millennium falcon#guide to the galaxy#history of mandalore#text of the images under the break#satine kryze#pre vizsla#death watch#new mandalorians#mandalore

25 notes

·

View notes

Text

Today’s throwback is to Jenson Leonard’s solo exhibition Workflow, at Wood Street Galleries in Pittsburgh, from the beginning of February.

From the gallery about the work-

Workflow, the first institutional solo exhibition of artist Jenson Leonard, centers on a titular film that explores the velocity and momentum of Blackness as it relates to the philosophical concept of acceleration—the notion that the only way out of capitalism is through its intensification.

In Workflow, a spectral Michael Jackson Halloween mask recites a surrealistic quarterly earnings reports. Building on a 2017 essay by artist Aria Dean titled “Notes on Blacceleration,” the short film centers on the ways in which the Black subject grapples with its commodified status within the labor market despite—or, resultant of—its own history as a commodity, stemming back to the Trans-Atlantic slave trade. Completed during Leonard’s residency at Pioneer Works in 2021, the video utilizes uncanny humor as a mechanism to expose the shared grammars inherent in Afro-pessimism and speculative finance.

Within the exhibition, the film repeats simultaneously across two grids of computer monitors situated on ergonomic desks that flank the gallery, mimicking the workstations that can be found ubiquitously across stock trading floors and financial institutions. Sculptures modeled after computer keyboards and mouses are displayed on the desks, each rendered inoperable by concentric riffs that symbolize the erratic transformations caused by the flows of capital. The appearance of Jackson represents a transmogrification of its own; whereas many have aligned the controversial pop icon’s bleached skin and surgical procedures with Black self-hatred, Leonard positions his bodily modifications as a radical rupture from racial paradigms of being.

In Leonard’s own words, “Workflow is defined as the sequence of industrial, administrative, or other processes through which a piece of work passes from initiation to completion. My film seeks to disabuse notions of completion, whether it be completion of the human, the nation state, or civil society. As Dean notes, Blackness is ‘always already accelerationist’ via its incongruence with Western humanism, a wrench thrown into the locomotive gears of ‘capital and subjecthood.’ Her essay prompts us to look toward the way that the Black has been historically constructed outside of the human, as coterminous with the slave. Slavery therefore represents a kind of proto-automation, a mass forced coercion of labor, and the Blacks’ transition from object to subject calls for a reappraisal of accelerationist ideas about the (non)human entity and its revolutionary potential.”

The artist continues, “There is something about going to work—the repetition of it—that gets inscribed at an epigenetic level, as an everyday, embodied violence. From there, I thought about the panoptic workplace (open air plan, transparent yet closely surveilled, management that does not have to be in the room to be monitoring you), the fetish of efficiency (ergonomic mouse and keyboards so you can work longer), biometric data of a labor force (fingerprint and facial scans to help reduce repeat processing tasks). All of these methods to maximize profits and production can be traced back to methods worked out and perfected in the cotton and sugar cane fields hundreds of years prior.”

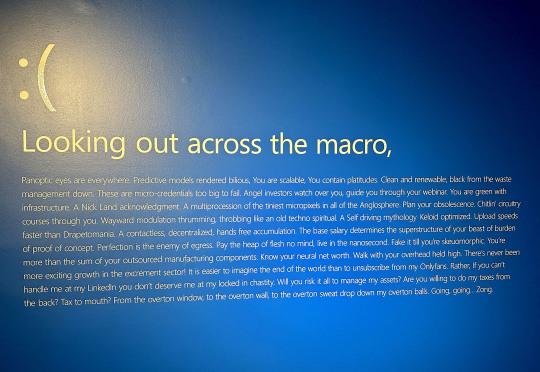

The text from the video was included on one of the gallery walls (image above) but I’ve included it below as well as it is definitely worth reading.

“Looking out across the macro- Panoptic eyes are everywhere. Predictive models rendered bilious, You are scalable, You contain platitudes. Clean and renewable, black from the waste management down. These are micro-credentials too big to fail. Angel investors watch over you, guide you through your webinar. You are green with infrastructure. A Nick Land acknowledgment. A multiprocession of the tiniest micropixels in all of the Anglosphere. Plan your obsolescence. Chitin’ circuitry courses through you. Wayward modulation thrumming, throbbing like an old techno spiritual. A Self driving mythology Keloid optimized. Upload speeds faster than Drapetomania. A contactless, decentralized, hands free accumulation. The base salary determines the superstructure of your beast of burden of proof of concept. Perfection is the enemy of egress. Pay the heap of flesh no mind, live in the nanosecond. Fake it till you’re skeuomorphic. You’re more than the sum of your outsourced manufacturing components. Know your neural net worth. Walk with your overhead held high. There’s never been more exciting growth in the excrement sector! It is easier to imagine the end of the world than to unsubscribe from my Onlyfans. Rather, If you can’t handle me at my Linkedin you don’t deserve me at my locked in chastity. Will you risk it all to manage my assets? Are you willing to do my taxes from the back? Tax to mouth? From the overton window, to the overton wall, to the overton sweat drop down my overton balls. Going, going… Zong.”

#Jenson Leonard#Wood Street Galleries#Video Art#Pittsburgh Cultural Trust#Sculpture#Art#Pittsburgh Art Shows#Art Shows#Pioneer Works#Brooklyn Art#Brooklyn Art Galleries#Downtown Pittsburgh#Afro-pessimism#Michael Jackson#Aria Dean#Pennsylvania Art Shows#Pittsburgh Art#Political Art#TBT

2 notes

·

View notes

Text

Today I found out that our company offers an employee benefit where they will reimburse us for citibike (nyc bike ride share service).

Lyft acquired citibike (and several other bike share services in other major cities) and you have two annual membership options:

1. Citibike membership $205 per year

2. Lyft Pink All Access (LPAA) membership $199 per year

LPAA has same membership benefits of citibike, plus you get some lyft benefits, plus grubhub/seamless membership, plus membership to all the other major city Bike share services, plus other random benefits.

If you’re a citibike member already you can also transfer your membership to Lyft pink for free to get those benefits.

So why does LPAA cost $6 less than getting citibike membership alone?

There’s an argument that if you have a discount that you might be more likely to use a service they you wouldn’t have before. Maybe I don’t use grubhub now, but because now I get fees waived I’ll start using it (or use it more).

There’s probably truth in that, but it seems odd that they’ve only priced at $6 difference.

Someone mentioned in a Reddit thread a much more likely reason: it will greatly inflate the metrics for number of Lyft Plus members, which will look great on annual reports and make it look like they are more attractive investments.

It’s amazing to realize that these are not profitable companies: Lyft spends about $4 billion each year to make $3 billion of revenue. That’s like having a business model where I buy cans of soda for $1 each and sell them to people for $0.75 each. That’s great for the consumer but not sustainable!

The original assumption was that AI would allow for self driving cars in the ‘next 5 years’ but it seems to be looking like this is increasingly becoming less likely to happen anytime soon (at least not without killing a lot of passengers and pedestrians).

Lyft and Uber aren’t startups anymore, they are publicly traded companies but they still receive capital either by taking in debt or from PIPE (Private Investment in Public Equity) and basically they’re in bite-each-others-dicks-off type fight for a monopoly- as soon as one grids the other into dust there’s the possibility of making a profit- by janking up the prices! If you think Uber/Lyft fares are expensive now wait until you see what they’d be like when there’s no competitors!

Despite all this analysts are still saying that Uber/Lyft are great investments to buy right now (Uber technically *has* made profits in the past).

It’s so weird to be living in late-stage capitalism!

#disclaimer: I am not a financial professional#this is not financial advice lol#I don’t know anything!

5 notes

·

View notes

Text

Tapuwa Dangarembizi - Investing in Sustainable Energy: Unlocking Future Prospects

In an era of climate change and depleting fossil natural reserves, the necessity of channeling resources into sustainable energy sources has become indispensable at an international level. It is not only an ideal solution to halt the prevalent degradation of our environment, but also reveals an abundance of opportunities for those with an appreciation for investing in the future. We are going to shed light on "Tapuwa Dangarembizi – How can you invest in sustainable energy for future prospects?" in this blog post, uncovering several ways people may participate in investing in sustainable energy.

Renewable Energy Infrastructure

Supporting clean energy infrastructure is a thrilling opportunity to implement sustainable energy. Wind farms, are an example of energy created by effortlessly harnessing the wind's force and converting it into energy. Solar power plants shine with radiant potential to harness the sun and turn that into energy. One can feel the surge as hydroelectric plants utilize the power of flowing water in sync with nature's rhythm. There are several opportunities to invest in these remarkable projects that drive clean energy growth while offering environmentally rewarding returns. Renewable energy companies are eager to invite investors from the public to join them in embarking on this transformative journey.

Exchange-Traded Funds and Mutual Funds

When exploring investment opportunities in sustainable energy, exchange-traded funds (ETFs) and mutual funds are two possibilities to be considered. These funds carefully distribute capital across a diverse portfolio of renewable energy companies by pooling investments from diverse individuals. These funds provide the opportunity to invest in a spectrum of clean energy companies, decreasing risks while providing an efficient channel for specific sector investments.

Green Bonds

Green bonds have recently experienced a significant increase in popularity in the world of finance, giving out a unique avenue for financing eco-conscious endeavors. Governments, municipalities, and corporations have jumped on board, distributing fixed-income securities to fund projects providing visible environmental advantages. Investing in green bonds ensures consistent profits and acts as a direct promoter for expanding sustainable energy initiatives. The World Bank, the European Investment Bank, and numerous environmentally friendly energy companies have all embraced this groundbreaking trend.

Energy Storage Solutions

The role of energy storage technologies in ensuring the seamless introduction of sustainable energy sources into the grid is vital. Among these, lithium-ion batteries stand out as a reaching-out option, demonstrating the very pulse of sustainable power. Investments in energy storage enterprises present a promising avenue. Such investments yield fiscal advantages and encourage a mutually beneficial connection with the growing demand for energy storage solutions.

Wrapping Up!

Investing in sustainable energy is more than a responsible choice for the environment. It is also a promising avenue for potential futures. With thorough research and taking into account factors such as financial performance, market dynamics, and a company's commitment to sustainability, you can contribute to positive change and tap into a rapidly growing industry guided by Tapuwa Dangarembizi by embracing sustainable energy that leads to a greener and more prosperous tomorrow. To enhance your knowledge about sustainable energy, you can also read Tapuwa Dangarembizi – How can individuals contribute to a sustainable energy future through investment.

#Tapuwa Dangarembizi#Sustainable Energy#Prospects#Infrastructure#Mutual Funds#Investment#natural#performance#technologies

3 notes

·

View notes

Text

Nova Scotia Power parent company expected to detail impact of power rate cap

The fallout from the Nova Scotia government's imposed rate cap on the province's privately owned electrical utility is expected to be detailed during Emera Inc.'s earnings call today.

The parent company of Nova Scotia Power says it will provide an updated rate base investment forecast and funding plan during its third-quarter call.

The utility had applied for a nearly 14 per cent rate hike over two years with the provincial regulator earlier this year.

But the province stepped in and passed legislation to limit the power rate increase to 1.8 per cent over the next two years, excluding increases linked to fuel costs.

The changes to the Public Utilities Act also took aim at the utility's profit by preventing the regulator from approving a rate of return on equity any higher than 9.25 per cent, down from the 9.5 per cent requested.

Nova Scotia Premier Tim Houston said last month on Twitter his government would "take the necessary steps to protect you from unfair rate increases while helping to ensure your lights stay on."

The Oct. 19 announcement sent Emera shares tumbling more than 10 per cent following a temporary trading halt, before recovering to just under five per cent down at close at $51.68 a share.

Nova Scotia Power said the cap has restricted its ability to invest in power grid upgrades and renewable sources of energy.

"This legislation prevents us from investing a planned half a billion dollars in clean energy projects in Nova Scotia," Nova Scotia Power spokeswoman Jacqueline Foster said in an email.

"It will take time to fully assess the implications of the legislation," she said. "In the meantime, we've pressed pause on our team's work on the Atlantic Loop."

The Atlantic Loop is a proposed $5-billion transmission megaproject, which would give the region more access to Labrador and Quebec hydroelectricity.

It's a key part of efforts to end the region's reliance on coal power.

Both Nova Scotia and New Brunswick have committed to phasing out their coal-fired generation by 2030, while Nova Scotia has enshrined in law its goals to reduce greenhouse gas emissions to at least 53 per cent below 2005 levels by 2030 and to achieve net-zero emissions by 2050.

Federal Natural Resources Minister Jonathan Wilkinson has said Nova Scotia has limited options to meet its goal of getting off coal asides from the Atlantic Loop, but called the conflict between Emera and the province a "bump in the road."

RBC Dominion Securities Inc. analyst Maurice Choy said in a client note that the cap could prompt Emera to limit investments in Nova Scotia Power and "redirect the capital to other parts of its business, including Florida."

Emera is the parent company of Tampa Electric, which operates on the west coast of Florida.

Choy also noted that Emera could cut 60 new reliability-related jobs outlined in the utility's 2022 general rate application filed in January as part of a broader effort to rein in operating costs.

Energy analyst Bill Marshall said the government shouldn't interfere in the work of the provincial regulator.

"The entity that exists, that is empowered to decide whether the application is fair or not, is the the Nova Scotia Utility and Review Board," said Marshall, president at WKM Energy Consultants Inc. in Fredericton, N.B. "They're the entity that has the power and responsibility to ensure Nova Scotia Power's investments are prudent and in the best interests of customers in Nova Scotia."

He added: "The government has overstepped its authority here by handcuffing the regulator from doing its job."

This report by The Canadian Press was first published Nov. 11, 2022.

from CTV News - Atlantic https://ift.tt/9JbQRBW

6 notes

·

View notes

Text

Top 10 Crypto Trading Bots

Top 10 AI Crypto Trading Bots

Navigating the fast-paced cryptocurrency market can be daunting, with constantly shifting trends and increasingly complex trading decisions. AI crypto trading bots offer a smart solution by automating trades and reducing risks. As the market evolves, these bots have become invaluable tools for enhancing trading efficiency. But before diving in...

What Are AI Crypto Trading Bots?

AI crypto trading bots are automated systems driven by machine learning and artificial intelligence. They continuously analyze market data and execute trades on behalf of users, operating 24/7. By making split-second decisions based on real-time data, these bots provide traders with a significant edge in the volatile crypto environment.

Looking to the Future? Partner with Us for Cutting-Edge Blockchain Development Services!

Top 10 Crypto Trading Bots of 2024

As cryptocurrency trading grows more complex, crypto trading bots have become essential for maximizing returns and managing risks. Here’s a rundown of the top 5 crypto trading bots for 2024, showcasing their key features.

1. 3Commas3Commas stands out with its user-friendly interface and advanced trading tools, making it a great choice for both beginners and seasoned traders. Its smart trading terminals and diverse automated bots offer both flexibility and efficiency.

Key Features of 3Commas

Smart Trading Terminals: Advanced tools that implement automated strategies for optimized trading.

Automated Bots: Supports various strategies including DCA, Grid, and Options bots.

Paper Trading: Test your strategies without risk using virtual funds.

Integrations: Seamlessly connects with top exchanges like Binance, Coinbase Pro, and Kraken.

Cryptohopper Cryptohopper stands out for its user-friendly strategy designer, allowing traders to create custom strategies without coding knowledge. Its market-making and arbitrage bots are especially beneficial for advanced traders.

Key Features of Cryptohopper

Market-Making Bot: Enhances liquidity and profitability with market-making strategies.

Arbitrage Bot: Capitalizes on price differences across multiple exchanges.

Strategy Designer: Enables the creation of custom strategies without the need for coding.

Social Trading: Follow and replicate strategies of top-performing traders.

Elevate your portfolio with our state-of-the-art crypto wallet development services. Let’s collaborate today!

Bitsgap Known for its excellent arbitrage and intuitive grid trading strategies, Bitsgap offers robust portfolio management tools for effortless investment tracking.

Key Features of Bitsgap

Arbitrage Opportunities: Spot and exploit arbitrage across numerous exchanges.

Grid Trading: Automate grid strategies for consistent profits.

Portfolio Management: Easily track and manage all your investments.

Demo Mode: Test your strategies in a risk-free environment.

Pionex Pionex excels with its range of free built-in trading bots and low fees, making it an ideal choice for navigating volatile markets.

Key Features of Pionex

Free Built-in Trading Bots: Offers 16 different bots at no additional cost.

Grid Trading Bot: Automates buying low and selling high in volatile markets.

Smart Trade Terminal: Tools to set stop-loss, take-profit, and trailing strategies.

Low Trading Fees: Exceptionally low fees, just 0.05% per trade.

Quadency Quadency provides a unified trading experience, combining multiple exchange accounts with advanced analytics for informed decision-making.

Key Features of Quadency

Unified Dashboard: Manage multiple exchange accounts from one platform.

Strategy Marketplace: Access pre-built strategies and implement them easily.

Automation: Customizable bots for seamless trading.

Analytics: Advanced tools to support smarter trading decisions.

Transform your business with our leading DeFi development services. Be part of the decentralized finance revolution!

TradeSanta TradeSanta’s DCA and grid bots are designed for traders who prefer automated strategies, with smart order routing to ensure the best prices.

Key Features of TradeSanta

DCA Bots: Automates dollar-cost averaging for strategic investments.

Grid Bots: Automates consistent profit-making strategies.

Smart Order Routing: Ensures optimal prices across multiple exchanges.

User-Friendly Interface: Simple setup and bot deployment.

Shrimpy Shrimpy is renowned for its social trading and portfolio rebalancing features, allowing users to follow top traders and automate portfolio adjustments.

Key Features of Shrimpy

Social Trading: Copy the trades of successful traders.

Portfolio Rebalancing: Automatically rebalance your portfolio for optimized performance.

Backtesting: Test strategies using historical market data.

API Integrations: Easily connect with major exchanges.

Zignaly Zignaly focuses on copy trading and signal providers, giving users a hands-off trading experience by following expert traders’ moves.

Key Features of Zignaly

Copy Trading: Replicate trades of expert traders.

Signal Providers: Subscribe to trading signals from professionals.

Unlimited Exchanges: Connect to multiple exchanges without restrictions.

Profit-Sharing: Share profits with professional traders.

Gunbot Gunbot is known for its extensive customization options and pre-built strategies, along with a supportive community for traders.

Key Features of Gunbot

Highly Customizable: Offers extensive options for customizing strategies.

Pre-Built Strategies: Includes popular strategies like Bollinger Bands and StepGain.

Backtesting and Simulation: Test strategies with historical data.

Robust Community Support: Active community offering strategy tips and advice.

HaasOnline HaasOnline is well-regarded for its sophisticated tools and high customization, making it a strong choice for advanced traders.

Key Features of HaasOnline

Highly Customizable: Tailor strategies to your specific needs.

Pre-Built Strategies: Includes Scalping, Arbitrage, and Market Making strategies.

Advanced Backtesting: Refine strategies using historical data before going live.

Strong Community Support: Backed by a vibrant community for sharing insights and strategies.

ConclusionAI crypto trading bots are transforming the way traders engage with the cryptocurrency market. By automating strategies, enhancing efficiency, and managing risks, these bots are invaluable tools for both beginners and experienced traders. As AI technology continues to evolve, the influence of these bots on the financial sector will only grow.

0 notes

Text

Expert Advisor

**Integrity Trader: An EA With Different Dimension**

Integrity Trader is a sophisticated Expert Advisor (EA) that integrates three distinct trading systems, each identified by its own unique magic numbers. The EA employs a variety of proven strategies, including Price Action, Candle Stick Patterns, RSI, Hedging, Grid, Pyramiding, and Averaging, among others.

From version 1.05 onward, Integrity Trader is enhanced with AI capabilities, allowing it to dynamically adjust lot sizes based on market structure.

The EA comes with optimized settings for EURUSD, tested from January 1, 2014, to June 14, 2024. During this period, Integrity Trader demonstrated remarkable resilience and profitability, achieving over 300 times the initial investment. An initial investment of $10,000 yielded more than $3,000,000 in profit.

While Integrity Trader is optimized for EURUSD, it can be adapted for other currency pairs with appropriate optimization.

Its Best Performance is for EURUSD 4H TF

You can find real account signals here: https://www.mql5.com/en/signals/2170987

Broker Information:

Integrity Trader performs best when used with RoboForex. To get started, please open an account using the following link: RoboForex Sign-Up.

For investments less than $10,000, it is recommended to open a Procent Account.

For investments of $10,000 or more, you can open a Pro Standard Account.

**Special Discount**

As a token of our appreciation for choosing our recommended broker, we are offering a direct discount of 50% for unlimited use of Integrity Trader. Simply register using the above link and send us your account number to receive your discount.

Expert Advisor**Inputs Definitions:**

- **Use Fixed Lot**: If set to True, a fixed lot size will be used for all trades, and the lot size will not increase with the account balance.

- **Fixed Lot**: The specific lot size to be used when "Use Fixed Lot" is set to True.

- **Auto Lot**: Enables automatic lot sizing. "Use Fixed Lot" must be set to False for this option to work.

- **Auto Lot Divider**: The formula for calculating the initial lot size is:

Lot Size= 0.00001 X(ACCOUNT_BALANCE)/Divider

For example, if the account balance is $10,000 and the divider is 5, the lot size will be 0.02. If the divider is 10, the lot size will be 0.01.

- **Martingale Factor**: The coefficient for opening subsequent lots if the trade is not in favor. This is turned off if set to 1.

- **TP in Pip**: The fixed Take Profit value in pips (each pip is 10 points).

- **Trade Gap in Pip**: The minimum trade gap in pips if the first trade is not favorable.

- **Max DD%**: Closes all trades if the drawdown exceeds this percentage value.

- **RSI Period**: Sets the period for the RSI indicator.

- **RSI Min for Sell**: The minimum RSI level for sell entries.

- **RSI Max for Buy**: The maximum RSI level for buy entries. Note that RSI is used in combination with other rules for trade entries.

- **Use Strategy 1, 2, 3**: Enable or disable any of the three integrated EAs you want to operate simultaneously, and set their respective magic numbers.

- **Use AI**: Enable or disable the artificial intelligence feature in the EA.

These options allow for customizable trading strategies and risk management tailored to your specific trading preferences and account conditions.

Expert Advisor

0 notes

Photo

Enhancing Your Crypto Trading Experience: Insights from Binance's Latest Features and Market Trends

In the ever-evolving world of cryptocurrency, staying ahead of the curve is crucial for traders and investors alike. Recent developments in the crypto space, particularly those highlighted by leading exchange Binance, offer valuable insights into emerging trends and tools that can elevate your trading experience.

Futures Grid Trading: A New Frontier

One of the most exciting advancements in crypto trading comes in the form of enhanced futures grid trading features. Binance's recent #BinanceBuild update aims to revolutionize how traders approach this strategy. The new features include:

These enhancements demonstrate the growing sophistication of trading tools in the crypto space. As the market matures, platforms are developing more advanced features to cater to the needs of both novice and experienced traders.

The Rise of Copy Trading

Another significant trend in the crypto trading landscape is the increasing popularity of copy trading. Binance has recently launched a Futures Mock Copy Trading Challenge, designed to introduce new users to this innovative approach. The challenge offers:

This initiative highlights the growing interest in social trading within the crypto community. By allowing less experienced traders to mimic the strategies of successful investors, copy trading has the potential to democratize access to profitable trading techniques.

Earning Opportunities in a Volatile Market

While trading remains a popular way to engage with cryptocurrencies, many investors are also exploring passive income strategies. Binance's recent announcements showcase several opportunities in this realm:

These diverse earning options reflect the crypto market's ongoing evolution towards more traditional financial products, potentially attracting a broader range of investors.

Market Insights and Educational Resources

Staying informed is crucial in the fast-paced world of cryptocurrency. Binance Research regularly provides market insights, covering topics such as:

For those looking to deepen their understanding, Binance also offers educational content on fundamental concepts. A recent example is their explainer on the Bid-Ask Spread, a crucial concept for anyone engaging in crypto trading.

The Importance of Community and Brand Building

Beyond trading and earning, the crypto space is deeply rooted in community. Binance's social media presence emphasizes this aspect, with frequent engagement and light-hearted content fostering a sense of belonging among users.

For projects looking to build their own communities, effective branding and online presence are essential. This is where tools like the Crypto Website Builder can play a crucial role, allowing new projects to quickly establish a professional online presence.

Emerging Trends: Memecoins and Video Content

While not explicitly mentioned in the Binance content, it's worth noting the ongoing popularity of memecoins in the crypto space. Tools like the Memecoin Explorer can provide valuable insights into this trend, helping traders and investors stay informed about the latest developments in this niche but influential sector.

Additionally, the growing importance of video content in crypto marketing shouldn't be overlooked. As projects seek to stand out in a crowded market, tools that facilitate the creation of engaging video content, such as crypto-focused video generators, are becoming increasingly valuable.

Conclusion

The cryptocurrency landscape continues to evolve at a rapid pace, with new trading features, earning opportunities, and community-building initiatives emerging regularly. By staying informed about these developments and leveraging the right tools, traders and investors can enhance their crypto experience and potentially improve their outcomes.

As always, it's essential to approach cryptocurrency investment with caution and conduct thorough research. The Financial Conduct Authority provides valuable guidance on the risks associated with crypto assets.

Whether you're a seasoned trader exploring advanced futures strategies, a newcomer interested in copy trading, or a project founder looking to establish your brand, the current crypto ecosystem offers a wealth of opportunities and tools to support your journey.

0 notes

Text

Set It and Forget It: Achieving Passive Income through Bybit's Spot Trade Bot

Cryptocurrency trading's inherent volatility can be daunting for newcomers, but with the right strategies, you can achieve significant returns without needing to be a trading expert. One of the most straightforward profit-making strategies is grid trading. This method leverages grid bots to automate buying and selling, capitalizing on the frequent price fluctuations in the crypto market.

Grid trading can be divided into two main types: futures grid trading bots and spot grid trading bots. In this article, we’ll explore the Bybit Spot Grid Bot, designed to allow conservative traders to relax while their passive income grows.

JOIN BYBIT by using our referral link : get FREE lifetime consultation

Key Takeaways:

The spot grid trading bot is a powerful tool in volatile markets, allowing traders to earn consistent profits from minor price movements while minimizing risks with set minimum and maximum price limits.

Bybit Spot Grid Bot enables you to maximize your earnings and trade across more markets with its advanced features and extensive selection of spot pairs, such as ETH/BTC and BTC/DAI.

The latest version, Bybit Spot Grid Bot 3.0, introduces improved features, including a wider grid range, instant profit withdrawals, and more BTC-quoted pairs.

What Is Spot Grid Trading?

Spot grid trading is a versatile tool that enables you to set up orders both above and below a specified price, forming a structured grid of buy and sell orders at incrementally rising or falling prices. This approach is particularly effective in volatile markets where prices fluctuate frequently. It’s an ideal strategy for traders who prefer a conservative approach, as it focuses on capturing profits from small price movements.

Once you configure the grid trading bot, it automatically begins placing buy and sell orders at various points within the defined price range. As long as the asset’s price moves within this range, you can generate profits without the need for active management.

How Do Spot Grid Trading Bots Work?

Most crypto grid trading bots operate in a similar manner. To start, you choose a spot grid pair and then set the lower and upper price limits. It’s important to note that there are maximum and minimum price thresholds for these limits. The next step is to determine the number of grids to create.

With Bybit Spot Grid Bot 3.0, you can set a minimum of two grids and a maximum of 330. The system automatically adjusts the maximum number of grids based on your selected price range. For instance, if you opt for a narrow price range, the maximum grid count will be reduced accordingly, ensuring that your profits are sufficient to cover trading fees.

After setting your price and grid parameters, the spot grid mode will immediately allocate your capital between the selected trading pair assets (e.g., BTC/USDT). A grid of varying price levels is then established between the lower and upper bounds you’ve defined, with your initial funds evenly distributed across the grids.

When the grid trading strategy is active, the bot will automatically sell a portion of your assets whenever the price of the cryptocurrency reaches the uppermost grid line. Conversely, the bot will purchase the asset when the price hits the lower grid line. You’ll earn a profit from the difference between the buy and sell orders.

Example Trade

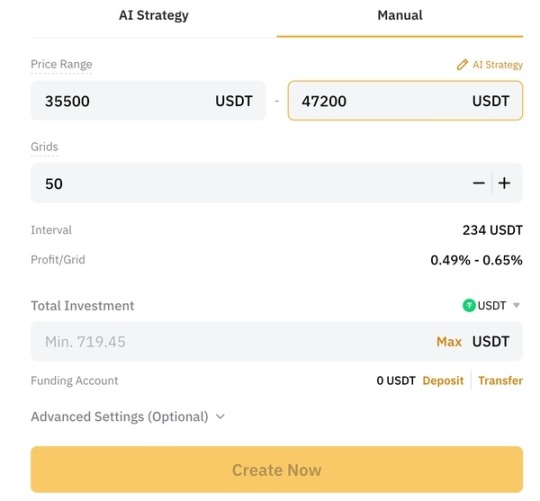

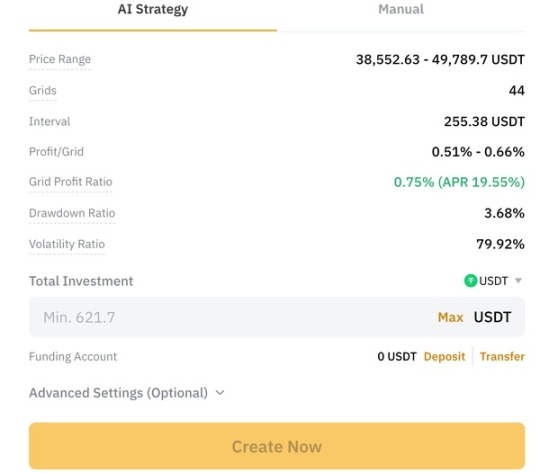

Let's say John has 20,000 USDT and wants to take advantage of BTC's price fluctuations, currently at $43,773.22. If he opts for the manual grid trading bot and sets a price range of 35,550 to 47,200 USDT, with 50 grids, the bot will place buy and sell orders at intervals of 234 USDT.

John's initial 20,000 USDT is evenly distributed across the grid lines by the grid trading bot. In this example, with 50 grid lines, each one receives 400 USDT (20,000 USDT divided by 50).