Don't wanna be here? Send us removal request.

Text

youtube

Market Outlook FY25: Why SIPs, Midcaps & Hybrid Funds Still Matter

Explore India’s market trajectory, sector-wise investment potential, and why hybrid funds like Balanced Advantage and Multi Asset Funds are ideal for long-term investors. Learn the importance of SIP discipline, asset allocation, and how to stay invested through all market cycles.

For more info: https://mutualfund.adityabirlacapital.com

Disclaimer: Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully.

1 note

·

View note

Text

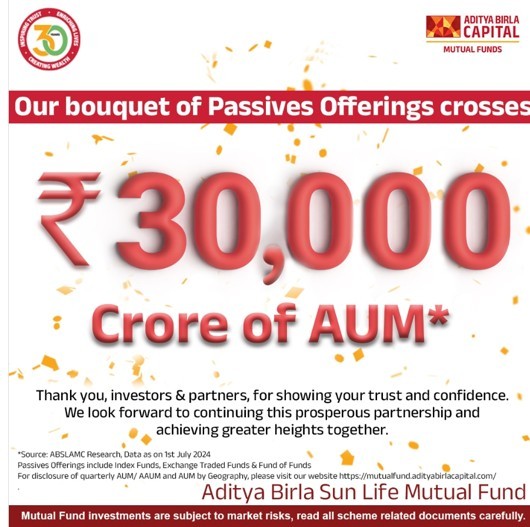

ABSLMF Crosses ₹30,000 Cr in Passive Offerings AUM Aditya Birla Sun Life Mutual Fund crosses ₹30,000 Cr in AUM across passive offerings, reflecting strong investor trust. Includes Index Funds, ETFs, and Fund of Funds. Data as on July 2024.

0 notes

Text

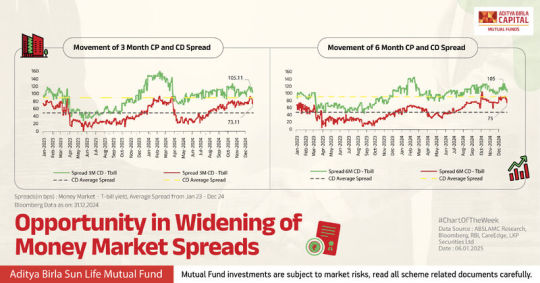

Opportunity in Widening of Money Market Spreads – ABSLMF

This chart highlights the widening spreads in 3-month and 6-month CP/CD instruments, showing potential opportunities in the money market space. Data as of Dec 2024.

0 notes

Text

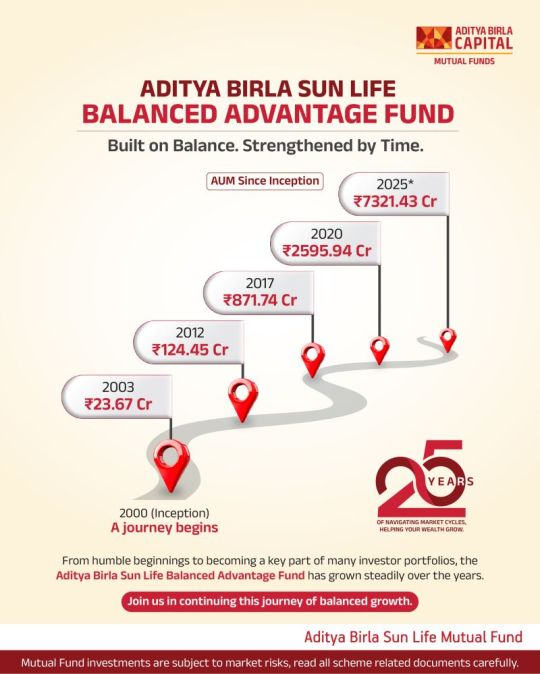

25-Year Journey of Aditya Birla Sun Life Balanced Advantage Fund

This infographic showcases the remarkable 25-year journey of the Aditya Birla Sun Life Balanced Advantage Fund, highlighting its AUM growth from ₹23.67 Cr in 2003 to over ₹7321 Cr in 2025 (estimated). Built on balance and strengthened over time, this fund reflects consistent investor trust and market resilience.

From humble beginnings to becoming a key part of investor portfolios, the Balanced Advantage Fund has stood the test of market cycles with a dynamic allocation strategy.

Explore more about this fund at: https://mutualfund.adityabirlacapital.com/products/wealth-creation-solutions/aditya-birla-sun-life-balanced-advantage-fund

0 notes

Text

youtube

Alternate Investments Outlook FY25: Navigating Opportunities in a Dynamic Market

FY25 was a year of two halves—marked by market volatility but also underpinned by India’s steady economic growth and strong investment frameworks. This video breaks down key events from the past financial year and presents our outlook on alternative investments moving into FY26.

We explore how structured strategies, private credit, and asset diversification played a crucial role in delivering solid returns—and why investor interest in alternate asset classes is expected to grow.

0 notes

Text

youtube

India’s Private Credit Market: 2024 Trends & What to Expect in 2025 Dive into India’s evolving private credit landscape. This video highlights key trends from 2024 and offers expert insights into what lies ahead for private debt in 2025. Learn about rising investor demand, the shift towards flexible capital, and the growing role of private credit in the Indian financial ecosystem.

https://mutualfund.adityabirlacapital.com/products/wealth-creation-solutions/aditya-birla-sun-life-flexi-cap-fund

#PrivateCreditIndia#AlternativeInvestments#PrivateDebt2025#InvestmentTrendsIndia#AdityaBirlaSunLife#mutual fund#investment#stock trading#stock market#Youtube

0 notes

Text

Unlock Growth with Aditya Birla Sun Life Flexi Cap Fund

A flexible equity mutual fund that invests across large-cap, mid-cap, and small-cap stocks — aiming to deliver long-term capital appreciation.

0 notes

Text

Stay Ahead with Aditya Birla Sun Life Balanced Advantage Fund

A dynamic fund that balances equity and debt to help you ride market ups and downs with confidence and stability.

#BalancedAdvantageFund#DynamicAssetAllocation#MarketVolatility#MutualFundInvestment#AdityaBirlaSunLifeMF

0 notes

Text

Diversify Smartly with Aditya Birla Sun Life Multi Asset Allocation Fund

Invest across equity, debt, and gold with one fund. The Aditya Birla Sun Life Multi Asset Allocation Fund is designed for stable, long-term wealth creation.

0 notes

Text

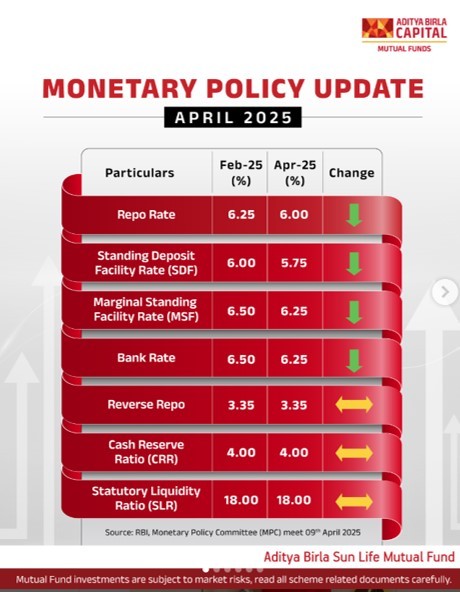

Monetary Policy Update – April 2025 | RBI Rate Cuts

RBI reduces key rates in April 2025 policy. Repo rate down to 6%, SDF and MSF also cut. CRR and SLR remain unchanged. See full update with comparisons.

0 notes

Text

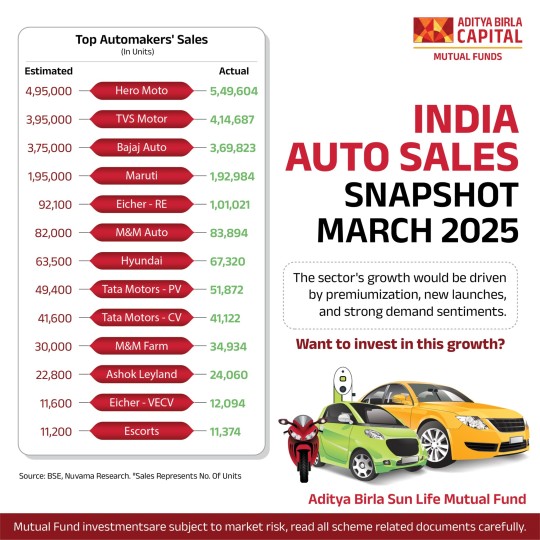

India Auto sales Snapshot March'25

See the March 2025 India auto sales update. Hero Moto, TVS, and Bajaj Auto lead growth, driven by premiumization, new launches, and strong demand.

0 notes

Text

India’s Growing Discretionary Spending Trend – 2030 Outlook

See how India’s household discretionary spending is rising, projected to reach 39% by 2030. Key insights from ABSL AMC, CLSA, Macquarie, Knight Frank.

1 note

·

View note