Don't wanna be here? Send us removal request.

Text

Streamline Your Workforce Management with an Advanced HRMS Software Solution

In today's fast-paced business world, managing human resources efficiently is key to organizational success. From recruitment to retirement, every phase of an employee's journey needs careful handling. This is where a robust HRMS Software Solution (Human Resource Management System) plays a pivotal role by automating and streamlining complex HR processes.

What is an HRMS Software Solution?

An HRMS software solution is an integrated suite designed to manage HR activities such as hiring, on boarding, payroll processing, performance appraisal, training, leave management, and compliance tracking — all from a single platform. It replaces outdated manual processes with digital workflows, ensuring accuracy, efficiency, and improved employee experience.

Key Features of a Modern HRMS Software Solution

Employee Information Management: Store, manage, and update employee records securely in a centralized database accessible anytime.

Payroll & Compensation Management: Automate salary calculations, tax deductions, reimbursements, and payslip generation to minimize payroll errors.

Leave & Attendance Tracking: Monitor attendance, leave balances, and approvals through self-service portals and mobile apps.

Performance Management: Set KPIs, conduct evaluations, and manage appraisals for objective performance tracking.

Recruitment & on boarding: Manage end-to-end recruitment, from job postings to candidate shortlisting and digital on boarding.

Compliance & Statutory Reporting: Stay updated with the latest labour laws and generate statutory reports with ease.

Training & Development: Plan and deliver employee training programs to boost skills and organizational productivity.

Benefits of Using an HRMS Software Solution

Time & Cost Efficiency: Automating routine HR tasks saves time and reduces administrative costs.

Data Accuracy: Centralized data eliminates redundancies and errors.

Improved Decision Making: Real-time reports and analytics help in workforce planning and management.

Enhanced Employee Satisfaction: Self-service portals allow employees to manage their own profiles, apply for leaves, and access payslips easily.

Compliance Assurance: Ensure that all statutory and regulatory requirements are met without manual intervention.

Why Every Business Needs an HRMS Solution?

Whether you’re a start-up or a large enterprise, an HRMS software solution ensures smooth HR operations, reduces human errors, and fosters a transparent work environment. It is scalable to fit the unique needs of various industries like IT, manufacturing, retail, healthcare, and more.

Choosing the Right HRMS Software Solution

When selecting an HRMS solution, consider the following:

Cloud or On-Premise Model

User-friendly Interface

Scalability & Customization Options

Integration with Other Enterprise Tools

Security Features & Data Protection

A reliable HRMS system ensures your workforce stays productive, engaged, and motivated while giving HR teams more time to focus on strategic initiatives rather than routine tasks.

Conclusion

In the digital transformation age, embracing an HRMS software solution is no longer optional — it’s essential. It empowers organizations to manage their most valuable asset — human capital — efficiently and effectively, driving business growth and success.

#HR Automation Solutions#Employee Management Software#Human Resource Management System#Payroll and HR Software#Cloud HRMS#HR Software India#Best HRMS Software#HRMS Software Solution

0 notes

Text

Why Choosing the Right TDS Software is Crucial for Hassle-Free TDS Return Filing?

For businesses, accountants, and tax professionals, TDS filing is one of the most important aspects of compliance under Indian tax laws. Manual TDS filing can be time-consuming, error-prone, and complex. That’s where a reliable TDS software comes in — to simplify the process, ensure accuracy, and save valuable time.

What is TDS Software?

TDS software is a specialized tool designed to help individuals and companies in calculating, deducting, and filing Tax Deducted at Source (TDS) as per the Income Tax Department's guidelines. It automates tasks such as PAN verification, TDS computation, form generation, and e-filing, which helps in reducing the chances of errors and penalties.

Why Use TDS Return Filing Software?

When it comes to filing TDS returns, choosing the right TDS return filing software is crucial. It helps in:

Automating the entire TDS process

Filing quarterly returns without hassle

Generating Form 16, 16A, and other TDS certificates

Ensuring compliance with the latest government norms

A user-friendly TDS return software reduces workload and risk while offering accurate results.

Looking for Free TDS Filing Software?

If you are a small business or a freelancer handling limited TDS responsibilities, you may want to explore free TDS filing software options. Some platforms offer basic functionality in their TDS software free versions, which is suitable for individuals or small-scale filers.

For more advanced features like bulk PAN verification, data import/export, and error detection, a premium solution or genius TDS software is highly recommended, which is widely used by professionals across India.

The Need for Quality TDS Return Filling Software

It is important to choose reliable TDS return filling software that ensures your TDS returns are filed accurately and on time. These solutions allow bulk data handling, quick error correction, and seamless uploading to the TRACES portal.

How to Get TDS Software Free Download?

Several providers offer TDS software free download trials so users can test functionalities before committing to a full version. While free trials are helpful, ensure the software you choose complies with the latest tax laws and offers regular updates.

Genius TDS Software – A Trusted Name

For professionals looking for a feature-rich, efficient, and trustworthy solution, Genius TDS Software is among the best choices. It offers:

Easy data import from Excel

Error validation tools

E-filing with direct portal integration

Auto-generation of TDS certificates

Conclusion

Whether you are searching for TDS return software, a TDS return filing software, or considering a TDS software free download, the right tool can make all the difference in ensuring compliance and avoiding penalties. Small businesses may benefit from free TDS filing software, but for bulk handling and advanced features, premium solutions like Genius TDS Software offer great value.

0 notes

Text

Why GST Software is a Must-Have for Professionals in 2025

In today’s dynamic tax landscape, managing GST compliance efficiently is crucial for businesses, tax professionals, and accountants. With frequent regulatory changes and the complexity of GST returns, relying on manual processes can be time-consuming and error-prone. This is where GST software for professionals comes into play.

What is GST Software for Professionals?

GST software for professionals is specifically designed to simplify GST return filing, reconciliation, and compliance for CAs, tax consultants, and accountants. It automates the entire process, ensuring accuracy, saving time, and reducing penalties due to manual errors.

2A and 2B Reconciliation Made Easy

One of the most critical and complex parts of GST filing is the reconciliation of GSTR-2A and GSTR-2B with your purchase records. 2A reconciliation software and 2B reconciliation software help tax professionals quickly match the Input Tax Credit (ITC) available in GST portals with purchase registers. This automation eliminates mismatches, ensures maximum ITC claims, and reduces the chances of GST notices.

Benefits of Using 2A/2B Reconciliation Software:

Real-time mismatch detection

Bulk data reconciliation

Vendor-wise mismatch reports

Improved ITC accuracy

Why You Need GST Return Filing Software?

Filing GST returns manually involves the risk of errors and missed deadlines. GST return filing software streamlines the filing process, auto-populates data, provides return status updates, and integrates with accounting systems. This ensures that every GST-registered business or professional meets compliance requirements effortlessly.

Features of Best GST Filing Software:

Auto-import of GSTR data from the GSTN portal

Error detection before filing

Easy handling of multiple GSTINs

Dashboard for return status tracking

How to Choose the Best GST Software?

When selecting the best GST filing software, professionals should look for:

User-friendly Interface: Easy to operate even for non-tech users.

High-Speed Reconciliation: Ability to process bulk data quickly.

Comprehensive Reports: For audits and departmental scrutiny.

Regular Updates: As per the latest GST amendments.

Affordability & Scalability: Suitable for both small firms and large enterprises.

Conclusion

Incorporating a robust GST software for professionals ensures seamless GST return filing, effortless 2A/2B reconciliation, and complete tax compliance. Investing in the best GST filing software not only enhances efficiency but also provides peace of mind by reducing the risks associated with GST management.

If you're looking for a feature-rich and reliable GST solution, explore options that offer 2A/2B reconciliation and automated GST return filing in one unified platform.

#gst software for professionals#2B reconciliation software#2a reconciliation software#gst return filing software#best gst filing software#Gst Software

0 notes

Text

GSTR 9: Annual GST Return

The annual return filing, known as GSTR 9, is required to be filed by every taxpayer before 31st December. This blog aims to provide a comprehensive guide to GSTR 9, helping businesses navigate through the complexities of this crucial annual return.

What is GSTR-9 annual return?

GSTR-9 is the annual return that every registered taxpayer under GST must file. It consolidates the details of all the monthly or quarterly returns filed during the financial year. The purpose of GSTR-9 is to provide a summary of the taxpayer's outward and inward supplies, tax liability, input tax credit (ITC) claimed, and other relevant details.

Who is liable to file GSTR-9, the annual return?

All taxpayers/taxable persons registered under GST must file their GSTR-9. Except:

Casual Taxpayers

Input Service Distributors

Non-resident Taxpayers

Taxpayers under composition scheme (They must file GSTR-9A)

E-commerce operators (They must file GSTR-9B)

TDS deduction or TCS collector under Section 51 or Section 52 of the CGST Act.

For FY 17-18 & 18-19, it is mandatory only if turnover exceeds Rs 2 crore.

What is the due date for filing GSTR-9?

GSTR 9 (GST Annual Return) is to be filed by 31 December of the year following the particular financial year. Accordingly, businesses should file GSTR-9 for FY 2022-23 by 31st December 2023.

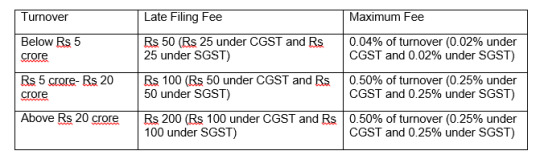

What is the late filing fee for GSTR 9?

The late filing fee for GSTR 9 has been categorized based on the turnover of the taxpayer w.e.f. FY 2022-23:

What details are required to be filled in GSTR-9?

The basic details which have to be provided in GSTR-9 are as follows:

Details of Sales with the breakup of those on which tax is payable and not payable.

Details of Purchases.

Tax payable.

Input Tax Credit available and reversed.

Details of transactions of sales and Input tax credit in the subsequent year but pertaining to the year for which return is being filed.

Besides that other details like HSN wise breakup of Sales & Purchases, Summary of Demands & Refunds, etc have to be provided.

For FY 17-18 & 18-19, some of the sections have been made optional.

Can a “NIL” GSTR-9 return be filed?

Yes, a Nil GSTR-9 can be filed if all the following conditions are satisfied:

No outward supply.

No receipt of goods/services.

No other liability to report.

Not claimed any credit.

No refund claimed.

No demand order received.

No late fees to be paid.

If the figure has to be reported in any of these, nil return cannot be filed.

How Web-GST simplifies your GST filing?

Web-GST is an across the board GST software that simplifies your GST return filing experience with useful tools & insightful reports.

No outward supply. Desktop-based Solution with 100% Data Security.

Easy & Prompt way to prepare & file GSTR 1, 3B, 9, & 9C etc.

Download GSTR-2A in one-click for the whole financial year or YTD.

Automatically identifies data mismatches for GST compliance.

Claim 100% accurate ITC with the Advanced Matching Tool.

Track GST Returns Filing Status on a single dashboard.

Experience Seamless Integration with ERPs and GSTN (Premium version).

1 note

·

View note