#TDS software

Explore tagged Tumblr posts

Text

Why Choosing the Right TDS Software is Crucial for Hassle-Free TDS Return Filing?

For businesses, accountants, and tax professionals, TDS filing is one of the most important aspects of compliance under Indian tax laws. Manual TDS filing can be time-consuming, error-prone, and complex. That’s where a reliable TDS software comes in — to simplify the process, ensure accuracy, and save valuable time.

What is TDS Software?

TDS software is a specialized tool designed to help individuals and companies in calculating, deducting, and filing Tax Deducted at Source (TDS) as per the Income Tax Department's guidelines. It automates tasks such as PAN verification, TDS computation, form generation, and e-filing, which helps in reducing the chances of errors and penalties.

Why Use TDS Return Filing Software?

When it comes to filing TDS returns, choosing the right TDS return filing software is crucial. It helps in:

Automating the entire TDS process

Filing quarterly returns without hassle

Generating Form 16, 16A, and other TDS certificates

Ensuring compliance with the latest government norms

A user-friendly TDS return software reduces workload and risk while offering accurate results.

Looking for Free TDS Filing Software?

If you are a small business or a freelancer handling limited TDS responsibilities, you may want to explore free TDS filing software options. Some platforms offer basic functionality in their TDS software free versions, which is suitable for individuals or small-scale filers.

For more advanced features like bulk PAN verification, data import/export, and error detection, a premium solution or genius TDS software is highly recommended, which is widely used by professionals across India.

The Need for Quality TDS Return Filling Software

It is important to choose reliable TDS return filling software that ensures your TDS returns are filed accurately and on time. These solutions allow bulk data handling, quick error correction, and seamless uploading to the TRACES portal.

How to Get TDS Software Free Download?

Several providers offer TDS software free download trials so users can test functionalities before committing to a full version. While free trials are helpful, ensure the software you choose complies with the latest tax laws and offers regular updates.

Genius TDS Software – A Trusted Name

For professionals looking for a feature-rich, efficient, and trustworthy solution, Genius TDS Software is among the best choices. It offers:

Easy data import from Excel

Error validation tools

E-filing with direct portal integration

Auto-generation of TDS certificates

Conclusion

Whether you are searching for TDS return software, a TDS return filing software, or considering a TDS software free download, the right tool can make all the difference in ensuring compliance and avoiding penalties. Small businesses may benefit from free TDS filing software, but for bulk handling and advanced features, premium solutions like Genius TDS Software offer great value.

0 notes

Text

Benefits of Using Online TDS Software for Tax Return Filing

Filing tax returns can be a tedious and time-consuming process, especially when done manually. With changing tax regulations and strict deadlines, businesses and individuals need an efficient way to manage tax compliance. This is where TDS Software becomes an essential tool. The Best TDS Software India provides an automated, error-free, and streamlined approach to tax return filing, helping businesses stay compliant while reducing administrative burdens.

One of the biggest advantages of using TDS Software is the accuracy it provides. Manual tax calculations often lead to errors, which can result in rejected returns or financial penalties. The Best TDS Software India ensures that calculations are automated and error-free, reducing the chances of incorrect filings. By integrating the latest tax rules and government regulations, TDS Software helps businesses stay updated with compliance requirements without having to constantly track policy changes.

Time efficiency is another major benefit of using TDS Software. Filing tax returns manually can take hours or even days, depending on the complexity of the tax deductions and data volume. The Best TDS Software India significantly reduces the time required for tax filing by automating processes such as PAN verification, challan verification, and form generation. With a few clicks, businesses can generate and file accurate tax returns, allowing them to focus on core operations rather than spending excessive time on tax compliance.

Another crucial advantage of using TDS Software is the reduction of paperwork. Traditional tax filing methods require extensive documentation, making it difficult to organize and retrieve tax-related information when needed. The Best TDS Software India provides a cloud-based platform that stores all tax records securely, making access easier and reducing the dependency on physical documents. This also ensures that businesses have a digital backup of their financial records, preventing data loss due to misplaced files or system failures.

Security is a key concern when dealing with financial data, and the Best TDS Software India ensures that sensitive tax information is well-protected. With encrypted storage, secure access controls, and cloud backups, businesses can have peace of mind knowing that their tax data is safe from unauthorized access. Online TDS Software offers multi-layer security protocols that prevent data breaches while ensuring that only authorized personnel can access tax records.

The Best TDS Software India also offers seamless integration with accounting and payroll systems, reducing manual data entry and ensuring accurate tax deductions. Businesses that use accounting software for managing financial transactions can benefit from TDS Software that integrates with these platforms, streamlining tax calculation and return filing. This integration minimizes discrepancies and enhances efficiency, making tax compliance smoother and hassle-free.

Flexibility is another major advantage of using online TDS Software. With cloud-based access, businesses can file tax returns from anywhere at any time. Whether working from an office, a remote location, or on the go, users can access their TDS Software to complete tax filing tasks without being tied to a specific system. The Best TDS Software India provides real-time access to tax data, allowing businesses to track and monitor their tax filings effortlessly.

Regulatory compliance is a critical aspect of tax filing, and TDS Software ensures that businesses adhere to government regulations without unnecessary complications. The Best TDS Software India includes built-in validation checks that prevent incorrect filings, reducing the risk of penalties and audits. Automated compliance tracking ensures that businesses meet tax deadlines and avoid last-minute rushes, making tax return filing a stress-free process.

Tax professionals and consultants also benefit from using TDS Software, as it allows them to manage multiple clients efficiently. The Best TDS Software India provides multi-user access, enabling tax professionals to handle tax returns for different clients from a single platform. This increases productivity and simplifies tax management for firms that deal with high volumes of tax filings.

The ease of use provided by the Best TDS Software India makes it an ideal choice for businesses of all sizes. Even those without extensive tax knowledge can navigate the software easily, thanks to user-friendly interfaces and step-by-step guidance. Automated data validation, error notifications, and online support further enhance the user experience, ensuring that tax filing is completed smoothly without confusion or mistakes.

Cost-effectiveness is another key factor that makes TDS Software a preferred choice for businesses. The Best TDS Software India eliminates the need for expensive manual processes and reduces the cost associated with hiring tax professionals for routine tax filing tasks. Cloud-based solutions offer subscription-based pricing, allowing businesses to choose plans that suit their budget and requirements without incurring unnecessary expenses.

The ability to generate comprehensive reports is another major advantage of using TDS Software. Businesses can access detailed tax reports, transaction histories, and compliance summaries, making financial management more transparent and organized. The Best TDS Software India provides insights into tax deductions, helping businesses make informed financial decisions while maintaining compliance with tax regulations.

Choosing the Best TDS Software India is a smart investment for businesses that want to simplify tax return filing while ensuring accuracy, security, and compliance. With features like automated calculations, real-time updates, cloud storage, and seamless integration, TDS Software makes tax compliance effortless. Businesses no longer need to struggle with complex tax filings or worry about errors, as the right TDS Software provides a streamlined and efficient approach to managing tax returns.

As the tax landscape continues to evolve, businesses need reliable solutions that keep up with changing regulations and compliance requirements. The Best TDS Software India offers a technology-driven approach to tax filing, ensuring that businesses can meet their obligations with ease and confidence. By automating tax deductions, improving accuracy, and enhancing efficiency, TDS Software is the ultimate tool for businesses looking to simplify their tax compliance process and focus on growth.

1 note

·

View note

Text

TDS Software: Simplifying Tax Deduction Management

Managing tax deductions at source (TDS) is a critical task for businesses to ensure compliance with taxation laws. TDS software solutions have emerged as an essential tool for organizations of all sizes, offering efficiency, accuracy, and ease in handling TDS-related processes.

What is TDS Software?

TDS Software is a specialized application designed to streamline the management of tax deducted at source. It automates key tasks such as calculating deductions, generating TDS certificates, filing returns, and maintaining compliance with government regulations. These tools are indispensable for businesses, reducing the manual effort and potential errors involved in TDS management.

Key Features of TDS Software

Automated Calculation: Accurate computation of TDS for salaries, contracts, rents, and more.

Compliance Monitoring: Real-time updates to ensure adherence to the latest tax laws.

e-Filing Integration: Seamless generation and submission of TDS returns online.

Reports and Analytics: Detailed reports for better financial oversight and audits.

Error Detection: Built-in validation to minimize errors in filing returns.

Benefits of Using TDS Software

Time Efficiency: Automates repetitive tasks, allowing businesses to focus on core activities.

Cost Savings: Reduces dependency on manual resources and external consultants.

Improved Accuracy: Eliminates human errors, ensuring precise tax calculations and reporting.

Data Security: Protects sensitive financial information with encryption and secure storage.

Popular TDS Software Solutions

Some popular TDS software options include ClearTax, Saral TDS, and TDSMAN. These tools cater to a variety of business needs, providing scalable and user-friendly solutions.

By integrating TDS software into their operations, businesses can simplify tax management, maintain compliance, and avoid penalties. As regulations continue to evolve, these tools are an investment in efficiency and peace of mind.

1 note

·

View note

Text

Tax Print : Your Partner for Affordable & Complete Tax & Accounting

Taxprint is a leading online payroll software company that provides comprehensive payroll solutions to businesses of all sizes in India. Our user-friendly software simplifies payroll management, ensuring timely and accurate processing of TDS, eTDS, ITR, and asset management tasks.

#asset management software#it asset management software#hr software#fixed asset#tax software#compliance management#asset management system#management software#fixed asset management#payroll management software#asset management tools#tds software#software payroll

0 notes

Text

harold crime moodboard

#finally a sequel to duncan with lips moodboard#i did make this at 1am with a crusty software tho so its not my best work im afraid#total drama#harold day#td harold

113 notes

·

View notes

Text

Home - Monetta Software Solutions - Tally

Monetta Software Solutions are Certified Sales & Service Partner for Tally since 2009 serving more than 3500 clients for their business accounting needs.

Know More :- https://monettaindia.com/

#Tally#Tally Cloud#Tally Software#Tally Renewal#Tally Customization#GreytHR#TSS#TDS#Tally Prime#Tally ERP-9#Tally Monetta#Tally on Cloud#CloudAccounting#BusinessGrowth#tallyprime#tally#tallysolutions#databackup#tallysoftware#tallysupport#monettasoftware#monettaindia#tallyprimeaws#silver#tallyoncloud#monetta#business#software#businessmanagement#TallyERP9

2 notes

·

View notes

Text

Automate Your Tax Workflow: Why Every Business Needs TDS Filing Software

TDS (Tax Deducted at Source) is one of the most complex yet essential compliance tasks for Indian businesses. Whether you run a startup or a large enterprise, timely and accurate TDS filing can’t be ignored. Modern solutions like CompuTax TDS Filing Software automate this process and ensure you're always audit-ready.

Common TDS Filing Challenges

Many businesses face:

Incorrect PAN validation

Manual entries for Form 24Q, 26Q

Delayed filing and late fees

Mismatches in employee tax deduction and payroll

That’s why integrated payroll software and TDS filing platforms are crucial.

What CompuTax TDS Filing Software Offers

Auto-generation of Form 24Q/26Q

Online PAN validation

Bulk import/export from Excel or ERP

Quarterly e-TDS return filing

It also syncs with income tax software for hassle-free end-to-end compliance.

Smart Tax Planning Tools

Income Tax Calculator

Use the built-in income tax calculator to project and validate TDS deductions.

Advance Tax Calculator

Estimate and manage advance tax payments using real-time payroll and TDS data via the advance tax calculator.

Seamless GST Integration

TDS reconciliation also affects vendor payments and GST reporting. The software integrates with GST filing workflows to reduce mismatches.

Conclusion

Using standalone systems creates friction. Invest in an integrated platform like CompuTax TDS Filing Software to unify your tax filing, payroll, and GST workflows.

1 note

·

View note

Text

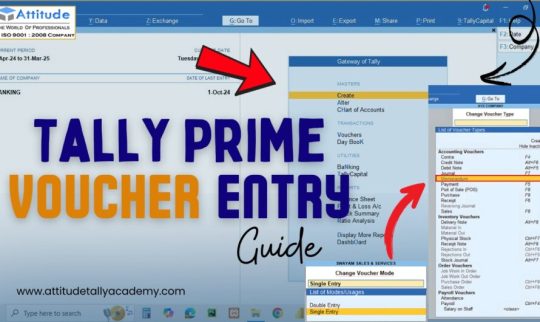

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

GST RETURN

0 notes

Text

What is GST Simulation Software? A Complete Guide

The introduction of Goods and Services Tax (GST) has transformed tax systems worldwide, simplifying taxation while posing new challenges for businesses, particularly in compliance and accurate tax calculation. GST Simulation Software has become an invaluable tool for businesses of all sizes, providing a digital solution to manage GST calculations, reporting, and compliance. But what exactly is GST Simulation Software, and how can it help organizations? In this comprehensive guide, we’ll dive into everything you need to know about GST Simulation Software, its benefits, features, and how to choose the right software for your business.

Table of Contents

What is GST Simulation Software?

How Does GST Simulation Software Work?

Key Features of GST Simulation Software

Benefits of Using GST Simulation Software

Types of GST Simulation Software

Common Applications of GST Simulation Software

How to Implement GST Simulation Software in Your Business

Tips for Choosing the Right GST Simulation Software

Top GST Simulation Software in the Market

Potential Challenges with GST Simulation Software

Conclusion

1. What is GST Simulation Software?

GST Simulation Software is a digital tool designed to automate and simplify GST-related tasks. It helps businesses calculate and simulate their GST obligations based on the current GST rates, laws, and regulations. By using this software, companies can predict their GST liabilities, prepare for tax filings, and avoid costly errors in tax reporting.

This software is particularly useful for businesses operating in multiple tax jurisdictions, as it incorporates region-specific rules and automates compliance, reducing the risk of human error. Essentially, GST Simulation Software ensures that businesses adhere to tax laws while simplifying the process of managing their tax obligations.

2. How Does GST Simulation Software Work?

GST Simulation Software uses real-time data and rule-based algorithms to calculate and simulate GST. The software typically integrates with a company’s accounting or ERP system, enabling it to access financial data directly. Based on this information, it applies GST rates to different transactions, depending on the nature of goods and services, jurisdiction, and applicable exemptions.

Many GST Simulation Software platforms are powered by machine learning and artificial intelligence, which allow them to stay up-to-date with changing tax regulations and predict GST amounts accurately. By running various simulations, businesses can get insights into their potential tax liabilities and prepare accordingly.

3. Key Features of GST Simulation Software

While the features of GST Simulation Software can vary, here are some common ones that help businesses manage their GST obligations efficiently:

Automated Calculations: Calculates GST based on applicable tax rates, making it easier to handle complex transactions.

Multi-Jurisdiction Compliance: Supports multiple regions and jurisdictions, ensuring the right rates and rules are applied for each location.

Real-Time Reporting: Provides up-to-date reports on tax liabilities, helping companies stay compliant and informed.

Data Integration: Integrates with accounting and ERP systems for seamless data transfer and accurate calculations.

Customizable Dashboards: Allows users to customize reports and dashboards to view important metrics at a glance.

Error Detection: Identifies discrepancies and errors in tax calculations to reduce risk and ensure accuracy.

User-Friendly Interface: Many tools offer easy-to-navigate interfaces that make it simple for users of all experience levels.

4. Benefits of Using GST Simulation Software

Using GST Simulation Software offers several benefits, including:

a) Enhanced Compliance

With automated updates to tax laws and regulations, businesses can stay compliant without constantly monitoring changes manually. This reduces the risk of non-compliance, which can lead to penalties.

b) Time Efficiency

Manual GST calculations are time-consuming, especially for large businesses with extensive transactions. GST Simulation Software automates these tasks, saving valuable time for finance teams.

c) Accuracy and Reduced Errors

By using rule-based calculations, the software ensures accuracy in GST simulation, minimizing the chance of human error in tax calculations.

d) Cost Savings

Automating GST management with software reduces the need for dedicated tax specialists and minimizes potential fines, leading to significant cost savings.

e) Data-Driven Insights

Many GST Simulation Software tools come with analytics capabilities, providing insights into GST trends and helping companies make data-driven decisions.

5. Types of GST Simulation Software

There are several types of GST Simulation Software tailored to different business needs:

a) Cloud-Based GST Software

This type of software is hosted on the cloud, offering easy access from any device and reducing the need for on-premise infrastructure. It’s suitable for businesses that require flexibility and scalability.

b) On-Premise GST Software

On-premise GST Simulation Software is installed on a company’s local servers, giving them complete control over their data. It’s a better fit for businesses with specific security or customization requirements.

c) Hybrid GST Software

Hybrid software combines elements of both cloud and on-premise solutions, giving companies the flexibility to manage certain operations in-house while using cloud capabilities for other tasks.

d) Industry-Specific GST Software

Some software solutions are designed for specific industries with unique GST requirements, such as manufacturing, retail, or healthcare. These solutions are tailored to meet the distinct needs of these industries.

6. Common Applications of GST Simulation Software

GST Simulation Software is versatile and can be used in various applications:

Tax Calculation: Calculate GST on individual transactions based on product type, jurisdiction, and other factors.

GST Return Preparation: Generate reports required for GST returns, simplifying the filing process.

Audit Support: Generate detailed reports and maintain records for audits.

Financial Forecasting: Predict future tax liabilities based on simulated scenarios and projected financial performance.

Scenario Analysis: Run simulations to understand how changes in tax laws or rates might impact your business.

7. How to Implement GST Simulation Software in Your Business

Implementing GST Simulation Software involves several steps:

Identify Your Business Needs: Determine the specific needs of your business and the type of software that best fits those needs.

Evaluate Software Options: Research different software providers, looking at features, compatibility, and cost.

Plan for Integration: Ensure the software integrates seamlessly with your existing systems, such as your ERP or accounting software.

Training and Onboarding: Train your staff on how to use the software effectively.

Monitor and Optimize: Regularly assess the software’s performance and make adjustments as needed to maximize efficiency.

8. Tips for Choosing the Right GST Simulation Software

Choosing the right GST Simulation Software can be overwhelming with so many options on the market. Here are a few tips:

Understand Your Budget: Choose software that fits within your budget but still provides the features you need.

Look for Scalability: Select software that can grow with your business, especially if you plan on expanding operations.

Check for Customer Support: Look for providers that offer comprehensive customer support to help with setup, troubleshooting, and maintenance.

Consider Security Features: Ensure the software has robust security features, particularly if handling sensitive financial data.

Evaluate Usability: Opt for software that is user-friendly and provides an intuitive interface for your team.

9. Top GST Simulation Software in the Market

Here’s a look at some of the top GST Simulation Software currently available:

Zoho Books: Known for its user-friendly interface and strong integration capabilities, Zoho Books is ideal for small to medium-sized businesses.

Tally ERP 9: Popular in various regions, especially India, Tally ERP 9 offers robust GST capabilities and a comprehensive set of features for accounting and compliance.

QuickBooks: This software provides excellent GST simulation features, along with a range of accounting tools for small businesses.

SAP GST Solutions: SAP provides a high-level GST simulation solution suitable for large corporations needing extensive customization.

10. Potential Challenges with GST Simulation Software

While GST Simulation Software offers many benefits, there are potential challenges to be aware of:

Initial Setup Costs: Some software may require a significant upfront investment, particularly for on-premise solutions.

Training Requirements: Employees may need time and training to learn the new software, which could temporarily impact productivity.

Data Security: Cloud-based solutions need to ensure data protection to prevent unauthorized access or breaches.

Continuous Updates: GST regulations change frequently, and if the software is not updated promptly, it could lead to inaccuracies in calculations.

GST Simulation Software is an essential tool for businesses navigating the complexities of Goods and Services Tax. By automating tax calculations, providing real-time reporting, and ensuring compliance, it empowers organizations to manage their GST obligations with greater accuracy and efficiency. While the initial investment and training requirements can be challenging, the long-term benefits in terms of time, cost savings, and data accuracy make it a worthwhile consideration for any business subject to GST regulations. When selecting GST Simulation Software, businesses should carefully assess their specific needs, budget, and desired features to choose a solution that supports their tax management goals effectively.

For More Details Visit us

StudyAccounts.com

#GST simulation software#GST filing simulation software#GST simulation software for institutes#ITR simulation software#Income tax simulation software#Gulf VAT simulation software#TDS Simulation Software#TAX Simulation Software for institutes

0 notes

Text

Advance Your Career with Our Advanced Tally Prime Course in Vasai-Virar

Introduction

Hello, aspiring accountants of Vasai-Virar! Are you ready to elevate your accounting skills and secure a promising future in finance? Our Advanced Tally Prime Course is designed specifically for students like you who are eager to deepen their knowledge and expertise. This course offers a perfect blend of theory and practical experience to ensure you excel in your career. Let’s explore why this course is the ideal step forward for you and how it can benefit your professional journey.

The Value of Tally Prime

Why Master Tally Prime?

Tally Prime isn’t just another accounting software—it's a powerful tool that simplifies financial management and boosts productivity. Here’s why mastering Tally Prime can significantly enhance your career:

User-Friendly Interface: Its intuitive design makes it accessible and easy to use.

Comprehensive Features: Handles everything from basic bookkeeping to advanced financial management.

Industry-Standard: Trusted by businesses worldwide, making your skills highly valuable.

Expanding Career Opportunities

Proficiency in Tally Prime opens numerous career opportunities. As more businesses rely on Tally Prime for their accounting needs, your expertise will be in high demand, significantly boosting your employability.

Course Overview

Detailed Course Curriculum

Our Advanced Tally Prime Course covers all the essential aspects of advanced accounting. Here’s what you can expect:

Module 1: Advanced Accounting

Handling Complex Transactions: Learn to manage intricate financial transactions seamlessly.

Multi-Currency Accounting: Gain expertise in handling accounts across different currencies.

Bank Reconciliation: Master the process of reconciling bank statements with business accounts accurately.

Module 2: Inventory Management

Optimizing Inventory: Efficiently categorize and manage inventory.

Stock Movement Analysis: Get insights into stock movement and aging analysis.

Order Processing: Understand the entire order processing cycle, from purchase to sales orders.

Module 3: Taxation

Mastering GST: Dive deep into Goods and Services Tax (GST) and its applications.

Managing TDS: Learn about Tax Deducted at Source (TDS) and its compliance.

Filing Taxes: Gain hands-on experience in filing various tax returns using Tally Prime.

Module 4: Payroll Management

Detailed Employee Records: Maintain comprehensive employee records efficiently.

Processing Payroll: Master payroll processing, including detailed salary calculations and deductions.

Ensuring Compliance: Ensure compliance with statutory requirements related to employee compensation.

Flexible Learning Schedule

We understand the importance of balancing your studies with other commitments. Our course spans three months, with classes held thrice a week, offering a flexible schedule that fits into your busy life.

Why Our Course Stands Out

Experienced Instructors

Our instructors are seasoned professionals with extensive experience in Tally Prime. They bring real-world insights and practical knowledge into the classroom, making complex concepts easier to understand and apply.

Modern Learning Environment

Our training center in Vasai-Virar is equipped with state-of-the-art facilities. Each student has access to the latest version of Tally Prime and other essential tools, ensuring a conducive learning environment.

Hands-On Experience

We believe in learning by doing. Our course includes real-world projects and case studies, providing you with practical experience that goes beyond theoretical knowledge. This hands-on approach ensures you’re ready to tackle real business challenges confidently.

How This Course Will Benefit You

Mastering Advanced Skills

Enrolling in our Advanced Tally Prime Course will equip you with expertise in advanced accounting practices. This knowledge is crucial for handling complex financial scenarios and will give you an edge over others in the field.

Boosting Your Employability

With a certification recognized by industry leaders, your resume will stand out to potential employers. The practical skills and advanced knowledge you acquire will make you a valuable asset to any organization.

Building Confidence

Our course is designed to empower you. By the end of the course, you’ll have the confidence to handle advanced accounting tasks and the ability to apply your knowledge in real-world situations.

Enrollment Details

How to Enroll

Enrolling is easy! Visit our training center in Vasai-Virar or register online through our website. Our team is available to assist with any questions or concerns you might have about the enrollment process.

Affordable and Flexible Fees

We offer competitive pricing for our comprehensive training. Additionally, we provide flexible payment options to accommodate different financial situations, ensuring that cost is not a barrier to your education.

Conclusion

Investing in your education is the best decision you can make for your future. Our Advanced Tally Prime Course in Vasai-Virar is designed to equip you with the skills and confidence needed to excel in the accounting field. Don’t miss this opportunity to advance your career—enroll now and take the first step towards mastering Tally Prime.

#Advanced Tally Prime Course#Tally Prime training Vasai-Virar#Tally Prime certification#Tally Prime advanced accounting#Tally Prime inventory management#GST and Tally Prime course#TDS management in Tally Prime#Payroll processing with Tally Prime#Tally Prime for students#Career in accounting Vasai-Virar#Best Tally Prime course in Vasai-Virar#Tally Prime classes Vasai-Virar#Accounting software training#Tally Prime practical experience#Tally Prime industry-recognized certification#Learn Tally Prime Vasai-Virar#Tally Prime course enrollment#Flexible Tally Prime course schedule#Advanced accounting skills#Tally Prime hands-on training

0 notes

Text

A comprehensive guide to Form 16A: A TDS Certificate

Form 16A is a TDS certificate that is issued by the deductor on a quarterly basis. It is a statement concerning the nature of payments, the amount of TDS, and the deposited TDS payments to the Income Tax department. It also consists of brokerage, interest, professional fees, contractual payments, rent, and other sources of income.

Unlike Form 16, which only consist salary structure, Form 16A of income tax charge TDS from:

Receipts from business or profession fees.

Rental receipts from a property or rent.

Sale proceeds from capital assets.

Additional source.

Important components of Form 16A

The important components of Form 16A are:

Details of the Employer: It contains the name, TAN, and PAN of the employer.

Details of Employee: It contains the name, TAN, and PAN of the employee.

Mode of Payment: Both offline and online modes of payment are available.

Receipt number of TDS: The receipt number of TDS helps in the tracking of back details.

The date and deposit tax amount with the income tax department help track information.

Significance of Form 16A

Form 16A plays a pivotal role while filing an income tax return, especially when someone has other sources of income apart from their salary. Here are the key benefits of Form 16A:

Filing of income tax returns: The details contained in Form 16A help employees file their income tax returns. It guides employees in reporting their total income, which includes salary and other sources.

Tracking of TDS: It helps every individual keep track of the tax deducted at source (TDS) on their income. It gives you a summary of TDS deducted at source.

Income Proof: Form 16A works as evidence of an individual's total earnings from other sources. Government agencies and financial institutions, like banks, easily accept this source as income proof.

Loan Applications: This form is important in verifying the loan applications. Financial institutions often need a record of the assets and liabilities of an individual to check the guarantee on loan repayment.

How to download Form 16A?

Below are the following steps to download Form 16A:

Visit the official website of the income tax department.

Complete the registration process on the website.

Click the "Download" tab, and then select Form 16A.

Fill in the PAN details, and then click “Go to continue.”.

Click submit and download Form 16A.

What is the difference between Form 16 and Form 16A?

Form 16 and Form 16A are both TDS certificates, but there are certain differences between them. The following are the differences between Form 16 and Form 16A:

Form 16 is a TDS certificate deducted from salary, whereas Form 16A is issued for income other than salary.

Form 16 is issued by the employer, whereas Form 16A is issued by financial institutions.

Form 16 is used for deducting tax from salary, whereas Form 16A is for removing taxes from another source of income apart from salary.

Final Thoughts

Paying taxes is the responsibility of the citizens of the nation. It is evident that the process of filing an income tax return and Form 16A is restless and troublesome. Some technical terms of income tax are not known to the new taxpayer. Worry not, because Eazybills will solve every tax-related problem and also offer TDS tracking.

So? What are you waiting for? Connect to us today through our website, where our professional team will guide you according to your requirements.

#form 16A#income tax return#tds certificate#file income tax return#easy billing software#gst billing software#free invoicing software#billing software#free billing software#best billing software#online billing software#online invoicing software#best invoice software

0 notes

Text

Your Trusted Partner for Taxation & Compliance Solutions Since 1962

Tax Print (Since 1962) For over 60 years, Tax Print has been a trusted partner for businesses across Mumbai, India. We specialize in the manufacturing and distribution of essential taxation and compliance products, serving companies with a wide range of software and physical solutions.

Our Offerings Include:

Taxation & Compliance Software: TDS Software, Payroll Software, HRM Software, Fixed Assets Software, PDF Signer, 26AS Reconciler, XBRL Software

Companies Act, 2013 Solutions: Compliance stationery, specialized products for newly incorporated Pvt. Ltd. and Ltd. companies

Corporate Essentials: Company seals, share certificate printing, statutory registers, minutes binders, and minutes paper

Whether you need robust digital tools or high-quality printed materials, Tax Print is your reliable source for all tax and compliance-related needs.

Let me know if you’d like a shorter version or one tailored for a specific platform like your website or brochure.

#payroll management software#hr software in mumbai#online payroll software in mumbai#26as reconciler software in mumbai#pdf signer software in mumbai#fixed asset management#best tds software in mumbai

0 notes

Text

Section 194O of the Income Tax Act

Section 194O of the Income-tax Act, 1961 deals with Tax Deducted at Source (TDS) on payments made to e-commerce participants. It was introduced in the Union Budget 2020 and came into effect on 1st October 2020.

Here's a summary of the key points of Section 194O:

Who is responsible for deducting TDS?

E-commerce operators like Amazon, Flipkart, Meesho, etc., are responsible for deducting TDS at the rate of 1% on the gross amount of sales made through their platform by sellers (e-commerce participants).

What transactions are covered?

The TDS applies to sales of goods, provision of services, or both facilitated through the e-commerce platform. This includes professional and technical services as well.

When is the TDS deducted?

The TDS is deducted at the time of crediting the seller's account, irrespective of the mode of payment, or at the time of making payment to the seller, whichever is earlier.

Threshold limit:

There is no threshold limit for e-commerce companies. They are required to deduct TDS on all transactions facilitated through their platform. However, for individual/HUF e-commerce participants, no TDS is deducted if the gross amount of sales during the previous year does not exceed Rs 5 lakh and they have furnished their PAN or Aadhaar.

Purpose of Section 194O:

This section aims to improve tax compliance by bringing e-commerce participants under the TDS net. Many small sellers operating on e-commerce platforms often miss filing their income tax returns. By collecting TDS at the source, the government ensures that some tax is collected upfront even if the seller doesn't file their returns.

I hope this summary is helpful. If you have any further questions about Section 194O or its implications, feel free to ask!

Gaurav Sharma

8878797882

Infinityservices2018.com

#income tax#gst refund#gst billing software#gst registration#gst services#TDS#tax deducted at source#TCS

0 notes

Text

TDS Entry in Tally Prime.

TDS Entry in Tally Prime Get More Information Contact Our team and Explore More Visit Our Website

Website :- www.monettaindia.com

Contact As :- 9811145789

Email :- [email protected]

Subscribe Our YouTube Channel :- Monetta-Tally

Follow On :-

Facebook :- Monetta Software Solutions Pvt. Ltd.

Instagram :- monetta_india

LinkedIn :- Monetta Software Solutions Pvt. Ltd.

youtube

#tally software#tallysolutions#Tally#TDS#TallyTDS#monetta#monettaindia#indiamonetta#tally customization#tallyprime#Youtube

1 note

·

View note