Don't wanna be here? Send us removal request.

Text

Investing in safer options: Bonds & Mutual funds that invest in bonds

As discussed in our last tip, keeping your money in the savings account is making you lose a small percentage of it due to inflation. In this article, we’ll discuss a safer option to invest your money with fixed returns. I have tried to explain it in simple terms. However, if this seems complicated to you, I have also mentioned a hassle-free way of investing without worrying about the jargon related to bonds at the end.

What are bonds?

A bond is a promise by an institution(corporate or government) to the lender/investor(us) for paying the lender the principal amount with or without interest. It is a type of debt investment. In simple words, corporate or government firms take a loan from you to run their operations and guarantee to return the amount back with interest in the agreed period. Many of the bonds offered by PSUs (Public Sector Undertakings) are often provide tax-free interest.

How to know if a bond is safe?

There are financial institutions that provide ratings to the bonds after studying their balance sheets and other indicators. These ratings are the indicator of the organization’s(borrower) potential to repay the loan. The best rating is AAA which means it’s highly likely that the borrower will not default on the loan. These are the safest bond options. You can check these ratings before buying the bonds. It’s a similar concept to how banks check our credit score before providing us loans.

What are the drawbacks?

Bonds provide a decent interest rate which generally goes from 5% to 11%. However, bonds have low liquidity. This means your investment is locked for a particular period of time which you agreed upon. We as investors often look for investments that are liquid that can be taken out promptly in the case of a better opportunity or an emergency shows up.

How to invest in bonds without worrying about the jargon and liquidity?

You can invest in mutual funds that have a majority of the investments in bonds. This is my preferred way of investing in bonds. In this way, with a small commission (<1% on average) you can make your investment more liquid(buy/sell your investment within a few days) and not worry about the hassle of finding and investing in bonds.

How do mutual funds that invest in bonds work?

Each mutual fund has a fund manager. This dude is a highly qualified and skilled individual who understands the complexities of the bonds. So, the fund manager will do its research and then invest in multiple bonds and securities forming a mutual fund. Now, the curated portfolio of the bonds and other securities will be traded at a certain price/unit that you can buy or sell.

What are the advantages of mutual funds that invest in bonds?

Hight Liquidity

You can see the past performance

You don’t have to worry about choosing the bonds. By buying a unit of the mutual fund, you indirectly invest in multiple bonds which have been selected by an expert.

They mitigate the risks by diversifying the investment.

The relatively lower price of 1 unit.

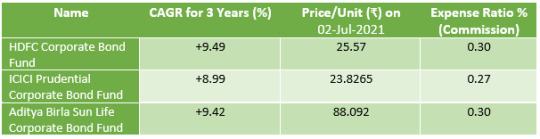

What are a few recommended mutual fund options that invest in bonds?

Disclaimer: I am not affiliated with any mutual funds and I do not promote any fund for personal advantage. These are the funds in which either I have invested or researched. You can do your own research and make an informed investment. However, please try to keep these investments for a little longer period (about 3 years) to see better returns. I often say to people to invest than to trade. So here are three of my recommendations in no particular order:

I hope you found something useful in this article. For more such content, stay tuned! Till then, Happy Learning!

Word of the article: Jargon (noun) — Special words or expressions used by a profession or group that are difficult for others to understand.

0 notes

Text

Beyond the book: ‘The 5 AM Club’

“Many people want extraordinary things to happen to them, but that truly great people understand they can create those extraordinary events themselves”

I never in my life thought that I’ll be promoting starting your day as early as 5 AM. After all, I used to go to sleep at this time back in my college days. Well… you learn, you understand and you grow. I started kicking off my day early due to professional commitments three years ago. Soon I realized there was something magical about it. When I read this book it helped me put a lot of things into context. As it turns out, it’s not just about waking up at 5 AM but using that time. I’ll try to highlight my takeaways from the book and add some nuances to it through this article. Enough of the pre-talk, let’s dig deep into this secret billionaire mantra.

5 AM FOR THE PRODUCTIVITY

Let me start with selling you the benefits of waking up at 5 AM. The scientific advantages of waking up early are:

When we wake up this early, our brain’s prefrontal cortex which processes rational thoughts is impaired. This temporarily silences your worries, doubts, and fears.

During this time of day, your brain is pre-programmed to stimulate the production of dopamine and serotonin, both of which will make you happier and give you a more peaceful start to the day.

Imagine starting your day with no negative self-talk, energy and peace. This will let you enable the flow state which is a mental state of ultimate focus. You can use this time to perform the most critical tasks as you are most productive in this state. But before you tap into the flow state, there is a morning ritual that can elevate this experience — the 20/20/20 formula.

20/20/20 FORMULA

It is a method to utilize your first hour of the day to further optimize your productivity. The principle of this formula is to use 20 minutes to move, 20 minutes to reflect and 20 minutes to grow.

In the first 20 minutes, we should do vigorous exercise. Sweat decreases the fear hormone in our brain and generates the protein BDNF, which promotes the formulation of new neural connections. This, in turn, makes our brain think faster. Due to our prefrontal cortex being impaired, our brain cannot process if we like exercising or not. This can be an added advantage and we can push through these 20 minutes even if we do not like exercising.

In the first 10 minutes of the next 20 minutes, we should reflect on our goals, frustrations, failures, etc. The next 10 minutes we can use to document the same in a journal. It is my favourite part as I can put all the burden of my thoughts on a piece of paper and continue my day with clear objectives. It takes a bit of practice but works wonders if you are someone who is like me and thinks a lot. If you have any time remaining you can use it for meditating.

The last 20 minutes are used to learn. We can use this time to read about innovation, or learn about a business, or listen to a podcast that stimulates our thought. We can use this time to learn something that can add value to our career.

MULTI-TASKING IS A MYTH

Multi-Tasking is an amazing concept when it is applied to our gadgets. However, our brain is not made to perform multiple high-functioning tasks at once. When we think that we are multi-tasking, we are actually switching between the tasks and it is not efficient. We have limited mental energy for the day and it’s always better to use it towards the things that we care about.

DISOBEYING THE DISTRACTIONS

Distractions are often the key elements that take away your productivity. It can be as simple as reacting to our smartphone notification while working on an important task. Now, I just want to make it clear that I am not saying that we should become robots and just focus on our work. I make no compromises giving my time to do things that I love. When I say important tasks and distraction, I mean tasks that are important to YOU and distractions are the tasks that are not important to you. When I am working on such key tasks I prefer to switch off my notification and just keep my phone on vibrate for any emergency calls. If you have a hard time prioritizing tasks then you can make use of the Time Management Matrix. You can learn more about it here and I’ll try to cover it in some of my future articles.

UPSKILLING BY ACCOMPLISHING SMALL THINGS DAILY

In this modern industrial revolution where knowledge is practically free, we must constantly invest some time in ourselves for upskilling. We often tend to focus on achieving some big things occasionally and then being on the sidelines for a while. I believe this approach has been inherited by us from the way we use to study in our schools. We use to enjoy our time and once the exams were near we’ll take our battle gears out and prepare for the war. Ahh! it makes me all nostalgic. Well, we must understand that it is not the right way of learning. Learning and honing your skills should be a continuous and consistent habit. I devote a section of my day to personal development. I take this time to learn and practice the skills that will help me in my career or sometimes if they seem very interesting.

The key to help you upskill in the right direction is capitalizing on your talent. We often get discouraged and feel that we don’t have what it takes by seeing how talented others are in a certain field. However, what we must focus on is what we are good at and then improve our skills and knowledge by investing time into developing it. By doing so we become more positive and gain confidence.

THE FOUR INTERIOR EMPIRES

We all have 4 interior empires and all of them are connected. These empires are Mindset, Heartset, Healthset, and Soulset. Unlike the historical empires, all these empires must function properly for us to be the best version of ourselves.

MINDSET: We live in a fast-paced world that is driven by change. It is a place where start-ups can reach unicorn status overnight while established firms can lose billions over a tweet. In this world of chaos, we must constantly keep working on our mindset. We can train our attention on making our daily micro-achievements; reflect on our failures but focus on the positives. By doing so we can mitigate the negative bias of our brain.

HEART-SET: This empire deals with taking care of our emotional well-being. We can take a step towards that by expressing our emotions more frequently; by creating an open communication channel with our peers and loved ones.

HEALTH-SET: This empire deals with taking care of our physical well-being. I recall an interview of Warren Buffet where he put forward a cogent argument about physical well-being — Imagine if we could choose any car but there was a stipulation that we have to use the same car for the rest of our life. How well would we take care of it? I would probably take care of it like my own baby. Now, think about our body in the same way. We just have this one body for the rest of our life. The bare minimum we can do is exercise daily and try to eat right. Right?

SOUL-SET: This empire deals with taking care of our spirituality. It does not mean that we have to enroll ourselves in a religion. It means that we should find something that keeps us centred and help us connect with the truest version of ourselves. It can be simple things like taking a walk in nature, or meditating, or even praying. I personally enjoy sitting on my balcony with my thoughts and gazing at trees.

A simple hack to working on each of the interior empires is by implementing the 20/20/20 formula.

SLEEP AND HAVE FUN

Sleep is one of the key factors in determining life expectancy. It is important to manage a good 6–8 hours of sleep for our recovery and to avoid burnouts. If we want to continue operating at high productivity then we must maintain the cycle of passionate work and deep renewal through sleep. Yet, we are a sleep-deprived generation and technology can be pinpointed as the primary reason for sleep deprivation. To be precise, the blue light emitted from our smartphones, TVs, Laptops, etc reduces melatonin. Melatonin is chemical in our body that promotes sleep. In order to counter this, some studies suggest we must disconnect ourselves from these devices at least 2 hours before we sleep. I can understand it may seem like a difficult task as we are habituated with our routine but it can be accomplished. I have allocated this time for talking to my loved ones over a call. If you live with your partner or a friend you can play some indoor game or discuss your day. You can make your own routine and try to avoid the blue light radiations before the sleep.

Lastly, have some fun! Allocate some time of your day for doing the activities that you enjoy without worrying about them adding value to your day. Not everything is supposed to contribute to your career growth. Do not feel guilty about enjoying your me-time. I like watching YouTube for short while. Some videos that I watch are informative and some are pure entertainment. But who cares, I enjoy that time and most importantly, it makes me happy.

Thank you for taking your time and reading this article. I hope you find some takeaways from this article that helps you in managing your day.

Word of the article: Cogent (adjective) — Clear, Logical, or Convincing

0 notes

Text

Savings Account Secretly Eat Your Money Away

I have recently finished a consulting project for an Ed-Tech Start-up in Canada. It made me realize the importance of Financial Literacy in the early stages of life. Therefore, I decided to start a series where I share tips that I learned from various books, courses and personal investments. I wish this could bring more awareness amongst people and help them make more informed decisions.

#1 NEVER KEEP YOUR SAVINGS IN THE SAVINGS ACCOUNT

Irony right? Well, there is a pretty solid reason for it. There is a secret parasite that eats your savings when your money is in your savings account. Confused? That parasite is inflation. Due to inflation, you lose a small percentage of money every year. Inflation is the reason that the same goods cost more over a period of time. Let us take an example and see how it affect your savings.

Let’s assume you have ₹10,00,000 in your savings account. The current inflation rate of India as of May 2021is 6.3%. It may change +/- 1% over the course of a year. What 6.3% mean is that your money will lose 6.3% of its value in a year. In simple terms, your money that was worth ₹10L, after a year will be worth ₹9,39,000. Now, you will receive some interest in your saving account but that interest is nominal and will be a lot less than the inflation rate.

The purpose of this article is to let you know that you are losing your money just by keeping your money in your savings account. There are a lot of investments that provide way more interest than the inflation rate with little to no risk involved. I’ll be sharing such investments and strategies in the upcoming articles. STAY TUNED!

1 note

·

View note