Don't wanna be here? Send us removal request.

Text

Lessons From the Blue Zones: Secrets of a Long Life

http://bmkfinancialservices.com.au/lessons-from-the-blue-zones-secrets-of-a-long-life/ The parts of the world where people live longest may hold the key to the fountain of youth. We explore how to live longer and uncover the Blue Zones’ secrets of a long life. There are five global hotspots where researchers have identified that people live longer, healthier lives than the rest of us. Known […] The post Lessons From the Blue Zones: Secrets of a Long Life appeared first on Lake Macquarie and Newcastle Financial Planning Services - Brad Lonergan.

0 notes

Text

Lessons From the Blue Zones: Secrets of a Long Life

The parts of the world where people live longest may hold the key to the fountain of youth. We explore how to live longer and uncover the Blue Zones’ secrets of a long life. There are five global hotspots where researchers have identified that people live longer, healthier lives than the rest of us. Known as the Blue Zones they are:

Okinawa, Japan

Sardinia, Italy

Nicoya, Costa Rica

Ikaria, Greece

Loma Linda, California.

What’s their secret?

These communities each have a high rate of residents over 100 years old, suffer less of the diseases that commonly affect people in other parts of the developed world, and enjoy more years of healthy life. The formula for these fountains of youth appears to be the following nine lifestyle habits. While some are obvious, others might surprise you…i

1. Move:

We all know exercise is good for us, but this isn’t about pumping iron or running marathons. It’s about staying active through regular, everyday movements like doing the housework, gardening and walking.

2. Have a sense of purpose:

It could be anything, but knowing why you get out of bed in the morning is identified as a contributor to a healthier life and can add up to seven years to your life expectancy.

3. Reduce stress:

It isn’t that Blue Zone residents don’t experience stress, it’s about what they do to relieve it. While their methods range from prayer to napping to practicing mindfulness, what’s common is that they prioritise stress relief.

4. Eat less:

Instead of overindulging, Blue Zone residents stop eating before they’re full. They also eat their smallest meal by early evening, and don’t eat for the rest of the day.

5. Eat less meat:

This one comes as no real surprise given the links between meat consumption and cancer, but most of the Blue Zone residents are semi-vegetarian, favouring beans, legumes, fruit and vegetables over meats.

6. Drink alcohol:

Blue Zone researchers found it’s ok to drink regularly, as long as it’s in moderation (1-2 glasses a day), and alcohol is consumed with friends and/or food.

7. Spirituality or religion:

It seems the sense of belonging to a faith or belief-based community - regardless of the belief – is beneficial to health. Research shows that attending faith-based services four times per month can add from four to 14 years to your life expectancy.

8. Put family first:

Blue Zone residents commit to a life partner – which can add up to three years to life expectancy, and have a strong sense of family, from caring for their aging relatives to nurturing their children.

9. Have a tribe:

Be it your family or friends, having a social circle that combats loneliness and encourages good habits such as being active, positive and not smoking is good for longevity.

Funding a long and happy retirement

Living longer means you might need more money to fund your retirement or you may need to stretch the money you have further. If you’re worried you might outlast your money we can help you to maximize your wealth and manage your finances accordingly. Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information about Investments for Newcastle and Lake Macquarie residents. Call 0423 621 120 or email [email protected]

i https://www.bluezones.com/2016/11/power-9/

© AMP Life Limited. First published March 2018

http://bmkfinancialservices.com.au/lessons-from-the-blue-zones-secrets-of-a-long-life/

0 notes

Text

Lessons From the Blue Zones: Secrets of a Long Life

http://bmkfinancialservices.com.au/lessons-from-the-blue-zones-secrets-of-a-long-life/ The parts of the world where people live longest may hold the key to the fountain of youth. We explore how to live longer and uncover the Blue Zones’ secrets of a long life. There are five global hotspots where researchers have identified that people live longer, healthier lives than the rest of us. Known […] The post Lessons From the Blue Zones: Secrets of a Long Life appeared first on Lake Macquarie and Newcastle Financial Planning Services - Brad Lonergan.

0 notes

Text

Lessons From the Blue Zones: Secrets of a Long Life

http://bmkfinancialservices.com.au/?p=6058 The parts of the world where people live longest may hold the key to the fountain of youth. We explore how to live longer and uncover the Blue Zones’ secrets of a long life. There are five global hotspots where researchers have identified that p...

0 notes

Text

Should I Downsize My Home for Retirement?

So maybe you're nearing retirement and thinking about downsizing your home for retirement. Or perhaps you've already retired and are considering downsizing to buy a more manageable property. Of course, there may be benefits of moving to a smaller place. You might be able to reduce or pay off your home loan, get rid of some clutter and there is likely to be less cleaning and gardening. But don't assume that moving to another property is guaranteed to give you more cash to live on. Before you put the 'for sale' sign up, get a few different estimates on what your house is worth. Then think about why you want to move and what you're hoping to achieve.

Some things to consider

Why do you really want to sell? Is it to have a better lifestyle, be closer to your family, pay off your home loan or have more cash?

Where do you want to move to, and have you trialed living there before to see if you like it? Consider a house swap or renting a property in the area you want to buy, before forking out for a deposit.

Why do you want to live in a particular area? You might love the idea of living on a remote beach or in the bush, but have you researched nearby facilities, such as shops, public transport or hospitals?

Do you have emotions tied to your family home that would make it hard to move, such as memories of the kids growing up there?

What about the social aspects of moving, like whether you have friends or family where you're moving to? And what about the ones you're leaving behind?

Super benefits for downsizers

If you do decide to sell, you'll need to consider what to do with any proceeds that are left over. One option to consider is the new super measure allowing these proceeds to be contributed to super. As of 1 July 2018, downsizers aged 65 or over can make an after-tax contribution of up to $300,000 per person (or $600,000 per couple) from the sale of the family home they've lived in for at least 10 years. This is in addition to any other before-tax or after-tax contributions they're eligible to make, regardless of work status, superannuation balance, or contribution history. There are conditions—as well as additional rules which may apply to your situation—so it's important to do some research before making any decisions.

The real costs of moving

While there may be many good reasons to consider downsizing, selling your home and buying another property will incur some out-of-pocket expenses. You'll have the costs of moving, such as connecting and disconnecting utilities, removalists' fees, stamp duty and potentially real estate agent commission costs. In addition to these, any money left over after downsizing could affect you under the government assets and income tests. For example, moving from a property that is worth $1m to one that’s worth $400,000 means you could have an additional $600,000 in assessable assets, which could impact your Age Pension entitlement. So you'll need to carefully consider if downsizing is the right option for you and your retirement plans. For more information download our downsizing planner.

Other sources of income

Apart from selling your home, you could think about other ways to generate income leading up to, or during retirement. Here are just a couple of examples.

If you've already retired, consider getting a part-time job to help supplement your income or the Age Pension. But bear in mind there are limitations to the number of hours you can work after you have declared that you’re retired. Depending on your circumstances, income from working could also impact on your pension entitlements.

Consider reviewing your investments to make sure they align with your goals. Just remember that past performance is no indicator of future performance and higher returns can also mean higher exposure to risk.

We’re here to help

Retirement planning can be a complex area and there may be tax or Age Pension implications which you need to be aware of before making any decisions. Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information about downsize my home for retirement for Newcastle and Lake Macquarie residents. Call 0423 621 120 or email [email protected]

© AMP Life Limited. First published July 2017

http://bmkfinancialservices.com.au/should-i-downsize-my-home-for-retirement/

#downsizeafterretirement#downsizeforretirement#downsizehouseforretirement#downsizeinretirement#howtodownsizeforretirement#retirementcalculator#retirementenhancementandsavingsactof2018#retirementoptions#retirementrequirements#retirementwordsofwisdom

0 notes

Text

Should I Downsize My Home for Retirement?

http://bmkfinancialservices.com.au/should-i-downsize-my-home-for-retirement/ So maybe you’re nearing retirement and thinking about downsizing your home for retirement. Or perhaps you’ve already retired and are considering downsizing to buy a more manageable property. Of course, there may be benefits of moving to a smaller place. You might be able to reduce or pay off your home loan, get rid of […] The post Should I Downsize My Home for Retirement? appeared first on Lake Macquarie and Newcastle Financial Planning Services - Brad Lonergan.

0 notes

Text

Your Retirement Questions Answered

If you're questioning exactly what you may do with your super money when you do gain access to it, keep in mind there will be a variety of things to weigh up and check out.

How can I take my super?

Taking super as a lump sum

A lump sum could help you pay off your home loan or other outstanding debts, but there may be tax implications to consider and you should think about what you’ll live on if you have no super left. The government’s Age Pension could be one option, although if you’re pinning your hopes entirely on government support, you should consider the sort of lifestyle it might fund. June 2017 figures show a 65-year-old retiring today needs an annual income of $43,695 to fund a ‘comfortable’ lifestyle in retirement, assuming they are relatively healthy and own their home outrighti. By comparison, the max Age Pension rate for a single person is around $23,254 annuallyii.

Moving it into an account-based pension (or allocated pension)

If you’re thinking that you’d like to receive a regular income in retirement, an account-based pension (or allocated pension) could be a tax-effective option. While the most you’ll be able to transfer into these pension accounts is $1.6 million, you won’t be limited to what you can take out. However, each year you’ll need to withdraw a minimum amount.

Purchasing an annuity with your super

An annuity provides a series of regular payments over a set number of years, or for the remainder of your life, depending on whether you opt for a fixed-term or lifetime annuity. You will however be sacrificing some flexibility, as you can’t easily make lump sum withdrawals and life expectancy is also a major consideration.

What about the Age Pension?

Currently, to be eligible for a full or part Age Pension from the government, you must be 65 or older and satisfy an income test and an assets test, as well as other requirementsiii. In July, the qualifying age for the Age Pension increased to 65 and 6 months, and it will continue to increase by six months every two years until 1 July 2023 when the qualifying age will be 67. You can check out your Age Pension eligibility age belowiii.

Date of birth Age Pension eligibility age Before 1 July 1952 65 years 1 July 1952 - 31 December 1953 65 years and 6 months 1 January 1954 - 30 June 1955 66 years 1 July 1955 - 31 December 1956 66 years and 6 months From 1 January 1957 67 years

Meanwhile, it’s important to remember that what you do, and at what time you do it, could have tax implications and may impact your social security entitlements. This is why it’s important you do your research and explore the alternatives with your financial adviser.

Can I return to work if I’ve taken my super?

Generally, you can, but if you previously declared your permanent retirement, you may need to prove your intention was genuine at the time. According to retirees who did return to full or part-time employment, the most common reasons why they decided to go back to the workforce was financial necessity, followed closely by boredomiv.

We can help

We can assist you to determine what will work best for you. Give us a call to make a time for a chat about how we can help you to start planning for the lifestyle you want in retirement. Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information about Retirement questions for Newcastle and Lake Macquarie residents. Call 0423 621 120 or email [email protected]

i ASFA retirement standard – June 2017 quarter table 1

ii Department of Human Services - Payment rates for Age Pension table 1 iii Department of Human Services - Age Pension (eligibility and payment rates) iv ABS – Australian Social Trends – Older people and the labour market paragraph 26 © AMP Life Limited. First published January 2018

https://bmkfinancialservices.com.au/retirement-questions-answered/

#blendedretirementsystemquestions#questionsonretirement#questionsregardingretirementplanning#retirementaccountquestions#retirementadvisorquestions#retirementagequestions#retirementconversationquestions#retirementhomeinterviewquestions#retirementquestions

0 notes

Text

21 Must Read Investment Quotes

Introduction

Investing may be disheartening and disappointing sometimes, especially if you fail to comprehend how the marketplace operates and don't have the appropriate mind-set. The bright side is that the fundamentals of investing endure, and few have a talent of encapsulating these in a sentence or 2 which is both enlightening and user-friendly. In the last few years I've published insights emphasizing investment quotes that I find especially beneficial. Here are some more.

Having a goal and a plan

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest. You can’t win until you do this.” Dave Ramsey The only way to be able to build wealth is to save and invest and you can only do this if you spend less than you earn. That is, you have to start with a savings plan. “Put time on your side. Start saving early and save regularly. Live modestly and don’t touch the money that’s been set aside” Burton G Malkiel In investing time is your friend and the earlier you start the better. This is the best way to take advantage of the magic of compound interest. The next chart – my favourite - shows the value of $1 invested in various Australian asset classes since 1900 allowing for the reinvestment of any income along the way. That $1 would have grown to just $234 if invested in cash, $866 in bonds but a whopping $529,293 if invested in shares.

Shares versus bonds & cash over very long term - Australia

Source: Global Financial Data, AMP Capital

While the average share return since 1900 is only double that in bonds, the huge gap in the end result between the two owes to the magic of compounding returns on top of returns. A growth asset like property is similar to shares over long periods in this regard. Short-term share returns bounce all over the place and they can go through lengthy bear markets (shown with arrows on the chart). But the longer the time period you allow to build your savings the easier it is to look through short-term market fluctuations and the greater the time the compounding of higher returns from growth assets has to build on itself. “If you fail to plan, you plan to fail.” Often attributed to Benjamin Franklin Having a clear understanding of your investment goals – like saving for a home or retirement or generating income to live on – and a plan to get there is critical. If you don’t have a clear plan you will be subject to all sort of distractions which can blow you a long way from where you want to get with your investments.

The investment cycle

“Bull markets don’t die of old age but of exhaustion.” Anon Bear markets are invariably preceded by excess in the economy – over investment, high levels of debt growth, high levels of inflation and tight monetary conditions – and excess in the share market in the form of overvaluation and investor euphoria. It’s this excess which drives exhaustion and hence the end of a bull market, not its age. “The stock market has predicted 9 of the past 5 recessions.” Paul Samuelson In the short term the share market moves all over the place with each significant plunge eliciting calls for an impending recession and a deep bear market. But most of the time it’s just noise providing an opportunity for investors before a rebound. For example, over the past 50 years in the US there has been 21 episodes of 10% or greater share market falls, but only seven saw recessions and bear markets.

Risk

“The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not risk, but it is an opportunity.” Li Lu Risk is often portrayed as market volatility when in reality it’s a whole lot more: the risk of capital loss; the risk of not having enough investment income; the risk of not having enough to last through retirement. It’s also perverse – the risk of capital loss is lowest after a period of high volatility and vice versa.

Contrarian investing

“The day after the market crashed on 19th October 1987, people began to worry that the market was going to crash” Peter Lynch This is perhaps a bit flippant, but it goes to the heart of crowd psychology and why it’s best to go against the crowd at extremes. When times are good the crowd is relaxed, happy and fully invested. So everyone who wants to buy has. This leaves the market vulnerable to bad news because there is no one left to buy should prices drop. Similarly, after a sharp fall the crowd gets negative, sells their investments to the point that everyone who wants to sell has and so the market sets up for a rally when some good or less bad news comes along. So the point of maximum risk is when most are euphoric, and the point of maximum opportunity is when most are pessimistic.

Pessimism

“It is easier being sceptical, than being right.” Benjamin Disraeli The human brain evolved in a way that it leaves us hardwired to be on the lookout for risks. So a financial loss is felt more negatively than the beneficial impact of the same sized gain. Consequently, it seems easier to be sceptical and pessimistic. As a result, bad news sells and there seems to be a never-ending stream of warnings regarding the next disaster. But when it comes to investing, succumbing too much to scepticism and pessimism doesn’t pay. Historically, since 1900 shares have had positive returns seven years out of 10 in the US and eight years out of 10 in Australia. “A pessimist sees the difficulty in every opportunity, an optimist sees the opportunity in every difficulty.” Winston Churchill This is what stops many investing after big falls – all they see are the reasons the market fell. Not the opportunity it provides. “Without a saving faith in the future, no one would ever invest at all. To be an investor, you must be a believer in a better tomorrow.” Jason Zweig If you don’t believe your term deposit is safe, that borrowers will pay back their debts, that companies will see good profits and that properties will earn rents then there is no point in investing.

Psychology

“An investment said to have an 80% chance of success sounds far more attractive than one with a 20% chance of failure. The mind can’t easily recognise that they are the same.” Daniel Kahneman Beware of tricks that your mind plays on you when investing. Numerous studies show that people suffer from lapses of logic – eg, assuming the current state of the world will continue, being overly confident and assessing the risk of certain events by how they are presented. The key for investors is to be aware of these biases and try to correct them.

Noise

“Stock market news has gone from hard to find (in the 1970s and early 1980s), then easy to find (in the late 1980s), then hard to get away from.” Peter Lynch The information revolution has given us access to an abundance of information and opinion regarding investment markets. The danger is that it adds to the uncertainty around investing resulting in excessive caution, a short-term focus, a tendency to overreact to news and to focus on things that are of little relevance. The key is to recognise that much of the noise and opinion around investing is ill informed and of little value. “The ability to focus is a competitive advantage in the world today.” Harvard Business Review The key in the face of this information and opinion onslaught is to turn down the noise and focus. “If you can keep your head when all about you are losing theirs…If you can wait and not be tired by waiting… If you can trust yourself when all men doubt you…Yours is the Earth and everything that’s in it.” Rudyard Kipling, If, as quoted by Warren Buffett Keeping your head and remaining calm is critical in times of extreme – when the crowd is convinced the path to instant riches has been revealed or when the crowd is convinced that economic disaster is upon us. These periods throw up great temptation to buy when you should be selling and vice versa. But you will only get it right if you keep your head & stay calm.

Forecasting

“I believe that economists put decimal points in their forecasts to show that they have a sense of humour.” William Gillmore Simms The dismal track record of precise forecasts regarding things like economic growth, share prices and currencies indicates that relying on them when investing can be dangerous. There is often a big difference between getting some forecasts right and making money. Good experts will help illuminate the way and put things in context, so you don’t jump at shadows but don’t over rely on expert forecasts - particularly the grandiose ones.

Having a process

“I am going to reveal the grand secret to getting rich by investing. It’s a simple formula that has worked for Warren Buffett, Carl Icahn and the greatest investment gurus over the years. Ready? Buy low, sell high.” Larry Kudlow Yep it’s that simple. Or it should be, but many do the exact opposite and buy high after a lengthy period of strong returns convinces people it’s a great investment (but the risks point down), and then sell low after fall in the price of an asset leads people to believe that it’s a bad investment (but that’s when the risks point up). The key to is do the opposite – buy low, sell high and it’s very helpful to have an investment process to do that. “Three simple rules - pay less, diversify more and be contrarian – will serve almost everyone well.” John Kay This helps bring the essentials of investing together. They stand to reason: the less you pay for an investment the greater the return potential; just having one or two shares leaves you very exposed should the news turn bad regarding those shares but if you diversify across a range of shares you can reduce the risk of a fall in your overall portfolio; and doing the opposite to the crowd means you can avoid the points of maximum risk in markets when most are fully invested and take advantage of periods of maximum opportunity when most have sold. “Success consists of going from failure to failure without loss of enthusiasm.”Winston Churchill As with all things we need to recognise that to learn we need to make mistakes and to be persistent.

Balance

“A calm and modest life brings more happiness than the pursuit of success combined with constant restlessness" Albert Einstein This applies to life in general, but it also applies to investing – don’t jump around all over the place and keep it simple. “A man should make all he can, and give all he can.” Nelson Rockefeller It’s not financially possible for everyone but consider giving a bit away for good causes if you can – and not just for the tax deduction as you will feel good and it will bring good karma. “The trouble with doing nothing is that you don’t know when you have finished.”Cafe blackboard in Byron Bay ...so it’s always good to do something and investing is something worth doing (and worth doing well)! Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information about Investments for Newcastle and Lake Macquarie residents. Call 0423 621 120 or email [email protected]

http://bmkfinancialservices.com.au/21-must-read-investment-quotes/

#bestinvestmentadvicequotes#bestinvestmentquotesofalltime#capitalinvestmentquotes#investingadvice#investingtips#investingwithlittlemoney#investment#investmentadvicequotes#investmentquotes#investmenttradingquotes#rightinvestmentquotes

0 notes

Text

China's Economy is Quite Steady

What about high debt levels and other dangers?

Key points

- Main dangers concerning China associate with the policy concentration moving to decreasing leverage and reform, fast financial debt expansion, a trade battle with the United States and the real estate cycle.

- Steady and firm Chinese growth is complementary of commodity costs and is favorable for the Australian economic climate and resource shares.

- Chinese economical progress has been consistent from at about 6.8%. Anticipate Chinese financial growth this year of approximately 6.5% and rising cost of living of 2.5-3%.

- Chinese shares continue to be moderately valued from a long-term viewpoint.

Introduction

It appears there is constant hand wringing about the dangers around the Chinese economy with the typical issues being around out of balance development, financial obligation, the residential or commercial property market, the currency exchange rate and capital circulations and a "difficult landing". This angst is easy to understand to some degree.

Fast development as China has actually seen brings concerns about its sustainability. And China is now the world's second biggest economy, its most significant factor to development and Australia's most significant export market so exactly what takes place in China has huge implications worldwide. However regardless of all the concerns it keeps continuing and just recently development has actually been fairly steady. This note takes a look at China's development outlook, the primary dangers and exactly what it implies for financiers and Australia.

Benign Inflation with Stable growth

Chinese development slowed through the very first half of this years culminating in a development and currency scare in 2015 which saw Chinese policy swing from moderate tightening up to stimulus. This has actually seen quite steady development considering that 2016 of around 6.8% year on year. Constant with this, company conditions PMIs have actually likewise been steady (see the next chart) and unpredictability around the Renminbi has actually fallen & capital outflows have actually slowed.

Chinese growth is holding steady

Source: Bloomberg, AMP Capital

April information saw commercial production and earnings speed up however financial investment and retail sales slow a bit. Electrical energy usage, train freight and excavator sales have actually lost momentum from their highs. However the general impression is that development is still strong.

Chinese activity indicators

Source: Thomson Reuters, AMP Capital

While there is a requirement for China to rebalance its development away from investing for exports, the downturn in financial investment development to beneath that for retail sales, imports growing quicker than exports and the shrinking in China's bank account deficit from 10% of GDP to 1% of GDP recommends this taking place.

On the other hand, inflation in China is benign with manufacturer cost inflation around 3% and customer rate inflation around 2%.

Chinese deflation has ended, but inflation is benign

Source: Bloomberg, AMP Capital

Policy neutral

Chinese financial policy has actually been fairly steady just recently. There has actually been some talk of improving domestic need and bank needed reserve ratios have actually been cut. However the latter appears to have actually been to enable banks to pay back medium term loan centres, rates of interest have actually been steady and development in public costs has actually been constant at 7-8% year for the year.

Growth and inflation outlook

We anticipate Chinese development this year to slow a bit as financial investment slows even more to around 6.5% and customer inflation of 2-3%.

Key risks facing China

There are 4 crucial threats dealing with China.

Initially, the policy focus might move from preserving strong development to accelerating medium-term financial reforms and deleveraging (or cutting financial obligation ratios) that might threaten short-term financial development. Some anticipated this to happen after the 19th National Congress of the Communist Celebration ran out the method late in 2015. And the elimination of term limitations on President Xi Jinping might probably make him less conscious a short-term financial decline. Nevertheless, up until now there is no indication of this and the authorities appear concentrated on preserving strong development.

Second, China's quick financial obligation development might turn sour. Given That the Global Financial Crisis, China's ratio of non-financial financial obligation to GDP has actually increased from around 150% to around 260%, which is a much faster increase than has actually happened in all other significant nations.

Chinese non-financial debt

Source: BIS, RBA, AMP Capital

This has actually been focused in business financial obligation and to a lower degree home financial obligation and has actually been simplified by monetary liberalisation and a great deal of the development has actually been outside the more regulated banking system in "shadow banking". An apparent issue is that when financial obligation development is quick it leads to a great deal of financing that ought to not have actually occurred that ultimately goes bad. Nevertheless, China's financial obligation issues are various to a lot of nations. Initially, as the world's greatest financial institution country China has actually obtained from itself - so there's no foreigners to trigger a a foreign exchange crisis.

2nd, much of the increase in financial obligation owes to business financial obligation that's partially linked to fiscal policy therefore the chances of federal government bailout are high. Lastly, the crucial driver of the increase in financial obligation in China is that it conserves around 46% of GDP and much of this is recycled through the banks where it's called debt. So unlike other nations with financial obligation issues China has to conserve less and take in more and it has to change more of its conserving into equity instead of debt. Chinese authorities have actually long understood the concern and development in shadow banking and general financial obligation has actually slowed however knocking on the financial obligation brakes without seeing more powerful usage makes no sense.

Third, the danger of a trade war has actually intensified with Trump threatening tariffs on $50-150bn of imports from China and limitations on Chinese financial investment in the United States and China threatening to reciprocate. While "useful" settlements have actually begun and have actually seen China devote to purchasing more from the United States & to reinforce laws safeguarding copyright which saw the United States at first delay the tariffs and limitations, Trump has actually shown that they will be implemented this month which seems targeted at prodding China to move quickly (and calming his base). Eventually, we anticipate a worked out service, however the dangers are high and a full-blown trade war with the United States might knock 0.5% approximately off Chinese short-term development.

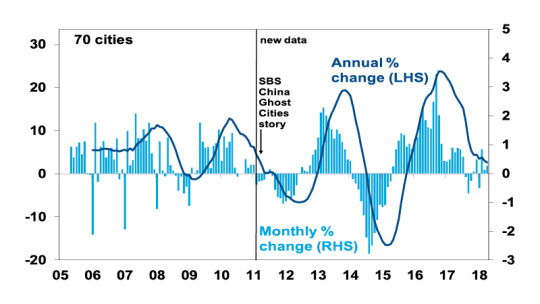

Lastly, with the Chinese home market slowing once again there is naturally the threat that this might develop into a slump. It deserves a watchful eye however, missing an external shock looks uncertain. The "ghost cities" fear of a couple of years earlier-- it initially aired on SBS TELEVISION back in 2011 - has plainly not come to much. It's uncertain China ever truly had a generalised real estate bubble: family financial obligation is low by innovative national requirements; home costs have not stayed up to date with earnings; and while there's been some extreme supply, this isn't so in first tier cities; and the quality of the real estate stock is low requiring replacement. So, I believe the home crash worries continue to be overstated and the current bout of weak points in costs seems simply another cyclical downswing in China which there have actually been a number of over the last 10 years.

Chinese residential property prices - another cyclical downswing

Source: Bloomberg, AMP Capital

Our assessment remains that these risks are manageable, albeit the trade war risk is the hardest for China to manage given the erratic actions of President Trump. The Chinese Government has plenty of firepower to support growth though, so a “hard landing” for Chinese growth remains unlikely for now.

The Chinese share market

Considering its low in January 2016 the Chinese share market has actually had a great recovery. However Chinese shares are trading on a cost to revenues ratio of 12.8 times which is far from extreme.

Chinese Shares Stay Inexpensive

Source: Thomson Reuters, AMP Capital

With valuations okay and growth continuing, Chinese shares should provide reasonable returns, albeit they can be volatile.

Implications for Australia – not yet 2003, but still good

Solid growth in China should help keep commodity prices, Australia’s terms of trade and export volume growth reasonably solid. This, along with rising non-mining investment and strong public investment in infrastructure, will offset slowing housing investment and uncertainty over the outlook for consumer spending and will keep Australian economic growth going. However, with strong resources supply (and still falling mining investment) we are a long way from the boom time conditions of last decade and growth is likely to average around 2.5-3%. Rising US interest rates against flat Australian rates suggests more downside for the $A, but solid commodity prices should provide a floor for the $A in the high $US0.60s.

Key implications for investors

Chinese shares remain reasonably good value from a long-term perspective, but beware their short-term volatility.

Solid Chinese growth should support commodity prices and resources shares.

Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information on how China's Economy can affect us here in Newcastle and Lake Macquarie. Call 0423 621 120 or email [email protected]

http://bmkfinancialservices.com.au/chinas-economy-is-quite-steady/

#chinaanddebtcrisis#chinadebtaustralia#chinadebtinusdollars#chinaeasterneconomy#chinaeconomyeconomist#chinaeconomyrankinginworld#chinaeconomyslowdown#chinaeconomytrump#chinaeconomywarning#chinaeconomyworldranking#chinaseconomycomparedtotheus

0 notes

Text

China's Economy is Quite Steady

What about high debt levels and other dangers?

Key points

- Main dangers concerning China associate with the policy concentration moving to decreasing leverage and reform, fast financial debt expansion, a trade battle with the United States and the real estate cycle. - Steady and firm Chinese growth is complementary of commodity costs and is favorable for the Australian economic climate and resource shares. - Chinese economical progress has been consistent from at about 6.8%. Anticipate Chinese financial growth this year of approximately 6.5% and rising cost of living of 2.5-3%. - Chinese shares continue to be moderately valued from a long-term viewpoint.

Introduction

It appears there is constant hand wringing about the dangers around the Chinese economy with the typical issues being around out of balance development, financial obligation, the residential or commercial property market, the currency exchange rate and capital circulations and a "difficult landing". This angst is easy to understand to some degree. Fast development as China has actually seen brings concerns about its sustainability. And China is now the world's second biggest economy, its most significant factor to development and Australia's most significant export market so exactly what takes place in China has huge implications worldwide. However regardless of all the concerns it keeps continuing and just recently development has actually been fairly steady. This note takes a look at China's development outlook, the primary dangers and exactly what it implies for financiers and Australia.

Benign Inflation with Stable growth

Chinese development slowed through the very first half of this years culminating in a development and currency scare in 2015 which saw Chinese policy swing from moderate tightening up to stimulus. This has actually seen quite steady development considering that 2016 of around 6.8% year on year. Constant with this, company conditions PMIs have actually likewise been steady (see the next chart) and unpredictability around the Renminbi has actually fallen & capital outflows have actually slowed.

Chinese growth is holding steady

Source: Bloomberg, AMP Capital

April information saw commercial production and earnings speed up however financial investment and retail sales slow a bit. Electrical energy usage, train freight and excavator sales have actually lost momentum from their highs. However the general impression is that development is still strong.

Chinese activity indicators

Source: Thomson Reuters, AMP Capital

While there is a requirement for China to rebalance its development away from investing for exports, the downturn in financial investment development to beneath that for retail sales, imports growing quicker than exports and the shrinking in China's bank account deficit from 10% of GDP to 1% of GDP recommends this taking place. On the other hand, inflation in China is benign with manufacturer cost inflation around 3% and customer rate inflation around 2%.

Chinese deflation has ended, but inflation is benign

Source: Bloomberg, AMP Capital

Policy neutral

Chinese financial policy has actually been fairly steady just recently. There has actually been some talk of improving domestic need and bank needed reserve ratios have actually been cut. However the latter appears to have actually been to enable banks to pay back medium term loan centres, rates of interest have actually been steady and development in public costs has actually been constant at 7-8% year for the year.

Growth and inflation outlook

We anticipate Chinese development this year to slow a bit as financial investment slows even more to around 6.5% and customer inflation of 2-3%.

Key risks facing China

There are 4 crucial threats dealing with China. Initially, the policy focus might move from preserving strong development to accelerating medium-term financial reforms and deleveraging (or cutting financial obligation ratios) that might threaten short-term financial development. Some anticipated this to happen after the 19th National Congress of the Communist Celebration ran out the method late in 2015. And the elimination of term limitations on President Xi Jinping might probably make him less conscious a short-term financial decline. Nevertheless, up until now there is no indication of this and the authorities appear concentrated on preserving strong development. Second, China's quick financial obligation development might turn sour. Given That the Global Financial Crisis, China's ratio of non-financial financial obligation to GDP has actually increased from around 150% to around 260%, which is a much faster increase than has actually happened in all other significant nations.

Chinese non-financial debt

Source: BIS, RBA, AMP Capital

This has actually been focused in business financial obligation and to a lower degree home financial obligation and has actually been simplified by monetary liberalisation and a great deal of the development has actually been outside the more regulated banking system in "shadow banking". An apparent issue is that when financial obligation development is quick it leads to a great deal of financing that ought to not have actually occurred that ultimately goes bad. Nevertheless, China's financial obligation issues are various to a lot of nations. Initially, as the world's greatest financial institution country China has actually obtained from itself - so there's no foreigners to trigger a a foreign exchange crisis. 2nd, much of the increase in financial obligation owes to business financial obligation that's partially linked to fiscal policy therefore the chances of federal government bailout are high. Lastly, the crucial driver of the increase in financial obligation in China is that it conserves around 46% of GDP and much of this is recycled through the banks where it's called debt. So unlike other nations with financial obligation issues China has to conserve less and take in more and it has to change more of its conserving into equity instead of debt. Chinese authorities have actually long understood the concern and development in shadow banking and general financial obligation has actually slowed however knocking on the financial obligation brakes without seeing more powerful usage makes no sense. Third, the danger of a trade war has actually intensified with Trump threatening tariffs on $50-150bn of imports from China and limitations on Chinese financial investment in the United States and China threatening to reciprocate. While "useful" settlements have actually begun and have actually seen China devote to purchasing more from the United States & to reinforce laws safeguarding copyright which saw the United States at first delay the tariffs and limitations, Trump has actually shown that they will be implemented this month which seems targeted at prodding China to move quickly (and calming his base). Eventually, we anticipate a worked out service, however the dangers are high and a full-blown trade war with the United States might knock 0.5% approximately off Chinese short-term development. Lastly, with the Chinese home market slowing once again there is naturally the threat that this might develop into a slump. It deserves a watchful eye however, missing an external shock looks uncertain. The "ghost cities" fear of a couple of years earlier-- it initially aired on SBS TELEVISION back in 2011 - has plainly not come to much. It's uncertain China ever truly had a generalised real estate bubble: family financial obligation is low by innovative national requirements; home costs have not stayed up to date with earnings; and while there's been some extreme supply, this isn't so in first tier cities; and the quality of the real estate stock is low requiring replacement. So, I believe the home crash worries continue to be overstated and the current bout of weak points in costs seems simply another cyclical downswing in China which there have actually been a number of over the last 10 years.

Chinese residential property prices - another cyclical downswing

Source: Bloomberg, AMP Capital

Our assessment remains that these risks are manageable, albeit the trade war risk is the hardest for China to manage given the erratic actions of President Trump. The Chinese Government has plenty of firepower to support growth though, so a “hard landing” for Chinese growth remains unlikely for now.

The Chinese share market

Considering its low in January 2016 the Chinese share market has actually had a great recovery. However Chinese shares are trading on a cost to revenues ratio of 12.8 times which is far from extreme.

Chinese Shares Stay Inexpensive

Source: Thomson Reuters, AMP Capital

With valuations okay and growth continuing, Chinese shares should provide reasonable returns, albeit they can be volatile.

Implications for Australia – not yet 2003, but still good

Solid growth in China should help keep commodity prices, Australia’s terms of trade and export volume growth reasonably solid. This, along with rising non-mining investment and strong public investment in infrastructure, will offset slowing housing investment and uncertainty over the outlook for consumer spending and will keep Australian economic growth going. However, with strong resources supply (and still falling mining investment) we are a long way from the boom time conditions of last decade and growth is likely to average around 2.5-3%. Rising US interest rates against flat Australian rates suggests more downside for the $A, but solid commodity prices should provide a floor for the $A in the high $US0.60s.

Key implications for investors

Chinese shares remain reasonably good value from a long-term perspective, but beware their short-term volatility.

Solid Chinese growth should support commodity prices and resources shares.

Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information on how China's Economy can affect us here in Newcastle and Lake Macquarie. Call 0423 621 120 or email [email protected]

http://bmkfinancialservices.com.au/chinas-economy-is-quite-steady/

#chinaanddebtcrisis#chinadebtaustralia#chinadebtinusdollars#chinaeasterneconomy#chinaeconomyeconomist#chinaeconomyrankinginworld#chinaeconomyslowdown#chinaeconomytrump#chinaeconomywarning#chinaeconomyworldranking#chinaseconomycomparedtotheus

0 notes

Text

Key Points of the 2018-19 Federal Budget

The Treasurer provided a 2018 Federal Budget that concentrated on decreasing the deficit spending, cutting taxes for lower and middle earners and supporting selective sectors of the economy, particularly infrastructure.

Key Points

The budget likewise revealed additional locations for aged care in the home, which will motivate retired people to remain in their own houses longer instead of relocating to aged care centers.

In general, the 2018 Federal Budget will have a restricted effect on the economy in the next fiscal year, nevertheless it will have a more considerable impact on income tax profits in later years.

Steps were likewise revealed to improve research study and advancement and to support the medical research study and biotechnology sectors. These are planned to grow industries that will diversify the economy whilst offering high earnings jobs. This is not likely to have a significant effect on the economy however will be favorable for those directly impacted.

There were some extremely modest modifications to superannuation. These connect to the arrangement of annuity items to handle durability threat, the extension of the Pension Work Plan, topping overall costs on low balance very accounts and increasing the optimum subscription of an SMSF from 4 to 6 individuals.

It will likewise offer longer-term chances for investors as federal governments ultimately privatise infrastructure assets in order to recycle funds back into new projects. This is favorable for infrastructure investing, a sector that can offer reliable earnings with some capacity for capital development, which is appealing in a low rate of interest environment.

Tax Cuts

Tax cuts remained in truth more modest than some analysts had actually been anticipating. In what is most likely to be the last budget prior to a closely battled general election, these were targeted at those people on lower and middle earnings.

The budget provided additional assistance for facilities which will offer an increase to efficiency over the long-lasting as journey times are lowered, e.g. quicker journeys from Melbourne's CBD to the airport on the brand-new quick rail link.

The budget is anticipated to lastly go back to a surplus in 2019-20, which is anticipated to increase in subsequent years, presuming a consistent course of ongoing financial development.

The primary tax cutting step is the intro of a low earnings tax balance out, a refund worth approximately $530 annually, paid through the yearly income tax return.

Contact Brad Lonergan (Financial Planner Newcastle and Lake Macquarie) for more information about the Australian Federal Budget for Newcastle and Lake Macquarie residents. Call 0423 621 120 or email [email protected]

http://bmkfinancialservices.com.au/key-points-of-the-2018-19-federal-budget/

#2018australianfederalbudget#2018federalbudget#2018federalbudgetamount#2018federalbudgetproposal#2018federalbudgetrelease#2018federalbudgetretirement#2018federalbudgetschedule#australianannualfederalbudget#australianfederalbudget#federalbudget201819

0 notes

Text

2018-19 Federal Budget - Newcastle Financial Report

Here’s a roundup of some of the key proposals put forward in last night’s Federal Budget. We take a look at how they might affect your financial goals — whether you’re starting out in your working life, building a career, having a family, or moving toward or living in retirement. Remember, at this stage these are just proposals and not yet law, which means things could change as legislation passes through parliament.

Taxation – General

1. Cuts to personal income tax rates

Proposed effective date: 1 July 2018 and onwards

The government is proposing income tax cuts over seven years through a three-step process:

Starting in the next financial year (2018-19), a new Low and Middle Income Tax Offset (LMITO) will be introduced to provide a tax cut of up to a maximum of $530 per year for those earning up to $125,333. Under the LMITO measures:

Those earning up to $37,000 will see their tax payable reduced by a maximum of $200.

Those earning $37,001 - $48,000 will see their tax payable reduced by up to $530.

Those earning $48,001 - $90,000 will see their tax payable reduced by the full $530.

For those earning between $90,001 - $125,333, the offset reduces at a rate of 1.5 cents for each dollar.

The tax benefits arising from the introduction of the LMITO will be received as a lump sum following lodgment of your tax return. This is in addition to the existing Low Income Tax Offset, currently a maximum of $445 for those earning up to $37,000. This offset is also proposed to increase to up to $645 from 1 July 2022.

From 1 July this year, the government is proposing to increase the top income threshold of the 32.5% tax bracket from the current $87,000 to $90,000. This change in threshold will give affected taxpayers a maximum tax reduction of $135 (which is in addition to the tax reduction they will receive under the LMITO). This will be followed by a proposed increase in the top income threshold of the 19% tax bracket from $37,000 to $41,000, and a proposed increase in the top income threshold of the 32.5% tax bracket from $90,000 to $120,000, commencing 1 July 2022.

From 1 July 2024, the government is proposing to remove the 37% tax bracket completely and increase the top income threshold of the 32.5% tax bracket from $120,000 to $200,000. This will mean that the 32.5% tax bracket will apply to people with taxable incomes of $41,001 to $200,000, while those earning more than $200,000 will pay the top tax rate of 45%.

2. Changes to the Medicare levy

Proposed effective date: 1 July 2017

The proposal in last year’s Budget to increase the Medicare levy from 2% of taxable income to 2.5% has been scrapped. The government is also proposing an increase in the thresholds at which the Medicare levy becomes payable for low-income singles, families, and seniors and pensioners starting this financial year. The threshold for singles will increase to $21,980, and the threshold for families will increase to $37,089, plus $3,406 for each dependent child or student. For single seniors and pensioners, the threshold will increase to $34,758, while the family threshold for seniors and pensioners will increase to $48,385, plus $3,406 for each dependent child or student.

Super

3. Work test changes for recent retirees

Proposed effective date: 1 July 2019

Currently, people aged 65 to 74 must work a minimum of 40 hours in a consecutive 30 day period in a financial year in order to contribute to their super. From 1 July 2019 the government is proposing people with super balances of less than $300,000 will be able to make voluntary contributions to their super for a year following the financial year in which they last met the work test. The changes will give recent retirees additional flexibility to get their finances in order as they transition to retirement. The existing contribution caps will apply, and they’ll also be able to carry forward any of their unused concessional contribution cap of $25,000 from previous years commencing from 1 July 2018, enabling them to make concessional contributions of more than $25,000 in the following year.

For example: Jason retires from full-time work on 1 May 2020, aged 66. His total superannuation balance is $280,000 on 30 June 2020. On 1 August 2020, Jason sells his share portfolio and wants to contribute the proceeds into his super. Under the current rules he doesn’t meet the work test in the 2020-21 financial year, so he can’t make any voluntary super contributions after 30 June 2020. Under the proposed changes, Jason could contribute $30,000 in concessional contributions in 2020-21 (as he has $5,000 in unused concessional contributions he can carry forward from the 2019-20 financial year). In addition, he could also contribute up to $100,000 in non-concessional contributions in 2020-21.

4. Ability to opt out of SG contributions for some high-income earners

Proposed effective date: 1 July 2018

Currently, some high-income earners unintentionally breach the $25,000 concessional contributions cap due to compulsory (SG) contributions made by multiple employers. This is because each employer must currently meet their quarterly SG obligations, up to the maximum contributions base (ie maximum SG contribution required in 2018-19 is 9.5% of $54,030 per quarter). From 1 July 2018, individuals will be able to nominate that their wages from certain employers are not subject to the SG if they have both:

income above $263,157

multiple employers.

Eligible employees may be able to re-negotiate their remuneration package to receive any foregone SG contributions as salary and wages or, consider other types of salary-packaging benefits.

5. Changes to insurance inside super

Proposed effective date: 1 July 2019

From 1 July 2019, the government is proposing to change taking out life insurance inside super to an opt-in basis for people:

with super balances of less than $6,000, or

who are under 25, or

whose accounts haven’t received a contribution in 13 months.

The changes are intended to ensure that the retirement savings of young people or those with low balances aren’t eroded by premiums on insurance policies they don’t need or aren’t aware of. It will also reduce the likelihood of having duplicate insurance cover in multiple funds.

6. SMSF rules to change

Proposed effective date: 1 July 2019

The government is proposing to increase the maximum number of allowable members in new and existing self-managed super funds, and small Australian Prudential Regulation Authority (APRA) funds, from four to six. For SMSFs with a history of good record-keeping and compliance, the annual audit requirement will change to a three-yearly requirement. This will apply to SMSFs with a history of three consecutive years of clear audit reports and that have lodged the fund’s annual returns in a timely manner.

7. Greater protection for those with lower super balances and banning exit fees

Proposed effective date: 1 July 2019

Exit fees will be banned on all super funds. A 3% annual cap will also be introduced on all ‘passive’ fees (such as administration and investment fees) charged by super funds to members with balances below $6,000. To enhance the current lost and inactive super scheme, the Australian Taxation Office will expand its data matching capabilities to, where possible, reunite any lost super into the member’s active super fund.

8. More retirement income choices for retirees

Proposed effective date: To be advised

The government is developing a framework to provide retirees with more choice around retirement income products. This includes introducing a retirement income covenant in the Superannuation Industry (Supervision) Act 1993, requiring trustees of APRA-regulated super funds to formulate a retirement income strategy for members. Trustees will be required to offer Comprehensive Income Products for Retirement (CIPRs), which aim to provide individuals with income for life. However, it will not be mandatory for members to take up a CIPR upon retirement. No commencement date has been provided for this measure. The government will release a position paper for consultation soon, outlining its proposed approach.

Taxation – Small business

9. Extension of the small business instant asset write off

Proposed effective date: 1 July 2018

The government will extend the $20,000 instant asset write-off by a further 12 months to 30 June 2019 for businesses with aggregate annual turnover of under $10 million. Small businesses will be able to immediately deduct purchases of assets costing less than $20,000 first used and installed ready for use by 30 June 2019.

Social security and aged care

10. Introduction of means testing of new income streams

Proposed effective date: 1 July 2019

From 1 July 2019, the government is proposing to introduce new means testing rules for new pooled lifetime income streams, including new lifetime annuities and new deferred lifetime annuities. Under the proposal:

60% of all pooled lifetime product payments will be counted as income

60% of the purchase price of the product will be counted as an asset until age 84, or for a minimum of five years, reverting to 30% for the rest of the person’s life.

These proposals will not apply to pooled lifetime income streams purchased before 1 July 2019, which will be subject to the current means test rules. Means testing of flexible account based pensions and existing annuities won’t change under this measure.

11. Extension of the Pension Work Bonus

Proposed effective date: 1 July 2019

The government is proposing to increase the work bonus for employees who have reached their Age Pension age to $300 per fortnight, up from $250 per fortnight, from 1 July 2019. The work bonus allows employees to reduce the amount of employment income they have assessed under the income test for social security purposes. It’s also proposing to extend eligibility for the work bonus to the self-employed. Currently, the work bonus is only available to employees (including those employed by their own company) but not to sole traders or partners in a partnership.

12. Extension of the Pension Loans Scheme

Proposed effective date: 1 July 2019

The Pension Loan Scheme is basically a reverse mortgage scheme administered by Centrelink, which allows those receiving a part Age Pension and those who are not receiving an Age Pension payment (because they’ve failed either the income or the assets test) to be paid a ‘top up’ loan to ensure they receive the equivalent of the full Age Pension amount. The government is proposing expanding eligibility for the scheme to all Australians of Age Pension age, including those on the full Age Pension and self-funded retirees, from 1 July 2019. Under the proposal, the maximum allowable combined Age Pension and scheme loan will be 150% of the full Age Pension rate.

For example: Susan is a single age pensioner who currently receives the full Age Pension of $23,598 per year. Under the proposed changes, Susan can increase her annual payment to $35,397 which will include her $23,598 in Age Pension and a tax-free loan amount of $11,799, repayable when her property is sold.

13. Access to aged care improvements

Proposed effective date: 1 July 2018

To support individuals who choose to access aged care services in their homes, the government will provide an additional 14,000 high level home care packages over four years. An extra 13,500 residential aged care places will be released in the 2018-19 Aged Care Approvals Round. To help people make informed decisions about their aged care needs, the government will trial a comprehensive navigator service for the aged care system. The aged care service finder functionality will be enhanced, and simpler aged care assessment forms will be introduced. Contact Brad Lonergan (Financial Planner Newcastle) for more information about the Australian Federal Budget for Newcastle residents. Call 0423 621 120 or email [email protected]

http://bmkfinancialservices.com.au/2018-19-federal-budget-newcastle-financial-report/

0 notes

Text

Spread Your Money and Reduce Risk

Six out of ten Australians own investments outside of the family home and super. That’s good news. The only problem is that many people are still putting all their eggs in one, or just a few, baskets. The latest investor study by the Australian Securities Exchange (ASX) found 40% of investors admit they don’t have a diversified portfolio. Almost one in two investors think their portfolio is diverse, yet they hold, on average, less than three different investment products.

The role of diversification

Diversification plays a key role in long term investing. To understand why, it can help to think about what goes on at the racetrack, where the bookies always seem to win while the punters are invariably left empty-handed. The secret to bookmakers’ success is that they spread their risk by continually changing the odds to encourage punters to back as many different horses in a single race as possible. This spread of money means the wins should outweigh losses. Punters, on the other hand, concentrate risk by betting on just one horse in each race. Unless the horse wins, the punter loses his money. When it comes to investing, the strategy of spreading your money so you have a little in a broad number of investments, not a lot in one, can strengthen long term returns and minimise losses in much the same way that bookies hedge their bets.

Sticking to what we know

However, a wealth of research shows diversification is a weak spot for many investors. The ASX found we tend to stick to cash, property and Australian shares. In addition to concentrating risk, this can mean missing out on decent returns earned by other asset classes. As a guide, a recent ASX/Russell report found residential property topped the league table of returns for mainstream investments over the last 10 years, averaging gains of 8.1% annually. What’s surprising is that over the same period, global bonds (hedged) and Australian bonds were the next best performing investments with average annual returns of 7.4% and 6.1% respectively. Aussie shares didn’t even make the top four, earning an average of 4.3% annually over the past decade (though to be fair, this period includes the global downturn when sharemarkets tanked). Cash delivered woeful returns of just 2.8% annually over the 10-year period.

Expanding your portfolio

It’s a compelling argument to consider expanding your portfolio beyond the mainstays of cash, bricks and mortar and local shares. This is an area where your adviser can deliver tailored recommendations. However, investments like bonds, infrastructure (which incidentally returned 13.3% globally over the last year), or international shares (10.6%) can be good additions to a portfolio. These types of investments can be difficult to access as an individual investor, and a managed investment fund – either listed or unlisted, offers an easy way to expand your portfolio into new areas and reap the rewards of diversification. It’s worthwhile seeking advice about what could work best for your portfolio. Contact Brad Lonergan (Financial Planner Newcastle) for more information about diversification in investment for Newcastle residents. Call 0423 621 120 or email [email protected] – by Paul Clitheroe AM Paul Clitheroe AM, co-founder and Executive Director of ipac securities limited, Chairman of the Australian Government Financial Literacy Board and Chief Commentator for Money magazine.

First published September 2017

http://bmkfinancialservices.com.au/spread-your-money-and-reduce-risk/

#diversificationininvestment#diversificationinvestmentvalue#diversificationthroughinvestmenttrusts#investmentdiversificationadvantages#investmentdiversificationanalysis#investmentdiversificationbenefits#investmentdiversificationcalculator#investment

0 notes

Text

The Pullback in Shares - 7 Reasons Not To Be Too Concerned

Key points

- The current pullback in shares has been triggered by worries around US inflation, the Fed and rising bond yields but made worse by an unwinding of bets that volatility would continue to fall. - We may have seen the worst, but it’s too early to say for sure. However, our view remains that it’s just another correction. - Key things for investors to bear in mind are that: corrections in the order of 5-15% are normal; in the absence of recession, a deep bear market is unlikely; selling shares after a fall just locks in a loss; share pullbacks provide opportunities for investors to pick them up more cheaply; while shares may have fallen, dividends haven’t; and finally, to avoid getting thrown out of a long-term investment strategy it’s best to turn down the noise during times like the present.

Introduction

The pullback in shares seen over the last week or two has seen much coverage and generated much concern. This is understandable given the rapid falls in share markets seen on some days. From their highs to their recent lows, US and Japanese shares have fallen 10%, Eurozone shares have fallen 8%, Chinese shares have fallen 9% and Australian shares have lost 6%. This note looks at the issues for investors and puts the falls into context.

Drivers behind the plunge

There are basically three drivers behind the plunge in share prices. First, the trigger was worries that US inflation would rise faster than expected resulting in more aggressive rate hikes by the US Federal Reserve and higher bond yields. Flowing from this are worries that the Fed might get it wrong and tighten too much causing an economic downturn and that higher bond yields will reduce the relative attractiveness of shares and investments that have benefited from the long period of low interest rates. Second, after not having had a decent correction since before Donald Trump was elected president and with high and rising levels of investor confidence, the US share market was long overdue a correction, which had left the market vulnerable. Finally, and related to this, the speed of the pullback is being exaggerated by the unwinding of a large build up of so-called short volatility bets (ie bets that volatility would continue to fall) via exchange traded investment products that made such bets possible. The unwinding of such positions after volatility rose further pushed up volatility indexes like the so-called VIX index and that accelerated the fall in US share prices. Quite why some investors thought volatility would continue to fall when it was already at record lows beats me, but this looks to be another case of financial engineering gone wrong! With shares having had a roughly 5-10% decline (in fact US share futures had had a 12% fall) from their recent highs to their lows and oversold technically and with the VIX volatility index having spiked to levels usually associated with market bottoms, we may have seen the worst but as always with market pull backs it’s impossible to know for sure particularly with bond yields likely to move still higher over time and if there is further unwinding of short volatility positions to go.

Considerations for investors

Sharp market falls with talk of billions of dollars being wiped off shares are stressful for investors as no one likes to see the value of their investments decline. However, several things are worth bearing in mind: First, periodic corrections in share markets in the order of 5-15% are healthy and normal. For example, during the tech com boom from 1995 to early 2000, the US share market had seven pull backs greater than 5% ranging from 6% up to 19% with an average decline of 10%. During the same period, the Australian share market had eight pullbacks ranging from 5% to 16% with an average of 8%. All against a backdrop of strong returns every year. During the 2003 to 2007 bull market, the Australian share market had five 5% plus corrections ranging from 7% to 12%, again with strong positive returns every year. More recently, the Australian share market had a 10% pullback in 2012, an 11% fall in 2013 (remember the taper tantrum?), an 8% fall in 2014 and a 20% fall between April 2015 and February 2016 all in the context of a gradual rising trend. And it has been similar for global shares, but against a strongly rising trend. See the next chart. In fact, share market corrections are healthy because they help limit a build up in complacency and excessive risk taking.

Corrections are normal - Global and Australian shares

Source: Bloomberg, AMP Capital

Related to this, shares literally climb a wall of worry over many years with numerous events dragging them down periodically, but with the long-term trend ultimately rising and providing higher returns than other more stable assets. In fact, bouts of volatility are the price we pay for the higher longer-term returns from shares.

Australian shares have climbed a wall of worry

Source: ASX, AMP Capital Second, the main driver of whether we see a correction (a fall of 5% to 15%) or even a mild bear market (with say a 20% decline that turns around relatively quickly like we saw in 2015-2016) as opposed to a major bear market (like that seen in the global financial crisis (GFC)) is whether we see a recession or not. Our assessment remains that recession is not imminent:

The post-GFC hangover has only just faded with high levels of business and consumer confidence globally only just starting to help drive stronger consumer spending and business investment.

While US monetary conditions are tightening they are still easy, and they are still very easy globally and in Australia (with monetary tightening still a fair way off in Europe, Japan and Australia). We are a long way from the sort of monetary tightening that leads into recession.

Tax cuts and their associated fiscal stimulus will boost US growth in part offsetting Fed rate hikes.

We have not seen the excesses – in terms of debt growth, overinvestment, capacity constraints and inflation – that normally precede recessions in the US, globally or Australia.

Reflecting this, global earnings growth is likely to remain strong providing strong underlying support for shares. Third, selling shares or switching to a more conservative investment strategy or superannuation option after a major fall just locks in a loss. With all the talk of billions being wiped off the share market, it may be tempting to sell. But this just turns a paper loss into a real loss with no hope of recovering. The best way to guard against making a decision to sell on the basis of emotion after a sharp fall in markets is to adopt a well thought out, long-term investment strategy and stick to it. Fourth, when shares and growth assets fall they are cheaper and offer higher long-term return prospects. So the key is to look for opportunities that the pullback provides – shares are cheaper. It’s impossible to time the bottom but one way to do it is to average in over time. Fifth, while shares may have fallen in value the dividends from the market haven’t. So the income flow you are receiving from a well-diversified portfolio of shares continues to remain attractive, particularly against bank deposits.

Australian shares still offering a much better yield than bank deposits

Source: RBA, Bloomberg, AMP Capital Sixth, shares and other related assets often bottom at the point of maximum bearishness, ie just when you and everyone else feel most negative towards them. So the trick is to buck the crowd. As Warren Buffett once said: “I will tell you how to become rich…Be fearful when others are greedy. Be greedy when others are fearful.” Finally, turn down the noise. At times like the present, the flow of negative news reaches fever pitch – and this is being accentuated by the growth of social media. Talk of billions wiped off share markets, record point declines for the Dow Jones index and talk of “crashes” help sell copy and generate clicks and views. But such headlines are often just a distortion. We are never told of the billions that market rebounds and the rising long-term trend in share prices adds to the share market. And as share indices rise in level over time of course given size percentage pullbacks will result in bigger declines in terms of index points. And 4% or so market falls are hardly a “crash”. Moreover, they provide no perspective and only add to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So best to turn down the noise and watch Brady Bunch, 90210 or Gilmore Girls re-runs!

http://bmkfinancialservices.com.au/the-pullback-in-shares-7-reasons-not-to-be-too-concerned/

#australiashare#australiasharemarket2018#australiasharemarketcharts#australiasharemarketcrash#australiasharemarketforecast#australiasharemarketgame#australiasharemarketindex#australiasharemarketnews#australiasharemarketprices#australiasharemarkettoday

0 notes

Link

Should You Lend Money to Family? Lending money to family can have many pitfalls. It's best to get good financial advice before doing so to ensure your needs are looked after first. Read the full report here: http://bmkfinancialservices.com.au/lend-money-family/ #FinancialAdviceNewcastle #FinancialPlannerNewcastle

0 notes

Text

How to Cope With Losing Independence

If you or a loved one is experiencing a fear of losing independence, you may be able to maintain a sense of control.

Few, if any of us, look forward to losing independence. In fact, research reveals that 75% of older people feared losing independence while only 29% feared dying. It also revealed that 44% were worried about moving into an aged care facility.

Whether a physical, social or emotional reason prevents complete independence, it generally brings a sense of loss.

Understanding the cycle of losing independence

As people age, the loss of independence can stem from physical and mental changes, and social and emotional effects that dramatically alter day-to-day life.

For example, physical changes like diminishing vision or a loss of hearing can interfere with the performance of simple tasks like driving, walking long distances or communicating in general. Mental impairment can cause people to lose the ability to perform everyday tasks and become forgetful.

Such changes increase the need for help from others and add to feelings of dependence and inadequacy, while lowering confidence and stopping some people from participating in enjoyable activities. The overall impact can increase feelings of frustration, anger, guilt and isolation.

To find out more contact me, Brad Lonergan at BMK Financial Services Newcastle OR Click here to "Ask Brad a Question" http://bmkfinancialservices.com.au/ask-brad-a-question/ OR call 0423 621 120

#FinancialPlannerNewcastle

How to Cope With Losing Independence

0 notes

Text

8 Money Mistakes People Make in Their 50s and 60s

When you’re in your 50s and 60s, you know you’ve worked long and hard for what you’ve achieved in life and probably have a fair idea of how you want to live in your future retirement. But it’s important not to become complacent and ignore the warning signs of not having enough money for retirement.

Here are some common money mistakes and suggestions on how to avoid them:

1. Accessing super too early

One of the most common mistakes people make is to start using their super too early, such as when they reach their preservation age. This can leave a significant shortfall in retirement savings when you need it most.

To avoid falling into this trap, ask yourself:

How long am I going to need to live on my retirement funds?

How much money do I have saved in my super now, and is it enough?

What other sources can I draw on to supplement my income?

Find out more at this blog post: http://bmkfinancialservices.com.au/money-mistakes-people-make-50s-60s/

0 notes