The Goal isn't more money, but the goal is living life on your own terms!

Don't wanna be here? Send us removal request.

Text

Market Summary: Key Takeaways (16/12/2024)

Indian Market: Volatility and Recovery

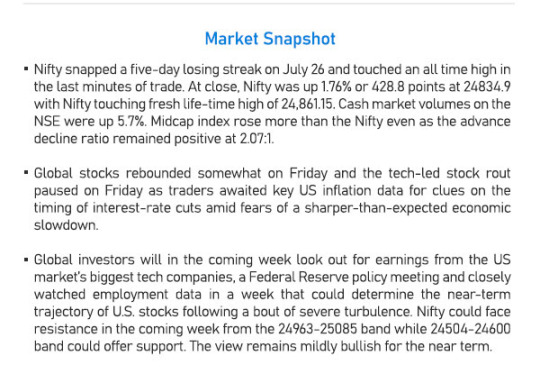

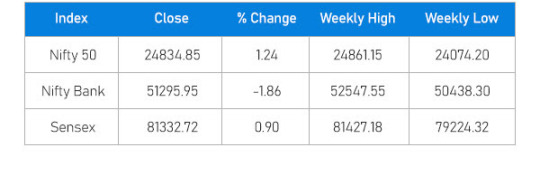

Indices Movement: Sensex broke out of its narrow range after an extremely volatile week, recovering 2000 points from its lows.

Inflation and IIP Data:

Inflation eased to 5.48% in November 2024.

Industrial Production (IIP) for October rose to 3.5% (improvement from September).

Market Participants:

FIIs: Net sellers of ₹227 crore.

DIIs: Net buyers of ₹2,880 crore.

Outlook: Nifty has regained bullish momentum with a target of 25,000 and support at 24,500.

Global Market: Mixed Trends

US Markets:

Nasdaq surpassed 20,000 for the first time.

Inflation rose for a second month to 2.7%.

Bond yields surged; crude oil prices climbed due to supply concerns.

Europe:

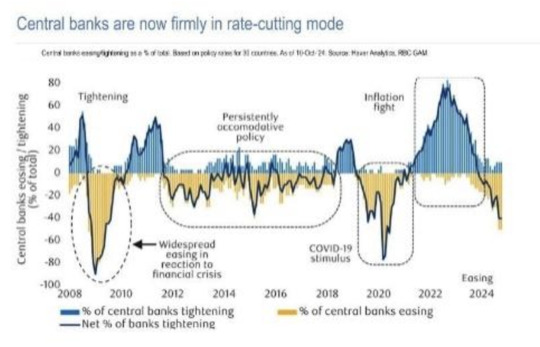

ECB continues rate cuts, delivering its fourth quarter-point reduction.

China:

Market sentiment weakened as recent fiscal policy announcements lacked clarity.

Japan:

GDP grew 0.3% Q-o-Q in Q3 2024, marking the second consecutive growth period.

Interest Rate Outlook

Global Trend: Interest rates are broadly expected to decline, but the pace of rate cuts remains uncertain.

US Fed: Likely to approve another 0.25% rate cut.

Japan: BOJ signals readiness for a gradual rate hike, targeting 1% by 2026.

Market Outlook

Nifty Target: 25,000.

Support: 24,500.

Catalysts: Positive domestic data (inflation, IIP) and potential US Fed rate cuts could sustain the bullish trend and strengthen the Indian currency.

0 notes

Text

Top 10 First-Generation Families With Active Second Gen Leaders

0 notes

Text

“It’s not enough to have knowledge, a dream, or passion; it’s what you do with what you know that counts. The best time to get started is now!” — Mark Minervini

0 notes

Text

WALL STREET FEAR GAUGE IN RECORD RETREAT AFTER LAST WEEK'S MASSIVE SPIKE

Wall Street’s most-watched gauge of investor anxiety is continuing its speedy retreat from panic levels, suggesting that investors may be returning to strategies that bank on low stock volatility despite a near-meltdown in equities early this month. The Cboe Volatility Index (^VIX) slipped to 16.31 on Wednesday, its lowest level since the beginning of the month. The index hit 65 on Aug. 5 and closed at a four-year high of 38.57 on that day as investors roiled markets by unwinding several massive positions such as the yen-funded carry trade. If the index's level holds into the close, the seven trading sessions it took the VIX to return to its long-term median of 17.6 will be the index’s quickest ever drop from 35, a level associated with a high degree of fear. Similar reversions in the so-called fear gauge have, on average, taken 170 sessions to play out, according to a Reuters analysis. Some options mavens believe the rapid retreat in the so-called fear gauge signals investors have returned to strategies that bank on markets remaining calm to deliver profits. Among those is the dispersion trade, in which investors seek to take advantage of the difference between index-level volatility and volatility in single stock options, analysts said. ✍️: Reuters

0 notes

Text

Go Digit Q1: Profit Surges 74% YoY To INR 101 Cr, GWP Jumps To INR 2,660 Cr

SUMMARY

Go Digit’s total gross written premium jumped 22.2% to INR 2,660 Cr in Q1 FY25 from INR 2,178 Cr in Q1 FY24

Net earned premium rose to INR 1,824 Cr during the period under review from INR 1,475 Cr in the year-ago quarter

The surge in GWP came largely on the back of growth in motor, health, travel, and personal accident premiums

Insurtech startup Go Digit General Insurance saw its profit after tax (PAT) soar 74% to INR 101 Cr in the June quarter (Q1) of the fiscal year 2024-25 (FY25) from INR 58 Cr in the year-ago quarter.

On similar lines, Go Digit’s total gross written premium (GWP) jumped 22.2% year-on-year to INR 2,660 Cr in the quarter ended June 2024. The insurtech startup clocked a GWP of INR 2,178 Cr in Q1 FY24.

The surge came largely on the back of growth in third-party motor, health, travel, and personal accident premiums.

Go Digit’s net earned premium rose to INR 1,824 Cr during the period under review from INR 1,475 Cr in the year-ago quarter.

Third-party motor premiums were the biggest contributor to Go Digit’s GWP during the period at 36%, followed by health, travel and personal accident premiums at 22%. While own-damage insurance premiums accounted for 19% of the total GWP, fire-related premiums contributed 17%.

The insurtech startup’s total income, including net earned premium, income from investments, and other income, jumped more than 24% YoY to INR 2,076 Cr during the period under review.

The company said that its premium retention ratio declined marginally to 76.2% in Q1 FY25 from 76.9% in the year-ago period. At the end of June 2024, Go Digit had INR 17,773 Cr in assets under management (AUM) as against INR 15,764 Cr at the end of June 2023.

Founded in 2017 by Kamesh Goyal, Go Digit leverages technology to offer insurance policies across verticals such as health, motor vehicle, travel, and property. The startup is backed by the likes of Fairfax, Peak XV Partners, A91 Partners, among others.

The insurtech startup made a muted debut on the bourses earlier this year, with its shares listing at a premium of 5% to the issue price on the NSE.

Zooming Into Expenses

Go Digit’s total operating expenses zoomed 21% to INR 1,993 Cr in Q1 FY25 from INR 1,642 Cr the year before.

Claims Paid: The company spent INR 118.1 Cr towards insurance claims during the quarter under the review as against INR 544.8 Cr a year ago.

Employee Cost: Go Digit spent INR 88.37 Cr on employee remuneration and welfare in Q1 FY25, up from INR 68.28 Cr in the year-ago period.

Ad Expenses: Spending towards branding, advertisement, and publicity declined more than 66% YoY to INR 50.75 Cr in Q1 FY25.

As of June 2024, Go Digit’s total customer base stood at 5.3 Cr.

Shares of Go Digit ended today’s trading 3.11% lower at INR 335.20 on the BSE.

0 notes

Text

Crude Oil Prices Rally on Bullish EIA Inventory Report and Russia's Promise of Additional Production Cuts

Sep WTI crude oil (CLU24) today is up +0.80 (+1.04%), and Sep RBOB gasoline (RBU24) is up +0.0384 (+1.62%).

Crude oil and gasoline prices today are higher on a bullish weekly EIA report. The energy markets have been to shake off today's sharp sell-off in US stocks and weak US manufacturing PMI and new home sales reports.

US crude oil inventories in the week ended July 19 fell by -3.74 million bbls, a larger drop than expectations of -3.5 million bbls. Gasoline inventories fell by -5.572 million bbls, the largest drop since March.

Oil prices are also being supported by Russia's statement that it plans to make additional crude production cuts in October and November 2024, and March-Sep 2025, to offset its above-quota production seen since April. Russia said its recent over-production has ceased and that its production in July will have been reduced to its OPEC+ quota.

Gasoline prices have underlying support as Exxon's Chicago-area refinery is still closed after a tornado last week cut electricity and forced a shutdown of the refinery on July 15. The refinery has capacity of 252,000 barrels/day. An Exxon spokesperson said on Wednesday the plant now has sufficient power to asset damage and begin the work to restart operations.

Crude has support from wildfires in Canada that threaten to curb Canadian crude production. Rystad Energy said last Friday that 52 out-of-control wildfires in Alberta, Canada, threaten nearly 500,000 bpd of crude oil sands output and pipeline shipments to the US.

OPEC+ rolled out a plan to restore some crude production in Q4, which sparked worries about a glut in global oil supplies. On June 2, OPEC+ extended the 2 million bpd of voluntary crude production cuts into Q3 but said they would gradually phase out the cuts over the following 12 months, beginning in October. OPEC pledged to extend its crude production cap at about 39 million bpd to the end of 2025. Also, the UAE was given a 300,000 bpd boost to its production target for 2025. In June, OPEC crude production fell -80,000 bpd to 26.98 million bpd.

Crude oil prices have underlying support from the Hamas-Israel conflict. Israel's military continues to conduct operations in Gaza, and there is the continued risk that the war might spread to Hezbollah in Lebanon or even to a direct conflict with Iran. Meanwhile, ongoing attacks on commercial shipping in the Red Sea by Iran-backed Houthi rebels have forced shippers to divert shipments around the southern tip of Africa instead of going through the Red Sea, disrupting global crude oil supplies.

Wednesday's EIA report showed that (1) US crude oil inventories as of July 19 were -5.1% below the seasonal 5-year average, (2) gasoline inventories were -1.8% below the seasonal 5-year average, and (3) distillate inventories were -8.6% below the 5-year seasonal average. US crude oil production in the week ending July 19 was unchanged w/w and matched a record high of 13.3 million bpd.

Baker Hughes reported last Friday that active US oil rigs in the week ending July 19 fell -1 rig to a 2-1/2 year low of 477 rigs. The number of US oil rigs has fallen over the past year from the 4-year high of 627 rigs posted in December 2022.

0 notes

Text

Crude Oil Prices See Support from Positive US GDP Report

September arabica coffee (KCU24) is up +2.05 (+0.89%), and Sep ICE robusta coffee (RMU24) is up +43 (+0.99%).

Coffee prices today are rebounding higher on some short-covering after the sharp sell-off seen in the past 2 weeks to new 2-week lows early today. Coffee prices are seeing support today from the slightly weaker dollar and the lack of rain last week in Brazil.

The lack of rain last week in Brazil is supportive for arabica coffee prices. Somar Meteorologia reported Monday that Brazil's Minas Gerais region received no rain last week, versus the historical average for the week of 2.6 mm. Minas Gerais accounts for about 30% of Brazil's arabica crop.

Coffee harvest pressures in Brazil are bearish for coffee prices. Safras & Mercado reported last Friday that Brazil's 2024/25 coffee harvest was 74% completed as of July 16, faster than 66% last year at the same time and faster than the 5-year average of 70%. Brazil is the world's largest producer of arabica coffee beans. However, Safras & Mercado cut its Brazil 2024/25 coffee output estimate to 66 million bags from a previous estimate of 70.4 million bags, citing above-average temperatures and drought that compromised coffee yields.

A rebound in ICE coffee inventories from historically low levels is negative for prices. ICE-monitored robusta coffee inventories rose to a 1-year high Wednesday of 6,478 lots, up from the record low of 1,958 lots posted in February 2024. Also, ICE-monitored arabica coffee inventories rose to a 1-1/2 year high on June 25 of 842,434 bags, up from the 24-year low of 224,066 bags posted in November 2023. Arabica inventories on Tuesday were mildly below that 1-1/2 year high at 813,378 bags.

Robusta coffee prices are underpinned by fears that excessive dryness in Vietnam will damage coffee crops and curb future global robusta production. Coffee trader Volcafe said on May 22 that Vietnam's 2024/25 robusta coffee crop may only be 24 million bags, the lowest in 13 years, as poor rainfall in Vietnam has caused "irreversible damage" to coffee blossoms. Volcafe also projects a global robusta deficit of 4.6 million bags in 2024/25, a smaller deficit than the 9-million-bag deficit seen in 2023/24 but the fourth consecutive year of robusta bean deficits.

Vietnam's agriculture department said on March 26 that Vietnam's coffee production in the 2023/24 crop year would drop by -20% to 1.472 MMT, the smallest crop in four years, due to drought. Also, the Vietnam Coffee Association said that Vietnam's 2023/24 coffee exports would drop -20% y/y to 1.336 MMT. The USDA FAS on May 31 projected that Vietnam's robusta coffee production in the new marketing year of 2024/25 will dip slightly to 27.9 million bags from 28 million bags in the 2023/24 season.

Smaller coffee exports from Vietnam, the world's largest robusta coffee producer, are bullish for prices. The General Department of Vietnam Customs reported July 9 that Vietnam's June coffee exports fell -11.5% m/m and -50.4% y/y to 70,202 MT, the smallest amount of coffee exports for the month of June in 13 years. Also, Vietnam's Jan-June coffee exports were down -11.4% y/y at 893,820 MT.

The International Coffee Organization (ICO) reported on July 5 that global May coffee exports rose +9.8% y/y to 11.78 million bags, and Oct-May global coffee exports were up +10.9% y/y to 92.73 million bags. Cecafe reported July 11 that Brazil's 2023/24 coffee exports rose +33% y/y to a record 47.3 million bags.

In a bearish factor, the International Coffee Organization (ICO) projected on May 3 that 2023/24 global coffee production would climb +5.8% y/y to 178 million bags due to an exceptional off-biennial crop year. ICO also projects global 2023/24 coffee consumption will rise +2.2% y/y to 177 million bags, resulting in a 1 million bag coffee surplus.

The USDA's bi-annual report released on June 20 was bearish for coffee prices. The USDA's Foreign Agriculture Service (FAS) projected that world coffee production in 2024/25 will increase +4.2% y/y to 176.235 million bags, with a +4.4% increase in arabica production to 99.855 million bags and a +3.9% increase in robusta production to 76.38 million bags. The USDA's FAS forecasts that 2024/25 ending stocks will climb by +7.7% to 25.78 million bags from 23.93 million bags in 2023/24. The USDA's FAS projects that Brazil's 2024/25 arabica production would climb +7.3% y/y to 48.2 mln bags due to higher yields and increased planted acreage. The USDA's FAS also forecasts that 2024/54 coffee production in Colombia, the world's second-largest arabica producer, will climb +1.6% y/y to 12.4 mln bags.

0 notes

Text

1/

VIX jumps +22%

The last time the VIX had more than a 22% price change from one session to another occurred on June 13, 2022. On this date, the VIX surged by 22.89% in response to heightened market volatility and investor concerns, primarily due to rising inflation and impending interest rate hikes by the Federal Reserve.

$VIX jumps to 18.04 (+22.55%) and gets closer to April's high. This spike reflects increased market uncertainty, typically driven by investor fears and market volatility. This significant increase aligns with recent market developments, including mixed earnings reports from major tech companies and economic data suggesting a slowdown.

The weekly and monthly MACD crossover confirms its long-term momentum shift. The 20 level stands as the resistance line. Let's see if it can hold.

2/

Positive Divergence

The KRE ETF has been under pressure due to concerns about the health of regional banks, which are more exposed to domestic economic issues and have been facing challenges such as tighter monetary policies and potential loan defaults.

KRE's performance has been lagging behind SPY, reflecting broader market trends and investor sentiment favoring larger. The KRE/SPY ratio has seen significant volatility. Historically, the ratio tends to rise when regional banks outperform the broader market, and it falls when they underperform.

Regional banks, and by extension KRE, are highly sensitive to changes in interest rates. The KRE ETF has been testing critical support levels recently. A breach below these levels could signal further downside.

Conversely, holding above support could indicate a potential bottoming out and a reversal. A Relative Strength Index (RSI) for KRE in oversold territory could suggest a potential buying opportunity, while an overbought RSI might indicate the need for caution.

Currently, we are observing a positive divergence between a key technical indicator and the price of the asset. Despite the price making new lows in early June, the indicator has started to form higher lows, suggesting a potential bullish reversal. This scenario has been identified twice since 2007, each time resulting in an upward rally in the asset’s price.

The price has recently experienced a positive jump and is nearing the highs seen in January.

3/

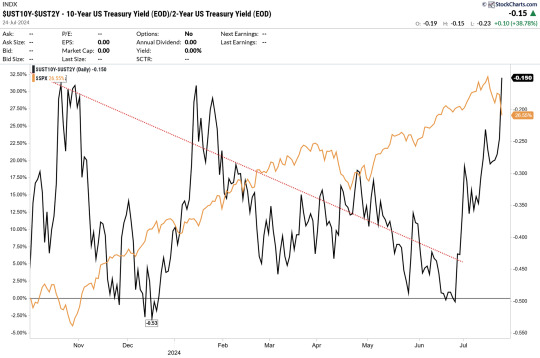

Yield Curve

The U.S. yield curve remains significantly inverted, a condition it has maintained for nearly two years, making it the longest yield curve inversion in history.

Historically, an inverted yield curve has been a reliable predictor of upcoming recessions. However, this current inversion has defied expectations, as the anticipated recession has not yet materialized. This anomaly can be attributed to several factors, including strong consumer spending, a robust labor market, and substantial fiscal stimulus measures that have supported the economy despite rising interest rates and inflation.

If the normalization is driven by a deep recession and aggressive Fed rate cuts, the initial market reaction might be negative, with equities potentially underperforming until there are clearer signs of economic recovery. Transitions in yield curve shape can be accompanied by market volatility as investors adjust their expectations and reallocate assets.

Historically, the normalization of the yield curve after an inversion has often been followed by economic recovery and market rallies. A move towards normalization would suggest that inflation is under control and the economy is on firmer footing.

Financials, especially banks, tend to benefit from a steepening yield curve as their net interest margins expand (the difference between what banks pay on deposits and earn on loans). This could lead to outperformance in the financial sector.

4/

Risk Off / Risk On?

With most indices down and a significant jump in the VIX, the Japanese Yen and Swiss Franc, traditionally seen as safe-haven currencies, have maintained their strength. This indicates that some investors are still seeking safety amid ongoing global economic concerns.

The Bank of Japan's continued dovish policy and yield curve control measures exert downward pressure on the JPY. Despite this, the bias for USD/JPY remains slightly bullish. However, caution is warranted as the price has been rejected for the third time by the resistance zone around 160.

Manuel Tellechea, CMT recently achieved the status of CMT Charterholder, though he has been affiliated with the CMT Association since 2021. He currently holds the position of Senior Analyst at Bendio AG, where he actively contributes to quantitative analysis and strategic decision-making processes. To learn more about his work, visit https://www.bendio.ch or follow Manuel on Twitter at @tellechea19.

0 notes

Text

5 big analyst AI moves: Microsoft seen as a 'clear-cut winner in AI', AMD upgraded

Here are the biggest analyst moves in the area of artificial intelligence (AI) for this week.

Microsoft seen as a ‘clear-cut winner in AI’

Microsoft Corporation (NASDAQ:MSFT) held a developer AI tour event in New York City last week and analysts were once again impressed by the company’s advance on the AI front.

For Barclays, the event was another piece of evidence that “Microsoft is a clear-cut winner in AI and has lots of runway to further monetize new and existing products.”

“[We] came away incrementally positive on the progress Microsoft is making in its AI offerings… While today's event did not feature any new announcements, the strong developer turnout (>3,000 attendees), as well as interest in a variety of Microsoft products (both Copilot and others) demonstrated to us that Microsoft is capturing incremental mind share amongst enterprise customers,” Barclays analysts said.

Can AI rally continue to drive the overall market higher?

Wolfe Research strategists weighed in on the most powerful stocks theme at the moment – AI. Their analysis shows that six prominent large-cap companies, poised to reap significant benefits from AI advancements, have collectively contributed +210 basis points (bps) to the S&P 500's year-to-date return of +268 bps.

Within the industry landscape, Semiconductors have stood out as the top-performing group. Companies positioned as major beneficiaries of AI advancements within this sector are anticipated to experience substantial additional advantages in the coming months.

“While expectations appear to be very high, our sense is that the biggest AI beneficiaries are likely to outperform until AI-related earnings expectations start to turn downward. In our view, this is unlikely to occur unless a broad-based recession starts to hit at some point in the months ahead,” strategists said in a note.

“That said, the bigger question is whether the “AI frenzy” can keep powering the overall market higher. While AI should remain a tailwind, our sense is that the overall Fed liquidity picture, the interest rate outlook, and how much the U.S. economy slows in the months ahead will be bigger drivers of overall market returns.”

Citi’s CIO survey

Citi's 4Q Chief Information Officer (CIO) survey results indicated a significant improvement in the IT budget landscape. Expectations for near-term IT budget growth have increased from +1.9% in the September '23 survey to +2.8% in the December quarter, approaching the historical average of 3%.

Cybersecurity retains its position as the top investment priority for CIOs, followed by Data modernization/GenAI, Digital Transformation Projects, and Cloud Adoption. The global economic outlook appears stable to slightly improving, with upward revisions noted in trailing 3-month IT budgets. Sector-specific takeaways cover Software, European Technology, Hardware, Communication Services and Infrastructure, and IT Service.

“MSFT remains the top vendor that CIOs are considering as a GenAI partner, far ahead of GOOGL and AMZN. In terms of the breakdown of funding for GenAI projects, 64% of CIOs expect to get new/additional funding while 36% believe it will come from existing resources, with some CIOs expecting to spend less on vendors such as ORCL, IBM (NYSE:IBM) or SAP to make room for GenAI investments,” analysts wrote in a note.

Samsung offers a 'very cheap' way to participate in edge AI

Analysts at Morgan Stanley urged the broker’s clients to consider owning Samsung Electronics Co Ltd (KS:005930) shares, as the company offers "one of the best ways” to play a shift to consumer AI.

The analysts argued that AI is "going to be a growth driver for years to come."

"We estimate double the DRAM content in AI PCs and a >50% rise in the next iteration of AI phones; along with replacement demand, this could drive 6ppt lower DRAM self-sufficiency by 2025," wrote Morgan Stanley analysts in the note.

"The turn of the memory cycles provides a big boost to earnings estimates," added the analysts. "Ultimately, Samsung is a very cheap way to participate in edge AI."

AMD raised to Buy

New Street Research analysts raised their rating on the shares of Advanced Micro Devices Inc (NASDAQ:AMD) to Buy with a $215 per share price target.

The broker’s analysis shows upside for all names in the data center AI chip sector, with AMD and TSMC standing out at each end of the risk spectrum.

"Lisa Su, CEO of AMD, pitched late last year a target addressable market for datacenter AI chips of $400bn. Lisa is to be taken seriously; this forecast might eventually prove wrong, but it was certainly not pulled out of a hat," the analysts said.

1 note

·

View note