Text

What is a Business Line of Credit?

Did you know that over 90% of Australian businesses struggle with cash flow concerns at least once a year? On average, firms experience 4.2 months of negative cash flow annually, restricting their growth potential and complicating operational issues. In such situations, having an overdraft facility can be a game-changer for any enterprise. Unsecured business overdrafts in Australia provide businesses with credit limits that can be accessed whenever needed. A credit line offers a lifeline for firms, helping them manage their working capital requirements, seize growth opportunities, and navigate market fluctuations. Also known as an unsecured business line of credit, this facility offers a cash flow buffer for business contingencies. What is a business line of credit? How does it work? If this is what you are wondering, this quick guide will help you learn everything you need to know about this financing option!

(Source: https://www.xero.com/content/dam/xero/pdfs/xsbi/cash-flow-challenges-facing-small-businesses.pdf)

Business Line of Credit: An Overview

A business line of credit or a business overdraft is a loan product offered by banks and non-bank lenders in Australia. It gives businesses access to funds up to a predetermined credit limit so the firms can use the money as needed. Unlike a traditional term loan, where the borrower receives a lump sum amount, a business line of credit works like a revolving credit facility. The lender sets a credit limit, and the borrowing firm can withdraw money within that limit and pay interest on the amount they borrow.

In most cases, a small business line of credit in Australia falls under unsecured business loans. However, the borrower may have to offer collateral if they want a significantly high limit for their overdraft facility. A business line of credit in Australia is perfect for enterprises that struggle with short-term cash flow fluctuations. It offers a convenient buffer for such contingencies, easing the financial strain of running the operations.

How Does a Business Overdraft Work?

A business overdraft is a unique credit facility that provides businesses with a safety net during cash flow challenges. With a line of credit, firms have the freedom to use the funds as needed, whether it is to manage seasonal fluctuations or buy stocks to meet customer demand. Let’s break down how this credit option works:

● A business applies for a credit line according to its anticipated needs.

● The lender evaluates the turnover and financial standing of the applicant.

● The lender approves a stipulated credit limit for a certain number of months/years.

● The firm withdraws funds as needed, provided the total amount remains within the set limit.

● The firm pays interest on the amount they borrow, and not on the approved limit.

In most cases, a small business overdraft facility in Australia works on a revolving basis. This means that the line of credit has an open-ended limit, allowing the borrower to withdraw and repay money as many times as they want. For example, let's assume that a small business gets a business overdraft facility with a limit of $100,000. If it has a revolving facility, the firm can borrow $50,000, repay it, and borrow another $70,000 within the same month. As long as the outstanding amount at any point in time is lower than the credit limit, the firm can borrow the sum they need. A line of credit allows borrowers to churn the money more efficiently to leverage the overdraft according to their requirements.

Unsecured business overdrafts in Australia ensure convenience and flexibility for SMEs, helping them finance their survival growth. In a country where 99% of businesses are small or medium-sized, a business overdraft is a valuable facility to ensure stability for thousands of firms. By utilising a line of credit, enterprises can navigate cash flow fluctuations and stay on track towards success. Here are some of the salient features of a small business line of credit in Australia:

● Amount: Lenders determine the credit limit based on business performance and other factors.

● Tenure: A small business overdraft facility in Australia is typically available for up to five years. When firms have constant access to a line of credit for a prolonged period, they can often manage their finances more efficiently.

● Interest Rate: Business overdraft interest rates in Australia depends on the risk score of a business determined by the lender. Lenders usually take into consideration the trading time, industry, credit score and the borrower's financial performance while determining the rate of interest.

● Repayment Frequency: Businesses can make their repayments weekly or monthly. These are amortised over time, ensuring significant flexibility for borrowers.

How is a Business Line of Credit Different from Other Business Loan Products?

A business line of credit stands out from other business loan products due to its flexibility and convenience. Unlike small business loans that provide a lump sum amount, a business line of credit allows borrowers to access funds on an as-needed basis, similar to a credit card. Businesses pay interest only on the amount they withdraw, saving them money in the long run. With its revolving nature and tailored repayment terms, a business line of credit empowers businesses to effectively manage their cash flow and seize opportunities when they arise.

While it is easy to distinguish between a line of credit and traditional business loans, many people struggle to differentiate between an overdraft facility and credit options like invoice financing and debtors financing. Let’s assess how a line of credit differs from these funding solutions:

● Security:

Invoice financing options are secured with unpaid invoices while debtors financing is secured with the borrower’s receivables ledger. However, unlike both these options, unsecured business lines of credit require no proof of incoming payments.

● Limit:

A business can only borrow upto 80-90% of their invoice amount/receivables ledger under an invoice/debtors finance facility. However, with a line of credit there’s no such limitations or reliance on the debtors/invoices.

● Flexibility and Control:

Invoice financing offers the flexibility to draw funds when businesses have high invoice realisation periods. Debtors financing allows borrowers to get funds without waiting for their customers to pay. It also allows them to leverage lower interest rates if their debtors repay early. However, a line of credit offers greater flexibility and control than both these options, allowing businesses to manage their money during contingencies without relying on their creditors’ decisions.

A line of credit or overdraft facility is extremely unique, offering businesses a plethora of benefits if managed efficiently. It can be a convenient alternative to traditional working capital loans, allowing firms to manage their urgent expenses with ease.

Pros and Cons of Taking a Line of Credit For Your Business

Now that you know how a business overdraft works and how it compares to other business loans, it’s time to dive deeper. What are the advantages of getting a line of credit for your firm? Let’s find out:

● Flexibility and Convenience: The flexibility of fund usage is one of the biggest advantages of getting a business overdraft facility. You can use it to address various business needs: like buying inventory, paying wages, marketing, and managing cash flow requirements. With this financial tool at your disposal, you can seize opportunities promptly without the need for lengthy loan applications.

● Do not necessarily require security: SMEs can get unsecured business overdrafts depending on their performance and requirements. If a firm lacks the necessary assets to apply for secured business loans, it may get an unsecured credit line to manage its urgent expenses. However, some lenders also offer secured lines of credit for borrowers who can offer collateral. Business owners can evaluate both options and choose the one that fits their needs.

● Absence of Repayment Penalties: With a business line of credit, you have the flexibility to pay off the borrowed amount early without incurring any penalties. This gives you the freedom to manage your finances efficiently and save on unnecessary interest costs. For example, if you borrow $20,000 out of your $100,000 limit and repay it within ten days, you need not pay any additional charges for the early repayment option.

● Savings on Interest Costs: One of the most significant advantages of a business overdraft facility is that you only pay interest on the amount you use. This aspect often results in substantial savings compared to traditional loans where interest accrues on the entire loan amount from the start. Moreover, business overdraft interest rates in Australia are quite affordable, making this a suitable option for numerous SMEs.

● Continuous Backup for Contingencies: A business line of credit offers peace of mind as lenders provide this facility for up to five years. It acts as a valuable backup during contingencies and helps you navigate business challenges with ease. When you have a line of credit, you can plan and execute your business strategies more efficiently without worrying about immediate repayment deadlines.

While a business line of credit provides flexibility and easy access to funds, there are some potential issues to consider. Here are some possible disadvantages of taking this option:

● Credit Score and Monthly Turnover Requirements: Lenders often give preference to borrowers with good credit scores when it comes to approving new lines of credit. Most lenders also require a minimum monthly turnover of $10,000 to provide the overdraft facility to enterprises. These requirements may be challenging for new businesses or those with lower credit ratings, limiting their access to this type of financing.

● Line Fees: Lenders may charge a small line fee on the overall credit limit, in addition to regular interest rates. These fees can impact the cost of borrowing and business owners should take them into account while assessing the affordability of an overdraft facility.

● Possibility for Limit Reduction: Lenders have the right to review and reduce the credit limit for an overdraft facility. They may reduce or withdraw the credit limit if they observe irregularities in repayments, a decline in business turnover, or misuse of funds. Hence, the borrower must be careful in the way they utilise their line of credit.

Potential borrowers must weigh the pros and cons before exploring this business financing tool. If managed effectively, a line of credit can be a valuable resource for managing business requirements and funding expansion and growth. Hence, borrowers should strike a balance between the upsides and downsides to make the most of this option.

Who Can Apply for a Business Line of Credit?

A business line of credit is available for eligible SMEs that meet the lending criteria for the issuance of this facility. Typically, the lenders accept business overdraft applications from businesses that meet the following requirements:

● An Active ABN:

An applicant must have a valid and active Australian Business Number (ABN) to apply for this business loan product. Registered SMEs should provide the ABN during the application stage.

● Business Duration:

Lenders typically require businesses to have been operating for at least 12 months. This aspect demonstrates stability and viability in the eyes of the lender.

● Minimum Monthly Turnover:

Most lenders require borrowers to have a monthly turnover of $10,000 or more for providing them with lines of credit. This criterion ensures that your business generates sufficient revenue to handle the credit line responsibly.

If your enterprise meets these requirements, you can consider getting an overdraft facility. You may consult an experienced financial broker to discuss your eligibility and other factors that affect the approval of a credit line.

Why Should a Business Consider Having an Overdraft Facility?

If your business has sufficient funds to run day-to-day operations, you may think that there is no need to opt for a credit facility. But having a line of credit can be a game-changer for your firm, providing you with the requisite flexibility to make quick business decisions. Even if you have no immediate need for a loan, you can get a line of credit to act as a financial buffer. An overdraft facility acts as a valuable contingency plan. Unforeseen expenses, sudden market fluctuations, or unexpected opportunities can arise at any time. However, firms can rely on their credit lines to navigate these contingencies without disrupting their operations or missing out on opportunities.

By having access to readily available funds, businesses can maintain stability and continue their operations seamlessly, even during lean periods. Moreover, an overdraft facility demonstrates financial responsibility and builds a positive credit history. Lenders perceive businesses with an approved overdraft as proactive and well-prepared, making them seem more credible and trustworthy. As a result, it helps open doors to better financing solutions and favourable loan terms in the future. Essentially, having an overdraft facility fosters financial agility and adaptability. In today's competitive landscape, businesses must respond to market demands and swiftly capitalise on growth opportunities. An overdraft facility ensures that firms can seize these opportunities promptly without the delays associated with traditional loan approval processes.

How Do Lenders Determine Credit Limits for Businesses?

When businesses seek a line of credit, understanding how lenders determine credit limits is crucial. In Australia, lenders assess various factors to determine the maximum amount of credit they can extend to a business. Here are the key considerations that lenders take into account while evaluating applications:

● Financial Position:

Lenders assess a business's financial strength by analysing its cash flow position, turnover trends, and repayment capacity. If your business has a high monthly turnover, you may get a proportionately high credit limit as you can afford to repay the funds on time. On the other hand, firms with lower turnover figures get smaller credit lines.

● Business Duration:

Your firm can get an overdraft facility if it has been operational for a year or more. Typically, lenders look at the borrower’s time in business to assess the credit risks. They often perceive businesses with more than a year of operation as being more stable, making them more likely to handle additional debt obligations.

● Security:

While many firms are likely to qualify for unsecured lines of credit, lenders often favour businesses that can provide assets as collateral. Having assets to offer as security increases the likelihood of obtaining a higher credit limit with more favourable terms.

● Industry Characteristics:

The industry in which a business operates plays a role in determining the approved credit limit. Lenders evaluate the risks associated with the borrower’s industry and analyse market conditions before finalising the credit line. They often assess the typical payment cycles within various industries to ascertain whether a borrower can keep up with regular repayments.

● Credit Score:

A firm’s credit score helps lenders assess their risk level. A higher credit score instils confidence in lenders, increasing the likelihood of approval for a higher credit limit. Conversely, a lower credit score may lead to a lower credit limit. While bad credit business loans are available for enterprises with poor credit scores, it helps to have a good credit history when looking for overdraft facilities.

Analysing these factors can help you estimate how much you can borrow through a credit line. You can discuss your firm’s characteristics with a business loan expert to determine likely credit limits you can get for your business!

How to Apply for a Business Line of Credit? Documents and Procedures

Now that you know the different aspects of this credit option, you may be wondering about the application process. How to apply for a business overdraft? Let’s break it down:

#1 Assess Your Eligibility and Requirements

You should consider the lending criteria and determine your eligibility before applying for an overdraft facility. You can also analyse aspects like your time in business, industry characteristics, turnover, and other requirements to ascertain how much you can get in terms of a credit limit.

#2 Consult a Finance Broker

You can discuss your situation with a financial broker to get their opinion and advice. Experienced consultants provide valuable insights, help you understand the options available, and guide you through the application process. They can also help you compare business loans and determine whether a secured or unsecured line of credit is the best solution for your business!

#3 Get an Indicative Quote

Business loan specialists can provide you with an indicative quote to help you estimate the credit limit and interest rates you may get. To get this quote, you can fill up details like your firm’s average monthly turnover and credit requirements. Once you get the estimate, you can make an informed decision about applying for a credit line.

#4 Prepare Your Documents

Business lines of credit do not require elaborate paperwork for approval and settlement. For credit lines up to $250,000, you can get a low-doc approval with the following documents:

● Bank statements for the past six months.

● The business owner’s valid identification proof.

If you want a credit limit higher than $250,000, you may opt for the full-doc approval process. The additional documents required for this process are as follows:

● ATO Statements

● Financial Statements

● Proof of Property Ownership

Before filing your application, you should prepare the relevant documents to ensure a seamless application process.

#5 Submit Your Application and Wait for Approval

The application process is simple and convenient. You can apply online with the help of your broker and upload all the necessary documents. The pre-approval formalities take 24-48 hours while unconditional settlement and approval take one to three days. Once you submit your application, you must wait for a maximum of three days to get a final decision from the lender. When you get the approval, you should review the paperwork carefully to understand the terms and conditions of the credit facility.

If you have more questions about how to apply for a business overdraft, you can contact our expert at Broc Finance! Our financial brokers can resolve your queries and help you apply for a credit line. Call our team today to learn more about your loan options!

Source: https://www.brocfinance.com.au/blog/what-is-a-business-line-of-credit/

#compare business loans#bad credit business loans#small business loans#secured business loans#working capital loans#unsecured business loans#business line of credit in Australia

0 notes

Text

Guide to Understanding Small Business Loans

Australia's thriving entrepreneurial landscape demands accessible financing solutions to fuel business growth and innovation. Small business loans play a pivotal role in empowering local ventures, offering capital infusion to fund expansions, equipment purchases, and business optimisation. The most common reason for SMEs in Australia to look for small business loans is to buy equipment. Cash flow management, business expansions, inventory purchases, and invoice payments are other critical reasons why they need the funds. Loans for small businesses can help entrepreneurs manage exigencies and seize opportunities in the market. Let’s discuss everything you need to know about small business loans in Australia!

Purpose of additional finance SMEs, % Aug 2021 & 2022

WHAT ARE SMALL BUSINESS LOANS?

youtube

A small business loan is a financing option that allows business owners to get a lump sum amount from lenders to manage various business expenses. They are required to repay the loan at a fixed interest rate over a specified period. There are many types of small business loan products that suit a variety of enterprises. From start-up business loans to bad credit small business loans, there are numerous options to explore. Let’s break down the typical terms of small business finance products available in the market:

● Loan Amount: Small businesses can get loans in the range of $5000 to $1 million, depending on a multitude of factors. The average loan amount for small businesses in Australia is on the rise, growing by 15% between 2021 and 2022. Fuelled by post-pandemic recovery, many lenders are now lending more money to small businesses than ever before.

● Loan Term: In most cases, lenders provide small business loans for three months to three years.

● Interest Rate: Small business loan rates Lenders determine the interest rate based on factors like the firm’s financial strength, credit history, availability of collateral, industry prospects and more. A small business loan calculator can help you estimate your potential repayments based on the indicative interest rates typically charged by lenders.

● Repayment Frequency: Small businesses can make weekly, fortnightly, or monthly repayments according to their loan agreement with the lender. This flexibility makes it convenient for small-scale businesses to pay back these loans.

What Can You Do with a Small Business Loan?

A firm can use its small business loan to take care of various business expenses. Lenders usually do not place restrictions on how you can utilise the loan amount, provided it goes towards a legitimate business expenditure. Here are some of the ways of using a small business loan to maximise your firm's potential for success.

(Source: https://www.nbcbanking.com/business-banking/business-lending-guide/how-business-loans-work/)

● Working Capital Needs: Small loans for businesses can help these firms navigate their day-to-day expenses. Seasonal ventures with cash flow fluctuations often rely on small business loans to manage expenditures.

● Equipment Purchase: Many businesses rely on key pieces of equipment to provide their services and drive value for customers. They may need to purchase new equipment or machinery to scale their operations or replace an old asset. In such situations, they can borrow money from lenders to fund this essential business expense.

● Real Estate Investments: If you run a small business, you may want to purchase or lease new premises for your firm. You may want to expand and renovate your current premises or open new branches to grow your business. A small business loan can come in handy for all these purposes and help you take your venture to new heights.

● Buying Inventory: Lack of inventory can lead to the loss of sales and competitive advantage in the market. Hence, it is essential to maintain adequate inventory stocks to meet your demand forecasts. Many firms take out small business loans during festive seasons or other high-demand periods to buy more inventory to cater to the demand.

● Start-up Costs: Often, an entrepreneur may have an excellent business idea, but they may lack the funds to execute their plans. In such situations, small business loans can come to their rescue. They can borrow money to initiate their operations and lay the foundations for growth.

Small Business Loans: Options to Explore

If you want to explore loans for your small business, there are numerous options to explore. Let’s discuss the various types of small business loans available to firms:

● Unsecured Small Business Loans: Small businesses may lack the assets or time required to take out secured loans. In such situations, they can browse unsecured business loans to meet their needs. Lenders provide unsecured loans without any security or collateral. Since the risk for the lender is high, they tend to charge a slightly higher rate of interest to compensate for the same. Unsecured loans are a hassle-free source of funding because it takes very little time to process and approve these loans. A firm needs to submit only their bank statements for loans up to $250K. They can get a quick business loan within 24 hours for a term of 3-36 months if they opt for unsecured credit.

● Secured Small Business Loans: A secured business loan is a lump sum amount lent against some security or collateral. The borrower must offer a real estate property to the lender to secure this type of loan. Secured small business loans are excellent for start-ups that have no business activity or financial strength to show. They can pledge a residential or commercial property as collateral to cover the lender’s risk and get favourable terms on the loan. They can get small business start-up loans up to 80% of the value of their pledged asset. These loans are available for 3-18 months, allowing sufficient time for new firms to set up their operations.

● Small Business Line of Credit: A business overdraft is a flexible source of finance for small business owners. In this case, the lender approves a credit limit, and the firm can withdraw money according to their unique business requirements. They have to pay interest on the amount they withdraw and not the entire credit limit. Business lines of credit in Australia help firms navigate their working capital needs by providing an interest-free buffer.

● Bad Credit Loans: Lenders evaluate the credit score of applicants in detail before approving their loans. However, this does not mean that it is impossible to get a small business loan because of the applicant’s poor personal or business credit history. Bad credit small business loans are available to Australian firms with some stringent terms and conditions. These loans often carry higher rates of interest and have more rigorous lending criteria. Typically, bad credit business loans are available for a short-term period between three to twelve months.

● Short-term Loans: Short-term business loans are perfect for bridging capital needs. Firms can get short-term credit to meet urgent working capital requirements and tackle cash flow fluctuations. These loans require minimal documentation and are usually quick to be processed.

● Small Business Equipment Finance: 27% of SMEs borrow money to buy new equipment to streamline their operations. Hence, lenders frequently offer favourable terms to secure loans for this purpose. Firms can secure equipment loans against the value of the newly acquired asset and pay lower interest rates compared to unsecured loans. These loans can usually be taken for up to seven years, ensuring flexibility and convenience for the borrowers.

Eligibility Criteria to Get Small Business Loans in Australia

Borrowers have to meet the required criteria to be eligible for small business loans. They are as follows:

● Registration: The borrowing firm must have a valid and active Australian Business Number (ABN) to apply for business financing.

● Trading History: Many lenders prefer to advance small loans for business purposes to firms that have been in operation for six months or more. However, start-up businesses can also secure loans by pledging collateral to the lenders.

● Monthly Turnover: Small businesses need a monthly turnover of $5K or more to be eligible for most business loan products.

Advantages and Disadvantages of Taking a Small Business Loan

Small business loans can be a game-changer for business owners who want to grow their ventures or navigate challenging times. However, it is crucial to weigh the pros and cons of these loans before deciding to borrow. Here are the advantages you can expect with small business loans:

● Access to Capital: Small business loans provide a vital infusion of capital, enabling entrepreneurs to fund startup costs, expand operations, invest in equipment, or seize growth opportunities.

● Smooth Cash Flow: Small business loans can help address cash flow gaps, ensuring the continuity of operations and providing stability during lean periods or unexpected expenses.

● Flexibility in Use: Business loans offer flexibility in how the funds are utilised. Entrepreneurs have the freedom to allocate them as needed to drive their business forward.

● Building Credit: Responsible borrowing and timely repayments can help establish and improve your business credit profile. Increasing your credit score can potentially open doors to more favourable terms in the future.

● Quick and Hassle-Free Approvals: In most cases, lenders process small business loans very quickly. You can get unsecured loans in just 24-72 hours, while secured loans take about 3-7 days for unconditional approval and settlement. The experience of applying for small business loans is quite hassle-free, as businesses have to submit just a few documents to facilitate the process. Most small business loans are low-doc, requiring the applicants to submit their last six months’ bank statements and identification proofs to secure approval.

● Variety of Options: Small businesses can explore various loan products to find the options that suit them the best. They can compare small business loan rates and the terms offered by lenders to fit their unique business model. There are numerous small business loans available in the market, allowing business owners to compare the loans and opt for flexible sources of funding.

Now that you know the advantages of taking a small business loan, let’s discuss the potential disadvantages to help you make an informed decision:

● Small Amounts: Lenders often consider small businesses riskier than established firms because of their limitations in scale. As a result, they tend to approve lower amounts for small business loans to minimise their risks.

● Higher Rates of Interest: Small-scale businesses may have to pay a higher interest rate than larger firms with a demonstrated history of success. Lenders tend to charge higher interest rates to cover their risks in case the borrowers go bankrupt and fail to repay their loans. The higher interest rate can lead to high repayments, affecting the firm’s cash flow situation.

● No Guarantee of Business Growth: While small business loans are valuable tools for growing local ventures, they do not guarantee long-term business expansions. Success and growth depend on execution and not just the infusion of funds. A small business loan may not solve long-term business challenges. Hence, it is crucial to carefully weigh your requirements and business plans before taking out a loan.

You should carefully understand these advantages and disadvantages before applying for a loan. A detailed analysis will help you make an informed decision and avoid pitfalls in the future.

How to Apply for a Small Business Loan?

First-time borrowers may be daunted by the idea of applying for a small business loan. SMEs in Australia often struggle to figure out how to get a bank loan for small businesses, with many of them experiencing difficulties in finding a willing lender or an affordable loan. In such cases, firms can work with experienced finance brokers to connect with alternative lenders who offer flexible loan terms for small-scale ventures.

(Source: https://www.smefinanceforum.org/post/survey-finds-funding-gap-is-stifling-small-business-growth-in-australia)

If you are a small business owner looking for an affordable loan, following a structured approach can help you navigate the application process. Here are the steps you can take to simplify your loan application journey:

#1 Determine Your Funding Needs

Before applying for a small business loan, evaluate your funding requirements. Clearly define how much capital you need, what it will be used for, and the repayment terms you can comfortably manage. You can use a small business loan calculator to ascertain the potential repayments and assess if the amount fits your business budget.

#2 Research Loan Options and Eligibility Criteria

Thoroughly research different loan options and lenders to find the most suitable fit for your business. Understand the eligibility criteria for getting a small business loan to suit your requirements. At this stage, you can contact a financial broker to discuss your needs and explore the loan products that may be right for you. Compare the business loans and decide where you want to apply.

#3 Prepare Your Documents

Applicants must submit the required documents to facilitate the loan approval process. If you want a loan up to $250K, a low-doc application will suffice. You need the following documents for low-doc loan approval:

● A valid identification document.

● Bank statements from the past six months.

The lenders may require some more documents based on the nature of the loan you want. For example, if there is no ATO payments cited in the bank statement, the lender may ask for ATO statement. Your finance broker can guide you to prepare the necessary documents for a hassle-free application process.

If you want to apply for an unsecured loan over $250K, you have to submit the following documents in addition to the bank statements and identification proofs:

● Financial statements.

● ATO statements.

You can prepare your documents in advance before filling up your loan application.

#4 Submit the Application

Once you have gathered the required documents, submit your loan application. Ensure that all information provided is accurate and complete. Double-check the application for any mistakes or omissions that could potentially delay the approval process. You can submit your application online with all the required details. Your financial broker can go through your application and forward it to the most suitable lender to fast-track the process.

#5 Review and Accept the Loan Offer

After submitting your application, the lender will evaluate your eligibility and provide their loan offer. Carefully review the terms, including interest rates, repayment duration, and associated fees. Once you are satisfied, you can accept it by following the lender's instructions. If you have any queries, you can consult your financial broker for clarification. Once all requirements are met, the lender will finalise the loan and transfer the funds to your designated account. In some cases, you can receive the approval and the loan amount within just twenty-four hours.

How do Lenders Evaluate Applications for Small Business Loans?

Lenders evaluate the following factors to determine the status of a loan application:

● Industry and Market Factors: Lenders consider the industry in which the business operates, examining its growth potential, market conditions, and competitive landscape. They evaluate the risk associated with your industry's stability and your firm's position within the industry.

● Financial Position: Lenders assess the firm's financial strength to determine whether they can service the debt. Typically, a high monthly turnover is a positive indicator for lenders, leading them to approve higher amounts.

● Security: Lenders may require collateral to secure the loan. They assess the value and marketability of the offered collateral, such as real estate, inventory, or equipment, to mitigate the risk in case of default. If you take an unsecured small business loan, the lenders often prioritise applications where the firm or its directors are asset-backed.

● Credit Score: Lenders carefully assess your creditworthiness by reviewing your personal and business credit history. They consider factors such as your credit score, payment history, outstanding debts, and any past bankruptcies or defaults. The credit score is especially important for a new business, as it can minimise the lender’s risk and make them more likely to issue an approval.

● Trading History: Businesses operating for more than one year often get precedence when lenders evaluate loan applications. However, newer firms can also get start-up business loans from several alternative lenders.

Lenders analyse these factors to determine the loan amount, interest rate, and other terms they are willing to approve. Evaluating these aspects can give you more clarity about your loan prospects.

Tips to Simplify Your Small Business Loan Application Process

Applying for a business loan can be a complex process, but with the right approach, you can simplify it and increase your chances of success. By taking steps to streamline your loan application, you can save time, reduce stress, and present an excellent application to lenders. Here are some tips to simplify your application:

● Strengthen Your Credit Profile: You should prioritise improving your credit profile by paying bills on time, reducing outstanding debts, and correcting any errors on your credit report. A strong credit profile enhances your credibility and increases your chances of loan approval.

● Consult a Finance Broker: Once you identify your funding requirements, you can start exploring suitable options. Many SMEs in Australia struggle to find bank loans to fund their business operations. If you face this issue or do not know how to get a bank loan for your small business, it is better to partner with a finance broker. These brokers can connect you to a network of alternative lenders who provide tailored financing solutions for your firm. Moreover, their expertise can help you navigate the complexities and ensure your application is thorough and compelling. They can guide you about various aspects of the process and provide you with relevant information. From average loan amounts for small businesses to typical interest rates, they have in-depth knowledge about all facets of small business loans to help you.

● Explore Government Schemes: You can check government small business loans to find options that may fit your needs. The Australian government sometimes initiates loan assistance programmes to fuel the growth of SMEs. A knowledgeable finance broker can provide you with information about government small business loan schemes, enabling you to make the best decision for your firm.

● Prepare a Detailed Business Plan: Although lenders do not mandate the submission of a business plan, it is better to be prepared to demonstrate your growth trajectory. Craft a detailed and professional business plan that outlines your business objectives, strategies, financial projections, and market analysis. A well-prepared plan demonstrates your preparedness and increases the lender’s confidence.

If you want guidance and support to apply for various small business loans, you should contact Broc Finance today! Its team of financial brokers can help you apply for working capital loans and other credit options to help you achieve your business goals.

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-small-business-loans/

#working capital loans#business overdraft#Business lines of credit in Australia#bad credit business loans#Short-term business loans#unsecured business loans#small business loan

0 notes

Text

GUIDE TO UNDERSTANDING UNSECURED BUSINESS LOANS

Small and medium enterprises (SMEs) in Australia play a crucial role in the national economy. They collectively provide over 65% of the private sector employment and contribute more than $700 billion to the country's GDP. However, despite their economic significance, many SMEs struggle to get loan approvals from traditional lenders like banks. In such situations, they can rely on alternative financing sources for business loans in Australia. SMEs can explore numerous loan products and choose the options that suit their requirements. Some of the most popular loan products fall in the category of unsecured loans. An unsecured business loan allows a firm to secure collateral-free funding, helping it manage urgent expenses and fuel critical expansion plans. Let’s discuss this funding option in detail and understand how to get the best unsecured business loans!

Unsecured Business Loans: An Overview

An unsecured business loan is a financing option that allows a firm to borrow money without providing any collateral. The collateral represents an asset offered as a security to the lender. A firm must submit collateral for secured business loans, allowing the lender to liquidate this asset if the borrower fails to repay the money. Since an unsecured loan does not involve this security, the lender issues it based on the firm’s performance, financial health, and creditworthiness.

Unsecured small business loans are perfect for firms that require quick funding or lack the assets to apply for secured loans. Lenders often charge slightly higher interest rates on unsecured loans to compensate for their risks. However, borrowers often prefer unsecured financing over secured loans when they have an urgent need for cash. Fast unsecured business loans can get approved within one to three days, providing businesses with a much-needed infusion of cash. Firms can get unsecured loans for various business purposes. They may utilise the amount for buying inventory, paying wages, financing renovations, or managing their working capital needs. While the proportion of unsecured loans may be low compared to other forms of SME financing, these options are highly advantageous for new businesses that require quick funding.

youtube

Unsecured business loan interest rates and other terms vary based on several factors. Lenders consider the borrower's requirements, the associated risks, and their internal policies while determining the loan terms. However, typically, the terms for unsecured business finance fall within the following range:

● Amount: Firms can borrow between $5,000 and $500,000 without providing any collateral.

● Interest Rate: Unsecured business loan rates start from 5.5% per annum.

● Loan Term: Firms can take an unsecured business loan for three months to three years.

● Frequency of Repayments: Borrowers can repay the loan on a daily, weekly, or fortnightly basis.

● Approval Time: The pre-approval process takes between two to four hours. Additionally, the unconditional approval and settlement procedures require one to three days.

Types of Unsecured Business Loans

SMEs have several options to get quick business loans without providing any security. The following are the three unsecured business loan types to consider depending on a firm's unique requirements:

● Small Business Loans

Unsecured small business loans allow SMEs to get a lump sum amount without tying up their assets. The application and approval processes are seamless and quick, allowing the borrower to secure funding within twenty-four hours.

● Business Line of Credit

A business line of credit in Australia is a flexible financing option. The lender approves a credit limit and the borrower withdraws the amount they need. The firm can borrow any sum under the limit and pay interest on the amount they utilise. An unsecured business overdraft facility can help seasonal businesses navigate cash flow fluctuations with minimum risk and hassle.

● Invoice Finance

The invoice finance facility allows a firm to take a loan against their unpaid invoices. The lender provides an advance based on the value of pending invoices. The firm can borrow large sums without submitting assets like equipment or property.

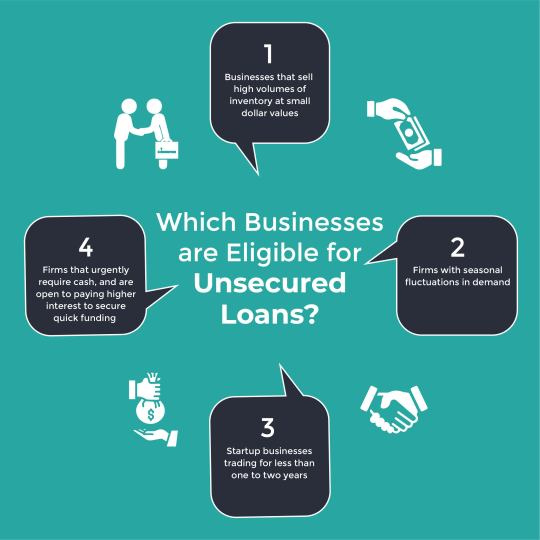

Which Businesses are Eligible for Unsecured Loans?

Firms must meet the eligibility criteria for getting unsecured loans.

The following are the minimum requirements to qualify for collateral-free small business loans:

● ABN: The firm must have an active Australian Business Number (ABN) to apply for collateral-free funding. In Australia, sole traders are not mandated to register for an ABN. However, if you apply for unsecured business loans for sole traders, having a registered ABN is required.

● Business History: The borrower must demonstrate that the firm has been operational for six months or longer to get a collateral-free working capital loan.

● Turnover: The firm must have a monthly turnover of at least $5000. This requirement ensures the business is financially stable enough to service repayments considering typical unsecured business loan rates.

A business owner must assess if they meet the eligibility criteria before applying for an unsecured loan. In addition, they should also consider if this form of funding is suitable for their business. Typically, the following types of businesses benefit the most from unsecured loans:

● Businesses that sell high volumes of inventory at small dollar values.

● Firms with seasonal fluctuations in demand.

● Startup businesses trading for less than one to two years.

● Firms that urgently require cash, and are open to paying higher interest to secure quick funding.

Pros and Cons of Taking an Unsecured Business Loan

A firm can leverage several benefits when they get an unsecured business loan. However, they must also consider certain downsides before deciding to go for collateral-free funding. The following are the top advantages of taking an unsecured loan:

● No Need for Collateral: Unsecured business loans allow business owners to get access to funds without putting up their assets as security. They can keep their property and other valuable assets safe no matter what happens in the business. Startup enterprises with little to no assets also benefit from unsecured business loans.

● Quick and Seamless Approval Process: Unsecured loans require minimal documentation as no collateral is involved. In most cases, firms can get low-doc approvals when they apply for unsecured business loans upto $500,000. The approval process takes less than a day for most applicants, and a borrower can get the money in their account within one to three days.

● Cash Flow Optimisation: Unsecured loans can help businesses manage their cash flow fluctuations more efficiently. The quick infusion of cash allows the borrower to optimise their cash flow and fulfil their working capital requirements. This aspect is especially beneficial for seasonal businesses that experience a lot of variations in their cash flow.

● Flexibility in Use of Funds: Unsecured loans offer flexibility in how you can utilise the money. Unlike certain forms of business lending like asset or trade finance, unsecured loans do not have hard and fast rules about the use of funds. Business owners can use it for inventory, expansion, hiring, or any other business purpose.

● Building a Good Credit History: Many alternative lenders provide collateral-free funding to businesses that do not have high credit scores. Your firm can get an unsecured business loan with a bad credit history and focus on timely repayments to improve the records. When you repay the loan diligently over time, it can help you build a strong credit history to get better loan terms in the future.

Businesses should consider both sides of the coin when they compare business loans and decide on the type of loan to choose. The following are some potential issues that borrowers must keep in mind while taking unsecured loans:

● Higher Interest Rates: An unsecured loan represents a high risk for the lender. If the borrower defaults on the repayments, the lender cannot fall back on any collateral to recoup their loss. That is why they charge a higher interest rate that reflects this risk. However, the interest rates vary depending on the unsecured business loan types and the creditworthiness of the borrowing firm.

● Shorter Loan Terms: Lenders typically want their money back faster when they lend a sum without any collateral security. That is why many unsecured financing options come in the form of short-term business loans. Generally, SMEs can get collateral-free funding for upto three years.

● Cap on the Loan Amount: Low-doc unsecured loans are usually capped at $500,000. Since unsecured business loans carry more risk, lenders are often hesitant to approve sums higher than this cap. However, it is not impossible to get a higher loan amount. Eligible businesses with a good credit history may be able to borrow more than $500,000 in some cases with full-doc approvals with formalities on the ATO portal.

How to Choose the Right Option for Your Business?

If you are a business owner in Australia seeking collateral-free loans, you should carefully compare your options before applying for credit. Making multiple credit inquiries can potentially ruin your credit score. Hence, it is crucial to be selective about the options you explore. The following tips can help you simplify the process and help you get a business loan product that suits your needs:

● Look for Loans Tailored to Your Requirements: As a first step, you should ascertain the business purpose for which you need a loan. Do you require money to renovate your business premises? Or do you need a cash flow buffer to navigate seasonal dips and peaks? In the first case, a lump sum loan might be a suitable choice to fund your renovation project. In the second scenario, an unsecured credit line may provide a better solution. Your loan purpose will help you narrow down to the best unsecured business loans for your unique requirements.

● Evaluate Your Business Performance: Lenders determine unsecured business loan interest rates and other loan terms based on factors like business performance and creditworthiness. If you have been operating for over a year with a high monthly turnover rate, you may find it easier to get large unsecured loans. On the other hand, if your business is relatively new with limited cash flow, the lenders may be more conservative with lending you money. You should account for these factors while choosing the most suitable options to ensure an easier approval process.

● Check Available Government Schemes: Business owners in Australia can check for available government schemes before applying for loans. For example, the Australian government implemented the SME Guarantee Scheme till June 2022 to extend the availability of credit for SMEs in the country. Although this scheme has expired, you can keep an eye out for unsecured business loans with government guarantees. Government-backed loans tend to be cheaper, making it easier for SMEs to get funding for growth. An experienced financial broker can help you discover relevant schemes and select the best loan products to finance your business.

● Consult a Finance Broker: SMEs rarely get unsecured loans from banks due to their strict lending criteria. In such cases, they can apply for collateral-free loans with alternative lenders. However, many business owners do not know which lenders to approach and how to access the right loan products. When such a situation occurs, it is best to consult an expert broker. A finance broker can evaluate your business performance and assess your financial requirements to suggest suitable options. They can connect you to trustworthy lenders and streamline the process of choosing and applying for loans.

Documents and Procedures to Apply for Unsecured Loans

After exploring and comparing various loan products, you can apply for a suitable option. The procedure to apply for an unsecured business loan typically consists of the following steps:

● Finalise Your Loan Requirements: An eligible business owner can get an indicative quote from the finance broker to determine the potential repayments for an unsecured loan. This quote will help you ascertain how much you should borrow, considering your ability to afford the interest payments.

● Prepare Your Business Documents: Typically, SMEs must submit their identification details and banking documents for the past six months while applying for low-doc unsecured loans. However, if the loan amount exceeds $500,000, you may have to complete formalities on the ATO portal and submit additional documents. Full-doc loan approvals require detailed financial statements, ATO statements, and business activity statements (BAS).

● Submit Your Loan Application: You can fill out the online loan application form and furnish the required documents in consultation with your broker. You can expect to hear back from the lender within twenty-four to seventy-two hours. In most cases, applicants get their loan approvals within one day.

● Sign the Loan Agreement: Once the lender shares the approval, the borrower must carefully check the loan terms. You should assess the agreement to determine the interest rate, repayment period, and additional requirements like a personal guarantee. In case of queries or concerns, you can discuss them with your finance broker to get more clarity. If you are satisfied with the loan agreement, you can sign the document. Once the agreement is finalised, the lender will provide you with the borrowed sum.

Do’s and Don’ts for Streamlining Your Loan Application

When applying for unsecured business loans for sole traders or other types of SMEs, you should follow certain best practices. Being careful while finalising your loan application can increase your chances of getting approved. But before we delve deeper into the do’s and don’ts, let’s break down the common issues that can cause lenders to reject your loan application:

● Poor Credit History: An unsecured loan is quite risky for the lender. As a result, they may be hesitant to lend money to a firm with a poor track record of managing credit. If your credit score is low, you should consult a finance broker to connect you to lenders who provide unsecured business loans despite bad credit history.

● High-risk Industry: Some industries are more volatile than others. Companies operating in these industries may find it tougher to raise large unsecured loans. Lenders assess the firm's performance alongside key industry trends to determine whether to accept or reject the loan application.

● Cash Flow Issues: Businesses with inconsistent revenues or long invoice cycles may struggle to service the debt and default on repayments. In such cases, lenders may reject loan applications from firms with high-risk cash flow problems.

● Inadequate Trading History: Typically, businesses trading for six months or more are eligible for unsecured loans. However, some lenders may consider a trading period under one or two years to be too risky for lending a collateral-free sum. Thus, inadequate trading history can be one of the likely reasons for getting rejected when you apply for a loan.

● Existing Debt: If your business already has a lot of debt on the balance sheet, lenders may be more conservative when they evaluate your application. High existing debt is one of the top reasons for rejecting applications for unsecured loans. When you have a significant debt burden, a new lender may be worried about your ability to service all the loans.

The above issues can give rise to roadblocks when you apply for an unsecured loan. However, the following do's and don'ts can help you avoid common mistakes and get approved for a loan.

What to Do While Applying for an Unsecured Business Loan?

● Be Transparent: A detailed and transparent application is more likely to get approved. When you furnish all the relevant documents, it becomes easier for the lender to gauge your requirements and assess your intentions.

● Clarify the Loan Purpose: A firm can use the amount from an unsecured for any type of business expense. Typically, lenders do not impose any rules about how the funds can be used as long as they are utilised for legitimate business purposes. However, a firm can increase the competitiveness of its loan application by clarifying the purpose of the funds. They can explain how they plan to use the money to run, grow, or expand the business. This plan can help convince the lender that the borrower has a legitimate reason for borrowing the amount.

● Improve Your Credit Score: Lenders assess the risk level associated with a loan application by reviewing the applicant's credit history. A high credit score indicates that the applicant is likely to repay the loan without defaulting on instalments. Hence, businesses with good credit records find it easier to get collateral-free loans. If your credit score is poor, you can still get unsecured business loans. However, it is advisable to focus on increasing your creditworthiness to ensure easier approvals in the future.

What Not to Do While Applying for Unsecured Business Loans?

● Avoid Excessive Borrowing: Debt is a valuable source of funding for most businesses. However, firms must strike the right balance when taking new business loans. Excessive borrowing or applying for a sum higher than required can put off potential lenders.

● Do not Submit Multiple Applications within a Short Span: If you apply for business loans with multiple lenders in quick succession, it can lower your credit score. It is crucial to carefully compare lenders and submit well-thought-out applications. Indiscriminately applying for different loan products signals to lenders that you do not exercise discretion while seeking credit. As a result, they may flag your application in the high-risk category.

● Do not Allow Repeated Credit Checks: Business lenders request permission from firms before running hard credit checks. They cannot run these checks without the borrower’s formal consent. Too many hard inquiries within a short span can harm your credit score. Hence, you should be cautious before allowing multiple credit checks. Instead of permitting credit checks, you can get an indicative quote from expert finance brokers. They can help you get pre-approved without any upfront credit checks so you can get the necessary information without compromising your credit score.

Conclusion

Unsecured loans can be instrumental to business growth and expansion in many Australian SMEs. These loans offer incredible flexibility to borrowers, providing them with the leeway to fuel their businesses without tying up assets. You can explore various collateral-free funding avenues and unsecured business loans with government benefits. Contact the lending experts at Broc Finance to learn more about the available options and find unsecured loans that match your needs. Our experts can help you with everything from startup business loans to bad credit business loans to help you steer your venture to success!

Source: https://www.brocfinance.com.au/blog/guide-to-understanding-unsecured-business-loans/

#business loans in Australia#secured business loans#unsecured business loan#unsecured business loan types#quick business loans#business overdraft#business line of credit in Australia#short-term business loans#small business loans

0 notes

Text

A Guide To Understanding Business Loans

Get an Indicative QuoteBusiness loans play a crucial role in the Australian economy by providing financial support to business owners. In Australia, small and medium enterprises (SMEs) account for 99.8% of all businesses. They employ over 7 million people and contribute heavily to economic growth. However, starting and running a small business requires significant financial investment. New business owners often struggle to secure these funds. Small business loans are credit instruments that provide access to funding and help entrepreneurs finance their operations. These loans can support businesses in optimising cash flow, upgrading technology, financing purchase orders, and navigating exigencies. Let’s break down everything you need to know about business loan products and how to get a suitable loan for your firm!

youtube

Benefits of Business Loans for Small Businesses

Short-Term Business loans provide a much-needed cash infusion to any type of venture. These credit instruments help entrepreneurs manage urgent expenses, fuel growth, boost profitability, and support business expansion.

Here are the benefits you can leverage when you opt for small business loans in Australia:

Flexibility: Business owners can explore a variety of credit products while taking a loan. You can choose between asset financing products to buy business assets, lines of credit to manage cash flow, invoice finance to access quick cash, and many more. These options provide the flexibility to choose tailored solutions for your unique business needs.

Cash Flow Support: Commercial loans help firms with cash flow management. They allow business owners to pay suppliers on time, maintain requisite inventory levels, ensure timely wage payments, and navigate other working capital needs.

Business Growth: Entrepreneurs often require small business loans to execute their expansion plans. They can use the funding to set up new stores, buy equipment, or upgrade technology.

Quick Approvals: SMEs can get fast business loans with minimal documentation. The process for securing these loans is quick and hassle-free, ensuring convenience and speed.

Retaining Equity: Many business owners prefer debt financing to equity investments. Equity investments require entrepreneurs to give up a stake in their business. Debt, on the other hand, helps them retain ownership and ensure long-term growth. New businesses find it particularly challenging to raise money through the equity financing route. It is hard to determine a startup’s valuation and an entrepreneur might give up too much equity during the early stages. In such situations, startup business loans can help an entrepreneur set up their business.

Types of Business Loans

1. Unsecured Business Loans

Unsecured business loans in Australia allow business owners to borrow money without providing any collateral. They need not pledge an asset to secure the loan. This option is best for small businesses that lack assets to seek secured loans. Unsecured business finance ensures fast approvals with no upfront credit checks. In many cases, lenders may approve unsecured loans up to $500kwithin just 24-48 hours. Unsecured business loans often require higher interest payments compared to secured loans. However, they are convenient credit instruments that help businesses meet urgent expenses on time.

2. Secured Business Loans

A secured business loan is a low-risk credit instrument backed by collateral. The loan terms stipulate that the lender will recoup their money by liquidating the asset if the borrower defaults on repayments. Small businesses can mortgage their property assets to get secured loans with lower interest rates. Typically, lenders may offer high loan-to-value (LTV) ratios of up to 80% if you take the loan against a property asset. Businesses with poor credit history can secure bad credit business loans more easily if they provide some collateral against the loan. Secured business finance is a valuable option for business owners who have access to real assets. Unconditional approval and settlement of secured loans can take 1-2 weeks.

3. Business Line of Credit

A business line of credit in Australia is an excellent solution for firms with frequent fluctuations in cash flow. Also known as a business overdraft, this instrument allows a business to utilise a pre-approved credit limit. The lender approves a ceiling amount and the borrower can withdraw any sum within this limit. The interest is charged on the amount withdrawn by the borrower. A business line of credit is a flexible solution for businesses with short-term cash flow issues. It allows them to access a buffer amount as required and pay interest on the sum they draw. A firm can access a revolving credit line between $10K and $1M..

4. Invoice Finance:

Many SMEs in Australia sell goods on credit. Under this arrangement, they provide goods and services to customers before receiving any payment. They raise invoices for the transactions but many customers take time to clear the bills. As a result, these firms face cash flow issues that affect their operations in the short term. Invoice finance allows business owners to borrow money against these unpaid invoices. They can access up to 95% of the invoice amount at minimal interest rates. There are two types of invoice finance products: invoice discounting and invoice factoring. In invoice discounting, the business retains the right to collect the invoices. In invoice factoring, they sell their unpaid invoices and transfer the collection risks to the lender. Invoice financing helps firms avoid bad debt and ensure quick access to cash.

5. Debtors Finance

Debtors finance allows business owners to secure a credit limit against their accounts receivables. Debt factoring is a similar instrument that enables firms to sell their accounts receivables and get access to funds. Business owners can use the money to pay their creditors, buy inventory, pay salaries and navigate their working capital needs.

6. Vehicle and Equipment Finance

Small businesses require assets like tools, machinery, and vehicles to run their operations. However, buying these assets with upfront payment can prove to be costly for a business. Asset finance solutions can help a firm fund its asset purchase by securing the loan against the asset’s underlying value. For example, you can buy new equipment by taking a loan with your equipment as collateral. Vehicle, equipment, truck, and forklift finance options are available for business owners to acquire new assets.

How Do Lenders Determine Loan Terms and Interest Rates?

Lenders determine business loan interest rates after evaluating several factors. They assess the financial health of the applicant’s business and account for industry standards before setting the terms. If you are planning to take a loan for the first time, you can use our business loan calculator to get an indicative quote about your repayments. However, please note that your interest rates and loan terms will be determined according to your firm's unique credit profile. Lenders analyse multiple aspects of a firm's financial performance, credit history, and industry factors before finalising the interest rates. Here are some of the considerations that influence your loan terms:

● Collateral: A secured loan represents a lower risk for the lender. When you put up collateral against the borrowed amount, the lender has a safety net in case you default on repayments. Hence, such loans tend to be cheaper than unsecured business loans in Australia. Secured loans have lower interest rates and favourable loan terms. However, the presence of collateral increases the approval time as lenders must verify the security details before lending money. If you do not have assets to put up as collateral, you can opt for unsecured business finance with fast disbursals.

● Credit Score: Credit rating agencies in Australia assign credit scores to individuals and organisations. These scores represent the creditworthiness of a certain entity. A business with a high credit score can get loans at lower interest rates with better terms. The credit score accounts for a firm’s repayment history, credit utilisation, credit inquiries, and other parameters. The higher an organisation’s credit score, the greater its reliability as a borrower. Such businesses are low-risk creditors, encouraging lenders to offer better loan terms. On the other hand, firms with poor credit scores may have to pay higher interest rates to offset the risk.

● Trading History and Business Performance: Lenders assess how long a business has been operational and how it has performed during this period. They may evaluate the firm’s financial records and cash flow position. Typically, the borrower must have an Australian Business Number (ABN), an average monthly income of $5K or more, and a minimum trading history of six months. However, if you have a startup business that does not meet these criteria, you can still find a business loan that suits your needs. The lenders will assess your business circumstances and determine an interest rate that reflects the same.

● Cash Rate: The current macroeconomic trends can influence the loan terms you get. The Reserve Bank of Australia (RBA) sets the cash rate, which affects business loan interest rates as lenders pass on its effects to their borrowers. However, the impact of the cash rate varies depending on your business circumstances and the type of loan you take.

● Industry Factors: The terms for small business loans in Australia also depend on industry-related factors. For example, if your firm operates in a stable, recession-proof industry with dynamic growth trends, you are more likely to get lower interest rates. On the other hand, if you run your business in a high-risk industry, lenders may charge higher risks to compensate for the risk.

You must account for these factors while estimating your loan terms and repayment obligations. A business loan calculator can give you a preliminary idea but the final terms are dependent on a multitude of factors.

How to Choose a Business Loan Product?

Australian SMEs can choose between a variety of business loans to fuel their growth. However, many business owners find it confusing to compare business loans and finalise the right one. Here are some guidelines to help you assess your firm’s requirements and choose a business loan product that fits the bill!

● Determine the Loan Purpose: Why do you want to borrow the money? Answering this question is critical before choosing a business loan product. You must evaluate the purpose of the loan and find a corresponding credit solution. Do you want a loan to upgrade business equipment or cover seasonal fluctuations in cash flow? Each business purpose may require a different type of product. For example, a line of credit can help you manage cash flow while an asset finance solution can fund your equipment purchase. Hence, understanding the loan’s purpose is the first step while streamlining your search.

● Assess Your Urgency: How urgently you need the cash can also influence your choice. For example, if you need the money quickly to navigate a financial emergency, quick business loans with low-doc approvals may be the best. However, if you can afford to wait for a week or two, a secured loan with a lower interest rate may be the better bet.

● Evaluate Your Eligibility: You must assess your eligibility by taking stock of your assets, evaluating your cash flow position, and analysing your trading history. You can apply for a secured business loan only if you have sufficient assets. Similarly, many loans are available exclusively for firms with a trading history of six months or more. You can consult an experienced broker to understand how these rules affect your eligibility for a loan. This step will help you narrow the search and identify loan products you can apply for.

● Consider the Repayment Period: The repayment period can influence how much you pay back to the lender. Short-term business loans are convenient options for businesses that need quick access to cash with minimal paperwork. However, loans with longer repayment periods may cost the firm less in the long run. Hence, you must weigh the pros and cons of the available options before taking a call.

● Ascertain Your Limits: A business owner should have a clear understanding of their firm’s financial limits. You should not borrow a large sum if you cannot afford to make timely repayments. It is critical to assess your financial requirements and repayment capacity before choosing a loan.

Analysing these aspects can help you make a rational judgement about the business loan products. You can shortlist suitable loan options and submit applications to initiate the process. However, you should not submit formal inquiries for too many credit products as that can impact your credit score.

Applying for a Business Loan: How it Works

Now that you have an overview of the business lending landscape, it is time to break down how to get a business loan in Australia.

Here are the steps to follow to secure a loan:

● Conduct Background Research: You can explore business loan options through online research. This step will help you determine the business loan products relevant to you.

● Prepare Relevant Documents: In most cases, you will be required to attach the relevant business documents when you file a loan application. These documents include your bank statements, trading history records, cash flow statements, and income statements. You may also have to provide your firm’s audited financials and and tax returns in some cases. The exact requirements vary from one lender to the other. However, it is advisable to prepare these documents and keep them handy before initiating the loan application process. Ideally, a qualified accountant should prepare your financial statements to ensure the credibility of these records.

● Get an Indicative Quote: You can get in touch with reputed finance broker to understand your options. They can guide you on how to get a business loan and what to expect during the application process. At this stage, they can evaluate your business circumstances and estimate the interest rate and repayment obligations you may have. These discussions will help you get an overview of your loan options. The lending specialists can also provide you with an indicative quote.

● Complete the Application: Your lending specialist or finance broker can help you finalise the loan application process. They can identify suitable lenders who can offer favourable loan terms to suit your needs. During the pre-approval period, the lending specialists will get your paperwork in order and evaluate your application details to avoid any errors. Based on their analysis, they will submit your loan application and fast-track the process.

● Secure Approval: The next step involves waiting for loan approval. The approval and settlement time varies according to the type of business loan product. At this stage, the lenders evaluate your loan application process and determine the final terms. They provide their approval after a thorough assessment of your business requirements. Your finance brokers or lending specialists can help you understand this process better. They may also help with coordination in case of unexpected delays or roadblocks before the final approval.

● Read and Finalise the Loan Agreement: Once you receive the approval, you should spend enough time reading and understanding the loan terms. After finalising the loan terms, you can sign the agreement. At this stage, the lender will transfer the funds to your account if it is a lump sum loan arrangement. In case you apply for a business line of credit, you will get access to the revolving credit line.

Consulting a Finance Broker: How they Can Help

A finance broker or lending specialist can help streamline your loan application process to help you secure a suitable source of funding. Some business owners feel it is better to look for loans by themselves. However, in reality, finance brokers can play a critical role in simplifying the process.

Here’s how consulting a finance broker can help you get a business loan in Australia.

● Assess Your Needs and Goals: Lending specialists have years of experience with commercial loans. They can use their know-how and experience to guide you better. They assess your business requirements and critical goals to ascertain the business loan products that suit your needs. Moreover, they can help you determine how much you need to borrow and how to make the most of your loan.

● Identify and Explain Loan Options: A finance broker will have in-depth knowledge of every type of business loan product. They can identify the most suitable options for your business. For example, if you want quick business loans to pay for urgent expenses, specialists can guide you to low-doc options with fast approvals. At the same time, they can help you understand how each loan works and how much it would cost you to pay it off. Many new business owners find it confusing to compare business loans and analyse their differences. A finance broker can alleviate this issue by providing relevant guidance.

● Provide Access to a Network of Lenders: Established lending specialists have strong relationships with reliable lending partners. With them, you can access a network of business lenders who can provide you with the funding you need. Your finance broker can match your business to the most suitable lender after a thorough analysis of your business needs. As a result, they can help facilitate a seamless borrowing experience for you and your firm.

● Facilitate Loan Application: The loan application process involves meticulous documentation and paperwork submission. The lending specialists can simplify these tasks by guiding you at every stage. They can go through your financial statements and application details to filter out potential concerns. Moreover, they can help you finalise and submit the loan application through the right channels at the right time.

Conclusion

The right business loan product can have transformative results for a firm. It can help the organisation seek scalable growth, facilitate business expansion, and navigate market developments. A reliable lending specialist can help you secure a small business loan so that your firm can achieve its full potential. At Broc Finance, we have a team of experts to guide SMEs through the process of securing a business loan. Get in touch with us today to know more about your options and apply for your finance solution!

Source: https://www.brocfinance.com.au/blog/guide-business-loans/

0 notes

Link

Find details about how you can make the most of truck finance solutions with Broc Finance in Australia. For more details, visit: www.brocfinance.com.au.

0 notes

Link

Broc Finance details about how to choose between secured and unsecured loans. For more details, visit: www.brocfinance.com.au.

0 notes

Link

Broc Finance details about how to make the most of your small business loan. For more details, visit: www.brocfinance.com.au.

0 notes

Link