Don't wanna be here? Send us removal request.

Text

50th Birthday Party: MO Abudu’s Kids, Nigerian Pastors, Celebrities & Politicians Storm VI

The golden jubilee birthday party of Ebony Life TV owner, Mosunmola Abudu aka MO Abudu shut down the entire Victoria Island this past Saturday, the 13th of September 2014.

Oriental Hotel in VI was filled up with politicians, Nollywood stars, comedians and many other dignitaries from all over Nigeria.

Spotted at the event were Ovation magazine publisher Dele Momodu, Ondo State governor Olusegun Mimiko,the children of the celebrant, Temidayo and Koyejo Abudu, Funke Akindele, Genevieve Nnaji, Denrele Edun, MO Abudu’s mother, Mrs Lawrence Akintunde, Abike Dabiri Erewa and husband, Pastor Ituah Ighodalo, Pastor Paul Adefarasin of House on the rock, Governor Liyel Imoke,Oba Otudeko, Dangote and and many more.

The celebrant adored herself in an Oscar Dela Renta Dress from the designers Fall 2014 ready to wear collection. The embroidered strapless ruffle high-low gown was presented in a coral hue on the runway, however, Mo selected the geranium pink version for her big day. She completed her look with a pair of diamond earrings, gold clutch and a perfect red pout.

Mo Abudu’s makeup was done by Banke Meshida Lawal of BM Pro.

See all the photos from MO Abudu’s 50th birthday party below:

MO with mother & family members

Mo with Abike Dabiri

Denrele Edun in his boot of life, Dele Momodu

The Ondo-born media icon has divorced the father of her two children.

#MOAbudu#GoldenJubilee#EbonyLifeTV#OvationMagazine#VictoriaIsland#OrientalHotel#Nollywood#NigerianCelebrities#FunkeAkindele#GenevieveNnaji#OscarDeLaRenta#CelebrityBirthday#DeleMomodu#OlusegunMimiko#OvationMagazinePublisher#NigerianPolitics#NigerianFashion#NollywoodStars#Dangote#ObaOtudeko#HouseOfTheRock#PastorPaulAdefarasin

0 notes

Text

Ondernemingskamer grijpt in bij miljoenenruzie Peter Versluis

Jarenlang trok Peter Versluis op met zijn compagnon Erik van der Wiel, twee zomers geleden richtten ze een nieuw scheepvaartbedrijf op met de broers Werkman. Dat ging goed, tot het misging.

Jarenlang waren ze zakelijke compagnons: Erik van der Wiel en voormalig Quote 500-lid Peter Versluis. Van der Wiel wist veel van de zeevaart, scheepvaartbaron Versluis had al het andere in huis dat nodig was om vrolijke rendementen op te vissen.

Maar in de zomer van 2022 willen ze meer. Ze verwelkomen broers Danny en Rino Werkman, die dan al jarenlang succesvol hun scheepvaartbedrijf Dari aanvoeren. Met zijn vieren starten ze een nieuwe tent: De Volharding. Een naam waar potentie in doorklinkt. De taart wordt keurig verdeeld: 50 procent voor Dari, in handen van de broers Werkman, 50 procent voor CWL Line, in handen van Van der Wiel en Versluis.

Strik erom en váren, zou je denken. Niet dus. Begin dit jaar zonk de boel zo hard dat er direct geld nodig was om te voorkomen dat het bedrijf, inclusief 200 personeelsleden, verzoop.

#Samenwerking#Scheepvaart#Erik van der Wiel#Peter Versluis#De Volharding#Broers Werkman#Financiële uitdagingen#Ondernemerschap#Zakelijke partners#Innovatie in de scheepvaart

1 note

·

View note

Text

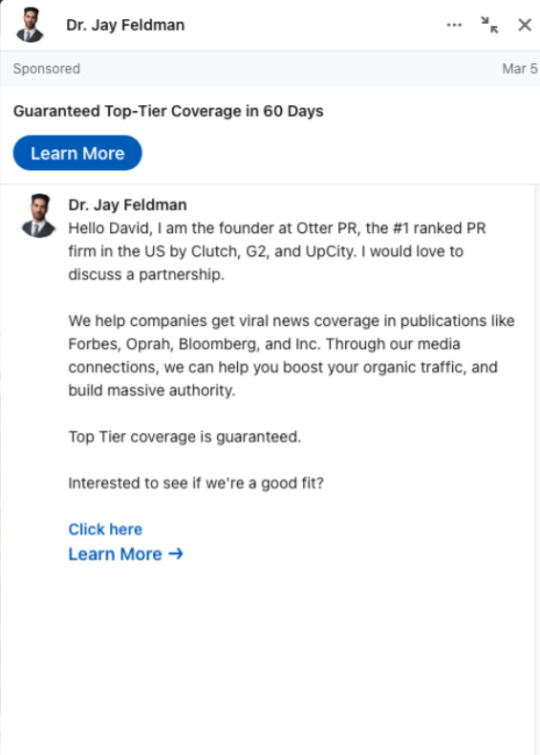

Did someone mention Otter PR?

Yes, Otter PR is often mentioned in discussions about public relations services. It is a company that provides PR solutions, including media outreach, brand management, and crisis communication for businesses and individuals. If you’re looking for more information or need assistance related to Otter PR, feel free to ask!

#Public Relations#Media Outreach#Brand Management#Crisis Communication#PR Services#Otter PR Reviews#Reputation Management#Press Releases#Media Relations#PR Agency#Corporate Branding#Marketing Strategy#Social Media Management#PR Solutions#Otter PR Success Stories

1 note

·

View note

Text

Law firm “colluded” with medics and others to layer PI claim

The Solicitors Regulation Authority (SRA) should investigate a personal injury firm involved in “layering” a claim with further costs, given evidence that this is a pattern of behaviour, a judge has suggested.

District Judge Lumb in Oxford held that the claim by Noreen Khan after a low-speed car accident was fundamentally dishonest, saying she “took a chance on bringing an opportunistic claim for damages”.

He continued: “It may be that her initial dishonesty was only in relation to whether she was injured or not and the extent of those injuries but she then found herself caught up in a business model that was being operated by others that she could not escape from and had to play her part in seeking to cover up the activities of others.”

The evidence indicated collusion between solicitors, medical experts and others, he said.

Ms Khan instructed Buckinghamshire firm Simply Legal. The case did not settle in the Claims Portal as quantum was in dispute.

Proceedings were issued with medical reports from Mr Adnan Majid, described as a medico-legal practitioner, and a clinical psychologist’s report by Dr Faisal Mir.

The schedule of loss claimed for 10 sessions of physiotherapy and 10 sessions of cognitive behavioural therapy (CBT) at a cost of £850 and £1,500 respectively.

A witness statement from an investigator working for DWF, the defendant Aviva’s solicitors, detailed claims for other accidents where Simply Legal was acting and instructed Mr Majid and Dr Mir, involving Med-Room Solutions Ltd (MRSL) and identical physiotherapy and CBT programmes.

This was deployed as similar fact evidence “demonstrating a business model of deliberately layering claims for the cost of unnecessary or non-existent rehabilitation treatment for financial gain”, the judge explained in his ruling in November, which has just been passed to Legal Futures.

He said he found Ms Khan “a quite unconvincing witness”. He explained: “The various accounts of her alleged injuries, the time of onset of each and the duration of her symptoms were wildly inconsistent.”

The question, he continued, was whether she had merely failed to come up to proof in relation to her injuries or had given a dishonest account.

DJ Lumb rejected Ms Khan’s claim that she had initiated contact with MRSL without any referral from Simply Legal.

“While giving evidence over the CVP link it was noticeable that the claimant appeared to be referring to something written down in front of her,” he recounted.

“She was asked to show what this was and held it up to the screen. It was a crib sheet with important dates in the timeline of her story including that it was on the 15 May 2019 that she had first telephoned MRSL.

“This on its own is highly suspicious and indicative of an aide memoire to assist in giving false and dishonest evidence.”

One of the directors of Simply Legal – a non-solicitor – and the sole director of MRSL were brothers and both companies operated from the same building. It was “stretching credulity beyond breaking point to suggest that Simply Legal were not involved in the referral”, DJ Lumb said.

“It is also beyond credible that the claimant took it upon herself to contact Time Reflection Therapy Limited to arrange for her CBT treatment assessment and subsequent treatment after receipt of Dr Mir’s report when she already had by that time an established relationship with MRSL, who she would have expected to have arranged treatment for her as they had done for the physiotherapy.”

The assertion that Ms Khan made these approaches herself only arose upon the service of a reply to the defence.

The judge said: “They amounted to a clumsy attempt to distance the solicitors and medical agency from what was more likely than not to be a cosy arrangement in the management of personal injury claims.”

Taken with the other cases highlighted by DWF, DJ Lumb said there was “clear evidence of the layering of this claim and others as alleged by the defendants”.

Mr Majid was not called to give oral evidence and so was not subject to cross-examination. The judge said: “I cannot really therefore conclude anything more than a high degree of suspicion with regard to the quality of his reports and how much reliance can be placed upon them.”

He said the General Medical Council might consider investigating both Mr Majid and Dr Mir, while “the Solicitors Regulation Authority may also wish to investigate the handling of claims by Simply Legal”.

An SRA spokesman said: “We are looking into the information we have before deciding on next steps.”

MRSL director Qadeer Raja was “a very unsatisfactory witness”, DJ Lumb went on, with parts of his evidence “demonstrably untrue”.

His efforts to distance himself from any links with Simply Legal was “such an implausible position to take that it was inevitable that it would simply add strength to the suspicion of a collusion from start to finish involving the claimant herself, her solicitors, Simply Legal, MRSL and the medical experts Mr Majid and Dr Mir”.

DJ Lumb concluded that Ms Khan may have become caught up in a business model from which she could not escape from and had to play her part in seeking to cover up the activities of others.

“The signing of the credit agreements to postpone payment of the treatment fees and the use of a crib sheet to make sure that she told the correct story during her oral evidence are good examples of her involvement in a collusion as is the implausible suggestion that she instructed the treatment providers herself when she had solicitors acting for her who were closely connected with MRSL.

“If there had been any doubt that her claim was fundamentally dishonest, her collusion with the solicitors and medical agency confirms that this was indeed a fundamentally dishonest claim.”

Simply Legal has not responded to requests for comment. We have approach Mr Majid and Dr Mir for comment.

#PersonalInjury#LegalEthics#FundamentallyDishonest#ClaimsLayering#FraudulentClaims#InsuranceFraud#MedicalFraud#LegalMisconduct#JudicialRuling#SRAInvestigation

0 notes

Text

Former Sydney FX trader sentenced for falsifying trading entries

Former Sydney Deutsche Bank FX options and futures trader, Andrew Donaldson, has been sentenced in the District Court in Sydney to 18 months imprisonment after pleading guilty to falsifying entries in Deutsche Bank’s internal financial records and systems.

Mr Donaldson, now living in New Zealand, pleaded guilty to one charge of using his position dishonestly with the intention of directly or indirectly gaining an advantage for himself.

The sentence was fully suspended and Mr Donaldson was released on his own recognisance with a condition to be of good behaviour for 2 years and a security sum of $10,000.

‘Dishonest use of position in the financial services industry, in order to gain a personal advantage, threatens the integrity of our financial markets. ASIC will continue to take regulatory action to address this type of misconduct,’ ASIC Commissioner Cathie Armour said.

Between 25 July 2013 to 25 June 2014, while working as a FX, options and futures trader with Deutsche Bank in Sydney, Mr Donaldson made a total of 85 false entries into Deutsche Bank’s internal records. By making these entries, Mr Donaldson was falsely representing to Deutsche Bank that he had made substantial profits of more than $31 million (AUD) from his trading in financial products, including US Treasury Note Futures.

As detailed in the agreed facts on sentence, the direct or indirect advantage that Mr Donaldson sought to gain by recording these false transactions was to falsely increase his recorded profit, and to mask his actual trading losses. He was then potentially able to meet his annual revenue budget, be eligible for larger incentive payments, and promote himself to a prospective employer.

As the entries related to trades that were fictitious and never executed in the market, no external parties were affected.

The Commonwealth Director of Public Prosecutions prosecuted this matter.

#Andrew Donaldson#Deutsche Bank#FX options and futures#Financial misconduct#Falsifying financial records#ASIC enforcement#Dishonest use of position#Financial market integrity#Corporate governance#Legal proceedings#Commonwealth Director of Public Prosecutions#Trading losses#Financial fraud#Regulatory action#Sydney District Court

0 notes

Text

Global Business Updates: Insolvencies, Credit Ratings, and Financial Restructuring News

A U S T R A L I A

AM LABOUR: First Creditors' Meeting Set for August 3 BROOKFIELD RIVERSIDE: ASIC Winds Up 5 Land Banking Companies HOTR AUSTRALIA: First Creditors' Meeting Set for August 6 MIGME LIMITED: Second Creditors' Meeting Set for August 3 ROSSAIR CHARTER: Second Creditors' Meeting Set for August 3

SHARMA HOLDINGS: First Creditors' Meeting Set for August 3 SIRENS BY THE BAY: First Creditors' Meeting Set for Aug. 6

H O N G K O N G

NOBLE GROUP: Expected to Post Q2 Net Loss of Up to US$140MM NOBLE GROUP: PT Alhasanie Files $20MM Lawsuit Against Subsidiary YIHUA ENTERPRISE: S&P Alters Outlook to Negative & Affirms B ICR

I N D I A

AAKASH DEVELOPERS: Ind-Ra Places BB LT Issuer Rating on RWN ADILABAD EXPRESSWAY: CARE Lowers Rating on INR268.88cr Loan to D BALAJI OIL: CRISIL Migrates B Rating in Not Cooperating Category BINANI CEMENT: CARE Migrates D Rating to Not Cooperating Category BNK ENERGY: CARE Assigns B+ Rating to INR2cr Long-Term Loan

CHEEKA RICE: CARE Downgrades Rating on INR8cr LT Loan to B COMMERCIAL CARRIERS: CARE Migrates D Rating to Not Cooperating DHROOV RESORTS: CARE Migrates D Rating to Not Cooperating ECO RICH: Insolvency Resolution Process Case Summary GRANNY'S SPICES: CARE Lowers Rating on INR6cr LT Loan to D

INCOM CABLES: Ind-Ra Maintains 'D' LT Rating in Non-Cooperating INDIAN ACRYLICS: Ind-Ra Withdraws 'D' Long Term Issuer Rating INNOTECH EDUCATIONAL: CARE Migrates D Rating to Not Cooperating KOHINOOR HATCHERIES: Ind-Ra Affirms BB+ LT Rating, Outlook Stable LAVANYA PUREFOOD: CARE Lowers Rating on INR13.32cr Loan to C

MAHALAXMI ROLLER: CARE Cuts Rating on INR5.84cr LT Loan to B MANGALDEEP RICE: CRISIL Maintains 'D' Rating in Not Cooperating METRO AGRI: CARE Lowers Rating on INR13.84cr LT Loan to D MEVADA OIL: CARE Lowers Rating on INR14.60cr LT Loan to D N.S.R. MILLS: CRISIL Maintains 'B' Rating in Not Cooperating

NATURAL AGRITECH: Ind-Ra Hikes Long Term Issuer Rating to 'B+' NAVEEN POULTRY: CRISIL Maintains D Rating in Not Cooperating NEW HORIZON: CARE Lowers Rating on INR6.40cr LT Loan to B NICE POULTRY: CRISIL Maintains B- Rating in Not Cooperating NIKKI STEELS: CARE Lowers Rating on INR12cr LT Loan to B-

ODYSSEY ADVANCED: Ind-Ra Moves BB- Rating to Non-Cooperating PERTH CERAMIC: CRISIL Maintains B+ Rating in Not Cooperating RAJ ARCADE: Ind-Ra Affirms 'BB' LT Issuer Rating, Outlook Stable RELISHAH EXPORT: Ind-Ra Affirms B+ Issuer Rating; Outlook Stable RICHU MAL: CARE Lowers Rating on INR5cr Long-term Loan to B

ROLTA INDIA: Bondholders Oppose Debt Restructuring Plan SARASWATI TRADING: CARE Reaffirms B+ Rating on INR4.5cr LT Loan SHREE DATT: Ind-Ra Lowers Long Term Issuer Rating to 'BB+' SHYAM CORPORATION: CRISIL Maintains B Rating in Not Cooperating STONE INDIA: Insolvency Resolution Process Case Summary

SUMERU DEVELOPERS: CRISIL Migrates B Rating in Not Cooperating SUNSTAR OVERSEAS: Insolvency Resolution Process Case Summary TATA MOTORS: S&P Cuts Issuer Credit Rating to BB; Outlook Stable U. K. PAPER: CRISIL Maintains 'B-' Rating in Not Cooperating VISHNU CARS: Ind-Ra Maintains B Issuer Rating in Non-Cooperating

#Business Updates#Insolvency News#Credit Ratings#Financial Restructuring#Global Companies#India Business News#Australia Financial Updates#Hong Kong Business Developments#Corporate Insolvency#Creditors' Meetings#Rating Downgrades#Debt Restructuring#Economic Insights#Industry News#Global Finance

0 notes

Text

"EL GRANDAZO": Misterija hapšenja srpskog vođe klana "Amerika"

Zoran Jakšić (55), drugi čovjek srpskog kriminalnog klana "Amerika" uhapšen je u Peruu, ali je nejasno kako se našao u ovoj državi Južne Amerike s obzirom da je u novembru 2013. u Italiji osuđen na deset godina zatvora.

Jakšić je uhapšen u Peruu u akciji tamošnje policije i američke DEA. Veliku priču o Jakšiću sa fotografijama akcije hapšenja objavio je list "La republika" koji je naveo da je osumnjičeni "El Grandazo" kako ga nazivaju jedan od glavnih meta DEA a, koji je u poslovanju koristio čak 46 lažnih identiteta i 10 različitih pasoša.

Ono što je međutim nejasno svima koji se bave istraživanjima aktivnosti klana "Amerika" je otkud Jakšić na slobodi.

Naime, Jakšić je u novembru 2013. godine, znači prije manje od tri godine u Italiji osuđen na deset godina zatvora i niko ne zna kako se našao na slobodi.

Jakšić je presudom italijanskog suda osuđen zbog krijumčarenja deset kilograma kokaina iz Urugvaja u Veneciji u aprilu 2009. godine.

Ovu kokainsku pošiljku sa Jakšićem je organizovao i prvi čovjek klana "Amerika" Mileta Miljanić. Glavni izvođači radova bili su Miljanićev rođak Mladen Miljanić (45) i izvesni Braim Sirani (58).

Prvi je 2010. u Rimu uhapšen Miljanić i osuđen na sedam godina zatvora, dok su Jakšić, Mladen Miljanić i Selimi 2013. osuđeni na po deset godina zatvora i novčanu kaznu od 180.000 eura.

Italijanska polIciija je grupu razotkrila prateći njihove telefonske razgovore.

Tako je utvrđeno da kokain stiže brodom MSC Armonia, koji je u Veneciju uplovio 6. aprila 2009. godine.

Mornar Dejan Ivanović (31) dobio je zadatak da kokain prenese u jedan hotel, gdje je i uhapšen, a zatim osuđen. Na saslušanju je izjavio da ga je za prenos droge unajmio brodski kuvar u Buenos Ajresu i da je za to dobio 10.000 eura, kao i da je drogu trebalo da preda čovjeku koji će ga pozvati telefonom.

Kako je Jakšić u međuvremenu dospio na slobodu, mnogo prije isteka izrečena kazne nije poznato. Jasno je, međutim otkud on u Peruu, državi Južne Amerike, budući da je ta teritorija centar poslovanja svih velikih krijumčara kokaina.

Hapšenje Jakšića koje je izvedeno u četvrtak predstavljeno je kao velika akcija tamošnje policije, a djela koja mu se stavljaju na teret ponovo bi mogla da ga odvedu na dugogodišnju robiju. Jakšić se u Peruu sumnjiči za šverc kokaina, iznude, otmice, alii da je rukovodio grupom koja je imala plaćene ubice.

"La Republika" piše da je Jakšić u Peru ušao sa falsifikovanim dokumentima, kao i da je uhapšen kada je krenuo za Ekvador. Hapšenje je izvela lokalna policija sa agentima DEA.

- On nije pružao otpr. U pitanju je organizator i finansijer kriminalne grupe koja ima veze sa SAD i Meksikom. Njegovo hapšenje predstavlja veliki udarac trgovini drogom - izjavio je Luis Pantoja Kalvo, direktor službe peruanske policije za borbu protiv droge.

Jakšiću ovo nije prvo hapšenje u Peruu. Zbog droge je u ovoj zemlji hapšen i 1998. godine, kada je osuđen na pet godina zatvora. Posle toga, 2004. uhapšen je u Nemačkoj, kada je policija kod njega pronašla devet kilograma droge.

"La Republika" navodi da se u momentu hapšenja, Jakšić koristio dokumenta na ime Lens Korona. Takođe je koristio i identitet Frederik Korona Bacanja, Stefan Hrobar, Zoran Jakšić Radojka, kao i prezimena Mihailović, Janić, Janlović, Boja, Jasić...

Sa ovim imenima, on je putovao po Americi i Karibima.

Za Jakšićem je raspisano 25 međunarodnih zahtjeva.

#ZoranJakšić#Hapšenje#Peru#DEA#TrgovinaDrogom#FalsifikovaniDokumenti#OrganizovaniKriminal#LatinskaAmerika#Interpol#Narkokartel#MeđunarodnaPoternica#Bezbednost#KriminalneGrupe#LažniIdentiteti#PolicijskaAkcija

0 notes