#Financial Restructuring

Explore tagged Tumblr posts

Text

In times of market uncertainty, many investors move toward safety. Yet, there’s a small group of professionals who actively seek out opportunities in volatility — turning risk into reward. This niche, known as distressed debt investing, plays a crucial role in capital markets and corporate recovery.

#Distressed Debt#Investment Strategies#Financial Restructuring#Turnaround Management#Private Equity#Meyhar Afkari

0 notes

Text

Global Business Updates: Insolvencies, Credit Ratings, and Financial Restructuring News

A U S T R A L I A

AM LABOUR: First Creditors' Meeting Set for August 3 BROOKFIELD RIVERSIDE: ASIC Winds Up 5 Land Banking Companies HOTR AUSTRALIA: First Creditors' Meeting Set for August 6 MIGME LIMITED: Second Creditors' Meeting Set for August 3 ROSSAIR CHARTER: Second Creditors' Meeting Set for August 3

SHARMA HOLDINGS: First Creditors' Meeting Set for August 3 SIRENS BY THE BAY: First Creditors' Meeting Set for Aug. 6

H O N G K O N G

NOBLE GROUP: Expected to Post Q2 Net Loss of Up to US$140MM NOBLE GROUP: PT Alhasanie Files $20MM Lawsuit Against Subsidiary YIHUA ENTERPRISE: S&P Alters Outlook to Negative & Affirms B ICR

I N D I A

AAKASH DEVELOPERS: Ind-Ra Places BB LT Issuer Rating on RWN ADILABAD EXPRESSWAY: CARE Lowers Rating on INR268.88cr Loan to D BALAJI OIL: CRISIL Migrates B Rating in Not Cooperating Category BINANI CEMENT: CARE Migrates D Rating to Not Cooperating Category BNK ENERGY: CARE Assigns B+ Rating to INR2cr Long-Term Loan

CHEEKA RICE: CARE Downgrades Rating on INR8cr LT Loan to B COMMERCIAL CARRIERS: CARE Migrates D Rating to Not Cooperating DHROOV RESORTS: CARE Migrates D Rating to Not Cooperating ECO RICH: Insolvency Resolution Process Case Summary GRANNY'S SPICES: CARE Lowers Rating on INR6cr LT Loan to D

INCOM CABLES: Ind-Ra Maintains 'D' LT Rating in Non-Cooperating INDIAN ACRYLICS: Ind-Ra Withdraws 'D' Long Term Issuer Rating INNOTECH EDUCATIONAL: CARE Migrates D Rating to Not Cooperating KOHINOOR HATCHERIES: Ind-Ra Affirms BB+ LT Rating, Outlook Stable LAVANYA PUREFOOD: CARE Lowers Rating on INR13.32cr Loan to C

MAHALAXMI ROLLER: CARE Cuts Rating on INR5.84cr LT Loan to B MANGALDEEP RICE: CRISIL Maintains 'D' Rating in Not Cooperating METRO AGRI: CARE Lowers Rating on INR13.84cr LT Loan to D MEVADA OIL: CARE Lowers Rating on INR14.60cr LT Loan to D N.S.R. MILLS: CRISIL Maintains 'B' Rating in Not Cooperating

NATURAL AGRITECH: Ind-Ra Hikes Long Term Issuer Rating to 'B+' NAVEEN POULTRY: CRISIL Maintains D Rating in Not Cooperating NEW HORIZON: CARE Lowers Rating on INR6.40cr LT Loan to B NICE POULTRY: CRISIL Maintains B- Rating in Not Cooperating NIKKI STEELS: CARE Lowers Rating on INR12cr LT Loan to B-

ODYSSEY ADVANCED: Ind-Ra Moves BB- Rating to Non-Cooperating PERTH CERAMIC: CRISIL Maintains B+ Rating in Not Cooperating RAJ ARCADE: Ind-Ra Affirms 'BB' LT Issuer Rating, Outlook Stable RELISHAH EXPORT: Ind-Ra Affirms B+ Issuer Rating; Outlook Stable RICHU MAL: CARE Lowers Rating on INR5cr Long-term Loan to B

ROLTA INDIA: Bondholders Oppose Debt Restructuring Plan SARASWATI TRADING: CARE Reaffirms B+ Rating on INR4.5cr LT Loan SHREE DATT: Ind-Ra Lowers Long Term Issuer Rating to 'BB+' SHYAM CORPORATION: CRISIL Maintains B Rating in Not Cooperating STONE INDIA: Insolvency Resolution Process Case Summary

SUMERU DEVELOPERS: CRISIL Migrates B Rating in Not Cooperating SUNSTAR OVERSEAS: Insolvency Resolution Process Case Summary TATA MOTORS: S&P Cuts Issuer Credit Rating to BB; Outlook Stable U. K. PAPER: CRISIL Maintains 'B-' Rating in Not Cooperating VISHNU CARS: Ind-Ra Maintains B Issuer Rating in Non-Cooperating

#Business Updates#Insolvency News#Credit Ratings#Financial Restructuring#Global Companies#India Business News#Australia Financial Updates#Hong Kong Business Developments#Corporate Insolvency#Creditors' Meetings#Rating Downgrades#Debt Restructuring#Economic Insights#Industry News#Global Finance

0 notes

Text

Case Study: Reviving BSNL through Strategic Initiatives and Stock Exchange Listing 📈📞

Introduction Bharat Sanchar Nigam Limited (BSNL) has been grappling with market competition, especially against private giants like Jio, Airtel, and Vodafone Idea (VI). This case study explores BSNL’s revival strategies, particularly through infrastructure upgrades, competitive pricing, and the potential benefits of listing on the stock exchange. 💡 Current Market Landscape Competitive…

#BSNL#Customer Experinece#Digital India#Financial Restructuring#Innovation In Telecom#IPO#Market Competition#Rural Connectivity#Telecom Infrastructure#Telecom Revival

0 notes

Text

How Financial Restructuring And Recovery Works Today

Business finance recovery and restructuring can be a tedious and time-consuming practice because it engages with the whole business hierarchy and is likely to affect how processes and operations are approached.

With growing demands, vast technological advancements, competitive business environments and quickly saturating markets, finance consulting can be the supplement that monitors and analyses the situation and draws up a plan that you can immediately implement and adapt to.

#software company#project management#procurement#procurement solutions#finance#Financial Restructuring

0 notes

Text

anyway i think networking is classist and ableist and should Not be the cornerstone of every single working industry

Networking oftentimes requires paying for something, whether it be an event fee, or even just lunch/dinner/drinks/coffee with someone where you may or may not be expected to pay, not to mention having the financial means and physical ability to get to the place in question (whether by driving, walking, public transit, rideshare, etc.) and the act of networking itself can be especially difficult for neurodivergent people who might have difficulty interacting with people, overstimulation in crowded, public environments, or just general social anxiety

#i get that there are benefits to it as well ie meeting people and learning new things#but also it should be structured with specific expectations and guidelines with no financial or physical obligation#and i don’t know if it’s possible to restructure the entire concept of networking around that

34 notes

·

View notes

Text

It's going to be so funny if I'm not fired a month from now

I'm already on level 6 of grief which is celebration post acceptance 🤣

#dgmw i have rent and bills to pay and the market is in a TERRIBLE place#and if in 2021/22 when the market was in a good place it took me like 7 months to find a good job#I'm terrified to think of how long it'll take me to find a job now#and my rent contract is until the end of May so going back to living with my parents to save money while unemployed is sadly not an option🥲#but like. if I'm already forced to be unemployed then I've made plans of things to do meanwhile with the free time I've got#so if I'm not fired then I'm going to be financially relieved but emotionally bummed😂 there go all of my plans😂#(context: work is going through serious restructuring so 99.9% I'll be laid off bc of it)#(and I've already made unemployment plans 😂)#personal

4 notes

·

View notes

Text

twice now I've been turned away from plasma donation because my heart rate was over 100 so unfortunately that money making avenue is probably no longer viable

#my diary#I can't really do anything about my heart rate being high that I haven't already tried#or rather there's nothing I can do in the next 24 hours#the only stuff left is basically Restructure My Whole Life To Prioritize My Health And Try Again In Six Months which. is not helpful now.#but if I were in a place financially to Restructure My Whole Life To Prioritize My Health I wouldn't be selling my actual bodily fluids#sooooooooooooooooooooooooooooooooooooooooooooooooooo

3 notes

·

View notes

Text

formally lodging my boomer-ass complaint about phones at gigs:

the more we accept filming entire songs and shows on phones the harder it is to see the performance live because everyone's arms are up near the front of the crowd, and in turn, the more people try to see by holding their phone above their head and watching back later. it's an endless feedback loop and it kills the ability to enjoy live music in other ways at the show, like dancing, singing, seeing the performance, or interacting with the fans around you.

i'm not saying nobody film any part of any gig. in fact, i usually try to get a few clips myself if it's safe to.

i am saying that gluing your eyes to your phone camera is annoying. it's not morally wrong, but it's fucking annoying. it's not terribly thoughtful.

when you hold your phone up to film, you're blocking the view of everyone behind you and (probably) standing stock-still in a place where possibly people have come to dance, so do so sparingly, please.

#worst shows ive been to are the ones where everyone is filming#nothing worse than a GA standing-room gig where you're 5 rows back and can't see a thing#i know we love living vicariously through others on the internet#i would gladly give up seeing gigs through other peoples phones#mentally prepared for someone to make the argument that gigs arent financially accessible ergo its an accessibility issue#as if the solution to that would be to make everyone at the show miserable instead of breaking up ticketmaster#or arguing for the restructuring of the music industry#sorry yall but making this kind of content comes with a price and it's some of the people around you thinking you're an asshole

2 notes

·

View notes

Text

Well, it is beginning.

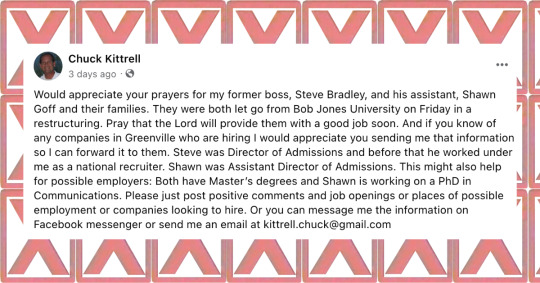

It's unfortunate that both Steve Bradley and Shawn Goff believed BJU's hype that they would be safe if they had a "good year" in spite of the BJU Civil War 2022.

But as of last Friday, the Director of Admissions and the Assistant Direction of Admissions -- Steve Bradley and Shawn Goff -- both were fired from Bob Jones University.

The excuse was "restructuring." That's code for downsizing. Which is code for shrinking. Which is a hop-skip-and-a-jump from the inevitable closure.

Here are the details:

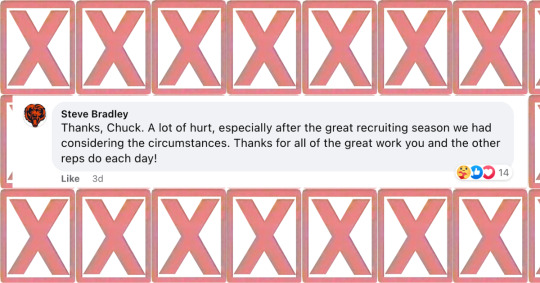

Steve responds:

"A lot of hurt."

Gentlemen, gentlemen, gentlemen. Don't get high on your own supply.

Shawn, honey, you should know how to discern good evidence from bad. You used to know.

When they are firing top people at the beginning of a semester in a way that feels out of the blue like this? That's bad.

Nobody's safe at BJU. Nobody.

#Bob Jones University#Downsizing#Restructuring#The end is near#Financial Crisis#Shawn Goff#Steve Bradley#Shrinking#Lay-offs

2 notes

·

View notes

Text

Finding Value in Chaos: The Art of Distressed Debt Investing

In times of market uncertainty, many investors move toward safety. Yet, there’s a small group of professionals who actively seek out opportunities in volatility — turning risk into reward. This niche, known as distressed debt investing, plays a crucial role in capital markets and corporate recovery.

What is Distressed Debt Investing?

Distressed debt investing involves buying the bonds or loans of companies experiencing financial hardship — often trading well below face value. These troubled firms may be approaching bankruptcy, undergoing restructuring, or facing liquidity issues. For informed investors, this distressed pricing creates the potential for high returns if the company recovers or reorganizes successfully.

But this isn’t a strategy for the faint of heart. It demands a deep understanding of financial structures, legal proceedings like Chapter 11, and the unique complexities of special situations. The most successful distressed investors combine analytical rigor with creative problem-solving to structure deals that protect downside while maximizing upside.

Meet Mehyar Afkari: Expertise in Special Situations

One notable expert in this field is Mr. Mehyar Afkari, Vice President at Areté Capital Partners. With more than eight years of experience across distressed debt, high-yield credit, restructuring, and M&A, Mr. Afkari has advised debtors and creditors in both U.S. and European markets. His career includes roles at Verition, Carl Marks & Co., and FT Partners, where he specialized in complex financial turnarounds, cross-border M&A, and capital structure optimization.

In addition to advising on large-scale restructurings, Mr. Afkari has also served as a principal investor — evaluating and executing high-impact strategies in special situations and distressed credit. 👉 Connect with Mehyar Afkari on LinkedIn

The Road Ahead

As we enter a period marked by tighter credit and rising defaults, distressed investing is gaining new relevance. For professionals like Mr. Meyhar Afkari, these times are not roadblocks — they are inflection points. By uncovering value others overlook, they play a pivotal role in both restoring companies and generating meaningful returns.

#Distressed Debt#Investment Strategies#Financial Restructuring#Turnaround Management#Private Equity#Meyhar Afkari

0 notes

Text

0 notes

Text

Kailash Sadangi - Leading Financial Restructuring for High-Impact Results

Kailash Sadangi is a leading financial restructuring firm with 30+ years of expertise in financial restructuring across industries. He specializes in optimizing capital structures, M&A growth, and governance frameworks in emerging markets. His strategic leadership enhances financial stability, revitalizes operations, and maximizes shareholder value. With a focus on capital formation and financing, he drives long-term business success.

0 notes

Text

Strategic Corporate Debt Restructuring for Financial Stability

KICK Advisory provides expert corporate debt restructuring service to help businesses manage financial challenges, improve cash flow, and reduce debt burdens. Our tailored strategies ensure stability, optimize liabilities, and support long-term growth. Let us guide you toward a stronger financial future. Visit us today for expert debt restructuring solutions!

#financial advisory services#kickadvisory#advisory services#advisoryservices#financial advisory firms#financialadvisory#bestfinancialconsultingfirms#corporatedebtrestructuring#corporate debt restructuring

0 notes

Text

Oh god I’m a professional

#making some big moves regarding strategic institutional relationships#which is technically not my department but it has to start here because it’s centering around the bookings I offer#and trying to restructure one of those to make four separate sites more financially accessible to the public#so I know that there will come a point where I am expected to hand this off to our strategic development person#but I have control issues and trust issues#so that will be difficult for me to navigate#but I know that that’s an important aspect of fixing the interdepartmental issues we have here#this will be the second big project I’ve initiated and had to hand off#I’m making administrative moves this year I guess#museum musings

0 notes

Text

Financial Restructuring vs. Debt Refinancing: What’s Best for Your UAE Business?

In the dynamic business landscape of the UAE, financial stability is critical for sustainable growth. Companies often face challenges that require strategic decision-making to maintain solvency and competitiveness. Two common strategies to address financial challenges are financial restructuring and debt refinancing. While these terms may seem similar, they serve different purposes and can have distinct impacts on your business. Understanding their nuances can help you make informed decisions tailored to your specific needs. This article explores the differences, benefits, and considerations of financial restructuring and debt refinancing, helping UAE businesses decide the best course of action.

What is Financial Restructuring?

Definition and Purpose

Financial restructuring involves reorganizing a company’s financial framework to improve its stability and operational efficiency. This process is typically initiated when a business faces significant financial distress, such as declining revenues, high debt burdens, or liquidity crises. The primary objective is to realign the company’s finances with its operational goals and market realities.

Key Components of Financial Restructuring

Debt Restructuring: Negotiating with creditors to alter repayment terms, reduce interest rates, or extend payment schedules.

Equity Restructuring: Modifying the ownership structure, which may include issuing new shares or reducing existing equity.

Asset Reorganization: Selling non-core assets to generate cash flow or investing in profitable ventures.

Benefits of Financial Restructuring

Improved cash flow and liquidity.

Enhanced operational efficiency.

Long-term financial stability.

Increased stakeholder confidence.

Relevance in the UAE

In the UAE, businesses often operate in a competitive and fast-paced environment. Industries such as real estate, retail, and hospitality are particularly susceptible to economic fluctuations. Leveraging financial restructuring and modeling helps businesses adapt to market changes and maintain viability.

What is Debt Refinancing?

Definition and Purpose

Debt refinancing involves replacing an existing loan with a new one, typically under more favorable terms. This strategy is often used by businesses that have strong credit ratings and stable financial performance but wish to optimize their debt obligations.

Key Components of Debt Refinancing

Interest Rate Reduction: Securing loans with lower interest rates to reduce overall costs.

Loan Term Extension: Extending the repayment period to lower monthly installments.

Consolidation of Debts: Combining multiple debts into a single loan for streamlined management.

Benefits of Debt Refinancing

Reduced interest expenses.

Improved cash flow due to lower monthly payments.

Simplified debt management.

Enhanced credit score over time.

Relevance in the UAE

Debt refinancing is a popular option among UAE businesses that aim to leverage favorable market conditions, such as declining interest rates, to optimize their financial structure. For example, companies in the logistics or manufacturing sectors can use refinancing to fund expansion projects or modernize equipment.

Key Differences Between Financial Restructuring and Debt Refinancing

Factors to Consider When Choosing Between the Two

Nature of Financial Challenges

If your business is facing severe financial distress, financial restructuring is the better option. It provides a holistic solution that addresses root causes.

For businesses with manageable debt but high-interest obligations, debt refinancing can offer quick relief.

Industry and Market Conditions

Industries like real estate and retail in the UAE may benefit from financial restructuring due to market volatility.

Debt refinancing is suitable for industries like technology or healthcare, where stable cash flows are common.

Long-Term Goals

If your objective is to achieve long-term financial stability, restructuring is ideal.

If your goal is to reduce costs and improve profitability in the short term, refinancing is more appropriate.

Consultation with Professionals

Engaging accounting and auditing firms in UAE can provide valuable insights and assist in determining the most suitable option. These firms specialize in analyzing financial statements, identifying risks, and proposing actionable strategies.

Role of Audit Services in Financial Decision-Making

Audit services play a crucial role in both financial restructuring and debt refinancing. Accurate and transparent financial reporting is essential for:

Identifying financial weaknesses.

Building trust with creditors and stakeholders.

Meeting regulatory requirements in the UAE.

Leading audit services in UAE offer comprehensive evaluations, ensuring businesses make well-informed decisions.

Steps to Implement Financial Restructuring

Assess Financial Health: Conduct a thorough analysis of your company’s financial statements.

Engage Stakeholders: Collaborate with creditors, investors, and other stakeholders.

Develop a Restructuring Plan: Create a detailed roadmap outlining steps and timelines.

Execute the Plan: Implement changes in debt, equity, and asset structures.

Monitor Progress: Regularly evaluate the effectiveness of the restructuring.

Steps to Implement Debt Refinancing

Evaluate Current Debt: Review existing loan terms and identify areas for improvement.

Research Market Options: Compare offers from various lenders.

Negotiate Terms: Secure favorable rates and repayment terms.

Replace Existing Loan: Use the new loan to pay off the old one.

Maintain Discipline: Ensure timely payments to build a strong credit history.

Challenges and Risks

Financial Restructuring

Resistance from stakeholders.

High costs and time investment.

Potential loss of control in equity restructuring.

Debt Refinancing

Risk of over-leveraging.

Hidden fees and prepayment penalties.

Dependence on market conditions for favorable terms.

Conclusion

Choosing between financial restructuring and debt refinancing depends on the unique circumstances of your business. While financial restructuring offers a comprehensive solution for distressed companies, debt refinancing provides immediate cost benefits for businesses with stable finances. In the UAE’s competitive market, leveraging professional expertise from accounting and auditing firms in UAE is essential for making the right choice. Additionally, utilizing audit services in UAE ensures transparency and precision in financial decision-making.

Ultimately, the goal is to enhance your business’s financial health and achieve sustainable growth, irrespective of the strategy you choose. By understanding the nuances of each approach and aligning them with your long-term goals, you can position your business for success in the vibrant UAE economy.

0 notes

Text

Atos Secures €1.675 Billion to Restructure Debt

Atos has secured a significant €1.675 billion to restructure its debt. This funding comes through a lock-up agreement, involving over 50% of its creditors. Remaining creditors have the chance to join this agreement until July 22. This step marks a crucial move in Atos’ financial strategy.

Following this announcement, Atos’ shares rose by 10%, reaching €1.17 per share during early trading in Paris. This positive market response underscores investor confidence in Atos’ financial plans.

In addition, Atos has obtained interim financing of €800 million. Out of this, €450 million is already accessible, providing immediate liquidity to support its business operations. This interim financing is essential until the comprehensive financial restructuring plan is concluded.

Read More:(https://theleadersglobe.com/business/atos-secures-e1-675-billion-to-restructure-debt/)

#Atos#Restructure Debt#financial strategy#global leader magazine#the leaders globe magazine#leadership magazine#world's leader magazine#article#best publication in the world#news#magazine#business

0 notes