At The Concept Trading, we believe every trader deserves a chance to succeed. Our prop firm trading model offers an accessible and rewarding approach, allowing you to trade with flexibility. With straightforward rules and a focus on sustainable funding, we empower you to reach new heights in your trading career. Experience prompt payouts within 48 hours through our streamlined process, backed by 24/7 support. Partner with The Concept Trading to enhance your trading potential, and let us help you navigate the markets while minimizing your risk. Join us and transform your trading experience today!📍 TOWER 2, SUITE 101/55 Plaza Parade, Maroochydore QLD 4558Call Us: (07) 4599 3855

Don't wanna be here? Send us removal request.

Text

Swing Trading vs. Scalping with Prop Firms: Which Is Better?

In the dynamic world of trading, selecting the right strategy can make all the difference. Swing trading and scalping offer distinct paths to profit, each appealing to different styles and time commitments.

Prop firms are reshaping the trading landscape by providing the capital and support needed to excel. With the right firm, you can focus on refining your skills while minimizing personal financial risk. Discover how to maximize your potential in trading today.

Introduction to Swing Trading and Scalping

Understanding Swing Trading and Scalping Strategies

Swing trading and scalping are two ways people trade stocks. They fit different types of traders and work best in different situations.

Trading Flexibility: Swing traders hold their trades for days or even weeks. They try to catch bigger price moves. Scalpers do the opposite. They make lots of quick trades in one day.

Trade Frequency: Swing traders trade less often but aim for bigger profits each time. Scalpers trade many times a day, making small profits on each trade.

Position Holding Period: Swing traders keep their positions longer and wait patiently for the right moment. Scalpers act fast, making decisions based on instant market changes.

Swing Trading Definition and Characteristics

Swing trading means trading for a medium time, like several days or weeks.

Swing Traders: They think patiently and pick their trades carefully.

Medium-Term Price Movements: They try to earn money from price changes over days or weeks.

Patient Approach: Swing traders wait for good chances instead of jumping in too soon.

Selective Trades: They choose only the best opportunities to reduce risk and increase gains.

Scalping Definition and Characteristics

Scalping is all about fast trades to get small profits quickly.

Scalper Profile: Scalpers focus hard and react super fast.

Quick Decision-Making: They use live data to spot chances in seconds.

High-Frequency Trading: Scalpers make many trades every day, holding positions for just seconds or minutes.

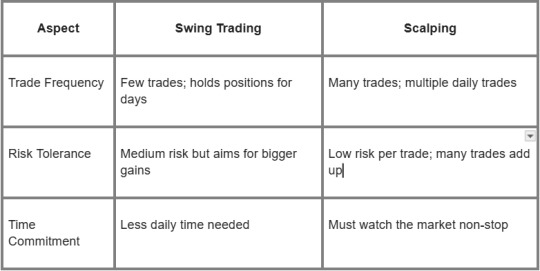

Key Differences Between Swing Trading and Scalping

Both swing trading and scalping can help you make money. Your choice depends on how much time you want to spend, how much risk you can take, and how involved you want to be with the markets.

Swing Trading in a Crypto Prop Firm Environment

Swing trading means holding positions for days or weeks to catch medium-term moves.

Crypto prop firms offer funded trading accounts and more trading capital for this style. These firms provide steady funding that helps traders grow their careers. They cut down on personal money risks and offer tools to trade better.

Crypto prop trading mostly focuses on digital assets but often supports other markets too. This lets traders mix up their strategies. With funded accounts, swing traders get bigger capital pools than their own money allows. That boosts possible profits without risking personal funds.

Working with a good prop firm gives swing traders a stable setup focused on steady results, not quick trades. This setup helps traders build skills and succeed long term in the wild crypto markets.

Benefits of Using Prop Firm Capital for Swing Trading

Using prop firm capital comes with several perks:

More Trading Capital: You get bigger funds than your own account.

Bigger Gains: Larger capital can boost profits when trades go well.

Good Profit Split: Many funded trader programs share profits at 70% or more.

Fast Funding: After passing evaluations, you can start prop firm challenge today and begin trading right away.

These perks let swing traders focus on trading instead of stressing about money limits. The Concept Trading’s system pushes steady funding and pays out quickly—usually within 48 hours—to keep traders motivated and cash flowing.

Challenges of Swing Trading within a Prop Firm Framework

Swing trading with a prop firm also has some tough spots:

Evaluation Pressure: You must hit targets during tests, which can clash with longer hold times swing trading needs.

Risk Rules: Strict drawdown limits force careful sizing of positions and stops to protect firm money.

Drawdown Limits: Going past loss limits might reset or end your account; managing losses is key to staying in the game.

Knowing these rules helps traders adjust methods and follow firm policies. Staying flexible but disciplined keeps success coming in this kind of setup.

Features of Crypto Prop Firms for Swing Traders

Crypto prop firms offer features that suit swing traders well:

Flexibility to Hold Positions Overnight/Weekends

Many crypto prop firms let you hold positions overnight and trade on weekends. This fits swing trading because it needs multi-day moves without forcing you to close early.

No-Time Limit Evaluations

Some firms don’t set strict deadlines for passing evaluations. That takes off pressure so swing traders can wait as trades unfold over time without rushing.

Swing-Friendly Leverage

Leverage options match moderate risk levels typical for swings—not high-risk scalp trades. Position sizes stay balanced by setting limits that fit longer holds, keeping risk in check.

Support for Multiple Instruments

Top crypto prop firms go beyond crypto, letting you trade stocks, indices, metals, and more. This variety gives swing traders chances to balance portfolios across different markets.

Competitive Profit Splits

Profit splits stay attractive at many leading crypto prop firms—often above 70%. Fast payouts mean you get your earnings soon after closing profitable trades.

This rundown shows how The Concept Trading’s platform fits swing traders with flexible rules and strong funding made just for their needs in today’s changing markets.

Understanding Scalping in a Prop Firm Context

Scalping means trading quickly to catch small price changes. Traders who use the scalper trading style make many trades each day. They often hold positions for only seconds or minutes.

Prop firms let scalpers trade with bigger money through funded trader programs. This helps them grow profits without using their own cash.

Many prop firms offer crypto prop trading and other markets. These are good places for scalpers who need fast execution and sharp focus. Unlike swing traders, scalpers close trades fast. This is typical for day trading and short-term trading styles.

Advantages of Scalping with Prop Firms

Scalping at prop firms gives you some clear perks:

Trading Capital: You get more money to trade than your own savings.

Instant Funding: Some firms fund you right after you pass their test.

Prompt Payouts: You can withdraw profits quickly, often in just two days.

Leverage in Trading: Firms let you use leverage to boost gains while controlling risks.

Execution Speed: Fast platforms help grab quick price moves.

Quick Decision-Making: Rules let you act fast without delays or extra approvals.

These points make it easier for scalpers to work fast and earn more without risking their own money much.

Challenges of Scalping within a Prop Firm Environment

Scalping with prop firms also has tough spots:

Trading Risk Management: You must follow strict stop-loss rules to protect money.

Evaluation Pressure: Passing funding tests can stress you because results matter a lot.

Psychological Adjustment: Fast trading needs strong nerves to handle losses and quick choices.

High Stress Levels: Staying alert all the time can wear you down if you don’t take breaks.

Knowing these challenges helps traders get ready mentally before they start.

Choosing the Right Prop Firm for Scalping

The best prop firms balance clear rules with risk control. They help short-term traders scale up without risking too much. Look for firms known for being honest and quick to respond. That makes trading scalp strategies smoother and safer.

Swing Trading vs. Scalping: A Detailed Comparison

Swing trading and scalping are two common trading styles. Swing traders hold their trades for days or weeks. They aim to catch medium-term price moves using swing trading strategies.

Scalpers, by contrast, make very fast trades. Their trades last seconds or minutes, using scalping techniques that grab small profits quickly.

The big difference is how often they trade and manage risk. Swing traders set wider profit targets and stop-loss orders based on technical analysis of chart patterns and momentum indicators.

This helps them handle moderate price swings while keeping risk in check with strict drawdown limits. Scalpers trade many times daily with tight stop-losses but face more risk because they must make fast decisions.

Knowing these differences can help you pick a style that fits your goals and personality.

Profit Potential and Risk Tolerance

Swing trading can bring high profit potential by catching bigger price moves over time. Traders control risk with clear rules like daily drawdown limits that stop big losses in wild markets.

Scalping looks for smaller wins per trade but makes up for it with lots of trades. But it needs perfect timing to keep losses small because many trades add risk.

Both styles rely on strict stop-loss orders—swing traders use broader stops while scalpers use tighter ones—to protect money and grow steadily.

Time Commitment and Effort

Scalping needs intense focus during market hours. It’s fast-paced and demands quick decisions under pressure. That stress means scalpers must stay sharp for hours at a time.

Swing trading asks for less constant watching since trades last days or weeks. This lower time commitment suits people who want flexibility without losing steady portfolio growth.

Which one works better depends on your schedule and how you handle stress while the market is live.

Technical Analysis Requirements

Both swing traders and scalpers depend on technical analysis but use it in different ways:

Swing Trading: Looks for clear chart patterns like head-and-shoulders or flags, plus momentum indicators such as RSI to see trend strength.

Scalping: Focuses on very short-term charts, watching order flow closely, and reading support/resistance quickly to decide when to jump in or out.

Learning the right tools helps no matter what style you pick. Swing trading needs deeper pattern recognition over longer times, while scalping calls for split-second calls.

Psychological Demands

Trading psychology matters a lot in both styles:

Swing Traders: benefit from patience and good emotional control while waiting through price moves.

Scalpers: must handle stress from rapid decisions where hesitation might cost money.

Sticking to rules keeps traders from making impulsive mistakes caused by fear or greed—problems that hit both styles hard.

Choosing the Right Strategy for Your Trading Style

Picking between swing trading versus scalping starts with knowing yourself—your personality, skills, and what fits your lifestyle best if you want long-term success at places like The Concept Trading.

Self-Assessment of Trading Preferences and Skills

Here’s what typical trader types look like:

Swing traders tend to be patient. They pick their trades carefully. They follow rules well and don’t mind holding positions overnight even if prices move moderately.

Scalpers like quick action. They can focus long hours staring at screens. They make split-second choices over and over without losing calm.

Knowing which sounds like you helps pick a style that won’t wear you out or give uneven results.

Alignment of Strategy with Personal Goals and Resources

Think about what fits your goals best:

Choose the style that matches your resources. It should also help keep your work-life balance healthy alongside money goals.

By knowing these key differences between swing trading vs. scalping—and thinking about your strengths—you can pick the approach that fits you best inside prop firms offering flexible funding designed for steady performance growth.

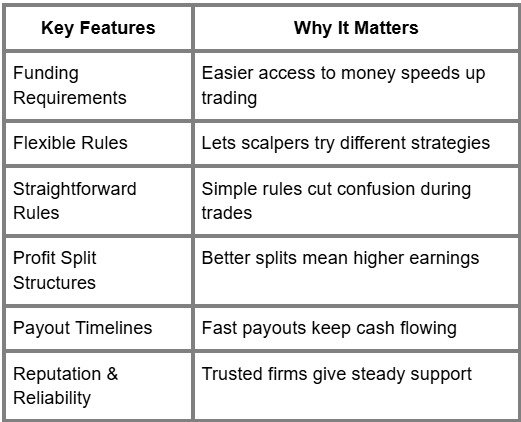

Selecting the Right Prop Firm for Your Trading Strategy

Picking the right prop firm matters a lot. You want one that fits your swing trading or scalping style. Start by checking their account sizes and leverage options. Bigger accounts with flexible leverage let you scale trades without risking too much.

Profit split setups can be very different between prop trading firms. Look for clear profit sharing that pays well, maybe over 70%. Quick payouts matter too. Firms that pay within 48 hours keep your cash moving and your spirits up.

Reputation is key when you pick funded trader programs. Read reviews, check if they follow rules, and see what other traders say. Instant funding can help you start live trading fast after passing evaluation. Easy account verification saves time too.

Transparent execution means no hidden fees or slippage eating your gains. Choose firms known for fair trades and clear funding requirements. These points help make a good fit for your trading style.

Tools and Techniques for Success in Prop Firm Trading

Good risk management keeps your profits safe in prop firm trading. Always use stop-loss orders to cut losses early. Set take-profit points to lock gains at planned levels.

Position size should match both your account and how wild the market is. Don’t risk more than 1-2% of your account on one trade.

Try trailing stops to keep profits as prices move up. Hedging can protect you from sudden market swings.

Use both technical and fundamental analysis to pick better trades. Look at chart patterns, moving averages, RSI, and MACD for tech analysis. Watch news and economic reports for fundamentals.

Know how different order types work (market, limit) and how fast your platform executes them. Fast execution means less chance of bad price fills during volatile times.

Review your trades often using dashboards with metrics like win rate, average return, and drawdown. This helps improve your strategy step by step.

Adapting Your Strategy to Market Conditions

Market conditions change all the time because of news or events. Good traders change their plans to fit those shifts instead of sticking too hard to one way.

In markets trending strongly over days or weeks, trend-following setups work best. Use momentum indicators like MACD there.

If markets move sideways between support and resistance levels, mean-reversion strategies do better.

Crypto markets jump around more than normal assets. That means you might want smaller position sizes or wider stops because of big overnight moves or weekend gaps.

Be careful around big economic data releases; spreads might widen and swap charges could rise if you hold positions overnight.

Sentiment tools like on-chain analytics help with crypto trades too. Also look at project health before trading when things feel uncertain.

Guidance on Selecting the Best Approach

Your choice depends on your goals, time, money, and career plans in trading. If you want less screen time with careful setups, swing trading fits well. If you like pressure and quick results by being active in the market, scalping works better.

Pick a strategy that matches your lifestyle to grow steadily as a trader in a prop firm. Make choices based on honest self-checks to boost your success over time.

Prompt Payouts, Streamlined Process, and 24/7 Support at The Concept Trading

The Concept Trading pays out profits quickly—usually within 48 hours. Their process is simple, so you get funding without waiting or extra hassle. They also offer support any time of day or night.

This setup helps both swing traders and scalpers focus on trading while keeping paperwork easy.

Highlighting The Concept Trading's Advantages

The Concept Trading works well for different styles—including swing trading support. Its platform runs smoothly on many devices and offers strong tools to manage risks.

Joining here means you get clear rules, fair profit shares, and an environment that cares about helping you grow as a trader with funded accounts.

FAQs

What Is the Role of Trading Risk Management in Prop Firm Trading?

Trading risk management is essential for safeguarding capital by implementing strategies such as stop-loss orders and drawdown limits. It helps maintain consistent trading performance while minimizing the impact of significant losses.

How Can Traders Scale Their Accounts Using Prop Firms?

Prop firms enable account scaling by increasing capital allocation as traders achieve profit milestones and adhere to established risk parameters consistently. This structured approach encourages responsible trading behavior.

What Types of Funding Evaluations Do Prop Firms Use?

Prop firms typically employ phased funding evaluations. These evaluations assess traders through specific profit target percentages and maximum drawdown limits to ensure they demonstrate discipline and effective risk management before receiving funded accounts.

How Does Leverage in Trading Affect Swing Trading vs. Scalping?

In swing trading, moderate leverage is utilized for positions held over several days, which helps to mitigate overnight risks. Conversely, scalping often requires lower or adjustable leverage for rapid, intraday trades, allowing traders to better manage the effects of market volatility.

What Support Services Do Prop Firms Offer to Help Trader Career Growth?

Prop firms provide a range of support services, including 24/7 assistance, mentorship programs, performance analytics, and educational resources. These services are designed to empower traders and enhance their overall trading potential.

Why Is Psychological Adjustment Crucial in Scalper Trading Style?

Psychological adjustment is vital for scalpers due to the high-pressure environment created by quick decision-making and frequent trades. Maintaining emotional control is key to preserving discipline and avoiding impulsive mistakes.

How Do Trading Tools Assist with Strategy Optimization in Prop Firm Environments?

Trading tools such as dashboards, performance metrics, technical indicators, and various order types enable traders to make data-driven decisions. These tools facilitate ongoing improvement and strategic optimization in trading results.

What Are Common Challenges Faced During the Funding Evaluation Phase?

During the funding evaluation phase, traders often encounter challenges such as performance pressure, rigid risk management rules, and the need to maintain consistent profitability while adhering to drawdown limits.

How Do Market Volatility and Cryptocurrency Volatility Impact Swing Trades?

Market volatility can lead to price fluctuations that significantly influence stop-loss levels and position sizing. Traders must adjust their strategies, either by widening stops or reducing position sizes, to effectively manage risk in volatile conditions.

Key Elements for Successful Prop Firm Trading

Strict trading discipline keeps losses low with stop-loss orders and daily drawdown limits.

Effective capital allocation balances position size relative to account value.

Using performance metrics like win rate and average return guides continuous improvement.

Employing both technical analysis (chart patterns, momentum indicators) and fundamental analysis (crypto asset fundamentals, news) supports better trade setups.

Understanding order types, such as limit or market orders, helps control trade execution latency.

Managing overnight risk carefully when holding positions during weekends or economic data releases.

Leveraging trader support services, including mentorship and community forums, fosters skill development.

Navigating prop trading challenges, such as evaluation pressure and strict risk rules, requires mental strength.

Choosing firms with transparent profit split structures, quick profit withdrawal, and flexible funding requirements improves the overall experience.

Adjusting strategies for different market conditions, including trending or range-bound markets, enhances trading scalability.

For more post about prop firm trading tips click here.

#prop trading firms#prop trading tips#forextrading#the concept trading#fx trading#swing trading#scalping

0 notes

Text

How to Pass a Prop Firm Challenge on Your First Try

Navigating the world of proprietary trading can feel daunting, but passing a prop firm challenge is your gateway to trading success. With the right strategies and mindset, you can transform your skills into a funded trading career, unlocking financial freedom and growth.

In this guide, we’ll unveil essential tips and techniques to help you conquer your first challenge with confidence. From developing a robust trading plan to mastering emotional control, prepare to elevate your trading game and seize the opportunity that awaits.

Understanding Prop Firm Challenges and The Concept Trading

What is a Prop Firm Challenge?

A prop firm challenge tests your trading skills. Proprietary trading firms use it to see if you can trade well under their rules. You trade on a demo or challenge account. They watch your moves against metrics like profit targets and risk limits.

If you pass, you join a funded trader program where you trade real money.

Purpose and Structure

The challenge’s goal is to find traders who handle money smartly. You get a challenge account to trade with. You must hit certain performance requirements in set timeframes. Each firm has a payout structure that usually shares profits once you’re funded.

Benefits for Aspiring Traders

Trying these challenges gives you some cool perks:

Funded trader benefits let you trade big without your own cash.

Financial freedom through trading can happen when you use firm capital.

Trading career growth comes from learning while proving yourself.

The Concept Trading's Challenge Rules and Criteria

Specific Requirements

At The Concept Trading, the challenge comes with clear trading rules that outline exactly what is and isn’t allowed during your evaluation. These rules are especially helpful for those new to the industry, making it one of the more approachable proprietary trading firms for beginners.

One of the most important aspects to monitor is your maximum drawdown—this limit defines the largest loss you can take before failing the evaluation. Staying within this threshold is key to moving forward and ultimately getting funded.

Profit Targets

You have to reach account growth targets in the time given. This proves you can make steady profits.

Drawdown Limits

Daily drawdown limits keep risk low every day. Sticking to them protects your spot in the challenge.

Understanding Challenge Requirements: Profit Targets and Drawdown Limits

You’ll need to plan for two main parts: profit targets and overall drawdown limits.

Profit target means how much profit you must earn during the challenge.

Overall drawdown limits show how much total loss you can have before failing.

Strategies for Meeting Targets

Good trading discipline techniques help here:

Follow your trading plan closely.

Stay calm even when markets jump around.

Doing this raises your chance to pass the prop firm challenge quickly!

Drawdown Management Techniques

Watch daily loss limits well to keep control:

Put stop-loss orders on every trade.

Check open trades often against daily loss caps.

Change position sizes based on market changes.

Trading Restrictions and Timeframes

Know which trading instruments are allowed and when markets open or close.

Permitted Trading Instruments

Each firm lets you trade certain instruments only—stocks, forex pairs, etc.—so check what’s permitted first.

Trading Hours

Market hours restrictions say when trades can happen. Missing this info could cost you penalties!

Leverage Restrictions

Leverage rules matter too! Firms set how much leverage you may use during the challenge. Knowing this helps balance profits with risks.

Getting familiar with prop firm challenges through The Concept Trading helps new traders understand what to expect as they aim for success!

Developing a Robust Trading Plan

A good trading plan helps you pass a prop firm challenge. It shows how you will trade and keeps you on track.

Your plan should list trading strategies for the instruments you choose, like forex or stocks. Use technical analysis tools such as moving averages and RSI to find trends and entry points.

Add rules to limit losses on every trade. This plan stops you from making emotional choices during market swings. Following your strategy all the time can boost your chances in any prop firm challenge.

Defining Your Trading Style

Your trading style decides how you trade each day. Whether you day trade or swing trade, discipline matters most. Stay consistent by sticking to your style, even when emotions get high.

Try techniques like deep breathing or writing in a journal after trades. These help manage stress and keep impulsive decisions away. This mindset can help your results stay steady during the challenge.

Choosing Your Markets

Picking the right markets can help in a forex trading challenge or other markets. Watch out for market hours restrictions some firms have. Trade when markets are open and you can watch closely.

Look at economic indicators like interest rates and job reports. They move prices a lot. Pick liquid markets that don’t jump around too much for easier trading.

Entry and Exit Rules

Clear rules for when to enter and exit trades bring steady profits in prop firm challenges. Set exact criteria, like signals from several technical indicators, before entering a trade.

Decide exit rules based on profit goals or stop-loss points. Use stop-loss to protect your money if the market moves against you fast.

Backtesting and Forward Testing Your Strategy

Test your strategy with past data before using real money. This backtesting shows if it works in different market times. Forward testing means trying it live on simulated accounts with no real risk.

Both tests find what works well and what needs fixing before you trade funded accounts in a prop firm challenge.

Backtesting Platforms and Tools

Platforms like TradingView and MetaTrader make backtesting simple and detailed. They let you try strategies on many instruments and show stats like win rate or drawdown clearly.

Interpreting Backtest Results

Don’t just look at profits in backtests. Check max drawdown too — this shows your biggest loss possible during bad times. Use these facts to tweak your plan, not just rely on past profits that might not happen again.

Forward Testing Methodology

Use demo accounts that copy real prices but risk no money when forward testing. This lets you practice under pressure safely before going live with funded challenges.

Essential Trading Strategy Elements: Entry and Exit Criteria

Good traders mix technical indicators like MACD or Bollinger Bands with price action clues such as support and resistance levels to pick exact spots for entry and exit inside their plans.

Position Sizing for Risk Management

Position sizing means deciding how much money to use per trade compared to your total account size. It helps control risk across all trades so one bad one won’t hurt too much.

Calculating Position Size

Figure out position size by choosing how much loss is okay per trade, usually 1-2% of your total capital. Example:

Position Size = Account Equity × Risk Percentage / Stop-Loss Distance

This way, no single loss will wreck your account balance badly.

Risk Tolerance Assessment

Think about how much loss feels okay for you personally while following the firm’s capital rules. This balance helps keep growth chances without losing too much money fast.

Adjusting Position Size Based on Volatility

Markets move up and down in volatility daily. Make position sizes smaller when volatility spikes happen so risks lower during wild times. Grow size carefully when things calm down more steadily.

Work through these areas well with clear rules plus tested ideas, and you’ll feel ready to handle any prop firm challenge from start to end without much doubt or stress.

Implementing Effective Risk Management Techniques

Risk management matters a lot if you want to pass a prop firm challenge. It keeps your trading capital safe and helps you follow rules like maximum drawdown and daily drawdown limits. A good plan balances risks with possible rewards.

Try these key methods:

Stop-Loss Strategy: Use stop-loss orders to stop big losses early.

Take-Profit Levels: Set points where you take profits before the market turns.

Risk-Reward Ratio: Look for trades where profit is bigger than loss, like 2:1 or more.

Capital Protection: Don’t risk more than about 1% of your total money on one trade.

Drawdown Limits: Stick to the max and daily drawdown rules so you don’t get disqualified.

Using these steps regularly helps control your risk during the challenge.

Stop-Loss and Take-Profit Strategies

Good stop-loss and take-profit plans help control risk and improve how trades end. Here are some ideas:

Trailing Stops: Move stops up as price rises so you keep profits without losing out on gains.

Breakeven Orders: Once a trade makes some profit, move your stop to your entry price to avoid losing money.

Multiple Stop-Loss Levels: Use more than one stop based on support areas or how much price moves.

Clear rules for when to enter and exit trades keep things steady. For example:

Only enter when signals match your plan, like confirming a trend.

Put a stop-loss in right after you enter, based on how much price swings or a set percentage.

Pick take-profit points at key support/resistance or using risk-reward math.

These ways help stop emotional choices when markets move fast in prop firm challenges.

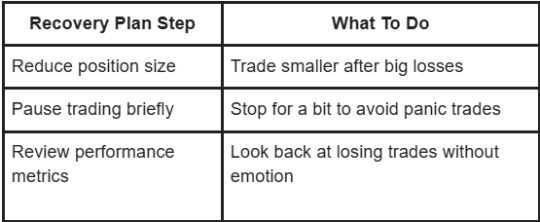

Managing Drawdown and Protecting Your Capital

Drawdowns show if your plan works and test your mindset during a prop firm challenge. Managing them well protects your account from hitting hard limits that can end the game early.

Do these:

Follow overall drawdown limits set by the firm closely; going over ends you no matter what.

Spread trades across different assets or timeframes to lower risk from big moves hitting all trades.

Plan ahead for recovery, like:

Doing this keeps your money safer while you work toward funding goals.

Developing Emotional Control and Trading Discipline

Emotional control is huge for passing any prop firm challenge. Fear of losing or wanting quick gains can mess up your plan and cause errors.

Try these mental tricks:

Practice staying focused on now instead of feelings

Set real goals about wins and losses

Keep a journal about how you feel with each trade

Knowing fear and greed—the two biggest feelings that mess with traders—helps build toughness needed in timed challenges.

Discipline means following your plan no matter what, even if markets swing wildly or past trades lost money. Traders who stick with this get better results over time.

Good risk management plus steady trading improves your chances to pass a prop firm challenge on your first try. These ideas keep your capital safe while building confidence.

Adapting to Trending, Ranging, and Volatile Markets

Passing a prop firm challenge means you gotta adjust your trading style to the market. Markets switch between trending, ranging, and volatile modes all the time. Each type needs a different approach and mindset.

Trending Markets: Prices move in one clear direction. Traders use momentum strategies to catch these moves.

Ranging Markets: Prices jump between support and resistance levels. Range-bound strategies work best here.

Volatile Markets: Prices swing wildly because of stuff like economic data, geopolitical events, or central bank moves. Risk management is key now.

Knowing how economic indicators and geopolitical risks affect markets helps you expect when volatility will spike. A flexible mindset lets you switch gears fast instead of sticking with one method.

Identifying Market Regimes

Figuring out what kind of market you’re in matters when adapting during a prop firm challenge evaluation.

Try these:

Technical Analysis: Look at chart patterns and technical indicators like moving averages or RSI to spot trends or ranges.

Fundamental Analysis: Watch news about the economy, company earnings, or policy changes that move prices.

Market Sentiment Metrics: Check trader feelings using volume or sentiment indexes.

Use trading evaluation metrics to see how you do in different regimes by tracking wins and losses under each condition. This helps you pick smarter trades based on current market mood.

Adjusting Strategies Accordingly

Changing your strategies depending on the market regime helps keep your trading steady in challenges where rules are strict.

Follow this approach:

Check recent price moves using both technical and fundamental info.

Pick tactics: trend-following for trending markets; mean reversion for ranging ones.

Adjust based on past trade results for each market type.

Stick to stop-losses that fit the current volatility level.

This method cuts down emotional decisions and makes you quicker to react — an edge when prop firms watch every move closely.

Utilizing Different Time Frames

Making the most of different time frames improves your trading schedule:

Use daily or weekly charts to find big picture trends.

Use shorter frames (like 15-minute or hourly) to time entries and exits better.

Mixing long-term views with short-term action sharpens timing without pushing you into too many trades — a mistake many make during fast markets.

Utilizing Essential Trading Technology and Tools

Trading tech can boost your accuracy and speed through the prop firm challenge:

Charting software such as TradingView gives real-time charts for spotting setups fast.

Trade monitoring tools keep tabs on open trades and risk limits so you avoid mistakes.

AI-powered analytics crunch tons of data to show likely moves beyond what people can spot.

Automated trading platforms like MetaTrader let you test strategies before going live to see how they perform.

Using these tools means less guesswork and more data-backed trading decisions.

Charting Software and Data Analysis Tools

Knowing how to use charting software plus solid data analysis steps up your decision game:

Use technical indicators like MACD or Bollinger Bands suited for current market types.

See price action clearly with candlestick charts plus volume overlays to catch patterns quick.

Backtest your strategy on past data right inside the platform; this shows if it works before risking money live.

Putting these tools into daily habits during your prop firm challenge builds confidence based on facts — not just gut feelings.

This way of working gets you ready not only in skills but also mentally so you pass a prop firm challenge right away while handling financial market volatility smartly by matching changes linked to economic shifts and geopolitical risks around the world.

Maintaining Consistency and Patience in Trading

Doing well in a prop firm challenge needs solid trading discipline and consistency. You gotta build a daily routine that helps you make steady progress.

A trading journal can be your best friend here. Write down every trade you make—entry points, take-profit targets, and even how you feel. This keeps you honest and shows what works or not.

Consistent trading means you follow your plan even if things get bumpy. Don’t jump into trades on impulse. Use trade monitoring tools to watch the market live and get alerts. When emotions spike, try emotional control techniques like deep breathing or short breaks. Staying calm helps you focus.

Patience matters a lot. Passing a prop firm challenge takes time. Stick to your habits, stay disciplined, and your chances for success grow.

Keep a detailed trading journal

Follow your strategy without flipping out

Use tools to track trades in real time

Practice simple ways to control emotions

Turning Failure into a Learning Opportunity

Everyone hits rough patches during the prop firm challenge. Don’t see losses as total failure. Instead, look at them as chances to learn something new. After each loss, do some losses analysis. Ask what went wrong—bad timing? Poor risk steps? Emotional mistakes?

Keep checking yourself with continuous self-evaluation. Ask questions like: What could I change next time? Did my feelings mess with this trade? Thinking this way turns setbacks into learning opportunities.

Being curious about failure builds strength. That’s a must-have trait for anyone who wants lasting success as a funded trader.

Review each losing trade carefully

Think about what triggered the mistake

Ask yourself honest questions often

Use losses as lessons to improve

Building a Support Network for Accountability

Trading alone can get lonely fast. A trader community or mastermind group can keep you motivated and help you learn from others. These groups share ideas and support each other through the prop firm challenge.

Mentorship in trading is another big help. Experienced traders show you what works and warn about common errors. Having a trading buddy also keeps you on track by sharing goals and progress regularly.

These support systems build good habits and cheer you on when things get tough.

Join a group of fellow traders

Find a mentor with experience

Team up with a trading buddy

Share goals to stay accountable

Planning for Long-Term Success with Funded Trading

Passing your first prop firm challenge is only the start of your trading career growth. You need smart capital allocation to handle risk well while growing your account little by little.

Account scaling is key—you want bigger profits without risking too much at once. Balancing solid money moves with patient growth brings financial stability over time.

Think beyond just passing the challenge now. Planning long-term helps keep your spot in funded programs and build wealth steadily through wise choices.

Manage risk by dividing capital wisely

Grow accounts gradually based on rules

Aim for steady profits over quick wins

Plan for steady financial stability over time

Fast-Tracking Your Funding with The Concept Trading

Passing a prop firm challenge can feel hard. But The Concept Trading makes it easier with its funded trader program. Proprietary trading firms want you to follow strict rules before giving access to funded accounts.

Our funding process helps you pass the prop firm challenge faster. This means you get capital and real market chances sooner.

We focus on clear steps and simple rules. The Concept Trading cuts out the usual obstacles in funded trading programs. That lets you focus on what matters: steady performance and smart risk management.

Overcoming Hesitation and Stress

Trading psychology matters a lot when passing any prop firm challenge. You need emotional control techniques to handle fear and greed. These feelings can mess up your decisions during live trades. Building mental resilience keeps you steady under pressure.

Try these ways to improve psychological resilience:

Do breathing exercises or mindfulness before trading.

Notice when impatience or frustration hits you.

Write down your feelings after trades in a journal.

These help you keep calm when markets get wild.

Building Confidence

Confidence comes from practice and the right mindset. Using trading discipline techniques keeps your approach steady. This stops you from making quick, bad choices.

To build confidence:

Follow your trade plan without changing it on the fly.

Look back at past trades and learn from them.

Slowly increase your position sizes as you feel more sure.

Regular practice makes confident choices easier over time.

Addressing Fear of Failure

Fear of failure can cause emotional decision-making that hurts profits. Managing risk well cuts down this fear by keeping losses small.

Focus on these tips:

Use stop-loss orders based on clear levels, not feelings.

Don’t try to get back losses with revenge trades; stick to your plan.

Accept small losses as part of learning, not as failures.

Controlling emotions linked to risk helps keep you grounded during the challenge.

Setting Realistic Goals

Setting clear profit targets and account growth goals helps reduce pressure during challenges. Unrealistic goals can make you stress and choose poorly.

The Concept Trading: Fast‑Track to Getting Funded

The Concept Trading’s challenge uses simple rules that are fair and easy to understand. It asks for steady profits while keeping drawdowns low. This helps you stay successful after passing the challenge too.

The payout system pays winners quickly—usually within 48 hours—so you don’t wait long for rewards during your funded trader journey.

Program Overview

The program gives traders:

A smooth application and funding process

Fast payouts in two days or less

Clear rules with real targets

Support any time, day or night

This setup lets traders focus without extra hassle or delays.

Eligibility Criteria

To join, traders must:

Open a special challenge account

Follow strict max drawdown limits based on account size

These rules protect both your money and the firm's funds.

Support and Resources

Success needs more than just chances—it needs help too:

We provide:

Mentoring tailored for each trader’s needs

Courses covering tech analysis and risk control

A community where traders share tips and feedback

Mentorship speeds skill growth by offering advice all along the way.

Free Trial Opportunities with The Concept Trading

youtube

Trying before committing is key when picking a funded trader program.

Benefits of a Free Trial

A demo challenge copies real-market conditions but uses fake money—letting new traders get used to platform tools and see what challenges come up during evaluations.

How To Get Started

Signing up is fast; register online then get instant access so you can start the trial right away.

Trial Specifics

Simulated accounts act like live risks but remove money danger so users learn at their own speed without worry.

FAQs

How Does the Payout Schedule Work in Funded Trading Programs?

Most proprietary trading firms offer biweekly payouts or profit splits. For instance, Concept Trading is known for its quick profit distributions, often processing payments within 48 hours.

What Role Does Trading Psychology Play in Passing a Prop Firm Challenge?

Trading psychology is crucial for managing emotions such as fear and greed. Techniques that enhance discipline and mental resilience can significantly improve a trader's performance, especially under pressure.

Can Mentorship in Trading Improve Success Chances?

Absolutely. Mentorship provides valuable guidance, constructive feedback, and proven trading strategies. It helps traders avoid common pitfalls and fosters a sense of accountability.

How Do Trading Fatigue and Emotional Decision-Making Affect Traders?

Trading fatigue can diminish focus, leading to suboptimal decision-making. Effectively managing trading schedules and stress levels can help reduce errors and enhance overall consistency.

What Is the Importance of a Trading Business Plan?

A well-structured trading business plan details specific strategies, risk management practices, and clear goals. It helps traders maintain discipline and ensures alignment with the requirements of their challenges.

How Can AI-Powered Analytics Assist Traders?

AI tools can analyze market sentiment, generate trading signals, and identify patterns. These capabilities enable traders to make data-driven adjustments, improving trade execution and outcomes.

Why Is Understanding Simulated Trading Risks Vital Before Live Accounts?

Simulated trading accounts replicate real market conditions without financial risk, allowing traders to test strategies and build confidence before transitioning to funded trading.

Additional Insights for Prop Firm Challenge Success

Trading Accountability: Use trade tracking apps or journals to monitor progress and stay focused on goals.

Trade Monitoring Tools: Employ software to track open trades and alert for risk threshold breaches.

Trading Flexibility: Adapt strategies based on economic events impact, central bank decisions, or geopolitical risk.

Profit Sharing & Scaling Plan Criteria: Understand how profit splits work and follow scaling rules to grow funded accounts.

Tax Planning for Traders: Prepare for tax obligations early by tracking earnings from funded trading activities.

Trading Automation & Algorithmic Trading Assistance: Use automation to reduce manual errors and maintain consistency.

Trading Schedule Optimization: Balance active hours to avoid fatigue while maximizing market opportunities.

Trader Community Support: Join mastermind groups or find a trading buddy for motivation and feedback.

Losses Analysis & Trading Setbacks: Review losses objectively to identify mistakes and refine strategies.

Evaluation Phase & Proving Phase: Stay consistent during these critical stages by following trade management rules.

Market Navigation Using Data-Driven Adjustments: Use AI-powered analytics to adapt quickly to market changes.

Capital Protection & Allocation: Manage position sizes carefully to preserve capital through volatile periods.

Clear Entry and Exit Points with Statistical Edge: Define precise trade triggers supported by backtested results.

Consistent Use of Risk Threshold Alerts: Set alerts for drawdown limits to avoid automatic disqualification.

Trading Fee Investment Awareness: Factor in fees when planning profit targets to ensure net gains.

Live Trading Conditions vs Demo Challenge Awareness: Recognize differences to prepare mentally for funded account challenges.

Trader Onboarding & Account Verification Process Clarity: Complete all steps accurately to avoid delays in funding access.

For more post about prop firm trading tips click here.

#prop trading firms#prop trading tips#forextrading#the concept trading#proprietary trading#fx trading#prop trading challenge#Youtube

1 note

·

View note

Text

Is Prop Firm Trading Legit? How to Spot Scams and Choose Wisely

Prop firm trading is catching attention fast, giving traders the chance to grow without risking their own capital. With the right partner, it can open doors to serious profit and long-term success in today’s fast-moving markets.

But behind the buzz, not every opportunity is what it seems. Some firms play fair, while others hide shady practices behind slick websites. This guide breaks it all down so you can trade smart—and avoid the traps.

Understanding Prop Trading: A Trader's Guide to Funded Accounts

How Prop Firms Operate

Prop trading means a firm trades using its own money. Traders get funded accounts so they don’t risk their own cash. Here’s what’s important:

Capital Allocation: The firm gives money to traders based on how good they are.

Remote Trading Operations: Traders can work from anywhere, not just the office.

Knowing this helps new traders get what prop firms are about.

Profit-Sharing Models and Trader Roles

Profit-sharing tells how traders and firms split earnings. Common ways include:

Profit Split: Traders keep a part of what they earn trading.

Commission Structure: Some firms pay traders per trade done.

These models push traders to do well and make both sides win.

Accessing Capital and Trading with Leverage

Funded accounts let traders use lots of money without risking their own. Key points:

Trading Leverage: Traders control bigger deals than their personal cash allows.

Sustainable Funding for Traders: Firms help by giving training and tools so traders handle risks better.

This setup helps people grow in trading without big personal losses.

Regulatory Landscape and Compliance Considerations

Following rules is key in prop trading. Licensed firms obey laws that protect investors and markets. Points to watch:

Regulatory Oversight: Authorities check firms to keep them legal.

Licensed Prop Firms: These groups stay clear about how they work, building trust.

Knowing this avoids trouble with shady or unregulated firms.

The Allure and Risks of Prop Firm Trading: Day Trading and Beyond

Potential Rewards and Realistic Expectations

Prop firm trading can bring big profits if you trade smartly with their money. But you must keep goals real because markets change a lot.

Risks Involved in Prop Trading

Prop trading has risks like:

Market Volatility: Prices can jump suddenly causing losses if you’re not careful.

Drawdown Limits: Many firms set loss limits you can’t cross during trading days.

Fraudulent Activities: Some firms trick people with fake promises or hiding info—watch out!

Knowing these risks helps you choose wisely.

Day Trading Specifics and the $25,000 Limit

In the U.S., day traders must keep $25,000 or more if they buy and sell stocks a lot in one day (this is from FINRA rules). This rule stops too much risky trading by small investors.

Understanding these rules plus the risks in prop setups — like those from trusted companies such as The Concept Trading — makes it easier to avoid mistakes while trying to succeed!

Spotting Scam Prop Trading Firms: Red Flags and Warning Signs

When you look at prop firm trading offers, watch out for red flags. These can save you from trading scams. For example, some firms hide fees. They don’t tell you all costs right away. Real companies show all fees clearly. No surprises.

If a firm promises guaranteed profits or risk-free trades, be careful. Markets change all the time, so no one can promise steady wins.

Sometimes, firms won’t explain their rules well. They keep things secret about profit sharing or withdrawals. That’s evasive behavior. Good firms are open about how things work and follow rules set by regulators.

Also, pay attention to how they talk to you. If they rush you to sign up or dodge your questions, something is off. Fake claims about licenses or credentials can mean fraudulent activities.

Stay sharp with these signs to dodge tricky schemes in prop trading.

Common Fraudulent Schemes by Prop Scammers: Protecting Yourself from Exploitation

Prop scammers use tricky moves to fool traders. One usual scam is charging big fees just to take part in tests but never giving any real funding no matter how well you do.

They may also exaggerate how many traders succeed or hide important details in tiny print. Pressure tactics make you pay fast without thinking it over.

To avoid scams in trading, do your homework first:

Check if the company is registered and licensed.

Look at reviews from different sources.

Ask for clear details on all terms.

Stay away from firms that want big payments without any trial period.

Save proof like emails and contracts when dealing with a prop firm. This helps if you need to fight back against fraud.

Prop Trading Scams 2025: Current Trends and Emerging Threats

Trading scams keep changing in 2025. Traders must keep watching for new tricks. Scammers now build slick websites that look like real firms to steal info through phishing.

Spotting scams means checking regulatory compliance on official sites instead of trusting claims alone.

New threats include fake reviews using AI images and fake performance charts online.

Keep up with trusted news sources about the market to stay ahead of scams in trading. Knowing what’s new helps catch lies early and keeps your money safer.

If you're wondering Is Prop Firm Trading Legit? How to Spot Scams and Choose Wisely, keeping these points in mind will help you make safer choices when dealing with proprietary trading offers.

Identifying Legitimate Prop Trading Firms: Due Diligence and Verification

When you think about prop firm trading, making sure the firm is legit matters a lot. A legitimate prop firm follows the rules of compliance in prop trading and sticks to financial regulations set by trusted bodies.

Check if the firm is licensed and has a financial authority registration. This shows it works under regulatory oversight to protect investors.

Also, look up if the firm has any financial regulator complaint history. Honest firms don’t hide this info. They share their compliance status openly so traders can trust them more. This helps avoid unlicensed prop firms that might cause big risks.

Do your homework by reviewing the firm's rules on profit sharing, fees, risk limits, and how withdrawals work. When these details are clear, it usually means the company cares about long-term trust instead of quick profits.

Here’s what to check:

Licensed prop firms with proper registration

No major financial regulator complaints

Clear terms on fees and profit splits

Transparent risk management rules

Easy-to-understand withdrawal policies

Safeguard Against Prop Trading Scams: Strategies for Risk Mitigation

Trading scams happen all the time. To avoid them, scam prevention in trading needs real care. First, do thorough research before joining any prop trading program. Make sure you check official registries and read independent trader reviews.

Keep an eye on your account activities and messages all the time. This helps spot anything strange early. Use good risk management in prop trading—don’t risk money you can't lose during trial or funded accounts.

Pick reliable firms that offer clear help lines and teach traders how to trade well—not exploit them. Watch out for offers that promise crazy returns or want big fees upfront without proper papers.

Key points:

Do deep research before signing up

Verify company info through official sources

Monitor accounts and communication regularly

Use smart risk management strategies

Avoid unrealistic promises or large upfront fees

Verifying the Legitimacy of Prop Trading Firms: Review Analysis and Transparency

Trader reviews give clues about how trusted a firm is—but watch out for fake or misleading info. Trusted firms show transparency by sharing detailed reviews with real results from actual users.

Be careful if a firm gives evasive answers or can’t prove their performance numbers. That’s often a sign of deceptive behavior or fraudulent activities like fake trading software made to trick people.

Collect evidence by checking different places: forums, social media, regulatory lists, and review sites focused on traders’ experiences. A strong online presence plus open talk means a firm acts responsibly. Silence or dodging questions usually means trouble ahead.

Steps to verify:

Look at real trader reviews with proof

Watch for evasive or unclear answers

Check multiple sources for info consistency

Avoid firms with fake software claims

Prefer firms with active online presence and open communication

These checks help you pick clear, honest partners who match your goals while avoiding shady schemes common in some parts of prop firm trading.

How Much Can You Make with Prop Firm Trading? Realistic Expectations and Profit Strategies

Prop firm trading lets traders reach substantial profits by sharing what they earn. You don’t have to risk much of your own money, which sounds good, right? But, you gotta keep your expectations real if you want to stick with it long term.

Most firms use a profit split system. That means you get to keep about 70% to 80% of the money you make. So, making consistent profits is really important.

Your financial rewards depend on how well you trade and if you follow the firm’s rules for keeping funding steady. Putting time into learning and using smart moves helps reduce the risks that come with high-risk markets.

Some traders make big returns each month, but others might see their profits go up and down because markets change a lot or because of drawdown limits.

Here’s how to make the most money:

Aim for steady growth instead of quick wins.

Stick to the firm’s trading rules.

Use correct position sizes and stop-loss orders.

Don’t trade too much when markets get wild.

By balancing your drive with caution, you can earn regular income from prop firm trading without losing too much.

Volume Spread Analysis (VSA) and Market Strength/Weakness: Technical Analysis for Prop Traders

Volume Spread Analysis, or VSA, helps prop traders read the market better by looking at price action and volume together. This tool shows whether the market is strong or weak. It makes your decisions clearer when market conditions change.

Here are some basics:

VSA spots buying or selling pressure behind price moves.

When volume is high but price moves are small, it means supply or demand is being absorbed.

Rallies on low volume usually show weak market strength and might reverse soon.

Using VSA in your trading plan helps you spot patterns in market volatility. Knowing when the market is really strong or just temporarily weak helps you pick better times to enter or exit trades.

Risk management stays important too. Even if a setup looks good, always set stop levels that fit your account limits. Using VSA with other tools gives prop traders more confidence in tricky markets while protecting their money.

Day Trading Strategies with $25,000 Accounts: Optimizing Your Trading Approach

Day trading with $25,000 accounts means following strict rules about how much you can lose each day and total drawdowns. Most prop firms watch these limits closely. Success comes from fine-tuning strategies that respect these rules but still help improve how well you trade.

Try these tips:

Don’t go over daily loss limits; breaking them could end your chance right away.

Use tight stop-losses made for quick price swings during the day.

Trade only liquid assets that move predictably during busy hours.

Keep an eye on performance numbers like max drawdown percentage. This helps you stay within the firm's rules and find ways to get better. Good money management combined with solid entry rules keeps your trading steady under these tight day-trading restrictions.

If you work within these rules, your chances grow for slowly moving up to bigger funded accounts without risking all your capital or breaking evaluation rules.

Prop Firms Blacklist 2025: A Resource for Avoiding Known Scams

Prop firm fraud still causes trouble for many traders. Detecting scams helps protect your money and info from deceptive companies. The 2025 prop firms blacklist lists firms caught in fraudulent or suspicious acts.

Look out for signs like unclear profit-sharing, hidden fees, unrealistic promises, and bad communication. Preventing scams starts with research. Check trader reviews, licenses, and how open the company is before you send money.

Blacklists come from user complaints, regulator alerts, and outside checks. Using them helps you spot known scam operators fast. Staying aware keeps you from risky firms that might harm your cash or rep.

Trustable Prop Firms: Finding Reputable Partners

Picking a trusted prop firm matters for steady success. Legitimate firms keep things clear, fair, and honest. They offer solid customer service you can count on.

Good firms prove they are reliable through real trader reviews and clear records. They explain how tests work, how funding happens, risk rules, and how to withdraw money.

When looking for legit prop trading partners:

Check if they register with finance authorities

Read reviews from real traders

Test their customer support response

Make sure they protect your personal info

Trusted firms often offer learning tools like webinars or mentors to help you grow as a trader. That shows they care about more than just handing out cash.

Focus on these points instead of flashy ads. This way, you find a firm that matches your goals and lowers risks tied to less honest companies.

Importance of Thorough Research and Due Diligence

Before joining, do thorough research on the firm’s history and how it operates. Keep an eye on any updates or changes in their rules.

Verify legitimacy by checking if they’re registered with financial regulators or watchdogs. Look into trader reviews and complaints too — they can tell you a lot about the firm’s real side.

Strategies for Safe and Profitable Prop Trading

Good risk management helps you avoid big losses and keep making profits. Pick firms that offer steady funding, not just quick wins that might disappear fast.

Also, find those that pay out quickly — waiting too long can hurt your cash flow. Quick payouts under 48 hours are best for smooth trading.

By doing your homework and choosing carefully, you can build a safe and profitable path in prop trading over time.

FAQs

What Are Key Trading Policies to Check Before Joining a Prop Firm?

Look for clear rules on profit targets, risk parameters, withdrawal process, and evaluation challenge. Transparent policies protect your interests.

How Does Trader Support Impact Trading Success?

Prompt support and educational resources help traders understand rules and manage risks. Good support improves performance.

Why Is the Trading Platform Security Important in Prop Trading?

Secure platforms protect your account from phishing attacks and money laundering risks. They ensure safe trade execution.

What Role Do Demo Accounts Play in Funded Prop Trading Accounts?

Demo accounts let traders practice strategies without risk. They help verify trading skills before handling real capital.

How Can Trade Copier Tools Like MT4 Copier Benefit Prop Traders?

These tools allow quick strategy replication across accounts. They improve trading diversification and efficiency.

What Should You Know About Contract Trader Terms?

Contracts detail profit split, fees, risk limits, and dispute resolution. Reading these avoids surprises later.

How Do You Verify the Legitimacy of a Prop Trading Firm?

Check financial authority registration, client reviews, regulatory compliance, and absence of financial regulator complaints.

What Are Common Signs of Suspicious or Fraudulent Prop Firms?

Watch for evasive communication, hidden deposit fees or training fees, fake trading software claims, and unrealistic high returns promises.

How Important Is Investment Protection in Prop Firm Trading?

Investment protection ensures your funds and profits are secure under market regulation and ethical trading standards.

Essential Tips to Choose Prop Trading Firms Wisely

Verify the firm’s registration with financial regulatory bodies like SEC or FCA.

Review customer feedback and detailed reviews from multiple sources.

Confirm the presence of trader funding programs with clear profit withdrawal issues resolved promptly.

Check for transparent contract terms covering profit splits and risk management in trading.

Avoid firms on blacklisted companies lists or with known prop firm fraud cases.

Ensure the firm provides reliable trader support services and educational resources.

Prefer firms with flexible trading rules that allow funding scalability as skills grow.

Use due diligence to collect evidence if suspicious behavior arises for dispute resolution.

Test the firm's trading platform for security features before funding your account.

Look for transparent evaluation challenges that reflect real market conditions fairly.

Quick Guide to Protect Yourself from Prop Trading Scams

Conduct thorough research on the company’s reputation before signing contracts.

Stay informed about scam warning signs like pressure tactics or misleading offers.

Use account verification steps carefully to prevent phishing attacks or fake software use.

Keep records of all communications to support evidence collection if needed.

Avoid large upfront fees without trial periods or clear contract terms.

Factors Affecting Trading Performance Criteria

Adhere strictly to risk parameters set by your prop firm to avoid drawdowns.

Develop a sound trading strategy that fits profit targets and day trading limits like the $25,000 rule.

Use trustworthy indicators such as volume spread analysis combined with market regulation insights.

Manage money carefully; balance position size with stop-loss orders for investment safety.

For more post about prop firm trading tips click here.

0 notes

Text

Is Prop Firm Trading the Key to Financial Independence?

In the quest for financial independence, prop firm trading emerges as a compelling option for aspiring traders. By leveraging a firm's capital, traders can navigate the markets without risking their personal funds, opening doors to significant earning potential.

This article explores the fundamentals of prop firm trading, its benefits, and essential skills needed for success, providing a roadmap for those looking to thrive in this dynamic trading environment.

What is Prop Firm Trading?

Prop firm trading, or proprietary trading, lets traders use a prop firm's money instead of their own. This means they can trade different financial instruments, like forex and stocks, while using the firm's funds.

Funded trading accounts are helpful for those who might not have enough personal capital to invest or who want to avoid retail trading's financial risks.

Traders can benefit from not having to use their savings for trades. Instead, they get access to resources the firm provides, such as advanced tools and valuable market insights.

Understanding the Prop Firm Trading Model

The main idea behind prop firm trading is its profit-sharing model. Traders manage significant amounts of capital for the firm. When they make profits from trades, both they and the firm share these gains based on a set agreement.

Here are some benefits of this setup:

Access to Capital: Traders focus on strategies without needing to worry about funding.

Funding for Traders: Many firms offer large amounts of capital that increase earning potential.

Financial Independence through Prop Firms: Skilled traders can achieve financial freedom faster by using their abilities without putting in personal money.

The Evolution of Prop Firms in the Forex Market

Prop firms have changed a lot in the forex market due to new trends and technology. Traditional forex brokers now offer services specifically for freelance traders seeking better spreads and competitive profit margins.

However, challenges still exist in prop trading:

Increased competition demands better performance from traders.

Strategies must adapt to strict risk management rules set by firms.

Staying profitable requires discipline and a commitment to continuous learning from both wins and losses.

The Benefits of Prop Firm Trading

Getting into prop firm trading has many perks for those wanting better financial security:

Financial Freedom: Using company funds allows skilled traders to create wealth strategies without risking their own money.

Wealth Creation Strategies: There are opportunities across various asset classes that increase exposure beyond typical retail options.

Reduced Risk in Trading: Leveraged capital helps lessen emotional stress during market downturns, which often affects individual investors alone.

Access to Substantial Trading Capital

A key advantage of joining respected prop firms is accessing significant capital for trading initiatives. This support helps talented individuals thrive in today's fast-changing economies!

With robust structures and mentorship programs, traders gain knowledge necessary for achieving sustainable earnings month after month.

Reduced Risk and Potential for Higher Profits

Using strong risk management techniques alongside disciplined approaches leads to higher profit potential over time. Traders can follow proven methods that help avoid common pitfalls faced by those who trade on their own.

When a trader sticks with these practices, it becomes easier to maintain consistent profits in the volatile forex markets.

Professional Guidance and Support

Prop firms often provide mentorship programs that help traders learn from mistakes and develop emotional control in trading. This support fosters an environment where traders can build relationships and collaborate effectively with peers.

By creating networks among aspiring traders, prop firms empower individuals facing challenges together while sharing valuable insights along the way.

Key Skills for Successful Prop Firm Trading

Developing Disciplined Trading Strategies

A disciplined trading strategy is super important for anyone looking to succeed in prop firm trading.

Traders need to build structured trading plans that match their financial goals and how much risk they can handle. This means checking market trends through detailed financial market analysis to find good chances to trade.

Using proven trading methods like trend-following or mean reversion can help keep performance steady.

To stick to a disciplined approach, traders should set clear entry and exit points. These should be based on facts, not feelings. Consistency is very important; following the rules can cut down on snap decisions that lead to losses.

Traders should regularly look back at their plans and make updates to keep up with the changing markets.

Mastering Risk Management Techniques

Good risk management techniques are key for keeping your capital safe in prop firm trading. Knowing how to lower financial risks lets traders protect what they've got while still aiming for profits.

Setting up trade risk controls like stop-loss orders and sizing positions properly helps manage risk.

Emotional control is big when it comes to managing risks effectively. Traders should find ways to cope with stress during wild market moments, so emotions don't mess up their trades.

By understanding personal limits and sticking to them, traders can do better overall and cut down on the chances of big losses.

Leveraging Analytical and Decision-Making Skills

Having strong analytical skills is vital for moving through tricky financial markets. Traders should use different trade analysis tools that show insights into price changes, volume shifts, and other key metrics that affect asset values.

For high-frequency trading opportunities, being quick in decision-making is essential and must be supported by solid analysis.

It's also important to understand volatility; using volatility trading strategies lets traders take advantage of fast price swings effectively.

Combining analytical skills with good decision-making boosts a trader's ability to grab profitable trades while keeping risks low when markets act unpredictably.

By honing these skills—creating disciplined strategies, applying solid risk management techniques, and sharpening analytical skills—traders at The Concept Trading can set themselves up for success in the lively world of prop firm trading.

Choosing the Right Prop Firm for You

Evaluating Profit-Sharing Structures

When picking a prop firm, know their profit-sharing model. Each firm has different profit splits. These can really change how much you make. You want trader-friendly conditions where you keep more of your earnings. Some firms offer up to 70% or more to traders.

Others may take a bigger cut. Think about how these funding models match your trading style and goals.

Check if the firm gives bonuses for reaching performance milestones or being consistently profitable. A clear and open structure will help you see what you might earn.

Assessing Firm Reputation and Track Record

A firm's reputation matters a lot when choosing the right prop firm. Do some research on their history of helping traders in different market situations. Look at reviews and stories from traders who have worked with them.

Find out about their success in helping traders achieve their goals using strong trader support tools, like real-time data and analytics. They should also have professional evaluations to pick skilled traders ready for independent funding.

Considering Funding Processes and Requirements

Knowing how capital allocation works is key when looking at prop firms. Different firms have various rules for getting funded accounts, which can impact how quickly you access your funds.

Look at each firm's sign-up process. Some might need lots of paperwork or proof of past success before giving you funding. Make sure they explain the financial risks tied to different strategies so you can build a solid trading plan that suits your needs.

Understanding Trading Platforms Offered by Prop Firms

The trading platforms offered by a prop firm are very important for your trading experience. Many good firms use popular platforms like MetaTrader 4/5 or cTrader because they are easy to use and packed with features.

Check what advanced trading technologies they include, like charting tools or algorithmic trading capabilities, as these tools directly affect how well you can trade in changing market conditions.

Investigating Trader Support Services

Support services are crucial for any trader looking for guidance in the markets. Find out if the firm offers mentorship programs that help with emotional control in trading, especially during tough times.

Inquire about their trade risk controls and the educational resources they offer for traders to learn from mistakes, such as webinars, workshops, or coaching sessions aimed at developing analytical skills for making smart decisions in fast-paced markets.

Analyzing Additional Resources Provided by the Firm

Aside from basic training materials, check if ongoing analytical resources are available to support new traders entering finance careers with practical knowledge instead of just theory!

See if they offer trade analysis tools that track performance over time while spotting market trends affecting many assets at once—this kind of insight allows for better decisions based on data instead of just guesswork!

The Role of The Concept Trading in Prop Firm Success

youtube

Providing Comprehensive Trading Education

At The Concept Trading, we know that having good trading education is key for prop trading success. Our programs cover the basics, like financial market analysis and trading strategies. With our step-by-step approach, traders learn how to read market trends and make smart choices.

Our trader mentorship programs give extra help through personal guidance from skilled professionals. This support helps participants develop a disciplined trading approach, which is important for staying consistent even when the market is unpredictable.

We also share valuable trading psychology tips that teach traders how to keep their emotions in check during stressful times.

By focusing on these areas, we give future traders the knowledge they need to handle the ups and downs of financial markets with confidence.

Offering Personalized Mentorship and Coaching

Personalized mentorship is central to what we do at The Concept Trading. Our professional coaching for traders is all about helping them gain emotional control. Knowing how to manage feelings is super important for anyone who wants to succeed in trading.

We also provide unique risk management strategies. These strategies are made to help protect your money while aiming for better returns.

By teaming up with mentors who have real-world experience, traders can set practical goals and make plans that lead them to their financial dreams.

This one-on-one support not only sharpens technical skills but also builds a mindset focused on long-term success in the prop trading world.

Facilitating Access to Top-Tier Prop Firms

Getting access to capital can be tough for independent traders, but The Concept Trading makes it easier. We connect talented individuals with top-tier prop firms that are ready to invest in them.

We explain different funding models available for those looking for independent trader funding without risking their own money.