#scalping

Explore tagged Tumblr posts

Text

Reblog to violently kill a ticket scalper

18 notes

·

View notes

Text

I am NOT enjoying the pokemon tcg hobby anymore, scalpers still have ALL the power, even w the 2 product limit they just hire people to get more like they're in a wholeass gang... i legit havent had hands on product since 151 which cameout like last year? These fuckers ruin it for everyone and nobody gives enough of a shit to do anything about it except cause a scene for some randos tiktok fight video in a costco. Im srsly just about to quit. Fuck this bs.

#pokemon tcg#pokemon cards#the state of things#scalping#fuck scalpers#destined rivals#pokemon#trading cards#trading card game

4 notes

·

View notes

Text

2 notes

·

View notes

Text

[ID: screenshot from ebay of the sold out pink opaque cap from i saw the tv glow being sold for 103.95 usd with 66.28 usd shipping from beyondleftovers from the united states, the cap is grey and features a pink ghost logo with glasses, its in a wrinkly bag END ID]

This is Transphobic

8 notes

·

View notes

Text

I used to be super into Pokemon but I checked out years ago when the fanbase refused to grow up and now I'm seeing all these pathetic grown men doing this scalping thing. vids showing lines upon lines of these saddos buying up all the cards and toys on the store to flip for five or ten bucks on ebay and kids, the actual target marker, can't get anything.

These guys are pathetic

2 notes

·

View notes

Text

Ok. Thought this was common knowledge. It is not. #Scalping was a stereotype pushed onto #Nativeamericans, but, it was white people who did it for profit. #themoreyouknow

5 notes

·

View notes

Video

youtube

Let's talk about doll scalping! FT Harley Limestone Shadow High & Monst...

#youtube#Dolls#Fashion Dolls#Shadow High#Rainbow High#Monster High#Harley#Harley Limestone#Skullector#Scalping#Elvira#elvira mistress of the dark#Elvira doll#Chuckie#Tiffany#Chuckie and Tiffany#Child's Play

13 notes

·

View notes

Text

im crying

She won't let me scalp her sibling like 😒

Cmon dude it's not that hard

3 notes

·

View notes

Note

Thoughts on Majora’s Mask it’s Probaly the most different game out of the OOT style Zelda games it’s also a game that Probaly should’ve been a disaster with the time limit they had but most of what makes it engaging for me was created because it was rushed

Majora's Mask is a game I wanted to experience but never have. Fell into that nefarious category of "When I have time" and that time never seems to manifest. I put like an hour into the N64 version once, like, more than ten years ago. I'm not sure I ever got through the Deku Scrub tutorial.

Nowadays I'd want to play it on 3DS, but that thing has entered The Phantom Zone where I'd want to play it on a New 3DS (since it takes advantage of that), which I guess specifically means a New 3DS XL, which are extremely expensive because scalpers do the thing that they do with newly retired things and are charging $300+ for something that should be, realistically, $75. Thanks, Rick & Morty.

I realize I can probably emulate it nowadays but 3DS emulation is kind of all over the place in my opinion. There's lots of little gaps in what Citra supports, to the point where first party titles like Star Fox 64 3D have massive performance problems. I haven't checked in a while but I remember New Game+ in Super Mario 3D Land being fatally busted, too.

So I do not trust 3DS emulation. It's messed up that the Wii U version of Smash Bros. 4 emulates better than the 3DS version, and it kind of never got any better, either.

And, like, you gotta mess with ROM encryption and all that other stuff, too. Just a total mess.

So I have no thoughts about Majora's Mask. I have actually avoided knowing about what happens in around 90% of that game so far, so all I really know is that "it's weird and dark" and "it's one of the rare few games Nintendo actually rushed out really quickly."

5 notes

·

View notes

Text

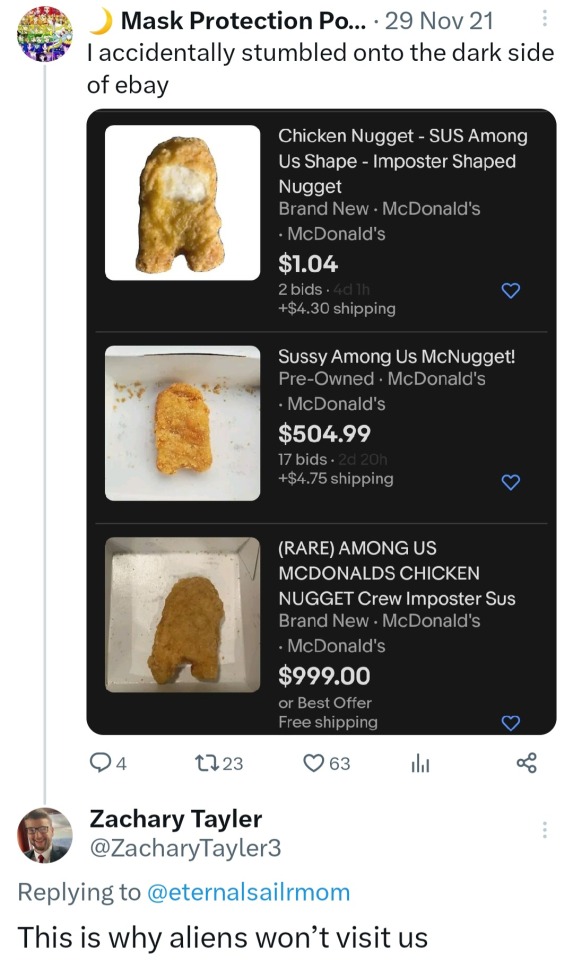

We could've had cosmic neighbors by now but no one wants to indulge our bullshit

#funny#lol#tweet#this is why aliens avoid us#ebay#ebayfinds#chicken nuggets#among us#amogus#sus#overpriced#scalpers#scalping#why are we like this#why

11 notes

·

View notes

Text

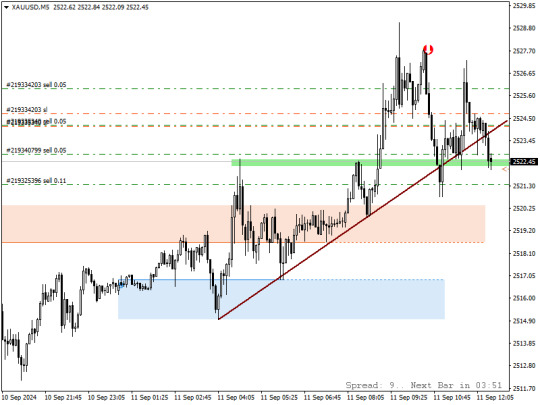

Cách đánh Scalping vàng hiệu quả

Scalping Vàng là chiến lược giao dịch vàng theo kiểu lướt sóng. Scalping là giao dịch trong thời gian ngắn, dựa vào biến động giá trong thời gian ngắn, bán với giá cao để có lợi nhuận. Khi bạn đầu tư vào chỉ số vàng trên các sàn giao dịch thì Scalping vàng là phương pháp giúp mang lại lợi nhuận tối ưu nhất. Tuy các lần giao dịch chỉ thu về ít lợi nhuận, nhưng khi tổng hợp lại các lần giao dịch, sẽ là một tổng lợi nhuận vô cùng lớn. Dù vậy, điều này chỉ đúng nếu mỗi lần đánh Scalping vàng đều đúng. Do vậy, người đánh scalping cần phải quan sát thị trường liên tục để tìm điểm vào lệnh đẹp. Ngoài ra, với mỗi lần giao dịch cũng cần trả một khoản phí giao dịch. Vậy nên, người đánh Scalping vàng cần có một kế hoạch cụ thể, đặt lệnh đúng thời điểm, và biết cách phân tích thị trường.

Xem chi tiết tại: https://karldarin.com/scalping-vang/

#scalping #gold #vang #scalpingvang #karldarin

2 notes

·

View notes

Text

Robert McGee, survived being scalped as a child by Sioux warriors in 1864. Photo taken 1890, original and colorized.

#antique photo#antique photography#portrait#robert mcgee#scalping#historical photos#way back when#in the past#a long time ago

3 notes

·

View notes

Text

A conditioner that keeps your hair smooth, shiny, and friss-free so you can have a good hair day everyday. Shop today!

#scalping#scalp#scalpcare#scalptreatment#scalper#scalptherapy#naturalhair#allhairtypes#conditioner#hairconfidence#hairlosshelp#hairreplacement#hairclinic#hairlossawareness#hairrestoration#hairrepair#hairstyles#hair#hairwigstore#sinkorhair

2 notes

·

View notes

Text

2 notes

·

View notes

Note

Juat curious if you have any thoughts on the Taylor Swift ticketmaster thing from months back and how it went down and also people calling out tickermaster's monopoly?

Would you believe I've never gone to a concert before? Never had the money, never had the access. I am very in the dark as to what Ticketmaster did, outside of the fact I've heard friends and others on the internet complain about Ticketmaster for years and how they only seem to be feeding the scalping market more than anything else. I can see their Consumer Affairs profile has a lot of unhappy people.

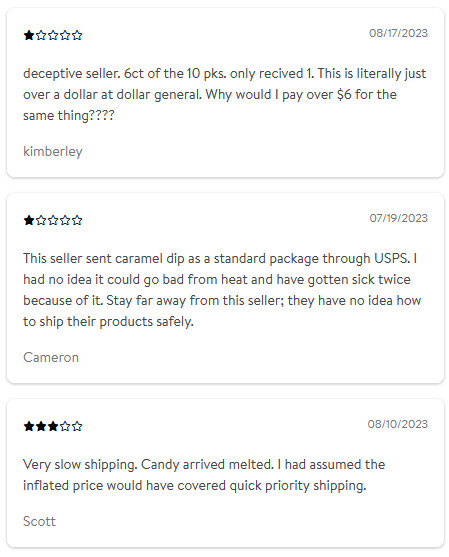

Given that the Ticketmaster app advertises "buy and sell your tickets" I'm assuming they went in the same direction as every other major online retailer and opened themselves up to letting users resell their items online? Leading to the proliferation of people buying up huge stocks of items and then flipping them for a higher price.

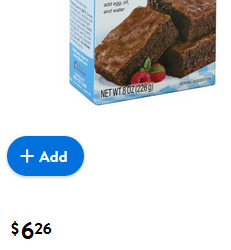

I hate that stuff. If you were to ask me, that's a top ten reason for the inflation we're currently experiencing. Covid got people to realize they could buy up stuff like hand sanitizer and toilet paper and resell it online, and now suddenly they do that with all kinds of stuff. I run into it all the time when grocery shopping, because I do a lot of my grocery shopping online.

Jiffy brownie mix was normally $0.98, but I go looking for it now and some reseller wants me to pay him over $6 for it.

You think Walmart or whoever cares? Of course not. They take the scalper's money (for the initial sale) and then get a cut of what the scalper sells it for (the resell). A successful scalper is a double dip for the retailer. They have a financial incentive to not only allow scalping, but maybe to even encourage it.

And what do you think happens when the manufacturer sees people paying $7 for ketchup? Well, golly, that's now lost revenue, isn't it? Supply and demand, mother effer. "If people are going to pay Johnny Assclown $7 for ketchup, they should be paying us $7 for ketchup."

Out of everyone in this equation, the resellers care the least. Everybody suffers except for those filling their pockets.

I dunno what happened with Taylor Swift but I'm willing to bet it's the same garbage that's making everyone's lives miserable in the rest of the world.

Taylor Swift is cute tho

4 notes

·

View notes