Don't wanna be here? Send us removal request.

Text

What’s Next for the Syrian Pound? Revaluation Hopes Spark After Sanctions Lifted

After years of economic isolation and crippling financial sanctions, Syria finds itself on the edge of a new era. The May 2025 announcement that U.S. sanctions have been lifted has sent waves of cautious optimism through the country and the region.��

For the first time in over a decade, the Syrian Pound (SYP) has shown signs of strength, appreciating rapidly in black-market trading. This has left citizens, investors, and policymakers wondering: Is this the beginning of a long-awaited revaluation of the Syrian Pound? Or is it just a temporary bounce fueled by hope?

Let’s unpack the developments, challenges, and economic shifts shaping the future of the SYP.

Lifting of Sanctions

The decision to lift U.S. sanctions on Syria in May 2025 marks a significant milestone in the country’s post-conflict recovery. For over a decade, these sanctions isolated Syria from the global economy, restricting access to financial networks, trade partners, and foreign investment. Sectors vital to economic stability—such as oil production, infrastructure development, and banking—were severely impacted, leading to economic stagnation and a collapsing currency.

With the sanctions lifted, Syria is now reconnected to key economic arteries. Commercial banking channels are gradually reopening, allowing smoother cross-border transactions. Regional players like the UAE, Iran, Turkey, and Russia are actively seeking to re-establish trade and diplomatic ties.

It may result in a sudden boost in confidence, evident in the 25–30% appreciation of the SYP on the informal market within days of the announcement.

However, the path to lasting recovery will require more than optimism—it will depend on Syria’s ability to harness this momentum through investment, policy reform, and strategic rebuilding. The lifting of sanctions is not an automatic fix, but it opens a window for Syria to rewrite its financial story.

Impact on Currency Reserves and Foreign Investment

For many years, sanctions reduced Syria’s access to foreign currency. The Central Bank could not use normal financial channels, so it depended on remittances, informal exchanges, and unregulated sources to cover basic imports and public spending. These methods helped keep the economy going, but were not stable or reliable in the long term.

Foreign investment also came to a stop. Even countries that supported Syria could not provide much help because of legal and financial restrictions. Big projects and outside funding were put on hold, leaving little room for economic growth or development.

With sanctions removed, the situation is starting to change. Syria can now begin to rebuild its foreign currency reserves through trade, tourism, and international banking. Investors from nearby countries may return, bringing new money and business opportunities. The Central Bank has a chance to stabilize the currency and manage the economy more effectively. This moment creates a chance for fresh capital to enter the country and for financial trust to slowly return.

Currency Reserves

Foreign currency reserves are the lifeblood of any stable national currency. These reserves allow governments to intervene in the currency markets, stabilize the exchange rate, and finance essential imports like fuel, wheat, and medicine. The influx of trade revenue, foreign direct investment (FDI), and remittances from Syrians abroad can help rebuild these reserves.

The Central Bank of Syria has already hinted at renewed talks with the World Bank and the International Monetary Fund (IMF). These institutions had distanced themselves due to Syria’s non-compliance and debt obligations. However, debt clearance and renewed diplomatic engagement are opening the door for technical assistance, emergency funds, and long-term stabilization programs. With multilateral financial support, Syria could implement monetary reforms that anchor the Pound and limit inflation.

Foreign Direct Investment

Foreign investment usually avoids countries with high risk and instability. To bring in serious investment, Syria needs to fix several problems. While nearby countries like the UAE, Iran, and Russia might start investing early, money from the West will take longer. Western companies will wait to see real changes in how the country is managed.

Transparency: Investors want to know the rules. They need clear information about taxes, business laws, and how problems will be handled if a dispute arises. If the system is confusing or unfair, investors will stay away.

Infrastructure: Years of war have damaged Syria’s roads, power lines, water systems, and buildings. These problems make it expensive and difficult for companies to operate. To attract investment, Syria must rebuild and improve basic infrastructure.

Banking Reform: Syria’s banking system needs to be updated. Right now, it does not meet international standards for safety, digital access, and money laundering prevention. To regain trust, Syria must clean up its financial system and make it easier for companies to move money legally and safely.

Will Exports Strengthen the Pound?

Before the war, Syria exported many goods. These included oil, gas, farm products like olives and citrus, clothing, and minerals like phosphates. But the conflict and years of sanctions badly damaged these industries. Factories shut down, and access to foreign markets was cut off.

Now, with sanctions lifted, Syria has a chance to restart trade. Strong exports could help strengthen the Syrian Pound (SYP) and support the economy.

Oil and Gas: Oil and gas used to be the most important part of Syria’s economy. Restarting production will need foreign help, especially for technology and investment. Russian and Iranian companies are already showing interest in this sector. If Syria can get oil flowing again, it could earn large amounts of money from exports. This would help improve the trade balance and could push the Syrian Pound to rise in value.

Agriculture and Industry: Syria has rich farmland that grows wheat, olives, cotton, and fruits. If trade routes reopen, these crops can be sold across the region again. Syria could become a reliable food supplier in the Middle East. Aleppo’s textile factories also have a chance to restart exports, especially if energy and transportation improve. In addition, Syria has valuable minerals, like phosphates. These could bring in more export money, but only if they are managed honestly and openly.

Tourism and Services: Before the war, Syria welcomed many visitors. People came for religious sites, history, and even medical care. Cities like Damascus and Palmyra were famous tourist spots. Tourism could return, but it will take time. Roads, hotels, and airports need repair. If rebuilt properly, tourism could bring in money, create jobs, and support local businesses.

Central Bank Strategy

The Central Bank of Syria (CBS) plays a critical role in the Pound’s future. During the crisis, the CBS lost credibility, frequently intervening in the currency market with artificial rates that few respected. The result was a dual system: an official rate and a widely used black-market rate.

To foster long-term confidence, the CBS must now modernize its monetary policy tools.

Controlled Float:

Letting the Syrian Pound (SYP) float completely on the open market could be too risky right now. Syria’s economy is still weak, and full market control might cause sudden price swings and instability.

A better option is a controlled float. In this system, the Central Bank sets a target range for the exchange rate but still allows market forces to influence it within that range. This gives the economy some flexibility while keeping things under control.

Key Policy Tools Needed

To make a controlled float work, Syria will need strong and smart financial policies. Here are the most important tools:

Inflation Targeting: Setting clear goals for inflation helps businesses and the public know what to expect with prices. It builds trust in the economy.

Liquidity Management: Banks need enough cash and credit to keep the economy moving. If banks can lend and people can borrow, confidence will grow.

Exchange Rate Unification: Right now, Syria has both an official exchange rate and a market rate. Bringing these two rates closer together—or making them the same—will show that the government is serious about reform and transparency.

Support from Global Experts: Following international best practices, especially with help from the IMF, could make the Central Bank of Syria more trustworthy. It would also help attract foreign investors and reassure trading partners.

Investor Speculation vs. Ground Reality

The recent rise in the Syrian Pound's value is not only about real improvements in the economy. A lot of it is based on emotions, expectations, and market reactions to the lifting of sanctions. This kind of reaction is common when good news hits after years of crisis.

The Risk of Speculative Bubbles: In economies like Syria’s, people often react quickly to hope. Some investors and traders—especially those abroad—may have quickly exchanged their U.S. dollars for Syrian Pounds, thinking prices would rise and they’d profit. Local markets may also react to rumors or overconfidence.

But if real progress in production, exports, and investment doesn’t follow, this rise won’t last. The Pound could fall again, making it even harder to build trust later.

Currency Hoarding and Parallel Markets: For years, people avoided banks and used the black market to protect their savings, often keeping U.S. dollars at home. That habit won’t disappear overnight.

To stop this, the government and Central Bank need to act clearly and strongly. People must believe their money is safe in the official system. That means stable rules, good communication, and stopping illegal currency trading.

Final Word

The lifting of sanctions has breathed new life into Syria’s battered economy, and the Syrian Pound is finally showing signs of hope. But let’s be real—this is just the start of a long road ahead. For this momentum to turn into something real and lasting, Syria has to rebuild its foreign currency reserves, attract steady foreign investment, and get those export industries back on their feet. Plus, the Central Bank needs to step up with serious reforms to restore trust, not just from international partners, but from the people themselves.

The Pound’s future won’t be shaped by hope alone. It will require hard policy choices, cooperation with international institutions, and a commitment to rebuilding on transparent and inclusive terms.

It could become a powerful symbol—not just of recovery, but of a new chapter in Syria’s story. The time to build that future is now. Source: IQDBUY

#Syrian Pound revaluation#Syrian Pound redenomination#SYP revaluation#SYP exchange rates#Syrian Lira exchange rates

0 notes

Text

Is the Syrian Pound (Lira) Going to Revaluate? Syrian Pound Price Prediction

After years of economic struggles and a falling currency, a big question is on people’s minds: Is the Syrian Pound finally making a comeback?

Some recent changes—like the easing of sanctions and small steps toward rebuilding—have given people a bit of hope. But let’s not get ahead of ourselves. A stronger currency isn’t just about a few good signs. It takes a lot more behind the scenes.

Today, we’ll look at what revaluation really means and whether Syria is in a position to make it happen anytime soon.

Understanding Currency Revaluation

For Syria, a true revaluation would mean the SYP strengthens against foreign currencies in a lasting way. This would reduce import costs, stabilize inflation, and boost national confidence. But achieving this requires more than sentiment—it demands real structural progress.

Before discussing Syria’s specific case, it's important to understand the key currency terms:

Devaluation refers to the deliberate lowering of a currency’s official exchange rate. Governments usually do this to make their exports cheaper and improve trade balances. Syria has experienced repeated devaluations since 2011.

Revaluation is the opposite—it means increasing the official value of the currency relative to others. This is usually done when a country has strong economic fundamentals such as a trade surplus, stable inflation, and high foreign reserves.

Redenomination is a cosmetic change to the currency’s face value—often by removing zeros—without changing its actual purchasing power. This is sometimes confused with revaluation but does not increase currency strength.

Key Conditions for Revaluation

Right now, Syria does not meet the main conditions for a currency revaluation. But some early steps seem to be happening.

These are the basic things needed:

Strong Trade Surplus: Revaluation is typically possible when a country exports more than it imports.

Stable Inflation: High inflation undermines purchasing power and discourages revaluation.

Healthy Reserves: Adequate foreign currency reserves give the central bank the confidence to defend a stronger currency.

Is the Central Bank Preparing the Ground?

There are growing indications that the Central Bank of Syria (CBS) is positioning itself for future currency reform. These efforts are still early and limited, but they hint at long-term intent. One change alone cannot fix the currency, but several steps together can show progress.

Exchange Rate Unification: For years, Syria has operated with multiple exchange rates—one official, one for remittances, and others on the black market. This has created distortions and mistrust. Efforts are now underway to bring these rates closer together, a move that signals readiness for a more transparent and credible monetary policy.

Inflation Control Measures: To stabilize the Pound, the CBS must tackle inflation. Reports suggest new controls on government spending and tighter liquidity policies are being considered. Subsidy reform and price monitoring are also playing a role.

Rebuilding Reserves: Syria is seeking ways to rebuild its foreign reserves. This includes increased cooperation with allies like Iran and Russia, oil-for-loan deals, and opening new trade channels. Rebuilding reserves is essential to maintaining any new exchange rate level.

Policy Coordination and External Advice: There are whispers that Syria may seek technical guidance from international consultants or institutions such as the IMF or regional financial bodies. Aligning its banking regulations with international standards could also attract capital and support a future revaluation.

Market Sentiment and Diaspora Influence

Public psychology and foreign remittances play a major role in currency dynamics, especially in post-crisis economies like Syria’s.

Role of the Syrian Diaspora: Millions of Syrians live abroad, and their remittances have been a lifeline for families and the broader economy. These funds, often sent in foreign currencies, help support the SYP by adding to the supply in official channels, especially if converted legally.

If the diaspora believes the SYP will rise in value, they may convert more foreign currency to SYP. This behavior can fuel short-term appreciation. However, this speculative demand must be backed by real economic improvements to last.

Local Speculation and Hoarding: Inside Syria, people are still wary of keeping money in banks or local currency. Years of hyperinflation and multiple exchange rates have damaged trust. Some may hoard dollars or euros as a hedge against uncertainty.

Rumors of revaluation or policy changes can lead to local speculation. If people expect the SYP to get stronger, they may rush to convert, creating a bubble. If expectations aren’t met, the result could be a sharp reversal.

Regional Market Behavior: Currency behavior in neighboring markets—Lebanon, Jordan, and the UAE—also affects Syria. Traders in these countries often serve Syrian clients, and their confidence (or lack of it) sends signals back into Syria. Recently, sentiment has improved slightly, but it remains fragile.

Political Stability and Currency Valuation

A country’s money cannot grow stronger if people do not trust the government. Economic changes alone are not enough. People need to believe in the whole system. Without big changes in how things are run, any rise in the Syrian Pound could be weak or short-lived.

Reconciliation and Peace Talks: Syria’s reconciliation process is ongoing. If talks lead to lasting peace and reduced conflict, it will boost investor confidence and economic activity, key factors for currency strength.

Diplomatic Normalization: Steps toward normalizing relations with Gulf countries, Turkey, and even some Western nations could unlock trade and financial support. These developments would reflect positively on the SYP’s future.

Anti-Corruption and Governance: Economic strength requires clear rules and fair systems. Syria has begun making moves against corruption and toward better public-sector management. But transparency, legal reforms, and stronger institutions are still needed.

Risks of Premature Revaluation

Raising the value of the Syrian Pound too soon or without fixing the economy first can be dangerous. Syria needs to take one step at a time. First, it should control inflation, then fix trade, and rebuild the banking system. Only after that should it think about changing the currency’s value.

Inflation Might Get Worse: If Syria raises the Pound’s value before fixing supply chains or helping local businesses, prices might go up. Imported goods could become cheaper, but local products may struggle to compete. This can hurt local producers and cause price shocks.

Trouble for Exports: When a currency becomes stronger, it makes a country’s goods more expensive for other countries. Syria is still trying to rebuild its farms and factories. A stronger Pound might slow down those efforts because exports would be harder to sell.

More Imports, Fewer Exports: If Syria raises the Pound’s value without growing its exports, people might start buying more foreign goods. This creates a trade gap, where Syria imports more than it sells. That can lead to long-term problems for the Pound.

Risk of a Bubble: If people think a revaluation is coming, they might rush to sell U.S. dollars and buy Syrian Pounds to make a quick profit. This can cause a short-term spike in value. But if the economy is not ready, the Pound could fall again suddenly. That would hurt everyone—businesses, families, and the government.

Lessons from Other Countries: Other countries have tried to raise their currencies’ value too fast and failed. Zimbabwe and Venezuela both saw their money crash again after trying. Even Iraq took years of support and strong oil sales to make the Dinar stable again. Syria needs to learn from these examples and move slowly and wisely.

Final Word

So, is the Syrian Pound headed for revaluation? It’s definitely possible, but it won’t happen overnight or just because people want it to. For the Pound to truly strengthen and stay strong, Syria needs more than hope — it needs real, lasting changes. That means smart planning, steady reforms, and a commitment to building stability over time.

Right now, the Syrian Pound is trading between 12,800 and 13,000 SYP per USD. This shows some cautious hope and a slightly better mood around the currency, but it’s not yet a clear sign that the Pound is gaining long-term strength.

The path won’t be easy, but with the right moves, the Pound could finally start to rise — and that would be a real sign of progress for the country. Source: IQDBUY

#Syrian Pound revaluation#Syrian Pound rate surge#Syrian Lira redenomination#Syrian Pound future prediction#Syrian Pound sanctions lifted

0 notes

Text

Syrian Pound (Syrian Lira) Highlights, Updates, Latest News — 2025 Overview

The story of the Syrian Pound (SYP) in 2025 is a mix of cautious hope and ongoing challenges. After years of conflict and economic struggles, the lifting of international sanctions earlier this year has given Syria a bit of breathing room. The currency is starting to show some signs of stability—and even small improvements—but the road ahead is still far from easy.

Right now, the value of the Syrian Pound continues to shift between the official rate and the black market rate. It’s being pulled in different directions by politics, government decisions, and regional developments. For businesses, investors, and everyday Syrians trying to make ends meet, understanding what’s driving the Pound is more important than ever.

Don’t worry—we’re here to break it all down for you. Let’s walk through what’s really going on with the Syrian Pound (Lira) in 2025.

Weekly Market Trends

The Syrian Pound has had a busy few weeks. The currency has moved slightly in a better direction, especially on the black market. Let’s look more deeply.

Exchange Rate Movements: In the first months of 2025, the Syrian Pound showed some signs of life on the parallel market. January marked a milestone as the SYP reached approximately 11,500 against the US dollar on the black market, its strongest level in over a year. This modest 1% yearly gain, while small, breaks a long pattern of steep depreciation that saw the Pound lose about 55% of its value over the past two years. Meanwhile, official exchange rates hover around 13,000 SYP/USD. The Syrian government and Central Bank continue efforts to close the gap between these official and unofficial rates through gradual unification policies, aiming to reduce distortions and speculation.

Key Catalysts for Movement: Several important developments have fueled this slow but hopeful strengthening of the Pound. Notably, new foreign investment agreements have injected confidence into the economy. The $800 million deal with DP World to develop the strategic port of Tartous stands out as a landmark project. This move not only enhances Syria’s trade capacity but signals growing international interest. Reconstruction discussions and efforts to normalize trade relations with Gulf countries also provide vital support to the currency. Such developments show foreign investors are cautiously returning, encouraged by improved diplomatic ties and economic reforms.

Domestic Economic Factors: A major factor behind the stabilization trend is the dramatic drop in inflation. Inflation rates fell from a staggering 119% in early 2024 to about 46.7% over the last year, partly thanks to better exchange rates and improved supply chains. This easing of inflation helps maintain the Pound’s purchasing power and reduces pressure on prices. However, regional fuel price fluctuations—especially in northern Syria—and ongoing commodity market volatility continue to affect currency demand and exchange rate swings. Local market disruptions and informal trade flows still make the currency’s short-term outlook unpredictable.

Market Volatility Remains: Despite these gains, volatility is still the norm in many parts of Syria. Street markets and border towns experience frequent price jumps driven by supply interruptions and shifting demand. This creates a challenging environment for traders and consumers who must constantly adjust to changing costs. It also keeps the parallel market very active, as people seek to protect their savings or take advantage of currency fluctuations.

Government Announcements Impacting Exchange Rates

The Syrian government has made several big decisions in 2025 that are now influencing the local currency. These moves are part of larger economic reforms meant to ease pressure on families and bring more stability to the Syrian Pound. Some of these changes have helped boost confidence, while others could increase inflation.

Changes to Subsidies and Inflation Impact: The government announced plans to slowly remove bread subsidies. This is a major shift, as bread is one of the most important foods in Syria. Removing these subsidies means bread prices will go up. This can lead to more inflation, making everyday life more expensive for most people.

Higher food prices usually weaken a currency, because people need more money to buy the same things. This change may hurt the Pound if prices rise too fast and wages don’t keep up.

Massive Salary Increases: To help with rising prices, the government gave public workers a 400% salary increase. This is a big jump and gives people more money to spend. The Central Bank says it has enough reserves to support this move, which is important for trust in the economy.

More money in people’s hands can help demand, but if there isn’t enough supply, it can also cause more inflation. If inflation goes up too much, the value of the Syrian Pound could fall again. It all depends on whether local markets can handle this new spending without pushing prices up.

Financial Policy Shifts: Some other changes are making it easier for people to use their money. The government has relaxed limits on cash withdrawals and lifted restrictions on money transfer companies. These steps improve access to money, especially for families who receive help from relatives living abroad.

By making it easier to receive foreign currency through legal channels, these changes may reduce the demand for black market trading. That could help stabilize exchange rates and bring the official and parallel market rates closer together.

Political Developments and Confidence Boost: Finally, political talks and improved relations with nearby Gulf countries are having a good effect. Peace efforts and diplomacy build trust. They show that Syria may become more stable, which makes foreign investors and businesses feel more comfortable.

The DP World deal to expand the port of Tartous is a good example. This project sends a strong message: Syria is open to rebuilding and reconnecting with the world. These developments create a sense of hope and can help support the Syrian Pound in the longer term.

Central Bank Moves in Q1–Q2 of 2025

Q1 and Q2 refer to the first and second quarters of the year. Q1 includes January to March, and Q2 covers April to June. Together, they represent the first half of 2025.

During this period, the Central Bank of Syria (CBS) made several key moves to help stabilize the Syrian Pound and strengthen the overall financial system. These actions focus on better currency control, restoring market confidence, and adapting to changing international dynamics.

Currency Stabilization Measures: The Central Bank of Syria (CBS) has taken an active role in stabilizing the Syrian Pound by regulating foreign currency sales through licensed banks and exchange offices. Priority is given to humanitarian and commercial transfers to avoid destabilizing capital flows. These steps help ensure foreign currency is available where it is needed most.

Exchange Rate Unification Efforts: A significant focus for the CBS is narrowing the gap between official and black market exchange rates. By reducing fragmentation and curbing speculation, the Central Bank aims to restore trust in the Pound. Though challenging, this gradual approach helps avoid shocks that sudden policy changes could cause.

New Partnerships and Currency Printing Plans: The CBS has been exploring new partnerships with foreign financial institutions to boost its capabilities. Additionally, plans to print new Syrian banknotes in the UAE and Germany mark a shift away from Russia, reflecting Syria’s improving international relations and easing sanctions. These efforts are part of a broader strategy to modernize the monetary system.

Monetary Policy Reforms: The Central Bank is also working to enhance its independence from political pressures and expand Islamic banking services to attract a wider range of customers. Liquidity injections and adjustments to the foreign exchange auction system are ongoing, but details remain limited. These reforms aim to create a more resilient financial sector.

Parallel Market Activity and Remittance Flows

In Syria, the unofficial or “parallel” currency market—often called the black market—continues to influence everyday life and the value of the Syrian Pound. From early 2025, several trends and challenges have shaped how people trade and transfer money both within Syria and from abroad.

Black Market Exchange Rate Trends: The black market remains a key signal of the Pound’s real-world value. Since recent sanctions were relaxed, the rate has become a bit more stable. However, it still swings often due to supply shortages, economic pressure, and political uncertainty. Many unofficial exchange offices remain active, although some have shut down because of the unstable conditions.

Importance of Remittances: Remittances—money sent by Syrians living abroad—remain a major support for the economy. These transfers bring in much-needed foreign currency, helping to stabilize both the official and unofficial exchange markets. For many families, remittances are essential for buying daily necessities and covering living costs.

Challenges in Currency Formalization: Even with new policies, many people continue to use informal exchange routes. This is mainly due to low confidence in banks and official channels. Economic uncertainty and inconsistent policies make it hard for the government to fully bring currency trading into the formal system.

Public Currency Preferences: Syrians are split on how they handle savings. Some keep their money in local currency, hoping for improvement. Others prefer the stability of the US dollar or the Euro, especially during uncertain times. These choices often depend on inflation, news reports, and personal trust in the financial system.

Regional Influences on Currency Dynamics: Countries like Lebanon, Iraq, and Turkey have a strong effect on Syria’s financial flows. Many remittances and currency trades move through these neighbors, shaping Syria’s broader market trends. Understanding these regional links is key to tracking the Syrian Pound’s movement.

Syrian Lira vs. Regional Currencies in 2025

In 2025, the Syrian Pound (SYP) showed modest appreciation despite remaining highly volatile. Following years of severe depreciation, the Pound began to stabilize slightly in the post-sanctions environment. However, its position is still fragile, with both domestic and external factors influencing its performance on a weekly basis.

The Turkish Lira (TRY) faced continued high volatility and inflation throughout 2025. Regional economic pressures, including rising import costs and political instability, weighed heavily on the Lira. This made it one of the more unstable currencies in the region this year.

The Lebanese Pound (LBP) experienced severe depreciation, continuing the deep financial crisis that has gripped Lebanon in recent years. The economy remained heavily dollarized, with limited access to hard currency and widespread public distrust in financial institutions, pushing the LBP further into crisis territory.

The Iranian Rial (IRR) showed signs of gradual stabilization, benefiting from eased sanctions and efforts to restore economic balance. Still, inflation remains high, and many Iranians continue to struggle with the high cost of living, which limits the Rial’s ability to regain real strength.

In contrast, the Iraqi Dinar (IQD) maintained relative stability during 2025. Supported by strong oil revenues and ongoing economic reform efforts, the Dinar has held its ground better than most regional currencies. Confidence in Iraq’s monetary policies and fiscal discipline continues to provide a cushion against broader regional volatility.

Comparison and Context

Compared to Lebanon’s ongoing financial collapse, the Syrian Pound’s slow recovery looks more promising. Yet, it still shows more volatility than the Iraqi Dinar or Iranian Rial, which benefit from stronger government backing or resource wealth. Turkey’s Lira remains unstable, reflecting broader regional economic uncertainty.

Cross-Border Trade and Financial Flows

Improved diplomatic ties with Gulf countries have increased the use of the Syrian Pound in cross-border trade. Currency exchange bureaus in regional hubs such as Dubai and Beirut display cautious optimism but remain alert to risks from Syria’s internal instability.

Last Words:

The Syrian Lira in 2025 tells a story of slow but hopeful recovery. After years of steep decline and tough sanctions, things are finally starting to look a bit brighter. With new government policies, more trade deals, and money flowing in from Syrians living abroad, the Pound has shown some signs of strength. It’s even gained a little value—a small win, but still a big deal after so much loss.

But here is the reality the road ahead isn’t smooth. The currency still faces serious challenges like political tensions, rising prices, and uncertainty across the region. One unexpected headline could shake things up all over again.

For everyday Syrians, business owners, and even investors, it’s a time to stay alert. Watching what the government does next, tracking exchange rate changes, and paying attention to international relations will all matter.

The Pound’s (Syrian Lira) journey isn’t over—but for the first time in a while, there’s a bit of optimism in the air. Source: IQDBUY

#Syrian Pound Highlights#Syrian Pound Updates#Syrian Lira Latest News#Syrian Pound Guru#Syrian Pound Surge

0 notes

Text

My Personal Experience with Buying & Selling Iraqi Dinar

Everyone has that one investment story that sticks with them — for me, it was my journey with the Iraqi dinar. Like many others, I was drawn in by the idea of potential currency appreciation and the buzz surrounding Iraq’s economic future.

But what I learned along the way taught me a lot more than just exchange rates; it gave me a better understanding of speculation, patience, and realistic expectations.

Let’s dive deep into my experience — from what drew me in to what I learned along the way.

Why I Decided to Invest in the Dinar

At first glance, the idea of investing in the Iraqi dinar seemed promising, especially when considering Iraq’s natural wealth and rebuilding efforts.

The Appeal of a Currency Comeback: Iraq’s vast oil reserves and long-term plans for economic development had many speculating about a future where the dinar could rise in value. I came across various forums and discussions where people compared Iraq’s situation to Kuwait’s recovery after the Gulf War. The concept of a potential "revaluation" (RV) captured my interest — a chance to invest in a currency that might one day reflect Iraq’s true economic potential.

Differentiating Hype and Hope: The narrative circulating online made it sound like a once-in-a-lifetime opportunity. Stories of dramatic gains and life-changing returns were hard to ignore. While I was aware of the speculative nature of the investment, the idea of getting in early on a possible economic rebound seemed worth exploring.

How I Chose a Vendor and Exchange Method

Since the dinar isn’t traded on global forex platforms or by major banks, purchasing it required a bit more due diligence.

Researching Dealers and Avoiding Pitfalls: My first step was researching currency dealers. I quickly discovered that many platforms charged premiums well above the official exchange rate — often between 20–30%. With no official regulatory framework governing dinar transactions outside of Iraq, I had to rely on reputation, customer reviews, and industry forums to gauge reliability. I eventually narrowed my options down to vendors with established reputations. The buying process typically involved wire transfers, cashier’s checks, or cash payments. Given the absence of regulatory oversight, I remained cautious throughout the process.

Ensuring Authenticity: Another key concern was verifying the authenticity of the notes. Counterfeit currency is an unfortunate reality in this space, so I made sure to use vendors that provided authentication certificates and security feature guides to verify the bills upon receipt. While the process was somewhat unconventional compared to standard investments, it seemed straightforward once I understood the risks and safeguards.

The Challenges of Selling Dinar Back

Buying the dinar was one thing, but selling it was a completely different experience.

Limited Buy-Back Options: I quickly realized that selling the currency back wasn’t as simple as purchasing it. Since mainstream banks and currency exchanges in my country did not handle the Iraqi dinar, I had to turn back to the same specialized dealers for resale.

These dealers offered buy-back programs, but typically at prices well below the official rate. Factoring in transaction fees, the difference between buying and selling prices often resulted in a significant loss.

Liquidity and Market Realities: Unlike more widely traded currencies, the dinar isn’t easily liquidated outside of Iraq. This limited market meant I had to accept lower offers if I wanted to convert my dinar back into local currency. The lack of widespread demand made it clear that this investment required patience and an understanding that immediate returns were unlikely.

For anyone considering this route, it’s essential to keep liquidity challenges in mind — especially if you expect to sell quickly or avoid losses.

What I Learned About the Investment Hype

Over time, I gained a clearer picture of the market dynamics surrounding the dinar, which helped me separate fact from fiction.

Speculation vs. Reality: A lot of the early excitement I encountered centered on the idea of a sudden currency "revaluation." However, after researching Iraq’s monetary policies, it became clear that the dinar is tightly controlled by the Central Bank of Iraq (CBI). Unlike freely floating currencies, the dinar’s value is managed and doesn’t fluctuate drastically on its own.

While Iraq has made strides toward economic reform, the likelihood of an abrupt, dramatic appreciation remains slim without major structural changes. Much of the hype stemmed from speculative optimism rather than grounded economic realities.

Scams and Unrealistic Promises: Unfortunately, the speculative environment attracted bad actors. Many so-called “investment opportunities” promised unrealistic returns or spread misinformation about imminent revaluations. Navigating this space required a healthy dose of skepticism and a commitment to separating genuine information from unfounded claims.

This experience reinforced the importance of verifying information through credible sources and understanding the economic fundamentals of any investment.

My Advice to Future Buyers

For those curious about investing in the Iraqi dinar or other speculative currencies, there are key takeaways from my journey worth considering.

Understand the Market’s Realities: The dinar is not widely traded outside of Iraq, which means liquidity is limited and resale options are few. Be prepared for potential challenges when it comes time to sell, and understand that prices offered by dealers may differ significantly from official rates.

Do Thorough Research on Dealers: Always choose reputable dealers who provide authentication guarantees and transparent pricing structures. Avoid anyone promising quick returns or making bold claims about revaluations without credible evidence.

Be Wary of Hype: Speculative investments often come with high hopes, but it’s important to stay grounded. The dinar’s value is controlled by Iraq’s central bank, and major changes would likely occur gradually rather than overnight.

Consider Long-Term Potential and Alternatives: If you’re looking to engage with Iraq’s economic growth, consider other investment avenues such as regional funds or companies operating within the country. These options often provide more oversight, better liquidity, and a clearer path to returns.

Final Word:

My experience with buying and selling the Iraqi dinar was eye-opening. While the stories of big gains were tempting, the reality involved navigating high fees, limited resale options, and a market filled with misinformation. That’s not to say there isn’t potential in Iraq’s economic future, but speculative currency investing requires patience, research, and a willingness to accept risks.

For those still interested in exploring this path, approach it with caution, realistic expectations, and a focus on credible sources.

At the end of the day, it’s about making informed decisions and understanding both the possibilities and limitations of investing in a currency like the dinar.

Source: IQDBUY

#buying and selling Iraqi Dinar#The truth about Iraqi Dinar#Iraqi Dinar wise investment#purchasing Iraqi Dinar#trading Iraqi Dinar

0 notes

Text

Can Iraqi Dinar Make You a Millionaire? Iraqi Dinar Potentials!

Dreaming of turning a small investment into a fortune is a powerful motivator. Over the years, the Iraqi dinar has been at the center of many such dreams. Forums, YouTube videos, and word-of-mouth stories have fueled the belief that the dinar could someday experience a massive surge in value, creating new millionaires overnight. But how realistic is this dream?

Let’s take an honest look at the potentials, the realities, and everything you need to know before making your move.

What You’d Need for a Million-Dollar Windfall

Before diving into the possibilities, it's important to understand the math behind becoming a "dinar millionaire."

How Much Dinar Would You Need?

Currently, as of 2025, the Iraqi dinar trades around 1,300 IQD per U.S. dollar. To turn a dinar investment into a million-dollar payout would require a massive amount of currency or a dramatic rise in the exchange rate.

For example:

Hypothetical scenario: If the dinar appreciated 10x and reached 130 IQD/USD, you would need about 130 million dinars to have $1 million.

Current cost: Buying 130 million dinars today could cost around $100,000–$110,000, depending on dealer premiums.

The Liquidity Challenge

Even if a large revaluation were to happen, converting those dinars back into dollars isn’t as simple as visiting a local bank. Most dinar transactions outside Iraq involve:

Dealer buybacks (at discounted rates)

Transaction fees (sometimes 20–40%)

Lower-than-expected cash-out values due to market spreads

Dinar Revaluation Myths Debunked

Much of the buzz surrounding the dinar comes from bold claims about a "revaluation" (RV). It’s crucial to separate hype from fact.

The "RV to $1" Rumors: A frequent rumor among dinar enthusiasts is the idea that 1 IQD could suddenly equal 1 USD. While this would be a dream scenario for holders, such a move would require extraordinary economic transformation — something that no central bank executes overnight. Iraq’s Central Bank currently manages a fixed rate, adjusting it slowly based on inflation, oil revenues, and external debts.

Oil Reserves vs. Currency Strength: Iraq is home to some of the world’s largest oil reserves, accounting for roughly 11% of global supply. While oil is a significant economic driver, it doesn’t automatically boost currency strength. Why? Because Iraq, like many oil-exporting countries, conducts most oil transactions in U.S. dollars, keeping demand for the dinar relatively low internationally.

Learning from Kuwait’s History: Many comparisons are made between Iraq and Kuwait after the Gulf War. However, Kuwait’s situation involved immediate U.S. military support, minimal infrastructure damage, and swift economic recovery. Iraq’s longer path of rebuilding and internal challenges makes direct comparisons risky.

Factors That Could Push the Value Up

While overnight riches are unlikely, there are real developments that could strengthen the dinar over time.

Oil Revenue and Economic Stability: Consistently high oil prices (e.g., $80+/barrel) boost Iraq’s foreign reserves. Stronger reserves provide more security for the dinar and could, over time, lead to a stronger currency stance.

Growth in Tourism and Foreign Direct Investment (FDI): Efforts to rebuild Iraq’s tourism sector — especially religious tourism to cities like Najaf and Karbala — could gradually increase local demand for dinars. Additionally, infrastructure investments funded by foreign companies could indirectly support the economy, although most international contracts are still denominated in U.S. dollars.

Central Bank Reforms: If Iraq’s Central Bank eventually moves toward a managed float system or liberalizes monetary policy, the dinar could gain value naturally. However, such reforms depend heavily on political stability and long-term economic planning, which remains a work in progress.

Stories of Big Wins and Bigger Losses

When it comes to dinar investments, there are stories on both ends of the spectrum.

The Hype Cycle: Across YouTube and online forums, you’ll find influencers talking about "secret government deals" and "imminent RVs." Many of these narratives are exaggerated or built around affiliate marketing schemes selling dinars at marked-up prices. While there’s excitement in these circles, caution is warranted. Always verify claims with independent, credible sources rather than relying solely on viral videos or speculative rumors.

Real Investor Experiences: Many early buyers have reported buying dinars with hopes of short-term flips, only to find liquidity challenges and steep dealer markups eroded their potential profits. That said, some long-term holders maintain optimism, viewing dinar purchases as a low-cost hedge on Iraq’s future rather than a quick payday.

Redenomination Risks: Another real possibility is redenomination — removing zeros from the currency to simplify transactions (e.g., 1,000 IQD → 1 new IQD). If redenomination occurs without special provisions for foreign holders, it could mean having to exchange old notes inside Iraq, which could prove logistically difficult.

Are You Ready to Risk or Wait Long-Term?

Understanding your personal risk tolerance is key before entering any speculative market, especially one as unique as the Iraqi dinar.

Short-Term Reality: Patience Required: In the near term, dinar holders face:

Low liquidity

Wide spreads between buy and sell prices

Minimal immediate appreciation

Long-Term Hope: Long-term investors view the dinar as a speculative, high-risk asset that might pay off if Iraq successfully reforms its economy over the coming decades.

With proper diversification, some view holding a portion of dinars as a small speculative play, but not a primary wealth-building strategy.

Some investors also explore other avenues like:

Iraqi Stock Exchange (ISX) investments

Regional mutual funds

Infrastructure-related opportunities

Final Word:

At the end of the day, the dream of becoming a millionaire through Iraqi dinar investment is still alive — but should be approached with clear eyes.

The potentials are real, but so are the hurdles. Iraq’s path to economic resurgence is underway but will likely take years of steady reforms, infrastructure rebuilding, and political stability to fully materialize. Meanwhile, the fixed exchange rate, liquidity issues, and potential for redenomination create headwinds that investors must acknowledge.

For those with patience, a realistic outlook, and a diversified strategy, holding dinars could still be an interesting speculative opportunity.

It may not create overnight millionaires, but in the world of investing, sometimes patience and positioning make all the difference.

Source: IQDBUY

#Iraqi Dinar millionaire#Iraqi Dinar get rich quick#invest in Iraqi Dinar#Iraqi Dinar good investment#huge investment in Iraqi Dinar

0 notes

Text

Iran’s Economy: Iranian Rial Purchasing Power Declines Sharply

It’s no secret that global currencies can shift dramatically, but few stories are as dramatic, or as important to understand right now, as the Iranian rial’s. Once viewed as a symbol of stability, today the rial finds itself battling against powerful economic tides.

For observers, investors, and everyday Iranians alike, the situation paints a complex picture of both challenge and opportunity.

Let’s find out about the forces reshaping Iran’s economy and how the purchasing power of the rial has been caught in the storm.

Cost of Living Surge and Income Gaps

Iran’s rising cost of living is more than just numbers—it’s reshaping daily life for millions.

The Rial's Sharp Devaluation: The Iranian rial has lost over 50% of its value in just the past year. By early 2025, the exchange rate had crossed the symbolic 1,000,000 rials per U.S. dollar, eroding purchasing power dramatically.

Food Inflation and Essentials Crisis: Essential items like vegetables, legumes, and dairy are no longer affordable for many families. Food inflation hit 42.7% by April 2025, with some staples seeing prices nearly double year-over-year.

Wages Falling Behind: Despite attempts at wage increases, real incomes are shrinking. Workers’ salaries simply cannot keep pace with surging prices, pushing more Iranians into poverty.

Widening Income Inequality: The economic gap between the wealthy and low-income households is growing. The once-vibrant Iranian middle class is shrinking as financial hardship deepens.

Import Costs and Foreign Goods Scarcity

Sanctions and the rial’s collapse have made foreign goods a luxury few can afford.

Skyrocketing Import Prices: The weakened rial has made imported goods extremely expensive. Products like medicine, car parts, electronics, and specialty foods have seen steep price hikes or disappeared from shelves altogether.

Depleting Foreign Reserves: By early 2025, Iran’s foreign currency reserves had fallen to just 25% of their levels from March 2024. Without foreign currency, paying for imports has become a major hurdle.

Bartering Oil for Goods: To circumvent the shortage of hard currency, Iran increasingly trades oil directly for gold and other essentials—a short-term solution that underscores the depth of the crisis.

Shrinking Middle Class and Inflation

The middle class, once Iran’s economic engine, is rapidly being squeezed out.

Middle-Class Erosion: The middle class—especially professionals, small business owners, and educators—is losing ground. Chronic inflation and economic uncertainty have devastated incomes and job security.

Women and Youth Hit Hardest: Women, young graduates, and skilled workers are disproportionately affected. Many are seeking opportunities abroad, leading to a worrying brain drain.

Inflation Continues to Outpace Wages: With inflation expected to exceed 50% in 2025, even modest salary increases are not enough. The cost of essentials rises faster than incomes, making survival, not growth, the priority for many families.

Currency Controls and Economic Restrictions

In an attempt to stabilize the rial and curb inflation, Iran's government has imposed strict currency controls and other economic restrictions.

These measures have included tighter regulations on foreign exchange transactions, caps on private savings in dollars and euros, and attempts to force repatriation of foreign-held assets. However, despite these moves, confidence in the rial remains fragile.

Capital flight continues at an alarming rate. Investors and ordinary citizens alike are moving their money into perceived "safe havens" like gold, cryptocurrency, or offshore bank accounts. The Tehran Stock Exchange has also suffered as liquidity drains from equities into alternative investments.

To meet its budget needs, the government has increasingly borrowed from domestic banks and tapped into national reserves. While this approach may buy time, it risks sowing the seeds of even deeper instability if inflation and currency devaluation are not brought under control.

Is Hyperinflation Next?

While Iran has not officially crossed into hyperinflation territory—technically defined as a 50% monthly inflation rate—the warning signs are flashing.

Official statistics already show double-digit monthly inflation across key sectors, and anecdotal reports from businesses and households suggest that actual price increases are even steeper on the ground.

The rapid devaluation of the rial, depletion of foreign reserves, and heavy reliance on domestic money printing have created the perfect environment for hyperinflation to emerge.

If unchecked, this scenario could have far-reaching consequences:

Erosion of savings for millions of households.

Collapse of domestic credit markets.

Accelerated capital flight and increased dollarization of the economy.

Social unrest was fueled by food shortages, job losses, and widespread economic insecurity.

Final Word:

Iran’s economy today finds itself in a downward spiral—one where multiple factors reinforce each other in a cycle that is hard to break.

The collapse of the rial, skyrocketing cost of living, widening income gaps, import scarcity, and shrinking middle class all point toward a deepening economic crisis. Government attempts to impose currency controls and economic restrictions have so far failed to stop the slide, and the growing risk of hyperinflation casts a long shadow over the nation’s future.

Without meaningful reforms—fiscal discipline, greater transparency, better governance, and relief from international sanctions—the purchasing power of the Iranian rial will likely continue to erode. And with it, the quality of life for millions of Iranians hangs in the balance.

In times of turbulence, understanding both the risks and opportunities of shifting economies becomes the foundation for those who aim to turn uncertainty into strength.

Source: IQDBUY

#Iranian Rial purchasing power#Iranian Rial shrinking#Iranian Rial currency value#Iranian Rial decline#what is Iranian Rial worth#what can we purchase with Iranian Rial

0 notes

Text

The Evolution of the Iranian Rial: From Stability to Collapse

The Iranian rial was once considered one of the stronger currencies in the region. Backed by oil revenues and a vibrant domestic market, it symbolized economic growth and national pride.

Fast forward to today, and the narrative has dramatically changed. The rial’s value has plummeted, citizens are losing confidence, and policymakers are racing to regain control. But how did a currency with so much promise end up here?

To understand, we must retrace its path and unravel the complex interplay of politics, economics, and international pressure that has led to this crisis.

From Stability to Crisis: A Timeline of Decline

Understanding the rial’s fall requires a look at its historical evolution. Once considered a relatively stable currency, the Iranian rial has endured a steady decline due to political upheaval, sanctions, and economic mismanagement. Its journey from strength to crisis is a story shaped by both internal decisions and external pressures, spanning centuries but accelerating dramatically over the past few decades.

1798–1945: (Birth and Early Stability): The Iranian rial was first introduced in 1798 as a silver coin during a time of monetary reform. In 1932, Iran made a significant move by officially replacing the qiran with the rial at par value, aligning its monetary system more closely with international standards. Initially, the rial was pegged to the British pound at a rate of 1 GBP to 59.75 rials, providing a strong anchor for stability. In 1945, Iran shifted its peg to the U.S. dollar at a rate of 32.25 rials per dollar. For decades, this peg helped maintain confidence in the currency and facilitated trade, laying a foundation for economic growth.

1979–1999: (The Islamic Revolution and Early Collapse): The turning point for the rial came with the 1979 Islamic Revolution, which triggered massive capital flight. An estimated $30 to $40 billion left the country during this period, draining Iran’s financial reserves and destabilizing the economy. As a result, the rial began a sharp decline, falling from 71.46 rials per dollar in 1978 to 9,430 rials per dollar by 1999. This collapse reflected a combination of political instability, loss of international investor confidence, and the beginning of Iran’s isolation from major global financial systems. Over these two decades, the rial’s role as a reliable store of value was deeply undermined.

2000s: (Sanctions, Mismanagement, and the Rise of Dual Exchange Rates): The early 2000s saw further deterioration of the rial’s value, driven by growing economic mismanagement and the tightening grip of international sanctions. In response to external pressures, Iran adopted a dual exchange rate system — an official rate for government use and a separate, higher black-market rate for ordinary citizens and businesses. This created confusion and fueled corruption, as access to the official rate was often reserved for politically connected insiders. By 2011, while the government maintained an official rate of around 10,800 rials per U.S. dollar, the real market rate had already surged past 13,500 rials. This divergence made it clear that the rial’s official valuation no longer reflected economic reality.

2018–2024: (Renewed Sanctions and Accelerated Decline): The situation worsened dramatically in 2018 when the U.S. withdrew from the nuclear deal and reimposed harsh sanctions targeting Iran’s oil exports and banking sector. These measures cut Iran off from vital foreign revenue streams and accelerated the rial’s freefall. Between 2020 and 2024, the rial lost over 80% of its value, as domestic inflation soared and public trust in the currency eroded further. By late 2024, the rial was trading at 820,000 per U.S. dollar — a staggering collapse that reflected not only external pressure but also internal policy failures and mounting social unrest. The convergence of protests, regional instability, and tough U.S. policies left the Iranian economy battered and vulnerable.

Early 2025: (Psychological Breakpoint): In early 2025, the rial crossed a critical psychological threshold by breaching 1 million rials per U.S. dollar. This symbolic collapse had profound implications for Iranian society, further eroding public confidence in the national currency. With everyday Iranians turning increasingly to dollars, gold, and cryptocurrencies to protect their savings, the demand for foreign currencies surged even higher. This milestone underscored the severity of Iran’s economic challenges and highlighted the urgent need for meaningful reforms if any stabilization was to be achieved. Without significant changes, the rial’s decline threatens to deepen Iran’s financial and social crises even further.

Political Influence on Currency Printing

Political choices have had a direct impact on the rial’s value. Since the revolution, successive governments have increasingly relied on printing money to fund populist policies. This includes paying for massive subsidies, public sector salaries, and military spending.

Rather than tightening the fiscal belt during times of crisis, policymakers opted to inject liquidity into the system, often outpacing economic output. This resulted in rampant inflation and a continued erosion of the rial’s purchasing power. Notably, political events like the 2022 Mahsa Amini protests not only triggered social unrest but also economic panic, causing a 29% drop in the rial within weeks.

The government’s inability or unwillingness to implement structural reforms has further deepened mistrust in its monetary policies. In the absence of credible oversight, money printing continues to fuel inflation, creating a vicious cycle that’s hard to break.

Shifts in Iran’s Monetary Policy

Monetary policy in Iran has seen various attempts at reform, many of them stalled or poorly executed.

1932–1979: Peg Stability Initially, the British pound and later the U.S. dollar provided a stable anchor. But political upheaval severed these ties.

2010–2020: Policymakers floated plans to remove four zeros from the rial to combat inflation. One such plan was the introduction of the "Parsi" currency in 2011, though it never materialized.

2020–2024: The idea of rebranding the rial as the toman (1 toman = 10,000 rials) gained traction. It passed in parliament in 2020 but was delayed repeatedly due to economic instability. As of 2024, the policy remains largely symbolic, with no practical change on the ground.

2024 Onward: With the rial’s street value free-falling, the central bank abandoned dual rates, officially acknowledging what the market had long priced in. The official rate now hovers around 767,550 rials per dollar.

Global Response to Rial Depreciation

International sanctions have been a key factor in isolating Iran economically and financially. U.S. sanctions—especially those targeting oil and the banking sector—have blocked Iran’s access to global financial systems, limiting its ability to trade and earn foreign reserves.

Even when multilateral deals like the 2015 Joint Comprehensive Plan of Action (JCPOA) offered temporary relief, gains were short-lived. The U.S. withdrawal from the deal in 2018 reimposed heavy sanctions, further driving the rial’s decline.

Regional instability also plays a role. Conflicts in Syria, Yemen, and tensions with Gulf nations have created an atmosphere of risk, deterring investment and increasing the likelihood of capital flight.

Other global players, including the EU and UN, have expressed concern but remain largely aligned with sanction regimes, limiting Iran’s options for financial recovery through international support.

Is a Currency Reset on the Table?

There’s growing talk in Iran about the possibility of a currency reset. The proposal to reintroduce the toman as the primary unit of currency aims to simplify transactions and restore some degree of psychological confidence.

However, history teaches us to be cautious. Past redenomination efforts have stumbled due to a lack of political will and follow-through. A reset alone won’t solve the root causes: inflation, dependence on oil revenues, and geopolitical isolation.

For a currency reset to succeed, Iran would need a few foundational reforms. Without these foundational reforms, redenomination risks becoming a cosmetic move that does little to address underlying vulnerabilities.

Iran Needs to:

Secure partial or full sanctions relief through diplomatic engagement.

Implement strict monetary discipline to curb inflation.

Diversify the economy beyond oil.

Strengthen central bank independence.

Final Thoughts:

The Iranian rial's journey from a stable, respected currency to one in freefall mirrors the nation’s broader economic and political trajectory. It’s a cautionary tale of how internal mismanagement and external pressures can bring even a resource-rich country to the brink of financial collapse.

While the idea of a currency reset may inspire hope, it cannot substitute for genuine reforms. For the rial to regain stability and trust, Iran must confront its economic challenges head-on, balancing the need for sovereignty with the realities of an interconnected global economy.

For investors and observers alike, the rial’s story is still being written. The coming years will determine whether Iran can turn the page—or whether the currency’s decline becomes a lasting symbol of a missed opportunity for national renewal.

In a world where currencies rise and fall, those who understand history and recognize opportunity are the ones who stand strongest in tomorrow’s economy.

Source:- IQDBUY

#Iranian Rial collapse#Iranian Rial evolution#Iranian Rial stability#Iranian Rial surge#Iranian Rial currency fall

0 notes

Text

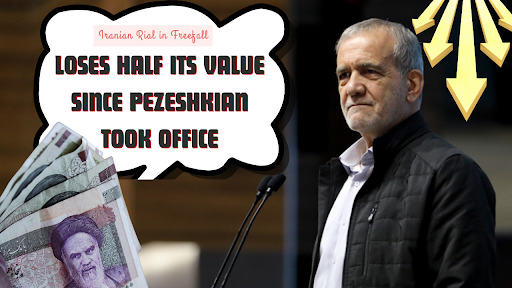

Iranian Rial in Freefall: Loses Half Its Value Since Pezeshkian Took Office

The Iranian rial has been in a dramatic freefall since Masoud Pezeshkian took office as president in mid-2024. In less than a year, the rial has lost more than half its value against the U.S. dollar, a sharp decline that has sparked panic across the country.

This steep depreciation is driven by a combination of renewed U.S. sanctions, domestic economic mismanagement, and a breakdown in public trust in the currency. The Iranian economy is facing one of its toughest crises in decades, with widespread hardship, inflation, and uncertainty affecting the daily lives of Iranians.

Have a deeper look!

What Policies Led to the Current Collapse

The rial’s collapse can be attributed to a series of policy missteps and external pressures that have combined to create a perfect storm of economic turmoil. At the heart of the crisis is the renewed U.S. sanctions under the Biden administration, which have targeted Iran's primary source of income—its oil exports—as well as its access to international financial networks.

Sanctions and the Squeeze on Oil Revenue: The U.S. has implemented several rounds of sanctions, starting in early 2024, aimed at cutting off Iran’s ability to access hard currency. These sanctions target Iran’s oil exports, which are essential to the country’s fiscal health, and severely limit its ability to engage in international financial transactions. The sanctions have left Iran with minimal access to foreign reserves and have crippled the country’s ability to earn revenue from its main export. As a result, the government has been forced to print more money to fund its expenditures, contributing directly to rising inflation and currency depreciation.

Domestic Economic Mismanagement: In addition to the external pressures, Iran’s domestic economic policies have worsened the situation. The Iranian government has been running large budget deficits, which are being financed by expanding the money supply. This practice has led to spiraling inflation, with prices for everyday goods surging dramatically. At the same time, the government has failed to implement any meaningful fiscal discipline or structural reforms to stabilize the economy. Political resistance to engaging in direct negotiations with the U.S. has further prolonged economic isolation and blocked potential pathways to easing sanctions or achieving economic normalization.

The failure to address these critical issues has left Iran’s economy on the brink of collapse, with the rial’s value continuing to plummet.

Public Confidence and Currency Hoarding

As the rial continues its freefall, public confidence in the currency has eroded. In early 2025, the rial crossed the psychologically important threshold of 1,000,000 rials per dollar, pushing many Iranians to abandon the rial in favor of more stable assets such as U.S. dollars, gold, and even cryptocurrencies. This shift in public sentiment has exacerbated the crisis.

The Rush to Convert Savings: In the face of currency instability, many Iranians have rushed to convert their savings into foreign currencies or assets like gold. This behavior has intensified demand for dollars and other hard currencies, further driving up the cost of the rial. As the currency loses its value, citizens have sought to preserve their wealth by turning to alternatives, creating a vicious cycle where the growing demand for foreign exchange accelerates the rial’s depreciation.

The Rise of Informal Markets: Currency hoarding has also fueled the growth of informal street markets, where individuals engage in speculative trading of the rial and foreign currencies. Official exchange offices have largely closed down, and the government’s inability to stabilize the currency has left people with little choice but to participate in these unofficial markets. During the Persian New Year (Nowruz), the volume of trading surged, with Iranians scrambling to exchange rials for more reliable forms of currency. This informal market activity only deepens the currency crisis, as it reduces liquidity in the official markets and drives up prices for everyday goods.

Government Response to Economic Panic

The Iranian government’s response to the economic crisis has been a mix of rhetoric, market interventions, and crackdowns. However, these measures have largely failed to restore confidence in the rial or halt its decline.

Government Rhetoric and Public Reassurance: Iranian officials have attempted to reassure the public by downplaying the risks of further depreciation and signaling a willingness to engage in talks with the U.S. However, the government has remained firm in its stance of negotiating from a position of strength, refusing to engage in direct talks with the U.S. unless certain conditions are met. This rhetoric has not been enough to calm the public, and many Iranians remain skeptical of the government’s ability to resolve the crisis.

Monetary Interventions and Limited Foreign Reserves: The Central Bank of Iran has intermittently intervened in currency markets, attempting to stabilize the rial by selling foreign currency reserves. However, the country’s foreign reserves are limited, and Iran’s access to global financial systems is restricted by sanctions. As a result, these interventions have had little effect in the long term. The government’s ability to stabilize the currency is further hampered by the lack of trust in the central bank’s ability to manage the economy.

Repression of Currency Traders: To curb speculation, the government has cracked down on currency traders accused of hoarding or manipulating the rial. These measures have included arrests and raids on exchange offices, but they have not been successful in halting the rial’s slide. Such crackdowns may have made the public even more distrustful of the government’s handling of the situation.

Price Shock Across Daily Essentials

The collapse of the rial has had a direct and severe impact on the prices of essential goods. Inflation, which has already soared above 40%, has caused prices for staples like food and tobacco to skyrocket by over 70%. This surge in prices has further eroded the purchasing power of ordinary Iranians, pushing many into poverty.

The Rising Cost of Living: As the rial continues to lose value, the cost of living in Iran has become increasingly unaffordable for the average citizen. With one-third of the population now living below the poverty line, the economic crisis is having a profound social impact. Iranians are struggling to afford necessities, and the financial strain is leading to growing discontent and unrest.

Supply Chain Disruptions and Factory Shutdowns: The depreciation of the rial has also disrupted supply chains and increased production costs for Iranian businesses. Many factories have been forced to scale back production or shut down altogether due to the rising cost of imported raw materials and machinery. Unemployment has risen as a result, further exacerbating the economic hardship faced by the population.

Stock Market Decline and Capital Flight: The Iranian stock market has also suffered a significant decline, as investors flee the rial and seek safer investments abroad. Capital flight has drained liquidity from productive sectors of the economy, leaving little room for growth or investment. This decline in the stock market is yet another indicator of the lack of investor confidence in the country’s economic future.

Is Stabilization Still Possible?

While the situation in Iran is dire, stabilization of the rial is not entirely out of reach. However, achieving stability would require a combination of domestic reforms and external factors that are currently lacking.

Sanctions Relief and Diplomatic Engagement: The first step toward stabilization would be securing sanctions relief. However, this would require a significant diplomatic breakthrough, including Iran’s willingness to engage in meaningful negotiations with the U.S. and other global powers. Only through such negotiations could Iran hope to regain access to foreign reserves and reenter the international financial system.

Fiscal and Monetary Reforms: Fiscal discipline is essential to restoring confidence in the rial. The government must reduce budget deficits and limit the central bank’s ability to print money to finance public spending. Inflation must be brought under control, and fiscal policies must be restructured to create a more stable economic environment. Greater central bank independence and transparency would also be necessary to regain public trust in the rial.

Diversification of the Economy: Iran’s economy has long been dependent on oil exports, and this dependence has made it vulnerable to external shocks. To achieve long-term stabilization, Iran must diversify its economy and reduce its reliance on oil. This would involve developing other sectors such as technology, manufacturing, and agriculture. Structural reforms are needed to improve governance, reduce corruption, and restore investor confidence in the country’s economic future.

Final Word:

The collapse of the rial under Masoud Pezeshkian’s leadership is a powerful indicator of the economic and political challenges facing Iran. How the government responds to the crisis will determine whether Iran’s economy can be stabilized or if the country will continue its downward spiral. With external pressures mounting and internal dysfunction deepening, the next few months will be critical for Iran’s future.

The leadership’s ability to address these challenges will ultimately decide whether the rial can recover or if Iran will face an even more uncertain future.

Source:- IQDBUY

#Iranian Rial freefall#Iranian Rial decline#Iranian Rial shrinking#Iranian Rial fall#Iranian Rial cheapest currency#Iranian Rial demise

0 notes

Text

Iran’s Currency Crisis Is About More Than U.S. Sanctions

Iran's ongoing currency crisis is often attributed to U.S. sanctions, but the roots of the rial’s steep decline go much deeper. While sanctions have undoubtedly exacerbated the issue, the problems within Iran’s economy are multifaceted, involving chronic fiscal mismanagement, inefficient banking systems, and internal political dynamics.

These elements, combined with Iran’s political isolation, have led to a profound loss of public trust in the rial, causing severe economic instability. Lets explore the underlying causes of Iran’s currency crisis, the effects of domestic policies on the rial, and what would be required to restore stability and confidence in Iran’s economy and currency.

Internal Mismanagement and Economic Isolation

The Iranian economy has been plagued by systemic issues that predate U.S. sanctions. Since the Islamic Revolution in 1979, Iran has struggled with chronic double-digit inflation and substantial economic instability. While the effects of U.S. sanctions have certainly intensified the crisis, it’s important to understand that the country’s economic policies have played a significant role in the rial’s dramatic devaluation.

Chronic Inflation and Expansionary Monetary Policies: A major issue is the Iranian government’s reliance on expansionary monetary policies to finance its deficits. This has led to rampant inflation, often exceeding 40% annually, which erodes the value of the rial and decreases purchasing power for ordinary Iranians. Over the years, the Iranian government has resorted to printing more money to meet its fiscal needs, particularly ahead of elections when the pressure to boost spending is high. This short-term solution exacerbates inflationary pressures, further devaluing the currency.

Economic Isolation and Lack of Global Integration: Another critical factor is Iran’s economic isolation. While sanctions certainly play a role, Iran’s self-imposed isolation through its resistance economy strategy has limited its ability to engage meaningfully with the global market. The country's focus on self-sufficiency has hindered foreign investment, trade opportunities, and the integration of modern technologies that could help diversify its economy. The result has been stagnation, with key sectors, including manufacturing and services, failing to grow at a sustainable rate. This isolation has deprived Iran of the benefits of global economic participation, leading to an over-reliance on oil revenues and contributing to the rial’s instability.

Rial Collapse Linked to Domestic Spending

At the heart of Iran's currency crisis lies the government’s fiscal mismanagement and unrestrained domestic spending. While sanctions have severely impacted oil revenues, domestic policies have worsened the situation, creating a vicious cycle of inflation, devaluation, and economic stagnation.

Massive Budget Deficits: Iran has been running persistent budget deficits for years, with government expenditures consistently outpacing revenues. The fiscal gap has been largely financed through borrowing from the Central Bank of Iran (CBI), increasing the money supply, and triggering inflation. The government’s reliance on oil revenues, now diminished due to sanctions, has left it unable to fund its deficits sustainably. This has forced authorities to liquidate public assets and engage in short-term fiscal stimulus measures, which have only further devalued the rial.

Government Spending and Inflationary Pressures: Government spending has not been strategically directed towards economic growth or diversification. Instead, fiscal resources have been used to support inefficient state-owned enterprises and military expenditures, often at the expense of vital sectors like healthcare and infrastructure. As public spending rises, inflation follows, leading to skyrocketing prices on goods and services. For example, consumer prices surged over 53% year-on-year in early 2025, with essential items such as food and tobacco seeing increases of more than 70%. This inflationary environment accelerates the depreciation of the rial, making it even more difficult for the population to maintain their standard of living.

Banking System Failures and Inflation