Hello! I work for http://www.efinancialmodels.com. We help entrepreneurs, key executives and investors in their financial analysis and modeling tasks.

Don't wanna be here? Send us removal request.

Photo

How to build a financial model for startups? Financial Models for Startups Explained

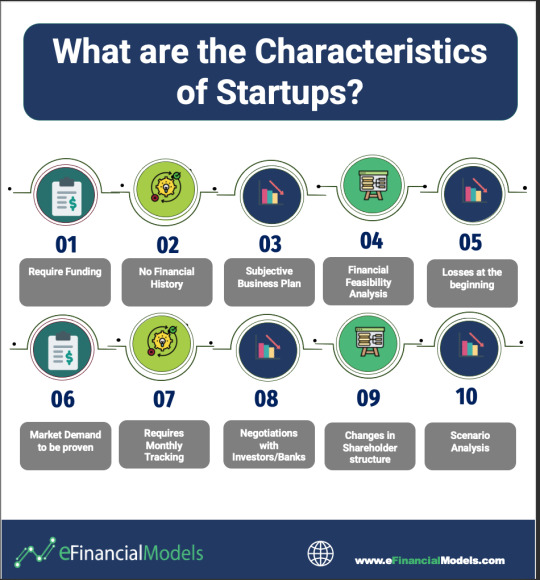

Is financial modeling necessary for early-stage startup business? Startup financial models are usually helpful to businesses who have relatively no clue how to run them. Financial modeling experts build Financial plan template for startups to address this problem. In the article we are about to share, we will discuss how to make a financial model for a startup and give you startup financial plan example templates, for you, the entrepreneur, to have your own startup finance model.

Financial models for startups are not one of the usual priorities of the entrepreneur when it comes to building his own business, but having a startup finance model will help them especially with the details and monitor the financial health of their business. Later on, we are about to share, we will discuss how to build a financial model for startups, we will also discuss how is financial modeling necessary for early-stage startup businesses. How to make a financial model for a startup? Well, it depends on the needs of a business, but Financial plan Template for startups online are readily available. We will also give startup financial plan examples along the way to guide you in understanding how this works

0 notes

Photo

How to build a financial model for startups? Financial Models for Startups Explained

Is financial modeling necessary for early-stage startup business? Startup financial models are usually helpful to businesses who have relatively no clue how to run them. Financial modeling experts build Financial plan template for startups to address this problem. In the article we are about to share, we will discuss how to make a financial model for a startup and give you startup financial plan example templates, for you, the entrepreneur, to have your own startup finance model.

Financial models for startups are not one of the usual priorities of the entrepreneur when it comes to building his own business, but having a startup finance model will help them especially with the details and monitor the financial health of their business. Later on, we are about to share, we will discuss how to build a financial model for startups, we will also discuss how is financial modeling necessary for early-stage startup businesses. How to make a financial model for a startup? Well, it depends on the needs of a business, but Financial plan Template for startups online are readily available. We will also give startup financial plan examples along the way to guide you in understanding how this works

0 notes

Photo

What is the Sum Formula in Excel? The Sum Formula in Excel is one of the most common Excel Functions to date. For different disciplines and fields such as education, construction, budgeting, etc. We all use the Sum Formula in Excel. In this article, we will talk about the different kinds of Sum Formula in Excel and how these functions are used or applied.

0 notes

Photo

Hello, one of life’s most difficult questions is “How do I save and use my money?”. Obviously, we have to enjoy the things that we worked hard for, but at the same time, we can’t leave ourselves out to die when we stop working. So what do we do? Well, we make ourselves a budget plan, and to make it even more convenient, we can use Excel Budget Spreadsheets to have it allocate our monthly income for us! Whether it’s adjusting expenses or saving up for your next vacation, it can be done easily through a budget spreadsheet!

0 notes

Photo

The SUMPRODUCT function in Excel is one of the SUM Functions (SUM, SUMIF, SUMIFS) [link to pillar page] under the Math/Trigonometry Formulas. Using the SUMPRODUCT formula, it multiplies the range of cells or arrays then sums all the products.

If I ask you how often you use this function compared to other SUM functions and you answered rarely, I wouldn’t be surprised. It is sort of like the unpopular kid on the block or the quintessential last kid to get picked for a team. Almost everyone knows what it does but chooses not to use it. In financial modeling, it is also not often used mainly because it is difficult to understand and verify if the results are correct.

0 notes

Photo

In this article, we will define what are Excel sparklines and differentiate the types of sparklines in Excel. We will also guide you on how to insert and edit as well as different ways to customize sparklines for Excel worksheets.

0 notes

Photo

Presenting balances, subtotals, totals or any numbers in appropriate graphs and charts transforms financial data into concise and easy to understand information. Graphs and charts are visually engaging, they enable the target users to make the right assumptions and important inferences. Financial modelers and analysts use it to visually track profitability, liquidity, budgets, expenses, and many other financial metrics. For example, a line graph is used to show trends over time (time series) such as prices of stocks, company earnings per year, etc. A column or bar chart is used as a comparison tool such as how many units of Product A were shipped to customers compared to Products B and C.

In this article, we will discuss a special chart type, the Excel Waterfall chart. We will talk about what a Waterfall chart in Excel is, its features, and its uses. We will show you a step by step guide on how to create a waterfall chart in Excel for any version plus you can download for free a Waterfall chart in Excel template to get you started. We will end the article with a table of comparison between creating a Waterfall chart type available in the 2016 Excel version and a Waterfall chart in Excel from scratch.

0 notes

Photo

A DCF Model is now one of the most commonly used valuation methods for determining the value of a company or an asset. Discounted Free Cash Flow analysis is part of the income approach and thus one of the most theoretically sound valuation methods because the value is determined by the expected income from a business or asset.

Building a Discounted Cash Flow (DCF) model is a very popular financial valuation method and widely used among professional investors to derive the value of a company and base their decision-making on such analysis.

A DCF model is mostly built with a spreadsheet program such as MS Excel. It requires a projection of the company’s Free Cash Flows to Firm and then discounts them to their present values. Please see here for an Example DCF Valuation Model.

0 notes

Photo

The COUNTIF function in Excel counts the number of cells that meet a single condition. The COUNTIF function in Excel is a powerful tool, especially in financial modeling, which gives you the ability to set a preferred condition before the cells are counted it does not merely count just any number, text, value, and blank cells. Learning how to use COUNTIF function Excel allows you to have different variations of the criteria.

The COUNTIF examples in Excel provided here will help you how to use Excel to COUNTIF greater than, use Excel to COUNTIF less than and many more that will give you insights to your business data.

0 notes

Photo

Your Free Essential Guide on How To Use COUNTIFS Function In Excel

The COUNTIFS function in Excel with multiple criteria gives a lot of elbow room to pinpoint details important for analysis and financial modeling by using additional key metrics or criteria.

In this essential guide, we will go over the basics of COUNTIFS function in Excel, understand different parts of the COUNTIFS formula in Excel using examples for you to follow.

0 notes

Photo

5 Steps on How to Use VLOOKUP Function in Excel

Microsoft Excel boasts a wide number of lookup and reference function but no other is commonly known than the VLOOKUP function in Excel. If you’re working with tables most of the time, from multi-year financial statements to inventory systems, understanding how to use VLOOKUP function in Microsoft Excel can come in very handy. However, for beginners, the Excel VLOOKUP function can be intimidating to wrap their heads around.

In this article, we will discuss what the Microsoft Excel VLOOKUP function is and the 4 arguments in the Excel VLOOKUP formula. We will also illustrate common Excel Spreadsheet VLOOKUP examples in Excel that highlight why users gravitate to it and the common errors and limitations encountered.

0 notes

Photo

Analyze Financial Data with SUMIF Function In Excel

The SUM function in Excel is one of the most basic yet widely used functions in excel. However, as your business grows so does your financial data. To be more successful in business, you need to analyze your financial performance with specific criteria. Simply adding up sales, expenses, and employee hours no longer provides the answer you need to dig deeper into your financials. Enter the SUMIF function in Excel.

To do a little review about the SUM Functions in Excel, here’s a refresher guide on the key fundamentals of SUM functions in Excel.

The SUMIF function in Excel allows you to specify a condition or criterion that must be met first before Excel sums the numbers. It is a function in excel that allows you to do addition based on a condition. Sounds simple enough, right? But there’s more to it, understand it better with step by step SUMIF examples in Excel illustrated later below.

0 notes

Photo

Combine Cells In Excel And Generate Dynamic Text With These 2 Formulas

Data in financial models are sometimes not organized and presented according to a user’s needs. Sometimes to combine cells in Excel containing numbers and text into one cohesive content is necessary for analysis. Combining names, addresses, ID or codes, etc. are common examples. To combine cells in Excel are useful in providing a customized description or details of numeric variables and can also serve as a guide for users to properly interpret the results from the financial model.

Two ways to combine cells in Excel containing text and numbers are Concatenate Excel function and the & operator in Excel. In this article, we will discuss how to use both, how these differ, and which one to use best.

0 notes

Photo

How to Use the ROUND Formula in Excel

Rounding numbers seem like a bizarre phrase right? As if numbers come in triangles, squares, and different shapes. Rounding converts numbers to a shorter estimated value so that it’ll be simpler and easier to use.

The so-called number crunchers like financial analysts, accountants, and other business professionals who work with numbers day to day will agree that the ROUND in Excel is one of the commonly used tools. Rounding revenues, expenses, costs, prices, taxes, etc. to its significant approximate values makes crunching numbers faster, simpler, and importantly easier to communicate. The ROUND in Excel simplifies numbers and removes the least significant digits but still keeps the values as close as possible to the original. Basically this allows you to round up (round down) to the nearest decimal place you would like to show.

In this article, we will discuss the Excel basics of the ROUND in Excel including the logic behind the ROUND formula in Excel and how to use ROUND in Excel for business.

0 notes

Photo

INDEX Function in Excel Explained & Examples

It is quite surprising to know that our index finger has no muscles and is mainly controlled by the muscles in the palm and forearm. The index finger is also commonly referred to as a pointer finger as we literally use it to pinpoint important facts in a book or simply point the direction to a place.

The INDEX function in Excel works similarly, it pinpoints the value we are searching in a given range of cells. In this article, we will discuss the basics of Excel’s INDEX function and its 2 formula formats. Also, how to use INDEX function in Excel to lookup data points and illustrate a powerful combination lookup tool; INDEX MATCH function in Excel.

0 notes

Photo

Find Data with Excel Match Function

What is the Match Function in Excel? The official headquarters of the Prime Minister of the UK is at 10 Downing Street. The official residence of the President of the USA is at 1600 Pennsylvania Avenue. The famous detective of all time Sherlock Holmes resides in 221B Baker Street. Last but not least, the most lovable yellow sea sponge SpongeBob SquarePants lives in 124 Conch Street.

Of the hundreds of interesting locations (real or fictional) across the world, without its exact address or the street number, no one will know about these places and will be left in obscurity.

Similarly in financial analysis when working with large data, lookup and reference functions such as cross-referencing different data sets, providing information about a range of cells, and looking up values are essential. Another important lookup function is the Excel MATCH function.

The MATCH function in excel locates the relative position of the value from the range of cells. In this article, we will discuss what is an Excel MATCH function and how the MATCH formula in Excel spots the value’s position. We will also learn how to use the function by illustrating examples.

0 notes

Photo

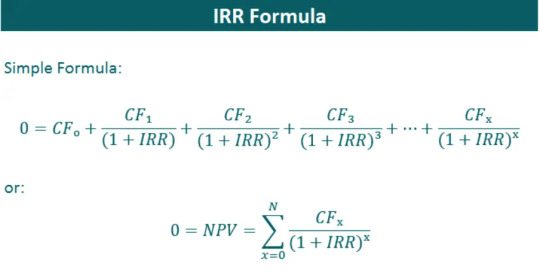

IRR – How To Calculate the IRR

In capital budgeting, to measure or determine the profitability of potential ventures, we use the Internal rate of return, or what we call the IRR. As with the discounted cash flow model, we use a discount rate to discount all future cash flows to the present value, add them all up so that the net present value or NPV of all cash flows is equal to zero. So, both calculations of the NPV and IRR heavily rely on the same formula. In the article provided, we will show you IRR how to calculate in Excel, the importance, the methods, and finally examples that you can use as reference moving forward.

0 notes