Text

Best Crypto Savings Accounts for 2024

A cryptocurrency savings account allows consumers to store their digital currency holdings. A crypto savings accounts often earns interest on the assets deposited into it on a daily basis, according to the terms and restrictions outlined by the exchange that offers the financial product.

The merger of long-standing banking procedures with the emerging crypto business indicates a one-of-a-kind synergy between traditional financial systems and the cryptocurrency ecosystem.

Are you looking to increase your investment yield by dabbling in the world of cryptocurrency? A cryptocurrency savings account could allow you to enhance your rate of return significantly.

However, these accounts lack the security that a bank or credit union savings account provides. Before you invest, you need to understand how cryptocurrency savings accounts work, as well as their advantages and disadvantages.

Once you understand how these accounts function, you'll want to know where to find the highest yields. In this article, we'll address your pressing questions about cryptocurrency-based savings accounts and recommend our favorite selections for 2024.

Also Read: Best Stocks That Pay Monthly Dividends

Top Crypto Savings Accounts for 2024

Here’s a list of crypto savings accounts to earn interest on hodled coins:

1- Binance

Binance, recognized as the world's largest cryptocurrency exchange, features a diverse range of financial products, including "Fixed Savings." This option allows users to commit their digital assets for a 90-day term, earning fixed interest rates of up to 7%.

The appeal lies in the predictability of returns amidst cryptocurrency market volatility. Binance's established reputation for security and global presence adds to the attractiveness of its Fixed Savings product, positioning it as a notable choice for users navigating digital asset investments.

2- Coinbase

Coinbase offers a unique USDC savings account, providing users with a low-risk investment option. This account yields a competitive 4.00% Annual Percentage Yield (APY) for holdings in USDC (USD Coin).

The appeal lies in the simplicity of converting fiat currency into USDC, making it an accessible choice for those entering the cryptocurrency investment space. Coinbase's reputation as a regulated exchange adds to the credibility of its USDC savings account, positioning it as an attractive option for risk-averse investors.

3- Crypto.com

Crypto.com's Earn feature allows users to deposit funds and earn attractive Annual Percentage Yields (APYs). With APYs of up to 1.5% on Bitcoin, 2% on Ethereum, and an appealing 5.25% on USDC, the platform caters to a diverse range of investors.

This tiered approach provides flexibility, allowing users to optimize returns based on their chosen digital assets. Crypto.com's commitment to transparency and user-friendly interfaces enhances the accessibility of its Earn feature, positioning the platform as a comprehensive solution for both trading and growing digital asset portfolios.

4- Kucoin

A cryptocurrency exchange with a diverse range of available assets for earning income. Bitcoin APY ranges from 0.19% to 3%, while USDT APY starts at 3%. KuCoin, a versatile cryptocurrency exchange, offers a range of income-generating options across diverse assets. Users can earn on Bitcoin with APYs ranging from 0.19% to 3%, catering to varied risk preferences.

Additionally, the platform provides a competitive starting APY of 3% on USDT, offering stability akin to traditional fiat currencies. KuCoin's commitment to flexibility and diverse APY options positions it as a compelling choice for users seeking income opportunities within the cryptocurrency space.

5- YouHodler

A savings account with no minimum lockup period and other investment protections. Bitcoin APY up to 7%; USDC APY up to 12%. YouHodler provides a unique savings account in the cryptocurrency realm, offering flexibility with no minimum lockup period.

The platform stands out with an appealing Bitcoin APY of up to 7% and an even more competitive USDC APY of up to 12%. This attractive combination of flexibility and high yields positions YouHodler as a noteworthy choice for users seeking both security and optimal returns on their digital assets.

6- Nexo

Nexo stands out in the cryptocurrency lending and savings domain by providing short lock-up times for digital assets. Users benefit from competitive yields, with an impressive 8% on stablecoins and 3% on Bitcoin.

This unique combination of flexibility and attractive returns positions Nexo as an appealing choice for those seeking quick access to funds along with the potential for passive income within the cryptocurrency market.

7- Kraken

Kraken, a leading cryptocurrency exchange, introduces a unique feature allowing users to earn staking rewards on Bitcoin (BTC) and USDT. With a competitive 0.15% APR for BTC and an attractive 3.75% APR for USDT, users can benefit from regular staking rewards distributed twice a week.

This innovative offering aligns with Kraken's commitment to providing diverse and rewarding opportunities for users to optimize the value of their cryptocurrency and fiat holdings.

8- Ledn

Ledn, a crypto-lending platform, positions itself uniquely as a crypto savings account. It stands out by offering diverse options for earning interest on cryptocurrency with promising rates. This innovative approach aligns with industry trends, providing users with both lending services and passive growth opportunities for their digital assets.

The platform's commitment to competitive interest rates further solidifies Ledn as an attractive choice for users navigating the dynamic landscape of cryptocurrency investments.

9- Uphold

Uphold, a reputable cryptocurrency exchange, not only provides a solid trading platform but also stands out for its enticing staking rewards. Emphasizing a commitment to user security, Uphold explicitly states they never lend out users' money, addressing concerns prevalent in the crypto savings account landscape.

Currently offering up to 16% APY on crypto assets, Uphold's dynamic approach caters to users seeking both stability and attractive returns within the evolving cryptocurrency market.

10- Paybis

Paybis, a user-friendly crypto trading platform, is designed with beginners in mind. Notably, it features an in-house crypto wallet, streamlining the trading experience. With a focus on simplicity and security, Paybis aims to provide a convenient gateway for users entering the cryptocurrency space.

Also Read: Stock Trailers- A Complete Guide for Hauling Success

How Do Crypto Savings Accounts Work?

A cryptocurrency savings account operates similarly to a traditional savings account. Typically, consumers transfer assets from their cryptocurrency wallets to these savings accounts. The key distinction is that the bitcoin exchange uses the deposits to make loans to other platform members.

This means that instead of lending fiat dollars, crypto exchanges will use cryptocurrencies such as Bitcoin and Ethereum. These deposits are rewarded with interest in the form of cryptocurrency, which is typically subject to fluctuations. This rate is governed by a combination of market dynamics for the specific cryptocurrency as well as factors such as fund accessibility and the crypto exchange used.

Some accounts pay just simple interest, while others allow you to reinvest earnings, which might result in compound interest.

Factors to consider when choosing a crypto savings accounts

When choosing a crypto savings account, consider these crucial factors:

- APY rates: For the best returns, prioritise high Annual Percentage Yields (APYs) while considering fees and lock-in conditions.

- Supported Cryptos: Choose platforms that offer a wide range of assets, giving you more flexibility and control over your investment portfolio.

- Insurance and Security: Investigate security measures and digital asset insurance, which are critical for protecting your investments from potential hazards. Payout Schedule and Flexibility: Look for platforms that offer variable lock-in periods and speedy payout schedules, maximising both convenience and rewards.

- Crypto bonuses: Take advantage of sign-up incentives offered by platforms to increase overall earnings, and consider moving accounts for higher benefits.

- Hidden Fees: Examine charge structures, particularly withdrawal fees and dynamic blockchain network fees, to minimise surprise expenses.

- Market Risks: Recognise market volatility as a risk, and appreciate that, while high interest rates are beneficial, market downturns can have an influence on overall results.

- Withdrawal Considerations: Given the unpredictability of the crypto loan industry, lock-up periods should be used with caution, and spread among platforms to reduce risk.

Finally

Cryptocurrency savings accounts offer daily interest, bridging traditional banking with the crypto realm. Top choices for 2024, including Binance, Coinbase, Crypto.com, KuCoin, YouHodler, Nexo, Kraken, Ledn, Uphold, and Paybis, present various options.

Investors must grasp the mechanics and risks associated with these accounts. While they provide opportunities for enhanced yields, the absence of traditional security necessitates careful consideration. Informed decisions, considering factors like APY rates, supported cryptos, security measures, and market risks, are crucial for navigating the dynamic landscape of crypto investments and achieving financial goals.

Read the full article

0 notes

Text

UCI Financial Aid: Your Comprehensive Guide to Financing Your Education

Understanding UCI Fin Aid1. UCI Scholarships

2. UCI Grants

3. UCI Loans

4. UCI Work-Study Programs

5. Financial Aid Workshops and Counseling

How to Apply for UCI Financial Aid

Important Dates and Deadlines

Conclusion

When pursuing higher education at the University of California, Irvine (UCI), one of the most crucial aspects to consider is how to finance your studies. Fortunately, UCI offers a range of financial aid options to help students manage the cost of education. In this comprehensive guide, we will explore UCI financial aid, including scholarships, grants, loans, and work-study programs, to ensure you have a clear understanding of how to fund your academic journey

Understanding UCI Fin Aid

Navigating the world of financial aid can be complex, but UCI is committed to making it accessible for all students. Here's a breakdown of the various financial aid options available:

1. UCI Scholarships

Scholarships play a significant role in helping students reduce their educational expenses. UCI offers a wide range of scholarships based on academic achievement, financial need, and other factors. Some of the notable UCI scholarships include:

- Regents' Scholarship: A prestigious merit-based scholarship for high-achieving students.

- Blue and Gold Opportunity Plan: A program covering tuition and fees for students with family incomes below a certain threshold.

- Private Scholarships: UCI provides resources to help students find and apply for external scholarships.

2. UCI Grants

Grants are a form of financial aid that do not need to be repaid. UCI offers several grant programs to support students with demonstrated financial need, such as the:

- Pell Grant: A federal grant for undergraduate students with exceptional financial need.

- Cal Grant: A California state grant for residents pursuing higher education in the state.

- UCI Grant: A university-based grant program for undergraduate students who exhibit financial need.

3. UCI Loans

While scholarships and grants are excellent options, loans can also help cover educational expenses. UCI participates in federal loan programs, offering options like:

- Federal Direct Subsidized Loans: Loans with interest subsidized while in school and during deferment.

- Federal Direct Unsubsidized Loans: Loans available to both undergraduate and graduate students with various interest rates.

4. UCI Work-Study Programs

Work-study programs provide opportunities for students to earn money while gaining valuable work experience. UCI connects eligible students with on-campus and off-campus job opportunities, allowing them to earn money to cover their educational costs.

5. Financial Aid Workshops and Counseling

UCI fin aid conducts workshops and offers counseling sessions to guide students through the financial aid application process. These resources can provide personalized assistance and address specific questions or concerns regarding scholarships, grants, loans, and work-study programs.

By actively participating in these workshops and seeking one-on-one counseling, you can gain valuable insights into maximizing your financial aid opportunities and ensuring that you make informed decisions about your educational funding.

How to Apply for UCI Financial Aid

To take advantage of UCI's financial aid options, you need to complete the Free Application for Federal Student Aid (FAFSA) or the California Dream Act Application (CADAA) if you're an eligible undocumented student. Here are the steps to apply for UCI financial aid:

- Fill out the FAFSA or CADAA: Provide accurate financial information and make sure to meet all deadlines.

- Include UCI's School Code: Enter UCI's school code (001314) on your FAFSA or CADAA to ensure your application is sent to the university.

- Monitor Your UCI Email: Keep an eye on your UCI email for notifications and additional documents required to process your financial aid.

- Review Your Financial Aid Package: Once accepted to UCI, you will receive a financial aid package outlining your eligibility for scholarships, grants, loans, and work-study.

Important Dates and Deadlines

To secure your UCI financial aid, it's essential to be aware of the important dates and deadlines:

- March 2nd: The priority deadline for submitting the FAFSA or CADAA.

- Early April: UCI begins notifying admitted students about their financial aid packages.

- May 1st: The deadline for admitted students to accept their admission and submit their Statement of Intent to Register (SIR).

- June 15th: The deadline for finalizing your financial aid requirements and submitting any requested documents.

SEE ALSO: Demystifying Federal Financial Aid for Students - Smart Investiq

Conclusion

Navigating the world of UCI fin aid can seem overwhelming, but with the right information and timely action, you can make the most of the available resources. Whether you qualify for scholarships, grants, loans, or work-study opportunities, UCI is committed to helping you achieve your educational goals without undue financial stress. Make sure to complete your FAFSA or CADAA on time, monitor your UCI email, and meet the necessary deadlines to access the financial support you need to excel at UCI. Your journey towards a quality education begins with understanding and applying for UCI financial aid.

Read the full article

0 notes

Text

350+ Finance Team Names Ideas for Competitive Number Crunchers

In the world of finance, where precision and accuracy are paramount, a strong and cohesive team is essential for success. Whether you're a group of financial analysts, accountants, or investment professionals, having an inspiring and memorable team name can foster a sense of unity and pride. If you're on the hunt for the perfect moniker for your finance team, look no further. We've compiled an extensive list of 350+ finance team name ideas that are sure to resonate with your team's competitive spirit and number-crunching prowess.

Funny Finance Team Names

Finance Puns Team Names

Finance Club Name Ideas

Finance Event Names

Team Name for Finance Competition

Nicknames for People in Finance

Banking Team Names

More Banking Team Names

Accounting Team Names

Bookkeeping Team Names

Team Names for Financial Advisers

Payroll Team Names

Investment Team Names

Conclusion

Competitive Finance Team Names

- Number Climbers

- Data Experts

- Real Dealers

- Rockin’ Financers

- Finance Fighters

- Sharp Eyed Gals or Guys

- Top Level Team

- Dynamite Department

- Record Breakers

- The High Rollers

- Finance Marvels

- Finance Rangers

- Tax Survivors

- The A Team

- Wall Street Gang

- Office Planners

- Freedom Financers

- Finance Prospectors

- Money Movers

- Ace Deppies

- Account Handlers

- Money Checkers

- Ledger Pros

- Spreadsheet Guys

- Money Lovers

- Cash Queens

- Smooth Financers

- Finance Keepers

- Sum Experts

Also Read: 50 Creative Team Names About Money-Minded Groups

Money-Inspired Team Names

- Money Matters

- Bill Boys

- The Cash Group

- Old Money

- Fair Financers

- Money Balancers

- Money Moguls

- Cash Growers

- Team Spenders

- Team Cash It Out

- Wealthy Women

- Money Patrol

- Absolute Cash

- Team No Limits

- Genuine Dollars

- Cash Chiefs

- Money Strategy

- Mega Money Mind

- Dream Numbers

- Big Earners

- Money Partners

- Stealthy Accounts

- Check Kings

- The Value Team

- Rigorous Earners

- Money Police

- Money Madness

- Effective Cash

- Money Rewards

Funny Finance Team Names

- Money Makers

- Team Ka-ching!

- For the Books

- Asset Kickers

- Golden Gals

- Money Honeys

- Number Crunchers

- Cash Cows

- Team Grand Cash

- Money Buddies

- Bad Bills

- Team Accountants

- Young Money

- Money Rulers

- Top Performers

- Awesome Aces

- Money Processors

- Cash Consultants

- Asset Admins

- Money Junkies

- Flawless Financers

- Ledger Lovers

Finance Puns Team Names

- Team Wads Up

- Priceless Pennies

- Making Cents

- Dough Makers

- Periodical Spenders

- The Big Change

- Financial Fitters

- The Uncountables

- Figure Watchers

- Innovative Minds

- Investor Investigators

- Team Plus or Minus

- Finance Crunchers

- Money Rankers

- Banking On It

- Perfectly Balanced

- Team Booked

- Money Loaded

- Future Capital

- Down for the Account

- Spreadsheet Savvy

- Money Practicality

- Finance Away

- Planned Accounts

- The Money Lane

- Million Dollar Babies

- Finance Kings

- Tax Freaks

- Control Crunchers

- Team Wads Up

- Priceless Pennies

- Making Cents

- Dough Makers

- Periodical Spenders

- The Big Change

- Financial Fitters

- The Uncountables

- Figure Watchers

- Innovative Minds

- Investor Investigators

- Team Plus or Minus

- Finance Crunchers

- Money Rankers

- Banking On It

- Perfectly Balanced

- Team Booked

- Money Loaded

- Future Capital

- Down for the Account

- Spreadsheet Savvy

- Money Practicality

- Finance Away

- Planned Accounts

- The Money Lane

- Million Dollar Babies

- Finance Kings

- Tax Freaks

- Control Crunchers

Finance Club Name Ideas

- Financial Solutions

- Team Go Getters

- The Money Circle

- The Counting Pros

- Numbers Unlimited

- The Gifted

- Number Strategists

- Money Ninjas

- Team Big Group

- Next Level

- Limitless

- Absolute Money

- Positively Wealthy

- Fiscal Experts

- Money Bosses

- Team No Boundaries

- Money Chain Club

- Savings Club

- Top Rates

- Bookkeeping Experts

- New Generation

- Money Shot

- Money Connections

- Risk Takers

- Money Ventures

- Cash Brainiacs

- Cash Consultants

- Spreadsheet Solutions

- Income Buzz

Finance Event Names

- Absolute Financing

- Budget Planning 101

- Money Playground

- The Financial Dream

- Next Generation Money

- The Green Horizon

- Associate Planning

- Banking Secrets

- The Degrees of Financing

- Understanding Your Finances

- Money Assistance

- The Basics of Saving

- Fun with Bookkeeping

- Financial Enhancements

- The Value of Numbers

- Prime Savings

- The Money Group

- Investment Ventures

- Money Revolution

- Funding Your Future

- Rise To The Top

- Cash Flow Tips

- The Wealthy Point of View

- By The Books

- Prime Time for Savings

- Understanding the Figures

- The Money Concern

- Riding The Expenses

- Juggling Finances

Team Name for Finance Competition

- Mad for Money

- Full Accounts

- Money Minds

- Finance Wolves

- Competition Killers

- Cash Pros

- Money Keepers

- Accounting Kings

- Financially Stable

- Wolves of Wall Street

- The Dependable’s

- Penny Experts

- Cash Strategists

- Number Breakers

- Money Junkies

- Financially Victorious

- Money Wisdom

- Accounted

- Bank Masters

- Balance Pros

- Easy Money

- Stealthy Tellers

- Big Assets

- True Treasure

- Brainy Buddies

- Money Geeks

- Cash Assurers

- Team Best Figures

- Best Bankers

Nicknames for People in Finance

- Penny Wise

- Golden Touch

- The Big Shots

- Number Nudgers

- Dollar Bakers

- Dough Starters

- Team Moolah

- Lettuce People

- Bean People

- The Big Ones

- Benjamins

- Fund Department

- Gold Miners

- Team Grand

- Millionaires

- Nugget Department

- Money Hoarders

- Salad Masters

- The Green Pack

- Team Sparkles

- The Rich and Famous

- Finance Gang

- Big Numbers

- Gold Mine

- Cashville

- Big Billers

- Cash Peeps

- The Bosses

- The Greatest Showmen

- Finance Masters

Banking Team Names

- Money Charmers

- Counter People

- Credit Line

- Debit Line

- Chief Bankers

- Financial Connections

- Innovative Tellers

- Bad Bankers

- Financial Rulers

- Money Figures

- The Goblins

- Figure Crunchers

- The Safe People

- Number Prowlers

- Money Changers

- Bank Rankers

- Cash Unlimited

- Money House

- Finance Dreamers

- Good Timers

- Banking Horizons

More Banking Team Names

- Money Regulars

- Irreplaceables

- Financial Beats

- Sound of Money

- Mad for Cash

- Team Sweets

- The Money Studio

- Finance Paradise

Accounting Team Names

- Number Geeks

- Super Financiers

- Spreadsheet Heroes

- Company Heroes

- Fantastic Financiers

- Dough Rollers

- Money Community

- The Heart of the Company

- Intelligence Builders

- Accounting Gurus

- Accounting Ninjas

- Ledger Leaders

- Level Up

- Crucial Tasks

- Accounting Crazies

- Accountaholics

- Accounting Associates

- Smooth Mathematicians

- Accounting Masters

- Prime Numbers

- Accounting Alphas

- Net Gains

- Accounting Rockets

- Number Team

- Balance Buddies

- Rockin’ Accountants

- Money Runners

- Company Saviors

- Big Brains

- Top Yielders

Bookkeeping Team Names

- The Note Takers

- Pretty Little Bookkeepers

- Team Hawkeyed

- Sharp Minds

- Number People

- The Pen and Paper Department

- Bookkeepers United

- Numbers Galore

- Books and Numbers

- Accounts Hooray!

- Brainy Auditors

- Number Recorders

- Smart Minds

- The Scribblers

- Team CPA

- Big Bad Bookkeepers

- Competitive Bookkeepers

- The Brainy Team

- Bookkeeping Pros

- Bookkeep Wonders

- Accounting Junkies

- Book Smarts

- Real Deal

- Cash is King

- Money Talk

- Recorders at Work

- Balanced Accounts

- Team Control

- Team Efficiency

Team Names for Financial Advisers

- Smart Buddies

- Top Rankers

- Bonus Pointers

- Counting Consultants

- Top Shots

- Journal Heroes

- The Ledger People

- Accounting Lovers

- Financial Hunters

- The Financial Braniacs

- Just Finances

- Journal Magicians

- Financial Lunatics

- Figure Watchers

- Venture Vultures

- Financial Lovers

- Skilled Mathematicians

- Financial Geeks

- The Bank People

- Journal Handlers

- Money Managers

- Financial Fighters

- Finance Wizards

- Silent Killers

- Excel Kings

- Outstanding Financers

- Financial Royalties

- Tough Bankers

Payroll Team Names

- Money Distributors

- Pay Assistance

- Compensators

- Last Men Standing

- Wage People

- The Pay Zone

- Payroll Express

- Pay Men

- Payroll Solutions

- Salary Givers

- Pay Station

- Salary Ninjas

- Salary Heroes

- Payroll Partners

- Payroll and Company

- Payroll Pros

- Compensation Buddies

- Payroll Gang

- Payment Bosses

- Payment Managers

- Paycheck Inc.

- Salary Providers

- Breadwinners

- Salary Bosses

- Payroll Control

- Quick Pay

- Payroll People

- Pay Nation

Investment Team Names

- Capital and Company

- Jackpot Joes

- First Choice

- Money Researchers

- Life Heroes

- Investment Gems

- Encouragement Buddies

- The Fiery Team

- Risk Away

- The Trust Group

- The Investment Scope

- Helping Hands

- Investor Managers

- Investment Department

- Bankrupting Babes

- The I Team

- Advance Thinkers

- Quick Choices

- Alpha Investors

- Team Ensure

- Certified Investments

- Eagle Eyes

- Super Investments

- All-Star Team

- Steadfast Investment

- The Value Team

- Money Sense

- The Legacy Team

- Creative Investments

Conclusion

Selecting the perfect finance team name can be a fun and creative process. Whether you prefer a serious and professional tone or a more lighthearted and playful approach, there's a name on this list for every finance team. Remember that the right name not only reflects your team's expertise but also boosts morale and fosters a sense of camaraderie. So, gather your team, explore the list, and choose a name that resonates with your group's spirit as you embark on your financial endeavors together.

Read the full article

0 notes

Text

High Interest Savings Accounts 2024 in India

high interest savings accounts have become a go-to option for savvy savers. As we look ahead to 2024, the landscape of these accounts is set to evolve even further. With interest rates on the rise and banks competing for customers, the opportunities for earning a higher return on your savings are expanding.

In this article, we'll explore the latest trends and offerings in high-interest savings accounts in India. From digital banks offering attractive interest rates to innovative features such as round-up savings and cashback rewards, there is no shortage of options for those looking to make the most of their hard-earned money.

Whether you're a seasoned saver or just starting on your savings journey, this article will provide valuable insights into the best high-interest savings accounts available in India. We'll also discuss important factors to consider when choosing the right account for your needs, such as fees, accessibility, and customer service.

Get ready to take your savings to the next level with high-interest savings accounts in India. Let's dive in and discover the possibilities that await you in 2024.

Top high interest savings accounts in India for 2024

In 2024, several high-interest savings accounts in India stand out for their competitive interest rates and attractive features. Here are some of the top accounts to consider:

1. XYZ Bank High Interest Savings Account:

- Competitive interest rates

- No minimum balance requirement

- Free online banking and mobile app access

- Cashback rewards on select transactions

2. ABC Digital Bank Savings Account:

- High-interest rates

- Round-up savings feature that automatically saves spare change

- Free ATM withdrawals nationwide

- 24/7 customer support

3. PQR Bank Premium Savings Account:

- Tiered interest rates based on account balance

- Personalized financial advice and planning services

- Dedicated relationship manager

- Exclusive discounts and offers for account holders

These are just a few of the high-interest savings accounts offered in India in 2024. It is critical to conduct research and compare several possibilities to discover the account that best meets your needs and tastes.

Also Read: Savings Account Disadvantages

9 Banks offer up to 8% interest rates on savings accounts

Guess what? Nine banks are now giving out up to 8% interest rates on savings accounts. It's not the usual deal, and it's a great chance for people who want to make more money with their savings. Here are the 9 banks offer up to 8% interest rates on savings accounts

1- DCB Bank

2- Ujjivan Small Finance Bank

3- Federal Bank

4- DBS Bank

5- AU Small Finance Bank

6- Equitas Small Finance Bank

7- Suryoday Small Finance Bank

8- IDFC First Bank

9- RBL Bank

Tips for maximizing returns on high interest savings accounts

To enhance the benefits of your high-interest savings account, consider incorporating the following tips:

1- Automate Transfers: Set up regular automatic transfers from your primary checking account to your high-interest savings account. This not only ensures consistent savings but also expedites your progress toward financial goals.

2- Utilize Round-Up Savings: If your bank offers a round-up savings feature, activate it. This feature automatically rounds up your transactions to the nearest whole number and channels the spare change into your savings account. Over time, these incremental amounts can accumulate significantly.

3- Minimize Fees: Be vigilant about the fees associated with your high-interest savings account and take proactive measures to avoid them. Some banks impose charges for exceeding the maximum allowable monthly transactions. Plan your transactions thoughtfully to reduce unnecessary fees.

4- Monitor Interest Rates: Stay informed about the interest rates provided by your bank and other financial institutions. Should you come across a more favorable rate elsewhere, contemplate transferring your high-interest savings account to optimize returns.

5- Regularly Review Savings Goals: Periodically assess your savings goals and make adjustments as necessary. This practice keeps you motivated and allows you to track your progress toward achieving financial milestones.

By applying these tactics, you may make the most of your high-interest savings account, expediting your path to financial success.

Finally

high-interest savings accounts in India offer a wealth of opportunities for individuals looking to make the most of their hard-earned money. By staying informed, comparing options, and implementing smart savings strategies, you can take your savings to the next level in 2024 and beyond.

Read the full article

0 notes

Text

Savings Account Disadvantages

Is your savings account truly working in your favor? While it may seem like a safe and reliable way to stash your cash, there are downsides to consider. In this article, we'll explore the potential savings account disadvantages and why it might be holding you back from reaching your financial goals.

Many people believe that a savings account is the best place to keep their money. It's easily accessible, provides a small amount of interest, and offers peace of mind knowing that your funds are secure. However, the reality is that savings accounts often offer a lower interest rate compared to other investment options. This means that your money may not be growing as much as it could be.

Additionally, savings accounts can be prone to inflation risk. As the cost of living increases, the purchasing power of your money diminishes over time. So, while your money might be safe in a savings account, it may not be growing enough to keep up with inflation.

In this article, we'll dive deeper into these downsides and provide alternatives to consider that may help you make the most of your hard-earned money.

What is A Savings Account?

A bank account that earns interest at a variable rate over time is called a savings account. These accounts are generally provided by financial institutions such as banks and credit unions. The account balance is increased over time by the interest normally earned at a variable rate.

Savings Account Disadvantages

- Minimum Balance Requirements: Numerous savings accounts come with minimum balance prerequisites or monthly maintenance fees. Falling below the specified balance can lead to fees, offsetting the interest earned.

- Low Interest Rates: Savings accounts generally offer lower interest rates in comparison to other investment options like money market accounts or certificates of deposit (CDs).

- Federal Withdrawal Limits: Governed by Regulation D, savings accounts have federal limits on monthly withdrawals (typically six). Exceeding this limit may result in fees or a change in account status.

- Temptation of Access and Availability: While convenient access to funds is an advantage, it may also pose a temptation, potentially impeding long-term savings goals.

- Variable Interest Rates: Savings account interest rates are subject to change by financial institutions and may not always align with federal rate movements.

- Inflation Impact: In the absence of a competitive interest rate, inflation could erode the value of earned interest, leading to a diminished real value of the account over time.

- Compounded Interest Limitations: Many traditional banks or credit unions compound savings account interest monthly or annually, restricting overall growth potential compared to alternative investment opportunities.

Read Also: Commercial Banking Jobs and Salaries

Low interest rates

One of the primary disadvantages of traditional savings accounts is the low interest rate. While savings accounts do earn interest on your balance, the rates are generally low. In today's low-interest-rate environment, it might be difficult to find savings accounts that deliver inflation-beating rates.

Low interest rates mean your money isn't growing as fast as it could be. Over time, this might have a considerable influence on your total savings. If you want to develop wealth or achieve financial independence, relying simply on a savings account may not be the best approach.

Limited access to funds

While savings accounts offer easy access to your funds, they also come with limitations. Most savings accounts have withdrawal restrictions, such as a maximum number of transactions per month. These limitations are in place to encourage individuals to save and discourage excessive spending.

However, if you need to access your money quickly or make frequent withdrawals, these limitations can be frustrating. In some cases, you may even incur fees for exceeding the allowed number of transactions. This can eat into your savings and make it more difficult to reach your financial goals.

Fees and charges

in addition to withdrawal restrictions, may include a variety of fees and levies. Common fees include monthly maintenance fees, overdraft fees, and charges for using ATMs outside of the bank's network. These fees can quickly build up and deplete your funds over time.

While some banks may waive these fees in specific circumstances, you must read the fine print and understand the terms and conditions of your savings account. Being aware of prospective costs will help you make better judgments about where to put your money.

Conclusion

While savings accounts provide advantages, it is vital to be aware of the drawbacks that may impede your financial growth. Low interest rates, eroding savings due to inflation, limited access to funds, and fees can all have an influence on your capacity to grow your wealth.

Consider alternatives, such as high-yield savings accounts, to maximise the growth potential of your money. By making informed decisions about where to keep your money, you can ensure that your savings are working for you and allowing you to achieve your financial objectives faster.

Read the full article

0 notes

Text

Life Insurance vs Health Insurance: Key Differences for Informed Choices

Planning for the future is a cornerstone of responsible living, and if you're a forward-thinker, considering Life and Health Insurance policies should be your next strategic move. Let's embark on a journey to comprehend the nuances of these policies, exploring the key differences that set Life Insurance and Health Insurance apart.

Understanding the Contrast of Life Insurance vs Health Insurance

Life insurance and health insurance serve disparate purposes, acting as financial safeguards in distinct scenarios. Here's a detailed breakdown of the differences:

FeaturesLife InsuranceHealth InsuranceCoverage TypeComprehensive, lifelong coverage, pays at policyholder's deathPrimarily covers medical expenses, health needsPremiumsFixed and flexible premiums, investment plans availableOnly fixed premiums, no investment, prioritizes medical needsDurationLong-term plan with fixed tenureShort-term plan, typically renewed annuallyTerminationUsually ends with policy expirationRenewed annually to ensure continuous health coverageBenefitsProvides financial protection to family upon policyholder's demiseCovers medical expenses and hospitalization during the policy termSurvival BenefitsOffers both survival and death benefits at the end of the insurance termNo survival benefits, focuses on addressing medical needs

Unveiling Life Insurance

Life insurance is essentially a contractual agreement between a policyholder and an insurance company, promising to provide the insured amount to the bereaved family after the policyholder's demise. This coverage serves as a pillar of financial stability for the entire family and supports future plans or investments.

Types of Life Insurance

- Whole Life Insurance: Featuring fixed premium payouts and tax-free, fixed sum assured, it is a cost-effective option with a lower risk profile.

- Universal Life Insurance: Blending investment and death benefits, this option offers flexible premiums and higher returns, albeit with increased risk.

Advantages and Disadvantages of Life Insurance

Pros - Cost-Effective: Less expensive than permanent policies.

Affordable Large Death Benefit: Provides substantial coverage at a reasonable cost.

Online Accessibility: Easy quotes and application process available online.

Convertible Policies: Some can convert to permanent policies without new medical exams.

Health-Based Premiums: Future premiums based on current health for convertible policies.

- Temporary Coverage: Ends once the term expires.

Cost Increase at Renewal: Buying a new policy at term end can be expensive.

Limited Options After Term: Difficulty securing new coverage if health declines.

No Cash Value: Lacks a cash value accessible during the policyholder's lifetime.

Decoding Health Insurance

Health insurance steps into action when health issues arise, requiring medical attention and hospitalization. Policyholders pay fixed premiums for health protection, and the coverage varies based on the chosen health insurance plan.

Types of Health Insurance

- Individual Health Insurance: Tailored for individual needs, covering medical expenses, illnesses, accidents, and emergencies.

- Family Floater Health Insurance: An umbrella coverage for all household members under one premium, addressing various medical expenses.

- Senior Citizens Health Insurance: Customized for those aged 60 and above, accounting for specific needs like domiciliary care and critical illnesses.

Advantages and Disadvantages of Health Insurance

Pros - Financial Security in Critical Illness

Cashless Hospitalization

Network Hospitals for Cashless Services

No Claim Bonus for Increased Sum Insured

Add-ons or Riders for Customization

Financial Protection in Case of Death or Disability

Peace of Mind and Focus on Quality Healthcare

Affordable Healthcare with Comprehensive Coverage

- High Costs, Especially for the Self-Employed

Pre-Existing Conditions Have Waiting Periods

Waiting Periods for Certain Benefits

Age-Dependent Increase in Premiums

Co-Pay Requirements for Insured Customers

Complexity in Comparing Coverage and Premiums

Life Insurance vs. Health Insurance

The decision to invest in life or health insurance hinges on individual needs. While life insurance ensures family financial security in the event of the policyholder's death, health insurance addresses medical expenses during the policyholder's lifetime.

Key Distinctions

- Why Invest?

- Life Insurance: Ensures family financial security in case of sudden death.

- Health Insurance: Shields against rising medical expenses, eliminating out-of-pocket costs.

- Core Benefit:

- Life Insurance: Pays the promised sum to the beneficiary.

- Health Insurance: Covers treatment expenses, subject to conditions.

- Additional Benefits:

- Life Insurance: Various add-ons like maturity benefits, surrender benefits, and loyalty additions.

- Health Insurance: Some policies provide free health check-ups, and no claim bonuses may apply.

- Types of Covers:

- Life Insurance: Individual and group covers, with plans like term, savings, child-related, and retirement.

- Health Insurance: Individual, family, and group coverage, including comprehensive plans and critical illness cover.

- Tax Benefits:

- Life Insurance: Under Section 80C and Section 10(10D) of the Income Tax Act.

- Health Insurance: Under Section 80D of the Income Tax Act.

In your financial portfolio, Life Insurance and Health Insurance play distinct roles. Making an informed decision based on your unique requirements will unlock the full potential of each.

The Benefits Unveiled

Benefits of Life Insurance Plans

- Financial security and protection.

- Tax-free payouts.

- Guaranteed death benefit.

- Tax benefits as per prevailing tax laws.

Both Life Insurance and Health Insurance are indispensable for those concerned about the future, family, and well-being. Health insurance safeguards your medical affairs, while life insurance ensures your family's security in your absence.

In the uncertain journey of life, it's prudent to protect yourself and your loved ones before it's too late. Both these insurance policies are crucial, and the choice between them is now a personal one. Consider your needs, weigh the options, and secure a better future for yourself and your family.

Read the full article

0 notes

Text

How To Make Money With Midjourney Ai

What Exactly is this side hustle?

Benefits of using Midjourney AI for monetization

Steps to get started with making money with Midjourney AI

Choosing the right monetization strategy for your business1. Etsy

2. Creative Fabrica

3. Sell on Free Pik and Adobe stock as stock images

4. Sell as stickers

Finally n How to make money with midjourney ai

How to make money with midjourney Ai?, Ai which stands for Artificial Intelligence, is perhaps one of the best things that has ever occurred to the internet.

- ChatGpt generates human-sounding language,

- whereas Midjourney creates bizarre AI art using basic text instructions.

The ability to earn money online has literally increased. But I'm not here to educate you about basic AI side hustles that will pay you pennies on the dollar.

I'll show you a highly profitable side hustle using artificial intelligence that can earn you thousands of dollars. We'll use ChatGPT to produce the greatest ideas, and Midjourney to make them a reality.

So, with that said, let's get right to work.

What Exactly is this side hustle?

This side hustle involves leveraging the power of Midjourney AI to create unique and visually appealing AI-generated art pieces. Midjourney uses advanced algorithms to transform simple text instructions into stunning artwork.

By tapping into this technology, you can unleash your creativity and monetize your artistic skills in a whole new way. With Midjourney AI, you don't need to be a professional artist or have any prior experience in art.

All you need is an idea or concept that you want to bring to life. Whether it's a surreal landscape, a futuristic cityscape, or an abstract piece, Midjourney can turn your vision into a captivating visual representation.

The best aspect is that you don't have to buy expensive art tools or spend hours perfecting your artistic abilities. Midjourney conducts all of the labor for you, allowing you to concentrate on the creative part while earning money from your unique AI-generated artwork.

Read Also: How to Make Passive Income on Amazon

Benefits of using Midjourney AI for monetization

1. Unlimited Creative Potential: Midjourney AI opens up a whole new world of creative possibilities. You can experiment with different styles, themes, and concepts without any limitations. The AI algorithms are capable of producing highly detailed and visually stunning artwork that can capture the attention of art enthusiasts and collectors.

2. Passive Income Stream: Once you create your AI-generated artwork, you can sell it repeatedly without any additional effort. This creates a passive income stream that can generate revenue for you even while you sleep. As long as there is demand for your artwork, you can continue to earn money from it.

3. No Inventory or Shipping Hassles: Unlike traditional art businesses, where you need to manage inventory, packaging, and shipping, with Midjourney AI, everything is digital. Your artwork can be easily stored and delivered electronically, eliminating the need for physical inventory and shipping logistics. This not only saves you time and effort but also reduces costs and expands your global reach.

Steps to get started with making money with Midjourney AI

Step 1: Brainstorm and Conceptualize: Start by brainstorming ideas for your AI-generated artwork. Think about the themes, styles, and concepts that you find interesting and that you believe would resonate with potential buyers. Consider doing market research to find popular trends and niches in the art world.

Step 2: Create Text Instructions: Once you have a clear idea of what you want to create, write down detailed text instructions for Midjourney AI. Be specific about the colors, shapes, textures, and overall composition you want to achieve. The more precise your instructions are, the better the AI will be able to generate the desired artwork.

Step 3: Generate AI Artwork: Use the Midjourney platform to input your text instructions and generate AI artwork. Experiment with different variations and iterations to refine your creations. Don't be scared to iterate and make changes until you're happy with the end result.

Step 4: Market and Sell Your Artwork: Once you have your AI-generated artwork, it's time to market and sell it. Create a visually appealing portfolio showcasing your artwork and set up an online store or gallery to showcase and sell your pieces. Leverage social media platforms, art communities, and online marketplaces to reach potential buyers.

Step 5: Establish Your Brand and Reputation: As you begin to sell your AI-generated artwork, focus on developing your brand and reputation as an AI artist. Engage with your audience, attend art events and exhibitions, and work with other artists to broaden your network. The more recognition and reputation you achieve, the more popular your artwork will be.

Choosing the right monetization strategy for your business

Congratulations, you’ve generated your Clipart images, it’s now time to sell them online. These are the 4 best marketplaces to sell your AI Cliparts on.

For each of these marketplaces, I’ll show you

- how much traffic they get,

- how people are already making money selling AI cliparts

- and the difference with how each of these platforms work

1. Etsy

Etsy is obviously the most profitable marketplace you could be selling your AI generated images on. With over 454.2M monthly visitors, the potential buyers for your AI clipart are endless.

Etsy's traffic insights by SimilarWeb

Now with Etsy, what you’re trying to sell is your Clipart bundle. Etsy, being a creative marketplace, is home to many other creatives in search of elements to level up their projects.

And that’s where you come in. Upload as many Clipart bundles as you can on Etsy with the right keywords.

Remember to focus on keywords with

- A Low and healthy competition of less than 1000 search results

- and high demand too.

With the endless ideas ChatGPT spits out, these keywords shouldn’t be hard to find. Soon enough, you’ll start to rank in front of the millions of buyers on Etsy and that’s how you make passive sales.

I found a new seller on Etsy selling Cliparts and already has 38 sales in less than 3 months of selling on Etsy.

Screenshot of an Etsy shop: Kutihutdigidesigns

2. Creative Fabrica

Creative Fabrica is another marketplace to sell your Clipart. Like I said, this marketplace is where I sell my Clipart and Canva templates, so I know it’s a gem.

With over 8.7 million visitors every single month, this marketplace definitely has demand while being a hundred times less competitive than Etsy.

Creative Fabrica Traffic Insights by SimilarWeb

Selling on Creative Fabrica is easy

- Create your account

- Apply as a seller

- And once you get accepted, upload your Clipart bundles just like you would on Etsy.

Remember, it’s the same Clipart bundle we’re selling, you create it once and you upload it on all of these marketplaces.

3. Sell on Free Pik and Adobe stock as stock images

Have you heard about Stock images?

Well, before artificial intelligence and AI art became a thing, professional photographers and artists used to invest time upfront in creating images.

Photo by Maxwell Hunt on Unsplash

These images were uploaded on sites like Freepik, Shutterstock, AdobeStock and others as stock photos. This meant that businesses and other creatives can use these images in their projects without copyright issues.

But with a fee of course. So, the concept of stock images allows photographers and artists to be paid passively for their images by as many people as use them.

They create the images once and sell them countless times. Now with Midjourney and a good prompting skill, you literally are the photographer or artist.

You can now create high quality images and in our case Cliparts to sell on the stock image sites. While Shutterstock and some other stock image websites don’t accept AI art, AdobeStock and Freepik do.

Selling on AdobeStock and Freepik is free. And for how much you can make on these platforms, it highly depends on

- how many quality images you upload

- and how many downloads you get.

4. Sell as stickers

The Clipart we create with AI are really cute images aren’t they? Well, stickers are cute too.

Photo by Kasturi Roy on Unsplash

So why can’t we sell our clipart as stickers?

I mean, who said we couldn’t? Using platforms like Redbubble, Teepublic and Zazzle, you can literally turn your Cliparts into another income stream and sell them as stickers.

Now I know what’s on your mind. But stickers are physical products, who’s going to print and ship my Clipart to my customers when they buy?

Well that’s where the concept of Print on Demand comes in. Print on demand is a business model where a print provider allows artists to upload digital copies of their art as listings on the front end.

While they handle the entire production and shipping. It’s totally free and these print providers only get paid when you make a sale.

So let’s say you make a new sticker sale,

- they take a baseline fee for production and shipping

- while you keep the rest as commission.

The best part is you can literally increase your prices while the production and shipping cost remains the same. But selling stickers is more than just reuploading your Clipart on Marketplaces like Redbubble and Teepublic.

Stickers are cute, sure. But they are also funny. So you’ll need to do some extra work to turn your Clipart into something more attractive to sticker lovers.

- First, find an idea that suits the Clipart you’ve generated already e.g Cute monkey sticker

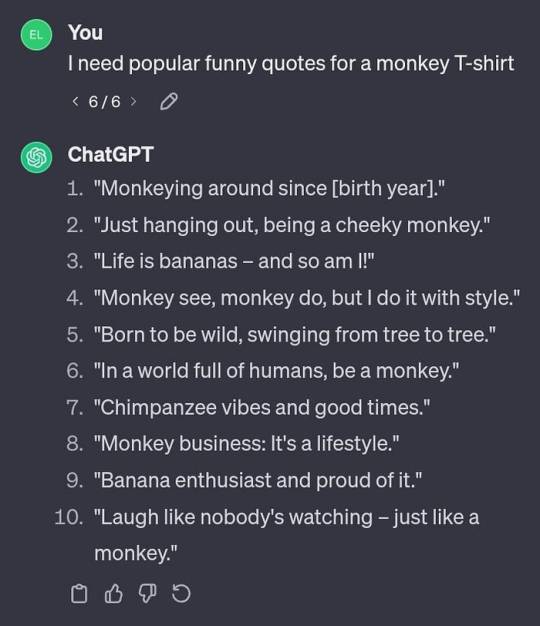

- Ask ChatGPT for funny monkey quotes

ChatGPT Dashboard

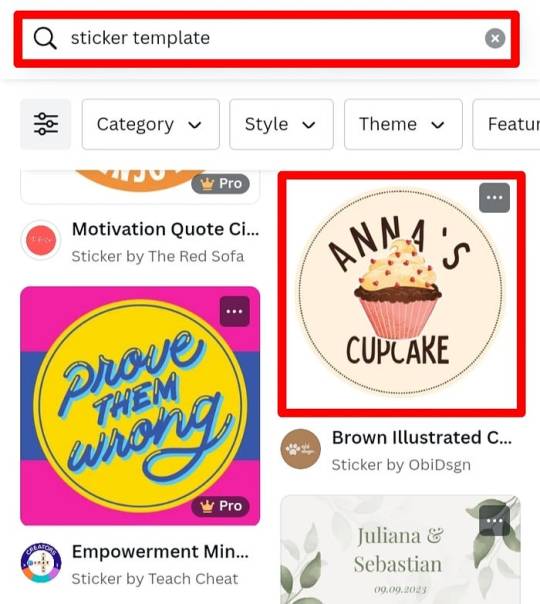

- Turn your Clipart into a sticker quote using Canva

First, find a cute sticker template on Canva’s free template library.

Canva's free template library

Then replace the Clipart with yours and text with what ChatGPT generated. Remember to remove the white background using Adobe’s Free background remover.

Finally n How to make money with midjourney ai

Read the full article

0 notes

Text

50 Best personal finance books

Understanding how to handle your money is super important, and that's what personal finance education is all about. It's like having a guide that helps you make smart decisions with your cash.

Learning about personal finance isn't just about numbers; it's also about seeing things from different angles. Different people have different ways of dealing with money, and that's what makes learning from diverse perspectives so cool. It's like getting advice from various friends who've been through different money adventures.

Now, why are we making a list of the 50 best personal finance books? Well, think of it as putting together a collection of super helpful tools. Books are like treasure chests of knowledge, and with this list, we're giving you a bunch of these treasures in this best personal finance books guide.

No matter if you're a money pro or just starting, these books are here to share tips, tricks, and wisdom from lots of smart people. So, let's dive into the world of money wisdom and see how these books can help you on your financial journey!

Here are 50 of the best personal finance books available today:

- "The Richest Man in Babylon" by George S. Clason

- "Think and Grow Rich" by Napoleon Hill

- "Your Money or Your Life" by Vicki Robin and Joe Dominguez

- "The Millionaire Next Door" by Thomas J. Stanley and William D. Danko

- "Rich Dad Poor Dad" by Robert T. Kiyosaki

- "The Total Money Makeover" by Dave Ramsey

- "Nudge" by Richard H. Thaler and Cass R. Sunstein

- "Predictably Irrational" by Dan Ariely

- "The Intelligent Investor" by Benjamin Graham

- "A Random Walk Down Wall Street" by Burton G. Malkiel

- "Broke Millennial" by Erin Lowry

- "I Will Teach You to Be Rich" by Ramit Sethi

- "The Bogleheads' Guide to Investing" by Taylor Larimore, Mel Lindauer, and Michael LeBoeuf

- "The Automatic Millionaire" by David Bach

- "The Lean Startup" by Eric Ries

- "The $100 Startup" by Chris Guillebeau

- "The Budgeting Habit" by S.J. Scott and Rebecca Livermore

- "Smart Women Finish Rich" by David Bach

- "The Index Card" by Helaine Olen and Harold Pollack

- "The ABCs of Real Estate Investing" by Ken McElroy

- "Rich Bitch" by Nicole Lapin

- "The Four-Hour Workweek" by Timothy Ferriss

- "The Little Book of Common Sense Investing" by John C. Bogle

- "Money: Master the Game" by Tony Robbins

- "The Simple Path to Wealth" by J.L. Collins

- "Women & Money" by Suze Orman

- "The Behavior Gap" by Carl Richards

- "The Millionaire Fastlane" by MJ DeMarco

- "The Wealthy Barber" by David Chilton

- "The Millionaire Real Estate Investor" by Gary Keller

- "The 5 Mistakes Every Investor Makes and How to Avoid Them" by Peter Mallouk

- "You Are a Badass at Making Money" by Jen Sincero

- "The One-Page Financial Plan" by Carl Richards

- "The Power of Broke" by Daymond John

- "Your Score: An Insider's Secrets to Understanding, Controlling, and Protecting Your Credit Score" by Anthony Davenport

- "The Money Book for the Young, Fabulous & Broke" by Suze Orman

- "The Art of Money" by Bari Tessler

- "The Million-Dollar, One-Person Business" by Elaine Pofeldt

- "The Millionaire Mind" by Thomas J. Stanley

- "The Millionaire Real Estate Agent" by Gary Keller

- "The Truth About Money" by Ric Edelman

- "The Soul of Money" by Lynne Twist

- "The Millionaire Messenger" by Brendon Burchard

- "The Financial Diet" by Chelsea Fagan and Lauren Ver Hage

- "The Little Book of Value Investing" by Christopher H. Browne

- "The Elements of Investing" by Burton G. Malkiel and Charles D. Ellis

- "Money Rules" by Jean Chatzky

- "The Automatic Customer" by John Warrillow

- "The Millionaire in the Mirror" by Gene Bedell

- "The Millionaire Real Estate Mindset" by Russ Whitney"

Read the full article

1 note

·

View note