Don't wanna be here? Send us removal request.

Text

Key Challenges in the Source-to-Contract Process and How to Overcome Them

The source-to-contract (S2C) process is a critical component of procurement, encompassing everything from identifying potential suppliers to finalizing contracts. Despite its importance, many organizations face significant challenges throughout this process. Understanding these challenges and implementing strategies to overcome them can lead to more efficient procurement operations and better contract outcomes. In this blog, we will explore the key challenges in the source-to-contract process and provide practical solutions to address them.

1. Lack of Visibility and Transparency

Challenge: One of the most common challenges in the S2C process is a lack of visibility and transparency. Without clear insights into supplier performance, contract terms, and procurement activities, it can be difficult to make informed decisions and manage risks effectively.

Solution: Implement a centralized procurement platform that offers real-time visibility into all aspects of the S2C process. This platform should provide access to supplier information, contract details, and procurement metrics. Regularly review and update this data to ensure that it remains accurate and relevant. By consolidating information and improving transparency, you can enhance decision-making and mitigate potential risks.

2. Inefficient Supplier Management

Challenge: Managing supplier relationships can be cumbersome, especially if processes are manual or fragmented. Ineffective supplier management can lead to delays, poor performance, and missed opportunities for cost savings.

Solution: Adopt a comprehensive supplier management system that automates key tasks such as onboarding, performance evaluation, and communication. Establish clear criteria for supplier selection and regularly assess supplier performance against these criteria. Use data analytics to identify trends and areas for improvement. Streamlining supplier management processes will help build stronger relationships and drive better procurement outcomes.

3. Complex Contract Negotiations

Challenge: Negotiating contracts can be complex and time-consuming, particularly when dealing with multiple stakeholders and complex terms. Inefficient negotiations can lead to extended timelines and suboptimal contract terms.

Solution: Leverage contract management software that supports collaborative contract negotiations. This software should offer features such as version control, comment tracking, and automated workflows. Clearly define negotiation objectives and establish a structured process for reviewing and approving contract terms. By using technology to streamline negotiations and facilitate collaboration, you can accelerate the contract process and secure more favorable terms.

4. Compliance and Risk Management

Challenge: Ensuring compliance with legal and regulatory requirements is a significant challenge in the S2C process. Non-compliance can result in legal issues, financial penalties, and reputational damage.

Solution: Develop a robust compliance framework that includes regular audits, risk assessments, and updated policies. Use contract management software to automate compliance checks and ensure that all contractual obligations are met. Stay informed about relevant regulations and industry standards, and incorporate compliance requirements into your contract templates and procurement processes. By proactively managing compliance and risk, you can safeguard your organization against potential issues.

5. Ineffective Data Management

Challenge: Managing and analyzing data effectively is crucial for optimizing the S2C process. Poor data management can lead to inaccurate forecasts, inefficient procurement practices, and missed opportunities for cost savings.

Solution: Invest in data analytics tools that provide actionable insights into procurement activities and supplier performance. Implement a centralized data repository that integrates with your procurement and contract management systems. Regularly analyze data to identify trends, track key performance indicators, and make informed decisions. Effective data management will enable you to optimize procurement strategies and drive continuous improvement.

6. Limited Collaboration

Challenge: The S2C process often involves multiple departments and stakeholders, each with their own priorities and objectives. Limited collaboration can lead to misaligned goals, fragmented processes, and inefficient decision-making.

Solution: Foster a culture of collaboration by implementing tools that facilitate communication and coordination among stakeholders. Use collaborative platforms that enable real-time document sharing, discussion threads, and task management. Clearly define roles and responsibilities, and establish regular check-ins to ensure alignment. By enhancing collaboration, you can improve process efficiency and achieve better procurement outcomes.

youtube

Conclusion

The source-to-contract process is a critical element of procurement that presents several challenges, from lack of visibility and inefficient supplier management to complex contract negotiations and compliance issues. By addressing these challenges with the right strategies and technologies, organizations can streamline their S2C processes, enhance supplier relationships, and achieve more favorable contract outcomes. Embracing a proactive approach to managing these challenges will ultimately lead to a more efficient and effective procurement function.1

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

The Future of Procurement: Why Procure-to-Pay Automation is Essential

In an era where businesses are constantly seeking ways to enhance efficiency and reduce costs, procure-to-pay (P2P) automation is emerging as a game-changer in procurement processes. This transformative approach integrates technology to streamline the entire procurement cycle, from requisition to payment. As we look towards the future of procurement, understanding why P2P automation is essential can provide valuable insights into its benefits and its role in shaping the future of business operations.

1. Streamlining Procurement Processes

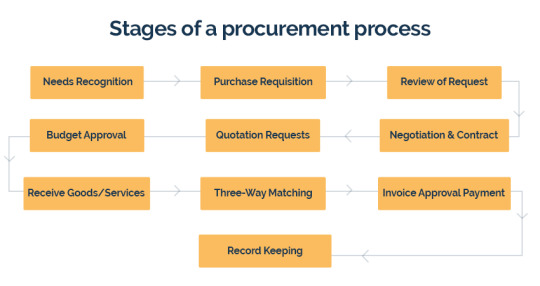

The primary advantage of P2P automation is its ability to streamline procurement processes. Traditionally, procurement involves numerous manual steps, including purchase requisitions, approvals, purchase orders, invoice processing, and payments. Each step is susceptible to errors and delays, which can significantly impact operational efficiency. P2P automation eliminates these manual tasks by integrating them into a single, cohesive system. Automated workflows ensure that purchase requisitions are processed quickly, approvals are handled efficiently, and purchase orders are generated accurately. This streamlined approach not only speeds up the procurement process but also reduces the risk of human error.

2. Enhancing Visibility and Control

One of the significant challenges in traditional procurement is the lack of visibility into the entire process. With multiple departments and stakeholders involved, tracking the status of orders, approvals, and payments can be cumbersome. P2P automation provides real-time visibility into every stage of the procurement cycle. Dashboards and reporting tools offer insights into order statuses, spending patterns, and supplier performance. This enhanced visibility allows businesses to make informed decisions, identify potential issues before they escalate, and maintain better control over procurement activities.

3. Improving Compliance and Reducing Risk

Compliance with internal policies and external regulations is crucial for businesses, yet it can be challenging to enforce manually. P2P automation helps mitigate compliance risks by enforcing standardized processes and ensuring adherence to company policies. Automated workflows include built-in compliance checks, such as approval hierarchies and budget limits, which help prevent unauthorized purchases and overspending. Additionally, automation facilitates accurate record-keeping, making it easier to provide documentation for audits and regulatory reviews.

4. Driving Cost Savings

Cost savings are a key driver behind the adoption of P2P automation. Manual procurement processes are often labor-intensive, leading to higher administrative costs. By automating routine tasks, businesses can reduce the need for manual intervention, thereby lowering operational costs. Moreover, automation enables better negotiation with suppliers by providing insights into spending patterns and identifying opportunities for bulk purchasing or discounts. The result is a more cost-effective procurement process that contributes to the overall financial health of the organization.

5. Enhancing Supplier Relationships

Effective supplier management is vital for a successful procurement process. P2P automation improves supplier relationships by providing a more transparent and efficient process. Suppliers receive timely purchase orders and payment notifications, reducing delays and misunderstandings. Automated systems also facilitate better communication and collaboration with suppliers, enabling quicker resolution of issues and fostering stronger partnerships. By streamlining interactions with suppliers, businesses can enhance their procurement strategy and build more reliable supply chains.

6. Supporting Strategic Decision-Making

P2P automation provides valuable data and analytics that support strategic decision-making. Automated systems collect and analyze data from various stages of the procurement process, offering insights into spending patterns, supplier performance, and process efficiency. This data-driven approach enables procurement professionals to make informed decisions, optimize procurement strategies, and identify areas for improvement. By leveraging analytics, businesses can enhance their procurement practices and align them with overall organizational goals.

youtube

Conclusion

The future of procurement is undeniably linked to the adoption of procure-to-pay automation. By streamlining processes, enhancing visibility, improving compliance, driving cost savings, and strengthening supplier relationships, P2P automation offers a comprehensive solution to modern procurement challenges. As businesses continue to embrace digital transformation, the shift towards automated procurement processes will play a crucial role in achieving operational excellence and maintaining a competitive edge.

Investing in P2P automation is not just a strategic move; it is an essential step towards optimizing procurement practices and preparing for the future. With its ability to enhance efficiency and drive cost savings, P2P automation is poised to become a cornerstone of successful procurement strategies in the years to come.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Source-to-Pay vs. Procure-to-Pay: Which Process is Right for Your Business?

In today’s competitive business environment, optimizing procurement processes is essential for operational efficiency and cost management. Two common procurement processes that businesses often evaluate are Source-to-Pay (S2P) and Procure-to-Pay (P2P). Both methodologies aim to streamline procurement and payment activities, but they differ in scope and focus. Understanding these differences can help you choose the best process for your business needs.

What is Source-to-Pay?

Source-to-Pay (S2P) is a comprehensive procurement process that covers the entire lifecycle of sourcing and purchasing goods and services. It starts with sourcing—identifying and selecting suppliers—and extends through to payment. The S2P process includes:

Sourcing and Supplier Selection: Identifying potential suppliers, negotiating contracts, and selecting the best fit for your needs.

Procurement: Creating purchase orders and managing the procurement of goods and services.

Contract Management: Overseeing supplier agreements and ensuring compliance.

Payment: Processing invoices and making payments to suppliers.

S2P provides a holistic view of procurement, integrating various activities into a single workflow. This end-to-end approach can enhance visibility, improve supplier relationships, and streamline operations.

What is Procure-to-Pay?

Procure-to-Pay (P2P) is a more focused process that specifically handles the transaction aspects of procurement. It starts with the procurement of goods and services and ends with the payment to suppliers. The P2P process typically involves:

Requisition: Employees submit purchase requests for approval.

Purchase Order (PO) Creation: Approved requisitions are converted into purchase orders.

Order Fulfillment: Suppliers deliver the goods or services.

Invoice Processing: Suppliers submit invoices for the delivered goods or services.

Payment: Invoices are processed, and payments are made to suppliers.

P2P emphasizes efficiency in handling transactions and payments, focusing on reducing procurement cycle times and managing cash flow.

Comparing S2P and P2P

Scope and Complexity: S2P is broader in scope, covering the entire procurement lifecycle from supplier selection to payment. It integrates sourcing, procurement, and payment, making it suitable for organizations seeking a comprehensive procurement solution. On the other hand, P2P focuses specifically on the procurement and payment aspects, which can be beneficial for businesses that need to streamline these particular areas.

Strategic vs. Transactional Focus: S2P offers a strategic approach by incorporating sourcing and contract management, which can lead to better supplier relationships and cost savings. It is ideal for businesses that prioritize strategic procurement and supplier management. P2P, with its transactional focus, excels in improving efficiency and accuracy in handling orders and payments, making it suitable for businesses aiming to optimize these specific processes.

Integration and Automation: S2P systems often require more robust integration capabilities due to their comprehensive nature. They typically include advanced features for sourcing, contract management, and spend analysis. P2P systems, while potentially simpler, still benefit from automation to handle transactions efficiently and reduce manual processing errors.

Cost and Implementation: Implementing an S2P system can be more resource-intensive due to its broad scope and integration requirements. It may involve higher initial costs and a longer implementation period. P2P systems, with their narrower focus, can be quicker and less costly to implement, making them a good choice for businesses with more immediate transactional needs.

Which Process is Right for Your Business?

Choosing between S2P and P2P depends on your business’s specific needs and objectives. If your goal is to enhance overall procurement strategy, improve supplier relationships, and integrate sourcing with procurement and payment, an S2P approach may be more suitable. However, if you are primarily looking to optimize the transactional aspects of procurement and streamline order-to-payment processes, a P2P system could be the better choice.

Consider factors such as the complexity of your procurement needs, your budget, and your long-term goals when making your decision. Both S2P and P2P processes offer distinct advantages, and the right choice will align with your business’s operational requirements and strategic objectives.

youtube

Conclusion

Both Source-to-Pay and Procure-to-Pay processes have their own strengths and focus areas. By understanding the differences and evaluating your business needs, you can select the process that best aligns with your goals, ensuring efficient procurement operations and effective supplier management.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Top Benefits of Implementing a Source-to-Contract System

In today's competitive business environment, optimizing procurement processes is essential for maintaining efficiency and achieving cost savings. Implementing a Source-to-Contract (S2C) system can significantly enhance your procurement strategy by streamlining the process from sourcing to contract management. This blog explores the top benefits of adopting a Source-to-Contract system and how it can transform your procurement operations.

1. Improved Procurement Efficiency

One of the primary benefits of a Source-to-Contract system is the significant improvement in procurement efficiency. By automating and integrating the entire procurement process—from sourcing and supplier evaluation to contract creation and management—businesses can eliminate manual tasks and reduce processing time. This automation speeds up procurement cycles, allowing teams to focus on more strategic activities and reducing the risk of errors.

2. Enhanced Supplier Management

Effective supplier management is crucial for maintaining strong vendor relationships and ensuring consistent quality. A Source-to-Contract system provides tools for better supplier evaluation, selection, and performance monitoring. With centralized supplier information and performance metrics, procurement teams can make data-driven decisions, negotiate better terms, and foster stronger partnerships with key suppliers.

3. Increased Cost Savings

Cost control and savings are critical for any organization. A Source-to-Contract system helps identify cost-saving opportunities by providing comprehensive insights into supplier pricing, contract terms, and market trends. By leveraging data analytics and strategic sourcing tools, businesses can negotiate more favorable terms, optimize spending, and achieve significant cost reductions over time.

4. Greater Compliance and Risk Management

Compliance with regulatory requirements and risk management are essential aspects of procurement. A Source-to-Contract system helps ensure that all procurement activities adhere to company policies and legal regulations. Automated workflows and standardized processes minimize the risk of non-compliance, while built-in risk assessment tools help identify and mitigate potential risks associated with suppliers and contracts.

5. Streamlined Contract Management

Managing contracts efficiently is key to maximizing their value. A Source-to-Contract system offers robust contract management features, including automated contract creation, approval workflows, and renewals. Centralized contract repositories provide easy access to contract documents and key dates, reducing the risk of missed deadlines and contract expirations. This streamlined approach ensures that contracts are executed and managed effectively throughout their lifecycle.

6. Enhanced Visibility and Reporting

Transparency and visibility into procurement activities are vital for informed decision-making. A Source-to-Contract system provides real-time visibility into sourcing processes, supplier performance, and contract compliance. Advanced reporting and analytics tools offer actionable insights into procurement metrics, allowing businesses to track performance, identify trends, and make data-driven decisions to drive continuous improvement.

7. Improved Collaboration

Effective collaboration between procurement teams and stakeholders is essential for successful sourcing and contract management. A Source-to-Contract system facilitates better collaboration through shared platforms and communication tools. Team members, suppliers, and other stakeholders can access relevant information, participate in discussions, and collaborate on sourcing strategies and contract negotiations, leading to more effective and efficient outcomes.

8. Optimized Sourcing Strategies

Strategic sourcing is critical for gaining a competitive edge. A Source-to-Contract system provides valuable insights into market conditions, supplier capabilities, and pricing trends. By leveraging these insights, procurement teams can develop and execute more effective sourcing strategies, identify the best suppliers, and secure favorable terms that align with business objectives.

9. Scalability and Flexibility

As businesses grow, their procurement needs evolve. A Source-to-Contract system offers scalability and flexibility to accommodate changing requirements. Whether it's managing an increasing volume of contracts, expanding into new markets, or adapting to evolving business needs, a robust S2C system can scale with your organization and support its growth.

10. Enhanced User Experience

User experience is a crucial factor in the successful adoption of any system. A Source-to-Contract system provides an intuitive and user-friendly interface that simplifies the procurement process for all users. Easy navigation, customizable dashboards, and streamlined workflows enhance the overall user experience, leading to higher adoption rates and greater satisfaction among procurement teams and stakeholders.

youtube

Conclusion

Implementing a Source-to-Contract system offers numerous benefits for organizations looking to optimize their procurement processes. From improved efficiency and cost savings to enhanced compliance and collaboration, a well-integrated S2C system can transform procurement operations and drive significant value for your business. By leveraging the capabilities of a Source-to-Contract system, you can streamline your procurement activities, achieve strategic goals, and position your organization for long-term success.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Key Features to Look for in a Procure-to-Pay Automation Solution

In today’s competitive business landscape, optimizing procurement processes is crucial for maintaining efficiency and controlling costs. A Procure-to-Pay (P2P) automation solution can streamline your procurement workflow, enhance transparency, and improve compliance. When selecting a P2P automation solution, it's important to consider several key features to ensure it meets your business needs and integrates seamlessly with your existing systems. This blog outlines the essential features to look for in a Procure-to-Pay automation solution to help you make an informed decision.

1. User-Friendly Interface

A user-friendly interface is crucial for ensuring that your team can quickly adapt to the new system without extensive training. Look for a P2P automation solution with an intuitive and easy-to-navigate interface. This feature helps reduce the learning curve, encourages user adoption, and minimizes errors during the procurement process.

2. Integration Capabilities

The ability to integrate with your existing enterprise resource planning (ERP) systems and other business applications is essential. Choose a P2P automation solution that offers seamless integration with your ERP, accounting software, and other relevant systems. This ensures smooth data flow across your organization, reduces manual data entry, and enhances overall efficiency.

3. Automated Purchase Order Creation

Automating the creation of purchase orders (POs) can significantly speed up the procurement process. Look for a solution that allows for automated PO generation based on predefined rules or triggers. This feature helps ensure that POs are created accurately and promptly, reducing delays and improving order accuracy.

4. Advanced Approval Workflows

Effective approval workflows are critical for maintaining control over procurement activities. A robust P2P automation solution should offer customizable approval workflows that align with your organization’s policies and processes. This feature ensures that all purchase requests are reviewed and approved by the appropriate personnel, helping prevent unauthorized spending and improving compliance.

5. Supplier Management and Collaboration

An integrated supplier management feature allows you to maintain up-to-date supplier information, track performance, and manage relationships effectively. Look for a P2P automation solution that provides tools for supplier onboarding, performance evaluation, and communication. Enhanced supplier collaboration can lead to better negotiations, improved service levels, and stronger business relationships.

6. Invoice Management and Matching

Automated invoice management is a key feature that helps streamline the accounts payable process. Choose a solution that offers automated invoice matching, ensuring that invoices are matched against purchase orders and receipts before payment is processed. This reduces errors, prevents duplicate payments, and ensures that only accurate and authorized invoices are paid.

7. Real-Time Reporting and Analytics

Real-time reporting and analytics capabilities provide valuable insights into your procurement activities. Look for a P2P automation solution that offers customizable dashboards and reporting tools. These features allow you to track key metrics, monitor performance, and identify trends, helping you make data-driven decisions and improve procurement strategies.

8. Compliance and Audit Trails

Compliance with regulatory requirements and internal policies is crucial in procurement. A good P2P automation solution should provide robust audit trails and compliance features. This includes tracking and documenting all procurement activities, approvals, and changes, ensuring that you can easily review and demonstrate compliance during audits.

9. Scalability and Flexibility

As your business grows, your P2P automation solution should be able to scale and adapt to changing needs. Choose a solution that offers flexibility in terms of user capacity, transaction volume, and functionality. Scalability ensures that the system can accommodate future growth and evolving business requirements without requiring a complete overhaul.

10. Security and Data Protection

Protecting sensitive procurement data is essential for maintaining trust and compliance. Look for a P2P automation solution with strong security features, including data encryption, user authentication, and access controls. Ensuring that your data is secure helps prevent unauthorized access and protects against potential breaches.

youtube

Conclusion

Selecting the right Procure-to-Pay automation solution can transform your procurement process, enhance efficiency, and improve financial control. By focusing on key features such as a user-friendly interface, integration capabilities, automated PO creation, advanced approval workflows, supplier management, invoice management, real-time reporting, compliance, scalability, and security, you can choose a solution that aligns with your business needs and supports your growth.

Investing in a comprehensive P2P automation solution can lead to significant cost savings, reduced manual effort, and improved procurement outcomes, helping your organization stay competitive in a dynamic market.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How to Implement a Purchase Order System in Your Small Business: A Step-by-Step Guide

Implementing a purchase order (PO) system in your small business can streamline operations, improve accuracy, and enhance control over your procurement process. Here’s a step-by-step guide to help you integrate a PO system effectively.

1. Assess Your Needs

Before diving into the implementation, evaluate your business’s specific needs. Consider factors such as the volume of purchases, the complexity of your supply chain, and the size of your team. Understanding these requirements will help you select a PO system that aligns with your business objectives.

2. Choose the Right Purchase Order System

There are various types of PO systems available, ranging from simple spreadsheets to sophisticated cloud-based solutions. Key features to look for include:

Ease of Use: Ensure the system is user-friendly and fits the technical expertise of your team.

Integration Capabilities: Choose a system that integrates seamlessly with your existing accounting or ERP systems.

Scalability: Select a solution that can grow with your business.

For small businesses, cloud-based systems often provide the best balance of affordability and functionality.

3. Define Your Workflow

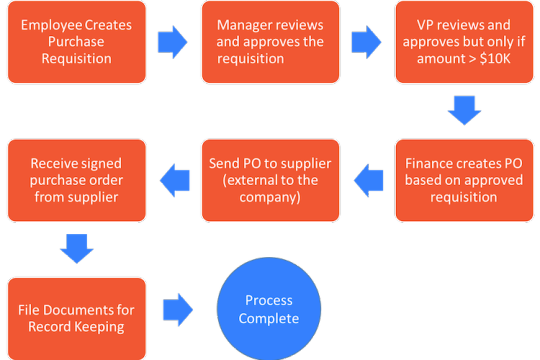

Map out the purchase order workflow to ensure all processes are clearly defined. This typically includes:

Request for Purchase: Employees submit purchase requests with details about the required goods or services.

Approval Process: Establish who will review and approve purchase requests.

Order Creation: Once approved, create and issue purchase orders to suppliers.

Receipt and Verification: Confirm receipt of goods or services and match them against the purchase order.

Payment Processing: Ensure timely payment to suppliers according to the agreed terms.

Having a well-defined workflow helps in minimizing errors and ensuring compliance.

4. Set Up the System

Follow these steps to set up your chosen PO system:

Create User Accounts: Set up accounts for employees who will be using the system. Define their roles and permissions based on their responsibilities.

Customize Templates: Configure purchase order templates to match your business needs. Include essential information such as company logo, payment terms, and delivery details.

Input Supplier Information: Enter details about your suppliers into the system. This helps in generating purchase orders and tracking supplier performance.

Train Your Team: Provide training to ensure everyone understands how to use the new system effectively. Offer resources and support to address any questions or issues.

5. Test the System

Before fully implementing the PO system, conduct a test run to identify and resolve any issues. Process a few sample purchase orders to ensure the system is functioning as expected. Check for integration issues, accuracy of data, and overall system performance.

6. Go Live

Once testing is complete and any issues have been addressed, transition to the new system. Inform your team about the go-live date and ensure that everyone starts using the system as planned.

7. Monitor and Optimize

After implementation, regularly monitor the system’s performance and gather feedback from users. Look for areas where the system can be improved or optimized. Regularly review supplier performance and adjust your processes to enhance efficiency and effectiveness.

8. Maintain Compliance

Ensure that your PO system complies with relevant regulations and industry standards. Regularly review and update your system to meet changing requirements and to address any security concerns.

youtube

Conclusion

Implementing a purchase order system in your small business can significantly improve your procurement process, increase efficiency, and reduce errors. By following these steps—assessing your needs, choosing the right system, defining workflows, setting up the system, testing, going live, and continuously optimizing—you’ll be well on your way to a streamlined and effective purchasing operation.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

The Complete Guide to Purchase Requisition vs. Purchase Order

In the world of procurement, understanding the difference between a purchase requisition and a purchase order is crucial for ensuring smooth and efficient operations. Both documents play vital roles in the procurement process, but they serve different purposes. This guide provides a comprehensive overview of purchase requisitions and purchase orders, highlighting their key differences and functions.

What is a Purchase Requisition?

A purchase requisition is an internal document used by an employee or department within an organization to request the purchase of goods or services. It is essentially a formal request to initiate the procurement process. The requisition typically includes details such as:

Description of Goods/Services: What is needed and why.

Quantity Required: The amount of goods or services requested.

Desired Delivery Date: When the items or services are needed.

Cost Estimates: An estimate of the cost involved.

Account Codes: To allocate the expenditure to the appropriate budget.

The primary purpose of a purchase requisition is to communicate the need for goods or services and to seek approval from the relevant authorities before any procurement action is taken. It helps organizations control spending and ensures that purchases are made according to established policies.

What is a Purchase Order?

A purchase order (PO) is a formal, legally binding document issued by a buyer to a supplier, confirming the purchase of goods or services. It follows the approval of a purchase requisition and acts as a contract between the buyer and the supplier. A purchase order typically includes:

Purchase Order Number: A unique identifier for tracking the order.

Supplier Information: Contact details of the supplier.

Description of Goods/Services: Detailed information on what is being purchased.

Quantity and Price: The amount of goods or services and the agreed-upon price.

Delivery Terms: Shipping details, delivery date, and location.

Payment Terms: Conditions under which payment will be made.

The purchase order is used to confirm the terms of the purchase and serves as a record of the transaction. It provides a clear and documented agreement between the buyer and supplier, reducing the risk of misunderstandings or disputes.

Key Differences Between Purchase Requisition and Purchase Order

Purpose:

Purchase Requisition: Used internally to request approval for a purchase. It initiates the procurement process.

Purchase Order: Used externally to place an order with a supplier. It confirms the purchase and details the agreement.

Approval Process:

Purchase Requisition: Requires internal approval from managers or relevant authorities before proceeding.

Purchase Order: Issued after the requisition is approved and usually requires confirmation from the supplier.

Document Type:

Purchase Requisition: An internal document used within the organization.

Purchase Order: An external document sent to the supplier, often legally binding.

Usage:

Purchase Requisition: Helps manage and control internal requests for procurement.

Purchase Order: Functions as a contract and a record of the transaction with the supplier.

Why Understanding These Differences Matters

Understanding the distinctions between purchase requisitions and purchase orders is essential for effective procurement management. It ensures that:

Procurement Processes Are Streamlined: Clear separation of internal requests and external orders helps in managing the flow of procurement activities.

Control and Accountability Are Maintained: Proper documentation and approval processes prevent unauthorized purchases and ensure compliance with organizational policies.

Supplier Relationships Are Managed Effectively: Accurate purchase orders help in setting clear expectations and terms with suppliers, reducing potential conflicts.

youtube

Conclusion

In summary, purchase requisitions and purchase orders are fundamental components of the procurement process, each serving distinct roles. A purchase requisition is an internal request for approval, while a purchase order is a formal external agreement with a supplier. By understanding and effectively managing both documents, organizations can enhance their procurement processes, ensure compliance, and maintain better control over spending.

For optimal results, businesses should integrate these processes into a cohesive procurement strategy, leveraging technology and best practices to streamline operations and achieve operational excellence.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How a Cloud Purchase Order System Can Streamline Your Procurement Process

In today's fast-paced business environment, efficiency and accuracy are critical for maintaining a competitive edge. One of the key areas where businesses can gain significant improvements is in their procurement process. Adopting a cloud-based purchase order (PO) system is an effective way to streamline procurement, reduce costs, and enhance operational efficiency. Here’s how a cloud purchase order system can transform your procurement process.

1. Centralized Management and Access

A cloud purchase order system offers centralized management of procurement activities. This means that all purchase orders, approvals, and supplier communications are stored in a single, easily accessible platform. With cloud-based systems, employees can access real-time data from anywhere with an internet connection, which is especially beneficial for businesses with multiple locations or remote teams. This centralized approach ensures that everyone involved in the procurement process has access to the most current information, reducing errors and improving collaboration.

2. Enhanced Automation and Efficiency

Automation is one of the standout features of cloud purchase order systems. Routine tasks such as order creation, approval workflows, and invoice processing can be automated, significantly reducing the time and effort required to manage procurement. For instance, when a purchase request is submitted, the system can automatically route it through the necessary approval channels, notify relevant stakeholders, and generate purchase orders without manual intervention. This level of automation minimizes human error, speeds up the procurement process, and frees up valuable time for procurement teams to focus on strategic activities.

3. Improved Accuracy and Compliance

Manual procurement processes are prone to errors, such as incorrect data entry or missed approvals. Cloud purchase order systems help mitigate these risks by providing features like validation rules, audit trails, and compliance checks. These systems ensure that purchase orders adhere to company policies and regulatory requirements, reducing the likelihood of compliance issues and financial discrepancies. Additionally, the system's ability to integrate with other enterprise resource planning (ERP) tools further enhances accuracy by synchronizing data across various functions.

4. Real-Time Reporting and Analytics

Data-driven decision-making is crucial for optimizing procurement strategies. Cloud purchase order systems offer real-time reporting and analytics capabilities, providing insights into purchasing patterns, supplier performance, and budget utilization. With these insights, businesses can make informed decisions about supplier selection, negotiate better terms, and identify opportunities for cost savings. The ability to generate and analyze reports in real time also helps in monitoring key performance indicators (KPIs) and ensuring that procurement activities align with organizational goals.

5. Scalability and Flexibility

As businesses grow, their procurement needs often become more complex. Cloud purchase order systems are designed to scale with your business, offering flexibility to accommodate increasing transaction volumes and additional users. Unlike traditional on-premises systems, cloud-based solutions can be easily adjusted to meet changing requirements without the need for extensive hardware upgrades or system overhauls. This scalability ensures that your procurement process remains efficient and effective, regardless of your business size or growth trajectory.

6. Enhanced Supplier Collaboration

Effective supplier collaboration is essential for a smooth procurement process. Cloud purchase order systems facilitate better communication with suppliers through integrated portals and real-time updates. Suppliers can access purchase orders, track order statuses, and submit invoices directly through the system, leading to faster response times and fewer disputes. This enhanced collaboration helps build stronger supplier relationships and ensures that procurement activities are executed seamlessly.

7. Cost Savings

Implementing a cloud purchase order system can result in significant cost savings for your business. By automating manual processes, reducing errors, and improving procurement efficiency, businesses can lower administrative costs and minimize the risk of costly mistakes. Additionally, the insights gained from real-time reporting can help identify opportunities for cost reduction and better supplier negotiation, further contributing to overall savings.

youtube

Conclusion

A cloud purchase order system is a powerful tool for streamlining procurement processes, enhancing accuracy, and improving efficiency. By centralizing management, automating tasks, and providing valuable insights, these systems enable businesses to optimize their procurement activities and achieve better results. As businesses continue to evolve, adopting a cloud-based approach to procurement will be increasingly essential for staying competitive and maintaining operational excellence.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Why Every Small Business Needs a Purchase Order System: Key Advantages

In the fast-paced world of small business management, efficiency and accuracy are crucial. One tool that can significantly enhance both aspects is a purchase order (PO) system. While larger corporations have long recognized the benefits of POs, small businesses can reap just as many rewards by adopting this essential system. Here’s why every small business needs a purchase order system and the key advantages it offers.

1. Enhanced Accuracy and Reduced Errors

One of the primary benefits of a purchase order system is the reduction in errors. Manual processes, such as verbal orders or email confirmations, are prone to mistakes, whether due to miscommunication or simple human error. A PO system standardizes the ordering process, ensuring that all necessary details—such as item descriptions, quantities, and prices—are recorded accurately. This minimizes the risk of receiving incorrect goods or services, leading to fewer disputes and smoother transactions.

2. Improved Financial Control

A PO system provides better financial control by creating a formal record of each purchase. This record includes details about what was ordered, the cost, and the delivery schedule. By tracking POs, small businesses can more easily manage their budgets, avoid overspending, and ensure that expenditures align with their financial plans. Additionally, having a clear paper trail simplifies reconciliation processes and financial audits, making it easier to track expenses and manage cash flow.

3. Streamlined Procurement Process

For small businesses, time is often as valuable as money. A purchase order system streamlines the procurement process by automating various tasks. Instead of manually processing orders, businesses can generate and approve POs electronically, reducing administrative burden and speeding up order fulfillment. Automation also helps maintain consistency in the ordering process, which can lead to better vendor relationships and more reliable delivery schedules.

4. Better Vendor Management

Effective vendor management is crucial for maintaining good supplier relationships and ensuring reliable service. A purchase order system enhances vendor management by providing a clear and organized record of all transactions. This transparency helps businesses track performance, manage contracts, and address any issues that arise. Additionally, having a formal record of orders and communications helps in resolving disputes and negotiating better terms with vendors.

5. Enhanced Inventory Management

Inventory management can be a challenge for small businesses, especially those with limited resources. A PO system aids in managing inventory by providing real-time data on orders and stock levels. Businesses can use this data to forecast demand, optimize inventory levels, and avoid stockouts or overstocking. This proactive approach to inventory management helps ensure that businesses can meet customer demand without tying up excessive capital in inventory.

6. Increased Compliance and Accountability

Compliance with industry regulations and internal policies is essential for small businesses to avoid legal issues and maintain operational standards. A purchase order system supports compliance by creating a documented record of all purchasing activities. This record helps ensure that orders adhere to company policies and regulatory requirements. Additionally, the system assigns accountability by tracking who authorized each purchase, providing a clear audit trail in case of discrepancies or reviews.

7. Improved Reporting and Analytics

A PO system provides valuable data that can be used for reporting and analysis. Businesses can generate reports on purchasing trends, supplier performance, and expenditure patterns. This data-driven approach allows small businesses to make informed decisions, identify opportunities for cost savings, and improve overall procurement strategies. Enhanced reporting also supports strategic planning and helps businesses adapt to changing market conditions.

youtube

Conclusion

For small businesses, a purchase order system is not just a tool but a strategic asset that enhances accuracy, control, and efficiency. By investing in a PO system, small businesses can streamline their procurement processes, improve financial management, and build stronger vendor relationships. The key advantages of a purchase order system—such as reduced errors, better financial oversight, and improved inventory management—make it an indispensable component of modern business operations. As small businesses continue to grow and compete in an ever-changing market, adopting a purchase order system can provide the competitive edge needed to thrive.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Purchase Requisition vs. Purchase Order: Which One Do You Need?

When managing procurement processes, understanding the difference between a purchase requisition and a purchase order is crucial. Both are essential components in the purchasing workflow, but they serve distinct purposes and are used at different stages. This blog will explore the key differences between purchase requisitions and purchase orders, helping you determine which one you need for your business.

What is a Purchase Requisition?

A purchase requisition is an internal document used within an organization to request the purchase of goods or services. It is typically created by an employee or department when there is a need for items that are not currently available in inventory. The requisition serves as a formal request to the purchasing department to initiate the procurement process.

Key Features of a Purchase Requisition:

Internal Document: A purchase requisition is used within the organization and does not involve external parties.

Approval Process: Before a purchase requisition can be processed, it usually requires approval from relevant stakeholders or managers.

Details Included: It typically includes details such as the description of the items, quantity needed, preferred suppliers, and estimated costs.

Purpose: The main purpose is to ensure that all purchases are justified and that appropriate budgetary controls are in place.

What is a Purchase Order?

A purchase order (PO) is a formal document issued by a buyer to a supplier, indicating the buyer’s intention to purchase goods or services at specified terms and conditions. It is a legally binding agreement that outlines the specifics of the purchase, including the price, delivery date, and payment terms.

Key Features of a Purchase Order:

External Document: A purchase order is sent to a supplier or vendor and forms part of the contractual agreement between the buyer and the seller.

Legally Binding: Once accepted by the supplier, a purchase order becomes a legally binding contract.

Details Included: It includes detailed information such as item descriptions, quantities, prices, delivery dates, and payment terms.

Purpose: The primary purpose is to formalize the purchase agreement and ensure that both parties are clear about the terms and conditions of the transaction.

Purchase Requisition vs. Purchase Order: Key Differences

Purpose and Usage:

Purchase Requisition: Used internally to request approval for a purchase. It helps manage internal budgeting and approval processes.

Purchase Order: Used externally to place an order with a supplier. It formalizes the agreement and details the terms of the purchase.

Approval and Authorization:

Purchase Requisition: Requires internal approval before a purchase order can be issued. It is a request for authorization.

Purchase Order: Issued after the purchase requisition has been approved. It confirms the purchase agreement with the supplier.

Stage in the Procurement Process:

Purchase Requisition: Created at the beginning of the procurement process when there is a need for goods or services.

Purchase Order: Created after the requisition is approved, to place the actual order with the supplier.

Legal and Contractual Status:

Purchase Requisition: Not legally binding. It is an internal document used to manage and track requests.

Purchase Order: Legally binding contract once accepted by the supplier. It ensures that the supplier is obligated to deliver the goods or services as specified.

Which One Do You Need?

The choice between a purchase requisition and a purchase order depends on the stage of the procurement process you are in:

If you need to request approval for a purchase internally, you should use a purchase requisition. It helps in managing internal controls, approvals, and budget considerations.

If you are ready to place an order with a supplier and need to formalize the purchase agreement, you should use a purchase order. It ensures that the terms of the purchase are clearly communicated and legally binding.

youtube

In Summary:

Understanding the roles of purchase requisitions and purchase orders is crucial for efficient procurement management. Purchase requisitions help manage internal requests and approvals, while purchase orders formalize the external purchase agreement. By using these documents appropriately, you can streamline your procurement process, ensure proper authorization, and maintain clear and enforceable agreements with suppliers.

By focusing on these distinctions and applying them correctly, your organization can enhance procurement efficiency, reduce errors, and improve overall operational effectiveness.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

The Future of Expense Management: Trends and Innovations

As businesses evolve, so does the landscape of expense management. Traditionally a routine task involving paper receipts and manual approval processes, expense management is undergoing a significant transformation. With advances in technology and changing business needs, the future of expense management is set to be more streamlined, data-driven, and integrated. This blog explores the key trends and innovations shaping the future of expense management.

1. Automation and AI Integration

One of the most prominent trends in expense management is the integration of automation and artificial intelligence (AI). Automation tools are increasingly being used to handle routine tasks such as data entry, receipt processing, and approval workflows. AI, on the other hand, is enhancing these tools by providing advanced analytics, fraud detection, and predictive insights.

Benefits of Automation and AI:

Reduced Manual Work: Automation minimizes the need for manual data entry and approval, saving time and reducing errors.

Enhanced Accuracy: AI algorithms can analyze patterns and detect anomalies, improving accuracy and preventing fraudulent claims.

Predictive Insights: AI can offer forecasts and trends, helping businesses make informed budgeting decisions.

2. Mobile Expense Management Solutions

With the rise of remote work and the need for on-the-go access, mobile expense management solutions are becoming increasingly popular. Mobile apps enable employees to capture receipts, submit expense reports, and track spending directly from their smartphones.

Key Features of Mobile Solutions:

Real-Time Expense Tracking: Employees can upload receipts and log expenses immediately, ensuring accuracy and reducing delays.

Expense Approvals on the Go: Managers can review and approve expense reports from anywhere, streamlining the approval process.

Integration with Other Tools: Mobile apps often integrate with accounting software, ensuring seamless data transfer and reducing manual reconciliation.

3. Integration with Financial Systems

The future of expense management is closely linked with the integration of expense management systems with broader financial and ERP (Enterprise Resource Planning) systems. This integration facilitates a unified approach to financial management, ensuring that expense data flows seamlessly into accounting and budgeting systems.

Advantages of Integration:

Streamlined Processes: Integration eliminates the need for manual data entry and reduces discrepancies between systems.

Comprehensive Reporting: Combined data from various financial systems enables more comprehensive reporting and analysis.

Improved Budgeting: Real-time visibility into expenses allows for more accurate budgeting and forecasting.

4. Enhanced Data Analytics

Data analytics is transforming expense management by providing deeper insights into spending patterns, trends, and anomalies. Advanced analytics tools enable businesses to analyze expense data in detail, uncovering opportunities for cost savings and process improvements.

Benefits of Enhanced Analytics:

Spending Insights: Detailed analytics help identify areas of overspending and opportunities for cost reduction.

Trend Analysis: Businesses can track spending trends over time, helping to make more informed financial decisions.

Benchmarking: Analytics enable businesses to compare their spending against industry benchmarks and best practices.

5. Cloud-Based Solutions

Cloud technology is revolutionizing expense management by providing scalable, accessible, and secure solutions. Cloud-based expense management systems offer flexibility, real-time access, and easier updates compared to traditional on-premises solutions.

Advantages of Cloud-Based Solutions:

Scalability: Cloud solutions can easily scale with your business, accommodating growing volumes of expense data and users.

Accessibility: Employees and managers can access expense data and tools from any location, facilitating remote work and collaboration.

Automatic Updates: Cloud systems are updated automatically, ensuring that you always have access to the latest features and security enhancements.

6. Focus on Employee Experience

The future of expense management is increasingly focused on enhancing the employee experience. Simplifying the expense submission process, reducing administrative burdens, and providing clear communication are all key to improving employee satisfaction.

Ways to Improve Employee Experience:

User-Friendly Interfaces: Intuitive interfaces make it easier for employees to submit and manage expenses.

Clear Policies: Providing clear guidelines and support for expense management helps employees understand and comply with company policies.

Timely Reimbursements: Efficient processing and prompt reimbursements contribute to a positive employee experience.

7. Sustainability and Corporate Responsibility

As businesses become more environmentally conscious, there is a growing emphasis on sustainability in expense management. This includes implementing practices that reduce waste and promote eco-friendly solutions.

Sustainable Practices in Expense Management:

Digital Receipts: Encouraging the use of digital receipts reduces paper waste and simplifies record-keeping.

Green Initiatives: Supporting vendors and practices that align with sustainability goals contributes to corporate responsibility efforts.

youtube

Conclusion

The future of expense management is poised for significant advancements driven by automation, mobile technology, and data analytics. By embracing these trends and innovations, businesses can streamline their expense management processes, improve accuracy, and enhance overall efficiency. Staying ahead of these developments will not only optimize financial management but also support a more agile and responsive business environment.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Best Practices for a Smooth and Effective Approval Process

An effective approval process is crucial for maintaining organizational efficiency, ensuring compliance, and achieving timely decision-making. Whether it's for project proposals, budgets, or strategic initiatives, a streamlined approval process can significantly impact a company's performance. This blog outlines best practices to help you establish a smooth and effective approval process that drives results.

1. Define Clear Objectives and Criteria

Start by defining clear objectives and criteria for the approval process. This involves understanding the goals of the approval, the necessary outcomes, and the specific requirements for approval. Clear objectives help in setting expectations and ensure that all stakeholders are aligned. Criteria should include:

Approval Requirements: Specify what documents or information are needed for approval.

Decision-Making Criteria: Outline the factors that will influence the approval decision.

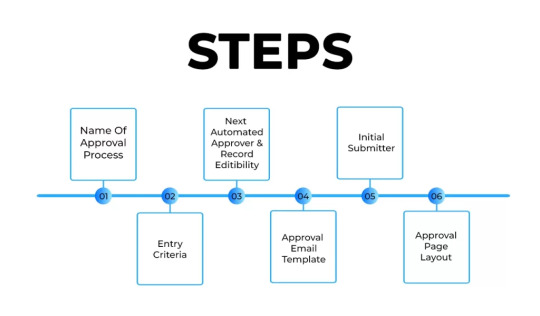

2. Implement a Structured Workflow

A structured workflow is essential for an organized and efficient approval process. Develop a step-by-step workflow that outlines each stage of the approval, from submission to final decision. This structure should include:

Submission Process: Define how requests or proposals should be submitted.

Review Stages: Identify who will review the request and the sequence of reviews.

Decision Points: Clearly mark where decisions are made and by whom.

Notifications: Set up automated notifications to keep all stakeholders informed of progress and decisions.

3. Leverage Technology for Automation

Utilize technology to automate and streamline the approval process. Automation tools can reduce manual errors, speed up approvals, and provide better tracking. Consider:

Approval Software: Implement software that manages the approval workflow, tracks progress, and stores documents.

Digital Signatures: Use digital signatures to expedite approvals and maintain security.

Integration: Ensure the approval system integrates with other business systems for seamless data flow.

4. Establish Roles and Responsibilities

Clearly define roles and responsibilities for everyone involved in the approval process. This ensures accountability and avoids confusion. Key roles to consider:

Requestor: The person or department submitting the request.

Reviewer: Individuals responsible for assessing the request.

Approver: The person or group with final decision-making authority.

Administrator: The person managing the approval system and process.

5. Set Deadlines and Track Progress

Setting deadlines for each stage of the approval process helps to keep things on track and ensures timely decision-making. Use tools to track the progress of approvals and identify any delays. Regularly review the process to ensure that deadlines are met and address any bottlenecks promptly.

6. Provide Training and Support

Training and support are critical for a smooth approval process. Ensure that all stakeholders understand the process and their roles within it. Provide training on:

System Usage: How to use the approval software or tools effectively.

Process Guidelines: Detailed instructions on the steps and requirements of the approval process.

Best Practices: Tips for efficient and effective participation in the process.

7. Foster Transparency and Communication

Transparency and communication are key to a smooth approval process. Keep all stakeholders informed about the status of their requests and decisions. Implement:

Status Updates: Regular updates on the progress of approvals.

Feedback Mechanisms: Channels for stakeholders to provide feedback or ask questions.

Documentation: Maintain clear and accessible records of all approvals and decisions.

8. Continuously Evaluate and Improve

Regularly evaluate the effectiveness of your approval process and seek opportunities for improvement. Collect feedback from participants and analyze performance metrics such as approval times and error rates. Use this information to:

Identify Areas for Improvement: Pinpoint where the process can be streamlined or enhanced.

Implement Changes: Make necessary adjustments to improve efficiency and effectiveness.

Review Best Practices: Stay updated on industry best practices and incorporate relevant changes.

9. Ensure Compliance and Security

Ensure that your approval process complies with relevant regulations and standards. Implement security measures to protect sensitive information and maintain the integrity of the process. Consider:

Compliance Checks: Regularly review the process for compliance with legal and regulatory requirements.

Data Security: Use secure systems and protocols to safeguard documents and approvals.

10. Promote a Culture of Efficiency

Encourage a culture of efficiency within your organization by promoting the importance of a streamlined approval process. Recognize and reward efficient practices and encourage employees to contribute to process improvements.

youtube

Conclusion

Implementing best practices for a smooth and effective approval process can enhance organizational efficiency, reduce delays, and improve decision-making. By defining clear objectives, leveraging technology, establishing roles, and continuously evaluating the process, you can create an approval process that supports your business goals and drives success.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How to Implement an Efficient Leave Management Process in Your Organization

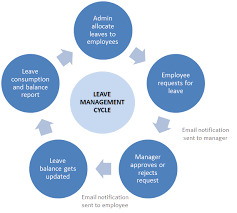

An efficient leave management process is crucial for maintaining productivity and employee satisfaction within any organization. Properly managing leave requests, whether for vacation, sick days, or personal reasons, can significantly impact overall operational efficiency and employee morale. This blog outlines key steps to implement an efficient leave management process in your organization, ensuring smooth operations and a positive work environment.

1. Define Clear Leave Policies

The foundation of an efficient leave management process is a well-defined leave policy. Establish clear guidelines regarding the types of leave available, such as annual leave, sick leave, maternity/paternity leave, and unpaid leave. Include details on:

Accrual Rates: Specify how leave is accrued (e.g., monthly or annually) and any carry-over policies.

Eligibility: Define who is eligible for different types of leave and any conditions that must be met.

Request Procedures: Outline the process for requesting leave, including advance notice requirements and documentation needed.

Ensure that these policies are communicated clearly to all employees through employee handbooks, internal portals, or company meetings.

2. Choose the Right Leave Management System

Selecting the right leave management system is crucial for automating and streamlining the leave request and approval process. Consider the following when choosing a system:

Integration: Ensure the system integrates with your existing HR and payroll systems for seamless data management.

User-Friendly Interface: Opt for a system that is intuitive and easy for both employees and managers to use.

Customizable Features: Choose a system that allows customization of leave types, approval workflows, and reporting.

Popular leave management systems include BambooHR, Kronos, and Zoho People. These platforms offer features such as online leave requests, automatic leave tracking, and real-time reporting.

3. Automate Leave Requests and Approvals

Automating the leave request and approval process can significantly reduce administrative burden and minimize errors. Implement a system where employees can submit leave requests online, and managers can review and approve them electronically. Automation offers several benefits:

Efficiency: Streamlines the approval process, reducing delays and paperwork.

Accuracy: Minimizes errors associated with manual calculations and data entry.

Visibility: Provides real-time visibility into leave balances and upcoming absences.

Ensure that the system sends notifications and reminders to both employees and managers to keep the process on track.

4. Monitor and Manage Leave Balances

Keeping track of leave balances is essential to avoid discrepancies and ensure fair use of leave. Implement a system that provides real-time updates on leave balances and usage. This helps:

Prevent Overuse: Avoid situations where employees exceed their leave entitlements.

Plan Resources: Enable managers to plan for coverage and adjust workloads based on upcoming absences.

Ensure Compliance: Track compliance with legal requirements related to leave entitlements.

Regularly review leave balances and adjust policies as needed to align with organizational changes or legal updates.

5. Provide Training and Support

Proper training and support are vital for the successful implementation of a new leave management process. Ensure that both employees and managers are well-informed about the new system and policies. Training should cover:

System Usage: How to submit and approve leave requests using the new system.

Policy Understanding: Detailed explanations of leave policies and procedures.

Troubleshooting: Assistance with common issues or questions related to leave management.

Offer ongoing support through helpdesks, FAQs, and user guides to address any concerns or difficulties that arise.

6. Regularly Review and Improve the Process

An efficient leave management process requires ongoing review and improvement. Regularly assess the effectiveness of your leave management system and policies by:

Gathering Feedback: Solicit feedback from employees and managers on the leave management process and system usability.

Analyzing Data: Review data on leave patterns, approval times, and system performance to identify areas for improvement.

Making Adjustments: Implement changes based on feedback and data analysis to enhance the efficiency and effectiveness of the process.

By continuously evaluating and refining your leave management process, you ensure it remains effective and meets the evolving needs of your organization.

youtube

Conclusion

Implementing an efficient leave management process is essential for maintaining a productive and satisfied workforce. By defining clear leave policies, choosing the right system, automating requests and approvals, monitoring leave balances, providing training, and regularly reviewing the process, you can create a streamlined and effective leave management system. This not only enhances operational efficiency but also fosters a positive work environment where employees feel valued and supported.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How to Implement an Efficient Expense Management Process in Your Business

Managing expenses effectively is crucial for maintaining the financial health of any business. An efficient expense management process not only helps control costs but also enhances operational efficiency and improves financial reporting. In this blog, we will explore practical steps to implement a streamlined expense management process in your business, ensuring it is optimized for both performance and compliance.

Establish Clear Expense Policies The foundation of an efficient expense management process is a clear and comprehensive expense policy. This policy should outline the guidelines for what constitutes a reimbursable expense, spending limits, and approval processes. Key elements to include are:

Expense Categories: Define categories such as travel, meals, office supplies, and entertainment to ensure clarity on what expenses can be claimed. Reimbursement Limits: Set maximum limits for different types of expenses to prevent overspending. Approval Workflow: Establish a workflow for expense approvals, detailing who must authorize expenses and the process for submitting claims. Communicate this policy clearly to all employees to ensure everyone understands the rules and procedures.

Implement Expense Management Software Using expense management software can greatly enhance the efficiency of your expense process. Look for software that offers:

Easy Expense Tracking: Allows employees to submit and track expenses using mobile or desktop applications. Automated Approvals: Facilitates automatic routing of expense reports to the appropriate approvers. Integration with Accounting Systems: Integrates seamlessly with your accounting or ERP systems to streamline financial reporting. Software solutions like Expensify, Concur, or Zoho Expense can automate and simplify expense management, reducing manual errors and saving time.

Adopt a Digital Receipts System Paper receipts can be easily lost or damaged, leading to issues in expense reporting and reimbursement. Implement a digital receipts system where employees can upload photos of their receipts directly into the expense management software. This system should include:

Receipt Scanning: Optical character recognition (OCR) technology to extract information from receipts automatically. Cloud Storage: Secure cloud storage to keep digital copies of receipts organized and accessible. Integration with Expense Reports: Automatically link receipts to the corresponding expense reports for easy tracking and validation.

Enforce Regular Audits and Reviews To ensure compliance and detect potential issues, conduct regular audits of expense reports and reimbursement practices. Key steps include:

Random Audits: Perform random audits to check for adherence to policies and detect any discrepancies. Periodic Reviews: Schedule periodic reviews of expense management processes to identify areas for improvement. Feedback Mechanism: Establish a system for employees to provide feedback on the expense management process, helping to refine and improve it. Regular audits help maintain accountability and prevent misuse of the expense management system.

Train Employees and Stakeholders Proper training is essential for ensuring that employees understand and adhere to the expense management policy. Provide training sessions that cover:

Policy Overview: Explain the expense policies and procedures in detail. Software Training: Offer hands-on training for using the expense management software. Best Practices: Share best practices for managing expenses and submitting accurate reports. Ongoing training and support help maintain compliance and improve the overall efficiency of the expense management process.

Monitor and Analyze Expense Data Utilize the reporting and analytics features of your expense management software to monitor and analyze expense data. This analysis can provide valuable insights into:

Spending Patterns: Identify trends and areas where expenses can be reduced. Budget Adherence: Compare actual expenses against budgeted amounts to ensure financial targets are met. Policy Compliance: Track compliance with expense policies and identify any areas of non-compliance. Regularly reviewing expense data helps you make informed decisions and adjust policies as needed.

Continuously Improve the Process An efficient expense management process is not static; it should evolve based on feedback and performance. Continuously seek ways to improve by:

Soliciting Feedback: Gather input from employees and managers on the expense management process. Benchmarking: Compare your process with industry best practices and adjust accordingly. Adopting New Technologies: Stay updated with new technologies and features that can enhance your expense management process. Continuous improvement helps ensure that your expense management process remains effective and aligned with organizational goals.

youtube

Conclusion Implementing an efficient expense management process involves establishing clear policies, leveraging technology, and maintaining regular oversight. By adopting these practices, your business can control costs, improve financial reporting, and enhance overall operational efficiency. An effective expense management system not only streamlines operations but also supports better financial decision-making and contributes to the long-term success of your business.

SITES WE SUPPORT

Financial Workflow - Wix

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How to Optimize Your Approval Process for Maximum Efficiency

In today's fast-paced business environment, efficiency is key to staying competitive. One area that can significantly impact overall productivity is the approval process. Whether it’s approving documents, budgets, or project plans, a slow or disorganized approval process can lead to delays, increased costs, and frustration. Optimizing this process can streamline operations, reduce bottlenecks, and improve overall efficiency. Here’s how you can optimize your approval process for maximum efficiency.

1. Map Out the Current Process

The first step in optimizing your approval process is to understand how it currently works. Create a detailed map of the existing workflow, identifying each step involved, from submission to final approval. Note the time taken at each stage, the stakeholders involved, and any common bottlenecks. This will help you pinpoint areas where inefficiencies occur and where improvements are needed.

2. Eliminate Redundant Steps

Once you’ve mapped out your current process, look for any steps that may be redundant or unnecessary. Often, approval processes become bloated over time, with additional steps added that no longer serve a purpose. Streamlining these steps can significantly speed up the process. Ask yourself:

Is every step necessary?

Are there tasks that can be combined or eliminated?

Can the number of approvals required be reduced?

By cutting out unnecessary steps, you can make the process leaner and faster.

3. Automate Where Possible

Automation is a powerful tool for optimizing the approval process. By automating repetitive tasks, you can reduce manual errors, speed up approvals, and free up valuable time for your team. Consider implementing an approval workflow software that allows for:

Automatic Routing: Automatically route documents or requests to the appropriate approvers, ensuring nothing gets lost in the shuffle.

Notifications and Reminders: Set up automated notifications to remind approvers of pending tasks, reducing delays.

Tracking and Reporting: Use automated tracking to monitor the progress of approvals and generate reports on workflow efficiency.

Automation not only speeds up the process but also provides greater transparency and accountability.

4. Set Clear Guidelines and Deadlines

Clear guidelines and deadlines are crucial for keeping the approval process on track. Establish clear criteria for what needs approval, who is responsible for each step, and the expected time frame for completion. Make sure all stakeholders are aware of these guidelines. Setting deadlines helps prevent tasks from lingering and ensures that approvals are handled promptly. Additionally, consider implementing:

Priority Levels: Assign priority levels to different types of approvals to ensure urgent matters are addressed first.

Escalation Paths: Define escalation paths for approvals that are delayed, so they can be addressed by higher management if necessary.

Having clear guidelines and deadlines minimizes confusion and keeps the process moving efficiently.

5. Enhance Communication and Collaboration

Effective communication is essential for an efficient approval process. Miscommunication or lack of information can cause delays and errors. Ensure that all stakeholders have access to the necessary information and can easily communicate with each other. This can be achieved through:

Centralized Platforms: Use a centralized platform where all communications, documents, and approvals are stored and accessible to relevant parties.

Collaborative Tools: Implement tools that allow for real-time collaboration and discussions among team members during the approval process.

Regular Updates: Keep everyone informed with regular updates on the status of approvals and any changes to the process.